false2024Q100011700102/290.500.50350,000,000350,000,000158,208,623158,079,033158,208,623158,079,0331,672,3871,614,924535,412507,20127.1400P3YP3YP3YP3YP1YP1YP3Ythree years00011700102023-03-012023-05-3100011700102023-06-22xbrli:shares0001170010kmx:UsedVehiclesMember2023-03-012023-05-31iso4217:USD0001170010kmx:UsedVehiclesMemberkmx:NetSalesAndOperatingRevenuesMember2023-03-012023-05-31xbrli:pure0001170010kmx:UsedVehiclesMember2022-03-012022-05-310001170010kmx:UsedVehiclesMemberkmx:NetSalesAndOperatingRevenuesMember2022-03-012022-05-310001170010kmx:WholesaleVehiclesMember2023-03-012023-05-310001170010kmx:WholesaleVehiclesMemberkmx:NetSalesAndOperatingRevenuesMember2023-03-012023-05-310001170010kmx:WholesaleVehiclesMember2022-03-012022-05-310001170010kmx:WholesaleVehiclesMemberkmx:NetSalesAndOperatingRevenuesMember2022-03-012022-05-310001170010kmx:OtherMember2023-03-012023-05-310001170010kmx:NetSalesAndOperatingRevenuesMemberkmx:OtherMember2023-03-012023-05-310001170010kmx:OtherMember2022-03-012022-05-310001170010kmx:NetSalesAndOperatingRevenuesMemberkmx:OtherMember2022-03-012022-05-310001170010kmx:NetSalesAndOperatingRevenuesMember2023-03-012023-05-3100011700102022-03-012022-05-310001170010kmx:NetSalesAndOperatingRevenuesMember2022-03-012022-05-310001170010kmx:UsedVehiclesMemberus-gaap:CostOfSalesMember2023-03-012023-05-310001170010kmx:UsedVehiclesMemberus-gaap:CostOfSalesMember2022-03-012022-05-310001170010kmx:WholesaleVehiclesMemberus-gaap:CostOfSalesMember2023-03-012023-05-310001170010kmx:WholesaleVehiclesMemberus-gaap:CostOfSalesMember2022-03-012022-05-310001170010kmx:OtherMemberus-gaap:CostOfSalesMember2023-03-012023-05-310001170010kmx:OtherMemberus-gaap:CostOfSalesMember2022-03-012022-05-310001170010us-gaap:CostOfSalesMember2023-03-012023-05-310001170010us-gaap:CostOfSalesMember2022-03-012022-05-310001170010kmx:GrossProfitMember2023-03-012023-05-310001170010kmx:GrossProfitMember2022-03-012022-05-310001170010kmx:NetIncomeLossFromFinancingMember2023-03-012023-05-310001170010kmx:NetIncomeLossFromFinancingMember2022-03-012022-05-310001170010us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-03-012023-05-310001170010us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-03-012022-05-310001170010kmx:DepreciationAndAmortizationMember2023-03-012023-05-310001170010kmx:DepreciationAndAmortizationMember2022-03-012022-05-310001170010us-gaap:InterestExpenseMember2023-03-012023-05-310001170010us-gaap:InterestExpenseMember2022-03-012022-05-310001170010us-gaap:NonoperatingIncomeExpenseMember2023-03-012023-05-310001170010us-gaap:NonoperatingIncomeExpenseMember2022-03-012022-05-310001170010kmx:EarningsBeforeIncomeTaxesMember2023-03-012023-05-310001170010kmx:EarningsBeforeIncomeTaxesMember2022-03-012022-05-310001170010kmx:IncomeTaxProvisionMember2023-03-012023-05-310001170010kmx:IncomeTaxProvisionMember2022-03-012022-05-310001170010kmx:NetEarningsMember2023-03-012023-05-310001170010kmx:NetEarningsMember2022-03-012022-05-31iso4217:USDxbrli:shares00011700102023-05-3100011700102023-02-2800011700102022-02-2800011700102022-05-310001170010us-gaap:CommonStockMember2023-02-280001170010us-gaap:AdditionalPaidInCapitalMember2023-02-280001170010us-gaap:RetainedEarningsMember2023-02-280001170010us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-02-280001170010us-gaap:RetainedEarningsMember2023-03-012023-05-310001170010us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-012023-05-310001170010us-gaap:AdditionalPaidInCapitalMember2023-03-012023-05-310001170010us-gaap:CommonStockMember2023-03-012023-05-310001170010us-gaap:CommonStockMember2023-05-310001170010us-gaap:AdditionalPaidInCapitalMember2023-05-310001170010us-gaap:RetainedEarningsMember2023-05-310001170010us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-05-310001170010us-gaap:CommonStockMember2022-02-280001170010us-gaap:AdditionalPaidInCapitalMember2022-02-280001170010us-gaap:RetainedEarningsMember2022-02-280001170010us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-02-280001170010us-gaap:RetainedEarningsMember2022-03-012022-05-310001170010us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-012022-05-310001170010us-gaap:AdditionalPaidInCapitalMember2022-03-012022-05-310001170010us-gaap:CommonStockMember2022-03-012022-05-310001170010us-gaap:CommonStockMember2022-05-310001170010us-gaap:AdditionalPaidInCapitalMember2022-05-310001170010us-gaap:RetainedEarningsMember2022-05-310001170010us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-05-31kmx:segment0001170010kmx:UsedVehiclesMember2023-03-012023-05-310001170010kmx:UsedVehiclesMember2022-03-012022-05-310001170010kmx:WholesaleVehiclesMember2023-03-012023-05-310001170010kmx:WholesaleVehiclesMember2022-03-012022-05-310001170010kmx:ExtendedprotectionplanDomain2023-03-012023-05-310001170010kmx:ExtendedprotectionplanDomain2022-03-012022-05-310001170010kmx:ThirdpartyfinancefeesDomain2023-03-012023-05-310001170010kmx:ThirdpartyfinancefeesDomain2022-03-012022-05-310001170010kmx:AdvertisingSubscriptionRevenuesDomain2023-03-012023-05-310001170010kmx:AdvertisingSubscriptionRevenuesDomain2022-03-012022-05-310001170010kmx:ServiceDomain2023-03-012023-05-310001170010kmx:ServiceDomain2022-03-012022-05-310001170010kmx:OtherDomain2023-03-012023-05-310001170010kmx:OtherDomain2022-03-012022-05-310001170010kmx:OtherMember2023-03-012023-05-310001170010kmx:OtherMember2022-03-012022-05-310001170010kmx:InterestAndFeeIncomeMember2023-03-012023-05-310001170010kmx:InterestAndFeeIncomeMember2022-03-012022-05-310001170010kmx:InterestIncomeExpenseNetMember2023-03-012023-05-310001170010kmx:InterestIncomeExpenseNetMember2022-03-012022-05-310001170010kmx:ProvisionForLoanLossesMember2023-03-012023-05-310001170010kmx:ProvisionForLoanLossesMember2022-03-012022-05-310001170010kmx:TotalInterestMarginAfterProvisionForLoanLossesMember2023-03-012023-05-310001170010kmx:TotalInterestMarginAfterProvisionForLoanLossesMember2022-03-012022-05-310001170010kmx:PayrollAndFringeBenefitExpenseMember2023-03-012023-05-310001170010kmx:PayrollAndFringeBenefitExpenseMember2022-03-012022-05-310001170010kmx:OtherDirectExpensesMember2023-03-012023-05-310001170010kmx:OtherDirectExpensesMember2022-03-012022-05-310001170010kmx:TotalDirectExpensesMember2023-03-012023-05-310001170010kmx:TotalDirectExpensesMember2022-03-012022-05-310001170010kmx:CarmaxAutoFinanceIncomeMember2023-03-012023-05-310001170010kmx:CarmaxAutoFinanceIncomeMember2022-03-012022-05-310001170010kmx:TermSecuritizationsMember2023-05-310001170010kmx:TermSecuritizationsMember2023-02-280001170010kmx:WarehouseFacilitiesReceivablesMember2023-05-310001170010kmx:WarehouseFacilitiesReceivablesMember2023-02-280001170010kmx:ExcessCollateralMember2023-05-310001170010kmx:ExcessCollateralMember2023-02-280001170010kmx:OtherReceivablesMember2023-05-310001170010kmx:OtherReceivablesMember2023-02-280001170010kmx:CoreManagedReceivablesMemberkmx:CreditGradeAMember2023-05-310001170010kmx:CoreManagedReceivablesMemberkmx:CreditGradeBMember2023-05-310001170010kmx:CoreManagedReceivablesMemberkmx:CreditGradeCAndOtherMember2023-05-310001170010kmx:CoreManagedReceivablesMember2023-05-310001170010kmx:CreditGradeCAndOtherMemberkmx:OtherManagedReceivablesMember2023-05-310001170010kmx:CoreManagedReceivablesMemberkmx:CreditGradeAMember2023-02-280001170010kmx:CoreManagedReceivablesMemberkmx:CreditGradeBMember2023-02-280001170010kmx:CoreManagedReceivablesMemberkmx:CreditGradeCAndOtherMember2023-02-280001170010kmx:CoreManagedReceivablesMember2023-02-280001170010kmx:CreditGradeCAndOtherMemberkmx:OtherManagedReceivablesMember2023-02-280001170010kmx:OtherManagedReceivablesMember2023-02-280001170010us-gaap:AllowanceForLoanAndLeaseLossesMember2023-02-280001170010kmx:CoreManagedReceivablesMember2023-03-012023-05-310001170010kmx:OtherManagedReceivablesMember2023-03-012023-05-310001170010kmx:OtherManagedReceivablesMember2023-05-310001170010us-gaap:AllowanceForLoanAndLeaseLossesMember2023-05-310001170010kmx:CoreManagedReceivablesMember2022-02-280001170010kmx:OtherManagedReceivablesMember2022-02-280001170010us-gaap:AllowanceForLoanAndLeaseLossesMember2022-02-280001170010kmx:CoreManagedReceivablesMember2022-03-012022-05-310001170010kmx:OtherManagedReceivablesMember2022-03-012022-05-310001170010kmx:CoreManagedReceivablesMember2022-05-310001170010kmx:OtherManagedReceivablesMember2022-05-310001170010us-gaap:AllowanceForLoanAndLeaseLossesMember2022-05-310001170010kmx:OneToThirtyDaysPastDueMember2023-05-310001170010kmx:CoreManagedReceivablesMemberkmx:ThirtyOneToSixtyDaysPastDueMemberkmx:CreditGradeAMember2023-05-310001170010kmx:CoreManagedReceivablesMemberkmx:CreditGradeBMemberkmx:ThirtyOneToSixtyDaysPastDueMember2023-05-310001170010kmx:CoreManagedReceivablesMemberkmx:ThirtyOneToSixtyDaysPastDueMemberkmx:CreditGradeCAndOtherMember2023-05-310001170010kmx:CoreManagedReceivablesMemberkmx:ThirtyOneToSixtyDaysPastDueMember2023-05-310001170010kmx:ThirtyOneToSixtyDaysPastDueMemberkmx:CreditGradeCAndOtherMemberkmx:OtherManagedReceivablesMember2023-05-310001170010kmx:ThirtyOneToSixtyDaysPastDueMember2023-05-310001170010kmx:CoreManagedReceivablesMemberkmx:SixtyOneToNinetyDaysPastDueMemberkmx:CreditGradeAMember2023-05-310001170010kmx:CoreManagedReceivablesMemberkmx:CreditGradeBMemberkmx:SixtyOneToNinetyDaysPastDueMember2023-05-310001170010kmx:CoreManagedReceivablesMemberkmx:SixtyOneToNinetyDaysPastDueMemberkmx:CreditGradeCAndOtherMember2023-05-310001170010kmx:CoreManagedReceivablesMemberkmx:SixtyOneToNinetyDaysPastDueMember2023-05-310001170010kmx:SixtyOneToNinetyDaysPastDueMemberkmx:CreditGradeCAndOtherMemberkmx:OtherManagedReceivablesMember2023-05-310001170010kmx:SixtyOneToNinetyDaysPastDueMember2023-05-310001170010kmx:CoreManagedReceivablesMemberkmx:GreaterThanNinetyDaysPastDueMemberkmx:CreditGradeAMember2023-05-310001170010kmx:CoreManagedReceivablesMemberkmx:GreaterThanNinetyDaysPastDueMemberkmx:CreditGradeBMember2023-05-310001170010kmx:CoreManagedReceivablesMemberkmx:GreaterThanNinetyDaysPastDueMemberkmx:CreditGradeCAndOtherMember2023-05-310001170010kmx:CoreManagedReceivablesMemberkmx:GreaterThanNinetyDaysPastDueMember2023-05-310001170010kmx:GreaterThanNinetyDaysPastDueMemberkmx:CreditGradeCAndOtherMemberkmx:OtherManagedReceivablesMember2023-05-310001170010kmx:GreaterThanNinetyDaysPastDueMember2023-05-310001170010kmx:OneToThirtyDaysPastDueMember2023-02-280001170010kmx:CoreManagedReceivablesMemberkmx:ThirtyOneToSixtyDaysPastDueMemberkmx:CreditGradeAMember2023-02-280001170010kmx:CoreManagedReceivablesMemberkmx:CreditGradeBMemberkmx:ThirtyOneToSixtyDaysPastDueMember2023-02-280001170010kmx:CoreManagedReceivablesMemberkmx:ThirtyOneToSixtyDaysPastDueMemberkmx:CreditGradeCAndOtherMember2023-02-280001170010kmx:CoreManagedReceivablesMemberkmx:ThirtyOneToSixtyDaysPastDueMember2023-02-280001170010kmx:ThirtyOneToSixtyDaysPastDueMemberkmx:CreditGradeCAndOtherMemberkmx:OtherManagedReceivablesMember2023-02-280001170010kmx:ThirtyOneToSixtyDaysPastDueMember2023-02-280001170010kmx:CoreManagedReceivablesMemberkmx:SixtyOneToNinetyDaysPastDueMemberkmx:CreditGradeAMember2023-02-280001170010kmx:CoreManagedReceivablesMemberkmx:CreditGradeBMemberkmx:SixtyOneToNinetyDaysPastDueMember2023-02-280001170010kmx:CoreManagedReceivablesMemberkmx:SixtyOneToNinetyDaysPastDueMemberkmx:CreditGradeCAndOtherMember2023-02-280001170010kmx:CoreManagedReceivablesMemberkmx:SixtyOneToNinetyDaysPastDueMember2023-02-280001170010kmx:SixtyOneToNinetyDaysPastDueMemberkmx:CreditGradeCAndOtherMemberkmx:OtherManagedReceivablesMember2023-02-280001170010kmx:SixtyOneToNinetyDaysPastDueMember2023-02-280001170010kmx:CoreManagedReceivablesMemberkmx:GreaterThanNinetyDaysPastDueMemberkmx:CreditGradeAMember2023-02-280001170010kmx:CoreManagedReceivablesMemberkmx:GreaterThanNinetyDaysPastDueMemberkmx:CreditGradeBMember2023-02-280001170010kmx:CoreManagedReceivablesMemberkmx:GreaterThanNinetyDaysPastDueMemberkmx:CreditGradeCAndOtherMember2023-02-280001170010kmx:CoreManagedReceivablesMemberkmx:GreaterThanNinetyDaysPastDueMember2023-02-280001170010kmx:GreaterThanNinetyDaysPastDueMemberkmx:CreditGradeCAndOtherMemberkmx:OtherManagedReceivablesMember2023-02-280001170010kmx:GreaterThanNinetyDaysPastDueMember2023-02-280001170010us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2023-03-012023-05-310001170010us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:NondesignatedMember2023-03-012023-05-310001170010us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2023-05-310001170010us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2023-02-280001170010us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:NondesignatedMember2023-05-310001170010us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:NondesignatedMember2023-02-280001170010us-gaap:FairValueInputsLevel1Member2023-05-310001170010us-gaap:FairValueInputsLevel2Member2023-05-310001170010us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel1Member2023-05-310001170010us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Member2023-05-310001170010us-gaap:DesignatedAsHedgingInstrumentMember2023-05-310001170010us-gaap:FairValueInputsLevel1Memberus-gaap:NondesignatedMember2023-05-310001170010us-gaap:FairValueInputsLevel2Memberus-gaap:NondesignatedMember2023-05-310001170010us-gaap:NondesignatedMember2023-05-310001170010us-gaap:FairValueInputsLevel1Member2023-02-280001170010us-gaap:FairValueInputsLevel2Member2023-02-280001170010us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel1Member2023-02-280001170010us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Member2023-02-280001170010us-gaap:DesignatedAsHedgingInstrumentMember2023-02-280001170010us-gaap:FairValueInputsLevel1Memberus-gaap:NondesignatedMember2023-02-280001170010us-gaap:FairValueInputsLevel2Memberus-gaap:NondesignatedMember2023-02-280001170010us-gaap:NondesignatedMember2023-02-280001170010us-gaap:RevolvingCreditFacilityMember2023-05-310001170010us-gaap:RevolvingCreditFacilityMember2023-02-280001170010kmx:TermLoanMember2023-05-310001170010kmx:TermLoanMember2023-02-280001170010kmx:October2021TermLoanMember2023-05-310001170010kmx:October2021TermLoanMember2023-02-280001170010kmx:A3.86seniornotesdues2023Member2023-05-310001170010kmx:A3.86seniornotesdues2023Member2023-02-280001170010kmx:A4.17seniornotesdue2026Member2023-05-310001170010kmx:A4.17seniornotesdue2026Member2023-02-280001170010kmx:A4.27seniornotesdue2028Member2023-05-310001170010kmx:A4.27seniornotesdue2028Member2023-02-280001170010us-gaap:LineOfCreditMember2023-05-310001170010kmx:TermLoanMember2023-05-310001170010kmx:October2021TermLoanMember2023-05-310001170010us-gaap:SeniorNotesMember2023-05-310001170010srt:MinimumMemberkmx:FinancingObligationMember2023-03-012023-05-310001170010kmx:FinancingObligationMembersrt:MaximumMember2023-03-012023-05-310001170010kmx:WarehouseFacilityOneMember2023-05-310001170010kmx:WarehouseFacilityThreeMember2023-05-310001170010kmx:WarehouseFacilityTwoMember2023-05-310001170010kmx:WarehouseFacilitiesMember2023-05-310001170010kmx:TermSecuritizationsDebtMember2023-05-310001170010kmx:ShareRepurchaseProgramMember2023-05-310001170010kmx:ShareRepurchaseProgramMember2023-03-012023-05-310001170010kmx:ShareRepurchaseProgramMember2022-03-012022-05-310001170010kmx:ShareRepurchaseProgramMember2022-05-310001170010us-gaap:StockOptionMember2023-03-012023-05-310001170010kmx:CashSettledRestrictedStockUnitsMember2023-03-012023-05-310001170010srt:MaximumMemberkmx:CashSettledRestrictedStockUnitsMember2023-03-012023-05-310001170010srt:MinimumMemberkmx:CashSettledRestrictedStockUnitsMember2023-03-012023-05-310001170010srt:MinimumMemberkmx:StockSettledRestrictedStockUnitsMember2023-03-012023-05-310001170010srt:MaximumMemberkmx:StockSettledRestrictedStockUnitsMember2023-03-012023-05-310001170010kmx:StockSettledRestrictedStockUnitsMember2023-03-012023-05-310001170010srt:MinimumMemberus-gaap:PerformanceSharesMember2023-03-012023-05-310001170010srt:MaximumMemberus-gaap:PerformanceSharesMember2023-03-012023-05-310001170010us-gaap:PerformanceSharesMember2023-03-012023-05-310001170010us-gaap:PerformanceSharesMemberkmx:Fiscal2022GrantsYear1Member2023-03-012023-05-310001170010us-gaap:PerformanceSharesMemberkmx:Fiscal2023GrantsYear1Member2023-03-012023-05-310001170010kmx:Fiscal2022GrantsYear2Memberus-gaap:PerformanceSharesMember2023-03-012023-05-310001170010kmx:PSUGrantsPerformanceTargetNotSetMemberus-gaap:PerformanceSharesMember2023-05-310001170010us-gaap:PerformanceSharesMember2023-05-310001170010kmx:DeferredStockUnitsMember2023-03-012023-05-310001170010kmx:DeferredStockUnitsMember2023-05-310001170010srt:MinimumMemberus-gaap:RestrictedStockMember2023-03-012023-05-310001170010srt:MaximumMemberus-gaap:RestrictedStockMember2023-03-012023-05-310001170010us-gaap:RestrictedStockMember2023-05-310001170010us-gaap:CostOfSalesMember2023-03-012023-05-310001170010us-gaap:CostOfSalesMember2022-03-012022-05-310001170010kmx:CarmaxAutoFinanceIncomeMember2023-03-012023-05-310001170010kmx:CarmaxAutoFinanceIncomeMember2022-03-012022-05-310001170010us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-03-012023-05-310001170010us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-03-012022-05-310001170010us-gaap:EmployeeStockOptionMember2023-03-012023-05-310001170010us-gaap:EmployeeStockOptionMember2022-03-012022-05-310001170010kmx:CashSettledRestrictedStockUnitsMember2022-03-012022-05-310001170010kmx:StockSettledRestrictedStockUnitsMember2022-03-012022-05-310001170010us-gaap:PerformanceSharesMember2022-03-012022-05-310001170010us-gaap:RestrictedStockMember2023-03-012023-05-310001170010us-gaap:RestrictedStockMember2022-03-012022-05-310001170010us-gaap:EmployeeStockMember2023-03-012023-05-310001170010us-gaap:EmployeeStockMember2022-03-012022-05-310001170010kmx:OthersharebasedincentivesMember2023-03-012023-05-310001170010kmx:OthersharebasedincentivesMember2022-03-012022-05-310001170010us-gaap:StockOptionMember2023-05-310001170010kmx:StockSettledRestrictedStockUnitsMember2023-05-310001170010kmx:OthersharebasedincentivesMember2023-05-310001170010us-gaap:StockOptionMember2023-02-280001170010us-gaap:StockOptionMember2022-03-012022-05-310001170010kmx:CashSettledRestrictedStockUnitsMember2023-02-280001170010kmx:CashSettledRestrictedStockUnitsMember2023-05-310001170010srt:MinimumMember2023-05-310001170010srt:MaximumMember2023-05-310001170010kmx:StockSettledRestrictedStockUnitsMember2023-02-280001170010us-gaap:EmployeeStockOptionMember2023-03-012023-05-310001170010us-gaap:EmployeeStockOptionMember2022-03-012022-05-310001170010kmx:StockSettledStockUnitsAndAwardsMember2023-03-012023-05-310001170010kmx:StockSettledStockUnitsAndAwardsMember2022-03-012022-05-310001170010kmx:UnrecognizedActuarialLossesMember2023-02-280001170010kmx:UnrecognizedHedgeLossesMember2023-02-280001170010kmx:UnrecognizedActuarialLossesMember2023-03-012023-05-310001170010kmx:UnrecognizedHedgeLossesMember2023-03-012023-05-310001170010kmx:UnrecognizedActuarialLossesMember2023-05-310001170010kmx:UnrecognizedHedgeLossesMember2023-05-310001170010kmx:CarmaxAutoFinanceMember2023-03-012023-05-310001170010kmx:CarmaxAutoFinanceMember2022-03-012022-05-310001170010srt:MinimumMember2023-03-012023-05-310001170010srt:MaximumMember2023-03-012023-05-31utr:Rate00011700102021-05-310001170010kmx:CarMaxSalesOperationsMember2023-03-012023-05-310001170010us-gaap:AllOtherSegmentsMember2023-03-012023-05-310001170010us-gaap:AllOtherSegmentsMemberus-gaap:IntersegmentEliminationMember2023-03-012023-05-310001170010us-gaap:IntersegmentEliminationMember2023-03-012023-05-310001170010us-gaap:OperatingSegmentsMemberkmx:CarMaxSalesOperationsMember2023-03-012023-05-310001170010us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2023-03-012023-05-310001170010kmx:CarMaxSalesOperationsMemberus-gaap:CostOfSalesMember2023-03-012023-05-310001170010us-gaap:AllOtherSegmentsMemberus-gaap:CostOfSalesMember2023-03-012023-05-310001170010kmx:CarMaxSalesOperationsMember2022-03-012022-05-310001170010us-gaap:AllOtherSegmentsMember2022-03-012022-05-310001170010us-gaap:AllOtherSegmentsMemberus-gaap:IntersegmentEliminationMember2022-03-012022-05-310001170010us-gaap:IntersegmentEliminationMember2022-03-012022-05-310001170010us-gaap:OperatingSegmentsMemberkmx:CarMaxSalesOperationsMember2022-03-012022-05-310001170010us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2022-03-012022-05-310001170010kmx:CarMaxSalesOperationsMemberus-gaap:CostOfSalesMember2022-03-012022-05-310001170010us-gaap:AllOtherSegmentsMemberus-gaap:CostOfSalesMember2022-03-012022-05-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended May 31, 2023

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 1-31420

CARMAX, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Virginia | | 54-1821055 |

(State or other jurisdiction of incorporation) | | (I.R.S. Employer Identification No.) |

| |

12800 Tuckahoe Creek Parkway | | 23238 |

Richmond, | Virginia | | |

(Address of Principal Executive Offices) | | (Zip Code) |

(804) 747-0422

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock | KMX | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| | | | | | | | |

| Class | | Outstanding as of June 22, 2023 |

| Common Stock, par value $0.50 | | 158,209,623 |

CARMAX, INC. AND SUBSIDIARIES

TABLE OF CONTENTS

| | | | | | | | | | | |

| | Page No. |

| PART I. | FINANCIAL INFORMATION | |

| | | |

| | Item 1. | Financial Statements: | |

| | | |

| | | Consolidated Statements of Earnings (Unaudited) – | |

| | | Three Months Ended May 31, 2023 and 2022 | |

| | | | |

| | | Consolidated Statements of Comprehensive Income (Unaudited) – | |

| | | Three Months Ended May 31, 2023 and 2022 | |

| | | | |

| | | Consolidated Balance Sheets (Unaudited) – | |

| | | May 31, 2023 and February 28, 2023 | |

| | | | |

| | | Consolidated Statements of Cash Flows (Unaudited) – | |

| | | Three Months Ended May 31, 2023 and 2022 | |

| | | | |

| | Consolidated Statements of Shareholders’ Equity (Unaudited) – | |

| | Three Months Ended May 31, 2023 and 2022 | |

| | | |

| | | Notes to Consolidated Financial Statements (Unaudited) | |

| | | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and | |

| | | Results of Operations | |

| | | |

| | Item 3. | Quantitative and Qualitative Disclosures About Market Risk | |

| | | |

| | Item 4. | Controls and Procedures | |

| | | |

| PART II. | OTHER INFORMATION | |

| | | |

| | Item 1. | Legal Proceedings | |

| | | |

| | Item 1A. | Risk Factors | |

| | | |

| | Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | |

| | | |

| Item 5. | Other Information | |

| | | |

| | Item 6. | Exhibits | |

| | | |

| SIGNATURES | |

| |

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

CARMAX, INC. AND SUBSIDIARIES

Consolidated Statements of Earnings

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended May 31 | | |

| (In thousands except per share data) | 2023 | %(1) | | 2022 | %(1) | | | | | | |

| SALES AND OPERATING REVENUES: | | | | | | | | | | | |

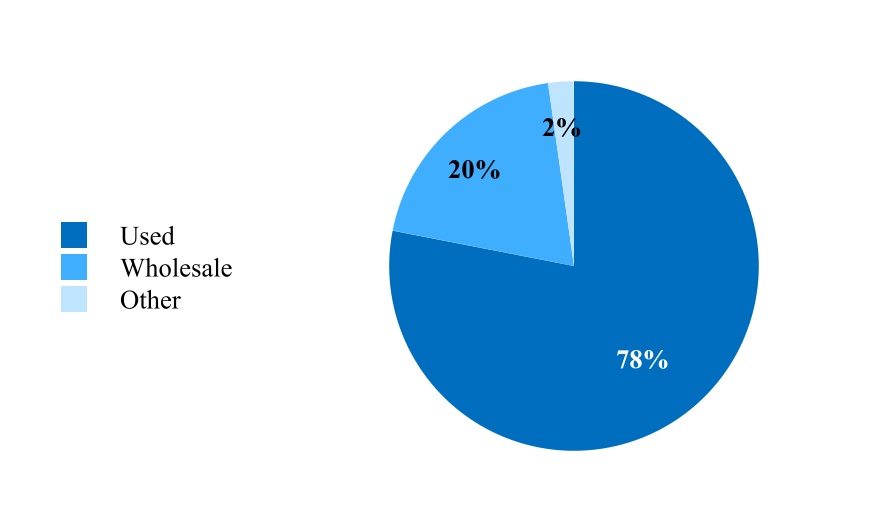

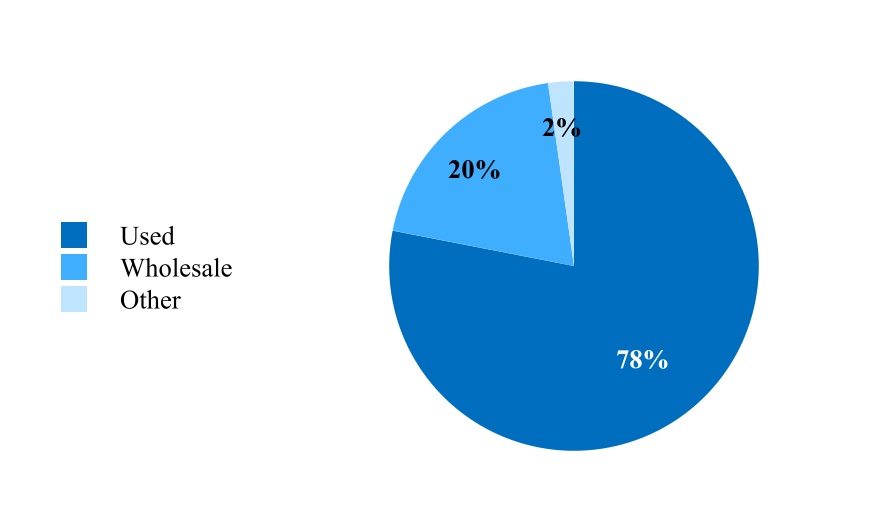

| Used vehicle sales | $ | 6,001,471 | | 78.1 | | | $ | 7,014,490 | | 75.3 | | | | | | | |

| Wholesale vehicle sales | 1,514,363 | | 19.7 | | | 2,116,517 | | 22.7 | | | | | | | |

| Other sales and revenues | 171,229 | | 2.2 | | | 180,614 | | 1.9 | | | | | | | |

| NET SALES AND OPERATING REVENUES | 7,687,063 | | 100.0 | | | 9,311,621 | | 100.0 | | | | | | | |

| COST OF SALES: | | | | | | | | | | | |

| Used vehicle cost of sales | 5,486,846 | | 71.4 | | | 6,451,010 | | 69.3 | | | | | | | |

| Wholesale vehicle cost of sales | 1,346,538 | | 17.5 | | | 1,924,850 | | 20.7 | | | | | | | |

| Other cost of sales | 36,289 | | 0.5 | | | 60,370 | | 0.6 | | | | | | | |

| TOTAL COST OF SALES | 6,869,673 | | 89.4 | | | 8,436,230 | | 90.6 | | | | | | | |

| GROSS PROFIT | 817,390 | | 10.6 | | | 875,391 | | 9.4 | | | | | | | |

| CARMAX AUTO FINANCE INCOME | 137,358 | | 1.8 | | | 204,473 | | 2.2 | | | | | | | |

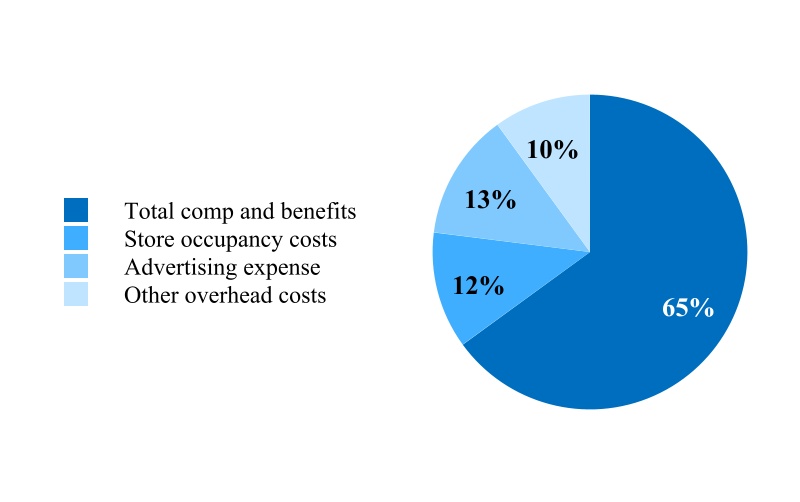

| Selling, general and administrative expenses | 559,837 | | 7.3 | | | 656,740 | | 7.1 | | | | | | | |

| Depreciation and amortization | 58,419 | | 0.8 | | | 55,648 | | 0.6 | | | | | | | |

| Interest expense | 30,466 | | 0.4 | | | 28,775 | | 0.3 | | | | | | | |

| Other (income) expense | (1,214) | | — | | | 2,099 | | — | | | | | | | |

| Earnings before income taxes | 307,240 | | 4.0 | | | 336,602 | | 3.6 | | | | | | | |

| Income tax provision | 78,942 | | 1.0 | | | 84,337 | | 0.9 | | | | | | | |

| NET EARNINGS | $ | 228,298 | | 3.0 | | | $ | 252,265 | | 2.7 | | | | | | | |

| WEIGHTED AVERAGE COMMON SHARES: | | | | | | | | | | | |

| Basic | 158,116 | | | | 160,298 | | | | | | | | |

| Diluted | 158,561 | | | | 161,798 | | | | | | | | |

| NET EARNINGS PER SHARE: | | | | | | | | | | | |

| Basic | $ | 1.44 | | | | $ | 1.57 | | | | | | | | |

| Diluted | $ | 1.44 | | | | $ | 1.56 | | | | | | | | |

(1) Percents are calculated as a percentage of net sales and operating revenues and may not total due to rounding.

See accompanying notes to consolidated financial statements.

CARMAX, INC. AND SUBSIDIARIES

Consolidated Statements of Comprehensive Income

(Unaudited)

| | | | | | | | | | | | | | | |

| | Three Months Ended May 31 | | |

| (In thousands) | 2023 | | 2022 | | | | |

| NET EARNINGS | $ | 228,298 | | | $ | 252,265 | | | | | |

| Other comprehensive (loss) income, net of taxes: | | | | | | | |

| Net change in retirement benefit plan unrecognized actuarial losses | 98 | | | 481 | | | | | |

| Net change in cash flow hedge unrecognized gains | (36,637) | | | 51,833 | | | | | |

| Other comprehensive (loss) income, net of taxes | (36,539) | | | 52,314 | | | | | |

| TOTAL COMPREHENSIVE INCOME | $ | 191,759 | | | $ | 304,579 | | | | | |

See accompanying notes to consolidated financial statements.

CARMAX, INC. AND SUBSIDIARIES

Consolidated Balance Sheets

(Unaudited)

| | | | | | | | | | | |

| | As of May 31 | | As of February 28 |

| (In thousands except share data) | 2023 | | 2023 |

| ASSETS | | | |

| CURRENT ASSETS: | | | |

| Cash and cash equivalents | $ | 264,247 | | | $ | 314,758 | |

| Restricted cash from collections on auto loans receivable | 506,465 | | | 470,889 | |

| Accounts receivable, net | 321,994 | | | 298,783 | |

| Inventory | 4,081,220 | | | 3,726,142 | |

| Other current assets | 189,742 | | | 230,795 | |

| TOTAL CURRENT ASSETS | 5,363,668 | | | 5,041,367 | |

| Auto loans receivable, net of allowance for loan losses of $535,412 and $507,201 as of May 31, 2023 and February 28, 2023, respectively | 16,744,865 | | | 16,341,791 | |

| Property and equipment, net of accumulated depreciation of $1,672,387 and $1,614,924 as of May 31, 2023 and February 28, 2023, respectively | 3,499,384 | | | 3,430,914 | |

| Deferred income taxes | 99,770 | | | 80,740 | |

| Operating lease assets | 541,908 | | | 545,677 | |

| Goodwill | 141,258 | | | 141,258 | |

| Other assets | 571,503 | | | 600,989 | |

| TOTAL ASSETS | $ | 26,962,356 | | | $ | 26,182,736 | |

| | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| CURRENT LIABILITIES: | | | |

| Accounts payable | $ | 967,420 | | | $ | 826,592 | |

| Accrued expenses and other current liabilities | 528,596 | | | 478,964 | |

| Accrued income taxes | 49,191 | | | — | |

| Current portion of operating lease liabilities | 55,126 | | | 53,287 | |

| | | |

| Current portion of long-term debt | 12,305 | | | 111,859 | |

| Current portion of non-recourse notes payable | 501,333 | | | 467,609 | |

| TOTAL CURRENT LIABILITIES | 2,113,971 | | | 1,938,311 | |

| Long-term debt, excluding current portion | 1,906,496 | | | 1,909,361 | |

| Non-recourse notes payable, excluding current portion | 16,252,958 | | | 15,865,776 | |

| Operating lease liabilities, excluding current portion | 519,184 | | | 523,828 | |

| Other liabilities | 346,579 | | | 332,383 | |

| TOTAL LIABILITIES | 21,139,188 | | | 20,569,659 | |

| | | |

| Commitments and contingent liabilities | | | |

| SHAREHOLDERS’ EQUITY: | | | |

| Common stock, $0.50 par value; 350,000,000 shares authorized; 158,208,623 and 158,079,033 shares issued and outstanding as of May 31, 2023 and February 28, 2023, respectively | 79,105 | | | 79,040 | |

| Capital in excess of par value | 1,731,341 | | | 1,713,074 | |

| Accumulated other comprehensive income | 61,330 | | | 97,869 | |

| Retained earnings | 3,951,392 | | | 3,723,094 | |

| TOTAL SHAREHOLDERS’ EQUITY | 5,823,168 | | | 5,613,077 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 26,962,356 | | | $ | 26,182,736 | |

See accompanying notes to consolidated financial statements.

CARMAX, INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows

(Unaudited)

| | | | | | | | | | | |

| | Three Months Ended May 31 |

| (In thousands) | 2023 | | 2022 |

| OPERATING ACTIVITIES: | | | |

| Net earnings | $ | 228,298 | | | $ | 252,265 | |

| Adjustments to reconcile net earnings to net cash (used in) provided by operating activities: | | | |

| Depreciation and amortization | 62,998 | | | 70,473 | |

| Share-based compensation expense | 36,384 | | | 22,443 | |

| Provision for loan losses | 80,890 | | | 57,840 | |

| Provision for cancellation reserves | 24,070 | | | 31,719 | |

| Deferred income tax (benefit) provision | (7,127) | | | 11,561 | |

| Other | 2,976 | | | 5,342 | |

| Net (increase) decrease in: | | | |

| Accounts receivable, net | (22,439) | | | (49,603) | |

| Inventory | (355,078) | | | 433,484 | |

| Other current assets | 30,923 | | | 73,315 | |

| Auto loans receivable, net | (483,964) | | | (440,744) | |

| Other assets | 634 | | | (15,154) | |

| Net increase (decrease) in: | | | |

| Accounts payable, accrued expenses and other | | | |

| current liabilities and accrued income taxes | 239,276 | | | 105,445 | |

| Other liabilities | (23,126) | | | (27,434) | |

| NET CASH (USED IN) PROVIDED BY OPERATING ACTIVITIES | (185,285) | | | 530,952 | |

| INVESTING ACTIVITIES: | | | |

| Capital expenditures | (136,719) | | | (94,808) | |

| Proceeds from disposal of property and equipment | 1,171 | | | — | |

| | | |

| Purchases of investments | (1,228) | | | (4,380) | |

| Sales and returns of investments | 17 | | | 150 | |

| | | |

| NET CASH USED IN INVESTING ACTIVITIES | (136,759) | | | (99,038) | |

| FINANCING ACTIVITIES: | | | |

| | | |

| Proceeds from issuances of long-term debt | 98,600 | | | 1,043,100 | |

| Payments on long-term debt | (201,377) | | | (1,629,024) | |

| Cash paid for debt issuance costs | (3,608) | | | (3,940) | |

| Payments on finance lease obligations | (3,785) | | | (2,925) | |

| Issuances of non-recourse notes payable | 3,125,929 | | | 3,569,605 | |

| Payments on non-recourse notes payable | (2,706,222) | | | (3,272,242) | |

| Repurchase and retirement of common stock | (3,931) | | | (162,974) | |

| Equity issuances | 989 | | | 3,443 | |

| NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES | 306,595 | | | (454,957) | |

| Decrease in cash, cash equivalents, and restricted cash | (15,449) | | | (23,043) | |

| Cash, cash equivalents, and restricted cash at beginning of year | 951,004 | | | 803,618 | |

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH AT END OF PERIOD | $ | 935,555 | | | $ | 780,575 | |

| | | |

| RECONCILIATION OF CASH, CASH EQUIVALENTS AND RESTRICTED CASH TO THE CONSOLIDATED BALANCE SHEETS: |

| Cash and cash equivalents | $ | 264,247 | | | $ | 95,313 | |

| Restricted cash from collections on auto loans receivable | 506,465 | | | 531,344 | |

| Restricted cash included in other assets | 164,843 | | | 153,918 | |

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH AT END OF PERIOD | $ | 935,555 | | | $ | 780,575 | |

See accompanying notes to consolidated financial statements.

CARMAX, INC. AND SUBSIDIARIES

Consolidated Statements of Shareholders’ Equity

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended May 31, 2023 |

| | | | | | | | | | Accumulated | | |

| | Common | | | | Capital in | | | | Other | | |

| | Shares | | Common | | Excess of | | Retained | | Comprehensive | | |

| (In thousands) | Outstanding | | Stock | | Par Value | | Earnings | | Income | | Total |

| Balance as of February 28, 2023 | 158,079 | | | $ | 79,040 | | | $ | 1,713,074 | | | $ | 3,723,094 | | | $ | 97,869 | | | $ | 5,613,077 | |

| Net earnings | — | | | — | | | — | | | 228,298 | | | — | | | 228,298 | |

| Other comprehensive loss | — | | | — | | | — | | | — | | | (36,539) | | | (36,539) | |

| Share-based compensation expense | — | | | — | | | 21,274 | | | — | | | — | | | 21,274 | |

| | | | | | | | | | | |

| Exercise of common stock options | 18 | | | 9 | | | 979 | | | — | | | — | | | 988 | |

| Stock incentive plans, net shares issued | 112 | | | 56 | | | (3,986) | | | — | | | — | | | (3,930) | |

| | | | | | | | | | | |

| Balance as of May 31, 2023 | 158,209 | | | $ | 79,105 | | | $ | 1,731,341 | | | $ | 3,951,392 | | | $ | 61,330 | | | $ | 5,823,168 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

CARMAX, INC. AND SUBSIDIARIES

Consolidated Statements of Shareholders’ Equity

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended May 31, 2022 |

| | | | | | | | | | Accumulated | | |

| | Common | | | | Capital in | | | | Other | | |

| | Shares | | Common | | Excess of | | Retained | | Comprehensive | | |

| (In thousands) | Outstanding | | Stock | | Par Value | | Earnings | | Income (Loss) | | Total |

| Balance as of February 28, 2022 | 161,054 | | | $ | 80,527 | | | $ | 1,677,268 | | | $ | 3,524,066 | | | $ | (46,422) | | | $ | 5,235,439 | |

| Net earnings | — | | | — | | | — | | | 252,265 | | | — | | | 252,265 | |

| Other comprehensive income | — | | | — | | | — | | | — | | | 52,314 | | | 52,314 | |

| Share-based compensation expense | — | | | — | | | 21,594 | | | — | | | — | | | 21,594 | |

| Repurchases of common stock | (1,644) | | | (822) | | | (17,207) | | | (139,565) | | | — | | | (157,594) | |

| Exercise of common stock options | 49 | | | 24 | | | 3,418 | | | — | | | — | | | 3,442 | |

| Stock incentive plans, net shares issued | 155 | | | 78 | | | (6,901) | | | — | | | — | | | (6,823) | |

| Balance as of May 31, 2022 | 159,614 | | | $ | 79,807 | | | $ | 1,678,172 | | | $ | 3,636,766 | | | $ | 5,892 | | | $ | 5,400,637 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

See accompanying notes to consolidated financial statements.

CARMAX, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(Unaudited)

1.Background

Business. CarMax, Inc. (“we,” “our,” “us,” “CarMax” and “the company”), including its wholly owned subsidiaries, is the nation’s largest retailer of used vehicles. We operate in two reportable segments: CarMax Sales Operations and CarMax Auto Finance (“CAF”). Our CarMax Sales Operations segment consists of all aspects of our auto merchandising and service operations, excluding financing provided by CAF. Our CAF segment consists solely of our own finance operation that provides financing to customers buying retail vehicles from CarMax. On June 1, 2021, we completed the acquisition of Edmunds Holding Company (“Edmunds”), which does not meet the quantitative thresholds to be considered a reportable segment. See Note 16 for additional information on our reportable segments.

We deliver an unrivaled customer experience by offering a broad selection of quality used vehicles and related products and services at competitive, no-haggle prices using a customer-friendly sales process. Our omni-channel platform, which gives us the largest addressable market in the used car industry, empowers our retail customers to buy a car on their terms – online, in-store or an integrated combination of both. We offer customers a range of related products and services, including the appraisal and purchase of vehicles directly from consumers; the financing of retail vehicle purchases through CAF and third-party finance providers; the sale of extended protection plan (“EPP”) products, which include extended service plans (“ESPs”) and guaranteed asset protection (“GAP”); and vehicle repair service. Vehicles purchased through the appraisal process that do not meet our retail standards are sold to licensed dealers through on-site or virtual wholesale auctions.

Basis of Presentation and Use of Estimates. The accompanying interim unaudited consolidated financial statements include the accounts of CarMax and our wholly owned subsidiaries. All significant intercompany balances and transactions have been eliminated in consolidation. These interim unaudited consolidated financial statements have been prepared in conformity with U.S. generally accepted accounting principles (“GAAP”) for interim financial information. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. In the opinion of management, such interim consolidated financial statements reflect all normal recurring adjustments considered necessary to present fairly the financial position and the results of operations and cash flows for the interim periods presented. The results of operations for the interim periods are not necessarily indicative of the results to be expected for the full fiscal year.

The accounting policies followed in the presentation of our interim financial results are consistent with those included in the company’s Annual Report on Form 10-K for the fiscal year ended February 28, 2023 (the “2023 Annual Report”), with the exception of those related to recent accounting pronouncements adopted in the current fiscal year. These interim unaudited consolidated financial statements should be read in conjunction with the audited consolidated financial statements and footnotes included in our 2023 Annual Report.

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses and the disclosure of contingent assets and liabilities. Actual results could differ from those estimates. Certain prior year amounts have been reclassified to conform to the current year’s presentation. Amounts and percentages may not total due to rounding.

Recent Accounting Pronouncements.

Adopted in the Current Period

In October 2021, the Financial Accounting Standards Board (“FASB”) issued an accounting pronouncement (ASU 2021-08) related to accounting for acquired revenue contracts with customers in a business combination. The amendments in this update address diversity in practice and inconsistency related to recognition of an acquired contract liability and the effect of payment terms on subsequent revenue recognition for the acquirer. This update is effective for fiscal years beginning after December 15, 2022, including interim periods within those fiscal years. We adopted this pronouncement for our fiscal year beginning March 1, 2023, and it did not have a material effect on our consolidated financial statements.

In March 2022, the FASB issued an accounting pronouncement (ASU 2022-01) related to the portfolio layer method of hedge accounting. The amendments in this update clarify the accounting and promote consistency in reporting for hedges where the portfolio layer method is applied. This update is effective for fiscal years beginning after December 15, 2022, and interim periods within those fiscal years. We adopted this pronouncement for our fiscal year beginning March 1, 2023, and it did not have a material effect on our consolidated financial statements.

In March 2022, the FASB issued an accounting pronouncement (ASU 2022-02) related to troubled debt restructurings (“TDRs”) and vintage disclosures for financing receivables. The amendments in this update eliminate the accounting guidance for TDRs by creditors while enhancing disclosure requirements for certain loan refinancing and restructurings by creditors made to borrowers experiencing financial difficulty. The amendments also require disclosure of current-period gross charge-offs by year of origination for financing receivables. The amendments in this update are effective for fiscal years beginning after December 15, 2022, including interim periods within those fiscal years. We adopted this pronouncement for our fiscal year beginning March 1, 2023, and made the necessary updates to our vintage disclosures. Aside from these disclosure changes, the amendments did not have a material effect on our consolidated financial statements.

In September 2022, the FASB issued an accounting pronouncement (ASU 2022-04) related to disclosure requirements for buyers in supplier finance programs. The amendments in the update require that buyers disclose qualitative and quantitative information about their supplier finance programs. Interim and annual requirements include disclosure of outstanding amounts under the obligations as of the end of the reporting period, and annual requirements include a rollforward of those obligations for the annual reporting period, as well as a description of payment and other key terms of the programs. This update is effective for annual periods beginning after December 15, 2022, and interim periods within those fiscal years, except for the requirement to disclose rollforward information, which is effective for fiscal years beginning after December 15, 2023. We adopted this pronouncement for our fiscal year beginning March 1, 2023, and it did not have a material effect on our consolidated financial statements.

2. Revenue

We recognize revenue when control of the good or service has been transferred to the customer, generally either at the time of sale or upon delivery to a customer. Our contracts have a fixed contract price and revenue is measured as the amount of consideration we expect to receive in exchange for transferring goods or providing services. We collect sales taxes and other taxes from customers on behalf of governmental authorities at the time of sale. These taxes are accounted for on a net basis and are not included in net sales and operating revenues or cost of sales. We generally expense sales commissions when incurred because the amortization period would have been less than one year. These costs are recorded within selling, general and administrative expenses. We do not have any significant payment terms as payment is received at or shortly after the point of sale.

Disaggregation of Revenue

| | | | | | | | | | | | | | | |

| Three Months Ended May 31 | | |

| (In millions) | 2023 | | 2022 | | | | |

| Used vehicle sales | $ | 6,001.5 | | | $ | 7,014.5 | | | | | |

| Wholesale vehicle sales | 1,514.4 | | | 2,116.5 | | | | | |

| Other sales and revenues: | | | | | | | |

| Extended protection plan revenues | 111.2 | | | 116.5 | | | | | |

| Third-party finance income, net | 0.3 | | | 3.4 | | | | | |

Advertising & subscription revenues (1) | 31.4 | | | 34.4 | | | | | |

| Service revenues | 22.1 | | | 21.9 | | | | | |

| Other | 6.2 | | | 4.4 | | | | | |

| Total other sales and revenues | 171.2 | | | 180.6 | | | | | |

| Total net sales and operating revenues | $ | 7,687.1 | | | $ | 9,311.6 | | | | | |

(1) Excludes intersegment sales and operating revenues that have been eliminated in consolidation. See Note 16 for further details.

Used Vehicle Sales. Revenue from the sale of used vehicles is recognized upon transfer of control of the vehicle to the customer. As part of our customer service strategy, we guarantee the retail vehicles we sell with a 30-day/1,500 mile, money-back guarantee. We record a reserve for estimated returns based on historical experience and trends. The reserve for estimated returns is presented gross on the consolidated balance sheets, with a return asset recorded in other current assets and a refund liability recorded in accrued expenses and other current liabilities. We also guarantee the used vehicles we sell with a 90-day/4,000-mile limited warranty. These warranties are deemed assurance-type warranties and are accounted for as warranty obligations. See Note 15 for additional information on this warranty and its related obligation.

Wholesale Vehicle Sales. Wholesale vehicles are sold at our auctions, and revenue from the sale of these vehicles is recognized upon transfer of control of the vehicle to the customer. Dealers also pay a fee to us based on the sale price of the

vehicles they purchase. This fee is recognized as revenue at the time of sale. While we provide condition disclosures on each wholesale vehicle sold, the vehicles are subject to a limited right of return. We record a reserve for estimated returns based on historical experience and trends. The reserve for estimated returns is presented gross on the consolidated balance sheets, with a return asset recorded in other current assets and a refund liability recorded in accrued expenses and other current liabilities.

EPP Revenues. We also sell ESP and GAP products on behalf of unrelated third parties, who are primarily responsible for fulfilling the contract, to customers who purchase a retail vehicle. The ESPs we currently offer on all used vehicles provide coverage up to 60 months (subject to mileage limitations), while GAP covers the customer for the term of their finance contract. We recognize revenue, on a net basis, at the time of sale. We also record a reserve, or refund liability, for estimated contract cancellations. The reserve for cancellations is evaluated for each product and is based on forecasted forward cancellation curves utilizing historical experience, recent trends and credit mix of the customer base. Our risk related to contract cancellations is limited to the revenue that we receive. Cancellations fluctuate depending on the volume of EPP sales, customer financing default or prepayment rates, and shifts in customer behavior, including those related to changes in the coverage or term of the product. The current portion of estimated cancellation reserves is recognized as a component of accrued expenses and other current liabilities with the remaining amount recognized in other liabilities. See Note 7 for additional information on cancellation reserves.

We are contractually entitled to receive profit-sharing revenues based on the performance of the ESPs administered by third parties. These revenues are a form of variable consideration included in EPP revenues to the extent that it is probable that it will not result in a significant revenue reversal. An estimate of the amount to which we expect to be entitled is determined upon satisfying the performance obligation of selling the ESP. This estimate is subject to various constraints; primarily, factors that are outside of the company’s influence or control. We have determined that these constraints generally preclude any profit-sharing revenues from being recognized before they are paid. As of May 31, 2023 and February 28, 2023, no current or long-term contract asset was recognized related to cumulative profit-sharing payments to which we expect to be entitled. The estimate of the amount to which we expect to be entitled is reassessed each reporting period and any changes are reflected in other sales and revenues on our consolidated statements of earnings and other assets on our consolidated balance sheets.

Third-Party Finance Income. Customers applying for financing who are not approved or are conditionally approved by CAF are generally evaluated by other third-party finance providers. These providers generally either pay us or are paid a fixed, pre-negotiated fee per contract. We recognize these fees at the time of sale.

Advertising and Subscription Revenues. Advertising and subscription revenues consist of revenues earned by our Edmunds business. Advertising revenues are derived from advertising contracts with automotive manufacturers based on fixed fees per impression and fees for certain activities completed by customers on the manufacturers' websites. These fees are recognized in the period the impressions are delivered or certain activities occurred. Subscription revenues are derived from packages sold to automotive dealers that include car leads, inventory listings and enhanced placement in Edmunds' dealer locator and are recognized over the period that the services are made available to the dealers. Subscription revenues also include a digital marketing subscription service, which allows dealers to gain exposure on third party partner websites. Revenues for this service are recognized on a net basis.

Service Revenues. Service revenue consists of labor and parts income related to vehicle repair service, including repairs of vehicles covered under an ESP we sell or warranty program. Service revenue is recognized at the time the work is completed.

Other Revenues. Other revenues include miscellaneous goods and services, which are immaterial to our consolidated financial statements.

3. CarMax Auto Finance

CAF provides financing to qualified retail customers purchasing vehicles from CarMax. CAF provides us the opportunity to capture additional profits, cash flows and sales while managing our reliance on third-party finance sources. Management regularly analyzes CAF’s operating results by assessing profitability, the performance of the auto loans receivable, including trends in credit losses and delinquencies, and CAF direct expenses. This information is used to assess CAF’s performance and make operating decisions, including resource allocation.

We typically use securitizations or other funding arrangements to fund loans originated by CAF. CAF income primarily reflects the interest and fee income generated by the auto loans receivable less the interest expense associated with the debt issued to fund these receivables, a provision for estimated loan losses and direct CAF expenses.

CAF income does not include any allocation of indirect costs. Although CAF benefits from certain indirect overhead expenditures, we have not allocated indirect costs to CAF to avoid making subjective allocation decisions. Examples of indirect costs not allocated to CAF include retail store expenses and corporate expenses. In addition, except for auto loans receivable, which are disclosed in Note 4, CAF assets are not separately reported nor do we allocate assets to CAF because such allocation would not be useful to management in making operating decisions.

Components of CAF Income

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended May 31 |

| (In millions) | 2023 | | % (1) | | 2022 | | % (1) |

| Interest margin: | | | | | | | |

| Interest and fee income | $ | 400.5 | | | 9.4 | | | $ | 346.7 | | | 8.8 | |

| Interest expense | (142.6) | | | (3.4) | | | (48.8) | | | (1.2) | |

| Total interest margin | 257.9 | | | 6.1 | | | 297.9 | | | 7.5 | |

| Provision for loan losses | (80.9) | | | (1.9) | | | (57.8) | | | (1.5) | |

| | | | | | | |

| Total interest margin after provision for loan losses | 177.0 | | | 4.2 | | | 240.1 | | | 6.1 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Direct expenses: | | | | | | | |

| Payroll and fringe benefit expense | (16.6) | | | (0.4) | | | (14.7) | | | (0.4) | |

| Depreciation and amortization | (4.1) | | | (0.1) | | | (3.8) | | | (0.1) | |

| Other direct expenses | (18.9) | | | (0.4) | | | (17.1) | | | (0.4) | |

| Total direct expenses | (39.6) | | | (0.9) | | | (35.6) | | | (0.9) | |

| CarMax Auto Finance income | $ | 137.4 | | | 3.2 | | | $ | 204.5 | | | 5.2 | |

| | | | | | | |

| Total average managed receivables | $ | 17,003.4 | | | | | $ | 15,817.0 | | | |

(1) Annualized percentage of total average managed receivables.

4. Auto Loans Receivable

Auto loans receivable include amounts due from customers related to retail vehicle sales financed through CAF and are presented net of an allowance for estimated loan losses. These auto loans represent a large group of smaller-balance homogeneous loans, which we consider to be part of one class of financing receivable and one portfolio segment for purposes of determining our allowance for loan losses. We generally use warehouse facilities to fund auto loans receivable originated by CAF until we elect to fund them through an asset-backed term funding transaction, such as a term securitization or alternative funding arrangement. We recognize transfers of auto loans receivable into the warehouse facilities and asset-backed term funding transactions (together, “non-recourse funding vehicles”) as secured borrowings, which result in recording the auto loans receivable and the related non-recourse notes payable on our consolidated balance sheets. The majority of the auto loans receivable serve as collateral for the related non-recourse notes payable of $16.78 billion as of May 31, 2023, and $16.36 billion as of February 28, 2023. See Note 9 for additional information on securitizations and non-recourse notes payable.

Interest income and expenses related to auto loans are included in CAF income. Interest income on auto loans receivable is recognized when earned based on contractual loan terms. All loans continue to accrue interest until repayment or charge-off. When a charge-off occurs, accrued interest is written off by reversing interest income. Direct costs associated with loan originations are not considered material, and thus, are expensed as incurred. See Note 3 for additional information on CAF income.

Auto Loans Receivable, Net

| | | | | | | | | | | |

| | As of May 31 | | As of February 28 |

| (In millions) | 2023 | | 2023 |

| Asset-backed term funding | $ | 12,036.8 | | | $ | 12,242.8 | |

| Warehouse facilities | 4,241.6 | | | 3,649.9 | |

Overcollateralization (1) | 757.2 | | | 739.9 | |

Other managed receivables (2) | 155.0 | | | 135.3 | |

| Total ending managed receivables | 17,190.6 | | | 16,767.9 | |

| Accrued interest and fees | 93.1 | | | 78.0 | |

| Other | (3.4) | | | 3.1 | |

| Less: allowance for loan losses | (535.4) | | | (507.2) | |

| Auto loans receivable, net | $ | 16,744.9 | | | $ | 16,341.8 | |

(1) Represents receivables restricted as excess collateral for the non-recourse funding vehicles.

(2) Other managed receivables includes receivables not funded through the non-recourse funding vehicles.

Credit Quality. When customers apply for financing, CAF’s proprietary scoring models utilize the customers’ credit history and certain application information to evaluate and rank their risk. We obtain credit histories and other credit data that includes information such as number, age, type of and payment history for prior or existing credit accounts. The application information that is used includes income, collateral value and down payment. The scoring models yield credit grades that represent the relative likelihood of repayment. Customers with the highest probability of repayment are A-grade customers. Customers assigned a lower grade are determined to have a lower probability of repayment. For loans that are approved, the credit grade influences the terms of the agreement, such as the required loan-to-value ratio and interest rate. After origination, credit grades are generally not updated.

CAF uses a combination of the initial credit grades and historical performance to monitor the credit quality of the auto loans receivable on an ongoing basis. We validate the accuracy of the scoring models periodically. Loan performance is reviewed on a recurring basis to identify whether the assigned grades adequately reflect the customers’ likelihood of repayment.

Ending Managed Receivables by Major Credit Grade

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of May 31, 2023 |

| Fiscal Year of Origination (1) | | | | |

| (In millions) | 2024 | | 2023 | | 2022 | | 2021 | | 2020 | | Prior to 2020 | | Total | | % (2) |

Core managed receivables (3): | | | | | | | | | | | | | | | |

| A | $ | 1,267.9 | | | $ | 3,520.0 | | | $ | 2,297.7 | | | $ | 972.2 | | | $ | 556.7 | | | $ | 173.7 | | | $ | 8,788.2 | | | 51.1 | |

| B | 800.6 | | | 2,275.5 | | | 1,662.9 | | | 724.9 | | | 414.8 | | | 197.9 | | | 6,076.6 | | | 35.4 | |

| C and other | 150.3 | | | 673.4 | | | 551.8 | | | 280.2 | | | 145.6 | | | 75.4 | | | 1,876.7 | | | 10.9 | |

| Total core managed receivables | 2,218.8 | | | 6,468.9 | | | 4,512.4 | | | 1,977.3 | | | 1,117.1 | | | 447.0 | | | 16,741.5 | | | 97.4 | |

Other managed receivables (4): | | | | | | | | | | | | | | | |

| C and other | 53.2 | | | 249.1 | | | 100.6 | | | 13.5 | | | 18.4 | | | 14.3 | | | 449.1 | | | 2.6 | |

| Total ending managed receivables | $ | 2,272.0 | | | $ | 6,718.0 | | | $ | 4,613.0 | | | $ | 1,990.8 | | | $ | 1,135.5 | | | $ | 461.3 | | | $ | 17,190.6 | | | 100.0 | |

| | | | | | | | | | | | | | | |

| Gross charge-offs | $ | 0.6 | | | $ | 50.2 | | | $ | 37.5 | | | $ | 10.7 | | | $ | 6.5 | | | $ | 4.3 | | | $ | 109.8 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of February 28, 2023 |

| Fiscal Year of Origination (1) | | | | |

| (In millions) | 2023 | | 2022 | | 2021 | | 2020 | | 2019 | | Prior to 2019 | | Total | | % (2) |

Core managed receivables (3): | | | | | | | | | | | | | | | |

| A | $ | 3,890.9 | | | $ | 2,555.3 | | | $ | 1,112.0 | | | $ | 677.1 | | | $ | 218.3 | | | $ | 36.3 | | | $ | 8,489.9 | | | 50.6 | |

| B | 2,497.5 | | | 1,839.9 | | | 816.2 | | | 488.9 | | | 215.1 | | | 56.0 | | | 5,913.6 | | | 35.3 | |

| C and other | 732.7 | | | 609.5 | | | 314.5 | | | 169.3 | | | 74.1 | | | 25.6 | | | 1,925.7 | | | 11.5 | |

| Total core managed receivables | 7,121.1 | | | 5,004.7 | | | 2,242.7 | | | 1,335.3 | | | 507.5 | | | 117.9 | | | 16,329.2 | | | 97.4 | |

Other managed receivables (4): | | | | | | | | | | | | | | | |

| C and other | 272.0 | | | 112.5 | | | 15.0 | | | 21.1 | | | 13.2 | | | 4.9 | | | 438.7 | | | 2.6 | |

| Total ending managed receivables | $ | 7,393.1 | | | $ | 5,117.2 | | | $ | 2,257.7 | | | $ | 1,356.4 | | | $ | 520.7 | | | $ | 122.8 | | | $ | 16,767.9 | | | 100.0 | |

(1) Classified based on credit grade assigned when customers were initially approved for financing.

(2) Percent of total ending managed receivables.

(3) Represents CAF's Tier 1 originations.

(4) Represents CAF's Tier 2 and Tier 3 originations.

Allowance for Loan Losses. The allowance for loan losses at May 31, 2023 represents the net credit losses expected over the remaining contractual life of our managed receivables. The allowance for loan losses is determined using a net loss timing curve, primarily based on the composition of the portfolio of managed receivables and historical gross loss and recovery trends. Due to the fact that losses for receivables with less than 18 months of performance history can be volatile, our net loss estimate weights both historical losses by credit grade at origination and actual loss data on the receivables to-date, along with forward loss curves, in estimating future performance. Once the receivables have 18 months of performance history, the net loss estimate reflects actual loss experience of those receivables to date, along with forward loss curves, to predict future performance. The forward loss curves are constructed using historical performance data and show the average timing of losses over the course of a receivable’s life. The net loss estimate is calculated by applying the loss rates developed using the methods described above to the amortized cost basis of the managed receivables at inception of the loan.

The output of the net loss timing curve is adjusted to take into account reasonable and supportable forecasts about the future. Specifically, the change in U.S. unemployment rates and the National Automobile Dealers Association used vehicle price index are used to predict changes in gross loss and recovery rates, respectively. An economic adjustment factor, based upon a single macroeconomic scenario, is developed to capture the relationship between changes in these forecasts and changes in gross loss and recovery rates. This factor is applied to the output of the net loss timing curve for the reasonable and supportable forecast period of two years. After the end of this two-year period, we revert to historical experience on a straight-line basis over a period of 12 months. We periodically consider whether the use of alternative metrics would result in improved model performance and revise the models when appropriate. We also consider whether qualitative adjustments are necessary for factors that are not reflected in the quantitative methods but impact the measurement of estimated credit losses. Such adjustments include the uncertainty of the impacts of recent economic trends on customer behavior. The change in the allowance for loan losses is recognized through an adjustment to the provision for loan losses.

Allowance for Loan Losses

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended May 31, 2023 |

| (In millions) | Core | | Other | | Total | | % (1) |

| Balance as of beginning of period | $ | 401.5 | | | $ | 105.7 | | | $ | 507.2 | | | 3.02 | |

| Charge-offs | (93.1) | | | (16.7) | | | (109.8) | | | |

Recoveries (2) | 50.5 | | | 6.6 | | | 57.1 | | | |

| Provision for loan losses | 68.6 | | | 12.3 | | | 80.9 | | | |

| Balance as of end of period | $ | 427.5 | | | $ | 107.9 | | | $ | 535.4 | | | 3.11 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended May 31, 2022 |

| (In millions) | Core | | Other | | Total | | % (1) |

| Balance as of beginning of period | $ | 377.5 | | | $ | 55.5 | | | $ | 433.0 | | | 2.77 | |

| Charge-offs | (61.4) | | | (6.8) | | | (68.2) | | | |

Recoveries (2) | 33.1 | | | 2.5 | | | 35.6 | | | |

| Provision for loan losses | 41.2 | | | 16.6 | | | 57.8 | | | |

| Balance as of end of period | $ | 390.4 | | | $ | 67.8 | | | $ | 458.2 | | | 2.85 | |

(1) Percent of total ending managed receivables.

(2) Net of costs incurred to recover vehicle.

During the first three months of fiscal 2024, the allowance for loan losses increased $28.2 million. The increase in the allowance (both in dollars and as a percent of total ending managed receivables) was primarily driven by unfavorable loss performance as well as the uncertain macroeconomic environment. The increase in net charge-offs primarily reflects customer hardship in the current economic environment. The allowance for loan losses as of May 31, 2023 reflects our best estimate of expected future losses based on recent trends in delinquencies, loss performance, recovery rates and the economic environment.

Past Due Receivables. An account is considered delinquent when the related customer fails to make a substantial portion of a scheduled payment on or before the due date. In general, accounts are charged-off on the last business day of the month during which the earliest of the following occurs: the receivable is 120 days or more delinquent as of the last business day of the month, the related vehicle is repossessed and liquidated, or the receivable is otherwise deemed uncollectible. For purposes of determining impairment, auto loans are evaluated collectively, as they represent a large group of smaller-balance homogeneous loans, and therefore, are not individually evaluated for impairment.

Past Due Receivables

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of May 31, 2023 |

| Core Receivables | | Other Receivables | | Total |

| (In millions) | A | | B | | C & Other | | Total | | C & Other | | $ | | % (1) |

| Current | $ | 8,745.3 | | | $ | 5,691.1 | | | $ | 1,545.9 | | | $ | 15,982.3 | | | $ | 322.4 | | | $ | 16,304.7 | | | 94.85 | |

| Delinquent loans: | | | | | | | | | | | | | |

| 31-60 days past due | 27.4 | | | 229.4 | | | 183.1 | | | 439.9 | | | 63.5 | | | 503.4 | | | 2.93 | |

| 61-90 days past due | 11.7 | | | 126.1 | | | 121.1 | | | 258.9 | | | 51.5 | | | 310.4 | | | 1.81 | |

| Greater than 90 days past due | 3.8 | | | 30.0 | | | 26.6 | | | 60.4 | | | 11.7 | | | 72.1 | | | 0.41 | |

| Total past due | 42.9 | | | 385.5 | | | 330.8 | | | 759.2 | | | 126.7 | | | 885.9 | | | 5.15 | |

| Total ending managed receivables | $ | 8,788.2 | | | $ | 6,076.6 | | | $ | 1,876.7 | | | $ | 16,741.5 | | | $ | 449.1 | | | $ | 17,190.6 | | | 100.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of February 28, 2023 |

| Core Receivables | | Other Receivables | | Total |

| (In millions) | A | | B | | C & Other | | Total | | C & Other | | $ | | % (1) |

| Current | $ | 8,450.3 | | | $ | 5,540.2 | | | $ | 1,612.3 | | | $ | 15,602.8 | | | $ | 327.6 | | | $ | 15,930.4 | | | 95.00 | |

| Delinquent loans: | | | | | | | | | | | | | |

| 31-60 days past due | 25.1 | | | 225.7 | | | 175.4 | | | 426.2 | | | 60.6 | | | 486.8 | | | 2.90 | |

| 61-90 days past due | 10.6 | | | 120.0 | | | 114.5 | | | 245.1 | | | 42.1 | | | 287.2 | | | 1.71 | |

| Greater than 90 days past due | 3.9 | | | 27.7 | | | 23.5 | | | 55.1 | | | 8.4 | | | 63.5 | | | 0.39 | |

| Total past due | 39.6 | | | 373.4 | | | 313.4 | | | 726.4 | | | 111.1 | | | 837.5 | | | 5.00 | |

| Total ending managed receivables | $ | 8,489.9 | | | $ | 5,913.6 | | | $ | 1,925.7 | | | $ | 16,329.2 | | | $ | 438.7 | | | $ | 16,767.9 | | | 100.00 | |

(1) Percent of total ending managed receivables.

5. Derivative Instruments and Hedging Activities

We use derivatives to manage certain risks arising from both our business operations and economic conditions, particularly with regard to issuances of debt. Primary exposures include LIBOR and other rates used as benchmarks in our securitizations and other debt financing. We enter into derivative instruments to manage exposures related to the future known receipt or payment of uncertain cash amounts, the values of which are impacted by interest rates, and generally designate these derivative instruments as cash flow hedges for accounting purposes. In certain cases, we may choose not to designate a derivative instrument as a cash flow hedge for accounting purposes due to uncertainty around the probability that future hedged transactions will occur. Our derivative instruments are used to manage (i) differences in the amount of our known or expected cash receipts and our known or expected cash payments principally related to the funding of our auto loans receivable, and (ii) exposure to variable interest rates associated with our term loans.

For the derivatives associated with our non-recourse funding vehicles that are designated as cash flow hedges, the changes in fair value are initially recorded in accumulated other comprehensive income (“AOCI”). For the majority of these derivatives, the amounts are subsequently reclassified into CAF income in the period that the hedged forecasted transaction affects earnings, which occurs as interest expense is recognized on those future issuances of debt. During the next 12 months, we estimate that an additional $42.9 million will be reclassified from AOCI as an increase to CAF income. Changes in fair value related to derivatives that have not been designated as cash flow hedges for accounting purposes are recognized in the income statement in the period in which the change occurs. For the three months ended May 31, 2023, we recognized expense of $9.3 million in CAF income representing these changes in fair value.

As of May 31, 2023 and February 28, 2023, we had interest rate swaps outstanding with a combined notional amount of $4.56 billion and $4.49 billion, respectively, that were designated as cash flow hedges of interest rate risk. As of May 31, 2023 and February 28, 2023, we had interest rate swaps with a combined notional amount of $1.22 billion and $1.14 billion, respectively, outstanding that were not designated as cash flow hedges for accounting purposes.

See Note 6 for discussion of fair values of financial instruments and Note 12 for the effect on comprehensive income.

6. Fair Value Measurements

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants in the principal market or, if none exists, the most advantageous market, for the specific asset or liability at the measurement date (referred to as the “exit price”). The fair value should be based on assumptions that market participants would use, including a consideration of nonperformance risk.

We assess the inputs used to measure fair value using the three-tier hierarchy. The hierarchy indicates the extent to which inputs used in measuring fair value are observable in the market.

Level 1 Inputs include unadjusted quoted prices in active markets for identical assets or liabilities that we can access at the measurement date.

Level 2 Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly, including quoted prices for similar assets in active markets, quoted prices from identical or similar assets in inactive markets, observable inputs, such as interest rates and yield curves, and assumptions about risk.

Level 3 Inputs that are significant to the measurement that are not observable in the market and include management’s judgments about the assumptions market participants would use in pricing the asset or liability (including assumptions about risk).

Our fair value processes include controls that are designed to ensure that fair values are appropriate. Such controls include model validation, review of key model inputs, analysis of period-over-period fluctuations and reviews by senior management.

Valuation Methodologies

Money Market Securities. Money market securities are cash equivalents, which are included in cash and cash equivalents, restricted cash from collections on auto loans receivable and other assets. They consist of highly liquid investments with original maturities of three months or less and are classified as Level 1.

Mutual Fund Investments. Mutual fund investments consist of publicly traded mutual funds that primarily include diversified equity investments in large-, mid- and small-cap domestic and international companies or investment grade debt securities. The investments, which are included in other assets, are held in a rabbi trust established to fund informally our executive deferred compensation plan and are classified as Level 1.

Derivative Instruments. The fair values of our derivative instruments are included in either other current assets, other assets, accounts payable or other liabilities. Our derivatives are not exchange-traded and are over-the-counter customized derivative instruments. All of our derivative exposures are with highly rated bank counterparties.

We measure derivative fair values assuming that the unit of account is an individual derivative instrument and that derivatives are sold or transferred on a stand-alone basis. We estimate the fair value of our derivatives using quotes determined by the derivative counterparties and third-party valuation services. Quotes from third-party valuation services and quotes received from bank counterparties project future cash flows and discount the future amounts to a present value using market-based expectations for interest rates and the contractual terms of the derivative instruments. The models do not require significant judgment and model inputs can typically be observed in a liquid market; however, because the models include inputs other than quoted prices in active markets, all derivatives are classified as Level 2.

Our derivative fair value measurements consider assumptions about counterparty and our own nonperformance risk. We monitor counterparty and our own nonperformance risk and, in the event that we determine that a party is unlikely to perform under terms of the contract, we would adjust the derivative fair value to reflect the nonperformance risk.

Items Measured at Fair Value on a Recurring Basis

| | | | | | | | | | | | | | | | | |

| | As of May 31, 2023 |

| (In thousands) | Level 1 | | Level 2 | | Total |

| Assets: | | | | | |

| Money market securities | $ | 866,338 | | | $ | — | | | $ | 866,338 | |

| Mutual fund investments | 24,458 | | | — | | | 24,458 | |

| | | | | |

| Derivative instruments designated as hedges | — | | | 63,427 | | | 63,427 | |

| Derivative instruments not designated as hedges | — | | | 24,595 | | | 24,595 | |

| Total assets at fair value | $ | 890,796 | | | $ | 88,022 | | | $ | 978,818 | |

| | | | | |

| Percent of total assets at fair value | 91.0 | % | | 9.0 | % | | 100.0 | % |

| Percent of total assets | 3.3 | % | | 0.3 | % | | 3.6 | % |

| | | | | |

| Liabilities: | | | | | |

| Derivative instruments designated as hedges | $ | — | | | $ | (3,008) | | | $ | (3,008) | |

| | | | | |

| | | | | |

| Total liabilities at fair value | $ | — | | | $ | (3,008) | | | $ | (3,008) | |

| | | | | |

| Percent of total liabilities | — | % | | — | % | | — | % |

| | | | | | | | | | | | | | | | | |

| | As of February 28, 2023 |

| (In thousands) | Level 1 | | Level 2 | | Total |

| Assets: | | | | | |

| Money market securities | $ | 865,943 | | | $ | — | | | $ | 865,943 | |

| Mutual fund investments | 22,671 | | | — | | | 22,671 | |

| Derivative instruments designated as hedges | — | | | 97,328 | | | 97,328 | |

| Derivative instruments not designated as hedges | — | | | 33,870 | | | 33,870 | |

| Total assets at fair value | $ | 888,614 | | | $ | 131,198 | | | $ | 1,019,812 | |

| | | | | |

| Percent of total assets at fair value | 87.1 | % | | 12.9 | % | | 100.0 | % |

| Percent of total assets | 3.4 | % | | 0.5 | % | | 3.9 | % |

| | | | | |

| Liabilities: | | | | | |

| | | | | |

| Total liabilities at fair value | $ | — | | | $ | — | | | $ | — | |

| | | | | |

| Percent of total liabilities | — | % | | — | % | | — | % |

Fair Value of Financial Instruments