FALSE2022FY0001289490P5YP3YP3YP6YP1YP6Mhttp://fasb.org/us-gaap/2022#RealEstateInvestmentPropertyNethttp://fasb.org/us-gaap/2022#RealEstateInvestmentPropertyNethttp://fasb.org/us-gaap/2022#OtherLiabilitieshttp://fasb.org/us-gaap/2022#OtherLiabilitiesP5Y4MP2YP3Y00012894902022-01-012022-12-3100012894902022-06-30iso4217:USD00012894902023-02-22xbrli:shares00012894902022-12-3100012894902021-12-31iso4217:USDxbrli:shares00012894902021-01-012021-12-3100012894902020-01-012020-12-310001289490exr:PreferredOperatingPartnershipMember2019-12-310001289490exr:CommonOperatingPartnershipMember2019-12-310001289490exr:NonControllingInterestOtherMember2019-12-310001289490us-gaap:CommonStockMember2019-12-310001289490us-gaap:AdditionalPaidInCapitalMember2019-12-310001289490us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001289490us-gaap:RetainedEarningsMember2019-12-3100012894902019-12-310001289490us-gaap:CommonStockMember2020-01-012020-12-310001289490us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001289490us-gaap:RetainedEarningsMember2020-01-012020-12-310001289490exr:CommonOperatingPartnershipMemberexr:RedemptionOfUnitsForCommonStockMember2020-01-012020-12-310001289490us-gaap:CommonStockMemberexr:RedemptionOfUnitsForCommonStockMember2020-01-012020-12-310001289490us-gaap:AdditionalPaidInCapitalMemberexr:RedemptionOfUnitsForCommonStockMember2020-01-012020-12-310001289490exr:CommonOperatingPartnershipMember2020-01-012020-12-310001289490exr:SeriesBUnitsMemberexr:PreferredOperatingPartnershipMemberexr:RedemptionOfUnitsForCashMember2020-01-012020-12-310001289490exr:SeriesBUnitsMemberexr:RedemptionOfUnitsForCashMember2020-01-012020-12-310001289490exr:SeriesDUnitsMemberexr:PreferredOperatingPartnershipMemberexr:RedemptionOfUnitsForCommonStockMember2020-01-012020-12-310001289490exr:SeriesDUnitsMemberus-gaap:CommonStockMemberexr:RedemptionOfUnitsForCommonStockMember2020-01-012020-12-310001289490exr:SeriesDUnitsMemberus-gaap:AdditionalPaidInCapitalMemberexr:RedemptionOfUnitsForCommonStockMember2020-01-012020-12-310001289490exr:SeriesDUnitsMemberexr:RedemptionOfUnitsForCommonStockMember2020-01-012020-12-310001289490exr:NonControllingInterestOtherMember2020-01-012020-12-310001289490exr:PreferredOperatingPartnershipMember2020-01-012020-12-310001289490us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001289490exr:PreferredOperatingPartnershipMember2020-12-310001289490exr:CommonOperatingPartnershipMember2020-12-310001289490exr:NonControllingInterestOtherMember2020-12-310001289490us-gaap:CommonStockMember2020-12-310001289490us-gaap:AdditionalPaidInCapitalMember2020-12-310001289490us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001289490us-gaap:RetainedEarningsMember2020-12-3100012894902020-12-310001289490us-gaap:CommonStockMember2021-01-012021-12-310001289490us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001289490exr:CommonOperatingPartnershipMemberexr:RedemptionOfUnitsForCommonStockMember2021-01-012021-12-310001289490us-gaap:CommonStockMemberexr:RedemptionOfUnitsForCommonStockMember2021-01-012021-12-310001289490us-gaap:AdditionalPaidInCapitalMemberexr:RedemptionOfUnitsForCommonStockMember2021-01-012021-12-310001289490exr:RedemptionOfUnitsForCommonStockMember2021-01-012021-12-310001289490exr:SeriesBUnitsMemberexr:PreferredOperatingPartnershipMemberexr:RedemptionOfUnitsForCommonStockMember2021-01-012021-12-310001289490exr:SeriesBUnitsMemberus-gaap:CommonStockMemberexr:RedemptionOfUnitsForCommonStockMember2021-01-012021-12-310001289490us-gaap:AdditionalPaidInCapitalMemberexr:SeriesBUnitsMemberexr:RedemptionOfUnitsForCommonStockMember2021-01-012021-12-310001289490exr:SeriesBUnitsMemberexr:RedemptionOfUnitsForCommonStockMember2021-01-012021-12-310001289490exr:CommonOperatingPartnershipMemberexr:RedemptionOfUnitsForCashMember2021-01-012021-12-310001289490us-gaap:AdditionalPaidInCapitalMemberexr:RedemptionOfUnitsForCashMember2021-01-012021-12-310001289490exr:RedemptionOfUnitsForCashMember2021-01-012021-12-310001289490exr:CommonOperatingPartnershipMember2021-01-012021-12-310001289490exr:SeriesDUnitsMemberexr:PreferredOperatingPartnershipMember2021-01-012021-12-310001289490exr:SeriesDUnitsMember2021-01-012021-12-310001289490exr:NonControllingInterestOtherMember2021-01-012021-12-310001289490exr:PreferredOperatingPartnershipMember2021-01-012021-12-310001289490us-gaap:RetainedEarningsMember2021-01-012021-12-310001289490us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001289490exr:PreferredOperatingPartnershipMember2021-12-310001289490exr:CommonOperatingPartnershipMember2021-12-310001289490exr:NonControllingInterestOtherMember2021-12-310001289490us-gaap:CommonStockMember2021-12-310001289490us-gaap:AdditionalPaidInCapitalMember2021-12-310001289490us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001289490us-gaap:RetainedEarningsMember2021-12-310001289490us-gaap:CommonStockMember2022-01-012022-12-310001289490us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001289490exr:CommonOperatingPartnershipMemberexr:RedemptionOfUnitsForCashMember2022-01-012022-12-310001289490us-gaap:AdditionalPaidInCapitalMemberexr:RedemptionOfUnitsForCashMember2022-01-012022-12-310001289490exr:RedemptionOfUnitsForCashMember2022-01-012022-12-310001289490exr:SeriesBUnitsMemberexr:PreferredOperatingPartnershipMemberexr:RedemptionOfUnitsForCashMember2022-01-012022-12-310001289490exr:SeriesBUnitsMemberexr:RedemptionOfUnitsForCashMember2022-01-012022-12-310001289490exr:CommonOperatingPartnershipMember2022-01-012022-12-310001289490exr:SeriesDUnitsMemberexr:PreferredOperatingPartnershipMember2022-01-012022-12-310001289490exr:SeriesDUnitsMember2022-01-012022-12-310001289490us-gaap:RetainedEarningsMember2022-01-012022-12-310001289490exr:NonControllingInterestOtherMember2022-01-012022-12-310001289490exr:PreferredOperatingPartnershipMember2022-01-012022-12-310001289490us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001289490exr:PreferredOperatingPartnershipMember2022-12-310001289490exr:CommonOperatingPartnershipMember2022-12-310001289490exr:NonControllingInterestOtherMember2022-12-310001289490us-gaap:CommonStockMember2022-12-310001289490us-gaap:AdditionalPaidInCapitalMember2022-12-310001289490us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001289490us-gaap:RetainedEarningsMember2022-12-310001289490exr:PreferredOPUnitsMember2022-01-012022-12-310001289490exr:PreferredOPUnitsMember2021-01-012021-12-310001289490exr:PreferredOPUnitsMember2020-01-012020-12-310001289490exr:CommonOPUnitsMember2022-01-012022-12-310001289490exr:CommonOPUnitsMember2021-01-012021-12-310001289490exr:CommonOPUnitsMember2020-01-012020-12-31exr:storeexr:stateexr:variable_interest_entity0001289490us-gaap:FairValueMeasurementsRecurringMember2022-12-310001289490us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001289490us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001289490us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001289490us-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001289490us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001289490us-gaap:EstimateOfFairValueFairValueDisclosureMember2021-12-310001289490us-gaap:CarryingReportedAmountFairValueDisclosureMember2021-12-310001289490us-gaap:BuildingAndBuildingImprovementsMembersrt:MinimumMember2022-01-012022-12-310001289490srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2022-01-012022-12-310001289490exr:EquipmentAndFixturesMembersrt:MinimumMember2022-01-012022-12-310001289490srt:MaximumMemberexr:EquipmentAndFixturesMember2022-01-012022-12-310001289490us-gaap:SoftwareDevelopmentMember2022-12-310001289490us-gaap:SoftwareDevelopmentMember2021-12-310001289490us-gaap:SoftwareDevelopmentMember2022-01-012022-12-310001289490us-gaap:SoftwareDevelopmentMember2021-01-012021-12-31exr:item0001289490exr:ManagementServicesAgreementsMSAMembersrt:MinimumMember2022-01-012022-12-310001289490srt:MaximumMemberexr:ManagementServicesAgreementsMSAMember2022-01-012022-12-31exr:claimxbrli:pure0001289490exr:CommonOPUnitsMember2022-01-012022-12-310001289490exr:CommonOPUnitsMember2021-01-012021-12-310001289490exr:CommonOPUnitsMember2020-01-012020-12-310001289490exr:SeriesAUnitsMember2022-01-012022-12-310001289490exr:SeriesAUnitsMember2021-01-012021-12-310001289490exr:SeriesAUnitsMember2020-01-012020-12-310001289490exr:SeriesBUnitsMember2022-01-012022-12-310001289490exr:SeriesBUnitsMember2021-01-012021-12-310001289490exr:SeriesBUnitsMember2020-01-012020-12-310001289490exr:SeriesDUnitsMember2022-01-012022-12-310001289490exr:SeriesDUnitsMember2021-01-012021-12-310001289490exr:SeriesDUnitsMember2020-01-012020-12-310001289490exr:SeriesAUnitsMember2022-12-310001289490srt:MinimumMember2022-01-012022-12-310001289490srt:MaximumMember2022-01-012022-12-3100012894902022-09-152022-09-150001289490exr:CommonOperatingPartnershipMember2022-09-150001289490exr:CommonOperatingPartnershipMember2022-09-152022-09-1500012894902022-09-15exr:land_parcel0001289490exr:BargoldMember2022-06-012022-06-010001289490exr:BargoldMember2022-06-01exr:storage_unit0001289490exr:BargoldMember2022-06-010001289490exr:SeriesDUnitsMemberexr:BargoldMember2022-06-012022-06-010001289490exr:CommonOPUnitsMemberexr:BargoldMember2022-06-012022-06-010001289490exr:BargoldMemberus-gaap:DevelopedTechnologyRightsMember2022-06-010001289490exr:BargoldMemberus-gaap:TrademarksMember2022-06-010001289490us-gaap:CustomerRelationshipsMemberexr:BargoldMember2022-06-010001289490exr:BargoldMember2022-01-012022-12-3100012894902022-01-012022-03-310001289490us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2021-12-162021-12-160001289490us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2021-03-012021-03-010001289490exr:UnconsolidatedJointVentureMember2021-03-0100012894902021-03-010001289490exr:PRISASelfStorageLLCMember2022-12-31exr:property0001289490exr:PRISASelfStorageLLCMember2021-12-310001289490exr:StoragePortfolioIIJVLLCMember2022-12-310001289490exr:StoragePortfolioIIJVLLCMember2021-12-310001289490exr:StoragePortfolioIVJVLLCMember2022-12-310001289490exr:StoragePortfolioIVJVLLCMember2021-12-310001289490exr:StoragePortfolioILLCMember2022-12-310001289490exr:StoragePortfolioILLCMember2021-12-310001289490exr:PRIIEXRJVLLCMember2022-12-310001289490exr:PRIIEXRJVLLCMember2021-12-310001289490exr:ESSCATIVSJVLPMember2022-12-310001289490exr:ESSCATIVSJVLPMember2021-12-310001289490exr:VRSSelfStorageLLCMember2022-12-310001289490exr:VRSSelfStorageLLCMember2021-12-310001289490exr:ARAEXRJVLLCMember2022-12-310001289490exr:ARAEXRJVLLCMember2021-12-310001289490exr:ESSNYFLJVLPMember2022-12-310001289490exr:ESSNYFLJVLPMember2021-12-310001289490exr:ExtraSpaceNorthernPropertiesSixLLCMember2022-12-310001289490exr:ExtraSpaceNorthernPropertiesSixLLCMember2021-12-310001289490exr:AlanJathooJVLLCMember2022-12-310001289490exr:AlanJathooJVLLCMember2021-12-310001289490exr:BristolInvestmentsLLCMember2022-12-310001289490exr:BristolInvestmentsLLCMember2021-12-310001289490exr:ESSBGOAtlantaGAJVLLCMember2022-12-310001289490exr:ESSBGOAtlantaGAJVLLCMember2021-12-310001289490exr:StoragePortfolioVJVLLCMember2022-12-310001289490exr:StoragePortfolioVJVLLCMember2021-12-310001289490exr:PREXRSelfStorageLLCMember2022-12-310001289490exr:PREXRSelfStorageLLCMember2021-12-310001289490exr:StoragePortfolioIIIJVLLCMember2022-12-310001289490exr:StoragePortfolioIIIJVLLCMember2021-12-310001289490exr:OtherMinorityOwnedPropertiesMember2022-12-310001289490exr:OtherMinorityOwnedPropertiesMembersrt:MinimumMember2022-12-310001289490exr:OtherMinorityOwnedPropertiesMembersrt:MaximumMember2022-12-310001289490exr:OtherMinorityOwnedPropertiesMember2021-12-310001289490exr:SmartStopSelfStorageREITIncSeriesAConvertiblePreferredStockMember2022-12-310001289490exr:SmartStopSelfStorageREITIncSeriesAConvertiblePreferredStockMember2021-12-310001289490exr:SmartStopSelfStorageREITIncSeriesAConvertiblePreferredStockMember2019-10-012019-10-310001289490exr:SmartStopSelfStorageREITIncSeriesAConvertiblePreferredStockMember2022-01-012022-12-3100012894902021-06-012021-06-30exr:joint_venture0001289490exr:WICNNJVLLCAndGFNJVLLCMember2021-06-012021-06-300001289490exr:SmartStopSelfStorageREITIncSeriesAConvertiblePreferredStockMember2021-01-012021-12-310001289490exr:SmartStopSelfStorageREITIncSeriesAConvertiblePreferredStockMember2020-01-012020-12-310001289490exr:PRISASelfStorageLLCMember2022-01-012022-12-310001289490exr:PRISASelfStorageLLCMember2021-01-012021-12-310001289490exr:PRISASelfStorageLLCMember2020-01-012020-12-310001289490exr:StoragePortfolioIIJVLLCMember2022-01-012022-12-310001289490exr:StoragePortfolioIIJVLLCMember2021-01-012021-12-310001289490exr:StoragePortfolioIIJVLLCMember2020-01-012020-12-310001289490exr:StoragePortfolioIVJVLLCMember2022-01-012022-12-310001289490exr:StoragePortfolioIVJVLLCMember2021-01-012021-12-310001289490exr:StoragePortfolioIVJVLLCMember2020-01-012020-12-310001289490exr:StoragePortfolioILLCMember2022-01-012022-12-310001289490exr:StoragePortfolioILLCMember2021-01-012021-12-310001289490exr:StoragePortfolioILLCMember2020-01-012020-12-310001289490exr:PRIIEXRJVLLCMember2022-01-012022-12-310001289490exr:PRIIEXRJVLLCMember2021-01-012021-12-310001289490exr:PRIIEXRJVLLCMember2020-01-012020-12-310001289490exr:ESSCATIVSJVLPMember2022-01-012022-12-310001289490exr:ESSCATIVSJVLPMember2021-01-012021-12-310001289490exr:ESSCATIVSJVLPMember2020-01-012020-12-310001289490exr:VRSSelfStorageLLCMember2022-01-012022-12-310001289490exr:VRSSelfStorageLLCMember2021-01-012021-12-310001289490exr:VRSSelfStorageLLCMember2020-01-012020-12-310001289490exr:ARAEXRJVLLCMember2022-01-012022-12-310001289490exr:ARAEXRJVLLCMember2021-01-012021-12-310001289490exr:ARAEXRJVLLCMember2020-01-012020-12-310001289490exr:ESSNYFLJVLLCMember2022-01-012022-12-310001289490exr:ESSNYFLJVLLCMember2021-01-012021-12-310001289490exr:ESSNYFLJVLLCMember2020-01-012020-12-310001289490exr:ExtraSpaceNorthernPropertiesSixLLCMember2022-01-012022-12-310001289490exr:ExtraSpaceNorthernPropertiesSixLLCMember2021-01-012021-12-310001289490exr:ExtraSpaceNorthernPropertiesSixLLCMember2020-01-012020-12-310001289490exr:ESSBGOAtlantaGAJVLLCMember2022-01-012022-12-310001289490exr:ESSBGOAtlantaGAJVLLCMember2021-01-012021-12-310001289490exr:ESSBGOAtlantaGAJVLLCMember2020-01-012020-12-310001289490exr:AlanJathooJVLLCMember2022-01-012022-12-310001289490exr:AlanJathooJVLLCMember2021-01-012021-12-310001289490exr:AlanJathooJVLLCMember2020-01-012020-12-310001289490exr:BristolInvestmentsLLCMember2022-01-012022-12-310001289490exr:BristolInvestmentsLLCMember2021-01-012021-12-310001289490exr:BristolInvestmentsLLCMember2020-01-012020-12-310001289490exr:StoragePortfolioVJVLLCMember2022-01-012022-12-310001289490exr:StoragePortfolioVJVLLCMember2021-01-012021-12-310001289490exr:StoragePortfolioVJVLLCMember2020-01-012020-12-310001289490exr:PREXRSelfStorageLLCMember2022-01-012022-12-310001289490exr:PREXRSelfStorageLLCMember2021-01-012021-12-310001289490exr:PREXRSelfStorageLLCMember2020-01-012020-12-310001289490exr:WICNNJVLLCMember2022-01-012022-12-310001289490exr:WICNNJVLLCMember2021-01-012021-12-310001289490exr:WICNNJVLLCMember2020-01-012020-12-310001289490exr:GFNJVLLCMember2022-01-012022-12-310001289490exr:GFNJVLLCMember2021-01-012021-12-310001289490exr:GFNJVLLCMember2020-01-012020-12-310001289490exr:OtherMinorityOwnedPropertiesMember2022-01-012022-12-310001289490exr:OtherMinorityOwnedPropertiesMember2021-01-012021-12-310001289490exr:OtherMinorityOwnedPropertiesMember2020-01-012020-12-310001289490exr:NexPointPreferredStockMember2022-12-310001289490exr:NexPointPreferredStockMember2021-12-310001289490us-gaap:BridgeLoanMember2022-12-310001289490us-gaap:BridgeLoanMember2021-12-310001289490us-gaap:NotesReceivableMember2022-12-310001289490us-gaap:NotesReceivableMember2021-12-3100012894902020-11-012020-11-300001289490exr:JCAPSeriesAPreferredStockMember2020-11-300001289490exr:JCAPSeriesAPreferredStockMember2020-11-012020-11-300001289490exr:JCAPSeriesBPreferredStockMember2020-11-300001289490exr:JCAPSeriesBPreferredStockMember2020-11-012020-11-300001289490exr:JCAPSeriesDPreferredStockMember2022-12-310001289490exr:JCAPSeriesDPreferredStockMember2022-12-012022-12-31exr:extension_option0001289490exr:JCAPSeriesDPreferredStockMember2022-01-012022-12-3100012894902022-12-012022-12-310001289490us-gaap:NotesReceivableMember2020-07-012020-07-310001289490us-gaap:NotesReceivableMember2020-07-3100012894902020-07-012020-07-310001289490us-gaap:NotesReceivableMember2022-02-012022-02-280001289490us-gaap:BridgeLoanMember2022-01-012022-12-310001289490us-gaap:SeniorNotesMemberexr:SeniorNotesDue2029Member2022-03-310001289490us-gaap:SeniorNotesMemberexr:SeniorNotesDue2032Member2021-09-300001289490us-gaap:SeniorNotesMemberexr:SeniorNotesDue2031Member2021-05-310001289490us-gaap:SeniorNotesMember2022-01-012022-12-310001289490exr:SecuredLoanWithBankMemberus-gaap:NotesPayableToBanksMember2022-12-310001289490exr:SecuredLoanWithBankMemberus-gaap:NotesPayableToBanksMember2021-12-310001289490exr:SecuredLoanWithBankMemberus-gaap:NotesPayableToBanksMembersrt:MinimumMember2022-12-310001289490exr:SecuredLoanWithBankMembersrt:MaximumMemberus-gaap:NotesPayableToBanksMember2022-12-310001289490exr:UnsecuredLoanWithBankMemberus-gaap:NotesPayableToBanksMember2022-12-310001289490exr:UnsecuredLoanWithBankMemberus-gaap:NotesPayableToBanksMember2021-12-310001289490exr:UnsecuredLoanWithBankMemberus-gaap:NotesPayableToBanksMembersrt:MinimumMember2022-12-310001289490srt:MaximumMemberexr:UnsecuredLoanWithBankMemberus-gaap:NotesPayableToBanksMember2022-12-310001289490us-gaap:NotesPayableToBanksMember2022-12-310001289490us-gaap:NotesPayableToBanksMember2021-12-310001289490us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-12-310001289490us-gaap:LineOfCreditMemberexr:Tranche1TermLoanFacilityMember2022-12-310001289490exr:Tranche2TermLoanFacilityMemberus-gaap:LineOfCreditMember2022-12-310001289490us-gaap:LineOfCreditMemberexr:Tranche3TermLoanFacilityMember2022-12-310001289490exr:Tranche4TermLoanFacilityMemberus-gaap:LineOfCreditMember2022-12-310001289490exr:Tranche5TermLoanFacilityMemberus-gaap:LineOfCreditMember2022-12-310001289490us-gaap:LineOfCreditMemberexr:Tranche6TermLoanFacilityMember2022-12-310001289490us-gaap:LineOfCreditMemberexr:Tranche7TermLoanFacilityMember2022-12-310001289490us-gaap:LineOfCreditMember2022-12-310001289490us-gaap:LineOfCreditMember2022-01-012022-12-310001289490us-gaap:BaseRateMemberus-gaap:LineOfCreditMember2022-01-012022-12-310001289490us-gaap:LineOfCreditMemberus-gaap:FederalFundsEffectiveSwapRateMember2022-01-012022-12-310001289490exr:SecuredOvernightFinancingRateSOFRMemberus-gaap:LineOfCreditMember2022-01-012022-12-310001289490exr:SecuredOvernightFinancingRateSOFRMemberus-gaap:LineOfCreditMembersrt:MinimumMember2022-01-012022-12-310001289490srt:MaximumMemberexr:SecuredOvernightFinancingRateSOFRMemberus-gaap:LineOfCreditMember2022-01-012022-12-310001289490us-gaap:BaseRateMemberus-gaap:LineOfCreditMembersrt:MinimumMember2022-01-012022-12-310001289490us-gaap:BaseRateMembersrt:MaximumMemberus-gaap:LineOfCreditMember2022-01-012022-12-310001289490us-gaap:LineOfCreditMemberexr:UnsecuredDebtTrancheOneMember2022-07-310001289490us-gaap:LineOfCreditMemberexr:UnsecuredDebtTrancheTwoMember2022-07-310001289490exr:AdjustedSecuredOvernightFinancingRateMemberus-gaap:LineOfCreditMemberexr:UnsecuredDebtTrancheOneMember2022-07-012022-07-310001289490exr:AdjustedSecuredOvernightFinancingRateMemberus-gaap:LineOfCreditMemberexr:UnsecuredDebtTrancheTwoMember2022-07-012022-07-310001289490exr:FirstCreditLineMember2022-12-310001289490exr:FirstCreditLineMemberexr:SecuredOvernightFinancingRateSOFRMember2022-01-012022-12-310001289490exr:SecondCreditLineMember2022-12-310001289490exr:SecuredOvernightFinancingRateSOFRMemberexr:SecondCreditLineMember2022-01-012022-12-310001289490exr:LinesOfCreditMember2022-12-310001289490exr:FirstCreditLineMemberus-gaap:SubsequentEventMember2023-01-130001289490exr:FirstCreditLineMemberus-gaap:SubsequentEventMember2023-01-132023-01-130001289490exr:SecondCreditLineMember2022-01-012022-12-31exr:derivative0001289490us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMembersrt:MinimumMember2022-12-310001289490srt:MaximumMemberus-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMember2022-12-310001289490us-gaap:OtherAssetsMember2022-12-310001289490us-gaap:OtherAssetsMember2021-12-310001289490us-gaap:OtherLiabilitiesMember2022-12-310001289490us-gaap:OtherLiabilitiesMember2021-12-310001289490us-gaap:InterestRateSwapMember2022-01-012022-12-310001289490us-gaap:InterestRateSwapMember2021-01-012021-12-310001289490us-gaap:InterestRateSwapMember2020-01-012020-12-310001289490exr:ExchangeableSeniorNotesThreePointOneTwoFivePercentDueTwoThousandAndThirtyFiveMember2015-09-300001289490exr:ExchangeableSeniorNotesThreePointOneTwoFivePercentDueTwoThousandAndThirtyFiveMember2015-09-012015-09-300001289490exr:ExchangeableSeniorNotesThreePointOneTwoFivePercentDueTwoThousandAndThirtyFiveMembersrt:MinimumMember2015-09-012015-09-300001289490srt:MaximumMemberexr:ExchangeableSeniorNotesThreePointOneTwoFivePercentDueTwoThousandAndThirtyFiveMember2015-09-012015-09-30exr:day0001289490exr:ExchangeableSeniorNotesThreePointOneTwoFivePercentDueTwoThousandAndThirtyFiveMember2022-12-310001289490exr:ExchangeableSeniorNotesThreePointOneTwoFivePercentDueTwoThousandAndThirtyFiveMemberus-gaap:DebtInstrumentRedemptionPeriodOneMember2020-10-012020-10-010001289490us-gaap:DebtInstrumentRedemptionPeriodTwoMemberexr:ExchangeableSeniorNotesThreePointOneTwoFivePercentDueTwoThousandAndThirtyFiveMember2020-11-022020-11-020001289490us-gaap:DebtInstrumentRedemptionPeriodThreeMemberexr:ExchangeableSeniorNotesThreePointOneTwoFivePercentDueTwoThousandAndThirtyFiveMember2020-11-022020-11-020001289490exr:ExchangeableSeniorNotesMember2022-12-310001289490exr:ExchangeableSeniorNotesMember2021-12-310001289490exr:ExchangeableSeniorNotesMember2020-12-310001289490exr:ExchangeableSeniorNotesMember2022-01-012022-12-310001289490exr:ExchangeableSeniorNotesMember2021-01-012021-12-310001289490exr:ExchangeableSeniorNotesMember2020-01-012020-12-310001289490exr:AtTheMarketEquityDistributionAgreementMember2021-08-092021-08-090001289490exr:AtTheMarketEquityDistributionAgreementMember2021-01-012021-08-080001289490exr:AtTheMarketEquityDistributionAgreementMember2021-08-0800012894902021-03-232021-03-2300012894902021-03-2300012894902020-10-150001289490exr:SeriesAUnitsMember2022-12-310001289490exr:SeriesAUnitsMember2021-12-310001289490exr:SeriesBUnitsMember2022-12-310001289490exr:SeriesBUnitsMember2021-12-310001289490exr:SeriesDUnitsMember2022-12-310001289490exr:SeriesDUnitsMember2021-12-310001289490exr:SeriesAUnitsMember2007-06-300001289490exr:HoldersOfSeriesAPreferredOperatingPartnershipUnitsMemberexr:SeriesAUnitsMember2014-10-012014-10-310001289490exr:SeriesAUnitsMember2014-10-310001289490exr:HoldersOfSeriesAPreferredOperatingPartnershipUnitsMemberexr:SeriesAUnitsMember2007-06-250001289490exr:HoldersOfSeriesAPreferredOperatingPartnershipUnitsMemberexr:SeriesAUnitsMember2017-04-182017-04-180001289490exr:HoldersOfSeriesAPreferredOperatingPartnershipUnitsMemberexr:SeriesAUnitsMember2007-06-252007-06-250001289490us-gaap:SubsequentEventMemberexr:SeriesAUnitsMember2023-01-252023-01-250001289490us-gaap:SubsequentEventMemberexr:HoldersOfSeriesAPreferredOperatingPartnershipUnitsMemberexr:SeriesAUnitsMember2023-01-252023-01-250001289490exr:SeriesBUnitsMember2022-12-310001289490exr:SeriesBUnitsMember2013-01-012014-12-310001289490exr:SeriesBUnitsMember2022-05-102022-05-1000012894902021-08-312021-08-310001289490exr:SeriesCUnitsMember2014-12-012014-12-310001289490exr:SeriesDUnitsMember2022-12-310001289490exr:SeriesDUnitsMembersrt:MinimumMember2020-01-012020-12-310001289490exr:SeriesDUnitsMembersrt:MaximumMember2020-01-012020-12-310001289490exr:SeriesDUnitsMemberus-gaap:SubsequentEventMember2023-01-032023-01-030001289490exr:CommonOperatingPartnershipMember2022-12-310001289490exr:NonControllingInterestOtherMemberstpr:FL2022-12-310001289490exr:StoreLeaseMember2022-12-31exr:lease0001289490exr:StoreLeaseMembersrt:MinimumMember2022-01-012022-12-310001289490srt:MaximumMemberexr:StoreLeaseMember2022-01-012022-12-310001289490exr:CorporateOfficeAndCallCenterLeaseMembersrt:MinimumMember2022-12-310001289490exr:CorporateOfficeAndCallCenterLeaseMembersrt:MaximumMember2022-12-310001289490exr:RegionalOfficeLeaseMember2022-12-310001289490srt:MinimumMemberexr:RegionalOfficeLeaseMember2022-12-310001289490srt:MaximumMemberexr:RegionalOfficeLeaseMember2022-12-310001289490exr:DistrictOfficeLeaseMember2022-12-310001289490us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001289490srt:MinimumMemberus-gaap:RestrictedStockMember2022-01-012022-12-310001289490srt:MaximumMemberus-gaap:RestrictedStockMember2022-01-012022-12-310001289490exr:ExercisePriceRangeOneMember2022-01-012022-12-310001289490exr:ExercisePriceRangeOneMember2022-12-310001289490exr:ExercisePriceRangeTwoMember2022-01-012022-12-310001289490exr:ExercisePriceRangeTwoMember2022-12-310001289490us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001289490us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001289490us-gaap:EmployeeStockOptionMember2022-12-310001289490us-gaap:RestrictedStockMember2022-01-012022-12-310001289490us-gaap:RestrictedStockMember2021-01-012021-12-310001289490us-gaap:RestrictedStockMember2020-01-012020-12-310001289490us-gaap:RestrictedStockMember2022-12-310001289490us-gaap:RestrictedStockMember2019-12-310001289490us-gaap:RestrictedStockMember2020-12-310001289490us-gaap:RestrictedStockMember2021-12-310001289490us-gaap:PerformanceSharesMember2022-01-012022-12-310001289490us-gaap:PerformanceSharesMember2019-12-310001289490us-gaap:PerformanceSharesMember2020-01-012020-12-310001289490us-gaap:PerformanceSharesMember2020-12-310001289490us-gaap:PerformanceSharesMember2021-01-012021-12-310001289490us-gaap:PerformanceSharesMember2021-12-310001289490us-gaap:PerformanceSharesMember2022-12-31exr:segment0001289490us-gaap:OperatingSegmentsMemberexr:SelfStorageOperationsMember2022-01-012022-12-310001289490us-gaap:OperatingSegmentsMemberexr:SelfStorageOperationsMember2021-01-012021-12-310001289490us-gaap:OperatingSegmentsMemberexr:SelfStorageOperationsMember2020-01-012020-12-310001289490exr:TenantReinsuranceMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001289490exr:TenantReinsuranceMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001289490exr:TenantReinsuranceMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001289490us-gaap:OperatingSegmentsMember2022-01-012022-12-310001289490us-gaap:OperatingSegmentsMember2021-01-012021-12-310001289490us-gaap:OperatingSegmentsMember2020-01-012020-12-310001289490exr:CommitmentToAcquireStoresMember2022-12-310001289490exr:CommitmentToAcquireRetailSpaceExpectedToCloseNextFiscalYearMember2022-12-310001289490exr:CommitmentToAcquireRetailSpaceExpectedToCloseIn2024Member2022-12-310001289490exr:CommitmentToAcquireRetailSpaceWithJointVenturePartnersMember2022-12-310001289490exr:SelfStorageFacilityMemberstpr:AL2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:AL2022-12-310001289490exr:SelfStorageFacilityMemberstpr:AZ2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:AZ2022-12-310001289490exr:SelfStorageFacilityMemberstpr:CA2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:CA2022-12-310001289490exr:SelfStorageFacilityMemberstpr:CO2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:CO2022-12-310001289490exr:SelfStorageFacilityMemberstpr:CT2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:CT2022-12-310001289490exr:SelfStorageFacilityMemberstpr:FL2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:FL2022-12-310001289490exr:SelfStorageFacilityMemberstpr:GA2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:GA2022-12-310001289490exr:SelfStorageFacilityMemberstpr:HI2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:HI2022-12-310001289490exr:SelfStorageFacilityMemberstpr:ID2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:ID2022-12-310001289490exr:SelfStorageFacilityMemberstpr:IL2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:IL2022-12-310001289490exr:SelfStorageFacilityMemberstpr:IN2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:IN2022-12-310001289490exr:SelfStorageFacilityMemberstpr:KS2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:KS2022-12-310001289490exr:SelfStorageFacilityMemberstpr:KY2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:KY2022-12-310001289490stpr:LAexr:SelfStorageFacilityMember2022-01-012022-12-310001289490stpr:LAexr:SelfStorageFacilityMember2022-12-310001289490stpr:MAexr:SelfStorageFacilityMember2022-01-012022-12-310001289490stpr:MAexr:SelfStorageFacilityMember2022-12-310001289490stpr:MDexr:SelfStorageFacilityMember2022-01-012022-12-310001289490stpr:MDexr:SelfStorageFacilityMember2022-12-310001289490exr:SelfStorageFacilityMemberstpr:MI2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:MI2022-12-310001289490exr:SelfStorageFacilityMemberstpr:MN2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:MN2022-12-310001289490exr:SelfStorageFacilityMemberstpr:MO2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:MO2022-12-310001289490exr:SelfStorageFacilityMemberstpr:MS2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:MS2022-12-310001289490exr:SelfStorageFacilityMemberstpr:NC2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:NC2022-12-310001289490exr:SelfStorageFacilityMemberstpr:NH2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:NH2022-12-310001289490exr:SelfStorageFacilityMemberstpr:NJ2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:NJ2022-12-310001289490exr:SelfStorageFacilityMemberstpr:NM2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:NM2022-12-310001289490exr:SelfStorageFacilityMemberstpr:NV2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:NV2022-12-310001289490exr:SelfStorageFacilityMemberstpr:NY2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:NY2022-12-310001289490stpr:OHexr:SelfStorageFacilityMember2022-01-012022-12-310001289490stpr:OHexr:SelfStorageFacilityMember2022-12-310001289490exr:SelfStorageFacilityMemberstpr:OK2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:OK2022-12-310001289490stpr:ORexr:SelfStorageFacilityMember2022-01-012022-12-310001289490stpr:ORexr:SelfStorageFacilityMember2022-12-310001289490exr:SelfStorageFacilityMemberstpr:PA2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:PA2022-12-310001289490exr:SelfStorageFacilityMemberstpr:RI2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:RI2022-12-310001289490stpr:SCexr:SelfStorageFacilityMember2022-01-012022-12-310001289490stpr:SCexr:SelfStorageFacilityMember2022-12-310001289490exr:SelfStorageFacilityMemberstpr:TN2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:TN2022-12-310001289490stpr:TXexr:SelfStorageFacilityMember2022-01-012022-12-310001289490stpr:TXexr:SelfStorageFacilityMember2022-12-310001289490stpr:UTexr:SelfStorageFacilityMember2022-01-012022-12-310001289490stpr:UTexr:SelfStorageFacilityMember2022-12-310001289490stpr:VAexr:SelfStorageFacilityMember2022-01-012022-12-310001289490stpr:VAexr:SelfStorageFacilityMember2022-12-310001289490exr:SelfStorageFacilityMemberstpr:WA2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:WA2022-12-310001289490exr:SelfStorageFacilityMemberstpr:DC2022-01-012022-12-310001289490exr:SelfStorageFacilityMemberstpr:DC2022-12-310001289490exr:OtherCorporateAssetsMember2022-12-310001289490exr:IntangibleTenantRelationshipsAndLeaseRightsMember2022-12-310001289490exr:ConstructionInProgressAndUndevelopedLandMember2022-12-310001289490exr:FinanceLeaseMember2022-12-310001289490exr:OperatingFacilitiesMember2021-12-310001289490exr:OperatingFacilitiesMember2020-12-310001289490exr:OperatingFacilitiesMember2019-12-310001289490exr:OperatingFacilitiesMember2022-01-012022-12-310001289490exr:OperatingFacilitiesMember2021-01-012021-12-310001289490exr:OperatingFacilitiesMember2020-01-012020-12-310001289490exr:OperatingFacilitiesMember2022-12-310001289490exr:RealEstateUnderDevelopmentMember2021-12-310001289490exr:RealEstateUnderDevelopmentMember2020-12-310001289490exr:RealEstateUnderDevelopmentMember2019-12-310001289490exr:RealEstateUnderDevelopmentMember2022-01-012022-12-310001289490exr:RealEstateUnderDevelopmentMember2021-01-012021-12-310001289490exr:RealEstateUnderDevelopmentMember2020-01-012020-12-310001289490exr:RealEstateUnderDevelopmentMember2022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One) | | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022

OR | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number: 001-32269

EXTRA SPACE STORAGE INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Maryland | | 20-1076777 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

2795 East Cottonwood Parkway, Suite 300

Salt Lake City, Utah 84121

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (801) 365-4600

Securities Registered Pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading symbol | Name of each exchange on which registered |

| Common Stock, $0.01 par value | EXR | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☒ | | Accelerated filer | | ☐ |

| Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

| | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the common stock held by non-affiliates of the registrant was $22,430,933,071 based upon the closing price on the New York Stock Exchange on June 30, 2022, the last business day of the registrant’s most recently completed second fiscal quarter. This calculation does not reflect a determination that persons whose shares are excluded from the computation are affiliates for any other purpose.

The number of shares outstanding of the registrant’s common stock, $0.01 par value per share, as of February 22, 2023 was 134,985,035.

Documents Incorporated by Reference

Portions of the registrant’s definitive proxy statement to be issued in connection with the registrant’s annual stockholders’ meeting to be held in 2023 are incorporated by reference into Part III of this Annual Report on Form 10-K.

Extra Space Storage Inc.

Annual Report on Form 10-K

For the Year Ended December 31, 2022

Table of Contents

| | | | | | | | |

| |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| |

| Item 15. | | |

| Item 16. | | |

| |

Statements Regarding Forward-Looking Information

Certain information set forth in this report contains “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements include statements concerning our plans, objectives, goals, strategies, future events, future revenues or performance, capital expenditures, financing needs, plans or intentions relating to acquisitions and other information that is not historical information. In some cases, forward-looking statements can be identified by terminology such as “believes,” “expects,” “estimates,” “may,” “will,” “should,” “anticipates,” or “intends” or the negative of such terms or other comparable terminology, or by discussions of strategy. We may also make additional forward-looking statements from time to time. All such subsequent forward-looking statements, whether written or oral, by us or on our behalf, are also expressly qualified by these cautionary statements.

All forward-looking statements, including without limitation, management’s examination of historical operating trends and estimates of future earnings, are based upon our current expectations and various assumptions. Our expectations, beliefs and projections are expressed in good faith and we believe there is a reasonable basis for them, but there can be no assurance that management’s expectations, beliefs and projections will result or be achieved. All forward-looking statements apply only as of the date made. We undertake no obligation to publicly update or revise forward-looking statements which may be made to reflect events or circumstances after the date made or to reflect the occurrence of unanticipated events.

There are a number of risks and uncertainties that could cause our actual results to differ materially from the forward-looking statements contained in or contemplated by this report. Any forward-looking statements should be considered in light of the risks referenced in “Part I. Item 1A. Risk Factors” below. Such factors include, but are not limited to:

•adverse changes in general economic conditions, the real estate industry and in the markets in which we operate;

•failure to close pending acquisitions and developments on expected terms, or at all;

•the effect of competition from new and existing stores or other storage alternatives, which could cause rents and occupancy rates to decline;

•potential liability for uninsured losses and environmental contamination;

•the impact of the regulatory environment as well as national, state, and local laws and regulations including, without limitation, those governing real estate investment trusts (“REITs”), tenant reinsurance and other aspects of our business, which could adversely affect our results;

•disruptions in credit and financial markets and resulting difficulties in raising capital or obtaining credit at reasonable rates or at all, which could impede our ability to grow;

•increased interest rates;

•reductions in asset valuations and related impairment charges;

•our lack of sole decision-making authority with respect to our joint venture investments;

•the effect of recent or future changes to U.S. tax laws;

•the failure to maintain our REIT status for U.S. federal income tax purposes;

•impacts from any outbreak of highly infectious or contagious diseases such as COVID-19, including reduced demand for self-storage space and ancillary products, and potential decreases in occupancy and rental rates and staffing levels, which could adversely affect our results; and

•economic uncertainty due to the impact of natural disasters, war or terrorism, which could adversely affect our business plan.

The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. These beliefs, assumptions and expectations are subject to risks and uncertainties and can change as a result of many possible events or factors, not all of which are known to us. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. You should carefully consider these risks before you make an investment decision with respect to our securities.

We disclaim any duty or obligation to update or revise any forward-looking statements set forth in this Annual Report on Form 10-K to reflect new information, future events or otherwise.

PART I

Item 1. Business

General

Extra Space Storage Inc. (“we,” “our,” “us” or the “Company”) is a fully integrated, self-administered and self-managed real estate investment trust (“REIT”) formed as a Maryland corporation on April 30, 2004. We closed our initial public offering (“IPO”) on August 17, 2004. Our common stock is traded on the New York Stock Exchange under the symbol “EXR.”

We were formed to continue the business of Extra Space Storage LLC and its subsidiaries, which had engaged in the self-storage business since 1977. These companies were reorganized after the consummation of our IPO and various formation transactions. Our executive management team and board of directors have extensive experience and ownership positions in the Company.

Substantially all of our business is conducted through Extra Space Storage LP (the “Operating Partnership”). Our primary assets are general partner and limited partner interests in the Operating Partnership. This structure is commonly referred to as an umbrella partnership REIT, or UPREIT. We have elected to be taxed as a REIT under the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”). To the extent we continue to qualify as a REIT we will not be subject to U.S. federal tax, with certain exceptions, on our REIT taxable income that is distributed to our stockholders.

Our principal offices are located at 2795 East Cottonwood Parkway, Suite 300, Salt Lake City, Utah 84121, telephone number (801) 365-4600.

Our internet address is www.extraspace.com. We file our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports with the Securities and Exchange Commission (the “SEC”). You may obtain copies of these documents by visiting the SEC’s website at www.sec.gov. In addition, as soon as reasonably practicable after such materials are furnished to the SEC, we make copies of these documents available to the public free of charge through the Investor Relations section of our website.

Self-Storage Operations

We own, operate, manage, provide lending to, acquire, develop and redevelop self-storage properties (“stores”). We operate and manage our business by evaluating the operating performance of the properties for our entire portfolio which includes wholly-owned stores, stores in which we have a partial ownership interest and managed stores. Stores offer month-to-month rental of storage space for personal or business use.

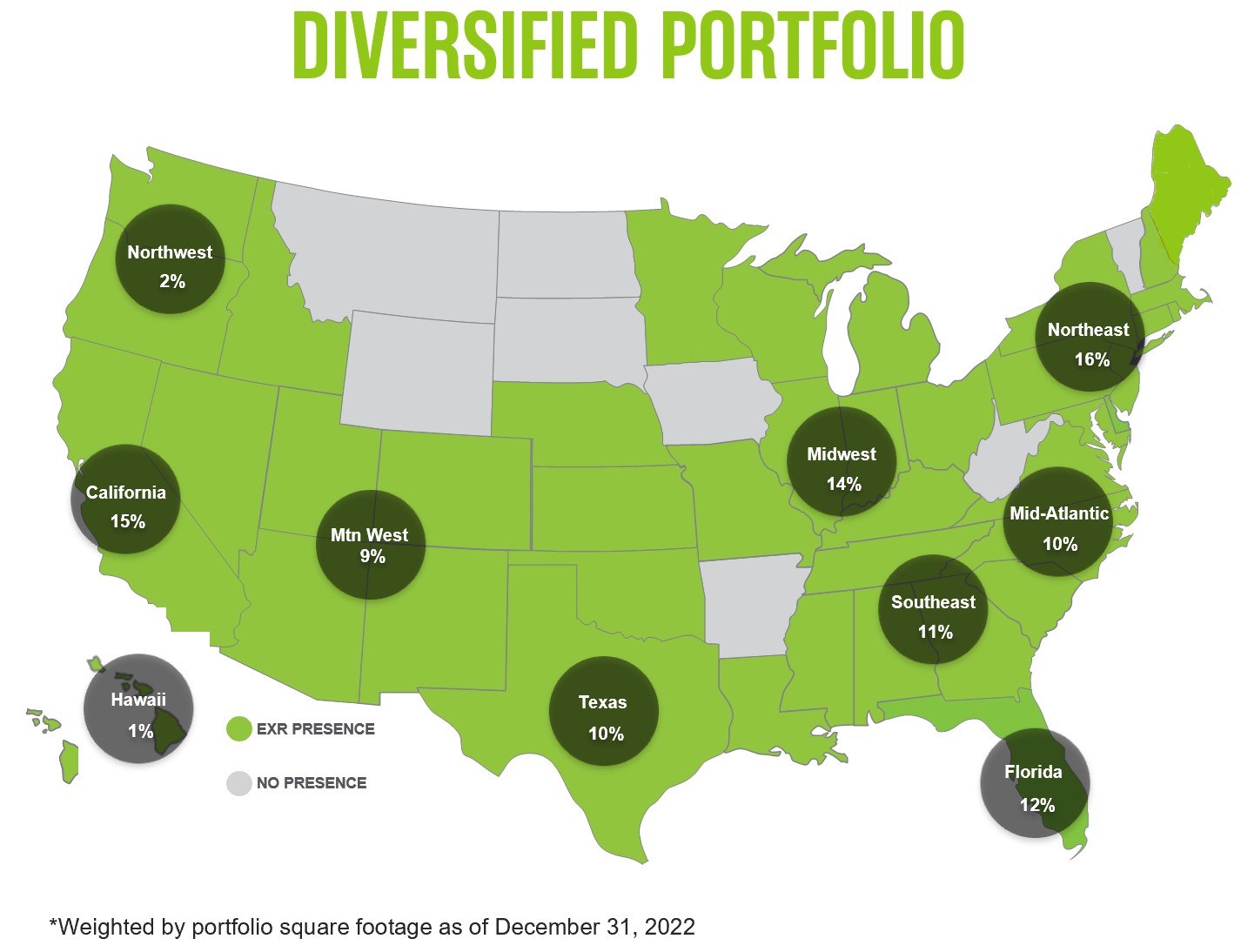

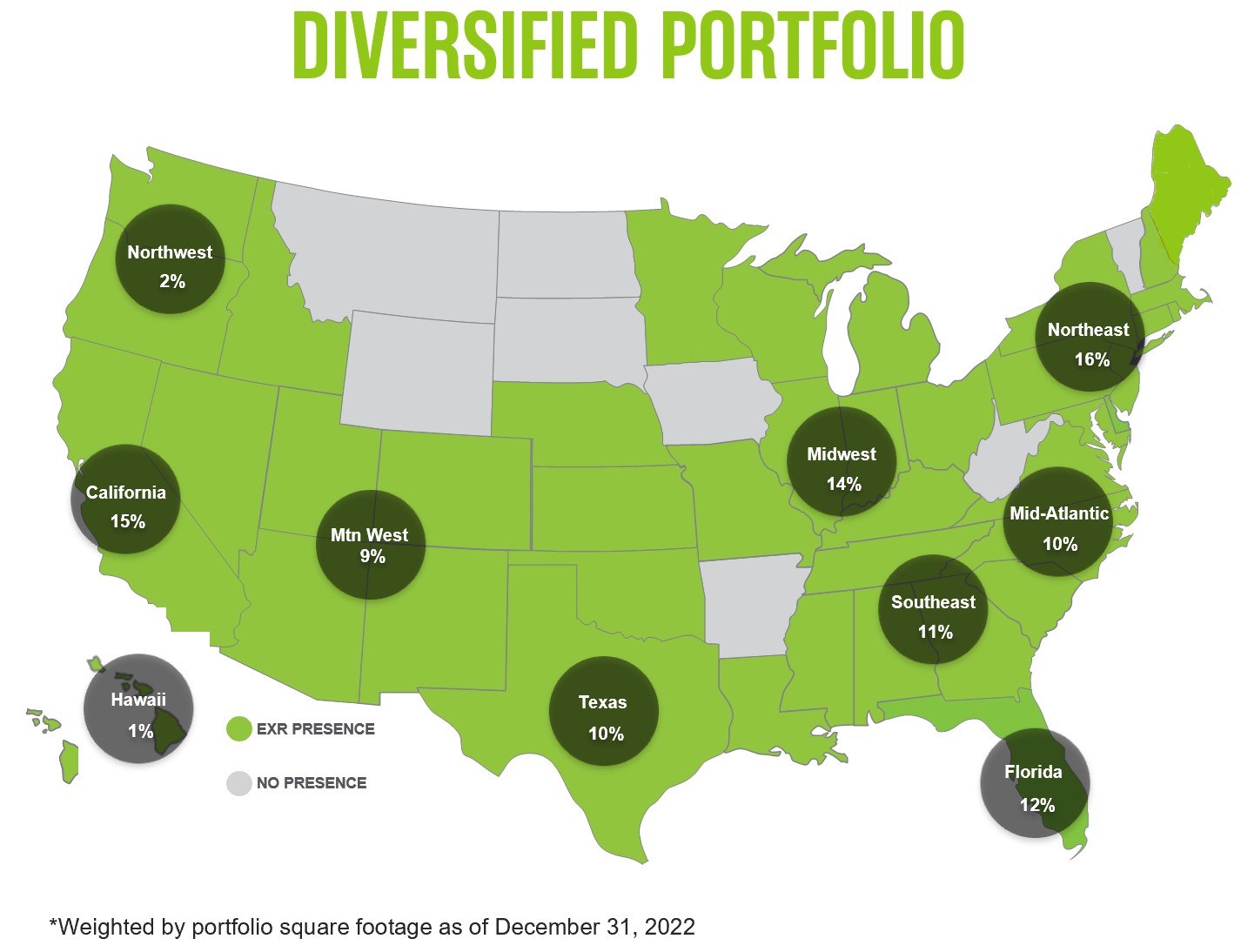

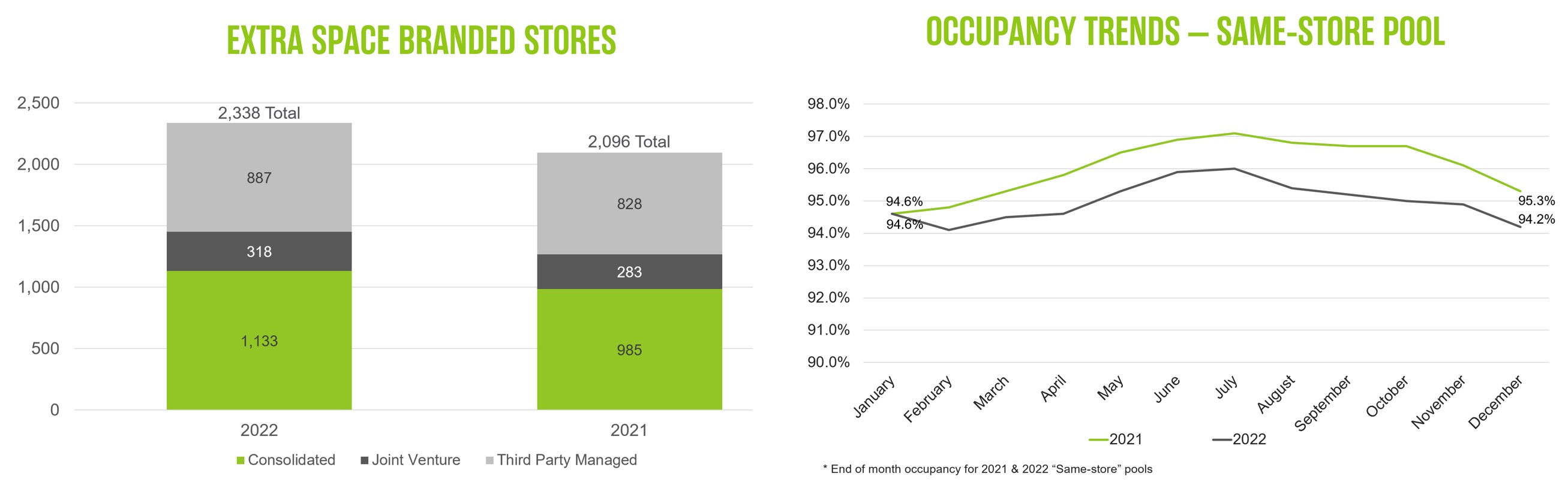

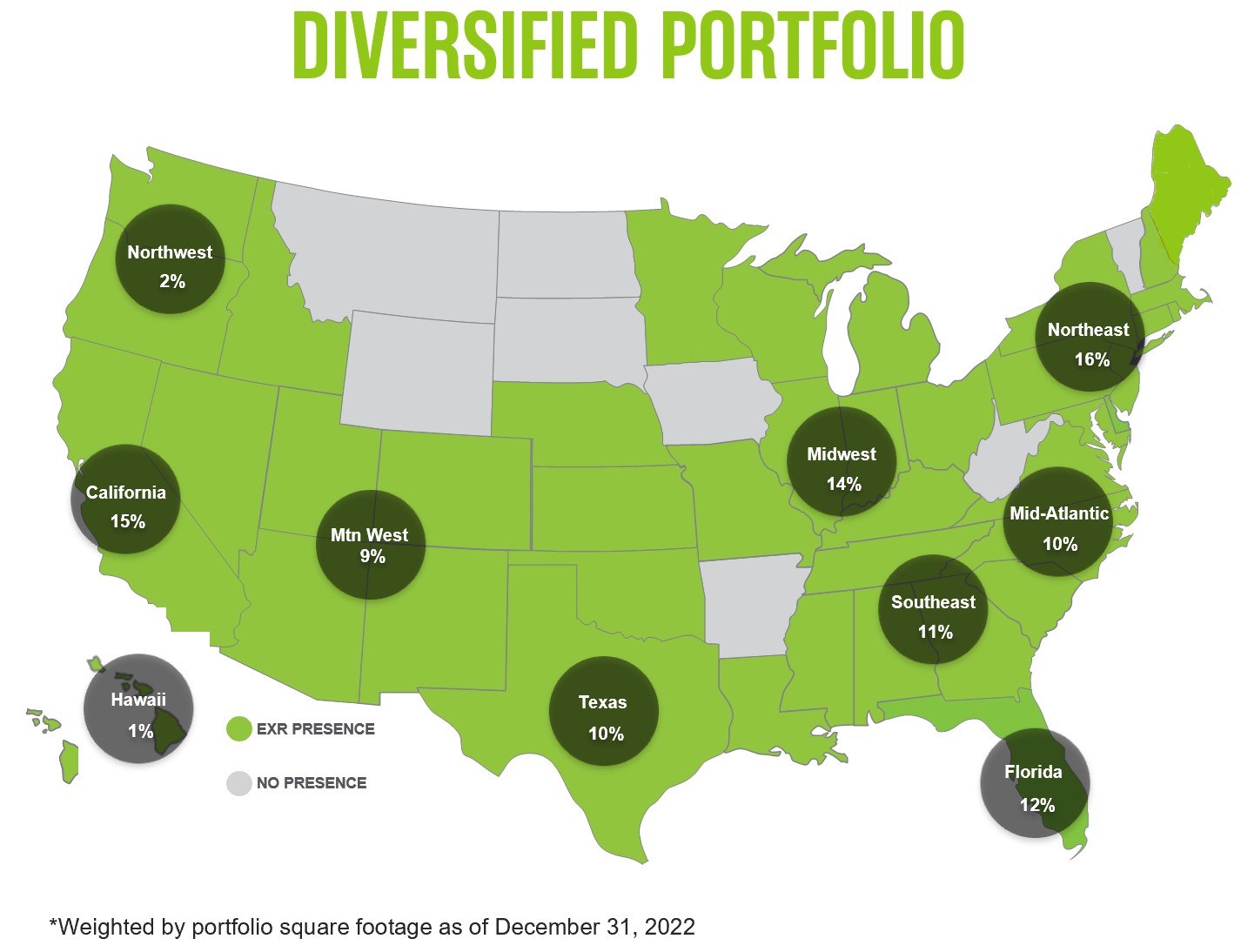

As of December 31, 2022, we owned and/or operated 2,338 stores in 41 states, and Washington, D.C., comprising approximately 176.1 million square feet of net rentable space in approximately 1.6 million units.

Other Operations

Our tenant reinsurance activities include the reinsurance of risks relating to the loss of goods stored by tenants in our stores. Our customers have the option of purchasing insurance from a non-affiliated insurance company to cover certain losses to their goods stored at our facilities, as well as those we manage for third parties. A wholly-owned, consolidated subsidiary fully reinsures such policies and thereby assumes all risk of losses under these policies and receives reinsurance premiums substantially equal to the premiums collected from our tenants, from the non-affiliated insurance company.

As of December 31, 2022, we managed 887 stores for third party owners. Our management business enables us to generate increased revenues through management fees as well as expand our geographic footprint, data sophistication and scale with little capital investment. We believe this expanded footprint enables us to reduce our operating costs through economies of scale. In addition, we see our management business as a potential future acquisition pipeline.

We have a bridge lending program, under which we provide financing to third party self storage owners for operating properties that we manage. This program helps us increase our management business, create additional potential future acquisition opportunities, and strengthen our relationships with partners, all while generating interest and fee income. We generally originate mortgage loans and mezzanine loans, with the intent to sell many of the mortgage loans to third parties, while retaining our interests in the mezzanine loans. As of December 31, 2022, the total principal balance of bridge loans receivable was $491.9 million.

We have made investments in preferred stock of other self-storage companies. These investments benefit us by providing dividend income, increasing our management business, and creating additional potential future acquisition opportunities through relationships with the companies in which we invest.

Operating Segments

We operate in two distinct segments: (1) self-storage operations; and (2) tenant reinsurance. Our self-storage operations activities include rental operations of wholly-owned stores. Tenant reinsurance activities include the reinsurance of risks relating to the loss of goods stored by tenants in our stores. For more information and comparative financial and other information on our reportable business segments, refer to the segment information footnote in the notes to the consolidated financial statements in Item 8 of this Form 10-K.

Long-Term Growth and Investment Strategies

Our primary business objectives are to maximize cash flow available for distribution to our stockholders and to achieve sustainable long-term growth in cash flow per share in order to maximize long-term stockholder value both at acceptable levels of risk. We continue to evaluate a range of growth initiatives and opportunities. Our primary strategies include the following:

Maximize the performance of our stores through strategic, efficient and proactive management

We pursue revenue-generating and expense-minimizing opportunities in our operations. We seek to maximize revenue by responding to changing market conditions through our advanced technology systems' ability to provide real-time, interactive rental rate and discount management. Our size allows us greater ability than the majority of our competitors to implement more dynamic online marketing programs, which we believe will attract more customers to our stores at a lower net cost.

We continually analyze our portfolio to look for long-term value-enhancing opportunities. We proactively redevelop properties to add units or modify existing unit mix to better meet the demand in a given market and to maximize revenue. We also redevelop properties to reduce their effective useful age, increase visual appeal, enhance security and to improve brand consistency across the portfolio.

Acquire self-storage stores

Our acquisitions team continues to pursue the acquisition of multi-store portfolios and single stores which can range from fully occupied to various stages of lease-up that we believe can provide stockholder value. We have established a reputation as a reliable, ethical buyer, which we believe enhances our ability to negotiate and close acquisitions. In addition, we believe our status as an UPREIT enables flexibility when structuring deals. We remain a disciplined buyer and only execute acquisitions that we believe will strengthen our portfolio and increase stockholder value.

In addition to the pursuit of operating stores, from time to time we develop stores from the ground up and provide the construction capital. We also purchase stores at the completion of construction from third party developers, who build to our specifications. These stores purchased at completion of construction (a "Certificate of Occupancy store"), create additional long-term value for our stockholders. We are typically able to acquire these assets at a lower price than a stabilized store, and expect greater long term returns on these stores on average. However, in the short term, these acquisitions cause dilution to our earnings during the two-to-four year period required to lease up the Certificate of Occupancy stores. We expect that this trend will continue as we continue to acquire Certificate of Occupancy stores.

Financing of Our Long-Term Growth Strategies

As a REIT, we are required to distribute at least 90%of our REIT taxable income to our stockholders. Consequently, we require access to additional sources of capital to fund our growth. We expect to maintain a flexible approach to financing growth. We plan to finance future acquisitions, store development and our bridge loan program through a diverse capital optimization strategy which includes but is not limited to: cash generated from operations, borrowings under our revolving lines of credit (the "Credit Lines"), secured and unsecured financing, equity offerings, joint ventures and the sale of stores.

Credit Lines - We have two credit lines which we primarily use as short-term bridge financing until we obtain longer-term financing through either debt or equity. As of December 31, 2022, our Credit Lines had available capacity of $1.4 billion, of which $445.0 million was undrawn.

Secured and Unsecured Debt - We primarily use public bonds, unsecured private placement bonds and unsecured bank term loans to finance store acquisitions and development efforts. We will continue to utilize a combination of secured and unsecured financing for future store acquisitions and development. As of December 31, 2022, we had $1.3 billion of secured notes payable and $5.1 billion of unsecured notes payable outstanding.

Equity - We have an active "at the market" ("ATM") program for selling stock. We sell stock under the ATM program from time to time to raise capital when we believe conditions are advantageous. During the year ended December 31, 2022, we didn't issue or sell any shares of common stock.

We view equity interests in our Operating Partnership as another source of capital that can provide an attractive tax planning opportunity to sellers of real estate. We issue common and preferred Operating Partnership units to sellers in certain acquisitions. Common Operating Partnership units receive distributions equal to the dividends on common stock, while Preferred Operating Partnership units receive distributions at various negotiated rates. We may issue additional units in the future when circumstances are favorable.

Joint Ventures - As of December 31, 2022, we owned 319 of our stores through joint ventures with third parties. Our joint venture partners typically provide most of the equity capital required for the acquisition of stores owned in these joint ventures. Most joint venture agreements include buy-sell rights, as well as rights of first offer in connection with the sale of stores by the joint venture. We manage the day-to-day operations of the stores owned in these joint ventures and have the right to participate in major decisions relating to sales of stores or financings by the applicable joint venture, but do not control the joint ventures.

Sale of Properties - We have not historically sold a high volume of stores, as we generally believe we are able to optimize the cash flow from stores through continued operations. However, we may sell more stores or interests in stores in the future in response to changing economic, financial or investment conditions. For the year ended December 31, 2022, we sold two stores for $38.7 million.

Industry & Competition

We are the second largest self-storage operator in the United States. Our four primary competitors who are public self-storage REITs are CubeSmart, Life Storage, National Storage Affiliates and Public Storage.

Stores offer month-to-month rental of storage space for personal or business use. Tenants typically rent fully enclosed spaces that vary in size and typically range from 5 feet by 5 feet to 20 feet by 20 feet, with an interior height of 8 feet to 12 feet. Tenants have responsibility for moving their items into and out of their units. Stores generally have on-site managers who supervise and run the day-to-day operations, providing tenants with assistance as needed.

Self-storage provides a convenient way for individuals and businesses to store their possessions due to life changes, or simply because of a need for storage space. The mix of residential tenants using a store is determined by a store’s local demographics and often includes people who are experiencing life changes such as downsizing their living space or others who are not yet settled into a permanent residence. Items that tenants place in self-storage are typically furniture, household items and appliances. Commercial tenants tend to include small business owners who require easy and frequent access to their goods, records, inventory or storage for seasonal goods.

Our research has shown that tenants choose a store based primarily on the convenience of the site to their home or business, making high-density, high-traffic population centers ideal locations for stores. A store’s visibility on the internet, price, perceived security, cleanliness, and the general professionalism of the store managers and staff are also contributing factors to a store’s ability to successfully secure rentals. Although most stores are leased to tenants on a month-to-month basis, tenants tend to continue their leases for extended periods of time.

The self-storage business is subject to seasonal fluctuations. A greater portion of revenues and profits are typically realized from May through September. Historically, our highest level of occupancy has been at the end of July, while our lowest level of occupancy has been in late February and early March.

The self-storage industry is a mature industry that has seen the average occupancy continue to increase. According to the Self-Storage Almanac (the “Almanac”), the national average physical occupancy rate was 90.2% of net rentable square feet in 2015, compared to an average physical occupancy rate of 93.4% in 2022. Our average occupancy for wholly-owned stores for 2022 was 93.3%.

The industry is also characterized by fragmented ownership. According to the Almanac, as of the end of 2022, the top ten self-storage companies in the United States operated approximately 24.2% of the total U.S. stores, and the top 50 self-storage

companies operated approximately 31.9% of the total U.S. stores. We believe this fragmentation will contribute to continued consolidation at some level in the future.

We believe that we are well positioned to compete for acquisitions. We have encountered competition when we have sought to acquire existing operating stores, especially for brokered portfolios. Competitive bidding practices have been commonplace between both public and private entities, and this will likely continue.

Regulation

Generally, stores are subject to various laws, ordinances and regulations, including regulations relating to lien sale rights and procedures and the Americans with Disabilities Act of 1990. Changes in any of these laws or regulations, as well as changes in laws, such as the Comprehensive Environmental Response and Compensation Liability Act, which increase the potential liability for environmental conditions or circumstances existing or created by tenants or others on stores, or laws affecting development, construction, operation, limitations on rent increases due to state of emergency or similar orders, upkeep, safety and taxation may result in significant unanticipated expenditures, loss of stores or other impairments to operations, which would adversely affect our financial position, results of operations or cash flows. In addition, noncompliance with any of these laws, ordinances or regulations could result in the imposition of fines or an award of damages to private litigants and also could require substantial capital expenditures to ensure compliance.

Insurance activities are subject to state insurance laws and regulations as determined by the particular insurance commissioner for each state in accordance with the McCarran-Ferguson Act, and are subject to the Gramm-Leach-Bliley Act and the privacy regulations promulgated by the Federal Trade Commission pursuant thereto. Store management activities may be subject to state real estate brokerage laws and regulations as determined by the particular real estate commission for each state. Our collection and processing of personal information may be subject to various data privacy and security laws, which govern the collection, use, disclosure of personal information and are constantly evolving, may conflict with each other to complicate compliance efforts and can results in investigations, proceedings, or actions that lead to significant civil and/or criminal penalties and restrictions on data processing. Changes in any of the laws governing our conduct could have an adverse impact on our ability to conduct our business or could materially affect our financial position, results of operations or cash flows.

Human Capital

At Extra Space, our culture is driven by our belief that our people are a key driver in our success. We believe that if we focus on attracting, developing, and retaining diverse top talent at all levels of the organization, our employees will take care of our customers and drive growth for our shareholders.

As of December 31, 2022, we had 4,781 employees and believe our relationship with our employees is good. Our employees are not represented by a collective bargaining agreement. In 2022, we invited our employees to participate in an employee satisfaction survey. We achieved an overall satisfaction score of 79% with over 91% of our employees participating in our survey.

Compensation, Health and Well Being

We offer competitive health benefits and encourage our employees to participate in employee health and wellness programs. Over 58% of our employees who are enrolled in our health plan participate in these programs. We offer individualized counseling to our employees to assist them with their journey towards better health. We also offer other health-oriented benefits such as smoking cessation programs and a fitness program that allows for reimbursements to employees for expenses incurred relating to fit-friendly activities, sports or exercise equipment.

Training and Development

In order to attract and retain diverse top talent, we offer training and development opportunities for our employees. In 2022, we invested in training and development for our employees, which included leadership training, communication training, individual learning plans, site manager training and mentorship programs. Our field employees received an average of eight hours of training and each new hire received an average of 82 hours of training in 2022. Additionally, we provide our employees with an education assistance program through Western Governors University that allows our employees a path to an undergraduate degree in business or information technology through scholarships and other assistance.

Diversity, Equity and Inclusion

We value diversity, equity and inclusion and undertake a wide spectrum of initiatives to attract and retain a diverse workforce. During 2022, we expanded participation in our employee resource groups that provide our employees a space to build community by celebrating their culture, providing mentoring opportunities and developing educational content for Extra Space. We will continue to implement and pursue diversity, equity and inclusion initiatives and tracking that allow us to attract and retain diverse top talent, improve employee engagement, increase innovation and customer insight and enhance the quality of our decision making. We also launched a formal internship program with Project Destined to support a more diverse talent pipeline into real estate professions. Utah Business Magazine recently recognized us as one of the top 100 Companies Championing Women.

Our employee population is approximately 47% female and approximately 44% have self-identified as people of color: Black or African American (16%), Hispanic or Latino (20%), Asian (2.4%), of two or more races (4.2%), Native American (0.6%), and Pacific Islander (0.5%).

We believe that our emphasis on training and development, employee safety, employee health and well-being, and a commitment to diversity, equity and inclusion leads to an increase in employee productivity and positions us to attract and retain top diverse talent.

Item 1A. Risk Factors

An investment in our securities involves various risks. All investors should carefully consider the following risk factors in conjunction with the other information contained in this Annual Report before trading in our securities. If any of the events set forth in the following risks actually occur, our business, operating results, prospects and financial condition could be harmed.

Our performance is subject to risks associated with real estate investments. We are a real estate company that derives our income from the operation of our stores. There are a number of factors that may adversely affect the income that our stores generate, including the following:

Risks Related to Our Stores and Operations

Adverse economic or other conditions in the markets in which we do business could negatively affect our occupancy levels and rental rates and therefore our operating results.

Our revenues and net operating income can be negatively impacted by general economic factors and other conditions that lead to a reduction in demand for rental space in the markets in which we operate. Our operations, revenues and operating income may be adversely impacted by, for example, increases in unemployment rates, rising interest rates, changing demographics, recessions, perceptions about the safety of our stores, changes in local zoning laws, consequences from climate change, public health emergencies, as well as earthquakes, hurricanes and other natural disasters, terrorist acts, civil disturbances or acts of war.

If we are unable to promptly re-let our units or if the rates upon such re-letting are significantly lower than expected, our business and results of operations would be adversely affected.

Virtually all of our leases are on a month-to-month basis. Any delay in re-letting units as vacancies arise would reduce our revenues and harm our operating results. In addition, lower than expected rental rates upon re-letting could adversely affect our revenues and impede our growth.

Uninsured losses or losses in excess of our insurance coverage could adversely affect our financial condition and our cash flow.

We maintain comprehensive property and casualty insurance policies, including liability, fire, flood, earthquake, wind (as we deem necessary or as required by our lenders), umbrella coverage and rental loss insurance with respect to our stores. Certain types of losses, however, may be either uninsurable, not economically insurable, or coverage may be excluded on certain policies, such as losses due to earthquakes, hurricanes, tornadoes, riots, acts of war, terrorism, or social engineering. Should an uninsured loss occur, we could lose both our investment in and anticipated profits and cash flow from a store. In addition, if any such loss is insured, we may be required to pay significant amounts on any claim for recovery of such a loss prior to our insurer being obligated to reimburse us for the loss, or the amount of the loss may exceed our coverage for the loss. As a result, our operating results may be adversely affected.

Legal disputes, settlement and defense costs could have an adverse effect on our operating results.

From time to time we have to make monetary settlements or defend actions or arbitration (including class actions) to resolve tenant, employment-related or other claims and disputes. Settling any such liabilities could negatively impact our operating results and cash available for distribution to stockholders, and could also adversely affect our ability to sell, lease, operate or encumber affected properties.

Our tenant reinsurance business is subject to significant governmental regulation, which may adversely affect our results.

Our tenant reinsurance business is subject to significant governmental regulation. The regulatory authorities generally have broad discretion to grant, renew and revoke licenses and approvals, to promulgate, interpret and implement regulations, and to evaluate compliance with regulations through periodic examinations, audits and investigations of the affairs of insurance providers. As a result of regulatory or private action in any jurisdiction, we may be temporarily or permanently suspended from continuing some or all of our reinsurance activities, or otherwise fined or penalized or suffer an adverse judgment, which could adversely affect our business and results of operations.

Environmental compliance costs and liabilities associated with operating our stores may adversely affect our results of operations.

Under various U.S. federal, state and local laws, ordinances and regulations, a current or previous owner, developer or operator of real estate may be liable for the costs of removal or remediation of certain hazardous or toxic substances, which could be substantial. Such laws often impose liability without regard to whether the owner or operator knew of, or was responsible for, the release or presence of such hazardous substances. From time to time, we may acquire properties, or interests in properties, with known adverse environmental conditions for which we believe that the environmental liabilities associated with these conditions are quantifiable and that the acquisition will yield a superior risk-adjusted return.

Costs associated with complying with the Americans with Disabilities Act of 1990 may result in unanticipated expenses.

Under the ADA, places of public accommodation are required to meet certain federal requirements related to access and use by disabled persons. A number of additional U.S. federal, state and local laws may also require modifications to our stores, or restrict certain further renovations of the stores, with respect to access thereto by disabled persons. If one or more of our stores is not in compliance with the ADA or other legislation, then we would be required to incur additional costs to bring the facility into compliance.

There is significant competition among self-storage operators and from other storage alternatives.

Competition in the local markets in which many of our stores are located is significant and has affected our occupancy levels, rental rates and operating expenses. Development of self-storage facilities has increased in recent years, which has intensified competition, and we expect it will continue to do so as newly developed facilities are opened. Development of self-storage facilities by other operators could continue to increase in the future. Actions by our competitors may decrease or prevent increases in our occupancy and rental rates, while increasing our operating expenses, which could adversely affect our business and results of operations.

We may not be successful in identifying and consummating suitable acquisitions that meet our criteria, which may impede our growth.

Our ability to expand through acquisitions is integral to our business strategy and requires us to identify suitable acquisition candidates or investment opportunities that meet our criteria and are compatible with our growth strategy. We may not be successful in identifying suitable stores or other assets that meet our acquisition criteria or in consummating acquisitions or investments on satisfactory terms or at all. Failure to identify or consummate acquisitions will slow our growth, which could in turn adversely affect our stock price.

Our ability to acquire stores on favorable terms and successfully integrate and operate them may be constrained by the following significant risks

•competition from local investors and other real estate investors with significant capital, including other publicly-traded REITs and institutional investment funds;

•competition from other potential acquirers may significantly increase the purchase price which could reduce our profitability;

•the inability to achieve satisfactory completion of due diligence investigations and other customary closing conditions; and

•we may acquire stores subject to liabilities without any recourse, or with only limited recourse, with respect to unknown liabilities such as liabilities for clean-up of undisclosed environmental contamination, claims by persons dealing with the former owners of the stores and claims for indemnification by general partners, directors, officers and others indemnified by the former owners of the stores.

We and our vendors rely on information technology, and any material failure, inadequacy, interruption or security failure of that technology could harm our business.

We rely on information technology networks and systems, including the Internet, to process, transmit and store electronic information, and to manage or support a variety of business processes, including financial transactions and records, personally identifiable information, and tenant and lease data. We purchase some of our information technology from vendors, on whom our systems depend. We rely on commercially available systems, software, tools and monitoring to provide security for processing, transmission and storage of confidential tenant and other sensitive information. Our information technology systems and those of our third-party service providers, strategic partners and other contractors or consultants are vulnerable to attack and damage or interruption from computer viruses and malware (e.g. ransomware), malicious code, natural disasters, terrorism, war, telecommunication and electrical failures, hacking, cyberattacks, phishing attacks and other social engineering schemes, employee theft or misuse, human error (e.g., social engineering, phishing), fraud, denial or degradation of service attacks, sophisticated nation-state and nation-state-supported actors or unauthorized access or use by persons inside our organization, or persons with access to systems inside our organization. Although we have taken steps to protect the security of our information systems and the data maintained in those systems, it is possible that our safety and security measures will not be able to prevent the systems’ improper functioning or damage, or the improper access or disclosure of personally identifiable information such as in the event of cyber-attacks. Security breaches, including physical or electronic break-ins, computer viruses, attacks by hackers and similar breaches, can create system disruptions, shutdowns or unauthorized disclosure of confidential information.

We and certain of our service providers are from time to time, subject to cyberattacks and security incidents. While to date, we do not believe that we have experienced any significant system failure, accident or security breach, this risk has generally increased as the number, intensity and sophistication of such breaches and attempted breaches from around the world have increased. Furthermore, because the technologies used to obtain unauthorized access to, or to sabotage or disrupt, systems change frequently and often are not recognized until launched against a target, we may be unable to anticipate these techniques or implement adequate preventative measures. We may also experience security breaches that may remain undetected for an extended period. Even if identified, we may be unable to adequately investigate or remediate incidents or breaches due to attackers increasingly using tools and techniques that are designed to circumvent controls, to avoid detection, and to remove or obfuscate forensic evidence. Any failure to maintain proper function, security and availability of our information systems could interrupt our operations, damage our reputation, divert significant management attention and resources to remedy any damages that result, subject us to liability claims or regulatory penalties and have a material adverse effect on our business and results of operations. Further, our insurance coverage may not be sufficient to cover the financial, legal, business or reputational losses that may result from an interruption or breach of our systems.

Failure to comply with laws and regulations relating to data privacy and protection, could adversely affect our business and our financial condition.

In the United States, both federal and various state governments have adopted, or are considering, laws, guidelines or rules for the collection, distribution, use and storage of information collected from or about consumers or their devices. For example, the California Consumer Privacy Act of 2018 ("CCPA") went into effect on January 1, 2020, and creates individual privacy rights for California consumers and increases the privacy and security obligations of entities handling certain personal information. The CCPA provides for civil penalties for violations, as well as a private right of action for data breaches that has increased the likelihood of, and risks associated with, data breach litigation. Further, the California Privacy Rights Act ("CPRA") generally went into effect in January 2023, and significantly amends the CCPA and will impose additional data protection obligations on covered businesses, including additional consumer rights processes, limitations on data uses, new audit requirements for higher risk data, and opt outs for certain uses of sensitive data. It also creates a new California data protection agency authorized to issue substantive regulations and could result in increased privacy and information security enforcement. Additional compliance investment and potential business process changes may be required. Similar laws have passed in Virginia, Utah, Connecticut and Colorado, and have been proposed in other states and at the federal level, reflecting a trend toward more stringent privacy legislation in the United States. The enactment of such laws could have potentially conflicting requirements that would make compliance challenging.

Although we work to comply with applicable laws, regulations and standards, our contractual obligations and other legal obligations, these requirements are evolving and may be modified, interpreted and applied in an inconsistent manner from one jurisdiction to another, and may conflict with one another or other legal obligations with which we must comply. Any failure or perceived failure by us or our employees, representatives, contractors, consultants, collaborators, or other third parties to

comply with such requirements or adequately address privacy and security concerns, even if unfounded, could result in additional cost and liability to us, damage our reputation, and adversely affect our business and results of operations.

Our property taxes could increase due to reassessment or property tax rate changes.

Real property taxes on our properties may increase as our properties are reassessed by taxing authorities or as property tax rates change. Therefore, the amount of property taxes we are required to pay could increase substantially from the property taxes we currently pay or have paid in the past, including on a retroactive basis. If our property taxes we pay increase, our cash flow would be adversely impacted, and our ability to pay any expected dividends to our stockholders and unitholders could be adversely affected.

Public health emergencies, such as pandemics including the COVID-19 pandemic, and measures intended to prevent the spread of a public health emergency, could adversely affect our results of operations.