false2024FY00011700102/290.500.50350,000,000350,000,000157,611,939158,079,033157,611,939158,079,033482,790507,20131510150.60.60.60.6P3YP3YP3YP3YP1YP1YP3Y3340311300011700102023-03-012024-02-2900011700102023-08-31iso4217:USD00011700102024-04-11xbrli:shares0001170010kmx:UsedVehiclesMember2023-03-012024-02-290001170010kmx:UsedVehiclesMemberkmx:NetSalesAndOperatingRevenuesMember2023-03-012024-02-29xbrli:pure0001170010kmx:UsedVehiclesMember2022-03-012023-02-280001170010kmx:UsedVehiclesMemberkmx:NetSalesAndOperatingRevenuesMember2022-03-012023-02-280001170010kmx:UsedVehiclesMember2021-03-012022-02-280001170010kmx:UsedVehiclesMemberkmx:NetSalesAndOperatingRevenuesMember2021-03-012022-02-280001170010kmx:WholesaleVehiclesMember2023-03-012024-02-290001170010kmx:WholesaleVehiclesMemberkmx:NetSalesAndOperatingRevenuesMember2023-03-012024-02-290001170010kmx:WholesaleVehiclesMember2022-03-012023-02-280001170010kmx:WholesaleVehiclesMemberkmx:NetSalesAndOperatingRevenuesMember2022-03-012023-02-280001170010kmx:WholesaleVehiclesMember2021-03-012022-02-280001170010kmx:WholesaleVehiclesMemberkmx:NetSalesAndOperatingRevenuesMember2021-03-012022-02-280001170010kmx:OtherMember2023-03-012024-02-290001170010kmx:NetSalesAndOperatingRevenuesMemberkmx:OtherMember2023-03-012024-02-290001170010kmx:OtherMember2022-03-012023-02-280001170010kmx:NetSalesAndOperatingRevenuesMemberkmx:OtherMember2022-03-012023-02-280001170010kmx:OtherMember2021-03-012022-02-280001170010kmx:NetSalesAndOperatingRevenuesMemberkmx:OtherMember2021-03-012022-02-280001170010kmx:NetSalesAndOperatingRevenuesMember2023-03-012024-02-2900011700102022-03-012023-02-280001170010kmx:NetSalesAndOperatingRevenuesMember2022-03-012023-02-2800011700102021-03-012022-02-280001170010kmx:NetSalesAndOperatingRevenuesMember2021-03-012022-02-280001170010kmx:UsedVehiclesMemberus-gaap:CostOfSalesMember2023-03-012024-02-290001170010kmx:UsedVehiclesMemberus-gaap:CostOfSalesMember2022-03-012023-02-280001170010kmx:UsedVehiclesMemberus-gaap:CostOfSalesMember2021-03-012022-02-280001170010kmx:WholesaleVehiclesMemberus-gaap:CostOfSalesMember2023-03-012024-02-290001170010kmx:WholesaleVehiclesMemberus-gaap:CostOfSalesMember2022-03-012023-02-280001170010kmx:WholesaleVehiclesMemberus-gaap:CostOfSalesMember2021-03-012022-02-280001170010kmx:OtherMemberus-gaap:CostOfSalesMember2023-03-012024-02-290001170010kmx:OtherMemberus-gaap:CostOfSalesMember2022-03-012023-02-280001170010kmx:OtherMemberus-gaap:CostOfSalesMember2021-03-012022-02-280001170010us-gaap:CostOfSalesMember2023-03-012024-02-290001170010us-gaap:CostOfSalesMember2022-03-012023-02-280001170010us-gaap:CostOfSalesMember2021-03-012022-02-280001170010kmx:GrossProfitMember2023-03-012024-02-290001170010kmx:GrossProfitMember2022-03-012023-02-280001170010kmx:GrossProfitMember2021-03-012022-02-280001170010kmx:NetIncomeLossFromFinancingMember2023-03-012024-02-290001170010kmx:NetIncomeLossFromFinancingMember2022-03-012023-02-280001170010kmx:NetIncomeLossFromFinancingMember2021-03-012022-02-280001170010us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-03-012024-02-290001170010us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-03-012023-02-280001170010us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-03-012022-02-280001170010kmx:DepreciationAndAmortizationMember2023-03-012024-02-290001170010kmx:DepreciationAndAmortizationMember2022-03-012023-02-280001170010kmx:DepreciationAndAmortizationMember2021-03-012022-02-280001170010us-gaap:InterestExpenseMember2023-03-012024-02-290001170010us-gaap:InterestExpenseMember2022-03-012023-02-280001170010us-gaap:InterestExpenseMember2021-03-012022-02-280001170010us-gaap:NonoperatingIncomeExpenseMember2023-03-012024-02-290001170010us-gaap:NonoperatingIncomeExpenseMember2022-03-012023-02-280001170010us-gaap:NonoperatingIncomeExpenseMember2021-03-012022-02-280001170010kmx:EarningsBeforeIncomeTaxesMember2023-03-012024-02-290001170010kmx:EarningsBeforeIncomeTaxesMember2022-03-012023-02-280001170010kmx:EarningsBeforeIncomeTaxesMember2021-03-012022-02-280001170010kmx:IncomeTaxProvisionMember2023-03-012024-02-290001170010kmx:IncomeTaxProvisionMember2022-03-012023-02-280001170010kmx:IncomeTaxProvisionMember2021-03-012022-02-280001170010kmx:NetEarningsMember2023-03-012024-02-290001170010kmx:NetEarningsMember2022-03-012023-02-280001170010kmx:NetEarningsMember2021-03-012022-02-28iso4217:USDxbrli:shares00011700102024-02-2900011700102023-02-2800011700102022-02-2800011700102021-02-280001170010us-gaap:CommonStockMember2021-02-280001170010us-gaap:AdditionalPaidInCapitalMember2021-02-280001170010us-gaap:RetainedEarningsMember2021-02-280001170010us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-02-280001170010us-gaap:RetainedEarningsMember2021-03-012022-02-280001170010us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-012022-02-280001170010us-gaap:AdditionalPaidInCapitalMember2021-03-012022-02-280001170010us-gaap:CommonStockMember2021-03-012022-02-280001170010us-gaap:CommonStockMember2022-02-280001170010us-gaap:AdditionalPaidInCapitalMember2022-02-280001170010us-gaap:RetainedEarningsMember2022-02-280001170010us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-02-280001170010us-gaap:RetainedEarningsMember2022-03-012023-02-280001170010us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-012023-02-280001170010us-gaap:AdditionalPaidInCapitalMember2022-03-012023-02-280001170010us-gaap:CommonStockMember2022-03-012023-02-280001170010us-gaap:CommonStockMember2023-02-280001170010us-gaap:AdditionalPaidInCapitalMember2023-02-280001170010us-gaap:RetainedEarningsMember2023-02-280001170010us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-02-280001170010us-gaap:RetainedEarningsMember2023-03-012024-02-290001170010us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-012024-02-290001170010us-gaap:AdditionalPaidInCapitalMember2023-03-012024-02-290001170010us-gaap:CommonStockMember2023-03-012024-02-290001170010us-gaap:CommonStockMember2024-02-290001170010us-gaap:AdditionalPaidInCapitalMember2024-02-290001170010us-gaap:RetainedEarningsMember2024-02-290001170010us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-02-29kmx:warehouse0001170010us-gaap:BuildingMember2024-02-290001170010us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-02-290001170010kmx:TermSecuritizationsDebtMember2024-02-290001170010kmx:TermSecuritizationsDebtMember2023-02-280001170010kmx:FinancingObligationsPortfolioSegmentDomain2024-02-290001170010srt:MinimumMemberkmx:FurnitureFixturesAndEquipmentMember2024-02-290001170010srt:MaximumMemberkmx:FurnitureFixturesAndEquipmentMember2024-02-290001170010us-gaap:LeaseholdsAndLeaseholdImprovementsMembersrt:MinimumMember2024-02-290001170010us-gaap:LeaseholdsAndLeaseholdImprovementsMembersrt:MaximumMember2024-02-290001170010kmx:UsedVehiclesMember2023-03-012024-02-290001170010kmx:UsedVehiclesMember2022-03-012023-02-280001170010kmx:UsedVehiclesMember2021-03-012022-02-280001170010kmx:WholesaleVehiclesMember2023-03-012024-02-290001170010kmx:WholesaleVehiclesMember2022-03-012023-02-280001170010kmx:WholesaleVehiclesMember2021-03-012022-02-280001170010kmx:ExtendedprotectionplanDomain2023-03-012024-02-290001170010kmx:ExtendedprotectionplanDomain2022-03-012023-02-280001170010kmx:ExtendedprotectionplanDomain2021-03-012022-02-280001170010kmx:ThirdpartyfinancefeesDomain2023-03-012024-02-290001170010kmx:ThirdpartyfinancefeesDomain2022-03-012023-02-280001170010kmx:ThirdpartyfinancefeesDomain2021-03-012022-02-280001170010kmx:AdvertisingSubscriptionRevenuesDomain2023-03-012024-02-290001170010kmx:AdvertisingSubscriptionRevenuesDomain2022-03-012023-02-280001170010kmx:AdvertisingSubscriptionRevenuesDomain2021-03-012022-02-280001170010kmx:ServiceDomain2023-03-012024-02-290001170010kmx:ServiceDomain2022-03-012023-02-280001170010kmx:ServiceDomain2021-03-012022-02-280001170010kmx:OtherDomain2023-03-012024-02-290001170010kmx:OtherDomain2022-03-012023-02-280001170010kmx:OtherDomain2021-03-012022-02-280001170010kmx:OtherMember2023-03-012024-02-290001170010kmx:OtherMember2022-03-012023-02-280001170010kmx:OtherMember2021-03-012022-02-280001170010kmx:InterestAndFeeIncomeMember2023-03-012024-02-290001170010kmx:InterestAndFeeIncomeMember2022-03-012023-02-280001170010kmx:InterestAndFeeIncomeMember2021-03-012022-02-280001170010kmx:InterestIncomeExpenseNetMember2023-03-012024-02-290001170010kmx:InterestIncomeExpenseNetMember2022-03-012023-02-280001170010kmx:InterestIncomeExpenseNetMember2021-03-012022-02-280001170010kmx:ProvisionForLoanLossesMember2023-03-012024-02-290001170010kmx:ProvisionForLoanLossesMember2022-03-012023-02-280001170010kmx:ProvisionForLoanLossesMember2021-03-012022-02-280001170010kmx:TotalInterestMarginAfterProvisionForLoanLossesMember2023-03-012024-02-290001170010kmx:TotalInterestMarginAfterProvisionForLoanLossesMember2022-03-012023-02-280001170010kmx:TotalInterestMarginAfterProvisionForLoanLossesMember2021-03-012022-02-280001170010kmx:PayrollAndFringeBenefitExpenseMember2023-03-012024-02-290001170010kmx:PayrollAndFringeBenefitExpenseMember2022-03-012023-02-280001170010kmx:PayrollAndFringeBenefitExpenseMember2021-03-012022-02-280001170010kmx:CAFDepreciationAndAmortizationMember2023-03-012024-02-290001170010kmx:CAFDepreciationAndAmortizationMember2022-03-012023-02-280001170010kmx:CAFDepreciationAndAmortizationMember2021-03-012022-02-280001170010kmx:OtherDirectExpensesMember2023-03-012024-02-290001170010kmx:OtherDirectExpensesMember2022-03-012023-02-280001170010kmx:OtherDirectExpensesMember2021-03-012022-02-280001170010kmx:TotalDirectExpensesMember2023-03-012024-02-290001170010kmx:TotalDirectExpensesMember2022-03-012023-02-280001170010kmx:TotalDirectExpensesMember2021-03-012022-02-280001170010kmx:CarmaxAutoFinanceIncomeMember2023-03-012024-02-290001170010kmx:CarmaxAutoFinanceIncomeMember2022-03-012023-02-280001170010kmx:CarmaxAutoFinanceIncomeMember2021-03-012022-02-280001170010kmx:TermSecuritizationsMember2024-02-290001170010kmx:TermSecuritizationsMember2023-02-280001170010kmx:WarehouseFacilitiesReceivablesMember2024-02-290001170010kmx:WarehouseFacilitiesReceivablesMember2023-02-280001170010kmx:ExcessCollateralMember2024-02-290001170010kmx:ExcessCollateralMember2023-02-280001170010kmx:OtherReceivablesMember2024-02-290001170010kmx:OtherReceivablesMember2023-02-280001170010kmx:CoreManagedReceivablesMemberkmx:CreditGradeAMember2024-02-290001170010kmx:CoreManagedReceivablesMemberkmx:CreditGradeBMember2024-02-290001170010kmx:CreditGradeCAndOtherMemberkmx:CoreManagedReceivablesMember2024-02-290001170010kmx:CoreManagedReceivablesMember2024-02-290001170010kmx:CreditGradeCAndOtherMemberkmx:OtherManagedReceivablesMember2024-02-290001170010kmx:CoreManagedReceivablesMemberkmx:CreditGradeAMember2023-02-280001170010kmx:CoreManagedReceivablesMemberkmx:CreditGradeBMember2023-02-280001170010kmx:CreditGradeCAndOtherMemberkmx:CoreManagedReceivablesMember2023-02-280001170010kmx:CoreManagedReceivablesMember2023-02-280001170010kmx:CreditGradeCAndOtherMemberkmx:OtherManagedReceivablesMember2023-02-280001170010kmx:OtherManagedReceivablesMember2023-02-280001170010us-gaap:AllowanceForLoanAndLeaseLossesMember2023-02-280001170010kmx:CoreManagedReceivablesMember2023-03-012024-02-290001170010kmx:OtherManagedReceivablesMember2023-03-012024-02-290001170010kmx:OtherManagedReceivablesMember2024-02-290001170010us-gaap:AllowanceForLoanAndLeaseLossesMember2024-02-290001170010kmx:CoreManagedReceivablesMember2020-03-010001170010kmx:OtherManagedReceivablesMember2020-03-0100011700102020-03-010001170010us-gaap:AllowanceForLoanAndLeaseLossesMember2020-03-010001170010kmx:CoreManagedReceivablesMember2022-03-012023-02-280001170010kmx:OtherManagedReceivablesMember2022-03-012023-02-280001170010us-gaap:FinancingReceivables1To29DaysPastDueMember2024-02-290001170010kmx:CoreManagedReceivablesMemberkmx:ThirtyOneToSixtyDaysPastDueMemberkmx:CreditGradeAMember2024-02-290001170010kmx:CoreManagedReceivablesMemberkmx:CreditGradeBMemberkmx:ThirtyOneToSixtyDaysPastDueMember2024-02-290001170010kmx:CreditGradeCAndOtherMemberkmx:CoreManagedReceivablesMemberkmx:ThirtyOneToSixtyDaysPastDueMember2024-02-290001170010kmx:CoreManagedReceivablesMemberkmx:ThirtyOneToSixtyDaysPastDueMember2024-02-290001170010kmx:CreditGradeCAndOtherMemberkmx:OtherManagedReceivablesMemberkmx:ThirtyOneToSixtyDaysPastDueMember2024-02-290001170010kmx:ThirtyOneToSixtyDaysPastDueMember2024-02-290001170010kmx:CoreManagedReceivablesMemberkmx:SixtyOneToNinetyDaysPastDueMemberkmx:CreditGradeAMember2024-02-290001170010kmx:CoreManagedReceivablesMemberkmx:SixtyOneToNinetyDaysPastDueMemberkmx:CreditGradeBMember2024-02-290001170010kmx:CreditGradeCAndOtherMemberkmx:CoreManagedReceivablesMemberkmx:SixtyOneToNinetyDaysPastDueMember2024-02-290001170010kmx:CoreManagedReceivablesMemberkmx:SixtyOneToNinetyDaysPastDueMember2024-02-290001170010kmx:CreditGradeCAndOtherMemberkmx:OtherManagedReceivablesMemberkmx:SixtyOneToNinetyDaysPastDueMember2024-02-290001170010kmx:SixtyOneToNinetyDaysPastDueMember2024-02-290001170010kmx:GreaterThanNinetyDaysPastDueMemberkmx:CoreManagedReceivablesMemberkmx:CreditGradeAMember2024-02-290001170010kmx:GreaterThanNinetyDaysPastDueMemberkmx:CoreManagedReceivablesMemberkmx:CreditGradeBMember2024-02-290001170010kmx:CreditGradeCAndOtherMemberkmx:GreaterThanNinetyDaysPastDueMemberkmx:CoreManagedReceivablesMember2024-02-290001170010kmx:GreaterThanNinetyDaysPastDueMemberkmx:CoreManagedReceivablesMember2024-02-290001170010kmx:CreditGradeCAndOtherMemberkmx:GreaterThanNinetyDaysPastDueMemberkmx:OtherManagedReceivablesMember2024-02-290001170010kmx:GreaterThanNinetyDaysPastDueMember2024-02-290001170010kmx:ManagedReceivablesMember2024-02-290001170010us-gaap:FinancingReceivables1To29DaysPastDueMember2023-02-280001170010kmx:CoreManagedReceivablesMemberkmx:ThirtyOneToSixtyDaysPastDueMemberkmx:CreditGradeAMember2023-02-280001170010kmx:CoreManagedReceivablesMemberkmx:CreditGradeBMemberkmx:ThirtyOneToSixtyDaysPastDueMember2023-02-280001170010kmx:CreditGradeCAndOtherMemberkmx:CoreManagedReceivablesMemberkmx:ThirtyOneToSixtyDaysPastDueMember2023-02-280001170010kmx:CoreManagedReceivablesMemberkmx:ThirtyOneToSixtyDaysPastDueMember2023-02-280001170010kmx:CreditGradeCAndOtherMemberkmx:OtherManagedReceivablesMemberkmx:ThirtyOneToSixtyDaysPastDueMember2023-02-280001170010kmx:ThirtyOneToSixtyDaysPastDueMember2023-02-280001170010kmx:CoreManagedReceivablesMemberkmx:SixtyOneToNinetyDaysPastDueMemberkmx:CreditGradeAMember2023-02-280001170010kmx:CoreManagedReceivablesMemberkmx:SixtyOneToNinetyDaysPastDueMemberkmx:CreditGradeBMember2023-02-280001170010kmx:CreditGradeCAndOtherMemberkmx:CoreManagedReceivablesMemberkmx:SixtyOneToNinetyDaysPastDueMember2023-02-280001170010kmx:CoreManagedReceivablesMemberkmx:SixtyOneToNinetyDaysPastDueMember2023-02-280001170010kmx:CreditGradeCAndOtherMemberkmx:OtherManagedReceivablesMemberkmx:SixtyOneToNinetyDaysPastDueMember2023-02-280001170010kmx:SixtyOneToNinetyDaysPastDueMember2023-02-280001170010kmx:GreaterThanNinetyDaysPastDueMemberkmx:CoreManagedReceivablesMemberkmx:CreditGradeAMember2023-02-280001170010kmx:GreaterThanNinetyDaysPastDueMemberkmx:CoreManagedReceivablesMemberkmx:CreditGradeBMember2023-02-280001170010kmx:CreditGradeCAndOtherMemberkmx:GreaterThanNinetyDaysPastDueMemberkmx:CoreManagedReceivablesMember2023-02-280001170010kmx:GreaterThanNinetyDaysPastDueMemberkmx:CoreManagedReceivablesMember2023-02-280001170010kmx:CreditGradeCAndOtherMemberkmx:GreaterThanNinetyDaysPastDueMemberkmx:OtherManagedReceivablesMember2023-02-280001170010kmx:GreaterThanNinetyDaysPastDueMember2023-02-280001170010kmx:ManagedReceivablesMember2023-02-280001170010us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-03-012024-02-290001170010us-gaap:NondesignatedMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2023-03-012024-02-290001170010us-gaap:NondesignatedMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2022-03-012023-02-280001170010us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-02-290001170010us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-02-280001170010us-gaap:NondesignatedMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2024-02-290001170010us-gaap:NondesignatedMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2023-02-280001170010us-gaap:FairValueInputsLevel1Member2024-02-290001170010us-gaap:FairValueInputsLevel2Member2024-02-290001170010us-gaap:FairValueInputsLevel1Memberus-gaap:DesignatedAsHedgingInstrumentMember2024-02-290001170010us-gaap:FairValueInputsLevel2Memberus-gaap:DesignatedAsHedgingInstrumentMember2024-02-290001170010us-gaap:DesignatedAsHedgingInstrumentMember2024-02-290001170010us-gaap:NondesignatedMemberus-gaap:FairValueInputsLevel1Member2024-02-290001170010us-gaap:FairValueInputsLevel2Memberus-gaap:NondesignatedMember2024-02-290001170010us-gaap:NondesignatedMember2024-02-290001170010us-gaap:FairValueInputsLevel1Member2023-02-280001170010us-gaap:FairValueInputsLevel2Member2023-02-280001170010us-gaap:FairValueInputsLevel1Memberus-gaap:DesignatedAsHedgingInstrumentMember2023-02-280001170010us-gaap:FairValueInputsLevel2Memberus-gaap:DesignatedAsHedgingInstrumentMember2023-02-280001170010us-gaap:DesignatedAsHedgingInstrumentMember2023-02-280001170010us-gaap:NondesignatedMemberus-gaap:FairValueInputsLevel1Member2023-02-280001170010us-gaap:FairValueInputsLevel2Memberus-gaap:NondesignatedMember2023-02-280001170010us-gaap:NondesignatedMember2023-02-280001170010us-gaap:LandMember2024-02-290001170010us-gaap:LandMember2023-02-280001170010kmx:LandHeldForDevelopmentMember2024-02-290001170010kmx:LandHeldForDevelopmentMember2023-02-280001170010us-gaap:BuildingMember2023-02-280001170010us-gaap:LeaseholdImprovementsMember2024-02-290001170010us-gaap:LeaseholdImprovementsMember2023-02-280001170010kmx:FurnitureFixturesAndEquipmentMember2024-02-290001170010kmx:FurnitureFixturesAndEquipmentMember2023-02-280001170010us-gaap:ConstructionInProgressMember2024-02-290001170010us-gaap:ConstructionInProgressMember2023-02-280001170010us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-02-280001170010kmx:CarMaxSalesOperationsMember2024-02-290001170010kmx:EdmundsMember2024-02-290001170010kmx:InternallyDevelopedSoftwareMember2024-02-290001170010us-gaap:CustomerRelationshipsMember2024-02-290001170010kmx:InternallyDevelopedSoftwareMember2023-02-280001170010us-gaap:CustomerRelationshipsMember2023-02-280001170010kmx:FederalNOLCarryforwardNoExpirationMember2024-02-290001170010kmx:FederalTaxCreditCarryforwardMember2024-02-290001170010kmx:StateNOLCarryforwardMember2024-02-290001170010kmx:StateTaxCreditCarryforwardMember2024-02-290001170010us-gaap:PensionPlansDefinedBenefitMember2024-02-290001170010us-gaap:PensionPlansDefinedBenefitMember2023-02-280001170010kmx:RestorationPlanMember2024-02-290001170010kmx:RestorationPlanMember2023-02-280001170010us-gaap:PensionPlansDefinedBenefitMember2023-03-012024-02-290001170010us-gaap:PensionPlansDefinedBenefitMember2022-03-012023-02-280001170010us-gaap:PensionPlansDefinedBenefitMember2021-03-012022-02-280001170010kmx:RestorationPlanMember2023-03-012024-02-290001170010kmx:RestorationPlanMember2022-03-012023-02-280001170010kmx:RestorationPlanMember2021-03-012022-02-280001170010us-gaap:FairValueInputsLevel1Memberkmx:EquitySecuritiesInternationalMemberkmx:MutualFundsMember2024-02-290001170010us-gaap:FairValueInputsLevel1Memberkmx:EquitySecuritiesInternationalMemberkmx:MutualFundsMember2023-02-280001170010us-gaap:ShortTermInvestmentsMemberkmx:CollectiveFundsMember2024-02-290001170010us-gaap:ShortTermInvestmentsMemberkmx:CollectiveFundsMember2023-02-280001170010us-gaap:EquitySecuritiesMemberkmx:CollectiveFundsMember2024-02-290001170010us-gaap:EquitySecuritiesMemberkmx:CollectiveFundsMember2023-02-280001170010us-gaap:FixedIncomeSecuritiesMemberkmx:CollectiveFundsMember2024-02-290001170010us-gaap:FixedIncomeSecuritiesMemberkmx:CollectiveFundsMember2023-02-280001170010kmx:InvestmentReceivablesNetMember2024-02-290001170010kmx:InvestmentReceivablesNetMember2023-02-280001170010us-gaap:EquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2024-02-290001170010us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMember2024-02-290001170010kmx:RetirementSavingsPlan401kMember2023-03-012024-02-290001170010kmx:RetirementSavingsPlan401kMember2022-03-012023-02-280001170010kmx:RetirementSavingsPlan401kMember2021-03-012022-02-280001170010us-gaap:RevolvingCreditFacilityMember2024-02-290001170010us-gaap:RevolvingCreditFacilityMember2023-02-280001170010kmx:TermLoanMember2024-02-290001170010kmx:TermLoanMember2023-02-280001170010kmx:October2021TermLoanMember2024-02-290001170010kmx:October2021TermLoanMember2023-02-280001170010kmx:A3.86seniornotesdues2023Member2024-02-290001170010kmx:A3.86seniornotesdues2023Member2023-02-280001170010kmx:A4.17seniornotesdue2026Member2024-02-290001170010kmx:A4.17seniornotesdue2026Member2023-02-280001170010kmx:A4.27seniornotesdue2028Member2024-02-290001170010kmx:A4.27seniornotesdue2028Member2023-02-280001170010us-gaap:LineOfCreditMember2024-02-290001170010us-gaap:LineOfCreditMember2023-02-280001170010us-gaap:LineOfCreditMember2022-02-280001170010kmx:TermLoanMember2024-02-290001170010kmx:October2021TermLoanMember2024-02-290001170010kmx:TermLoanMember2023-02-280001170010kmx:TermLoanMember2022-02-280001170010us-gaap:SeniorNotesMember2024-02-290001170010kmx:FinancingObligationMembersrt:MinimumMember2023-03-012024-02-290001170010kmx:FinancingObligationMembersrt:MaximumMember2023-03-012024-02-290001170010kmx:WarehouseFacilityOneMember2024-02-290001170010kmx:WarehouseFacilityTwoMember2024-02-290001170010kmx:WarehouseFacilityThreeMember2024-02-290001170010kmx:WarehouseFacilitiesMember2024-02-290001170010kmx:WarehouseFacilityOneMember2024-03-312024-03-310001170010kmx:WarehouseFacilityOneMember2024-03-310001170010us-gaap:PreferredStockMember2024-02-290001170010kmx:ShareRepurchaseProgramMember2024-02-290001170010kmx:ShareRepurchaseProgramMember2023-03-012024-02-290001170010kmx:ShareRepurchaseProgramMember2022-03-012023-02-280001170010kmx:ShareRepurchaseProgramMember2021-03-012022-02-280001170010kmx:ShareRepurchaseProgramMember2023-02-280001170010kmx:ShareRepurchaseProgramMember2022-02-280001170010us-gaap:StockCompensationPlanMember2024-02-290001170010us-gaap:StockOptionMember2023-03-012024-02-290001170010kmx:CashSettledRestrictedStockUnitsMember2023-03-012024-02-290001170010kmx:CashSettledRestrictedStockUnitsMembersrt:MaximumMember2023-03-012024-02-290001170010kmx:CashSettledRestrictedStockUnitsMembersrt:MinimumMember2023-03-012024-02-290001170010srt:MinimumMemberkmx:StockSettledRestrictedStockUnitsMember2023-03-012024-02-290001170010srt:MaximumMemberkmx:StockSettledRestrictedStockUnitsMember2023-03-012024-02-290001170010kmx:StockSettledRestrictedStockUnitsMember2023-03-012024-02-290001170010srt:MinimumMemberus-gaap:PerformanceSharesMember2023-03-012024-02-290001170010srt:MaximumMemberus-gaap:PerformanceSharesMember2023-03-012024-02-290001170010us-gaap:PerformanceSharesMember2023-03-012024-02-290001170010kmx:Fiscal2022GrantsYear1Memberus-gaap:PerformanceSharesMember2023-03-012024-02-290001170010kmx:Fiscal2022GrantsYear2Memberus-gaap:PerformanceSharesMember2023-03-012024-02-290001170010us-gaap:PerformanceSharesMemberkmx:Fiscal2023GrantsYear1Member2023-03-012024-02-290001170010kmx:GrantsPerformanceTargetNotSetMemberus-gaap:PerformanceSharesMember2024-02-290001170010us-gaap:PerformanceSharesMember2024-02-290001170010kmx:DeferredStockUnitsMember2023-03-012024-02-290001170010kmx:DeferredStockUnitsMember2024-02-290001170010srt:MinimumMemberus-gaap:RestrictedStockMember2023-03-012024-02-290001170010us-gaap:RestrictedStockMembersrt:MaximumMember2023-03-012024-02-290001170010us-gaap:RestrictedStockMember2024-02-290001170010us-gaap:EmployeeStockMember2024-02-290001170010us-gaap:EmployeeStockMember2023-03-012024-02-290001170010us-gaap:EmployeeStockMember2022-03-012023-02-280001170010us-gaap:EmployeeStockMember2021-03-012022-02-280001170010us-gaap:CostOfSalesMember2023-03-012024-02-290001170010us-gaap:CostOfSalesMember2022-03-012023-02-280001170010us-gaap:CostOfSalesMember2021-03-012022-02-280001170010kmx:CarmaxAutoFinanceIncomeMember2023-03-012024-02-290001170010kmx:CarmaxAutoFinanceIncomeMember2022-03-012023-02-280001170010kmx:CarmaxAutoFinanceIncomeMember2021-03-012022-02-280001170010us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-03-012024-02-290001170010us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-03-012023-02-280001170010us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-03-012022-02-280001170010us-gaap:EmployeeStockOptionMember2023-03-012024-02-290001170010us-gaap:EmployeeStockOptionMember2022-03-012023-02-280001170010us-gaap:EmployeeStockOptionMember2021-03-012022-02-280001170010kmx:CashSettledRestrictedStockUnitsMember2022-03-012023-02-280001170010kmx:CashSettledRestrictedStockUnitsMember2021-03-012022-02-280001170010kmx:StockSettledRestrictedStockUnitsMember2022-03-012023-02-280001170010kmx:StockSettledRestrictedStockUnitsMember2021-03-012022-02-280001170010us-gaap:PerformanceSharesMember2022-03-012023-02-280001170010us-gaap:PerformanceSharesMember2021-03-012022-02-280001170010kmx:DeferredStockUnitsMember2022-03-012023-02-280001170010kmx:DeferredStockUnitsMember2021-03-012022-02-280001170010us-gaap:RestrictedStockMember2023-03-012024-02-290001170010us-gaap:RestrictedStockMember2022-03-012023-02-280001170010us-gaap:RestrictedStockMember2021-03-012022-02-280001170010kmx:OthersharebasedincentivesMember2023-03-012024-02-290001170010kmx:OthersharebasedincentivesMember2022-03-012023-02-280001170010kmx:OthersharebasedincentivesMember2021-03-012022-02-280001170010us-gaap:StockOptionMember2024-02-290001170010kmx:StockSettledRestrictedStockUnitsMember2024-02-290001170010us-gaap:StockOptionMember2023-02-280001170010us-gaap:StockOptionMember2022-03-012023-02-280001170010us-gaap:StockOptionMember2021-03-012022-02-280001170010kmx:CashSettledRestrictedStockUnitsMember2023-02-280001170010kmx:CashSettledRestrictedStockUnitsMember2024-02-290001170010srt:MinimumMember2024-02-290001170010srt:MaximumMember2024-02-290001170010kmx:StockSettledRestrictedStockUnitsMember2023-02-280001170010us-gaap:EmployeeStockOptionMember2023-03-012024-02-290001170010us-gaap:EmployeeStockOptionMember2022-03-012023-02-280001170010us-gaap:EmployeeStockOptionMember2021-03-012022-02-280001170010kmx:StockSettledRestrictedStockUnitsMember2023-03-012024-02-290001170010kmx:StockSettledRestrictedStockUnitsMember2022-03-012023-02-280001170010kmx:StockSettledRestrictedStockUnitsMember2021-03-012022-02-280001170010kmx:UnrecognizedActuarialLossesMember2021-02-280001170010kmx:UnrecognizedHedgeLossesMember2021-02-280001170010kmx:UnrecognizedActuarialLossesMember2021-03-012022-02-280001170010kmx:UnrecognizedHedgeLossesMember2021-03-012022-02-280001170010kmx:UnrecognizedActuarialLossesMember2022-02-280001170010kmx:UnrecognizedHedgeLossesMember2022-02-280001170010kmx:UnrecognizedActuarialLossesMember2022-03-012023-02-280001170010kmx:UnrecognizedHedgeLossesMember2022-03-012023-02-280001170010kmx:UnrecognizedActuarialLossesMember2023-02-280001170010kmx:UnrecognizedHedgeLossesMember2023-02-280001170010kmx:UnrecognizedActuarialLossesMember2023-03-012024-02-290001170010kmx:UnrecognizedHedgeLossesMember2023-03-012024-02-290001170010kmx:UnrecognizedActuarialLossesMember2024-02-290001170010kmx:UnrecognizedHedgeLossesMember2024-02-290001170010kmx:CarmaxAutoFinanceMember2023-03-012024-02-290001170010kmx:CarmaxAutoFinanceMember2022-03-012023-02-280001170010kmx:CarmaxAutoFinanceMember2021-03-012022-02-280001170010srt:MinimumMember2023-03-012024-02-290001170010srt:MaximumMember2023-03-012024-02-29utr:Rate00011700102020-05-3100011700102023-03-012023-05-3100011700102023-06-012023-08-310001170010kmx:CarMaxSalesOperationsMember2023-03-012024-02-290001170010us-gaap:AllOtherSegmentsMember2023-03-012024-02-290001170010us-gaap:AllOtherSegmentsMemberus-gaap:IntersegmentEliminationMember2023-03-012024-02-290001170010us-gaap:IntersegmentEliminationMember2023-03-012024-02-290001170010us-gaap:OperatingSegmentsMemberkmx:CarMaxSalesOperationsMember2023-03-012024-02-290001170010us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2023-03-012024-02-290001170010kmx:CarMaxSalesOperationsMemberus-gaap:CostOfSalesMember2023-03-012024-02-290001170010us-gaap:AllOtherSegmentsMemberus-gaap:CostOfSalesMember2023-03-012024-02-290001170010kmx:CarMaxSalesOperationsMember2022-03-012023-02-280001170010us-gaap:AllOtherSegmentsMember2022-03-012023-02-280001170010us-gaap:AllOtherSegmentsMemberus-gaap:IntersegmentEliminationMember2022-03-012023-02-280001170010us-gaap:IntersegmentEliminationMember2022-03-012023-02-280001170010us-gaap:OperatingSegmentsMemberkmx:CarMaxSalesOperationsMember2022-03-012023-02-280001170010us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2022-03-012023-02-280001170010kmx:CarMaxSalesOperationsMemberus-gaap:CostOfSalesMember2022-03-012023-02-280001170010us-gaap:AllOtherSegmentsMemberus-gaap:CostOfSalesMember2022-03-012023-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended February 29, 2024

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____ to ____

Commission file number 001-31420

CARMAX, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Virginia | | 54-1821055 |

(State or other jurisdiction of incorporation) | | (I.R.S. Employer Identification No.) |

| |

12800 Tuckahoe Creek Parkway | | |

Richmond, | Virginia | | 23238 |

(Address of Principal Executive Offices) | | (Zip Code) |

(804) 747-0422

Registrant's telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock | KMX | New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the registrant’s common stock held by non-affiliates as of August 31, 2023, computed by reference to the closing price of the registrant’s common stock on the New York Stock Exchange on that date, was $12,959,000,271.

On April 11, 2024, there were 157,387,560 outstanding shares of CarMax, Inc. common stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the CarMax, Inc. Notice of 2024 Annual Meeting of Shareholders and Proxy Statement are incorporated by reference in Part III of this Form 10-K.

| | | | | | | | | | | | | | | | | | | | | | | |

| Auditor Name: | KPMG LLP | | Auditor Location: | Richmond, VA | | Auditor Firm ID: | 185 |

CARMAX, INC.

FORM 10-K

FOR FISCAL YEAR ENDED FEBRUARY 29, 2024

TABLE OF CONTENTS

| | | | | | | | | | | | | | |

| | | | | Page No. |

| | | | | |

| PART I |

| | | | | |

| Item 1. | | Business | | |

| Item 1A. | | Risk Factors | | |

| Item 1B. | | Unresolved Staff Comments | | |

| Item 1C. | | Cybersecurity | | |

| Item 2. | | Properties | | |

| Item 3. | | Legal Proceedings | | |

| Item 4. | | Mine Safety Disclosures | | |

| | | | |

| | | Executive Officers of the Company | | |

| | | | |

| PART II |

| Item 5. | | Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases

of Equity Securities | | |

| Item 6. | | [Reserved] | | |

| Item 7. | | Management’s Discussion and Analysis of Financial Condition and Results of Operations | | |

| Item 7A. | | Quantitative and Qualitative Disclosures about Market Risk | | |

| Item 8. | | Consolidated Financial Statements and Supplementary Data | | |

| Item 9. | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | |

| Item 9A. | | Controls and Procedures | | |

| Item 9B. | | Other Information | | |

| Item 9C. | | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | | |

| | | | |

| PART III |

| Item 10. | | Directors, Executive Officers and Corporate Governance | | |

| Item 11. | | Executive Compensation | | |

| Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder

Matters | | |

| Item 13. | | Certain Relationships and Related Transactions and Director Independence | | |

| Item 14. | | Principal Accountant Fees and Services | | |

| | | | |

| PART IV |

| Item 15. | | Exhibits and Financial Statement Schedules | | |

| Item 16. | | Form 10-K Summary | | |

| | | Signatures | | |

PART I

In this document, “we,” “our,” “us,” “CarMax” and “the company” refer to CarMax, Inc. and its wholly owned subsidiaries, unless the context requires otherwise.

FORWARD-LOOKING AND CAUTIONARY STATEMENTS

This Annual Report on Form 10-K and, in particular, the description of our business set forth in Item 1 and our Management’s Discussion and Analysis of Financial Condition and Results of Operations set forth in Item 7 contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”), including statements regarding:

•Our projected future sales and market share growth, comparable store sales growth, margins, tax rates, earnings, CarMax Auto Finance income and earnings per share.

•Our business strategies.

•Our expectations for strategic investments.

•Our expectations of factors that could affect CarMax Auto Finance income.

•Our expected future expenditures, cash needs, and financing sources.

•Our expected capital structure, stock repurchases and indebtedness.

•The projected number, timing and cost of new location openings.

•Our gross profit margin, inventory levels and ability to leverage selling, general and administrative and other fixed costs.

•Our sales and marketing plans.

•The capabilities of our proprietary information technology systems and other systems.

•Our assessment of the potential outcome and financial impact of litigation and the potential impact of unasserted claims.

•Our assessment of competitors and potential competitors.

•Our expectations for growth in our markets and business sectors.

•Our assessment of the effect of recent regulations, legislation and accounting pronouncements.

In addition, any statements contained in or incorporated by reference into this report that are not statements of historical fact should be considered forward-looking statements. You can identify these forward-looking statements by the use of words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “outlook,” “plan,” “positioned,” “predict,” “should,” “target,” “will” and other similar expressions, whether in the negative or affirmative. We cannot guarantee that we will achieve the plans, intentions or expectations disclosed in the forward-looking statements. There are a number of important risks and uncertainties that could cause actual results to differ materially from those indicated by our forward-looking statements. These risks and uncertainties include, without limitation, those set forth in Item 1A under the heading “Risk Factors.” We caution investors not to place undue reliance on any forward-looking statements as these statements speak only as of the date when made. We disclaim any intent or obligation to update any forward-looking statements made in this report.

Item 1. Business.

BUSINESS OVERVIEW

CarMax Background

CarMax, Inc. delivers an unrivaled customer experience by offering a broad selection of quality used vehicles and related products and services at competitive, no-haggle prices using a customer-friendly sales process. We are the nation’s largest retailer of used cars, and we sold 765,572 used vehicles at retail during the fiscal year ended February 29, 2024. We are also one of the nation’s largest operators of wholesale vehicle auctions, with 546,331 vehicles sold during fiscal 2024, and one of the nation’s largest providers of used vehicle financing, servicing approximately 1.1 million customer accounts in our $17.39 billion portfolio of managed receivables as of February 29, 2024. Our omni-channel platform, which gives us the largest addressable market in the used car industry, empowers our retail customers to buy a car on their terms – online, in-store or an integrated combination of both.

CarMax was incorporated under the laws of the Commonwealth of Virginia in 1996. CarMax, Inc. is a holding company and our operations are conducted through our subsidiaries. Under the ownership of Circuit City Stores, Inc. (“Circuit City”), we began operations in 1993 with the opening of our first CarMax store in Richmond, Virginia. On October 1, 2002, the CarMax business was separated from Circuit City through a tax-free transaction, becoming an independent, publicly traded company. As of February 29, 2024, we operated 245 used car stores in 109 U.S. television markets. Our home office is located at 12800 Tuckahoe Creek Parkway, Richmond, Virginia.

On June 1, 2021, we completed the acquisition of Edmunds Holding Company (“Edmunds”), one of the most well established and trusted online guides for automotive information and a recognized leader in digital car shopping innovations. With this acquisition, CarMax has enhanced its digital capabilities and further strengthened its role and reach across the used auto ecosystem while adding exceptional technology and creative talent.

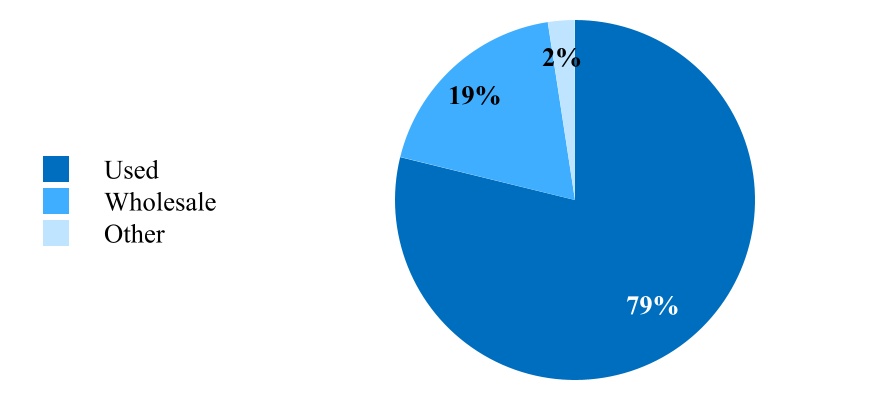

CarMax Business

We operate in two reportable segments: CarMax Sales Operations and CarMax Auto Finance (“CAF”). Our CarMax Sales Operations segment consists of all aspects of our auto merchandising and service operations, excluding financing provided by CAF. Our CAF segment consists solely of our own finance operation that provides financing to customers buying retail vehicles from CarMax. Our consolidated financial statements include the financial results related to our Edmunds business, which does not meet the definition of a reportable segment.

CarMax Sales Operations. Our CarMax Sales Operations segment sells used vehicles, purchases used vehicles from customers and other sources, sells related products and services, and arranges financing options for customers, all for competitive, no-haggle prices. We enable our customers to separately evaluate each component of the sales process based on comprehensive information about the terms and associated prices of each component. Customers can accept or decline any individual element of the offer without affecting the price or terms of any other component of the offer.

Purchasing a Vehicle:

The vehicle purchase process at CarMax differs fundamentally from the traditional auto retail experience. Our no-haggle pricing removes a frequent customer frustration with the purchase process and allows customers to shop for vehicles the same way they shop for other consumer products. Our omni-channel platform further empowers our customers to buy a car on their own terms – online, in-store or an integrated combination of both.

Our omni-channel platform provides multiple ways for our customers to interact with us, including completely online. A customer may interact with our customer experience consultants via phone, text messages or chat. These employees are paid a fixed hourly rate and receive incentive bonuses based on their ability to effectively progress the customer through their car-buying journey. Customers may also interact in-person with our sales consultants who are generally paid commissions on a fixed dollars-per-unit standard, thereby earning the same commission regardless of the vehicle being sold, the amount a customer finances or the related interest rate. These pay structures align our associates’ interests with those of our customers, in contrast to other dealerships where sales and finance personnel may receive higher commissions for negotiating higher prices and interest rates, or steering customers to vehicles with higher gross profits.

We recondition every used vehicle we retail to meet our CarMax Quality Certified standards, and each vehicle must pass an inspection before being offered for sale. We stand behind every used vehicle we sell with our Love Your Car Guarantee. This guarantee gives customers the ability to take 24-hour test drives before committing to purchase as well as provides a 30-day/1,500 mile money-back guarantee and a 90-day/4,000-mile limited warranty. In May 2024, we will replace our 30-day

money-back guarantee with a 10-day money-back guarantee. Our CarMax Quality Certified standards were developed internally by CarMax and are not affiliated with any third party or original equipment manufacturer program.

We maximize customer choice by offering a large selection of inventory on our lots and by making our nationwide inventory available for viewing on carmax.com as well as our mobile app. As of February 29, 2024, we had approximately 64,000 saleable retail vehicles in our inventory. Vehicles in-transit or on customer hold are not visible on our website. Upon request by a customer, we will transfer virtually any used vehicle in our inventory. This gives CarMax customers access to a much larger selection of vehicles than any traditional auto retailer. In fiscal 2024, approximately 36% of our vehicles sold were transferred at customer request.

Selling us a Vehicle:

We have separated the practice of trading in a used vehicle in conjunction with the purchase of another vehicle into two distinct and independent transactions. We will appraise a customer’s vehicle in-person free of charge and make a written, guaranteed offer to buy that vehicle regardless of whether the owner is purchasing a vehicle from us. This no-haggle offer is good for seven days. We also provide online instant appraisal offers, which quickly give customers an offer on their vehicle. The success of these offerings strengthens our leadership position as the largest used vehicle buyer from consumers in the U.S.

Vehicle purchases are also made through MaxOffer, our digital appraisal product for dealers. We leverage the Edmunds sales team to open new markets and sign-up new dealers for MaxOffer.

In fiscal 2024, we purchased approximately 1.1 million vehicles from consumers and dealers.

Based on age, mileage or condition, approximately half of the vehicles acquired through our appraisal processes meet our retail standards. Those vehicles that do not meet our retail standards are sold to licensed dealers through our wholesale auctions. Unlike many other auto auctions, we own all the vehicles that we sell in our auctions, which allows us to maintain a high auction sales rate. This high sales rate, combined with dealer-friendly practices, makes our auctions an attractive source of vehicles for licensed dealers. We continue to further enhance our auction products to improve dealer experiences. For fiscal 2024, our average auction sales rate was approximately 97%.

Financing a Vehicle:

The availability of financing is a critical component of the vehicle purchase process, and having an array of finance sources increases approvals, expands access to financing for our customers and mitigates risk to CarMax. Our finance program accommodates customers across a wide range of the credit spectrum through both CAF and third-party providers. We believe that our processes and systems, transparency of pricing, and vehicle quality, as well as the integrity of the information collected at the time the customer applies for credit, enable CAF and our third-party providers to make underwriting decisions in a unique and advantageous environment distinct from the traditional auto retail environment. All finance offers, whether from CAF or our third-party providers, are backed by a 3-day payoff option, which allows customers to refinance their loan with another finance provider within three business days at no charge.

We offer pre-qualification and finance-based shopping products nationwide, which are supported by CAF and multiple third-party providers. These products enable customers to request pre-qualification online with no impact to credit scores and receive their decisions and terms within minutes, empowering them to conveniently shop with their personalized, pre-qualification terms across our nationwide inventory. These products seamlessly provide consumers with the information and capabilities they need to shop for financing that best meets their budget and needs, further differentiating CarMax’s customer-centric financing experience. Over 80% of our customers use our online finance-based shopping tool as they begin the credit process. We have also established an online checkout and purchasing experience, which integrates our financing process, allowing eligible customers to apply and accept finance offers online without the assistance of an associate. We continue to enhance and further expand these products and experiences.

Related Products and Services:

We provide customers with a range of other related products and services, including extended protection plan (“EPP”) products and vehicle repair service. EPP products include extended service plans (“ESPs”) and guaranteed asset protection (“GAP”), which is designed to cover the unpaid balance on an auto loan in the event of a total loss of the vehicle or unrecovered theft. Our ESP customers have access to vehicle repair service at each CarMax store and at thousands of independent and franchised service providers. We believe that the broad scope of our ESPs helps promote customer satisfaction and loyalty, and thus increases the likelihood of repeat and referral business. In fiscal 2024, approximately 58% of the customers who purchased a retail used vehicle also purchased an ESP and approximately 16% purchased GAP.

CarMax Auto Finance. CAF provides financing solely to customers buying retail vehicles from CarMax. CAF allows us to manage our reliance on third-party finance providers and to leverage knowledge of our business to provide qualifying customers a competitive financing option. CAF utilizes proprietary scoring models based upon the credit history and other credit data of the customer along with CAF’s historical experience to predict the likelihood of customer repayment. Because CAF offers financing solely to CarMax customers, our scoring models are optimized for the CarMax channel. We believe CAF enables us to capture additional profits, cash flows and sales. After the effect of 3-day payoffs and vehicle returns, CAF financed 42.9% of our retail used vehicle unit sales in fiscal 2024.

CAF also services all auto loans it originates and is responsible for providing billing statements, collecting payments, maintaining contact with delinquent customers, and arranging for the repossession of vehicles securing defaulted loans.

Competition

CarMax Sales Operations. The U.S. used car marketplace is highly fragmented, and we face competition from franchised dealers, who sell both new and used vehicles; online and mobile sales platforms; independent used car dealers; and private parties. According to industry sources, as of December 31, 2023, there were over 18,000 franchised dealers in the U.S., who sell the majority of late-model used vehicles. Competition in our industry has evolved with the adoption of online platforms and marketing tools, all of which facilitate increased competition.

Based on industry data, there were approximately 37 million used cars sold in the U.S. in calendar 2023, of which approximately 19 million were estimated to be age 0- to 10-year old vehicles. While we are the largest retailer of used vehicles in the U.S., in calendar 2023, we estimate we sold approximately 3.7% of the age 0- to 10-year old vehicles sold on a nationwide basis, a decrease from 4.0% in calendar 2022. Market share performance in calendar 2023 was negatively impacted by sharp vehicle depreciation in the used car industry and our focus on profitable market share. Our market share is generally correlated to the length of time we have operated in a given market.

We believe that our principal competitive advantages in used vehicle retailing include our ability to provide a high degree of customer satisfaction with the car-buying experience by virtue of our competitive, no-haggle prices and our customer-friendly sales process; our breadth of selection of the most popular makes and models available; the quality of our vehicles; our proprietary information systems; the transparency and availability of CAF and third-party financing; the locations of our retail stores; and our commitment to evolving our car-buying experience to meet customers’ changing expectations. We believe our omni-channel platform reinforces our competitive advantages as it empowers customers to buy a car on their own terms, whether online, in-store or through an integrated combination of online and in-store experiences. Our diversified business model, combined with our exceptional associates and unparalleled omni-channel experience, is a unique advantage in the used car industry that firmly positions us to drive profitable market share gains while creating shareholder value over the long-term.

In addition, we believe our willingness to appraise and purchase a customer’s vehicle, whether or not the customer is buying a car from us, provides a competitive sourcing advantage for retail vehicles. Our high volume of appraisal purchases, which has increased further with the rollout of our instant appraisal offers and MaxOffer, supplies not only a large portion of our retail inventory, but also provides the scale that enables us to conduct our own wholesale auctions to dispose of vehicles that do not meet our retail standards.

Our wholesale auctions compete with other automotive in-person and online auctions. These competitors auction vehicles of all ages, while CarMax’s auctions predominantly sell older, higher mileage vehicles. Our wholesale auctions were primarily conducted virtually during fiscal 2024.

CarMax Auto Finance. CAF operates and is a significant participant in the auto finance sector of the consumer finance market. This sector is primarily comprised of banks, captive finance divisions of new car manufacturers, credit unions and independent finance companies. According to industry sources, this sector represented more than $1.6 trillion in outstanding receivables as of December 31, 2023. CAF’s primary competitors are banks and credit unions that offer direct financing to customers purchasing used cars.

We believe that CAF’s principal competitive advantage is its strategic position as the primary finance source for CarMax customers, and that CAF’s primary driver for growth is the growth in CarMax’s retail used unit sales. We periodically test different credit offers and closely monitor acceptance rates and the effect on sales to assess market competitiveness. We also monitor 3-day payoffs, as the percentage of customers exercising this option can be an indication of the competitiveness of our offer.

Products and Services

Retail Merchandising. We offer customers a broad selection of makes and models of used vehicles, including domestic, imported and luxury vehicles, as well as hybrid and electric vehicles (“EV”), at competitive prices. Our focus is vehicles that are 0 to 10 years old; over the past three fiscal years, these vehicles generally ranged in price from $14,000 to $49,000. The mix of our used vehicle inventory by make, model and age will vary from time to time, depending on consumer preferences, seasonality and market pricing and availability.

Wholesale Auctions. The typical vehicle sold at our wholesale auctions is approximately 10 years old and has more than 100,000 miles. We provide condition disclosures on each vehicle, including those for vehicles with major mechanical issues, possible frame or flood damage, branded titles, salvage history and unknown true mileage. Professional, licensed auctioneers conduct our auctions. Dealers pay a fee to us based on the sales price of the vehicles they purchase. Our auctions are generally held on a weekly or bi-weekly basis.

Extended Protection Plans. In conjunction with the sale of a vehicle, we offer customers EPP products. We receive revenue for selling these plans on behalf of unrelated third parties, who are the primary obligors. We have no contractual liability to customers for claims under these agreements. The ESPs we currently offer on all used retail vehicles provide coverage up to 60 months (subject to mileage limitations). GAP covers the customer for the term of their finance contract. The EPPs that we sell have been designed to our specifications and are administered by the third parties through private-label arrangements. Periodically, we may receive profit-sharing revenues based upon the performance of the ESP policies administered by third parties. As of February 29, 2024, our third-party ESP providers included Assurant, Inc., CNA National Warranty Corporation and Fidelity Warranty Services, Inc. Our third-party GAP provider as of February 29, 2024 was Safe-Guard Products International LLC.

Reconditioning and Service. An integral part of our used car consumer offer is the reconditioning process designed to make sure every car meets our internal standards before it can become a CarMax Quality Certified vehicle. This process includes an inspection of the engine and all major systems. Based on this inspection, we determine the reconditioning necessary to bring the vehicle up to our internal quality standards. Many of our stores depend upon nearby, typically larger, CarMax stores for reconditioning, which increases efficiency and reduces overhead. We perform most routine mechanical and minor body repairs in-house; however, for some reconditioning services, including, but not limited to, services related to manufacturer’s warranties, we engage third parties specializing in those services. CarMax does not have manufacturer authorization to complete recall-related repairs, and some vehicles CarMax sells may have unrepaired safety recalls. However, safety recall information, as reported by the National Highway Traffic Safety Administration, is available on our website, and we review any unrepaired safety recall information with our used vehicle customers before purchase.

All CarMax used car stores provide vehicle repair service, including repairs of vehicles covered by the ESPs we sell. Additionally, we have partnered with third-party auto service and repair providers. Through these partnerships, our customers have access to a nationwide network of trusted, quality and fair-priced service and repair locations.

Customer Credit. We offer financing alternatives for retail customers across a wide range of the credit spectrum through CAF and arrangements with several financial institutions. Vehicles are financed using retail installment contracts secured by the vehicle. As of February 29, 2024, our network of third-party finance providers included Ally Financial, American Credit Acceptance, Capital One Auto Finance, Chase Auto Finance, Exeter Finance Corp., Santander Consumer USA and Westlake Financial Services. We have no recourse liability for credit losses on retail installment contracts arranged and held by third-party providers, and we periodically test additional third-party providers.

Generally, credit applications submitted by customers to CarMax are initially reviewed by CAF using our proprietary underwriting standards. Based on that review, CAF makes financing offers designed to create a loan portfolio that meets our targeted risk profile in the aggregate. Applications that CAF declines or approves with conditions are generally evaluated by other third-party finance providers. Third-party providers generally either pay us or are paid a fixed, pre-negotiated fee per contract. We refer to the providers who generally pay us a fee or to whom no fee is paid as Tier 2 providers, and we refer to providers to whom we pay a fee as Tier 3 providers. We are willing to pay a fee to Tier 3 providers because we believe their participation provides us with incremental sales by enabling customers to secure financing that they may not otherwise be able to obtain. All fees either received or paid are pre-negotiated at a fixed amount and do not vary based on the amount financed, the interest rate, the term of the loan or the loan-to-value ratio. CAF also provides financing for a small percentage of customers who would typically be financed by a Tier 2 or Tier 3 provider.

We do not offer financing to dealers purchasing vehicles at our wholesale auctions. However, we have made arrangements to have third-party financing available to our auction customers.

Suppliers for Used Vehicles

We acquire a significant percentage of our retail used vehicle inventory directly from consumers through our in-store and online appraisal processes, as well as through local, regional and online auctions. We also acquire used vehicle inventory from wholesalers, franchised and independent dealers and fleet owners, such as leasing companies and rental companies. Instant offer, our online consumer-facing appraisal tool, as well as MaxOffer, our digital appraisal product for dealers, have significantly driven the increase in our vehicle purchases. The buy rate for customers who engage with us after first receiving an online instant appraisal offer is typically higher than through our traditional appraisal lane. The used vehicle inventory we acquire directly from consumers through our appraisal process helps provide an inventory of makes and models that reflects consumer preferences in each market.

The supply of late-model used vehicles is influenced by a variety of factors, including the total number of vehicles in operation; the volume of new vehicle sales, which in turn generate used car trade-ins; and the number of used vehicles sold or remarketed through retail channels, wholesale transactions and at automotive auctions. According to industry sources, there were approximately 289 million light vehicles in operation in the U.S. as of December 31, 2023. During calendar year 2023, it is estimated that approximately 15 million new cars and 37 million used cars were sold at retail, many of which were accompanied by trade-ins, and approximately 10 million wholesale vehicles were sold at auctions and through other channels.

Based on the large number of vehicles remarketed each year, consumer acceptance of our appraisal process, our experience and success in acquiring vehicles from auctions and other sources, and the large size of the U.S. auction market relative to our needs, we believe that sources of used vehicles will continue to be sufficient to meet our current and future needs.

Seasonality

Historically, our business has been seasonal. Our stores typically experience their strongest traffic and sales in the spring and summer, with an increase in traffic and sales in February and March, coinciding with federal income tax refunds.

Technology

We leverage a combination of cloud-based solutions and proprietary technologies to run our operations. We have a strong software engineering discipline and we have adopted Agile, DevOps, Lean and other leading digital delivery practices. Technology teams are tightly integrated with the rest of the business and are embedded within our cross-functional “Product” teams. Our Product teams use a “test and learn” approach to iterate and deploy new technology-enabled experiences to our associates and customers. We use advanced data science, artificial intelligence and machine learning capabilities to optimize our business and the customer experience. Our business is supported by digital and mobile technologies that provide enhanced customer experience while enabling highly integrated automation of all operating functions, including credit processing and supply chain management. Buyers and sales consultants are equipped with mobile and centralized tools that allow them to access real-time information to better serve our customers. Our proprietary digital technology provides our management with real-time information about many aspects of our omni-channel operations, such as inventory management, pricing, vehicle transfers, wholesale auctions and sales consultant productivity. Real-time access to a complete view of our customer interactions from omni-channel allows our associates to provide a tailored and differentiated experience to our customers. In addition, through our systematic integrations with our third-party finance partners, we are able to provide our finance-based shopping experience. We continue to build our technologies to expand our reach and integrate CarMax into a broader ecosystem of partnerships.

Our proprietary centralized inventory management and pricing system tracks each vehicle throughout the sales process and allows us to buy the mix of makes, models, age, mileage and price points tailored to customer buying preferences at each CarMax location. Leveraging our thirty years of experience buying and selling millions of used vehicles, our system generates recommended initial retail price points, as well as retail price markdowns for specific vehicles based on algorithms that account for factors including sales history, consumer interest and seasonal patterns. We believe this systematic approach to vehicle pricing allows us to optimize inventory turns, which reduces the depreciation risk inherent in used cars and helps us to achieve our targeted gross profit dollars per unit. Because of the pricing discipline afforded by our inventory management and pricing system, generally 99% of our entire used car inventory offered at retail is sold at retail.

Marketing and Advertising

Our marketing strategies are focused on driving customer growth through building awareness and affinity for the brand and acquiring in-market shoppers and sellers. These strategies are implemented through a broad range of media including, but not limited to, traditional broadcast, digital, search, social, out-of-home, sports sponsorships and newer influencer and activation programs. Our website and related mobile app received an average of 34 million monthly visits during fiscal 2024 and are a critical part of the customer’s journey, allowing them to learn about CarMax, explore our full inventory in real time, initiate vehicle transfers, apply for financing pre-qualification, receive an appraisal offer and even buy a car fully online. Our survey

data indicates that during fiscal 2024, approximately 95% of customers who purchased a vehicle from us had first visited us online. In addition, approximately 70% of our customers leveraged some or all of our digital capabilities to complete their transactions in fiscal 2024. We believe consumers in the used car industry will increasingly prefer to have the ability to shop and transact digitally.

In fiscal 2024, we continued building the CarMax brand through new creative campaigns promoting our omni-channel platform as well as brand reassurance messaging, highlighting our money back guarantee and up-front pricing. We launched a new campaign with the NBA/WNBA alongside the announcement of CarMax as the newest WNBA Changemaker. In addition, we launched our Never Settle campaign, encouraging customers to never settle for less than the CarMax experience when buying or selling a car. We also continued our multi-year partnership with the NWSL. As part of this partnership, CarMax is the presenting sponsor of the NWSL Shield, awarded to the club with the best regular season record.

Human Capital Resources

CarMax’s purpose, to drive integrity by being honest and transparent in every interaction, is brought to life each day by our associates’ commitment to living our core values. We recognize that our associates are the key to our success, and we are proud to provide an award-winning workplace where we value the diversity and contribution of all associates and foster a culture where associates can achieve their career goals. Our associates are further guided by the policies and procedures we have in place to ensure everyone is treated with respect and has opportunities to reach their full potential.

On February 29, 2024, we had a total of 29,836 full- and part-time associates, of which 970 work in our CAF segment and 473 work for our Edmunds business. We had 25,122 hourly and salaried associates, as well as 3,077 in-store sales associates, 1,525 sales associates in our Customer Experience Centers (“CECs”) and 112 Edmunds sales associates. Our in-store sales associates predominantly work on a commission basis while our CEC sales associates are hourly employees who are incentive eligible. We employ additional associates during peak selling seasons. No associate is subject to a collective bargaining agreement. We annually review our pay in each geographic market to ensure we are providing a fair and competitive wage. As of February 29, 2024, all our associates were paid above the applicable minimum wage. We offer a broad range of benefits to our associates, including health benefits for full-time associates.

Throughout the implementation of our omni-channel car buying experience, the shape of our workforce has evolved and the number of technology, product and data science associates has increased. As of February 29, 2024, we had 1,469 technology, product and data science associates. In response, we created a rotational program for college technology hires and implemented a technology and data science reskilling program. All roles working on our innovation efforts are eligible for equity or equity-based grants through our standard compensation plan, which serve as a meaningful engagement and retention tool. We believe this evolution in our workforce has been and will continue to be critical to the development of our technology platforms and strategic initiatives.

Our commitment to our associates is reflected in our fair and broad-based compensation packages and benefit programs, our continuous investment in talent acquisition, engagement, and development activities, and our comprehensive safety and security program. We review pay equity annually based on objective factors such as position, tenure, and location. If we find discrepancies that cannot be explained by these objective factors, we make appropriate adjustments. Our commitment is to provide equal pay for comparable work regardless of gender, age, race or ethnicity.

We have been recognized for 20 consecutive years as one of Fortune magazine’s 100 Best Companies to Work For® and have also been recognized as one of Training magazine’s “Training APEX Award” recipients for 17 years in a row. These awards reflect our ability to provide associates with the tools and environment they need to succeed and grow in their careers. We have an Associate Experience Team and a cross-functional Associate Experience Advisory Group dedicated to ensuring an inclusive and engaging workplace. We also continued to measure engagement via biannual associate voice surveys, and across the company, teams created focused plans to continually improve engagement based on survey results. Our goal is to achieve world-class associate engagement and responding to associate feedback enables us to focus on the issues that matter to our associates.

Diversity and Inclusion. The CarMax culture of diversity and inclusion is built on a foundation of integrity and respect, and we value the diverse backgrounds and perspectives our associates bring to locations across the country. Our commitment to diversity and inclusion is based on a company vision to ensure everyone, everywhere has the opportunity to reach their full potential.

Our diversity and inclusion governance model includes a council as well as an executive steering committee, of which the CEO is a member. We also have a Corporate Social Responsibility (“CSR”) team, led by our Vice President, CSR. The CSR team includes, in part, the Community Relations, Diversity and Inclusion and Internal Communications teams.

We have a company-wide associate training program on diversity and inclusion. This program includes required trainings for all associates, with a completion rate of over 90% in fiscal 2024. Our board of directors participated in this training as well, with a 100% completion rate in fiscal 2024. The program also includes additional self-service training and learning materials as well as leader perspective videos and discussion guides to aid team conversations.

We remain committed to fostering a work environment that celebrates diversity and operates in an all-inclusive manner for associates, and which authentically reflects our value of putting people first. We celebrate and champion a broad diversity of individuals, perspectives, and ideas, which we believe meaningfully strengthens our ability to innovate and continue expanding the value we provide customers.

Foundational principles are formalized in both our diversity and inclusion framework and our commitment to diversity policy. Our vision is to provide everyone, everywhere with the same opportunities to reach their full potential. This commitment extends to every facet of our business interactions, from associates within CarMax to job applicants, customers, vendors, shareholders, and business partners, to ensure everyone is treated fairly and impartially.

We consider a wide set of different suppliers when conducting business, including small, local businesses. These businesses are vital to their respective communities and help CarMax build resiliency in every area we operate. Accordingly, we have revamped our external supplier inclusion webpage, where potential suppliers can register with CarMax, enabling us to better identify suppliers for specific procurement opportunities. Maintaining a diversified supplier base remains essential to CarMax’s strategy of mitigating sourcing risks and remaining resilient.

We plan to publish our 2024 Responsibility Report in May 2024, where we will further describe our broader environmental, social and governance efforts.

Intellectual Property

Our brand image is a critical element of our business strategy. We rely on trademarks, domain names and copyrights to protect core aspects of CarMax’s look and feel. Innovation and technology also play an increasingly vital role in all aspects of the business. We actively pursue appropriate intellectual property protection for our state-of-the-art work by filing patent applications in areas ranging from vehicle reconditioning and digital merchandising to image capture, online shopping innovations and search engine optimization.

Laws and Regulations

Vehicle Dealer and Other Laws and Regulations. We operate in a highly regulated industry. In every state in which we operate, we must obtain licenses and permits to conduct business, including dealer, service, sales, transportation and finance licenses issued by state and local regulatory authorities. A wide range of federal, state and local laws and regulations govern the manner in which we conduct business, including logistics, advertising, sales, financing and employment practices. These laws include consumer protection laws and privacy laws, as well as other laws and regulations applicable to motor vehicle dealers. These laws also include federal and state wage-hour, anti-discrimination and other employment practices laws. Our financing activities with customers are subject to federal truth-in-lending, consumer leasing, equal credit opportunity and fair credit reporting laws and regulations, as well as state and local motor vehicle finance, collection, repossession and installment finance laws. Our activities are subject to oversight by the Federal Trade Commission and other federal and state regulators, and our financing activities are also subject to enforcement by the Consumer Financial Protection Bureau (“CFPB”).

The CFPB has supervisory authority over large nonbank auto finance companies, including CAF. The CFPB uses this authority to conduct supervisory examinations to ensure compliance with various federal consumer protection laws.

Claims arising out of actual or alleged violations of law could be asserted against us by individuals or governmental authorities and could expose us to significant damages or other penalties, including revocation or suspension of the licenses necessary to conduct business and fines.

We may also be subject, from time to time, to laws, regulations, and other governmental actions instituted in response to public health emergencies. Among other things, these actions have required and may continue to require, in many localities, store occupancy restrictions, store closures and restrictions on in-person wholesale auctions.

Environmental Laws and Regulations. We are subject to a variety of federal, state and local laws and regulations that pertain to the environment. Our business involves the use, handling and disposal of hazardous materials and wastes, including motor oil, gasoline, solvents, lubricants, paints and other substances. We are subject to compliance with regulations concerning, among other things, the operation of underground and above-ground gasoline storage tanks, gasoline dispensing equipment, above-ground oil tanks and automotive paint booths.

AVAILABILITY OF REPORTS AND OTHER INFORMATION

The following items are available free of charge on our website through the “Financials” link on our investor relations home page at investors.carmax.com, shortly after we file them with, or furnish them to, the U.S. Securities and Exchange Commission (the “SEC”): annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements on Schedule 14A, and any amendments to those reports. The following documents are also available free of charge on our website: Corporate Governance Guidelines, Code of Business Conduct, and the charters of the Audit, Nominating and Governance, Compensation and Personnel, and Technology and Innovation Committees. We publish any changes to these documents on our website. We also promptly disclose reportable waivers of the Code of Business Conduct on our website. The contents of our website are not, however, part of this report.

Printed copies of these documents are also available to any shareholder, without charge, upon written request to our corporate secretary at the address set forth on the cover page of this report.

Item 1A. Risk Factors.

We are subject to a variety of risks, the most significant of which are described below. Our business, sales, results of operations and financial condition could be materially adversely affected by any of these risks.

BUSINESS RISKS

We operate in a highly competitive industry. Failure to develop and execute strategies to remain the nation’s preferred retailer of used vehicles and to adapt to the increasing use of digital and online tools to market, buy, sell and finance used vehicles could adversely affect our business, sales and results of operations.

Automotive retailing is a highly competitive and highly fragmented business. Our competition includes publicly and privately owned new and used car dealers and online and mobile sales platforms, as well as millions of private individuals. Competitors buy and sell the same or similar makes of vehicles that we offer in the same or similar markets at competitive prices. New car dealers leverage their franchise relationships with automotive manufacturers to brand certain used cars as “certified pre-owned,” which could provide those competitors with an advantage over CarMax.

Retail Competition. Some of our competitors have replicated or attempted to replicate portions of the consumer offer that we pioneered when we opened our first used car store in 1993, including our use of competitive, no-haggle prices and our commitment to buy a customer’s vehicle even if they do not purchase one from us.