As filed with the U.S. Securities and Exchange Commission on January 11, 2023

1933 Act File No. 333-[ ]

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 [X]

Pre-Effective Amendment No. ___ Post-Effective Amendment No. ___

The Weitz Funds

(Exact Name of Registrant as Specified in Charter)

Suite 200

1125 South 103rd Street

Omaha, NE 68124-1071

(Address of Principal Executive Offices)

402-391-1980

(Registrant’s Telephone Number)

Wallace R. Weitz

Suite 200

1125 South 103rd Street

Omaha, NE 68124-1071

(Name and Address of Agent for Service)

Copies of all communications to:

Patrick W.D. Turley, Esq.

Dechert LLP

1900 K Street N.W.

Washington, DC 20006

Title of Securities being Registered: Investor Class Shares of the Weitz Partners Value Fund.

Approximate Date of Proposed Public Offering: As soon as practicable after the Registration Statement becomes effective under the Securities Act of 1933, as amended.

It is proposed that this Registration Statement will become effective on February 10, 2023 pursuant to Rule 488 under the Securities Act of 1933, as amended.

No filing fee is required under the Securities Act of 1933, as amended, because an indefinite number of shares of beneficial interest have previously been registered pursuant to Section 24(f) of the Investment Company Act of 1940, as amended.

THE WEITZ FUNDS

Weitz Hickory Fund (WEHIX)

1125 South 103rd Street, Suite 200

Omaha, Nebraska 68124

February [ ], 2023

Dear Shareholder:

The Board of Trustees of The Weitz Funds (the “Trust”) recently approved an Agreement and Plan of Reorganization relating to the Hickory Fund, a series of the Trust (the “Acquired Fund”). Under the Agreement and Plan of Reorganization, the Acquired Fund would be combined with the Partners Value Fund (the “Acquiring Fund”), another series of the Trust, in a tax-free reorganization (the “Reorganization”).

The Board unanimously approved the Reorganization of the Acquired Fund into the Acquiring Fund after considering the recommendation of Weitz Investment Management, Inc., the investment adviser to both Funds, and concluding that the Reorganization would be in the best interests of the Acquired Fund and its shareholders. The Reorganization is expected to occur on or about March 24, 2023. Upon completion of the Reorganization, you will become a shareholder of the Acquiring Fund, and you will receive shares of the Acquiring Fund equal in value to your shares of the Acquired Fund on the closing date of the transaction. The Reorganization is expected to be tax-free to you for Federal income tax purposes, and no commission, redemption fee or other transactional fee will be charged as a result of the Reorganization.

You are not being asked to vote on this action, as the Reorganization does not require shareholder approval. We do, however, ask that you carefully review the enclosed Information Statement/Prospectus, which contains important information about each of the Funds.

If you have any questions, please call us toll-free at 1-888-859-0698 between 8:00 a.m. and 4:30 p.m., Central Time, Monday through Friday.

| Sincerely, |

Wallace R. Weitz

President

The Weitz Funds

INFORMATION

STATEMENT/PROSPECTUS

FEBRUARY [ ], 2023

INFORMATION STATEMENT FOR:

Hickory Fund

1125 South 103rd Street, Suite 200

Omaha, Nebraska 68124

1-888-859-0698

PROSPECTUS FOR:

Partners Value Fund

1125 South 103rd Street, Suite 200

Omaha, Nebraska 68124

1-888-859-0698

INTRODUCTION

This combined Information Statement and Prospectus (“Information Statement/Prospectus”) is being furnished in connection with the upcoming reorganization (the “Reorganization”) of the Hickory Fund (the “Acquired Fund”), a series of The Weitz Funds, a Delaware statutory trust (the “Trust”), with and into the Partners Value Fund, another series of the Trust (the “Acquiring Fund” and together with the Acquired Fund, the “Funds”).

This Information Statement/Prospectus is being provided to shareholders of the Acquired Fund to inform you of the pending Reorganization and to provide you with information concerning the Acquiring Fund. Because shareholders of the Acquired Fund will ultimately hold shares of the Acquiring Fund, this Information Statement/Prospectus also serves as a Prospectus for the Acquiring Fund.

This Information Statement/Prospectus is for informational purposes only and you do not need to do anything in response to receiving it. We are not asking you for a proxy or written consent, and you are requested not to send us a proxy or written consent.

This Information Statement/Prospectus, which should be read and retained for future reference, sets forth concisely the information about the Acquiring Fund that a shareholder should know before investing. A Statement of Additional Information (the “SAI”) relating to this Information Statement/Prospectus dated February [ ], 2023, containing additional information about the Reorganization and the Funds, has been filed with the U.S. Securities and Exchange Commission (the “SEC”) and is incorporated herein by reference. You may receive a copy of the SAI without charge by contacting the Funds at 4221 North 203rd Street, Suite 100, Elkhorn, Nebraska, or calling toll free 1-888-859-0698.

For more information regarding the Acquiring Fund, see the Prospectus and the SAI for the Acquiring Fund each dated July 31, 2022, as supplemented and restated October 24, 2022, which have been filed with the SEC and which are incorporated herein by reference. The Annual Report of the Funds for the fiscal year ended March 31, 2022, and the Semi-Annual Report of the Funds for the semi-annual period ended September 30, 2022, which highlight certain important information such as investment results and financial information for each of the Funds and which have been filed with the SEC, are incorporated herein by reference. You may receive copies of each of the Prospectus, the SAI, the Annual Report and Semi-Annual Report mentioned above without charge by contacting the Funds at c/o Ultimus Fund Solutions, LLC, P.O. Box 541150, Omaha, NE 68154 or by calling toll free 1-888-859-0698.

Reports and other information about the Funds are available on the EDGAR Database on the SEC’s Internet site at http://www.sec.gov. You may obtain copies of this information, after paying a duplicating fee, by electronic request at the following e-mail address: publicinfo@sec.gov.

THE U.S. SECURITIES AND EXCHANGE COMMISSION

HAS NOT APPROVED OR

DISAPPROVED THESE SECURITIES, OR DETERMINED THAT THIS INFORMATION

STATEMENT/PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY

REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

TABLE OF CONTENTS

| SUMMARY | 1 |

| The Reorganization | 1 |

| Board Consideration | 1 |

| The Trust | 1 |

| COMPARISON OF INVESTMENT OBJECTIVES AND PRINCIPAL INVESTMENT STRATEGIES | 2 |

| COMPARISON OF FEES AND EXPENSES | 5 |

| COMPARISON OF SALES LOAD AND DISTRIBUTION ARRANGEMENTS | 6 |

| COMPARISON OF PURCHASE, REDEMPTION AND EXCHANGE POLICIES AND PROCEDURES | 6 |

| COMPARISON OF FUNDAMENTAL AND NON-FUNDAMENTAL INVESTMENT RESTRICTIONS | 6 |

| COMPARISON OF PRINCIPAL RISKS OF INVESTING IN THE FUNDS | 7 |

| COMPARISON OF PERFORMANCE | 8 |

| INFORMATION ABOUT THE REORGANIZATION | 11 |

| The Agreement and Plan of Reorganization | 11 |

| Reasons for the Reorganization and Board Considerations | 11 |

| Tax Considerations | 12 |

| Expenses of the Reorganization | 15 |

| ADDITIONAL INFORMATION ABOUT THE FUNDS | 15 |

| Investment Adviser | 15 |

| Other Service Providers | 16 |

| ADDITIONAL INFORMATION ABOUT THE FUNDS | 16 |

| Financial Highlights | 16 |

| Form of Organization | 16 |

| Capitalization | 17 |

| Security Ownership of Certain Beneficial Owners | 17 |

| EXHIBIT A - AGREEMENT AND PLAN OF REORGANIZATION | A-1 |

| EXHIBIT B – PARTNERS VALUE FUND SHAREHOLDER INFORMATION | B-1 |

SUMMARY

This Summary is qualified in its entirety by reference to the additional information contained elsewhere in this Information Statement/Prospectus and in the Agreement and Plan of Reorganization, a form of which is attached to this Information Statement/Prospectus as Exhibit A. Shareholders should read this entire Information Statement/Prospectus carefully. For more complete information, please read each Fund’s Prospectus.

The Reorganization

The Board of Trustees of The Weitz Funds (the “Trust”) has approved the Agreement and Plan of Reorganization, which provides for the following:

| · | the transfer of all of the assets of the Acquired Fund to the Acquiring Fund in exchange for shares of beneficial interest of the Acquiring Fund; |

| · | the assumption by the Acquiring Fund of all of the liabilities of the Acquired Fund; |

| · | the distribution of Acquiring Fund shares of beneficial interest to the shareholders of the Acquired Fund; and |

| · | the complete termination and liquidation of the Acquired Fund. |

The Agreement and Plan of Reorganization is not subject to approval by shareholders of the Acquired Fund. The Reorganization is scheduled to be effective upon the close of business on March 24, 2023, or on a later date as the parties may agree (the “Closing Date”). As a result of the Reorganization, each shareholder of the Acquired Fund will become the owner of the number of full and fractional Investor Class Shares of the Acquiring Fund having an aggregate net asset value (“NAV”) equal to the aggregate NAV of the shareholder’s shares of the Acquired Fund as of the close of business on the Closing Date. See “INFORMATION ABOUT THE REORGANIZATION,” below. It is expected that the Reorganization will be a tax-free reorganization. See “INFORMATION ABOUT THE REORGANIZATION – Tax Considerations,” below.

Board Consideration

For the reasons set forth below under “Reasons for the Reorganization and Board Considerations,” the Board of Trustees, including all of the Trustees who are not “interested persons” of the Trust, as that term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”), (the “Independent Trustees”), has concluded that the Reorganization is in the best interest of the Acquired Fund and its shareholders, and that the interests of the Acquired Fund’s existing shareholders would not be diluted as a result of the Reorganization. The Board of Trustees has also approved the Reorganization on behalf of the Acquiring Fund and has concluded that the Reorganization is in the best interest of the Acquiring Fund and its shareholders, and that the interests of the Acquiring Fund’s existing shareholders would not be diluted as a result of the Reorganization.

The Trust

Both Funds are series of the Trust, an open-end management investment company organized as a Delaware statutory trust. The Trust offers redeemable shares in different classes and series. The Acquiring Fund currently offers for sale two classes of shares, Institutional Class Shares and Investor Class Shares. The Acquired Fund offers one class of shares. As of the close of business on the Closing Date, shareholders of the Acquired Fund will become shareholders of Investor Class Shares of the Acquiring Fund.

1

COMPARISON OF INVESTMENT OBJECTIVES AND PRINCIPAL INVESTMENT STRATEGIES

This section will help you compare the investment objectives and principal investment strategies of the Acquired Fund and the Acquiring Fund, as well as compare other characteristics of the Acquired Fund and the Acquiring Fund.

The investment objective of both the Acquired Fund and Acquiring Fund is capital appreciation.

The principal investment strategies of each Fund are not materially different. While the Acquired Fund will invest the majority of its assets in common stock of medium-sized companies, the Acquiring Fund is a multi-cap fund and may invest in securities of any market capitalization. The Acquired Fund considers medium-sized companies to be issuers with market capitalizations less than or equal to the largest company in the Russell Midcap Index, which was $54.74 billion as of November 30, 2022. Both Funds look to buy above-average to highest quality businesses, at prices Weitz Investment Management, Inc., the investment adviser to each of the Funds (“Weitz Inc.” or the “Adviser”), believes are less than what the companies are worth. Both Funds may invest in securities issued by non-U.S. companies, which may be denominated in U.S. Dollars or foreign currencies. Both Funds may also concentrate their investments in securities of relatively few issuers. Both Funds may also invest in the securities of other investment companies. Both Funds may also invest for temporary defensive purposes a portion or all of its assets in high-quality nonconvertible preferred stock, high-quality nonconvertible debt securities and high-quality U.S. Government, state and municipal and governmental agency and instrumentality obligations, or retain funds in cash or cash equivalents, such as money market fund shares, when Weitz Inc. believes that circumstances warrant such a temporary defensive investment position.

Set forth below is a side-by-side comparison of the investment objectives, principal investment strategies and other characteristics of each of the Funds.

| Hickory Fund/Acquired Fund | Partners Value Fund/Acquiring Fund | |

| Investment Objective | The investment objective of the Fund is capital appreciation. |

The investment objective of the Fund is capital appreciation.

|

2

|

Principal Investment Strategies |

The Fund’s investment strategy (which we call “Quality at a Discount”) is to buy above-average to highest-quality businesses, at prices that we believe are less than what the companies are worth. Under normal circumstances, the Fund will invest the majority of its assets in common stock of medium-sized companies. The Fund considers medium-sized companies to be issuers with market capitalizations less than or equal to the largest company in the Russell Midcap Index, which was $54.74 billion as of November 30, 2022. The Fund may invest in securities issued by non-U.S. companies, which may be denominated in U.S. dollars or foreign currencies. As part of the Fund’s strategy, the Fund may concentrate its investments in securities of relatively few issuers.

We assess a company’s quality based on its competitive position, return on invested capital, ability to redeploy capital, cash flow consistency, financial leverage and management team. We compare the company’s stock price to our estimate of business value, i.e., all the cash that the company will generate for its owners in the future. For each company, we look at a range of business value estimates. We then seek to buy stocks of companies that meet our quality criteria when they are priced are at a discount to our estimates of business value.

We invest with a multiple-year time horizon. We believe that purchasing stocks at prices less than our business value estimates provides opportunities for stock price appreciation, both as business values grow and as the market recognizes companies’ values. Typically, we consider selling stocks as they approach or exceed our business value estimates. We may also sell stocks for other reasons, including for the purchase of stocks that we believe offer better investment opportunities.

We do not try to “time” the market. However, if there is cash available for investment and there are not securities that meet the Fund’s investment criteria, the Fund may invest without limitation in high-quality cash and cash equivalents such as U.S. government securities or government money market fund shares. If the Fund takes such a defensive position, it may be temporarily unable to achieve its investment objective.

|

The Fund’s investment strategy (which we call “Quality at a Discount”) is to buy above-average to highest-quality businesses, at prices that we believe are less than what the companies are worth. The Fund is a “multi-cap” fund and may invest in securities of any market capitalization. The Fund may invest in securities issued by non-U.S. companies, which may be denominated in U.S. dollars or foreign currencies. As part of the Fund’s strategy, the Fund may concentrate its investments in securities of relatively few issuers.

We assess a company’s quality based on its competitive position, return on invested capital, ability to redeploy capital, cash flow consistency, financial leverage and management team. We compare the company’s stock price to our estimate of business value, i.e., all the cash that the company will generate for its owners in the future. For each company, we look at a range of business value estimates. We then seek to buy stocks of companies that meet our quality criteria when they are priced are at a discount to our estimates of business value.

We invest with a multiple-year time horizon. We believe that purchasing stocks at prices less than our business value estimates provides opportunities for stock price appreciation, both as business values grow and as the market recognizes companies’ values. Typically, we consider selling stocks as they approach or exceed our business value estimates. We may also sell stocks for other reasons, including for the purchase of stocks that we believe offer better investment opportunities.

We do not try to “time” the market. However, if there is cash available for investment and there are not securities that meet the Fund’s investment criteria, the Fund may invest without limitation in high-quality cash and cash equivalents such as U.S. government securities or government money market fund shares. If the Fund takes such a defensive position, it may be temporarily unable to achieve its investment objective.

|

| Portfolio Turnover | Each Fund pays transactions costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the example, affect a Fund’s performance. During the most recent fiscal year, the portfolio turnover for the Acquiring Fund was 8% of the average value of the portfolio and was 15% of the average value of the Acquired Fund’s portfolio. | |

3

| 1940 Act Diversification | The Acquired Fund is diversified. | The Acquiring Fund is diversified. |

| Benchmark | Russell Midcap Index | Russell 3000 Index |

| Investment Adviser | Weitz Investment Management, Inc. | Weitz Investment Management, Inc. |

| Portfolio Managers |

Wallace R. Weitz, CFA Andrew S. Weitz |

Wallace R. Weitz, CFA Bradley P. Hinton, CFA Andrew S. Weitz |

4

COMPARISON OF FEES AND EXPENSES

The following table compares the Total Annual Fund Operating Expenses, expressed as a percentage of net assets, of the Acquired Fund with the Total Annual Fund Operating Expenses of the Investor Class Shares of the Acquiring Fund and the estimated (pro forma) Total Annual Fund Operating Expenses of the Investor Class Shares of the Acquiring Fund assuming completion of the Reorganization. The Total Annual Fund Operating Expenses provided below are based on the unaudited financials for the Acquired Fund and Acquiring Fund for the semi-annual period ended September 30, 2022. The pro forma Total Annual Fund Operating Expenses show projected estimated expenses, but actual expenses may be higher or lower than those shown. As shown in the table, the Other Expenses of the Investor Class Shares of the Acquiring Fund are lower than the Other Expenses of the Acquired Fund. The Other Expenses of the Investor Class Shares of the Acquiring Fund and the Other Expenses of the Acquired Fund include the fees payable by the Acquiring Fund and by the Acquired Fund pursuant to the Administrative Services Plan that is equally applicable with respect to the Acquiring Fund and the Acquired Fund. Other Expenses also include fees paid by each of the Funds for services provided under a business administration, sub-administration and transfer agency services agreements that are equally applicable to each of the Funds. As further shown in the table, the Management Fees applicable with respect to the Acquiring Fund are lower than the Management Fees applicable to the Acquired Fund.

Fees and Expenses

| Shareholder Fees (fees paid directly from your investment) |

Hickory Fund/Acquired Fund |

Partners Value Fund/Acquiring Fund – Investor Class Shares |

Combined Fund -Investor Class Shares Pro Forma | |||

| Maximum sales charge (Load) on purchase | None | None | None | |||

| Maximum deferred sales charge (Load) | None | None | None | |||

| Redemption Fee | None | None | None | |||

|

Annual Fund Operating Expenses |

||||||

| Management Fees | 0.85% | 0.75% | 0.75%% | |||

| Distribution (12b-1) Fees | None | None | None | |||

| Other Expenses | 0.38% | 0.32% | 0.32% | |||

| Total Annual Fund Operating Expenses | 1.23% | 1.07% | 1.07% | |||

| Fee waiver and/or expense reimbursement | (0.16)%(1) | None(2) | None(2) | |||

| Total annual fund operating expenses after fee waiver and/or expense reimbursement | 1.07% | 1.07% | 1.07% |

| (1) | The Adviser has agreed in writing to waive its fees and reimburse certain expenses (excluding taxes, interest, brokerage costs, acquired fund fees and expenses and extraordinary expenses) to limit the total annual fund operating expenses for Hickory Fund to 1.09% of the Fund’s average daily net assets through July 31, 2023. This agreement may only be terminated by the Board of Trustees of the Funds. |

| (2) | The Adviser has agreed in writing to waive its fees and reimburse certain expenses (excluding taxes, interest, brokerage costs, acquired fund fees and expenses and extraordinary expenses) to limit the total annual fund operating expenses for Investor Class Shares of Partners Value Fund to 1.09% of the Fund’s average daily net assets through July 31, 2024. This agreement may only be terminated by the Board of Trustees of the Funds |

5

Examples

The following examples are intended to help you compare the costs of investing in each Fund and the combined Fund. The examples assume that you invest $10,000 in each Fund and in the combined Fund after the Reorganization for the periods indicated and then redeem in full at the end of each of the periods indicated. The examples also assume that your investment has a 5% return each year and that each Fund’s operating expenses remain the same each year. The examples reflect the contractual fee waiver and/or expense reimbursement arrangement, if applicable, for the current duration of the arrangement only. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

Fund |

1 year |

3 years |

5 years |

10 years |

| Acquired Fund | $109 | $374 | $660 | $1,475 |

| Acquiring Fund | ||||

| Investor Class Shares | $109 | $340 | $590 | $1,306 |

|

Acquiring Fund Pro Forma Combined |

||||

| Investor Class Shares | $109 | $340 | $590 | $1,306 |

COMPARISON OF SALES LOAD AND DISTRIBUTION ARRANGEMENTS

The Acquiring Fund offers two classes of shares: Institutional Class Shares and Investor Class Shares. The Acquired Fund offers one class of shares. Weitz Securities, Inc. acts as the distributor (the “Distributor”) for both the Acquiring Fund and the Acquired Fund. Neither the Acquiring Fund nor the Acquired Fund have adopted a distribution plan pursuant to Rule 12b-1 under the 1940 Act, and therefore, neither Fund is subject to any distribution fees payable for distribution of the Fund’s shares. The Distributor provides distribution services without compensation from the Funds. Neither the Acquiring Fund or the Acquired Fund is subject to a front-end sales load or a contingent deferred sales charge.

COMPARISON OF PURCHASE, REDEMPTION AND EXCHANGE POLICIES AND PROCEDURES

The Funds have the same policies with respect to purchases, redemptions and exchanges by shareholders. More complete information regarding the Funds may be found in Exhibit B to this Information Statement/Prospectus.

COMPARISON OF FUNDAMENTAL AND NON-FUNDAMENTAL INVESTMENT RESTRICTIONS

The Funds have adopted fundamental investment restrictions, which cannot be changed without the approval of the majority of the respective Fund’s outstanding shares. “Majority” means, the lesser of (a) 67% or more of a Fund’s outstanding shares voting at a special or annual meeting of shareholders at which more than 50% of the outstanding shares are represented in person or by proxy or (b) more than 50% of a Fund’s outstanding shares. The fundamental investment restrictions of the Acquired Fund and Acquiring Fund are identical, and are set forth below.

6

Neither the Acquiring Fund nor the Acquired Fund may:

| 1. | Underwrite or deal in offerings of securities of other issuers as a sponsor or underwriter in any way. |

| 2. | Purchase or sell real estate except as permitted under the 1940 Act, and as interpreted or modified by regulatory authority having jurisdiction, from time to time. |

| 3. | Purchase or sell physical commodities or commodity futures contracts, except as permitted under the 1940 Act, and as interpreted or modified by regulatory authority having jurisdiction, from time to time. |

| 4. | Issue any senior security, except as permitted under the 1940 Act, and as interpreted or modified by regulatory authority having jurisdiction, from time to time. |

| 5. | Make loans to others, except as permitted under the 1940 Act, and as interpreted or modified by regulatory authority having jurisdiction, from time to time. |

| 6. | Borrow money, except as permitted under the 1940 Act, and as interpreted or modified by regulatory authority having jurisdiction, from time to time. |

| 7. | Invest more than 25% of the value of its total assets in the securities of any one industry. This restriction does not apply to securities of the U.S. Government or its agencies and instrumentalities and repurchase agreements relating thereto. |

| 8. | As to 50% of its total assets, (a) invest more than 5% of its total assets (taken at market value at the time of each investment) in the securities of any one issuer, nor (b) purchase more than 10% of the outstanding voting securities of an issuer, except that such restrictions shall not apply to securities issued or guaranteed by the U.S. Government or its agencies, bank money instruments or bank repurchase agreements. |

COMPARISON OF PRINCIPAL RISKS OF INVESTING IN THE FUNDS

The following summarizes and compares the principal risks of investing in the Funds. The fact that a risk is not listed as a principal risk does not necessarily mean that shareholders of that Fund are not subject to that risk. You may lose money on your investment in any Fund. The value of each Fund’s shares may go up or down, sometimes rapidly and unpredictably. Market conditions, financial conditions of issuers represented in a Fund, investment strategies, portfolio management, and other factors affect the volatility of each Fund’s shares.

Similar Risks of the Funds

Because of the similarities between the investment objectives, strategies and restrictions of the Funds, the risks of investing in the Acquiring Fund are almost identical to the risks of investing in the Acquired Fund. Risks shared by the Acquiring Fund and Acquired Fund, as well as risks specific to either of the Funds, if applicable, is listed below:

Shared Risks of the Acquiring Fund and the Acquired Fund:

Market Risk – As with any mutual fund, investment return and principal value will fluctuate, depending on general market conditions and other factors. Market risk includes political, regulatory, economic, social and health risks (including the risks presented by the spread of infectious diseases) which can lead to increased market volatility and negative impacts on local and global financial markets, and the duration and severity of the impact of these risks on markets cannot be reasonably estimated. You may lose money if you invest in the Fund.

7

Active Management Risk – The investment adviser’s judgment about the attractiveness, value or potential appreciation of the Fund’s investments may prove to be incorrect. The Fund could underperform other funds with similar objectives or investment strategies, if the Fund’s overall investment selections or strategies fail to produce the intended results.

Concentration Risk – The risk that the Fund’s performance may be hurt disproportionately by the poor performance of relatively few stocks. The Fund tends to invest a high percentage of assets in its largest holdings.

Mid-Size Company Risk – Securities of mid-size companies may be more volatile and less liquid, compared to those of large companies, due to the mid-size companies’ limited product lines, markets, financing sources and management depth. Also, securities of mid-size companies may be affected to a greater extent by the underperformance of a sector or changing market conditions.

Non-U.S. Securities Risk – The Fund may invest in securities issued by non-U.S. issuers, which securities may be denominated in U.S. dollars or foreign currencies. Investments in non-U.S. securities may involve additional risks including exchange rate fluctuation, political or economic instability, the imposition of exchange controls, expropriation, limited disclosure and illiquid markets.

Failure to Meet Investment Objective – There can be no assurance that the Fund will meet its investment objective.

Risks Specific to the Acquiring Fund:

Large Company Risk – Securities of large companies tend to have less overall volatility compared to those of mid-size and small companies; however, large companies may not be able to attain the high growth rates of successful mid-size or small companies. In addition, large companies may be less capable of responding to competitive challenges and disruptive changes.

Small Company Risk – Securities of small companies may be more volatile and less liquid, compared to those of large and mid-size companies, due to the small companies’ size, limited product lines, markets, financing sources and management depth. Also, securities of small companies may be affected to a greater extent by the underperformance of a sector or changing market conditions.

COMPARISON OF PERFORMANCE

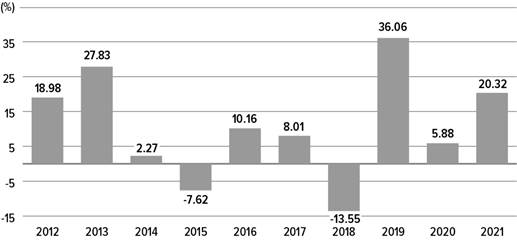

Set forth below is performance information for the Acquiring Fund and the Acquired Fund.

The following chart and table provide an indication of the risks of investing in each of the Funds by showing changes in each Fund’s performance from year to year over the period indicated and by showing how the Fund’s average annual total returns for the periods indicated, both before and after taxes, compared to those of relevant broad-based securities market indices. All Fund performance numbers are calculated after deducting fees and expenses, and all numbers assume reinvestment of dividends. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waivers and/or reimbursements. Each Fund’s past performance is not necessarily an indication of how such Fund will perform in the future both before or after taxes. Updated performance is available at weitzinvestments.com or by calling toll-free 888-859-0698.

8

Acquiring Fund – Investor Class Shares

Calendar Year Total Returns

The year-to-date return for the Acquiring Fund’s Investor Class Shares for the nine months ended September 30, 2022 was -27.32%.

|

BEST AND WORST PERFORMING QUARTERS (during the period shown above) | ||

| Quarter/Year | Total Return | |

| Best quarter | 2nd quarter 2020 | 18.23% |

| Worst quarter | 1st quarter 2020 | -26.32% |

Acquiring Fund’s Average Annual Total Returns for the periods ended December 31, 2021

|

AVERAGE ANNUAL TOTAL RETURNS (for periods ended December 31, 2021) | |||

| 1 Year | 5 Year | 10 Year | |

| Investor Class | |||

| Return before taxes | 23.57% | 11.81% | 10.86% |

| Return after taxes on distributions | 21.69% | 9.95% | 9.54% |

| Return after taxes on distributions and sale of fund shares | 15.26% | 9.03% | 8.68% |

| Comparative Indices (reflect no deduction for fees, expenses or taxes): | |||

| Russell 3000 Index (the Fund’s primary benchmark, effective July 31, 2022) | 25.66% | 17.96% | 16.29% |

| Standard & Poor’s 500 Index (the Fund’s former primary benchmark, prior to July 31, 2022) | 28.71% | 18.46% | 16.53% |

After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. In some instances, the return after taxes may be greater than the return before taxes because you are assumed to be able to use the capital loss on the sale of Fund shares to offset other taxable gains. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as a 401(k) account or individual retirement account (IRA).

9

Acquired Fund

Calendar Year Total Returns

The Acquired Fund’s year-to-date return for the nine months ended September 30, 2022 was -31.34%.

|

BEST AND WORST PERFORMING QUARTERS (during the period shown above) | ||

| Quarter/Year | Total Return | |

| Best quarter | 2nd quarter 2020 | 18.24% |

| Worst quarter | 1st quarter 2020 | -27.69% |

Acquired Fund’s Average Annual Total Returns for the periods ended December 31, 2021

|

AVERAGE ANNUAL TOTAL RETURNS (for periods ended December 31, 2021) | |||

| 1 Year | 5 Year | 10 Year | |

| Return before taxes | 20.32% | 10.11% | 9.86% |

| Return after taxes on distributions | 17.93% | 8.26% | 8.48% |

| Return after taxes on distributions and sale of fund shares | 13.66% | 7.65% | 7.80% |

| Comparative Index (reflects no deduction for fees, expenses or taxes): | |||

| Russell Midcap Index | 22.58% | 15.09% | 14.89% |

After-tax returns are calculated using the highest

historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns

depend on an investor’s tax situation and may differ from those shown. In some instances, the return after taxes may be greater

than the return before taxes because you are assumed to be able to use the capital loss on the sale of Fund shares to offset other taxable

gains. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as a 401(k)

account or individual retirement account (IRA).

10

INFORMATION ABOUT THE REORGANIZATION

The Agreement and Plan of Reorganization

The terms and conditions under which the proposed Reorganization may be consummated are set forth in the Agreement and Plan of Reorganization. Significant provisions of the Agreement and Plan of Reorganization are summarized below, however, this summary is qualified in its entirety by reference to the form of the Agreement and Plan of Reorganization attached to this Information Statement/Prospectus as Exhibit A.

The Agreement and Plan of Reorganization provides for: (i) the transfer, as of the Closing Date, of all of the assets of the Acquired Fund in exchange for shares of beneficial interest of the Acquiring Fund and the assumption by the Acquiring Fund of all of the Acquired Fund’s liabilities; and (ii) the distribution of Investor Class Shares of the Acquiring Fund to shareholders of the Acquired Fund, as provided for in the Agreement and Plan of Reorganization. The Acquired Fund will then be terminated and liquidated.

After the Reorganization, each shareholder of the Acquired Fund will own Investor Class Shares of the Acquiring Fund having an aggregate value equal to the aggregate value of the Shares in the Acquired Fund held by that shareholder as of the Closing Date. In the interest of economy and convenience, shares of the Acquiring Fund will not be represented by physical certificates.

The Acquiring Fund and the Acquired Fund have adopted the same valuation policies and procedures and therefore there are no differences between their respective valuation policies and procedures for purposes of valuing assets in each respective Fund.

Until the Closing Date, shareholders of the Acquired Fund will continue to be able to redeem or exchange their shares.

The obligations of the Funds under the Agreement and Plan of Reorganization are subject to various conditions, including receipt of an opinion from legal counsel that the Reorganization will qualify as a tax-free reorganization for Federal income tax purposes. The Agreement and Plan of Reorganization may be terminated by mutual agreement of the parties or on certain other grounds. Please refer to Exhibit A to review the terms and conditions of the Agreement and Plan of Reorganization.

Reasons for the Reorganization and Board Considerations

The proposed Reorganization was presented to the Board of Trustees of the Trust for consideration at a meeting held on January 11, 2023. At this meeting, representatives of the Adviser provided, and the Board reviewed, information about the proposed Reorganization. For the reasons discussed below, the Trustees, including all of the Independent Trustees, determined that the Reorganization is in the best interests of both Funds and their shareholders and that the interests of the Funds and their shareholders would not be diluted as a result of the Reorganization. The Board took note of the fact that the Reorganization is being conducted in accordance with an applicable rule under the 1940 Act, Rule 17a-8, which permits affiliated mutual funds to be reorganized without obtaining the vote of shareholders if certain conditions are met, and the Board considered that the relevant conditions of Rule 17a-8 were satisfied in connection with the Reorganization and that shareholders of the Acquired Fund would receive prior notice of the Reorganization. For these purposes, the Funds may rely on Rule 17a-8 in order to be reorganized without a shareholder vote because: (i) none of the fundamental policies of the Acquired Fund is materially different from a fundamental policy of the Acquiring Fund; (ii) the investment advisory agreement between the Acquired Fund and the Adviser is not materially different from the investment advisory agreement between the Acquiring Fund and the Adviser; (iii) the independent board members overseeing the Acquired Fund who were elected by shareholders comprise a majority of the independent board members who oversee the Acquiring Fund; and (iv) neither the Acquired Fund or the Acquiring Fund have adopted a distribution plan pursuant to Rule 12b-1 under the 1940 Act, and therefore, neither Fund is subject to a distribution fee.

11

Representatives of the Adviser had informed the Board of Trustees that they had determined that the Reorganization would be advisable and in the best interests of the Acquired Fund, the Acquiring Fund, and their shareholders because the primary purpose of the Reorganization is to combine two funds with similar investment strategies and investments into a single fund having a larger asset base that has the potential to produce economies of scale by spreading costs over a larger base of assets. The Adviser informed the members of the Board that it had determined that it was advisable to seek a reorganization transaction for the Acquired Fund due to the fact that the two Funds have similar investment strategies and that the Adviser has elected to continue offering the strategy pursued by the Acquiring Fund with its multi-cap investment strategy rather than continuing to offer the mid-cap investment strategy utilized by the Acquired Fund. The Board took note of the long-term performance record of the Acquiring Fund over the past 10 years as compared to the long-term performance record of the Acquired Fund over the past 10 years, as well as the performance record of each of the Funds over shorter time periods. The Board also took note of the long-term sales prospects of the Acquiring Fund as compared to the Acquired Fund.

The Board of Trustees of the Trust, in determining to approve the proposed Reorganization, considered a number of factors in connection with this decision. Among the factors considered by the Board were: (1) the terms of the proposed Reorganization, including the anticipated tax-free nature of the transaction for the Funds and their shareholders; (2) that the investment objectives and principal investment strategies of the Funds are not materially different, while the Acquiring Fund maintains a particular emphasis on a multi-cap investment strategy as compared to the mid-cap investment strategy of the Acquired Fund; (3) the operating expense ratios of the Funds for the most recently completed semi-annual period and the potential for lower operating expenses for the Funds as a result of the Reorganization; (4) that the Adviser has indicated that it does not expect to continue operating the Acquired Fund; (5) the comparative investment performance of each of the Funds over the past 10 years; and (6) that neither the Funds nor their shareholders will bear any costs of the Reorganization because the Adviser has agreed to bear all of the costs of the transaction.

Tax Considerations

The following is a general summary of the material U.S. federal income tax considerations of the Reorganization and is based upon the current provisions of the Internal Revenue Code of 1986, as amended (the “Code”), the existing U.S. Treasury regulations thereunder, current administrative rulings of the IRS and published judicial decisions, all of which are subject to change. These considerations are general in nature and individual shareholders should consult their own tax advisers as to the federal, state, local, and foreign tax considerations applicable to them and their individual circumstances. These same considerations generally do not apply to shareholders who hold their shares in tax-advantaged accounts.

The Reorganization is intended to qualify as a “reorganization” under Section 368(a) of the Code. As a condition to the closing of the Reorganization, the Acquired Fund and the Acquiring Fund will receive an opinion from Dechert LLP substantially to the effect that, as further described below, on the basis of existing provisions of the Code, U.S. Treasury regulations issued thereunder, current administrative rules, pronouncements and court decisions, generally for U.S. federal income tax purposes:

| · | The Reorganization will constitute a tax-free reorganization within the meaning of Section 368(a) of the Code and the Acquiring Fund and the Acquired Fund will each be a “party to a reorganization” within the meaning of Section 368(b) of the Code; |

| · | Under Section 1032 of the Code, no gain or loss will be recognized by the Acquiring Fund upon the receipt of the assets of the Acquired Fund solely in exchange for the assumption of the liabilities of the Acquired Fund and issuance of the Acquiring Fund Shares; |

12

| · | Under Sections 361 and 357(a) of the Code, no gain or loss will be recognized by the Acquired Fund upon the transfer of the assets of the Acquired Fund to the Acquiring Fund solely in exchange for the assumption by the Acquiring Fund of the Acquired Fund’s liabilities and the Acquiring Fund Shares or upon the distribution (whether actual or constructive) of the Acquiring Fund Shares to the Acquired Fund Shareholders in exchange for their Acquired Fund Shares, except for any gain or loss that may be required to be recognized solely as a result of the close of the Acquired Fund’s taxable year due to the Reorganization or as a result of the transfer of any stock in a passive foreign investment company as defined in Section 1297(a) of the Code. |

| · | Under Section 354 of the Code, no gain or loss will be recognized by any Acquired Fund Shareholder upon the exchange of its Acquired Fund Shares solely for Acquiring Fund Shares; |

| · | Under Section 358 of the Code, the aggregate tax basis of the Acquiring Fund Shares received by each Acquired Fund Shareholder pursuant to the Reorganization will be the same as the aggregate tax basis of the Acquired Fund Shares held by such Acquired Fund Shareholder immediately prior to the Reorganization; |

| · | Under Section 1223(1) of the Code, the holding period of Acquiring Fund Shares received by each Acquired Fund Shareholder will include the period during which the Acquired Fund Shares exchanged therefor were held by such shareholder, provided the Acquired Fund Shares are held as capital assets at the time of the Reorganization; |

| · | Under Section 362(b) of the Code, the tax basis of the assets of the Acquired Fund acquired by the Acquiring Fund will be the same as the tax basis of such assets to the Acquired Fund immediately prior to the Reorganization, except for any assets which may be marked to market for U.S. federal income tax purposes on the termination of the Acquired Fund’s taxable year or on which gain was recognized upon the transfer to the Acquiring Fund; |

| · | Under Section 1223(2) of the Code, the holding period of the assets of the Acquired Fund in the hands of the Acquiring Fund will include the period during which those assets were held by the Trust on behalf of the Acquired Fund (except to the extent that the investment activities of the Acquiring Fund reduce or eliminate such holding period and except for any assets on which gain is recognized on the transfer to the Acquiring Fund); and |

| · | The Acquiring Fund will succeed to and take into account the items of the Acquired Fund described in Section 381(c) of the Code, subject to the conditions and limitations specified in Sections 381, 382, 383 and 384 of the Code and the Treasury Regulations thereunder. |

The opinion will be conditioned upon, among other things, the accuracy, as of the Closing Date, of certain representations of the Acquired Fund and the Acquiring Fund upon which Dechert LLP will rely in rendering its opinion and will also be based on customary assumptions. It is possible that the IRS or a court could disagree with Dechert LLP’s opinion, which therefore cannot be free from doubt. A copy of the opinion will be filed with the SEC and will be available for public inspection. Neither the Acquired Fund nor the Acquiring Fund have requested or will request an advance ruling from the IRS as to the U.S. federal tax consequences of the Reorganization. No opinion will be expressed with respect to the effect of the

13

Reorganization on any transferred assets as to which any unrealized gain or loss is required to be recognized under federal income tax principles: (i) at the end of a taxable year or upon termination thereof, or (ii) upon the transfer of such assets regardless of whether such a transfer would otherwise be a non-taxable transaction.

Opinions of counsel are not binding upon the IRS or the courts. If the Reorganization is consummated but the IRS or the courts determine that the Reorganization does not qualify as a “reorganization” within the meaning of Section 368(a) of the Code, the Acquired Fund would recognize gain or loss on the transfer of its assets to the Acquiring Fund and each shareholder of the Acquired Fund that held shares in a taxable account would recognize a taxable gain or loss equal to the difference between its tax basis in its Acquired Fund shares and the fair market value of the shares of the Acquiring Fund it receives in the exchange.

Prior to the closing of the Reorganization, the Acquired Fund will distribute to its shareholders, in one or more taxable distributions, all previously undistributed investment company taxable income (that is, generally, net investment income plus net short-term capital gains) and net capital gain (that is, the excess of net long-term capital gains over net short-term capital losses), if any, generated for taxable years ending on or prior to the date of closing of the Reorganization.

Assuming the Reorganization qualifies as a tax-free reorganization, as expected, the Acquiring Fund will succeed to the capital loss carryovers, if any, of the Acquired Fund upon the closing of the Reorganization for federal income tax purposes. The capital loss carryovers, if any, of both Funds will be available to offset future gains recognized by the combined Acquiring Fund, subject to limitations under the Code. Where these limitations apply, all or a portion of a Fund’s capital loss carryovers may become unavailable, the effect of which may be to accelerate the recognition of taxable gain to the combined Acquiring Fund and its shareholders post-closing. First, a Fund’s capital loss carryovers are subject to an annual limitation if a Fund undergoes a more than 50% change in ownership. The actual annual limitation will equal the aggregate NAV of the smaller Fund in the Reorganization on the Closing Date multiplied by the long-term tax-exempt rate for ownership changes during the month in which the Reorganization closes; such limitation will be increased by the amount of any built-in gain (i.e., unrealized appreciation in the value of investments of the smaller Fund on the Closing Date that is recognized in a taxable year). Second, if either Fund has net unrealized built-in gains at the time of the Reorganization that are realized by the combined Acquiring Fund in the five-year period following the Reorganization, such built-in gains, when realized, may not be offset by the losses (including any capital loss carryovers and “built-in losses”) of the other Fund. Third, the capital losses of the Acquired Fund that may be used by the Acquiring Fund (including to offset any “built-in gains” of the Acquired Fund itself) for the first taxable year ending after the Closing Date will be limited to an amount equal to the capital gain net income of the Acquired Fund for such taxable year (excluding capital loss carryovers) treated as realized post-closing based on the number of days remaining in such year. As of September 30, 2022, the Acquired Fund did not have any capital loss carryovers.

Shareholders of the Acquired Fund will receive a proportionate share of any taxable income and gains realized by the Acquiring Fund and not distributed to its shareholders prior to the Reorganization when such income and gains are eventually distributed by the combined Fund. As a result, shareholders of the Acquired Fund may receive a greater amount of taxable distributions than they would have if the Reorganization had not occurred. In addition, if the Acquiring Fund, following the Reorganization, has proportionately greater unrealized appreciation in its portfolio investments as a percentage of its NAV than the Acquired Fund, shareholders of the Acquired Fund, post-closing, may receive greater amounts of taxable gain as such portfolio investments are sold than they otherwise might have had if the Reorganization had not occurred.

This discussion is only a general summary of certain U.S. federal income tax consequences. You should consult your tax adviser regarding the U.S. federal income tax consequences as well as the state, local and foreign consequences to you, if any, of a Reorganization in light of your particular circumstances.

14

Expenses of the Reorganization

The Adviser is responsible for the expenses related to the Reorganization, and neither of the Funds will bear any of the costs or expenses incurred in connection with carrying out the Reorganization.

ADDITIONAL INFORMATION ABOUT THE FundS

Investment Adviser

Weitz Investment Management, Inc., located at One Pacific Place, 1125 South 103rd Street, Omaha, Nebraska 68124, serves as the investment adviser to both the Acquired Fund and the Acquiring Fund. Weitz Inc. provides investment advice to each Fund and is responsible for the overall management of Weitz Funds’ business affairs, subject to the supervision of the Board of Trustees of the Trust. Weitz Inc. is a Nebraska corporation and also serves as investment adviser to certain other entities. As of December 31, 2022, Weitz Inc. managed approximately $3.6 billion in assets. The Reorganization will not result in a change in investment adviser.

Portfolio Managers

The following individuals serve as portfolio managers of the Acquired Fund:

| · | Wallace R. Weitz, CFA, founded Weitz Inc. in 1983. He is Co-Chief Investment Officer of Weitz Inc. |

| · | Andrew S. Weitz joined Weitz Inc. in 2009 and became a portfolio manager in 2011. |

The following individuals serve as portfolio managers of the Acquiring Fund:

| · | Wallace R. Weitz, CFA, founded Weitz Inc. in 1983. He is Co-Chief Investment Officer of Weitz Inc. |

| · | Andrew S. Weitz joined Weitz Inc. in 2009 and became a portfolio manager in 2011. |

| · | Bradley P. Hinton, CFA, joined Weitz Inc. in 2001 and became a portfolio manager in 2003. He is Co-Chief Investment Officer of Weitz Inc. |

The Funds’ SAI provides additional information about the Portfolio Managers’ compensation, other accounts managed and the Portfolio Managers’ ownership of shares in the Funds.

Subject to the general oversight of the Board of Trustees of the Trust, the Adviser is directly responsible for making the investment decisions for the Acquiring Fund and is responsible for the purchase and sale of the Acquiring Fund’s investments.

Pursuant to its Investment Advisory Agreement with the Acquiring Fund, for its services to the Acquiring Fund, the Adviser is entitled to receive a monthly advisory fee equal on an annual basis with the following schedule:

| AVERAGE DAILY NET ASSET BREAK POINTS | ||

| Greater than | Less than or equal to | Rate |

| $0 | $5,000,000,000 | 0.75% |

| $5,000,000,000 | 0.70% | |

15

Through July 31, 2024, Weitz Inc. has agreed in writing pursuant to the terms of an Expense Limitation Agreement entered into with the Acquiring Fund or waive its fees and/or reimburse certain of the Acquiring Fund’s expenses to the extent that the Acquiring Fund’s total annual fund operating expenses (excluding taxes, interest, brokerage costs, acquired fund fees and expenses and extraordinary expenses) exceed 1.09% of the Investor Class Shares’ annual average daily net assets. This agreement may only be terminated by the Board of Trustees of the Fund. Pursuant to the terms of the Expense Limitation Agreement, the Adviser is not eligible to recoup any of the fees and/or expenses that it is required to waive and/or reimburse in accordance with the relevant provisions of the Expense Limitation Agreement.

In addition to the aforementioned expense reimbursements, the Adviser may voluntarily waive all or a portion of its fees for the Acquiring Fund from time to time. The Adviser may discontinue or modify any such voluntary waiver at any time without notice.

The Adviser also provides certain business administration services to the Acquiring Fund pursuant to a Business Administration Agreement, including, without limitation, supervising all aspects of the management and operation of the Trust, which includes monitoring the Acquiring Fund’s relationships with third-party services providers retained by the Trust, monitoring the Trust’s compliance with provisions of, and regulation under the 1940 Act, coordinating audit examinations by outside auditors, and providing officers of the Trust that are deemed necessary for carrying out the executive functions of the Trust. The Business Administration Agreement provides that the Adviser, as the Trust’s administrator, is entitled to receive 0.03% of the average daily net assets of the Acquiring Fund, computed daily and payable monthly.

Information regarding the basis on which the Board of Trustees approved the Acquiring Fund’s Investment Advisory Agreement is included in the Acquiring Fund’s September 30, 2022 Semi-Annual Report to Shareholders, which is available at weitzinvestments.com.

Other Service Providers

Citi Fund Services Ohio, Inc. serves as sub-administrator for both the Acquiring Fund and the Acquired Fund.

Ultimus Fund Solutions, LLC serves as the transfer agent for both the Acquiring Fund and the Acquired Fund.

Citibank, N.A., serves as the custodian for both the Acquiring Fund and the Acquired Fund.

ADDITIONAL INFORMATION ABOUT THE FUNDS

Financial Highlights

The fiscal year end of the Funds is March 31. The financial statements and financial highlights of each of the Acquired Fund and the Acquiring Fund for the five (5) years ended March 31, 2022 and the six months ended September 30, 2022, are contained in the most recent Semi-Annual Report of the Funds. The financial statements and financial highlights for the fiscal year-ended March 31, 2022 have been audited by Ernst & Young LLP, the independent registered public accounting firm of the Funds, whose report on such financial statements is contained in the Funds’ March 31, 2022 Annual Report and is incorporated by reference herein.

Form of Organization

The Funds are series of the Trust, which is an open-end management investment company organized as a Delaware statutory trust. The Trust is governed by a Board of Trustees consisting of eight members.

16

Capitalization

The following table shows the capitalization of each of the Funds as of September 30, 2022, and on a pro forma basis as of September 30, 2022 giving effect to the Reorganization as if it had occurred on that date:

| Hickory Fund/Acquired Fund | Partners Value Fund/Acquiring Fund | Adjustments | Combined Fund Pro Forma Combined | |

| Net Assets | ||||

| Institutional Class Shares | N/A | $216,172,532 | $ - | $216,172,532 |

| Investor Class Shares | $145,185,873 | $163,094,095 | $ - | $308,279,968 |

| Shares Outstanding | ||||

| Institutional Class Shares | N/A | 8,234,272 | N/A | 8,234,272 |

| Investor Class Shares | 3,677,758 | 6,365,949 | N/A | 12,032,786 |

| Net Asset Value Per Share | ||||

| Institutional Class Shares | N/A | $26.25 | $ - | $26.25 |

| Investor Class Shares | $39.48 | $25.62 | $ - | $25.62 |

Security Ownership of Certain Beneficial Owners

As of January 31, 2023, the following persons owned beneficially or of record 5% or more of the outstanding Shares of the Acquired Fund:

| Name and Address of Owner | Percentage Ownership of Share Class | Type of Ownership |

As of January 31, 2023, the Officers and Trustees of the Trust collectively owned [ ] shares or [ ]% of the Acquired Fund’s shares.

As of January 31, 2023, the following persons owned beneficially or of record 5% or more of the outstanding Shares of the Acquiring Fund:

17

|

Name and Address of Owner |

Percentage Ownership of Share Class | Type of Ownership |

As of January 31, 2023, the Officers and Trustees of the Trust collectively owned [ ] shares or [ ]% of the Acquiring Fund’s Investor Class shares.

EXHIBIT A

AGREEMENT AND PLAN OF REORGANIZATION

THIS AGREEMENT AND PLAN OF REORGANIZATION (the “Agreement”), is made as of the 11th day of January, 2023, by The Weitz Funds, a Delaware statutory trust (the “Trust”) with its principal place of business at 1125 South 103rd Street, Omaha, Nebraska 68124-1071, on behalf of each of its two separate investment series, Weitz Partners Value Fund (the “Acquiring Fund”) and Weitz Hickory Fund (the “Acquired Fund”), with respect to the reorganization transaction described herein.

This Agreement is intended to be and is adopted as a plan of reorganization and liquidation within the meaning of Section 368(a)(1) of the United States Internal Revenue Code of 1986, as amended (the “Code”). The reorganization (the “Reorganization”) will consist of the transfer of all of the assets of the Acquired Fund to the Acquiring Fund in exchange solely for Investor Class Shares of the Acquiring Fund (the “Acquiring Fund Shares”), the assumption by the Acquiring Fund of all of the liabilities of the Acquired Fund described in paragraph 1.3, and the distribution of the Acquiring Fund Shares to the shareholders of Acquired Fund in complete liquidation of the Acquired Fund as provided herein, all upon the terms and conditions hereinafter set forth in this Agreement.

WHEREAS, the Acquired Fund and Acquiring Fund are each separate investment series of an open-end, registered investment company of the management type and the Acquired Fund owns securities that generally are assets of the character in which the Acquiring Fund is permitted to invest; and

WHEREAS, the Board of Trustees of the Trust has determined, with respect to the Acquiring Fund, that the exchange of all of the assets of the Acquired Fund for the Acquiring Fund Shares and the assumption of all of the liabilities of the Acquired Fund by the Acquiring Fund, as described in paragraph 1.3 herein, is in the best interests of the Acquiring Fund and its shareholders and that the interests of the existing shareholders of the Acquiring Fund would not be diluted as a result of this transaction; and

WHEREAS, the Board of Trustees of the Trust has also determined, with respect to the Acquired Fund, that the exchange of all of the assets of the Acquired Fund for the Acquiring Fund Shares and the assumption of the liabilities of the Acquired Fund by the Acquiring Fund, as described in paragraph 1.3 herein, is in the best interests of the Acquired Fund and its shareholders and that the interests of the existing shareholders of the Acquired Fund would not be diluted as a result of this transaction;

NOW, THEREFORE, in consideration of the premises and of the covenants and agreements hereinafter set forth, the Trust, on behalf of each of the Acquiring Fund and the Acquired Fund, respectively, hereby covenants and agrees as follows:

| 1. | TRANSFER OF ASSETS OF THE ACQUIRED FUND TO THE ACQUIRING FUND IN EXCHANGE FOR ACQUIRING FUND SHARES, THE ASSUMPTION OF THE LIABILITIES OF THE ACQUIRED FUND AND THE LIQUIDATION OF THE ACQUIRED FUND |

1.1. Subject to the requisite approvals and the other terms and conditions herein set forth and on the basis of the representations and warranties contained herein, the Acquired Fund agrees to transfer all of its respective assets, as set forth in paragraph 1.2, to the Acquiring Fund, and the Acquiring Fund agrees in exchange therefor: (i) to deliver to the Acquired Fund the number of full and fractional Acquiring Fund Shares as of the time and date set forth in paragraph 2.1 and (ii) to assume the liabilities of the Acquired Fund, as set forth in paragraph 1.3. Such transactions shall take place at the closing provided for in paragraph 3.1 (the “Closing”).

A-1

1.2. The assets of the Acquired Fund to be acquired by the Acquiring Fund shall consist of all assets and property, including, without limitation, all cash, securities, commodities and futures interests, claims (whether absolute or contingent, known or unknown, accrued or unaccrued) and dividends or interest receivable that are owned by the Acquired Fund and any deferred or prepaid expenses shown as an asset on the books of the Acquired Fund on the closing date provided for in paragraph 3.1 (the “Closing Date”) (collectively, “Assets”).

1.3. The Acquiring Fund shall assume all of the liabilities of the Acquired Fund. The Acquired Fund shall deliver to the Acquiring Fund the Acquired Fund’s Statement of Assets and Liabilities as of the Closing Date pursuant to paragraph 7.2 hereof.

1.4. On or as soon as practicable prior to the Closing Date, the Acquired Fund will declare, to the extent applicable, and pay to its shareholders of record one or more dividends and/or other distributions so that it will have distributed all of its investment company taxable income (computed without regard to any deduction for dividends paid) and realized net capital gain, if any, for the current taxable year through the Closing Date.

1.5. Immediately after the transfer of assets provided for in paragraph 1.1, the Acquired Fund will: (i) distribute to the Acquired Fund’s shareholders of record, determined as of immediately after the close of business on the Closing Date, on a pro rata basis, the Shares of the Acquiring Fund received by the Acquired Fund pursuant to paragraph 1.1 and (ii) completely liquidate. Such distribution and liquidation will be accomplished, with respect to the Acquired Fund’s shares, by the transfer of the Acquiring Fund Shares then credited to the account of the Acquired Fund on the books of the Acquiring Fund to open accounts on the share records of the Acquiring Fund in the names of the shareholders of record of the Acquired Fund’s shares, determined as of immediately after the close of business on the Closing Date (the “Acquired Fund Shareholders”). The aggregate net asset value of such Acquiring Fund Shares to be so credited to such Acquired Fund Shareholders shall be equal to the aggregate net asset value of the outstanding classes of Shares of the Acquired Fund owned by such shareholders on the Closing Date. All issued and outstanding Shares of the Acquired Fund will simultaneously be canceled on the books of the Acquired Fund. The Acquiring Fund shall not issue certificates representing such Acquiring Fund Shares in connection with such exchange.

1.6. Ownership of Acquiring Fund Shares of the Acquiring Fund will be shown on its books. Acquiring Fund Shares will be issued in the manner described in the Acquiring Fund’s current prospectus.

1.7. Any reporting responsibility of the Acquired Fund including, but not limited to, the responsibility for filing of regulatory reports, tax returns, or other documents with the U.S. Securities and Exchange Commission (the “Commission”), any state securities commission, and any federal, state or local tax authorities or any other relevant regulatory authority, is and shall remain the responsibility of the Acquired Fund.

1.8. As soon as reasonably practicable after the Closing Date, the Acquired Fund shall make all filings and take all steps as shall be necessary and proper to effect its complete dissolution.

| 2. | VALUATION |

2.1. The value of the Assets shall be the value computed as of immediately after the close of business of the New York Stock Exchange (and after the declaration of any dividends) (such time and date being hereinafter called the “Valuation Date”), using the valuation procedures set forth in the Trust’s Declaration of Trust and then-current prospectus and statement of additional information with respect to the Acquiring Fund, and valuation procedures established by the Acquiring Fund’s Board.

A-2

2.2. All computations of value shall be made by the Acquiring Fund’s accounting agent and shall be subject to review by the Acquired Fund’s accounting agent and by each Fund’s independent registered public accounting firm.

| 3. | CLOSING AND CLOSING DATE |

3.1. The Closing Date shall be held on March 24, 2023, or such other date as the parties may agree to in writing. All acts taking place at the Closing shall be deemed to take place simultaneously as of immediately after the close of business on the Closing Date unless otherwise agreed to by the parties. The close of business on the Closing Date shall be as of 4:00 p.m., Eastern Time. The Closing shall be held at the offices of the Trust or at such other time and/or place as the parties may agree.

3.2. The Trust shall direct Citibank, N.A., as custodian for the Acquired Fund (the “Custodian”), to deliver, at the Closing, a certificate of an authorized officer stating that: (i) the Assets shall have been delivered in proper form to the Acquiring Fund within two business days prior to or on the Closing Date; and (ii) all necessary taxes in connection with the delivery of the Assets, including all applicable federal and state stock transfer stamps, if any, have been paid or provision for payment has been made. The Acquired Fund’s portfolio securities represented by a certificate or other written instrument shall be presented by the Custodian to those persons at the Custodian who have primary responsibility for the safekeeping of the Assets of the Acquiring Fund for examination no later than five business days preceding the Closing Date, and shall be transferred and delivered by the Acquired Fund as of the Closing Date for the account of the Acquiring Fund duly endorsed in proper form for transfer in such condition as to constitute good delivery thereof. The Trust on behalf of the Acquired Fund, shall direct the Custodian to deliver as of the Closing Date by book entry, in accordance with the customary practices of the Custodian and any securities depository (as defined in Rule 17f-4 under the Investment Company Act of 1940, as amended (the “1940 Act”)) in which the Assets are deposited, the Acquired Fund’s portfolio securities and instruments deposited with such depositories. The cash to be transferred by the Acquired Fund shall be delivered by wire transfer of federal funds on the Closing Date.

3.3. The Trust shall direct Ultimus Fund Solutions, LLC (the “Transfer Agent”), on behalf of the Acquired Fund, to deliver at the Closing a certificate of an authorized officer stating that its records contain the names and addresses of the Acquired Fund Shareholders and the number and percentage ownership of outstanding shares owned by each such shareholder immediately prior to the Closing. The Acquiring Fund shall issue and deliver a confirmation evidencing the Acquiring Fund Shares to be credited on the Closing Date to the Secretary of the Acquired Fund, or provide evidence satisfactory to the Acquired Fund that such Acquiring Fund Shares have been credited to the Acquired Fund’s account on the books of the Acquiring Fund. At the Closing, each party shall deliver to the other such bills of sale, checks, assignments, share certificates, if any, receipts or other documents as such other party or its counsel may reasonably request.

3.4. In the event that on the Valuation Date: (a) the New York Stock Exchange or another primary trading market for portfolio securities of the Acquired Fund shall be closed to trading or trading thereupon shall be restricted, or (b) trading or the reporting of trading on such Exchange or elsewhere shall be disrupted so that, in the judgment of the Board of the Trust, accurate appraisal of the value of the net assets of the Acquired Fund is impracticable, the Closing Date shall be postponed until the first business day after the day when trading shall have been fully resumed and reporting shall have been restored.

A-3

| 4. | REPRESENTATIONS AND WARRANTIES |

4.1. The Trust, on behalf of the Acquired Fund, represents and warrants to the Acquiring Fund as follows:

(a) The Acquired Fund is duly organized as a series of the Trust, which is a statutory trust duly organized, validly existing and in good standing under the laws of the State of Delaware, with power under the Trust’s Declaration of Trust and By-Laws to own all of its properties and assets and to carry on its business as it is presently being conducted;

(b) The Trust is a registered investment company classified as a management company of the open-end type, and its registration with the Commission as an investment company under the 1940 Act, and the registration of shares of the Acquired Fund under the Securities Act of 1933, as amended (“1933 Act”), is in full force and effect;

(c) No consent, approval, authorization, or order of any court or governmental authority is required for the consummation by the Acquired Fund of the transactions contemplated herein, except such as have been obtained under the 1933 Act, the Securities Exchange Act of 1934, as amended (the “1934 Act”) and the 1940 Act and such as may be required by state securities or blue sky laws;

(d) The current prospectuses and statement of additional information of the Acquired Fund and each prospectus and statement of additional information of the Acquired Fund used during the three years previous to the date of this Agreement conforms or conformed at the time of its use in all material respects to the applicable requirements of the 1933 Act and the 1940 Act and the rules and regulations of the Commission thereunder and does not, or did not at the time of its use, include any untrue statement of a material fact or omit to state any material fact required to be stated therein or necessary to make the statements therein, in light of the circumstances under which they were made, not materially misleading;

(e) On the Closing Date, the Acquired Fund will have good and marketable title to the Assets and full right, power, and authority to sell, assign, transfer and deliver such Assets hereunder free of any liens or other encumbrances, and upon delivery and payment for such Assets, the Acquiring Fund will acquire good and marketable title thereto, subject to no restrictions on the full transfer thereof, including such restrictions as might arise under the 1933 Act, other than as disclosed to the Acquiring Fund;

(f) The Acquired Fund is not engaged currently, and the execution, delivery and performance of this Agreement will not result, in: (i) a material violation of the Trust’s Declaration of Trust or By-Laws or of any agreement, indenture, instrument, contract, lease or other undertaking to which the Trust, on behalf of the Acquired Fund, is a party or by which it is bound, other than as disclosed to the Acquiring Fund; or (ii) the acceleration of any obligation, or the imposition of any penalty, under any agreement, indenture, instrument, contract, lease, judgment or decree to which the Acquired Fund is a party or by which it is bound, other than as disclosed to the Acquiring Fund;

(g) All material contracts or other commitments of the Acquired Fund (other than this Agreement and certain investment contracts including options, futures and forward contracts) will terminate without liability, or will be continued with respect to the Acquired Fund as of the Closing Date;

(h) Except as otherwise disclosed in writing by the Trust, on behalf of the Acquiring Fund, no litigation or administrative proceeding or investigation of or before any court or governmental body is presently pending or, to the best of its knowledge, threatened against the Trust, on behalf of the Acquired Fund, or any of the its properties or assets that, if adversely determined, would materially and

A-4

adversely affect its financial condition or the conduct of its business. Except as otherwise disclosed in writing by the Trust, on behalf of the Acquiring Fund, the Trust knows of no facts which might form the basis for the institution of such proceedings and is not a party to or subject to the provisions of any order, decree or judgment of any court or governmental body which materially and adversely affects its business or its ability to consummate the transactions herein contemplated;

(i) The Statement of Assets and Liabilities and Schedule of Investments of the Acquired Fund as of March 31, 2022, and the related Statement of Operations, Changes in Net Assets and Financial Highlights for the periods then ended, have been audited by Ernst & Young LLP, an independent registered public accounting firm, included in its report dated May 23, 2022, and are in accordance with generally accepted accounting principles (“U.S. GAAP”) consistently applied, and such statements (copies of which have been furnished to the Acquiring Fund) present fairly, in all material respects, the financial condition of the Acquired Fund as of such date, and the results of its operations and the changes in its net assets for the year then ended, in accordance with U.S. GAAP, and there are no known material contingent liabilities of the Acquired Fund required to be reflected on a statement of assets and liabilities (including the notes thereto) in accordance with U.S. GAAP as of such date not disclosed therein;

(j) Since March 31, 2022, there have not been any material adverse changes in the Acquired Fund’s financial condition, assets, liabilities or business, other than changes occurring in the ordinary course of business, or any incurrence by the Acquired Fund of indebtedness maturing more than one year from the date such indebtedness was incurred, in each case except as otherwise disclosed to the Acquiring Fund (for the purposes of this subparagraph (j), a decline in net asset value per share of the Acquired Fund due to declines in market values of securities in the Acquired Fund’s portfolio, the discharge of the Acquired Fund’s liabilities, or the redemption of Acquired Fund shares by shareholders of the Acquired Fund shall not constitute a material adverse change);

(k) On the Closing Date, all Federal and other tax returns, dividend reporting forms, and other tax-related reports of the Acquired Fund required by law to have been filed by such date (including any extensions) shall have been filed and are or will be correct in all material respects, and all Federal and other taxes shown as due or required to be shown as due on said returns and reports shall have been paid or provision shall have been made for the payment thereof, and to the best of the Acquired Fund’s knowledge, no such return is currently under audit and no assessment has been asserted with respect to such returns;

(l) For each taxable year of its operation (including the taxable year ending on the Closing Date), the Acquired Fund has met (or will meet) the requirements of Subchapter M of the Code for qualification and treatment as a regulated investment company and has elected to be treated as such, and has been (or will be) eligible to and has computed (or will compute) its federal income tax under Section 852 of the Code and will have distributed all of its investment company taxable income and net capital gain (as defined in the Code), to the extent applicable, that will have accrued through the Closing Date;