Exhibit 21.1

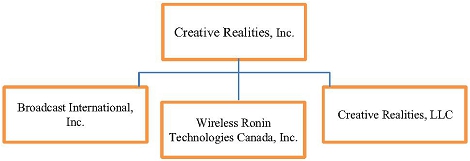

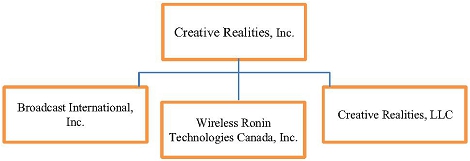

Our corporate structure, including our principal operating subsidiaries, is as follows:

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark one)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 001-33169

CREATIVE REALITIES, INC.

(Exact name of registrant as specified in its charter)

| Minnesota | 41-1967918 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 22 Audrey Place, Fairfield | NJ 07004 | |

| (Address of principal executive offices) | (Zip Code) |

(973) 244-9911

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act:

Securities registered pursuant to Section 12(b) of the Exchange Act: None

Securities registered pursuant to Section 12(g) of the Exchange Act: Common Stock, Par Value $0.01

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

The aggregate market value of the common equity held by non-affiliates of the issuer as of June 30, 2014, was approximately $4,720,081, based upon the last sale price of one share on such date.

As of May 5, 2015, the issuer had outstanding 46,217,968 shares of common stock.

TABLE OF CONTENTS

| 2 |

Overview

Creative Realities, Inc. is a Minnesota corporation that provides innovative digital marketing technology solutions to retailers, brand marketers, venue-operators, enterprises, non-profits and other organizations throughout the United States and a growing number of international markets. Our technology and solutions include: digital merchandising systems, interactive digital shopping assistants and kiosks, mobile digital marketing platforms, digital way-finding platforms, digital menu board systems, dynamic signage, and other digital marketing technologies. We enable our clients’ engagement with consumers by using combinations of our technology and solutions that interact with mobile, social media, point-of-sale, wireless networks and web-based platforms. We have expertise in a broad range of existing and emerging digital marketing technologies, as well as the following related aspects of our business: content, network management, and connected device software and firmware platforms; customized software service layers; hardware platforms; digital media workflows; and proprietary processes and automation tools. We believe we are one of the world’s leading digital marketing technology companies focused on helping retailers and brands use the latest technologies to create better shopping experiences.

Our main operations are conducted directly through Creative Realities, Inc. (f/k/a Wireless Ronin Technologies, Inc.), and under our wholly owned subsidiaries Creative Realities, LLC, a Delaware limited liability company, Broadcast International, Inc., a Utah corporation, and Wireless Ronin Technologies Canada, Inc., a Canadian corporation.

Recent Developments

Acquisition of Broadcast International

On March 5, 2014, we entered into an Agreement and Plan of Merger and Reorganization with Broadcast Acquisition Co., a wholly owned subsidiary of ours, and Broadcast International, Inc., which agreement was later amended on April 11, 2014 (as amended, the “Broadcast Merger Agreement”). We completed the contemplated merger at the close of business on August 1, 2014, and thereupon acquired the business and assets of Broadcast International. As a result of this merger, each share of common stock of Broadcast International, including securities convertible or exercisable into shares of Broadcast International common stock, issued and outstanding immediately prior to the close of business on August 1, 2014 was converted into the right to receive .00535594 validly issued, fully paid and non-assessable shares of our common stock, resulting in our issuance of an aggregate of 7,093,273 shares of common stock to the former security holders of Broadcast International.

Preferred Stock Financing

On August 18, 2014, we entered into a Securities Purchase Agreement with institutional and accredited investors pursuant to which we offered and sold an aggregate of 5,190,000 shares of our Series A Convertible Preferred Stock at $1.00 per share, and issued five-year warrants to purchase an aggregate of 6,487,000 shares of common stock at a per-share price of $0.50 (subject to adjustment), in a private placement exempt from registration under the Securities Act of 1933.

The preferred stock entitles its holders to a 6% dividend, payable semi-annually in cash or in kind. On December 31, 2014, the Company issued an aggregate of 112,448 shares of preferred stock in satisfaction of its semi-annual dividend obligation.

The preferred stock may be converted into our common stock at the option of a holder at an initial conversion price of $0.40 per share, subject to adjustment. Subject to certain conditions, we may call and redeem the preferred stock after three years. During such time as a majority of the preferred stock sold remains outstanding, holders will have the right to elect a member to our Board of Directors. The preferred stock has full-ratchet price protection in the event that we issue common stock below the conversion price, as adjusted, subject to certain customary exceptions. The warrants issued to purchasers of the preferred stock contain weighted-average price protection in the event that we issue common stock below the exercise price, as adjusted, again subject to certain customary exceptions. In the Securities Purchase Agreement, we granted purchasers of the preferred stock certain registration rights pertaining to the common shares they may receive upon conversion of their preferred stock and upon exercise of their warrants.

Securities Purchase Agreement with Mill City Ventures III, Ltd.

On February 18, 2015, the Company entered into a Securities Purchase Agreement with Mill City Ventures III, Ltd. (“Mill City”), pursuant to which it offered and sold a secured convertible promissory note in the principal amount of $1,000,000 and a five-year warrant to purchase up to 1,515,152 shares of the Company’s common stock at a per-share price of $0.38, in a private placement exempt from registration under the Securities Act of 1933.

Creative Realities, LLC, Wireless Ronin Technologies Canada, Inc., and Broadcast International, Inc., the Company’s principal subsidiaries, are co-makers with the Company of the secured convertible promissory note. Obligations under the secured convertible promissory note are secured by a grant of collateral security in the accounts receivable and related proceeds of all co-makers pursuant to the terms of a security agreement.

The secured convertible promissory note bears interest at the annual rate of 12%, and matures on August 18, 2016. At any time prior to the maturity date, Mill City may convert the outstanding principal and accrued and unpaid interest at a conversion rate of $0.33 per share, as adjusted for stock splits and similar adjustments. Upon the consummation of a change in control transaction of the Company or of an offering of securities of the Company in which the gross proceeds to be received by the Company equal, when aggregated with all prior financings involving the sale of securities of the Company from and after February 18, 2015 (but exclusive of the amounts borrowed under the Mill City secured convertible promissory note), at least $3.5 million, Mill City may elect to convert the secured convertible promissory note into shares of common stock of the Company or elect repayment. The Company may prepay the secured convertible promissory note at any time; provided any principal amount prepaid must be accompanied by the payment of minimum amount of interest that, when aggregated with earlier payments of interest, equals at least 365 days of interest thereon. The secured convertible promissory note contains other customary terms.

| 3 |

Acquisition of Creative Realities

The financing effected by our sale of the preferred stock (Creative Realities) was a condition to the closing of a merger contemplated by June 26, 2014 Agreement and Plan of Merger we entered into with Creative Realities, LLC and later amended on August 20, 2014 (as amended, the “Creative Realities Merger Agreement”).

On August 20, 2014, we completed the merger contemplated by the Creative Realities Merger Agreement, thereby acquiring the business of Creative Realities. At the effective time of the merger and pursuant to the Creative Realities Merger Agreement, Slipstream Funding, LLC, a Delaware limited liability company and then the sole member of Creative Realities, received shares of our common stock equivalent to approximately 59.2% of common stock issued and outstanding after the merger, calculated on a modified fully diluted basis, together with a warrant to purchase an additional number of common shares equal to 1.5% of our common stock outstanding immediately after the merger, again calculated on a modified fully diluted basis. In each case, “modified fully basis” means inclusion of all shares of outstanding common stock together with common stock issuable upon exercise or conversion of outstanding securities, other than the Series A Convertible Preferred Stock (see above) and certain shares of common stock issuable upon exercise of warrants and options having an exercise price agreed by the parties to have been significantly out of the money.

As a result of this merger transaction and a contemporaneous investment in our Series A Convertible Preferred Stock by an affiliate of Slipstream Funding, Slipstream Funding and its affiliates beneficially own 32,249,949 shares of common stock, representing beneficial ownership (as calculated under applicable SEC rules) of approximately 45.8% of our outstanding common stock immediately after the merger.

Creative Realities, LLC was the “accounting acquirer” in the merger transaction, while Wireless Ronin Technologies (the registrant) was the “legal acquirer,” and therefore the merger was accounted for as a reverse acquisition. Creative Realities, LLC was determined to be the accounting acquirer since its former shareholder has majority control of the common stock, is the largest shareholder, and has the majority members of the board of directors and of the executive officers. In accordance with reverse acquisition accounting, the historical financial statements of the registrant will become those of Creative Realities, with the financial results of Wireless Ronin Technologies included only beginning with the merger date. Effective September 15, 2014, Wireless Ronin Technologies, Inc. changed its name to Creative Realities, Inc.

As used throughout this report, the “Company” generally refers to the registrant (Creative Realities, Inc., formerly known as Wireless Ronin Technologies, Inc.), unless the context otherwise indicates or requires. Use of the first person “we” refers to the Company or, if the context so requires, to the historical business of Creative Realities or the registrant itself, in each case prior to the consummation of the August 20, 2014 merger transaction.

Changes in Management and Board of Directors

On August 20, 2014, our directors Steve Birke, Scott Koller and Howard Liszt resigned their positions on our Board of Directors, and Messrs. Paul Price, Alec Machiels and David Bell were appointed by the board to fill the vacancies created by those resignations. At the time of their resignations, Messrs. Birke and Liszt each served on the board’s audit and compensation committees. On the same date, Mr. Scott Koller resigned his position as our Chief Executive Officer but retained the title of President, and Mr. Paul Price was appointed as our Chief Executive Officer. Mr. John Walpuck retained his titles as our Chief Financial Officer and Chief Operating Officer. On September 30, 2014, we delivered Mr. Koller a written notice of termination, which termination was effective December 4, 2014. On March 9, 2015, Kent Lillemoe resigned his position on our Board of Directors. On April 13, 2015, the Board of Directors and Paul Price agreed to terminate Mr. Price's employment agreement with the Company without cause. Such termination was effective immediately and effected the immediate removal of Mr. Price from his position as a member of the Board of Directors. Also on April 13, 2015, the Board of Directors appointed John Walpuck as Creative Realities' interim Chief Executive Officer.

| 4 |

Business Strategy

We believe that our existing business model is highly scalable and can be expanded successfully as we continue to grow organically and integrate our recent merger transactions, strengthen our operational practices and procedures, further streamline our administrative office functions, and continue to capitalize on various marketing programs and activities.

Another key component of our business and market strategy, especially given the evolving industry dynamics in which we operate, is also to acquire and integrate other operating companies in the industry in conjunction with pursuing our organic growth objectives. We believe that the selective acquisition and successful integration of certain companies will: accelerate our growth; enable us to aggregate multiple customer bases onto a single business and technology platform; provide us with greater operating scale; enable us to leverage a common set of processes and tools, and cost efficiencies; and ultimately result in higher operating profitability and cash flow from operations. Our management team is actively pursuing and evaluating alternative acquisition opportunities on an ongoing basis. Our management team and Board of Directors have broad experience with the execution, integration and financing of mergers and acquisitions. We believe that, based on the foregoing and other factors, the Company can successfully serve as a consolidator of multiple business and technology platforms serving similar markets.

Industry Background

Over approximately the past 18-24 months, we believe certain digital marketing technology industry trends are creating the opportunity for retailers, brands, venue-operators, enterprises, non-profits and other organizations to create innovative shopping, marketing, and informational experiences for their customers and other stakeholders in various venues worldwide. These trends include: (i) the expectations of technology-savvy consumers; (ii) addressing on-line competitors by improving physical experiences (iii) accelerating decline in the cost of hardware configurations (primarily flat panel displays) and software media players; (ii) the continued evolution of mobile, social, software and hardware technologies, applications and tools; (iii) the increasing sophistication of social networking platforms; (iv) increasingly complex customer requirements related to their specific digital marketing technology and solution objectives; and (v) customers challenging service providers with the delivery of a satisfactory consumer experience with the traditional pressure on reducing installation and ongoing operating costs.

As a result, a growing number of retailers, brands, venue-operators and other organizations have identified the need and opportunity to implement increasingly cost-effective and “sales-lifting” digital marketing, and interactive experiences to market to their customers. These include: creating unique and customized experiences for targeted, timely offerings and relevant promotions; improving engagement resulting in increased sales; and increasing shopping basket size. Our clients believe that capitalizing on these industry trends is increasingly critical to any successful “store of the future” retail and brand sales environment, especially where sales staff turnover is high, training outcomes are inconsistent and product knowledge is low.

Companies are accomplishing their strategies by implementing various digital marketing technology solutions, which: are implemented in multiple forms and types of configurations and locations; attempt to achieve any of a broad range of individual or combination of objectives; contain various levels of targeting; have the ability to instantly manage single or multiple locations remotely from a customer’s desktop or other connected device at each location; and are built to deliver or contain a standard or customized experience unique to and within the customer’s environment. Examples of such solutions include:

| ● | Digital Merchandising Systems, which aim to inform and interact with customers through various types of content in an integrated experience, improve in-store customer experiences and increase overall sales, upsells, and/or cross-sales; | |

| ● | Digital Sales Assistants, which aim to replace or augment existing sales resources and the level of interactive and informational sales assistance inside the store; | |

| ● | Digital Way-Finders, which aim to help customers navigate their way around individual retail stores and multi-store locations or venues, or within individual brand categories; | |

| ● | Digital Kiosks, which aim to provide data, specialized and customized broadcasts, promotional information and coupons, train, and other forms of information and interaction with customers in a variety of deployment forms, types, configurations and experiences; |

| 5 |

| ● | Digital Menu-Board Systems, which aim to enable various types of restaurant operators the ability to remotely and on a scheduled basis, update and modify menu information, promotions, and other forms of content dynamically; | |

| ● | Dynamic Digital Signage which aims to deliver and manage in-store marketing and advertising campaigns, specialized and customized broadcasts, and various other forms of messaging targeting customers in a particular experience or environment. |

Our Markets

We currently market and sell our marketing technology solutions through our direct sales force and word-of-mouth referrals from existing customers. Select strategic partnerships and lead generation programs also drive business to the Company through targeted business development initiatives. We market to companies that seek digital marketing solutions across multiple connected devices and who specifically seek or could benefit from enhancements to the customer experience offered in their stores, venues, brands or organizations.

Our digital marketing technology solutions have application in a wide variety of industries. The industries in which we sell our solutions are established and include of hospitality, branded retail, automotive, food service and retail healthcare, but the planning, development, implementation and maintenance of technology-enabled experiences is relatively new and evolving. Moreover, a number of participants in these industries have only recently started considering or expanding the adoption of these types of technologies, solutions and experiences as part of their overall marketing strategies.

Seasonality

A portion of our customer activity is influenced by seasonal effects related to traditional end of calendar year peak retail sales periods and other factors that arise from our target customer base. Nevertheless, our revenues can be materially affected by the launch of new markets, the timing of production rollouts, and other factors, any of which have the ability to reduce or outweigh certain seasonal effects.

Effect of General Economic Conditions on our Business

We believe that demand for our services will increase in part as a result of recovering retail-related real estate investments and new construction since the economic crash beginning in the fall of 2008; and the recent economic recovery in general. These general economic improvements generally make it easier for our customers to justify decisions to invest in digital marketing technology solutions.

Services

We generally provide the following services:

| ● | consulting with our customers to determine the technologies and solutions required to achieve their specific goals, strategies and objectives; |

| ● | designing our customers’ digital marketing experiences, content and interfaces; |

| ● | engineering the systems architecture delivering the digital marketing experiences we design – both software and hardware – and integrating those systems into a customized, reliable and effective digital marketing experience; |

| ● | managing the efficient, timely and cost-effective deployment of our digital marketing technology solutions for our customers; |

| ● | delivering and updating the content of our digital marketing technology solutions using a suite of advanced media, content and network management software products; and |

| 6 |

| ● | maintaining our customers’ digital marketing technology solutions by: providing content production and related services; creating additional software-based features and functionality; hosting the solutions; monitoring solution service levels; and responding to and/or managing remote or onsite field service maintenance, troubleshooting and support calls. |

These services generate revenue through: bundled-solution sales; service fees for consulting, experience design, content development and production, software development, engineering, implementation, and field services; software license fees; and maintenance and support services related to our software, managed systems and solutions.

Competition

While we believe there is presently no direct competitor with the comprehensive offering of technologies, solutions and services we provide to our customers, there are individual competitors who offer pieces of our solution stack. These include digital signage software companies such as Stratacache, Four Winds Interactive, or ComQi; marketing services companies such as Sapient Nitro or digital signage systems integrators such as Convergent. Some of these competitors may have significantly greater financial, technical and marketing resources than we do and may be able to respond more rapidly than we can to new or emerging technologies or changes in customer requirements. We believe that our sales and business development capabilities, network operations center capabilities, our comprehensive offering of digital marketing technology solutions, brand awareness, focus, and proprietary processes are the primary factors affecting our competitive position.

Territories

Our Company sells products and services primarily throughout North America.

Regulation

We are subject to regulation by various federal and state governmental agencies. Such regulation includes radio frequency emission regulatory activities of the U.S. Federal Communications Commission, the consumer protection laws of the U.S. Federal Trade Commission, product safety regulatory activities of the U.S. Consumer Product Safety Commission, and environmental regulation in areas in which we conduct business. Some of the hardware components that we supply to customers may contain hazardous or regulated substances, such as lead. A number of U.S. states have adopted or are considering “takeback” bills addressing the disposal of electronic waste, including CRT style and flat panel monitors and computers. Electronic waste legislation is developing. Some of the bills passed or under consideration may impose on us, or on our customers or suppliers, requirements for disposal of systems we sell and the payment of additional fees to pay costs of disposal and recycling. Presently, we do not believe that any such legislation or proposed legislation will have a materially adverse impact on our business.

Employees

We have approximately 66 employees as of May 1, 2015. We do not have any employees that operate under collective-bargaining agreements.

| 7 |

| ITEM 1a | RISK FACTORS |

Investing in our securities involves a high degree of risk. You should carefully consider the specific risks described below, and any risks described in our other filings with the Securities and Exchange Commission, pursuant to Sections 13(a), 13(c), 14, or 15(d) of the Securities Exchange Act of 1934, before making an investment decision. See the section of this prospectus entitled “Where You Can Find More Information.” Any of the risks we describe below could cause our business, financial condition, results of operations or future prospects to be materially adversely affected.

Risks Related to Our Business and Our Industry

We have recently incurred losses, and may never become or remain profitable.

Recently, we have incurred net losses. We incurred net losses in each of the years ended December 31, 2014 and 2013, respectively. We do not know with any degree of certainty whether or when we will become profitable. Even if we are able to achieve profitability in future periods, we may not be able to sustain or increase our profitability in successive periods.

We have formulated our business plans and strategies based on certain assumptions regarding the acceptance of our business model and the marketing of our products and services. Nevertheless, our assessments regarding market size, market share, market acceptance of our products and services and a variety of other factors may prove incorrect. Our future success will depend upon many factors, including factors which may be beyond our control or which cannot be predicted at this time.

We have limited operating history as a combined company and cannot ensure the long-term successful operation of our business or the execution of our business plan.

We have limited operating history as a combined company since the closing of the merger transactions summarized herein, and our digital marketing technology and solutions are an evolving business offering. As a result, investors have a limited track record by which to evaluate our future performance. Our prospects must be considered in light of the risks, expenses and difficulties frequently encountered by growing companies in new and rapidly evolving markets. We may be unable to accomplish any of the following, which would materially impact our ability to implement our business plan:

| ● | establishing and maintaining broad market acceptance of our technology, solutions, services, and platforms, and converting that acceptance into direct and indirect sources of revenue; |

| ● | establishing and maintaining adoption of our technology, solutions, services, and platforms in and on a variety of environments, experiences, and device types; |

| ● | timely and successfully developing new technology, solution, service, and platform features, and increasing the functionality and features of our existing technology, solution, service, and platform offerings; |

| ● | developing technology, solutions, services, and platforms that result in a high degree of customer satisfaction and a high level of end-customer usage; |

| ● | successfully responding to competition, including competition from emerging technologies and solutions; |

| ● | developing and maintaining strategic relationships to enhance the distribution, features, content and utility of our technology, solutions, services, and platforms; and |

| 8 |

| ● | identifying, attracting and retaining talented engineering, network operations, program management, technical services, creative services, and other personnel at reasonable market compensation rates in the markets in which we employ such personnel. |

Our business strategy may be unsuccessful and we may be unable to address the risks we face in a cost-effective manner, if at all. If we are unable to successfully accomplish these tasks, our business will be harmed.

Adequate funds for our operations may not be available, requiring us to raise additional financing or else curtail our activities significantly.

We will likely be required to raise additional funding through public or private financings, including equity financings, in 2015. Any additional equity financings may be dilutive to shareholders and may be completed at a discount to the then-current market price of our common stock. Debt financing, if available, would likely involve restrictive covenants on our operations or pertaining to future financing arrangements. Nevertheless, we may not successfully complete any future equity or debt financing. Adequate funds for our operations, whether from financial markets, collaborative or other arrangements, may not be available when needed or on terms attractive to us. If adequate funds are not available, our plans to operate our business may be adversely affected and we could be required to curtail our activities significantly and/or cease operating.

We will be unable to implement our business plan if we cannot raise sufficient capital and may be required to pay a high price for capital.

We will need to obtain additional capital to implement our business plan and meet our financial obligations as they become due. We may not be able to raise the additional capital needed or may be required to pay a high price for capital. Factors affecting the availability and price of capital may include the following:

| ● | the availability and cost of capital generally; |

| ● | our financial results; |

| ● | the experience and reputation of our management team; |

| ● | market interest, or lack of interest, in our industry and business plan; |

| ● | the trading volume of, and volatility in, the market for our common stock; |

| ● | our ongoing success, or failure, in executing our business plan; |

| ● | the amount of our capital needs; and |

| ● | the amount of debt, options, warrants, and convertible securities we have outstanding. |

We may be unable to meet our current or future obligations or to adequately exploit existing or future opportunities if we cannot raise sufficient capital. If we are unable to obtain capital for an extended period of time, we may be forced to discontinue operations.

We expect that there will be significant consolidation in our industry. Our failure or inability to lead that consolidation would have a severe adverse impact on our access to financing, customers, technology, and human resources.

Our industry is currently composed of a large number of relatively small businesses, no single one of which is dominant or which provides integrated solutions and product offerings incorporating much of the available technology. Accordingly, we believe that substantial consolidation may occur in our industry in the near future. If we do not play a positive role in that consolidation, either as a leader or as a participant whose capability is merged in a larger entity, we may be left out of this process, with product offerings of limited value compared with those of our competitors. Moreover, even if we lead the consolidation process, the market may not validate the decisions we make in that process.

| 9 |

Our success depends on our interactive marketing technologies achieving and maintaining widespread acceptance in our targeted markets.

Our success will depend to a large extent on broad market acceptance of our interactive marketing technologies among our current and prospective customers. Our prospective customers may still not use our solutions for a number of other reasons, including preference for static advertising, lack of familiarity with our technology, preference for competing technologies or perceived lack of reliability. We believe that the acceptance of our interactive marketing technologies by prospective customers will depend primarily on the following factors:

| ● | our ability to demonstrate the economic and other benefits attendant our marketing technologies; |

| ● | our customers becoming comfortable with using our interactive marketing technologies; and |

| ● | the reliability of our interactive marketing technologies. |

Our interactive technologies are complex and must meet stringent user requirements. Some undetected errors or defects may only become apparent as new functions are added to our technologies and products. The need to repair or replace pSeroducts with design or manufacturing defects could temporarily delay the sale of new products and adversely affect our reputation. Delays, costs and damage to our reputation due to product defects could harm our business.

Our financial condition and potential for continued net losses may negatively impact our relationships with customers, prospective customers and third-party suppliers.

Our financial condition and potential for continued net losses may cause current and prospective customers to defer placing orders with us, to require terms that are less favorable to us, or to place their orders with competing marketing technology suppliers, which could adversely affects our business, financial condition and results of operations. On the same basis, third-party suppliers may refuse to do business with us, or may do so only on terms that are unfavorable to us, which also could cause our revenue to decline.

Because we do not have long-term purchase commitments from our customers, the failure to obtain anticipated orders or the deferral or cancellation of commitments could have adverse effects on our business.

Our business is characterized by short-term purchase orders and contracts that do not require that purchases be made. This makes forecasting our sales difficult. The failure to obtain anticipated orders and deferrals or cancellations of purchase commitments because of changes in customer requirements, or otherwise, could have a material adverse effect on our business, financial condition and results of operations. We have experienced such challenges in the past and may experience such challenges in the future.

Our continued growth could be adversely affected by the loss of several key customers.

Our largest customers account for a majority of our total revenue on a pro forma, consolidated basis. We had 2 and 2 customers that accounted for 41% and 44% of accounts receivable as of December 31, 2014 and December 31, 2013, respectively. Decisions by one or more of these key customers and/or partners to not renew, terminate or substantially reduce their use of our products, technology, services, and platform could substantially slow our revenue growth and lead to a decline in revenue. Our business plan assumes continued growth in revenue, and it is unlikely that we will become profitable without a continued increase in revenue.

Most of our contracts are terminable by our customers with limited notice and without penalty payments, and early terminations could have a material effect on our business, operating results and financial condition.

Most of our contracts are terminable by our customers following limited notice and without early termination payments or liquidated damages due from them. In addition, each stage of a project often represents a separate contractual commitment, at the end of which the customers may elect to delay or not to proceed to the next stage of the project. We cannot assure you that one or more of our customers will not terminate a material contract or materially reduce the scope of a large project. The delay, cancellation or significant reduction in the scope of a large project or a number of projects could have a material adverse effect on our business, operating results and financial condition.

| 10 |

It is common for our current and prospective customers to take a long time to evaluate our products, most especially during economic downturns that affect our customers’ businesses. The lengthy and variable sales cycle makes it difficult to predict our operating results.

It is difficult for us to forecast the timing and recognition of revenue from sales of our products and services because our actual and prospective customers often take significant time to evaluate our products before committing to a purchase. Even after making their first purchases of our products and services, existing customers may not make significant purchases of those products and services for a long period of time following their initial purchases, if at all. The period between initial customer contact and a purchase by a customer may be years with potentially an even longer period separating initial purchases and any significant purchases thereafter. During the evaluation period, prospective customers may decide not to purchase or may scale down proposed orders of our products for various reasons, including:

| ● | reduced need to upgrade existing visual marketing systems; |

| ● | introduction of products by our competitors; |

| ● | lower prices offered by our competitors; and |

| ● | changes in budgets and purchasing priorities. |

Our prospective customers routinely require education regarding the use and benefit of our products. This may also lead to delays in receiving customers’ orders.

Our industry is characterized by frequent technological change. If we are unable to adapt our products and services and develop new products and services to keep up with these rapid changes, we will not be able to obtain or maintain market share.

The market for our products and services is characterized by rapidly changing technology, evolving industry standards, changes in customer needs, heavy competition and frequent new product and service introductions. If we fail to develop new products and services or modify or improve existing products and services in response to these changes in technology, customer demands or industry standards, our products and services could become less competitive or obsolete.

We must respond to changing technology and industry standards in a timely and cost-effective manner. We may not be successful in using new technologies, developing new products and services or enhancing existing products and services in a timely and cost-effective manner. Furthermore, even if we successfully adapt our products and services, these new technologies or enhancements may not achieve market acceptance.

A portion of business involves the use of software technology that we have developed or licensed. Industries involving the ownership and licensing of software-based intellectual property are characterized by frequent intellectual-property litigation, and we could face claims of infringement by others in the industry. Such claims are costly and add uncertainty to our operational results.

A portion of our business involves our ownership and licensing of software. This market space is characterized by frequent intellectual-property claims and litigation. We could be subject to claims of infringement of third-party intellectual-property rights resulting in significant expense and the potential loss of our own intellectual-property rights. From time to time, third parties may assert copyright, trademark, patent or other intellectual-property rights to technologies that are important to our business. Any litigation to determine the validity of these claims, including claims arising through our contractual indemnification of our business partners, regardless of their merit or resolution, would likely be costly and time consuming and divert the efforts and attention of our management and technical personnel. If any such litigation resulted in an adverse ruling, we could be required to:

| ● | pay substantial damages; |

| 11 |

| ● | cease the development, use, licensing or sale of infringing products; |

| ● | discontinue the use of certain technology; or |

| ● | obtain a license under the intellectual property rights of the third party claiming infringement, which license may not be available on reasonable terms or at all. |

Our proprietary platform architectures and data tracking technology underlying certain of our services are complex and may contain unknown errors in design or implementation that could result in system performance failures or inability to scale.

The platform architecture, data tracking technology and integration layers underlying our proprietary platforms, our contract administration, procurement, timekeeping, content and network management, network services, device management, virtualized services, software automation and other tools, and back-end services are complex and include software and code used to generate customer invoices. This software and code is developed internally, licensed from third parties, or integrated by in-house personnel and third parties. Any of the system architecture, system administration, integration layers, software or code may contain errors, or may be implemented or interpreted incorrectly, particularly when they are first introduced or when new versions or enhancements to our tools and services are released. Consequently, our systems could experience performance failure or we may be unable to scale our systems, which may:

| ● | adversely impact our relationship with customers and others who experience system failure, possibly leading to a loss of affected and unaffected customers; |

| ● | increase our costs related to product development or service delivery; or |

| ● | adversely affect our revenues and expenses. |

Our business may be adversely affected by malicious applications that interfere with, or exploit security flaws in, our products and services.

Our business may be adversely affected by malicious applications that make changes to our customers’ computer systems and interfere with the operation and use of our products or products that impact our business. These applications may attempt to interfere with our ability to communicate with our customers’ devices. The interference may occur without disclosure to or consent from our customers, resulting in a negative experience that our customers may associate with our products and services. These applications may be difficult or impossible to uninstall or disable, may reinstall themselves and may circumvent other applications’ efforts to block or remove them. The ability to provide customers with a superior interactive marketing technology experience is critical to our success. If our efforts to combat these malicious applications fail, or if our products and services have actual or perceived vulnerabilities, there may be claims based on such failure or our reputation may be harmed, which would damage our business and financial condition.

We compete with other companies that have more resources, which puts us at a competitive disadvantage.

The market for interactive marketing technologies is generally highly competitive and we expect competition to increase in the future. Some of our competitors or potential competitors may have significantly greater financial, technical and marketing resources than us. These competitors may be able to respond more rapidly than we can to new or emerging technologies or changes in customer requirements. They may also devote greater resources to the development, promotion and sale of their products than us.

| 12 |

We expect competitors to continue to improve the performance of their current products and to introduce new products, services and technologies. Successful new product and service introductions or enhancements by our competitors could reduce sales and the market acceptance of our products and services, cause intense price competition or make our products and services obsolete. To be competitive, we must continue to invest significant resources in research and development, sales and marketing and customer support. If we do not have sufficient resources to make these investments or are unable to make the technological advances necessary to be competitive, our competitive position will suffer. Increased competition could result in price reductions, fewer customer orders, reduced margins and loss of market share. Our failure to compete successfully against current or future competitors could adversely affect our business and financial condition.

Our future success depends on key personnel and our ability to attract and retain additional personnel.

On April 13, 2015, the Board of Directors and Paul Price agreed to terminate Mr. Price's employment agreement with the Company without cause. Such termination was effective immediately and effected the immediate removal of Mr. Price from his position as a member of the Board of Directors. Also on April 13, 2015, the Board of Directors appointed John Walpuck as the Company’s interim Chief Executive Officer.

If we fail to retain Mr. Walpuck and our key personnel or fail to attract, retain and motivate other qualified employees, including a new Chief Executive Officer, our ability to maintain and develop our business may be adversely affected. Our future success depends significantly on the continued service of our key technical, sales and senior management personnel and their ability to execute our growth strategy. The loss of the services of our key employees could harm our business. We may be unable to retain our employees or to attract, assimilate and retain other highly qualified employees who could migrate to other employers who offer competitive or superior compensation packages.

Unpredictability in financing markets could impair our ability to grow our business through acquisitions.

We anticipate that opportunities to acquire similar businesses will materially depend on the availability of financing alternatives with acceptable terms. As a result, poor credit and other market conditions or uncertainty in financial markets could materially limit our ability to grow through acquisitions since such conditions and uncertainty make obtaining financing more difficult.

Our reliance on information management and transaction systems to operate our business exposes us to cyber incidents and hacking of our sensitive information if our outsourced service provider experiences a security breach.

Effective information security internal controls are necessary for us to protect our sensitive information from illegal activities and unauthorized disclosure in addition to denial of service attacks and corruption of our data. In addition, we rely on the information security internal controls maintained by our outsourced service provider. Breaches of our information management system could also adversely affect our business reputation. Finally, significant information system disruptions could adversely affect our ability to effectively manage operations or reliably report results.

Because our technology, products, platform, and services are complex and are deployed in and across complex environments, they may have errors or defects that could seriously harm our business.

Our technology, proprietary platforms, products and services are highly complex and are designed to operate in and across data centers, large and complex networks, and other elements of the digital media workflow that we do not own or control. On an ongoing basis, we need to perform proactive maintenance services on our platform and related software services to correct errors and defects. In the future, there may be additional errors and defects in our software that may adversely affect our services. We may not have in place adequate reporting, tracking, monitoring, and quality assurance procedures to ensure that we detect errors in our software in a timely manner. If we are unable to efficiently and cost-effectively fix errors or other problems that may be identified, or if there are unidentified errors that allow persons to improperly access our services, we could experience loss of revenues and market share, damage to our reputation, increased expenses and legal actions by our customers.

| 13 |

We may have insufficient network or server capacity, which could result in interruptions in our services and loss of revenues.

Our operations are dependent in part upon: network capacity provided by third-party telecommunications networks; data center services provider owned and leased infrastructure and capacity; the Company’s dedicated and virtualized server capacity located at its data center services provider partner and a geo-redundant micro-data center location; and the Company’s own infrastructure and equipment. Collectively, this infrastructure, equipment, and capacity must be sufficiently robust to handle all of our customers' web-traffic, particularly in the event of unexpected surges in high-definition video traffic and network services incidents. We may not be adequately prepared for unexpected increases in bandwidth and related infrastructure demands from our customers. In addition, the bandwidth we have contracted to purchase may become unavailable for a variety of reasons, including payment disputes, outages, or such service providers going out of business. Any failure of these service providers or the Company’s own infrastructure to provide the capacity we require, due to financial or other reasons, may result in a reduction in, or interruption of, service to our customers, leading to an immediate decline in revenue and possible additional decline in revenue as a result of subsequent customer losses.

We do not have sufficient capital to engage in material research and development, which may harm our long-term growth.

In light of our limited resources in general, we have made no material investments in research and development over the past several years. This conserves capital in the short term. In the long term, as a result of our failure to invest in research and development, our technology and product offerings may not keep pace with the market and we may lose any existing competitive advantage. Over the long term, this may harm our revenues growth and our ability to become profitable.

Our business operations are susceptible to interruptions caused by events beyond our control.

Our business operations are susceptible to interruptions caused by events beyond our control. We are vulnerable to the following potential problems, among others:

| ● | our platform, technology, products, and services and underlying infrastructure, or that of our key suppliers, may be damaged or destroyed by events beyond our control, such as fires, earthquakes, floods, power outages or telecommunications failures; |

| ● | we and our customers and/or partners may experience interruptions in service as a result of the accidental or malicious actions of Internet users, hackers or current or former employees; |

| ● | we may face liability for transmitting viruses to third parties that damage or impair their access to computer networks, programs, data or information. Eliminating computer viruses and alleviating other security problems may require interruptions, delays or cessation of service to our customers; and |

| ● | failure of our systems or those of our suppliers may disrupt service to our customers (and from our customers to their customers), which could materially impact our operations (and the operations of our customers), adversely affect our relationships with our customers and lead to lawsuits and contingent liability. |

The occurrence of any of the foregoing could result in claims for consequential and other damages, significant repair and recovery expenses and extensive customer losses and otherwise have a material adverse effect on our business, financial condition and results of operations.

| 14 |

General global market and economic conditions may have an adverse impact on our operating performance and results of operations.

Our business has been and could continue to be affected by general global economic and market conditions. Weakness in the United States and worldwide economy has had and could continue to have a negative effect on our operating results, including a decrease in revenue and operating cash flow. To the extent our customers are unable to profitably leverage various forms of digital marketing technology and solutions, and/or the content we create, deliver and publish on their behalf, they may reduce or eliminate their purchase of our products and services. Such reductions in traffic would lead to a reduction in our revenues. Additionally, in a down-cycle economic environment, we may experience the negative effects of increased competitive pricing pressure, customer loss, slowdown in commerce over the Internet and corresponding decrease in traffic delivered over our network and failures by our customers to pay amounts owed to us on a timely basis or at all. Suppliers on which we rely for equipment, field services, servers, bandwidth, co-location and other services could also be negatively impacted by economic conditions that, in turn, could have a negative impact on our operations or revenues. Flat or worsening economic conditions may harm our operating results and financial condition.

The markets in which we operate are rapidly emerging, and we may be unable to compete successfully against existing or future competitors to our business.

The market in which we operate is becoming increasingly competitive. Our current competitors generally include general digital signage companies, specialized digital signage operators targeting certain vertical markets (e.g., financial services), content management software companies, or integrators and vertical solution providers who develop single implementations of content distribution, digital marketing technology, and related services. These competitors, including future new competitors who may emerge, may be able to develop a comparable or superior solution capabilities, software platform, technology stack, and/or series of services that provide a similar or more robust set of features and functionality than the technology, products and services we offer. If this occurs, we may be unable to grow as necessary to make our business profitable.

Whether or not we have superior products, many of these current and potential future competitors have a longer operating history in their current respective business areas and greater market presence, brand recognition, engineering and marketing capabilities, and financial, technological and personnel resources than we do. Existing and potential competitors with an extended operating history, even if not directly related to our business, have an inherent marketing advantage because of the reluctance of many potential customers to entrust key operations to a company that may be perceived as unproven. In addition, our existing and potential future competitors may be able to use their extensive resources:

| ● | to develop and deploy new products and services more quickly and effectively than we can; |

| ● | to develop, improve and expand their platforms and related infrastructures more quickly than we can; |

| ● | to reduce costs, particularly hardware costs, because of discounts associated with large volume purchases and longer term relationships and commitments; |

| ● | to offer less expensive products, technology, platform, and services as a result of a lower cost structure, greater capital reserves or otherwise; |

| ● | to adapt more swiftly and completely to new or emerging technologies and changes in customer requirements; |

| ● | to take advantage of acquisition and other opportunities more readily; and |

| ● | to devote greater resources to the marketing and sales of their products, technology, platform, and services. |

If we are unable to compete effectively in our various markets, or if competitive pressures place downward pressure on the prices at which we offer our products and services, our business, financial condition and results of operations may suffer.

| 15 |

Risks Related to Our Securities and Our Company

Because of our early stage of operations and limited resources, we may not have in place various processes and protections common to more mature companies and may be more susceptible to adverse events.

We are in an early stage of operations and have limited resources after accounting for a significant amount of restructuring and integration costs. As a result, we may not have in place systems, processes and protections that many of our competitors have or that may be essential to protect against various risks. For example, we have in place only limited resources and processes addressing human resources, timekeeping, data protection, business continuity, personnel redundancy, and knowledge institutionalization concerns. As a result, we are at risk that one or more adverse events in these and other areas may materially harm our business, balance sheet, revenues, expenses or prospects.

As part of the integration of our acquired businesses, we may become subject to unknown liabilities.

Our Company acquired each of Broadcast International, Inc. and Creative Realities, LLC by merger with our subsidiaries. As a result, Broadcast International, Inc. and Creative Realities, LLC are subsidiaries of the Company, and any liabilities of these companies, known or unknown have become obligations of our subsidiaries. As a result, there are outstanding liabilities for which our subsidiaries are liable and, despite our due diligence investigations, other unknown liabilities may arise for which our subsidiaries, and possibly the Company, may become liable.

Failure to achieve and maintain effective internal controls could limit our ability to detect and prevent fraud and thereby adversely affect our business and stock price.

Effective internal controls are necessary for us to provide reliable financial reports. Nevertheless, all internal control systems, no matter how well designed, have inherent limitations. Even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation. Our inability to maintain an effective control environment may cause investors to lose confidence in our reported financial information, which could in turn have a material adverse effect on our stock price. The Company in reviewing its internal controls has noted material weaknesses. See Item 9A for further details.

Our controlling shareholder possesses controlling voting power with respect to our common stock and voting preferred stock, which will limit your influence on corporate matters.

Our controlling shareholder, Slipstream Funding, LLC, has beneficial ownership of 30,349,949 shares of common stock, including common shares beneficially owned by an affiliate of Slipstream Funding named Slipstream Communication, LLC. These shares represent beneficial ownership of approximately 68.98% of our common stock as of the date of this prospectus. As a result, Slipstream Funding has the ability to control our management and affairs through the election and removal of our entire Board of Directors and all other matters requiring shareholder approval, including the future merger, consolidation or sale of all or substantially all of our assets. This concentrated control could discourage others from initiating any potential merger, takeover or other change-of-control transaction that may otherwise be beneficial to our shareholders. Furthermore, this concentrated control will limit the practical effect of your participation in Company matters, through shareholder votes and otherwise.

Our Articles of Incorporation grant our Board of Directors the power to issue additional shares of common and preferred stock and to designate other classes of preferred stock, all without shareholder approval.

Our authorized capital consists of 250 million shares of capital stock. Pursuant to authority granted by our Articles of Incorporation, our Board of Directors, without any action by our shareholders, may designate and issue shares in such classes or series (including other classes or series of preferred stock) as it deems appropriate and establish the rights, preferences and privileges of such shares, including dividends, liquidation and voting rights, provided it is consistent with Minnesota law. The rights of holders of other classes or series of stock that may be issued could be superior to the rights of holders of our common shares. The designation and issuance of shares of capital stock having preferential rights could adversely affect other rights appurtenant to shares of our common stock. Furthermore, any issuances of additional stock (common or preferred) will dilute the percentage of ownership interest of then-current holders of our capital stock and may dilute our book value per share.

| 16 |

Significant issuances of our common stock, or the perception that significant issuances may occur in the future, could adversely affect the market price for our common stock.

Significant actual or perceived potential future issuance our common stock could adversely affect the market price of our common stock. Generally, issuances of substantial amounts of common stock in the public market, and the availability of shares for future sale, including up to 24,593,060 shares of our common stock that are covered by the registration statement of which this prospectus is a part and issuable upon conversions of preferred stock or exercise of outstanding warrants, could adversely affect the prevailing market price of our common stock and could cause the market price of our common stock to remain low for a substantial amount of time.

We cannot foresee the impact of potential securities issuances of common shares on the market for our common stock, but it is possible that the market for our shares may be adversely affected, perhaps significantly. It is also unclear whether or not the market for our common stock could absorb a large number of attempted sales in a short period of time, regardless of the price at which they might be offered. Even if a substantial number of sales do not occur within a short period of time, the mere existence of this “market overhang” could have a negative impact on the market for our common stock and our ability to raise additional equity capital.

Our common stock trades only in an illiquid trading market.

Trading of our common stock is conducted on the OTC Markets (OTCQB). This has an adverse effect on the liquidity of our common stock, not only in terms of the number of shares that can be bought and sold at a given price, but also through delays in the timing of transactions and reduction in security analysts’ and the media’s coverage of us and our common stock. This may result in lower prices for our common stock than might otherwise be obtained and could also result in a larger spread between the bid and asked prices for our common stock.

There is not now and there may not ever be an active market for shares of our common stock.

In general, there has been minimal trading volume in our common stock. The small trading volume will likely make it difficult for our shareholders to sell their shares as and when they choose. Furthermore, small trading volumes are generally understood to depress market prices. As a result, you may not always be able to resell shares of our common stock publicly at the time and prices that you feel are fair or appropriate.

We do not intend to pay dividends on our common stock for the foreseeable future. We will, however, pay dividends on our Series A Convertible Preferred Stock.

When permitted by Minnesota law, we are required to pay dividends to the holders of our Series A Convertible Preferred Stock, each share of which carries a $1.00 stated value. As of December 31, 2014, there were 5.3 million shares of Series A Convertible Preferred Stock outstanding. Our Series A Convertible Preferred Stock entitles its holders to:

| ● | a cumulative 6% dividend, payable on a semi-annual basis in cash unless (i) we are unable to pay the dividend in cash under applicable law, or (ii) we have demonstrated positive cashflow during the prior quarter reported on our Form 10-Q, in which case we may at our election pay the dividend through the issuance of additional shares of preferred stock; |

| ● | in the event of a liquidation or dissolution of the Company, a preference in the amount of all accrued but unpaid dividends plus the stated value of such shares before any payment shall be made or any assets distributed to the holders of any junior securities, including our common stock; |

| ● | convert their preferred shares into our common shares at a conversion rate of $0.40 per share (the equivalent of two and one-half shares of common for each full share of preferred stock converted), subject, however, to full-ratchet price protection in the event that we issue common stock below the then-current conversion price, (subject to certain customary exceptions); and |

| ● | vote their preferred shares on an as-if-converted basis. |

After August 20, 2017, we will have the right to call and redeem some or all of such preferred shares, subject to a 30-day notice period and certain other conditions, at a price equal to $1.00 per share plus accrued but unpaid dividends thereon. Holders of Series A Convertible Preferred Stock have no preemptive or cumulative-voting rights.

| 17 |

We do not anticipate that we will pay any dividends for the foreseeable future on our common stock. Accordingly, any return on an investment in us will be realized only when you sell shares of our common stock. When legally permitted, we must expect to pay dividends to our preferred shareholders.

We do not have significant tangible assets that could be sold upon liquidation.

We have nominal tangible assets. As a result, if we become insolvent or otherwise must dissolve, there will be no tangible assets to liquidate and no corresponding proceeds to disburse to our shareholders. If we become insolvent or otherwise must dissolve, shareholders will likely not receive any cash proceeds on account of their shares.

| ITEM 1b | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2 | PROPERTIES |

Our headquarters is located at 55 Broadway, New York, New York 10006. There, we have approximately 5,500 square-feet of space, which we believe is sufficient for our projected near-term future growth. The monthly lease amount is currently $16,332 and escalates to $18,479 by the end of the lease term in November 2019. The corporate phone number is (212) 324-6660. We have an operations center that is material to our business located at 22 Audrey Place, Fairfield, New Jersey 07004. At that location, we have approximately 18,000 square-feet of space, which we also believe is sufficient for our projected near-term future growth. The monthly lease amount is currently $19,743 and escalates to $22,974 by the end of the lease term on September 2020. Additionally, we have an operations center in Minnetonka, Minnesota 55345. At this location, we have approximately 19,000 square feet of office and warehouse space under a lease that extends through January 2018. The monthly lease amount is $15,223 and escalates to $16,639 by the end of the lease term. Effective November 2014, we are subletting approximately 9,000 square feet of the Minnetonka space to a third party at an annual rate of $11 per square foot, subject to annual increases of 2.5%. We also lease office space of approximately 10,000 square feet to support its Canadian operations at a facility located at 4510 Rhodes Drive, Suite 800, Windsor, Ontario under a lease that through June 30, 2016 with a monthly rental of $3,802 CAD per month.

| ITEM 3 | LEGAL PROCEEDINGS |

We are involved in a variety of legal claims and proceedings incidental to our business, including customer bankruptcy and employment-related matters from time to time, and other legal matters that arise in the normal course of business. We believe these claims and proceedings are not out of the ordinary course for a business of the type and size in which we are engaged. While we are unable to predict the ultimate outcome of these claims and proceedings, management believes there is not a reasonable possibility that the costs and liabilities of such matters, individually or in the aggregate, are likely to have a material adverse effect on our financial condition or results of operations.

| ITEM 4 | MINE SAFETY DISCLOSURES |

Not applicable.

| 18 |

| ITEM 5 | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

Our common stock is listed for trading on the OTC Bulletin Board, the “OTCQB,” under the symbol “CREX.” The transfer agent and registrar for our common stock is Registrar & Transfer, Inc., 10 Commerce Drive, Cranford, New Jersey 07016. The following table sets forth the high and low bid prices for our common stock as reported by the OTC Markets in 2014 and 2013. These quotations reflect inter-dealer prices, without retail mark-up, markdown, or commission, and may not represent actual transactions. Trading in the Company’s common stock during the period represented was sporadic, exemplified by low trading volume and many days during which no trades occurred. Prior to September 17, 2014, our common stock traded under the symbol “RNIN.”

| High | Low | |||||||

| 2014 | ||||||||

| First Quarter | $ | 1.13 | $ | 0.53 | ||||

| Second Quarter | $ | 0.89 | $ | 0.60 | ||||

| Third Quarter | $ | 0.75 | $ | 0.41 | ||||

| Fourth Quarter | $ | 0.73 | $ | 0.20 | ||||

| High | Low | |||||||

| 2013 | ||||||||

| First Quarter | $ | 4.28 | $ | 1.41 | ||||

| Second Quarter | $ | 1.60 | $ | 0.80 | ||||

| Third Quarter | $ | 0.98 | $ | 0.64 | ||||

| Fourth Quarter | $ | 0.83 | $ | 0.37 | ||||

Shareholders

As of May 4, 2015, there were approximately 281 holders of record of our common stock.

Dividend Policy

We have never declared or paid cash dividends on our common stock. We currently intend to retain future earnings, if any, to operate and expand our business, and we do not anticipate paying cash dividends on our common stock in the foreseeable future. Any payment of cash dividends in the future will be at the discretion of our board of directors and will depend upon our results of operations, earnings, capital requirements, contractual restrictions and other factors deemed relevant by our board of directors.

Holders of our common stock are entitled to share pro rata in dividends and distributions with respect to the common stock when, as and if declared by our Board of Directors out of funds legally available therefor. We have not paid any dividends on our common stock and intend to retain earnings, if any, to finance the development and expansion of our business. In addition, we must first pay dividends on our Series A Convertible Preferred Stock which have priority over any dividends to be paid to holders of our common stock. The current dividend payable to the holders of Series A Convertible Preferred Stock aggregates to up to $155,700 on a semi-annual basis (although under certain circumstances we may be able to satisfy our dividend-payment obligations relating to the Series A Convertible Preferred Stock through the issuance of additional shares of preferred stock). Other than with respect to shares of Series A Convertible Preferred Stock, future dividend policy is subject to the sole discretion of our Board of Directors and will depend upon a number of factors, including future earnings, capital requirements and our financial condition.

Securities Authorized for Issuance Under Equity Compensation Plans

See “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” in Item 12 for information regarding securities authorized for issuance under our equity compensation plans.

Sales of Unregistered Securities During the Fourth Quarter of Fiscal Year 2014

None.

| ITEM 6 | SELECTED FINANCIAL DATA |

Not applicable.

| 19 |

| ITEM 7 | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Forward-Looking Statements

The following discussion contains various forward-looking statements within the meaning of Section 21E of the Exchange Act. Although we believe that, in making any such statement, our expectations are based on reasonable assumptions, any such statement may be influenced by factors that could cause actual outcomes and results to be materially different from those projected. When used in the following discussion, the words “anticipates,” “believes,” “expects,” “intends,” “plans,” “estimates” and similar expressions, as they relate to us or our management, are intended to identify such forward-looking statements. These forward-looking statements are subject to numerous risks and uncertainties that could cause actual results to differ materially from those anticipated. Factors that could cause actual results to differ materially from those anticipated, certain of which are beyond our control, are set forth in Item 1A under the caption “Risk Factors.”

Our actual results, performance or achievements could differ materially from those expressed in, or implied by, forward-looking statements. Accordingly, we cannot be certain that any of the events anticipated by forward-looking statements will occur or, if any of them do occur, what impact they will have on us. We caution you to keep in mind the cautions and risks described in this document and to refrain from attributing undue certainty to any forward-looking statements, which speak only as of the date of the document in which they appear. We do not undertake to update any forward-looking statement.

Overview

Creative Realities, Inc. is a Minnesota corporation that provides innovative digital marketing technology solutions to retailers, brand marketers, venue-operators, enterprises, non-profits and other organizations throughout the United States and a growing number of international markets. Our technology and solutions include: digital merchandising systems, interactive digital shopping assistants and kiosks, mobile digital marketing platforms, digital way-finding platforms, digital menu board systems, dynamic signage, and other digital marketing technologies. We enable our clients’ engagement with consumers by using combinations of our technology and solutions that interact with mobile, social media, point-of-sale, wireless networks and web-based platforms. We have expertise in a broad range of existing and emerging digital marketing technologies, as well as the following related aspects of our business: content, network management, and connected device software and firmware platforms; customized software service layers; hardware platforms; digital media workflows; and proprietary processes and automation tools. We believe we are one of the world’s leading digital marketing technology companies focused on helping retailers and brands use the latest technologies to create better shopping experiences.

Our main operations are conducted directly through Creative Realities, Inc. (f/k/a Wireless Ronin Technologies, Inc.), and under our wholly owned subsidiaries Creative Realities, LLC, a Delaware limited liability company, Broadcast International, Inc., a Utah corporation, and Wireless Ronin Technologies Canada, Inc., a Canadian corporation.

We generate revenue in this business by:

| ● | consulting with our customers to determine the technologies and solutions required to achieve their specific goals, strategies and objectives; |

| ● | designing our customers’ digital marketing experiences, content and interfaces; |

| ● | engineering the systems architecture delivering the digital marketing experiences we design – both software and hardware – and integrating those systems into a customized, reliable and effective digital marketing experience; |

| ● | managing the efficient, timely and cost-effective deployment of our digital marketing technology solutions for our customers; |

| 20 |

| ● | delivering and updating the content of our digital marketing technology solutions using a suite of advanced media, content and network management software products; and |

| ● | maintaining our customers’ digital marketing technology solutions by: providing content production and related services; creating additional software-based features and functionality; hosting the solutions; monitoring solution service levels; and responding to and/or managing remote or onsite field service maintenance, troubleshooting and support calls. |