000136425012/312024Q1falsexbrli:sharesiso4217:USDiso4217:USDxbrli:sharesutr:sqftnysedei:unitnysedei:parcelnysedei:propertynysedei:venturexbrli:purenysedei:instrumentnysedei:segmentnysedei:buildingnysedei:apartment00013642502024-01-012024-03-3100013642502024-05-0300013642502024-03-3100013642502023-12-310001364250nysedei:RentalRevenueAndTenantRecoveryRevenueMembernysedei:OfficeSegmentMember2024-01-012024-03-310001364250nysedei:RentalRevenueAndTenantRecoveryRevenueMembernysedei:OfficeSegmentMember2023-01-012023-03-310001364250nysedei:ParkingRevenueAndOtherIncomeMembernysedei:OfficeSegmentMember2024-01-012024-03-310001364250nysedei:ParkingRevenueAndOtherIncomeMembernysedei:OfficeSegmentMember2023-01-012023-03-310001364250nysedei:OfficeSegmentMember2024-01-012024-03-310001364250nysedei:OfficeSegmentMember2023-01-012023-03-310001364250nysedei:MultifamilySegmentMembernysedei:RentalRevenueMember2024-01-012024-03-310001364250nysedei:MultifamilySegmentMembernysedei:RentalRevenueMember2023-01-012023-03-310001364250nysedei:ParkingRevenueAndOtherIncomeMembernysedei:MultifamilySegmentMember2024-01-012024-03-310001364250nysedei:ParkingRevenueAndOtherIncomeMembernysedei:MultifamilySegmentMember2023-01-012023-03-310001364250nysedei:MultifamilySegmentMember2024-01-012024-03-310001364250nysedei:MultifamilySegmentMember2023-01-012023-03-3100013642502023-01-012023-03-310001364250us-gaap:CommonStockMember2023-12-310001364250us-gaap:CommonStockMember2022-12-310001364250us-gaap:CommonStockMember2024-01-012024-03-310001364250us-gaap:CommonStockMember2023-01-012023-03-310001364250us-gaap:CommonStockMember2024-03-310001364250us-gaap:CommonStockMember2023-03-310001364250us-gaap:AdditionalPaidInCapitalMember2023-12-310001364250us-gaap:AdditionalPaidInCapitalMember2022-12-310001364250us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001364250us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001364250us-gaap:AdditionalPaidInCapitalMember2024-03-310001364250us-gaap:AdditionalPaidInCapitalMember2023-03-310001364250us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001364250us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001364250us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001364250us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001364250us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001364250us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001364250us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2023-12-310001364250us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2022-12-310001364250us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2024-01-012024-03-310001364250us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2023-01-012023-03-310001364250us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2024-03-310001364250us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2023-03-310001364250us-gaap:NoncontrollingInterestMember2023-12-310001364250us-gaap:NoncontrollingInterestMember2022-12-310001364250us-gaap:NoncontrollingInterestMember2024-01-012024-03-310001364250us-gaap:NoncontrollingInterestMember2023-01-012023-03-310001364250us-gaap:NoncontrollingInterestMember2024-03-310001364250us-gaap:NoncontrollingInterestMember2023-03-3100013642502022-12-3100013642502023-03-310001364250us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2024-01-012024-03-310001364250us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2023-01-012023-03-310001364250srt:OfficeBuildingMembernysedei:WhollyOwnedAndConsolidatedPropertiesMember2024-03-310001364250nysedei:WhollyOwnedAndConsolidatedPropertiesMembersrt:MultifamilyMember2024-03-310001364250nysedei:WhollyOwnedAndConsolidatedPropertiesMember2024-03-310001364250srt:OfficeBuildingMemberus-gaap:UnconsolidatedPropertiesMember2024-03-310001364250srt:OfficeBuildingMemberus-gaap:WhollyOwnedPropertiesMembersrt:ReportableLegalEntitiesMember2024-03-310001364250srt:OfficeBuildingMemberus-gaap:WhollyOwnedPropertiesMember2024-03-310001364250srt:OfficeBuildingMembersrt:ReportableLegalEntitiesMemberus-gaap:ConsolidatedPropertiesMember2024-03-310001364250srt:OfficeBuildingMemberus-gaap:ConsolidatedPropertiesMember2024-03-310001364250srt:OfficeBuildingMembersrt:ReportableLegalEntitiesMemberus-gaap:UnconsolidatedPropertiesMember2024-03-310001364250srt:OfficeBuildingMembersrt:ReportableLegalEntitiesMember2024-03-310001364250srt:OfficeBuildingMember2024-03-310001364250us-gaap:WhollyOwnedPropertiesMembersrt:MultifamilyMembersrt:ReportableLegalEntitiesMember2024-03-310001364250us-gaap:WhollyOwnedPropertiesMembersrt:MultifamilyMember2024-03-310001364250srt:MultifamilyMembersrt:ReportableLegalEntitiesMemberus-gaap:ConsolidatedPropertiesMember2024-03-310001364250srt:MultifamilyMemberus-gaap:ConsolidatedPropertiesMember2024-03-310001364250srt:MultifamilyMembersrt:ReportableLegalEntitiesMember2024-03-310001364250srt:MultifamilyMember2024-03-310001364250srt:ReportableLegalEntitiesMember2024-03-310001364250srt:SubsidiariesMember2023-12-310001364250srt:SubsidiariesMember2024-03-310001364250nysedei:SubsidiariesAndJointVenturesMember2024-03-310001364250nysedei:SubsidiariesAndJointVenturesMember2023-12-310001364250nysedei:TenantRecoveriesMember2024-01-012024-03-310001364250nysedei:TenantRecoveriesMember2023-01-012023-03-310001364250us-gaap:BuildingImprovementsMember2024-03-310001364250nysedei:AboveMarketTenantLeasesMember2024-03-310001364250nysedei:AboveMarketTenantLeasesMember2023-12-310001364250nysedei:AboveMarketGroundLeasesMember2024-03-310001364250nysedei:AboveMarketGroundLeasesMember2023-12-310001364250nysedei:BelowMarketTenantLeasesMember2024-03-310001364250nysedei:BelowMarketTenantLeasesMember2023-12-310001364250nysedei:TenantLeaseMembernysedei:OperatingLeaseRevenueMember2024-01-012024-03-310001364250nysedei:TenantLeaseMembernysedei:OperatingLeaseRevenueMember2023-01-012023-03-310001364250nysedei:AboveMarketGroundLeasesMembernysedei:OfficeParkingAndOtherIncomeMember2024-01-012024-03-310001364250nysedei:AboveMarketGroundLeasesMembernysedei:OfficeParkingAndOtherIncomeMember2023-01-012023-03-310001364250nysedei:PartnershipXMember2024-03-310001364250srt:OfficeBuildingMemberus-gaap:UnconsolidatedPropertiesMember2023-03-310001364250nysedei:PartnershipXMember2023-12-300001364250nysedei:PartnershipXMember2023-12-310001364250nysedei:PartnershipXMember2024-02-290001364250us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2024-03-310001364250us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2023-12-310001364250srt:SubsidiariesMemberus-gaap:SecuredDebtMembernysedei:TermLoanMarch32025MaturityMember2024-01-012024-03-310001364250srt:SubsidiariesMemberus-gaap:SecuredDebtMembernysedei:TermLoanMarch32025MaturityMember2024-03-310001364250srt:SubsidiariesMemberus-gaap:SecuredDebtMembernysedei:TermLoanMarch32025MaturityMember2023-12-310001364250srt:SubsidiariesMembernysedei:SecuredOvernightFinancingRateSOFRMemberus-gaap:SecuredDebtMembernysedei:TermLoanMarch32025MaturityMember2024-01-012024-03-310001364250srt:SubsidiariesMemberus-gaap:SecuredDebtMembernysedei:FannieMaeLoanApril12025MaturityMember2024-01-012024-03-310001364250srt:SubsidiariesMemberus-gaap:SecuredDebtMembernysedei:FannieMaeLoanApril12025MaturityMember2024-03-310001364250srt:SubsidiariesMemberus-gaap:SecuredDebtMembernysedei:FannieMaeLoanApril12025MaturityMember2023-12-310001364250srt:SubsidiariesMembernysedei:SecuredOvernightFinancingRateSOFRMemberus-gaap:SecuredDebtMembernysedei:FannieMaeLoanApril12025MaturityMember2024-01-012024-03-310001364250nysedei:TermLoanAug152026MaturityMembersrt:SubsidiariesMemberus-gaap:SecuredDebtMember2024-01-012024-03-310001364250nysedei:TermLoanAug152026MaturityMembersrt:SubsidiariesMemberus-gaap:SecuredDebtMember2024-03-310001364250nysedei:TermLoanAug152026MaturityMembersrt:SubsidiariesMemberus-gaap:SecuredDebtMember2023-12-310001364250nysedei:TermLoanAug152026MaturityMembersrt:SubsidiariesMembernysedei:SecuredOvernightFinancingRateSOFRMemberus-gaap:SecuredDebtMember2024-01-012024-03-310001364250srt:SubsidiariesMemberus-gaap:SecuredDebtMembernysedei:TermLoanSep192026MaturityMember2024-01-012024-03-310001364250srt:SubsidiariesMemberus-gaap:SecuredDebtMembernysedei:TermLoanSep192026MaturityMember2024-03-310001364250srt:SubsidiariesMemberus-gaap:SecuredDebtMembernysedei:TermLoanSep192026MaturityMember2023-12-310001364250srt:SubsidiariesMembernysedei:SecuredOvernightFinancingRateSOFRMemberus-gaap:SecuredDebtMembernysedei:TermLoanSep192026MaturityMember2024-01-012024-03-310001364250srt:SubsidiariesMembernysedei:TermLoanSep262026MaturityMemberus-gaap:SecuredDebtMember2024-01-012024-03-310001364250srt:SubsidiariesMembernysedei:TermLoanSep262026MaturityMemberus-gaap:SecuredDebtMember2024-03-310001364250srt:SubsidiariesMembernysedei:TermLoanSep262026MaturityMemberus-gaap:SecuredDebtMember2023-12-310001364250srt:SubsidiariesMembernysedei:TermLoanSep262026MaturityMembernysedei:SecuredOvernightFinancingRateSOFRMemberus-gaap:SecuredDebtMember2024-01-012024-03-310001364250srt:SubsidiariesMemberus-gaap:SecuredDebtMembernysedei:TermLoanNov12026MaturityMember2024-01-012024-03-310001364250srt:SubsidiariesMemberus-gaap:SecuredDebtMembernysedei:TermLoanNov12026MaturityMember2024-03-310001364250srt:SubsidiariesMemberus-gaap:SecuredDebtMembernysedei:TermLoanNov12026MaturityMember2023-12-310001364250srt:SubsidiariesMembernysedei:SecuredOvernightFinancingRateSOFRMemberus-gaap:SecuredDebtMembernysedei:TermLoanNov12026MaturityMember2024-01-012024-03-310001364250nysedei:FannieMaeLoanJune12027MaturityMembersrt:SubsidiariesMemberus-gaap:SecuredDebtMember2024-01-012024-03-310001364250nysedei:FannieMaeLoanJune12027MaturityMembersrt:SubsidiariesMemberus-gaap:SecuredDebtMember2024-03-310001364250nysedei:FannieMaeLoanJune12027MaturityMembersrt:SubsidiariesMemberus-gaap:SecuredDebtMember2023-12-310001364250nysedei:FannieMaeLoanJune12027MaturityMembersrt:SubsidiariesMembernysedei:SecuredOvernightFinancingRateSOFRMemberus-gaap:SecuredDebtMember2024-01-012024-03-310001364250nysedei:TermLoanMay182028MaturityMembersrt:SubsidiariesMemberus-gaap:SecuredDebtMember2024-01-012024-03-310001364250nysedei:TermLoanMay182028MaturityMembersrt:SubsidiariesMemberus-gaap:SecuredDebtMember2024-03-310001364250nysedei:TermLoanMay182028MaturityMembersrt:SubsidiariesMemberus-gaap:SecuredDebtMember2023-12-310001364250nysedei:TermLoanMay182028MaturityMembersrt:SubsidiariesMembernysedei:SecuredOvernightFinancingRateSOFRMemberus-gaap:SecuredDebtMember2024-01-012024-03-310001364250nysedei:TermLoanJanuary12029MaturityMembersrt:SubsidiariesMemberus-gaap:SecuredDebtMember2024-01-012024-03-310001364250nysedei:TermLoanJanuary12029MaturityMembersrt:SubsidiariesMemberus-gaap:SecuredDebtMember2024-03-310001364250nysedei:TermLoanJanuary12029MaturityMembersrt:SubsidiariesMemberus-gaap:SecuredDebtMember2023-12-310001364250nysedei:TermLoanJanuary12029MaturityMembersrt:SubsidiariesMembernysedei:SecuredOvernightFinancingRateSOFRMemberus-gaap:SecuredDebtMember2024-01-012024-03-310001364250srt:SubsidiariesMemberus-gaap:SecuredDebtMembernysedei:FannieMaeLoanMHAJune12029MaturityMember2024-01-012024-03-310001364250srt:SubsidiariesMemberus-gaap:SecuredDebtMembernysedei:FannieMaeLoanMHAJune12029MaturityMember2024-03-310001364250srt:SubsidiariesMemberus-gaap:SecuredDebtMembernysedei:FannieMaeLoanMHAJune12029MaturityMember2023-12-310001364250srt:SubsidiariesMembernysedei:SecuredOvernightFinancingRateSOFRMemberus-gaap:SecuredDebtMembernysedei:FannieMaeLoanMHAJune12029MaturityMember2024-01-012024-03-310001364250srt:SubsidiariesMembernysedei:FannieMaeLoansBoutiquesJune12029MaturityMemberus-gaap:SecuredDebtMember2024-01-012024-03-310001364250srt:SubsidiariesMembernysedei:FannieMaeLoansBoutiquesJune12029MaturityMemberus-gaap:SecuredDebtMember2024-03-310001364250srt:SubsidiariesMembernysedei:FannieMaeLoansBoutiquesJune12029MaturityMemberus-gaap:SecuredDebtMember2023-12-310001364250srt:SubsidiariesMembernysedei:FannieMaeLoansBoutiquesJune12029MaturityMembernysedei:SecuredOvernightFinancingRateSOFRMemberus-gaap:SecuredDebtMember2024-01-012024-03-310001364250nysedei:FannieMaeLoanAugust12033MaturityMembersrt:SubsidiariesMemberus-gaap:SecuredDebtMember2024-01-012024-03-310001364250nysedei:FannieMaeLoanAugust12033MaturityMembersrt:SubsidiariesMemberus-gaap:SecuredDebtMember2024-03-310001364250nysedei:FannieMaeLoanAugust12033MaturityMembersrt:SubsidiariesMemberus-gaap:SecuredDebtMember2023-12-310001364250nysedei:FannieMaeLoanAugust12033MaturityMembersrt:SubsidiariesMembernysedei:SecuredOvernightFinancingRateSOFRMemberus-gaap:SecuredDebtMember2024-01-012024-03-310001364250srt:SubsidiariesMemberus-gaap:SecuredDebtMembernysedei:TermLoanFixedJune12038MaturityMember2024-01-012024-03-310001364250srt:SubsidiariesMemberus-gaap:SecuredDebtMembernysedei:TermLoanFixedJune12038MaturityMember2024-03-310001364250srt:SubsidiariesMemberus-gaap:SecuredDebtMembernysedei:TermLoanFixedJune12038MaturityMember2023-12-310001364250nysedei:TermLoanDecember192024MaturityMemberus-gaap:SecuredDebtMembersrt:AffiliatedEntityMember2024-01-012024-03-310001364250nysedei:TermLoanDecember192024MaturityMemberus-gaap:SecuredDebtMembersrt:AffiliatedEntityMember2024-03-310001364250nysedei:TermLoanDecember192024MaturityMemberus-gaap:SecuredDebtMembersrt:AffiliatedEntityMember2023-12-310001364250nysedei:SecuredOvernightFinancingRateSOFRMembernysedei:TermLoanDecember192024MaturityMemberus-gaap:SecuredDebtMembersrt:AffiliatedEntityMember2024-01-012024-03-310001364250nysedei:TermLoanMay152027MaturityMemberus-gaap:SecuredDebtMembersrt:AffiliatedEntityMember2024-01-012024-03-310001364250nysedei:TermLoanMay152027MaturityMemberus-gaap:SecuredDebtMembersrt:AffiliatedEntityMember2024-03-310001364250nysedei:TermLoanMay152027MaturityMemberus-gaap:SecuredDebtMembersrt:AffiliatedEntityMember2023-12-310001364250nysedei:TermLoanMay152027MaturityMembernysedei:SecuredOvernightFinancingRateSOFRMemberus-gaap:SecuredDebtMembersrt:AffiliatedEntityMember2024-01-012024-03-310001364250nysedei:TermLoanAugust192028MaturityMemberus-gaap:SecuredDebtMembersrt:AffiliatedEntityMember2024-01-012024-03-310001364250nysedei:TermLoanAugust192028MaturityMemberus-gaap:SecuredDebtMembersrt:AffiliatedEntityMember2024-03-310001364250nysedei:TermLoanAugust192028MaturityMemberus-gaap:SecuredDebtMembersrt:AffiliatedEntityMember2023-12-310001364250nysedei:SecuredOvernightFinancingRateSOFRMembernysedei:TermLoanAugust192028MaturityMemberus-gaap:SecuredDebtMembersrt:AffiliatedEntityMember2024-01-012024-03-310001364250nysedei:TermLoanApril262029MaturityMemberus-gaap:SecuredDebtMembersrt:AffiliatedEntityMember2024-01-012024-03-310001364250nysedei:TermLoanApril262029MaturityMemberus-gaap:SecuredDebtMembersrt:AffiliatedEntityMember2024-03-310001364250nysedei:TermLoanApril262029MaturityMemberus-gaap:SecuredDebtMembersrt:AffiliatedEntityMember2023-12-310001364250nysedei:TermLoanApril262029MaturityMembernysedei:SecuredOvernightFinancingRateSOFRMemberus-gaap:SecuredDebtMembersrt:AffiliatedEntityMember2024-01-012024-03-310001364250nysedei:FannieMaeLoanJune12029MaturityMemberus-gaap:SecuredDebtMembersrt:AffiliatedEntityMember2024-01-012024-03-310001364250nysedei:FannieMaeLoanJune12029MaturityMemberus-gaap:SecuredDebtMembersrt:AffiliatedEntityMember2024-03-310001364250nysedei:FannieMaeLoanJune12029MaturityMemberus-gaap:SecuredDebtMembersrt:AffiliatedEntityMember2023-12-310001364250nysedei:FannieMaeLoanJune12029MaturityMembernysedei:SecuredOvernightFinancingRateSOFRMemberus-gaap:SecuredDebtMembersrt:AffiliatedEntityMember2024-01-012024-03-310001364250nysedei:SecuredOvernightFinancingRateSOFRMemberus-gaap:SecuredDebtMember2024-01-012024-03-310001364250nysedei:FannieMaeLoanJune12027MaturityMembersrt:SubsidiariesMember2024-03-310001364250nysedei:FannieMaeLoanAugust12033MaturityMembersrt:SubsidiariesMember2024-03-310001364250us-gaap:SecuredDebtMembernysedei:TermLoanFixedJune12038MaturityMember2024-01-012024-03-310001364250nysedei:EffectiveFixedRateLoansMember2024-03-310001364250nysedei:EffectiveFixedRateLoansMember2023-12-310001364250nysedei:FixedRateLoansMember2024-03-310001364250nysedei:FixedRateLoansMember2023-12-310001364250nysedei:CappedRateLoansMember2024-03-310001364250nysedei:CappedRateLoansMember2023-12-310001364250nysedei:VariableRateLoansMember2024-03-310001364250nysedei:VariableRateLoansMember2023-12-310001364250us-gaap:InterestExpenseMember2024-01-012024-03-310001364250us-gaap:InterestExpenseMember2023-01-012023-03-310001364250us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2024-03-310001364250us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateCapMemberus-gaap:CashFlowHedgingMember2024-03-310001364250us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2024-03-310001364250us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2023-12-310001364250us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2023-12-310001364250us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2024-01-012024-03-310001364250us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2023-01-012023-03-310001364250us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMemberus-gaap:CashFlowHedgingMember2024-01-012024-03-310001364250us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMemberus-gaap:CashFlowHedgingMember2023-01-012023-03-310001364250nysedei:UnconsolidatedFundsMember2024-03-310001364250nysedei:DouglasEmmettOperatingPartnershipMember2024-03-310001364250nysedei:DouglasEmmettOperatingPartnershipMemberus-gaap:CommonStockMember2024-03-310001364250nysedei:OperatingPartnershipUnitsMember2024-01-012024-03-310001364250nysedei:OperatingPartnershipUnitsMember2023-01-012023-03-310001364250nysedei:VestedLongTermIncentivePlanLTIPUnitsMember2024-01-012024-03-310001364250nysedei:VestedLongTermIncentivePlanLTIPUnitsMember2023-01-012023-03-310001364250us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-03-310001364250us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001364250us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2024-03-310001364250us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2023-12-310001364250us-gaap:FairValueInputsLevel2Member2024-03-310001364250us-gaap:FairValueInputsLevel2Member2023-12-310001364250us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMemberus-gaap:FairValueInputsLevel2Member2024-03-310001364250us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMemberus-gaap:FairValueInputsLevel2Member2023-12-310001364250us-gaap:OperatingSegmentsMembernysedei:OfficeSegmentMember2024-01-012024-03-310001364250us-gaap:OperatingSegmentsMembernysedei:OfficeSegmentMember2023-01-012023-03-310001364250us-gaap:OperatingSegmentsMembernysedei:MultifamilySegmentMember2024-01-012024-03-310001364250us-gaap:OperatingSegmentsMembernysedei:MultifamilySegmentMember2023-01-012023-03-310001364250us-gaap:OperatingSegmentsMember2024-01-012024-03-310001364250us-gaap:OperatingSegmentsMember2023-01-012023-03-310001364250us-gaap:WhollyOwnedPropertiesMember2024-03-310001364250nysedei:DevelopmentProjectsMemberstpr:HI2024-03-310001364250nysedei:DevelopmentProjectsMemberstpr:HI2024-01-012024-03-310001364250nysedei:DevelopmentProjectsMember2024-03-310001364250nysedei:RepositioningsCapitalExpenditureProjectsAndTenantImprovementsMember2024-03-310001364250nysedei:TermLoanApril262029MaturityMembersrt:SubsidiariesMemberus-gaap:SecuredDebtMember2023-11-300001364250us-gaap:LoansPayableMembernysedei:PartnershipXMember2024-03-310001364250us-gaap:LoansPayableMembernysedei:PartnershipXMember2024-01-012024-03-310001364250nysedei:SecuredOvernightFinancingRateSOFRMemberus-gaap:LoansPayableMembernysedei:PartnershipXMember2024-01-012024-03-310001364250us-gaap:InterestRateSwapMemberus-gaap:LoansPayableMembernysedei:PartnershipXMember2024-03-310001364250us-gaap:InterestRateSwapMemberus-gaap:LoansPayableMembernysedei:PartnershipXMember2024-01-012024-03-31

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 10-Q

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2024

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____ to _____

Commission file number: 001-33106

Douglas Emmett, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Maryland | | 20-3073047 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | | | | | |

1299 Ocean Avenue, Suite 1000, Santa Monica, California | | 90401 |

| (Address of principal executive offices) | | (Zip Code) |

(310) 255-7700

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common Stock, $0.01 par value per share | | DEI | | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| | | | | | | | | | | |

| Class | | Outstanding at | May 3, 2024 |

| Common Stock, $0.01 par value per share | | 167,378,737 | shares |

| | | | | | | | |

DOUGLAS EMMETT, INC. FORM 10-Q |

| Table of Contents |

| | |

| | Page |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| | | |

| | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Abbreviations used in this Report:

| | | | | |

| AOCI | Accumulated Other Comprehensive Income (Loss) |

| ASC | Accounting Standards Codification |

| ASU | Accounting Standards Update |

| BOMA | Building Owners and Managers Association |

| CEO | Chief Executive Officer |

| CFO | Chief Financial Officer |

| Code | Internal Revenue Code of 1986, as amended |

| COVID-19 | Coronavirus Disease 2019 |

| DEI | Douglas Emmett, Inc. |

| EPS | Earnings Per Share |

| Exchange Act | Securities Exchange Act of 1934, as amended |

| FASB | Financial Accounting Standards Board |

| FCA | Financial Conduct Authority |

| FDIC | Federal Deposit Insurance Corporation |

| FFO | Funds From Operations |

| Fund | Unconsolidated Institutional Real Estate Fund |

| GAAP | Generally Accepted Accounting Principles (United States) |

| JV | Joint Venture |

| LIBOR | London Interbank Offered Rate |

| LTIP Units | Long-Term Incentive Plan Units |

| NAREIT | National Association of Real Estate Investment Trusts |

| OCI | Other Comprehensive Income (Loss) |

| OP Units | Operating Partnership Units |

| Operating Partnership | Douglas Emmett Properties, LP |

| Partnership X | Douglas Emmett Partnership X, LP |

| PCAOB | Public Company Accounting Oversight Board (United States) |

| REIT | Real Estate Investment Trust |

| Report | Quarterly Report on Form 10-Q |

| SEC | Securities and Exchange Commission |

| Securities Act | Securities Act of 1933, as amended |

| SOFR | Secured Overnight Financing Rate |

| TRS | Taxable REIT Subsidiary(ies) |

| US | United States |

| USD | United States Dollar |

| VIE | Variable Interest Entity(ies) |

Defined terms used in this Report:

| | | | | |

| Annualized Rent | Annualized cash base rent (excludes tenant reimbursements, parking and other revenue) before abatements under leases commenced as of the reporting date and expiring after the reporting date. Annualized Rent for our triple net office properties (in Honolulu and one single tenant building in Los Angeles) is calculated by adding expense reimbursements and estimates of normal building expenses paid by tenants to base rent. Annualized Rent does not include lost rent recovered from insurance and rent for building management use. Annualized Rent includes rent for our corporate headquarters in Santa Monica. We report Annualized Rent because it is a widely reported measure of the performance of equity REITs, and is used by some investors as a means to determine tenant demand and to compare our performance and value with other REITs. We use Annualized Rent to manage and monitor the performance of our office and multifamily portfolios. |

| Consolidated Portfolio | Includes all of the properties included in our consolidated results, including our consolidated JVs. |

Funds From Operations (FFO)

| We calculate FFO in accordance with the standards established by NAREIT by excluding gains (or losses) on sales of investments in real estate, gains (or losses) from changes in control of investments in real estate, real estate depreciation and amortization (other than amortization of right-of-use assets for which we are the lessee and amortization of deferred loan costs), impairment write-downs of real estate and impairment write-downs of our investment in our unconsolidated Fund from our net income (loss) (including adjusting for the effect of such items attributable to our consolidated JVs and our unconsolidated Fund, but not for noncontrolling interests included in our Operating Partnership). FFO is a non-GAAP supplemental financial measure that we report because we believe it is useful to our investors. See Management’s Discussion and Analysis of Financial Condition and Results of Operations in Item 2 of this Report for a discussion of FFO. |

| Leased Rate | The percentage leased as of the reporting date. Management space is considered leased. Space taken out of service during a repositioning or which is vacant as a result of a fire or other damage is excluded from both the numerator and denominator for calculating the Leased Rate. For newly developed buildings going through initial lease up, units are included in both the numerator and denominator as they are leased. We report Leased Rate because it is a widely reported measure of the performance of equity REITs, and is also used by some investors as a means to determine tenant demand and to compare our performance with other REITs. We use Leased Rate to manage and monitor the performance of our office and multifamily portfolios. |

Net Operating Income (NOI)

| We calculate NOI as revenue less operating expenses attributable to the properties that we own and operate. NOI is calculated by excluding the following from our net income (loss): general and administrative expenses, depreciation and amortization expense, other income, other expenses, income (loss) from unconsolidated Fund, interest expense, gains (or losses) on sales of investments in real estate and net income (loss) attributable to noncontrolling interests. NOI is a non-GAAP supplemental financial measure that we report because we believe it is useful to our investors. See Management’s Discussion and Analysis of Financial Condition and Results of Operations in Item 2 of this Report for a discussion of our Same Property NOI. |

| Occupancy Rate | We calculate Occupancy Rate by excluding signed leases not yet commenced from the Leased Rate. Management space is considered occupied. Space taken out of service during a repositioning or which is vacant as a result of a fire or other damage is excluded from both the numerator and denominator for calculating the Occupancy Rate. For newly developed buildings going through initial lease up, units are included in both the numerator and denominator as they are occupied. We report Occupancy Rate because it is a widely reported measure of the performance of equity REITs, and is also used by some investors as a means to determine tenant demand and to compare our performance with other REITs. We use Occupancy Rate to manage and monitor the performance of our office and multifamily portfolios. |

| Recurring Capital Expenditures | Building improvements required to maintain revenues once a property has been stabilized, and excludes capital expenditures for (i) acquired buildings being stabilized, (ii) newly developed space, (iii) upgrades to improve revenues or operating expenses or significantly change the use of the space, (iv) casualty damage and (v) bringing the property into compliance with governmental or lender requirements. We report Recurring Capital Expenditures because it is a widely reported measure of the performance of equity REITs, and is used by some investors as a means to determine our cash flow requirements and to compare our performance with other REITs. We use Recurring Capital Expenditures to manage and monitor the performance of our office and multifamily portfolios. |

| | | | | |

| |

| |

Defined terms used in this Report (continued): |

| |

Rentable Square Feet

| Based on the BOMA remeasurement and consists of leased square feet (including square feet with respect to signed leases not commenced as of the reporting date), available square feet, building management use square feet and square feet of the BOMA adjustment on leased space. We report Rentable Square Feet because it is a widely reported measure of the performance and value of equity REITs, and is also used by some investors to compare our performance and value with other REITs. We use Rentable Square Feet to manage and monitor the performance of our office portfolio. |

| Rental Rate | We present two forms of Rental Rates - Cash Rental Rates and Straight-Line Rental Rates. Cash Rental Rate is calculated by dividing the rent paid by the Rentable Square Feet. Straight-Line Rental Rate is calculated by dividing the average rent over the lease term by the Rentable Square Feet. |

| Same Properties | Our consolidated properties that have been owned and operated by us in a consistent manner, and reported in our consolidated results during the entire span of both periods being compared. We exclude from our same property subset any properties that during the comparable periods were: (i) acquired, (ii) sold, held for sale, contributed or otherwise removed from our consolidated financial statements, (iii) that underwent a major repositioning project or were impacted by development activity, or suffered significant casualty loss that we believed significantly affected the properties' operating results. We also exclude rent received from ground leases. |

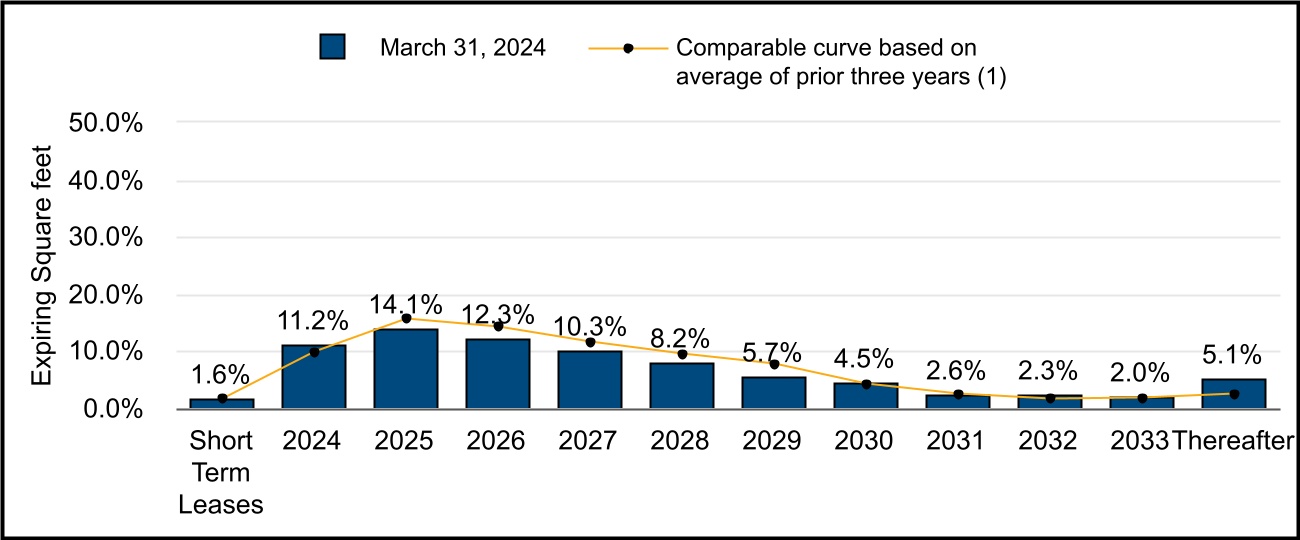

| Short-Term Leases | Represents leases that expired on or before the reporting date or had a term of less than one year, including hold over tenancies, month to month leases and other short-term occupancies. |

| Total Portfolio | Includes our Consolidated Portfolio plus the properties owned by our Fund. |

Forward Looking Statements

This Report contains forward-looking statements within the meaning of the Section 27A of the Securities Act and Section 21E of the Exchange Act. You can find many (but not all) of these statements by looking for words such as “believe”, “expect”, “anticipate”, “estimate”, “approximate”, “intend”, “plan”, “would”, “could”, “may”, “future” or other similar expressions in this Report. We claim the protection of the safe harbor contained in the Private Securities Litigation Reform Act of 1995. We caution investors that any forward-looking statements used in this Report, or those that we make orally or in writing from time to time, are based on our beliefs and assumptions, as well as information currently available to us. Actual outcomes will be affected by known and unknown risks, trends, uncertainties and factors beyond our control or ability to predict. Although we believe that our assumptions are reasonable, they are not guarantees of future performance and some will inevitably prove to be incorrect. As a result, our future results can be expected to differ from our expectations, and those differences may be material. Accordingly, investors should use caution when relying on previously reported forward-looking statements, which were based on results and trends at the time they were made, to anticipate future results or trends. Some of the risks and uncertainties that could cause our actual results, performance or achievements to differ materially from those expressed or implied by forward-looking statements include the following:

•adverse economic, political or real estate developments affecting Southern California or Honolulu, Hawaii;

•competition from other real estate investors in our markets;

•decreasing rental rates or increasing tenant incentive and vacancy rates;

•reduced demand for office space, including as a result of remote work and flexible working arrangements that allow work from remote locations other than the employer’s office premises;

•defaults on, early terminations of, or non-renewal of leases by tenants;

•increases in interest rates;

•increases in operating costs, including due to inflation;

•insufficient cash flows to service our outstanding debt or pay rent on ground leases;

•difficulties in raising capital;

•inability to liquidate real estate or other investments quickly;

•adverse changes to rent control laws and regulations;

•environmental uncertainties;

•natural disasters;

•fire and other property damage;

•insufficient insurance, or increases in insurance costs;

•inability to successfully expand into new markets and submarkets;

•difficulties in identifying properties to acquire and failure to complete acquisitions successfully;

•failure to successfully operate acquired properties;

•risks associated with property development;

•risks associated with JVs;

•conflicts of interest with our officers and reliance on key personnel;

•changes in zoning and other land use laws;

•adverse results of litigation or governmental proceedings;

•failure to comply with laws, regulations and covenants that are applicable to our business;

•possible terrorist attacks or wars;

•possible cyber attacks or intrusions;

•adverse changes to accounting rules;

•weaknesses in our internal controls over financial reporting;

•failure to maintain our REIT status under federal tax laws; and

•adverse changes to tax laws, including those related to property taxes.

For further discussion of these and other risk factors see Item 1A. "Risk Factors” in our 2023 Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and Item 1A. "Risk Factors" in this Report. This Report and all subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We do not undertake any obligation to release publicly any revisions to our forward-looking statements to reflect events or circumstances after the date of this Report.

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

| | | | | | | | | | | |

Douglas Emmett, Inc. Consolidated Balance Sheets (Unaudited; In thousands, except share data) |

| | | |

| | | |

| | March 31, 2024 | | December 31, 2023 |

| | | |

| Assets | | | |

| Investment in real estate, gross | $ | 12,432,301 | | | $ | 12,405,814 | |

| Less: accumulated depreciation and amortization | (3,721,673) | | | (3,652,630) | |

| Investment in real estate, net | 8,710,628 | | | 8,753,184 | |

| | | |

| Ground lease right-of-use asset | 7,445 | | | 7,447 | |

| Cash and cash equivalents | 556,677 | | | 523,082 | |

| Tenant receivables | 5,783 | | | 6,096 | |

| Deferred rent receivables | 115,120 | | | 115,321 | |

| Acquired lease intangible assets, net | 2,848 | | | 2,971 | |

| Interest rate contract assets | 170,607 | | | 170,880 | |

| Investment in unconsolidated Fund | 24,996 | | | 15,977 | |

| Other assets | 42,963 | | | 49,260 | |

| Total Assets | $ | 9,637,067 | | | $ | 9,644,218 | |

| | | |

| Liabilities | | | |

| Secured notes payable, net | $ | 5,544,517 | | | $ | 5,543,171 | |

| Ground lease liability | 10,832 | | | 10,836 | |

| Interest payable, accounts payable and deferred revenue | 153,235 | | | 131,237 | |

| Security deposits | 62,428 | | | 61,958 | |

| Acquired lease intangible liabilities, net | 17,373 | | | 19,838 | |

| | | |

| Dividends payable | 31,812 | | | 31,781 | |

| Total Liabilities | 5,820,197 | | | 5,798,821 | |

| | | |

| Equity | | | |

| Douglas Emmett, Inc. stockholders' equity: | | | |

Common Stock, $0.01 par value, 750,000,000 authorized, 167,371,920 and 167,206,267 outstanding at March 31, 2024 and December 31, 2023, respectively | 1,674 | | | 1,672 | |

| Additional paid-in capital | 3,395,499 | | | 3,392,955 | |

| Accumulated other comprehensive income | 118,999 | | | 115,917 | |

| Accumulated deficit | (1,313,573) | | | (1,290,682) | |

| Total Douglas Emmett, Inc. stockholders' equity | 2,202,599 | | | 2,219,862 | |

| Noncontrolling interests | 1,614,271 | | | 1,625,535 | |

| Total Equity | 3,816,870 | | | 3,845,397 | |

| Total Liabilities and Equity | $ | 9,637,067 | | | $ | 9,644,218 | |

See accompanying notes to the consolidated financial statements.

Douglas Emmett, Inc.

Consolidated Statements of Operations

(Unaudited; in thousands, except per share data)

| | | | | | | | | | | | | | | |

| | | | Three Months Ended March 31, |

| | | | | | 2024 | | 2023 |

| | | | | | | |

| Revenues | | | | | | | |

| Office rental | | | | | | | |

| Rental revenues and tenant recoveries | | | | | $ | 169,726 | | | $ | 176,345 | |

| Parking and other income | | | | | 28,211 | | | 27,013 | |

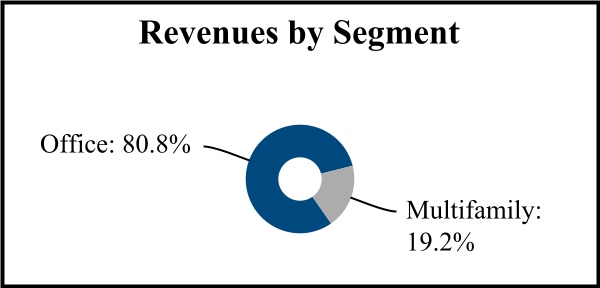

| Total office revenues | | | | | 197,937 | | | 203,358 | |

| | | | | | | |

| Multifamily rental | | | | | | | |

| Rental revenues | | | | | 43,220 | | | 43,973 | |

| Parking and other income | | | | | 3,812 | | | 5,062 | |

| Total multifamily revenues | | | | | 47,032 | | | 49,035 | |

| | | | | | | |

| Total revenues | | | | | 244,969 | | | 252,393 | |

| | | | | | | |

| Operating Expenses | | | | | | | |

| Office expenses | | | | | 67,220 | | | 72,768 | |

| Multifamily expenses | | | | | 15,850 | | | 16,888 | |

| General and administrative expenses | | | | | 11,571 | | | 10,940 | |

| Depreciation and amortization | | | | | 95,769 | | | 93,176 | |

| Total operating expenses | | | | | 190,410 | | | 193,772 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other income | | | | | 7,044 | | | 3,283 | |

| Other expenses | | | | | (114) | | | (520) | |

| (Loss) income from unconsolidated Fund | | | | | (26) | | | 289 | |

| Interest expense | | | | | (55,332) | | | (45,511) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net income | | | | | 6,131 | | | 16,162 | |

| Net loss attributable to noncontrolling interests | | | | | 2,778 | | | 2,211 | |

| Net income attributable to common stockholders | | | | | $ | 8,909 | | | $ | 18,373 | |

| | | | | | | |

| Net income per common share – basic and diluted | | | | | $ | 0.05 | | | $ | 0.10 | |

| | | | | | | |

See accompanying notes to the consolidated financial statements.

Douglas Emmett, Inc.

Consolidated Statements of Comprehensive Income (Loss)

(Unaudited and in thousands)

| | | | | | | | | | | | | | | |

| | | | Three Months Ended March 31, |

| | | | | | 2024 | | 2023 |

| | | | | | | |

| Net income | | | | | $ | 6,131 | | | $ | 16,162 | |

| Other comprehensive income (loss): cash flow hedges | | | | | 4,100 | | | (51,897) | |

| Comprehensive income (loss) | | | | | 10,231 | | | (35,735) | |

| Comprehensive loss attributable to noncontrolling interests | | | | | 1,760 | | | 18,121 | |

| Comprehensive income (loss) attributable to common stockholders | | | | | $ | 11,991 | | | $ | (17,614) | |

See accompanying notes to the consolidated financial statements.

Douglas Emmett, Inc.

Consolidated Statements of Equity

(Unaudited; in thousands, except dividend per share data)

| | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended March 31, |

| | | | | | 2024 | | 2023 |

| | | | | | | | |

| Shares of Common Stock | Beginning balance | | | | | 167,206 | | | 175,810 | |

| Exchange of OP Units for common stock | | | | | 166 | | | — | |

| | | | | | | |

| Repurchases of common stock | | | | | — | | | (1,435) | |

| Ending balance | | | | | 167,372 | | | 174,375 | |

| | | | | | | | |

| Common Stock | Beginning balance | | | | | $ | 1,672 | | | $ | 1,758 | |

| Exchange of OP units for common stock | | | | | 2 | | | — | |

| | | | | | | |

| Repurchases of common stock | | | | | — | | | (14) | |

| Ending balance | | | | | $ | 1,674 | | | $ | 1,744 | |

| | | | | | | | |

| Additional Paid-in Capital | Beginning balance | | | | | $ | 3,392,955 | | | $ | 3,493,307 | |

| Exchange of OP Units for common stock | | | | | 2,543 | | | — | |

| Repurchases of OP Units with cash | | | | | 1 | | | 4 | |

| | | | | | | |

| | | | | | | |

| Repurchases of common stock | | | | | — | | | (16,500) | |

| Ending balance | | | | | $ | 3,395,499 | | | $ | 3,476,811 | |

| | | | | | | | |

| Accumulated Other Comprehensive Income | Beginning balance | | | | | $ | 115,917 | | | $ | 187,063 | |

| | | | | | | |

| Cash flow hedge adjustments | | | | | 3,082 | | | (35,987) | |

| Ending balance | | | | | $ | 118,999 | | | $ | 151,076 | |

| | | | | | | | |

| Accumulated Deficit | Beginning balance | | | | | $ | (1,290,682) | | | $ | (1,119,714) | |

| | | | | | | |

| | | | | | | |

| Net income attributable to common stockholders | | | | | 8,909 | | | 18,373 | |

| Dividends | | | | | (31,800) | | | (33,131) | |

| Ending balance | | | | | $ | (1,313,573) | | | $ | (1,134,472) | |

| | | | | | | | |

| Noncontrolling Interests | Beginning balance | | | | | $ | 1,625,535 | | | $ | 1,713,369 | |

| | | | | | | |

| Net loss attributable to noncontrolling interests | | | | | (2,778) | | | (2,211) | |

| Cash flow hedge adjustments | | | | | 1,018 | | | (15,910) | |

| Contributions | | | | | — | | | 125 | |

| | | | | | | |

| | | | | | | |

| Distributions | | | | | (10,457) | | | (10,140) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Exchange of OP Units for common stock | | | | | (2,545) | | | — | |

| Repurchases of OP Units with cash | | | | | (7) | | | (93) | |

| | | | | | | |

| Stock-based compensation | | | | | 3,505 | | | 3,507 | |

| Ending balance | | | | | $ | 1,614,271 | | | $ | 1,688,647 | |

| | | | | | | | |

| Statement continues on the next page. |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Douglas Emmett, Inc.

Consolidated Statements of Equity

(Unaudited; in thousands, except dividend per share data)

| | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | Three Months Ended March 31, |

| | | | | | 2024 | | 2023 |

| | | | | | | | |

| Total Equity | Beginning balance | | | | | $ | 3,845,397 | | | $ | 4,275,783 | |

| | | | | | | |

| | | | | | | |

| Net income | | | | | 6,131 | | | 16,162 | |

| Cash flow hedge adjustments | | | | | 4,100 | | | (51,897) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Repurchases of OP Units with cash | | | | | (6) | | | (89) | |

| Repurchases of common stock | | | | | — | | | (16,514) | |

| Contributions | | | | | — | | | 125 | |

| | | | | | | |

| Dividends | | | | | (31,800) | | | (33,131) | |

| Distributions | | | | | (10,457) | | | (10,140) | |

| Stock-based compensation | | | | | 3,505 | | | 3,507 | |

| Ending balance | | | | | $ | 3,816,870 | | | $ | 4,183,806 | |

| | | | | | | | |

| Dividends declared per common share | | | | | $ | 0.19 | | | $ | 0.19 | |

See accompanying notes to the consolidated financial statements.

Douglas Emmett, Inc.

Consolidated Statements of Cash Flows

(Unaudited and in thousands)

| | | | | | | | | | | |

| | Three Months Ended March 31, |

| 2024 | | 2023 |

| Operating Activities | | | |

| Net income | $ | 6,131 | | | $ | 16,162 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Loss (income) from unconsolidated Fund | 26 | | | (289) | |

| | | |

| | | |

| | | |

| Depreciation and amortization | 95,769 | | | 93,176 | |

| Net accretion of acquired lease intangibles | (2,343) | | | (3,037) | |

| Straight-line rent | 202 | | | 126 | |

| | | |

| Loan premium amortized and written off | (115) | | | (113) | |

| Deferred loan costs amortized and written off | 2,209 | | | 2,134 | |

| | | |

| Amortization of stock-based compensation | 2,863 | | | 2,794 | |

| Operating distributions from unconsolidated Fund | 248 | | | 289 | |

| | | |

| Change in working capital components: | | | |

| Tenant receivables | 313 | | | 2,061 | |

| Interest payable, accounts payable and deferred revenue | 26,945 | | | 28,176 | |

| Security deposits | 470 | | | 298 | |

| Other assets | 6,306 | | | 3,697 | |

| Net cash provided by operating activities | 139,024 | | | 145,474 | |

| | | |

| Investing Activities | | | |

| Capital expenditures for improvements to real estate | (48,127) | | | (40,031) | |

| Capital expenditures for developments | (9,678) | | | (11,953) | |

| Insurance recoveries for damage to real estate | 475 | | | 529 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Acquisition of additional interest in unconsolidated Fund | (5,214) | | | — | |

| Capital distributions from unconsolidated Fund | 96 | | | 52 | |

| Net cash used in investing activities | (62,448) | | | (51,403) | |

| | | |

| Financing Activities | | | |

| Proceeds from borrowings | — | | | 10,000 | |

| Repayment of borrowings | (222) | | | (10,212) | |

| | | |

| Loan cost payments | (526) | | | (696) | |

| | | |

| | | |

| Contributions from noncontrolling interests in consolidated JVs | — | | | 125 | |

| Distributions paid to noncontrolling interests | (10,457) | | | (10,140) | |

| | | |

| Dividends paid to common stockholders | (31,770) | | | (33,403) | |

| | | |

| | | |

| | | |

| Repurchases of OP Units | (6) | | | (89) | |

| | | |

| Repurchases of common stock | — | | | (16,514) | |

| Net cash used in financing activities | (42,981) | | | (60,929) | |

| | | |

| Increase in cash and cash equivalents and restricted cash | 33,595 | | | 33,142 | |

| Cash and cash equivalents and restricted cash - beginning balance | 523,183 | | | 268,938 | |

| Cash and cash equivalents and restricted cash - ending balance | $ | 556,778 | | | $ | 302,080 | |

|

| | | |

| | | |

| | | |

Douglas Emmett, Inc.

Consolidated Statements of Cash Flows

(Unaudited and in thousands)

| | | | | | | | | | | |

| Reconciliation of Ending Cash Balance |

| March 31, 2024 | | March 31, 2023 |

| | | |

| Cash and cash equivalents | $ | 556,677 | | | $ | 301,979 | |

| Restricted cash (included in Other assets on our consolidated balance sheets) | 101 | | | 101 | |

| Cash and cash equivalents and restricted cash | $ | 556,778 | | | $ | 302,080 | |

Supplemental Cash Flows Information

| | | | | | | | | | | |

| | Three Months Ended March 31, |

| | 2024 | | 2023 |

| | | |

| Cash paid for interest, net of capitalized interest | $ | 53,247 | | | $ | 41,371 | |

| Capitalized interest paid | $ | 1,824 | | | $ | 513 | |

| | | |

| Non-cash Investing Transactions | | | |

| Accrual for real estate and development capital expenditures | $ | 11,716 | | | $ | 29,904 | |

| Capitalized stock-based compensation for improvements to real estate and developments | $ | 642 | | | $ | 713 | |

| Removal of fully depreciated and amortized buildings, building improvements, tenant improvements and lease intangibles | $ | 24,878 | | | $ | 22,812 | |

| Removal of fully amortized acquired lease intangible assets | $ | 81 | | | $ | 75 | |

| Removal of fully accreted acquired lease intangible liabilities | $ | 1,863 | | | $ | 3,721 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Non-cash Financing Transactions | | | |

| | | |

| Gain (loss) recorded in AOCI - consolidated derivatives | $ | 38,842 | | | $ | (19,817) | |

| Gain (loss) recorded in AOCI - unconsolidated Fund's derivatives (our share) | $ | 5,047 | | | $ | (272) | |

| | | |

| | | |

| | | |

| Dividends declared | $ | 31,812 | | | $ | 33,142 | |

| Exchange of OP Units for common stock | $ | 2,545 | | | $ | — | |

| | | |

| | | |

See accompanying notes to the consolidated financial statements.

Douglas Emmett, Inc.

Notes to Consolidated Financial Statements (unaudited)

1. Overview

Organization and Business Description

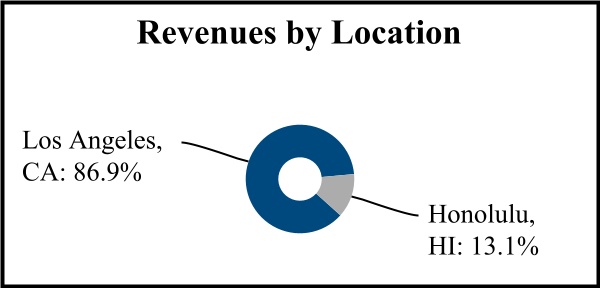

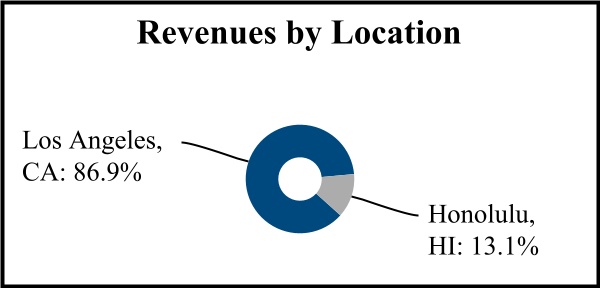

Douglas Emmett, Inc. is a fully integrated, self-administered and self-managed REIT. We are one of the largest owners and operators of high-quality office and multifamily properties in Los Angeles County, California and Honolulu, Hawaii. Through our interest in our Operating Partnership and its subsidiaries, consolidated JVs and unconsolidated Fund, we focus on owning, acquiring, developing and managing a substantial market share of top-tier office properties and premier multifamily communities in neighborhoods that possess significant supply constraints, high-end executive housing and key lifestyle amenities. The terms "us," "we" and "our" as used in the consolidated financial statements refer to Douglas Emmett, Inc. and its subsidiaries on a consolidated basis.

At March 31, 2024, our Consolidated Portfolio consisted of (i) a 17.6 million square foot office portfolio, (ii) 4,528 multifamily apartment units and (iii) fee interests in two parcels of land from which we receive rent under ground leases. We also manage and own an equity interest in an unconsolidated Fund which, at March 31, 2024, owned an additional 0.4 million square feet of office space. We manage our unconsolidated Fund alongside our Consolidated Portfolio, and we therefore present the statistics for our office portfolio on a Total Portfolio basis. As of March 31, 2024, our portfolio consisted of the following (including ancillary retail space and excluding two parcels of land from which we receive rent under ground leases):

| | | | | | | | | | | |

| | Consolidated Portfolio | | Total

Portfolio |

| Office | | | |

| Wholly-owned properties | 52 | | 52 |

| Consolidated JV properties | 16 | | 16 |

| Unconsolidated Fund properties | — | | 2 |

| 68 | | 70 |

| | | |

| Multifamily | | | |

| Wholly-owned properties | 12 | | 12 |

| Consolidated JV properties | 2 | | 2 |

| 14 | | 14 |

| | | |

| Total | 82 | | 84 |

Basis of Presentation

The accompanying consolidated financial statements are the consolidated financial statements of Douglas Emmett, Inc. and its subsidiaries, including our Operating Partnership and our consolidated JVs. All significant intercompany balances and transactions have been eliminated in our consolidated financial statements.

We consolidate entities in which we are considered to be the primary beneficiary of a VIE or have a majority of the voting interest of the entity. We are deemed to be the primary beneficiary of a VIE when we have (i) the power to direct the activities of that VIE that most significantly impact its economic performance, and (ii) the obligation to absorb losses or the right to receive benefits that could potentially be significant to the VIE. We do not consolidate entities in which the other parties have substantive kick-out rights to remove our power to direct the activities, most significantly impacting the economic performance, of that VIE. In determining whether we are the primary beneficiary, we consider factors such as ownership interest, management representation, authority to control decisions, and contractual and substantive participating rights of each party.

We consolidate our Operating Partnership through which we conduct substantially all of our business, and own, directly and through subsidiaries, substantially all of our assets, and are obligated to repay substantially all of our liabilities. The consolidated debt, excluding our consolidated JVs, was $3.76 billion as of March 31, 2024 and December 31, 2023. See Note 8. We also consolidate four JVs through our Operating Partnership. We consolidate our Operating Partnership and our four JVs because they are VIEs and we or our Operating Partnership are the primary beneficiary for each.

Douglas Emmett, Inc.

Notes to Consolidated Financial Statements (unaudited) (continued)

As of March 31, 2024, our consolidated VIE entities, excluding our Operating Partnership, had:

•aggregate consolidated assets of $3.82 billion (of which $3.45 billion related to investment in real estate), and

•aggregate consolidated liabilities of $1.89 billion (of which $1.81 billion related to debt).

As of December 31, 2023, our consolidated VIE entities, excluding our Operating Partnership, had:

•aggregate consolidated assets of $3.83 billion (of which $3.47 billion related to investment in real estate), and

•aggregate consolidated liabilities of $1.88 billion (of which $1.81 billion related to debt).

The accompanying unaudited interim consolidated financial statements have been prepared pursuant to the rules and regulations of the SEC in conformity with US GAAP as established by the FASB in the ASC. Certain information and footnote disclosures normally included in the consolidated financial statements prepared in conformity with US GAAP may have been condensed or omitted pursuant to SEC rules and regulations, although we believe that the disclosures are adequate to make their presentation not misleading. The accompanying unaudited interim consolidated financial statements include, in our opinion, all adjustments, consisting of normal recurring adjustments, necessary to present fairly the financial information set forth therein. The results of operations for the interim periods are not necessarily indicative of the results that may be expected for the year ending December 31, 2024. The interim consolidated financial statements should be read in conjunction with the consolidated financial statements in our 2023 Annual Report on Form 10-K and the notes thereto. Any references to the number or class of properties, square footage, per square footage amounts, apartment units and geography, are outside the scope of our independent registered public accounting firm’s review of our consolidated financial statements in accordance with the standards of the PCAOB.

2. Summary of Significant Accounting Policies

We have not made any changes to our significant accounting policies disclosed in our 2023 Annual Report on Form 10-K.

Use of Estimates

The preparation of consolidated financial statements in conformity with US GAAP requires management to make certain estimates that affect the reported amounts in the consolidated financial statements and accompanying notes. Actual results could differ materially from those estimates.

Revenue Recognition

Rental revenues and tenant recoveries

We account for our rental revenues, and variable lease payments such as tenant recoveries and parking revenues, in accordance with Topic 842. We adopted a practical expedient which allows us to account for our rental revenues, tenant recoveries and parking revenues on a combined basis. Rental revenues and tenant recoveries from tenant leases are included in Rental revenues and tenant recoveries on our consolidated statements of operations. Tenant recoveries were $9.1 million and $13.1 million for the three months ended March 31, 2024 and 2023, respectively. Parking revenues are included in Parking and other income on our consolidated statements of operations.

Collectibility

In accordance with Topic 842, we perform an assessment as to whether or not substantially all of the amounts due under a tenant’s lease agreement is deemed probable of collection. This assessment involves using a methodology that requires judgment and estimates about matters that are uncertain at the time the estimates are made, including tenant specific factors, specific industry conditions, and general economic trends and conditions.

Douglas Emmett, Inc.

Notes to Consolidated Financial Statements (unaudited) (continued)

For leases where we have concluded it is probable that we will collect substantially all the lease payments due under those leases, we continue to record lease income on a straight-line basis over the lease term. For leases where we have concluded that it is not probable that we will collect substantially all the lease payments due under those leases, we limit the lease income to the lesser of the income recognized on a straight-line basis or cash basis. We write-off tenant receivables and deferred rent receivables as a charge against rental revenues and tenant recoveries in the period we conclude that substantially all of the lease payments are not probable of collection. If we subsequently collect amounts that were previously written off then the amounts collected are recorded as an increase to our rental revenues and tenant recoveries in the period they are collected. If our conclusion of collectibility changes, we will record the difference between the lease income that would have been recognized on a straight-line basis and cash basis as a current-period adjustment to rental revenues and tenant recoveries.

Income Taxes

We have elected to be taxed as a REIT under the Code. Provided that we qualify for taxation as a REIT, we are generally not subject to corporate-level income tax on the earnings distributed currently to our stockholders that we derive from our REIT qualifying activities. We are subject to corporate-level tax on the earnings that we derive through our TRS.

New Accounting Pronouncements

Changes to US GAAP are implemented by the FASB in the form of ASUs. We consider the applicability and impact of all ASUs. As of the date of this Report, the FASB has not issued any ASUs that we expect to be applicable and have a material impact on our consolidated financial statements.

3. Investment in Real Estate

The table below summarizes our investment in real estate:

| | | | | | | | | | | |

| (In thousands) | March 31, 2024 | | December 31, 2023 |

| | | |

| Land | $ | 1,185,977 | | $ | 1,185,977 |

Buildings and improvements(1) | 10,156,062 | | 10,142,410 |

| Tenant improvements and lease intangibles | 1,029,496 | | 1,020,988 |

Property under development(1) | 60,766 | | 56,439 |

| Investment in real estate, gross | $ | 12,432,301 | | $ | 12,405,814 |

________________________________________________

(1) During the three months ended March 31, 2024, Property under development balances transferred to Building and improvements for real estate placed into service was $3.2 million.

Property to be Removed from Service

During the second quarter of 2023, we removed our Barrington Plaza Apartments property in Los Angeles from the rental market.

Douglas Emmett, Inc.

Notes to Consolidated Financial Statements (unaudited) (continued)

4. Ground Lease

We pay rent under a ground lease located in Honolulu, Hawaii, which expires on December 31, 2086. The rent is fixed at $733 thousand per year until February 28, 2029, after which it will reset to the greater of the existing ground rent or the market rent at the time.

As of March 31, 2024, the ground lease right-of-use asset carrying value was $7.4 million and the ground lease liability was $10.8 million.

Ground rent expense, which is included in Office expenses on our consolidated statements of operations, was $183 thousand for each of the three month periods ended March 31, 2024 and 2023.

The table below, which assumes that the ground rent payments will continue to be $733 thousand per year after February 28, 2029, presents the future minimum ground lease payments as of March 31, 2024:

| | | | | |

| Twelve months ending March 31: | (In thousands) |

| |

| 2025 | $ | 733 | |

| 2026 | 733 | |

| 2027 | 733 | |

| 2028 | 733 | |

| 2029 | 733 | |

| Thereafter | 42,330 | |

| Total future minimum lease payments | $ | 45,995 | |

Douglas Emmett, Inc.

Notes to Consolidated Financial Statements (unaudited) (continued)

5. Acquired Lease Intangibles

Summary of our Acquired Lease Intangibles

| | | | | | | | | | | |

| (In thousands) | March 31, 2024 | | December 31, 2023 |

| | | |

| Above-market tenant leases | $ | 4,460 | | | $ | 4,541 | |

| Above-market tenant leases - accumulated amortization | (2,468) | | | (2,430) | |

| Above-market ground lease where we are the lessor | 1,152 | | | 1,152 | |

| Above-market ground lease - accumulated amortization | (296) | | | (292) | |

| Acquired lease intangible assets, net | $ | 2,848 | | | $ | 2,971 | |

| | | |

| Below-market tenant leases | $ | 46,145 | | | $ | 48,008 | |

| Below-market tenant leases - accumulated accretion | (28,772) | | | (28,170) | |

| Acquired lease intangible liabilities, net | $ | 17,373 | | | $ | 19,838 | |

Impact on the Consolidated Statements of Operations

The table below summarizes the net amortization/accretion related to our above- and below-market leases:

| | | | | | | | | | | | | | | |

| | | | Three Months Ended March 31, |

| (In thousands) | | | | | 2024 | | 2023 |

| | | | | | | |

Net accretion of above- and below-market tenant lease assets and liabilities(1) | | | | | $ | 2,347 | | | $ | 3,041 | |

Amortization of an above-market ground lease asset(2) | | | | | (4) | | | (4) | |

| Total | | | | | $ | 2,343 | | | $ | 3,037 | |

______________________________________________

(1) Recorded as a net increase to office and multifamily rental revenues.

(2) Recorded as a decrease to office parking and other income.

Douglas Emmett, Inc.

Notes to Consolidated Financial Statements (unaudited) (continued)

6. Investment in Unconsolidated Fund

Description of our Fund

As of March 31, 2024, we managed and owned an equity interest of 74.0% in an unconsolidated Fund, Partnership X, through which we and other investors in the Fund owned two office properties totaling 0.4 million square feet. During 2023 we owned an equity interest of 33.5% in the Fund. On December 31, 2023, we purchased an additional 20.2% equity interest in the Fund which increased our equity interest in the Fund to 53.8%. On February 29, 2024, we purchased an additional 20.2% equity interest in the Fund which increased our equity interest in the Fund to 74.0%.

Partnership X pays us fees and reimburses us for certain expenses related to property management and other services we provide, which are included in Other income on our consolidated statements of operations. We also receive distributions based on invested capital and on any profits that exceed certain specified cash returns to the investors. The table below presents the cash distributions we received from Partnership X:

| | | | | | | | | | | |

| Three Months Ended March 31, |

| (In thousands) | 2024 | | 2023 |

| | | |

| Operating distributions received | $ | 248 | | | $ | 289 | |

| Capital distributions received | 96 | | | 52 | |

| Total distributions received | $ | 344 | | | $ | 341 | |

Summarized Financial Information for Partnership X

The tables below present selected financial information for Partnership X. The amounts presented reflect 100% (not our pro-rata share) of the amounts related to the Fund, and are based upon historical book value:

| | | | | | | | | | | |

| (In thousands) | March 31, 2024 | | December 31, 2023 |

| | | |

| Total assets | $ | 147,959 | | | $ | 146,945 | |

| Total liabilities | $ | 119,561 | | | $ | 118,822 | |

| Total equity | $ | 28,398 | | | $ | 28,123 | |

| | | | | | | | | | | |

| | Three Months Ended March 31, |

| (In thousands) | 2024 | | 2023 |

| | | |

| Total revenues | $ | 3,823 | | | $ | 4,642 | |

| Operating income | $ | 360 | | | $ | 1,305 | |

| Net (loss) income | $ | (73) | | | $ | 749 | |

7. Other Assets

| | | | | | | | | | | |

| (In thousands) | March 31, 2024 | | December 31, 2023 |

| | | |

| Restricted cash | $ | 101 | | | $ | 101 | |

| Prepaid expenses | 16,417 | | | 20,594 | |

| Indefinite-lived intangibles | 1,988 | | | 1,988 | |

Deposit with lender(1) | 13,540 | | | 13,440 | |

| Furniture, fixtures and equipment, net | 6,946 | | | 7,014 | |

| Other | 3,971 | | | 6,123 | |

| Total other assets | $ | 42,963 | | | $ | 49,260 | |

_______________________________________________________________________

(1) In connection with the Barrington Plaza loan, we deposited cash into an interest-bearing collateral account with the lender. See our debt disclosures in Note 8 (note 4 to the table) for more detail regarding this loan and the related deposit.

Douglas Emmett, Inc.

Notes to Consolidated Financial Statements (unaudited) (continued)

8. Secured Notes Payable, Net

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Description | | Maturity Date(1) | | Principal Balance as of March 31, 2024 | | Principal Balance as of December 31, 2023 | | Variable Interest Rate | | Fixed Interest Rate(2) | | Swap Maturity Date |

| | | | | | | | | | | | |

| | | | (In thousands) | | | | | | |

| | | | | | | | | | | | |

| Consolidated Wholly Owned Subsidiaries |

Term loan(3)(5) | | 3/3/2025 | | $ | 335,000 | | | $ | 335,000 | | | SOFR + 1.41% | | N/A | | N/A |

Fannie Mae loan(3)(5) | | 4/1/2025 | | 102,400 | | | 102,400 | | | SOFR + 1.36% | | N/A | | N/A |

Term loan(3) | | 8/15/2026 | | 415,000 | | | 415,000 | | | SOFR + 1.20% | | 3.07% | | 8/1/2025 |

Term loan(3) | | 9/19/2026 | | 400,000 | | | 400,000 | | | SOFR + 1.25% | | 2.44% | | 9/1/2024 |

Term loan(3) | | 9/26/2026 | | 200,000 | | | 200,000 | | | SOFR + 1.30% | | 2.36% | | 10/1/2024 |

Term loan(3) | | 11/1/2026 | | 400,000 | | | 400,000 | | | SOFR + 1.25% | | 2.31% | | 10/1/2024 |

Fannie Mae loan(3)(4) | | 6/1/2027 | | 550,000 | | | 550,000 | | | SOFR + 1.48% | | N/A | | N/A |

Term loan(3) | | 5/18/2028 | | 300,000 | | | 300,000 | | | SOFR + 1.51% | | 2.21% | | 6/1/2026 |

Term loan(3) | | 1/1/2029 | | 300,000 | | | 300,000 | | | SOFR + 1.56% | | 2.66% | | 1/1/2027 |

Fannie Mae loan(3) | | 6/1/2029 | | 255,000 | | | 255,000 | | | SOFR + 1.09% | | 3.26% | | 6/1/2027 |

Fannie Mae loan(3) | | 6/1/2029 | | 125,000 | | | 125,000 | | | SOFR + 1.09% | | 3.25% | | 6/1/2027 |

Fannie Mae loan(3)(5) | | 8/1/2033 | | 350,000 | | | 350,000 | | | SOFR + 1.37% | | N/A | | N/A |

Term loan(6) | | 6/1/2038 | | 27,419 | | | 27,640 | | | N/A | | 4.55% | | N/A |

| Total Wholly-Owned Subsidiary Debt | 3,759,819 | | | 3,760,040 | | | | | | | |

| | | | | | | | | | | | |

| Consolidated JVs |

Term loan(3)(9) | | 12/19/2024 | | 400,000 | | | 400,000 | | | SOFR + 1.40% | | N/A | | N/A |

Term loan(3) | | 5/15/2027 | | 450,000 | | | 450,000 | | | SOFR + 1.45% | | 2.26% | | 4/1/2025 |

Term loan(3) | | 8/19/2028 | | 625,000 | | | 625,000 | | | SOFR + 1.45% | | 2.12% | | 6/1/2025 |

Term loan(3)(7) | | 4/26/2029 | | 175,000 | | | 175,000 | | | SOFR + 1.25% | | 3.90% | | 5/1/2026 |

Fannie Mae loan(3) | | 6/1/2029 | | 160,000 | | | 160,000 | | | SOFR + 1.09% | | 3.25% | | 7/1/2027 |

Total Consolidated Debt(8) | 5,569,819 | | | 5,570,040 | | | | | | | |

Unamortized loan premium, net(9) | 2,973 | | | 3,087 | | | | | | | |

Unamortized deferred loan costs, net(10) | (28,275) | | | (29,956) | | | | | | | |

| Total Consolidated Debt, net | $ | 5,544,517 | | | $ | 5,543,171 | | | | | | | |

_______________________________________________________________________

Except as noted below, our loans: (i) are non-recourse, (ii) are secured by separate collateral pools consisting of one or more properties, (iii) require interest-only monthly payments with the outstanding principal due upon maturity, and (iv) contain certain financial covenants which could require us to deposit excess cash flow with the lender under certain circumstances unless we (at our option) either provide a guarantee or additional collateral or pay down the loan within certain parameters set forth in the loan documents. Certain loans with maturity date extension options require us to meet minimum financial thresholds in order to extend the loan maturity date.

(1)Maturity dates include extension options.

(2)Effective rate as of March 31, 2024. Includes the effect of interest rate swaps (if applicable) and excludes the effect of prepaid loan fees and loan premiums. See Note 10 for details of our interest rate swaps. See further below for details of our loan costs and loan premiums.

(3)The loan agreement includes a zero-percent SOFR floor. If the loan is swap-fixed then the related swaps do not include such a floor.

(4)The loan is secured by four residential properties. A portion of the loan totaling $472 million has a lender-required out-of-the-money interest rate cap at a weighted average of 8.99% until July 2026. For the portion of the loan relating to Barrington Plaza, in connection with the removal of that property from the rental market during 2023, the lender is treating the debt as a construction loan and we signed a construction completion guarantee in January 2024. The lender also required a $13.3 million cash deposit, which we placed into an interest bearing collateral account during 2023. The lender will return the deposit at the earlier of August 2026 or when the loan is paid in full. The deposit is included in Other assets in our consolidated balance sheets. See Note 7.

(5)The loan has a lender-required out-of-the-money interest rate cap at an interest rate of 7.84% until August 2026.

(6)The loan requires monthly payments of principal and interest. The principal amortization is based upon a 30-year amortization schedule.

(7)We guaranteed the portion of the loan principal that would need to be paid down in order to meet the minimum debt yield in the loan agreement. See Note 16.

(8)The table does not include our unconsolidated Fund's loan - see Note 16. See Note 13 for our debt fair value disclosures.

(9)Balances are net of accumulated amortization of $4.2 million and $4.1 million at March 31, 2024 and December 31, 2023, respectively.

(10)Balances are net of accumulated amortization of $57.7 million and $56.0 million at March 31, 2024 and December 31, 2023, respectively.

Douglas Emmett, Inc.

Notes to Consolidated Financial Statements (unaudited) (continued)

Debt Statistics

The table below summarizes our consolidated fixed and floating rate debt:

| | | | | | | | | | | | | | |

| (In thousands) | | Principal Balance as of March 31, 2024 | | Principal Balance as of December 31, 2023 |

| | | | |

| Aggregate swapped to fixed rate loans | | $ | 3,805,000 | | | $ | 3,805,000 | |

| Aggregate fixed rate loans | | 27,419 | | | 27,640 | |

| Aggregate capped rate loans | | 822,000 | | | 822,000 | |

| Aggregate floating rate loans | | 915,400 | | | 915,400 | |

| Total Debt | | $ | 5,569,819 | | | $ | 5,570,040 | |

The table below summarizes certain consolidated debt statistics as of March 31, 2024:

| | | | | | | | |

| Statistics for consolidated loans with interest fixed under the terms of the loan or a swap |

| | |

| Principal balance (in billions) | | $3.83 |

| Weighted average remaining life (including extension options) | | 3.8 years |

| Weighted average remaining fixed interest period | | 1.6 years |

| Weighted average annual interest rate | | 2.66% |

Future Principal Payments

At March 31, 2024, the minimum future principal payments due on our consolidated secured notes payable were as follows:

| | | | | | | | |

| Twelve months ending March 31: | | Including Maturity Extension Options(1) |

| | |

| | (In thousands) |

| | |

| 2025 | | $ | 735,912 | |

| 2026 | | 103,354 | |

| 2027 | | 1,415,999 | |

| 2028 | | 1,001,045 | |

| 2029 | | 1,226,094 | |

| Thereafter | | 1,087,415 | |

| Total future principal payments | | $ | 5,569,819 | |

________________________________________________

(1) Some of our loan agreements require that we meet certain minimum financial thresholds to be able to extend the loan maturity.

Loan Premium and Loan Costs

The table below presents loan premium and loan costs, which are included in Interest expense on our consolidated statements of operations:

| | | | | | | | | | | | | | | |

| | | | Three Months Ended March 31, |

| (In thousands) | | | | | 2024 | | 2023 |

| | | | | | | |

| Loan premium amortized and written off | | | | | $ | (115) | | | $ | (113) | |

| Deferred loan costs amortized and written off | | | | | 2,209 | | | 2,134 | |

| Loan costs expensed | | | | | 52 | | | 3 | |

| Total | | | | | $ | 2,146 | | | $ | 2,024 | |

Douglas Emmett, Inc.

Notes to Consolidated Financial Statements (unaudited) (continued)

9. Interest Payable, Accounts Payable and Deferred Revenue

| | | | | | | | | | | |

| (In thousands) | March 31, 2024 | | December 31, 2023 |

| | | |

| Interest payable | $ | 18,638 | | | $ | 18,647 | |

| Accounts payable and accrued liabilities | 88,493 | | | 61,767 | |

| Deferred revenue | 46,104 | | | 50,823 | |

| Total interest payable, accounts payable and deferred revenue | $ | 153,235 | | | $ | 131,237 | |

10. Derivative Contracts

We make use of interest rate swap and cap contracts to manage the risk associated with changes in interest rates on our floating-rate debt and to satisfy certain lender requirements. When we enter into a floating-rate term loan, we generally enter into an interest rate swap agreement for the equivalent principal amount, for a period covering the majority of the loan term, which effectively converts our floating-rate debt to a fixed-rate basis during that time. We also enter into interest rate cap agreements from time to time to cap the interest rates on our floating rate loans. We may enter into derivative contracts that are intended to hedge certain economic risks, even though hedge accounting does not apply or we elect to not apply hedge accounting. We do not speculate in derivatives and we do not make use of any other derivative instruments. See Note 8 regarding our debt and our consolidated JVs' debt that is hedged.

Derivative Summary

The table below summarizes our derivative contracts as of March 31, 2024:

| | | | | | | | | | | |