00013769869/30X12023Q1False—00013769862022-10-012022-12-3100013769862022-12-31xbrli:sharesiso4217:USD00013769862022-09-300001376986tve:PowerProgramAppropriationInvestmentMember2022-09-300001376986tve:PowerProgramRetainedEarningsMember2022-09-300001376986tve:NonpowerProgramsAppropriationInvestmentNetMember2022-09-300001376986us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-3000013769862021-10-012021-12-310001376986us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-012022-12-3100013769862021-09-3000013769862021-12-310001376986tve:PowerProgramAppropriationInvestmentMember2021-09-300001376986tve:PowerProgramRetainedEarningsMember2021-09-300001376986tve:NonpowerProgramsAppropriationInvestmentNetMember2021-09-300001376986us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-09-300001376986tve:PowerProgramAppropriationInvestmentMember2021-10-012021-12-310001376986tve:PowerProgramRetainedEarningsMember2021-10-012021-12-310001376986tve:NonpowerProgramsAppropriationInvestmentNetMember2021-10-012021-12-310001376986us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-10-012021-12-310001376986tve:PowerProgramAppropriationInvestmentMember2021-12-310001376986tve:PowerProgramRetainedEarningsMember2021-12-310001376986tve:NonpowerProgramsAppropriationInvestmentNetMember2021-12-310001376986us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001376986tve:PowerProgramAppropriationInvestmentMember2022-10-012022-12-310001376986tve:PowerProgramRetainedEarningsMember2022-10-012022-12-310001376986tve:NonpowerProgramsAppropriationInvestmentNetMember2022-10-012022-12-310001376986tve:PowerProgramAppropriationInvestmentMember2022-12-310001376986tve:PowerProgramRetainedEarningsMember2022-12-310001376986tve:NonpowerProgramsAppropriationInvestmentNetMember2022-12-310001376986us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-31tve:People0001376986us-gaap:PortionAtOtherThanFairValueFairValueDisclosureMember2022-12-310001376986us-gaap:PortionAtOtherThanFairValueFairValueDisclosureMember2022-09-300001376986us-gaap:CommodityContractMemberus-gaap:OtherCurrentAssetsMember2022-12-310001376986us-gaap:CommodityContractMemberus-gaap:OtherCurrentAssetsMember2022-09-3000013769862019-04-012021-03-310001376986us-gaap:OtherNoncurrentAssetsMember2022-12-310001376986us-gaap:OtherNoncurrentAssetsMember2022-09-300001376986us-gaap:OtherNoncurrentAssetsMember2022-12-310001376986us-gaap:OtherNoncurrentAssetsMember2022-09-300001376986tve:EnergyRightMembersrt:MinimumMember2022-10-012022-12-310001376986tve:EnergyRightMembersrt:MaximumMember2022-10-012022-12-310001376986tve:EnergyRightMember2022-10-012022-12-310001376986us-gaap:AccountsReceivableMember2022-12-310001376986us-gaap:AccountsReceivableMember2022-09-300001376986tve:EnergyRightLoanReserveMember2022-12-310001376986tve:EnergyRightLoanReserveMember2022-09-300001376986tve:EconomicDevelopmentLoanCollectiveReserveMember2022-12-310001376986tve:EconomicDevelopmentLoanCollectiveReserveMember2022-09-300001376986tve:EconomicDevelopmentLoanSpecificLoanReserveMember2022-12-310001376986tve:EconomicDevelopmentLoanSpecificLoanReserveMember2022-09-300001376986tve:UnrealizedLossesOnInterestRateDerivativesMember2022-12-310001376986tve:UnrealizedLossesOnInterestRateDerivativesMember2022-09-300001376986us-gaap:DeferredDerivativeGainLossMember2022-12-310001376986us-gaap:DeferredDerivativeGainLossMember2022-09-300001376986us-gaap:DeferredFuelCostsMember2022-12-310001376986us-gaap:DeferredFuelCostsMember2022-09-300001376986us-gaap:PensionCostsMember2022-12-310001376986us-gaap:PensionCostsMember2022-09-300001376986tve:NonNuclearDecommissioningMember2022-12-310001376986tve:NonNuclearDecommissioningMember2022-09-300001376986tve:NuclearDesommissioningCostsMember2022-12-310001376986tve:NuclearDesommissioningCostsMember2022-09-300001376986tve:OtherNonCurrentRegulatoryAssetsMember2022-12-310001376986tve:OtherNonCurrentRegulatoryAssetsMember2022-09-300001376986us-gaap:DeferredIncomeTaxChargesMember2022-12-310001376986us-gaap:DeferredIncomeTaxChargesMember2022-09-300001376986us-gaap:DeferredDerivativeGainLossMember2022-12-310001376986us-gaap:DeferredDerivativeGainLossMember2022-09-300001376986us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2012-09-300001376986tve:JsccgMember2012-09-300001376986tve:HoldcoMember2012-09-300001376986tve:SCCGMember2013-09-3000013769862013-09-30xbrli:pure0001376986us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-12-310001376986us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-09-300001376986us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-10-012022-12-310001376986us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-10-012021-12-310001376986us-gaap:OtherNoncurrentLiabilitiesMember2022-12-310001376986us-gaap:OtherNoncurrentLiabilitiesMember2022-09-300001376986us-gaap:AccountsPayableAndAccruedLiabilitiesMember2022-12-310001376986us-gaap:AccountsPayableAndAccruedLiabilitiesMember2022-09-300001376986tve:OperatingLeaseLiabilityMember2022-12-310001376986tve:OperatingLeaseLiabilityMember2022-09-300001376986us-gaap:OtherCurrentLiabilitiesMember2022-12-310001376986us-gaap:OtherCurrentLiabilitiesMember2022-09-300001376986tve:NuclearMember2022-09-300001376986tve:NonNuclearMember2022-09-300001376986tve:NuclearMember2022-10-012022-12-310001376986tve:NonNuclearMember2022-10-012022-12-310001376986tve:NuclearMember2022-12-310001376986tve:NonNuclearMember2022-12-310001376986us-gaap:AccountsPayableAndAccruedLiabilitiesMember2022-10-012022-12-310001376986tve:A2009SeriesBMember2022-10-012022-12-310001376986us-gaap:RevolvingCreditFacilityMember2022-12-31tve:Credit_facilities0001376986us-gaap:LetterOfCreditMember2022-12-310001376986us-gaap:LetterOfCreditMember2022-09-300001376986us-gaap:LineOfCreditMember2022-12-310001376986tve:KemperLagoonCreekLeaseholdInterestsMember2022-09-300001376986tve:KemperLagoonCreekLeaseholdInterestsMember2022-10-012022-12-310001376986tve:LagoonCreekMember2022-10-012022-12-310001376986tve:LagoonCreekMember2022-10-012022-12-310001376986tve:LagoonCreekMembersrt:ScenarioForecastMember2022-10-012023-09-300001376986tve:LagoonCreekMembersrt:ScenarioForecastMember2023-10-012024-09-300001376986us-gaap:InterestRateSwapMember2022-10-012022-12-310001376986us-gaap:InterestRateSwapMember2021-10-012021-12-310001376986tve:CommodityContractUnderFHPMember2022-10-012022-12-310001376986tve:CommodityContractUnderFHPMember2021-10-012021-12-310001376986tve:A250MillionSterlingCurrencySwapMember2022-12-310001376986tve:A250MillionSterlingCurrencySwapMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMember2022-12-310001376986us-gaap:OtherNoncurrentLiabilitiesMembertve:A250MillionSterlingCurrencySwapMember2022-12-310001376986tve:A250MillionSterlingCurrencySwapMember2022-09-300001376986tve:A250MillionSterlingCurrencySwapMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMember2022-09-300001376986us-gaap:OtherNoncurrentLiabilitiesMembertve:A250MillionSterlingCurrencySwapMember2022-09-300001376986tve:A150MillionSterlingCurrencySwapMember2022-12-310001376986tve:A150MillionSterlingCurrencySwapMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMember2022-12-310001376986us-gaap:OtherNoncurrentLiabilitiesMembertve:A150MillionSterlingCurrencySwapMember2022-12-310001376986tve:A150MillionSterlingCurrencySwapMember2022-09-300001376986tve:A150MillionSterlingCurrencySwapMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMember2022-09-300001376986us-gaap:OtherNoncurrentLiabilitiesMembertve:A150MillionSterlingCurrencySwapMember2022-09-300001376986tve:A10BillionNotionalInterestRateSwapMember2022-12-310001376986us-gaap:AccountsPayableAndAccruedLiabilitiesMembertve:A10BillionNotionalInterestRateSwapMember2022-12-310001376986tve:InterestPayableCurrentMembertve:A10BillionNotionalInterestRateSwapMember2022-12-310001376986us-gaap:OtherNoncurrentLiabilitiesMembertve:A10BillionNotionalInterestRateSwapMember2022-12-310001376986tve:A10BillionNotionalInterestRateSwapMember2022-09-300001376986us-gaap:AccountsPayableAndAccruedLiabilitiesMembertve:A10BillionNotionalInterestRateSwapMember2022-09-300001376986tve:InterestPayableCurrentMembertve:A10BillionNotionalInterestRateSwapMember2022-09-300001376986us-gaap:OtherNoncurrentLiabilitiesMembertve:A10BillionNotionalInterestRateSwapMember2022-09-300001376986us-gaap:InterestRateSwapMember2022-12-310001376986us-gaap:InterestRateSwapMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMember2022-12-310001376986us-gaap:InterestRateSwapMemberus-gaap:OtherNoncurrentLiabilitiesMember2022-12-310001376986us-gaap:InterestRateSwapMember2022-09-300001376986us-gaap:InterestRateSwapMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMember2022-09-300001376986tve:InterestPayableCurrentMemberus-gaap:InterestRateSwapMember2022-09-300001376986us-gaap:InterestRateSwapMemberus-gaap:OtherNoncurrentLiabilitiesMember2022-09-300001376986us-gaap:CommodityContractMember2022-12-310001376986us-gaap:CommodityContractMemberus-gaap:OtherNoncurrentAssetsMember2022-12-310001376986us-gaap:CommodityContractMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMember2022-12-310001376986us-gaap:CommodityContractMemberus-gaap:OtherNoncurrentLiabilitiesMember2022-12-310001376986us-gaap:CommodityContractMember2022-09-300001376986tve:CommodityContractNotUnderFHPMemberus-gaap:OtherCurrentAssetsMember2022-09-300001376986us-gaap:CommodityContractMemberus-gaap:OtherNoncurrentAssetsMember2022-09-300001376986us-gaap:CommodityContractMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMember2022-09-300001376986us-gaap:CommodityContractMemberus-gaap:OtherNoncurrentLiabilitiesMember2022-09-300001376986tve:CommodityContractUnderFHPMember2022-12-310001376986us-gaap:OtherNoncurrentAssetsMembertve:CommodityContractUnderFHPMember2022-12-310001376986tve:CommodityContractUnderFHPMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMember2022-12-310001376986us-gaap:OtherNoncurrentLiabilitiesMembertve:CommodityContractUnderFHPMember2022-12-310001376986tve:CommodityContractUnderFHPMember2022-09-300001376986us-gaap:AccountsReceivableMembertve:CommodityContractUnderFHPMember2022-09-300001376986us-gaap:OtherCurrentAssetsMembertve:CommodityContractUnderFHPMember2022-09-300001376986us-gaap:OtherNoncurrentAssetsMembertve:CommodityContractUnderFHPMember2022-09-300001376986tve:CommodityContractUnderFHPMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMember2022-09-3000013769862022-03-31tve:Bond_issues0001376986srt:MinimumMember2022-10-012022-12-310001376986srt:MaximumMember2022-10-012022-12-310001376986tve:CommodityContractNotUnderFHPMember2022-12-31tve:Years0001376986srt:NaturalGasReservesMember2022-12-310001376986srt:NaturalGasReservesMember2022-09-300001376986us-gaap:CurrencySwapMember2022-12-310001376986us-gaap:CurrencySwapMember2022-09-300001376986us-gaap:InterestRateContractMember2022-12-310001376986us-gaap:InterestRateContractMember2022-09-300001376986us-gaap:FairValueInputsLevel2Member2022-12-310001376986us-gaap:FairValueInputsLevel2Member2022-09-300001376986us-gaap:CollateralizedSecuritiesMember2022-12-310001376986tve:CreditOfCustomersMember2022-10-012022-12-31tve:Customers0001376986srt:MoodysA1RatingMember2022-10-012022-12-310001376986srt:MoodysCaa1RatingMember2022-10-012022-12-31tve:Units0001376986us-gaap:EquityFundsMember2022-12-310001376986us-gaap:RealEstateFundsMember2022-12-310001376986us-gaap:CreditMember2022-12-310001376986us-gaap:PrivateEquityFundsMember2022-12-310001376986tve:PrivateRealEstateFundsMember2022-12-310001376986tve:PrivateCreditMember2022-12-310001376986tve:NdtMember2022-10-012022-12-310001376986tve:NdtMember2021-10-012021-12-310001376986tve:ArtMember2022-10-012022-12-310001376986tve:ArtMember2021-10-012021-12-310001376986tve:SerpMember2022-10-012022-12-310001376986tve:SerpMember2021-10-012021-12-310001376986us-gaap:FairValueInputsLevel1Member2022-12-310001376986us-gaap:FairValueInputsLevel3Member2022-12-310001376986us-gaap:FairValueInputsLevel1Membertve:CommodityContractUnderFHPMember2022-12-310001376986us-gaap:FairValueInputsLevel2Membertve:CommodityContractUnderFHPMember2022-12-310001376986us-gaap:FairValueInputsLevel3Membertve:CommodityContractUnderFHPMember2022-12-310001376986srt:AffiliatedEntityMember2022-12-310001376986us-gaap:FairValueInputsLevel1Member2022-09-300001376986us-gaap:FairValueInputsLevel3Member2022-09-300001376986us-gaap:FairValueInputsLevel1Membertve:CommodityContractUnderFHPMember2022-09-300001376986us-gaap:FairValueInputsLevel2Membertve:CommodityContractUnderFHPMember2022-09-300001376986us-gaap:FairValueInputsLevel3Membertve:CommodityContractUnderFHPMember2022-09-300001376986srt:AffiliatedEntityMember2022-09-300001376986stpr:AL2022-10-012022-12-310001376986stpr:AL2021-10-012021-12-310001376986stpr:GA2022-10-012022-12-310001376986stpr:GA2021-10-012021-12-310001376986stpr:KY2022-10-012022-12-310001376986stpr:KY2021-10-012021-12-310001376986stpr:MS2022-10-012022-12-310001376986stpr:MS2021-10-012021-12-310001376986stpr:NC2022-10-012022-12-310001376986stpr:NC2021-10-012021-12-310001376986stpr:TN2022-10-012022-12-310001376986stpr:TN2021-10-012021-12-310001376986stpr:VA2022-10-012022-12-310001376986stpr:VA2021-10-012021-12-310001376986tve:LpcsDomain2022-10-012022-12-310001376986tve:LpcsDomain2021-10-012021-12-310001376986tve:IndustriesdirectlyservedDomain2022-10-012022-12-310001376986tve:IndustriesdirectlyservedDomain2021-10-012021-12-310001376986tve:FederalagenciesandotherDomain2022-10-012022-12-310001376986tve:FederalagenciesandotherDomain2021-10-012021-12-310001376986srt:ScenarioForecastMember2022-10-012023-09-300001376986tve:A20yearTerminationNoticeMember2022-10-012022-12-310001376986tve:A5yearterminationnoticeMember2022-12-310001376986tve:A5yearterminationnoticeMember2022-10-012022-12-310001376986us-gaap:PensionPlansDefinedBenefitMember2022-10-012022-12-310001376986us-gaap:PensionPlansDefinedBenefitMember2021-10-012021-12-310001376986us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-10-012022-12-310001376986us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-10-012021-12-310001376986us-gaap:OtherPensionPlansDefinedBenefitMembersrt:MinimumMember2022-10-012022-12-310001376986us-gaap:OtherPensionPlansDefinedBenefitMember2022-10-012022-12-310001376986tve:A401KMember2022-10-012022-12-310001376986tve:RebatesMember2022-10-012022-12-310001376986tve:SerpMember2022-10-012022-12-310001376986srt:ScenarioForecastMember2022-10-012026-09-30tve:Insurance_layerstve:reactorstve:Procedures0001376986srt:ScenarioForecastMembertve:DeferredDerivativeGainLossUnderFHPMember2023-01-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(MARK ONE)

x QUARTERLY REPORT PURSUANT TO SECTION 13, 15(d), OR 37 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended December 31, 2022

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission file number 000-52313

TENNESSEE VALLEY AUTHORITY

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

A corporate agency of the United States created by an act of Congress (State or other jurisdiction of incorporation or organization) | | 62-0474417 (I.R.S. Employer Identification No.) |

| |

400 W. Summit Hill Drive Knoxville, Tennessee (Address of principal executive offices) | | 37902 (Zip Code) |

(865) 632-2101

(Registrant's telephone number, including area code)

None

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| N/A | N/A | N/A |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13, 15(d), or 37 of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o

Non-accelerated filer x Smaller reporting company o

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

Number of shares of common stock outstanding at January 30, 2023: N/A

| | | | | |

| Table of Contents |

| | |

| | Page |

GLOSSARY OF COMMON ACRONYMS...................................................................................................................................... | |

FORWARD-LOOKING INFORMATION......................................................................................................................................... | |

GENERAL INFORMATION............................................................................................................................................................ | |

| | |

|

| | |

ITEM 1. FINANCIAL STATEMENTS............................................................................................................................................. | |

| |

| |

| |

| |

| |

| |

| | |

| |

Executive Overview............................................................................................................................................................... | |

Results of Operations............................................................................................................................................................ | |

Liquidity and Capital Resources............................................................................................................................................ | |

| |

| |

| |

| |

Critical Accounting Estimates................................................................................................................................................ | |

| |

| |

| | |

| |

| | |

ITEM 4. CONTROLS AND PROCEDURES.................................................................................................................................. | |

| |

| |

| | |

|

| | |

ITEM 1. LEGAL PROCEEDINGS.................................................................................................................................................. | |

| |

ITEM 1A. RISK FACTORS............................................................................................................................................................ | |

| |

| |

| |

ITEM 6. EXHIBITS........................................................................................................................................................................ | |

| | |

SIGNATURES............................................................................................................................................................................... | |

| | | | | | | | |

| GLOSSARY OF COMMON ACRONYMS |

Following are definitions of some of the terms or acronyms that may be used in this Quarterly Report on Form 10-Q for the quarter ended December 31, 2022 (the "Quarterly Report"): |

| |

| Term or Acronym | | Definition |

| | |

| | |

| | |

| | |

| AOCI | | Accumulated other comprehensive income (loss) |

| ARO | | Asset retirement obligation |

| ART | | Asset Retirement Trust |

| Bonds | | Bonds, notes, or other evidences of indebtedness |

| | |

| | |

| CAA | | Clean Air Act |

| Caledonia CC | | Caledonia Combined Cycle Plant |

| CCR | | Coal combustion residuals |

| | |

| CERCLA | | Comprehensive Environmental Response, Compensation, and Liability Act |

| | |

| | |

| COVID-19 | | Coronavirus Disease 2019 |

| | |

| CSAPR | | Cross-State Air Pollution Rule |

| CTs | | Combustion turbine unit(s) |

| CVA | | Credit valuation adjustment |

| CWA | | Clean Water Act |

| | |

| CY | | Calendar year |

| | |

| DCP | | Deferred Compensation Plan |

| DER | | Distributed energy resources |

| | |

| | |

| EIS | | Environmental Impact Statement |

| | |

| | |

| EO(s) | | Executive Order(s) |

| EPA | | Environmental Protection Agency |

| | |

| | |

| | |

| | |

| FERC | | Federal Energy Regulatory Commission |

| | |

| FHP | | Financial Hedging Program |

| | |

| GAAP | | Accounting principles generally accepted in the United States of America |

| GAC | | Grid access charge |

| GHG | | Greenhouse gas |

| | |

| HAP | | Hazardous Air Pollutants |

| | |

| | |

| Holdco | | John Sevier Holdco LLC |

| JSCCG | | John Sevier Combined Cycle Generation LLC |

| | |

| kWh | | Kilowatt hours |

| LPCs | | Local power company customers |

| | |

| | |

| MD&A | | Management's Discussion and Analysis of Financial Condition and Results of Operations |

| MLGW | | Memphis Light, Gas and Water Division |

| mmBtu | | Million British thermal unit(s) |

| MtM | | Mark-to-market |

| MW | | Megawatts |

| MWh | | Megawatt hours |

| | |

| NAV | | Net asset value |

| NDT | | Nuclear Decommissioning Trust |

| NEIL | | Nuclear Electric Insurance Limited |

| NEPA | | National Environmental Policy Act |

| | |

| NES | | Nashville Electric Service |

NOx | | Nitrogen oxides |

| | |

| NRC | | Nuclear Regulatory Commission |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| PPA(s) | | Power Purchase Agreement(s) |

| | |

| QTE | | Qualified technological equipment and software |

| | |

| | | | | | | | |

| RCRA | | Resource Conservation and Recovery Act |

| RECs | | Renewable Energy Certificates |

| | |

| RFP(s) | | Request(s) for proposals |

| SCCG | | Southaven Combined Cycle Generation LLC |

| SCRs | | Selective catalytic reduction systems |

| SEC | | Securities and Exchange Commission |

| | |

| SERP | | Supplemental Executive Retirement Plan |

| SHLLC | | Southaven Holdco LLC |

| | |

| | |

| | |

| | |

| TDEC | | Tennessee Department of Environment and Conservation |

| | |

| TVA | | Tennessee Valley Authority |

| TVA Act | | The Tennessee Valley Authority Act of 1933, as amended, 16 U.S.C. §§ 831-831ee |

| TVA Board | | TVA Board of Directors |

| TVARS | | Tennessee Valley Authority Retirement System |

| | |

| U.S. Treasury | | United States Department of the Treasury |

| | |

| | |

| VIE | | Variable interest entity |

| | |

| XBRL | | eXtensible Business Reporting Language |

FORWARD-LOOKING INFORMATION

This Quarterly Report contains forward-looking statements relating to future events and future performance. All statements other than those that are purely historical may be forward-looking statements. In certain cases, forward-looking statements can be identified by the use of words such as "may," "will," "should," "expect," "anticipate," "believe," "intend," "project," "plan," "predict," "assume," "forecast," "estimate," "objective," "possible," "probably," "likely," "potential," "speculate," "aim," "aspiration," "goal," "seek," "strategy," "target," the negative of such words, or other similar expressions.

Although the Tennessee Valley Authority ("TVA") believes that the assumptions underlying any forward-looking statements are reasonable, TVA does not guarantee the accuracy of these statements. Numerous factors could cause actual results to differ materially from those in any forward-looking statements. These factors include, among other things:

•Significant delays and additional costs, and/or inability to obtain necessary regulatory approvals, licenses, or permits, for major projects, including for assets that TVA needs to serve its existing and future load and to meet its carbon reduction aspirations;

•Events at a nuclear facility, whether or not operated by or licensed to TVA, which, among other things, could lead to increased regulation or restriction on the construction, ownership, operation, or decommissioning of nuclear facilities or on the storage of spent fuel, obligate TVA to pay retrospective insurance premiums, reduce the availability and affordability of insurance, increase the costs of operating TVA's existing nuclear units, or cause TVA to forego future construction at these or other facilities;

•Risks associated with the operation of nuclear facilities or other generation and related facilities, including coal combustion residuals ("CCR") facilities;

•Inability to continue to operate certain assets, especially nuclear facilities, including due to the inability to obtain, or loss of, regulatory approval for the operation of assets;

•Significant additional costs for TVA to manage and operate its CCR facilities;

•Physical attacks, threats, or other interference causing damage to TVA's facilities or interfering with TVA's operations;

•The failure of TVA's generation, transmission, navigation, flood control, and related assets and infrastructure, including CCR facilities and spent nuclear fuel storage facilities, to operate as anticipated, resulting in lost revenues, damages, or other costs that are not reflected in TVA's financial statements or projections, including due to aging or technological issues;

•Costs or liabilities that are not anticipated in TVA's financial statements for third-party claims, natural resource damages, environmental cleanup activities, or fines or penalties associated with unexpected events such as failures of a facility or infrastructure;

•Events at a TVA facility, which, among other things, could result in loss of life, damage to the environment, damage to or loss of the facility, or damage to the property of others;

•Events that negatively impact TVA's reliability, including from problems at other utilities or at TVA facilities or the increase in intermittent sources of power;

•Events or changes involving transmission lines, dams, and other facilities not operated by TVA, including those that affect the reliability of the interstate transmission grid of which TVA's transmission system is a part and those that increase flows across TVA's transmission grid;

•Disruption of supplies of fuel, purchased power, or other critical items or services, which may result from, among other things, economic conditions, weather conditions, physical or cyber attacks, political developments, international trade restrictions or tariffs, legal actions, mine closures or reduced mine production, increases in fuel exports, environmental regulations affecting TVA's suppliers, transportation or delivery constraints, shortages of raw materials, supply chain difficulties, labor shortages, strikes, inflation, or similar events and which may, among other things, hinder TVA's ability to operate its assets and to complete projects on time and on budget;

•Circumstances that cause TVA to change its determinations regarding the appropriate mix of generation assets;

•Costs or other challenges resulting from a failure by TVA to meet its carbon reduction aspirations;

•New, amended, or existing laws, regulations, executive orders ("EOs"), or administrative orders or interpretations, including those related to climate change and other environmental matters, and the costs of complying with these laws, regulations, EOs, or administrative orders or interpretations;

•The cost of complying with known, anticipated, or new environmental requirements, some of which could render continued operation of many of TVA's aging coal-fired generation units not cost-effective or result in their removal from service, perhaps permanently;

•Actions taken, or inaction, by the United States ("U.S.") government relating to the national debt ceiling or automatic spending cuts in government programs;

•Inability to respond quickly enough to current or potential customer demands or needs or to act solely in the interest of ratepayers;

•Negative outcomes of current or future legal or administrative proceedings;

•Federal legislation aimed specifically at curtailing TVA's activities, including legislation that may cause TVA to lose its protected service territory, its sole authority to set rates, or its authority to manage the Tennessee River system or the real property currently entrusted to TVA; subject TVA to additional environmental regulation or additional requirements of the North American Electric Reliability Corporation; require the divestiture of TVA or the sale of certain of TVA's assets; lower the debt ceiling on bonds, notes, or other evidences of indebtedness (collectively, "Bonds") specified in the Tennessee Valley Authority Act of 1933, as amended, 16 U.S.C. §§ 831-831ee ("TVA Act"); or restrict TVA's access to its

funds;

•Cyber attacks on TVA's assets or the assets of third parties upon which TVA relies;

•Other unforeseeable occurrences negatively impacting TVA assets or their supporting infrastructure;

•The need for significant future contributions associated with TVA's pension plans, other post-retirement benefit plans, or health care plans;

•Increases in TVA's financial liabilities for decommissioning its nuclear facilities and retiring other assets;

•The requirement or decision to make additional contributions to TVA's Nuclear Decommissioning Trust ("NDT") or Asset Retirement Trust ("ART");

•Differences between estimates of revenues and expenses and actual revenues earned and expenses incurred;

•Limitations on TVA's ability to borrow money, which may result from, among other things, TVA's approaching or substantially reaching the debt ceiling or TVA's losing access to the debt markets;

•An increase in TVA's cost of capital, which may result from, among other things, changes in the market for Bonds, changes in the credit rating of TVA or the U.S. government, or, potentially, an increased reliance by TVA on alternative financing should TVA approach its debt limit;

•The inaccuracy of certain assumptions about the future, including economic forecasts, anticipated energy and commodity prices, cost estimates, construction schedules, power demand forecasts, the appropriate generation mix to meet demand, and assumptions about potential regulatory environments;

•Significant decline in the demand for electricity that TVA produces, which may result from, among other things, economic downturns or recessions, loss of customers, reductions in demand for electricity generated from non-renewable sources or centrally located generation sources, increased utilization of distributed energy resources ("DER"), increased energy efficiency and conservation, or improvements in alternative generation and energy storage technologies;

•Changes in customer preferences for energy produced from cleaner generation sources;

•Addition or loss of customers by TVA or TVA's local power company customers ("LPCs");

•Potential for increased demand for energy resulting from, among other things, an increase in the population of TVA's service area;

•Changes in technology, which, among other things, may affect relationships with customers and require TVA to change how it conducts its operations;

•Changes in the economy and volatility in financial markets;

•Reliability or creditworthiness of counterparties;

•Changes in the market price of commodities such as purchased power, coal, uranium, natural gas, fuel oil, crude oil, construction materials, reagents, or emission allowances;

•Changes in the market price of equity securities, debt securities, or other investments;

•Changes in interest rates, currency exchange rates, or inflation rates;

•Failure to attract or retain an appropriately qualified, diverse, and inclusive workforce;

•Changes in the membership of the TVA Board of Directors ("TVA Board") or TVA senior management, which may impact how TVA operates;

•Weather conditions, including changing weather patterns, extreme weather conditions, and other events such as flooding, droughts, wildfires, and snow or ice storms that may result from climate change, which may hamper TVA's ability to supply power, cause customers' demand for power to exceed TVA's then-present power supply, or otherwise negatively impact net revenue;

•Events affecting the supply or quality of water from the Tennessee River system or Cumberland River system, or elsewhere, which could interfere with TVA's ability to generate power;

•Catastrophic events, such as fires, earthquakes, explosions, solar events, electromagnetic pulses, geomagnetic disturbances, droughts, floods, hurricanes, tornadoes, polar vortexes, icing events, or other casualty events, wars, national emergencies, terrorist activities, pandemics, or other similar destructive or disruptive events;

•Inability to use regulatory accounting for certain costs;

•Ineffectiveness of TVA's financial control system to control issues and instances of fraud or to detect errors;

•Ineffectiveness of TVA's disclosure controls and procedures or its internal control over financial reporting;

•Adverse effects from the Coronavirus Disease 2019 ("COVID-19") or future pandemics;

•Inability of TVA to implement its business strategy successfully, including due to the increased use in the public of DER or energy-efficiency programs;

•Inability of TVA to adapt its business model to changes in the utility industry and customer preferences and to remain cost competitive;

•Loss of quorum of the TVA Board, which may limit TVA's ability to adapt to meet changing business conditions;

•Negative impacts on TVA's reputation; or

•Other unforeseeable events.

See also Part I, Item 1A, Risk Factors, and Part II, Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations in TVA's Annual Report on Form 10-K for the year ended September 30, 2022 (the "Annual Report"), and Part I, Item 2, Management's Discussion and Analysis of Financial Condition and Results of Operations in this Quarterly Report for a discussion of factors that could cause actual results to differ materially from those in any forward-looking statement. New factors emerge from time to time, and it is not possible for TVA to predict all such factors or to assess the extent to which any factor or combination of factors may impact TVA's business or cause results to differ materially from those contained in any forward-looking statement. TVA undertakes no obligation to update any forward-looking statement to reflect developments that occur after the statement is made, except as required by law.

GENERAL INFORMATION

Fiscal Year

References to years (2023, 2022, etc.) in this Quarterly Report are to TVA's fiscal years ending September 30. Years that are preceded by "CY" are references to calendar years.

Notes

References to "Notes" are to the Notes to Consolidated Financial Statements contained in Part I, Item 1, Financial Statements in this Quarterly Report.

Available Information

TVA files annual, quarterly, and current reports with the Securities and Exchange Commission ("SEC") under Section 37 of the Securities Exchange Act of 1934 (the "Exchange Act"). TVA's SEC filings are available to the public at www.tva.com, free of charge, as soon as reasonably practicable after such reports are electronically filed with or furnished to the SEC. Information contained on or accessible through TVA's website shall not be deemed to be incorporated into, or to be a part of, this Quarterly Report or any other report or document that TVA files with the SEC. All TVA SEC reports are available to the public without charge from the website maintained by the SEC at www.sec.gov.

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED BALANCE SHEETS (Unaudited)

(in millions)

| | | | | | | | | | | |

| ASSETS |

| | December 31, 2022 | | September 30, 2022 |

| Current assets | | | |

| Cash and cash equivalents | $ | 500 | | | $ | 500 | |

| | | |

| | | |

| Accounts receivable, net | 1,749 | | | 2,007 | |

| Inventories, net | 1,207 | | | 1,072 | |

| Regulatory assets | 320 | | | 138 | |

| Other current assets | 221 | | | 257 | |

| Total current assets | 3,997 | | | 3,974 | |

| | | |

| Property, plant, and equipment | | | |

| Completed plant | 66,728 | | | 66,442 | |

| Less accumulated depreciation | (34,517) | | | (34,239) | |

| Net completed plant | 32,211 | | | 32,203 | |

| Construction in progress | 2,648 | | | 2,535 | |

| Nuclear fuel | 1,520 | | | 1,492 | |

| Finance leases | 615 | | | 630 | |

| Total property, plant, and equipment, net | 36,994 | | | 36,860 | |

| | | |

| Investment funds | 3,913 | | | 3,671 | |

| | | |

| Regulatory and other long-term assets | | | |

| Regulatory assets | 5,909 | | | 6,134 | |

| Operating lease assets, net of amortization | 144 | | | 155 | |

| Other long-term assets | 353 | | | 394 | |

| Total regulatory and other long-term assets | 6,406 | | | 6,683 | |

| | | |

| Total assets | $ | 51,310 | | | $ | 51,188 | |

| The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED BALANCE SHEETS (Unaudited)

(in millions)

| | | | | | | | | | | |

| LIABILITIES AND PROPRIETARY CAPITAL |

| December 31, 2022 | | September 30, 2022 |

| Current liabilities | | | |

| Accounts payable and accrued liabilities | $ | 2,362 | | | $ | 2,466 | |

| | | |

| Accrued interest | 255 | | | 273 | |

| Asset retirement obligations | 287 | | | 275 | |

| | | |

| | | |

| Regulatory liabilities | 277 | | | 391 | |

| Short-term debt, net | 1,618 | | | 1,172 | |

| Current maturities of power bonds | 29 | | | 29 | |

| Current maturities of long-term debt of variable interest entities | 39 | | | 39 | |

| | | |

| Total current liabilities | 4,867 | | | 4,645 | |

| | | |

| Other liabilities | | | |

| Post-retirement and post-employment benefit obligations | 2,998 | | | 3,072 | |

| Asset retirement obligations | 6,868 | | | 6,887 | |

| Finance lease liabilities | 619 | | | 628 | |

| Other long-term liabilities | 1,374 | | | 1,485 | |

| | | |

| Regulatory liabilities | 109 | | | 172 | |

| Total other liabilities | 11,968 | | | 12,244 | |

| | | |

| Long-term debt, net | | | |

| Long-term power bonds, net | 17,865 | | | 17,826 | |

| Long-term debt of variable interest entities, net | 968 | | | 968 | |

| | | |

| Total long-term debt, net | 18,833 | | | 18,794 | |

| | | |

| Total liabilities | 35,668 | | | 35,683 | |

| | | |

Contingencies and legal proceedings (Note 20) | | | |

| | | |

| Proprietary capital | | | |

| Power program appropriation investment | 258 | | | 258 | |

| Power program retained earnings | 14,902 | | | 14,800 | |

| Total power program proprietary capital | 15,160 | | | 15,058 | |

| Nonpower programs appropriation investment, net | 531 | | | 533 | |

| Accumulated other comprehensive loss | (49) | | | (86) | |

| Total proprietary capital | 15,642 | | | 15,505 | |

| | | |

| Total liabilities and proprietary capital | $ | 51,310 | | | $ | 51,188 | |

| The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

Three Months Ended December 31

(in millions)

| | | | | | | | | | | | | | | |

| | | |

| | | | | | 2022 | | 2021 |

| Operating revenues | | | | | | | |

| Revenue from sales of electricity | | | | | $ | 2,963 | | | $ | 2,538 | |

| Other revenue | | | | | 52 | | | 45 | |

| Total operating revenues | | | | | 3,015 | | | 2,583 | |

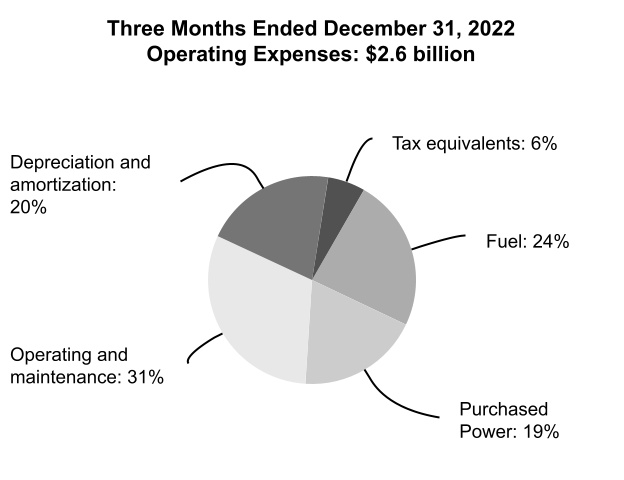

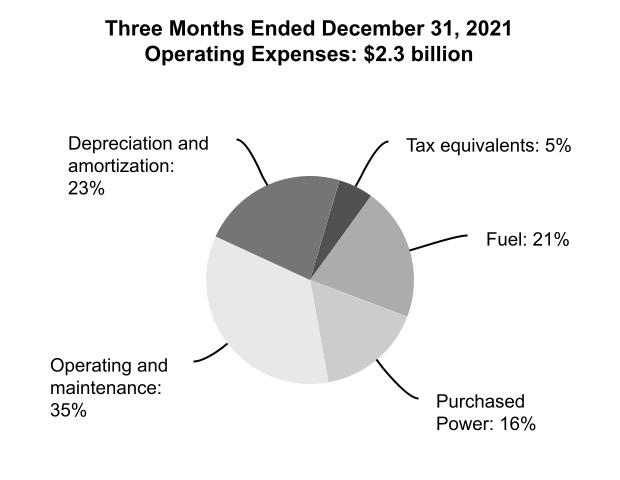

| Operating expenses | | | | | | | |

| Fuel | | | | | 615 | | | 466 | |

| Purchased power | | | | | 491 | | | 369 | |

| Operating and maintenance | | | | | 827 | | | 780 | |

| Depreciation and amortization | | | | | 533 | | | 510 | |

| Tax equivalents | | | | | 151 | | | 133 | |

| Total operating expenses | | | | | 2,617 | | | 2,258 | |

| Operating income | | | | | 398 | | | 325 | |

| Other income, net | | | | | 16 | | | 14 | |

| Other net periodic benefit cost | | | | | 51 | | | 65 | |

| Interest expense | | | | | 262 | | | 263 | |

| Net income | | | | | $ | 101 | | | $ | 11 | |

| The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (Unaudited)

Three Months Ended December 31

(in millions)

| | | | | | | | | | | | | | | |

| | | |

| | | | | | 2022 | | 2021 |

| Net income | | | | | $ | 101 | | | $ | 11 | |

| Other comprehensive income (loss) | | | | | | | |

| Net unrealized gain on cash flow hedges | | | | | 71 | | | 5 | |

| Net unrealized gain reclassified to earnings from cash flow hedges | | | | | (34) | | | (1) | |

| Total other comprehensive income | | | | | 37 | | | 4 | |

| Total comprehensive income | | | | | $ | 138 | | | $ | 15 | |

| The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

For the Three Months Ended December 31

(in millions)

| | | | | | | | | | | |

| | 2022 | | 2021 |

| Cash flows from operating activities | | | |

| Net income | $ | 101 | | | $ | 11 | |

| Adjustments to reconcile net income to net cash provided by operating activities | | | |

Depreciation and amortization(1) | 538 | | | 515 | |

| Amortization of nuclear fuel cost | 88 | | | 88 | |

| Non-cash retirement benefit expense | 63 | | | 82 | |

| | | |

| Other regulatory amortization and deferrals | (69) | | | 32 | |

| | | |

| | | |

| | | |

| Changes in current assets and liabilities | | | |

| Accounts receivable, net | 256 | | | 181 | |

| Inventories and other current assets, net | (216) | | | (101) | |

| Accounts payable and accrued liabilities | (86) | | | (140) | |

| Accrued interest | (16) | | | (13) | |

| | | |

| Pension contributions | (75) | | | (76) | |

| | | |

| | | |

| | | |

| Other, net | (145) | | | (86) | |

| Net cash provided by operating activities | 439 | | | 493 | |

| | | |

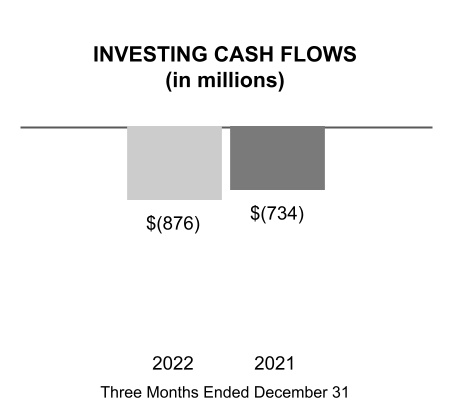

| Cash flows from investing activities | | | |

| Construction expenditures | (605) | | | (612) | |

| | | |

| Nuclear fuel expenditures | (192) | | | (137) | |

| | | |

| Acquisition of leasehold interests in combustion turbine assets | (78) | | | — | |

| Loans and other receivables | | | |

| Advances | — | | | (3) | |

| Repayments | 3 | | | 6 | |

| Other, net | (4) | | | 12 | |

| Net cash used in investing activities | (876) | | | (734) | |

| | | |

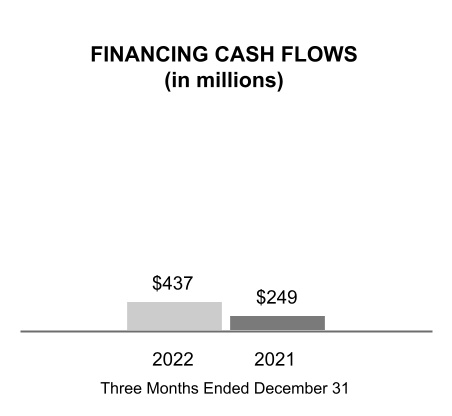

| Cash flows from financing activities | | | |

| Long-term debt | | | |

| | | |

| | | |

| Redemptions and repurchases of power bonds | (1) | | | (1) | |

| | | |

| | | |

| Short-term debt issues, net | 446 | | | 286 | |

| Payments on leases and leasebacks | (10) | | | (31) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Other, net | 2 | | | (5) | |

| Net cash provided by financing activities | 437 | | | 249 | |

| Net change in cash, cash equivalents, and restricted cash | — | | | 8 | |

| Cash, cash equivalents, and restricted cash at beginning of period | 520 | | | 518 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 520 | | | $ | 526 | |

| | | |

| | | |

| | | |

| | | |

| | | |

Note (1) Includes amortization of debt issuance costs and premiums/discounts. |

| The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF CHANGES IN PROPRIETARY CAPITAL (Unaudited)

For the Three Months Ended December 31, 2022 and 2021

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Power Program Appropriation Investment | |

Power Program Retained Earnings | | Nonpower Programs Appropriation Investment, Net | | Accumulated

Other

Comprehensive

Income (Loss) | |

Total |

| Balance at September 30, 2021 | $ | 258 | | | $ | 13,689 | | | $ | 540 | | | $ | (22) | | | $ | 14,465 | |

| Net income (loss) | — | | | 13 | | | (2) | | | — | | | 11 | |

| Total other comprehensive income | — | | | — | | | — | | | 4 | | | 4 | |

| Return on power program appropriation investment | — | | | (1) | | | — | | | — | | | (1) | |

| | | | | | | | | |

Balance at December 31, 2021 | $ | 258 | | | $ | 13,701 | | | $ | 538 | | | $ | (18) | | | $ | 14,479 | |

| | | | | | | | | |

| Balance at September 30, 2022 | $ | 258 | | | $ | 14,800 | | | $ | 533 | | | $ | (86) | | | $ | 15,505 | |

| Net income (loss) | — | | | 103 | | | (2) | | | — | | | 101 | |

| Total other comprehensive income | — | | | — | | | — | | | 37 | | | 37 | |

| Return on power program appropriation investment | — | | | (1) | | | — | | | — | | | (1) | |

Balance at December 31, 2022 | $ | 258 | | | $ | 14,902 | | | $ | 531 | | | $ | (49) | | | $ | 15,642 | |

The accompanying notes are an integral part of these consolidated financial statements. |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

(Dollars in millions except where noted)

| | | | | | | | | | | |

| Note | Page |

| 1 | | Summary of Significant Accounting Policies | |

| 2 | | Impact of New Accounting Standards and Interpretations | |

| 3 | | Accounts Receivable, Net | |

| 4 | | Inventories, Net | |

| 5 | | Other Current Assets | |

| 6 | | Plant Closures | |

| | | |

| 7 | | Other Long-Term Assets | |

| 8 | | Regulatory Assets and Liabilities | |

| 9 | | Variable Interest Entities | |

| 10 | | Other Long-Term Liabilities | |

| 11 | | Asset Retirement Obligations | |

| 12 | | Debt and Other Obligations | |

| | | |

| 13 | | Risk Management Activities and Derivative Transactions | |

| 14 | | Fair Value Measurements | |

| 15 | | Revenue | |

| 16 | | Other Income, Net | |

| 17 | | Supplemental Cash Flow Information | |

| 18 | | Benefit Plans | |

| 19 | | Collaborative Arrangement | |

| 20 | | Contingencies and Legal Proceedings | |

| 21 | | Subsequent Events | |

1. Summary of Significant Accounting Policies

General

The Tennessee Valley Authority ("TVA") is a corporate agency and instrumentality of the United States ("U.S.") that was created in 1933 by federal legislation in response to a proposal by President Franklin D. Roosevelt. TVA was created to, among other things, improve navigation on the Tennessee River, reduce the damage from destructive flood waters within the Tennessee River system and downstream on the lower Ohio and Mississippi Rivers, further the economic development of TVA's service area in the southeastern U.S., and sell the electricity generated at the facilities TVA operates. Today, TVA operates the nation's largest public power system and supplies power in most of Tennessee, northern Alabama, northeastern Mississippi, and southwestern Kentucky and in portions of northern Georgia, western North Carolina, and southwestern Virginia to a population of approximately 10 million people.

TVA also manages the Tennessee River, its tributaries, and certain shorelines to provide, among other things, year-round navigation, flood damage reduction, and affordable and reliable electricity. Consistent with these primary purposes, TVA also manages the river system and public lands to provide recreational opportunities, adequate water supply, improved water quality, cultural and natural resource protection, and economic development. TVA performs these management duties in cooperation with other federal and state agencies that have jurisdiction and authority over certain aspects of the river system. In addition, the TVA Board of Directors ("TVA Board") has established two councils — the Regional Resource Stewardship Council and the Regional Energy Resource Council — to advise TVA on its stewardship activities in the Tennessee Valley and its energy resource activities.

The power program has historically been separate and distinct from the stewardship programs. It is required to be self-supporting from power revenues and proceeds from power financings, such as proceeds from the issuance of bonds, notes, or other evidences of indebtedness (collectively, "Bonds"). Although TVA does not currently receive Congressional appropriations, it is required to make annual payments to the United States Department of the Treasury ("U.S. Treasury") as a return on the government's appropriation investment in TVA's power facilities (the "Power Program Appropriation Investment"). In the 1998 Energy and Water Development Appropriations Act, Congress directed TVA to fund essential stewardship activities related to its management of the Tennessee River system and nonpower or stewardship properties with power revenues in the event that there were insufficient appropriations or other available funds to pay for such activities in any fiscal year. Congress has not provided any appropriations to TVA to fund such activities since 1999. Consequently, during 2000, TVA began paying for essential stewardship activities primarily with power revenues, with the remainder funded with user fees and other forms of

revenues derived in connection with those activities. The activities related to stewardship properties do not meet the criteria of an operating segment under accounting principles generally accepted in the United States of America ("GAAP"). Accordingly, these assets and properties are included as part of the power program, TVA's only operating segment.

Power rates are established by the TVA Board as authorized by the Tennessee Valley Authority Act of 1933, as amended, 16 U.S.C. §§ 831-831ee ("TVA Act"). The TVA Act requires TVA to charge rates for power that will produce gross revenues sufficient to provide funds for operation, maintenance, and administration of its power system; payments to states and counties in lieu of taxes ("tax equivalents"); debt service on outstanding indebtedness; payments to the U.S. Treasury in repayment of and as a return on the Power Program Appropriation Investment; and such additional margin as the TVA Board may consider desirable for investment in power system assets, retirement of outstanding Bonds in advance of maturity, additional reduction of the Power Program Appropriation Investment, and other purposes connected with TVA's power business. TVA fulfilled its requirement to repay $1.0 billion of the Power Program Appropriation Investment with the 2014 payment; therefore, this repayment obligation is no longer a component of rate setting. In setting TVA's rates, the TVA Board is charged by the TVA Act to have due regard for the primary objectives of the TVA Act, including the objective that power shall be sold at rates as low as are feasible. Rates set by the TVA Board are not subject to review or approval by any state or other federal regulatory body.

Fiscal Year

TVA's fiscal year ends September 30. Years (2023, 2022, etc.) refer to TVA's fiscal years unless they are preceded by "CY," in which case the references are to calendar years.

Cost-Based Regulation

Since the TVA Board is authorized by the TVA Act to set rates for power sold to its customers, TVA is self-regulated. Additionally, TVA's regulated rates are designed to recover its costs. Based on current projections, TVA believes that rates, set at levels that will recover TVA's costs, can be charged and collected. As a result of these factors, TVA records certain assets and liabilities that result from the regulated ratemaking process that would not be recorded under GAAP for non-regulated entities. Regulatory assets generally represent incurred costs that have been deferred because such costs are probable of future recovery in customer rates. Regulatory liabilities generally represent obligations to make refunds to customers for previous collections for costs that are not likely to be incurred or deferral of gains that will be credited to customers in future periods. TVA assesses whether the regulatory assets are probable of future recovery by considering factors such as applicable regulatory changes, potential legislation, and changes in technology. Based on these assessments, TVA believes the existing regulatory assets are probable of recovery. This determination reflects the current regulatory and political environment and is subject to change in the future. If future recovery of regulatory assets ceases to be probable, or TVA is no longer considered to be a regulated entity, then costs would be required to be written off. All regulatory asset write-offs would be required to be recognized in earnings in the period in which future recovery ceases to be probable.

Basis of Presentation

TVA prepares its consolidated interim financial statements in conformity with GAAP for consolidated interim financial information. Accordingly, TVA's consolidated interim financial statements do not include all of the information and notes required by GAAP for annual financial statements. As such, they should be read in conjunction with the audited financial statements for the year ended September 30, 2022, and the notes thereto, which are contained in TVA's Annual Report on Form 10-K for the year ended September 30, 2022 (the "Annual Report"). In the opinion of management, all adjustments (consisting of items of a normal recurring nature) considered necessary for fair presentation are included on the consolidated interim financial statements.

The accompanying consolidated interim financial statements, which have been prepared in accordance with GAAP, include the accounts of TVA and variable interest entities ("VIEs") of which TVA is the primary beneficiary. See Note 9 — Variable Interest Entities. Intercompany balances and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of financial statements requires TVA to estimate the effects of various matters that are inherently uncertain as of the date of the consolidated financial statements. Although the consolidated financial statements are prepared in conformity with GAAP, TVA is required to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities, and the amounts of revenues and expenses, reported during the reporting period. Each of these estimates varies in regard to the level of judgment involved and its potential impact on TVA's financial results. Estimates are considered critical either when a different estimate could have reasonably been used, or where changes in the estimate are reasonably likely to occur from period to period, and such use or change would materially impact TVA's financial condition, results of operations, or cash flows.

Cash, Cash Equivalents, and Restricted Cash

Cash includes cash on hand, non-interest bearing cash, and deposit accounts. All highly liquid investments with original maturities of three months or less are considered cash equivalents. Cash and cash equivalents that are restricted, as to withdrawal or use under the terms of certain contractual agreements, are recorded in Other long-term assets on the Consolidated Balance Sheets. Restricted cash and cash equivalents include cash held in trusts that are currently restricted for TVA economic development loans and for certain TVA environmental programs in accordance with agreements related to compliance with certain environmental regulations.

The following table provides a reconciliation of cash, cash equivalents, and restricted cash reported on the Consolidated Balance Sheets and Consolidated Statements of Cash Flows:

| | | | | | | | | | | |

Cash, Cash Equivalents, and Restricted Cash (in millions) |

| | At December 31, 2022 | | At September 30, 2022 |

| Cash and cash equivalents | $ | 500 | | | $ | 500 | |

| | | |

| Restricted cash and cash equivalents included in Other long-term assets | 20 | | | 20 | |

| Total cash, cash equivalents, and restricted cash | $ | 520 | | | $ | 520 | |

Allowance for Uncollectible Accounts

TVA recognizes an allowance that reflects the current estimate for credit losses expected to be incurred over the life of the financial assets based on historical experience, current conditions, and reasonable and supportable forecasts that affect the collectability of the reported amounts. The appropriateness of the allowance is evaluated at the end of each reporting period.

To determine the allowance for trade receivables, TVA considers historical experience and other currently available information, including events such as customer bankruptcy and/or a customer failing to fulfill payment arrangements by the due date. TVA's corporate credit department also performs an assessment of the financial condition of customers and the credit quality of the receivables. In addition, TVA reviews other reasonable and supportable forecasts to determine if the allowance for uncollectible amounts should be further adjusted in accordance with the accounting guidance for Current Expected Credit Losses.

To determine the allowance for loans receivables, TVA aggregates loans into the appropriate pools based on the existence of similar risk characteristics such as collateral types and internal assessed credit risks. In situations where a loan exhibits unique risk characteristics and is no longer expected to experience similar risks to the rest of its pool, the loan will be evaluated separately. TVA derives an annual loss rate based on historical loss and then adjusts the rate to reflect TVA's consideration of available information on current conditions and reasonable and supportable future forecasts. This information may include economic and business conditions, default trends, and other internal and external factors. For periods beyond the reasonable and supportable forecast period, TVA uses the current calculated long-term average historical loss rate for the remaining life of the loan portfolio.

The allowance for uncollectible accounts was less than $1 million at both December 31, 2022, and September 30, 2022, for trade accounts receivable. Additionally, loans receivable of $109 million and $105 million at December 31, 2022, and September 30, 2022, respectively, are included in Accounts receivable, net and Other long-term assets, for the current and long-term portions, respectively. Loans receivables are reported net of allowances for uncollectible accounts of $3 million at both December 31, 2022 and September 30, 2022.

Inventories

Certain Fuel, Materials, and Supplies. Materials and supplies inventories are valued using an average unit cost method. A new average cost is computed after each inventory purchase transaction, and inventory issuances are priced at the latest moving weighted average unit cost. Coal, fuel oil, and natural gas inventories are valued using an average cost method. A new weighted average cost is computed monthly, and monthly issues are priced accordingly.

Renewable Energy Certificates. TVA accounts for Renewable Energy Certificates ("RECs") using the specific identification cost method. RECs that are acquired through power purchases are recorded as inventory and charged to purchased power expense when the RECs are subsequently used or sold. TVA assigns a value to the RECs at the inception of the power purchase arrangement using a relative standalone selling price approach. RECs created through TVA-owned asset generation are recorded at zero cost.

Emission Allowances. TVA accounts for emission allowances using the specific identification cost method. Allowances that are acquired through third party purchases are recorded as inventory at cost and charged to operating expense based on tons emitted during the respective compliance periods.

Allowance for Inventory Obsolescence. TVA reviews materials and supplies inventories by category and usage on a periodic basis. Each category is assigned a probability of becoming obsolete based on the type of material and historical usage data. TVA has a fleet-wide inventory management policy for each generation type. Based on the estimated value of the inventory, TVA adjusts its allowance for inventory obsolescence.

Revenues

TVA recognizes revenue from contracts with customers to depict the transfer of goods or services to customers in an amount to which the entity expects to be entitled in exchange for those goods or services. For the generation and transmission of electricity, this is generally at the time the power is delivered to a metered customer delivery point for the customer's consumption or distribution. As a result, revenues from power sales are recorded as electricity is delivered to customers. In addition to power sales invoiced and recorded during the month, TVA accrues estimated unbilled revenues for power sales provided to five customers whose billing date occurs prior to the end of the month. Exchange power sales are presented in the accompanying Consolidated Statements of Operations as a component of sales of electricity. Exchange power sales are sales of excess power after meeting TVA native load and directly served requirements. Native load refers to the customers on whose behalf a company, by statute, franchise, regulatory requirement, or contract, has undertaken an obligation to serve. TVA engages in other arrangements in addition to power sales. Certain other revenue from activities related to TVA's overall mission is recorded in Other revenue. Revenues that are not related to the overall mission are recorded in Other income, net.

Depreciation

TVA accounts for depreciation of its properties using the composite depreciation convention of accounting. Under the composite method, assets with similar economic characteristics are grouped and depreciated as one asset. Depreciation is generally computed on a straight-line basis over the estimated service lives of the various classes of assets. The estimation of asset useful lives requires management judgment, supported by external depreciation studies of historical asset retirement experience. Depreciation rates are determined based on external depreciation studies that are updated approximately every five years, with the latest study implemented during the first quarter of 2022. Depreciation expense was $466 million and $453 million for the three months ended December 31, 2022 and 2021, respectively. See Note 6 — Plant Closures for a discussion of the impact of plant closures.

2. Impact of New Accounting Standards and Interpretations

The following accounting standards have been issued but, at December 31, 2022, were not effective and had not been adopted by TVA:

| | | | | |

|

| |

| |

| |

|

|

| |

| |

| |

|

|

| |

| |

| |

|

|

| |

| |

| |

|

|

| |

| |

| |

|

Accounting for Contract Assets and Contract Liabilities from Contracts with Customers |

| Description | This guidance requires an entity (acquirer) to recognize and measure contract assets and contract liabilities acquired in a business combination in accordance with revenue with customers. It is expected that an acquirer will generally recognize and measure acquired contract assets and contract liabilities in a manner consistent with how the acquiree recognized and measured contract assets and contract liabilities in the acquiree’s financial statements. The entity should apply the standard prospectively to business combinations occurring on or after the effective date of the standard. |

| Effective Date for TVA | This new standard is effective for TVA’s interim and annual reporting periods beginning October 1, 2023. While early adoption is permitted, TVA does not currently plan to adopt this standard early. |

| Effect on the Financial Statements or Other Significant Matters | TVA does not expect the adoption of this standard to have a material impact on its financial condition, results of operations, or cash flows. |

|

|

| |

| |

| |

|

|

| |

| |

| |

| | | | | |

|

| |

| |

| |

|

|

| |

| |

| |

|

|

| |

| |

| |

|

|

| |

| |

| |

|

|

| |

| |

| |

|

Troubled Debt Restructurings and Vintage Disclosures |

| Description | This guidance eliminates the recognition and measurement guidance on troubled debt restructuring for creditors that have adopted Financial Instruments-Credit Losses and requires enhanced disclosures about loan modifications for borrowers experiencing financial difficulty. Additionally, the guidance requires public business entities to present current-period gross write-offs by year of origination in their vintage disclosures. The entity should apply the standard prospectively except for the transition method related to the recognition and measurement of troubled debt restructuring. For the transition method, an entity has the option to apply a modified retrospective transition method, resulting in a cumulative-effect adjustment to retained earnings in the period of adoption. |

| Effective Date for TVA | This new standard is effective for TVA’s interim and annual reporting periods beginning October 1, 2023. While early adoption is permitted, TVA does not currently plan to adopt this standard early. |

| Effect on the Financial Statements or Other Significant Matters | TVA does not expect the adoption of this standard to have a material impact on its financial condition, results of operations, or cash flows. |

|

|

| |

| |

| |

|

|

| |

| |

| |

3. Accounts Receivable, Net

Accounts receivable primarily consist of amounts due from customers for power sales. The table below summarizes the types and amounts of TVA's accounts receivable:

| | | | | | | | | | | |

Accounts Receivable, Net (in millions) |

| | At December 31, 2022 | | At September 30, 2022 |

| Power receivables | $ | 1,633 | | | $ | 1,899 | |

| Other receivables | 116 | | | 108 | |

| | | |

Accounts receivable, net(1) | $ | 1,749 | | | $ | 2,007 | |

Note

(1) Allowance for uncollectible accounts was less than $1 million at both December 31, 2022, and September 30, 2022, and therefore is not represented in the table above.

4. Inventories, Net

The table below summarizes the types and amounts of TVA's inventories:

| | | | | | | | | | | |

Inventories, Net (in millions) |

| | At December 31, 2022 | | At September 30, 2022 |

| Materials and supplies inventory | $ | 824 | | | $ | 808 | |

| Fuel inventory | 426 | | | 303 | |

| Renewable energy certificates/emissions allowance inventory, net | 19 | | | 18 | |

| Allowance for inventory obsolescence | (62) | | | (57) | |

| Inventories, net | $ | 1,207 | | | $ | 1,072 | |

5. Other Current Assets

Other current assets consisted of the following:

| | | | | | | | | | | |

Other Current Assets (in millions) |

| | At December 31, 2022 | | At September 30, 2022 |

| Commodity contract derivative assets | $ | 59 | | | $ | 172 | |

| Collateral receivable | 50 | | | — | |

| Other | 112 | | | 85 | |

| Other current assets | $ | 221 | | | $ | 257 | |

Commodity Contract Derivative Assets. TVA enters into certain derivative contracts for natural gas that require physical delivery of the contracted quantity of the commodity as well as certain financial derivative contracts to hedge exposure to the price of natural gas. Commodity contract derivative assets classified as current include deliveries or settlements that will occur within 12 months or less. See Note 13 — Risk Management Activities and Derivative Transactions — Derivatives Not Receiving Hedge Accounting Treatment — Commodity Derivatives and — Commodity Derivatives under the FHP for a discussion of TVA's commodity contract derivatives.

Collateral Receivable. On December 27, 2022, TVA deposited $50 million of cash collateral with PJM Settlement Inc. (“PJM”) to provide security for TVA’s power purchases from PJM during the winter season.

6. Plant Closures

Background

TVA must continuously evaluate all generating assets to ensure an optimal energy portfolio that provides safe, clean, and reliable power while maintaining flexibility and fiscal responsibility to the people of the Tennessee Valley. Based on results of assessments presented to the TVA Board in 2019, the retirement of Bull Run Fossil Plant ("Bull Run") by December 2023 was approved. In addition, TVA is evaluating the impact of retiring the balance of the coal-fired fleet by 2035, and that evaluation

includes environmental reviews, public input, and TVA Board approval. Due to these evaluations, certain planning assumptions were updated, and their financial impacts are discussed below.

In January 2023, TVA issued its Record of Decision to retire the two remaining coal-fired units at Cumberland Fossil Plant ("Cumberland") by the end of CY 2026 and CY 2028.

Financial Impact

TVA's policy is to adjust depreciation rates to reflect the most current assumptions, ensuring units will be fully depreciated by the applicable retirement dates. As a result of TVA's decision to accelerate the retirement of Bull Run, TVA has recognized a cumulative $518 million of accelerated depreciation since the second quarter of 2019. Of this amount, $36 million and $35 million were recognized for Bull Run during the three months ended December 31, 2022 and 2021, respectively.

TVA also recognized $4 million and $6 million in Operating and maintenance expense related to additional inventory reserves and write-offs for the coal-fired fleet, including Bull Run, during the three months ended December 31, 2022 and 2021, respectively.

7. Other Long-Term Assets

The table below summarizes the types and amounts of TVA's other long-term assets:

| | | | | | | | | | | |

Other Long-Term Assets (in millions) |

| At December 31, 2022 | | At September 30, 2022 |

| | | |

| Loans and other long-term receivables, net | $ | 106 | | | $ | 99 | |

EnergyRight® receivables, net | 48 | | | 49 | |

| Prepaid long-term service agreements | 63 | | | 74 | |

| Commodity contract derivative assets | 43 | | | 102 | |

| | | |

| | | |

| | | |

| Other | 93 | | | 70 | |

| Total other long-term assets | $ | 353 | | | $ | 394 | |

Loans and Other Long-Term Receivables. TVA's loans and other long-term receivables primarily consist of economic development loans for qualifying organizations and a receivable for reimbursements to recover the cost of providing long-term, on-site storage for spent nuclear fuel. The current and long-term portions of the loans receivable are reported in Accounts receivable, net and Other long-term assets, respectively, on TVA's Consolidated Balance Sheets. At December 31, 2022 and September 30, 2022, the carrying amount of the loans receivable, net of discount, reported in Accounts receivable, net was approximately $3 million and $6 million, respectively.

EnergyRight® Receivables. In association with the EnergyRight® program, TVA's local power company customers ("LPCs") offer financing to end-use customers for the purchase of energy-efficient equipment. Depending on the nature of the energy-efficiency project, loans may have a maximum term of five years or 10 years. TVA purchases the resulting loans receivable from its LPCs. The loans receivable are then transferred to a third-party bank with which TVA has agreed to repay in full any loans receivable that have been in default for 180 days or more or that TVA has determined are uncollectible. Given this continuing involvement, TVA accounts for the transfer of the loans receivable as secured borrowings. The current and long-term portions of the loans receivable are reported in Accounts receivable, net and Other long-term assets, respectively, on TVA's Consolidated Balance Sheets. At both December 31, 2022, and September 30, 2022, the carrying amount of the loans receivable, net of discount, reported in Accounts receivable, net was approximately $13 million. See Note 10 — Other Long-Term Liabilities for information regarding the associated financing obligation.

Allowance for Loan Losses. The allowance for loan loss is an estimate of expected credit losses, measured over the estimated life of the loan receivables, that considers reasonable and supportable forecasts of future economic conditions in addition to information about historical experience and current conditions. See Note 1 — Summary of Significant Accounting Policies — Allowance for Uncollectible Accounts.

The allowance components, which consist of a collective allowance and specific loans allowance, are based on the risk characteristics of TVA's loans. Loans that share similar risk characteristics are evaluated on a collective basis in measuring credit losses, while loans that do not share similar risk characteristics with other loans are evaluated on an individual basis.

| | | | | | | | | | | |

Allowance Components (in millions) |

| At December 31, 2022 | | At September 30, 2022 |

EnergyRight® loan reserve | $ | 1 | | | $ | 1 | |

| Economic development loan collective reserve | 1 | | | 1 | |

| Economic development loan specific loan reserve | 1 | | | 1 | |

| | | |

| Total allowance for loan losses | $ | 3 | | | $ | 3 | |

Prepaid Long-Term Service Agreements. TVA has entered into various long-term service agreements for major maintenance activities at certain of its combined cycle plants. TVA uses the direct expense method of accounting for these arrangements. TVA accrues for parts when it takes ownership and for contractor services when they are rendered. Under certain of these agreements, payments made exceed the value of parts received and services rendered. The current and long-term portions of the resulting prepayments are reported in Other current assets and Other long-term assets, respectively, on TVA's Consolidated Balance Sheets. At December 31, 2022, and September 30, 2022, prepayments of $17 million and $12 million, respectively, were recorded in Other current assets.

Commodity Contract Derivative Assets. TVA enters into certain derivative contracts for natural gas that require physical delivery of the contracted quantity of the commodity as well as certain financial derivative contracts to hedge exposure to the price of natural gas. See Note 13 — Risk Management Activities and Derivative Transactions — Derivatives Not Receiving Hedge Accounting Treatment — Commodity Derivatives and — Commodity Derivatives under the FHP for a discussion of TVA's commodity contract derivatives.

8. Regulatory Assets and Liabilities

TVA records certain assets and liabilities that result from the regulated ratemaking process that would not be recorded under GAAP for non-regulated entities. As such, certain items that would generally be reported in earnings or that would impact the Consolidated Statements of Operations are recorded as regulatory assets or regulatory liabilities. Regulatory assets generally represent incurred costs that have been deferred because such costs are probable of future recovery in customer rates. Regulatory liabilities generally represent obligations to make refunds to customers for previous collections for costs that are not likely to be incurred or deferral of gains that will be credited to customers in future periods. Components of regulatory assets and regulatory liabilities are summarized in the table below.

| | | | | | | | | | | |

Regulatory Assets and Liabilities (in millions) |

| | At December 31, 2022 | | At September 30, 2022 |

| Current regulatory assets | | | |

| | | |

| Unrealized losses on interest rate derivatives | $ | 41 | | | $ | 47 | |

| | | |

| Unrealized losses on commodity derivatives | 137 | | | 14 | |

| | | |

| | | |

| Fuel cost adjustment receivable | 142 | | | 77 | |

| | | |

| Total current regulatory assets | 320 | | | 138 | |

| | | |

| Non-current regulatory assets | | | |

| Retirement benefit plans deferred costs | 1,809 | | | 1,839 | |

| Non-nuclear decommissioning costs | 2,769 | | | 2,856 | |

| | | |