psa-20211231FALSE2021FY000139331100013933112021-01-012021-12-310001393311us-gaap:CommonStockMember2021-01-012021-12-310001393311us-gaap:SeriesFPreferredStockMember2021-01-012021-12-310001393311us-gaap:SeriesGPreferredStockMember2021-01-012021-12-310001393311us-gaap:SeriesHPreferredStockMember2021-01-012021-12-310001393311psa:SeriesIPreferredStockMember2021-01-012021-12-310001393311psa:SeriesJPreferredStockMember2021-01-012021-12-310001393311psa:SeriesKPreferredStockMember2021-01-012021-12-310001393311psa:SeriesLPreferredStockMember2021-01-012021-12-310001393311psa:SeriesMPreferredStockMember2021-01-012021-12-310001393311psa:SeriesNPreferredStockMember2021-01-012021-12-310001393311psa:SeriesOPreferredStockMember2021-01-012021-12-310001393311psa:SeriesPPreferredStockMember2021-01-012021-12-310001393311psa:SeriesQPreferredStockMember2021-01-012021-12-310001393311psa:SeriesRPreferredStockMember2021-01-012021-12-310001393311psa:SeriesSPreferredStockMember2021-01-012021-12-310001393311psa:NotesDue2032Member2021-01-012021-12-310001393311psa:NotesDue2030Member2021-01-012021-12-3100013933112021-06-30iso4217:USD00013933112022-02-18xbrli:shares00013933112021-12-3100013933112020-12-31iso4217:USDxbrli:shares0001393311psa:SelfStorageOperationsMember2021-01-012021-12-310001393311psa:SelfStorageOperationsMember2020-01-012020-12-310001393311psa:SelfStorageOperationsMember2019-01-012019-12-310001393311psa:AncillaryOperationsMember2021-01-012021-12-310001393311psa:AncillaryOperationsMember2020-01-012020-12-310001393311psa:AncillaryOperationsMember2019-01-012019-12-3100013933112020-01-012020-12-3100013933112019-01-012019-12-310001393311us-gaap:PreferredStockMember2018-12-310001393311us-gaap:CommonStockMember2018-12-310001393311us-gaap:AdditionalPaidInCapitalMember2018-12-310001393311us-gaap:RetainedEarningsMember2018-12-310001393311us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310001393311us-gaap:ParentMember2018-12-310001393311us-gaap:NoncontrollingInterestMember2018-12-3100013933112018-12-310001393311us-gaap:PreferredStockMember2019-01-012019-12-310001393311us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001393311us-gaap:ParentMember2019-01-012019-12-310001393311us-gaap:CommonStockMember2019-01-012019-12-310001393311us-gaap:NoncontrollingInterestMember2019-01-012019-12-310001393311us-gaap:RetainedEarningsMember2019-01-012019-12-310001393311us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001393311us-gaap:PreferredStockMember2019-12-310001393311us-gaap:CommonStockMember2019-12-310001393311us-gaap:AdditionalPaidInCapitalMember2019-12-310001393311us-gaap:RetainedEarningsMember2019-12-310001393311us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001393311us-gaap:ParentMember2019-12-310001393311us-gaap:NoncontrollingInterestMember2019-12-3100013933112019-12-310001393311us-gaap:PreferredStockMember2020-01-012020-12-310001393311us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001393311us-gaap:ParentMember2020-01-012020-12-310001393311us-gaap:CommonStockMember2020-01-012020-12-310001393311us-gaap:NoncontrollingInterestMember2020-01-012020-12-310001393311us-gaap:RetainedEarningsMember2020-01-012020-12-310001393311us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001393311us-gaap:PreferredStockMember2020-12-310001393311us-gaap:CommonStockMember2020-12-310001393311us-gaap:AdditionalPaidInCapitalMember2020-12-310001393311us-gaap:RetainedEarningsMember2020-12-310001393311us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001393311us-gaap:ParentMember2020-12-310001393311us-gaap:NoncontrollingInterestMember2020-12-310001393311us-gaap:PreferredStockMember2021-01-012021-12-310001393311us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001393311us-gaap:ParentMember2021-01-012021-12-310001393311us-gaap:CommonStockMember2021-01-012021-12-310001393311us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001393311us-gaap:RetainedEarningsMember2021-01-012021-12-310001393311us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001393311us-gaap:PreferredStockMember2021-12-310001393311us-gaap:CommonStockMember2021-12-310001393311us-gaap:AdditionalPaidInCapitalMember2021-12-310001393311us-gaap:RetainedEarningsMember2021-12-310001393311us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001393311us-gaap:ParentMember2021-12-310001393311us-gaap:NoncontrollingInterestMember2021-12-310001393311psa:PublicStorageMember2021-12-31psa:storageFacilityutr:sqftpsa:state0001393311psa:CommercialAndRetailSpaceMemberpsa:PublicStorageMember2021-12-310001393311psa:ShurgardSelfStorageSaMember2021-12-31xbrli:pure0001393311psa:ShurgardSelfStorageSaMember2020-12-31psa:country0001393311psa:PSBusinessParksMember2021-12-310001393311srt:MinimumMember2021-01-012021-12-310001393311srt:MaximumMember2021-01-012021-12-310001393311srt:WeightedAverageMember2021-01-012021-12-310001393311srt:WeightedAverageMember2020-01-012020-12-310001393311srt:WeightedAverageMember2019-01-012019-12-310001393311psa:AcquisitionOfSelfStorageFacilitiesMember2021-01-012021-12-310001393311psa:ExpansionProjectsMemberpsa:CompletedDevelopmentAndExpansionProjectMember2021-01-012021-12-310001393311psa:DisposalOfRealEstateFacilitiesMember2021-01-012021-12-310001393311psa:AcquisitionOfSelfStorageFacilitiesMember2020-01-012020-12-310001393311psa:ExpansionProjectsMemberpsa:CompletedDevelopmentAndExpansionProjectMember2020-01-012020-12-310001393311psa:AcquisitionOfSelfStorageFacilitiesMember2019-01-012019-12-310001393311psa:AcquisitionOfCommercialFacilityMember2019-01-012019-12-31psa:commercialFacility0001393311psa:AcquisitionOfSelfStorageFacilitiesMember2019-12-310001393311psa:ExpansionProjectsMemberpsa:CompletedDevelopmentAndExpansionProjectMember2019-01-012019-12-310001393311psa:PSBusinessParksMember2020-12-310001393311psa:PSBusinessParksMember2021-01-012021-12-310001393311psa:PSBusinessParksMember2020-01-012020-12-310001393311psa:PSBusinessParksMember2019-01-012019-12-310001393311psa:ShurgardSelfStorageSaMember2021-01-012021-12-310001393311psa:ShurgardSelfStorageSaMember2020-01-012020-12-310001393311psa:ShurgardSelfStorageSaMember2019-01-012019-12-310001393311psa:PSBAndShurgardMember2021-01-012021-12-310001393311psa:PSBAndShurgardMember2020-01-012020-12-310001393311psa:PSBAndShurgardMember2019-01-012019-12-310001393311psa:PSBAndShurgardMember2021-12-310001393311psa:PSBAndShurgardMember2020-12-31iso4217:EURxbrli:shares0001393311us-gaap:LicenseMemberpsa:ShurgardSelfStorageSaMember2021-01-012021-12-310001393311us-gaap:LicenseMemberpsa:ShurgardSelfStorageSaMember2020-01-012020-12-310001393311us-gaap:LicenseMemberpsa:ShurgardSelfStorageSaMember2019-01-012019-12-310001393311us-gaap:TradeNamesMember2021-12-310001393311us-gaap:TradeNamesMember2020-12-310001393311us-gaap:RevolvingCreditFacilityMember2021-12-310001393311us-gaap:RevolvingCreditFacilityMembersrt:MinimumMember2021-01-012021-12-310001393311us-gaap:RevolvingCreditFacilityMembersrt:MaximumMember2021-01-012021-12-310001393311us-gaap:RevolvingCreditFacilityMember2021-12-312021-12-310001393311us-gaap:RevolvingCreditFacilityMemberus-gaap:SubsequentEventMember2022-02-220001393311us-gaap:StandbyLettersOfCreditMember2021-12-310001393311us-gaap:StandbyLettersOfCreditMember2020-12-310001393311psa:USDollarDenominatedUnsecuredDebtMemberpsa:NotesDueSeptember152022Member2021-12-310001393311psa:USDollarDenominatedUnsecuredDebtMemberpsa:NotesDueApril232024Memberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2021-12-312021-12-310001393311psa:USDollarDenominatedUnsecuredDebtMemberpsa:NotesDueApril232024Member2021-12-310001393311psa:USDollarDenominatedUnsecuredDebtMemberpsa:NotesDueFebruary152026Member2021-12-310001393311psa:USDollarDenominatedUnsecuredDebtMemberpsa:NotesDueNovember92026Member2021-12-310001393311psa:USDollarDenominatedUnsecuredDebtMemberpsa:NotesDueSeptember152027Member2021-12-310001393311psa:USDollarDenominatedUnsecuredDebtMemberpsa:NotesDueMay12028Member2021-12-310001393311psa:USDollarDenominatedUnsecuredDebtMemberpsa:NotesDueNovember92028Member2021-12-310001393311psa:USDollarDenominatedUnsecuredDebtMemberpsa:NotesDueMay12029Member2021-12-310001393311psa:USDollarDenominatedUnsecuredDebtMemberpsa:NotesDueMay12031Member2021-12-310001393311psa:USDollarDenominatedUnsecuredDebtMemberpsa:NotesDueNovember92031Member2021-12-310001393311psa:USDollarDenominatedUnsecuredDebtMember2021-12-310001393311psa:EuroDenominatedUnsecuredDebtMemberpsa:NotesDueApril122024Member2021-12-310001393311psa:EuroDenominatedUnsecuredDebtMemberpsa:NotesDueNovember32025Member2021-12-310001393311psa:EuroDenominatedUnsecuredDebtMemberpsa:NotesDueSeptember92030Member2021-12-310001393311psa:EuroDenominatedUnsecuredDebtMemberpsa:NotesDueJanuary242032Member2021-12-310001393311psa:EuroDenominatedUnsecuredDebtMember2021-12-310001393311us-gaap:MortgagesMember2021-12-31psa:company0001393311psa:USDollarDenominatedUnsecuredDebtMemberpsa:NotesDueSeptember152022Member2020-12-310001393311psa:USDollarDenominatedUnsecuredDebtMemberpsa:NotesDueSeptember152027Member2020-12-310001393311psa:USDollarDenominatedUnsecuredDebtMemberpsa:NotesDueMay12029Member2020-12-310001393311psa:USDollarDenominatedUnsecuredDebtMember2020-12-310001393311psa:EuroDenominatedUnsecuredDebtMemberpsa:NotesDueApril122024Member2020-12-310001393311psa:EuroDenominatedUnsecuredDebtMemberpsa:NotesDueNovember32025Member2020-12-310001393311psa:EuroDenominatedUnsecuredDebtMemberpsa:NotesDueJanuary242032Member2020-12-310001393311psa:EuroDenominatedUnsecuredDebtMember2020-12-310001393311us-gaap:MortgagesMember2020-12-310001393311psa:USDollarDenominatedUnsecuredDebtMemberpsa:NotesDueFebruary152026Member2021-01-190001393311psa:USDollarDenominatedUnsecuredDebtMemberpsa:NotesDueApril232024Member2021-04-230001393311psa:USDollarDenominatedUnsecuredDebtMemberpsa:NotesDueMay12028Member2021-04-230001393311psa:USDollarDenominatedUnsecuredDebtMemberpsa:NotesDueMay12031Member2021-04-230001393311psa:USDollarDenominatedUnsecuredDebtMemberpsa:NotesDueApril232024Memberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2021-04-232021-04-230001393311psa:USDollarDenominatedUnsecuredDebtMemberpsa:NotesDueApril232024May12028AndMay12031Member2021-04-230001393311psa:USDollarDenominatedUnsecuredDebtMemberpsa:NotesDueNovember92026Member2021-11-090001393311psa:USDollarDenominatedUnsecuredDebtMemberpsa:NotesDueNovember92028Member2021-11-090001393311psa:USDollarDenominatedUnsecuredDebtMemberpsa:NotesDueNovember92031Member2021-11-090001393311psa:USDollarDenominatedUnsecuredDebtMemberpsa:NotesDueNovember92026November92028AndNovember92031Member2021-11-090001393311psa:USDollarDenominatedUnsecuredDebtMemberpsa:NotesDueMay12029Member2019-04-120001393311psa:USDollarDenominatedUnsecuredDebtMemberpsa:MaximumCovenantMember2021-12-310001393311psa:USDollarDenominatedUnsecuredDebtMembersrt:MinimumMember2021-01-012021-12-310001393311psa:USDollarDenominatedUnsecuredDebtMember2021-01-012021-12-31psa:tranche0001393311psa:EuroDenominatedUnsecuredDebtMemberpsa:NotesDueNovember32025Member2015-11-03iso4217:EUR0001393311psa:EuroDenominatedUnsecuredDebtMemberpsa:NotesDueNovember32025Member2015-11-032015-11-030001393311psa:EuroDenominatedUnsecuredDebtMemberpsa:NotesDueApril122024Member2016-04-120001393311psa:EuroDenominatedUnsecuredDebtMemberpsa:NotesDueApril122024Member2016-04-122016-04-120001393311psa:EuroDenominatedUnsecuredDebtMemberpsa:NotesDueJanuary242032Member2020-01-240001393311psa:EuroDenominatedUnsecuredDebtMemberpsa:NotesDueJanuary242032Member2020-01-242020-01-240001393311psa:EuroDenominatedUnsecuredDebtMemberpsa:NotesDueSeptember92030Member2021-09-090001393311psa:EuroDenominatedUnsecuredDebtMemberpsa:NotesDueSeptember92030Member2021-09-092021-09-090001393311us-gaap:MortgagesMember2019-12-310001393311us-gaap:MortgagesMembersrt:MinimumMember2021-12-310001393311srt:MaximumMemberus-gaap:MortgagesMember2021-12-310001393311us-gaap:UnsecuredDebtMember2021-12-310001393311us-gaap:NotesPayableToBanksMember2021-12-310001393311psa:AcquisitionOfSelfStorageFacilitiesMemberus-gaap:NoncontrollingInterestMember2021-12-310001393311us-gaap:SeriesCPreferredStockMember2021-01-012021-12-310001393311us-gaap:SeriesCPreferredStockMember2021-12-310001393311us-gaap:SeriesCPreferredStockMember2020-12-310001393311us-gaap:SeriesDPreferredStockMember2021-01-012021-12-310001393311us-gaap:SeriesDPreferredStockMember2021-12-310001393311us-gaap:SeriesDPreferredStockMember2020-12-310001393311us-gaap:SeriesEPreferredStockMember2021-01-012021-12-310001393311us-gaap:SeriesEPreferredStockMember2021-12-310001393311us-gaap:SeriesEPreferredStockMember2020-12-310001393311us-gaap:SeriesFPreferredStockMember2021-12-310001393311us-gaap:SeriesFPreferredStockMember2020-12-310001393311us-gaap:SeriesGPreferredStockMember2021-12-310001393311us-gaap:SeriesGPreferredStockMember2020-12-310001393311us-gaap:SeriesHPreferredStockMember2021-12-310001393311us-gaap:SeriesHPreferredStockMember2020-12-310001393311psa:SeriesIPreferredStockMember2021-12-310001393311psa:SeriesIPreferredStockMember2020-12-310001393311psa:SeriesJPreferredStockMember2021-12-310001393311psa:SeriesJPreferredStockMember2020-12-310001393311psa:SeriesKPreferredStockMember2021-12-310001393311psa:SeriesKPreferredStockMember2020-12-310001393311psa:SeriesLPreferredStockMember2021-12-310001393311psa:SeriesLPreferredStockMember2020-12-310001393311psa:SeriesMPreferredStockMember2021-12-310001393311psa:SeriesMPreferredStockMember2020-12-310001393311psa:SeriesNPreferredStockMember2021-12-310001393311psa:SeriesNPreferredStockMember2020-12-310001393311psa:SeriesOPreferredStockMember2021-12-310001393311psa:SeriesOPreferredStockMember2020-12-310001393311psa:SeriesPPreferredStockMember2021-12-310001393311psa:SeriesQPreferredStockMember2021-12-310001393311psa:SeriesRPreferredStockMember2021-12-31psa:dividendpsa:boardMember0001393311psa:SeriesPQAndRPreferredStockMember2021-12-310001393311psa:SeriesPQAndRPreferredStockMember2021-01-012021-12-310001393311psa:SeriesLMNAndOPreferredStockMember2020-12-310001393311psa:SeriesLMNAndOPreferredStockMember2020-01-012020-12-310001393311psa:SeriesHIJAndKPreferredStockMember2019-12-310001393311psa:SeriesHIJAndKPreferredStockMember2019-01-012019-12-310001393311psa:SeriesCDAndEPreferredStockMember2021-12-310001393311psa:SeriesCDAndEPreferredStockMember2021-01-012021-12-310001393311psa:SeriesVWXAndBPreferredStockMember2020-12-310001393311psa:SeriesVWXAndBPreferredStockMember2020-01-012020-12-310001393311psa:SeriesYZUAndAPreferredStockMember2019-12-310001393311psa:SeriesYZUAndAPreferredStockMember2019-01-012019-12-3100013933112021-01-012021-03-3100013933112021-04-012021-06-3000013933112021-07-012021-09-3000013933112021-10-012021-12-310001393311psa:HughesOwnedCanadianFacilitiesMembercountry:CA2021-12-310001393311psa:EquityAndPerformanceBasedIncentiveCompensationPlan2021Member2021-04-260001393311psa:EquityAndPerformanceBasedIncentiveCompensationPlan2021Member2021-12-310001393311psa:DirectCostsOfLeasedAndRentedPropertyOrEquipmentMember2021-01-012021-12-310001393311psa:DirectCostsOfLeasedAndRentedPropertyOrEquipmentMember2020-01-012020-12-310001393311psa:DirectCostsOfLeasedAndRentedPropertyOrEquipmentMember2019-01-012019-12-310001393311psa:OtherCostOfOperatingRevenueMember2021-01-012021-12-310001393311psa:OtherCostOfOperatingRevenueMember2020-01-012020-12-310001393311psa:OtherCostOfOperatingRevenueMember2019-01-012019-12-310001393311us-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-12-310001393311us-gaap:GeneralAndAdministrativeExpenseMember2020-01-012020-12-310001393311us-gaap:GeneralAndAdministrativeExpenseMember2019-01-012019-12-310001393311us-gaap:EmployeeStockOptionMembersrt:MinimumMember2021-01-012021-12-310001393311srt:MaximumMemberus-gaap:EmployeeStockOptionMember2021-01-012021-12-310001393311us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001393311us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001393311us-gaap:EmployeeStockOptionMember2019-01-012019-12-310001393311us-gaap:EmployeeStockOptionMemberpsa:BoardMembersMember2021-01-012021-12-310001393311us-gaap:EmployeeStockOptionMemberpsa:BoardMember5Member2021-01-012021-12-310001393311us-gaap:EmployeeStockOptionMemberpsa:BoardMember1Member2021-01-012021-12-310001393311us-gaap:EmployeeStockOptionMemberpsa:BoardMember4Member2021-01-012021-12-310001393311us-gaap:EmployeeStockOptionMemberpsa:BoardMember2Member2021-01-012021-12-310001393311psa:BoardMember3Memberus-gaap:EmployeeStockOptionMember2021-01-012021-12-310001393311us-gaap:ShareBasedCompensationAwardTrancheOneMemberpsa:PerformanceTargetStockOptionsMember2021-01-012021-12-310001393311us-gaap:ShareBasedCompensationAwardTrancheOneMemberpsa:PerformanceTargetStockOptionsMember2021-12-310001393311us-gaap:ShareBasedCompensationAwardTrancheTwoMemberpsa:PerformanceTargetStockOptionsMember2020-01-012020-12-310001393311us-gaap:ShareBasedCompensationAwardTrancheTwoMemberpsa:PerformanceTargetStockOptionsMember2021-12-310001393311us-gaap:ShareBasedCompensationAwardTrancheTwoMemberpsa:PerformanceTargetStockOptionsMember2020-12-310001393311us-gaap:ShareBasedCompensationAwardTrancheTwoMemberpsa:PerformanceTargetStockOptionsMember2021-01-012021-12-310001393311us-gaap:EmployeeStockOptionMember2021-12-310001393311psa:ServiceBasedStockOptionsMember2018-12-310001393311psa:PerformanceBasedStockOptionsMember2018-12-310001393311psa:ServiceBasedStockOptionsMember2019-01-012019-12-310001393311psa:PerformanceBasedStockOptionsMember2019-01-012019-12-310001393311psa:ServiceBasedStockOptionsMember2019-12-310001393311psa:PerformanceBasedStockOptionsMember2019-12-310001393311psa:ServiceBasedStockOptionsMember2020-01-012020-12-310001393311psa:PerformanceBasedStockOptionsMember2020-01-012020-12-310001393311psa:ServiceBasedStockOptionsMember2020-12-310001393311psa:PerformanceBasedStockOptionsMember2020-12-310001393311psa:ServiceBasedStockOptionsMember2021-01-012021-12-310001393311psa:PerformanceBasedStockOptionsMember2021-01-012021-12-310001393311psa:ServiceBasedStockOptionsMember2021-12-310001393311psa:PerformanceBasedStockOptionsMember2021-12-310001393311psa:ShareBasedPaymentArrangementOptionValuedWithBlackScholesMethodMember2021-01-012021-12-310001393311psa:ShareBasedPaymentArrangementOptionValuedWithBlackScholesMethodMember2020-01-012020-12-310001393311psa:ShareBasedPaymentArrangementOptionValuedWithBlackScholesMethodMember2019-01-012019-12-310001393311psa:ShareBasedPaymentArrangementOptionValuedWithMonteCarloSimulationMethodMember2021-01-012021-12-310001393311srt:MinimumMemberus-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001393311srt:MaximumMemberus-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001393311us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001393311us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001393311us-gaap:RestrictedStockUnitsRSUMember2019-01-012019-12-310001393311psa:PerformanceTargetRestrictedShareUnitsMember2021-01-012021-12-310001393311psa:PerformanceTargetRestrictedShareUnitsMember2021-12-310001393311us-gaap:RestrictedStockUnitsRSUMember2021-12-310001393311us-gaap:RestrictedStockUnitsRSUMember2020-12-310001393311us-gaap:RestrictedStockUnitsRSUMember2019-12-310001393311us-gaap:RestrictedStockUnitsRSUMember2018-12-310001393311us-gaap:OperatingSegmentsMemberpsa:SelfStorageOperationsMember2021-01-012021-12-310001393311us-gaap:OperatingSegmentsMemberpsa:SelfStorageOperationsMember2020-01-012020-12-310001393311us-gaap:OperatingSegmentsMemberpsa:SelfStorageOperationsMember2019-01-012019-12-310001393311psa:AncillaryOperationsMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001393311psa:AncillaryOperationsMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001393311psa:AncillaryOperationsMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001393311us-gaap:OperatingSegmentsMember2021-01-012021-12-310001393311us-gaap:OperatingSegmentsMember2020-01-012020-12-310001393311us-gaap:OperatingSegmentsMember2019-01-012019-12-310001393311us-gaap:MaterialReconcilingItemsMember2021-01-012021-12-310001393311us-gaap:MaterialReconcilingItemsMember2020-01-012020-12-310001393311us-gaap:MaterialReconcilingItemsMember2019-01-012019-12-31psa:certificate0001393311psa:AcquisitionOfSelfStorageFacilitiesMemberus-gaap:SubsequentEventMember2022-02-220001393311psa:AcquisitionOfSelfStorageFacilitiesMemberus-gaap:SubsequentEventMember2022-01-012022-02-220001393311psa:SeriesSPreferredStockMemberus-gaap:SubsequentEventMember2022-01-130001393311psa:SeriesSPreferredStockMemberus-gaap:SubsequentEventMember2022-01-132022-01-130001393311psa:SelfStorageFacilitiesMemberpsa:LosAngelesMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:DallasFtWorthMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:HoustonMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:SanFranciscoMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:ChicagoMember2021-12-310001393311psa:WashingtonDCMemberpsa:SelfStorageFacilitiesMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:AtlantaMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:SeattleTacomaMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:MiamiMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:NewYorkCityMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:OrlandoDaytonaMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:DenverMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:MinneapolisStPaulMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:PhiladelphiaMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:CharlotteMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:TampaMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:DetroitMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:PortlandMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:BaltimoreMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:PhoenixMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:WestPalmBeachMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:SanAntonioMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:AustinMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:RaleighMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:NorfolkMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:SacramentoMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:IndianapolisMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:KansasCityMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:BostonMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:StLouisMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:ColumbusMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:ColumbiaMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:OklahomaCityMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:SanDiegoMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:LasVegasMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:CincinnatiMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:NashvilleBowlingGreenMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:ColoradoSpringsMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:MilwaukeeMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:LouisvilleMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:JacksonvilleMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:BirminghamMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:RichmondMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:GreensboroMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:CharlestonMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:FortMyersNaplesMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:ChattanoogaMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:SavannahMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:GreensvilleSpartanburgAshevilleMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:HonoluluMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:HartfordNewHavenMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:NewOrleansMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:SaltLakeCityMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:MemphisMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:MobileMember2021-12-310001393311psa:OmahaMemberpsa:SelfStorageFacilitiesMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:BuffaloRochesterMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:ClevelandAkronMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:AugustaMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:RenoMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:TucsonMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:WichitaMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:MontereySalinasMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:BoiseMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:EvansvilleMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:DaytonMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:HuntsvilleDecaturMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:FortWayneMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:RoanokeMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:PalmSpringsMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:ProvidenceMember2021-12-310001393311psa:ShreveportMemberpsa:SelfStorageFacilitiesMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:SpringfieldHolyokeMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:RochesterMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:SantaBarbaraMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:TopekaMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:LansingMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:FlintMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:JoplinMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:SyracuseMember2021-12-310001393311psa:SelfStorageFacilitiesMemberpsa:ModestoFresnoStocktonMember2021-12-310001393311psa:CommercialAndNonOperatingRealEstateMember2021-12-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2021.

or

☐ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from to .

Commission File Number: 001-33519

PUBLIC STORAGE

(Exact name of Registrant as specified in its charter)

| | | | | | | | |

| Maryland | | 95-3551121 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

701 Western Avenue, Glendale, California 91201-2349

(Address of principal executive offices) (Zip Code)

(818) 244-8080

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Class | Trading Symbol | Name of exchange on which registered |

| | |

| Common Shares, $0.10 par value | PSA | New York Stock Exchange |

| Depositary Shares Each Representing 1/1,000 of a 5.150% Cum Pref Share, Series F, $0.01 par value | PSAPrF | New York Stock Exchange |

| Depositary Shares Each Representing 1/1,000 of a 5.050% Cum Pref Share, Series G, $0.01 par value | PSAPrG | New York Stock Exchange |

| Depositary Shares Each Representing 1/1,000 of a 5.600% Cum Pref Share, Series H, $0.01 par value | PSAPrH | New York Stock Exchange |

| Depositary Shares Each Representing 1/1,000 of a 4.875% Cum Pref Share, Series I, $0.01 par value | PSAPrI | New York Stock Exchange |

| Depositary Shares Each Representing 1/1,000 of a 4.700% Cum Pref Share, Series J, $0.01 par value | PSAPrJ | New York Stock Exchange |

| Depositary Shares Each Representing 1/1,000 of a 4.750% Cum Pref Share, Series K, $0.01 par value | PSAPrK | New York Stock Exchange |

| Depositary Shares Each Representing 1/1,000 of a 4.625% Cum Pref Share, Series L, $0.01 par value | PSAPrL | New York Stock Exchange |

| Depositary Shares Each Representing 1/1,000 of a 4.125% Cum Pref Share, Series M, $0.01 par value | PSAPrM | New York Stock Exchange |

| Depositary Shares Each Representing 1/1,000 of a 3.875% Cum Pref Share, Series N, $0.01 par value | PSAPrN | New York Stock Exchange |

| Depositary Shares Each Representing 1/1,000 of a 3.900% Cum Pref Share, Series O, $0.01 par value | PSAPrO | New York Stock Exchange |

| Depositary Shares Each Representing 1/1,000 of a 4.000% Cum Pref Share, Series P, $0.01 par value | PSAPrP | New York Stock Exchange |

| Depositary Shares Each Representing 1/1,000 of a 3.950% Cum Pref Share, Series Q, $0.01 par value | PSAPrQ | New York Stock Exchange |

| Depositary Shares Each Representing 1/1,000 of a 4.000% Cum Pref Share, Series R, $0.01 par value | PSAPrR | New York Stock Exchange |

| Depositary Shares Each Representing 1/1,000 of a 4.100% Cum Pref Share, Series S, $0.01 par value | PSAPrS | New York Stock Exchange |

| 0.875% Senior Notes due 2032 | PSA32 | New York Stock Exchange |

| 0.500% Senior Notes due 2030 | PSA30 | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | Accelerated filer | Non-accelerated filer | Smaller reporting company | Emerging growth company |

| ☒ | ☐ | ☐ | ☐ | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

The aggregate market value of the voting and non-voting common shares held by non-affiliates of the Registrant as of June 30, 2021:

Common Shares, $0.10 par value per share – $45,156,391,000 (computed on the basis of $300.69 per share, which was the reported closing sale price of the Company's Common Shares on the New York Stock Exchange (the “NYSE”) on June 30, 2021).

As of February 18, 2022, there were 175,462,248 outstanding Common Shares, $0.10 par value per share.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement to be filed in connection with the Annual Meeting of Shareholders to be held in 2022 are incorporated by reference into Part III of this Annual Report on Form 10-K to the extent described therein.

PART I

ITEM 1. Business

Cautionary Statement Regarding Forward Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements in this document, other than statements of historical fact, are forward-looking statements and may be identified by the use of the words "expects," "believes," "anticipates," "should," "estimates" and similar expressions.

These forward-looking statements involve known and unknown risks and uncertainties, which may cause our actual results and performance to be materially different from those expressed or implied in the forward-looking statements. Risks and uncertainties that may impact future results and performance include, but are not limited to, those described in Part 1, Item 1A, "Risk Factors" of this report and in our other filings with the Securities and Exchange Commission (the “SEC”). These include changes in demand for our facilities, impacts of natural disasters, adverse changes in laws and regulations including governing property tax, evictions, rental rates, minimum wage levels and insurance, adverse economic effects from the COVID-19 Pandemic or similar public health events, increases in the costs of our primary customer acquisition channels, unfavorable foreign currency rate fluctuations, changes in federal or state tax laws related to the taxation of REITs, security breaches, including ransomware, or a failure of our networks, systems or technology.

These forward looking statements speak only as of the date of this report or as of the dates indicated in the statements. All of our forward-looking statements, including those in this report, are qualified in their entirety by this cautionary statement. We expressly disclaim any obligation to update publicly or otherwise revise any forward-looking statements, whether as a result of new information, new estimates, or other factors, events or circumstances after the date of these forward looking statements, except when expressly required by law. Given these risks and uncertainties, you should not rely on any forward-looking statements in this report, or which management may make orally or in writing from time to time, neither as predictions of future events nor guarantees of future performance.

General Discussion of our Business

Public Storage (referred to herein as “the Company”, “we”, “us”, or “our”), a Maryland REIT, was organized in 1980. Our principal business activities include the ownership and operation of self-storage facilities and other related operations including tenant reinsurance and third-party self-storage management. We are the industry leading owner and operator of self-storage properties with a recognizable brand, including the ubiquitous orange color, which is one of the most recognizable within the industry.

Self-storage Operations:

We acquire, develop, own and operate self-storage facilities, which offer storage spaces for lease on a month-to-month basis, for personal and business use. We are the largest owner and operator of self-storage facilities in the United States ("U.S.") with physical presence in most major markets and 39 states. We believe our scale, brand name and technology platform afford us competitive advantages. At December 31, 2021, we held interests in and consolidated 2,787 self-storage facilities (an aggregate of 198 million net rentable square feet of space) operating under the Public Storage® name.

Other Operations:

Our customers have the option of purchasing insurance from a non-affiliated insurance company to cover certain losses to their goods stored at our facilities, as well as those we manage for third parties. A wholly-owned, consolidated subsidiary of Public Storage fully reinsures such policies and thereby assumes all risk of losses under these policies and receives reinsurance premiums substantially equal to the premiums collected from our tenants, from the non-affiliated insurance company. These policies cover claims for losses related to specified events up to a maximum limit of $5,000 per storage unit. We reinsure all risks in this program but purchase insurance from an independent third party insurer to cover this exposure for a limit of $15.0 million for losses in excess of $5.0 million per occurrence. At December 31, 2021, there were approximately 1.2 million certificates of insurance held by our self-storage customers, representing aggregate coverage of approximately $4.9 billion.

At December 31, 2021, we managed 93 facilities for third parties, and were under contract to manage 59 additional facilities including 54 facilities that are currently under construction. In addition, we sell merchandise, primarily locks and cardboard boxes at our self-storage facilities.

We hold a 41% equity interest in PS Business Parks, Inc. (“PSB”) and a 35% interest in Shurgard Self Storage SA (“Shurgard”). PSB is a publicly held REIT traded on the NYSE under the "PSB" symbol that owns, operates, acquires and develops commercial properties, primarily multi-tenant flex, office, and industrial parks. At December 31, 2021, PSB owned and operated 28 million rentable square feet of commercial space. Shurgard is a public company traded on Euronext Brussels under the “SHUR” symbol. At December 31, 2021, Shurgard owned and operated 253 self-storage facilities (14 million net rentable square feet) located in seven countries in Western Europe under the Shurgard® name.

For all periods presented herein, we have elected to be treated as a REIT, as defined in the Internal Revenue Code of 1986, as amended (the “Code”). For each taxable year in which we qualify for taxation as a REIT, we will not be subject to U.S. federal corporate income tax on our “REIT taxable income” (generally, taxable income subject to specified adjustments, including a deduction for dividends paid and excluding our net capital gain) that is distributed to our shareholders. We believe we met these requirements in all periods presented herein and we expect to continue to qualify as a REIT.

We report annually to the SEC on Form 10-K, which includes consolidated financial statements certified by our independent registered public accountants. We also report quarterly to the SEC on Form 10-Q, which includes unaudited consolidated financial statements. We expect to continue such reporting.

On our website, www.publicstorage.com, we make available, free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, definitive proxy statements, and other reports required to be filed with the SEC, as well as all amendments to those reports as soon as reasonably practicable after the reports and amendments are electronically filed with or furnished to the SEC. The information contained on our website is not a part of, or incorporated by reference into, this Annual Report on Form 10-K.

Competition

Ownership and operation of self-storage facilities is highly fragmented. As the largest owner of self-storage facilities, we believe that we own approximately 9% of the self-storage square footage in the U.S. and that collectively the five largest self-storage owners in the U.S. own approximately 19%, with the remaining 81% owned by regional and local operators. We believe our Public Storage® brand awareness is a competitive advantage in acquiring customers relative to other self-storage operators.

The high level of ownership fragmentation in the industry is partially attributable to the relative simplicity of managing a local self-storage facility, such that small-scale owners can operate self-storage facilities at a basic level of profitability without significant managerial or operational infrastructure. Our facilities compete with nearby self-storage facilities owned by other operators using marketing channels, including Internet advertising, signage, and banners and offering services similar to ours. As a result, competition is significant and affects the occupancy levels, rental rates, rental income and operating expenses of our facilities. However, we believe that the economies of scale inherent in this business result in our being able to operate self-storage facilities at a materially higher level of cash flow per square foot than other operators without our scale.

Technology

We believe technology enables revenue optimization and cost efficiencies. Over the past few years we have invested in technologies that we believe have enabled us to operate and compete more effectively by providing customers with a modern digital experience.

Convenient shopping experience: Customers can conveniently shop for available storage space, reviewing attributes such as facility location, size, amenities such as climate-control, as well as pricing, through the following marketing channels:

•Our Desktop and Mobile Websites: The online marketing channel is a key source of customers. Approximately 76% of our move-ins in 2021 were sourced through our website and we believe that many of our other customers who reserved directly through our customer care center or arrived at a facility and

moved in without a reservation, have reviewed our pricing and availability online through our websites. We seek to regularly update the structure, layout, and content of our website in order to enhance our placement in “unpaid” search in Google and related websites, to improve the efficiency of our bids in “paid” search campaigns, and to maximize users’ likelihood of reserving space on our website.

•Our Customer Care Center: Our customer care center is staffed by skilled sales specialists and customer service representatives. Customers reach our customer care center by calling our advertised toll-free telephone numbers provided on search engines, from our website, the Public Storage App, or from our in-store kiosks. We believe giving customers the option to interact with a live agent, despite the higher marginal cost relative to a reservation made on our website, enhances our ability to close sales with potential customers and results in greater satisfaction. In 2021, we added live internet chat capability as another channel for our customers to engage our agents, cost effectively improving customer responsiveness.

•Our Properties: Customers can also shop at any one of our facilities. Property managers access the same information that is available on our website and to our customer care center agents and can inform the customer of available space at that site or at our other nearby storage facilities. Property managers are trained to maximize the conversion of such “walk in” shoppers into customers. We are expanding the use of in-store kiosks to give customers the options of a full self-service experience or a two-way video assisted service via our existing customer care center.

eRental® move-in process: To further enhance the move-in experience, in 2020 we initiated our “eRental®” process whereby prospective tenants (including those who initially reserved a space) are able to execute their rental agreement from their smartphone or computer and then go directly to their space on the move-in date. Approximately half of customers elected this “eRental®” process during 2021.

Public Storage App: During the fourth quarter of 2020, we implemented an industry leading customer smartphone application. The Public Storage App provides our customers with digital access to our properties, as well as payment and other account management functions.

Centralized information networks: Our centralized reporting and information network enables us to identify changing market conditions and operating trends as well as analyze customer data and, on an automated basis, quickly change each of our individual property’s pricing and promotions, as well as to drive marketing spending such as the relative level of bidding for various paid search terms on paid search engines.

Growth and Investment Strategies

Our ongoing growth strategies consist of: (i) improving the operating performance of our existing self-storage facilities, (ii) acquiring and developing facilities and (iii) growing ancillary business activities including tenant reinsurance and third-party management services. While our long-term strategy includes each of these elements, in the short run the level of growth in our asset base in any period is dependent upon the cost and availability of capital, as well as the relative attractiveness of available investment alternatives.

Improve the operating performance of existing facilities: We regularly update and enhance our strategies to increase the net cash flow of our existing self-storage facilities through maximizing revenues and controlling operating costs. We maximize revenues through striking the appropriate balance between occupancy and rates to new and existing tenants by regularly adjusting (i) our promotional and other discounts, (ii) the rental rates we charge to new and existing customers, and (iii) our marketing spending and intensity. We inform these pricing and marketing decisions by observing their impact on web and customer care center traffic, reservations, move-ins, move-outs, tenant length of stay, and other indicators of response. The size and scope of our operations have enabled us to achieve high operating margins and a low level of administrative costs relative to revenues through the centralization of many functions, such as facility maintenance, employee compensation and benefits programs, revenue management, as well as the development and documentation of standardized operating procedures.

Acquire existing properties: We seek to capitalize on the fragmentation of the self-storage business through acquiring attractively priced, well-located existing self-storage facilities. We believe our presence in and knowledge of substantially all of the major markets in the U.S. enhances our ability to identify attractive acquisition opportunities. Data on the rental rates and occupancy levels of our existing facilities provide us an advantage in evaluating the potential of

acquisition opportunities. Our aggressiveness in bidding for particular marketed facilities depends upon many factors including the potential for future growth, the quality of construction and location, the cash flow we expect from the facility when operated on our platform, how well the facility fits into our current geographic footprint, as well as our return on capital expectations.

Develop new self-storage facilities and expand existing facilities: The development of new self-storage locations and the expansion of existing facilities has been an important source of our growth. Our operating experience in major markets and experience in stabilizing new properties provides us advantages in developing new facilities. We plan to increase our development activity when attractive risk adjusted return profile with yields above those of acquisitions. However, our level of development is dependent upon many factors, including the cost and availability of land, the cost and availability of construction materials and labor, zoning and permitting limitations, our cost of capital, the cost of acquiring facilities relative to developing new facilities, as well as local demand and economic conditions.

Grow ancillary business activities: We pursue growth initiatives aimed at increasing our insurance offering coverage for tenants who choose to protect their stored items against loss and desire to maximize their storage experience. As we grow our self-storage portfolio we have the opportunity to increase the growth profile of our tenant reinsurance business.

Our third party management business enables us to generate revenues through management fees, expand our presence, increase our economies of scale, promote our brand, and enhance our ability to acquire additional facilities over the medium and long-term as a result of strategic relationships forged with third-party owners.

Compliance with Government Regulations

We are subject to various laws, ordinances and regulations, including various federal, state and local regulations that apply generally to the ownership of real property and the operation of self-storage properties. These include various laws and government regulations concerning environmental matters, labor matters and employee safety and health matters. Further, our insurance activities are subject to state insurance laws and regulations as determined by the particular insurance commissioner for each state in accordance with certain federal regulations.

Refer to Item 1A, “Risk Factors” below for a discussion of certain risks related to government regulations, including risks related to environmental regulations, emergency regulations adopted in response to the COVID Pandemic or wildfires that restrict access to our facilities or the rents we can charge our customers, wage regulations, income tax regulations including relating to REIT qualification, and property tax regulations.

Aside from the regulations discussed therein, we are not aware of any government regulations that have resulted or that we expect will result in compliance costs that had or will have a material effect on our capital expenditures, earnings or competitive position. We are committed to a long-term environmental stewardship program that reduces emissions of hazardous materials into the environment and the remediation of identified existing environmental concerns, including environmentally-friendly capital initiatives and building and operating properties with a high structural resilience and low obsolescence. We accrue environmental assessments and estimated remediation costs when it is probable that such efforts will be required and the related costs can be reasonably estimated. Our current practice is to conduct environmental investigations in connection with property acquisitions. Although there can be no assurance, we are not aware of any environmental contamination of any of our facilities, which individually or in the aggregate would be material to our overall business, financial condition, or results of operations.

Human Capital Resources

Our employees are the foundation of our business and fundamental to our ability to execute our corporate strategies and build long-term value for our stakeholders. In order to maintain a strong foundation, our key human capital management objectives are to attract, develop, and retain the highest quality talent. We achieve these objectives by committing to our employees to provide a diverse and inclusive workplace, regular and open communication, competitive and supportive compensation and benefits programs, and opportunities for career growth and development. Together with our core values of doing the right thing and integrity in all that we do, which serve as the cornerstone of our corporate culture, we believe that this commitment facilitates employee engagement and their commitment to Public Storage. While most of our employees join without experience in the self-storage industry, many find career success with us given our emphasis on training, development, and promotion from within.

We have approximately 5,800 employees, including 5,060 customer facing roles (such as property level and customer care center personnel), 340 field management employees, and 400 employees in our corporate operations.

The following is an overview of our key programs and initiatives focused on attracting, developing, and retaining the highest quality talent:

Diversity and Inclusion

We are committed to creating a diverse and inclusive environment where all employees feel valued, included, and excited to be part of a best-in-class team. Our employees come from all different races, backgrounds, and life experiences, and we celebrate inclusion and value the diversity each person brings to Public Storage. Our commitment to diversity and inclusion transcends the organization and drives everything we do, from the people we hire, to the business decisions we make.

In 2021, our Chief Executive Officer signed the CEO Action for Diversity & Inclusion pledge, reflecting our commitment to foster an environment where everyone feels valued, included, engaged, and excited to be part of our best-in-class team. We began implementing the pledge throughout the year, including with unconscious bias training for our leaders and various listening and learning programs for all employees directed at raising diversity awareness and encouraging honest and open discussions.

Public Storage hires based on character, skills, and experience, without regard to age, gender, race, ethnicity, religion, sexual orientation, or other protected characteristic. Adherence to this practice has resulted in a diverse and inclusive employee base that reflects the diversity of customers we serve. We maintain policies regarding diversity, equal opportunity, pay-for-performance, discrimination, harassment, and labor (including opposition to child, forced, and compulsory labor). In 2021, we also formalized into policy our long-standing practice of requiring that diverse candidate slates be considered for all director positions and above.

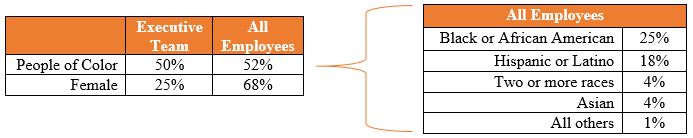

Our long-held practice of hiring “the best” has fostered a diverse and inclusive workforce that represents the communities in which we operate. Our commitment to diversity is evident at all levels of the organization. Additionally, by having a balanced mix of generations in the organization, we gain from the experiences each age group brings – our employees are 10% Boomer, 37% Gen X, 38% Gen Y and 15% Gen Z.

Communication and Engagement

Given the geographically dispersed nature of our business, regular and clear communication is critical to ensuring that employees feel informed, included, and engaged. We communicate through various channels, such as monthly meetings, frequent email communications and updates from our management team, company intranet postings, engagement surveys, and monthly newsletters. Our monthly newsletter is fundamental to our communication and engagement efforts. It contains a CEO message, recognizes employee achievements and promotions, and provides company strategy and performance updates, health and wellness tips, and other pertinent information.

In order to better understand the effectiveness of our engagement strategies, we conduct various surveys that measure employee commitment, motivation, and engagement, and solicit employee feedback that helps us improve. In the first quarter of 2021, we conducted our first formal full employee engagement survey, which we followed with a “pulse check” update in the fourth quarter. We were pleased to see employee engagement increase 3% over this period, from 76% in the first quarter to 79% in the fourth quarter of 2021. We believe these results were driven by the enhanced commitment to providing career development opportunities that we introduced during the year, which we discuss further below under “Training, Development, Growth and Recognition.” We intend to complete a full engagement survey followed by an interim pulse check update to monitor our performance each year.

We believe that the success of our engagement strategies can also be seen through third party surveys and recognition, such as our placement on the Forbes 2022 list of best employers.

Compensation, Health and Wellness

Public Storage maintains compensation and benefits programs designed to incentivize, reward, and support our employees. We believe in aligning employee compensation with our short- and long-term performance goals and providing the compensation and incentives needed to attract, motivate, and retain employees who are crucial to our success. We tailor our compensation programs to each employee group to ensure competitiveness in the market and to drive employee engagement.

We are committed to the total well-being of all our employees and provide resources to help support them in times of need along with access to targeted solutions to help them achieve their personal and financial goals. We provide affordable health plans and programs to virtually all our employees (99.5%). Anyone working 20 hours or more is eligible to participate in our health benefit offerings, which include medical, dental, vision, flexible and health savings accounts, discount programs, and income protection plans. We also offer a 401(k) plan with generous matching employer contributions to help our employees prepare for retirement. In addition to these programs, we maintain various employee support programs, including access to counseling, life planning tools, and discount programs for fitness, legal services, and home, auto, and pet insurance. Finally, we offer a range of educational tools and resources, including a dedicated health and wellness website, to help empower our employees to maintain a healthy and balanced lifestyle.

Training, Development, Growth, and Recognition

We provide training and development programs across all levels of Public Storage. All new hires in our field and customer care center operations complete robust training programs designed to help them quickly learn and operate in the self-storage business. This includes hands-on training with a key training professional (“KTP”) in coordination with close coaching and development from a district manager, which has our newly onboarded teammates ready to manage a property in their first two weeks. In addition, all new hires in leadership roles complete property-level training that gives them a hands-on view of our day-to-day operations at our properties. This training helps facilitate engagement across all levels of the Company and is designed to provide our leaders with an understanding of the fundamentals of our business and operations, including the challenges our front-line employees face and our customers’ needs and expectations.

Most new hires join us as property managers without any experience in the self-storage industry. In 2021, we enhanced our commitment to providing career development opportunities across Public Storage. We have multiple career path opportunities for our property teams, and many choose to grow their entire career with us while learning new skills and taking on additional responsibility. Some choose to focus on developing people as a KTP, others desire to learn multi-unit property management and local compliance requirements as a delinquent tenant specialist, and many want to build their career around ensuring our customers receive the best possible service as part of our customer care center. For those who enjoy the challenges that come with managing multi-unit portfolios and people, we offer our District Manager in Training program, which prepares some of our best teammates to become successful district managers with Public Storage through a three-month development program that includes online courses and partnership with a peer trainer and mentor. We also maintain a six-month development program to develop senior district managers.

In addition to these structured programs, we also offer ongoing training, development, and leadership programs for our entire workforce designed to facilitate professional growth and career advancement. Many of these programs leverage our online learning platform of training courses and reference materials. Public Storage employees completed 440,000 formal training hours in 2021, up from 367,000 in 2020. Our leadership development programs bring together senior leaders and leaders-in-training to teach management skills and strategies and ensure our new leaders have a clear understanding of their role, a strong bond with their peers, and an expanded professional network. In addition to formal training programs, we also offer a variety of one-on-one coaching, job shadowing, and mentoring programs.

Our online training and development platform also allows us to reinforce our culture of ongoing recognition by providing a means to show appreciation to others across all levels of the business by awarding employee recognition badges such as the team player or appreciation badges. Over 78,000 badges were awarded in 2021, 46% more than in 2020.

Performance Management and Succession Planning

Our performance management processes are designed to be collaborative, where employees and management work together to plan, monitor and review the employee’s objectives and career aspirations, and set short- and long-term goals to achieve outcomes. This process is continual, with regular opportunities for management and employees to give and receive feedback. We believe every employee should know where they stand and how they can be successful in their career at Public Storage.

Succession planning is a top priority for management and our Board of Trustees (our "Board") to ensure business continuity. Leaders at all levels review development opportunities, provide feedback, and facilitate career progression conversations on an ongoing basis to ensure that employees can reach their full potential. No less than annually, the executive teams meet to review succession bench strength, calibrate talent, and provide recommendations to prepare succession candidates for future leadership roles within the organization. This broad and collaborative approach to talent management works to ensure opportunities are made available to employees to grow outside of their current function and responsibilities.

Our People Power our Brand

Every day, our teammates deliver the Public Storage brand and experience to our customers through countless personal interactions. While we enthusiastically celebrate our ability to bring self-storage solutions to our customers where and how they are needed, we recognize that our most important asset in doing so is our people behind the orange door.

Climate Change and Environmental Stewardship

We are committed to managing climate-related risks and opportunities. This commitment is a key component of our recognition that we must operate in a responsible and sustainable manner that aligns with our long-term corporate strategy and promotes our best interests along with those of our stakeholders, including our customers, investors, employees, and the communities in which we do business.

Our management Environmental, Social, and Governance Steering Committee (our “Sustainability Committee”) guides our commitment to sustainability and has primary responsibility for climate-related activities. The Sustainability Committee reports directly to the Nominating, Governance, and Sustainability Committee of our Board, which oversees all of our sustainability initiatives.

We consider potential environmental impacts—both positive and negative—into our decision making across the business. The following features of our properties reflect our commitment to responsible environmental stewardship:

- Low environmental impact. Our property portfolio has an inherently light footprint that we further reduce through environmentally friendly capital initiatives.

- Low obsolescence. Our properties have retained functional and physical usefulness over many decades. In fact, many customers favor our single-story, drive-up properties built in the 1970s and 1980s due to their central locations and accessibility. This contrasts with other real estate types that require frequent reinvestment (i.e., capital expenditures) to stay current with consumer preference, remain competitive with newer competition, offset heavier wear-and-tear by users, and maintain structural operating efficiency.

- High structural resilience. We build and operate our properties to withstand the test of time, including general aging and acute and chronic risks from rising water levels, changing temperatures, and natural disasters.

We measure and monitor our environmental impact and leverage sustainability measures to reduce this impact while achieving cost efficiencies in our operations by implementing a range of energy, water, and waste management initiatives. Many of these initiatives are integrated into our ongoing Property of Tomorrow capital investment program.

In regard to climate, we assess risks and opportunities in conjunction with ongoing operating and risk management processes across the company. We give primary consideration to physical, regulatory, legal, market, and reputational risks. Examples of these risks include natural disasters, pandemics, temperature change, rising water levels, and regulatory compliance. The risks we are more commonly exposed to and seek to mitigate include flooding and storm damage in the southern and eastern United States and wildfires in the western United States. We actively engage in

identifying and acting upon the opportunities associated with these risks including LED lighting, solar power generation, low-water-use landscaping, and enhancing our broader enterprise risk management framework.

We will continue to utilize our unique competitive advantages in furthering our environmental stewardship. Moreover, we are committed to improving our climate initiatives and long-term sustainability strategies, including:

•proactively evaluating our building prototype and design standards for opportunities to further reduce our environmental impact, including an effort underway to refine our green building implementation strategy in conjunction with U.S. Green Building Council through LEED© certification;

•prioritizing our understanding of Paris Climate Agreement and the potential paths towards a carbon neutral future; and

•evaluating the feasibility of instituting medium and/or long-term greenhouse gas emissions reduction targets or other climate-focus targets to encourage or increase adoption of renewable energy or energy efficiency measures.

Our annual Sustainability Report, which details our commitment to environmental stewardship along with our results, performance and progress, is accessible on our website at www.publicstorage.com.

Seasonality

We experience minor seasonal fluctuations in the demand for self-storage space, with demand and rental rates generally higher in the summer months than in the winter months. We believe that these fluctuations result in part from increased moving activity during the summer months.

ITEM 1A. Risk Factors

In addition to the other information in our Annual Report on Form 10-K, you should consider the risks described below that we believe may be material to investors in evaluating the Company. This section contains forward-looking statements, and in considering these statements, you should refer to the qualifications and limitations on our forward-looking statements that are described in Item 1, “Business.”

Risks Related to Our Business

We have significant exposure to real estate risk.

Since our business consists primarily of acquiring, developing, and operating real estate, we are subject to risks related to the ownership and operation of real estate that could result in reduced revenues, increased expenses, increased capital expenditures, or increased borrowings, which could negatively impact our operating results, cash flow available for distribution or reinvestment, and our stock price, including:

Natural disasters or terrorist attacks could cause damage to our facilities, resulting in increased costs and reduced revenues. Natural disasters, such as earthquakes, fires, hurricanes and floods, or terrorist attacks could cause significant damage to our facilities and require significant repair costs, and make facilities temporarily uninhabitable, thereby reducing our revenues. Damage and business interruption losses could exceed the aggregate limits of our insurance coverage. In addition, because we self-insure a portion of our risks, losses below a certain level may not be covered by insurance. See Note 14 to our December 31, 2021 consolidated financial statements for a description of the risks of losses that are not covered by third-party insurance contracts. We may not have sufficient insurance coverage for losses caused by a terrorist attack, or such insurance may not be maintained, available or cost-effective. In addition, significant natural disasters, terrorist attacks, threats of future terrorist attacks, or resulting wider armed conflicts could have negative impacts on self-storage demand and/or our revenues.

Consequences of climate change, including severe weather events, and the steps taken to prevent climate change, could result in increased capital expenditures, increased expenses, and reduced revenues: Direct and indirect impacts of climate change, such as increased destructive weather events, floods, fires, and drought could result in significant damage to our self-storage facilities, increase our costs, or reduce demand for our self-storage facilities. Consistent with our commitment to sustainability in our business operations, we have undertaken a number of initiatives to reduce emissions and energy consumption, water usage, and waste, including through our Property of Tomorrow program, pursuant to which we are upgrading all of our older properties by the end of 2025, which has already resulted in investment of approximately

$230 million in improvements through December 31, 2021. Governmental, political, and societal pressure, including expectations of institutional and activist investors and other interest groups, could require us to accelerate our initiatives and, with it, the costs of their implementation. These same potential governmental, political, and social pressure could in the future result in (i) costly changes to newly developed facilities or retrofits of our existing facilities to reduce carbon emissions through multiple avenues, including changes to insulation, space configuration, lighting, heating, and air conditioning, (ii) increased energy costs as a result of transitioning to less carbon-intensive, but more expensive, sources of energy to operate our facilities, and (iii) consumers reducing their individual carbon footprints by owning fewer durable material consumer goods, collectibles, and other such items requiring storage, resulting in a reduced demand for our self-storage space.

Operating costs, including property taxes, could increase. We could be subject to increases in insurance premiums, property or other taxes, repair and maintenance costs, payroll, utility costs, workers compensation, and other operating expenses due to various factors such as inflation, labor shortages, commodity and energy price increases, weather, increases to minimum wage rates, changes to governmental safety and real estate use limitations, as well as other governmental actions. Our property tax expense, which totaled approximately $335.1 million during the year ended December 31, 2021, generally depends upon the assessed value of our real estate facilities as determined by assessors and government agencies, and accordingly could be subject to substantial increases if such agencies changed their valuation approaches or opinions or if new laws are enacted, especially if new approaches are adopted or laws are enacted that result in increased property tax assessments in states or geographies where we have a high concentration of facilities. See also “We have exposure to increased property tax in California” below.

The acquisition of existing properties or self-storage operating companies is subject to risks that may adversely affect our growth and financial results. We have acquired self-storage facilities from third parties in the past, and we expect to continue to do so in the future. We face significant competition for suitable acquisition properties from other real estate investors. As a result, we may be unable to acquire additional properties we desire or the purchase price for desirable properties may be significantly increased. Failures or unexpected circumstances in integrating facilities that we acquire directly or via the acquisition of operating companies into our operations, or circumstances we did not detect or anticipate during due diligence, such as environmental matters, needed repairs or deferred maintenance, customer collection issues, assumed liabilities, turnover of critical personnel involved in acquired operating companies, or the effects of increased property tax following reassessment of a newly-acquired property, as well as the general risks of real estate investment and mergers and acquisitions, could jeopardize realization of the anticipated earnings from an acquisition.

Development of self-storage facilities can subject us to risks. At December 31, 2021, we had a pipeline of development projects totaling $800.0 million (subject to contingencies), and we expect to continue to seek additional development projects. There are significant risks involved in developing self-storage facilities, such as delays or cost increases due to changes in or failure to meet government or regulatory requirements, failure of revenue to meet our underwriting estimates, delays caused by weather issues, unforeseen site conditions, or personnel problems. Self-storage space is generally not pre-leased, and rent-up of newly developed space can be delayed or ongoing cash flow yields can be reduced due to competition, reductions in storage demand, or other factors.

There is significant competition among self-storage operators and from other storage alternatives. Our self-storage facilities generate most of our revenue and earnings. Significant competition from self-storage operators, property developers, and other storage alternatives may adversely impact our ability to attract and retain customers and may negatively impact our ability to generate revenue. Competition in the local market areas in which many of our properties are located is significant and has affected our occupancy levels, rental rates, and operating expenses. There is also an increasing influx of capital from outside financing sources driving more money, development, and supply into the industry. Development of self-storage facilities has increased in recent years, which has intensified competition and will continue to do so as newly developed facilities are opened. Development of self-storage facilities by other operators could continue to increase, due to increases in availability of funds for investment or other reasons, and further intensify competition.

Demand for self-storage facilities may be affected by customer perceptions and factors outside of our control. Significantly lower logistics costs could introduce new competitors such as valet-style storage services, which may reduce the demand for traditional self-storage. Customer preferences and/or needs for self-storage could change, decline, or shift to other product types thereby impacting our business model and ability to grow and/or generate revenues. Shifts in population and demographics could cause the geographical distribution of our portfolio to be suboptimal and affect our ability to maintain occupancy and attract new customers. Security incidents could result in the perception that our properties are not safe. If our customers do not feel our properties are safe, they may select competitors for their self-

storage needs, or if there is an industry perception of inadequate security generally, customer use of self-storage could be negatively impacted.

Our newly developed and expanded facilities, and facilities that we manage for third party owners, may negatively impact the revenues of our existing facilities. We continue to develop new self-storage facilities and expand our existing self-storage facilities. In addition, we are seeking to increase the number of self-storage facilities that we manage for third party owners in exchange for a fee, many of which are in the process of stabilization and are in proximity to our existing stabilized self-storage facilities. In order to hasten the fill-up of these new facilities, we aggressively price such space during the fill-up period. While we believe that this aggressive pricing allows us to increase our market share relative to our competitors and increase the cash flows of these properties, such pricing and the added capacity may also negatively impact our existing stabilized self-storage facilities that are in proximity to these unstabilized facilities.

Many of our existing self-storage facilities may be at a competitive disadvantage to newly developed facilities. There is a significant level of development of new self-storage facilities, by us and other operators. These newly developed facilities are generally of high quality, with a more fresh and vibrant appearance, more amenities such as climate control, more attractive office configurations, newer elements, and a more attractive retail presence as compared to many of our existing stabilized self-storage facilities, some of which were built as much as 50 years ago. Such qualitative differentials may negatively impact our ability to compete with these facilities for new tenants and our existing tenants may move to newly developed facilities.

We may incur significant liabilities from environmental contamination or moisture infiltration. Existing or future laws impose or may impose liability on us to clean up environmental contamination on or around properties that we currently or previously owned or operated, even if we were not responsible for or aware of the environmental contamination or even if such environmental contamination occurred prior to our involvement with the property. We have conducted preliminary environmental assessments on most of our properties, which have not identified any material liabilities. These assessments, commonly referred to as “Phase 1 Environmental Assessments,” include an investigation (excluding soil or groundwater sampling or analysis) and a review of publicly available information regarding the site and other nearby properties.

We are also subject to potential liability relating to moisture infiltration, which can result in mold or other damage to our or our customers’ property, as well as potential health concerns. When we receive a complaint or otherwise become aware that an air quality concern exists, we implement corrective measures and seek to work proactively with our customers to resolve issues, subject to our contractual limitations on liability for such claims.