| Label |

Element |

Value |

|

(Retirement Choices at 2055 Portfolio - Classes R1, R2 and R4) | (Retirement Choices at 2055 Portfolio)

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

Investment objective

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

To seek high total return until the fund's target retirement date, with a greater focus on income as the target date approaches. Total return, commonly understood as the combination of income and capital appreciation, includes interest, capital gains, dividends, and distributions realized over a given period of time.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

Fees and expenses

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

This table describes the fees and expenses you may pay if you buy and hold shares of the fund.

|

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

Shareholder fees (fees paid directly from your investment)

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

Annual fund operating expenses (%) (expenses that you pay each year as a percentage of the value of your investment)

|

[1] |

| Fee Waiver or Reimbursement over Assets, Date of Termination |

rr_FeeWaiverOrReimbursementOverAssetsDateOfTermination |

December 31, 2015 |

|

| Acquired Fund Fees and Expenses, Based on Estimates [Text] |

rr_AcquiredFundFeesAndExpensesBasedOnEstimates |

"Acquired fund fees and expenses" are based on the estimated indirect net expenses associated with the fund's anticipated investments in underlying investment companies. |

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

Expense example

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. Please see below a hypothetical example showing the expenses of a $10,000 investment for the time periods indicated and then assuming a redemption of all of your shares at the end of those periods. The example assumes a 5% average annual return. The example assumes fund expenses will not change over the periods. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

Portfolio turnover

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The fund, which operates as a fund of funds and invests in underlying funds, does not pay transaction costs, such as commissions, when it buys and sells shares of underlying funds (or "turns over" its portfolio). An underlying fund does pay transaction costs when it turns over its portfolio, and a higher portfolio turnover rate may indicate higher transaction costs. A higher portfolio turnover rate may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the performance of the underlying funds and of the fund. Because the fund had not commenced operations as of the date of this prospectus, there is no portfolio turnover to report.

|

|

| Strategy [Heading] |

rr_StrategyHeading |

Principal investment strategies

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

Under normal market conditions, the fund primarily invests its assets in underlying funds using an asset allocation strategy designed for investors expected to retire around the year 2055.

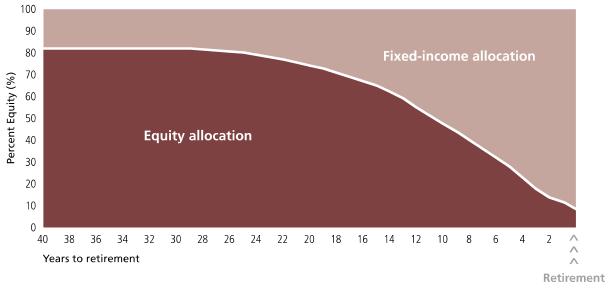

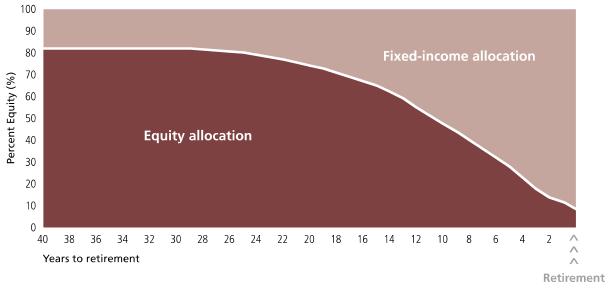

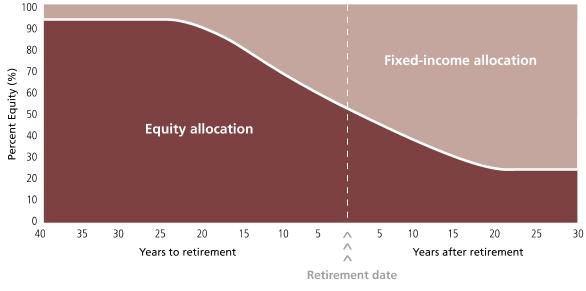

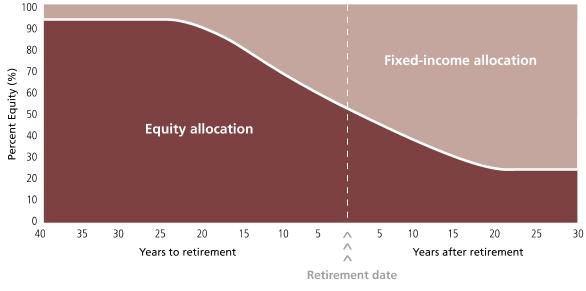

The portfolio managers of the fund allocate assets among the underlying funds according to an asset allocation strategy that becomes increasingly conservative over time. John Hancock Retirement Choices at 2055 Portfolio, which is designed for investors planning to retire around the year 2055, has a target asset allocation of 82% of its assets in underlying funds that invest primarily in equity securities. The fund will have greater exposure to underlying funds that invest primarily in equity securities than will a John Hancock Retirement Choices Portfolio with a closer target date. Over time, the asset allocation strategy will change according to a predetermined "glide path" shown in the following chart. As the glide path shows, the fund's asset mix becomes more conservative as time elapses. This reflects the desire to reduce investment risk and volatility as retirement approaches.

GLIDE PATH CHART

The allocations reflected in the glide path are referred to as neutral allocations because they do not reflect active decisions made by the portfolio managers to produce an overweight or an underweight position in a particular asset class based on the portfolio managers' market outlook. Any such decisions would be made from a strategic, long-term perspective. The fund has a target allocation for the broad asset classes of equity and fixed-income securities but may invest outside these target allocations to protect the fund or help it achieve its investment objective. The target allocation may be changed without shareholder approval if it is believed that such a change would benefit the fund and its shareholders. There is no guarantee that the portfolio managers will correctly predict the market or economic conditions and, as with other mutual fund investments, you could lose money even if the fund is at or close to its designated retirement year.

The fund is designed for an investor who anticipates reevaluating his or her retirement allocation strategies at the target date. In the designated retirement year, as indicated by the fund's name, under normal market conditions the fund is expected to have an equity allocation of 8% in underlying funds that invest primarily in equity securities, and maintain a static equity allocation of 8% in underlying funds that invest primarily in equity securities. This static allocation will be put into place after December 31 of the designated retirement year. This allocation may be appropriate for those investors who want a static allocation of about 8% in equity, however, other investors may wish to reallocate their investment and may remove all or most of their investment at retirement.

In addition to investing in exchange-traded funds (ETFs), the fund may also invest in U.S. government securities and derivatives, such as credit default swaps and options on equity index futures, interest-rate swaps, and foreign currencies, in each case for the purposes of reducing risk, obtaining efficient market exposure, and/or enhancing investment returns. The fund may invest in exchange-traded notes (ETNs).

The fund may invest in various actively and passively managed underlying funds that as a group hold a wide range of equity-type securities in their portfolios, including convertible securities. These include small-, mid-, and large-capitalization stocks, domestic and foreign securities (including emerging-market securities), and sector holdings. Certain equity underlying funds may invest in initial public offerings (IPOs). Each of the equity underlying funds has its own investment strategy that, for example, may focus on growth stocks or value stocks, or may employ a strategy combining growth and income stocks, and/or may invest in derivatives such as credit default swaps, foreign currency forwards, interest rate swaps, options on securities, and futures contracts. Certain of the actively and passively managed underlying funds focus their investment strategy on fixed-income securities, which may include investment-grade and below-investment-grade debt securities with maturities that range from short to longer term. The fixed-income underlying funds collectively hold various types of debt instruments such as corporate bonds and mortgage-backed, government-issued, domestic, and international securities (including emerging market securities). Certain underlying funds may invest in illiquid securities, and certain underlying funds may be non-diversified.

The Board of Trustees of the fund may, in its discretion, determine to combine the fund with another fund if the target allocation of the fund matches the target allocation of the other fund. In such event, the fund's shareholders will become shareholders of the other fund. To the extent permitted by applicable regulatory requirements, such a combination would be implemented without seeking the approval of shareholders. There is no assurance that the Board of Trustees at any point will determine to implement such a combination.

The fund bears its own expenses and, in addition, indirectly bears its proportionate share of the expenses of the underlying funds in which it invests. The investment performance of the fund will reflect both its portfolio managers' allocation decisions with respect to underlying funds and investments and the investment decisions made by the underlying funds.

|

|

| Risk [Heading] |

rr_RiskHeading |

Principal risks

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

An investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The fund's shares will go up and down in price, meaning that you could lose money by investing in the fund. Many factors influence a mutual fund's performance.

Instability in the financial markets has led many governments, including the U.S. government, to take a number of unprecedented actions designed to support certain financial institutions and segments of the financial markets that have experienced extreme volatility and, in some cases, a lack of liquidity. Federal, state, and other governments, and their regulatory agencies or self-regulatory organizations, may take actions that affect the regulation of the instruments in which the fund invests, or the issuers of such instruments, in ways that are unforeseeable. Legislation or regulation may also change the way in which the fund itself is regulated. Such legislation or regulation could limit or preclude the fund's ability to achieve its investment objective. In addition, political events within the United States and abroad, including the U.S. government's ongoing difficulty agreeing on a long-term budget and deficit reduction plan and uncertainty surrounding sovereign debt of European Union members, could negatively impact financial markets and the fund's performance. Further, certain municipalities of the United States and its territories are financially strained and may face the possibility of default on their debt obligations, which could directly or indirectly detract from the fund's performance.

Governments or their agencies may also acquire distressed assets from financial institutions and acquire ownership interests in those institutions. The implications of government ownership and disposition of these assets are unclear, and such a program may have positive or negative effects on the liquidity, valuation, and performance of the fund's portfolio holdings. Furthermore, volatile financial markets can expose the fund to greater market and liquidity risk and potential difficulty in valuing portfolio instruments held by the fund.

Because this fund has a greater exposure to underlying funds that invest primarily in equity securities than John Hancock Retirement Choices Portfolios with closer target dates, equity security risks are more prevalent in this fund than in these other target-date funds. In addition to equity securities risk, the funds' other main risk factors are listed below in alphabetical order. Before investing, be sure to read the additional descriptions of these risks beginning on page 8 of the prospectus.

Principal risks of investing in the fund of funds

Active management risk. The subadvisors' investment strategy may fail to produce the intended result.

Economic and market events risk. Events in the financial markets have resulted, and may continue to result, in an unusually high degree of volatility in the financial markets, both domestic and foreign. In addition, reduced liquidity in credit and fixed-income markets may adversely affect issuers worldwide. Banks and financial services companies could suffer losses if interest rates were to rise or economic conditions deteriorate.

Exchange-traded funds risk. Owning an ETF generally reflects the risks of owning the underlying securities it is designed to track. An ETF has its own fees and expenses, which are indirectly borne by the fund.

Exchange-traded notes risk. Similar to ETFs, owning an ETN generally reflects the risks of owning the assets that comprise the underlying market benchmark or strategy that the ETN is designed to reflect. ETNs also are subject to issuer and fixed-income risks.

Fund of funds risk. The fund is subject to the performance and expenses of the underlying funds in which it invests.

Hedging, derivatives, and other strategic transactions risk. Hedging, derivatives, and other strategic transactions may increase the volatility of a fund and, if the transaction is not successful, could result in a significant loss to a fund. The use of derivative instruments could produce disproportionate gains or losses, more than the principal amount invested. Investing in derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments and, in a down market, could become harder to value or sell at a fair price. The following is a list of certain derivatives and other strategic transactions which the fund intends to utilize and the main risks associated with each of them:

Credit default swaps. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), interest-rate risk, risk of default of the underlying reference obligation, and risk of disproportionate loss are the principal risks of engaging in transactions involving credit default swaps.

Foreign currency forward contracts. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), foreign currency risk, and risk of disproportionate loss are the principal risks of engaging in transactions involving foreign currency forward contracts.

Interest-rate swaps. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), interest-rate risk, and risk of disproportionate loss are the principal risks of engaging in transactions involving interest-rate swaps.

Options. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), and risk of disproportionate loss are the principal risks of engaging in transactions involving options. Counterparty risk does not apply to exchange-traded options.

Investment company securities risk. The fund bears its own expenses and indirectly bears its proportionate share of expenses of the underlying funds in which it invests.

Lifecycle risk. There is no guarantee that the subadvisors will correctly predict the market or economic conditions and, as with other mutual fund investments, you could lose money even if the fund is at or close to its designated retirement year or in its postretirement stage.

Target allocation risk. From time to time, one or more of the underlying funds may experience relatively large redemptions or investments due to reallocations or rebalancings of the assets of a portfolio, which could affect the performance of the underlying funds and, therefore, the performance of the fund.

Principal risks of investing in the underlying funds

Equity securities risk. The value of a company's equity securities is subject to changes in the company's financial condition and overall market and economic conditions. The securities of growth companies are subject to greater price fluctuations than other types of stocks because their market prices tend to place greater emphasis on future earnings expectations. The securities of value companies are subject to the risk that the companies may not overcome adverse business developments or other factors causing their securities to be underpriced or that the market may never come to recognize their fundamental value.

Active management risk. A fund's investment strategy may fail to produce the intended result.

Commodity risk. The market price of commodity investments may be volatile due to fluctuating demand, supply disruption, speculation, and other factors.

Convertible securities risk. The market values of convertible securities tend to decline as interest rates increase and, conversely, to increase as interest rates decline. In addition, as the market price of the underlying common stock declines below the conversion price, the price of the convertible security tends to be increasingly influenced more by the yield of the convertible security.

Credit and counterparty risk. The issuer or guarantor of a fixed-income security, the counterparty to an over-the-counter derivatives contract, or a borrower of a fund's securities may be unable or unwilling to make timely principal, interest, or settlement payments, or otherwise honor its obligations. U.S. government securities are subject to varying degrees of credit risk depending upon the nature of their support. Funds that invest in fixed-income securities are subject to varying degrees of risk that the issuers of the securities will have their credit rating downgraded or will default, potentially reducing a fund's share price and income level.

Currency risk. Fluctuations in exchange rates may adversely affect the U.S. dollar value of a fund's investments. Currency risk includes the risk that currencies in which a fund's investments are traded, or currencies in which a fund has taken an active position, will decline in value relative to the U.S. dollar.

Economic and market events risk. Events in the financial markets have resulted, and may continue to result, in an unusually high degree of volatility in the financial markets, both domestic and foreign. In addition, reduced liquidity in credit and fixed-income markets may adversely affect issuers worldwide. Banks and financial services companies could suffer losses if interest rates were to rise or economic conditions deteriorate.

Fixed-income securities risk. Fixed-income securities are affected by changes in interest rates and credit quality. A rise in interest rates typically causes bond prices to fall. The longer the average maturity or average duration of the bonds held by a fund, the more sensitive the fund is likely to be to interest-rate changes. There is the possibility that the issuer of the security will not repay all or a portion of the principal borrowed and will not make all interest payments.

Foreign securities risk. As compared with U.S. companies, there may be less publicly available information relating to foreign companies. Foreign securities may be subject to foreign taxes. The value of foreign securities is subject to currency fluctuations and adverse political and economic developments. Investments in emerging-market countries are subject to greater levels of foreign investment risk.

Hedging, derivatives, and other strategic transactions risk. Hedging, derivatives, and other strategic transactions may increase the volatility of a fund and, if the transaction is not successful, could result in a significant loss to a fund. The use of derivative instruments could produce disproportionate gains or losses, more than the principal amount invested. Investing in derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments and, in a down market, could become harder to value or sell at a fair price. The following is a list of certain derivatives and other strategic transactions which a fund may utilize and the main risks associated with each of them:

Credit default swaps. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), interest-rate risk, risk of default of the underlying reference obligation, and risk of disproportionate loss are the principal risks of engaging in transactions involving credit default swaps.

Foreign currency forward contracts. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), foreign currency risk, and risk of disproportionate loss are the principal risks of engaging in transactions involving foreign currency forward contracts.

Futures contracts. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), and risk of disproportionate loss are the principal risks of engaging in transactions involving futures contracts.

Interest-rate swaps. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), interest-rate risk, and risk of disproportionate loss are the principal risks of engaging in transactions involving interest-rate swaps.

Options. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), and risk of disproportionate loss are the principal risks of engaging in transactions involving options. Counterparty risk does not apply to exchange-traded options.

Industry or sector investing risk. The performance of a fund that focuses on a single industry or sector of the economy depends in large part on the performance of that industry or sector. As a result, the value of an investment may fluctuate more widely than it would in a fund that is diversified across industries or sectors.

Initial public offerings risk. IPO shares may have a magnified impact on fund performance and are frequently volatile in price. They can be held for a short period of time, causing an increase in portfolio turnover.

Issuer risk. An issuer of a security may perform poorly and, therefore, the value of its stocks and bonds may decline. An issuer of securities held by a fund could default or have its credit rating downgraded.

Lower-rated fixed-income securities risk and high-yield securities risk. Lower-rated fixed-income securities and high-yield fixed-income securities (commonly known as junk bonds) are subject to greater credit quality risk and risk of default than higher-rated fixed-income securities. These securities may be considered speculative and the value of these securities can be more volatile due to increased sensitivity to adverse issuer, political, regulatory, market, or economic developments and can be difficult to resell.

Medium and smaller company risk. The prices of medium and smaller company stocks can change more frequently and dramatically than those of large company stocks. Market capitalizations of companies change over time.

Mortgage-backed and asset-backed securities

risk. Different types of mortgage-backed securities and asset-backed securities are subject to different combinations of prepayment, extension, interest-rate, and/or other market risks.

Non-diversified risk. Overall risk can be reduced by investing in securities from a diversified pool of issuers and is increased by investing in securities of a small number of issuers. Investments in a non-diversified fund may magnify the fund's losses from adverse events affecting a particular issuer.

Short sales risk. Short sales involve costs and risk. A fund must pay the lender interest on the security it borrows, and the fund will lose money if the price of the security increases between the time of the short sale and the date when the fund replaces the borrowed security.

|

|

| Risk Nondiversified Status [Text] |

rr_RiskNondiversifiedStatus |

Non-diversified risk. Overall risk can be reduced by investing in securities from a diversified pool of issuers and is increased by investing in securities of a small number of issuers. Investments in a non-diversified fund may magnify the fund's losses from adverse events affecting a particular issuer. |

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

The fund's shares will go up and down in price, meaning that you could lose money by investing in the fund. |

|

| Risk Not Insured Depository Institution [Text] |

rr_RiskNotInsuredDepositoryInstitution |

An investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. |

|

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

Past performance

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

This section normally shows how the fund's total returns have varied from year to year, along with a broad-based market index for reference. Because the fund had not commenced operations as of the date of this prospectus, there is no past performance to report.

|

|

|

(Retirement Choices at 2055 Portfolio - Classes R1, R2 and R4) | (Retirement Choices at 2055 Portfolio) | Class R1

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Cumulative Sales Charge Over Other |

rr_MaximumCumulativeSalesChargeOverOther |

none

|

|

| Maximum Deferred Sales Charge Over Other |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Management fee |

rr_ManagementFeesOverAssets |

0.20% |

|

| Distribution and service (Rule 12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.50% |

|

| Service plan fee |

rr_Component1OtherExpensesOverAssets |

0.25% |

|

| Remainder of other expenses |

rr_Component2OtherExpensesOverAssets |

14.05% |

|

| Other Expenses Over Assets |

rr_OtherExpensesOverAssets |

14.30% |

|

| Acquired fund fees and expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.39% |

[2] |

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

15.39% |

|

| Contractual expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

(14.00%) |

[3],[4] |

| Total annual fund operating expenses after expense reimbursements |

rr_NetExpensesOverAssets |

1.39% |

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 142 |

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

3,008 |

|

|

(Retirement Choices at 2055 Portfolio - Classes R1, R2 and R4) | (Retirement Choices at 2055 Portfolio) | Class R2

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Cumulative Sales Charge Over Other |

rr_MaximumCumulativeSalesChargeOverOther |

none

|

|

| Maximum Deferred Sales Charge Over Other |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Management fee |

rr_ManagementFeesOverAssets |

0.20% |

|

| Distribution and service (Rule 12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.25% |

|

| Service plan fee |

rr_Component1OtherExpensesOverAssets |

0.25% |

|

| Remainder of other expenses |

rr_Component2OtherExpensesOverAssets |

14.05% |

|

| Other Expenses Over Assets |

rr_OtherExpensesOverAssets |

14.30% |

|

| Acquired fund fees and expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.39% |

[2] |

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

15.14% |

|

| Contractual expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

(14.00%) |

[3],[4] |

| Total annual fund operating expenses after expense reimbursements |

rr_NetExpensesOverAssets |

1.14% |

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

116 |

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

2,950 |

|

|

(Retirement Choices at 2055 Portfolio - Classes R1, R2 and R4) | (Retirement Choices at 2055 Portfolio) | Class R4

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Cumulative Sales Charge Over Other |

rr_MaximumCumulativeSalesChargeOverOther |

none

|

|

| Maximum Deferred Sales Charge Over Other |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Management fee |

rr_ManagementFeesOverAssets |

0.20% |

|

| Distribution and service (Rule 12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.25% |

|

| Service plan fee |

rr_Component1OtherExpensesOverAssets |

0.10% |

|

| Remainder of other expenses |

rr_Component2OtherExpensesOverAssets |

19.37% |

|

| Other Expenses Over Assets |

rr_OtherExpensesOverAssets |

19.47% |

|

| Acquired fund fees and expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.39% |

[2] |

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

20.31% |

|

| Contractual expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

(19.42%) |

[3],[4] |

| Total annual fund operating expenses after expense reimbursements |

rr_NetExpensesOverAssets |

0.89% |

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

91 |

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

3,697 |

|

|

(Retirement Choices at 2055 Portfolio - Classes R3 and R5) | (Retirement Choices at 2055 Portfolio)

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

Investment objective

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

To seek high total return until the fund's target retirement date, with a greater focus on income as the target date approaches. Total return, commonly understood as the combination of income and capital appreciation, includes interest, capital gains, dividends, and distributions realized over a given period of time.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

Fees and expenses

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

This table describes the fees and expenses you may pay if you buy and hold shares of the fund.

|

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

Shareholder fees (fees paid directly from your investment)

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

Annual fund operating expenses (%) (expenses that you pay each year as a percentage of the value of your investment)

|

[1] |

| Fee Waiver or Reimbursement over Assets, Date of Termination |

rr_FeeWaiverOrReimbursementOverAssetsDateOfTermination |

December 31, 2015 |

|

| Acquired Fund Fees and Expenses, Based on Estimates [Text] |

rr_AcquiredFundFeesAndExpensesBasedOnEstimates |

"Acquired fund fees and expenses" are based on the estimated indirect net expenses associated with the fund's anticipated investments in underlying investment companies. |

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

Expense example

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. Please see below a hypothetical example showing the expenses of a $10,000 investment for the time periods indicated and then assuming a redemption of all of your shares at the end of those periods. The example assumes a 5% average annual return. The example assumes fund expenses will not change over the periods. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

Portfolio turnover

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The fund, which operates as a fund of funds and invests in underlying funds, does not pay transaction costs, such as commissions, when it buys and sells shares of underlying funds (or "turns over" its portfolio). An underlying fund does pay transaction costs when it turns over its portfolio, and a higher portfolio turnover rate may indicate higher transaction costs. A higher portfolio turnover rate may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the performance of the underlying funds and of the fund. Because the fund had not commenced operations as of the date of this prospectus, there is no portfolio turnover to report.

|

|

| Strategy [Heading] |

rr_StrategyHeading |

Principal investment strategies

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

Under normal market conditions, the fund primarily invests its assets in underlying funds using an asset allocation strategy designed for investors expected to retire around the year 2055.

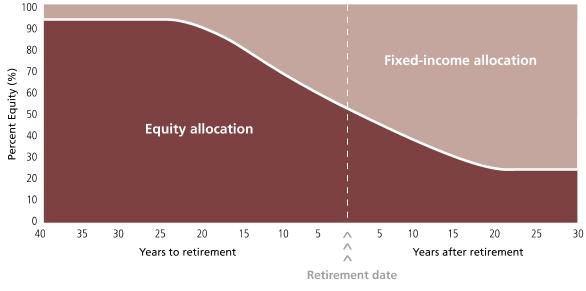

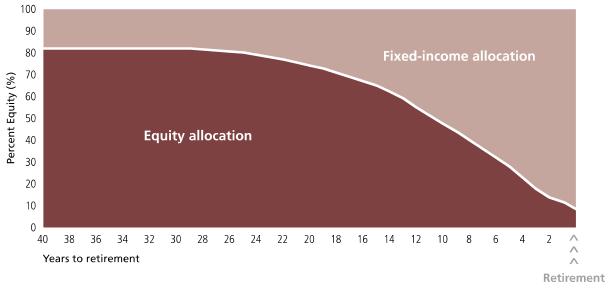

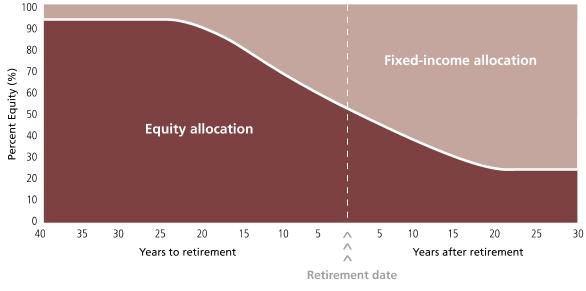

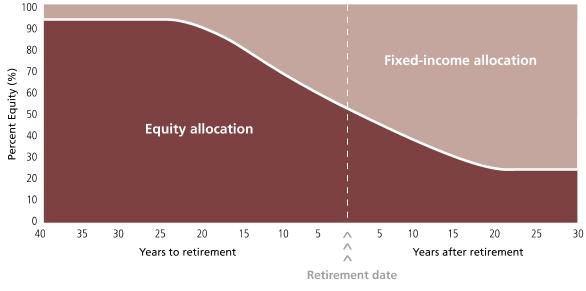

The portfolio managers of the fund allocate assets among the underlying funds according to an asset allocation strategy that becomes increasingly conservative over time. John Hancock Retirement Choices at 2055 Portfolio, which is designed for investors planning to retire around the year 2055, has a target asset allocation of 82% of its assets in underlying funds that invest primarily in equity securities. The fund will have greater exposure to underlying funds that invest primarily in equity securities than will a John Hancock Retirement Choices Portfolio with a closer target date. Over time, the asset allocation strategy will change according to a predetermined "glide path" shown in the following chart. As the glide path shows, the fund's asset mix becomes more conservative as time elapses. This reflects the desire to reduce investment risk and volatility as retirement approaches.

GLIDE PATH CHART

The allocations reflected in the glide path are referred to as neutral allocations because they do not reflect active decisions made by the portfolio managers to produce an overweight or an underweight position in a particular asset class based on the portfolio managers' market outlook. Any such decisions would be made from a strategic, long-term perspective. The fund has a target allocation for the broad asset classes of equity and fixed-income securities but may invest outside these target allocations to protect the fund or help it achieve its investment objective. The target allocation may be changed without shareholder approval if it is believed that such a change would benefit the fund and its shareholders. There is no guarantee that the portfolio managers will correctly predict the market or economic conditions and, as with other mutual fund investments, you could lose money even if the fund is at or close to its designated retirement year.

The fund is designed for an investor who anticipates reevaluating his or her retirement allocation strategies at the target date. In the designated retirement year, as indicated by the fund's name, under normal market conditions the fund is expected to have an equity allocation of 8% in underlying funds that invest primarily in equity securities, and maintain a static equity allocation of 8% in underlying funds that invest primarily in equity securities. This static allocation will be put into place after December 31 of the designated retirement year. This allocation may be appropriate for those investors who want a static allocation of about 8% in equity, however, other investors may wish to reallocate their investment and may remove all or most of their investment at retirement.

In addition to investing in exchange-traded funds (ETFs), the fund may also invest in U.S. government securities and derivatives, such as credit default swaps and options on equity index futures, interest-rate swaps, and foreign currencies, in each case for the purposes of reducing risk, obtaining efficient market exposure, and/or enhancing investment returns. The fund may invest in exchange-traded notes (ETNs).

The fund may invest in various actively and passively managed underlying funds that as a group hold a wide range of equity-type securities in their portfolios, including convertible securities. These include small-, mid-, and large-capitalization stocks, domestic and foreign securities (including emerging-market securities), and sector holdings. Certain equity underlying funds may invest in initial public offerings (IPOs). Each of the equity underlying funds has its own investment strategy that, for example, may focus on growth stocks or value stocks, or may employ a strategy combining growth and income stocks, and/or may invest in derivatives such as credit default swaps, foreign currency forwards, interest rate swaps, options on securities, and futures contracts. Certain of the actively and passively managed underlying funds focus their investment strategy on fixed-income securities, which may include investment-grade and below-investment-grade debt securities with maturities that range from short to longer term. The fixed-income underlying funds collectively hold various types of debt instruments such as corporate bonds and mortgage-backed, government-issued, domestic, and international securities (including emerging market securities). Certain underlying funds may invest in illiquid securities, and certain underlying funds may be non-diversified.

The Board of Trustees of the fund may, in its discretion, determine to combine the fund with another fund if the target allocation of the fund matches the target allocation of the other fund. In such event, the fund's shareholders will become shareholders of the other fund. To the extent permitted by applicable regulatory requirements, such a combination would be implemented without seeking the approval of shareholders. There is no assurance that the Board of Trustees at any point will determine to implement such a combination.

The fund bears its own expenses and, in addition, indirectly bears its proportionate share of the expenses of the underlying funds in which it invests. The investment performance of the fund will reflect both its portfolio managers' allocation decisions with respect to underlying funds and investments and the investment decisions made by the underlying funds.

|

|

| Risk [Heading] |

rr_RiskHeading |

Principal risks

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

An investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The fund's shares will go up and down in price, meaning that you could lose money by investing in the fund. Many factors influence a mutual fund's performance.

Instability in the financial markets has led many governments, including the U.S. government, to take a number of unprecedented actions designed to support certain financial institutions and segments of the financial markets that have experienced extreme volatility and, in some cases, a lack of liquidity. Federal, state, and other governments, and their regulatory agencies or self-regulatory organizations, may take actions that affect the regulation of the instruments in which the fund invests, or the issuers of such instruments, in ways that are unforeseeable. Legislation or regulation may also change the way in which the fund itself is regulated. Such legislation or regulation could limit or preclude the fund's ability to achieve its investment objective. In addition, political events within the United States and abroad, including the U.S. government's ongoing difficulty agreeing on a long-term budget and deficit reduction plan and uncertainty surrounding sovereign debt of European Union members, could negatively impact financial markets and the fund's performance. Further, certain municipalities of the United States and its territories are financially strained and may face the possibility of default on their debt obligations, which could directly or indirectly detract from the fund's performance.

Governments or their agencies may also acquire distressed assets from financial institutions and acquire ownership interests in those institutions. The implications of government ownership and disposition of these assets are unclear, and such a program may have positive or negative effects on the liquidity, valuation, and performance of the fund's portfolio holdings. Furthermore, volatile financial markets can expose the fund to greater market and liquidity risk and potential difficulty in valuing portfolio instruments held by the fund.

Because this fund has a greater exposure to underlying funds that invest primarily in equity securities than John Hancock Retirement Choices Portfolios with closer target dates, equity security risks are more prevalent in this fund than in these other target-date funds. In addition to equity securities risk, the funds' other main risk factors are listed below in alphabetical order. Before investing, be sure to read the additional descriptions of these risks beginning on page 8 of the prospectus.

Principal risks of investing in the fund of funds

Active management risk. The subadvisors' investment strategy may fail to produce the intended result.

Economic and market events risk. Events in the financial markets have resulted, and may continue to result, in an unusually high degree of volatility in the financial markets, both domestic and foreign. In addition, reduced liquidity in credit and fixed-income markets may adversely affect issuers worldwide. Banks and financial services companies could suffer losses if interest rates were to rise or economic conditions deteriorate.

Exchange-traded funds risk. Owning an ETF generally reflects the risks of owning the underlying securities it is designed to track. An ETF has its own fees and expenses, which are indirectly borne by the fund.

Exchange-traded notes risk. Similar to ETFs, owning an ETN generally reflects the risks of owning the assets that comprise the underlying market benchmark or strategy that the ETN is designed to reflect. ETNs also are subject to issuer and fixed-income risks.

Fund of funds risk. The fund is subject to the performance and expenses of the underlying funds in which it invests.

Hedging, derivatives, and other strategic transactions risk. Hedging, derivatives, and other strategic transactions may increase the volatility of a fund and, if the transaction is not successful, could result in a significant loss to a fund. The use of derivative instruments could produce disproportionate gains or losses, more than the principal amount invested. Investing in derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments and, in a down market, could become harder to value or sell at a fair price. The following is a list of certain derivatives and other strategic transactions which the fund intends to utilize and the main risks associated with each of them:

Credit default swaps. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), interest-rate risk, risk of default of the underlying reference obligation, and risk of disproportionate loss are the principal risks of engaging in transactions involving credit default swaps.

Foreign currency forward contracts. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), foreign currency risk, and risk of disproportionate loss are the principal risks of engaging in transactions involving foreign currency forward contracts.

Interest-rate swaps. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), interest-rate risk, and risk of disproportionate loss are the principal risks of engaging in transactions involving interest-rate swaps.

Options. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), and risk of disproportionate loss are the principal risks of engaging in transactions involving options. Counterparty risk does not apply to exchange-traded options.

Investment company securities risk. The fund bears its own expenses and indirectly bears its proportionate share of expenses of the underlying funds in which it invests.

Lifecycle risk. There is no guarantee that the subadvisors will correctly predict the market or economic conditions and, as with other mutual fund investments, you could lose money even if the fund is at or close to its designated retirement year or in its postretirement stage.

Target allocation risk. From time to time, one or more of the underlying funds may experience relatively large redemptions or investments due to reallocations or rebalancings of the assets of a portfolio, which could affect the performance of the underlying funds and, therefore, the performance of the fund.

Principal risks of investing in the underlying funds

Equity securities risk. The value of a company's equity securities is subject to changes in the company's financial condition and overall market and economic conditions. The securities of growth companies are subject to greater price fluctuations than other types of stocks because their market prices tend to place greater emphasis on future earnings expectations. The securities of value companies are subject to the risk that the companies may not overcome adverse business developments or other factors causing their securities to be underpriced or that the market may never come to recognize their fundamental value.

Active management risk. A fund's investment strategy may fail to produce the intended result.

Commodity risk. The market price of commodity investments may be volatile due to fluctuating demand, supply disruption, speculation, and other factors.

Convertible securities risk. The market values of convertible securities tend to decline as interest rates increase and, conversely, to increase as interest rates decline. In addition, as the market price of the underlying common stock declines below the conversion price, the price of the convertible security tends to be increasingly influenced more by the yield of the convertible security.

Credit and counterparty risk. The issuer or guarantor of a fixed-income security, the counterparty to an over-the-counter derivatives contract, or a borrower of a fund's securities may be unable or unwilling to make timely principal, interest, or settlement payments, or otherwise honor its obligations. U.S. government securities are subject to varying degrees of credit risk depending upon the nature of their support. Funds that invest in fixed-income securities are subject to varying degrees of risk that the issuers of the securities will have their credit rating downgraded or will default, potentially reducing a fund's share price and income level.

Currency risk. Fluctuations in exchange rates may adversely affect the U.S. dollar value of a fund's investments. Currency risk includes the risk that currencies in which a fund's investments are traded, or currencies in which a fund has taken an active position, will decline in value relative to the U.S. dollar.

Economic and market events risk. Events in the financial markets have resulted, and may continue to result, in an unusually high degree of volatility in the financial markets, both domestic and foreign. In addition, reduced liquidity in credit and fixed-income markets may adversely affect issuers worldwide. Banks and financial services companies could suffer losses if interest rates were to rise or economic conditions deteriorate.

Fixed-income securities risk. Fixed-income securities are affected by changes in interest rates and credit quality. A rise in interest rates typically causes bond prices to fall. The longer the average maturity or average duration of the bonds held by a fund, the more sensitive the fund is likely to be to interest-rate changes. There is the possibility that the issuer of the security will not repay all or a portion of the principal borrowed and will not make all interest payments.

Foreign securities risk. As compared with U.S. companies, there may be less publicly available information relating to foreign companies. Foreign securities may be subject to foreign taxes. The value of foreign securities is subject to currency fluctuations and adverse political and economic developments. Investments in emerging-market countries are subject to greater levels of foreign investment risk.

Hedging, derivatives, and other strategic transactions risk. Hedging, derivatives, and other strategic transactions may increase the volatility of a fund and, if the transaction is not successful, could result in a significant loss to a fund. The use of derivative instruments could produce disproportionate gains or losses, more than the principal amount invested. Investing in derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments and, in a down market, could become harder to value or sell at a fair price. The following is a list of certain derivatives and other strategic transactions which a fund may utilize and the main risks associated with each of them:

Credit default swaps. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), interest-rate risk, risk of default of the underlying reference obligation, and risk of disproportionate loss are the principal risks of engaging in transactions involving credit default swaps.

Foreign currency forward contracts. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), foreign currency risk, and risk of disproportionate loss are the principal risks of engaging in transactions involving foreign currency forward contracts.

Futures contracts. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), and risk of disproportionate loss are the principal risks of engaging in transactions involving futures contracts.

Interest-rate swaps. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), interest-rate risk, and risk of disproportionate loss are the principal risks of engaging in transactions involving interest-rate swaps.

Options. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), and risk of disproportionate loss are the principal risks of engaging in transactions involving options. Counterparty risk does not apply to exchange-traded options.

Industry or sector investing risk. The performance of a fund that focuses on a single industry or sector of the economy depends in large part on the performance of that industry or sector. As a result, the value of an investment may fluctuate more widely than it would in a fund that is diversified across industries or sectors.

Initial public offerings risk. IPO shares may have a magnified impact on fund performance and are frequently volatile in price. They can be held for a short period of time, causing an increase in portfolio turnover.

Issuer risk. An issuer of a security may perform poorly and, therefore, the value of its stocks and bonds may decline. An issuer of securities held by a fund could default or have its credit rating downgraded.

Lower-rated fixed-income securities risk and high-yield securities risk. Lower-rated fixed-income securities and high-yield fixed-income securities (commonly known as junk bonds) are subject to greater credit quality risk and risk of default than higher-rated fixed-income securities. These securities may be considered speculative and the value of these securities can be more volatile due to increased sensitivity to adverse issuer, political, regulatory, market, or economic developments and can be difficult to resell.

Medium and smaller company risk. The prices of medium and smaller company stocks can change more frequently and dramatically than those of large company stocks. Market capitalizations of companies change over time.

Mortgage-backed and asset-backed securities

risk. Different types of mortgage-backed securities and asset-backed securities are subject to different combinations of prepayment, extension, interest-rate, and/or other market risks.

Non-diversified risk. Overall risk can be reduced by investing in securities from a diversified pool of issuers and is increased by investing in securities of a small number of issuers. Investments in a non-diversified fund may magnify the fund's losses from adverse events affecting a particular issuer.

Short sales risk. Short sales involve costs and risk. A fund must pay the lender interest on the security it borrows, and the fund will lose money if the price of the security increases between the time of the short sale and the date when the fund replaces the borrowed security.

|

|

| Risk Nondiversified Status [Text] |

rr_RiskNondiversifiedStatus |

Non-diversified risk. Overall risk can be reduced by investing in securities from a diversified pool of issuers and is increased by investing in securities of a small number of issuers. Investments in a non-diversified fund may magnify the fund's losses from adverse events affecting a particular issuer. |

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

The fund's shares will go up and down in price, meaning that you could lose money by investing in the fund. |

|

| Risk Not Insured Depository Institution [Text] |

rr_RiskNotInsuredDepositoryInstitution |

An investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. |

|

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

Past performance

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

This section normally shows how the fund's total returns have varied from year to year, along with a broad-based market index for reference. Because the fund had not commenced operations as of the date of this prospectus, there is no past performance to report.

|

|

|

(Retirement Choices at 2055 Portfolio - Classes R3 and R5) | (Retirement Choices at 2055 Portfolio) | Class R3

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Cumulative Sales Charge Over Other |

rr_MaximumCumulativeSalesChargeOverOther |

none

|

|

| Maximum Deferred Sales Charge Over Other |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Management fee |

rr_ManagementFeesOverAssets |

0.20% |

|

| Distribution and service (Rule 12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.50% |

|

| Service plan fee |

rr_Component1OtherExpensesOverAssets |

0.15% |

|

| Remainder of other expenses |

rr_Component2OtherExpensesOverAssets |

15.14% |

|

| Other Expenses Over Assets |

rr_OtherExpensesOverAssets |

15.29% |

|

| Acquired fund fees and expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.39% |

[2] |

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

16.38% |

|

| Contractual expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

(0.03%) |

[5] |

| Total annual fund operating expenses after expense reimbursements |

rr_NetExpensesOverAssets |

16.35% |

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

1,542 |

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

4,125 |

|

|

(Retirement Choices at 2055 Portfolio - Classes R3 and R5) | (Retirement Choices at 2055 Portfolio) | Class R5

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Cumulative Sales Charge Over Other |

rr_MaximumCumulativeSalesChargeOverOther |

none

|

|

| Maximum Deferred Sales Charge Over Other |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Management fee |

rr_ManagementFeesOverAssets |

0.20% |

|

| Distribution and service (Rule 12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Service plan fee |

rr_Component1OtherExpensesOverAssets |

0.05% |

|

| Remainder of other expenses |

rr_Component2OtherExpensesOverAssets |

15.14% |

|

| Other Expenses Over Assets |

rr_OtherExpensesOverAssets |

15.19% |

|

| Acquired fund fees and expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.39% |

[2] |

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

15.78% |

|

| Contractual expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

(0.03%) |

[5] |

| Total annual fund operating expenses after expense reimbursements |

rr_NetExpensesOverAssets |

15.75% |

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

1,490 |

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

4,012 |

|

|

(Retirement Choices at 2055 Portfolio - Class R6) | (Retirement Choices at 2055 Portfolio)

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

Investment objective

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

To seek high total return until the fund's target retirement date, with a greater focus on income as the target date approaches. Total return, commonly understood as the combination of income and capital appreciation, includes interest, capital gains, dividends, and distributions realized over a given period of time.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

Fees and expenses

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

This table describes the fees and expenses you may pay if you buy and hold shares of the fund.

|

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

Shareholder fees (fees paid directly from your investment)

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

Annual fund operating expenses (%) (expenses that you pay each year as a percentage of the value of your investment)

|

[1] |

| Fee Waiver or Reimbursement over Assets, Date of Termination |

rr_FeeWaiverOrReimbursementOverAssetsDateOfTermination |

December 31, 2015 |

|

| Acquired Fund Fees and Expenses, Based on Estimates [Text] |

rr_AcquiredFundFeesAndExpensesBasedOnEstimates |

"Acquired fund fees and expenses" are based on the estimated indirect net expenses associated with the fund's anticipated investments in underlying investment companies. |

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

Expense example

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. Please see below a hypothetical example showing the expenses of a $10,000 investment for the time periods indicated and then assuming a redemption of all of your shares at the end of those periods. The example assumes a 5% average annual return. The example assumes fund expenses will not change over the periods. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

Portfolio turnover

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The fund, which operates as a fund of funds and invests in underlying funds, does not pay transaction costs, such as commissions, when it buys and sells shares of underlying funds (or "turns over" its portfolio). An underlying fund does pay transaction costs when it turns over its portfolio, and a higher portfolio turnover rate may indicate higher transaction costs. A higher portfolio turnover rate may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the performance of the underlying funds and of the fund. Because the fund had not commenced operations as of the date of this prospectus, there is no portfolio turnover to report.

|

|

| Strategy [Heading] |

rr_StrategyHeading |

Principal investment strategies

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

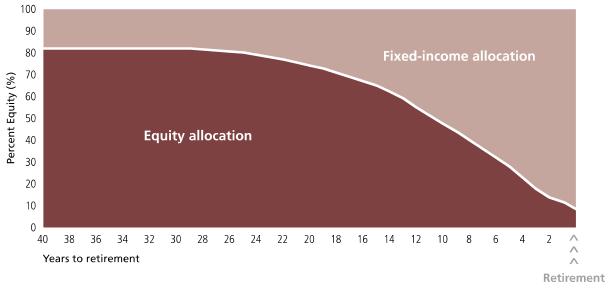

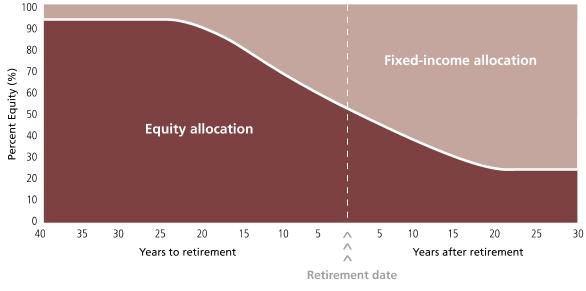

Under normal market conditions, the fund primarily invests its assets in underlying funds using an asset allocation strategy designed for investors expected to retire around the year 2055.

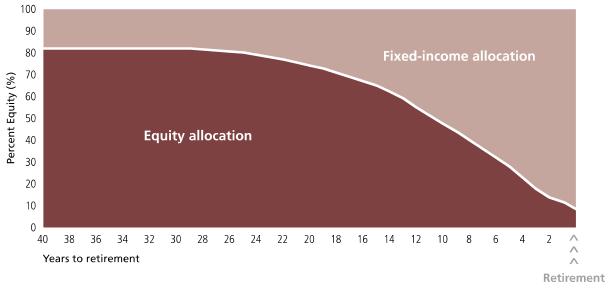

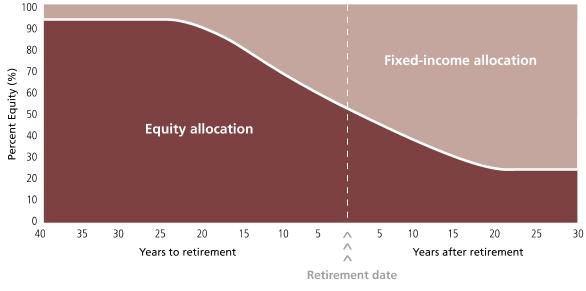

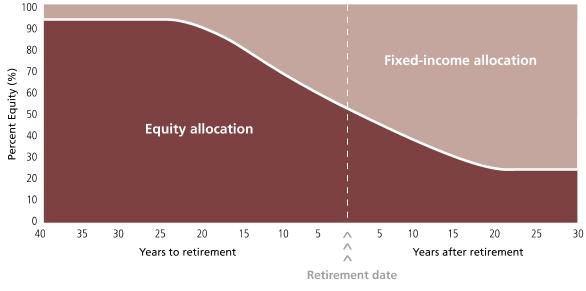

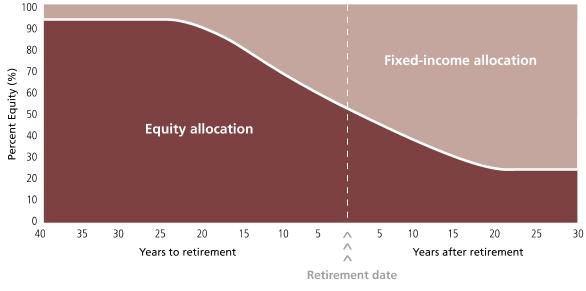

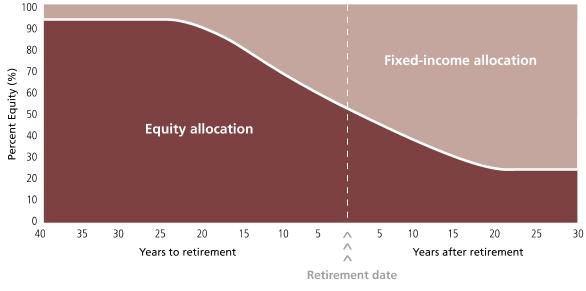

The portfolio managers of the fund allocate assets among the underlying funds according to an asset allocation strategy that becomes increasingly conservative over time. John Hancock Retirement Choices at 2055 Portfolio, which is designed for investors planning to retire around the year 2055, has a target asset allocation of 82% of its assets in underlying funds that invest primarily in equity securities. The fund will have greater exposure to underlying funds that invest primarily in equity securities than will a John Hancock Retirement Choices Portfolio with a closer target date. Over time, the asset allocation strategy will change according to a predetermined "glide path" shown in the following chart. As the glide path shows, the fund's asset mix becomes more conservative as time elapses. This reflects the desire to reduce investment risk and volatility as retirement approaches.

GLIDE PATH CHART

The allocations reflected in the glide path are referred to as neutral allocations because they do not reflect active decisions made by the portfolio managers to produce an overweight or an underweight position in a particular asset class based on the portfolio managers' market outlook. Any such decisions would be made from a strategic, long-term perspective. The fund has a target allocation for the broad asset classes of equity and fixed-income securities but may invest outside these target allocations to protect the fund or help it achieve its investment objective. The target allocation may be changed without shareholder approval if it is believed that such a change would benefit the fund and its shareholders. There is no guarantee that the portfolio managers will correctly predict the market or economic conditions and, as with other mutual fund investments, you could lose money even if the fund is at or close to its designated retirement year.

The fund is designed for an investor who anticipates reevaluating his or her retirement allocation strategies at the target date. In the designated retirement year, as indicated by the fund's name, under normal market conditions the fund is expected to have an equity allocation of 8% in underlying funds that invest primarily in equity securities, and maintain a static equity allocation of 8% in underlying funds that invest primarily in equity securities. This static allocation will be put into place after December 31 of the designated retirement year. This allocation may be appropriate for those investors who want a static allocation of about 8% in equity, however, other investors may wish to reallocate their investment and may remove all or most of their investment at retirement.

In addition to investing in exchange-traded funds (ETFs), the fund may also invest in U.S. government securities and derivatives, such as credit default swaps and options on equity index futures, interest-rate swaps, and foreign currencies, in each case for the purposes of reducing risk, obtaining efficient market exposure, and/or enhancing investment returns. The fund may invest in exchange-traded notes (ETNs).

The fund may invest in various actively and passively managed underlying funds that as a group hold a wide range of equity-type securities in their portfolios, including convertible securities. These include small-, mid-, and large-capitalization stocks, domestic and foreign securities (including emerging-market securities), and sector holdings. Certain equity underlying funds may invest in initial public offerings (IPOs). Each of the equity underlying funds has its own investment strategy that, for example, may focus on growth stocks or value stocks, or may employ a strategy combining growth and income stocks, and/or may invest in derivatives such as credit default swaps, foreign currency forwards, interest rate swaps, options on securities, and futures contracts. Certain of the actively and passively managed underlying funds focus their investment strategy on fixed-income securities, which may include investment-grade and below-investment-grade debt securities with maturities that range from short to longer term. The fixed-income underlying funds collectively hold various types of debt instruments such as corporate bonds and mortgage-backed, government-issued, domestic, and international securities (including emerging market securities). Certain underlying funds may invest in illiquid securities, and certain underlying funds may be non-diversified.

The Board of Trustees of the fund may, in its discretion, determine to combine the fund with another fund if the target allocation of the fund matches the target allocation of the other fund. In such event, the fund's shareholders will become shareholders of the other fund. To the extent permitted by applicable regulatory requirements, such a combination would be implemented without seeking the approval of shareholders. There is no assurance that the Board of Trustees at any point will determine to implement such a combination.

The fund bears its own expenses and, in addition, indirectly bears its proportionate share of the expenses of the underlying funds in which it invests. The investment performance of the fund will reflect both its portfolio managers' allocation decisions with respect to underlying funds and investments and the investment decisions made by the underlying funds.

|

|

| Risk [Heading] |

rr_RiskHeading |

Principal risks

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

An investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The fund's shares will go up and down in price, meaning that you could lose money by investing in the fund. Many factors influence a mutual fund's performance.

Instability in the financial markets has led many governments, including the U.S. government, to take a number of unprecedented actions designed to support certain financial institutions and segments of the financial markets that have experienced extreme volatility and, in some cases, a lack of liquidity. Federal, state, and other governments, and their regulatory agencies or self-regulatory organizations, may take actions that affect the regulation of the instruments in which the fund invests, or the issuers of such instruments, in ways that are unforeseeable. Legislation or regulation may also change the way in which the fund itself is regulated. Such legislation or regulation could limit or preclude the fund's ability to achieve its investment objective. In addition, political events within the United States and abroad, including the U.S. government's ongoing difficulty agreeing on a long-term budget and deficit reduction plan and uncertainty surrounding sovereign debt of European Union members, could negatively impact financial markets and the fund's performance. Further, certain municipalities of the United States and its territories are financially strained and may face the possibility of default on their debt obligations, which could directly or indirectly detract from the fund's performance.

Governments or their agencies may also acquire distressed assets from financial institutions and acquire ownership interests in those institutions. The implications of government ownership and disposition of these assets are unclear, and such a program may have positive or negative effects on the liquidity, valuation, and performance of the fund's portfolio holdings. Furthermore, volatile financial markets can expose the fund to greater market and liquidity risk and potential difficulty in valuing portfolio instruments held by the fund.

Because this fund has a greater exposure to underlying funds that invest primarily in equity securities than John Hancock Retirement Choices Portfolios with closer target dates, equity security risks are more prevalent in this fund than in these other target-date funds. In addition to equity securities risk, the funds' other main risk factors are listed below in alphabetical order. Before investing, be sure to read the additional descriptions of these risks beginning on page 8 of the prospectus.

Principal risks of investing in the fund of funds

Active management risk. The subadvisors' investment strategy may fail to produce the intended result.

Economic and market events risk. Events in the financial markets have resulted, and may continue to result, in an unusually high degree of volatility in the financial markets, both domestic and foreign. In addition, reduced liquidity in credit and fixed-income markets may adversely affect issuers worldwide. Banks and financial services companies could suffer losses if interest rates were to rise or economic conditions deteriorate.

Exchange-traded funds risk. Owning an ETF generally reflects the risks of owning the underlying securities it is designed to track. An ETF has its own fees and expenses, which are indirectly borne by the fund.

Exchange-traded notes risk. Similar to ETFs, owning an ETN generally reflects the risks of owning the assets that comprise the underlying market benchmark or strategy that the ETN is designed to reflect. ETNs also are subject to issuer and fixed-income risks.

Fund of funds risk. The fund is subject to the performance and expenses of the underlying funds in which it invests.

Hedging, derivatives, and other strategic transactions risk. Hedging, derivatives, and other strategic transactions may increase the volatility of a fund and, if the transaction is not successful, could result in a significant loss to a fund. The use of derivative instruments could produce disproportionate gains or losses, more than the principal amount invested. Investing in derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments and, in a down market, could become harder to value or sell at a fair price. The following is a list of certain derivatives and other strategic transactions which the fund intends to utilize and the main risks associated with each of them:

Credit default swaps. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), interest-rate risk, risk of default of the underlying reference obligation, and risk of disproportionate loss are the principal risks of engaging in transactions involving credit default swaps.

Foreign currency forward contracts. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), foreign currency risk, and risk of disproportionate loss are the principal risks of engaging in transactions involving foreign currency forward contracts.

Interest-rate swaps. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), interest-rate risk, and risk of disproportionate loss are the principal risks of engaging in transactions involving interest-rate swaps.

Options. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), and risk of disproportionate loss are the principal risks of engaging in transactions involving options. Counterparty risk does not apply to exchange-traded options.

Investment company securities risk. The fund bears its own expenses and indirectly bears its proportionate share of expenses of the underlying funds in which it invests.

Lifecycle risk. There is no guarantee that the subadvisors will correctly predict the market or economic conditions and, as with other mutual fund investments, you could lose money even if the fund is at or close to its designated retirement year or in its postretirement stage.

Target allocation risk. From time to time, one or more of the underlying funds may experience relatively large redemptions or investments due to reallocations or rebalancings of the assets of a portfolio, which could affect the performance of the underlying funds and, therefore, the performance of the fund.

Principal risks of investing in the underlying funds

Equity securities risk. The value of a company's equity securities is subject to changes in the company's financial condition and overall market and economic conditions. The securities of growth companies are subject to greater price fluctuations than other types of stocks because their market prices tend to place greater emphasis on future earnings expectations. The securities of value companies are subject to the risk that the companies may not overcome adverse business developments or other factors causing their securities to be underpriced or that the market may never come to recognize their fundamental value.

Active management risk. A fund's investment strategy may fail to produce the intended result.

Commodity risk. The market price of commodity investments may be volatile due to fluctuating demand, supply disruption, speculation, and other factors.

Convertible securities risk. The market values of convertible securities tend to decline as interest rates increase and, conversely, to increase as interest rates decline. In addition, as the market price of the underlying common stock declines below the conversion price, the price of the convertible security tends to be increasingly influenced more by the yield of the convertible security.

Credit and counterparty risk. The issuer or guarantor of a fixed-income security, the counterparty to an over-the-counter derivatives contract, or a borrower of a fund's securities may be unable or unwilling to make timely principal, interest, or settlement payments, or otherwise honor its obligations. U.S. government securities are subject to varying degrees of credit risk depending upon the nature of their support. Funds that invest in fixed-income securities are subject to varying degrees of risk that the issuers of the securities will have their credit rating downgraded or will default, potentially reducing a fund's share price and income level.

Currency risk. Fluctuations in exchange rates may adversely affect the U.S. dollar value of a fund's investments. Currency risk includes the risk that currencies in which a fund's investments are traded, or currencies in which a fund has taken an active position, will decline in value relative to the U.S. dollar.

Economic and market events risk. Events in the financial markets have resulted, and may continue to result, in an unusually high degree of volatility in the financial markets, both domestic and foreign. In addition, reduced liquidity in credit and fixed-income markets may adversely affect issuers worldwide. Banks and financial services companies could suffer losses if interest rates were to rise or economic conditions deteriorate.

Fixed-income securities risk. Fixed-income securities are affected by changes in interest rates and credit quality. A rise in interest rates typically causes bond prices to fall. The longer the average maturity or average duration of the bonds held by a fund, the more sensitive the fund is likely to be to interest-rate changes. There is the possibility that the issuer of the security will not repay all or a portion of the principal borrowed and will not make all interest payments.

Foreign securities risk. As compared with U.S. companies, there may be less publicly available information relating to foreign companies. Foreign securities may be subject to foreign taxes. The value of foreign securities is subject to currency fluctuations and adverse political and economic developments. Investments in emerging-market countries are subject to greater levels of foreign investment risk.