2024 Proxy Statement

and Notice of Annual Meeting

| Filed by the Registrant | ☒ | |

| Filed by a Party other than the Registrant | ☐ | |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Rule Sec.240.14a-12 |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials: |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

2024 Proxy Statement

and Notice of Annual Meeting

| ||

| Dear Fellow Stockholders,

Celsius became a billion-dollar-revenue brand in 2023, achieving what few other beverage companies have ever accomplished, thanks to a winning combination of the right product for today’s health-minded consumers, the best team, and committed, long-term supporters like you, our stockholders. The Celsius brand stands for Living Fit, and billions of cans of Celsius have been enjoyed by millions of consumers who aspire to find and lead their own fit lifestyles. We're on a mission to inspire millions more consumers to do the same. | ||

Celsius today holds the #3 share position among energy drink brands in the United States. More than 75% of our growth has been incremental to the category, appealing to both entry-point consumers and older cohorts seeking better-for-you, functional beverages that taste great. Celsius is available to more consumers today than at any point in our brand’s history with 98% ACV, the percentage of all tracked retail locations where a Celsius has been sold.

We finished 2023 with more than 100% revenue growth as compared to 2022. We believe that our ongoing growth drivers remain strong, our foundation for growth is solid, and we’re optimistic for the growth that is yet to come.

FINANCIAL PERFORMANCE: Celsius continued to improve across the most meaningful metrics to our business in 2023.

| • | Increased gross margin by 660 bps year-over-year to end 2023 at 48.0%. Improvements came from raw material savings as well as benefits of scale. |

| • | Achieved record annual revenue of $1,318 million, up 102% from $654 million for 2022. |

| • | Achieved net income of $227 million, up from a loss of $187 million in 2022. |

| • | Achieved net income attributed to common stockholders of $182 million, up from a loss of $199 million in 2022. |

| • | Achieved $295.6 million in Adjusted EBITDA(1), a 316% increase over 2022. |

CHANNEL GROWTH: Meaningful growth continued across all channels with notable bright spots in the convenience and gas channel as well as distinctive penetration in food service.

| • | Club channel revenue increased 83.6% in 2023 versus a year ago, representing more than $250 million in revenue. |

| • | Celsius achieved the #1 position on Amazon in 2023, representing a 20% share of the energy drink category. |

| • | We believe that our growth potential remains very strong within the convenience and gas channel, where Celsius derived just 55% percent of our revenue, compared to a category average of roughly 70%. |

| • | Food service performed well for Celsius in 2023, as we debuted in more than 2,700 Jersey Mike’s locations and secured authorization to be sold in more than 3,000 Dunkin’ Donuts stores. |

| • | Colleges, universities and vending remain healthy growth areas for the brand, which is highly popular among students seeking no-crash, cleaner-energy drink options. |

BRAND GROWTH: We continue to invest in growing our brand awareness, especially among under-penetrated consumer groups and geographies. Accordingly, we entered into multi-national brand marketing partnerships with the Scuderia Ferrari Formula 1 racing team and Major League Soccer to support our international expansion.

| • | We are engaging more consumers in more places through a growing Celsius University program, which increased participants nearly three-fold in 2023. Celsius student marketing ambassadors drive on-campus trial and gain meaningful career experience through personal ownership of their goals and performance. |

| • | Growing our Scuderia Ferrari Formula 1 team sponsorship from a U.S. footprint in 2023 to become an official global Team Partner for 2024 and beyond, supporting our growing international brand presence. |

| • | Diversifying our professional sports sponsorship program through a Major League Soccer partnership as well as with several MLS teams, including our own hometown favorite, Inter Miami CF. |

| • | Driving relevance with our core consumers through ongoing support within the fitness community, including leading gyms, athletes, trainers and influential industry figures. |

| • | Supporting our consumers’ passion for live music experiences with owned, branded music properties and better-for-you beverage options at leading music festivals to create positive, lasting memories. |

INNOVATION GROWTH: Celsius continued strong flavor and package size innovation in 2023 within an energy drink category that has approached near sales parity between sugar-free and full-sugar varieties. All Celsius energy products remain sugar-free as they’ve been since our founding nearly 20 years ago.

| • | Celsius ESSENTIALS debuted to great acclaim in the fourth quarter of 2023 with four, 16-ounce, performance-forward varieties. This fast-growing line achieved 40% ACV by January of 2024. |

| • | We kept our Celsius core and Celsius Vibe lines fresh and refreshing with successful additions, including Celsius Sparkling Green Apple Cherry and Celsius Cosmic Vibe. |

| • | Celsius On The Go Powders rose to the top category position in energy powders in early 2024, and several new additions, including Celsius Strawberry Coconut Energy Powder, continued to provide Essential Energy to a loyal energy powders consumer base. |

DISTRIBUTION GROWTH: Our reach across the United States and among sales channels strengthened in 2023 to achieve near complete distribution by the end of the year thanks to our strong and growing Celsius sales organization and PepsiCo partnership.

| • | We cycled a full year together with our partner PepsiCo, which has enabled our refreshing products to reach more shelves, especially among independent convenience stores and in the food service channel. Together, our teams work tirelessly to keep Celsius stacked high and kept cold with great in-store visibility. |

| • | We announced methodical international expansion plans, beginning with Canada, alongside PepsiCo as our distribution partner. Sales in Canada began in January 2024, and we announced additional international growth plans for the United Kingdom, Ireland, France, Australia and New Zealand. |

FUTURE GROWTH DRIVERS: Looking further into 2024, we’re optimistic consumer taste and preference for Celsius will continue to fuel our growth. We expect that investment in our operations and marketing will continue at similar levels as we introduce the brand to more consumers across more consumption occasions in more geographies.

| • | Retailer shelf resets conducted in the spring provide opportunities for increased total distribution points (TDPs), improved placements and additional SKU counts per store. |

| • | We’re pursuing excellent in-store execution by over-indexing in displays and Celsius-branded coolers to place Celsius in more and better locations resulting in increased points of interruption on the shopper’s journey. |

| • | Product innovation is expected to delight consumers with more refreshing flavors across our Celsius core, Celsius Vibe, Celsius Fizz Free, Celsius ESSENTIALS and Celsius On The Go Powders lines. |

| • | The food service channel and meal occasion are strengths to continue leveraging due to Celsius’ unique combination of great taste, functionality and better-for-you positioning sought by today’s consumers. |

| • | We have planned continued international expansion in 2024 at a methodical pace and measured investment level. |

| • | Continued focus on operational excellence designed to drive efficiency, provide best-in-class service, and support our pursuit of being a great place to work for high-performing talent. |

Celsius’ strong past performance and exciting path forward reflect the professionalism and deep industry experience of our company’s leaders. Every day I learn something new, and increasingly it is our own talented team who teach me how to be a better leader and steward of this incredible brand. There is no shortage of passion and energy among our talented team members who inspire me to fervently continue advancing our journey to become the #1 energy drink brand in the world.

Thank you for your continued confidence in Celsius and the investment you’ve made in our success. Stay healthy and Live Fit.

John Fieldly

Chairman of the Board of Directors and Chief Executive Officer

| (1) | Adjusted EBITDA is a non-GAAP financial measure. For a description of the rationale for presenting Adjusted EBITDA and a reconciliation of net income to Adjusted EBITDA, please see Annex A to this Proxy Statement. |

CELSIUS HOLDINGS, INC.

2424 N. Federal Highway, Suite 208

Boca Raton, Florida 33431

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on May 28, 2024

To our Stockholders:

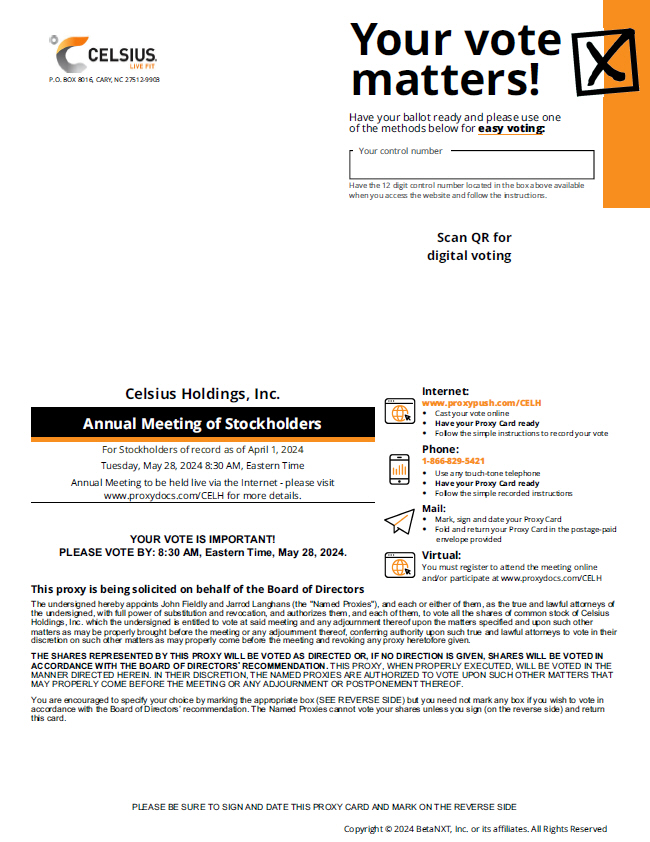

On behalf of the Board of Directors, it is my pleasure to invite you to attend the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Celsius Holdings, Inc., a Nevada corporation (the “Company”), which will be held at 8:30 a.m., Eastern Time on May 28, 2024. The Annual Meeting will be held entirely virtually.

You may register to attend the virtual Annual Meeting via the Internet at https://www.proxydocs.com/CELH. You will then receive a registration confirmation email, with details on how to attend the meeting.

The Annual Meeting will be held for the following purposes, which are more fully described in the accompanying proxy statement:

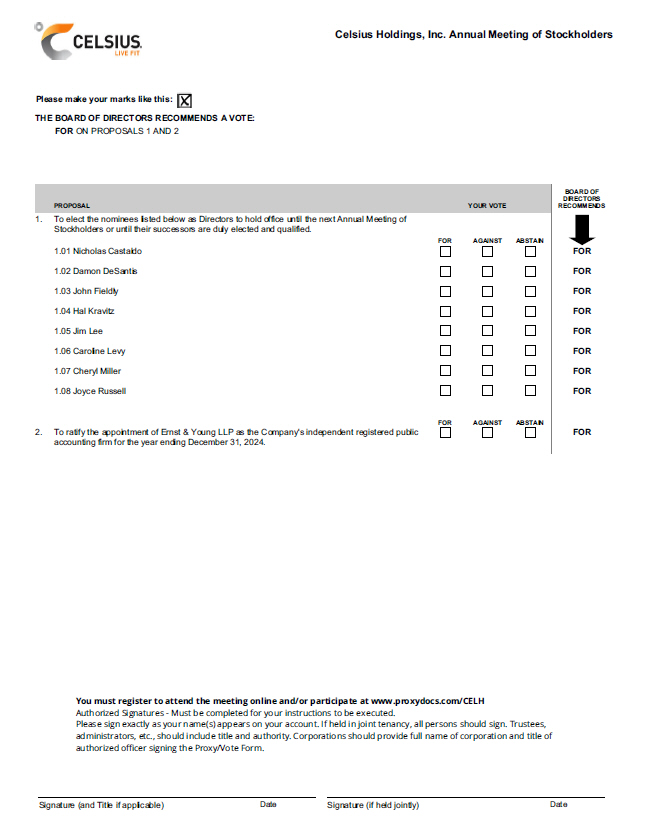

| 1. | To vote to elect as directors the eight nominees named in the attached proxy statement to serve until the 2025 annual meeting of stockholders and until their respective successors are duly elected and qualified; |

| 2. | To ratify the appointment of Ernst & Young LLP (“Ernst & Young”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024; and |

| 3. | To transact such other business as may be properly brought before the Annual Meeting and any adjournments thereof. |

The Board of Directors of the Company has fixed the close of business on April 1, 2024 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and at any adjournments thereof. Accordingly, you may attend virtually and vote your common stock at the Annual Meeting if you were a record owner of the Company’s common stock at the close of business on April 1, 2024.

We are mailing a Notice of Internet Availability of Proxy Materials (“Notice”) to our stockholders as of the Record Date instead of paper copies of our proxy statement and 2023 annual report. The Notice contains instructions on how to access those documents via the Internet. The Notice also contains instructions on how stockholders can receive a paper copy of our proxy materials, including the proxy statement, our 2023 annual report and proxy card. The Notice is first being mailed, and the proxy statement, 2023 annual report, and form of proxy are being distributed to stockholders of record as of the Record Date and made available on the Internet on or about April 12, 2024.

It is important that you cast your vote either by remote communication at the Annual Meeting or by proxy. You may vote your shares (1) at the virtual meeting, (2) by telephone, (3) on the Internet or (4) by completing and mailing a proxy card if you receive your proxy materials by mail. For instructions on how to vote your shares, please see the instructions from your broker or other fiduciary, as applicable, as well as the section titled “General Information About the Annual Meeting” of the accompanying proxy statement. If you decide to change your vote, you may revoke your proxy in the manner described in the accompanying proxy statement at any time before it is voted. You are urged to vote in accordance with the instructions set forth in the proxy statement. If you have questions about voting your shares, please contact our Corporate Secretary at Celsius Holdings, Inc., 2424 N. Federal Highway, Suite 208, Boca Raton, Florida 33431, telephone number (561) 276-2239. Whether or not you expect to virtually attend the Annual Meeting, please vote at your earliest convenience by following the instructions in the Notice or the proxy card you received in the mail.

Thank you for your continued support of Celsius Holdings, Inc. We look forward to your participation in the Annual Meeting.

| Dated: April 12, 2024 | By Order of the Board of Directors of Celsius Holdings, Inc. | |

| Sincerely, | ||

|

| ||

| Richard S. Mattessich | ||

| Corporate Secretary | ||

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON MAY 28, 2024 AT 8:30 A.M. EASTERN TIME:

The Notice of Internet Availability of Proxy Materials, Notice of Meeting, Proxy Statement and 2023 Annual Report to Stockholders, and the means to vote are available free of charge at https://www.proxydocs.com/CELH

REFERENCES TO ADDITIONAL INFORMATION

This proxy statement incorporates by reference important business and financial information about Celsius Holdings, Inc. that is not included in or delivered with this document. You may obtain this information without charge through the Securities and Exchange Commission website (www.sec.gov) or upon your written or oral request by contacting the Corporate Secretary of Celsius Holdings, Inc., at 2424 N. Federal Highway, Suite 208, Boca Raton, Florida 33431, telephone number (561) 276-2239.

Table of Contents

| Page | ||

| 1 | ||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

7 | |

| 10 | ||

| 11 | ||

| INFORMATION ABOUT THE BOARD OF DIRECTORS, COMMITTEES AND CORPORATE GOVERNANCE |

14 | |

| 22 | ||

| 38 | ||

| 49 | ||

| 51 | ||

| 52 | ||

| 53 | ||

| 54 | ||

| 54 | ||

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

CELSIUS HOLDINGS, INC.

2424 N. Federal Highway, Suite 208

Boca Raton, Florida 33431

(561) 276-2239

PROXY STATEMENT

Annual Meeting of Stockholders to be Held on May 28, 2024

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

This proxy statement, along with the accompanying Notice of the Annual Meeting of Stockholders, contains information about the 2024 Annual Meeting of Stockholders of Celsius Holdings, Inc., including any adjournments or postponements thereof (the “Annual Meeting”). The Annual Meeting will be held at 8:30 a.m. Eastern Time on May 28, 2024, or such later date or dates as such Annual Meeting date may be adjourned.

When used in this proxy statement, unless otherwise indicated, the terms “the Company,” “Celsius,” “we,” “us” and “our” refer collectively to Celsius Holdings, Inc. and its subsidiaries.

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), the Company uses the Internet as the primary means of furnishing proxy materials to its stockholders. Accordingly, the Company is sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to the Company’s stockholders. The Notice, proxy statement, form of proxy and our 2023 Annual Report are first being distributed and made available to stockholders via the Internet on or about April 12, 2024, to all stockholders of record as of April 1, 2024, who are entitled to virtually attend and vote at the Annual Meeting. This proxy statement has been prepared by the management of Celsius Holdings, Inc.

You are encouraged to read this proxy statement, our 2023 Annual Report and form of proxy carefully and in their entirety and submit your proxy as soon as possible so that your shares can be voted at the Annual Meeting in accordance with your instructions. Even if you plan to attend the Annual Meeting virtually, you are encouraged to submit your vote promptly. You have a choice of submitting your proxy by Internet, by telephone, or by mail, and the proxy materials provide instructions for each option.

The Board of Directors of the Company (the “Board of Directors” or the “Board”) is soliciting proxies, in the accompanying form, to be used at the Annual Meeting and any adjournments thereof.

Why is this year’s Annual Meeting being held in a virtual format?

In an effort to ensure that all stockholders have an opportunity to attend our Annual Meeting and minimize potential travel burdens, our Board of Directors has determined to hold our Annual Meeting by remote communication via webcast. Stockholders may attend the Annual Meeting via webcast, regardless of location.

How can I participate in the Annual Meeting?

You can register to attend the virtual Annual Meeting by accessing the Annual Meeting URL at https://www.proxydocs.com/CELH. You will then receive a registration confirmation email, with details on how to attend the meeting.

The Annual Meeting will begin promptly at 8:30 a.m. Eastern Time on May 28, 2024. Online access will be available beginning at 8:15 a.m. Eastern Time for you to obtain your information and you will be able to vote your shares online until 8:30 a.m. should you not have done so previously. We encourage you to access the Annual Meeting webcast prior to the start time.

Rules for the virtual meeting will be no different than if it were solely an in-person meeting. Professional conduct is appreciated and all question and answer sessions will be conducted at the appropriate time.

|

|

2024 PROXY STATEMENT |

1 |

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

How can I ask questions during the Annual Meeting?

You can submit questions when registering for the Annual Meeting, or during the virtual meeting by using the Q&A tab. You must first join the Annual Meeting as described above in “How can I participate in the Annual Meeting?”

Who Can Vote?

Stockholders who owned shares of the Company’s common stock, par value $0.001 per share (“common stock”), at the close of business on April 1, 2024 (the “Record Date”), are entitled to virtually attend and vote at the Annual Meeting. As of the Record Date, there were 233,070,146 shares of common stock outstanding and entitled to vote.

You do not need to attend the Annual Meeting virtually to vote your shares. Shares represented by valid proxies, received in time for the Annual Meeting and not revoked prior to the Annual Meeting, will be voted at the Annual Meeting. A stockholder may revoke a proxy before the proxy is voted by delivering to our Secretary a signed statement of revocation or a duly executed proxy card bearing a later date. Any stockholder who has executed a proxy card but attends the Annual Meeting may revoke the proxy and vote at the Annual Meeting.

How Many Votes Do I Have?

Each share of common stock that you own entitles you to one vote.

How Do I Vote?

Whether you plan to attend the Annual Meeting virtually or not, we urge you to vote by proxy. All shares represented by valid proxies that we receive through this solicitation, and that are not validly revoked, will be voted in accordance with your instructions on the proxy card or as instructed via the Internet or telephone. You may specify whether your shares should be voted “for” a proposal or nominee for director, “against” a proposal or nominee or director, or whether you abstain from voting “for” or “against” any proposal or nominee for director. Except as set forth below, if you properly submit a proxy without giving specific voting instructions, your shares will be voted in accordance with the Board’s recommendations as noted below. Voting by proxy will not affect your right to attend the Annual Meeting. If your shares are registered directly in your name through our stock transfer agent, Direct Transfer LLC, or you have stock certificates, you may vote:

| • | By mail. You may complete and mail the proxy card in the postage prepaid envelope we will provide. Your proxy will be voted in accordance with your instructions. If you sign the proxy card, but do not specify how you want your shares voted, they will be voted as recommended by the Board. |

| • | By Internet or by telephone. You may vote via the Internet by visiting https://www.proxypush.com/CELH or by telephone by calling 1-866-829-5421. |

| • | By remote communication at the Annual Meeting. You may vote at the virtual Annual Meeting using the unique link that will be provided to you by email one hour prior to the meeting. |

If your shares are held in “street name” (i.e., held in the name of a bank, broker or other nominee), then you must provide your bank, broker or other nominee with instructions on how to vote your shares and can do so as follows:

| • | By Internet or by telephone. Follow the instructions you receive from your broker or other nominee to vote by Internet or telephone. |

| • | By mail. Follow the instructions you receive from your broker or other nominee. |

| • | By virtually attending the Annual Meeting. Contact your broker or other nominee who holds your shares to obtain a broker’s proxy card and present it to the inspector of election with your ballot when you vote at the Annual Meeting virtually. You will not be able to attend the Annual Meeting virtually unless you have a proxy card from your broker. |

| 2 | 2024 PROXY STATEMENT |

|

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

How Does the Board Recommend That You Vote on the Proposals?

The Board recommends that you vote as follows:

| • | “FOR” the election of the Board nominees identified in this proxy statement; and |

| • | “FOR” the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024. |

If any other matter is property presented at the Annual Meeting, then the proxy card provides that your shares will be voted by the proxy holder listed on the proxy card in accordance with his or her best judgment. As of the date of this proxy statement, we knew of no matters to be acted on at the Annual Meeting, other than those described in this proxy statement.

May I Change or Revoke My Proxy?

You may change or revoke your proxy at any time before the Annual Meeting. You may change or revoke your proxy in any one of the following ways:

| • | signing a new proxy card and submitting it as instructed above; |

| • | if your shares are held in street name, re-voting by Internet or by telephone as instructed above – only your latest Internet or telephone vote will be counted; |

| • | if your shares are registered in your name, notifying the Company’s Corporate Secretary in writing before the Annual Meeting that you have revoked your proxy; or |

| • | voting virtually at the Annual Meeting. |

What If I Receive More Than One Proxy Card?

You may receive more than one proxy card or voting instruction form if you hold shares of our common stock in more than one account, which may be in registered form or held in street name. Please vote in the manner described above or under “Voting Instructions” on the proxy card for each account to ensure that all your shares are voted.

Will My Shares Be Voted If I Do Not Return My Proxy Card? What is the Effect of a “Broker Non-Vote”?

If your shares are registered in your name or if you have stock certificates, they will not be voted if you do not return your proxy card by mail or vote at the Annual Meeting as described above under “How Do I Vote?”

If your shares are held by a bank, broker or other nominee, then that nominee may vote your shares on “routine” matters. Brokerage firms have discretionary authority under applicable stock exchange rules to vote their customers’ shares in the brokerage firms’ discretion on “routine” matters if their customers do not provide voting instructions. When a brokerage firm votes its customers’ shares on a routine matter without receiving voting instructions (referred to as a “broker vote”), these shares are counted both for establishing a quorum to conduct business at the Annual Meeting and in determining the number of shares voted “FOR” or “AGAINST” the routine matter. For purposes of the Annual Meeting, the proposal to ratify Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024 (Proposal 2) is a “routine” matter.

However, a broker may not vote on a “non-routine” matter if the applicable beneficial owner of the shares of common stock has not provided voting instructions. A “broker non-vote” generally occurs when a broker delivers a proxy but cannot vote the shares represented by that proxy on a particular matter because it has not received voting instructions from the beneficial owner and does not have discretionary voting power on that matter (or the broker chooses not to vote on a matter for which it does have discretionary voting authority). Broker non-votes are counted for purposes of determining the existence of a quorum at the Annual Meeting, but they will have no effect on the outcome of any proposal.

|

|

2024 PROXY STATEMENT |

3 |

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

Under applicable stock exchange rules, the proposal to elect the Board nominees identified in this proxy statement as directors (Proposal 1) is a “non-routine” matter for which brokerage firms do not have discretionary authority to vote their customers’ shares if their customers did not provide voting instructions.

For purposes of the Annual Meeting, if your shares are held in street name and you do not provide voting instructions to the bank, broker or other nominee that holds your shares as described above under “How Do I Vote?,” then the bank, broker or other nominee has the authority, even if it does not receive instructions from you, to vote on your behalf for the proposal to ratify Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024 (Proposal 2), but does not have authority to vote your shares for the proposal to elect Board nominees identified in this proxy statement as directors (Proposal 1). Therefore, we encourage you to provide voting instructions because this will ensure your shares will be voted at the Annual Meeting in the manner you desire.

What Constitutes a Quorum for the Annual Meeting?

The presence, virtually or by proxy, of the holders of a majority of the shares entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. Votes of stockholders of record who are present at the Annual Meeting virtually or by proxy, abstentions, and broker non-votes are counted for purposes of determining whether a quorum is present.

What Vote is Required to Approve Each Proposal and How are Votes Counted?

Proposal 1: Election of Directors

Under our Amended and Restated Bylaws (“Bylaws”), in an uncontested election, if a quorum is present, the affirmative vote of a majority of the votes cast with respect to a director nominee is required to elect that person as a director. In a contested election, if a quorum is present, directors are elected by a plurality of the votes cast. The election of directors at the Annual Meeting will be an uncontested election. Our Bylaws also provide that any director that does not receive an affirmative vote of the majority of the votes cast shall submit such person’s resignation to the Board of Directors. The Board of Directors is not legally obligated to accept such resignation and can take any factors and other information into consideration that it deems appropriate or relevant. You may vote either “FOR” all or any one or more of the nominees, “AGAINST” all or any one or more of the nominees, or “ABSTAIN” your vote from all or any one or more of the nominees. Abstentions with respect to this proposal are counted for purposes of establishing a quorum at the Annual Meeting but will not have any effect on the outcome of the election of any director nominee.

Proposal 2: Ratification of the Appointment of Ernst & Young LLP as our Independent Registered Public Accounting Firm for the Fiscal Year Ending December 31, 2024

If a quorum is present, the affirmative vote of a majority of the votes cast with respect to this proposal is required to ratify the appointment of Ernst & Young LLP as our independent registered public accountant for the fiscal year ending December 31, 2024. Abstentions with respect to this proposal are counted for purposes of establishing a quorum at the Annual Meeting but will not have any effect on the outcome of this proposal. We are not required to obtain our stockholders’ ratification of the appointment of the Company’s independent registered public accounting firm, but we believe that submitting this matter to our stockholders is a part of good corporate governance. If our stockholders do not ratify the appointment of Ernst &Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024, then the Audit and Enterprise Risk Committee of the Board may reconsider the appointment. However, the Audit and Enterprise Risk Committee is solely responsible for the appointment and termination of our auditors and may do so at any time in its discretion.

Householding of Annual Disclosure Documents

Under applicable SEC rules, we or brokers and other nominees holding our shares on your behalf may send a single set of proxy materials, including our annual report, to any household at which two or more of our stockholders reside, if either we or the brokers believe that such stockholders are members of the same family. This practice, referred to as “householding,” benefits both stockholders and us. It reduces the volume of duplicate information received by you and helps to reduce our expenses, and we believe it is an environmentally friendly action. The rule applies to our annual reports, proxy statements

| 4 | 2024 PROXY STATEMENT |

|

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

and information statements. Once stockholders receive notice from their brokers or from us that communications to their addresses will be “householded,” the practice will continue until stockholders are otherwise notified or until they revoke their consent to the practice. Each stockholder will continue to receive a separate proxy card or voting instruction card.

Those stockholders who either (i) do not wish to participate in “householding” and would like to receive their own sets of our annual disclosure documents in future years or (ii) who share an address with another one of our stockholders and who would like to receive only a single set of our annual disclosure documents should follow the instructions described below:

| • | Stockholders whose shares are registered in their own name should contact our transfer agent, Direct Transfer LLC, 1 Glenwood Avenue STE 1001 Raleigh, NC 27603. Telephone: (919) 481-4000. E-mail: Proxy@issuerdirect.com. |

| • | Stockholders whose shares are held by a broker or other nominee should contact such broker or other nominee directly and inform them of their request. Stockholders should be sure to include their name, the name of their brokerage firm and their account number. |

Upon written or oral request of a stockholder at a shared address to which a single copy of the proxy statement and annual report was delivered, we will deliver promptly separate copies of these documents.

Who is paying for this proxy solicitation?

The Company is making this solicitation and will pay the cost of soliciting your proxy. In addition to the use of mail, our directors, officers and employees may also solicit proxies in person, by telephone, or by other means of communication. We will not pay our directors, officers or employees any additional compensation for soliciting proxies. We may reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

Is my vote confidential?

Proxy instructions, ballots, and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within our Company or to third parties, except as necessary to meet applicable legal requirements, to allow for the tabulation of votes and certification of the vote, or to facilitate a successful proxy solicitation.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K within four business days after the Annual Meeting, then we will file a Current Report on Form 8-K to publish preliminary results and will provide the final results in an amendment to such Current Report on Form 8-K as soon as they become available.

When are stockholder proposals due for next year’s annual meeting?

At our annual meeting each year, our Board of Directors submits to stockholders its nominees for election as directors. In addition, the Board of Directors may submit other matters to the stockholders for action at the annual meeting.

Pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (“Exchange Act”), stockholders may present proper proposals for inclusion in the Company’s proxy statement for consideration at the following annual meeting of stockholders (the “2025 Annual Meeting”) by submitting their proposals to the Company in a timely manner. These proposals must meet the stockholder eligibility and other requirements of the SEC. To be considered timely for inclusion in the proxy materials for the 2025 Annual Meeting, you must submit your proposal in writing by December 13, 2024 to our Corporate Secretary, 2424 N. Federal Highway, Suite 208, Boca Raton, Florida 33431.

The Company’s Bylaws set forth specific procedures and requirements in order to nominate a director or submit a proposal to be considered at the 2025 Annual Meeting. These procedures require that any nominations or proposals must be received by the Company no earlier than the close of business on January 28, 2025, and no later than the close of business on February 27, 2025, in order to be considered.

|

|

2024 PROXY STATEMENT |

5 |

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

If, however, the date of the 2025 Annual Meeting is more than 30 days before or more than 70 days after May 28, 2025, stockholders must submit such nominations or proposals not later than the earlier of: (A) the close of business on the 10th day following the day that the public announcement of the date of the 2025 Annual Meeting is first made by the Company and (B) the close of business on the date which is 90 days prior to the date of the 2025 Annual Meeting. In addition, with respect to nominations for directors, if the number of directors to be elected at the 2025 Annual Meeting is increased and there is no public announcement by us naming all of the nominees for director or specifying the size of the increased Board of Directors at least 10 days before the last day a stockholder may deliver a notice of nominations, a stockholder’s notice will also be considered timely, but only with respect to nominees for any new positions created by such increase, if it is delivered to our Corporate Secretary at our principal executive offices not later than the close of business on the 10th day following the day on which such public announcement is first made by us.

In addition to satisfying the foregoing advance notice requirements under our Bylaws, to comply with the universal proxy rules under the Exchange Act, stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than March 29, 2025.

If a stockholder notifies us of an intent to present a proposal at the 2025 Annual Meeting at any time after February 26, 2025 (and for any reason the proposal is voted on at that meeting), it will be considered untimely and our proxy holders will have the right to exercise discretionary voting authority with respect to the proposal, if presented at the meeting, without including information regarding the proposal in our proxy materials.

Interest of Certain Persons in Matters to be Acted Upon

Other than for any interest arising from (i) the ownership of our common stock or (ii) any nominee’s election to office, we are not aware of any substantial interest of any director, executive officer, nominee for election as a director or associate of any of the foregoing in any matter to be acted upon at the Annual Meeting.

Other Matters to be Presented for Action at the Annual Meeting

Management is not aware of any other matters to be presented for action at the Annual Meeting. However, if any other matter is properly presented at the Annual Meeting or any adjournment thereof, it is the intention of the persons named in the enclosed proxy to vote in accordance with their best judgment on such matter.

| 6 | 2024 PROXY STATEMENT |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of the Record Date, the beneficial ownership of our common stock, or an earlier date for information based on filings with the SEC, by: (i) each of our named executive officers; (ii) each of our current directors; (iii) each person, or group of affiliated persons, known by us to beneficially own more than 5% of our common stock; and (iv) all of our current executive officers and directors as a group. The address of the each of the executive officers and directors set forth in the table is c/o Celsius Holdings, Inc., 2424 N. Federal Highway, Suite 208, Boca Raton, Florida 33431.

Beneficial ownership is determined in accordance with the rules of the SEC. To our knowledge, except as indicated in the footnotes to this table, the persons listed in the table have sole investment and voting power with respect to all Company securities owned by them.

Under the rules of the SEC, a person (or group of persons) is deemed to be a “beneficial owner” of a security if he or she, directly or indirectly, has or shares the power to vote or to direct the voting of such security, or the power to dispose of or to direct the disposition of such security. Accordingly, more than one person may be deemed to be a beneficial owner of the same security. Additionally, under SEC rules, in computing the number of shares beneficially owned by a person or entity and the percentage ownership of that person or entity in the table below, shares that may be acquired by such person or entity within 60 days (such as upon exercise of options) are deemed outstanding and beneficially owned by such person or entity. These shares were not deemed outstanding, however, for the purpose of computing the percentage ownership of any other person or entity.

The following information is based upon information provided to us or filed with the SEC by the stockholders identified in the table below. Percentage ownership calculations are based on 233,070,146 shares of common stock outstanding as of the Record Date.

| Names and addresses of beneficial owners | Number of Shares common stock |

Percentage of class (%) |

||||||||||

| NEOs and Directors: | ||||||||||||

| John Fieldly | 3,509,831 | (1) | 1.5% | |||||||||

| Toby David | 415,135 | (2) | * | |||||||||

| Tony Guilfoyle | — | * | ||||||||||

| Jarrod Langhans | 39,858 | (3) | * | |||||||||

| Paul Storey | 6,290 | (4) | * | |||||||||

| Nicholas Castaldo | 351,288 | * | ||||||||||

| Damon DeSantis | 717,147 | * | ||||||||||

| Hal Kravitz | 216,206 | * | ||||||||||

| Jim Lee | — | * | ||||||||||

| Caroline Levy | 106,315 | (5) | * | |||||||||

| Cheryl Miller | 15,165 | * | ||||||||||

| Joyce Russell | 16,665 | * | ||||||||||

| All current executive officers and directors as a group (thirteen (13) persons)(6) | 5,249,079 | 2.2% | ||||||||||

| Greater than 5% stockholders: | ||||||||||||

| William H. Milmoe(7) 190 S.E. Fifth Avenue Suite 200 Delray Beach, FL 33483 |

42,645,027 | (8) | 18.2% | |||||||||

|

|

2024 PROXY STATEMENT |

7 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

| Names and addresses of beneficial owners | Number of Shares common stock |

Percentage of class (%) |

||||||||||

| Deborah DeSantis(7) 190 S.E. Fifth Avenue Suite 200 Delray Beach, FL 33483 |

42,548,921 | (9) | 18.3% | |||||||||

| Dean DeSantis(7) 190 S.E. Fifth Avenue Suite 200 Delray Beach, FL 33483 |

52,075,137 | (10 | ) | 22.3% | ||||||||

| CD Financial, LLC(7) 190 S.E. Fifth Avenue Suite 200 Delray Beach, FL 33483 |

31,603,782 | (11) | 13.6% | |||||||||

| BlackRock, Inc. 50 Hudson Yards New York, NY 10001 |

14,501,762 | (12) | 6.2% | |||||||||

| FMR LLC 245 Summer Street Boston, MA 02210 |

16,349,200 | (13) | 7.0% | |||||||||

| Chau Hoi Shuen Solina Holly Suites PT. 2909 & 2910, Harbour Centre 25 Harbour Road Wanchai, Hong Kong 999077 |

23,040,969 | (14) | 9.9% | |||||||||

| The Vanguard Group 100 Vanguard Blvd. Malvern, PA 19355 |

13,746,472 | (15) | 5.9% | |||||||||

| * | Less than 1% |

| (1) | Includes 3,198,225 shares of our common stock that are issuable upon the exercise of vested stock options held by Mr. Fieldly. |

| (2) | Includes 360,177 shares of our common stock that are issuable upon the exercise of vested stock options held by Mr. David. |

| (3) | Includes 11,157 shares of our common stock subject to restricted stock units (“RSUs”) that will vest within 60 days of the Record Date held by Mr. Langhans. |

| (4) | Includes (a) 5,142 shares of our common stock subject to RSUs that will vest within 60 days of the Record Date held by Mr. Storey, and (b) 450 shares of our common stock held jointly with his spouse. |

| (5) | Includes 70,000 shares of our common stock that are issuable upon the exercise of vested stock options held by Ms. Levy. |

| (6) | In addition to the individuals listed above, includes Mr. Mattessich and Ms. Watson, each of whom the Board has determined is an executive officer within the meaning of Rule 3b-7 under the Securities Exchange Act of 1934, as amended, and excludes Mr. David whom the Board determined did not meet such definition upon its annual review in February 2024, though all of his duties and his role remain the same. |

| (7) | Substantially all of the shares shown as beneficially owned by Dean DeSantis include the shares beneficially owned by William H. Milmoe, Deborah DeSantis and CD Financial, LLC. See the applicable footnote for each such person for details regarding such person’s beneficial ownership of common stock. |

| 8 | 2024 PROXY STATEMENT |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

| (8) | The information as to beneficial ownership is based on a Schedule 13G filed on February 14, 2024 with the SEC on behalf of William H. Milmoe. Represents (a) 59,745 shares of common stock held of record by Mr. Milmoe, (b) 165,000 shares of common stock underlying options held by Mr. Milmoe, (c) 16,500 shares of common stock representing the unvested portion of a restricted stock grant held by Mr. Milmoe, (d) 31,603,782 shares of common stock held of record by CD Financial, LLC (“CD Financial”), and (e) 10,800,000 shares of common stock held of record by GRAT 1, LLC (“GRAT 1”). The Schedule 13G states that Mr. Milmoe has shared voting and dispositive power with respect to shares of common stock held by CD Financial and GRAT 1. |

| (9) | The information as to beneficial ownership is based on a Schedule 13G filed on February 14, 2024 with the SEC on behalf of Deborah DeSantis. Represents (a) 1,579,179 shares of common stock held of record by Ms. DeSantis, (b) 13,860 shares of common stock held of record by Ms. DeSantis’ spouse, (c) 31,603,782 shares of common stock held of record by CD Financial, and (c) 9,352,098 shares of common stock held of record by the Carl DeSantis Retained Annuity Trust #2 (“CD Retained Trust #2”). The Schedule 13G states that Ms. DeSantis has shared voting and dispositive power with respect to shares of common stock held by CD Financial and CD Retained Trust #2. |

| (10) | The information as to beneficial ownership is based on a Schedule 13G filed on February 14, 2024 with the SEC on behalf Dean DeSantis. Represents (a) 319,257 shares of common stock held of record by Dean DeSantis, (b) 31,603,782 shares of common stock held of record by CD Financial, (c) 10,800,000 shares of common stock held by GRAT 1, and (d) 9,352,098 shares of common stock held of record by Carl DeSantis Grantor Annuity Trust #2 (“CD Grantor Trust #2”). The Schedule 13G states that Dean DeSantis has shared voting and dispositive power with respect to the shares of common stock held by CD Financial, GRAT 1 and CD Grantor Trust #2. |

| (11) | The information as to beneficial ownership is based on a Schedule 13G filed on February 14, 2024 with the SEC on behalf of CD Financial, LLC. The Schedule 13G states that CD Financial has sole dispositive power over 31,603,782 shares of common stock. |

| (12) | The information as to beneficial ownership is based on a Schedule 13G/A filed on January 29, 2024 with the SEC on behalf of BlackRock, Inc. The Schedule 13G/A states that BlackRock, Inc. has sole voting power over 13,820,846 shares of common stock and sole dispositive power over 14,501,762 shares of common stock. |

| (13) | The information as to beneficial ownership is based on a Schedule 13G/A filed on February 9, 2024 with the SEC on behalf of FMR LLC and Abigail P. Johnson. The Schedule 13G/A states that FMR LLC has sole voting power over 14,451,042 shares of common stock and sole dispositive power over 16,349,200 shares of common stock. The Schedule 13G/A states that Abigail P. Johnson has sole voting and dispositive power over the shares of common stock held by FMR LLC. |

| (14) | The information as to beneficial ownership is based on a Schedule 13G/A filed on February 12, 2024 with the SEC on behalf of Chau Hoi Shuen Solina Holly, Grieg International Limited and Oscar Time Limited. Represents (a) 7,680,323 shares of common stock held of record by Grieg International Limited, and (b) 235,955 shares of common stock held by Oscar Time Limited. The Schedule 13G/A states that Chau Hoi Shuen Solina Holly has sole voting and dispositive power over the shares of common stock held by Grieg International Limited and Oscar Time Limited. The foregoing figures do not give effect to the three-for-one stock split of our common stock that became effective on November 15, 2023; however, the aggregate ownership figures presented in the table above have been adjusted to give effect to the split. |

| (15) | The information as to beneficial ownership is based on a Schedule 13G/A filed on February 13, 2024 with the SEC on behalf of The Vanguard Group - 23-1945930 (the “Vanguard Reporting Person”). The Schedule 13G/A states that Vanguard Reporting Person has shared voting power over 97,462 shares of common stock, shared dispositive power over 218,478 shares of common stock and sole dispositive power over 13,527,994 shares of common stock. |

|

|

2024 PROXY STATEMENT |

9 |

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires that the Company’s officers, directors and persons owning more than 10% percent of a registered class of the Company’s equity securities file reports of ownership and changes in ownership of such securities and derivative securities of the Company with the SEC. Based solely on a review of such forms and related amendments filed with the SEC, and, where applicable, written representations from the Company’s officers and directors, Caroline Levy timely filed a Form 5, no other Form 5s were required to be filed, and the Company believes that during the year ended December 31, 2023, all of the Company’s current executive officers, directors and beneficial owners of more than 10% percent of the Company’s equity securities timely complied with all applicable filing requirement under Section 16(a) of the Exchange Act, except as set forth below:

| • | Mr. Nicholas Castaldo filed one late Form 4 on January 4, 2023 to report one transaction that occurred on January 1, 2023; |

| • | Mr. Carl DeSantis filed one late Form 4 on March 15, 2023 to report seven transactions that occurred on January 5, 2023; |

| • | Mr. Damon DeSantis filed late Forms 4 on (i) January 5, 2023 to report one transaction that occurred on January 1, 2023, and (ii) February 22, 2023 to report one transaction that occurred on January 1, 2022; |

| • | Mr. John Fieldly filed late Forms 4 on (i) January 4, 2023 to report one transaction that occurred on January 1, 2023, (ii) August 31, 2023 to report one transaction that occurred on August 1, 2023, (iii) September 8, 2023 to report one transaction that occurred on August 21, 2023, and (iv) January 5, 2024 to report ten transactions that occurred on October 23, 2019, July 30, 2020, November 12, 2020, two transactions on January 1, 2021, two transactions on January 1, 2022 and August 19, 2022, and two transactions on January 2, 2023; |

| • | Mr. Tony Guilfoyle filed late Forms 4 on (i) August 23, 2023 to report one transaction that occurred on January 1, 2023, (ii) September 8, 2023 to report one transaction that occurred on August 21, 2023, and (iii) January 5, 2024 to report one transaction that occurred on March 6, 2023. Mr. Guilfoyle also filed a late Form 3 on August 23, 2023, reflecting a date of event of December 31, 2022; |

| • | Mr. Hal Kravitz filed late Forms 4 on (i) January 4, 2023 to report one transaction that occurred on January 1, 2023, and (ii) February 23, 2023 to report to report two transactions that occurred on January 1, 2021 and January 1, 2022; |

| • | Mr. Jarrod Langhans filed late Forms 4 on (i) January 4, 2023 to report one transaction that occurred on January 1, 2023, (ii) August 24, 2023 to report one transaction that occurred on August 21, 2023, (iii) August 31, 2023 to report one transaction that occurred on August 1, 2023, (iv) September 8, 2023 to report one transaction that occurred on August 21, 2023, and (v) January 5, 2024 to report three transactions that occurred on April 18, 2022, August 26, 2022, and April 18, 2023; |

| • | Ms. Caroline Levy filed late Forms 4 on (i) January 5, 2023 to report one transaction that occurred on January 1, 2023, (ii) April 24, 2023 to report two transactions that occurred on January 1, 2021 and January 1, 2022, and (iii) May 25, 2023 to report one transaction that occurred on May 18, 2023; |

| • | Ms. Cheryl Miller filed late Forms 4 on (i) January 6, 2023 to report one transaction that occurred on January 1, 2023, and (ii) March 24, 2023 to report one transaction that occurred on January 1, 2022; |

| • | Ms. Joyce Russell filed late Forms 4 on (i) January 6, 2023 to report one transaction that occurred on January 1, 2023, and (ii) February 21, 2023 to report one transaction that occurred on January 1, 2022; and |

| • | Mr. Paul Storey filed late Forms 4 on (i) August 24, 2023 to report one transaction that occurred on January 1, 2023, (ii) September 8, 2023 to report one transaction that occurred on August 21, 2023, and (iii) January 5, 2024 to report two transactions that occurred on March 6, 2023, and May 12, 2023. Mr. Storey also filed a late Form 3 on August 24, 2023, reflecting a date of event of December 31, 2022. |

| 10 | 2024 PROXY STATEMENT |

|

PROPOSAL NO. 1 ELECTION OF DIRECTORS

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Governance and Nominating Committee of the Board of Directors recommended for nomination, and the Board of Directors nominated, the eight directors identified in the table below for election at the Annual Meeting. Each nominee, if elected, will serve until the next annual meeting of stockholders and until a successor is named and qualified, or until his or her earlier resignation or removal. All of the nominees are current members of the Board of Directors. We have no reason to believe that any of the nominees is unable or will decline to serve as a director if elected. Although the Company knows of no reason why any nominee could not serve as a director, if any nominee shall be unable to serve, the accompanying proxy may be voted for a substitute nominee in the discretion of the proxyholder(s).

Nominees for Director

| Name |

Age |

Position with the Company | ||

| John Fieldly |

44 | Chairman of the Board and Chief Executive Officer | ||

| Nicholas Castaldo |

72 | Director | ||

| Damon DeSantis |

60 | Director | ||

| Hal Kravitz |

66 | Lead Independent Director | ||

| Jim Lee |

49 | Director | ||

| Caroline Levy |

61 | Director | ||

| Cheryl Miller |

51 | Director | ||

| Joyce Russell |

63 | Director | ||

The Governance and Nominating Committee and the Board seek, and the Board is composed of, individuals whose characteristics, skills, expertise, and experience complement those of other Board members and whom the Board believes best serve the interests of the Company and our stockholders. We have set out below biographical and professional information about each of the nominees, along with a brief discussion of the experience, qualifications, and skills that the Board considered important in concluding that each such individual should serve as a current director and as a nominee for election as a member of our Board.

Nominee Biographies

John Fieldly has served as Chairman of the Board of Directors since August 2021, as Chief Executive Officer since April 2018 and as a member of the Board since March 2017. Mr. Fieldly joined the Company in January 2012 as its Chief Financial Officer and from March 2017 to March 2018 served as both Interim Chief Executive Officer and Chief Financial Officer. Prior to joining the Company, Mr. Fieldly held leadership roles at Oragenics, Inc., Lebhar-Friedman and Eckerd Drugs, Inc. Mr. Fieldly received a degree in accounting from the University of South Florida, and is a Certified Public Accountant in Florida. Mr. Fieldly’s qualifications to serve on the Board and as Chief Executive Officer include his deep knowledge of the Company and the energy drink industry, as well as significant experience in accounting, finance and executive leadership.

Nicholas Castaldo has served as a director since March 2013. Mr. Castaldo’s career spans over 35 years in consumer businesses in the food and beverage industry with executive positions in public and private companies, multi-nationals and start-ups. He is a member of the Advisory Board of Frank Pepe Pizzeria, a regional casual dining restaurant concept. He is an Equity Partner of Lime Fresh Mexican Grill, a fast-casual Mexican restaurant chain where he served as the company’s Chief Marketing Officer for two years. Mr. Castaldo was an Equity Partner and member of the founding management team of Anthony’s Coal Fired Pizza, a casual dining restaurant chain, where he served as President, as Senior Vice-President and Chief Marketing Officer, and as a board member for 12 years. He also served for eight years as President of Pollo Tropical, a Miami-based fast casual restaurant chain. He has also held senior marketing positions at Denny’s, CitiCorp Savings and Burger King. Mr. Castaldo is a member of the Marketing Advisory Board and an adjunct professor at the H. Wayne Huizenga College of

|

|

2024 PROXY STATEMENT |

11 |

PROPOSAL NO. 1 ELECTION OF DIRECTORS

Business and Entrepreneurship at Nova Southeastern University. He earned his MBA from the Harvard Business School at Harvard University. Mr. Castaldo’s qualifications to serve on the Board include his significant experience in the food and beverage industry, as well as his executive leadership and management experience.

Damon DeSantis has served as a director since August 2021. Since June 2022, Mr. DeSantis has also served as a member of the board of directors of Integrated BioPharma Inc. (OTC: INBP), an established manufacturing and sales company engaging primarily in the manufacturing, distributing, marketing and sales of vitamins, nutritional supplements, and herbal products. Since January 2019, he has also served as a member of the board of advisors of MacPherson’s, the largest employee-owned distributor of creative materials and art supplies in North America. Mr. DeSantis’ corporate business interests continue with ownership, direct investment, and board membership in a variety of private businesses in the hospitality, financial services, automotive, spirits and cannabis industries. Previously, until 2001, Mr. DeSantis served as Chief Executive Officer and as a member of the board of directors of Rexall Sundown Nutritional Company, a former Nasdaq 100 company. Rexall Sundown was in the business of developing, manufacturing, packaging, marketing, and distributing nutritional products with over 2800 SKUs to wholesalers, distributors, and retailers in the United States and worldwide. He is the son of Carl DeSantis, who was formerly one of the principal stockholders of Celsius. Mr. DeSantis’ qualifications toserve on the Board include his wide array of business experience.

Hal Kravitz has served as a director since April 2016 and as the Lead Independent Director since July 2021. Since October 2023, Mr. Kravitz has served as an external advisor for the consumer products and retail practices at Bain & Company, a management consulting company. From November 2018 through November 2021, Mr. Kravitz served as President, Certified Management Group, a division of Advantage Solutions. From 2014 to 2018, Mr. Kravitz served as Chief Executive Officer of AQUAhydrate, Inc., a company engaged in the manufacture, distribution, and marketing of premium bottled water. In 2013, Mr. Kravitz helped form InterContinental Beverage Capital as a founding member, a New York-based merchant bank focused on investments in the beverage and other consumer packaged goods industries. For 30 years prior thereto, Mr. Kravitz served in positions of increasing responsibility within the Coca-Cola system, including as an executive officer and in other management positions, and as President of Glaceau Company, makers of Vitaminwater® and Smartwater®. Mr. Kravitz received a degree in accounting from the University of Georgia. Mr. Kravitz’s qualifications to serve on the Board include his extensive experience in the beverage industry.

Jim Lee has served as a director since August 2022. Mr. Lee has served in roles of increasing responsibility with PepsiCo, Inc. (NASDAQ: PEP) (“PepsiCo”) for over 25 years and currently serves as Deputy Chief Financial Officer and Senior Vice President. In this role, he leads PepsiCo’s tax, treasury, investor relations and ESG reporting functions as well as having functional ownership for the finance teams in the international sectors. Prior to that, Mr. Lee was Senior Vice President, Corporate Finance for PepsiCo where he led tax, treasury and the global SAP program. In addition, he was Senior Vice President, Chief Strategy and Transformation Officer for PepsiCo Beverages North America (“PBNA”), where he was responsible for leading PBNA’s long-term strategy, business development, digital and value chain transformation, and sustainability. Mr. Lee joined PepsiCo in 1998 and has held several finance leadership roles since that time, including Senior Vice President Finance for PBNA, Senior Vice President and Chief Financial Officer of the Russia and CIS Region, Vice President and Chief Financial Officer of Southeast Europe, Senior Director and Chief Financial Officer of PepsiCo Australia and New Zealand, and Senior Director, Strategy and Planning of China Beverages. Mr. Lee holds a BSE in Operations Research from Princeton University and an MBA from Columbia University. Mr. Lee also serves on the board of directors for Tropicana Brands Group, and on the board of trustees for Caramoor Center for Music and Arts. Mr. Lee’s qualifications to serve on the Board include his extensive experience in the beverage industry.

Mr. Lee was elected to serve on the Board pursuant to an agreement between the Company and PepsiCo whereby PepsiCo currently has the right to designate one nominee to the Board.

Caroline Levy has served as a director since July 2020. Since November 2019, Ms. Levy has served as the founder of Caroline Levy Advisory Services, which provides strategic and financial advice to investors and corporations in the beverage, household products and cosmetics industries. From June 2017 to November 2019, Ms. Levy served as Senior Equity Research Analyst at Macquarie Group Limited, covering both large and small cap beverage companies. Prior to that, Ms. Levy spent eight years as a managing director and senior analyst at CLSA. This followed a decade at UBS, where

| 12 | 2024 PROXY STATEMENT |

|

PROPOSAL NO. 1 ELECTION OF DIRECTORS

Ms. Levy headed the U.S. consumer research team, while also holding the position of Chief Operating Officer for U.S. Equity Research and Chair of the Investment Review Committee. Ms. Levy also serves on the board of directors of Health-Ade Kombucha, a maker of kombucha products, where she also serves on the Strategy Committee, and Athletic Brewing Company, a non-alcoholic craft beer company. She is also an advisor to Nirvana Water Sciences, a producer of bottled water and other products. Ms. Levy holds degrees in economics and accounting from the University of Cape Town. Ms. Levy has made numerous media appearances including CNBC’s “Mad Money with Jim Cramer” and Bloomberg. Additionally, she has been recognized multiple times, including “The Institutional Investor All Star survey” and “The Wall Street Journal analyst rankings”, for stock picking and earnings accuracy. Ms. Levy’s qualifications to serve on the Board include her experience in equity analysis and capital markets in the beverage company sector.

Cheryl Miller has served as a director since August 2021. From January 2022 to October 2022, Ms. Miller served as Chief Financial Officer of West Marine, the nation’s leading omni-channel provider of products, services and expertise for the marine aftermarket. Prior to that, from April 2021 to December 2021, Ms. Miller served as an executive strategic advisor for JM Family Enterprises, a diversified automotive company, where she also served as Executive Vice President and Chief Financial Officer from January 2021 to April 2021. Ms. Miller has also previously served as President and Chief Executive Officer and held positions of Executive Vice President and Chief Financial Officer, Treasurer and Vice President of Investor Relations between 2010 and April 2020 with AutoNation Inc. (NYSE: AN), a publicly traded Fortune 150 automotive retailer. She also served on AutoNation Inc.’s board of directors from July 2019 to July 2020. In addition, since 2016, Ms. Miller has served on the board of directors of Tyson Foods, Inc. (NYSE: TSN), one of the world’s largest public food companies where she is a member of the audit committee and chairs the compensation & leadership development committee. Ms. Miller holds a bachelor’s degree in finance and business administration from James Madison University. Ms. Miller’s qualifications to serve on the Board include her corporate finance experience in consumer-focused industries, including her experience as a corporate chief financial officer.

Joyce Russell has served as a director since October 2021. Since its formation in 2019, Ms. Russell has served as President of the Adecco Group U.S. Foundation, which is focused on up/re-skilling American workers and helping to ensure work equality for all. Ms. Russell previously served as President of Adecco Staffing U.S. from 2004 to 2018, an affiliate of the Swiss public company Adecco Group AG, a Fortune Global 500 company, and she brings over 36 years of experience specializing in human resource solutions. Ms. Russell is a member of Women Corporate Directors and the Committee of 200. She is also on the board of directors of the American Staffing Association and Dress for Success Worldwide. Ms. Russell has been a panelist at the World Economic Forum in Davos and a panelist at Fortune’s Most Powerful Women Summit. Ms. Russell holds a Bachelor of Arts degree in business and communications from Baylor University. Ms. Russell’s qualifications to serve on the Board include her extensive experience in human resources.

Other than the designation of Mr. Lee by PepsiCo as a member of our Board, there are no arrangements or understandings between any of our director nominees or executive officers or any other person pursuant to which any director or executive officer was or is to be selected as a director or executive officer.

Family Relationships

There are no family relationships among our executive officers or director nominees.

Involvement in Certain Legal Proceedings

During the past 10 years, none of our directors, executive officers, promoters, control persons, or nominees has been involved in any legal proceedings requiring disclosure under Item 401(f) of Regulation S-K.

Vote Required

This election of directors is uncontested. Under our Bylaws, in an uncontested election, the affirmative vote of a majority of the votes cast with respect to a director nominee is required to elect such director.

THE BOARD RECOMMENDS A VOTE “FOR” THE ELECTION OF THE NOMINEES NAMED ABOVE AS DIRECTORS.

|

|

2024 PROXY STATEMENT |

13 |

INFORMATION ABOUT THE BOARD OF DIRECTORS, COMMITTEES AND CORPORATE GOVERNANCE

INFORMATION ABOUT THE BOARD OF DIRECTORS, COMMITTEES AND

CORPORATE GOVERNANCE

Director Attendance at Board, Committee, and Other Meetings

During the year ended December 31, 2023, the Board of Directors held nine meetings, the Audit and Enterprise Risk Committee met five times, and the Human Resource and Compensation Committee met nine times. The Governance and Nominating Committee met seven times. Each director attended at least 75% of the total number of meetings of the Board and of each committee on which such director served (in each case, during the periods that such director served). Additionally, our independent directors meet at regularly scheduled executive sessions without management participation.

As set forth in our Corporate Governance Principles, all directors are expected to attend the Company’s annual meeting of stockholders. All of our directors attended the 2023 annual meeting of stockholders.

Director Independence and Board Committees

Director Independence

Our Board of Directors has determined that each of our directors, except John Fieldly, is independent within the meaning of the applicable rules and regulations of the SEC and the listing standards of Nasdaq. Our Board of Directors consults with advisors to ensure that the Board’s determinations are consistent with relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of Nasdaq, as in effect from time to time. In making the independence determinations, the Board considered a number of factors and relationships, including without limitation all relevant identified transactions or relationships between each director, or any of his or her family members, and the Company, its senior management and its independent auditors. Each of our directors serving on our Audit and Enterprise Risk Committee and Human Resource and Compensation Committee satisfies the applicable heightened independence standards requires by SEC and Nasdaq rules for service on such committees.

Board Committees

Our Board of Directors has established three standing committees: the Audit and Enterprise Risk Committee; the Human Resource and Compensation Committee; and the Governance and Nominating Committee. The table below sets forth the members of each of these committees:

| Audit and Enterprise Risk Committee |

Human Resource and Compensation Committee |

Governance and Nominating Committee | ||

| Cheryl Miller (Chairperson) Jim Lee Caroline Levy Joyce Russell |

Joyce Russell (Chairperson) Nicholas Castaldo Hal Kravitz Alexandre Ruberti(1) |

Damon DeSantis (Chairperson) Nicholas Castaldo Jim Lee Caroline Levy Cheryl Miller | ||

| (1) | Mr. Ruberti served on the Human Resources and Compensation Committee throughout 2023 and until his resignation from the Board on March 28, 2024. |

The principal responsibilities of each of these committees are described generally below and in detail in their respective committee charters, which are available on the Company’s website at www.celsiusholdingsinc.com. The information on our website is not incorporated by reference into, or made a part of, this proxy statement.

Each of Ms. Levy, Mr. Lee and Ms. Miller qualifies as an “audit committee financial expert” as defined in Item 407 of Regulation S-K, based on such person’s business and professional experience in the financial and accounting fields.

Audit and Enterprise Risk Committee

The Audit and Enterprise Risk Committee assists our Board of Directors in its oversight of the Company’s financial reporting, compliance, and risk functions, including (i) the accounting and financial reporting processes of the Company, the audits of the Company’s financial statements and the integrity of the Company’s financial statements, (ii) the

| 14 | 2024 PROXY STATEMENT |

|

INFORMATION ABOUT THE BOARD OF DIRECTORS, COMMITTEES AND CORPORATE GOVERNANCE

independent auditor’s qualifications and independence, (iii) the performance of the Company’s internal audit function and independent auditors, (iv) the effectiveness of the Company’s internal control structure, (v) the compliance by the Company with significant legal and regulatory requirements, (vi) risk exposures and the Company’s policies with respect to risk assessment and risk management, and (vii) such other matters as directed by the Board. Further, the Audit and Enterprise Risk Committee, among its other responsibilities:

| • | has sole responsibility for the appointment, compensation, retention, evaluation, termination and oversight of the work of any independent auditor engaged for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Company; |

| • | reviews and pre-approves all the audit services to be performed and the proposed fees in connection with such audit services; |

| • | reviews with management, the independent auditors and the internal auditors the quality and adequacy of internal controls that could significantly affect the Company’s financial statements and the disclosure controls and procedures designed to ensure compliance with applicable laws and regulations; |

| • | reviews with the independent auditors the Company’s relationships and transactions with related parties that are significant to the Company; |

| • | discusses with management and the independent auditors the quality and adequacy of the Company’s internal control over financial reporting and its disclosure controls and procedures, and reviews disclosures made by the Company’s principal executive officer and principal financial officer in the Company’s periodic reports filed with the SEC regarding compliance with their certification obligations; |

| • | discusses the annual audited financial statements and the quarterly unaudited financial statements with management and the independent auditors prior to their filing with the SEC in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q; |

| • | reviews and discusses with management and the independent auditors the Company’s quarterly earnings press releases, as well as financial information and earnings guidance to be provided to investors, analysts or rating agencies; |

| • | reviews and discusses with management the effect of regulatory and accounting initiatives, as well as any off-balance sheet structures that may have a material impact on the Company’s financial statements; |

| • | discusses with management and the independent auditors matters related to (a) the Company’s major financial risk exposures, including financial, operational, compliance, strategic, privacy, cybersecurity, business continuity, third party risks, legal and regulatory risks, and any emerging risks, (b) the Company’s policies with respect to risk assessment and risk management, and (c) the steps management has taken to monitor and control these exposures; |

| • | reviews with the Company’s Chief Legal Officer any legal and regulatory matters that may have a material impact on the Company’s financial statements, including litigation and regulatory investigations, and any material reports or inquiries received from regulators or government agencies; |

| • | periodically reviews the Company’s material policies and procedures regarding ethics and compliance, including the Company’s Code of Ethical Conduct and the Company’s Code of Ethics for Senior Financial Officers; |

| • | maintains open, continuing and direct communication between the Board of Directors, the Audit and Enterprise Risk Committee and the Company’s independent auditors; and |

| • | annually reviews and reassesses the adequacy of, and compliance with, the Audit and Enterprise Risk Committee’s charter, and recommends any proposed changes to the Board for approval. |

Ms. Miller is the current chairperson of our Audit and Enterprise Risk Committee and will stand for re-election as a director at the Annual Meeting.

|

|

2024 PROXY STATEMENT |

15 |

INFORMATION ABOUT THE BOARD OF DIRECTORS, COMMITTEES AND CORPORATE GOVERNANCE

Human Resource and Compensation Committee

The Human Resource and Compensation Committee (the “Compensation Committee”) aids our Board of Directors by: (i) reviewing and approving the compensation of our executive officers; (ii) administering all incentive compensation plans and equity-based plans of the Company; and (iii) reviewing and making recommendations to the Board regarding the compensation of non-employee independent directors, among other duties. Further, the Compensation Committee, among its other responsibilities:

| • | annually reviews and approves the goals, objectives and philosophies with respect to the compensation of the Company’s Chief Executive Officer and other executive officers, and oversees their implementation, consistent with approved compensation plans, to ensure that compensation decisions regarding executive officers are aligned with such goals, objectives and philosophies; |

| • | annually reviews and approves the compensation of our executive officers, including annual base salary, short-term incentive awards, long-term incentive awards, severance benefits, perquisites and any other special or supplemental benefits; |

| • | reviews and approves compensation plans and retirement plans with respect to our executive officers and, to the extent it deems necessary or appropriate, makes recommendations regarding the establishment, amendment or modification of any such plans; |

| • | administers and interprets the Company’s incentive and equity compensation plans, to the extent required by the terms of such plans, or applicable law, rules or regulations; |

| • | reviews and approves employment, severance, change in control, termination and retirement arrangements for our executive officers; |

| • | periodically reviews non-employee director compensation and benefits for service on the Board and Board committees in relation to other comparable companies and in light of such factors as the committee may deem appropriate, and makes recommendations to the Board regarding compensation for non-employee directors; |

| • | reviews and approves all of the Company’s material compensation-related policies (including policies on claw backs, hedging and pledging); |

| • | reviews, makes recommendations with respect to, and annually monitors compliance with stock ownership guidelines; |

| • | periodically reviews reports from management regarding funding the Company’s pension, retirement, and other management welfare and benefit plans; |

| • | oversees the development of succession plans for the CEO and other executive officers, as appropriate; |

| • | oversees and at least annually reviews the assessment and mitigation of risks associated with the Company’s compensation policies and practices; |

| • | reviews and discusses with management the Company’s Compensation Discussion and Analysis (“CD&A”) and, based on such review and discussion, recommends to the Board that the CD&A should be included in the Company’s Annual Report on Form 10-K or Proxy Statement on Schedule 14A; |

| • | prepares an annual “Compensation Committee Report” for inclusion in the Company’s Annual Report on Form 10-K or Proxy Statement on Schedule 14A; and |

| • | annually reviews and assesses the adequacy of the Compensation Committee’s charter, structure, processes and membership requirements, and submits any recommended changes to the Board. |

| 16 | 2024 PROXY STATEMENT |

|

INFORMATION ABOUT THE BOARD OF DIRECTORS, COMMITTEES AND CORPORATE GOVERNANCE