Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2013 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission File No. 814-00663 |

||

ARES CAPITAL CORPORATION

(Exact name of registrant as specified in its charter)

| Maryland | 33-1089684 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

245 Park Avenue, 44th Floor, New York, New York 10167 (Address of principal executive offices) (Zip Code) |

||

(212) 750-7300 (Registrant's telephone number, including area code) |

||

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Stock, par value $0.001 per share | The NASDAQ Global Select Market | |

| 5.875% Senior Notes due 2022 | The New York Stock Exchange | |

| 7.00% Senior Notes due 2022 | The New York Stock Exchange | |

| 7.75% Senior Notes due 2040 | The New York Stock Exchange | |

| 6.875% Senior Notes due 2047 | The New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section §232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act:

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the voting stock held by non-affiliates of the registrant on June 28, 2013, based on the closing price on that date of $17.20 on The NASDAQ Global Select Market, was approximately $4,614,974,622. As of February 24, 2014, there were 297,970,920 shares of the registrant's common stock outstanding.

Portions of the registrant's Proxy Statement for its 2014 Annual Meeting of Stockholders to be filed not later than 120 days after the end of the fiscal year covered by this Annual Report on Form 10-K are incorporated by reference into Part III of this Form 10-K.

GENERAL

Ares Capital Corporation, a Maryland corporation (together with its subsidiaries, where applicable, "Ares Capital" or the "Company," which may also be referred to as "we," "us" or "our"), is a specialty finance company that is a closed-end, non-diversified management investment company. We have elected to be regulated as a business development company, or a "BDC," under the Investment Company Act of 1940, as amended, and the rules and regulations promulgated thereunder or the "Investment Company Act." We were founded on April 16, 2004, were initially funded on June 23, 2004 and completed our initial public offering on October 8, 2004. We are one of the largest BDCs with approximately $8.1 billion of total assets as of December 31, 2013.

We are externally managed by our investment adviser, Ares Capital Management LLC ("Ares Capital Management" or our "investment adviser"), a wholly owned subsidiary of Ares Management LLC ("Ares Management"), a global alternative asset manager and a Securities and Exchange Commission ("SEC") registered investment adviser with approximately $74 billion of assets under management ("AUM")(1) as of December 31, 2013. Ares Operations LLC ("Ares Operations" or our "administrator"), our administrator, a wholly owned subsidiary of Ares Management, provides administrative services necessary for us to operate.

Our investment objective is to generate both current income and capital appreciation through debt and equity investments. We invest primarily in U.S. middle-market companies, where we believe the supply of primary capital is limited and the investment opportunities are most attractive. However, we may from time to time invest in larger or smaller (in particular, for investments in early-stage and/or venture capital-backed) companies. We generally use the term "middle-market" to refer to companies with annual EBITDA between $10 million and $250 million. As used herein, EBITDA represents net income before net interest expense, income tax expense, depreciation and amortization.

We invest primarily in first lien senior secured loans (including "unitranche" loans, which are loans that combine both senior and mezzanine debt, generally in a first lien position), second lien senior secured loans and mezzanine debt, which in some cases includes an equity component. First and second lien senior secured loans generally are senior debt instruments that rank ahead of subordinated debt of a given portfolio company. Mezzanine debt is subordinated to senior loans and is generally unsecured. Our investments in corporate borrowers generally range between $30 million and $400 million each, investments in project finance/power generation projects generally range between $10 million and $200 million each and investments in early-stage and/or venture capital-backed companies generally range between $1 million and $25 million each. However, the investment sizes may be more or less than these ranges and may vary based on, among other things, our capital availability, the composition of our portfolio and general micro- and macro-economic factors.

To a lesser extent, we also make preferred and/or common equity investments, which have generally been non-control equity investments of less than $20 million (usually in conjunction with a concurrent debt investment). However, we may increase the size or change the nature of these investments.

- (1)

- AUM refers to the assets of the funds, alternative asset companies and other entities and accounts that are managed or co-managed by Ares Management. It also includes funds managed by Ivy Hill Asset Management, L.P., a wholly owned portfolio company of Ares Capital, and a registered investment adviser. It includes drawn and undrawn amounts, including certain amounts that are subject to regulatory leverage restrictions and/or borrowing base restrictions. AUM amounts are as of December 31, 2013 and are unaudited. Certain amounts are preliminary and remain subject to change, and differences may arise due to rounding.

1

The proportion of these types of investments will change over time given our views on, among other things, the economic and credit environment in which we are operating. In connection with our investing activities, we may make commitments with respect to indebtedness or securities of a potential portfolio company substantially in excess of our final investment. In such situations, while we may initially agree to fund up to a certain dollar amount of an investment, we may subsequently syndicate or sell a portion of such amount (including, without limitation, to vehicles managed by our portfolio company, Ivy Hill Asset Management, L.P. ("IHAM")), such that we are left with a smaller investment than what was reflected in our original commitment. In addition to originating investments, we may also acquire investments in the secondary market (including purchases of a portfolio of investments).

The first and second lien senior secured loans in which we invest generally have stated terms of three to 10 years and the mezzanine debt investments in which we invest generally have stated terms of up to 10 years, but the expected average life of such first and second lien loans and mezzanine debt is generally between three and seven years. However, we may invest in loans and securities with any maturity or duration. The instruments in which we invest typically are not rated by any rating agency, but we believe that if such instruments were rated, they would be below investment grade (rated lower than "Baa3" by Moody's Investors Service, lower than "BBB-" by Fitch Ratings or lower than "BBB-" by Standard & Poor's Rating Services), which, under the guidelines established by these entities, is an indication of having predominantly speculative characteristics with respect to the issuer's capacity to pay interest and repay principal. Bonds that are rated below investment grade are sometimes referred to as "high yield bonds" or "junk bonds." We may invest without limit in debt or other securities of any rating, as well as debt or other securities that have not been rated by any nationally recognized statistical rating organization.

We believe that our investment adviser, Ares Capital Management, is able to leverage the current investment platform, resources and existing relationships of Ares Management with financial sponsors, financial institutions, hedge funds and other investment firms to provide us with attractive investment opportunities. For purposes of this document, we refer to Ares Management and its affiliated companies (other than portfolio companies of its affiliated funds) as "Ares." In addition to deal flow, the Ares investment platform assists our investment adviser in analyzing, structuring and monitoring investments. Ares has been in existence for more than 16 years and its senior partners have an average of over 26 years of experience in leveraged finance, private equity, distressed debt, commercial real estate finance, investment banking and capital markets. The Company has access to Ares' investment professionals and administrative professionals, who provide assistance in accounting, finance, legal, compliance, operations, information technology and investor relations. As of December 31, 2013, Ares had 307 investment professionals and 430 administrative professionals.

We and General Electric Capital Corporation and GE Global Sponsor Finance LLC (collectively, "GE") also co-invest in first lien senior secured loans of middle market companies through an unconsolidated vehicle, the Senior Secured Loan Fund LLC, which operates using the name "Senior Secured Loan Program" (the "SSLP"). As of December 31, 2013, the SSLP had available capital of $11.0 billion of which approximately $8.7 billion in aggregate principal amount was funded at December 31, 2013. As of December 31, 2013, we had agreed to make available to the SSLP approximately $2.3 billion, of which approximately $1.7 billion was funded. The SSLP is capitalized as transactions are completed and all portfolio decisions and generally all other decisions in respect of the SSLP must be approved by an investment committee of the SSLP consisting of representatives of the Company and GE (with approval from a representative of each required). As of December 31, 2013, our investment in the SSLP was approximately $1.8 billion at fair value (including unrealized appreciation of $26.2 million), which represented approximately 23% of our total portfolio at fair value. For more information on the SSLP, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Portfolio and Investment Activity—Senior Secured Loan Program."

2

While our primary focus is to generate current income and capital appreciation through investments in first and second lien senior secured loans and mezzanine debt and, to a lesser extent, equity securities of eligible portfolio companies, we also may invest up to 30% of our portfolio in non-qualifying assets, as permitted by the Investment Company Act. Specifically, as part of this 30% basket, we may invest in entities that are not considered "eligible portfolio companies" (as defined in the Investment Company Act), including companies located outside of the United States, entities that are operating pursuant to certain exceptions under the Investment Company Act, and publicly traded entities whose public equity market capitalization exceeds the levels provided for under the Investment Company Act.

In the first quarter of 2011, the staff of the SEC (the "Staff") informally communicated to certain BDCs the Staff's belief that certain entities, which would be classified as an "investment company" under the Investment Company Act but for the exception from the definition of "investment company" set forth in Rule 3a-7 promulgated under the Investment Company Act, could not be treated as eligible portfolio companies (as defined in Section 2(a)(46) under the Investment Company Act) (i.e., in a BDC's 70% basket of "qualifying assets"). Subsequently, in August 2011 the SEC issued a concept release (the "Concept Release") which stated that "[a]s a general matter, the Commission presently does not believe that Rule 3a-7 issuers are the type of small, developing and financially troubled businesses in which the U.S. Congress intended BDCs primarily to invest" and requested comment on whether or not a 3a-7 issuer should be considered an "eligible portfolio company." We provided a comment letter in respect of the Concept Release and continue to believe that the language of Section 2(a)(46) of the Investment Company Act permits a BDC to treat as "eligible portfolio companies" entities that rely on the 3a-7 exception. However, given the current uncertainty in this area (including the language in the Concept Release), we have, solely for purposes of calculating the composition of our portfolio pursuant to Section 55(a) of the Investment Company Act, identified such entities, which include the SSLP, as "non-qualifying assets" should the Staff ultimately take an official view that 3a-7 issuers are not "eligible portfolio companies."

As of December 31, 2013, our portfolio company, IHAM, which became an SEC registered investment adviser effective March 30, 2012, managed 13 vehicles and served as the sub-manager/sub-servicer for three other vehicles (these vehicles managed or sub-managed/sub-serviced by IHAM are collectively referred to as the "IHAM Vehicles"). See Note 4 to our consolidated financial statements for the year ended December 31, 2013. As of December 31, 2013, IHAM's assets under management ("IHAM AUM")(2) was approximately $2.8 billion. As of December 31, 2013, Ares Capital had invested approximately $171 million (at amortized cost) in IHAM. In connection with IHAM's registration as a registered investment adviser, on March 30, 2012, we received exemptive relief from the SEC allowing us to, subject to certain conditions, own directly or indirectly up to 100% of IHAM's outstanding equity interests and make additional investments in IHAM once IHAM became an SEC registered investment adviser. From time to time, IHAM or certain IHAM Vehicles may purchase investments from us or sell investments to us, in each case for a price equal to the fair market value of such investments determined at the time of such transactions.

About Ares

Founded in 1997, Ares is a global alternative asset manager and an SEC registered investment adviser with approximately $74 billion of total AUM and 737 employees as of December 31, 2013.

- (2)

- IHAM AUM refers to the assets of the vehicles managed, sub-managed and sub-serviced by IHAM. It includes drawn and undrawn amounts, including amounts that are subject to certain restrictions. IHAM AUM amounts are as of December 31, 2013 and are unaudited. Certain amounts are preliminary and remain subject to change, and differences may arise due to rounding.

3

Ares specializes in originating and managing assets in the leveraged finance, commercial real estate and private equity markets. Ares' leveraged finance activities include the origination, acquisition and management of senior loans, high yield bonds, mezzanine debt and special situation investments. Ares' commercial real estate activities generally focus on lending to U.S. middle-market real estate projects. Ares' private equity activities generally focus on control-oriented equity investments in under-capitalized companies with capital structure issues. Ares has the ability to invest across a capital structure, from senior debt to common equity. This flexibility, combined with Ares' "buy and hold" philosophy, enables Ares to structure an investment to meet the specific needs of a company rather than the less flexible demands of the public markets.

The following chart shows the structure and various investment strategies of Ares as of December 31, 2013:

|

||

- (1)

- AUM refers to the assets of the funds, alternative asset companies and other entities and accounts that are managed or co-managed by Ares Management. It also includes funds managed by IHAM. It includes drawn and undrawn amounts, including certain amounts that are subject to regulatory leverage restrictions and/or borrowing base restrictions. AUM amounts are as of December 31, 2013 and are unaudited. Certain amounts are preliminary and remain subject to change, and differences may arise due to rounding.

Ares is organized around four primary investment platforms: Tradable Credit, Direct Lending, Private Equity and Real Estate. Ares' senior partners have been working together as a group for many years and have an average of over 26 years of experience in leveraged finance, private equity, distressed debt, real estate, investment banking and capital markets. They are backed by a team of 307 highly disciplined investment professionals which as of December 31, 2013 covered investments in more than 1,000 companies and more than 300 properties across over 30 industries. Ares' rigorous investment approach is based upon an intensive, independent financial analysis, with a focus on preservation of capital, diversification and active portfolio management. These fundamentals underlie Ares' investment strategy and have resulted in large pension funds, banks, insurance companies, endowments and high net worth individuals investing in Ares' funds.

Ares Capital Management

Ares Capital Management, our investment adviser, is served by an origination, investment and portfolio management team of 82 U.S.-based investment professionals as of December 31, 2013 and led by the senior partners of the Ares Management Direct Lending Group: Michael Arougheti, Kipp deVeer, Mitchell Goldstein and Michael Smith. Ares Capital Management leverages off of Ares' investment platform and benefits from the significant capital markets, trading and research expertise of Ares' investment professionals. Ares Capital Management's investment committee has seven members,

4

including the senior partners of the Ares Management Direct Lending Group, senior partners in the Ares Management Private Equity Group and a senior adviser to the Ares Management Tradable Credit Group.

MARKET OPPORTUNITY

We believe that current market conditions present attractive opportunities for us to invest in middle-market companies, specifically:

- •

- We believe that the disruption and volatility in the credit markets between 2008 and 2009 reduced capital available to

certain specialty finance companies and other capital providers, causing a reduction in competition. These market conditions may continue to create opportunities to achieve attractive risk-adjusted

returns.

- •

- We believe that many commercial and investment banks have, in recent years, de-emphasized their service and product

offerings to middle-market businesses in favor of lending to large corporate clients and managing capital markets transactions. In addition, these lenders may be constrained in their ability to

underwrite and hold bank loans and high yield securities for middle-market issuers as they seek to meet existing and future regulatory capital requirements. These factors may result in opportunities

for alternative funding sources to middle-market companies and therefore more new-issue market opportunities for us.

- •

- We believe that there is a lack of bank market participants that are willing to hold meaningful amounts of certain

middle-market loans. As a result, we believe our ability to minimize syndication risk for a company seeking financing by being able to hold our loans without having to syndicate them is a competitive

advantage.

- •

- We believe there is a large pool of un-invested private equity capital for middle-market businesses. We expect private equity firms will seek to leverage their investments by combining equity capital with senior secured loans and mezzanine debt from other sources such as us.

COMPETITIVE ADVANTAGES

We believe that we have the following competitive advantages over other capital providers to middle-market companies:

The Ares Platform

As of December 31, 2013, Ares had approximately $74 billion of total AUM in the related asset classes of non-syndicated first and second lien senior secured corporate and commercial real estate loans, syndicated corporate and commercial real estate loans, high yield bonds, corporate and commercial real estate mezzanine debt and private equity. We believe Ares' current investment platform provides a competitive advantage in terms of access to origination and marketing activities and diligence for us. In particular, we believe that the Ares platform provides us with an advantage through its deal flow generation and investment evaluation process. Ares' asset management platform also provides additional market information, company knowledge and industry insight that benefit our investment and due diligence process. Ares' professionals maintain extensive financial sponsor and intermediary relationships, which provide valuable insight and access to transactions and information.

Seasoned Management Team

The investment professionals in the Ares Management Direct Lending Group and members of our investment adviser's investment committee also have significant experience investing across market cycles. This experience also provides us with a competitive advantage in identifying, originating, investing in and managing a portfolio of investments in middle-market companies.

5

Broad Origination Strategy

We focus on self-originating most of our investments by pursuing a broad array of investment opportunities in middle-market companies across multiple channels. We also leverage off of the extensive relationships of the broader Ares platform, including relationships with the portfolio companies in the IHAM Vehicles, to identify investment opportunities. We believe that this allows for asset selectivity and that there is a significant relationship between proprietary deal origination and credit performance. We believe that our focus on generating proprietary deal flow and lead investing also gives us greater control over capital structure, deal terms, pricing and documentation and enables us to actively manage our portfolio investments. Moreover, by leading the investment process, we are often able to secure controlling positions in credit tranches, thereby providing additional control in investment outcomes. We also have originated substantial proprietary deal flow from middle-market intermediaries, which often allows us to act as the sole or principal source of institutional capital to the borrower.

Scale and Flexible Transaction Structuring

We believe that being one of the largest BDCs makes us a more desirable and flexible capital provider, especially in competitive markets. We are flexible and have significant experience in structuring investments, including the types of investments and the terms associated with such investments. We believe this approach and experience enables our investment adviser to identify attractive investment opportunities throughout economic cycles and across a company's capital structure so we can make investments consistent with our stated investment objective and preserve principal while seeking appropriate risk adjusted returns. In addition, we have the ability to provide "one stop" financing with the ability to invest capital across the balance sheet and syndicate and hold larger investments than many of our competitors. We believe that the ability to underwrite, syndicate and hold larger investments benefits our stockholders by (a) potentially increasing net income and earnings through syndication, (b) increasing originated deal flow flexibility, (c) broadening market relationships and deal flow, (d) allowing us to optimize our portfolio composition and (e) allowing us to provide capital to a broader spectrum of middle-market companies, which we believe currently have limited access to capital from traditional lending sources. In addition, we believe that the ability to provide capital at every level of the balance sheet provides a strong value proposition to middle-market borrowers and our senior debt capabilities provide superior deal origination and relative value analysis capabilities compared to traditional "mezzanine only" lenders.

Experience with and Focus on Middle-Market Companies

Ares has historically focused on investments in middle-market companies and we benefit from this experience. In sourcing and analyzing deals, our investment adviser benefits from Ares' extensive network of relationships focused on middle-market companies, including management teams, members of the investment banking community, private equity groups and other investment firms with whom Ares has had long-term relationships. We believe this network enables us to identify well-positioned prospective portfolio company investments. The Ares Management Direct Lending Group works closely with Ares' other investment professionals. As of December 31, 2013, Ares oversaw a portfolio of investments in over 1,000 companies and more than 300 properties across over 30 industries, which provides access to an extensive network of relationships and insights into industry trends and the state of the capital markets.

Disciplined Investment Philosophy

In making its investment decisions, our investment adviser has adopted Ares' long-standing, consistent, credit-based investment approach that was developed over 16 years ago by its founders. Specifically, our investment adviser's investment philosophy, portfolio construction and portfolio

6

management involve an assessment of the overall macroeconomic environment and financial markets and company-specific research and analysis. Its investment approach emphasizes capital preservation, low volatility and minimization of downside risk. In addition to engaging in extensive due diligence from the perspective of a long-term investor, our investment adviser's approach seeks to reduce risk in investments by focusing on:

- •

- businesses with strong franchises and sustainable competitive advantages;

- •

- industries with positive long-term dynamics;

- •

- businesses and industries with cash flows that are dependable and predictable;

- •

- management teams with demonstrated track records and appropriate economic incentives;

- •

- rates of return commensurate with the perceived risks;

- •

- securities or investments that are structured with appropriate terms and covenants; and

- •

- businesses backed by experienced private equity sponsors.

Extensive Industry Focus

We seek to concentrate our investing activities in industries with a history of predictable and dependable cash flows and in which the Ares investment professionals have had extensive investment experience. Ares investment professionals have developed long-term relationships with management teams and management consultants in over 30 industries, and have accumulated substantial information and identified potential trends within these industries. In turn, we benefit from these relationships, information and identification of potential trends in making investments.

OPERATING AND REGULATORY STRUCTURE

Our investment activities are managed by our investment adviser Ares Capital Management, which is wholly owned by Ares, and supervised by our board of directors, a majority of whom are independent of Ares and its affiliates. Ares Capital Management is registered under the Investment Advisers Act of 1940, or the "Advisers Act." Under our Amended and Restated Investment Advisory and Management Agreement with Ares Capital Management, referred to herein as our "investment advisory and management agreement," we have agreed to pay Ares Capital Management an annual base management fee based on our total assets, as defined under the Investment Company Act (other than cash and cash equivalents, but including assets purchased with borrowed funds), and an incentive fee based on our performance. See "Investment Advisory and Management Agreement." Ares Operations provides us with administrative services necessary for us to operate pursuant to an Amended and Restated Administration Agreement, referred to herein as our "administration agreement." See "Administration Agreement."

7

As a BDC, we are required to comply with certain regulatory requirements. For example, we are not generally permitted to invest in any portfolio company in which a fund managed by Ares or any of its downstream affiliates (other than us and our downstream affiliates) currently has an investment. However, we may co-invest on a concurrent basis with funds managed by Ares or any of its downstream affiliates, subject to compliance with existing regulatory guidance, applicable regulations and our allocation procedures. Certain types of co-investment transactions would only be permitted pursuant to an exemptive order from the SEC, for which we have applied. Any such order will be subject to certain terms and conditions. Further there is no assurance that this application for exemptive relief will be granted by the SEC.

Also, while we may borrow funds to make investments, our ability to use debt is limited in certain significant aspects. In particular, BDC's must have at least 200% asset coverage calculated pursuant to the Investment Company Act in order to incur debt or issue preferred stock (which we refer to collectively as "senior securities"), which requires us to finance our investments with at least as much equity as senior securities in the aggregate. Certain of our credit facilities also require that we maintain asset coverage of at least 200%.

In addition, as a consequence of our being a regulated investment company ("RIC") for U.S. federal income tax purposes, as well as our status as a BDC, our asset growth is dependent on our ability to raise equity capital through the issuance of common stock. RICs generally must distribute substantially all of their earnings to stockholders as dividends in order to preserve their status as a RIC and avoid additional corporate-level income taxes. This requirement, in turn, generally prevents us from using earnings to support our operations including making new investments.

MARKET CONDITIONS

From time to time, capital markets may experience periods of disruption and instability. For example, between 2008 and 2009, the global financial markets experienced stress, volatility, instability, illiquidity and disruption, and as a result, during this time the availability of capital and access to capital markets was limited. While market conditions have experienced relative stability in recent years, there have been continuing periods of volatility and there can be no assurances that adverse market conditions will not repeat themselves or worsen in the future. If they do, we could face difficulty raising new capital on attractive terms. Consequently, our operating strategy could be materially and adversely affected. As the global liquidity situation and market conditions evolve, we will continue to monitor and adjust our approach to funding accordingly. See "Risk Factors—Risks Relating to Our Business—The capital markets may experience periods of disruption and instability. Such market conditions may materially and adversely affect debt and equity capital markets in the United States, which may have a negative impact on our business and operations."

In connection with the prior depressed market conditions of the general economy during the period between 2008 and 2009, the stocks of BDCs as an industry traded at near historic lows as a result of concerns over liquidity, credit quality, leverage restrictions and distribution requirements. In some cases, certain BDCs became "forced sellers" of assets, defaulted on their indebtedness, decreased their distributions to stockholders or announced share repurchase programs. Although we believe that we currently have sufficient capital to fund our investments and operations, if such adverse market conditions repeat themselves, we cannot assure you that the market pressures we may face in the future will not have a material adverse effect on our business, financial condition and results of operations.

INVESTMENTS

Ares Capital Corporation Portfolio

We have built an investment portfolio of primarily first and second lien senior secured loans, mezzanine debt and, to a lesser extent, equity investments in private middle-market companies. Our

8

portfolio is well diversified by industry sector and its concentration to any single issuer is limited. Our largest investment as of December 31, 2013 was in the subordinated certificates of the SSLP. The SSLP consists of a diverse portfolio of first lien senior secured loans to 47 different borrowers as of December 31, 2013 and the portfolio companies in the SSLP are in industries similar to the companies in Ares Capital's portfolio. Our investment in the SSLP represented approximately 23% of our portfolio fair value as of December 31, 2013.

Our debt investments in corporate borrowers generally range between $30 million and $400 million each, investments in project finance/power generation projects generally range between $10 million and $200 million each and investments in early-stage and/or venture capital-backed companies generally range between $1 million and $25 million each. However, the sizes of our investments may be more or less than these ranges and may vary based on, among other things, our capital availability, the composition of our portfolio and general micro- and macro-economic factors.

Our preferred and/or common equity investments have generally been non-control equity investments of less than $20 million (usually in conjunction with a concurrent debt investment). However, we may increase the size or change the nature of these investments.

In addition, the proportion of these types of investments will change over time given our views on, among other things, the economic and credit environment in which we are operating. In connection with our investing activities, we may make commitments with respect to indebtedness or securities of a potential portfolio company substantially in excess of our expected final hold size. In such situations, while we may initially agree to fund up to a certain dollar amount of an investment, we may subsequently syndicate a portion of such amount such that we are left with a smaller investment than what was reflected in our original commitment. We may also syndicate a "first out" tranche of a loan to an investor and retain a "last out" tranche of such loan, in which case the "first out" tranche of such loan will generally receive priority with respect to payments of principal, interest and any other amounts due thereunder. In addition to originating investments, we may also acquire investments in the secondary market (including purchases of a portfolio of investments).

We make senior secured loans primarily in the form of first lien loans (including unitranche loans) and second lien loans. Our senior secured loans generally have terms of three to 10 years. In connection with our senior secured loans we generally receive a security interest in certain of the assets of the borrower and consequently such assets serve as collateral in support of the repayment of such senior secured loans. Senior secured loans are generally exposed to the least amount of credit risk because they typically hold a senior position with respect to scheduled interest and principal payments and security interests in assets of the borrower. However, unlike mezzanine debt, senior secured loans typically do not receive any stock, warrants to purchase stock or other yield enhancements. Senior secured loans may include both revolving lines of credit and term loans.

Structurally, mezzanine debt usually ranks subordinate in priority of payment to senior secured loans and is often unsecured. However, mezzanine debt ranks senior to common and preferred equity in a borrowers' capital structure. Mezzanine debt investments generally offer lenders fixed returns in the form of interest payments and will often provide lenders an opportunity to participate in the capital appreciation of a borrower, if any, through an equity interest. This equity interest typically takes the form of an equity co-investment and/or warrants. Due to its higher risk profile and often less restrictive covenants as compared to senior secured loans, mezzanine debt generally bears a higher stated interest rate than senior secured loans. The equity co-investment and warrants (if any) associated with a mezzanine debt investment typically allow lenders to receive repayment of their principal on an agreed amortization schedule while retaining their equity interest in the borrower. Equity issued in connection with mezzanine debt also may include a "put" feature, which permits the holder to sell its equity interest back to the borrower at a price determined through an agreed formula.

9

In making an equity investment, in addition to considering the factors discussed below under "—Investment Selection," we also consider the anticipated timing of a liquidity event, such as a public offering, sale of the company or redemption of our equity securities.

We generally seek to invest in companies in the industries in which Ares' investment professionals have direct expertise. The following is a representative list of the industries in which we have invested:

- •

- Aerospace and Defense

- •

- Automotive Services

- •

- Business Services

- •

- Consumer Products

- •

- Containers and Packaging

- •

- Education

- •

- Energy

- •

- Environmental Services

- •

- Financial Services

- •

- Food and Beverage

- •

- Healthcare Services

- •

- Investment Funds and Vehicles

- •

- Manufacturing

- •

- Oil and Gas

- •

- Other Services

- •

- Restaurant and Food Services

- •

- Retail

- •

- Telecommunications

However, we may invest in other industries if we are presented with attractive opportunities.

10

The industrial and geographic compositions of our portfolio at fair value as of December 31, 2013 and 2012 were as follows:

| |

As of December 31, | ||||||

|---|---|---|---|---|---|---|---|

| |

2013 | 2012 | |||||

Industry |

|||||||

Investment Funds and Vehicles(1) |

23.6 | % | 21.7 | % | |||

Healthcare Services |

15.4 | 12.9 | |||||

Business Services |

9.2 | 6.4 | |||||

Education |

7.5 | 7.8 | |||||

Other Services |

6.7 | 6.7 | |||||

Energy |

5.4 | 3.7 | |||||

Restaurants and Food Services |

5.2 | 7.1 | |||||

Financial Services |

5.1 | 7.3 | |||||

Consumer Products |

3.5 | 6.6 | |||||

Containers and Packaging |

3.3 | 5.1 | |||||

Manufacturing |

3.3 | 2.4 | |||||

Automotive Services |

2.9 | 3.4 | |||||

Retail |

1.6 | 0.1 | |||||

Chemicals |

1.4 | — | |||||

Aerospace and Defense |

1.4 | 2.0 | |||||

Other |

4.5 | 6.8 | |||||

| | | | | | | | |

Total |

100.0 | % | 100.0 | % | |||

| | | | | | | | |

| | | | | | | | |

- (1)

- Includes our investment in the SSLP, which had made first lien senior secured loans to 47 and 36 different borrowers as of December 31, 2013 and 2012, respectively. The portfolio companies in the SSLP are in industries similar to the companies in the Company's portfolio.

| |

As of December 31, | ||||||

|---|---|---|---|---|---|---|---|

| |

2013 | 2012 | |||||

Geographic Region |

|||||||

West(1) |

50.0 | % | 49.1 | % | |||

Mid Atlantic |

15.9 | 12.8 | |||||

Midwest |

15.8 | 19.2 | |||||

Southeast |

13.6 | 14.7 | |||||

International |

3.7 | 1.9 | |||||

Northeast |

1.0 | 2.3 | |||||

| | | | | | | | |

Total |

100.0 | % | 100.0 | % | |||

| | | | | | | | |

| | | | | | | | |

- (1)

- Includes our investment in the SSLP, which represented 23.2% and 21.3% of the total investment portfolio at fair value as of December 31, 2013 and 2012, respectively.

11

Since our initial public offering on October 8, 2004 through December 31, 2013, our exited investments resulted in an aggregate cash flow realized internal rate of return (as discussed in more detail in footnote 1 to the table below) to us of approximately 13% (based on original cash invested, net of syndications, of approximately $7.7 billion and total proceeds from such exited investments of approximately $9.4 billion). Approximately 72% of these exited investments resulted in an aggregate cash flow realized internal rate of return to us of 10% or greater.

The aggregate cash flow realized internal rate of return, original cash invested, net of syndications, and total proceeds, in each case from exited investments, are listed below from our initial public offering on October 8, 2004 through the end of each fiscal year shown below.

| |

Exited Investments IPO through December 31, |

||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

(dollar amounts in millions)

|

2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||||||||||||

Realized internal rate of return(1) |

13 | % | 13 | % | 14 | % | 15 | % | 14 | % | 19 | % | 21 | % | 26 | % | 41 | % | 17 | % | |||||||||||

Original cash invested, net of syndications |

$ | 7,717 | $ | 6,817 | $ | 4,638 | $ | 2,696 | $ | 1,220 | $ | 923 | $ | 684 | $ | 424 | $ | 119 | $ | 28 | |||||||||||

Total proceeds |

$ | 9,445 | $ | 8,264 | $ | 5,627 | $ | 3,256 | $ | 1,405 | $ | 1,104 | $ | 818 | $ | 511 | $ | 140 | $ | 32 | |||||||||||

- (1)

- Internal rate of return is the discount rate that makes the net present value of all cash flows related to a particular investment equal to zero. Internal rate of return is gross of expenses related to investments as these expenses are not allocable to specific investments. Investments are considered to be exited when the original investment objective has been achieved through the receipt of cash and/or non-cash consideration upon the repayment of a debt investment or sale of an investment or through the determination that no further consideration was collectible and, thus, a loss may have been realized.

Additionally, since our initial public offering on October 8, 2004 through December 31, 2013, our realized gains exceeded our realized losses by approximately $258 million (excluding a one-time gain on the acquisition of Allied Capital Corporation ("Allied Capital") and realized gains/losses from the extinguishment of debt and other assets). For the same time period, our average annualized net realized gain rate was approximately 1.1% (excluding a one-time gain on the acquisition of Allied Capital and realized gains/losses from the extinguishment of debt and from other assets). Net realized gain/loss rates for a particular period are the amount of net realized gains/losses during such period divided by the average quarterly investments at amortized cost in such period.

Information included herein regarding internal rates of return, realized gains and losses and annualized net realized gain rates since our initial public offering are historical results relating to our past performance and are not necessarily indicative of future results, the achievement of which cannot be assured.

INVESTMENT SELECTION

Ares' investment philosophy was developed over the past 16 years and has remained consistent and relevant throughout a number of economic cycles. We are managed using a similar investment philosophy used by the investment professionals of Ares in Ares' investment funds.

This investment philosophy involves, among other things:

- •

- an assessment of the overall macroeconomic environment and financial markets and how such assessment may impact industry

and asset selection;

- •

- company-specific research and analysis; and

- •

- with respect to each individual company, an emphasis on capital preservation, low volatility and minimization of downside risk.

12

The foundation of Ares' investment philosophy is intensive credit investment analysis, a portfolio management discipline based on both market technicals and fundamental value-oriented research, and diversification strategy. We follow a rigorous investment process based on:

- •

- a comprehensive analysis of issuer creditworthiness, including a quantitative and qualitative assessment of the issuer's

business;

- •

- an evaluation of management and its economic incentives;

- •

- an analysis of business strategy and industry trends; and

- •

- an in-depth examination of capital structure, financial results and projections.

We seek to identify those companies exhibiting superior fundamental risk-reward profiles and strong defensible business franchises while focusing on the relative value of the investment across the industry as well as for the specific company.

Intensive Due Diligence

The process through which an investment decision is made involves extensive research into the target company, its industry, its growth prospects and its ability to withstand adverse conditions. If the senior investment professional responsible for the transaction determines that an investment opportunity should be pursued, we will engage in an intensive due diligence process. Approximately 30-40% of the investments initially reviewed by us proceed to this phase. Though each transaction will involve a somewhat different approach, the regular due diligence steps generally undertaken include:

- •

- meeting with the target company's management to get an insider's view of the business, and to probe for potential

weaknesses in business prospects;

- •

- checking management's backgrounds and references;

- •

- performing a detailed review of historical financial performance, including performance through various economic cycles,

and the quality of earnings;

- •

- visiting headquarters and company operations and meeting with top and middle-level executives;

- •

- contacting customers and vendors to assess both business prospects and standard practices;

- •

- conducting a competitive analysis, and comparing the issuer to its main competitors on an operating, financial, market

share and valuation basis;

- •

- researching the industry for historic growth trends and future prospects as well as to identify future exit alternatives

(including available Wall Street research, industry association literature and general news);

- •

- assessing asset value and the ability of physical infrastructure and information systems to handle anticipated growth; and

- •

- investigating legal risks and financial and accounting systems.

Selective Investment Process

After an investment has been identified and preliminary diligence has been completed, a credit research and analysis report is prepared. This report is reviewed by the senior investment professional in charge of the potential investment. If such senior and other investment professionals are in favor of the potential investment, then it is first presented to an underwriting committee, which is comprised of senior members of the Ares Direct Lending Group.

After the investment is approved by the underwriting committee, a more extensive due diligence process is employed by the transaction team. Additional due diligence with respect to any investment may be conducted on our behalf by attorneys, independent accountants, and other third party consultants and research firms prior to the closing of the investment, as appropriate on a case-by-case basis. Approximately 7-10% of all investments initially reviewed by us will be presented to the

13

investment committee. Approval of an investment for funding requires the approval of the majority of the investment committee of Ares Capital Management, although unanimous consent is sought.

Issuance of Formal Commitment

Once we have determined that a prospective portfolio company is suitable for investment, we work with the management and/or sponsor of that company and its other capital providers, including senior, junior and equity capital providers, if any, to finalize the structure of the investment. Approximately 5-7% of the investments initially reviewed by us eventually result in the issuance of formal commitments and the closing of such transactions.

Debt Investments

We invest in portfolio companies primarily in the form of first lien senior secured loans (including unitranche loans), second lien senior secured loans and mezzanine debt. The first and second lien senior secured loans generally have terms of three to 10 years. In connection with our first and second lien senior secured loans we generally receive security interests in certain assets of our portfolio companies that will serve as collateral in support of the repayment of such loans. First and second lien senior secured loans generally have floating interest rates, which may have LIBOR floors, and also may provide for some amortization of principal and excess cash flow payments, with the remaining principal balance due at maturity.

We structure our mezzanine investments primarily as unsecured subordinated loans that provide for relatively high fixed interest rates that provide us with significant current interest income. The mezzanine debt investments generally have terms of up to 10 years. These loans typically have interest-only payments, with amortization of principal, if any, deferred to the later years of the mezzanine investment. In some cases, we may enter into loans that, by their terms, convert into equity or additional debt or defer payments of interest (or at least cash interest) for the first few years after our investment. Also, in some cases our mezzanine debt will be secured by a subordinated lien on some or all of the assets of the borrower.

In some cases, our debt investments may provide for a portion of the interest payable to be payment-in-kind ("PIK") interest. To the extent interest is PIK, it will be payable through the increase of the principal amount of the loan by the amount of interest due on the then-outstanding aggregate principal amount of such loan.

In the case of our first and second lien senior secured loans and mezzanine debt, we tailor the terms of the investment to the facts and circumstances of the transaction and the prospective portfolio company, negotiating a structure that aims to protect our rights and manage our risk while creating incentives for the portfolio company to achieve its business plan and improve its profitability. For example, in addition to seeking a senior position in the capital structure of our portfolio companies, we will seek, where appropriate, to limit the downside potential of our investments by:

- •

- targeting a total return on our investments (including both interest and potential equity appreciation) that compensates

us for credit risk;

- •

- incorporating "put" rights, call protection and LIBOR floors for floating rate loans, into the investment structure; and

- •

- negotiating covenants in connection with our investments that afford our portfolio companies as much flexibility in managing their businesses as possible, consistent with preservation of our capital. Such restrictions may include affirmative and negative covenants, default penalties, lien protection, change of control provisions and board rights, including either observation or participation rights.

We generally require financial covenants and terms that require an issuer to reduce leverage, thereby enhancing credit quality. These methods include: (a) maintenance leverage covenants requiring

14

a decreasing ratio of indebtedness to cash flow over time, (b) maintenance cash flow covenants requiring an increasing ratio of cash flow to the sum of interest expense and capital expenditures and (c) indebtedness incurrence prohibitions, limiting a company's ability to take on additional indebtedness. In addition, by including limitations on asset sales and capital expenditures we may be able to prevent a company from changing the nature of its business or capitalization without our consent.

Our debt investments may include equity features, such as warrants or options to buy a minority interest in the portfolio company. Warrants we receive with our debt investments may require only a nominal cost to exercise, and thus, as a portfolio company appreciates in value, we may achieve additional investment return from this equity interest. We may structure the warrants to provide provisions protecting our rights as a minority-interest holder, as well as puts, or rights to sell such securities back to the portfolio company, upon the occurrence of specified events. In many cases, we also obtain registration rights in connection with these equity interests, which may include demand and "piggyback" registration rights.

Equity Investments

To a lesser extent, we also make preferred and/or common equity investments, which have generally been non-control equity investments of less than $20 million (usually in conjunction with a concurrent debt investment). However, we may increase the size or change the nature of these investments.

ON-GOING RELATIONSHIPS WITH AND MONITORING OF PORTFOLIO COMPANIES

We closely monitor each investment we make, maintain a regular dialogue with both the management team and other stakeholders and seek specifically tailored financial reporting. In addition, senior investment professionals may take board seats or obtain board observation rights in connection with our portfolio companies. As of December 31, 2013, of our 193 portfolio companies, we were entitled to board seats or board observation rights on 42% of these companies and these companies represented approximately 64% of our portfolio at fair value.

We seek to exert significant influence post-investment, in addition to covenants and other contractual rights and through board participation, when appropriate, by actively working with management on strategic initiatives. We often introduce managers of companies in which we have invested to other portfolio companies to capitalize on complementary business activities and best practices.

Our investment adviser employs an investment rating system to categorize our investments. In addition to various risk management and monitoring tools, our investment adviser grades the credit risk of all investments on a scale of 1 to 4 no less frequently than quarterly. This system is intended primarily to reflect the underlying risk of a portfolio investment relative to our initial cost basis in respect of such portfolio investment (i.e., at the time of origination or acquisition), although it may also take into account under certain circumstances the performance of the portfolio company's business, the collateral coverage of the investment and other relevant factors. Under this system, investments with a grade of 4 involve the least amount of risk to our initial cost basis. The trends and risk factors for this investment since origination or acquisition are generally favorable, which may include the performance of the portfolio company or a potential exit. Investments graded 3 involve a level of risk to our initial cost basis that is similar to the risk to our initial cost basis at the time of origination or acquisition. This portfolio company is generally performing as expected and the risk factors to our ability to ultimately recoup the cost of our investment are neutral to favorable. All investments or acquired investments in new portfolio companies are initially assessed a grade of 3. Investments graded 2 indicate that the risk to our ability to recoup the initial cost basis of such investment has increased materially since origination or acquisition, including as a result of factors such as declining performance and non-compliance with debt covenants; however, payments are generally not more than 120 days past

15

due. An investment grade of 1 indicates that the risk to our ability to recoup the initial cost basis of such investment has substantially increased since origination or acquisition, and the portfolio company likely has materially declining performance. For debt investments with an investment grade of 1, most or all of the debt covenants are out of compliance and payments are substantially delinquent. For investments graded 1, it is anticipated that we will not recoup our initial cost basis and may realize a substantial loss of our initial cost basis upon exit. For investments graded 1 or 2, our investment adviser enhances its level of scrutiny over the monitoring of such portfolio company. The grade of a portfolio investment may be reduced or increased over time.

As of December 31, 2013, the weighted average grade of our portfolio was 3.0. For more information, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Portfolio and Investment Activity."

MANAGERIAL ASSISTANCE

As a BDC, we must offer, and must provide upon request, significant managerial assistance to certain of our portfolio companies. This assistance could involve, among other things, monitoring the operations of our portfolio companies, participating in board and management meetings, consulting with and advising officers of portfolio companies and providing other organizational and financial guidance. Ares Operations may provide all or a portion of this assistance pursuant to our administration agreement, the costs of which will be reimbursed by us. We may receive fees for these services.

COMPETITION

Our primary competitors include public and private funds, commercial and investment banks, commercial finance companies, other BDCs and private equity funds, each of which we compete with for financing opportunities. Many of our competitors are substantially larger and have considerably greater financial and marketing resources than we do. For example, some competitors may have access to funding sources that are not available to us. In addition, some of our competitors may have higher risk tolerances or different risk assessments, which could allow them to consider more investments and establish more relationships than we do. Furthermore, many of our competitors are not subject to the regulatory restrictions that the Investment Company Act imposes on us as a BDC. For additional information concerning the competitive risks we face, see "Risk Factors—Risks Relating to Our Business—We operate in a highly competitive market for investment opportunities."

We believe that the relationships of the members of our investment adviser's investment committee and of the senior partners of Ares enable us to learn about, and compete effectively for, financing opportunities with attractive middle-market companies in the industries in which we seek to invest. We believe that Ares' professionals' deep and long-standing direct sponsor relationships and the resulting proprietary transaction opportunities that these relationships often present, provide valuable insight and access to transactions and information. We use the industry information of Ares' investment professionals to which we have access to assess investment risks and determine appropriate pricing for our investments in portfolio companies.

STAFFING

We do not currently have any employees and do not expect to have any employees. Services necessary for our business are provided by individuals who are employees or affiliates of our investment adviser, Ares Capital Management, and our administrator, Ares Operations, each of which is a wholly owned subsidiary of Ares Management, pursuant to the terms of our investment advisory and management agreement and our administration agreement, respectively, each as described below. Each of our executive officers is an employee or affiliate of Ares Capital Management or Ares Operations. Our day-to-day investment activities are managed by our investment adviser. Most of the services necessary for the origination of our investment portfolio are provided by investment professionals

16

employed by Ares Capital Management. Ares Capital Management had 82 U.S.-based investment professionals as of December 31, 2013 who focus on origination, transaction development, investment and the ongoing monitoring of our investments. See "Investment Advisory and Management Agreement" below. We reimburse both our investment adviser and our administrator for a certain portion of expenses incurred in connection with such staffing, as described in more detail below. Because we have no employees, Ares Capital does not have a formal employee relations policy.

INVESTMENT ADVISORY AND MANAGEMENT AGREEMENT

Management Services

Ares Capital Management serves as our investment adviser and is registered as an investment adviser under the Advisers Act. Subject to the overall supervision of our board of directors, our investment adviser manages the day-to-day operations of, and provides investment advisory and management services to, Ares Capital. Under the terms of the investment advisory and management agreement, Ares Capital Management:

- •

- determines the composition of our portfolio, the nature and timing of the changes to our portfolio and the manner of

implementing such changes;

- •

- identifies, evaluates and negotiates the structure of the investments we make (including performing due diligence on our

prospective portfolio companies);

- •

- closes and monitors the investments we make;

- •

- determines the investments and other assets that we purchase, retain or sell; and

- •

- provides us with such other investment advisory and research and related services as we may from time to time reasonably require.

Ares Capital Management's services to us under the investment advisory and management agreement are not exclusive, and it is free to furnish similar services to other entities. Similarly, affiliates of our investment adviser may directly or indirectly manage funds or other investment vehicles with investment objectives similar to ours. Accordingly, we may compete with these Ares funds or other investment vehicles managed by our investment adviser and its affiliates for capital and investment opportunities. Ares Capital Management endeavors to allocate investment opportunities in a fair and equitable manner, and in any event consistent with any fiduciary duties owed to Ares Capital. Nevertheless, it is possible that we may not be given the opportunity to participate in certain investments made by investment funds or other investment vehicles managed by Ares Capital Management or its affiliates.

The sole member of Ares Capital Management is Ares Management, a global alternative asset manager and an SEC-registered investment adviser. As of December 31, 2013, Ares had approximately $74 billion of total AUM.

Management Fee

Pursuant to the investment advisory and management agreement and subject to the overall supervision of our board of directors, our investment adviser provides investment advisory and management services to us. For providing these services, our investment adviser receives a fee from us consisting of two components—a base management fee and an incentive fee.

The base management fee is calculated at an annual rate of 1.5% based on the average value of our total assets (other than cash or cash equivalents but including assets purchased with borrowed funds) at the end of the two most recently completed calendar quarters. The base management fee is payable quarterly in arrears.

17

Incentive Fee

The incentive fee has two parts. The first part is calculated and payable quarterly in arrears based on our pre-incentive fee net investment income for the quarter. Pre-incentive fee net investment income means interest income, dividend income and any other income (including any other fees such as commitment, origination, structuring, diligence and consulting fees or other fees that we receive from portfolio companies but excluding fees for providing managerial assistance) accrued during the calendar quarter, minus operating expenses for the quarter (including the base management fee, any expenses payable under the administration agreement, and any interest expense and dividends paid on any outstanding preferred stock, but excluding the incentive fee). Pre-incentive fee net investment income includes, in the case of investments with a deferred interest feature such as market discount, debt instruments with PIK interest, preferred stock with PIK dividends and zero coupon securities, accrued income that we have not yet received in cash. Our investment adviser is not under any obligation to reimburse us for any part of the incentive fee it received that was based on accrued interest that we never actually receive. See "Risk Factors—Risks Relating to Our Business—There are significant potential conflicts of interest that could impact our investment returns" and "Risk Factors—Risks Relating to Our Business—We may be obligated to pay our investment adviser incentive compensation even if we incur a loss."

Pre-incentive fee net investment income does not include any realized capital gains, realized capital losses, unrealized capital appreciation, unrealized capital depreciation or income tax expense related to realized gains. Because of the structure of the incentive fee, it is possible that we may pay an incentive fee in a quarter where we incur a loss. For example, if we receive pre-incentive fee net investment income in excess of the hurdle rate (as defined below) for a quarter, we will pay the applicable incentive fee even if we have incurred a loss in that quarter due to realized and/or unrealized capital losses.

Pre-incentive fee net investment income, expressed as a rate of return on the value of our net assets (defined as total assets less indebtedness and before taking into account any incentive fees payable during the period) at the end of the immediately preceding calendar quarter, is compared to a fixed "hurdle rate" of 1.75% per quarter. If market credit spreads rise, we may be able to invest our funds in debt instruments that provide for a higher return, which may increase our pre-incentive fee net investment income and make it easier for our investment adviser to surpass the fixed hurdle rate and receive an incentive fee based on such net investment income. To the extent we have retained pre-incentive fee net investment income that has been used to calculate this part of the incentive fee, it is also included in the amount of our total assets (other than cash and cash equivalents but including assets purchased with borrowed funds) used to calculate the 1.5% base management fee.

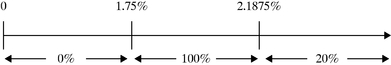

We pay our investment adviser an incentive fee with respect to our pre-incentive fee net investment income in each calendar quarter as follows:

- •

- no incentive fee in any calendar quarter in which our pre-incentive fee net investment income does not exceed the hurdle

rate;

- •

- 100% of our pre-incentive fee net investment income with respect to that portion of such pre-incentive fee net investment

income, if any, that exceeds the hurdle rate but is less than 2.1875% in any calendar quarter. We refer to this portion of our pre-incentive fee net investment income (which exceeds the hurdle rate

but is less than 2.1875%) as the "catch-up" provision. The "catch-up" is meant to provide our investment adviser with 20% of the pre-incentive fee net investment income as if a hurdle rate did not

apply if this net investment income exceeded 2.1875% in any calendar quarter; and

- •

- 20% of the amount of our pre-incentive fee net investment income, if any, that exceeds 2.1875% in any calendar quarter.

18

The following is a graphical representation of the calculation of the income-related portion of the incentive fee:

Quarterly Incentive Fee Based on Net Investment Income

Pre-incentive fee net investment income return

(expressed as a percentage of the value of net assets)

Percentage of pre-incentive fee net investment income

allocated to income-related portion of incentive fee

These calculations will be appropriately pro rated for any period of less than three months and adjusted for any share issuances or repurchases during the calendar quarter.

The second part of the incentive fee (the "Capital Gains Fee"), is determined and payable in arrears as of the end of each calendar year (or, upon termination of our investment advisory and management agreement, as of the termination date) and is calculated at the end of each applicable year by subtracting (a) the sum of our cumulative aggregate realized capital losses and aggregate unrealized capital depreciation from (b) our cumulative aggregate realized capital gains, in each case calculated from October 8, 2004. Realized capital gains and losses include gains and losses on investments and foreign currencies, as well as gains and losses on extinguishment of debt and other assets. If such amount is positive at the end of such year, then the Capital Gains Fee for such year is equal to 20% of such amount, less the aggregate amount of Capital Gains Fees paid in all prior years. If such amount is negative, then there is no Capital Gains Fee for such year.

The cumulative aggregate realized capital gains are calculated as the sum of the differences, if positive, between (a) the net sales price of each investment in our portfolio when sold and (b) the accreted or amortized cost basis of such investment.

The cumulative aggregate realized capital losses are calculated as the sum of the amounts by which (a) the net sales price of each investment in our portfolio when sold is less than (b) the accreted or amortized cost basis of such investment.

The aggregate unrealized capital depreciation is calculated as the sum of the differences, if negative, between (a) the valuation of each investment in our portfolio as of the applicable Capital Gains Fee calculation date and (b) the accreted or amortized cost basis of such investment.

Notwithstanding the foregoing, as a result of an amendment to the capital gains portion of the incentive fee under the investment advisory and management agreement (the "Capital Gains Amendment") that was approved on June 6, 2011, if we are required by generally accepted accounting principles ("GAAP") to record an investment at its fair value as of the time of acquisition instead of at the actual amount paid for such investment by us (including, for example, as a result of the application of the acquisition method of accounting), then solely for the purposes of calculating the Capital Gains Fee, the "accreted or amortized cost basis" of an investment shall be an amount (the "Contractual Cost Basis") equal to (1) (x) the actual amount paid by us for such investment plus (y) any amounts recorded in our financial statements as required by GAAP that are attributable to the accretion of such investment plus (z) any other adjustments made to the cost basis included in our financial statements, including PIK interest or additional amounts funded (net of repayments) minus (2) any amounts recorded in our financial statements as required by GAAP that are attributable to the amortization of such investment, whether such calculated Contractual Cost Basis is higher or lower than the fair value of such investment (as determined in accordance with GAAP) at the time of acquisition.

19

We defer cash payment of any incentive fee otherwise earned by our investment adviser if during the most recent four full calendar quarter period ending on or prior to the date such payment is to be made the sum of (a) the aggregate distributions to our stockholders and (b) the change in net assets (defined as total assets less indebtedness and before taking into account any incentive fees payable during the period) is less than 7.0% of our net assets (defined as total assets less indebtedness) at the beginning of such period. Any deferred incentive fees are carried over for payment in subsequent calculation periods to the extent such payment is payable under our investment advisory and management agreement.

Payment of Our Expenses

The services of all investment professionals and staff of our investment adviser, when and to the extent engaged in providing investment advisory and management services to us and routine overhead expenses of such personnel allocable to such services, are provided and paid for by our investment adviser. We bear all other costs and expenses of our operations and transactions, including, but not limited to, those relating to: rent; organization; calculation of our net asset value (including, but not limited to, the cost and expenses of any independent valuation firm); expenses incurred by our investment adviser payable to third parties, including agents, consultants or other advisers, in monitoring our financial and legal affairs and in monitoring our investments and performing due diligence on our prospective portfolio companies; interest payable on indebtedness, if any, incurred to finance our investments; offerings of our common stock and other securities; investment advisory and management fees; administration fees; fees payable to third parties, including agents, consultants or other advisers, relating to, or associated with, evaluating and making investments; transfer agent and custodial fees; registration fees; listing fees; taxes; independent directors' fees and expenses; costs of preparing and filing reports or other documents with the SEC; the costs of any reports, proxy statements or other notices to stockholders, including printing costs; to the extent we are covered by any joint insurance policies, our allocable portion of the insurance premiums for such policies; direct costs and expenses of administration, including auditor and legal costs; and all other expenses incurred by us or our administrator in connection with administering our business as described in more detail under "Administration Agreement" below.

Duration, Termination and Amendment

At an in-person meeting of our board of directors on March 16, 2011, the form of our current investment advisory and management agreement, including two proposed amendments to our then existing investment advisory and management agreement, was approved by our board of directors with the recommendation that stockholders of the Company vote to approve the proposed amendments. On June 6, 2011, our stockholders approved the proposed amendments and we entered into a restated investment advisory and management agreement, reflecting such amendments on June 6, 2011. At an in-person meeting of our board of directors on May 2, 2013, our board of directors, including a majority of the directors who are not "interested persons" of the Company as defined in the Investment Company Act, voted to approve the continuation of the investment advisory and management agreement to June 6, 2014.

Unless terminated earlier, the investment advisory and management agreement will automatically renew for successive annual periods if approved annually by our board of directors or by the affirmative vote of the holders of a majority of our outstanding voting securities, including, in either case, approval by a majority of our directors who are not "interested persons" of the Company (as defined in the Investment Company Act).

In voting to approve the current investment advisory and management agreement, the independent directors had the opportunity to consult in executive session with counsel to the Company regarding the approval of such agreement. In reaching a decision to approve the current investment advisory and

20

management agreement, our board of directors reviewed a significant amount of information and considered, among other things: