_____________________________________________________________________________________________________________________________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________

FORM 10-K

For the fiscal year ended December 31, 2024

OR

For the transition period from _____ to _____

Commission File No. | Commission File No. | ||||

| (Exact name of registrant as specified in its charter) | (Exact name of registrant as specified in its charter) | ||||

| (I.R.S. Employer Identification Number) | (I.R.S. Employer Identification Number) | ||||

| (State or other jurisdiction of incorporation or organization) | |||||

( | (Address of principal executive offices, including zip code) | ||||

| (Registrants' telephone number, including area code) | |||||

| Securities registered pursuant to Section 12(b) of the Act: | |||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | |||||||||

| Anywhere Real Estate Inc. | |||||||||||

| Anywhere Real Estate Group LLC | None | None | None | ||||||||

Securities registered pursuant to Section 12(g) of the Act: None

___________________________

Indicate by check mark if the Registrants are a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Anywhere Real Estate Inc. Yes ¨ No þ Anywhere Real Estate Group LLC Yes ¨ No þ

Indicate by check mark if the Registrants are not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Anywhere Real Estate Inc. Yes ¨ No þ Anywhere Real Estate Group LLC Yes þ No ¨

Indicate by check mark whether the Registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. Anywhere Real Estate Inc. Yes þ No ¨ Anywhere Real Estate Group LLC Yes ¨ No þ

Indicate by check mark whether the Registrants have submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrants were required to submit such files).

Anywhere Real Estate Inc. Yes þ No ¨ Anywhere Real Estate Group LLC Yes þ No ¨

Indicate by check mark whether the Registrants are large accelerated filers, accelerated filers, non-accelerated filers, smaller reporting companies, or emerging growth companies. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | Smaller reporting company | Emerging growth company | |||||||||||||||||||||||||||

| Anywhere Real Estate Inc. | ¨ | þ | ¨ | ||||||||||||||||||||||||||

| Anywhere Real Estate Group LLC | ¨ | ¨ | þ | ||||||||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. þ

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b) ☐

Indicate by check mark whether the Registrants are a shell company (as defined in Rule 12b-2 of the Exchange Act).

Anywhere Real Estate Inc. Yes ☐ No þ Anywhere Real Estate Group LLC Yes ☐ No þ

The aggregate market value of the voting and non-voting common equity of Anywhere Real Estate Inc. held by non-affiliates as of the close of business on June 30, 2024 was $357 million. There were 111,261,825 shares of Common Stock, $0.01 par value, of Anywhere Real Estate Inc. outstanding as of February 21, 2025.

Anywhere Real Estate Group LLC meets the conditions set forth in General Instruction I(1)(a) and (b) of Form 10-K and is therefore filing this Form with the reduced disclosure format applicable to Anywhere Real Estate Group LLC.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement prepared for the Annual Meeting of Stockholders to be held May 7, 2025 are incorporated by reference into Part III of this report.

_____________________________________________________________________________________________________________________________________________________________________________________

| TABLE OF CONTENTS | |||||

| Page | |||||

| PART I | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

Item 1C. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| PART II | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| PART III | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| PART IV | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

FORWARD-LOOKING STATEMENTS

Forward-looking statements included in this Annual Report on Form 10-K (this "Annual Report") and our other public filings or other public statements that we make from time to time are based on various facts and derived utilizing numerous important assumptions and are subject to known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements include the information concerning our future financial performance, business strategy, projected plans and objectives, as well as projections of macroeconomic and industry trends, which are inherently unreliable due to the multiple factors that impact economic trends, and any such variations may be material. Statements preceded by, followed by or that otherwise include the words "believes," "expects," "anticipates," "intends," "projects," "estimates," "potential," "plans," and similar expressions or future or conditional verbs such as "will," "should," "would," "may" and "could" are generally forward-looking in nature and not historical facts. You should understand that important factors could affect our future results and may cause actual results to differ materially from those expressed in the forward-looking statements, including those listed directly below under "Summary of Risk Factors" and as described in more detail under "Item 1A.—Risk Factors" and those described in "Item 7.—Management’s Discussion and Analysis of Financial Condition and Results of Operations" of this Annual Report. Most of these factors are difficult to anticipate and are generally beyond our control. You should consider these factors in connection with any forward-looking statements that may be made by us and our businesses generally.

All forward-looking statements herein speak only as of the date of this report and are expressly qualified in their entirety by the cautionary statements included in or incorporated by reference into this report. Except as is required by law, we expressly disclaim any obligation to publicly release any revisions to forward-looking statements to reflect events after the date of this report. For any forward-looking statement contained in this Annual Report, our public filings or other public statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

SUMMARY OF RISK FACTORS

The following summary of risk factors is not exhaustive. We are subject to other risks discussed under "Item 1A.—Risk Factors," and under "Item 7.—Management's Discussion and Analysis of Financial Condition and Results of Operations," as well as risks that may be discussed in other reports filed with the SEC. As noted under "Forward-Looking Statements" above, these factors could affect our future results and cause actual results to differ materially from those expressed in our forward-looking statements. Investors and other readers are urged to consider all of these risks, uncertainties and other factors carefully in evaluating our business.

•The residential real estate market is cyclical, and we are negatively impacted by downturns and disruptions in this market, including factors that impact homesale transaction volume (homesale sides times average homesale price), such as:

◦prolonged periods of a high mortgage rate and/or high inflation rate environment;

◦continued or accelerated reductions in housing affordability, whether at initial purchase or ongoing ownership cost;

◦insufficient or excessive home inventory levels by market or price point;

◦continued or accelerated declines, or the absence of significant increases, in the number of home sales;

◦stagnant or declining home prices; and

◦changes in consumer preferences in the U.S.;

•We are negatively impacted by adverse developments or the absence of sustained improvement in macroeconomic conditions (such as business, economic or political conditions) on a global, domestic or local basis;

•Changes to industry rules or practices that prohibit, restrict or adversely alter policies, practices, rules or regulations governing the functioning of the residential real estate market (regardless of whether such changes are driven by regulatory action, litigation outcomes, or otherwise) could materially adversely affect our operations and financial results, including, but not limited to, changes related to:

◦the clear cooperation policy, which is a National Association of Realtors (“NAR”) mandated policy that requires a listing broker to submit a listing to the multiple listing services ("MLSs") for cooperation with other MLS participants within a specified time of marketing a property to the public (the “Clear Cooperation Policy”);

◦the rules mandating participation in state and national Realtor associations in order to post on the local MLS; and

◦the rules limiting access to lock-boxes used to facilitate property showings and the rules that limit display of co-mingled MLS and non-MLS listings;

•Risks related to the impact of evolving competitive and consumer dynamics on both the Company and affiliated franchisees, whether driven by competitive or regulatory factors or other changes to industry rules or practices, which could include, but are not limited to:

◦meaningful decreases in the average homesale broker commission rate (including the average buy-side commission rate);

◦continued erosion of our share of the commission income generated by homesale transactions;

◦our ability (and the ability of affiliated joint ventures and franchisees) to compete against traditional and non-traditional competitors, including those that adapt more effectively, including by growing inorganically, to the continuing downturn in the housing market and the changes in industry rules and practices;

◦our ability to adapt our business to changing consumer preferences; and

◦further disruption in the residential real estate brokerage industry related to listing aggregator market power and concentration, including with respect to ancillary services;

•Our business and financial results may be materially and adversely impacted if we are unable to execute our business strategy, including if we are not successful in our efforts to:

◦recruit and retain productive independent sales agents and teams, and other agent-facing talent;

◦attract and retain franchisees or renew existing franchise agreements without reducing contractual royalty rates or increasing the amount and prevalence of sales incentives;

◦develop or procure products, services and technology that support our strategic initiatives;

◦successfully adopt and integrate artificial intelligence and similar technology into our products and services;

◦achieve or maintain cost savings and other benefits from our cost-saving initiatives;

◦generate a meaningful number of high-quality leads for independent sales agents and franchisees; and

◦complete, integrate or realize the expected benefits of acquisitions and joint ventures;

•Adverse developments or resolutions in litigation, in particular large scale litigation, involving significant claims, such as class action antitrust litigation and litigation related to the Telephone Consumer Protection Act ("TCPA"), may materially harm our business, results of operations and financial condition;

•Our substantial indebtedness, alone or in combination with other factors, particularly heightened during industry downturns or broader recessions, could (i) adversely limit our operations, including our ability to grow our business whether organically or via acquisitions, (ii) adversely impact our liquidity including, but not limited to, with respect to our interest obligations and the negative covenant restrictions contained in our debt agreements and/or (iii) adversely impact our ability, and any actions we may take, to refinance, restructure or repay our indebtedness or incur additional indebtedness;

•We have substantial indebtedness that will mature (or may spring forward) in 2026 and we may not be able to refinance or restructure any such debt on terms as favorable as those of currently outstanding debt, or at all;

•An event of default under our material debt agreements would adversely affect our operations and our ability to satisfy obligations under our indebtedness;

•A downgrade, suspension or withdrawal of the rating assigned by a rating agency to us or our indebtedness could make it more difficult for us to refinance or restructure our debt or obtain additional debt financing in the future;

•Variable rate indebtedness subjects us to interest rate risk, which could cause our debt service obligations to increase;

•Our financial condition and/or results of operations may be adversely impacted by risks related to our business structure, including, but not limited to:

◦the operating results of affiliated franchisees and their ability to pay franchise and related fees;

◦continued consolidation among our top 250 franchisees;

◦challenges relating to the owners of the two brands we do not own;

◦the geographic and high-end market concentration of our company owned brokerages;

◦the loss of our largest real estate benefit program client or continued reduction in spending on relocation services;

◦the failure of third-party vendors or partners to perform as expected or our failure to adequately monitor them;

◦our ability to continue to securitize certain of the relocation assets of Cartus;

◦our reliance on information technology to operate our business and maintain our competitiveness; and

◦the negligence or intentional actions of affiliated franchisees and their independent sales agents or independent sales agents engaged by our company owned brokerages, which are traditionally outside of our control;

•Risks related to legal and regulatory matters may cause us to incur increased costs and/or result in adverse financial, operational or reputational consequences to us, including but not limited to, our failure or alleged failure to comply with laws, regulations and regulatory interpretations and any changes or stricter interpretations of any of the foregoing, including but not limited to: (1) antitrust laws and regulations, (2) the Real Estate Settlement Procedures Act ("RESPA") or other federal or state consumer protection or similar laws, (3) state or federal employment laws or regulations that would require reclassification of independent contractor sales agents to employee status, (4) the TCPA and any related laws limiting solicitation of business, and (5) privacy or cybersecurity laws and regulations;

•We face reputational, business continuity and legal and financial risks associated with cybersecurity incidents;

•The weakening or unavailability of our intellectual property rights could adversely impact our business;

•Our goodwill and other long-lived assets are subject to further impairment which could negatively impact our earnings;

•We could be subject to significant losses if banks do not honor our escrow and trust deposits;

•Changes in accounting standards and management assumptions and estimates could have a negative impact on us;

•We face risks related to potential attrition among our senior executives or other key employees and related to our ability to develop our existing workforce and to recruit talent in order to advance our business strategies;

•We face risks related to our Exchangeable Senior Notes and exchangeable note hedge and warrant transactions;

•We face risks related to severe weather events, natural disasters and other catastrophic events, such as the wildfires recently impacting California;

•Increasing scrutiny and changing expectations related to corporate sustainability practices may impose additional costs on us or expose us to reputational or other risks;

•Market forecasts and estimates, including our internal estimates, may prove to be inaccurate; and

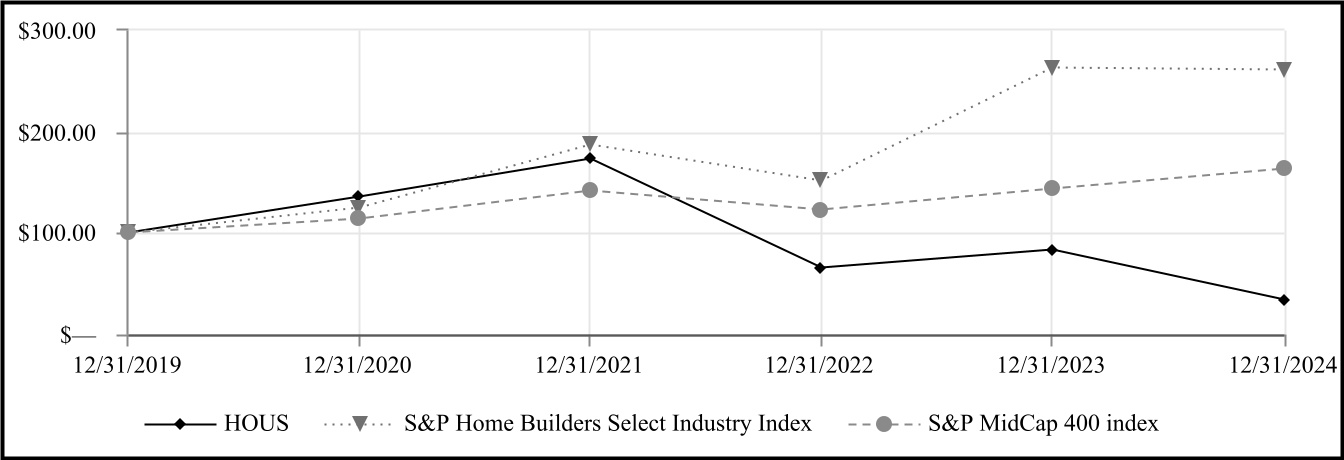

•We face risks related to our common stock, including that price of our common stock may fluctuate significantly.

TRADEMARKS AND SERVICE MARKS

We own or have rights to use the trademarks, service marks and trade names that we use in conjunction with the operation of our business. Some of the more important trademarks that we own or have rights to use that appear in this Annual Report include the CENTURY 21®, COLDWELL BANKER®, ERA®, CORCORAN®, COLDWELL BANKER COMMERCIAL®, SOTHEBY’S INTERNATIONAL REALTY®, BETTER HOMES AND GARDENS® Real Estate, and CARTUS® marks, which are registered in the United States and/or registered or pending registration in other jurisdictions, as appropriate to the needs of our relevant business. Each trademark, trade name or service mark of any other company appearing in this Annual Report is owned by such company.

PART I

Except as otherwise indicated or unless the context otherwise requires, the terms "we," "us," "our," "our company," "Anywhere" and the "Company" refer to Anywhere Real Estate Inc., a Delaware corporation, and its consolidated subsidiaries, including Anywhere Intermediate Holdings LLC, a Delaware limited liability company ("Anywhere Intermediate"), and Anywhere Real Estate Group LLC, a Delaware limited liability company ("Anywhere Group"). Neither Anywhere, the indirect parent of Anywhere Group, nor Anywhere Intermediate, the direct parent company of Anywhere Group, conducts any operations other than with respect to its respective direct or indirect ownership of Anywhere Group. As a result, the consolidated financial positions, results of operations and cash flows of Anywhere, Anywhere Intermediate and Anywhere Group are the same.

As used in this Annual Report:

•"Senior Secured Credit Agreement" refers to the Amended and Restated Credit Agreement dated as of March 5, 2013, as amended, amended and restated, modified or supplemented from time to time, that governs the senior secured credit facility, or "Senior Secured Credit Facility", which includes the "Revolving Credit Facility";

•"Term Loan A Agreement" refers to the Term Loan A Agreement dated as of October 23, 2015, as amended, amended and restated, modified or supplemented from time to time, also referred to as the "Term Loan A Facility" (paid in full in August 2024);

•"7.00% Senior Secured Second Lien Notes" refers to our 7.00% Senior Secured Second Lien Notes due 2030;

•"5.75% Senior Notes" and "5.25% Senior Notes" refer to our 5.75% Senior Notes due 2029 and 5.25% Senior Notes due 2030, respectively, and are referred to collectively as the "Unsecured Notes;" and

•"Exchangeable Senior Notes" refers to our 0.25% Exchangeable Senior Notes due 2026.

Item 1. Business.

Our Company

A leader of integrated residential real estate services in the U.S., Anywhere includes franchise, brokerage, relocation, and title and settlement businesses, as well as mortgage and title insurance underwriter joint ventures, supporting approximately 1 million closed homesale sides (either the "buy" or "sell" side of a homesale transaction) in 2024. The diverse Anywhere brand portfolio includes some of the most recognized names in real estate: Better Homes and Gardens® Real Estate, CENTURY 21®, Coldwell Banker®, Coldwell Banker Commercial®, Corcoran®, ERA®, and Sotheby’s International Realty®. Using innovative technology, data and marketing products, high-quality lead generation programs, and best-in-class learning and support services, Anywhere fuels the productivity of its approximately 179,200 independent sales agents in the U.S. and approximately 132,700 independent sales agents in 118 other countries and territories, helping them build stronger businesses and best serve today’s consumers.

Segment Overview

We report our operations in three segments, each of which receives fees based upon services performed for our customers:

•Anywhere Brands ("Franchise Group")—franchises a portfolio of well-known, industry-leading franchise brokerage brands, including Better Homes and Gardens® Real Estate, Century 21®, Coldwell Banker®, Coldwell Banker Commercial®, Corcoran®, ERA® and Sotheby's International Realty®. This segment also includes our global relocation services operation through Cartus® Relocation Services ("Cartus") and lead generation activities through Anywhere Leads Inc. ("Leads Group").

•Anywhere Advisors ("Owned Brokerage Group")—operates a full-service real estate brokerage business under the Coldwell Banker®, Corcoran® and Sotheby's International Realty® brand names in many of the largest metropolitan areas in the U.S. This segment also includes our share of equity earnings or losses from our minority-owned real estate auction joint venture.

•Anywhere Integrated Services ("Title Group")—provides full-service title, escrow and settlement services to consumers, real estate companies, corporations and financial institutions primarily in support of residential real estate transactions. This segment also includes our share of equity earnings or losses from Guaranteed Rate Affinity, our minority-owned mortgage origination joint venture, and from our minority-owned title insurance underwriter joint venture.

* * *

Our headquarters is located at 175 Park Avenue, Madison, New Jersey 07940. Our general telephone number is (973) 407-2000. The Company files electronically with the Securities and Exchange Commission (the "SEC") required reports on Form 8-K, Form 10-Q and Form 10-K; proxy materials; registration statements and other forms or reports as required. Certain of the Company's officers and directors also file ownership reports for insiders as required by Section 16 of the Securities Exchange Act of 1934. Such materials may be accessed electronically on the SEC's Internet site (www.sec.gov). We maintain an Internet website at http://anywhere.re and make available free of charge on or through our website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, Section 16 reports and any amendments to these reports in the Investors section of our website as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. Our website address is provided as an inactive textual reference. The contents of our website are not incorporated by reference herein or otherwise a part of this Annual Report.

MARKET AND INDUSTRY DATA AND FORECASTS

This Annual Report includes historical data, forecasts and information obtained from independent sources such as the Federal Home Loan Mortgage Corporation ("Freddie Mac"), the U.S. Bureau of Labor Statistics, the U.S. Federal Reserve Board (the "Federal Reserve"), NAR, the Federal National Mortgage Association ("Fannie Mae"), trade associations, industry publications and surveys, and other information available to us. Some data is also based on our good faith estimates, which are derived from management’s knowledge of the industry and independent sources. While we believe that the industry data presented herein is derived from the most widely recognized sources for reporting U.S. residential housing market statistical data, we caution that such information is subject to change and do not endorse or suggest reliance on this data or information alone. For example, in 2022, NAR significantly revised its previously published average (mean) sales price (“ASP”) data for U.S. existing homes for prior periods, which resulted in discontinuing our usage of NAR ASP data in our SEC filings.

Forecasts regarding rates of home ownership, sales price, volume of homesales, and other metrics included in this Annual Report to describe the housing industry are inherently uncertain or speculative in nature and actual results for any period could materially differ. Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but such information may not be accurate or complete. We have not independently verified any of the data from third-party sources nor have we ascertained the underlying economic assumptions relied upon therein. Statements as to our market position are based on market data currently available to us. While we are not aware of any misstatements regarding industry data provided herein, our estimates involve risks and uncertainties and are subject to change based upon various factors, including those discussed under the headings "Risk Factors" and "Forward-Looking Statements." Similarly, we believe our internal research is reliable, even though such research has not been verified by any independent sources.

Industry Overview

Industry definition. We primarily operate in the U.S. residential real estate industry and derive substantially all of our revenues from serving the needs of buyers and sellers of existing homes rather than new homes manufactured and sold by homebuilders. Residential real estate brokerage companies typically realize revenues in the form of a commission that is based on a percentage of the price of each home sold. As a result, the real estate industry generally benefits from rising home prices and increasing homesale transactions (and conversely is adversely impacted by falling prices and lower homesale transactions). We believe that existing homesale transactions and the services associated with these transactions, such as mortgage origination, title services and relocation services, represent one of the most attractive segments of the residential real estate industry for the following reasons:

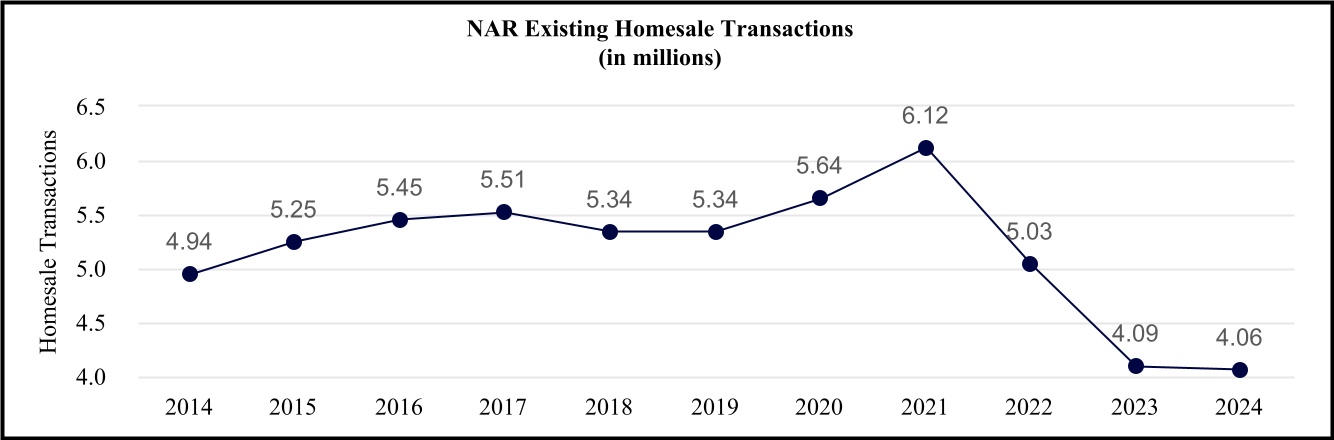

•the existing homesales segment represents a significantly larger addressable market than new homesales. Of the approximately 4.7 million homesales in the U.S. in 2024, NAR estimates that approximately 4.1 million were existing homesales, representing approximately 86% of the overall sales as measured in units;

•existing homesales afford us the opportunity to represent either the buyer or the seller and in some cases both the buyer and the seller; and

•we are able to generate revenues from other Company services provided to our customers.

Our business model relies heavily on affiliated independent sales agents, who play a critical consumer-facing role in the home buying and selling experience for both our company owned and franchise brokerages. While substantially all homebuyers start their search for a home using the Internet, according to NAR, approximately 88% of home buyers and 90% of home sellers used an agent or broker in 2024. We believe that agents or brokers will continue to be directly involved

6

in most home purchases and sales, primarily because real estate transactions have certain characteristics that benefit from the service and value offered by an agent or broker, including the following:

•the average homesale transaction value is very high and generally is the largest transaction one does in a lifetime;

•homesale transactions occur infrequently;

•there is a compelling need for personal service as home preferences are unique to each buyer;

•a high level of support is required given the complexity associated with the process, including specific marketing and technology services as well as assistance with the inspection process and other aspects of the transaction;

•the consumer preference to visit properties for sale in person, notwithstanding the availability of online images and property tours; and

•there is a high variance in price, depending on neighborhood, floor plan, architecture, fixtures, and outdoor space.

Cyclical nature of industry, long-term demographics and seasonality. The U.S. residential real estate industry exhibits a cyclical nature, characterized by periods of downturns as observed since mid-2022 and from 2006 to 2011, followed by phases of recovery and growth, exemplified from 2012 to 2021. Currently, the market is at historic lows, with 2023 and 2024 having the lowest homesale transactions since 1995, according to NAR data. These cycles are typically affected by broader economic shifts and conditions within the residential real estate market, factors largely beyond our control.

We believe that long-term demand for housing and the growth of our industry is impacted by various factors. Chief among these are housing affordability, the overall economic well-being of the U.S., and pivotal demographic trends, including generational transitions, and the rise in U.S. household formations. Elements such as mortgage rates and mortgage availability, tax incentives, job market dynamics, the conversion of renters to homebuyers, and the intrinsic benefits associated with homeownership further contribute to the industry's trajectory.

While the U.S. residential real estate market experienced substantial declines since 2022, we maintain an optimistic outlook on the growth of the residential real estate market over the mid to long term. Our optimism is rooted in the anticipation of enduring positive fundamentals, such as U.S. population over the last decade, and the expected growth in the number of U.S. households, particularly among the millennial generation, over the coming decade.

The U.S. residential housing market is also seasonal. Typically, a heightened volume of homesale transactions occurs in the second and third quarters of each year. Consequently, our historical data reveals stronger operating results and revenues during these periods.

Uncertainties Relating to the Residential Real Estate Industry. The U.S. residential real estate brokerage industry is currently in the midst of a period of significant uncertainty driven by actual and potential changes to a number of industry rules or practices that impact the functioning of the U.S. residential brokerage industry and our business. For more information, see "Item 7.—Management's Discussion and Analysis—Current Business and Industry Trends" and "Item 1A.—Risk Factors—Regulatory and Legal Risks".

Participation in Multiple Aspects of Residential Real Estate

We participate in services associated with many aspects of the residential real estate market. Our complementary businesses and minority-held joint ventures, including our mortgage origination and title insurance underwriter joint ventures, work together, allowing us to generate revenue at various points in a residential real estate transaction, including the purchase or sale of homes, corporate relocation, lead generation services, settlement and title services, and franchising of our brands. The businesses each benefit from our deep understanding of the industry, strong relationships with real estate brokers, sales agents and other real estate professionals and expertise across the transactional process. Unlike other industry participants who offer only one or two services, we can offer homeowners, our franchisees and our corporate and real estate benefit program clients ready access to numerous associated services that facilitate and simplify the home purchase and sale process. These services provide further revenue opportunities for our owned businesses and those of our franchisees. All of our businesses and our minority-owned joint ventures can derive revenue from the same real estate transaction.

7

Our Brands

Our brands are among the most well-known and established real estate brokerage brands in the real estate industry.

Together with our strategic joint ventures, our brands allow us to leverage our strengths, while participating in multiple markets within the real estate industry. Specifically, while all of our brands compete to varying extents in the high-end markets, our Sotheby’s International Realty® and Corcoran® brands are particularly well-positioned to benefit from growth in high-end markets. Likewise, while all of our brands utilize offerings through Title Group, our company owned Coldwell Banker® brand shares synergies with our title business as well as our mortgage origination and title insurance underwriter joint ventures that allow us to progress towards our goal to integrate and streamline the residential real estate transaction. In addition, our global franchise brands including Better Homes and Gardens® Real Estate, CENTURY 21® and ERA®, as well as franchised Sotheby’s International Realty®, Corcoran® and Coldwell Banker® brokerages, provide us with attractive scale and afford us the ability to offer versatility of choice to franchisees and consumers.

Our real estate brands are listed in the following chart, which includes information as of December 31, 2024, for both our franchised and company owned offices:

Brands (1) |  |  |  |  |  |  | |||||||||||||||||||||||||||||||||||||||||||||||

Worldwide Offices (2) | 11,000 | 2,900 | 1,100 | 2,300 | 400 | 100 | |||||||||||||||||||||||||||||||||||||||||||||||

Worldwide Brokers and Sales Agents (2) | 130,200 | 96,300 | 26,100 | 43,200 | 11,200 | 4,900 | |||||||||||||||||||||||||||||||||||||||||||||||

U.S. Annual Sides | 219,329 | 468,004 | 117,860 | 70,092 | 58,231 | 16,494 | |||||||||||||||||||||||||||||||||||||||||||||||

# of Countries and Territories with Owned or Franchised Operations | 79 | 45 | 84 | 37 | 6 | 9 | |||||||||||||||||||||||||||||||||||||||||||||||

Characteristics | A 50+ year leader in brand awareness and a top recognized and respected name in real estate Significant international office footprint | 119-year legacy in real estate Coldwell Banker Global Luxury® program to uniquely market top tier listings Long-time industry leader in effective advertising | Synonymous with luxury Strong ties to auction house established in 1744 Powerful global presence Longstanding commitment to technology and innovation | Driving performance through innovation, collaboration, diversity and growth Unique opportunity for flexible branding | Strong brand name recognition Unique access to consumers, marketing channels and content through brand licensing relationship with a leading media company | Leading residential real estate brand for 50+ years Commitment to white-glove service, customer-centric brand, and "Live Who You Are" philosophy | |||||||||||||||||||||||||||||||||||||||||||||||

_______________

(1)Information presented for Coldwell Banker® includes Coldwell Banker Commercial®.

(2)Includes information reported to us by independently owned franchisees (including approximately 12,500 offices and approximately 132,700 related brokers and independent sales agents of non-U.S. franchisees and franchisors).

8

Anywhere Brands—Franchise Group

Overview—Franchise Business

Franchise Group is comprised of our franchise business as well as our lead generation and relocation services operations.

As of December 31, 2024, our real estate franchise systems and proprietary brands had approximately 311,900 independent sales agents worldwide, including approximately 179,200 independent sales agents operating in the U.S. (which included approximately 52,900 company owned brokerage independent sales agents). As of December 31, 2024, our real estate franchise systems and proprietary brands had approximately 17,800 offices worldwide in 119 countries and territories in North and South America, Europe, Asia, Africa, the Middle East and Australia, including approximately 5,300 brokerage offices in the U.S. (which included approximately 580 company owned brokerage offices).

As of December 31, 2024, on a year-over-year basis, independent sales agents affiliated with our company owned brokerages experienced a 7% decline (based on the Company's internal data) and independent sales agents affiliated with our U.S. franchisees experienced a 4% decline (based on information provided by our affiliated franchisees).

The average tenure among our U.S. franchisees is approximately 23 years as of December 31, 2024. Our franchisees pay us fees for the right to operate under one of our trademarks and to enjoy the benefits of the systems and business enhancing tools provided by our real estate franchise operations. In addition to highly competitive brands that provide unique offerings to our franchisees, we support our franchisees with servicing programs, technology, and learning and development as well as dedicated national marketing programs to facilitate our franchisees in developing their business.

Our primary objectives as a franchisor of residential real estate brokerages are to retain and expand existing franchises, sell new franchises, and most importantly, provide branding and support (including via proprietary and third-party products and services) to our franchisees and their independent sales agents.

Operations—Franchising

We derive substantially all of our real estate franchising revenues from royalties and marketing fees received under long-term franchise agreements with our domestic franchisees and Owned Brokerage Group for the right to operate under one of our trademarks and to utilize the benefits of the franchise systems. Royalties are based on a percentage of the franchisees’ sales commission earned from closed homesale sides, which we refer to as gross commission income.

Franchise Group's domestic annual net royalty revenues from franchisees (other than our company owned brokerages at Owned Brokerage Group) can be represented by multiplying (1) that year's total number of closed homesale sides (either the "buy" side and/or the "sell" side of a real estate transaction) in which those franchisees participated by (2) the average sale price of those homesales by (3) the average brokerage commission rate charged by these franchisees by (4) Franchise Group's net contractual royalty rate. Franchise Group's net contractual royalty rate represents the average percentage of our franchisees' commission revenues paid to us as a royalty, net of volume incentives achieved, if applicable, and net of other incentives granted to franchisees.

In addition to domestic royalty revenue, Franchise Group earns revenue from marketing fees, the strategic alliance program, international affiliates and upfront international fees.

During 2024, none of our franchisees (other than Owned Brokerage Group) generated more than 3% of the total revenue of our real estate franchise business.

Our franchisees (other than our company owned brokerages at Owned Brokerage Group) are independent business operators and we do not exercise control over their day-to-day operations, including with respect to their pricing, hiring or affiliation practices.

Domestic Franchisees. Franchise agreements set forth certain limited guidelines on the business and operations of the franchisees and require them to comply with the mandatory identity standards set forth in each brand's policy and procedures manuals. A franchisee's failure to comply with these restrictions and standards could result in a termination of the franchise agreement. The franchisees generally are not permitted to terminate the franchise agreements prior to their expiration, and in those cases where termination rights do exist, they are limited (e.g., if the franchisee retires, becomes disabled or dies). Generally, new domestic franchise agreements have a term of ten years.

These franchisee agreements generally require the franchisee to pay us an initial franchise fee for the franchisee's principal office plus a royalty fee that is a percentage of gross commission income, if any, earned by the franchisee. Franchisee fees can be structured in numerous ways, and we have and may continue, from time to time, to introduce pilot programs or

9

restructure or revise the model used at one or more franchised brands, including with respect to fee structures, minimum production requirements or other terms.

Certain of our brands utilize a volume-based incentive model with a royalty fee rate that is initially equal to 6% of the franchisee's gross commission income, but subject to reduction based upon volume incentives. Under this model, the franchisee is eligible to receive a refund of a portion of the royalties paid upon the satisfaction of certain conditions. The volume incentive is calculated for each eligible franchisee as a progressive percentage of each franchisee's annual gross revenue (paid timely) for each calendar year. The volume incentive varies for each franchise system. We provide a detailed table to each eligible franchisee that describes the gross revenue thresholds required to achieve a volume incentive and the corresponding incentive amounts. We reserve the right to increase or decrease the percentage and/or dollar amounts in the table on an annual basis, subject to certain limitations.

Certain franchisees (including some of our largest franchisees) have a flat percentage royalty fee. Under this model, franchisees pay a fixed percentage (generally less than 6%) of their commission income to us and the percentage does not change during the year or over the term of their franchise agreement. Franchisees on this model are generally not eligible for volume incentives.

Our Better Homes and Gardens® Real Estate franchise business utilizes a capped fee model, which has applied to any new franchisee since 2019 as well as preexisting franchisees who elect to switch from their current royalty fee structure to the capped fee model. Under this model, franchisees pay a royalty fee (generally equal to 5% of their commission income) capped at a set amount per independent sales agent per year, subject to our right to annually modify or increase the independent sales agent cap. Franchisees on this model are generally not eligible for volume incentives.

Our Corcoran franchise business utilizes a tiered royalty fee model under which franchisees pay us a percentage of their gross commission income as a royalty fee. The royalty fee percentage is generally set at an initial rate of 6% and decreases in steps during each calendar year to a minimum of 4% as the franchisee’s gross commission income reaches certain levels. Similarly, our Coldwell Banker® residential franchise business began offering a tiered royalty fee model in 2021, under which the royalty fee percentage is generally set at an initial rate of 5.5% and decreases in steps during the calendar year to a minimum of 3% as the franchisee’s gross commission income reaches certain levels. Under this tiered royalty fee model, we reserve the right to annually modify or increase the gross commission income levels, subject to certain limitations. Franchisees on the tiered royalty fee model are generally not eligible for volume incentives.

Other incentives may be used as consideration to attract new franchisees, grow franchisees (including through independent sales agent recruitment) or extend existing franchise agreements. Under certain circumstances, we extend conversion notes or other note-backed funding which we provide to eligible franchisees for the purpose of providing an incentive to join the brand, to renew their franchise agreements, or to facilitate their growth opportunities. Growth opportunities include the expansion of franchisees' existing businesses by opening additional offices, through the consolidation of operations of other franchisees, as well as through the acquisition of independent sales agents and offices operated by independent brokerages. Franchisees may also use the proceeds from note-backed funding to update marketing materials or upgrade technology and websites. The notes are not funded until appropriate credit checks and other due diligence matters are completed, and the business is opened and operating under one of our brands. Upon satisfaction of certain revenue performance-based thresholds, the notes are forgiven ratably generally over the term of the franchise agreement. If the revenue performance thresholds are not met or the franchise agreement terminates, franchisees may be required to repay a portion of the outstanding notes.

Each of our current franchise systems requires franchisees and company owned brokerages to make monthly contributions to marketing funds maintained by each brand in accordance with the applicable franchise agreement. These contributions are used primarily for the development, implementation, production, placement and payment of national and regional advertising, marketing, promotions, public relations, broker and agent marketing tools and products and/or other marketing-related activities, such as lead generation, all to promote and further the recognition of each brand and its independent franchisees and their affiliated independent sales agents. In addition to the contributions from franchisees and company owned offices, in certain instances, Franchise Group may be required to make contributions to certain marketing funds and may make discretionary contributions (at its option) to any of the marketing funds.

In addition to offices owned and operated by our third-party franchisees, as of December 31, 2024, we, through Owned Brokerage Group, own and operate approximately 580 offices under the Coldwell Banker®, Sotheby's International Realty® and Corcoran® brand names. The domestic royalty revenue from Owned Brokerage Group is calculated by multiplying (i) homesale sides by (ii) average sale price by (iii) average brokerage commission rate by (iv) their contractual royalty rate. Owned Brokerage Group pays intercompany royalty fees of approximately 6% and marketing fees to Franchise Group in connection with its operation of these offices. These fees are recognized as income or expense by the applicable segment

10

level and eliminated in the consolidation of our businesses. Owned Brokerage Group does not participate in volume incentive or other incentive programs.

International Third-Party Franchisees. In the U.S., we employ a direct franchising model whereby we contract with and provide services directly to independent owner-operators. We also utilize a direct franchising model outside of the U.S. for Sotheby's International Realty® and Corcoran® and, in some cases, Better Homes and Gardens® Real Estate. For all other brands, we generally employ a master franchise model outside of the U.S., whereby we contract with a qualified third party to build a franchise network in the country or region in which franchising rights have been granted. Under both the direct and master franchise models outside of the U.S., we typically enter into long-term franchise agreements (often 25 years in duration) and receive an initial area development fee and ongoing royalties. Under the master franchise model, the ongoing royalties we receive are generally a percentage of the royalties received by the master franchisor from its franchisees with which it contracts. Under the direct franchise model, a royalty fee is paid to us on transactions conducted by our franchisees in the applicable country or region.

Intellectual Property

We own the trademarks Century 21®, Coldwell Banker®, Coldwell Banker Commercial®, Corcoran®, ERA® and related trademarks and logos, and such trademarks and logos are material to the businesses that are part of our real estate franchise segment. Our franchisees and our subsidiaries actively use these trademarks, and all of the material trademarks are registered (or have applications pending) with the United States Patent and Trademark Office as well as with corresponding trademark offices in major countries worldwide where these businesses have significant franchised operations.

We have an exclusive license to own, operate and franchise the Sotheby's International Realty® brand to qualified residential real estate brokerage offices and individuals operating in eligible markets pursuant to a license agreement with SPTC Delaware LLC, a subsidiary of Sotheby's ("Sotheby's"). Such license agreement has a 100-year term, which consists of an initial 50-year term ending February 16, 2054 and a 50-year renewal option. We pay a licensing fee to Sotheby's for the use of the Sotheby's International Realty® name equal to 9.5% of the net royalties earned by Franchise Group attributable to franchisees affiliated with the Sotheby's International Realty® brand, including our company owned offices. Our license agreement is terminable by Sotheby's prior to the end of the license term if certain conditions occur, including but not limited to the following: (1) we attempt to assign any of our rights under the license agreement in any manner not permitted under the license agreement, (2) we become bankrupt or insolvent, (3) a court issues a non-appealable, final judgment that we have committed certain breaches of the license agreement and we fail to cure such breaches within 60 days of the issuance of such judgment, or (4) we discontinue the use of all of the trademarks licensed under the license agreement for a period of twelve consecutive months.

In October 2007, we entered into a long-term license agreement to own, operate and franchise the Better Homes and Gardens® Real Estate brand from Meredith Operations Corporation, successor in interest to Meredith Corporation ("Meredith Ops"). The license agreement between Anywhere and Meredith Ops is for a 50-year term, with a renewal option for another 50 years at our option. We pay a licensing fee to Meredith Ops for the use of the Better Homes and Gardens® Real Estate brand name equal to 9.0% of the net royalties earned by Franchise Group attributable to franchisees affiliated with the Better Homes and Gardens® Real Estate brand, subject to a minimum annual licensing fee. Our license agreement is terminable by Meredith Ops prior to the end of the license term if certain conditions occur, including but not limited to the following: (1) we attempt to assign any of our rights under the license agreement in any manner not permitted under the license agreement, (2) we become bankrupt or insolvent, or (3) a trial court issues a final judgment that we are in material breach of the license agreement or any representation or warranty we made was false or materially misleading when made.

Operations—Other

Cartus® Relocation Services. Cartus, a provider of global relocation services, offers a broad range of world-class employee relocation services designed to manage all aspects of an employee's move to facilitate a smooth transition in what otherwise may be a complex and difficult process for employee and employer. The wide range of services we offer allow our clients to outsource their entire relocation programs to us. Our broad array of services include, but are not limited to, homesale assistance, relocation policy counseling and group move management services, consulting services, expense processing and relocation-related accounting, compensation support and compliance, and visa and immigration support. We also arrange household goods moving services and provide support for all aspects of moving a transferee's household goods.

We primarily offer corporate clients employee relocation services, including 38% of the Fortune 50 companies in 2024. As of December 31, 2024, the top 25 relocation clients had an average tenure of approximately 25 years with us. Substantially all of our contracts with our relocation clients are terminable at any time at the option of the client and are non-exclusive. If

11

a client ceases or reduces volume under its contract, we will be compensated for all services performed up to the time that volume ceases and reimbursed for all expenses incurred.

There are a number of different revenue streams associated with relocation services. We earn a commission from real estate brokers and household goods moving companies that provide services to the transferee. Clients may also pay transactional fees for the services performed. Furthermore, Cartus continues to provide value through the generation of leads to real estate agent and brokerage participants in the networks maintained by Leads Group, which drives downstream revenue for our businesses.

Lead Generation. Through Leads Group, a part of Franchise Group, we seek to provide high-quality leads to independent sales agents, through real estate benefit programs that provide home-buying and selling assistance to customers of lenders, organizations such as credit unions and interest groups that have established members who are buying or selling a home as well as to consumers and corporations who have expressed interest in a certain brand, product or service (such as relocation services), including those offered by Anywhere. Our real estate benefit program revenues are highly concentrated, with one client-directed real estate benefit program contributing a substantial majority of the high-quality leads generated through our lead generation programs, and our client-directed programs are non-exclusive and terminable at any time at the option of the client. We also maintain Company-driven real estate benefit programs and additional leads may be generated via other strategic initiatives, including through consumer-focused products and services we may develop or offer. We expect that significant time, effort and meaningful investment will be required to increase awareness of, and participation in, programs, partnerships or products and services that are intended to aid in lead generation.

Strategic Alliance Program. We offer third-party service providers an opportunity to market their products to our franchisees and their independent sales agents and customers through our strategic alliance program. To participate in this program, service providers generally agree to provide preferred pricing to our franchisees and/or their customers or independent sales agents and to pay us an initial access fee, subsequent marketing fees and/or commissions based upon our franchisees' or independent sales agents' usage of the strategic alliance vendors.

Anywhere Advisors—Owned Brokerage Group

Overview

Through Owned Brokerage Group we own and operate a full-service real estate brokerage business in many of the largest metropolitan areas in the U.S. Our brokerage offices are geographically diverse with a strong presence in the east and west coast areas, primarily around large metropolitan areas in the U.S., where home prices are generally higher. Our company owned real estate brokerage business operates under the Coldwell Banker®, Sotheby's International Realty® and Corcoran® franchised brands.

As of December 31, 2024, we had approximately 580 company owned brokerage offices and approximately 52,900 independent sales agents working with these company owned offices. Of those offices, we operated approximately 88% of our offices under the Coldwell Banker® brand name, approximately 8% of our offices under the Sotheby's International Realty® brand name and approximately 4% of our offices under the Corcoran® brand name.

We intend to continue to seek to increase the productivity of company owned brokerage offices, including by optimizing efficiencies, streamlining transactional processes and centralizing back-office operations. We will continue to work with office managers to attract and retain independent sales agents who can successfully engage in and promote transactions from new and existing clients. From time to time, we may also execute strategic acquisitions. Following the completion of an acquisition, we tend to consolidate the newly acquired operations with our existing operations to reduce or eliminate duplicative costs and to leverage our existing infrastructure to support newly affiliated independent sales agents.

Operations—Brokerage

Our company owned real estate brokerage business derives revenue primarily from gross commission income received for serving as the broker at the closing of real estate transactions. For the year ended December 31, 2024, our average homesale broker commission rate was 2.37%, which represents the average commission rate earned on either the "buy" side or the "sell" side of a homesale transaction. Gross commission income is also earned on non-sale transactions such as home rentals. Owned Brokerage Group, as a franchisee of Franchise Group, pays marketing fees and a royalty fee of approximately 6% of the gross commission income earned per real estate transaction to Franchise Group; however, such amounts are eliminated in consolidation. Owned Brokerage Group paid marketing fees and royalties to Franchise Group of $319 million and $315 million for the years ended December 31, 2024 and 2023, respectively.

12

The remainder of gross commission income is split between the broker (Owned Brokerage Group) and the independent sales agent in accordance with their applicable independent contractor agreement (which specifies the portion of the broker commission to be paid to the agent), which varies by agent.

In addition, as a full-service real estate brokerage company, we promote the complementary services offered through our other segments, including title, escrow and settlement, mortgage origination, homeowners insurance and relocation services. We believe we provide integrated services that enhance the customer experience.

When we assist the seller in a real estate transaction, independent sales agents generally provide the seller with an array of services, which may include developing a direct marketing plan for the property, assisting the seller in pricing the property and preparing it for sale, listing it on multiple listing services, advertising the property (including on websites), showing the property to prospective buyers, assisting the seller in sale negotiations, and assisting the seller in preparing for closing the transaction. When we assist the buyer in a real estate transaction, independent sales agents generally help the buyer in locating specific properties that meet the buyer's personal and financial specifications, show properties to the buyer, and assist the buyer in negotiating (where permissible) and preparing for closing the transaction. In addition, Owned Brokerage Group has relationships with developers in select major cities (in particular New York City) to provide marketing and brokerage services in new developments.

Anywhere Integrated Services—Title Group

Overview

Title Group is comprised of our title agency business that conducts title, escrow and settlement services and also includes the Company' share of equity earnings and losses from certain non-exclusive joint ventures, including, among others, Guaranteed Rate Affinity (a mortgage origination joint venture) and the title insurance underwriter joint venture (see below under the header "Title Insurance Underwriter Joint Venture" for additional information). Our equity earnings or losses related to minority-owned joint ventures such as Guaranteed Rate Affinity and the title insurance underwriter joint venture are included in the financial results of Title Group but are not reported as revenue to Title Group.

Our title agency business provides title search, examination, clearance and policy issuance services and conducts the closing process and funds disbursement for lenders, real estate agents, attorneys and homebuilders and their customers on purchase transactions and lenders and their customers on refinance transactions.

We intend to grow our title, escrow and settlement services business by recruiting successful title and escrow sales personnel in existing markets. We will also seek to increase our capture rate of title business from Owned Brokerage Group homesale sides.

Operations

Title Agency Services; Title, Escrow and Settlement Services. We are licensed as a title agent in 43 states and Washington, D.C., and have physical locations in 25 states and Washington, D.C. We operate mostly in major metropolitan areas. As of December 31, 2024, we had approximately 350 offices, approximately 126 of which are co-located within one of our company owned brokerage offices. In addition to our own title, escrow and settlement services, we also coordinate a nationwide network of attorneys, title agents and notaries to service financial institution clients on a national basis.

Our title, escrow and settlement services business provides full-service title, escrow and settlement (i.e., closing and escrow) services to consumers, real estate companies, corporations and financial institutions with many of these services provided in connection with the Company's real estate brokerage and relocation services businesses. We provide closing and escrow services relating to the closing of home purchases and refinancing of home loans. For refinance transactions, we generate title and escrow revenues from financial institutions and loan officers throughout the mortgage lending industry.

Our company owned brokerage operations are the principal source of our title, escrow and settlement services business for homesale transactions. Many of our offices have subleased space from and are co-located within our company owned brokerage offices. In 2024, our title, escrow and settlement services business was involved in approximately 39,000 transactions related to Owned Brokerage Group. The capture rate of our title, escrow and settlement services business from buyers or sellers represented by our company owned brokerages was approximately 31% in 2024. Other sources of our title, escrow and settlement services homesale business include Franchise Group, Leads Group, home builders and unaffiliated brokerage operations.

Virtually all lenders require their borrowers to obtain title insurance policies at the time mortgage loans are made on real property. The terms and conditions upon which the real property will be insured are determined in accordance with the

13

standard policies and procedures of the title underwriter. When our title agencies sell title insurance, the title search (searching for and retrieving all public records concerning the property and its owners) may be performed by the title agent, an underwriter or contracted to a third party while the examination function (inspecting all such public records for any defects in the chain of title) is always performed by the agent. The title agent and underwriter split the premium. The amount of such premium "split" is generally determined by agreement between the agency and underwriter and, in some states, is promulgated by state law. We derive revenue through fees charged in real estate transactions for rendering the services described above, fees charged for escrow and closing services, and a percentage of the title premium on each title insurance policy sold.

We have entered into underwriting agreements with various underwriters, which state the conditions under which we may issue a title insurance policy on their behalf. For policies issued through our agency operations, assuming no negligence on our part, we are not typically liable for losses under those policies; rather the title insurer is typically liable for such losses.

Other Revenue. Other revenue generated by our title agency business includes closing protection letters, title searches, survey business, tax search, wire fees, and other fees ancillary to their services.

Joint Ventures.

Mortgage Origination. Guaranteed Rate Affinity, our mortgage origination joint venture with Guaranteed Rate, Inc. ("Guaranteed Rate"), began doing business in August 2017. Guaranteed Rate Affinity originates mortgage loans, including both purchase and refinancing transactions, to be sold in the secondary market. Guaranteed Rate Affinity originates and markets its mortgage lending services to real estate agents across the country (including to independent sales agents affiliated with our company owned and franchised brokerages) and relocation companies (including our relocation operations) as well as a broad consumer audience.

Many of Guaranteed Rate Affinity’s offices have subleased space from and are co-located within our company owned brokerage offices. Our company owned brokerage operations represented approximately half of Guaranteed Rate Affinity's purchase transactions, as well as approximately half of Guaranteed Rate Affinity’s mortgage origination business for the year ended December 31, 2024.

Under the Operating Agreement (the "GRA Agreement") between a subsidiary of Title Group and a subsidiary of Guaranteed Rate (the "GRA Member"), we own 49.9% of the home mortgage joint venture and Guaranteed Rate indirectly owns the remaining 50.1%. Under the GRA Agreement, Guaranteed Rate Affinity is to distribute to each of the Company and Guaranteed Rate the distributable net income based on each member's ownership interest percentage following the close of each quarter. While we have certain governance rights, we do not have a controlling financial or operating interest in the joint venture. Guaranteed Rate Affinity is licensed to conduct mortgage operations in 50 states and Washington, D.C.

The GRA Agreement is for an initial 10-year term (ending August 2027) and automatically renews for additional 5-year terms, unless either party provides advance notice to terminate, provided that if certain performance metrics are achieved after the fifth year of the agreement, the first 5-year extension is not subject to termination upon advance notice. Either party can terminate the GRA Agreement upon the occurrence of certain events including, but not limited to, a change in control of the other member, subject to certain exceptions, or upon material breach by the other member not remediated within the cure period. We have certain additional performance-based termination rights.

The GRA Agreement does not prohibit Guaranteed Rate, directly or indirectly through joint ventures with other parties, from operating its separate mortgage origination business and does not limit the Company, Guaranteed Rate, or either of their subsidiaries from operating non-mortgage origination lines of business in locations where Guaranteed Rate Affinity operates. In addition, the Company is permitted to have ventures with other mortgage loan originators, but Guaranteed Rate has a 30-day right-of-first-refusal to acquire any mortgage origination business that we intend to acquire.

Title Insurance Underwriter Joint Venture. In March 2022, the Company sold its title insurance underwriter, Title Resources Guaranty Company (the "Title Underwriter") (previously reported in the Title Group reportable segment) in exchange for cash and a minority equity stake in the form of common units in a title insurance underwriter joint venture that owns the Title Underwriter (the "Title Insurance Underwriter Joint Venture"). The Company owns a 22% equity interest and other joint venture partners own a majority equity stake in the joint venture in the form of preferred units that carry liquidation preference rights. While we have certain governance rights, we do not have a controlling financial or operating interest in the joint venture.

During the fourth quarter of 2024, the Company entered into a binding term sheet with a subsidiary of the Title Insurance Underwriter Joint Venture related to the sale of 10% of the preferred equity in entities containing the assets of certain of the Company's title and escrow entities for $18.8 million, with a right to purchase 100% of those entities at the same valuation

14

used for the initial purchase. The transaction includes customary minority protections, is contingent on certain conditions, and remains subject to termination provisions outlined in the term sheet.

Products, Technology and Marketing

Products and Technology—Agents. Core to our integrated business strategy is our ability to provide independent sales agents at company owned and franchised brokerages with compelling data and technology-powered products and services to make them more productive and their businesses more profitable.

The marketing and technology services and support provided by independent sales agents to their customers are an important element of the value offered by an agent in the home purchase and sale process. Our commitment to continuously develop and improve our marketing and technology-powered products and services is part of our value proposition to company owned and franchised real estate brokerages, affiliated independent sales agents and their customers as well as to our other businesses. Increasingly, these products and services are desired as an integrated set of tools, rather than stand-alone products and services.

We continue to develop product and marketing capabilities designed to support the continuous creation and delivery of both our proprietary tools and third-party products to affiliated independent sales agents in order to deliver a more comprehensive platform experience. Our technology platform is designed to offer affiliated independent sales agents and brokers seamless access to both proprietary tools and third-party products, enabling choice among such agents and brokers to leverage the mix of tools that best serve their needs.

We have invested, and expect to continue to invest, substantial time, capital, and other resources to identify the needs of company owned brokerages, franchisees, independent sales agents and their customers and to develop or procure marketing, technology and service offerings to meet the needs of affiliated independent sales agents.

Our Anywhere-provided platform is designed to increase the value proposition to our independent sales agents, franchisees (and their independent sales agents) and consumers by:

•aiding in lead generation and obtaining additional homesale transactions;

•connecting affiliated agents and brokers to a CRM tool that allows for the cultivation of productive relationships with consumers at all stages of the transaction;

•enhancing access to listing distributions through mobile applications and websites;

•informing affiliated agents of valuable client insight to help those agents increase their productivity;

•providing consumers with a streamlined yet comprehensive user experience to facilitate the necessary steps for researching homes, communities and independent sales agents;

•providing key back-office processes, including listing and transaction management, reporting, marketing, and agent profiles; and

•delivering business planning tools that enable our franchisees to track their progress against key business objectives in real time.

Products and Technology—Consumers. We continue to focus on the consumer experience as well, seeking to improve the experience of buying and selling a home by creating an easier and integrated experience for all parts of a consumer's transaction. We expect to continue to invest in the development and/or procurement of products and technology designed to deliver valuable capabilities via digital channels throughout the lifecycle of home ownership.

Marketing. Each of our brands manages a comprehensive system of marketing tools that can be accessed through freestanding brand intranet sites to assist our company owned brokerages and affiliated franchisees and their respective independent sales agents in becoming the best marketer of their listings. Advertising is primarily used by the brands to drive leads to affiliated agents, increase brand awareness and perception, promote our network and offerings to the real estate industry and engage our customer base.

Each of our franchise brands operates a marketing fund that is funded principally by our franchisees (including company owned offices), although we may make discretionary contributions to any of the marketing funds and in certain instances are required to make contributions to certain marketing funds.

Likewise, our company owned brokerages sponsor a wide array of marketing programs, materials and opportunities to complement the sales work of our affiliated independent sales agents and increase brand awareness. The effectiveness and quality of marketing programs play a significant role in attracting and retaining independent sales agents.

15

Our marketing programs, tools and initiatives primarily focus on attracting potential new home buyers and sellers to our company owned brokerages and affiliated franchisees and their respective affiliated independent sales agents by:

•showcasing the inventory of our real estate listings and the affiliated independent sales agents who are the listing agents of these properties;

•building and maintaining brand awareness and preference for the brand; and

•increasing the local recognition of affiliated agents and brokerages.

Marketing programs are executed using a variety of media including, but not limited to, social media, advertising, direct marketing and internet advertising.

Listings and Websites. The internet is the primary advertising channel in our industry and we have sought to become a leader among full-service residential real estate brokerage firms in the use and application of marketing technology. We transmit listings to various platforms and services, place our property listings on hundreds of real estate websites, and operate a variety of our own websites. We place significant emphasis on distributing our real estate listings with third-party websites to expand a homebuyer's access to such listings, at times enhancing the presentation of the listings on third-party websites to make the listings more attractive to consumers.

Our brand websites contain listing information on a regional and national market basis, independent sales agent information, community profiles, home buying and selling advice, relocation tips and mortgage financing information and unique property and neighborhood insights from local agents. Additionally, each brand website allows independent sales agents to market themselves to consumers.

Education

Each real estate brand provides franchisees access to learning, development, and continuing education materials for use in connection with their real estate sales businesses. Use of such materials by affiliated brokers and independent sales agents is voluntary and discretionary. Independent sales agents affiliated with a company owned brokerage must complete onboarding training and compliance training related to fair housing (in addition to their state licensing fair housing obligations).

Human Capital Resources

Employees. Our employees are critical to the success of our business strategy. Our team includes a broad range of professionals, given the breadth of services offered by our three business segments and Corporate. The wide array of skills, experience and industry knowledge of our key employees significantly benefits our operations and performance.

At December 31, 2024, we had approximately 7,805 full-time employees and 100 part-time employees. At December 31, 2024, approximately 575 of our employees were located outside of the U.S., almost all of whom were employed by Cartus (a part of Anywhere Brands).

At December 31, 2024, approximately half of our employees continued to work remotely on a full-time basis. Certain employees, in particular consumer-facing employees at our company-owned brokerages, operated in an office-based environment, while other employees worked in a hybrid model.

None of our employees are represented by a union.

To assess and improve employee retention and engagement, we annually survey employees with the assistance of third-party consultants and implement actions to address areas of employee feedback. In 2024, we achieved an 86% engagement score and an 87% response rate.