UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| [X] | QUARTERLY REPORT UNDER TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED March 31, 2019

OR

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 000-52837

GOLDEN STAR RESOURCE CORP.

(An Exploration Stage Company)

(Exact name of registrant as specified in its charter)

NEVADA

(State or other jurisdiction of incorporation or organization)

#300 – 500 North Rainbow Blvd

Las Vegas, Nevada 89107

(Address of principal executive offices, including zip code.)

(760) 464-9869

(telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES [X] NO [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES [ ] NO [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | [ ] | |

| Non-accelerated filer | [ ] | Smaller reporting company | [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES [ ] NO [X]

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 7,070,000 as of March 31, 2019.

TABLE OF CONTENTS

| 2 |

CONDENSED INTERIM FINANCIAL STATEMENTS

NINE MONTHS ENDED

MARCH 31, 2019 AND 2018

(Stated in U.S. Dollars)

(Unaudited)

| 3 |

CONDENSED INTERIM BALANCE SHEETS

(Stated in U.S. Dollars)

(Unaudited)

| MARCH 31, 2019 | JUNE 30, 2018 | |||||||

| ASSETS | ||||||||

| Current | ||||||||

| Cash | $ | 40 | $ | 5 | ||||

| Prepaid fees | 5,417 | 2,166 | ||||||

| TOTAL ASSETS | 5,457 | 2,171 | ||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIENCY) | ||||||||

| Current | ||||||||

| Accounts payables and accrued liabilities | $ | 181,380 | $ | 178,445 | ||||

| Loan payable (Note 7) | 201,558 | 201,558 | ||||||

| Due to related parties (Note 6) | 209,567 | 182,628 | ||||||

| TOTAL LIABILITIES | 592,505 | 562,631 | ||||||

| STOCKHOLDERS’ (DEFICIENCY) EQUITY | ||||||||

| Capital stock (Note 5) | ||||||||

| Authorized: | ||||||||

| 100,000,000 voting common shares with a par value of $0.00001 per share 100,000,000 preferred shares with a par value of $0.00001 per share; none issued | ||||||||

| Issued: | ||||||||

| 7,070,000 common shares at March 31, 2019 & June 30, 2018 | $ | 70 | $ | 70 | ||||

| Additional paid in capital | 106,990 | 106,990 | ||||||

| Deficit Accumulated During the Exploration Stage | (694,108 | ) | (667,520 | ) | ||||

| (587,048 | ) | (560,460 | ) | |||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIENCY | $ | 5,457 | $ | 2,171 | ||||

Nature of operations and going concern (note 1)

The accompanying notes are an integral part of these interim financial statements

| 4 |

CONDENSED INTERIM STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(Stated in U.S. Dollars)

(Unaudited)

| THREE MONTHS ENDED | NINE MONTHS ENDED | |||||||||||||||

| MARCH 31, | MARCH 31, | |||||||||||||||

| 2019 | 2018 | 2019 | 2018 | |||||||||||||

| Expenses | ||||||||||||||||

| Foreign exchange loss | $ | - | $ | 37 | $ | - | $ | 1,514 | ||||||||

| Bank fees | 16 | 14 | 39 | 42 | ||||||||||||

| Professional fees | 1,294 | 1,265 | 11,349 | 13,117 | ||||||||||||

| Office expenses | 1,000 | 2,000 | 3,000 | 2,000 | ||||||||||||

| Transfer and filing fees | 4,047 | 3,797 | 12,200 | 12,175 | ||||||||||||

| 6,357 | 7,113 | 26,588 | 28,848 | |||||||||||||

| Net Loss and Comprehensive Loss | $ | (6,357 | ) | $ | (7,113 | ) | $ | (26,588 | ) | $ | (28,848 | ) | ||||

| Basic and fully diluted loss per share | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | ||||

| Weighted average number of common shares outstanding | 7,070,000 | 7,070,000 | 7,070,000 | 7,070,000 | ||||||||||||

The accompanying notes are an integral part of these interim financial statements

| 5 |

CONDENSED INTERIM STATEMENTS OF CASH FLOWS

(Stated in U.S. Dollars)

(Unaudited)

| NINE MONTHS ENDED | ||||||||

| MARCH 31, | ||||||||

| 2019 | 2018 | |||||||

| Cash flow from operating activities: | ||||||||

| Net loss for the period | $ | (26,588 | ) | $ | (28,848 | ) | ||

| Change in working capital items: | ||||||||

| Prepaid expense | (3,250 | ) | (3,417 | ) | ||||

| Accounts payables and accrued liabilities | 2,934 | 3,786 | ||||||

| Net Cash Used in Operating Activities | (26,904 | ) | (28,479 | ) | ||||

| Cash flow from financing activities | ||||||||

| Due to related parties | 26,939 | 28,473 | ||||||

| Net Cash Provided by Financing Activities | 26,939 | 28,473 | ||||||

| Cash increase in the period | 35 | (6 | ) | |||||

| Cash, beginning of period | 5 | 6 | ||||||

| Cash, end of period | $ | 40 | $ | - | ||||

The accompanying notes are an integral part of these interim financial statements

| 6 |

CONDENSED INTERIM STATEMENTS OF STOCKHOLDERS’ (DEFICIENCY) EQUITY

(Stated in U.S. Dollars)

FOR THE PERIOD ENDED MARCH 31, 2019

(Unaudited)

| NUMBER OF COMMON SHARES | PAR VALUE | ADDITIONAL PAID-IN CAPITAL | DEFICIT ACCUMULATED DURING THE EXPLORATION STAGE | TOTAL | ||||||||||||||||

| Balance, June 30, 2017 | 7,070,000 | $ | 70 | $ | 106,990 | $ | (631,178 | ) | $ | (524,118 | ) | |||||||||

| Net loss for the period | (28,848 | ) | (28,848 | ) | ||||||||||||||||

| Balance, March 31, 2018 | 7,070,000 | $ | 70 | $ | 106,990 | $ | (660,026 | ) | $ | (552,966 | ) | |||||||||

| Balance, June 30, 2018 | 7,070,000 | $ | 70 | $ | 106,990 | $ | (667,520 | ) | $ | (560,460 | ) | |||||||||

| Net loss for the period | (26,588 | ) | (26,588 | ) | ||||||||||||||||

| Balance, March 31, 2019 | 7,070,000 | $ | 70 | $ | 106,990 | $ | (694,108 | ) | $ | (587,048 | ) | |||||||||

The accompanying notes are an integral part of these interim financial statements

| 7 |

NOTES TO CONDENSED INTERIM FINANCIAL STATEMENTS

MARCH 31, 2019

(Stated in U.S. Dollars)

(Unaudited)

| 1. | NATURE OF OPERATIONS |

Organization

The Company was incorporated in the State of Nevada, U.S.A. on April 21, 2006.

Exploration Stage Activities

The Company has been in the exploration stage since its formation and is primarily engaged in the acquisition and exploration of mining claims. Upon location of a commercial minable reserve, the Company expects to actively prepare the site for its extraction and enter a development stage. During the year ended June 30, 2014, the Company entered into an agreement with Kee Nez Resources and acquired a resource property in Nevada (Note 4). Currently, the Company is actively looking for other mineral properties for its planned business operation.

| 2. | BASIS OF PRESENTATION AND GOING CONCERN |

BASIS OF PRESENTATION

The accompanying condensed interim financial statements have been prepared in accordance with Generally Accepted Accounting Principles (“GAAP”) in the United States of America (“U.S.”) as promulgated by the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) and with the rules and regulations of the U.S Securities and Exchange Commission (“SEC”) for interim financial information. The condensed interim financial statements reflect all normal recurring adjustments, which, in the portion of management, are considered necessary for a fair presentation of the results for the periods shown. The results of operations for the periods presented are not necessarily indicative of the results expected for any future period. The information included in these condensed interim financial statements should be read in conjunction with Management’s Discussion and Analysis and the audited financial statements and accompanying notes filed in Form 10-K for the year ended June 30, 2018 filed on September 28, 2018 with the U.S. Securities and Exchange Commission.

GOING CONCERN

The general business strategy of the Company is to acquire and explore mineral properties. The continued operations of the Company and the recoverability of mineral property costs is dependent upon the existence of economically recoverable mineral reserves, the ability of the Company to obtain necessary financing to complete the development of its properties, and upon future profitable production. The Company has not generated any revenues or completed development of any properties to date. Further, the Company has a working capital deficit of $587,048 (June 30, 2018 - $560,460), has incurred losses of $694,108 since inception, and further significant losses are expected to be incurred in the exploration and development of its mineral properties. The Company will require additional funds to meet its obligations and maintain its operations. There can be no guarantee that the Company will be successful in raising the necessary financing. Management’s plans in this regard are to raise equity financing as required.

These conditions raise substantial doubt about the Company’s ability to continue as a going concern. These financial statements do not include any adjustments that might result from this uncertainty.

| 8 |

GOLDEN STAR RESOURCE CORP.

NOTES TO CONDENSED INTERIM FINANCIAL STATEMENTS

MARCH 31, 2019

(Stated in U.S. Dollars)

(Unaudited)

| 3. | RECENT ADOPTED AND FUTURE ACCOUNTING STANDARD |

RECENT ADOPTED ACCOUNTING STANDARD

The following accounting standards were adopted by the Company effective July 1, 2018:

ASU 2018-03, Technical Corrections and Improvements to Financial Instruments—Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities, that clarifies the guidance in ASU No. 2016-01, Financial Instruments—Overall (Subtopic 825-10). The new guidance provides amendments clarify the guidance in No. 2016-01, Financial Instruments—Overall (Subtopic 825-10). ASU 2018-03 is effective for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years beginning after June 15, 2018. Public business entities with fiscal years beginning between December 15, 2017, and June 15, 2018, are not required to adopt ASU 2018-03 until the interim period beginning after June 15, 2018, and public business entities with fiscal years beginning between June 15, 2018, and December 15, 2018, are not required to adopt these amendments before adopting the amendments in ASU 2016-01.

ASU 2016-15, Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments. The new guidance is intended to reduce diversity in practice in how certain transactions are classified in the statement of cash flows. ASU 2016-15 is effective for public business entities for fiscal years beginning after 15 December 2017, and interim periods within those years. For all other entities, it is effective for fiscal years beginning after 15 December 2018, and interim periods within fiscal years beginning after 15 December 2019. Early adoption is permitted. Entities will have to apply the guidance retrospectively, but if it is impracticable to do so for an issue, the amendments related to that issue would be applied prospectively.

ASU 2016-18, Restricted Cash. Entities will be required to show the changes in the total of cash, cash equivalents, restricted cash and restricted cash equivalents in the statement of cash flows. As a result, entities will no longer present transfers between cash and cash equivalents and restricted cash and restricted cash equivalents in the statement of cash flows.

ASU 2014-09, Revenue from Contracts with Customers, as a new Topic, ASC 606. The new revenue recognition standard provides a five-step analysis of transactions to determine when and how revenue is recognized. The core principle is that a company should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. Companies may apply the new guidance using either the full retrospective transition method, which requires restating each prior period presented, or the modified retrospective transition method, under which the new guidance is applied to the current period presented in the financial statements and a cumulative-effect adjustment is recorded as of the date of adoption.

The adoption of the standards above has no impact on the Company’s financial statements.

| 9 |

GOLDEN STAR RESOURCE CORP.

NOTES TO CONDENSED INTERIM FINANCIAL STATEMENTS

MARCH 31, 2019

(Stated in U.S. Dollars)

(Unaudited)

| 3. | RECENT ADOPTED AND FUTURE ACCOUNTING STANDARD (Continued) |

RECENT ISSUED ACCOUNTING STANDARDS NOT YET ADOPTED

In March 2016, the FASB issued ASU 2016-02, Leases, which supersedes ASC Topic 840, Leases, and sets forth the principles for the recognition, measurement, presentation, and disclosure of leases for both lessees and lessors. ASU 2016-02 requires lessees to classify leases as either finance or operating leases and to record on the balance sheet a right-of-use asset and a lease liability, equal to the present value of the remaining lease payments, for all leases with a term greater than 12 months regardless of the lease classification. The lease classification will determine whether the lease expense is recognized based on an effective interest rate method or a straight-line basis over the term of the lease. ASU 2016-02 will be effective beginning January 1, 2019, with early adoption permitted. Entities are required to use a modified retrospective transition method for existing leases.

In February 2018, the Financial Accounting Standards Board (FASB) issued ASU No. 2018-02, “Income Statement-Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income,” which amends its guidance to allow a reclassification from Accumulated Other Comprehensive Income to Retained Earnings for the stranded income tax effects resulting from The Tax Cuts and Jobs Act of 2017 (the Tax Act). The amendments are effective for the Company beginning in the first quarter of fiscal year 2020, with early adoption permitted.

In August 2017, the FASB issued ASU No. 2017-12, “Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities,” which amends the hedge accounting recognition and presentation requirements to better align an entity’s risk management activities with its financial reporting. This standard also simplifies the application of hedge accounting in certain situations. The new guidance is effective for the Company beginning in the first quarter of fiscal year 2020, with early adoption permitted.

In January 2017, the FASB issued ASU No. 2017-04, “Intangibles-Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment,” which eliminates the requirement to calculate the implied fair value of goodwill to measure a goodwill impairment charge. The new guidance is effective for the Company beginning in the first quarter of fiscal year 2021, with early adoption permitted.

The Company does not expect the adoption of recently issued accounting pronouncements to have a significant impact on the Company’s results of operations, financial position or cash flow.

| 4. | MINERAL CLAIM INTEREST |

On August 15, 2013, the Company entered into a Quitclaim Deed (the “Deed”) with Kee Nez Resources, LLC (“Grantor”), a Utah limited liability company. Pursuant to the Deed, the Grantor, in consideration of $10 and other valuable consideration, remise, release, and forever quitclaim unto the Company all of Grantor’s right, title, and interest in and to the GSR group of unpatented lode mining claims situated in Churchill Country, Nevada. As a result, the Company has obtained title to the GSR claims in August 2013.

The Company did not incur further expenditures on the property during the period ending March 31, 2019 (June 30, 2018: $nil) due to lack of cash.

| 10 |

GOLDEN STAR RESOURCE CORP.

NOTES TO CONDENSED INTERIM FINANCIAL STATEMENTS

MARCH 31, 2019

(Stated in U.S. Dollars)

(Unaudited)

| 5. | CAPITAL STOCK |

| a) | On April 24, 2006, the Company issued 6,000,000 common shares at $0.00001 per share to two founding shareholders. | |

| b) | On March 28, 2007, the Company closed its public offering and issued additional 1,070,000 common shares at $0.10. | |

| c) | The Company has not issued any shares during the period ended December 31, 2018 and it has no stock option plan, warrants or other dilutive securities. |

| 6. | DUE TO RELATED PARTIES |

As of March 31, 2019 due to related parties balance of $209,567 (June 30, 2018: $182,628) represents the combination of the following:

| a) | $54,959 (June 30, 2018: $54,959) owed to a company controlled by a former director and principal shareholder of the Company, for the amount of office, transfer agent and travel expenses paid by the related party on behalf of the Company. The amount is unsecured, non-interest bearing and due on demand; | |

| b) | $28,000 (June 30, 2018: $28,000) owed to a director of the Company, for the amount of office, travel and telephone expenses paid by the related party on behalf of the Company. The amount is unsecured, non-interest bearing and due on demand. | |

| c) | $126,608 (June 30, 2018: $99,669) was payable to a principal shareholder’s company, for the operating expenses paid by the related party on behalf of the Company. The loan amount is unsecured, non-interest bearing and due on demand. |

| 7. | LOAN PAYABLE |

Loan payable consists of the following:

$201,558 (June 30, 2018: $201,558) was payable to non-related parties. The loan amount is unsecured, non-interest bearing and due on demand.

| 8. | ACCOUNTS PAYABLE |

As of March 31, 2019 accounts payable balance of $181,380 (June 30, 2018: $178,445) represents payable related to company operation and administration.

| 11 |

GOLDEN STAR RESOURCE CORPORATION

MANAGEMENT DISCUSSION & ANALYSIS

For the Period Ended

MARCH 31, 2019

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

This section of the quarterly report includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this prospectus. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or our predictions.

Plan of Operation

We are a start-up, exploration Stage Corporation and have not yet generated or realized any revenues from our business operations.

Our auditors have issued a going concern opinion. This means there is substantial doubt that we can continue as an on-going business for the next twelve months unless we obtain additional capital to pay our bills. This is because we have not generated any revenues and do not anticipate generating any revenues until we begin removing and selling minerals. There is no assurance we will ever achieve these goals. Accordingly, we must raise cash from sources other than the sale of minerals in order to implement our project and stay in business. Our only other source for cash at this time is investments by others.

Our exploration target is to find a mineralized material, specifically, an ore body containing gold. Our success depends upon finding mineralized material. This includes a determination by our consultant that the property contains reserves. We have not yet selected a consultant. Mineralized material is a mineralized body which has been delineated by appropriate spaced drilling or underground sampling to support sufficient tonnage and average grade of metals to justify removal. If we don’t find mineralized material or if it is not economically feasible to remove it, we will cease operations and you will lose your investment.

In addition, we may not have enough money to complete the acquisition and exploration of a property. If it turns out that we have not raised enough money to complete our acquisition we will try to raise additional funds from a second public offering, a private placement or through loans. At the present time, we have not made any plans to raise additional money and there is no assurance that we would be able to raise additional money in the future. If we need additional money and cannot raise it, we will have to suspend or cease operations.

Research & Development

As an exploration stage company in the mining industry we are not involved in any research and development.

Effects of Compliance with Environmental Laws

As a company in the mining industry we are subject to numerous environmental laws and regulations. We strive to comply with all applicable environmental, health and safety laws and regulations are currently taking the steps indicated above. We believe that our operations are in compliance with all applicable laws and regulations on environmental matters. These laws and regulations, on federal, state and local levels, are evolving and frequently modified and we cannot predict accurately the effect, if any, they will have on its business in the future. In many instances, the regulations have not been finalized, or are frequently being modified. Even where regulations have been adopted, they are subject to varying and contradicting interpretations and implementation. In some cases, compliance can only be achieved by capital expenditure and we cannot accurately predict what capital expenditures, if any, may be required.

| 12 |

Limited Operating History; Need for Additional Capital

There is no historical financial information about us upon which to base an evaluation of our performance. We are an exploration stage corporation and have not generated any revenues from operations. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources, possible delays in the acquisition and exploration of our properties, and possible cost overruns due to price increases in services.

To become profitable and competitive, we need to identify a property and conduct research and explore our property before we start production of any minerals we may find. If we do find mineralized material, we will need additional funding to move beyond the research and exploration stage. We have no assurance that future financing will be available to us on acceptable terms. If financing is not available on satisfactory terms, we may be unable to continue, develop or expand our operations. Equity financing could result in additional dilution to existing shareholders.

Liquidity and Capital Resources

We have completed our public offering as of March 28, 2007 and to date have raised $107,060, we will attempt to raise additional money through a subsequent private placement, public offering or through loans.

Currently, we do not have sufficient funds for our intended business operation. One of our officers and directors, has agreed in financing the related operating expenditures to maintain the Company. The foregoing agreement is oral; we have nothing in writing. While it was agreed to advance the funds, the agreement is unenforceable as a matter of law because no consideration was given. At the present time, we have not made any arrangements to raise additional cash. If we need additional cash and can’t raise it, we will either have to suspend operations until we do raise the cash, or cease operations entirely. Other than as described in this paragraph, we have no other financing plans.

Since inception, we have issued 7,070,000 shares of our common stock and received $107,060.

In April 2006, we issued 3,000,000 shares of common stock to a former officer and director, in consideration of $30 and we issued 3,000,000 shares of common stock to one of our officers and directors in consideration of $30 pursuant to the exemption from registration contained in Regulation S of the Securities Act of 1993.

We issued 1,070,000 shares of common stock pursuant to the exemption from registration contained in section 4(2) of the Securities Act of 1933. This was accounted for as a purchase of shares of common stock.

As of March 31, 2019, due to related parties balance of $209,567 (June 30, 2018: $182,628) represents the combination of the following:

$54,959 (June 30, 2018: $54,959) owed to a company controlled by a former director and principal shareholder of the Company, for the amount of office, transfer agent and travel expenses paid by the related party on behalf of the Company. The amount is unsecured, non-interest bearing and due on demand.

$28,000 (June 30, 2018: $28,000) owed to a director of the Company, for the amount of office, travel and telephone expenses paid by the related party on behalf of the Company. The amount is unsecured, non-interest bearing and due on demand.

$126,608 (June 30, 2018: $99,669) was payable to a principal shareholder’s company, for the operating expenses paid by the related party on behalf of the Company. The loan amount is unsecured, non-interest bearing and due on demand.

| 13 |

Loan payable consists of the following:

$201,558 (June 30, 2018: $201,558) was payable to non-related parties. The loan amount is unsecured, non-interest bearing and due on demand.

Where you can find more information

You are advised to read this Quarterly Report on Form 10-Q in conjunction with other reports and documents that we file from time to time with the SEC. In particular, please read our Quarterly Reports on Form 10-Q, Annual Report on Form 10-K, and Current Reports on Form 8-K that we file from time to time. You may obtain copies of these reports directly from us or from the SEC at the SEC’s Public Reference Room at 100 F. Street, N.E. Washington, D.C. 20549, and you may obtain information about obtaining access to the Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains information for electronic filers at its website http://www.sec.gov.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

ITEM 4. CONTROLS AND PROCEDURES.

Under the supervision and with the participation of our management, including the Principal Executive Officer and Principal Financial Officer, we have evaluated the effectiveness of our disclosure controls and procedures as required by Exchange Act Rule 13a-15(b) as of the end of the period covered by this report. Based on that evaluation, the Principal Executive Officer and Principal Financial Officer have concluded that these disclosure controls and procedures are effective. There were no changes in our internal control over financial reporting during the quarter ended September 30, 2018 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

| 14 |

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

Summary

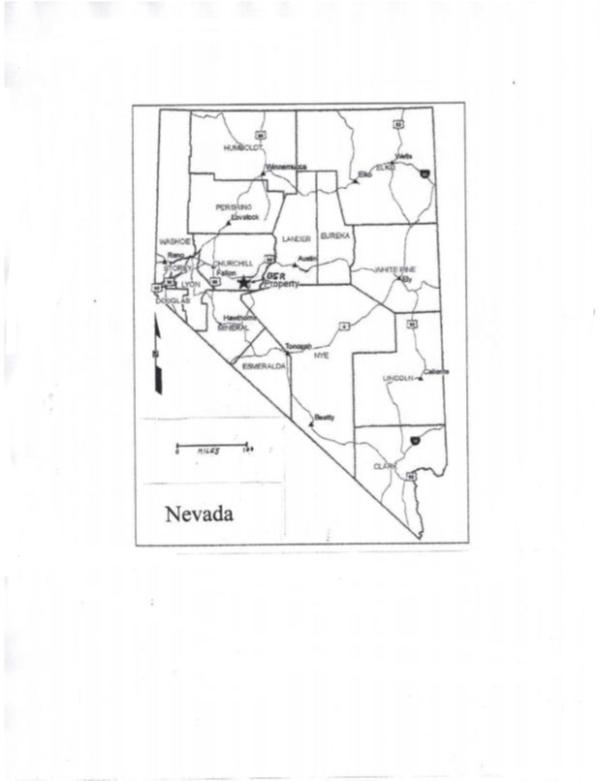

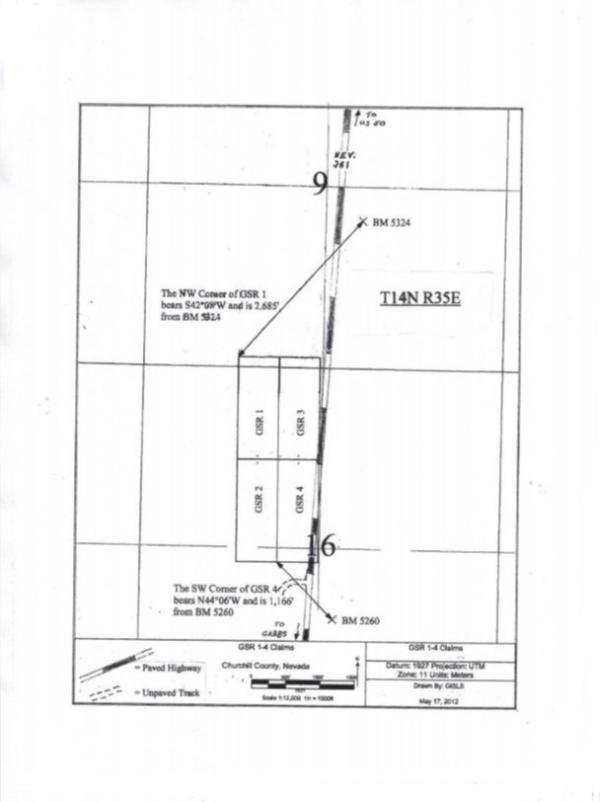

The following is a description of the Company’s mineral properties. The Company holds a 100% interest on four contiguous Federal BLM unpatented lode mining claims in Nevada that were acquired for mineral exploration purposes, primarily in exploration for precious metals.

The Property

The four GSR lode mining claims, named GSR 1, 2, 3 and 4, were staked on Federal BLM lands on July 9, 2012 by Kee Nez Resources, LLC, a Utah limited liability company. The BLM claim numbers for claims GSR 1, 2, 3 and 4 are 1076314, 1076315, 1076316 and 1076317 respectively. Each of the four claims are 20.66 acres in size for a total of 82.64 acres.

The Company acquired these unpatented claims on August 15, 2013, from Kee Nez Resources, LLC, who quitclaimed the four claims to the Company. This transfer was filed and recorded with the BLM on August 23, 2013. As a result, Golden Star Resource Corp. holds a 100% interest in the four claims. There are no underlying agreements or royalties.

A Maintenance Fee or a Maintenance Fee Waiver Certification must be filed annually on or before September 1st in order to keep the claims valid and is filed in advance for the upcoming assessment year. Since the Company holds less than 10 Federal unpatented lode mining claims it is entitled to file a Maintenance Fee Waiver Certification in lieu of paying the fee of $155 per claim. Payment of the Maintenance Fee or filing of the Fee Waiver Certification is the responsibility of Golden Star Resource Corp. Notice of Holding of these claims is also filed annually with Churchill County.

All requirements have been met until the next annual due date of September 1, 2019.

There are no buildings, equipment or other facilities on the claims. Sources of power and water have not been investigated to date.

The Company only has mineral rights by virtue of these claims. It does not hold any surface rights.

Location

The GSR 1-4 unpatented lode mining claims are situated in Sections 9 and 16, T14N, R35E, MDM, in Churchill County, Nevada.

The property is located 98 air miles southeast of Reno, NV and 48 air miles southeast of Fallon, NV. The property can be accessed from Fallon by heading east on US Hwy 50 for 46 miles and then heading south on NV 361 for 15 miles. This paved highway cuts across the southeast corner of the claim group (see Fig 2).

| 15 |

Location Map:

| 16 |

Claim Map:

| 17 |

Geology

The GSR property lies in the Basin and Range Province near its western margin where it adjoins the northwest-southeast trending Walker Lane mineral belt. This boundary is about 20 miles west of the GSR property. The Basin and Range Province is a major physiographic region of the western US, centered on Nevada and western Utah, typified by north-northeast trending mountain ranges separated by broad flat alluvium filled valleys. Gold and silver mineralization is known to occur in many parts of this Province.

In the vicinity of the GSR property there are numerous historical small mine workings in the surrounding mountain ranges, an active exploration project at Bell Mt. 8 miles to the northwest and several past producing large gold mines, such as Paradise Peak 25 miles to the southeast and Rawhide 25 miles to the west.

The near-surface rocks in the area of the GSR property are a series of sub-outcropping Mesozoic Age metasedimentary rocks overlain by Tertiary Age rhyolitic lavas and volcanoclastics.

No exploration has been carried out on the property by GSR and it has not been examined by a GSR contracted professional geologist or by GSR’s officers or directors.

Due to current subdued market conditions in the junior natural resource markets the Company has no plans for an exploration program until it has the ability to raise sufficient funds to engage in an exploration program. Such a program would likely initially entail prospecting, geological mapping and rock-chip sampling. Quality Assurance and Quality Controls for sampling collection protocols will be developed with the exploration program as funding allows. There would be no permitting or bonding requirements for this preliminary phase of exploration. Permits and bonding would be required if and when exploration advanced to a drilling or trenching phase since those activities cause surface disturbance.

The property is currently without any known reserves and any program to be proposed in the future would be exploratory in nature.

The following documents are included herein:

| Exhibit No. | Document Description | |

| 31.1 | Certification of Principal Executive Officer pursuant Section 302 of the Sarbanes-Oxley Act of 2002. | |

| 31.2 | Certification of Principal Financial Officer pursuant Section 302 of the Sarbanes-Oxley Act of 2002. | |

| 32.1 | Certification of Chief Executive Officer pursuant Section 906 of the Sarbanes-Oxley Act of 2002. | |

| 32.2 | Certification of Chief Financial Officer pursuant Section 906 of the Sarbanes-Oxley Act of 2002. | |

| 101.INS | XBRL Instance Document | |

| 101.SCH | XBRL Taxonomy Extension Schema | |

| 101.CAL | XBRL Taxonomy Extension Calculation Linkbase | |

| 101.DEF | XBRL Taxonomy Extension Definition Linkbase | |

| 101.LAB | XBRL Taxonomy Extension Label Linkbase | |

| 101.PRE | XBRL Taxonomy Extension Presentation Linkbase |

| 18 |

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following person on behalf of the Registrant and in the capacities on this 13th day of May, 2019.

| GOLDEN STAR RESOURCE CORP. | ||

| (Registrant) | ||

| By: | /s/ Steven Bergstrom | |

| Steven Bergstrom | ||

| President, Principal Executive Officer and a member of the Board of Directors. | ||

| By: | /s/ Marilyn Miller | |

| Marilyn Miller | ||

| Principal Financial Officer, Principal Accounting Officer, Secretary/Treasurer and a member of the Board of Directors. | ||

| 19 |