WisdomTree Emerging Markets ex-State-Owned Enterprises Fund – XSOE (NYSE Arca)

Summary Prospectus – March 15, 2024

Before you invest in the Fund, as defined below, you may want to review the Fund’s prospectus and statement of additional information (“SAI”), which contain more information about the Fund and the risks of investing in the Fund. The Fund’s current prospectus and SAI are incorporated by reference into this summary prospectus. You can find the Fund’s prospectus and SAI, reports to shareholders, as well as other information about the Fund, online at www.wisdomtree.com/investments/resource-library/prospectus-regulatory-reports. You may also obtain this information at no charge by calling 1-866-909-9473 or by sending an e-mail request to getinfo@wisdomtree.com.

Investment Objective

The WisdomTree Emerging Markets ex-State-Owned Enterprises Fund (the “Fund”) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Emerging Markets ex-State-Owned Enterprises Index (the “Index”).

Fees and Expenses of the Fund

The following table describes the fees and expenses you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and example below. The fees are expressed as a percentage of the Fund’s average net assets.

| Shareholder Fees (fees paid directly from your investment) | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |

| Management Fees | 0.32% |

| Distribution and/or Service (12b-1) Fees | None |

| Other Expenses | 0.00% |

| Total Annual Fund Operating Expenses | 0.32% |

Example

The following example is intended to help retail investors compare the cost of investing in the Fund with the cost of investing in other funds. It illustrates the hypothetical expenses that such investors would incur over various periods if they were to invest $10,000 in the Fund for the time periods indicated and then redeem all of their shares at the end of those periods. This example assumes that the Fund provides a return of 5% a year and that operating expenses remain the same. This example does not include the brokerage commissions that retail investors may pay to buy and sell shares of the Fund. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |

| $ 33 | $ 103 | $ 180 | $ 406 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 28% of the average value of its portfolio, excluding the value of portfolio securities received or delivered as a result of in-kind creations or redemptions of the Fund’s capital shares.

| WisdomTree Trust Prospectus 1 |

Principal Investment Strategies of the Fund

The Fund employs a “passive management” – or indexing – investment approach designed to track the performance of the Index. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of the securities in the Index whose risk, return and other characteristics resemble the risk, return, and other characteristics of the Index as a whole. Under normal circumstances, at least 80% of the Fund’s total assets (exclusive of collateral held from securities lending) will be invested in component securities of the Index and investments that have economic characteristics that are substantially identical to the economic characteristics of such component securities.

The Index is a modified float-adjusted market cap weighted index that consists of common stocks in emerging markets, excluding common stocks of “state-owned enterprises.” WisdomTree, Inc. (“WisdomTree”), as Index provider, defines state-owned enterprises as companies with over 20% government ownership. The starting universe for the Index (the “pre-screening universe”) includes companies that: (i) are incorporated or domiciled (i.e., maintain their principal place of business) in one of the following emerging market countries: Argentina, Brazil, Chile, China, Czech Republic, Hungary, India, Indonesia, Korea, Malaysia, Mexico, the Philippines, Poland, Russia, Saudi Arabia, South Africa, Taiwan, Thailand, or Turkey; (ii) list shares on a stock exchange in one of the foregoing emerging market countries or the United States (except Chinese companies may have shares listed in Hong Kong); (iii) have a float-adjusted market capitalization of at least $1 billion as of the Index screening date (“float-adjusted” means that the share amounts reflect only shares available to investors); (iv) have a median daily dollar trading volume of at least $100,000 for the three months preceding the Index screening date; and (v) trade at least 250,000 shares per month or $25 million notional for each of the six months preceding the Index screening date. The Index is comprised of the companies in the pre-screening universe that are not state-owned enterprises as of the annual Index screening date.

Securities are weighted in the Index based on a modified market cap weighting scheme that adjusts the weight of Index securities from each country to approximate the weight of securities from that country in the pre-screening universe (excluding any domestic listed Chinese securities). The weight of Index securities from a single country, however, will not be multiplied by a factor greater than three. After applying the foregoing country weight adjustment, should any sector have a weight that is 3% higher or lower than its pre-screening universe sector weight, such sector’s weight will be adjusted by a factor so that the sector’s weight is 3% higher or lower, respectively, than its pre-screening universe weight. Companies that are not state-owned, but are incorporated within countries that have relatively high government ownership among initial screening constituents, could potentially see higher weights than they would under a normal market cap weighting scheme. Companies that are not state-owned, but are incorporated within countries that have relatively low government ownership among initial screening constituents, could potentially see lower weights than they would under a normal market cap weighting scheme. The Index also may adjust the weight of individual components on the annual screening date based on certain quantitative thresholds or limits tied to key metrics of a component security, such as its market capitalization and trading volume. To the extent the Index reduces an individual component’s weight, the excess weight will be reallocated pro rata among the other components. Similarly, if the Index increases a component’s weight, the weight of the other components will be reduced on a pro rata basis to contribute the weight needed for such increase. The weight of a sector or individual component in the Index may fluctuate above or below specified caps and thresholds, respectively, between screening dates in response to market conditions.

WisdomTree, Inc. (“WisdomTree”), as Index provider, currently uses the Global Industry Classification Standard (GICS®), a widely recognized industry classification methodology developed by MSCI, Inc. and Standard & Poor’s Financial Services LLC, to define companies within a sector. The following sectors are included in the Index: communication services, consumer discretionary, consumer staples, energy, financials, health care, industrials, information technology, materials, real estate, and utilities. A sector is comprised of multiple industries. For example, the energy sector is comprised of companies in the energy equipment and services industry as well as the oil, gas and consumable fuels industry. As of June 30, 2023, companies in the information technology, consumer discretionary, and financials sectors comprised a significant portion (i.e., in excess of 15% of the Index’s total weighting) of the Index; however, the Index's sector exposure may change from time to time.

To the extent the Index concentrates (i.e., holds 25% or more of its total assets) in the securities of a particular industry or group of industries, the Fund will concentrate its investments to approximately the same extent as the Index.

As of June 30, 2023, the equity securities of companies domiciled in or otherwise tied to China, India and Taiwan comprised a significant portion (i.e., in excess of 15% of the Index’s total weighting) of the Index, although the Index’s geographic exposure may change from time to time.

2 WisdomTree Trust Prospectus |

Principal Risks of Investing in the Fund

You can lose money on your investment in the Fund. While certain of the risks are prioritized in terms of their relevance to the Fund’s investment strategies, most risks are presented in alphabetical order. This ordering approach is designed to both facilitate an investor’s understanding of the Fund’s risks and enable an investor to easily locate and compare risks among funds. Each risk summarized below is considered a “principal risk” of investing in the Fund, regardless of the order in which it appears. Some or all of these risks may adversely affect the Fund’s net asset value per share (“NAV”), trading price, yield, total return and/or ability to meet its objective. For more information about the risks of investing in the Fund, see the sections in the Fund’s Prospectus titled “Additional Principal Risk Information About the Funds” and “Additional Non-Principal Risk Information.”

| ■ | Emerging Markets Risk. Investments in securities and instruments traded in developing or emerging markets, or that provide exposure to such securities or markets, can involve additional risks relating to political, economic, or regulatory conditions not associated with investments in U.S. securities and instruments or investments in more developed international markets. Such conditions may impact the ability of the Fund to buy, sell or otherwise transfer securities, adversely affect the trading market and price for Fund shares and cause the Fund to decline in value. |

| ■ | Investment Risk. As with all investments, an investment in the Fund is subject to loss, including the possible loss of the entire principal amount of an investment, over short or long periods of time. |

| ■ | Market Risk. The trading prices of equity securities and other instruments fluctuate in response to a variety of factors, such as economic, financial or political events that impact the entire market, market segments, or specific issuers. The Fund’s NAV and market price may fluctuate significantly in response to these and other factors. As a result, an investor could lose money over short or long periods of time. |

| ■ | Shares of the Fund May Trade at Prices Other Than NAV. As with all exchange-traded funds (“ETFs”), Fund shares may be bought and sold in the secondary market at market prices. The market prices of the Fund’s shares in the secondary market generally differ from the Fund’s daily NAV, and there may be times when the market price of the shares is more than the NAV (premium) or less than the NAV (discount). This risk is heightened in times of market volatility or periods of steep market declines. Because securities held by the Fund trade on, or have exposure to, foreign exchanges that are closed when the Fund’s primary listing exchange is open, the Fund is likely to experience premiums and discounts greater than those of domestic ETFs. Additionally, in stressed market conditions, the market for the Fund’s shares may become less liquid in response to deteriorating liquidity in the markets for the Fund’s underlying portfolio holdings. |

| ■ | Capital Controls and Sanctions Risk. Economic conditions, such as volatile currency exchange rates and interest rates, political events, military action and other conditions may, without prior warning, lead to foreign government intervention (including intervention by the U.S. government with respect to foreign governments, economic sectors, foreign companies and related securities and interests) and the imposition of capital controls and/or sanctions, which may also include retaliatory actions of one government against another government, such as seizure of assets. Capital controls and/or sanctions include the prohibition of, or restrictions on, the ability to own or transfer currency, securities or other assets, which may potentially include derivative instruments related thereto. Capital controls and/or sanctions may also impact the ability of the Fund to buy, sell, transfer, receive, deliver or otherwise obtain exposure to, foreign securities or currency, negatively impact the value and/or liquidity of such instruments, adversely affect the trading market and price for shares of the Fund, and cause the Fund to decline in value. |

| ■ | Cash Redemption Risk. The Fund generally redeems shares for cash or otherwise includes cash as part of its redemption proceeds. The Fund may be required to sell or unwind portfolio investments to obtain the cash needed to distribute redemption proceeds. This may cause the Fund to recognize a capital gain that it might not have recognized if it had made a redemption in kind. As a result, the Fund may pay out higher annual capital gain distributions than if the Fund redeemed shares in kind. |

| ■ | Consumer Discretionary Sector Risk. The Fund currently invests a significant portion of its assets in the consumer discretionary sector, and therefore, the Fund’s performance could be negatively impacted by events affecting this sector. The consumer discretionary sector includes, for example, automobile, textile and retail companies, as well as hotels, restaurants and other leisure facilities. This sector can be significantly affected by, among other things, changes in domestic and international economies, exchange and interest rates, economic growth, worldwide demand, supply chain constraints, social trends, consumers’ disposable income levels, and propensity to spend. |

| WisdomTree Trust Prospectus 3 |

| ■ | Currency Exchange Rate Risk. Changes in currency exchange rates and the relative value of non-U.S. currencies will affect the value of the Fund’s investment and the value of your Fund shares. Currency exchange rates can be very volatile and can change quickly and unpredictably. As a result, the value of an investment in the Fund may also change quickly, unpredictably, and without warning, and you may lose money. |

| ■ | Cybersecurity Risk. The Fund and its service providers may be susceptible to operational and information security risks resulting from a breach in cybersecurity, including cyber-attacks. A breach in cybersecurity, intentional or unintentional, may adversely impact the Fund in many ways, including, but not limited to, disruption of the Fund’s operational capacity, loss of proprietary information, theft or corruption of data, denial-of-service attacks on websites or network resources, and the unauthorized release of confidential information. Cyber-attacks affecting the Fund’s third-party service providers, market makers, institutional investors authorized to purchase and redeem shares directly from the Fund (i.e., Authorized Participants), or the issuers of securities in which the Fund invests may subject the Fund to many of the same risks associated with direct cybersecurity breaches. |

| ■ | Financials Sector Risk. The Fund currently invests a significant portion of its assets in the financials sector, and therefore, the Fund’s performance could be negatively impacted by events affecting this sector. The financials sector includes, for example, companies engaged in banking, financial services, consumer finance, capital markets and insurance activities as well as financial exchanges, financial data providers and mortgage real estate investment trusts. This sector can be significantly affected by, among other things, changes in interest rates, government regulation, the rate of defaults on corporate, consumer and government debt, and the availability and cost of capital. |

| ■ | Foreign Securities Risk. Investments in non-U.S. securities involve political, regulatory, and economic risks that may not be present in U.S. securities. For example, investments in non-U.S. securities may be subject to risk of loss due to foreign currency fluctuations, political or economic instability, or geographic events that adversely impact issuers of foreign securities. Investments in non-U.S. securities also may be subject to withholding or other taxes and may be subject to additional trading, settlement, custodial, and operational risks. These and other factors can make investments in the Fund more volatile and potentially less liquid than other types of investments and may be heightened in connection with investments in developing or emerging markets countries. |

| ■ | Geographic Investment Risk. To the extent the Fund invests a significant portion of its assets in securities of companies of a single country or region, it is more likely to be impacted by events or conditions affecting that country or region. |

Investments in China

Although the Chinese economy has grown rapidly during recent years and the Chinese government has implemented significant economic

reforms to liberalize trade policy, promote foreign investment, and reduce government control of the economy, there can be no guarantee

that economic growth or these reforms will continue. The Chinese economy may also experience a decline in its growth rate if global or

domestic demand for Chinese goods decreases significantly and/or key trading partners apply trade tariffs or implement other protectionist

measures, including measures implemented in connection with ongoing tensions between China and the United States. The Chinese economy

is susceptible to rising rates of inflation, economic recession, market inefficiency, volatility, and pricing anomalies that may be connected

to governmental influence, a lack of publicly-available information and/or political and social instability. The government of China maintains

strict currency controls in order to achieve economic, trade and political objectives and regularly intervenes in the currency market.

The Chinese government also plays a major role in the country’s economic policies regarding foreign investments. Foreign investors

are subject to the risk of loss from expropriation or nationalization of their investment assets and property and governmental restrictions

on foreign investments and the repatriation of capital invested. These risks may be exacerbated by actions by the U.S. government, such

as the recent delisting from U.S. national securities exchanges of certain Chinese companies. The Chinese government also may intervene

or seek to control the operations, structure, or ownership of Chinese companies, including with respect to foreign investors of such companies.

For example, the Fund may invest to a significant extent in variable interest entity (“VIE”) structures. VIE structures can

vary, but generally consist of a U.S.-listed company with contractual arrangements, through one or more wholly-owned special purpose vehicles,

with a Chinese company that ultimately provides the U.S.-listed company with contractual rights to exercise control over and obtain economic

benefits from the Chinese company. The VIE structure enables foreign investors, such as the Fund, to obtain investment exposure similar

to that of an equity owner in a Chinese company in situations in which the Chinese government has restricted or prohibited the ownership

of such company by foreign investors. As a result, an investment in a VIE structure subjects the Fund to the risks

4 WisdomTree Trust Prospectus |

associated with the underlying Chinese company. Intervention by the Chinese government into the operation or ownership of VIE structures could significantly and adversely affect the Chinese company’s performance and thus, the value of the Fund’s investment in the VIE, as well as the enforceability of the VIE contractual arrangements with the underlying Chinese company. In the event of such an occurrence, the Fund, as a foreign investor, may have little or no legal recourse. The Fund’s investment in a VIE structure is also subject to the risk that the underlying Chinese company (or its officers, directors, or Chinese equity owners) may breach its contractual arrangements with the other entities in the VIE structure, or Chinese law changes in a way that adversely affects the enforceability of these arrangements, or those contracts are otherwise not enforceable under Chinese law, in which case the Fund may suffer significant losses on its VIE investments with little or no recourse available. The regulatory requirements applicable to Chinese companies, including accounting standards and auditor oversight, generally are not comparable to those applicable to U.S. companies or companies organized and operating in more developed countries. As a result, information about the Chinese companies in which the Fund invests may be less reliable or incomplete. The lack of available information may be a significant obstacle to pursuing investigations into or litigation against Chinese companies, and as a shareholder, the Fund may have limited legal remedies. The Chinese securities markets are subject to more frequent trading halts and low trading volume, resulting in substantially less liquidity and greater price volatility. These and other factors could have a negative impact on the Fund’s performance and increase the volatility of an investment in the Fund.

Investments in India

Political and economic conditions and changes in regulatory, tax, or economic policy in India could significantly affect the market

in India and in surrounding or related countries and could have a negative impact on the Fund. While the Indian government has implemented

reforms designed to liberalize many aspects of India's economy, there is not assurance that these policies will be successful or continue.

Indian is also subject to religious and social unrest as well as border disputes with neighboring countries such as Pakistan and China.

Investments in Taiwan

The economy of Taiwan is heavily dependent on exports. Currency fluctuations, increasing competition from Asia’s other emerging

economies, and conditions that weaken demand for Taiwan’s export products worldwide could have a negative impact on the Taiwanese

economy as a whole. Concerns over Taiwan’s history of political contention and its current relationship with China may also have

a significant impact on the economy of Taiwan.

| ■ | Geopolitical Risk. Some countries and regions in which the Fund invests have experienced security concerns, war, threats of war, aggression and/or conflict, terrorism, economic uncertainty, sanctions or the threat of sanctions, natural and environmental disasters, the spread of infectious illness, widespread disease or other public health issues and/or systemic market dislocations (including due to events outside of such countries or regions) that have led, and in the future may lead, to increased short-term market volatility and may have adverse long-term effects on the U.S. and world economies and markets generally, each of which may negatively impact the Fund’s investments. |

| ■ | Index and Data Risk. The Fund is not “actively” managed and seeks to track the price and yield performance, before fees and expenses, of the Index. The Index may not perform as intended. The Index provider has the right to make adjustments to the Index or to cease making the Index available without regard to the particular interests of the Fund or its shareholders. If the computers or other facilities of the Index provider, Index calculation agent, data providers and/or relevant stock exchange malfunction for any reason, calculation and dissemination of Index values may be delayed and trading in Fund shares may be suspended for a period of time. Errors in Index data, Index calculations and/or the construction of the Index may occur from time to time and may not be identified and/or corrected by the Index provider, Index calculation agent or other applicable party for a period of time or at all, which may have an adverse impact on the Fund and its shareholders. The potential risk of continuing error may be particularly heightened in the case of the Index, which is generally not used as a benchmark by other funds or managers. |

| ■ | Information Technology Sector Risk. The Fund currently invests a significant portion of its assets in the information technology sector, and therefore, the Fund’s performance could be negatively impacted by events affecting this sector. The information technology sector includes, for example, companies that offer software and information technology services, manufacturers and distributors of technology hardware and equipment such as communications equipment, cellular phones, computers and peripherals, electronic equipment and related |

| WisdomTree Trust Prospectus 5 |

| instruments, and semiconductors and related equipment and materials. This sector can be significantly affected by, among other things, the supply and demand for specific products and services, the pace of technological development, and government regulation. |

| ■ | Investment Style Risk. The Fund invests in the securities included in, or representative of, the Index regardless of their investment merit. The Fund does not attempt to outperform the Index or take defensive positions in declining markets. As a result, the Fund’s performance may be adversely affected by a general decline in the market segments relating to the Index. |

| ■ | Issuer-Specific Risk. Issuer-specific events, including changes in the actual or perceived financial condition of an issuer, can have a negative impact on the value of the Fund. |

| ■ | Large-Capitalization Investing Risk. The Fund may invest in the securities of large-capitalization companies. As a result, the Fund’s performance may be adversely affected if securities of these companies underperform securities of smaller capitalization companies or the market as a whole. Large-capitalization companies may adapt more slowly to new competitive challenges and be subject to slower growth during times of economic expansion. |

| ■ | Mid-Capitalization Investing Risk. The Fund may invest in the securities of mid-capitalization companies. As a result, the Fund’s performance may be adversely affected if securities of these companies underperform securities of other capitalization ranges or the market as a whole. Securities of mid-capitalization companies are often less stable and more vulnerable to market volatility and adverse economic developments than securities of larger companies, but mid-capitalization companies may also underperform the securities of small-capitalization companies because medium capitalization companies are more mature and are subject to slower growth during economic expansion. |

| ■ | Non-Correlation Risk. As with all index funds, the performance of the Fund and that of its Index may differ from each other for a variety of reasons. For example, the Fund incurs operating expenses and portfolio transaction costs, while also managing cash flows and potential operational inefficiencies, not incurred by its Index. In addition, when markets are volatile, the ability to sell securities at fair market prices may be adversely affected and may result in additional trading costs and/or increase the non-correlation risk. The Fund's use of sampling techniques also may affect its ability to achieve close correlation with its Index. |

| ■ | Non-Diversification Risk. The Fund is considered to be non-diversified, which means that it may invest more of its assets in the securities of a single issuer or a smaller number of issuers than if it were a diversified fund. To the extent the Fund invests a significant percentage of its assets in a limited number of issuers, the Fund is subject to the risks of investing in those few issuers, and may be more susceptible to a single adverse economic or regulatory occurrence. As a result, changes in the market value of a single security could cause greater fluctuations in the value of Fund shares than would occur in a diversified fund. |

Fund Performance

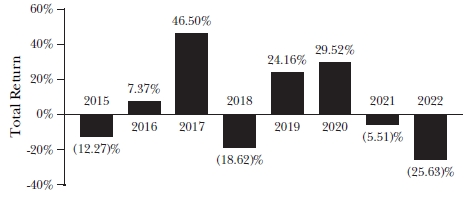

Historical Fund performance, which varies over time, can provide an indication of the risks of investing in the Fund. The bar chart that follows shows the annual total returns of the Fund for each full calendar year since the Fund commenced operations, or the past 10 calendar years, as applicable. The table that follows the bar chart shows the Fund’s average annual total returns, both before and after taxes. This table also shows how the Fund’s performance compares to the Index and the MSCI Emerging Markets Index, a relevant broad-based securities index. Index returns do not reflect deductions for fees, expenses or taxes. All returns assume reinvestment of dividends and distributions. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information for the Fund is available online on the Fund’s website at www.wisdomtree.com/investments.

6 WisdomTree Trust Prospectus |

The Fund’s year-to-date total return as of June 30, 2023 was 4.16%.

Best and Worst Quarter Returns (for the periods reflected in the bar chart above)

| Return | Quarter/Year | |

| Highest Return | 22.86% | 2Q/2020 |

| Lowest Return | (21.32)% | 1Q/2020 |

After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your tax situation and may differ from those shown and are not relevant if you hold your shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the return after taxes may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

| WisdomTree Trust Prospectus 7 |

Average Annual Total Returns for the periods ending December 31, 2022

| WisdomTree Emerging Markets ex-State-Owned Enterprises Fund | 1 Year | 5 Years | Since Inception December 10, 2014 |

| Return Before Taxes Based on NAV | (25.63)% | (1.66)% | 2.92% |

| Return After Taxes on Distributions | (25.96)% | (1.96)% | 2.61% |

| Return After Taxes on Distributions and Sale of Fund Shares | (14.76)% | (1.13)% | 2.39% |

| WisdomTree Emerging Markets ex-State-Owned Enterprises Index (Reflects no deduction for fees, expenses or taxes) | (25.06)% | (1.12)% | 3.85% |

| MSCI Emerging Markets Index (Reflects no deduction for fees, expenses or taxes) | (20.09)% | (1.40)% | 2.39% |

Management

Investment Adviser and Sub-Adviser

WisdomTree Asset Management, Inc. (“WisdomTree Asset Management” or the “Adviser”) serves as investment adviser to the Fund. Mellon Investments Corporation (the “Sub-Adviser”) serves as sub-adviser to the Fund.

Portfolio Managers

The Fund is managed by the Sub-Adviser’s Equity Index Strategies Portfolio Management team. The individual members of the team jointly and primarily responsible for the day-to-day management of the Fund’s portfolio are identified below.

Marlene Walker-Smith, a Director, Head of Equity Index Portfolio Management, has been a portfolio manager of the Fund since October 2020.

David France, CFA, a Vice President, Senior Portfolio Manager and Team Manager, has been a portfolio manager of the Fund since June 2021.

Todd Frysinger, CFA, a Vice President, Senior Portfolio Manager and Team Manager, has been a portfolio manager of the Fund since June 2021.

Vlasta Sheremeta, CFA, a Vice President, Senior Portfolio Manager and Team Manager, has been a portfolio manager of the Fund since June 2021.

Michael Stoll, a Vice President, Senior Portfolio Manager and Team Manager, has been a portfolio manager of the Fund since June 2021.

Buying and Selling Fund Shares

The Fund is an ETF. This means that individual shares of the Fund are listed on a national securities exchange, such as NYSE Arca, and may only be purchased and sold in the secondary market through a broker-dealer at market prices. Because Fund shares trade at market prices rather than NAV, shares may trade at a price greater than NAV (premium) or less than NAV (discount). In addition, an investor may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase shares (bid) and the lowest price a seller is willing to accept for shares (ask) when buying and selling shares in the secondary market (the “bid/ask spread”). Recent information regarding the Fund, including its NAV, market price, premiums and discounts, and bid/ask spreads, is available on the Fund’s website at www.wisdomtree.com/investments.

The Fund issues and redeems shares at NAV only in large blocks of shares (“Creation Units”), which only certain institutions or large investors (typically market makers or other broker-dealers) may purchase or redeem. The Fund issues and redeems Creation Units in exchange for a portfolio of securities and/or U.S. cash.

Tax Information

The Fund intends to make distributions that may be taxed as ordinary income, qualified dividend income, or capital gains.

8 WisdomTree Trust Prospectus |

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank) (an “Intermediary”), WisdomTree Asset Management or its affiliates may pay Intermediaries for certain activities related to the Fund, including participation in activities that are designed to make Intermediaries more knowledgeable about exchange-traded products, including the Fund, or for other activities, such as marketing, educational training or other initiatives related to the sale or promotion of Fund shares. These payments may create a conflict of interest by influencing the Intermediary and your salesperson to recommend the Fund over another investment. Any such arrangements do not result in increased Fund expenses. Ask your salesperson or visit the Intermediary’s website for more information.

WisdomTree Trust Prospectus 9 |

(This page intentionally left blank.)

(This page intentionally left blank.)

WIS-XSOE-SUM-0324