UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT UNDER TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE YEAR ENDED JUNE 30, 2019 |

| OR | |

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 000-52837

GOLDEN STAR RESOURCE CORP.

(Exact name of registrant as specified in its charter)

NEVADA

(State or other jurisdiction of incorporation or organization)

#300 – 500 North Rainbow Blvd

Las Vegas, Nevada

89107

(Address of principal executive offices, including zip code.)

(210) 862-3372

(telephone number, including area code)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act:

Yes [ ] No [X]

Indicate by check mark whether the registrant(1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 day.

Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 if the Exchange Act.

| Large Accelerated Filer | [ ] | Accelerated Filer | [ ] |

| Non-accelerated Filer | [ ] | Smaller Reporting Company | [X] |

| (Do not check if a smaller reporting company) | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of June 30, 2019: $0.90.

TABLE OF CONTENTS

| 2 |

General

We were incorporated in the State of Nevada on April 21, 2006. We are an exploration stage corporation. An exploration stage corporation is one engaged in the search for mineral deposits or reserves which are not in either development or production stages. We maintain our statutory registered agent’s office at The Corporation Trust Company of Nevada, 6100 Neil Road, Suite 500, Reno, Nevada 89511. Our business office is located at #300 – 500 North Rainbow Blvd, Las Vegas, Nevada 89107. This is our mailing address as well. Our telephone number (210) 862-3372. Ms. Miller, our secretary/treasurer, provides our office space on a rent-free basis.

We have no revenues, have achieved losses since inception, have no operations, have been issued a going concern opinion and rely upon the sale of our securities and loans from our officers and directors to fund operations.

We have no plans to change our business activities or to combine with another business. We are not aware of any events or circumstances that might cause us to change our plans.

Background

We are an exploration stage mining company, incorporated in Nevada.

The Company has been in the exploration stage since its formation and is primarily engaged in the acquisition and exploration of mining claims. Upon location of a commercial minable reserve, the Company expects to actively prepare the site for its extraction and enter a development stage.

On August 15, 2013, the Company entered into a Quitclaim Deed (the “Deed”) with Kee Nez Resources, LLC (“Grantor”), a Utah limited liability company. Pursuant to the Deed, the Grantor, in consideration of $10 and other valuable consideration, remise, release, and forever quitclaim unto the Company all of Grantor’s right, title, and interest in and to the GSR group of unpatented lode mining claims situated in Churchill Country, Nevada. As a result, the Company has obtained title to the GSR claims in August 2013.

The Company did not incur further expenditures on the properties during the year ended June 30, 2019 (2018: $nil) due to a lack of cash.

Employees

We intend to use the services of subcontractors for manual labor exploration work on our properties.

Employees and Employment Agreements

At present, we have no full-time employees. Our two officers and directors are part-time employees and each will devote about 10% of their time or four hours per week to our operation. Our officers and directors do not have employment agreements with us. We presently do not have pension, health, annuity, insurance, stock options, profit sharing or similar benefit plans. However, we may adopt plans in the future. There are presently no personal benefits available to our officers and directors. Marilyn Miller, one of our officers and directors, will handle our administrative duties. Because our officers and directors are inexperienced with exploration, they will hire qualified persons to perform the surveying, exploration, and excavating of the property. As of today, we have engaged private companies to review and evaluate properties mineral claims located in USA and (Mexico).

Our Office

Our business office is located at #300 – 500 North Rainbow Blvd, Las Vegas, Nevada 89107. This is our mailing address as well. Our telephone number is (210) 862-3372. We use this space on a rent free basis.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

| 3 |

ITEM 1B. UNRESOLVED STAFF COMMENTS.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

Summary

The following is a description of the Company’s mineral properties. The Company holds a 100% interest on four contiguous Federal BLM unpatented lode mining claims in Nevada that were acquired for mineral exploration purposes, primarily in exploration for precious metals.

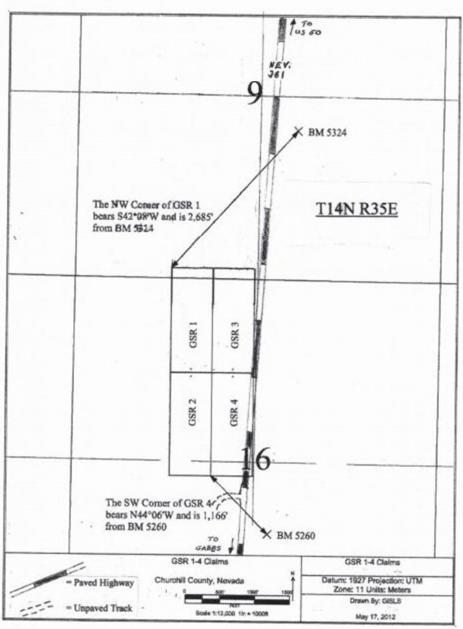

The Property

The four GSR lode mining claims, named GSR 1, 2, 3 and 4, were staked on Federal BLM lands on July 9, 2012 by Kee Nez Resources, LLC, a Utah limited liability company. The BLM claim numbers for claims GSR 1, 2, 3 and 4 are 1076314, 1076315, 1076316 and 1076317 respectively. Each of the four claims are 20.66 acres in size for a total of 82.64 acres.

The Company acquired these unpatented claims on August 15, 2013, from Kee Nez Resources, LLC, who quitclaimed the four claims to the Company. This transfer was filed and recorded with the BLM on August 23, 2013. As a result, Golden Star Resource Corp. holds a 100% interest in the four claims. There are no underlying agreements or royalties.

A Maintenance Fee or a Maintenance Fee Waiver Certification must be filed annually on or before September 1st in order to keep the claims valid and is filed in advance for the upcoming assessment year. Since the Company holds less than 10 Federal unpatented lode mining claims it is entitled to file a Maintenance Fee Waiver Certification in lieu of paying the fee of $155 per claim. Payment of the Maintenance Fee or filing of the Fee Waiver Certification is the responsibility of Golden Star Resource Corp. Notice of Holding of these claims is also filed annually with Churchill County.

All requirements have been met until the next annual due date of September 1, 2020

There are no buildings, equipment or other facilities on the claims. Sources of power and water have not been investigated to date.

The Company only has mineral rights by virtue of these claims. It does not hold any surface rights.

Location

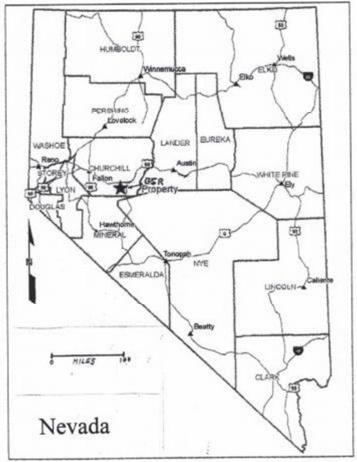

The GSR 1-4 unpatented lode mining claims are situated in Sections 9 and 16, T14N, R35E, MDM, in Churchill County, Nevada.

The property is located 98 air miles southeast of Reno, NV and 48 air miles southeast of Fallon, NV. The property can be accessed from Fallon by heading east on US Hwy 50 for 46 miles and then heading south on NV 361 for 15 miles. This paved highway cuts across the southeast corner of the claim group (see Fig 2).

| 4 |

Location Map:

Claim Map:

| 5 |

Geology

The GSR property lies in the Basin and Range Province near its western margin where it adjoins the northwest-southeast trending Walker Lane mineral belt. This boundary is about 20 miles west of the GSR property. The Basin and Range Province is a major physiographic region of the western US, centered on Nevada and western Utah, typified by north-northeast trending mountain ranges separated by broad flat alluvium filled valleys. Gold and silver mineralization is known to occur in many parts of this Province.

In the vicinity of the GSR property there are numerous historical small mine workings in the surrounding mountain ranges, an active exploration project at Bell Mt. 8 miles to the northwest and several past producing large gold mines, such as Paradise Peak 25 miles to the southeast and Rawhide 25 miles to the west.

The near-surface rocks in the area of the GSR property are a series of sub-outcropping Mesozoic Age metasedimentary rocks overlain by Tertiary Age rhyolitic lavas and volcanoclastics.

No exploration has been carried out on the property by GSR and it has not been examined by a GSR contracted professional geologist or by GSR’s officers or directors.

Due to current subdued market conditions in the junior natural resource markets the Company has no plans for an exploration program until it has the ability to raise sufficient funds to engage in an exploration program. Such a program would likely initially entail prospecting, geological mapping and rock-chip sampling. Quality Assurance and Quality Controls for sampling collection protocols will be developed with the exploration program as funding allows. There would be no permitting or bonding requirements for this preliminary phase of exploration. Permits and bonding would be required if and when exploration advanced to a drilling or trenching phase since those activities cause surface disturbance.

The property is currently without any known reserves and any program to be proposed in the future would be exploratory in nature.

We are not presently a party to any litigation.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

During the fourth quarter, there were no matters submitted to a vote of our shareholders.

ITEM 5. MARKET FOR COMMON STOCK AND RELATED STOCKHOLDER MATTERS

Only a limited market exists for our securities. There is no assurance that our limited market will develop into a regular trading market, or if developed, that it will be sustained. Therefore, a shareholder in all likelihood will be unable to resell his securities in our company. Furthermore, it is unlikely that a lending institution will accept our securities as pledged collateral for loans unless a regular trading market develops.

Our company’s securities are traded over-the-counter on the Bulletin Board operated by the Financial Industry Regulatory Authority (FINRA) under the symbol “GLNS”. Our shares were listed for trading on July 3, 2007.

Fiscal Year 2019 | High Bid | Low Bid | ||||||

| Fourth Quarter 4-01-19 to 6-30-19 | $ | 0.90 | $ | 0.0 | ||||

Third Quarter 1-01-19 to 3-31-19 | $ | 1.05 | $ | 0.0 | ||||

| Second Quarter 10-01-18 to 12-31-18 | $ | 1.11 | $ | 0.0 | ||||

First Quarter 7-01-18 to 9-30-18 | $ | 1.11 | $ | 0.0 | ||||

| Fiscal Year 2018 | High Bid | Low Bid | ||||||

| Fourth Quarter 4-01-18 to 6-30-18 | $ | 1.11 | $ | 0.0 | ||||

Third Quarter 1-01-18 to 3-31-18 | $ | 1.50 | $ | 0.0 | ||||

| Second Quarter 10-01-17 to 12-31-17 | $ | 0.51 | $ | 0.0 | ||||

| First Quarter 7-01-17 to 9-30-17 | $ | 0.25 | $ | 0.0 | ||||

Dividend Policy

We have not declared any cash dividends. We do not intend to pay dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

Section 15(g) of the Securities Exchange Act of 1934

Our shares are covered by section 15(g) of the Securities Exchange Act of 1934, as amended that imposes additional sales practice requirements on broker/dealers who sell such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses). For transactions covered by the Rule, the broker/dealer must make a special suitability determination for the purchase and have received the purchaser’s written agreement to the transaction prior to the sale. Consequently, the Rule may affect the ability of broker/dealers to sell our securities and also may affect your ability to sell your shares in the secondary market.

| 6 |

Section 15(g) also imposes additional sales practice requirements on broker/dealers who sell penny securities. These rules require a one page summary of certain essential items. The items include the risk of investing in penny stocks in both public offerings and secondary marketing; terms important to in understanding of the function of the penny stock market, such as “bid” and “offer” quotes, a dealers “spread” and broker/dealer compensation; the broker/dealer compensation, the broker/dealers duties to its customers, including the disclosures required by any other penny stock disclosure rules; the customers rights and remedies in causes of fraud in penny stock transactions; and, the NASD’s toll free telephone number and the central number of the North American Administrators Association, for information on the disciplinary history of broker/dealers and their associated persons.

Securities authorized for issuance under equity compensation plans

We have no equity compensation plans and accordingly we have no shares authorized for issuance under an equity compensation plan.

Status of our public offering

On October 25, 2006, the Securities and Exchange Commission declared our Form SB-2 Registration Statement effective, file number 333-137922, permitting us to offer up to 2,000,000 shares of common stock at $0.10 per share. There was no underwriter involved in our public offering.

On March 28, 2007, we completed our public offering by raising $107,000. We sold 1,070,000 shares of our common stock at an offering price of $0.10 per share.

Use of Proceeds

Since the time of raising money by offering shares of our stock, we have net proceeds of $107,060. We have used proceeds (net of $178,445 accounts payable and accrued liabilities, $201,558 loan payable and $182,628 due to related parties) for the following: $225,076 for professional fees, $49,500 for administration, $98,359 for consulting fees, $13,177 for mineral claim payment, $107,640 for transfer and filing fees, $53,855 for office and sundry, $54,360 for interest expenses, $18,500 for rent, and $54,381 for travel. Our total cash outlays have been offset by a $7,328 foreign exchange gain.

ITEM 6. SELECTED FINANCIAL DATA.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

This section of the quarterly report includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this prospectus. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or our predictions.

| 7 |

Plan of Operation

We are a start-up, exploration Stage Corporation and have not yet generated or realized any revenues from our business operations.

There is substantial doubt that we can continue as an on-going business for the next twelve months unless we obtain additional capital to pay our bills. This is because we have not generated any revenues and do not anticipate generating any revenues until we begin removing and selling minerals. There is no assurance we will ever achieve these goals. Accordingly, we must raise cash from sources other than the sale of minerals in order to implement our project and stay in business. Our only other source for cash at this time is investments by others.

Our exploration target is to find a mineralized material, specifically, an ore body containing gold. Our success depends upon finding mineralized material. This includes a determination by our consultant that the property contains reserves. We have not yet selected a consultant. Mineralized material is a mineralized body which has been delineated by appropriate spaced drilling or underground sampling to support sufficient tonnage and average grade of metals to justify removal. If we don’t find mineralized material or if it is not economically feasible to remove it, we will cease operations and you will lose your investment.

In addition, we may not have enough money to complete the acquisition and exploration of a property. If it turns out that we have not raised enough money to complete our acquisition we will try to raise additional funds from a second public offering, a private placement or through loans. At the present time, we have not made any plans to raise additional money and there is no assurance that we would be able to raise additional money in the future. If we need additional money and cannot raise it, we will have to suspend or cease operations.

Research & Development

As an exploration stage company in the mining industry we are not involved in any research and development.

Effects of Compliance with Environmental Laws

As a company in the mining industry we are subject to numerous environmental laws and regulations. We strive to comply with all applicable environmental, health and safety laws and regulations are currently taking the steps indicated above. We believe that our operations are in compliance with all applicable laws and regulations on environmental matters. These laws and regulations, on federal, state and local levels, are evolving and frequently modified and we cannot predict accurately the effect, if any, they will have on its business in the future. In many instances, the regulations have not been finalized, or are frequently being modified. Even where regulations have been adopted, they are subject to varying and contradicting interpretations and implementation. In some cases, compliance can only be achieved by capital expenditure and we cannot accurately predict what capital expenditures, if any, may be required.

| 8 |

Limited Operating History; Need for Additional Capital

There is no historical financial information about us upon which to base an evaluation of our performance. We are an exploration stage corporation and have not generated any revenues from operations. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources, possible delays in the acquisition and exploration of our properties, and possible cost overruns due to price increases in services.

To become profitable and competitive, we need to identify a property and conduct research and explore our property before we start production of any minerals we may find. If we do find mineralized material, we will need additional funding to move beyond the research and exploration stage. We have no assurance that future financing will be available to us on acceptable terms. If financing is not available on satisfactory terms, we may be unable to continue, develop or expand our operations. Equity financing could result in additional dilution to existing shareholders.

Liquidity and Capital Resources

We have completed our public offering as of March 28, 2007 and to date have raised $107,060, we will attempt to raise additional money through a subsequent private placement, public offering or through loans.

Currently, we do not have sufficient funds for our intended business operation. One of our officers and directors, has agreed in financing the related operating expenditures to maintain the Company. The foregoing agreement is oral; we have nothing in writing. While it was agreed to advance the funds, the agreement is unenforceable as a matter of law because no consideration was given. At the present time, we have not made any arrangements to raise additional cash. If we need additional cash and can’t raise it, we will either have to suspend operations until we do raise the cash, or cease operations entirely. Other than as described in this paragraph, we have no other financing plans.

Since inception, we have issued 7,070,000 shares of our common stock and received $107,060.

In April 2006, we issued 3,000,000 shares of common stock to a former officer and director, in consideration of $30 and we issued 3,000,000 shares of common stock to one of our officers and directors in consideration of $30 pursuant to the exemption from registration contained in Regulation S of the Securities Act of 1993.

We issued 1,070,000 shares of common stock pursuant to the exemption from registration contained in section 4(2) of the Securities Act of 1933. This was accounted for as a purchase of shares of common stock.

As of June 30, 2019, due to related parties balance of $211,541 (June 30, 2018: $182,628) represents the combination of the following:

$54,959 (June 30, 2018: $54,959) owed to a company controlled by a former director and principal shareholder of the Company, for the amount of office, transfer agent and travel expenses paid by the related party on behalf of the Company. The amount is unsecured, non-interest bearing and due on demand.

$28,000 (June 30, 2018: $28,000) owed to a director of the Company, for the amount of office, travel and telephone expenses paid by the related party on behalf of the Company. The amount is unsecured, non-interest bearing and due on demand.

$128,582 (June 30, 2018: $99,669) was payable to a principal shareholder’s company, for the operating expenses paid by the related party on behalf of the Company. The loan amount is unsecured, non-interest bearing and due on demand.

Loan payable consists of the following:

$201,558 (June 30, 2018: $201,558) was payable to non-related parties. The loan amount is unsecured, non-interest bearing and due on demand.

Where you can find more information

You are advised to read this Quarterly Report on Form 10-Q in conjunction with other reports and documents that we file from time to time with the SEC. In particular, please read our Quarterly Reports on Form 10-Q, Annual Report on Form 10-K, and Current Reports on Form 8-K that we file from time to time. You may obtain copies of these reports directly from us or from the SEC at the SEC’s Public Reference Room at 100 F. Street, N.E. Washington, D.C. 20549, and you may obtain information about obtaining access to the Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains information for electronic filers at its website http://www.sec.gov.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

| 9 |

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

GOLDEN STAR RESOURCE CORP.

FINANCIAL STATEMENTS

YEARS ENDED

JUNE 30, 2019 AND 2018

(Stated in U.S. Dollars)

| F-1 |

GOLDEN STAR RESOURCE CORP.

FINANCIAL STATEMENTS

YEARS ENDED

JUNE 30, 2019 AND 2018

(Stated in U.S. Dollars)

| F-2 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of Golden Star Resource Corp.

Opinion on the Financial Statements

We have audited the accompanying balance sheets of Golden Star Resource Corp. (the “Company”) as of June 30, 2019 and 2018, and the related statements of operations and comprehensive loss, stockholders’ (deficiency) equity, and cash flows for years then ended, and the related note (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of June 30, 2019 and 2018, and the results of its operations and its cash flows for each of the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Material Uncertainty Related to Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company has incurred losses from inception and has not generated revenue to date. These factors raise substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 2 The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

MNP

We have served as the Company’s auditor since 2011.

| Vancouver, British Columbia | |

| September 27, 2019 | Chartered Professional Accountants |

| F-3 |

BALANCE SHEETS

(Stated in U.S. Dollars)

| June 30, 2019 | June 30, 2018 | |||||||

| ASSETS | ||||||||

| Current | ||||||||

| Cash | $ | 16 | $ | 5 | ||||

| Prepaid fees | 2,167 | 2,166 | ||||||

| TOTAL ASSETS | 2,183 | 2,171 | ||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIENCY) | ||||||||

| Current | ||||||||

| Accounts payables and accrued liabilities | $ | 182,436 | $ | 178,445 | ||||

| Loan payable (Note 7) | 201,558 | 201,558 | ||||||

| Due to related parties (Note 6) | 211,541 | 182,628 | ||||||

| TOTAL LIABILITIES | 595,535 | 562,631 | ||||||

| STOCKHOLDERS’ (DEFICIENCY) EQUITY | ||||||||

| Capital stock (Note 5) | ||||||||

| Authorized: | ||||||||

| 100,000,000 voting common shares with a par value of $0.00001 per share | ||||||||

| 100,000,000 preferred shares with a par value of $0.00001 per share; none issued | ||||||||

| Issued: | ||||||||

| 7,070,000 common shares at June 30, 2019 & June 30, 2018 | $ | 70 | $ | 70 | ||||

| Additional paid in capital | 106,990 | 106,990 | ||||||

| Deficit accumulated during the exploration stage | (700,412 | ) | (667,520 | ) | ||||

| (593,352 | ) | (560,460 | ) | |||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ (DEFICIENCY) EQUITY | $ | 2,183 | $ | 2,171 | ||||

Nature of operations and going concern (note 1)

The accompanying notes are an integral part of these financial statements

| F-4 |

STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(Stated in U.S. Dollars)

| YEAR ENDED | ||||||||

| JUNE 30, | ||||||||

| 2019 | 2018 | |||||||

| Expenses | ||||||||

| Foreign exchange loss (gain) | $ | (9 | ) | $ | 1,514 | |||

| Bank fees | 54 | 56 | ||||||

| Professional fees | 11,349 | 13,336 | ||||||

| Office expenses | 4,500 | 4,500 | ||||||

| Transfer and filing fees | 16,998 | 16,936 | ||||||

| 32,892 | 36,342 | |||||||

| Net Loss and Comprehensive Loss | $ | (32,892 | ) | $ | (36,342 | ) | ||

| Basic and fully diluted loss per share | $ | (0.00 | ) | $ | (0.01 | ) | ||

| Weighted average number of common shares outstanding | 7,070,000 | 7,070,000 | ||||||

The accompanying notes are an integral part of these financial statements

| F-5 |

STATEMENTS OF CASH FLOWS

(Stated in U.S. Dollars)

| YEAR ENDED | ||||||||

| JUNE 30, | ||||||||

| 2019 | 2018 | |||||||

| Cash flow from operating activities: | ||||||||

| Net loss for the period | $ | (32,892 | ) | $ | (36,342 | ) | ||

| Items not affecting cash: | ||||||||

| Prepaid expense | (1 | ) | (166 | ) | ||||

| Accounts payables and accrued liabilities | 3,991 | 6,505 | ||||||

| Net Cash Used in Operating Activities | (28,902 | ) | (30,003 | ) | ||||

| Cash flow from financing activities | ||||||||

| Due to related parties | 28,913 | 30,002 | ||||||

| Net Cash Provided by Financing Activities | 28,913 | 30,002 | ||||||

| Cash increase (decrease) in the period | 11 | (1 | ) | |||||

| Cash, beginning of period | 5 | 6 | ||||||

| Cash, end of period | $ | 16 | $ | 5 | ||||

The accompanying notes are an integral part of these financial statements

| F-6 |

STATEMENTS OF STOCKHOLDERS’ (DEFICIENCY) EQUITY

(Stated in U.S. Dollars)

FOR THE YEAR ENDED JUNE 30, 2019 AND 2018

| NUMBER OF COMMON SHARES | PAR VALUE | ADDITIONAL PAID-IN CAPITAL | DEFICIT ACCUMULATED DURING THE EXPLORATION STAGE | TOTAL | ||||||||||||||||

| Balance, June 30, 2017 | 7,070,000 | $ | 70 | $ | 106,990 | $ | (631,178 | ) | $ | (524,118 | ) | |||||||||

| Net loss for the period | (36,342 | ) | (36,342 | ) | ||||||||||||||||

| Balance, June 30, 2018 | 7,070,000 | $ | 70 | $ | 106,990 | $ | (667,520 | ) | $ | (560,460 | ) | |||||||||

| Balance, June 30, 2018 | 7,070,000 | $ | 70 | $ | 106,990 | $ | (667,520 | ) | $ | (560,460 | ) | |||||||||

| Net loss for the period | (32,892 | ) | (32,892 | ) | ||||||||||||||||

| Balance, June 30, 2019 | 7,070,000 | $ | 70 | $ | 106,990 | $ | (700,412 | ) | $ | (593,352 | ) | |||||||||

The accompanying notes are an integral part of these financial statements

| F-7 |

NOTES TO FINANCIAL STATEMENTS

JUNE 30, 2019 and 2018

(Stated in U.S. Dollars)

| 1. | NATURE OF OPERATIONS AND GOING CONCERN |

Organization

The Company was incorporated in the State of Nevada, U.S.A. on April 21, 2006.

Exploration Stage Activities

The Company has been in the exploration stage since its formation and is primarily engaged in the acquisition and exploration of mining claims. Upon location of a commercial minable reserve, the Company expects to actively prepare the site for its extraction and enter a development stage. Currently, the Company is actively looking for other mineral properties for its planned business operation.

GOING CONCERN

The general business strategy of the Company is to acquire and explore mineral properties. The continued operations of the Company and the recoverability of mineral property costs is dependent upon the existence of economically recoverable mineral reserves, the ability of the Company to obtain necessary financing to complete the development of its properties, and upon future profitable production. The Company has not generated any revenues or completed development of any properties to date. Further, the Company has a working capital deficit of $593,352 (June 30, 2018 - $560,460), has incurred losses of $700,412 since inception, and further significant losses are expected to be incurred in the exploration and development of its mineral properties. The Company will require additional funds to meet its obligations and maintain its operations. There can be no guarantee that the Company will be successful in raising the necessary financing. Management’s plans in this regard are to raise equity financing as required.

These conditions raise substantial doubt about the Company’s ability to continue as a going concern. These financial statements do not include any adjustments that might result from this uncertainty.

| 2. | BASIS OF PRESENTATION AND SIGNIFICANT ACCOUNTING POLICIES |

BASIS OF PRESENTATION

The accompanying financial statements have been prepared in accordance with Generally Accepted Accounting Principles (“GAAP”) in the United States of America (“U.S.”) as promulgated by the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) and with the rules and regulations of the U.S Securities and Exchange Commission (“SEC”) for interim financial information. The financial statements reflect all normal recurring adjustments, which, in the portion of management, are considered necessary for a fair presentation of the results for the periods shown. The results of operations for the periods presented are not necessarily indicative of the results expected for any future period. The information included in these financial statements should be read in conjunction with Management’s Discussion and Analysis and the audited financial statements and accompanying notes filed in Form 10-K for the year ended June 30, 2019 filed on September 27, 2019 with the U.S. Securities and Exchange Commission.

| F-8 |

GOLDEN STAR RESOURCE CORP.

NOTES TO FINANCIAL STATEMENTS

JUNE 30, 2019 and 2018

(Stated in U.S. Dollars)

SIGNIFICANT ACCOUNTING POLICIES

Cash and Cash Equivalents

Cash and cash equivalents consist entirely of readily available cash balances. There were no cash equivalents as of June 30, 2019 and 2018.

Income Taxes

Income taxes are accounted for under the liability method of accounting for income taxes. Under the liability method, deferred tax liabilities and assets are recognized for the estimated future tax consequences attributable to differences between the amounts reported in the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted income tax rates expected to apply when the asset is realized or the liability is settled. The effect of a change in income tax rates on deferred tax liabilities and assets is recognized in income in the period in which the change occurs. Deferred tax assets are recognized to the extent that they are considered more likely than not to be realized.

Per FASB ASC 740 “Income taxes” under the liability method, it is the Company’s policy to provide for uncertain tax positions and the related interest and penalties based upon management’s assessment of whether a tax benefit is more likely than not to be sustained upon examination by tax authorities. At June 30, 2019, the Company believes it has appropriately accounted for any unrecognized tax benefits. To the extent the Company prevails in matters for which a liability for an unrecognized benefit is established or is required to pay amounts in excess of the liability, the Company’s effective tax rate in a given financial statement period may be affected. Interest and penalties associated with the Company’s tax positions are recorded as Interest Expense.

Comprehensive Income (Loss)

The Company accounts for comprehensive income under the provisions of ASC Topic 220-10, Comprehensive Income – Overall, which establishes standards for reporting and display of comprehensive income, its components and accumulated balances. The Company is disclosing this information on its Statements of Operations and Comprehensive Loss.

Earnings (Loss) Per Share

Basic loss per share is computed on the basis of the weighted average number of common shares outstanding during each period. Diluted loss per share is computed on the basis of the weighted average number of common shares and dilutive securities outstanding. Stock options are considered to be common stock equivalents and were not included in the net loss per share calculation for the year ended June 30, 2019 and 2018 because the inclusion of such underlying shares would have had an anti-dilutive effect.

Financial Instruments and Fair Value of Financial Instruments

Fair Value of Financial Instruments – the Company adopted SFAS ASC 820-10-50, “Fair Value Measurements”. This guidance defines fair value, establishes a three-level valuation hierarchy for disclosures of fair value measurement and enhances disclosure requirements for fair value measures. The three levels are defined as follows:

| ● | Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. | |

| ● | Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument. | |

| ● | Level 3 inputs to valuation methodology are unobservable and significant to the fair measurement. |

| F-9 |

GOLDEN STAR RESOURCE CORP.

NOTES TO FINANCIAL STATEMENTS

JUNE 30, 2019 and 2018

(Stated in U.S. Dollars)

As at June 30, 2019, the fair value of cash and cash equivalents was measured using Level 1 inputs.

The Company’s financial instruments are cash, accounts payable and accrued liabilities, loan payable and due to related party. The recorded values of cash and cash equivalents, accounts payable and accrued liabilities and loan payable approximate their fair values based on their short-term nature.

| 3. | RECENT ADOPTED AND FUTURE ACCOUNTING STANDARD |

RECENT ADOPTED ACCOUNTING STANDARD

The following accounting standards were adopted by the Company effective July 1, 2018:

In May 2017, the FASB issued ASU 2017-09, Compensation – Stock Compensation (Topic 718): Scope of Modification Accounting. This update provided clarity and reduced both diversity in practice and cost and complexity when applying the guidance in Topic 718, Compensation – Stock Compensation, to a change to the terms or conditions of a share-based payment award.

In August 2016, the FASB issued ASU 2016-15, Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments. The new guidance reduced diversity in practice in how certain transactions are classified in the statement of cash flows.

In January 2016, the FASB issued ASU 2016-01, Financial Instruments - Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities. The amendments to the guidance enhance the reporting model for financial instruments, which includes amendments to address aspects of recognition, measurement, presentation, and disclosure.

In January 2017, the FASB issued ASU 2017-01, Business Combinations (Topic 805): Clarifying the Definition of a Business. The amendments clarified the definition of a business. The amendments affect all companies that must determine whether they have acquired or sold a business.

The adoption of the standards above has no impact on the Company’s financial statements.

RECENT ISSUED ACCOUNTING STANDARDS NOT YET ADOPTED

In July 2017, the FASB issued ASU 2017-11”Earnings Per Share (Topic 260); Distinguishing Liabilities from Equity (Topic 480); Derivatives and Hedging (Topic 815): (Part I) Accounting for Certain Financial Instruments with Down Round Features; (Part II) Replacement of the Indefinite Deferral for Mandatorily Redeemable Financial Instruments of Certain Nonpublic Entities and Certain Mandatorily Redeemable Noncontrolling Interests with a Scope Exception” (“ASU 2017-11”). ASU 2017-11 allows companies to exclude a down round feature when determining whether a financial instrument (or embedded conversion feature) is considered indexed to the entity’s own stock. As a result, financial instruments (or embedded conversion features) with down round features may no longer be required to be accounted for as derivative liabilities. A company will recognize the value of a down round feature only when it is triggered, and the strike price has been adjusted downward. For equity-classified freestanding financial instruments, an entity will treat the value of the effect of the down round as a dividend and a reduction of income available to Common Stockholders in computing basic earnings per share. For convertible instruments with embedded conversion features containing down round provisions, entities will recognize the value of the down round as a beneficial conversion discount to be amortized to earnings. ASU 2017-11 is effective for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years. Early adoption is permitted.

| F-10 |

GOLDEN STAR RESOURCE CORP.

NOTES TO FINANCIAL STATEMENTS

JUNE 30, 2019 and 2018

(Stated in U.S. Dollars)

| 3. | RECENT ADOPTED AND FUTURE ACCOUNTING STANDARD (Continued) |

In August 2018, the FASB issued ASU 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurement. For all entities, amendments are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019. The amendments on changes in unrealized gains and losses, the range and weighted average of significant unobservable inputs used to develop Level 3 fair value measurements, and the narrative description of measurement uncertainty should be applied prospectively for only the most recent interim or annual period presented in the initial fiscal year of adoption. All other amendments should be applied retrospectively to all periods presented upon their effective date. Early adoption is permitted. An entity is permitted to early adopt any removed or modified disclosures upon issuance of ASU No. 2018-13 and delay adoption of the additional disclosures until their effective date.

In June 2018, the FASB issued ASU 2018-07, Compensation-Stock Compensation (Topic 718): Improvements to Nonemployee Share-Based Payment Accounting. These amendments expand the scope of Topic 718, Compensation—Stock Compensation (which currently only includes share-based payments to employees) to include share-based payments issued to nonemployees for goods or services. Consequently, the accounting for share-based payments to nonemployees and employees will be substantially aligned. The ASU supersedes Subtopic 505-50, Equity—Equity-Based Payments to Non-Employees. This standard is effective for fiscal years beginning after December 15, 2018, including interim periods within that fiscal year. Early adoption is permitted, but no earlier than a company’s adoption date of Topic 606, Revenue from Contracts with Customers.

In February 2016, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update No. 2016-02 (Topic 842) “Leases.” Topic 842 supersedes the lease requirements in Accounting Standards Codification (ASC) Topic 840, “Leases.” Under Topic 842, lessees are required to recognize assets and liabilities on the balance sheet for most leases and provide enhanced disclosures. Leases will continue to be classified as either finance or operating.

In July 2018, the FASB issued ASU 2018-10, Codification Improvements to Topic 842, Leases. For entities that early adopted Topic 842, the amendments are effective upon issuance of ASU 2018-10, and the transition requirements are the same as those in Topic 842. For entities that have not adopted Topic 842, the effective date and transition requirements will be the same as the effective for use for fiscal years beginning after December 15, 2018.

The Company does not expect the adoption of recently issued accounting pronouncements to have a significant impact on the Company’s results of operations, financial position or cash flow statements.

| F-11 |

GOLDEN STAR RESOURCE CORP.

NOTES TO FINANCIAL STATEMENTS

JUNE 30, 2019 and 2018

(Stated in U.S. Dollars)

| 4. | MINERAL CLAIM INTEREST |

On August 15, 2013, the Company entered into a Quitclaim Deed (the “Deed”) with Kee Nez Resources, LLC (“Grantor”), a Utah limited liability company. Pursuant to the Deed, the Grantor, in consideration of $10 and other valuable consideration, remise, release, and forever quitclaim unto the Company all of Grantor’s right, title, and interest in and to the GSR group of unpatented lode mining claims situated in Churchill Country, Nevada. As a result, the Company has obtained title to the GSR claims in August 2013.

The Company did not incur further expenditures on the property during the period ending June 30, 2019 (June 30, 2018: $nil) due to lack of cash.

| 5. | CAPITAL STOCK |

| a) | On April 24, 2006, the Company issued 6,000,000 common shares at $0.00001 per share to two founding shareholders. | |

| b) | On March 28, 2007, the Company closed its public offering and issued additional 1,070,000 common shares at $0.10. | |

| c) | The Company has not issued any shares during the year ended June 30, 2019 and 2018 and it has no stock option plan, warrants or other dilutive securities. |

| 6. | DUE TO RELATED PARTIES |

As of June 30, 2019 due to related parties balance of $211,541 (June 30, 2018: $182,628) represents the combination of the following:

| a) | $54,959 (June 30, 2018: $54,959) owed to a company controlled by a former director and principal shareholder of the Company, for the amount of office, transfer agent and travel expenses paid by the related party on behalf of the Company. The amount is unsecured, non-interest bearing and due on demand; | |

| b) | $28,000 (June 30, 2018: $28,000) owed to a director of the Company, for the amount of office, travel and telephone expenses paid by the related party on behalf of the Company. The amount is unsecured, non-interest bearing and due on demand. | |

| c) | $128,582 (June 30, 2018: $99,669) was payable to a principal shareholder’s company, for the operating expenses paid by the related party on behalf of the Company. The loan amount is unsecured, non-interest bearing and due on demand. |

| 7. | LOAN PAYABLE |

Loan payable consists of the following:

$201,558 (June 30, 2018: $201,558) was payable to non-related parties. The loan amount is unsecured, non-interest bearing and due on demand.

| F-12 |

GOLDEN STAR RESOURCE CORP.

NOTES TO FINANCIAL STATEMENTS

JUNE 30, 2019 and 2018

(Stated in U.S. Dollars)

| 8. | INCOME TAXES |

A reconciliation of income tax expense to the amount computed at the statutory rate is as follows:

| 2019 | 2018 | |||||||

| Net loss for the year | $ | (32,892 | ) | $ | (36,342 | ) | ||

| Statutory tax rate | 21.00 | % | 27.50 | % | ||||

| Computed expected (benefit) income taxes | (6,907 | ) | (9,994 | ) | ||||

| Income tax benefit not recognized | 6,907 | 9,994 | ||||||

| $ | - | $ | - | |||||

Significant components of deferred income tax assets are as follows:

| 2019 | 2018 | |||||||

| Operating losses carried forward | $ | 140,000 | $ | 140,000 | ||||

| Valuation allowance | (140,000 | ) | (140,000 | ) | ||||

| $ | - | $ | - | |||||

The Company has incurred operating losses of approximately $689,000 which, if unutilized, will expire through to 2039. Future tax benefits, which may arise as a result of these losses, have not been recognized in these financial statements, and have been offset by a valuation allowance. The following table lists the fiscal year in which the loss was incurred and the expiration date of the operating loss carry forwards:

| Amount | Expiration Date | |||||

| 37,000 | 2027 | |||||

| 68,000 | 2028 | |||||

| 22,000 | 2029 | |||||

| 13,000 | 2030 | |||||

| 88,000 | 2031 | |||||

| 107,000 | 2032 | |||||

| 125,000 | 2033 | |||||

| 54,000 | 2034 | |||||

| 57,000 | 2035 | |||||

| 30,000 | 2036 | |||||

| 19,000 | 2037 | |||||

| 36,000 | 2038 | |||||

| 33,000 | 2039 | |||||

| Total income tax operating loss carry forward | 689,000 | |||||

| F-13 |

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE.

| a) | There have been no disagreements on accounting and financial disclosures from the inception of our company through the date of this Form 10-K. Our financial statements for the period from inception to June 30, 2019, included in this report have been audited by MNP LLP, as set forth in this annual report. | |

| b) | On July 7, 2011, Chang Lee LLP (“Chang Lee”) resigned as the Company’s independent registered public accounting firm as Chang Lee was merged with MNP LLP (“MNP”). Most of the professional staff of Chang Lee continued with MNP either as employees or partners of MNP and will continue their practice with MNP. On Date, the Company, through and with the approval of its Board of Director, engaged MNP as its independent registered public accounting firm. | |

| c) | Prior to engaging MNP, the Company did not consult with MNP regarding the application of accounting principles to a specific completed or contemplated transaction or regarding the type of audit opinions that might be rendered by MNP on the Company’s financial statements, and MNP did not provide any written or oral advice that was an important factor considered by the Company in reaching a decision as to any such accounting, auditing or financial reporting issue. | |

| d) | The reports of Chang Lee regarding the Company’s financial statements for the fiscal years ended June 30, 2010 and 2009 did not contain any adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles. During the years ended June 30, 2010 and 2009, and during the period from June 30, 2010 to July 7, 2011, the date of resignation, there were no disagreements with Chang Lee on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures, which disagreements, if not resolved to the satisfaction of Chang Lee would have caused it to make reference to such disagreement in its reports. |

ITEM 9A. CONTROLS AND PROCEDURES.

EVALUATION OF DISCLOSURE CONTROLS AND PROCEDURES

As required by Rule 13a-15 under the Securities Exchange Act of 1934, as of the end of the period covered by this annual report, being June 30, 2019, we have carried out an evaluation of the effectiveness of the design and operation of our company’s disclosure controls and procedures. This evaluation was carried out under the supervision and with the participation of our management, including our Chief Executive Officer. Based upon that evaluation, our Chief Executive Officer concluded that our disclosure controls and procedures are effective as at the end of the period covered by this report. There have been no significant changes in our internal controls over financial reporting that occurred during our most recent fiscal year ended June 30, 2019 that have materially affected, or are reasonably likely to materially affect our internal controls over financial reporting.

Disclosure controls and procedures and other procedures that are designed to ensure that information required to be disclosed in our reports filed or submitted under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported, within the time period specified in the Securities and Exchange Commission’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed in our reports filed under the Securities Exchange Act of 1934 is accumulated and communicated to management, including our Chief Executive Officer to allow timely decisions regarding required disclosure.

Our management, including our Chief Executive Officer and Chief Financial Officer, does not expect that our disclosure controls and procedures or our internal controls will prevent all errors and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of the controls can provide absolute assurance that all control issues and instances of fraud, if any, within our company have been detected.

| 10 |

ITEM 9A. CONTROLS AND PROCEDURES - continued

Management’s Report on Internal Controls over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting as defined in Rule 13a-15(f) or 15d-15(f) promulgated under the Securities Exchange Act of 1934. Our internal control over financial reporting is a process designed to provide reasonable assurance with respect to the reliability of financial reporting and the preparation and fair presentation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures which pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of our assets; provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that our receipts and expenditures are being made only in accordance with authorizations of our management and directors; and provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on the financial statements.

Under the supervision and with the participation of our management, including our chief executive officer, we conducted an evaluation of the effectiveness of our internal control over financial reporting based on the criteria established in Internal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”). Based on this evaluation under the criteria established in Internal Control – Integrated Framework, our management concluded that our internal control over financial reporting was effective as of June 30, 2019.

This Annual Report does not include an attestation report of our registered public accounting firm with respect to internal control over financial reporting. Management’s report was not subject to attestation by our registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission which permit us to provide only our management’s report in this Annual Report.

Changes in Internal Control over Financial Reporting

There have been no changes in our internal control over financial reporting identified during the year ended June 30, 2019 which have materially affected, or were reasonably likely to materially affect, our internal control over financial reporting.

None.

ITEM 10. DIRECTORS AND EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS.

Our directors serve until their successor is elected and qualified. Our officers are elected by the board of directors to a term of one (1) year and serve until their successor is duly elected and qualified, or until they are removed from office. The board of directors has no nominating, auditing or compensation committees.

The names, addresses, ages and positions of our present officers and directors are set forth below:

| Name and Address | Age | Position(s) | ||

| Steven Bergstrom | 66 | President, Principal Executive Officer and a member | ||

| 3390 Toopal Drive | of the Board of Directors | |||

| Oceanside, California 92058 | ||||

| Marilyn Miller | 49 | Principal Accounting Officer, Principal Financial | ||

| 3390 Toopal Drive | Officer, Secretary, Treasurer and a member of our | |||

| Oceanside, California 92058 | board of directors | |||

The persons named above have held their offices/positions are expected to hold their offices/positions until the next annual meeting of our stockholders.

| 11 |

ITEM 10. DIRECTORS AND EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS - continued

Background of Officers and Directors

On October 17, 2007, Steven Bergstrom was appointed President, Principal Executive Officer and member of the Board of Directors. Since April 1985, Mr. Bergstrom has been serving as President for Triad Exploration Inc. a private Washington based, exploration company. He founded Triad Exploration to exploit opportunities in the base and precious metal mining industry. Triad Exploration specializes in the acquisition of base and precious metal mining properties and also provides consulting services to other mineral exploration companies. From December 1986 until February 2001, Mr. Bergstrom was Vice President of Mining Operations for Triumph Corporation, a private Colorado exploration company headquartered in Spokane Valley, Washington. Triumph Corporation is a precious metals exploration company. Mr. Bergstrom currently sits on the Board of Directors of Triumph Corporation. From September 1999 to March 2003, Mr. Bergstrom was a Director for Nevak Mining Ltd., a private Nevada based, gold producing company no longer in operation. The Mud Creek Mine on the Seward Peninsula in Alaska was the once operational mine of Nevak Mining. From October 1979 to November 1984, Mr. Bergstrom founded and served as President for International Bullion Inc., a private Nevada based, exploration company no longer in operation. International Bullion was a mining company that built, operated, and sold a heap leach gold project in Nevada. The company expanded it operations to include the direct importation of precious metal concentrates and precipitates that were subsequently processed and sold to refineries. Steve Bergstrom also serves as President for Silver Hill Mines Inc, a Nevada exploration company headquartered in Greenacres, Washington. He is President of Alliance Aviation LLC, a Nevada aviation services company headquartered in Laguna Niguel, California; Alliance Aviation’s primary aviation service will be charter operations for corporate clients. Other aviation services provided will be aircraft leasing, maintenance, and finance. He is President of Western Locators LLC, a Harrison, Idaho based exploration services and land services company; Western Locators provides exploration services such as claim staking, filing services, property acquisition consulting, land status reports, and other services necessary for the evaluation and acquisition of potential mineral properties. He is a Managing Member of AuTech LLC, a Nevada based gold extraction technology company with headquarters in Verndale, Washington. AuTech is involved in acquiring and developing a proprietary process related to the extraction of gold from ores. All of these companies are private companies. He holds a bachelors degree in Economics from North Dakota State University(1970), has served as an E-4 in the US Army at West Point and he is a Vietnam Veteran.

On September 5, 2008, Marilyn Miller was appointed principal accounting officer, principal financial officer, secretary/treasurer and a member of the board of directors. Since May 26, 2005, Marilyn Miller has been the Vice President of Marathon Gold Corp. and a member of the board of directors. Marathon Gold is in the business of gold mining and exploration. Since January 2007, Ms. Miller has been a director of Cierra Pacific Ventures. Cierra Pacific is in the business of mining exploration. Cierra Pacific does not file reports with the United States Securities and Exchange Commission, but is listed for trading on the TSX Venture Exchange under the symbol CIZ.H. Since April 2007, Ms. Miller has been President, Secretary Treasurer and a director of Royal Mining Corp., a private company. Since June 2007, Ms. Miller has been the President, Secretary, Treasurer and a director of Goldstream Mining Corp., a private company. Since July 2007, Ms. Miller has been a director of Tapestry Resource Corp. Tapestry Ventures is engaged in the business of mining exploration. Tapestry Ventures does not file reports with the United States Securities and Exchange Commission, but is listed for trading on the TSX Venture Exchange under the symbol TPV.H. From December 2000 to 2001, Ms. Miller was earning her degree at the Gemological Institute of America (GIA) in San Diego. Ms. Miller is self-employed as a GIA Graduate Gemologist Consultant since October, 2001. The Gemological Institute of America (GIA) is the world’s foremost respected authority in gemology. Marilyn Miller graduated as a Graduate Gemologist from GIA in May, 2001. Since December 2001, Ms. Miller has been President of Obelisk International Corporation. Obelisk International Corporation is located in Vancouver, British Columbia and is involved in the capital raising and development of diamond exploration and other resource projects. Marilyn Miller previously worked as an Investment Associate with REFCO Canada Corporation in Toronto, Ontario from February 1995 to June 2000. Marilyn Miller was an Investment Associate for RBC Dominion Securities, in Toronto, Ontario from September 1992 to January 1995. Marilyn Miller attended the University of Toronto, September 1988 to May 1992.

Conflicts of Interest

At the present time, we do not foresee a direct conflict of interest because we do not intend to acquire any additional properties. The only conflict that we foresee is Mr. Bergstrom’s and Ms. Miller’s devotion of time to projects that do not involve us. In the event that Mr. Bergstrom and Ms. Miller ceases devoting time to our operations, they have agreed to resign as officers and directors. We have no policies relating to conflicts of interest.

| 12 |

ITEM 10. DIRECTORS AND EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS - continued

Involvement in Certain Legal Proceedings

Other than as described in this section, to our knowledge, during the past five years, no present or former director or executive officer of our company: (1) filed a petition under the federal bankruptcy laws or any state insolvency law, nor had a receiver, fiscal agent or similar officer appointed by a court for the business or present of such a person, or any partnership in which he was a general partner at or within two years before the time of such filing, or any corporation or business association of which he was an executive officer within two years before the time of such filing; (2) was convicted in a criminal proceeding or named subject of a pending criminal proceeding (excluding traffic violations and other minor offenses); (3) was the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from or otherwise limiting the following activities: (i) acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, associated person of any of the foregoing, or as an investment advisor, underwriter, broker or dealer in securities, or as an affiliated person, director of any investment company, or engaging in or continuing any conduct or practice in connection with such activity; (ii) engaging in any type of business practice; (iii) engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of federal or state securities laws or federal commodity laws; (4) was the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any federal or state authority barring, suspending or otherwise limiting for more than 60 days the right of such person to engage in any activity described above under this Item, or to be associated with persons engaged in any such activity; (5) was found by a court of competent jurisdiction in a civil action or by the Securities and Exchange Commission to have violated any federal or state securities law and the judgment in subsequently reversed, suspended or vacate; (6) was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated.

Audit Committee and Charter

We have a separately-designated audit committee of the board. Audit committee functions are performed by our board of directors. None of our directors are deemed independent. All directors also hold positions as our officers. Our audit committee is responsible for: (1) selection and oversight of our independent accountant; (2) establishing procedures for the receipt, retention and treatment of complaints regarding accounting, internal controls and auditing matters; (3) establishing procedures for the confidential, anonymous submission by our employees of concerns regarding accounting and auditing matters; (4) engaging outside advisors; and, (5) funding for the outside auditory and any outside advisors engagement by the audit committee. A copy of our audit committee charter was filed as Exhibit 99.2 to our Form 10-KSB, on September 28, 2007. The audit committee met four (4) times during the year.

Code of Ethics

We have adopted a corporate code of ethics. We believe our code of ethics is reasonably designed to deter wrongdoing and promote honest and ethical conduct; provide full, fair, accurate, timely and understandable disclosure in public reports; comply with applicable laws; ensure prompt internal reporting of code violations; and provide accountability for adherence to the code. A copy of the code of ethics has been filed as Exhibit 14.1 to our Form 10-KSB, on September 28, 2007.

Disclosure Committee and Charter

We have a disclosure committee and disclosure committee charter. Our disclosure committee is comprised of all of our officers and directors. The purpose of the committee is to provide assistance to the Chief Executive Officer and the Chief Financial Officer in fulfilling their responsibilities regarding the identification and disclosure of material information about us and the accuracy, completeness and timeliness of our financial reports. A copy of the disclosure committee charter is filed as Exhibit 99.3 to our Form 10-KSB, on September 28, 2007.

Section 16(a) of the Securities Exchange Act of 1934

As of the date of this report, we are subject to section 16(a) of the Securities Exchange Act of 1934.

| 13 |

ITEM 11. EXECUTIVE COMPENSATION

The following table sets forth the compensation paid by us to our officers for the last four years. The compensation addresses all compensation awarded to, earned by, or paid to the named executive officers for the fiscal year ended June 30, 2019. This information includes the dollar value of base salaries, bonus awards and number of stock options granted, and certain other compensation, if any.

| Non- | Nonqualified | |||||||||||||||||||||||||||||||||

| Equity | Deferred | All | ||||||||||||||||||||||||||||||||

| Incentive | Compensa- | Other | ||||||||||||||||||||||||||||||||

| Stock | Option | Plan | tion | Compen- | ||||||||||||||||||||||||||||||

| Name and | Salary | Bonus | Awards | Awards | Compensation | Earnings | sation | Total | ||||||||||||||||||||||||||

| Principal Position | Year | (US$) | (US$) | (US$) | (US$) | (US$) | (US$) | (US$) | (US$) | |||||||||||||||||||||||||

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | (i) | (j) | |||||||||||||||||||||||||

| Steven Bergstrom | 2019 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||||||||||||||

| President & CEO | 2018 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||||||||||||||

| 2017 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||||||||||||

| 2016 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||||||||||||

| Marilyn Miller | 2019 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||||||||||||||

| CAO, CFO & | 2018 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||||||||||||||

| Secretary/Treasurer | 2017 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||||||||||||||

| 2016 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||||||||||||

| Egil Livgard | 2019 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||||||||||||||

| (resigned 10/07) | 2018 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||||||||||||||

| 2017 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||||||||||||

| 2016 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||||||||||||

| Kathrine MacDonald | 2019 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||||||||||||||

| (resigned 9/08) | 2018 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||||||||||||||

| 2017 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||||||||||||

| 2016 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||||||||||||

The following table sets forth information with respect to compensation paid by us to our directors during the last completed fiscal year. Our fiscal year end is June 30.

| Director Compensation Table | ||||||||||||||||||||||||||||

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | |||||||||||||||||||||

| Change in | ||||||||||||||||||||||||||||

| Pension | ||||||||||||||||||||||||||||

| Value and | ||||||||||||||||||||||||||||

| Fees | Non-Equity | Nonqualified | All | |||||||||||||||||||||||||

| Earned | Incentive | Deferred | Other | |||||||||||||||||||||||||

| or Paid | Stock | Option | Plan | Compensation | Compen- | |||||||||||||||||||||||

| in Cash | Awards | Awards | Compensation | Earnings | sation | Total | ||||||||||||||||||||||

| Name | ($) | ($) | ($) | ($) | ($) | ($) | ($) | |||||||||||||||||||||

| Steven Bergstrom | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||||||||||

| Marilyn Miller | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||||||||||

| Egil Livgard (resigned) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||||||||||

We have not paid any salaries in 2016 and we do not anticipate paying any salaries at any time in 2017. We will not begin paying salaries until we have adequate funds to do so. Our directors do not receive any compensation for serving as members of the board of directors.

On July 1, 2010, we entered into a consulting agreement with our director Marilyn Miller for a term of 24 months for a fee of $2,500 per month and was cancelled on the same date. As at June 30, 2016 no consulting was charges by a related party.

| 14 |

ITEM 11. EXECUTIVE COMPENSATION - continued

There are no other stock option plans, retirement, pension, or profit sharing plans for the benefit of our officers and directors other than as described herein.

To date, we have not entered into employment contracts with any of our officers and do not intend to enter into any employment contracts until we have adequate funds to do so.

Long-Term Incentive Plan Awards

We do not have any long-term incentive plans that provide compensation intended to serve as incentive for performance.

Indemnification

Under our Articles of Incorporation and Bylaws of the corporation, we may indemnify an officer or director who is made a party to any proceeding, including a law suit, because of his position, if he acted in good faith and in a manner he reasonably believed to be in our best interest. We may advance expenses incurred in defending a proceeding. To the extent that the officer or director is successful on the merits in a proceeding in which he is to be indemnified, we must indemnify him against all expenses incurred, including attorney’s fees. With respect to a derivative action, indemnity may be made only for expenses actually and reasonably incurred in defending the proceeding, and if the officer or director is judged liable, only by a court order. The indemnification is intended to be to the fullest extent permitted by the laws of the State of Nevada.

Regarding indemnification for liabilities arising under the Securities Act of 1933, which may be permitted to directors or officers under Nevada law, we are informed that, in the opinion of the Securities and Exchange Commission, indemnification is against public policy, as expressed in the Act and is, therefore, unenforceable.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of the date of this report, the total number of shares owned beneficially by each of our directors, officers and key employees, individually and as a group, and the present owners of 5% or more of our total outstanding shares.

The stockholder listed below has direct ownership of his shares and possesses sole voting and dispositive power with respect to the shares.

| Name and Address | Number of | Percentage of | ||||||

| Beneficial Ownership [1] | Shares | Ownership | ||||||

| Steven Bergstrom | 0 | 0 | % | |||||

| 3390 Toopal Drive | ||||||||

| Oceanside, California 92058 | ||||||||

| Marilyn Miller | 3,000,000 | 42.43 | % | |||||

| 3390 Toopal Drive | ||||||||

| Oceanside, California 92058 | ||||||||

| All Officers and Directors | 3,000,000 | 42.43 | % | |||||

| as a Group (2 persons) | ||||||||

| Kathrine MacDonald [2] | 3,000,000 | 42.43 | % | |||||

| 850 West Hastings Street, Suite 201 | ||||||||

| Vancouver, British Columbia V5C 1E1 | ||||||||

| [1] | The persons named above “promoters” as defined in the Securities Exchange Act of 1934. Mr. Bergstrom and Ms. Miller are the only “promoters” of our company. |

| [2] | Ms. MacDonald holds title to her common stock in the name of Dimac Capital Corp., a British Columbia corporation which she owns and controls. |

Future Sales by Existing Stockholders

A total of 6,000,000 shares of our stock are currently owned by one of our officers and directors, Marilyn Miller, and one individual. 3,000,000 shares of common stock were issued to Dimac Capital Corp., a corporation owned and controlled by Kathrine MacDonald, our former officer and director, in April 2006. Another 3,000,000 shares of common stock were issued to Marilyn Miller, one of our officers and directors. The 6,000,000 shares are restricted securities, as defined in Rule 144 of the Rules and Regulations of the SEC promulgated under the Securities Act. Under Rule 144, the shares can be publicly sold, subject to volume restrictions and restrictions on the manner of sale, commencing one year after their acquisition. Rule 144 provides that a person may not sell more than 1% of the total outstanding shares in any three month period and the sales must be sold either in a brokers’ transaction or in a transaction directly with a market maker.

| 15 |

Ms. MacDonald and Ms. Miller will likely sell a portion of their stock, if the market price goes above $0.10. If they sell their stock into the market, the sales may cause the market price of the stock to drop. In general, sales of shares held by officers or large shareholders, after applicable restrictions expire, could have a depressive effect on the market price of our common stock.

Because our officers, directors and a principle shareholder control us, regardless of the number of shares sold, your ability to change the course of our operations is eliminated. As such, there is no value attributable to the right to vote. This could result in a reduction in value to the shares you own because of the ineffective voting power.

No common stock is subject to outstanding options, warrants or securities convertible into common stock.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE