cvi-202112310001376139false2021FY0.1http://fasb.org/us-gaap/2021-01-31#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2021-01-31#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationP4YP2YP1Yhttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2021-01-31#LongTermDebtAndCapitalLeaseObligationsP1YP1Y—33.3333.3333.3300013761392021-01-012021-12-3100013761392021-06-30iso4217:USD00013761392022-02-18xbrli:shares0001376139us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-12-310001376139us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2020-12-3100013761392021-12-3100013761392020-12-31iso4217:USDxbrli:shares00013761392020-01-012020-12-3100013761392019-01-012019-12-310001376139us-gaap:CommonStockMember2018-12-310001376139us-gaap:AdditionalPaidInCapitalMember2018-12-310001376139us-gaap:RetainedEarningsMember2018-12-310001376139us-gaap:TreasuryStockMember2018-12-310001376139us-gaap:ParentMember2018-12-310001376139us-gaap:NoncontrollingInterestMember2018-12-3100013761392018-12-310001376139us-gaap:RetainedEarningsMember2019-01-012019-12-310001376139us-gaap:ParentMember2019-01-012019-12-310001376139us-gaap:NoncontrollingInterestMember2019-01-012019-12-310001376139us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001376139srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AdditionalPaidInCapitalMember2018-12-310001376139srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:ParentMember2018-12-310001376139srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-12-310001376139us-gaap:CommonStockMember2019-12-310001376139us-gaap:AdditionalPaidInCapitalMember2019-12-310001376139us-gaap:RetainedEarningsMember2019-12-310001376139us-gaap:TreasuryStockMember2019-12-310001376139us-gaap:ParentMember2019-12-310001376139us-gaap:NoncontrollingInterestMember2019-12-3100013761392019-12-310001376139us-gaap:RetainedEarningsMember2020-01-012020-12-310001376139us-gaap:ParentMember2020-01-012020-12-310001376139us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001376139us-gaap:NoncontrollingInterestMember2020-01-012020-12-310001376139us-gaap:CommonStockMember2020-12-310001376139us-gaap:AdditionalPaidInCapitalMember2020-12-310001376139us-gaap:RetainedEarningsMember2020-12-310001376139us-gaap:TreasuryStockMember2020-12-310001376139us-gaap:ParentMember2020-12-310001376139us-gaap:NoncontrollingInterestMember2020-12-310001376139us-gaap:RetainedEarningsMember2021-01-012021-12-310001376139us-gaap:ParentMember2021-01-012021-12-310001376139us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001376139us-gaap:CommonStockMember2021-12-310001376139us-gaap:AdditionalPaidInCapitalMember2021-12-310001376139us-gaap:RetainedEarningsMember2021-12-310001376139us-gaap:TreasuryStockMember2021-12-310001376139us-gaap:ParentMember2021-12-310001376139us-gaap:NoncontrollingInterestMember2021-12-310001376139cvi:CVRPartnersLPMember2021-01-012021-12-310001376139cvi:CVRPartnersLPMember2020-01-012020-12-310001376139cvi:CVRPartnersLPMember2019-01-012019-12-310001376139us-gaap:MajorityShareholderMember2021-01-012021-12-31xbrli:pure00013761392019-10-2300013761392019-10-232019-10-230001376139cvi:CVRRefiningLimitedPartnershipPublicUnitPurchaseMember2019-01-290001376139cvi:CVRRefiningLimitedPartnershipPublicUnitPurchaseMember2019-01-292019-01-290001376139cvi:CVRRefiningLimitedPartnershipAffiliateUnitPurchaseMembercvi:AmericanEntertainmentPropertiesCorpandIEPEnergyLLCMember2019-01-292019-01-290001376139cvi:CVRRefiningLimitedPartnershipMember2019-01-292019-01-290001376139us-gaap:MediumTermNotesMembercvi:JefferiesFinanceLLCCreditAgreementMember2019-01-290001376139cvi:CVRServicesLLCMembercvi:CVRPartnersLPMember2021-01-012021-12-310001376139cvi:CVRServicesLLCMembercvi:CVRGPLLCMember2021-01-012021-12-310001376139cvi:CVRPartnersLPMember2020-05-060001376139cvi:CVRPartnersLPMember2021-02-220001376139cvi:CVRPartnersLPMember2021-12-310001376139us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001376139cvi:CVRPartnersLPMember2020-11-232020-11-230001376139cvi:OneCustomerMemberus-gaap:CreditConcentrationRiskMemberus-gaap:AccountsReceivableMember2021-01-012021-12-310001376139cvi:OneCustomerMemberus-gaap:CreditConcentrationRiskMemberus-gaap:AccountsReceivableMember2020-01-012020-12-310001376139cvi:PetroleumSegmentMember2020-01-012020-03-310001376139cvi:PetroleumSegmentMember2020-04-012020-12-310001376139cvi:PetroleumSegmentMember2021-01-012021-12-310001376139cvi:NitrogenFertilizerSegmentMember2021-12-310001376139cvi:NitrogenFertilizerSegmentMember2020-12-310001376139srt:MinimumMemberus-gaap:LandAndLandImprovementsMember2021-01-012021-12-310001376139srt:MaximumMemberus-gaap:LandAndLandImprovementsMember2021-01-012021-12-310001376139srt:MinimumMemberus-gaap:BuildingAndBuildingImprovementsMember2021-01-012021-12-310001376139us-gaap:BuildingAndBuildingImprovementsMembersrt:MaximumMember2021-01-012021-12-310001376139srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2021-01-012021-12-310001376139srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2021-01-012021-12-310001376139srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2021-01-012021-12-310001376139us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2021-01-012021-12-310001376139srt:MinimumMember2021-01-012021-12-310001376139srt:MaximumMember2021-01-012021-12-310001376139us-gaap:PropertyPlantAndEquipmentOtherTypesMembersrt:MinimumMember2021-01-012021-12-310001376139us-gaap:PropertyPlantAndEquipmentOtherTypesMembersrt:MaximumMember2021-01-012021-12-310001376139us-gaap:MachineryAndEquipmentMember2021-12-310001376139us-gaap:MachineryAndEquipmentMember2020-12-310001376139us-gaap:BuildingAndBuildingImprovementsMember2021-12-310001376139us-gaap:BuildingAndBuildingImprovementsMember2020-12-310001376139us-gaap:LandAndLandImprovementsMember2021-12-310001376139us-gaap:LandAndLandImprovementsMember2020-12-310001376139us-gaap:FurnitureAndFixturesMember2021-12-310001376139us-gaap:FurnitureAndFixturesMember2020-12-310001376139us-gaap:ConstructionInProgressMember2021-12-310001376139us-gaap:ConstructionInProgressMember2020-12-310001376139us-gaap:PropertyPlantAndEquipmentOtherTypesMember2021-12-310001376139us-gaap:PropertyPlantAndEquipmentOtherTypesMember2020-12-310001376139us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2019-05-212019-05-210001376139cvi:NitrogenFertilizerSegmentMember2019-12-310001376139cvi:NitrogenFertilizerSegmentMember2020-04-012020-06-30cvi:product0001376139cvi:PetroleumSegmentMembersrt:MinimumMember2021-01-012021-12-310001376139cvi:PetroleumSegmentMembersrt:MaximumMember2021-01-012021-12-310001376139srt:MinimumMembercvi:NitrogenFertilizerSegmentMember2021-01-012021-12-310001376139srt:MaximumMembercvi:NitrogenFertilizerSegmentMember2021-01-012021-12-310001376139cvi:PetroleumSegmentMember2021-12-310001376139cvi:PetroleumSegmentMember2020-12-310001376139cvi:PetroleumSegmentMember2019-12-310001376139cvi:NitrogenFertilizerSegmentMember2021-01-012021-12-310001376139cvi:NitrogenFertilizerSegmentMember2020-01-012020-12-310001376139cvi:NitrogenFertilizerSegmentMember2019-01-012019-12-310001376139cvi:CVRRefiningLimitedPartnershipMembercvi:EnableSouthCentralPipelineLLCMembercvi:EnableSouthCentralPipelineLLCMember2021-12-310001376139cvi:CVRRefiningLimitedPartnershipMembercvi:EnableSouthCentralPipelineLLCMember2021-12-31utr:mi0001376139cvi:CVRRefiningLimitedPartnershipMembercvi:EnableSouthCentralPipelineLLCMember2021-01-012021-12-31utr:bblutr:D0001376139cvi:MidwayPipelineLLCMembercvi:CVRRefiningLimitedPartnershipMembercvi:MidwayPipelineLLCMember2021-12-310001376139cvi:MidwayPipelineLLCMembercvi:CVRRefiningLimitedPartnershipMember2021-12-310001376139cvi:MidwayPipelineLLCMembercvi:CVRRefiningLimitedPartnershipMember2021-01-012021-12-310001376139cvi:CVRRefiningLimitedPartnershipMembercvi:EnableSouthCentralPipelineLLCMember2019-12-310001376139cvi:MidwayPipelineLLCMembercvi:CVRRefiningLimitedPartnershipMember2019-12-310001376139cvi:CVRRefiningLimitedPartnershipMember2019-12-310001376139cvi:CVRRefiningLimitedPartnershipMembercvi:EnableSouthCentralPipelineLLCMember2020-01-012020-12-310001376139cvi:MidwayPipelineLLCMembercvi:CVRRefiningLimitedPartnershipMember2020-01-012020-12-310001376139cvi:CVRRefiningLimitedPartnershipMember2020-01-012020-12-310001376139cvi:CVRRefiningLimitedPartnershipMembercvi:EnableSouthCentralPipelineLLCMember2020-12-310001376139cvi:MidwayPipelineLLCMembercvi:CVRRefiningLimitedPartnershipMember2020-12-310001376139cvi:CVRRefiningLimitedPartnershipMember2020-12-310001376139cvi:CVRRefiningLimitedPartnershipMember2021-01-012021-12-310001376139cvi:CVRRefiningLimitedPartnershipMember2021-12-310001376139cvi:PipelinesandStorageTanksMember2021-12-310001376139cvi:PipelinesandStorageTanksMember2020-12-310001376139cvi:RailcarsMember2021-12-310001376139cvi:RailcarsMember2020-12-310001376139us-gaap:RealEstateMember2021-12-310001376139us-gaap:RealEstateMember2020-12-310001376139srt:MaximumMember2020-07-310001376139us-gaap:SeniorNotesMembercvi:CVRPartnersLPMembercvi:NinePointTwoFivePercentSeniorSecuredNotesDue2023Member2021-12-310001376139us-gaap:SeniorNotesMembercvi:CVRPartnersLPMembercvi:NinePointTwoFivePercentSeniorSecuredNotesDue2023Member2020-12-310001376139us-gaap:SeniorNotesMembercvi:SixPointOneTwoFivePercentNotesDueJune2028Membercvi:CVRPartnersLPMember2021-12-310001376139cvi:CVRPartnersLPMember2020-12-310001376139us-gaap:SeniorNotesMembersrt:ParentCompanyMembercvi:FivePointTwoFivePercentNotesDue2025Member2021-12-310001376139us-gaap:SeniorNotesMembersrt:ParentCompanyMembercvi:FivePointTwoFivePercentNotesDue2025Member2020-12-310001376139cvi:FivePointSevenFivePercentNotesDue2028Memberus-gaap:SeniorNotesMembersrt:ParentCompanyMember2021-12-310001376139cvi:FivePointSevenFivePercentNotesDue2028Memberus-gaap:SeniorNotesMembersrt:ParentCompanyMember2020-12-310001376139srt:ParentCompanyMember2021-12-310001376139srt:ParentCompanyMember2020-12-310001376139us-gaap:SeniorNotesMembercvi:CVRPartnersLPMembercvi:NinePointTwoFivePercentSeniorSecuredNotesDue2023Member2021-06-232021-06-230001376139us-gaap:SeniorNotesMembercvi:CVRPartnersLPMembercvi:NinePointTwoFivePercentSeniorSecuredNotesDue2023Member2021-09-232021-09-230001376139us-gaap:SeniorNotesMembercvi:CVRPartnersLPMembercvi:NinePointTwoFivePercentSeniorSecuredNotesDue2023Member2021-12-222021-12-220001376139us-gaap:SeniorNotesMembercvi:SixPointFiveZeroPercentNotesDue2021Membercvi:CVRPartnersLPMember2021-04-150001376139us-gaap:LineOfCreditMembercvi:CVRPartnersLPMembercvi:AssetBasedCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2021-12-310001376139cvi:CVRRefiningLimitedPartnershipMembercvi:AmendedAndRestatedAssetBasedCreditAgreementMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2021-12-310001376139us-gaap:LineOfCreditMembercvi:WellsFargoBankNationalAssociationMembercvi:CVRPartnersLPMembercvi:AssetBasedCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2021-09-300001376139cvi:UANABLCreditAgreementMemberus-gaap:LineOfCreditMembercvi:CVRPartnersLPMemberus-gaap:RevolvingCreditFacilityMember2021-09-300001376139cvi:DebtInstrumentCovenantQuarterlyExcessAvailabilityGreaterThanSeventyFivePercentMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:LineOfCreditMembercvi:CVRPartnersLPMembercvi:AssetBasedCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2021-09-302021-12-310001376139us-gaap:BaseRateMembercvi:DebtInstrumentCovenantQuarterlyExcessAvailabilityGreaterThanSeventyFivePercentMemberus-gaap:LineOfCreditMembercvi:CVRPartnersLPMembercvi:AssetBasedCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2021-09-302021-12-310001376139cvi:DebtInstrumentCovenantQuarterlyExcessAvailabilityGreaterThanFiftyPercentButLessThanSeventyFivePercentMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:LineOfCreditMembercvi:CVRPartnersLPMembercvi:AssetBasedCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2021-09-302021-12-310001376139cvi:DebtInstrumentCovenantQuarterlyExcessAvailabilityGreaterThanFiftyPercentButLessThanSeventyFivePercentMemberus-gaap:BaseRateMemberus-gaap:LineOfCreditMembercvi:CVRPartnersLPMembercvi:AssetBasedCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2021-09-302021-12-310001376139cvi:DebtInstrumentCovenantQuarterlyExcessAvailabilityNotGreaterThanFiftyPercentMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:LineOfCreditMembercvi:CVRPartnersLPMembercvi:AssetBasedCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2021-09-302021-12-310001376139us-gaap:BaseRateMembercvi:DebtInstrumentCovenantQuarterlyExcessAvailabilityNotGreaterThanFiftyPercentMemberus-gaap:LineOfCreditMembercvi:CVRPartnersLPMembercvi:AssetBasedCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2021-09-302021-12-310001376139cvi:DebtInstrumentCovenantQuarterlyExcessAvailabilityGreaterThanFiftyPercentMembercvi:CVRRefiningLimitedPartnershipMemberus-gaap:LondonInterbankOfferedRateLIBORMembercvi:AmendedAndRestatedAssetBasedCreditAgreementMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2021-01-012021-12-310001376139cvi:DebtInstrumentCovenantQuarterlyExcessAvailabilityGreaterThanFiftyPercentMemberus-gaap:BaseRateMembercvi:CVRRefiningLimitedPartnershipMembercvi:AmendedAndRestatedAssetBasedCreditAgreementMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2021-01-012021-12-310001376139cvi:CVRRefiningLimitedPartnershipMemberus-gaap:LondonInterbankOfferedRateLIBORMembercvi:AmendedAndRestatedAssetBasedCreditAgreementMembercvi:DebtInstrumentCovenantQuarterlyExcessAvailabilityNotGreaterThanFiftyPercentMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2021-01-012021-12-310001376139us-gaap:BaseRateMembercvi:CVRRefiningLimitedPartnershipMembercvi:AmendedAndRestatedAssetBasedCreditAgreementMembercvi:DebtInstrumentCovenantQuarterlyExcessAvailabilityNotGreaterThanFiftyPercentMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2021-01-012021-12-310001376139us-gaap:SeniorNotesMembercvi:SixPointOneTwoFivePercentNotesDueJune2028Membercvi:CVRPartnersLPMember2021-06-230001376139us-gaap:SeniorNotesMembercvi:SixPointOneTwoFivePercentNotesDueJune2028Membercvi:CVRPartnersLPMember2021-06-232021-06-230001376139cvi:SixPointOneTwoFivePercentNotesDueJune2028Member2021-01-012021-12-310001376139cvi:SixPointOneTwoFivePercentNotesDueJune2028Memberus-gaap:DebtInstrumentRedemptionPeriodOneMember2021-01-012021-12-310001376139us-gaap:DebtInstrumentRedemptionPeriodTwoMembercvi:SixPointOneTwoFivePercentNotesDueJune2028Member2021-01-012021-12-310001376139us-gaap:DebtInstrumentRedemptionPeriodThreeMembercvi:SixPointOneTwoFivePercentNotesDueJune2028Member2021-01-012021-12-310001376139us-gaap:SeniorNotesMembercvi:CVRPartnersLPMembercvi:NinePointTwoFivePercentSeniorSecuredNotesDue2023Member2016-06-100001376139us-gaap:DebtInstrumentRedemptionPeriodOneMembercvi:NinePointTwoFivePercentSeniorSecuredNotesDue2023Member2021-06-152021-06-150001376139us-gaap:SeniorNotesMembercvi:NinePointTwoFivePercentSeniorSecuredNotesDue2023Member2021-06-150001376139us-gaap:SeniorNotesMembercvi:CVRPartnersLPMembercvi:NinePointTwoFivePercentSeniorSecuredNotesDue2023Member2021-06-230001376139cvi:CVRPartnersLPMember2021-04-012021-06-300001376139us-gaap:SeniorNotesMembercvi:CVRPartnersLPMembercvi:NinePointTwoFivePercentSeniorSecuredNotesDue2023Member2021-06-300001376139us-gaap:SeniorNotesMembercvi:CVRPartnersLPMembercvi:NinePointTwoFivePercentSeniorSecuredNotesDue2023Member2021-12-220001376139us-gaap:SeniorNotesMemberus-gaap:SubsequentEventMembercvi:CVRPartnersLPMembercvi:NinePointTwoFivePercentSeniorSecuredNotesDue2023Member2022-02-220001376139cvi:CVRPartnersLPMembersrt:ScenarioForecastMember2022-01-012022-03-310001376139us-gaap:SeniorNotesMembersrt:ScenarioForecastMembercvi:CVRPartnersLPMembercvi:NinePointTwoFivePercentSeniorSecuredNotesDue2023Member2022-03-310001376139us-gaap:BridgeLoanMemberus-gaap:LineOfCreditMembercvi:WellsFargoBankNationalAssociationMembercvi:CVRPartnersLPMembercvi:AssetBasedCreditAgreementMember2021-09-300001376139us-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMembercvi:WellsFargoBankNationalAssociationMembercvi:CVRPartnersLPMembercvi:AssetBasedCreditAgreementMember2021-09-300001376139us-gaap:LineOfCreditMembercvi:CVRPartnersLPMembercvi:AssetBasedCreditAgreementMember2021-12-310001376139cvi:CreditPartiesMembercvi:AmendedAndRestatedAssetBasedCreditAgreementMember2017-11-140001376139us-gaap:LetterOfCreditMembercvi:CreditPartiesMembercvi:AmendedAndRestatedAssetBasedCreditAgreementMember2017-11-140001376139cvi:CreditPartiesMemberus-gaap:BridgeLoanMembercvi:AmendedAndRestatedAssetBasedCreditAgreementMember2017-11-140001376139us-gaap:SeniorNotesMembercvi:FivePointTwoFivePercentNotesDue2025Member2020-01-270001376139cvi:FivePointSevenFivePercentNotesDue2028Memberus-gaap:SeniorNotesMember2020-01-270001376139us-gaap:SeniorNotesMembercvi:SixPointFiveZeroPercentNotesDue2025And2028Member2020-01-272020-01-270001376139us-gaap:SeniorNotesMembercvi:SixPointFiveZeroPercentNotesDue2025And2028Member2020-01-270001376139us-gaap:SeniorNotesMembercvi:FivePointTwoFivePercentNotesDue2025Memberus-gaap:DebtInstrumentRedemptionPeriodOneMember2021-01-012021-12-310001376139cvi:FivePointSevenFivePercentNotesDue2028Memberus-gaap:SeniorNotesMemberus-gaap:DebtInstrumentRedemptionPeriodOneMember2021-01-012021-12-310001376139us-gaap:SeniorNotesMemberus-gaap:DebtInstrumentRedemptionPeriodTwoMembercvi:FivePointTwoFivePercentNotesDue2025Member2021-01-012021-12-310001376139cvi:FivePointSevenFivePercentNotesDue2028Memberus-gaap:SeniorNotesMemberus-gaap:DebtInstrumentRedemptionPeriodTwoMember2021-01-012021-12-310001376139us-gaap:SeniorNotesMemberus-gaap:DebtInstrumentRedemptionPeriodThreeMembercvi:FivePointTwoFivePercentNotesDue2025Member2021-01-012021-12-310001376139cvi:FivePointSevenFivePercentNotesDue2028Memberus-gaap:SeniorNotesMemberus-gaap:DebtInstrumentRedemptionPeriodThreeMember2021-01-012021-12-310001376139cvi:FivePointSevenFivePercentNotesDue2028Memberus-gaap:SeniorNotesMemberus-gaap:DebtInstrumentRedemptionPeriodFourMember2021-01-012021-12-310001376139cvi:PetroleumSegmentMembercvi:ProductGasolineMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001376139cvi:ProductGasolineMemberus-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMember2021-01-012021-12-310001376139cvi:ProductGasolineMemberus-gaap:IntersegmentEliminationMember2021-01-012021-12-310001376139cvi:ProductGasolineMember2021-01-012021-12-310001376139cvi:ProductDistillatesMembercvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001376139cvi:ProductDistillatesMemberus-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMember2021-01-012021-12-310001376139cvi:ProductDistillatesMemberus-gaap:IntersegmentEliminationMember2021-01-012021-12-310001376139cvi:ProductDistillatesMember2021-01-012021-12-310001376139cvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMembercvi:ProductAmmoniaMember2021-01-012021-12-310001376139us-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMembercvi:ProductAmmoniaMember2021-01-012021-12-310001376139us-gaap:IntersegmentEliminationMembercvi:ProductAmmoniaMember2021-01-012021-12-310001376139cvi:ProductAmmoniaMember2021-01-012021-12-310001376139cvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMembercvi:ProductUANMember2021-01-012021-12-310001376139us-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMembercvi:ProductUANMember2021-01-012021-12-310001376139us-gaap:IntersegmentEliminationMembercvi:ProductUANMember2021-01-012021-12-310001376139cvi:ProductUANMember2021-01-012021-12-310001376139cvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMembercvi:ProductOtherUreaProductsMember2021-01-012021-12-310001376139us-gaap:OperatingSegmentsMembercvi:ProductOtherUreaProductsMembercvi:NitrogenFertilizerSegmentMember2021-01-012021-12-310001376139cvi:ProductOtherUreaProductsMemberus-gaap:IntersegmentEliminationMember2021-01-012021-12-310001376139cvi:ProductOtherUreaProductsMember2021-01-012021-12-310001376139cvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMembercvi:ProductFreightRevenueMember2021-01-012021-12-310001376139us-gaap:OperatingSegmentsMembercvi:ProductFreightRevenueMembercvi:NitrogenFertilizerSegmentMember2021-01-012021-12-310001376139cvi:ProductFreightRevenueMemberus-gaap:IntersegmentEliminationMember2021-01-012021-12-310001376139cvi:ProductFreightRevenueMember2021-01-012021-12-310001376139cvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMembercvi:ProductsOtherMember2021-01-012021-12-310001376139us-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMembercvi:ProductsOtherMember2021-01-012021-12-310001376139cvi:ProductsOtherMemberus-gaap:IntersegmentEliminationMember2021-01-012021-12-310001376139cvi:ProductsOtherMember2021-01-012021-12-310001376139us-gaap:ProductMembercvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001376139us-gaap:ProductMemberus-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMember2021-01-012021-12-310001376139us-gaap:ProductMemberus-gaap:IntersegmentEliminationMember2021-01-012021-12-310001376139us-gaap:ProductMember2021-01-012021-12-310001376139cvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMembercvi:ServiceCrudeOilSalesMember2021-01-012021-12-310001376139us-gaap:OperatingSegmentsMembercvi:ServiceCrudeOilSalesMembercvi:NitrogenFertilizerSegmentMember2021-01-012021-12-310001376139cvi:ServiceCrudeOilSalesMemberus-gaap:IntersegmentEliminationMember2021-01-012021-12-310001376139cvi:ServiceCrudeOilSalesMember2021-01-012021-12-310001376139cvi:PetroleumSegmentMemberus-gaap:ServiceOtherMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001376139us-gaap:ServiceOtherMemberus-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMember2021-01-012021-12-310001376139us-gaap:ServiceOtherMemberus-gaap:IntersegmentEliminationMember2021-01-012021-12-310001376139us-gaap:ServiceOtherMember2021-01-012021-12-310001376139cvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001376139us-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMember2021-01-012021-12-310001376139us-gaap:IntersegmentEliminationMember2021-01-012021-12-310001376139cvi:PetroleumSegmentMembercvi:ProductGasolineMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001376139cvi:ProductGasolineMemberus-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMember2020-01-012020-12-310001376139cvi:ProductGasolineMemberus-gaap:IntersegmentEliminationMember2020-01-012020-12-310001376139cvi:ProductGasolineMember2020-01-012020-12-310001376139cvi:ProductDistillatesMembercvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001376139cvi:ProductDistillatesMemberus-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMember2020-01-012020-12-310001376139cvi:ProductDistillatesMemberus-gaap:IntersegmentEliminationMember2020-01-012020-12-310001376139cvi:ProductDistillatesMember2020-01-012020-12-310001376139cvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMembercvi:ProductAmmoniaMember2020-01-012020-12-310001376139us-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMembercvi:ProductAmmoniaMember2020-01-012020-12-310001376139us-gaap:IntersegmentEliminationMembercvi:ProductAmmoniaMember2020-01-012020-12-310001376139cvi:ProductAmmoniaMember2020-01-012020-12-310001376139cvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMembercvi:ProductUANMember2020-01-012020-12-310001376139us-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMembercvi:ProductUANMember2020-01-012020-12-310001376139us-gaap:IntersegmentEliminationMembercvi:ProductUANMember2020-01-012020-12-310001376139cvi:ProductUANMember2020-01-012020-12-310001376139cvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMembercvi:ProductOtherUreaProductsMember2020-01-012020-12-310001376139us-gaap:OperatingSegmentsMembercvi:ProductOtherUreaProductsMembercvi:NitrogenFertilizerSegmentMember2020-01-012020-12-310001376139cvi:ProductOtherUreaProductsMemberus-gaap:IntersegmentEliminationMember2020-01-012020-12-310001376139cvi:ProductOtherUreaProductsMember2020-01-012020-12-310001376139cvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMembercvi:ProductFreightRevenueMember2020-01-012020-12-310001376139us-gaap:OperatingSegmentsMembercvi:ProductFreightRevenueMembercvi:NitrogenFertilizerSegmentMember2020-01-012020-12-310001376139cvi:ProductFreightRevenueMemberus-gaap:IntersegmentEliminationMember2020-01-012020-12-310001376139cvi:ProductFreightRevenueMember2020-01-012020-12-310001376139cvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMembercvi:ProductsOtherMember2020-01-012020-12-310001376139us-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMembercvi:ProductsOtherMember2020-01-012020-12-310001376139cvi:ProductsOtherMemberus-gaap:IntersegmentEliminationMember2020-01-012020-12-310001376139cvi:ProductsOtherMember2020-01-012020-12-310001376139us-gaap:ProductMembercvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001376139us-gaap:ProductMemberus-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMember2020-01-012020-12-310001376139us-gaap:ProductMemberus-gaap:IntersegmentEliminationMember2020-01-012020-12-310001376139us-gaap:ProductMember2020-01-012020-12-310001376139cvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMembercvi:ServiceCrudeOilSalesMember2020-01-012020-12-310001376139us-gaap:OperatingSegmentsMembercvi:ServiceCrudeOilSalesMembercvi:NitrogenFertilizerSegmentMember2020-01-012020-12-310001376139cvi:ServiceCrudeOilSalesMemberus-gaap:IntersegmentEliminationMember2020-01-012020-12-310001376139cvi:ServiceCrudeOilSalesMember2020-01-012020-12-310001376139cvi:PetroleumSegmentMemberus-gaap:ServiceOtherMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001376139us-gaap:ServiceOtherMemberus-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMember2020-01-012020-12-310001376139us-gaap:ServiceOtherMemberus-gaap:IntersegmentEliminationMember2020-01-012020-12-310001376139us-gaap:ServiceOtherMember2020-01-012020-12-310001376139cvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001376139us-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMember2020-01-012020-12-310001376139us-gaap:IntersegmentEliminationMember2020-01-012020-12-310001376139cvi:PetroleumSegmentMembercvi:ProductGasolineMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001376139cvi:ProductGasolineMemberus-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMember2019-01-012019-12-310001376139cvi:ProductGasolineMemberus-gaap:IntersegmentEliminationMember2019-01-012019-12-310001376139cvi:ProductGasolineMember2019-01-012019-12-310001376139cvi:ProductDistillatesMembercvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001376139cvi:ProductDistillatesMemberus-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMember2019-01-012019-12-310001376139cvi:ProductDistillatesMemberus-gaap:IntersegmentEliminationMember2019-01-012019-12-310001376139cvi:ProductDistillatesMember2019-01-012019-12-310001376139cvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMembercvi:ProductAmmoniaMember2019-01-012019-12-310001376139us-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMembercvi:ProductAmmoniaMember2019-01-012019-12-310001376139us-gaap:IntersegmentEliminationMembercvi:ProductAmmoniaMember2019-01-012019-12-310001376139cvi:ProductAmmoniaMember2019-01-012019-12-310001376139cvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMembercvi:ProductUANMember2019-01-012019-12-310001376139us-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMembercvi:ProductUANMember2019-01-012019-12-310001376139us-gaap:IntersegmentEliminationMembercvi:ProductUANMember2019-01-012019-12-310001376139cvi:ProductUANMember2019-01-012019-12-310001376139cvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMembercvi:ProductOtherUreaProductsMember2019-01-012019-12-310001376139us-gaap:OperatingSegmentsMembercvi:ProductOtherUreaProductsMembercvi:NitrogenFertilizerSegmentMember2019-01-012019-12-310001376139cvi:ProductOtherUreaProductsMemberus-gaap:IntersegmentEliminationMember2019-01-012019-12-310001376139cvi:ProductOtherUreaProductsMember2019-01-012019-12-310001376139cvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMembercvi:ProductFreightRevenueMember2019-01-012019-12-310001376139us-gaap:OperatingSegmentsMembercvi:ProductFreightRevenueMembercvi:NitrogenFertilizerSegmentMember2019-01-012019-12-310001376139cvi:ProductFreightRevenueMemberus-gaap:IntersegmentEliminationMember2019-01-012019-12-310001376139cvi:ProductFreightRevenueMember2019-01-012019-12-310001376139cvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMembercvi:ProductsOtherMember2019-01-012019-12-310001376139us-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMembercvi:ProductsOtherMember2019-01-012019-12-310001376139cvi:ProductsOtherMemberus-gaap:IntersegmentEliminationMember2019-01-012019-12-310001376139cvi:ProductsOtherMember2019-01-012019-12-310001376139us-gaap:ProductMembercvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001376139us-gaap:ProductMemberus-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMember2019-01-012019-12-310001376139us-gaap:ProductMemberus-gaap:IntersegmentEliminationMember2019-01-012019-12-310001376139us-gaap:ProductMember2019-01-012019-12-310001376139cvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMembercvi:ServiceCrudeOilSalesMember2019-01-012019-12-310001376139us-gaap:OperatingSegmentsMembercvi:ServiceCrudeOilSalesMembercvi:NitrogenFertilizerSegmentMember2019-01-012019-12-310001376139cvi:ServiceCrudeOilSalesMemberus-gaap:IntersegmentEliminationMember2019-01-012019-12-310001376139cvi:ServiceCrudeOilSalesMember2019-01-012019-12-310001376139cvi:PetroleumSegmentMemberus-gaap:ServiceOtherMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001376139us-gaap:ServiceOtherMemberus-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMember2019-01-012019-12-310001376139us-gaap:ServiceOtherMemberus-gaap:IntersegmentEliminationMember2019-01-012019-12-310001376139us-gaap:ServiceOtherMember2019-01-012019-12-310001376139cvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001376139us-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMember2019-01-012019-12-310001376139us-gaap:IntersegmentEliminationMember2019-01-012019-12-310001376139cvi:NitrogenFertilizerSegmentMember2022-01-012021-12-3100013761392023-01-01cvi:NitrogenFertilizerSegmentMember2021-12-310001376139cvi:OneCustomerMembercvi:PetroleumSegmentMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-310001376139cvi:PetroleumSegmentMembercvi:TwoCustomersMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310001376139cvi:PetroleumSegmentMembercvi:TwoCustomersMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2019-01-012019-12-310001376139cvi:OneCustomerMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembercvi:NitrogenFertilizerSegmentMember2021-01-012021-12-310001376139cvi:TwoCustomersMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembercvi:NitrogenFertilizerSegmentMember2020-01-012020-12-310001376139cvi:TwoCustomersMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembercvi:NitrogenFertilizerSegmentMember2019-01-012019-12-310001376139cvi:NitrogenFertilizerSegmentMember2024-01-012021-12-310001376139cvi:ForwardContractsRenewableIdentificationNumbersMemberus-gaap:LongMember2021-12-31cvi:derivative0001376139cvi:CommoditySwapMember2021-12-310001376139cvi:CommoditySwapMember2020-01-012020-12-31utr:bbl0001376139us-gaap:ForwardContractsMemberus-gaap:LongMember2021-01-012021-12-310001376139us-gaap:ForwardContractsMemberus-gaap:LongMember2020-01-012020-12-310001376139us-gaap:ForwardContractsMemberus-gaap:ShortMember2021-01-012021-12-310001376139us-gaap:ForwardContractsMemberus-gaap:ShortMember2020-01-012020-12-310001376139us-gaap:ForwardContractsMembercvi:CostOfMaterialsAndOtherMember2021-01-012021-12-310001376139us-gaap:ForwardContractsMembercvi:CostOfMaterialsAndOtherMember2020-01-012020-12-310001376139us-gaap:ForwardContractsMembercvi:CostOfMaterialsAndOtherMember2019-01-012019-12-310001376139cvi:CommoditySwapMembercvi:CostOfMaterialsAndOtherMember2021-01-012021-12-310001376139cvi:CommoditySwapMembercvi:CostOfMaterialsAndOtherMember2020-01-012020-12-310001376139cvi:CommoditySwapMembercvi:CostOfMaterialsAndOtherMember2019-01-012019-12-310001376139us-gaap:FutureMembercvi:CostOfMaterialsAndOtherMember2021-01-012021-12-310001376139us-gaap:FutureMembercvi:CostOfMaterialsAndOtherMember2020-01-012020-12-310001376139us-gaap:FutureMembercvi:CostOfMaterialsAndOtherMember2019-01-012019-12-310001376139cvi:CostOfMaterialsAndOtherMember2021-01-012021-12-310001376139cvi:CostOfMaterialsAndOtherMember2020-01-012020-12-310001376139cvi:CostOfMaterialsAndOtherMember2019-01-012019-12-310001376139cvi:CurrentAssetsMemberus-gaap:CommodityContractMember2021-12-310001376139cvi:CurrentAssetsMemberus-gaap:CommodityContractMember2020-12-310001376139cvi:CurrentLiabilitiesMemberus-gaap:CommodityContractMember2021-12-310001376139cvi:CurrentLiabilitiesMemberus-gaap:CommodityContractMember2020-12-310001376139cvi:DelekUSHoldingsIncMember2021-06-102021-06-100001376139us-gaap:FairValueInputsLevel1Memberus-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001376139us-gaap:FairValueInputsLevel2Memberus-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001376139us-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001376139us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001376139us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001376139us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001376139us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001376139us-gaap:FairValueMeasurementsRecurringMember2021-12-310001376139cvi:RenewableFuelStandardObligationMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001376139us-gaap:FairValueInputsLevel2Membercvi:RenewableFuelStandardObligationMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001376139cvi:RenewableFuelStandardObligationMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001376139cvi:RenewableFuelStandardObligationMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001376139us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001376139us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001376139us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001376139us-gaap:FairValueMeasurementsRecurringMember2020-12-310001376139us-gaap:FairValueInputsLevel1Memberus-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001376139us-gaap:FairValueInputsLevel2Memberus-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001376139us-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001376139us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001376139cvi:RenewableFuelStandardObligationMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001376139us-gaap:FairValueInputsLevel2Membercvi:RenewableFuelStandardObligationMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001376139cvi:RenewableFuelStandardObligationMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001376139cvi:RenewableFuelStandardObligationMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001376139cvi:PhantomUnitsAndIncentiveUnitAwardsMember2021-01-012021-12-310001376139cvi:PhantomUnitsAndIncentiveUnitAwardsMember2020-12-310001376139cvi:PhantomUnitsAndIncentiveUnitAwardsMember2021-12-310001376139cvi:PhantomUnitsAndIncentiveUnitAwardsMembercvi:LTIPsMember2021-12-310001376139cvi:PerformanceUnitAwardsMembercvi:CEOPerformanceAward2018Member2017-11-012017-11-01cvi:agreement0001376139cvi:PerformanceUnitAwardsMembercvi:CEOPerformanceAward2018Member2018-01-012018-12-310001376139cvi:PerformanceUnitAwardsMembercvi:CEOPerformanceAward2018Member2019-02-012019-02-280001376139cvi:PerformanceUnitAwardsMembercvi:CEOPerformanceAward2018Member2021-12-222021-12-220001376139cvi:IncentiveUnitAwardMember2021-01-012021-12-310001376139cvi:IncentiveUnitAwardMember2020-01-012020-12-310001376139cvi:IncentiveUnitAwardMember2019-01-012019-12-310001376139cvi:IncentiveUnitAwardMember2021-12-310001376139cvi:PhantomUnitsMember2021-01-012021-12-310001376139cvi:PhantomUnitsMember2020-01-012020-12-310001376139cvi:PhantomUnitsMember2019-01-012019-12-310001376139cvi:PhantomUnitsMember2021-12-310001376139cvi:PerformanceUnitAwardsMembercvi:CEOPerformanceAwardMember2021-01-012021-12-310001376139cvi:PerformanceUnitAwardsMembercvi:CEOPerformanceAwardMember2020-01-012020-12-310001376139cvi:PerformanceUnitAwardsMembercvi:CEOPerformanceAwardMember2019-01-012019-12-310001376139cvi:PerformanceUnitAwardsMembercvi:CEOPerformanceAwardMember2021-12-31cvi:plan0001376139us-gaap:ShareBasedCompensationAwardTrancheOneMembercvi:PhantomUnitsAndIncentiveUnitAwardsMember2021-01-012021-12-310001376139us-gaap:ShareBasedCompensationAwardTrancheTwoMembercvi:PhantomUnitsAndIncentiveUnitAwardsMember2021-01-012021-12-310001376139us-gaap:ShareBasedCompensationAwardTrancheThreeMembercvi:PhantomUnitsAndIncentiveUnitAwardsMember2021-01-012021-12-310001376139cvi:CVRRefiningLimitedPartnershipMembercvi:ExchangeOfferCVRRefiningCommonUnitsForCVREnergyCommonStockMember2018-08-012018-08-310001376139cvi:ExchangeOfferCVRRefiningCommonUnitsForCVREnergyCommonStockMember2018-08-012018-08-310001376139us-gaap:MajorityShareholderMembercvi:AmericanEntertainmentPropertiesCorpMember2021-12-310001376139cvi:AmericanEntertainmentPropertiesCorpMember2020-12-310001376139cvi:AmericanEntertainmentPropertiesCorpMember2021-12-310001376139us-gaap:StateAndLocalJurisdictionMember2021-12-310001376139cvi:ContractedVolumeMembercvi:PetroleumSegmentMembercvi:NewVitolAgreementMemberus-gaap:SupplierConcentrationRiskMember2021-01-012021-12-310001376139cvi:ContractedVolumeMembercvi:PetroleumSegmentMembercvi:NewVitolAgreementMemberus-gaap:SupplierConcentrationRiskMember2020-01-012020-12-310001376139cvi:ContractedVolumeMembercvi:PetroleumSegmentMembercvi:NewVitolAgreementMemberus-gaap:SupplierConcentrationRiskMember2019-01-012019-12-310001376139cvi:NewVitolAgreementMember2012-08-312012-08-310001376139cvi:CallOptionLawsuitsMembercvi:CVREnergyCVRRefiningAndGeneralPartnerCVRRefiningHoldingsIEPAndCertainDirectorsAndAffiliatesMember2019-12-31cvi:lawsuit0001376139cvi:CallOptionLawsuitsMembercvi:CVREnergyCVRRefiningAndGeneralPartnerCVRRefiningHoldingsIEPAndCertainDirectorsAndAffiliatesMembersrt:MinimumMember2021-12-222021-12-220001376139cvi:CallOptionLawsuitsMembercvi:CVREnergyCVRRefiningAndGeneralPartnerCVRRefiningHoldingsIEPAndCertainDirectorsAndAffiliatesMemberus-gaap:SubsequentEventMember2021-01-272022-01-300001376139cvi:CallOptionLawsuitsMembercvi:CVREnergyCVRRefiningAndGeneralPartnerCVRRefiningHoldingsIEPAndCertainDirectorsAndAffiliatesMember2021-01-272021-01-270001376139cvi:EnvironmentalHealthAndSafetyMattersMembercvi:PetroleumSegmentMember2021-01-012021-12-310001376139cvi:EnvironmentalHealthAndSafetyMattersMembercvi:PetroleumSegmentMember2020-01-012020-12-310001376139cvi:EnvironmentalHealthAndSafetyMattersMembercvi:PetroleumSegmentMember2019-01-012019-12-310001376139cvi:EnvironmentalHealthAndSafetyMattersMembercvi:PetroleumSegmentMember2021-12-310001376139cvi:EnvironmentalHealthAndSafetyMattersMembercvi:PetroleumSegmentMember2020-12-310001376139cvi:WynnewoodRefiningCompanyLLCAndOthersMemberus-gaap:UnfavorableRegulatoryActionMember2021-06-252021-06-25cvi:claimant0001376139us-gaap:UnfavorableRegulatoryActionMembercvi:WynnewoodRefiningCompanyLLCMember2019-01-012019-12-31cvi:plaintiff0001376139us-gaap:UnfavorableRegulatoryActionMembercvi:WynnewoodRefiningCompanyLLCMember2021-12-07cvi:petition0001376139cvi:EnvironmentalHealthAndSafetyMattersMembercvi:CoffeyvilleResourcesRefiningAndMarketingMembercvi:CleanAirActMatterMember2020-12-012020-12-31cvi:count0001376139cvi:EnvironmentalHealthAndSafetyMattersMembercvi:CoffeyvilleResourcesRefiningAndMarketingMemberus-gaap:SubsequentEventMembercvi:CleanAirActMatterMember2022-02-102022-02-100001376139cvi:EnvironmentalHealthAndSafetyMattersMember2021-12-310001376139cvi:EnvironmentalHealthAndSafetyMattersMember2020-12-31cvi:segment0001376139cvi:CorporateAndReconcilingItemsMember2021-01-012021-12-310001376139cvi:CorporateAndReconcilingItemsMember2020-01-012020-12-310001376139cvi:CorporateAndReconcilingItemsMember2019-01-012019-12-310001376139cvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMember2021-12-310001376139cvi:PetroleumSegmentMemberus-gaap:OperatingSegmentsMember2020-12-310001376139us-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMember2021-12-310001376139us-gaap:OperatingSegmentsMembercvi:NitrogenFertilizerSegmentMember2020-12-310001376139cvi:CorporateAndReconcilingItemsMember2021-12-310001376139cvi:CorporateAndReconcilingItemsMember2020-12-310001376139cvi:JointVentureTransportationAgreementMembercvi:EnableSouthCentralPipelineLLCMember2021-01-012021-12-310001376139cvi:JointVentureTransportationAgreementMembercvi:EnableSouthCentralPipelineLLCMember2020-01-012020-12-310001376139cvi:JointVentureTransportationAgreementMembercvi:EnableSouthCentralPipelineLLCMember2019-01-012019-12-310001376139us-gaap:MajorityShareholderMember2020-01-012020-12-310001376139us-gaap:MajorityShareholderMember2019-01-012019-12-310001376139cvi:TaxAllocationAgreementMembercvi:AmericanEntertainmentPropertiesCorpMember2021-01-012021-12-310001376139cvi:TaxAllocationAgreementMembercvi:AmericanEntertainmentPropertiesCorpMember2020-01-012020-12-310001376139cvi:TaxAllocationAgreementMembercvi:AmericanEntertainmentPropertiesCorpMember2019-01-012019-12-310001376139cvi:CVRRefiningLimitedPartnershipMembercvi:JointVentureTransportationAgreementMembercvi:EnableSouthCentralPipelineLLCMember2021-01-012021-12-310001376139cvi:CrudeOilTransportationServicesMembercvi:MidwayPipelineLLCMembercvi:CoffeyvilleResourcesRefiningAndMarketingMember2021-01-012021-12-310001376139cvi:CrudeOilTransportationServicesMembercvi:MidwayPipelineLLCMembercvi:CoffeyvilleResourcesRefiningAndMarketingMember2020-01-012020-12-310001376139cvi:CrudeOilTransportationServicesMembercvi:MidwayPipelineLLCMembercvi:CoffeyvilleResourcesRefiningAndMarketingMember2019-01-012019-12-3100013761392021-10-012021-12-310001376139cvi:DelekUSHoldingsIncMember2021-05-262021-05-2600013761392021-05-262021-05-260001376139cvi:DelekUSHoldingsIncMember2021-06-100001376139cvi:DelekUSHoldingsIncMembercvi:IEPEnergyLLCMember2021-06-102021-06-100001376139cvi:IEPEnergyLLCMember2021-06-102021-06-1000013761392021-06-102021-06-100001376139cvi:CVRPartnersLPMember2021-08-232021-08-230001376139cvi:CVRPartnersLPMembercvi:CommonUnitholdersMember2021-08-232021-08-230001376139srt:ParentCompanyMembercvi:CVRPartnersLPMember2021-08-232021-08-230001376139cvi:CVRPartnersLPMember2021-11-222021-11-220001376139cvi:CVRPartnersLPMembercvi:CommonUnitholdersMember2021-11-222021-11-220001376139srt:ParentCompanyMembercvi:CVRPartnersLPMember2021-11-222021-11-220001376139cvi:CVRPartnersLPMembercvi:CommonUnitholdersMember2021-01-012021-12-310001376139srt:ParentCompanyMembercvi:CVRPartnersLPMember2021-01-012021-12-310001376139srt:ParentCompanyMembercvi:CVRPartnersLPMember2019-01-012019-12-310001376139us-gaap:SubsequentEventMembercvi:CVRPartnersLPMember2022-02-212022-02-210001376139cvi:CVREnergyMembersrt:ScenarioForecastMember2022-03-142022-03-14

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________________

Form 10-K | | | | | | | | |

| (Mark One) |

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended | December 31, 2021 |

| OR |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from to |

Commission file number: 001-33492

_____________________________________________________________

CVR Energy, Inc.

(Exact name of registrant as specified in its charter) | | | | | | | | |

| Delaware | | 61-1512186 |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

2277 Plaza Drive, Suite 500, Sugar Land, Texas 77479

(Address of principal executive offices) (Zip Code)

281-207-3200

(Registrant’s Telephone Number, including Area Code)

____________________________________________________________

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of Each Class | Ticker Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, $0.01 par value per share | CVI | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☑ | Non-accelerated filer | ☐ |

| Smaller reporting company | ☐ | Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm prepared or issued its audit report. ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

At June 30, 2021, the aggregate market value of the voting common stock held by non-affiliates of the registrant was approximately $527 million based upon the closing price of its common stock on the New York Stock Exchange Composite tape. As of February 18, 2022, there were 100,530,599 shares of the registrant’s common stock outstanding.

Documents Incorporated By Reference

Portions of the registrant’s Proxy Statement to be filed pursuant to Regulation 14A pertaining to the 2022 Annual Meeting of Stockholders are incorporated by reference into Part III hereof. The Company intends to file such Proxy Statement no later than 120 days after the end of the fiscal year covered by this Form 10-K.

TABLE OF CONTENTS

CVR Energy, Inc.

Annual Report on Form 10-K

| | | | | | | | | | | | | | | | | | | | |

| PART I | | | PART III | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| PART II | | | PART IV | |

| | | | | | |

| | | | | | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

GLOSSARY OF SELECTED TERMS

The following are definitions of certain terms used in this Annual Report on Form 10-K for the year ended December 31, 2021 (this “Report”).

2-1-1 crack spread — The approximate gross margin resulting from processing two barrels of crude oil to produce one barrel of gasoline and one barrel of distillate. The 2-1-1 crack spread is expressed in dollars per barrel and is a proxy for the per barrel margin that a sweet crude oil refinery would earn assuming it produced and sold the benchmark production of gasoline and distillate.

Ammonia — Ammonia is a direct application fertilizer and is primarily used as a building block for other nitrogen products for industrial applications and finished fertilizer products.

Biodiesel — A domestically produced, renewable fuel that can be manufactured from vegetable oils, animal fats, or recycled restaurant grease for use in diesel vehicles or any equipment that operates on diesel fuel and has physical properties similar to those of petroleum diesel.

Blendstocks — Various compounds that are combined with gasoline or diesel from the crude oil refining process to make finished gasoline and diesel fuel; these may include natural gas liquids, ethanol, or reformate, among others.

Bpd — Abbreviation for barrels per day.

Bulk sales — Volume sales through third-party pipelines, in contrast to tanker truck quantity rack sales.

Capacity — Capacity is defined as the throughput a process unit is capable of sustaining, either on a calendar or stream day basis. The throughput may be expressed in terms of maximum sustainable, nameplate or economic capacity. The maximum sustainable or nameplate capacities may not be the most economical. The economic capacity is the throughput that generally provides the greatest economic benefit based on considerations such as crude oil and other feedstock costs, product values, regulatory compliance costs and downstream unit constraints.

Catalyst — A substance that alters, accelerates, or instigates chemical changes, but is neither produced, consumed nor altered in the process.

Corn belt —The primary corn producing region of the United States, which includes Illinois, Indiana, Iowa, Minnesota, Missouri, Nebraska, Ohio and Wisconsin.

Crack spread — A simplified calculation that measures the difference between the price for light products and crude oil.

Distillates — Primarily diesel fuel, kerosene and jet fuel.

Ethanol — A clear, colorless, flammable oxygenated hydrocarbon. Ethanol is typically produced chemically from ethylene, or biologically from fermentation of various sugars from carbohydrates found in agricultural crops and cellulosic residues from crops or wood. It is used in the United States as a gasoline octane enhancer and oxygenate.

Feedstocks — Petroleum products, such as crude oil or fluid catalytic cracking unit gasoline, that are processed and blended into refined products, such as gasoline, diesel fuel, and jet fuel during the refining process.

Group 3 — A geographic subset of the PADD II region comprising refineries in the midcontinent portion of the United States, specifically Oklahoma, Kansas, Missouri, Nebraska, Iowa, Minnesota, North Dakota, and South Dakota.

Light crude oil — A relatively expensive crude oil characterized by low relative density and viscosity. Light crude oils require lower levels of processing to produce high value products such as gasoline and diesel fuel.

Liquid volume yield — A calculation of the total liquid volumes produced divided by total throughput.

MMBtu — One million British thermal units, or Btu: a measure of energy. One Btu of heat is required to raise the temperature of one pound of water one degree Fahrenheit.

Petroleum coke (pet coke) — A coal-like substance that is produced during the refining process.

Product pricing at gate — Product pricing at gate represents net sales less freight revenue divided by product sales volume in tons. Product pricing at gate is also referred to as netback.

Rack sales — Sales which are made at terminals into third-party tanker trucks or railcars.

RBOB — Reformulated blendstocks for oxygenate blending.

Renewable diesel — An advanced biofuel that is made from the same renewable resources as biodiesel but using a process that involves heat, pressure and hydrogen to create a cleaner fuel that’s chemically identical to petroleum diesel.

RDU — Renewable diesel unit.

Refined products — Petroleum products, such as gasoline, diesel fuel, and jet fuel, that are produced by a refinery.

Sour crude oil — A crude oil that is relatively high in sulfur content, requiring additional processing to remove the sulfur. Sour crude oil is typically less expensive than sweet crude oil.

Southern Plains — Primarily includes Oklahoma, Texas and New Mexico.

Spot market — A market in which commodities are bought and sold for cash and delivered immediately.

Sweet crude oil — A crude oil that is relatively low in sulfur content, requiring less processing to remove the sulfur. Sweet crude oil is typically more expensive than sour crude oil.

Throughput — The quantity of crude oil and other feedstocks processed at a refinery measured in barrels per day.

Turnaround — A periodically performed standard procedure to inspect, refurbish, repair, and maintain the refinery or nitrogen fertilizer plant assets. This process involves the shutdown and inspection of major processing units and occurs every four to five years for the refineries and every two to three years for the nitrogen fertilizer facilities. A turnaround will typically extend the operating life of a facility and return performance to desired operating levels.

UAN — An aqueous solution of urea and ammonium nitrate used as a fertilizer.

ULSD — Ultra low sulfur diesel.

Utilization — Measurement of the annual production of UAN and Ammonia expressed as a percentage of each facilities nameplate production capacity.

WCS —Western Canadian Select crude oil, a medium to heavy, sour crude oil, characterized by an American Petroleum Institute gravity (“API gravity”) of between 20 and 22 degrees and a sulfur content of approximately 3.3 weight percent.

WTI — West Texas Intermediate crude oil, a light, sweet crude oil, characterized by an API gravity between 39 and 41 degrees and a sulfur content of approximately 0.4 weight percent that is used as a benchmark for other crude oils.

WTL — West Texas Light crude oil, a light, sweet crude oil, characterized by an API gravity between 44 and 50 degrees and a sulfur content of approximately 0.4 weight percent that is used as a benchmark for other crude oils with a slightly heavier grade than WTI.

Yield — The percentage of refined products that is produced from crude oil and other feedstocks.

Important Information Regarding Forward Looking Statements

This Annual Report on Form 10-K contains forward looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including, but not limited to, those under Item 1. Business, Item 1A. Risk Factors, and Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations. These forward looking statements are subject to a number of risks and uncertainties, many of which are beyond our control. All statements other than statements of historical fact, including without limitation, statements regarding future operations, financial position, estimated revenues and losses, growth, capital projects, stock or unit repurchases, impacts of legal proceedings, projected costs, prospects, plans, and objectives of management are forward looking statements. The words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “may,” “continue,” “predict,” “potential,” “project,” and similar terms and phrases are intended to identify forward looking statements.

Although we believe our assumptions concerning future events are reasonable, a number of risks, uncertainties, and other factors could cause actual results and trends to differ materially from those projected or forward looking. Forward looking statements, as well as certain risks, contingencies or uncertainties that may impact our forward looking statements, include but are not limited to the following:

•volatile margins in the refining industry and exposure to the risks associated with volatile crude oil, refined product and feedstock prices;

•the availability of adequate cash and other sources of liquidity for the capital needs of our businesses;

•the severity, magnitude, duration, and impact of the novel coronavirus 2019 and any variant thereof (collectively, “COVID-19”) pandemic and of businesses’ and governments’ responses to such pandemic on our operations, personnel, commercial activity, and supply and demand across our and our customers’ and suppliers’ business;

•changes in market conditions and market volatility arising from the COVID-19 pandemic, including crude oil and other commodity prices, demand for those commodities, storage and transportation capacities, and the impact of such changes on our operating results and financial position;

•expectations regarding our business and the economic recovery relating to the COVID-19 pandemic, including beliefs regarding future customer activity and the timing of the recovery;

•the ability to forecast our future financial condition, results of operations, revenues and expenses;

•the effects of transactions involving forward or derivative instruments;

•changes in laws, regulations and policies with respect to the export of crude oil, refined products, other hydrocarbons or renewable feedstocks or products including, without limitation, the actions of the Biden Administration that impact oil and gas operations in the U.S.;

•interruption in pipelines supplying feedstocks or distributing the petroleum business’ products;

•competition in the petroleum and nitrogen fertilizer businesses, including potential impacts of domestic and global supply and demand and/or domestic or international duties, tariffs, or similar costs;

•capital expenditures;

•changes in our or our segments’ credit profiles;

•the cyclical and seasonal nature of the petroleum and nitrogen fertilizer businesses;

•the supply, availability and price levels of essential raw materials and feedstocks;

•our production levels, including the risk of a material decline in those levels;

•accidents or other unscheduled shutdowns or interruptions affecting our facilities, machinery, or equipment, or those of our suppliers or customers;

•existing and future laws, regulations or rulings, including but not limited to those relating to the environment, climate change, renewables, safety, security and/or the transportation of production of hazardous chemicals like ammonia, including potential liabilities or capital requirements arising from such laws, regulations or rulings;

•potential operating hazards from accidents, fire, severe weather, tornadoes, floods, or other natural disasters;

•the impact of weather on commodity supply and/or pricing and on the nitrogen fertilizer business including our ability to produce, market or sell fertilizer products profitability or at all;

•rulings, judgments or settlements in litigation, tax or other legal or regulatory matters;

•the dependence of the nitrogen fertilizer business on customers and distributors including to transport goods and equipment;

•the reliance on, or the ability to procure economically or at all, pet coke our nitrogen fertilizer business purchases from Coffeyville Resources Refining & Marketing, LLC (“CRRM”), a subsidiary of CVR Refining, LP, and third-party suppliers or the natural gas, electricity, oxygen, nitrogen, sulfur processing and compressed dry air and other products purchased from third parties by the nitrogen fertilizer and petroleum businesses;

•risks associated with third party operation of or control over important facilities necessary for operation of our refineries and nitrogen fertilizer facilities;

•risks of terrorism, cybersecurity attacks, and the security of chemical manufacturing facilities and other matters beyond our control;

•our lack of diversification of assets or operating and supply areas;

•the petroleum business’ and nitrogen fertilizer business’ dependence on significant customers and the creditworthiness and performance by counterparties;

•the potential loss of the nitrogen fertilizer business’ transportation cost advantage over its competitors;

•the potential inability to successfully implement our business strategies at all or on time and within our anticipated budgets, including significant capital programs or projects, turnarounds or renewable or carbon reduction initiatives at our refineries and fertilizer facilities, including pretreater, carbon sequestration, segregation of our renewables business and other projects;

•our ability to continue to license the technology used for our operations;

•our petroleum business’ purchase of, or ability to purchase, renewable identification numbers (“RINs”) on a timely and cost effective basis or at all;

•the impact of refined product demand, declining inventories, and Winter Storm Uri on refined product prices and crack spreads;

•Organization of Petroleum Exporting Countries’ (“OPEC”) production levels and pricing;

•the impact of RINs pricing, our blending and purchasing activities and governmental actions, including by the U.S. Environmental Protection Agency (the “EPA”) on our RIN obligation, open RINs positions, small refinery exemptions, and our estimated consolidated cost to comply with our Renewable Fuel Standard (“RFS”) obligations;

•our businesses’ ability to obtain, retain or renew environmental and other governmental permits, licenses or authorizations necessary for the operation of its business;

•existing and proposed laws, regulations or rulings, including but not limited to those relating to climate change, alternative energy or fuel sources, and existing and future regulations related to the end-use of our products or the application of fertilizers;

•refinery and nitrogen fertilizer facilities’ operating hazards and interruptions, including unscheduled maintenance or downtime and the availability of adequate insurance coverage;

•risks related to services provided by or competition among our subsidiaries, including conflicts of interests and control of CVR Partners, LP’s general partner;

•instability and volatility in the capital and credit markets;

•restrictions in our debt agreements;

•asset impairments and impacts thereof;

•the variable nature of CVR Partners, LP’s distributions, including the ability of its general partner to modify or revoke its distribution policy, or to cease making cash distributions on its common units;

•changes in tax and other laws, regulations and policies, including, without limitation, actions of the Biden Administration that impact conventional fuel operations or favor renewable energy projects in the U.S.;

•changes in CVR Partners’ treatment as a partnership for U.S. federal income or state tax purposes; and

•our ability to recover under our insurance policies for damages or losses in full or at all.

All forward looking statements contained in this Report only speak as of the date of this Report. We undertake no obligation to publicly update or revise any forward looking statements to reflect events or circumstances that occur after the date of this Report, or to reflect the occurrence of unanticipated events, except to the extent required by law.

Information About Us

Investors should note that we make available, free of charge on our website at cvrenergy.com, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. We also post announcements, updates, events, investor information and presentations on our website in addition to copies of all recent news releases. We may use the Investor Relations section of our website to communicate with investors. It is possible that the financial and other information posted there could be deemed to be material information. Documents and information on our website are not incorporated by reference herein.

The SEC maintains a website at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers, including us, that file electronically with the SEC.

PART I

Part I should be read in conjunction with Management’s Discussion and Analysis in Item 7 and our consolidated financial statements and related notes thereto in Item 8.

Item 1. Business

Overview

CVR Energy, Inc. is a diversified holding company formed in September 2006 which is primarily engaged in the petroleum refining and nitrogen fertilizer manufacturing industries through its holdings in CVR Refining, LP, which was a publicly traded limited partnership prior to January 29, 2019 (the “Petroleum Segment” or “CVR Refining”), and CVR Partners, LP, a publicly traded limited partnership (the “Nitrogen Fertilizer Segment” or “CVR Partners”). CVR Refining is an independent petroleum refiner and marketer of high value transportation fuels. CVR Partners produces and markets nitrogen fertilizers in the form of UAN and ammonia. As used in this Annual Report on Form 10-K, the terms “CVR Energy”, the “Company”, “we”, “us”, or “our” generally include CVR Refining, CVR Partners, and their respective subsidiaries, as consolidated subsidiaries of the Company, subject to certain exceptions where there are transactions or obligations between and among CVR Refining, CVR Partners, and CVR Energy, including their respective subsidiaries. Refer to “Petroleum” and “Nitrogen Fertilizer” below for further details on our two business segments.

Our common stock is listed on the New York Stock Exchange (“NYSE”) under the symbol “CVI,” and CVR Partners’ common units are listed on the NYSE under the symbol “UAN.” As of December 31, 2021, Icahn Enterprises L.P. and its affiliates (“IEP”) owned approximately 71% of our outstanding common stock.

As of December 31, 2021, we owned the general partner and approximately 36% of the outstanding common units representing limited partner interests in CVR Partners, with the public owning the remaining outstanding common units of CVR Partners.

As of December 31, 2021, we owned the general partner and all outstanding common units of CVR Refining, including the common units of CVR Refining that we or our subsidiaries purchased on January 29, 2019 from unaffiliated common unitholders following the assignment by CVR Refining’s general partner to us of its right to purchase all such common units (the “Public Unit Purchase”) and from IEP pursuant to an agreement containing substantially similar terms as the Public Unit Purchase (the “Affiliate Unit Purchase” and together with the Public Unit Purchase, the “CVRR Unit Purchase”). As a result of the CVRR Unit Purchase, CVR Refining’s common units were delisted effective January 29, 2019, and its reporting obligations under Sections 13(a) and 15(d) of the Exchange Act were suspended as of February 8, 2019. Refer to Part II, Item 8, Note 1 (“Organization and Nature of Business”) of this Report for further discussion of the CVRR Unit Purchase.

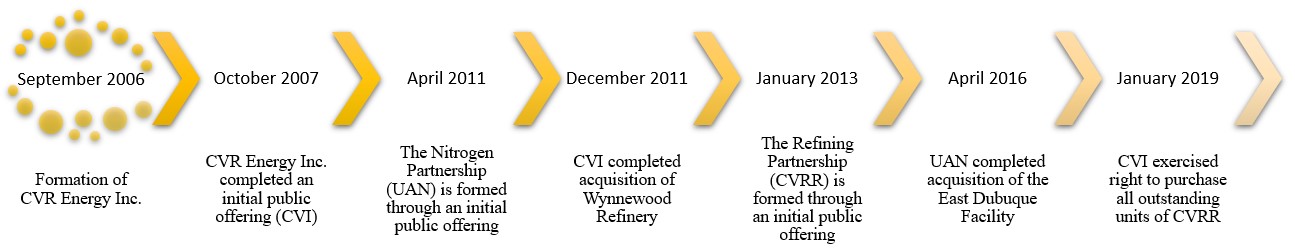

Our History

The following graphic depicts the Company’s history and key events that have occurred since the Company’s formation.

Petroleum

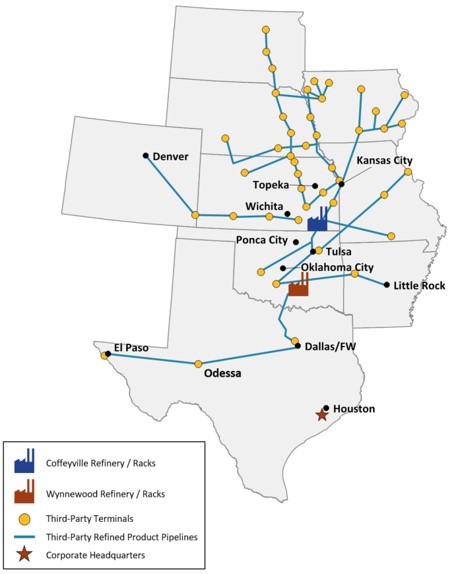

Our Petroleum Segment is composed of the assets and operations of CVR Refining, including two refineries located in Coffeyville, Kansas and Wynnewood, Oklahoma and supporting logistics assets in the region.

Facilities

Coffeyville Refinery - We own a complex full coking, medium-sour crude oil refinery in southeast Kansas, approximately 100 miles from Cushing, Oklahoma (“Cushing”) with a name plate crude oil capacity of 132,000 bpd (the “Coffeyville Refinery”). The major operations of the Coffeyville Refinery include fractionation, catalytic cracking, hydrotreating, reforming, coking, isomerization, alkylation, sulfur recovery, and propane and butane recovery operating units. The Coffeyville Refinery benefits from significant refining unit redundancies, which include two crude oil distillation and vacuum towers, two sulfur recovery units, and five hydrotreating units. These redundancies allow the Coffeyville Refinery to continue to receive and process crude oil even if one tower requires maintenance without having to shut down the entire refinery. In addition, Coffeyville Resources Refining & Marketing, LLC (“CRRM”), a subsidiary of CVR Refining, has a hydrogen sale agreement with Coffeyville Resources Nitrogen Fertilizer, LLC (“CRNF”), a subsidiary of CVR Partners, where a fixed monthly volume of hydrogen is sold as part of the Coffeyville Master Service Agreement (the “Coffeyville MSA”).

In May 2021, CVR Energy’s board of directors (the “Board”) approved the completion of the design for a potential conversion of an existing hydrotreater at our Coffeyville Refinery to renewable diesel service.

Wynnewood Refinery - We own a complex crude oil refinery in Wynnewood, Oklahoma approximately 65 miles south of Oklahoma City, Oklahoma and approximately 130 miles from Cushing with a name plate crude oil capacity of 74,500 bpd capable of processing 20,000 bpd of light sour crude oil (the “Wynnewood Refinery” and together with the Coffeyville Refinery, the “Refineries”). The major operations of the Wynnewood Refinery include fractionation, hydrocracking, hydrotreating, reforming, solvent deasphalting, alkylation, sulfur recovery, and propane and butane recovery operating units. Similar to the Coffeyville Refinery, the Wynnewood Refinery benefits from unit redundancies, including two crude oil distillation and vacuum towers and four hydrotreating units.

In December 2020, the Board approved a renewable diesel project at our Wynnewood Refinery, which would convert the Wynnewood Refinery’s hydrocracker to an RDU capable of producing 100 million gallons of renewable diesel per year and approximately 170 to 180 million RINs annually. Currently, total estimated cost for the project is $170 million. Mechanical completion and startup of the RDU is expected to occur in the second quarter of 2022. As a result of the conversion of the hydrocracker to an RDU, the crude oil capacity of the Wynnewood Refinery would be reduced by approximately 4,500 bpd to 70,000 bpd. However, we may continue to choose to operate the Wynnewood Refinery in conventional hydrocracking mode instead of renewable diesel mode depending on which is most favorable economically.

In May 2021, CVR Energy’s board of directors (the “Board”) approved a $10 million capital expenditure for the completion of the design and ordering of certain long-lead equipment relating to a potential project to add pretreating capabilities for the RDU at our Wynnewood Refinery. In November 2021, the Board approved a project to install a renewable feedstock pretreatment unit at the Wynnewood Refinery, which is expected to be completed in the fourth quarter of 2022 at an estimated cost of $60 million. The pretreatment unit should enable us to process a wider variety of renewable diesel feedstocks at the Wynnewood Refinery, most of which have a lower carbon intensity than soybean oil and currently generate additional low carbon fuel standard credits.

Throughput by Refinery

| | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2021 |

| (in bpd) | Coffeyville | | Wynnewood | | Total |

| | | | | |

| Total crude throughput | 121,514 | | | 73,386 | | | 194,900 | |

| All other feedstock and blendstock | 10,788 | | | 3,396 | | | 14,184 | |

| Total throughput | 132,302 | | | 76,782 | | | 209,084 | |

| | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2020 |

| (in bpd) | Coffeyville | | Wynnewood | | Total |

| | | | | |

| Total crude throughput | 100,722 | | | 70,636 | | | 171,358 | |

| All other feedstock and blendstock | 8,321 | | | 3,616 | | | 11,937 | |

| Total throughput | 109,043 | | | 74,252 | | | 183,295 | |

Production by Refinery | | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2021 |

| (in bpd) | Coffeyville | | Wynnewood | | Total |

| | | | | |

| Gasoline | 71,070 | | | 39,858 | | | 110,928 | |

| Diesel fuels | 53,441 | | | 31,662 | | | 85,103 | |

| Other refined products | 8,727 | | | 2,883 | | | 11,610 | |

| Total production | 133,238 | | | 74,403 | | | 207,641 | |

| | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2020 |

| (in bpd) | Coffeyville | | Wynnewood | | Total |

| | | | | |

| Gasoline | 59,419 | | | 38,640 | | | 98,059 | |

| Diesel fuels | 43,209 | | | 30,638 | | | 73,847 | |

| Other refined products | 7,072 | | | 2,654 | | | 9,726 | |

| Total production | 109,700 | | | 71,932 | | | 181,632 | |

Supply

The Coffeyville Refinery has the capability to process a variety of crude oils ranging from heavy sour to light sweet crude oil. Currently, the Coffeyville Refinery crude oil slate consists of a blend of mid-continent domestic grades and various Canadian medium and heavy sours and other similarly sourced crudes. Other blendstocks include ethanol, biodiesel, normal butane, natural gasoline, alkylation feeds, naphtha, gas oil, and vacuum tower bottoms. The Wynnewood Refinery has the capability to process a variety of crude oils ranging from medium sour to light sweet crude oil. Isobutane, gasoline components, and normal butane blendstocks are also typically used.

In addition to the use of third-party pipelines, we have an extensive gathering system consisting of logistics assets that are owned, leased, or part of a joint venture operation. These assets include the following:

| | | | | | | | | | | | | | | | | |

| | | As of December 31, 2021 |

| Pipeline Segment | | Length (miles) | | Capacity (bpd) |

| Joint Ventures: | | | | |

| Midway Pipeline LLC (“Midway JV”) (1) | | 99 | | 150,000 |

| Enable South Central Pipeline (“Enable JV”) (1) | | 26 | | 115,000 |

| Owned Pipelines: | | | | |

| East Tank Farm to Refinery 16” (2) | | 2 | | 160,000 |

| Broome to East Tank Farm 16” (2) | | 19 | | 120,000 |

| Broome to East Tank Farm 12” (2) | | 19 | | 52,000 |

| Enable tie-in to Payson 8” (Red River) | | 78 | | 40,000 |

| Payson to Cushing 10” (Red River) | | 30 | | 40,000 |

| Springer to Cushing 8” | | 122 | | 30,000 |

| Hooser to Broome 8” | | 43 | | 22,800 |

| Wynnewood to Springer 8” | | 23 | | 20,000 |

| Wynnewood to Maysville 8” | | 21 | | 20,000 |

| Madill to Springer 6” | | 32 | | 15,000 |

| Maysville to Cushing 6” & 8” | | 131 | | 14,000 |

| Velma to Maysville 6” & 8” | | 29 | | 8,000 |

| Plainville to Natoma 6” | | 11 | | 6,500 |

| Shidler to Hooser 4” | | 23 | | 6,500 |

| Phillipsburg to Plainville 6” | | 36 | | 6,000 |

| Enville to Wynnewood 4” & 6” | | 74 | | 6,000 |

| | | | | |

| Leased Pipelines: | | | | |

| Kelly to Caney Jct. 8” | | 66 | | 7,200 |

| Humboldt to Broome 8” | | 63 | | 7,000 |

| | | | | |

(1)CVR Refining owns a 50% interest in the Midway JV and a 40% interest in the Enable JV. While CVR Refining has the ability to exercise influence through its participation on the board of directors of each of the Midway JV and the Enable JV, it does not serve as the day-to-day operator. We have determined that these entities should not be consolidated and apply the equity method of accounting. Refer to Part II, Item 8, Note 3 (“Equity Method Investments”) of this Report for further discussion of these investments.

(2)In support of our Coffeyville Refinery, we own and operate a tank storage facility in close proximity to the Coffeyville Refinery (the “East Tank Farm”).

For the acquisition of crude oil within close proximity of the Refineries, we operate a fleet of approximately 127 trucks and have contracts with third-party trucking fleets to acquire and deliver crude oil to our pipeline system or directly to the Refineries for consumption or resale. For the year ended December 31, 2021, the gathering system, which includes the pipelines outlined above and our trucking operations, supplied approximately 38% and 92% of the Coffeyville and Wynnewood Refineries’ crude oil demand, respectively. Regionally sourced crude oils delivered to the Refineries usually have a transportation cost advantage compared to other domestic or international crudes given the Refineries’ proximity to the producing areas. However, sometimes slightly heavier and more sour crudes may offer improved economics to the Refineries,

notwithstanding the higher transportation costs. The regionally-sourced crude oils we purchase are light and sweet enough to allow the Refineries to blend higher percentages of lower cost crude oils, such as heavy Canadian sour, to optimize economics within operational constraints.

Crude oils sourced outside of our gathering system are delivered to Cushing by various third-party pipelines, including the Keystone and Spearhead pipelines on which we can be subject to proration, and subsequently to the Broome Station facility via the Midway JV pipeline. From the Broome Station facility, crude oil is delivered to the Coffeyville Refinery via the Petroleum Segment’s 170,000 bpd proprietary pipeline system. Crude oils are delivered to the Wynnewood Refinery through third-party and joint venture pipelines and received into storage tanks at terminals located within or near the refinery. We also lease tank storage totaling 2.2 million barrels, including 2.0 million barrels at Cushing.