UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2011 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission file number: 001-34463

A123 Systems, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

04-3583876 (I.R.S. Employer Identification No.) |

|

A123 Systems, Inc. 200 West Street Waltham, Massachusetts (Address of principal executive offices) |

02451 (Zip Code) |

617-778-5700

(Registrant's telephone number, including area code)

Securities issued pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| Common Stock, Par Value $0.001 | NASDAQ Global Select Market |

Securities issued pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed at $5.32 per share, the price at which the common equity was last sold on the NASDAQ Global Select Market on June 30, 2011, the last business day of the registrant's most recently completed second fiscal quarter, was $546,375,821.

Number of shares outstanding of the registrant's Common Stock, $0.001 par value, as of March 5, 2012: 146,862,868.

Documents incorporated by reference:

Portions of our definitive proxy statement to be filed with the Securities and Exchange Commission for our 2012 annual meeting of stockholders to be held on May 23, 2011 are incorporated by reference into Part II and Part III of this Report.

A123 Systems, Inc.

Annual Report on Form 10-K

For the Fiscal Year Ended December 31, 2011

INDEX

EX-31.1 CEO Certification pursuant to Section 302 of the Sarbanes-Oxley Act |

||

EX-31.2 CFO Certification pursuant to Section 302 of the Sarbanes-Oxley Act |

||

EX-32.1 CEO Certification pursuant to Section 906 of the Sarbanes-Oxley Act |

||

EX-32.2 CFO Certification pursuant to Section 906 of the Sarbanes-Oxley Act |

||

EX-101.INS—XBRL Instance Document |

||

EX-101.SCH—XBRL Taxonomy Extension Schema Document |

||

EX-101.CAL—XBRL Taxonomy Extension Calculation Linkbase Document |

||

EX-101.LAB—XBRL Taxonomy Extension Label Linkbase Document |

||

EX-101.PRE—XBRL Taxonomy Extension Presentation Linkbase Document |

||

EX-101.DEF—XTRL Taxonomy Extension Definition |

||

ii

NOTE ABOUT FORWARD LOOKING STATEMENTS

Certain statements in this report contain "forward-looking statements" within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These statements are often identified by the use of words such as "may," "expect," "believe," "anticipate," "intend," "could," "estimate," or "continue," and similar expressions or variations. All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including without limitation statements regarding industry trends, management's expectations, competitive strengths or market position, market expectations, business opportunities, projections of revenue, expenses, profits, management's confidence in our strategies and other matters that do not relate strictly to historical facts. Such forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in the section titled "Risk Factors," set forth in Part I, Item 1A of this Annual Report on Form 10-K and elsewhere in this Annual Report on Form 10-K. The forward-looking statements in this Annual Report on Form 10-K represent our views as of the date of this Annual Report on Form 10-K. We anticipate that subsequent events and developments will cause our views to change. We undertake no obligation to update these forward-looking statements except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this Annual Report on Form 10-K.

Overview

We design, develop, manufacture and sell advanced, rechargeable lithium-ion batteries and energy storage systems. We believe that lithium-ion batteries will play an increasingly important role in facilitating a shift toward cleaner forms of energy. Using our innovative approach to materials science and battery engineering and our systems integration and manufacturing capabilities, we have developed a broad family of high-power lithium-ion batteries and battery systems. This family of products, combined with our strategic partner relationships in the transportation, electric grid services and commercial markets, positions us well to address these markets for next-generation energy storage solutions.

In our largest target market, the transportation industry, we are working with major global automotive manufacturers and tier 1 suppliers to develop batteries and battery systems for hybrid electric vehicles, or HEVs, plug-in hybrid electric vehicles, or PHEVs, and electric vehicles, or EVs. For example, we are designing and developing batteries and battery systems for ALTe, Axeon, BAE Systems, BMW, Daimler, Delphi, Fisker Automotive, Inc., or Fisker, General Motors, or GM, Magna Steyr, Navistar, Shanghai Automotive Industry Corp., or SAIC, Smith Electric Vehicles, Via Motors, and other customers, for multiple vehicle models. As of January 2012, we had 22 transportation programs that are either sourced for production or in production.

Our transportation business is divided into two categories: heavy-duty and passenger. In the heavy-duty, commercial-vehicle market, we are engaged in design and development activities with multiple heavy-duty vehicle manufacturers and tier 1 suppliers regarding their HEV, PHEV and EV development efforts for trucks and buses, and we have been selected to co-develop battery systems for several of them. For example, pursuant to our supply agreement with Magna Steyr, we are providing batteries for use in battery systems developed by Magna Steyr for deployment in a heavy-duty HEV application. In addition, we have a long-term supply agreement with BAE Systems, pursuant to which we are in volume production for battery systems for BAE Systems' HybriDrive propulsion system,

1

which is currently being deployed in buses sold to various manufacturers, including Daimler's Orion VII hybrid electric buses. Our battery systems include both roof mount and cabin mount designs for use in a number of different heavy-duty vehicles. We are supplying Navistar battery systems for eStar electric vehicles. We also have been selected to develop the battery system for an additional Daimler hybrid electric bus program.

In the market for passenger vehicles, we currently supply advanced automotive battery systems to Fisker for their Karma PHEV, as part of a multi-year supply agreement. We are also supplying battery systems to BMW for their 2012 ActiveHybrid HEV programs. We have been selected to develop battery packs for a new, 2012 model year electric passenger car from SAIC, the largest automaker in China, and we are currently providing the development work related to this agreement. We have also established a joint venture with SAIC which will assemble battery packs for subsequent sale to SAIC. The joint venture agreement provides that we will supply the joint venture with battery cells for its production of packs. Additionally, we currently supply battery technology to SAIC for several of its other electric drive-train vehicles in development, including the Roewe 750 hybrid electric sedan and the Roewe 550 plug-in hybrid electric sedan. We have also been selected by GM to supply battery packs for the Chevrolet Spark EV, a new EV expected to be sold globally in multiple markets starting in 2013.

We also have been awarded production programs with a number of OEMs for starter batteries or micro hybrid batteries.

In addition to the activities described above, we have entered into development programs with other major passenger original equipment manufacturers, or OEMs, and are bidding for programs with several other vehicle manufacturers to develop and/or supply batteries and battery systems for HEVs, PHEVs and EVs.

Our cylindrical batteries are in volume production and are commercially available for use in automotive and heavy duty vehicles. Our next-generation prismatic batteries are currently being produced in our Livonia, Michigan facility, which officially opened in September, 2010. This 291,000 square foot facility enables the complete production process, including research and development, manufacturing of high-value components, cell fabrication, module fabrication and the final assembly of complete battery packs ready for vehicle integration. We have expanded our overall manufacturing capabilities by approximately 500 megawatt hours per year, bringing our manufacturing capabilities to more than 645 megawatt hours annually at the end of 2011. As part of our continuing U.S. manufacturing ramp-up, we also opened a coating plant in Romulus, Michigan, which came on line during the first half of 2011 and completed qualification in October, 2011.

In another key market, we also produce energy storage solutions that improve the reliability and efficiency of the electric power grid and help to integrate renewable sources of power generation. We have leveraged our patented Nanophosphate® technology to deliver dynamic energy storage solutions for power generation, transmission and distribution. We design, manufacture and install multi-megawatt battery systems with integrated power electronics and smart grid control systems that provide electric and ancillary services such as standby reserve capacity and regulation services. Our products provide standby reserve capacity, by delivering power quickly in order to offset supply shortages caused by generator or transmission outages, and regulation, by regulating the minute-to-minute frequency fluctuations in the grid that are caused by instantaneous changes in supply and demand. Our systems can also be used to smooth the intermittent output from wind and solar generation facilities. As these facilities are expected to represent a larger percentage of total generating capacity, our systems will become increasingly important. The AES Gener Los Andes substation in the Atacama Desert is a frequency regulation and spinning reserve project helping to improve the reliability of the electric grid in Northern Chile. AES Gener is receiving additional revenue for its increased output capacity enabled by our battery system installed there. We have also delivered a multi-megawatt system to AES for use

2

in Westover, New York and a 32-megawatt system that AES has deployed in Mt. Laurel, West Virginia. In addition, we have delivered two systems to Edison Material Company, a Southern California Edison Company, or SCE, for use in a pilot program. By the end of 2011, we had shipped more than 90 megawatts of grid energy storage systems worldwide.

Grid operators in New England (ISONE), the Mid-Atlantic (PJM), New York (NYISO), the Midwest (MISO) and California (CAISO) allow energy storage providers to sell grid ancillary services, such as spinning reserve and frequency regulation, in their respective electricity markets. On October 20, 2011, the Federal Energy Regulatory Commission (FERC) issued pay-for-performance rules for frequency regulation in organized electricity markets. The 'pay for performance' principle recognizes that faster and more accurate resources provide greater benefits to the grid, and those resources should be compensated for that additional capability. Our batteries can respond nearly instantaneously to commands to increase or decrease output. As more markets develop market structures that compensate these fast-responding resources, we believe that our customers will realize higher value from deploying our grid systems. The end result is that through proper design, the market will provide the most efficient and least-cost mix of resources for regulation service.

We are also focusing on the commercial market. We first commercialized our battery technologies for use in cordless power tools. We have agreements with The Gillette Company, a wholly-owned subsidiary of The Procter & Gamble Company, to supply Gillette with materials and technology for use in their consumer products. In other commercial areas, we believe our products are well-suited to applications in telecommunications, IT infrastructure, medical systems, auxiliary power units, or APU's, material handling equipment and industrial controls.

During 2009, 2010 and 2011, 59%, 59% and 61% of our product revenue was derived from sales in the transportation market, 15%, 18% and 28% was derived from sales in the electric grid market, and 26%, 23% and 11% was derived from sales in the commercial market, respectively. For the year ended December 31, 2011, revenue from our two largest customers, Fisker and AES Energy Storage, LLC and its affiliates, or AES, represented 26% and 24% of our revenue, respectively.

Our proprietary technology includes nanoscale materials initially developed at and exclusively licensed from the Massachusetts Institute of Technology. We are developing new generations of this core Nanophosphate® technology, as well as other battery technologies, to achieve additional performance improvements and to expand the range of applications for our batteries. For example, for the 2009 Formula One racing season, we developed an ultra high power battery for Mercedes-Benz HighPerformanceEngines for use by the Vodafone McLaren Mercedes team that provided more than ten times the power density (W/kg) as compared to a standard Prius battery. In addition, we are working on next generation technology for this application.

Our research and development team comprises over 373 employees and has significant expertise in battery materials science, process engineering and battery-package engineering, as well as battery system design and integration. As of December 31, 2011, we own or exclusively license 75 issued patents and more than 335 pending patents in the United States and internationally.

We are taking advantage of programs established by the U.S. Federal government and various State government programs to stimulate the economy and increase domestic investment in the battery industry and we intend to continue doing so. Access to these State and Federal government funds offsets some of our capital expenditure and operating cash needs. For additional details of these government programs see the Government Initiatives and Contract Research section in Item I of this Annual Report on Form 10-K.

We perform most of our manufacturing at our facilities using our proprietary, high-volume process technologies. Our internal manufacturing operations allow us to directly control product quality and minimize the risks associated with disclosing proprietary technology to outside parties during

3

production. We control every stage in the manufacture of our products except for the final assembly of one battery cell model and certain battery systems. Over the past several years, we have developed high-volume production expertise and replicable manufacturing processes that we believe we can scale to meet increasing demands for our products. Our manufacturing processes can be modified to manufacture battery products for different applications and can be replicated to meet increasing customer demands. As of December 31, 2011, our annual manufacturing capacity was approximately 645.8 million watt hours. We have approximately 840,000 square feet of manufacturing facilities in China; Korea; Livonia, Michigan; Romulus, Michigan; Hopkinton, Massachusetts and Westborough, Massachusetts available for active manufacturing use. In conjunction with receiving federal and state incentive funding, we are currently expanding our domestic battery manufacturing capacity. This expansion would complement our existing manufacturing facilities in Asia.

We were incorporated in 2001. We began selling our first products commercially in the first quarter of 2006. We have approximately 2,000 employees worldwide. Our revenue has grown from $91.0 million for the year ended December 31, 2009 to $97.3 million for the year ended December 31, 2010 and to $159.1 million for year ended December 31, 2011. We experienced net losses of $85.8 million, $152.6 million and $257.7 million for the years ended December 31, 2009, 2010 and 2011, respectively.

Watt Hours Operating Metric

We measure our product shipments in Wh, which refers to the aggregate amount of energy that could be delivered in a single complete discharge by a battery. We calculate Wh for each of our battery models by multiplying the battery's amp hour, or Ah, storage capacity by the battery's voltage rating. For example, our 26650 battery is a 2.3 Ah battery that operates at 3.3 V, resulting in a 7.6 Wh rating. We determine a battery's Ah storage capacity at a specific discharge rate and a specific depth of discharge. We do this by charging the battery to its top voltage and by discharging it to zero capacity (2 volt charge level). The Wh metric allows us and our investors to measure our manufacturing capacity and shipments, regardless of battery voltages and Ah specifications, utilizing a uniform and consistent metric.

Industry Background

The world economy is undergoing a transformation driven by rising demands for high-output, fuel-efficient energy solutions that are less harmful to the environment. Global economic growth, geo-political conflict in oil-producing regions and escalating exploration and production costs are increasing market demand for innovative energy alternatives that can help reduce dependence on oil. Meanwhile, heightened concerns about global warming and climate change are giving rise to stricter environmental standards and stronger regulatory support for energy sources that are not harmful to the environment. As a result, clean energy technologies are experiencing increasing popularity and greater adoption which is fueling continued innovation and improving the economic viability of such technologies. We believe these clean energy trends are contributing to a growing demand for advanced battery technologies in end markets such as transportation, electric grid services and commercial.

Transportation

We believe consumers are shifting away from conventional gasoline engines to HEVs, PHEVs and EVs because of the high prices of conventional fuel, greater awareness of environmental issues and government regulation. These vehicles offer improved gas mileage and reduced carbon emissions, and may ultimately provide a vehicle alternative that eliminates the need for conventional gasoline engines. Industry experts project that by 2020, almost half of U.S. vehicles will require some form of battery technology to meet new Corporate Average Fuel Economy, or CAFE, regulatory standards. President Obama has announced national standards to cut emissions and increase gas mileage, mandating that

4

U.S. passenger vehicles and light trucks must average 35.5 miles per gallon by 2016. On November 16, 2011, the U.S. Environmental Protection Agency or EPA and National Highway Traffic Safety Administration or NHTSA issued their joint proposal to extend emissions and fuel economy standards to model year 2017-2025. The proposed standards are projected to require on an average industry fleet wide basis 163 grams/mile of carbon dioxide, which is equivalent to 54.5 miles per gallon (mpg).

In addition, state and federal governments continue to implement economic incentives related to fuel efficiency. For example, since February 2009, the U.S. government has, among other things, provided for a tax credit of between $2,500 and $7,500 for the purchase of plug-in electric vehicles depending on the battery capacity. Moreover, governments across the globe are considering or have already implemented policies which similarly support vehicle electrification. While the mix between regulatory constraints and incentives vary by country, we believe the overall effect is increasing demand for greener vehicle technologies including advanced batteries.

On a cost per mile driven basis, electricity is a more economical source of energy than gasoline. However, the vehicle operating savings of using electricity have been historically more than offset by the cost of the corresponding electrical powertrains. With the advancement of battery technologies, the use of battery systems to deliver energy to hybrid powertrains is becoming more economically attractive. We believe this trend will lead to increased adoption of HEVs, PHEVs and EVs and, as a result, create significant opportunities for battery suppliers with the necessary technology, experience and manufacturing capabilities to develop high performance batteries. We expect that if consumers begin realizing more immediate cost savings by switching away from gasoline powered vehicles to hybrid vehicles, the resulting increased adoption of HEVs, PHEVs and EVs will significantly contribute to the growth of the next-generation battery market. The growth in HEVs will likely include start-stop or micro hybrids, which can offer fuel savings with relatively minor modifications in the vehicle.

Similar industry dynamics are creating a demand for new battery technology applications in the heavy-duty transportation market, particularly in buses, trucks and other industrial vehicles. The higher fuel consumption rate of these large vehicles makes the potential fuel cost savings derived from the use of batteries even greater. In addition, these vehicles are typically used for more hours per day than passenger vehicles, which help provide a faster return on investment. Several government authorities and corporations are evaluating battery technologies for their large fleets of heavy-duty vehicles. For example, the City of London has announced plans to convert its fleet of buses to HEVs and had 200 hybrid buses on January 26, 2012, making it the largest fleet of these environmentally friendly vehicles in the United Kingdom.

Electric Grid Services

Applications in the electric grid market present another significant opportunity for the use of advanced battery systems. Performance and reliability are essential to electric transmission and distribution grids. To preserve electric grid integrity, grid operators often need to call on resources to provide critical ancillary services such as standby reserve capacity and frequency regulation services. Resources required for standby reserve capacity services must ramp up and down quickly to offset sudden, short-term generator or transmission line outages. Resources for frequency regulation services are called upon to adjust for minute-to-minute frequency fluctuations in the grid due to demand and supply changes. Traditionally, these grid services are provided by running select power plants on the grid below their full load capability so they can be called on and ramped up quickly as needed. Advanced batteries capable of providing rapid charge and discharge cycles as well as high power over a long period provide these services more cost effectively and efficiently than running power plants at sub-optimal operating levels. FERC has issued pay-for-performance rules which reward fast-performing resources appropriate for the services they offer. Through the use of batteries, the portion of power plant capacity normally reserved for ancillary services to provide standby reserve capacity and frequency

5

regulation can be freed up to operate at full capacity and produce more electricity and associated revenue.

We believe the escalating demand for renewable energy technologies will serve as an additional catalyst for the adoption of advanced batteries in electric grid applications. Wind and solar energy facilities are expected to be important sources of new electricity generation in the future. However, wind and solar are intermittent power sources that put additional demands on grid stabilization. Advanced batteries can be used to supplement these new generation technologies by smoothing their output providing regulation services and excess energy storage during periods of high transmission line usage or low customer demand.

The ARRA provides for $4.5 billion in direct spending on the U.S. electric grid, including funds to modernize the grid with so-called "Smart Grid" technologies, which are intended to stimulate investment by utilities in a smarter, more efficient grid and cleaner, renewable electricity generation technology. Emerging Smart Grid practices and technologies, such as the deployment and integration of advanced energy storage technologies, are designed to modernize the electric power grid. We believe utility companies that benefit from the ARRA's Smart Grid initiative will increase spending on advanced batteries and battery systems.

Commercial

Commercial applications represent another attractive market for advanced batteries. There are two types of batteries for commercial applications: high-energy batteries and high-power batteries. High-energy batteries are designed to store large amounts of energy for long periods, but are not required to release this energy at a high rate. These batteries are used in certain portable consumer electronics such as laptop computers, PDAs and cell phones, which require gradual, consistent delivery of energy in low-power form. High-power batteries, on the other hand, are designed not only to store large amounts of energy, but also to deliver it at a very high rate, or in high-power form. While the battery market for high energy, low-power portable consumer products is mature and well supplied by several vendors, a market opportunity exists for advanced batteries that can deliver high-power in a light-weight and portable package.

High-power batteries can transform appliances, tools and equipment traditionally powered from electric outlets into more convenient, portable devices. These batteries are currently being used in cordless power tools with additional potential applications in home appliances and commercial cleaning equipment. Consumers in these initial applications continue to demand high-power batteries for portable applications that are smaller, lighter and longer lasting than those currently used. In addition, with escalating environmental concerns around battery disposal, the market is also increasingly focused on replacing battery technologies which utilize toxic metals such as nickel or lead.

Challenges in Battery and Battery System Design

The performance and specific characteristics of rechargeable batteries depend on the properties of their materials, the design of the batteries and the battery systems and the manufacturing process. Providers of rechargeable batteries face a number of challenges in addressing the requirements of transportation, electric grid services and commercial applications:

- •

- Delivery of sufficient power for target applications. A

battery must be able to deliver the electrical power required by the application. Electrical power, measured in watts, is the rate at which electrical energy is delivered. Having adequate power is

particularly important in applications such as electric-drive vehicles, where acceleration is an essential component of performance.

- •

- Ability to operate for sufficient duration between charges. A battery can provide a certain total amount of electrical energy to the application. Energy is the product of power and time,

6

- •

- Delivery of sufficient energy at high power. The total

energy that a battery can deliver also depends on the power requirements of the application being addressed. When a battery is used at higher power, the usable energy of the battery is less than it is

at lower power. Battery types vary widely in the amount of energy that can be delivered when the battery is used at high power.

- •

- Ability to operate safely. Safety is a primary concern for

batteries used in commercial products, transportation vehicles and electric grid applications. For example, battery types differ in their susceptibility to thermal runaway, which is the internal

generation of significant heat leading to battery damage and potential combustion.

- •

- Sufficient cycle and calendar life. The cycle life of a

battery is the number of times it can be recharged without significantly reducing its ability to accept a charge. The calendar life is the total time in service before the battery can no longer

deliver the energy or power required by the application.

- •

- Ability to be rapidly charged. Batteries differ in the

time required to charge before use or in their ability to be partially-charged using a high power pulse. For example, HEVs require a battery that can be charged quickly in order to take advantage of

the energy savings provided by regenerative braking.

- •

- Minimizing size and weight while delivering sufficient power and

energy. Size and weight are critical considerations for many battery applications, including automobiles and power tools. For a specific

application, batteries with higher energy and power per unit of size and weight can be made smaller and lighter. This is especially important for portable and transportation applications.

- •

- Maintenance of charge when stored. All batteries

experience some self discharge, which is a slow loss of energy from the battery during storage. The rate of self discharge may be affected by battery chemistry, battery design or manufacturing

quality. Self discharge tends to occur more rapidly when batteries are stored at high temperatures.

- •

- Power and energy degradation over life. Batteries will

lose some of their ability to deliver power and store energy throughout their normal usage life. The degradation typically increases with repeated charge and discharge and if the battery is exposed to

high temperatures. The rate of power and energy degradation can determine the cycle life or calendar life of the battery.

- •

- Delivering maximum performance for the lowest

cost. Batteries are typically evaluated based on their performance in relation to their cost. The cost of raw materials and components

and the battery's design are key factors affecting this evaluation. Other attributes such as manufacturing efficiency, battery system design and electronic control circuitry can also impact a battery

system's cost.

- •

- Availability of raw materials. For applications such as

transportation and electric grid services, if widespread adoption occurs, the large expected volume will require batteries based on raw materials that are in abundant, readily available supply.

- •

- Requirements for environmentally-friendly disposal. Nickel-cadmium and lead-acid rechargeable batteries contain toxic metals that raise environmental concerns in disposal. Consumer awareness and government regulations are contributing to the need for rechargeable batteries that contain materials that can be disposed of with the least harmful impact on the environment.

measured in watt hours. Batteries with higher energy can function for longer periods when used at a certain power than those of lower energy. Thus, in PHEV and EV applications, the energy of the battery determines the automobile's mileage range while it is running only on electricity.

7

The most prevalent battery technologies currently available that address the transportation, electric grid services or commercial markets include:

- •

- Lead-acid batteries. Lead acid is one of the

oldest and most developed battery technologies. It is an inexpensive and popular storage choice that is generally reliable and relatively simple to manufacture. Most automobile manufacturers use lead

acid in automotive starter batteries. Lead-acid batteries have also traditionally been used in electric grid services applications. However, lead-acid batteries are heavier per

unit of stored energy than some other battery technologies and are therefore not practical for use in many commercial applications. They also have long charge times and low power output for their

mass. In addition, lead can be hazardous to the environment.

- •

- Nickel-based batteries. Nickel-based batteries come in

two main forms: nickel cadmium, or NiCd, and nickel metal hydride, or NiMH. NiCd batteries are inexpensive and durable and have high power, making them suitable for commercial applications. However,

cadmium metal is toxic and can cause several acute and chronic health effects in humans and NiCd batteries are hazardous to the environment. NiMH batteries, which provide a less toxic alternative to

NiCd, have greater energy than lead-acid batteries and have been used in automotive applications, such as the Toyota Prius HEV model. Some NiMH batteries are light and have a fast charge

rate, which makes them appropriate for use in portable products. However, NiMH batteries lack the energy density to make them practical for many PHEV and EV applications.

- •

- Conventional Lithium-ion

Technologies. Lithium-ion batteries have higher energy density than lead-acid, NiCd or NiMH batteries and can be

made smaller and lighter than these batteries. After their commercial introduction in the early 1990s, lithium-ion batteries were adopted quickly for small portable electronics

applications such as cell phones and laptop computers. However, until recently, lithium-ion technology was not widely used other than for small portable device applications due to

limitations on their power, safety and life. Furthermore, the world's supply of cobalt, a metal used in most conventional lithium-ion batteries, is more limited than the supply of other

metals used in advanced lithium-ion batteries.

- •

- Advanced Lithium-ion Batteries. In the late 1990s, a new generation of lithium-ion chemistries capable of delivering improved performance emerged. Some of these technologies offered greater power. Other technologies introduced improvements in safety and battery life relative to conventional lithium-ion batteries. In addition, the development of lithium-ion polymer technology, utilizing modified chemistries and manufacturing methods, allowed a range of flat, or prismatic, battery shapes to be manufactured. However, existing limitations in the areas of safety and life prevented the widespread use of lithium-ion in large, high-power applications. Though some advanced lithium-ion batteries are safer than conventional lithium-ion, protective measures to prevent overcharge-related safety issues remain necessary. Furthermore, battery systems such as those being developed for HEV, PHEV and EV powertrains require not only higher levels of power and/or energy, but also the ability to function over a wide range of temperatures and a longer calendar life. For example, portable electronic devices only require about 300 to 400 recharge cycles and a calendar life of about three years, whereas typical vehicle applications require several hundred thousand shallow recharge cycles for HEV applications and several thousand deep cycles for PHEV and EV applications, with a calendar life of approximately ten years.

8

- •

- Other Technologies. Other technologies such as ultra capacitors and fuel cells have been considered as potential alternatives to batteries. Ultra capacitors are energy storage devices that deliver high power and have a long cycle and calendar life. However, they lack sufficient energy density to meet the needs of most battery applications. Fuel cells generate energy locally by consuming a fuel, usually hydrogen. Fuel cell systems currently offer similar energy density to advanced lithium-ion batteries, and may eventually be capable of greater energy density, but fuel cell systems typically have lower power and shorter calendar life. Moreover, hydrogen must be replenished after use, is difficult to store and distribute, and is currently produced in energy-inefficient ways.

Our Solution

We believe our batteries and battery systems overcome the limitations of other currently available lithium-ion formulations and non-lithium-ion battery technologies. Our solution is based on proprietary Nanophosphate® chemistry originally developed by one of our founders, along with others, at the Massachusetts Institute of Technology and is exclusively licensed to us. We continue to innovate our battery chemistry by improving our existing Nanophosphate® chemistry and exploring new material chemistries. Our battery chemistry is supplemented with innovative battery designs as well as systems and pack technologies that increase the performance and scalability of battery systems used for high-power applications. As a result, while other battery technologies offer competitive performance in some metrics, we believe our batteries and battery systems deliver superior performance by combining the following key characteristics:

- •

- High power. Our proprietary battery chemistry and design

enable high electric power comparable to that available from ultra capacitor technology. For example, for the 2009 Formula One racing season, we developed an ultra high power battery for

Mercedes-Benz HighPerformanceEngines for use by the Vodafone McLaren Mercedes team that delivered more than ten times the power density (W/kg) as compared to the power delivered by the

battery used in a standard Prius.

- •

- High useable energy. Because our batteries maintain high

power over a wide range of charge levels, our batteries provide more useable energy for a given size than many batteries based on other chemistries.

- •

- Improved safety. Our batteries are more resistant than

conventional and other advanced lithium-ion batteries to failures such as fire and explosion under certain conditions, including overcharge, overheating and physical damage.

- •

- Long cycle and calendar life. Our batteries are designed

to retain their power and energy over thousands of full recharge cycles and for up to ten years of calendar life, allowing them to meet or exceed customer requirements in our target markets.

- •

- Fast charge capability. Our proprietary battery chemistry

and design enable some of our batteries to reach 90% charge from a fully discharged state in as few as six minutes.

- •

- Reduced size and weight. The high power and high usable

energy exhibited by our batteries allow us to design smaller and lighter battery systems using fewer batteries to meet an application's power and energy needs. In addition, our stable battery

chemistry reduces the need for control electronics that add to the battery system's size and weight.

- •

- Low power degradation over life. Our batteries lose less storage capacity than many competing batteries after repeated charging and exposure to high operating temperatures. As a result, we have to add less excess capacity to our battery systems in order to account for power degradation over calendar life and still meet minimum end-of-life power requirements.

9

- •

- Compelling balance of cost and performance. Our batteries

are cost efficient in multiple areas. Lithium and other key materials used in our batteries are in readily available supply. Furthermore, our batteries' higher power and energy density and lower power

degradation can result in deployment of fewer batteries to meet specified application requirements.

- •

- Environmental benefits. Unlike many other batteries, the active materials in our Nanophosphate® batteries do not contain nickel or manganese compounds which are classified as toxic by the U.S. Environmental Protection Agency in the Toxics Release Inventory. In addition, at the end of their useful life for a particular application, it may be possible to re-purpose our batteries for other applications, which maximizes the use of raw materials and resources. In addition, a significant portion of our battery's materials can be recycled when the battery is no longer in use.

Our Competitive Strengths

We believe the following combination of capabilities distinguishes us from our competitors and positions us to compete effectively and benefit from the expected growth in the advanced energy storage market:

- •

- Materials science and development expertise. Our

proprietary materials formulations and coating techniques allow us to adjust the characteristics of our battery components to meet different energy and power requirements across our many applications.

For example, we have developed new battery components that operate in temperature environments ranging from -30°C to over 60°C. Our core materials science has been

successfully taken from the research laboratory to the mass market, where it has been validated in high-volume production. We plan to continue to commercialize products based on our core

materials and to explore a variety of next generation chemistries that are intended to provide even higher energy and power combinations without sacrificing battery safety or life.

- •

- Battery design capabilities. We have been an innovator in

the packaging of lithium-ion batteries. For example, we believe we were the world's first mass producer of cylindrical, aluminum, laser-welded packaged batteries. Prior to this

development, most cylindrical batteries used crimped steel cans and internal mechanical designs that are heavier, have more difficulty delivering high currents and are more permeable to humidity than

our design. These capabilities allow us to introduce optimal packages in various forms and sizes designed to deliver our technology into many different applications. We have introduced or are

developing several new cylindrical battery cell models for diverse applications as well as several new prismatic, or flat rectangular, battery cell models targeted at the transportation and grid

markets. Prismatic batteries offer improved energy density, by minimizing the amount of inert materials, which add to the weight and size of the battery.

- •

- Battery systems engineering and integration expertise. A battery system typically includes a battery management system, battery supervisory circuits, state of charge algorithms, thermal management and power electronics. We have developed systems engineering and integration expertise in all of these areas. These capabilities allow us to customize our batteries and deliver fully-integrated systems, which are necessary to compete successfully in certain end markets. In addition, our system integration expertise allows us to understand system level requirements and inform our chemistry development process. It also provides us with the necessary expertise to partner with leading system integrators, understand their design requirements and assist them in developing solutions that take advantage of our battery products. We believe our system engineering capabilities accelerate the adoption of our technology across our target markets by reducing the development and integration efforts of our system integration partners and end customers. We have two groups with integration capabilities located in Massachusetts (electric

10

- •

- Vertical integration from battery chemistry to battery system design

services. We provide a broad spectrum of highly customized solutions to our partners and customers. Our vertical integration from

batteries to battery systems has allowed us to develop flexible technology modules at every step of battery development, including a patent-pending scalable prismatic battery system architecture that

allows common modules to be configured according to varied transportation customer requirements. The ability to work with partners and customers across the design process provides us with a better

understanding of customer needs and allows us to customize our modules and design steps to their specific requirements. This understanding of our customer needs often reduces our development time

because we can address design requirements at the chemistry, battery or battery system levels. Furthermore, by managing each design step from battery to battery system, we can better protect our

intellectual property.

- •

- Industry-leading partners in focused markets. We work with

leaders in each of our target markets, such as AES, BAE Systems, BMW, Daimler, Fisker, Gillette, GM, Navistar, SAIC and SCE. We have entered into agreements relating to joint design and development

efforts with several major passenger vehicle manufacturers and tier 1 suppliers, including BMW for its HEV program, Fisker for its PHEV program, Navistar for its EV program and SAIC for its

HEV, PHEV and EV programs. We also continue to work with General Electric to draw on their research and technology development expertise in our target markets. We believe our experience with our

development partners provides us with a significant research and development advantage, greater access to end customers, market credibility and additional avenues to secure supply contracts.

- •

- High-quality, volume manufacturing facilities and proprietary process

technologies. As of December 31, 2011, we have approximately 840,000 square feet of manufacturing facilities in China, Korea,

Michigan and Massachusetts that are available for active manufacturing use. Our internal manufacturing operations provide us with direct control over the quality of our products and improve the

protection of our materials science, systems and production process intellectual property. In addition, we believe our manufacturing control allows us to rapidly modify and adapt standard equipment

for our particular production requirements, thereby reducing our overall development time to market. Over the past several years, we have developed high-volume production expertise and

replicable manufacturing processes that we believe we can scale to meet increasing demands for our products. We are compliant with ISO 9001:2000 certification and received TS16949 certification

for our cylindrical cell design and manufacturing operations worldwide. We are the first major U.S.-based battery manufacturer to receive this automotive certification for cylindrical

lithium-ion cells, which validates that our product design and manufacturing process meet the highest standards for manufacturing excellence in the automotive industry.

- •

- Cells with proven capabilities across multiple transportation applications. Through our supply agreements in the transportation market, we have demonstrated the ability to compete in all transportation markets, including heavy-duty, both EV and HEV, as well as passenger car, EV, PHEV and HEV. Also, we have demonstrated our ability to compete in markets across all regions of the globe. We believe these programs demonstrate and validate the price to performance of our cells, modules and systems in the marketplace.

grid and commercial services) and in Michigan (transportation). In addition, our St. Louis office supports our electric grid business, especially in the area of software controls.

11

Our Strategy

Our goal is to utilize our materials science expertise, our systems engineering expertise and our manufacturing process technologies to provide advanced energy storage solutions. We intend to pursue the following strategies to attain this goal:

- •

- Pursue markets and customers where our technologies create a competitive

advantage. We will continue to focus our efforts in markets where customers place a premium on high-quality batteries,

innovation and differentiated performance. We believe our battery technologies, our design and systems expertise and manufacturing processes, provide us with a competitive edge in enabling new battery

applications that address challenging design constraints and demanding performance requirements, including high reliability and long life.

- •

- Partner with industry leaders to adapt and commercialize our products to best meet the requirements of our target

markets. In each of our target markets, we have entered into joint development and supply agreements with industry-leading companies.

These relationships provide us insight into the performance requirements of that market, allow us to share product development costs, and position our products to serve as a key strategic element for

our partner's success. We intend to continue to pursue partnerships in our target markets to enhance our product offerings and to facilitate expansion into new geographies.

- •

- Actively pursue federal and state incentive funding for battery development, facility expansion and job

creation. We intend to take advantage of U.S. government and state programs established to increase domestic investment in the battery

industry. To date, we have been awarded a $249.1 million grant under the DOE Battery Initiative and have applied for a federal loan of up to $233 million to support our manufacturing

expansion in the United States. We have been awarded loans, tax credits and other credits from the State of Michigan as well as the Commonwealth of Massachusetts. We are also pursuing other funding

opportunities.

- •

- Expand our manufacturing capacity in the United States. As

we receive sufficient federal and state incentive funding and the actual and anticipated future demand for our products increases as expected, we plan to further expand our domestic battery

manufacturing capacity. Our plan involves operating vertically integrated manufacturing plants in the United States that encompass the full production process, including the manufacturing of our

proprietary cathode powder, electrode coating, battery fabrication and the assembly of complete battery systems ready for vehicle integration.

- •

- Pursue opportunities globally. Many potential customers

exist outside of the United States. China, for example, is the largest and fastest growing automotive market in the world. Growing awareness among governments around the world has also led to

increased interest in vehicle manufacturers, both for passenger and commercial vehicles. In addition to the opportunities in the transportation sector, the electric grid is also a growing market for

energy storage systems. Plans to modernize power delivery infrastructure and integrate renewable sources of power, such as wind and solar, also are creating numerous opportunities globally.

- •

- Remain on the forefront of innovation and commercialization of new battery and system

technologies. We intend to continue to innovate in materials science and product design to enhance the benefits of our product

offerings. This innovation will be derived from our internal research and development efforts, from our close development partnerships with our customers and from licensing or acquiring new

technologies developed by third parties. We maintain relationships with top industry leaders, government labs and universities to advance research and to track promising developments and technologies.

- •

- Reduce costs through manufacturing improvements, supply chain efficiencies and innovation in materials. We intend to lower our manufacturing costs by improving our manufacturing

12

performance and lowering our materials cost. As we continue to grow, we are focused on increasing the yield in our manufacturing and improving our margins as production volumes increase. We also manage our working capital requirements in manufacturing through inventory management and additional supply chain efficiencies. In addition, we continuously evaluate how to improve our product offerings and lower costs through further materials innovation. We are actively developing new materials with properties we believe will allow us to build batteries that require fewer control and electronic components and enable our battery systems to maintain or improve performance at a lower cost.

Our Products

Our current product offerings include batteries in various sizes and forms as well as packaged modules and fully-tested battery systems. The platform for battery and battery system development is our patented Nanophosphate® material, which can be engineered to meet the strict requirements of a broad set of applications in our target markets.

Energy Storage

Our batteries based on our Nanophosphate® technology for application development in the transportation, electric grid services and commercial markets, as summarized below:

| |

|

||||||||

|---|---|---|---|---|---|---|---|---|---|

| |

|||||||||

Cell Product Model Number |

ANR26650 |

APR18650 |

AHR32113 |

AMP20 |

|||||

Nominal capacity* (Ah) |

2.3 Ah | 1.1 Ah | 4.4 Ah | 20 Ah | |||||

Energy (Wh) |

7.6 Wh | 3.6 Wh | 14.6 Wh | 64 Wh | |||||

Power to energy ratio |

High | Medium | Ultra High | Medium | |||||

Electrode type** |

M1 | M1 | M1 Ultra | M1 HD | |||||

Status |

Volume production |

Volume production |

Volume production |

Volume production |

|||||

Applications |

Consumer and Professional, Hybrid Transit Buses, Electric Vehicles, Electric Grid Services |

Consumer and Professional Applications | Hybrid Electric Vehicles, Hybrid Transit Buses and Heavy Duty Hybrid Electric Vehicles |

Extended Range Electric Vehicles, Plug-In Hybrid and Electric Vehicles |

|||||

- *

- The

capacity of a battery is the amount of charge it can store, typically given in units of amp hours, or Ah.

- **

- We have developed several electrode technologies based on our Nanophosphate® chemistry for our batteries depending on their application. M1 offers a combination of energy and power. M1 Ultra is designed for high power applications. M1 HD is designed for high energy applications.

- •

- ANR26650. We originally developed the ANR26650 (26 mm in

diameter, 65 mm in height) for DeWalt's 36V series of professional power tools. This battery offers a combination of power and energy that allows it to be used in a diverse set of applications,

including power tools, BAE Systems' Hybridrive® propulsion system for the Daimler Orion VII hybrid-electric bus and AES's Smart Grid Stabilization Systems.

- •

- APR18650. The APR18650 (18 mm in diameter, 65 mm in height) has a similar design as the ANR26650, but comes in a smaller, industry-standard package. We are producing this battery through partnerships with third-party suppliers rather than building our own production capacity.

13

- •

- AHR32113. The AHR32113 (32 mm in diameter, 113 mm in

height) is designed for high-power HEV applications and to offer significantly higher power than our other cylindrical cells. The cell is designed to address markets where power is the

main requirement and where cost per unit of power is the key metric. We have recently completed the upgrade of this cell resulting in higher capacity and power, and further optimization for high

volume manufacturing. Currently in production, the AHR32113 has been sourced for HEV programs including those produced by BMW, Magna Steyr and Delphi for SAIC.

- •

- AMP20. The AMP20 (7.2 mm thick, 161 mm wide, 227 mm in height) is designed for high-power PHEV and EV applications. Our 20Ah building block for PHEV and EV applications is currently in production. This prismatic cell is an advanced high power and long-life lithium-ion energy storage solution for next-generation applications and is being used in the majority of our transportation customers and a growing percentage of our grid customers.

Battery Systems

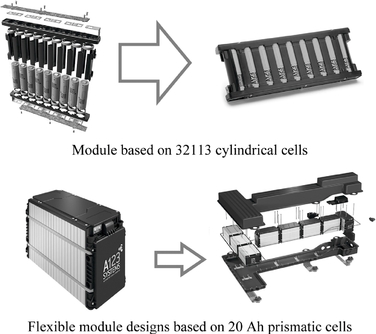

Our energy solutions group offers a variety of fully-packaged systems as well as sub-module building blocks for battery system development. Our development of integrated systems includes not only the packaging of our batteries, but also power electronics, safety systems, thermal management, testing, production and qualification. We design standard systems as well as custom systems using a modular design based on standard building blocks. We manufacture a variety of battery systems, in which cells or modules are connected in various configurations to meet the design requirements of specific applications. The following are examples of a modular building block based on our 32113 HEV cylindrical cells and various module designs using our scalable 20Ah prismatic cells.

Our prismatic battery system's design allows for various battery configurations, providing pack design versatility for the automotive market. This design reduces retooling time when reconfiguring our assembly lines for different customers. Our battery systems are highly engineered to incorporate safety and control features that extend life and improve performance. Module-level fusing, temperature sensing and other safety controls provide additional containment safeguards to isolate and protect against cell-level failure. Active overvoltage protection provides monitoring and balancing of individual series elements to protect cells from abuse and to extend life. These battery systems are designed to accommodate either liquid or air-cooled thermal management systems, and have mechanical structures

14

designed to withstand the harsh vibration and mechanical shock environment of automotive applications.

Current product offerings include the following:

- •

- BAE Systems Energy Storage Solution. We produce energy

storage solutions for BAE Systems' HybriDrive drive train for the Daimler Orion VII hybrid-electric bus. The 180 kW system incorporates our ANR26650 batteries into sub-modules that include

a redundant, fault-tolerant design. Air-cooled with safety systems designed in, this energy storage solution reached volume production in 2008 as a replacement for a lead-acid

solution that weighs approximately three times as much as our solution, with half the expected life.

- •

- Grid Storage Solutions. We have developed and installed

multi-megawatt battery systems, for AES, Southern California Edison and other companies capable of performing ancillary electric grid services, including standby reserve capacity and frequency

regulation services.

- •

- Prismatic Battery Systems. We are working with a number of

passenger and commercial vehicle manufacturers to develop and supply prismatic battery systems.

- •

- Starter Battery Systems. We have developed starter

batteries to replace the standard lead acid batteries that are currently used. Our starter batteries offer higher power in a lighter package, in addition to a longer life.

- •

- Lead acid replacement batteries. Our ALM line of lead acid replacement batteries use our Nanophosphate® technology packaged in widely-used lead acid form factors. These batteries offer superior life and lighter weight than traditional lead acid batteries, making them well-suited to applications such as IT, telecom, material handling, auxiliary power units, and medical systems.

Technology Overview

Lithium-ion batteries are rechargeable batteries in which lithium is reversibly transported through a nonaqueous liquid electrolyte, or ionically conductive medium, between positive and negative electrodes that store lithium in the solid state. Lithium-ion batteries are distinguished from disposable lithium batteries, or rechargeable lithium metal batteries, by not utilizing metallic lithium as a negative electrode material. Instead, both electrodes utilize compounds in which lithium atoms may be stored at relatively high concentrations without forming lithium metal, an attribute that is key to safe and prolonged recharging. The non-aqueous electrolyte in lithium-ion batteries allows operation at a high voltage (up to 4.4 V for current technology) without suffering electrolyte decomposition. The combination of a high voltage and high charge storage capacity in both the positive and negative electrodes provides for the high specific energy (50-230 Wh/kg) and energy density (100-450 Wh/liter) of current lithium-ion batteries. These energy values span a wide range for several reasons. Batteries designed for high power typically utilize thin electrode coatings which result in lower overall active materials content and therefore lower energy. The energy per mass and per volume also varies with form factor, cylindrical batteries typically having higher values than prismatic batteries, and battery size, smaller batteries typically having lower values due to higher packaging factor. Importantly, the choice of positive and negative electrode materials has a large impact on the energy that can be stored and the power that can be delivered using a specific battery.

We are primarily focused on developing a new generation of lithium-ion batteries and battery systems to serve applications and markets outside the historical domain of lithium-ion. These applications include HEVs, PHEVs and EVs, electric grid services, industrial, and commercial products. These applications frequently require battery systems having much higher total energy or power outputs than required by previous lithium-ion applications, and place a premium on one or more of the attributes of high energy, high power, improved safety, long life, and high reliability. We also maintain

15

an active research and development effort to develop future generations of materials for several key components of battery systems, and improved battery and battery systems designs to take advantage of the attributes of those materials.

Customers

Our primary customers are industry-leading companies that value and require high battery performance. Our customers and development partners span multiple industries and include the following organizations, in addition to others, in our target markets:

- •

- Transportation. We are currently working under

non-exclusive arrangements with major global automotive manufacturers and tier 1 suppliers to develop batteries and battery systems for the HEV, PHEV and EV markets. We have entered

into a supply agreement with BMW to supply HEV batteries, GM, Navistar, and SAIC to supply EV batteries and we are supplying batteries to Delphi for a mass-produced HEV by SAIC

Motor Co. Ltd., or SAIC Motor, in China. We have also been supplying batteries to SAIC for a PHEV platform they are developing. To assist us in getting penetration into China's

transportation industry, our wholly-owned subsidiary, A123 Systems Hong Kong Limited, entered into a joint venture agreement in December 2009 with SAIC for the development, production and sale of the

vehicle battery systems in China for use in HEVs and EVs. Additionally, we entered into a supply agreement with Fisker in January 2010 and have been supplying battery systems for Fisker's Karma PHEV

programs. Our other automotive development partners include tier 1 suppliers, such as Magna Steyr and Delphi, major automobile manufacturers, and EV manufacturers, which provides EVs with

lithium-ion battery systems that can be easily recharged or switched through a network of charge locations and battery switch stations. Our March 2009 supply agreement with Magna Steyr

provides for an initial seven-year term during which Magna Steyr may order batteries from us based on monthly forecasts over a rolling three-month period. In the heavy-duty

vehicle market, we are supplying battery systems to BAE Systems pursuant to an amended long term supply agreement executed in December 2010. BAE Systems is initially using our battery systems in its

HybriDrive propulsion system, which is currently being deployed in Daimler's Orion VII hybrid electric buses. We have also been selected by Daimler to supply battery systems for use in systems

developed by Daimler's EvoBus subsidiary. We have also signed supply agreements with ALTe and Via Motors, two companies that develop alternative drivetrains using chassis from other manufacturers. In

addition, we have entered into supply and development agreements with a number of vehicle manufacturers for our Nanophosphate starter battery product.

- •

- Electric Grid Services. We have developed multi-megawatt battery systems capable of performing ancillary electric grid services, including standby reserve capacity and frequency regulation services. The first system, a two megawatt system housed in a 53-foot trailer, was installed at an AES facility in California, and we have shipped additional units for AES to various locations including Chile, New York, and West Virginia. Some of these deployments were part of an AES order for 44 megawatts to be installed in various projects including an energy storage project in the PJM Interconnection market, which coordinates the movement of electricity in all or part of 13 states and the District of Columbia. In September 2010, we shipped a large battery system to Vestas Wind Systems A/S to be integrated with a wind farm in Europe. In addition, we have been selected as the battery supplier to three Smart Grid projects funded by DOE ARRA funding awards to SCE and The Detroit Edison Company, or DTE, to demonstrate the viability of advanced Smart Grid technologies. SCE will use our advanced battery technology and DOE funding to implement a $53.5 million Tehachapi Wind Energy Storage Project. DTE is expected to use our battery technology in its plan to implement Community Energy Storage systems in its Michigan service territory. In October 2011, AES Energy Storage started operation on a 32 MW facility in Mt. Laurel, West Virginia, using a battery system supplied by A123. In December

16

- •

- Commercial. We have entered into license and materials supply agreements with Gillette pursuant to which we granted Gillette an exclusive license to certain of our technology and are supplying materials to Gillette for use in their consumer products (excluding power tools and certain other consumer products). We are also pursuing opportunities in emerging applications, including telecommunications, IT infrastructure, medical systems, auxiliary power units, or APU's, material handling equipment, and industrial controls. In addition, we are developing and selling products for consumer applications, selling primarily through a network of global distributors.

2011, we announced three projects: Sempra Generation, Maui Electric Company, and NStar, which expand the use of A123's grid energy storage technology to new applications and markets.

We also sell our batteries and battery systems directly to end-user customers as well as through reseller and distributor channels.

Our contracts with customers include the purchase of our products, and in some cases, engineering and design work, maintenance and support services. These contracts include terms and conditions, including payment, delivery and termination that we believe are customary and standard in our industry. The majority of our customers are not contractually committed to purchase any minimum quantities of products from us and orders are generally cancelable prior to shipment. In addition, government entities may terminate their contracts with any party at any time. As a result, we do not disclose our order backlog, since we believe that our order backlog at any particular date is not necessarily indicative of actual revenue for any future period.

Development Partners and Joint Ventures

Pursuant to our joint venture agreement with SAIC, we have invested $4.7 million into the joint venture in return for a 49% ownership interest in the joint venture. The agreement provides that our subsidiary is responsible for supplying the joint venture with our battery cells according to the joint venture's production plan and for providing certain services and granting technology licenses to the joint venture under terms and conditions, including fees and royalties, to be agreed upon. Both parties agreed not to establish any new joint venture or any new business in China that would compete with the joint venture's activities in China. The agreement is for a twenty-year term and may be extended by mutual agreement of the joint venture parties and approval of the relevant Chinese authorities. In connection with the agreement, we irrevocably and unconditionally guaranteed to SAIC the full and prompt performance by our subsidiary of its obligations under the agreement.

Under our exclusive license agreement with Gillette, Gillette paid us an up-front, support and additional license fees totaling $28.0 million. In addition, the agreement requires Gillette to pay us royalty fees on net sales of products that include our technology. We have agreed with Gillette that if, during a certain period following execution of the license agreement, we enter into an agreement with a third party that materially restricts Gillette's license rights under the license agreement, then we may be required to refund to Gillette all license and support fees paid to us by Gillette under the license agreement, plus, in certain cases, an additional amount to cover Gillette's capital and other expenses paid and/or committed by Gillette in reliance upon its rights under the license agreement.

17

In January 2010, we entered into an agreement to purchase preferred stock of Fisker, an automaker of PHEV and EV vehicles. We invested $13.0 million in cash, and 479,282 shares of our common stock, which, when transferred to Fisker, had a fair market value of $7.5 million. We also entered into a supply agreement with Fisker to supply prismatic batteries that are being used in the Fisker Karma PHEV. During the year ended December 31, 2011, we elected not to participate in Fisker's subsequent stock financing. This election not to participate resulted in the conversion of our preferred shares of Fisker to common shares on a 2:1 ratio. As such, we performed an analysis and valuation of our investment in Fisker resulting to the recognition of an impairment charge of $11.6 million for the year ended December 31, 2011.

In August 2010, we entered into an agreement with 24M Technologies, Inc., or 24M, a company focused on battery development to improve on energy storage capabilities, to transfer certain patents in return for a minority ownership interest in 24M.

In November 2011, we entered into an expanded partnership with IHI Corporation, or IHI, a 150-year old, $13-billion Japanese company that develops solutions for a number of diverse global industries, including automotive, energy, aerospace, and marine. Pursuant to our agreement with IHI Corporation, we have licensed our battery system technology to IHI to develop solutions for the Japanese transportation market, which we believe gives us access to a market that has shown considerable support for electrification. In addition, IHI invested $25.0 million in our common stock.

Government Initiatives and Contract Research

Federal Government

In February 2009, the U.S. government enacted the ARRA, which provides for $2 billion in grants under the DOE Battery Initiative to support the construction and capacity expansion of U.S. manufacturing plants to produce batteries and electric drive components for HEV, PHEV and EV vehicles. We were selected to receive a $249.1 million grant award under the DOE Battery Initiative to support our manufacturing expansion and in December 2009, we completed an agreement on the grant's terms and conditions. We are required to spend one dollar of our own funds for every incentive dollar we receive under the DOE Battery Initiative. We have incurred allowable costs entitling us to receive approximately $127.8 million in reimbursements which we have reported to DOE.

We have also applied for direct loans under the Department of Energy Advance Technology Vehicles Manufacturing Program or DOE ATVM Program, to support our manufacturing expansion. If awarded, we believe we will be permitted to borrow up to $233 million under the ATVM Program. We expect we will be required to spend one dollar of our own funds for every four dollars we borrow under the ATVM Program. The timing and the amount of any loan we may receive under the ATVM Program, as well as the specific terms and conditions applicable to any loan we may receive are currently not known by us, and, once disclosed to us, are subject to change and negotiation with the federal government.

State of Michigan

The State of Michigan awarded us a $10.0 million grant as an incentive to establish a lithium-ion battery manufacturing plant. We received $3.0 million of the $10.0 million grant in March 2009 and $6.0 million in July 2010, with the remainder to be paid based on the achievement of certain milestones in our facility development. We have used $8.3 million of these funds and intend to continue to use these funds to support the expansion of our facilities in Livonia and Romulus, Michigan.

In October 2009, we entered into a High-Tech Credit agreement with the Michigan Economic Growth Authority, or MEGA, pursuant to which we are eligible for a 15-year tax credit, beginning with payments made for the 2011 fiscal year. The amount of credit is dependent on the number of qualified

18

jobs we create over the benefit period. Depending on the period over which we are able to maintain the number of qualified jobs created, we may be required to repay 50% to 100% of the tax credit received. In November 2009, we entered into a Cell Manufacturing Credit agreement with MEGA pursuant to which we are eligible for a credit equal to 50% of our capital investment expenses commencing January 2009, up to a maximum of $100 million over a four-year period related to the construction of our integrated battery cell manufacturing plant. The tax credit shall not exceed $25.0 million per year beginning with the tax year of 2012. The tax credit may be claimed under the Michigan Business Tax, or MBT, Act which states that an election may be made on each year's MBT return where the credit is claimed, to either have the amount of the credit that exceeds the respective year's MBT liability to be refunded or carried forward for ten years. We are required to create 300 jobs no later than December 31, 2016 in order for the tax credit proceeds to be non-refundable. The tax credit is subject to a repayment provision in the event we relocate 51% or more of the 300 jobs outside of the State of Michigan within three years after the last year we received the tax credit. Through December 31, 2011, we have incurred expenses exceeding $200.0 million related to the construction of our Livonia and Romulus facilities. When we have met the filing requirements for the tax year ending December 31, 2012, we expect to receive approximately $100.0 million in proceeds related to these expenditures.

The State of Michigan has also offered us a low interest forgivable loan of up to $4.0 million effective August 2009 with the objective of conducting advance vehicle technology operations to promote and enhance job creation within the State of Michigan. To receive advances from the loan, we are required to achieve certain key milestones related to the development of our manufacturing facility. We received $4.0 million under this loan during the year ended December 31, 2011. We have no obligation to pay any principal or interest until August 2012. If we create 350 full time jobs by August 2012 and maintain the jobs in the State of Michigan for three years after the end of the loan, the entire debt will be forgiven.