2015

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2015

Commission file number 1-16811

(Exact name of registrant as specified in its charter)

Delaware | 25-1897152 | |

(State of Incorporation) | (I.R.S. Employer Identification No.) | |

600 Grant Street, Pittsburgh, PA 15219-2800

(Address of principal executive offices)

Tel. No. (412) 433-1121

Securities registered pursuant to Section 12 (b) of the Act:

Title of Each Class | Name of Exchange on which Registered | |

United States Steel Corporation Common Stock, par value $1.00 | New York Stock Exchange, Chicago Stock Exchange | |

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for at least the past 90 days. Yes þ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer þ | Accelerated filer | |

Non-accelerated filer (Do not check if a smaller reporting company) | Smaller reporting company | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No þ

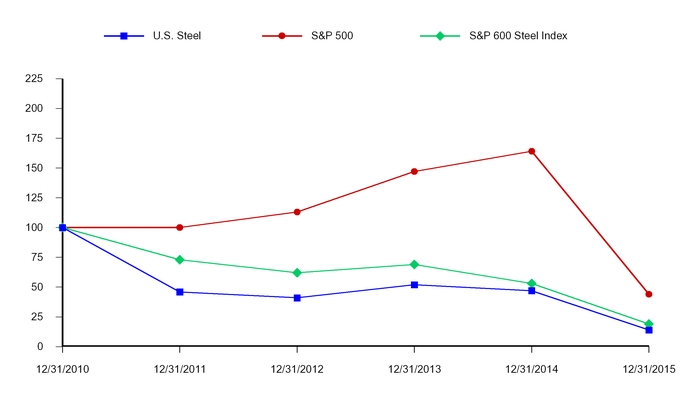

Aggregate market value of Common Stock held by non-affiliates as of June 30, 2015 (the last business day of the registrant’s most recently completed second fiscal quarter): $3.0 billion. The amount shown is based on the closing price of the registrant’s Common Stock on the New York Stock Exchange composite tape on that date. Shares of Common Stock held by executive officers and directors of the registrant are not included in the computation. However, the registrant has made no determination that such individuals are “affiliates” within the meaning of Rule 405 under the Securities Act of 1933.

There were 146,284,894 shares of United States Steel Corporation Common Stock outstanding as of February 25, 2016.

Documents Incorporated By Reference:

Portions of the Proxy Statement for the 2016 Annual Meeting of Stockholders are incorporated into Part III.

INDEX

Item 1. | |||

Item 1A | |||

Item 1B | |||

Item 2. | |||

Item 3. | |||

Item 4. | |||

Item 5. | |||

Item 6. | |||

Item 7. | |||

Item 7A | |||

Item 8. | |||

Item 9. | |||

Item 9A | |||

Item 9B | |||

Item 10. | |||

Item 11. | |||

Item 12. | |||

Item 13. | |||

Item 14. | |||

Item 15. | |||

TOTAL NUMBER OF PAGES | 108 | ||

FORWARD-LOOKING STATEMENTS

This report contains information that may constitute “forward-looking statements” within the meaning of Section 27 of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We intend the forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in those sections. Generally, we have identified such forward-looking statements by using the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “target,” “forecast,” “aim,” “will” and similar expressions or by using future dates in connection with any discussion of, among other things, operating performance, trends, events or developments that we expect or anticipate will occur in the future, statements relating to volume growth, share of sales and earnings per share growth, and statements expressing general views about future operating results. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Forward-looking statements are not historical facts, but instead represent only the Company’s beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of the Company’s control. It is possible that the Company’s actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. Management believes that these forward-looking statements are reasonable as of the time made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. Our Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our Company's historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to the risks and uncertainties described in this report in “Item 1A. Risk Factors” and those described from time to time in our future reports filed with the Securities and Exchange Commission.

References in this Annual Report on Form 10-K to "U. S. Steel," "the Company," "we," "us," and "our" refer to United States Steel Corporation and its consolidated subsidiaries unless otherwise indicated by the context.

3

10-K SUMMARY

Our Vision is to become the Iconic Corporation, returning to our stature as a leading business in the United States. This vision is about more than U. S. Steel; it is about having a strong manufacturing presence in the United States of America.

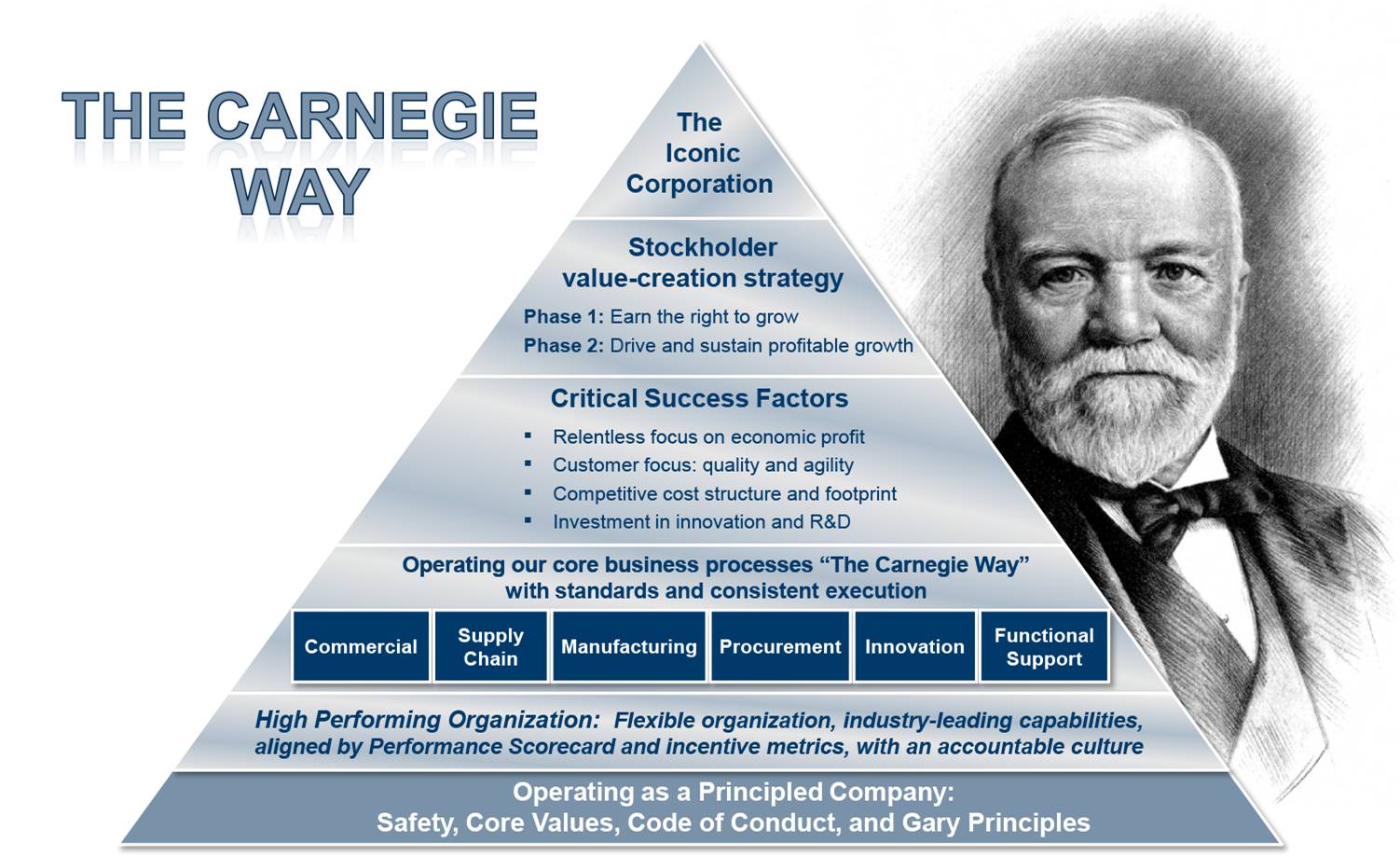

During 2015, we continued to transform U. S. Steel through the two phases of a focused execution on our stockholder value creation strategy: (1) earn the right to grow, and (2) drive and sustain profitable growth. Our long-term success depends on our ability to execute these phases and earn an economic profit across the business cycle. Through a disciplined approach we refer to as “The Carnegie Way,” we continue working toward strengthening our balance sheet, with a strong focus on cash flow, liquidity, and financial flexibility.

4

Based on the Carnegie Way philosophy, we have launched a series of initiatives that we believe will enable us to add value, re-shape the Company, and improve our performance across our core business processes, including commercial, supply chain, manufacturing, procurement, innovation, and operational and functional support. We are on a mission to become an iconic industry leader, as we create a sustainable competitive advantage with a relentless focus on economic profit, our customers, cost structure and innovation. In pursuing our financial goals, we will not sacrifice our commitment to safety and environmental stewardship. We recognize that achieving this goal requires exemplary leadership and collaboration of all employees.

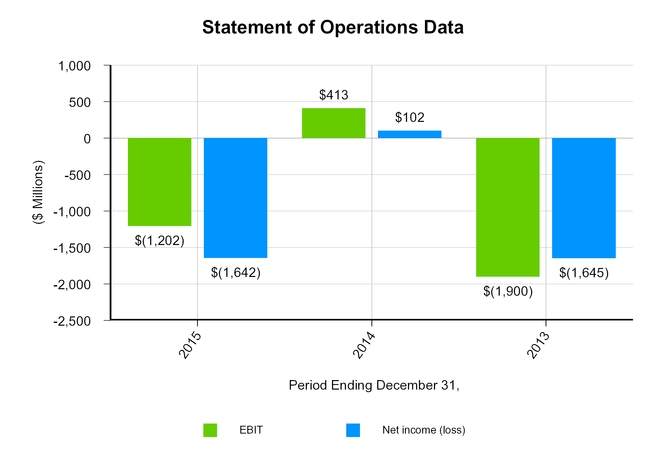

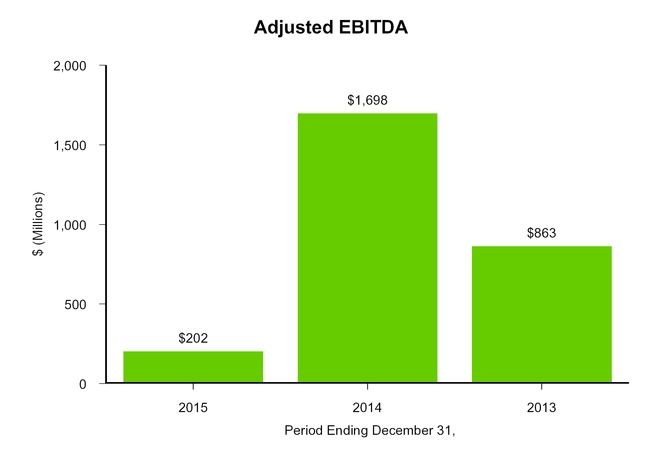

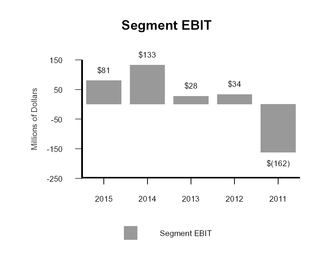

In 2015 and 2014, our earnings (loss) before interest and income taxes (EBIT) was $(1,202) million and $413 million, respectively, compared to adjusted EBITDA in 2015 and 2014 of $202 million and $1,698 million, respectively.

2015 vs. 2014 Consolidated Adjusted EBITDA(a)

($ in millions)

(a) Earnings (loss) before interest, income taxes, depreciation and amortization (EBITDA). Adjusted EBITDA is a non-GAAP measure, which is used as an additional measurement to enhance the understanding of our operating performance and facilitate a comparison with that of our competitors. The adjustments to EBITDA primarily consist of losses associated with U. S. Steel Canada, Inc., restructuring and impairment charges. See reconciliation to EBIT, as reported, on page 17.

5

KEY PERFORMANCE INDICATORS

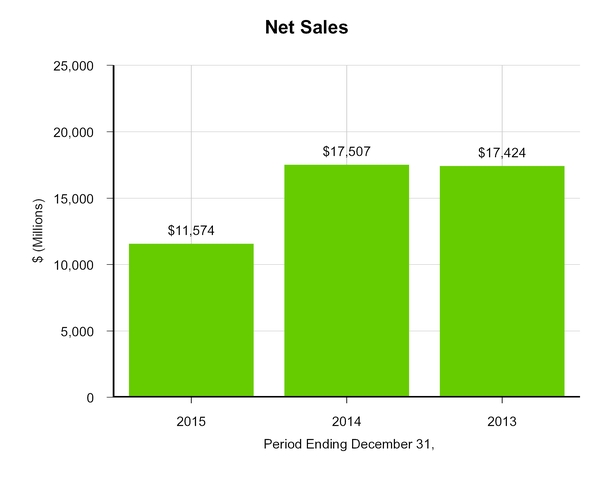

This section provides an overview of select key performance indicators for U. S. Steel which management and investors use to assess the Company's financial performance. It does not contain all of the information you should consider. Fluctuations for year to year changes are explained in Item 7. "Management's Discussion and Analysis of Financial Condition and Results of Operations." In addition, the results do not include U. S. Steel Canada Inc. (USSC) subsequent to USSC's filing for CCAA protection on September 16, 2014. Please read the entire Annual Report on Form 10-K.

• | The $815 million of Carnegie Way benefits realized in 2015 show that we continue to make significant progress toward our goal of achieving economic profit across the business cycle. Our progress is real and it is substantial, but our 2015 results show that it is not yet enough to fully overcome some of the worst market and business conditions we have seen. |

6

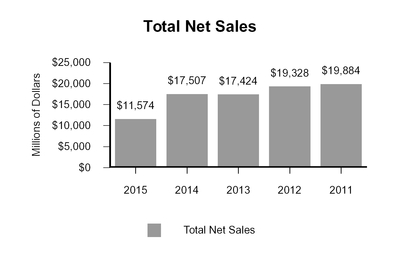

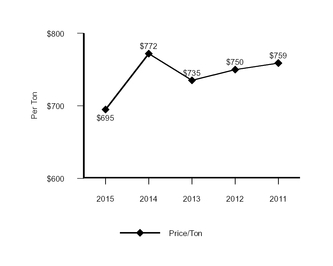

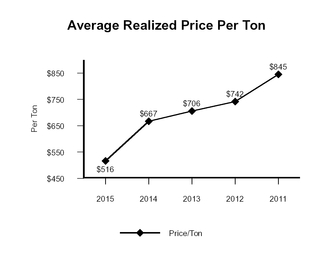

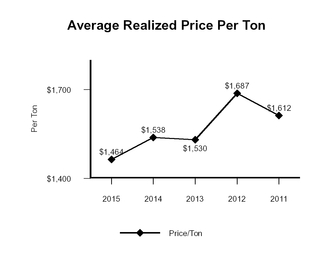

• | Decrease in net sales in 2015 is primarily due to decreased shipment volumes and lower average realized prices as a result of challenging market conditions, including high import levels, much of which we believe are unfairly traded, which have served to reduce shipment volumes and drastically depress both spot and contract prices. |

7

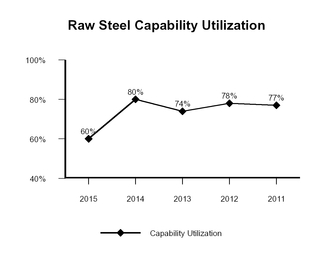

• | We reported positive adjusted EBITDA in 2015 under difficult market conditions and the lowest utilization of our steelmaking production facilities since 2009. |

• | See reconciliation to EBIT, as reported, on page 17. |

8

• | Our efforts towards achieving economic profit across the business cycle, guided by the Carnegie Way, continue, but in 2015, they were not enough to overcome some of the worst market and business conditions we have seen. |

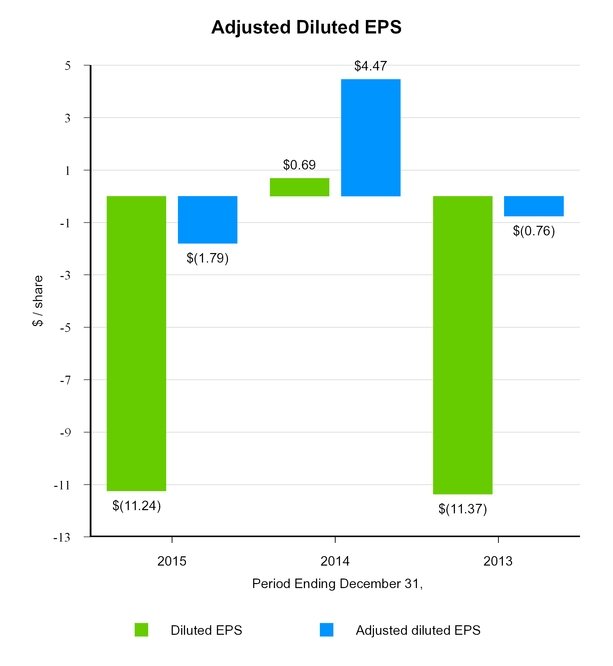

• | See reconciliation to net (loss) earnings attributable to United States Steel Corporation on page 15. |

9

• | See reconciliation to diluted net loss per share on page 16. |

10

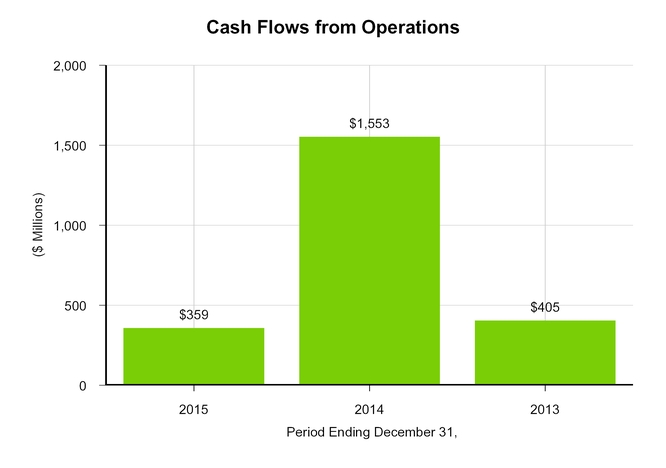

• | Positive cash from operations due to efficient working capital management in 2015. |

11

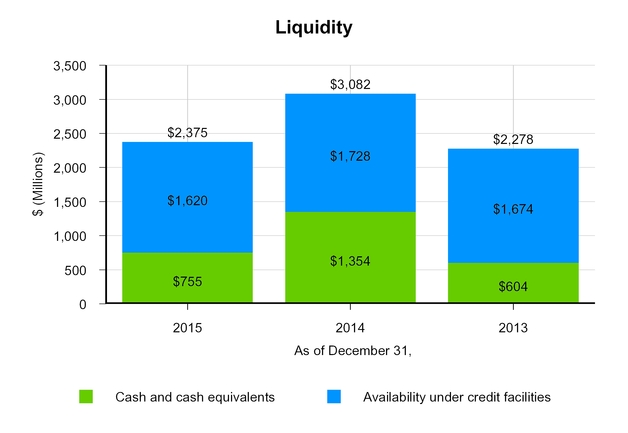

• | Maintaining strong cash and liquidity is a strategic priority. |

12

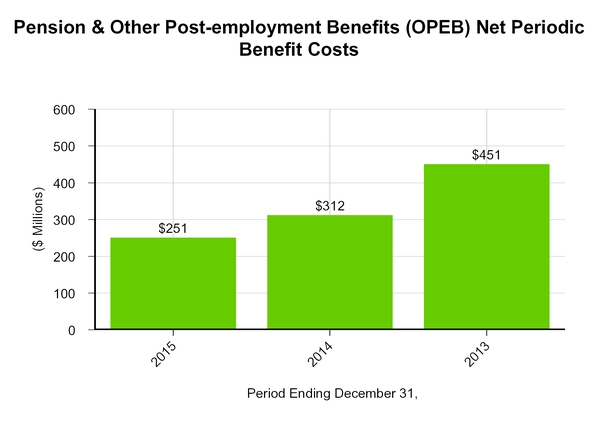

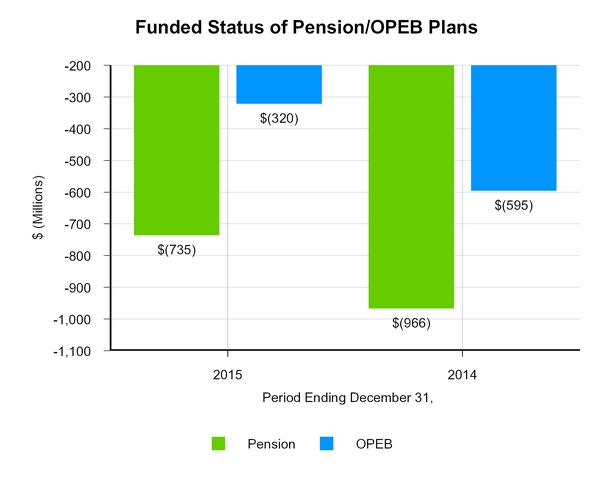

• | Decrease in expense is primarily due to the natural maturation of the plans, partially offset by a lower discount rate and a lower expected return on asset assumption. |

• | 2016 Pension and OPEB expense is expected to be approximately $93 million. |

• | For further details, see Note 17 to the Consolidated Financial Statements. |

13

• | An increase in the discount rate lowered pension and OPEB obligations and was partially offset by a decrease in the fair value of plan assets. |

• | As we maintain focus on strengthening the balance sheet, the unfunded status of our benefit plans is improving. This is partially attributable to the decision to freeze benefit accruals in the defined benefit pension plan and changes made to the OPEB plans. |

• | For further details, see Note 17 to the Consolidated Financial Statements. |

14

NON-GAAP FINANCIAL MEASURES

We present EBITDA, adjusted EBITDA, adjusted net earnings (loss) and adjusted net earnings (loss) per diluted share, which are non-GAAP measures, as an additional measurement to enhance the understanding of our operating performance and facilitate a comparison with that of our competitors. EBITDA is defined as earnings (loss) before interest, income taxes, depreciation and amortization. Adjusted EBITDA and adjusted net earnings (loss) are not, however, intended as alternative measures of operating results or cash flow from operations as determined in accordance with GAAP and are not necessarily comparable to similarly titled measures used by other companies.

(a) The adjustments included in this table have been tax affected at the quarterly effective tax rate with the exception of the fourth quarter of 2015 items which have been tax affected at a 0% tax rate due to the recognition of a full valuation allowance in the fourth quarter of 2015.

RECONCILIATION OF ADJUSTED NET (LOSS) EARNINGS (a) | ||||||||||||

Year Ended December 31, | ||||||||||||

(Dollars in millions) | 2015 | 2014 | 2013 | |||||||||

Reconciliation to net (loss) earnings attributable to United States Steel Corporation | ||||||||||||

Adjusted net (loss) earnings attributable to United States Steel Corporation | $ | (262 | ) | $ | 676 | $ | (110 | ) | ||||

Losses associated with U. S. Steel Canada Inc. | (266 | ) | (385 | ) | — | |||||||

Loss on shutdown of Fairfield Flat-Rolled operations (b) (c) | (53 | ) | — | — | ||||||||

Loss on shutdown of coke production facilities (c) | (65 | ) | — | — | ||||||||

Restructuring and other charges (c) (d) | (64 | ) | — | (258 | ) | |||||||

Granite City Works temporary idling charges | (99 | ) | — | — | ||||||||

Postemployment benefit actuarial adjustment | (26 | ) | — | — | ||||||||

Impairment of equity investment | (18 | ) | — | — | ||||||||

Loss on retirement of senior convertible notes | (36 | ) | — | — | ||||||||

Deferred tax asset valuation allowance | (753 | ) | — | — | ||||||||

Impairment of carbon alloy facilities (c) | — | (161 | ) | — | ||||||||

Litigation reserves | — | (46 | ) | — | ||||||||

Write-off of pre-engineering costs at Keetac (c) | — | (30 | ) | — | ||||||||

Loss on assets held for sale | — | (9 | ) | — | ||||||||

Gain on sale of real estate assets (e) | — | 45 | — | |||||||||

Curtailment gain | — | 12 | — | |||||||||

Impairment of goodwill | — | — | (1,795 | ) | ||||||||

Repurchase premium charge (f) | — | — | (22 | ) | ||||||||

Environmental remediation charge | — | — | (21 | ) | ||||||||

Write-off of equity investment | — | — | (15 | ) | ||||||||

Tax benefits (g) | — | — | 561 | |||||||||

Supplier contract dispute settlement | — | — | 15 | |||||||||

Total Adjustments | (1,380 | ) | (574 | ) | (1,535 | ) | ||||||

Net (loss) earnings attributable to United States Steel Corporation, as reported | $ | (1,642 | ) | $ | 102 | $ | (1,645 | ) | ||||

(b) Fairfield Flat-Rolled Operations includes the blast furnace and associated steelmaking operations, along with most of the flat-rolled finishing operations at Fairfield Works. The slab and rounds casters remain operational and the #5 coating line continues to operate.

(c) Included in restructuring and other charges on the Consolidated Statement of Operations.

(d) The 2015 amount consists primarily of employee related costs, including costs for severance, supplemental unemployment benefits and continuation of health care benefits. The 2013 amount is related primarily to the shut down of the iron and steelmaking facilities at Hamilton Works.

(e) Gain on sale of surface rights and mineral royalty revenue streams in the state of Alabama.

(f) Related to the repurchases of $542 million principal amount of our 2014 Senior Convertible Notes.

(g) Related to a tax restructuring and other items.

15

RECONCILIATION OF ADJUSTED NET (LOSS) EARNINGS PER SHARE | ||||||||||||

Year Ended December 31, | ||||||||||||

2015 | 2014 | 2013 | ||||||||||

Reconciliation to diluted net (loss) earnings per share | ||||||||||||

Adjusted diluted net (loss) earnings per share | $ | (1.79 | ) | $ | 4.47 | $ | (0.76 | ) | ||||

Losses associated with U. S. Steel Canada Inc. | (1.82 | ) | (2.52 | ) | — | |||||||

Loss on shutdown of Fairfield Flat-Rolled operations (a) (b) | (0.37 | ) | — | — | ||||||||

Loss on shutdown of coke production facilities (b) | (0.44 | ) | — | — | ||||||||

Restructuring and other charges (b)(c) | (0.44 | ) | — | (1.79 | ) | |||||||

Granite City Works temporary idling charges | (0.68 | ) | — | — | ||||||||

Postemployment benefit actuarial adjustment | (0.18 | ) | ||||||||||

Impairment of equity investment | (0.12 | ) | — | — | ||||||||

Loss on retirement of senior convertible notes | (0.25 | ) | — | — | ||||||||

Deferred tax asset valuation allowance | (5.15 | ) | — | — | ||||||||

Impairment of carbon alloy facilities (b) | — | (1.06 | ) | — | ||||||||

Litigation reserves | — | (0.31 | ) | — | ||||||||

Write-off of pre-engineering costs at Keetac (b) | — | (0.21 | ) | — | ||||||||

Loss on assets held for sale | — | (0.06 | ) | — | ||||||||

Gain on sale of real estate assets (d) | — | 0.30 | — | |||||||||

Curtailment gain | — | 0.08 | — | |||||||||

Impairment of goodwill | — | — | (12.41 | ) | ||||||||

Repurchase premium charge (e) | — | — | (0.15 | ) | ||||||||

Environmental remediation charge | — | — | (0.14 | ) | ||||||||

Write-off of equity investment | — | — | (0.10 | ) | ||||||||

Tax benefits (f) | — | — | 3.88 | |||||||||

Supplier contract dispute settlement | — | — | 0.10 | |||||||||

Total adjustments | (9.45 | ) | (3.78 | ) | (10.61 | ) | ||||||

Diluted net loss per share, as reported | $ | (11.24 | ) | $ | 0.69 | $ | (11.37 | ) | ||||

(a) Fairfield Flat-Rolled Operations includes the blast furnace and associated steelmaking operations, along with most of the flat-rolled finishing operations at Fairfield Works. The slab and rounds casters remain operational and the #5 coating line continues to operate.

(b) Included in restructuring and other charges on the Consolidated Statement of Operations.

(c) The 2015 amount consists primarily of employee related costs, including costs for severance, supplemental unemployment benefits and continuation of health care benefits. The 2013 amount is related primarily to the shut down of the iron and steelmaking facilities at Hamilton Works.

(d) Gain on sale of surface rights and mineral royalty revenue streams in the state of Alabama.

(e) Related to the repurchases of $542 million principal amount of our 2014 Senior Convertible Notes.

(f) Related to a tax restructuring and other items.

16

RECONCILIATION OF EBITDA AND ADJUSTED EBITDA | ||||||||||||

Year Ended December 31, | ||||||||||||

(Dollars in millions) | 2015 | 2014 | 2013 | |||||||||

Reconciliation to (loss) earnings before interest and income taxes (EBIT) | ||||||||||||

Adjusted EBITDA | $ | 202 | $ | 1,698 | $ | 863 | ||||||

Losses associated with U. S. Steel Canada Inc. | (392 | ) | (416 | ) | — | |||||||

Loss on shutdown of Fairfield Flat-Rolled operations (a) (b) | (91 | ) | — | — | ||||||||

Loss on shutdown of coke production facilities (b) | (153 | ) | — | — | ||||||||

Restructuring and other charges (b)(c) | (78 | ) | — | (248 | ) | |||||||

Granite City Works temporary idling charges | (99 | ) | — | — | ||||||||

Postemployment benefit actuarial adjustment | (26 | ) | — | — | ||||||||

Impairment of equity investment | (18 | ) | — | — | ||||||||

Impairment of carbon alloy facilities (b) | — | (195 | ) | — | ||||||||

Litigation reserves | — | (70 | ) | — | ||||||||

Write-off of pre-engineering costs at Keetac (b) | — | (37 | ) | — | ||||||||

Loss on assets held for sale | — | (14 | ) | — | ||||||||

Gain on sale of real estate assets (d) | — | 55 | — | |||||||||

Curtailment gain | — | 19 | — | |||||||||

Impairment of goodwill | — | — | (1,806 | ) | ||||||||

Environmental remediation charge | — | — | (32 | ) | ||||||||

Write-off of equity investment | — | — | (16 | ) | ||||||||

Supplier contract dispute settlement | — | — | 23 | |||||||||

EBITDA | (655 | ) | 1,040 | (1,216 | ) | |||||||

Depreciation, depletion and amortization expense | (547 | ) | (627 | ) | (684 | ) | ||||||

EBIT, as reported (e) | $ | (1,202 | ) | $ | 413 | $ | (1,900 | ) | ||||

(a) Fairfield Flat-Rolled Operations includes the blast furnace and associated steelmaking operations, along with most of the flat-rolled finishing operations at Fairfield Works. The slab and rounds casters remain operational and the #5 coating line continues to operate.

(b) Included in restructuring and other charges on the Consolidated Statement of Operations.

(c) The 2015 amount consists primarily of employee related costs, including costs for severance, supplemental unemployment benefits and continuation of health care benefits. The 2013 amount is related primarily to the shut down of the iron and steelmaking facilities at Hamilton Works.

(d) Gain on sale of surface rights and mineral royalty revenue streams in the state of Alabama.

(e) Adjustments to reconcile to net (loss) earnings are derived from the face of the Consolidated Statements of Operations and include net interest and other financial costs, and income tax provision (benefit).

17

PART I

Item 1. BUSINESS

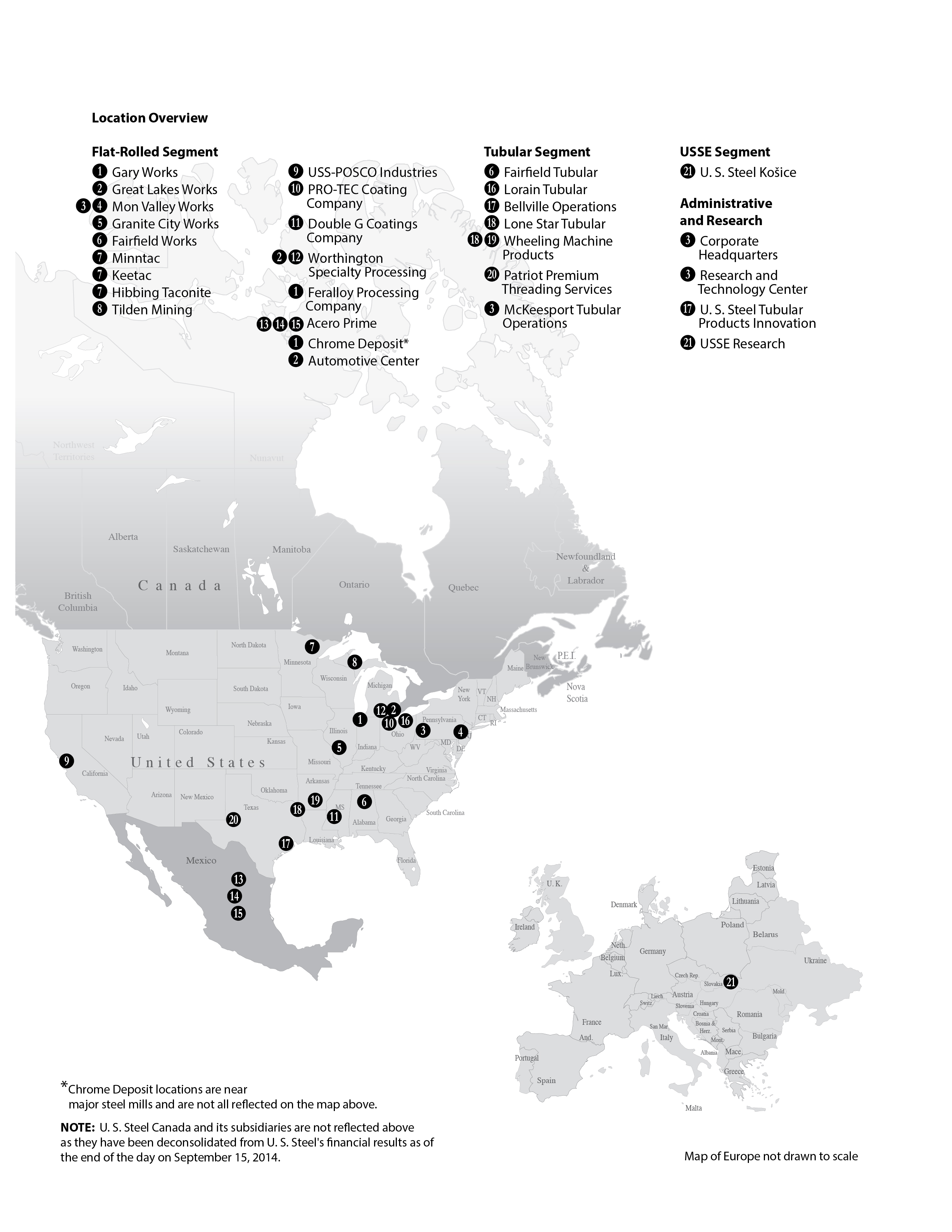

United States Steel Corporation (U. S. Steel) is an integrated steel producer of flat-rolled and tubular products with major production operations in North America and Europe. An integrated steel producer uses iron ore and coke as primary raw materials for steel production. U. S. Steel has annual raw steel production capability of 22.0 million net tons (17.0 million tons in the United States and 5.0 million tons in Europe), which reflects a reduction of 2.4 million tons as a result of the permanent shutdown of the blast furnace and associated steelmaking operations, along with most of the flat-rolled finishing operations at Fairfield Works, during the third quarter of 2015. According to worldsteel Association’s latest published statistics, U. S. Steel was the fifteenth largest steel producer in the world in 2014. U. S. Steel is also engaged in other business activities consisting primarily of railroad services and real estate operations.

During 2015, we continued to transform U. S. Steel through the two phases of a focused execution on our stockholder value creation strategy: (1) earn the right to grow, and (2) drive and sustain profitable growth. Through a disciplined approach we refer to as “The Carnegie Way,” we continue working toward strengthening our balance sheet, with a strong focus on cash flow, liquidity, and financial flexibility. Based on this philosophy, we have launched a series of initiatives that we believe will enable us to add value, re-shape the Company, and improve our performance across our core business processes, including commercial, supply chain, manufacturing, procurement, innovation, and operational and functional support. We are on a mission to become an iconic industry leader, as we create a sustainable competitive advantage with a relentless focus on economic profit, our customers, cost structure and innovation. In pursuing our financial goals, we will not sacrifice our commitment to safety and environmental stewardship. We recognize that achieving this goal requires exemplary leadership and collaboration of all employees, and we are committed to attracting, developing and retaining a workforce with the talent and skills needed for our long-term success.

The Company had a net loss of $1.6 billion in 2015, and faced significant price and volume headwinds, particularly in the second half of the year, but finished 2015 with adjusted EBITDA of $202 million despite a nearly $6 billion decrease in revenues from 2014.

We made several difficult decisions in 2015 in response to the conditions in the markets we serve, including the permanent shut down of our steelmaking operations at Fairfield Works and the temporary idling of Granite City Works and our Keetac mining operations. We also had a significant number of lay-offs at other facilities that are operating at reduced rates.

We continued to generate cash flow throughout 2015, finishing the year with $359 million of operating cash flow and repaid $379 million of debt in 2015.

Our structured approach, using the Carnegie Way value creation methodology, gives us the confidence that we can continue to make progress and create value for our customers, and when we create value for our customers, we create value for all of our stakeholders - our stockholders, our suppliers, our employees and the communities where we do business.

18

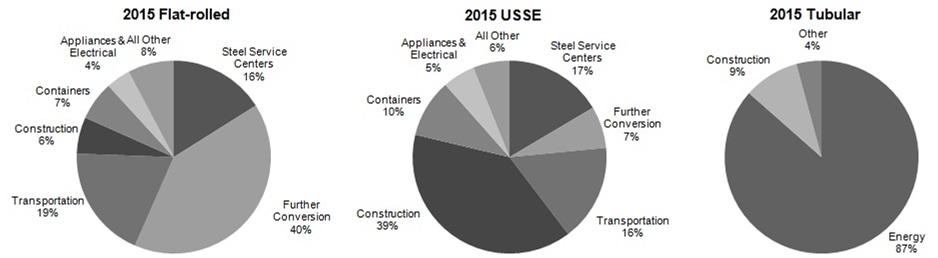

Segments

U. S. Steel has three reportable operating segments: Flat-Rolled Products (Flat-Rolled), U. S. Steel Europe (USSE) and Tubular Products (Tubular). The results of our railroad and real estate businesses that do not constitute reportable segments are combined and disclosed in the Other Businesses category.

The Flat-Rolled segment includes the operating results of U. S. Steel’s integrated steel plants and equity investees in the United States involved in the production of slabs, rounds, strip mill plates, sheets and tin mill products, as well as all iron ore and coke production facilities in the United States. These operations primarily serve North American customers in the service center, conversion, transportation (including automotive), construction, container, and appliance and electrical markets. Flat-Rolled also supplies steel rounds and hot-rolled bands to Tubular. In the third quarter of 2015, the blast furnace and associated steelmaking operations along with most of the flat-rolled finishing operations at Fairfield Works were shutdown. Therefore, Flat-Rolled is currently not supplying rounds to Tubular.

On September 16, 2014, U. S. Steel Canada, Inc. (USSC), a wholly owned subsidiary of U. S. Steel, applied for relief from its creditors pursuant to Canada’s Companies’ Creditors Arrangement Act (CCAA). As a result of USSC filing for CCAA protection (CCAA filing), U. S. Steel determined that USSC and its subsidiaries would be deconsolidated from U. S. Steel’s financial statements on a prospective basis effective as of the date of the CCAA filing. We recorded total non-cash charges of $392 million related to the write down of our retained interest and other charges in 2015 and $416 million in 2014 related to the deconsolidation of USSC. Subsequent to USSC's CCAA filing on September 16, 2014, the Flat-Rolled segment information does not include USSC, but transactions between U. S. Steel and USSC are considered related party transactions.

Effective January 1, 2015, the Flat-Rolled segment was realigned to better service customer needs through the creation of five commercial entities to specifically address customers in the automotive, consumer, industrial, service center and mining market sectors.

Beginning January 1, 2016, the Flat-Rolled segment has been further streamlined and consolidated to consist of three commercial entities: automotive, consumer, which includes the packaging, appliance and construction industries, and the combined industrial, service center and mining commercial entities. This realignment will not affect the Company's reportable segments as they currently exist. For further information, see Item 1. "Business Strategy."

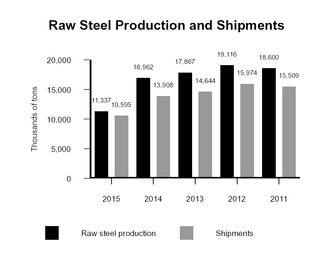

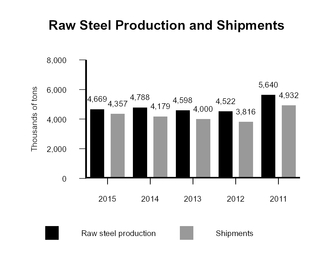

Flat-Rolled has annual raw steel production capability of 17.0 million tons. Prior to the permanent shut down of the Fairfield Flat-Rolled operations beginning in August 2015, the CCAA filing and the deconsolidation of USSC in September 2014, and the permanent shut down of the iron and steelmaking facilities at Hamilton Works in December 2013, annual raw steel production capability for Flat-Rolled was 19.4 million tons, 22.0 million tons and 24.3 million tons, respectively. Raw steel production was 11.3 million tons in 2015, 17.0 million tons in 2014 and 17.9 million tons in 2013. Raw steel production averaged 60 percent of capability in 2015, 80 percent of capability in 2014 and 74 percent of capability in 2013.

The USSE segment includes the operating results of U. S. Steel Košice (USSK), U. S. Steel’s integrated steel plant and coke production facilities in Slovakia. USSE primarily serves customers in the European construction, service center, conversion, container, transportation (including automotive), appliance and electrical, and oil, gas and petrochemical markets. USSE produces and sells slabs, sheet, strip mill plate, tin mill products and spiral welded pipe, as well as heating radiators and refractory ceramic materials.

USSE has annual raw steel production capability of 5.0 million tons. USSE’s raw steel production was 4.7 million tons in 2015, 4.8 million tons in 2014, and 4.6 million tons in 2013. USSE’s raw steel production averaged 93 percent of capability in 2015, 96 percent of capability in 2014 and 92 percent of capability in 2013.

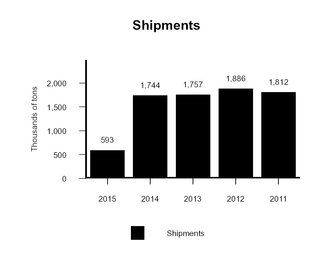

The Tubular segment includes the operating results of U. S. Steel’s tubular production facilities, primarily in the United States, and equity investees in the United States and Brazil. These operations produce and sell seamless and electric resistance welded (ERW) steel casing and tubing (commonly known as oil country tubular goods or OCTG), standard and line pipe and mechanical tubing and primarily serve customers in the oil, gas and petrochemical markets. Tubular’s annual production capability is 2.8 million tons and U. S. Steel is the largest domestic supplier of OCTG. U. S. Steel Tubular Products, Inc. (USSTP) is designing and developing a range of premium and semi-premium connections to address the growing needs for technical solutions to our end users' well site production challenges. USSTP also offers rig site services, which provides the technical expertise for proper installation of our tubular products and proprietary connections at the well site.

19

For further information, see Note 3 to the Consolidated Financial Statements.

20

Financial and Operational Highlights

Steel Shipments by Product and Segment

The following table shows steel shipments to end customers, joint ventures and equity investees of U. S. Steel.

(Thousands of Tons) | Flat-Rolled | USSE | Tubular | Total | ||||||||

Product—2015 | ||||||||||||

Hot-rolled Sheets | 3,283 | 1,165 | — | 4,448 | ||||||||

Cold-rolled Sheets | 3,507 | 470 | — | 3,977 | ||||||||

Coated Sheets | 2,511 | 865 | — | 3,376 | ||||||||

Tin Mill Products | 927 | 428 | — | 1,355 | ||||||||

Oil country tubular goods (OCTG) | — | — | 345 | 345 | ||||||||

Standard and line pipe | — | 55 | 248 | 303 | ||||||||

Semi-finished and Plates | 47 | 1,374 | — | 1,421 | ||||||||

Other | 320 | — | — | 320 | ||||||||

TOTAL | 10,595 | 4,357 | 593 | 15,545 | ||||||||

Memo: Intersegment Shipments from Flat-Rolled to Tubular | ||||||||||||

Hot-rolled sheets | 219 | |||||||||||

Rounds | 197 | |||||||||||

Product—2014 | ||||||||||||

Hot-rolled Sheets | 4,909 | 1,374 | — | 6,283 | ||||||||

Cold-rolled Sheets | 4,207 | 518 | — | 4,725 | ||||||||

Coated Sheets | 3,316 | 775 | — | 4,091 | ||||||||

Tin Mill Products | 1,180 | 411 | — | 1,591 | ||||||||

Oil country tubular goods (OCTG) | — | — | 1,308 | 1,308 | ||||||||

Standard and line pipe | — | 62 | 314 | 376 | ||||||||

Semi-finished and Plates | 165 | 1,039 | — | 1,204 | ||||||||

Other | 131 | — | 122 | 253 | ||||||||

TOTAL | 13,908 | 4,179 | 1,744 | 19,831 | ||||||||

Memo: Intersegment Shipments from Flat-Rolled to Tubular | ||||||||||||

Hot-rolled sheets | 863 | |||||||||||

Rounds | 849 | |||||||||||

Product—2013 | ||||||||||||

Hot-rolled Sheets | 5,028 | 1,426 | — | 6,454 | ||||||||

Cold-rolled Sheets | 4,347 | 553 | — | 4,900 | ||||||||

Coated Sheets | 3,599 | 762 | — | 4,361 | ||||||||

Tin Mill Products | 1,204 | 385 | — | 1,589 | ||||||||

Oil country tubular goods (OCTG) | — | — | 1,370 | 1,370 | ||||||||

Standard and line pipe | — | 69 | 264 | 333 | ||||||||

Semi-finished and Plates | 466 | 805 | — | 1,271 | ||||||||

Other | — | — | 123 | 123 | ||||||||

TOTAL | 14,644 | 4,000 | 1,757 | 20,401 | ||||||||

Memo: Intersegment Shipments from Flat-Rolled to Tubular | ||||||||||||

Hot-rolled sheets | 923 | |||||||||||

Rounds | 776 | |||||||||||

21

Steel Shipments by Market and Segment

The following table does not include shipments to end customers by joint ventures and other equity investees of U. S. Steel. Shipments of materials to these entities are included in the “Further Conversion – Joint Ventures” market classification. No single customer accounted for more than 10 percent of gross annual revenues.

(Thousands of Tons) | Flat-Rolled | USSE | Tubular | Total | ||||||||

Major Market – 2015 | ||||||||||||

Steel Service Centers | 1,702 | 718 | — | 2,420 | ||||||||

Further Conversion – Trade Customers | 3,039 | 304 | — | 3,343 | ||||||||

– Joint Ventures | 1,254 | — | — | 1,254 | ||||||||

Transportation (Including Automotive) | 2,011 | 705 | — | 2,716 | ||||||||

Construction and Construction Products | 649 | 1,703 | 55 | 2,407 | ||||||||

Containers | 692 | 424 | — | 1,116 | ||||||||

Appliances and Electrical Equipment | 429 | 236 | — | 665 | ||||||||

Oil, Gas and Petrochemicals | — | — | 513 | 513 | ||||||||

Exports from the United States | 234 | — | 25 | 259 | ||||||||

All Other | 585 | 267 | — | 852 | ||||||||

TOTAL | 10,595 | 4,357 | 593 | 15,545 | ||||||||

Major Market – 2014 | ||||||||||||

Steel Service Centers | 2,578 | 682 | — | 3,260 | ||||||||

Further Conversion – Trade Customers | 4,013 | 299 | — | 4,312 | ||||||||

– Joint Ventures | 1,519 | — | — | 1,519 | ||||||||

Transportation (Including Automotive) | 2,445 | 674 | — | 3,119 | ||||||||

Construction and Construction Products | 775 | 1,584 | 122 | 2,481 | ||||||||

Containers | 1,287 | 403 | — | 1,690 | ||||||||

Appliances and Electrical Equipment | 616 | 267 | — | 883 | ||||||||

Oil, Gas and Petrochemicals | — | 3 | 1,545 | 1,548 | ||||||||

Exports from the United States | 263 | — | 77 | 340 | ||||||||

All Other | 412 | 267 | — | 679 | ||||||||

TOTAL | 13,908 | 4,179 | 1,744 | 19,831 | ||||||||

Major Market – 2013 | ||||||||||||

Steel Service Centers | 2,721 | 560 | — | 3,281 | ||||||||

Further Conversion – Trade Customers | 4,409 | 286 | — | 4,695 | ||||||||

– Joint Ventures | 1,664 | — | — | 1,664 | ||||||||

Transportation (Including Automotive) | 2,480 | 709 | — | 3,189 | ||||||||

Construction and Construction Products | 773 | 1,501 | 132 | 2,406 | ||||||||

Containers | 1,259 | 393 | — | 1,652 | ||||||||

Appliances and Electrical Equipment | 666 | 275 | — | 941 | ||||||||

Oil, Gas and Petrochemicals | — | 15 | 1,540 | 1,555 | ||||||||

Exports from the United States | 365 | — | 85 | 450 | ||||||||

All Other | 307 | 261 | — | 568 | ||||||||

TOTAL | 14,644 | 4,000 | 1,757 | 20,401 | ||||||||

22

Business Strategy

During 2015, we have continued to transform U. S. Steel through the two phases of a focused execution on our stockholder value creation strategy: (1) earn the right to grow, and (2) drive and sustain profitable growth. Through a disciplined approach we refer to as “The Carnegie Way,” we continue working toward strengthening our balance sheet, with a strong focus on cash flow, liquidity, and financial flexibility and have launched a series of initiatives that we believe will enable us to add value, re-shape the Company, and improve our performance across our core business processes, including commercial, supply chain, manufacturing, procurement, innovation, and operational and functional support. We are on a mission to become an iconic industry leader, as we create a sustainable competitive advantage with a relentless focus on economic profit, customers, cost structure and innovation. In pursuing our financial goals, we will not sacrifice our commitment to safety and environmental stewardship. We recognize that achieving this goal requires exemplary leadership and collaboration of all employees, and we are committed to attracting, developing and retaining a workforce with the talent and skills needed for our long-term success.

As part of the Carnegie Way transformation process, during 2015, the Company's Flat-Rolled, USSE and Tubular reportable segments were realigned to target achieving the following strategic goals:

• | collaborate better with our customers to create and deliver smarter, more innovative relationships in order to be a more customer-centric global solutions provider; |

• | provide focus to Carnegie Way projects within the operating units including reliability centered maintenance and quality, with a continued commitment to safety; and |

• | continue earning the right to grow by creating clearer and more focused and effective accountability. |

During the fourth quarter of 2015, we completed a strategic review of our business. As a result of that review, we realigned certain portions of our business to strengthen customer intimacy, operational excellence, and personal and professional accountability, streamlining our executive management team, reducing costs, and integrating innovation within our accountable commercial entity structure. U. S. Steel continuously evaluates potential strategic and organizational opportunities, which may include the acquisition, divestiture or consolidation of assets. The Company will pursue opportunities based on the financial condition of the Company, its long-term strategy, and what the Board of Directors determines to be in the best interests of the Company's stockholders.

Beginning January 1, 2016, the Company's Flat-Rolled facilities report through three streamlined and consolidated commercial entities: automotive, consumer, and the combined industrial, service center and mining commercial entities.

The commercial entities have worked, and continue to work, to position the Company to be best-in-class in innovation, quality and providing customer service and solutions to our customers. The strategic move to position operations within the streamlined commercial entities enhances our ability to better hear the voice of the customer, ensuring that we deliver superior value and drive results in the markets we serve.

This realignment will not affect the Company's reportable segments as they currently exist.

Automotive Solutions is based at the Company's Automotive Center in Troy, Michigan, where the Company works jointly with customers to develop solutions using its expertise as well as the next generation of advanced high-strength steel to address challenges facing the automotive industry, including increased fuel economy standards and enhanced safety requirements.

Consumer Solutions partners with customers in the appliance, packaging, container and construction markets. Consumer Solutions has a robust presence with our tin customers, who represent more than one quarter of this market category. Additional product lines within the market category include the Company's COR-TEN AZP®, ACRYLUME®, GALVALUME® and Weathered Metals Series®.

Industrial, Service Center and Mining Solutions focuses on the Company's customers in the pipe and tube manufacturing market, the agricultural and industrial equipment markets, as well as operations relating to the Company's Minnesota Ore Operations facilities - Minntac in Mt. Iron, MN, and Keetac in Keewatin, MN, and the Company's iron ore equity joint ventures. U. S. Steel's integrated steel plants are the primary customers of Mining Solutions.

USSE's customer focus has accelerated to further conform with the Company's Carnegie Way transformation efforts.

23

The Tubular segment's commercial and manufacturing operations have been aligned to include customer solutions for the oil and gas industry, focusing on the end user customer from the Company's production facilities to rig well sites.

We believe this enhanced commercial concentration will put U. S. Steel in a stronger position to be best-in-class in product innovation, quality and providing service and solutions to our customers, as well as steel manufacturing.

24

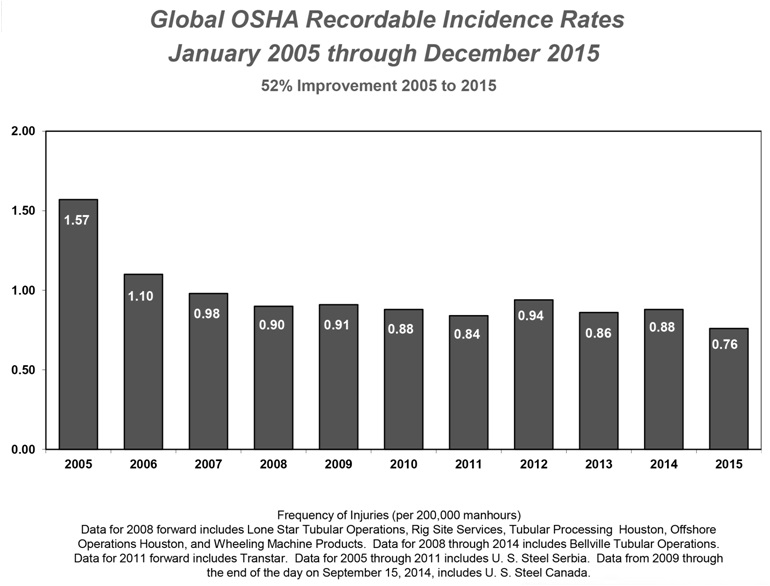

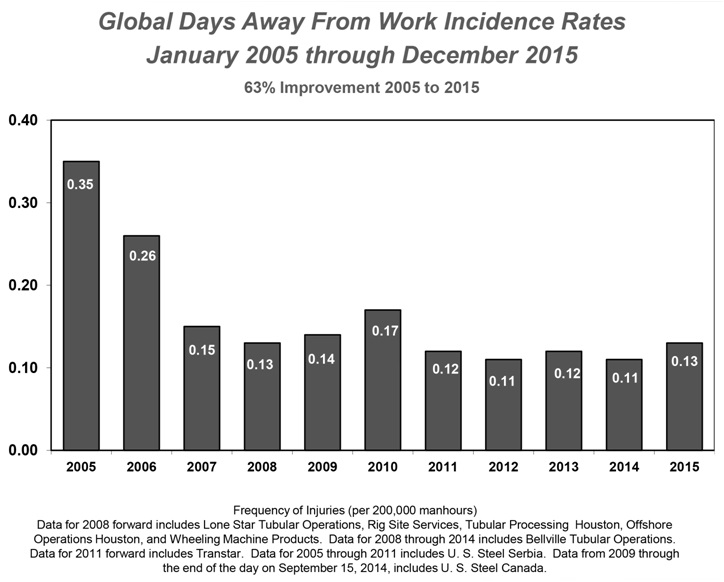

Safety

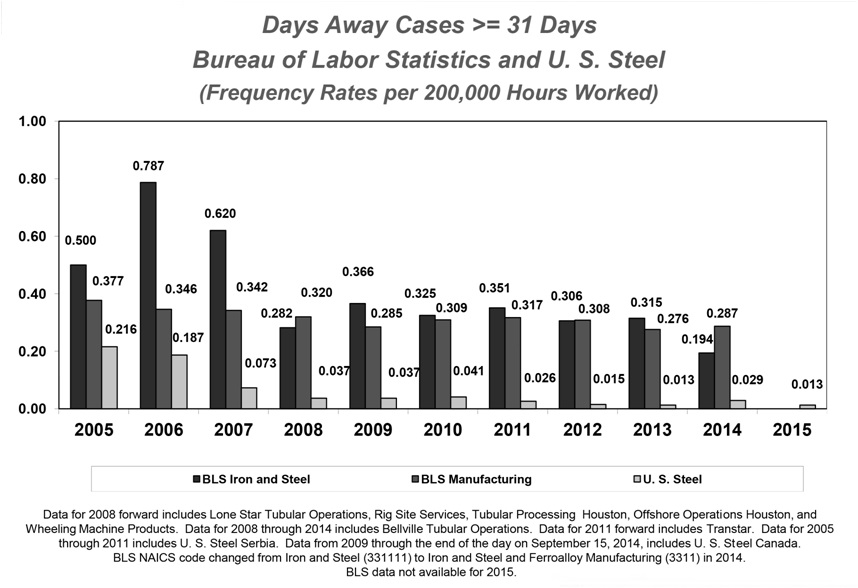

U. S. Steel has a long standing commitment to the safety of our employees, and we have prioritized safety and improving safety performance as one of our core values. We also recognize that ensuring a safe workplace also improves productivity, quality, reliability and financial performance. A "safety first" mindset is essential to our success as a business. Through 2015 the ten year trends for our global key safety measurements: recordable injuries, days away from work rate and severity rate showed improvement of 52 percent, 63 percent and 94 percent respectively, as shown in the following graphs.

25

26

Environmental Stewardship

Throughout its history, U. S. Steel has either led the industry or used methods consistent with prevailing industry practices in its commitment to environmental stewardship. We have implemented and continue to develop business practices that are environmentally efficient. We believe part of being a good corporate citizen requires a dedicated focus on how our industry affects the environment, and have taken the actions described below in furtherance of that goal.

The Executive Environmental Committee, which is comprised of U. S. Steel officers and other key leaders, meets regularly to review environmental issues and compliance. Also, U. S. Steel, largely through the American Iron and Steel Institute (AISI), the worldsteel Association and the European Confederation of Iron and Steel Industries (Eurofer), is involved in the promotion of cost effective environmental strategies through the development of appropriate air, water, waste and climate change laws and regulations at the local, state, national and international levels.

We are committed to reducing emissions as well as our carbon footprint. We have investigated, created and implemented innovative, best practice solutions throughout U. S. Steel to manage and reduce energy consumption and greenhouse gas (GHG) emissions. We are also committed to investing in technologies to further improve the environmental performance of our steelmaking process. In addition, we continue to focus on implementing energy reduction strategies, use of efficient energy sources, waste reduction management and the utilization of by-product fuels.

According to the American Iron and Steel Institute, relative to competing materials, steel has approximately one-fifth the carbon footprint of aluminum, one-twelfth the footprint of magnesium, and about one-ninth the footprint of carbon fiber composites. Our Advanced High Strength Steels used in today’s vehicles affords significant light-weighting opportunities. When comparing steel to aluminum in terms of sustainability, steel has a smaller carbon footprint and costs less.

U. S. Steel has historically recycled between 4 and 5 million tons of purchased and produced steel scrap every year. Because of steel’s physical properties, our products can be recycled at the end of their useful life without loss of quality, contributing to steel’s high recycling rate and affordability. Comparatively, due to limitations in aluminum processing, very little recycled aluminum is included in aluminum sheet goods used for automotive or aircraft applications. This means that any increased use of aluminum sheet for high-end applications must come from greenhouse gas (GHG) intensive primary aluminum, which generates significantly more GHG emissions than steel.

All of our major production facilities have Environmental Management Systems that are certified to the ISO 14001 Standard. This standard, published by the International Organization for Standardization, provides the framework for the measurement and improvement of environmental impacts of the certified facility.

Commercial Strategy

Our commercial strategy is focused on providing customer focused solutions with value-added steel products, including advanced high strength steels and coated sheets for the automotive and appliance industries, electrical steel sheets for the manufacture of motors and electrical equipment, galvanized and Galvalume® sheets for construction, tin mill products for the container industry and OCTG and premium connections for the oil and gas industry, including steel for the North American shale oil and gas markets.

We are committed to anticipating our customers' changing needs by developing new steel products and uses for steel that meet the evolving regulatory requirements imposed on them. In connection with this commitment, we have research centers in Pittsburgh, Pennsylvania, and Košice, Slovakia, an automotive center in Troy, Michigan and an innovation and technology center for Tubular products in Houston, Texas. The focus of these centers is to develop new products and work with our customers to better serve their needs. Examples of our customer focused product innovation include the development of advanced high strength steels, including Dual-Ten® and Transformation Induced Plasticity (TRIP) steels, that provide high strength to meet automobile passenger safety requirements while significantly reducing weight to meet vehicle fuel efficiency requirements; and a line of premium and semi-premium tubular connections to meet our customers’ increasingly complex needs for offshore and horizontal drilling. Designed and developed at the Innovation and Technology Center in Houston, USS- Liberty TC™ is the first domestically made threaded and coupled premium connection with a metal-to-metal seal that has been tested to the 2014 version of API 5C5 CAL IV. USS- Liberty TC™ was successfully installed by a subsidiary of Range Resources Corporation and is available to other energy producers. This work in premium connection development is supported by our investment in a new full scale

27

tubular connection test frame located at Offshore Operations in Houston, Texas. Please refer to Item I. Business Strategy for further details of our commercial entities and related strategies.

Capital Projects and Other Investments

We are currently developing projects within our Flat-Rolled, USSE and Tubular segments, such as facility enhancements, advanced high strength steels and additional premium connections, that will further improve our ability to support our customers’ evolving needs and increase our value-added product capabilities. We are nearing the completion of our efforts to implement an Enterprise Resource Planning (ERP) system to replace our existing information technology systems, which will enable us to operate more efficiently, and we anticipate this implementation will be completed in 2016. The completion of the ERP system is expected to provide further opportunities to streamline, standardize and centralize business processes in order to maximize cost effectiveness, efficiency and control across our global operations.

With reduced pricing for iron ore, management is considering its options with respect to the Company's iron ore position in the United States. The Company is also exploring opportunities related to the availability of reasonably priced natural gas as an alternative to coke in the iron reduction process to improve our cost competitiveness, while reducing our dependence on coal and coke. After receiving the necessary authorizations from the Jefferson County Department of Health and the Alabama Department of Environmental Management for the Fairfield electric arc furnace (EAF) project, construction began in the second quarter of 2015, but due to challenging market conditions resulting from depressed oil prices and reduced oil rig counts, the construction of the Fairfield EAF has been delayed until market conditions improve.

Workforce

At U. S. Steel, we are committed to attracting, developing, and retaining a workforce of talented, diverse people — all working together to deliver superior results for our Company, stockholders, customers and communities. We regularly review our human capital needs and focus on the selection, development and retention of employees in order to sustain and enhance our competitive position in the markets we serve.

Capital Structure and Liquidity

Our primary financial goal is to enhance our capital structure, liquidity, and financial flexibility by deploying cash strategically as we earn the right to grow. Our cash deployment strategy includes maintaining a healthy pension plan; delivering operational excellence with a focus on safety, quality and reliability; and improving the outcomes of capital investments. In 2015, we implemented a program called "Quick Wins," to focus on low complexity, low dollar, high return capital projects, while at the same time, putting more focus and discipline around the business outcomes of larger, strategic projects.

During 2015, U. S. Steel repaid $379 million of debt. We ended 2015 with $755 million of cash and cash equivalents on hand and total liquidity of approximately $2.4 billion.

Steel Industry Background and Competition

U. S. Steel's competitive position may be affected by, among other things, differences among U. S. Steel's and its competitors' cost structure, labor costs, environmental remediation and compliance costs and the existence and magnitude of government subsidies.

U. S. Steel competes with many North American and international steel producers. Competitors include integrated producers, which, like U. S. Steel, use iron ore and coke as the primary raw materials for steel production, as well as electric arc furnace (EAF) producers, which primarily use steel scrap and other iron-bearing feedstocks as raw materials. Global steel capacity has continued to increase, with some published sources estimating that steel capacity in China alone is at or is nearing one billion metric tons per year. In addition, other products, such as aluminum, plastics and composites, compete with steel in some applications.

EAF producers typically require lower capital expenditures for construction of facilities and may have lower total employment costs; however, these competitive advantages may be minimized or eliminated by the cost of scrap when scrap prices are high. Some mini-mills utilize thin slab casting technology to produce flat-rolled products and are increasingly able to compete directly with integrated producers in a number of flat-rolled product applications previously produced only by integrated steelmakers.

28

U. S. Steel provides defined benefit pension and/or other postretirement benefits to approximately 105,000 current employees, retirees and their beneficiaries. Most of our other competitors do not have comparable retiree obligations. Effective December 31, 2015, the Company froze the defined benefit pension plans for non-union participants.

The global steel industry is cyclical, highly competitive and has historically been characterized by overcapacity.

U. S. Steel believes that our major North American and many European integrated steel competitors are confronted with substantially similar environmental regulatory conditions and thus does not believe that its relative position with regard to such competitors will be materially affected by the impact of environmental laws and regulations. However, if the final regulations do not recognize the fact that the integrated steel process involves a series of chemical reactions involving carbon that create CO2 emissions, our competitive position relative to mini-mills will be adversely impacted. Our competitive position compared to producers in developing nations such as China, Russia, Ukraine and India, will be harmed unless such nations require commensurate reductions in CO2 emissions. Competing materials such as plastics may not be similarly impacted. The specific impact on each competitor will vary depending on a number of factors, including the age and location of its operating facilities and its production methods. U. S. Steel is also responsible for remediation costs related to former and present operating locations and disposal of environmentally sensitive materials. Many of our competitors, including North American producers, or their successors, that have been the subject of bankruptcy relief have no or substantially lower liabilities for such environmental remediation matters.

U. S. Steel faces competition from foreign steel producers, many of which are heavily subsidized by their governments and dump steel into the U.S. market. Trade-distorting policies and practices, coupled with global steel overcapacity, impact pricing in the U.S. market and influence the Company's ability to compete on a level playing field. For a detailed discussion of international trade issues impacting the Company and the actions the Company has taken to address them see Part II, "Item 7. - Management's Discussion and Analysis" for further details regarding U.S. Steel's international trade and global public policy.

29

Facilities and Locations

30

Flat-Rolled

During 2015, U. S. Steel adjusted its operating levels at several of its Flat-Rolled operations as a result of unfavorable market conditions, primarily driven by dramatically lower oil prices, lower steel prices, and the impact of the stronger U.S. dollar, global overcapacity and imports on our operations. Customer order rates will determine the size and duration of any adjustments that we make at our Flat-Rolled operations during 2016.

Except for the Fairfield pipe facility, the operating results of all facilities within U. S. Steel’s integrated steel plants in the U.S. are included in Flat-Rolled. These facilities include Gary Works, Great Lakes Works, Mon Valley Works, Granite City Works and Fairfield Works. The operating results of U. S. Steel’s coke and iron ore pellet operations and many equity investees in the United States are also included in Flat-Rolled. The Flat-Rolled segment information subsequent to September 16, 2014 does not include USSC, which applied for relief from its creditors pursuant to CCAA on that date.

Gary Works, located in Gary, Indiana, has annual raw steel production capability of 7.5 million tons. Gary Works has four blast furnaces, six steelmaking vessels, a vacuum degassing unit and four slab casters. Finishing facilities include a hot strip mill, two pickling lines, two cold reduction mills, three temper mills, a double cold reduction line, four annealing facilities and two tin coating lines. Principal products include hot-rolled, cold-rolled, and coated sheets and tin mill products. Gary Works also produces strip mill plate in coil. In May 2015, Gary Works one remaining coke battery was shut down. The Midwest Plant and East Chicago Tin are operated as part of Gary Works.

The Midwest Plant, located in Portage, Indiana, processes hot-rolled and cold rolled bands and produces tin mill products, hot dip galvanized, cold-rolled and electrical lamination sheets. Midwest facilities include a pickling line, two cold reduction mills, two temper mills, a double cold reduction mill, two annealing facilities, two hot dip galvanizing lines, a tin coating line and a tin-free steel line.

East Chicago Tin is located in East Chicago, Indiana and produces tin mill products. Facilities include a pickling line, a cold reduction mill, two annealing facilities, a temper mill, a tin coating line and a tin-free steel line.

Great Lakes Works, located in Ecorse and River Rouge, Michigan, has annual raw steel production capability of 3.8 million tons. Great Lakes facilities include three blast furnaces, two steelmaking vessels, a vacuum degassing unit, two slab casters, a hot strip mill, a pickling line, a tandem cold reduction mill, three annealing facilities, a temper mill, a recoil and inspection line, an electrolytic galvanizing line and a hot dip galvanizing line. Principal products include hot-rolled, cold-rolled and coated sheets.

On May 29, 2015, the Company purchased the 50 percent joint venture interest in Double Eagle Steel Coating Company (DESCO) that it did not previously own for $25 million. The facility coats sheet steel with free zinc or zinc alloy coatings, primarily for use in the automotive industry. DESCO’s annual production capability is approximately 720,000 tons. DESCO's electrolytic galvanizing line (EGL) has become part of the larger operational footprint of U. S. Steel's Great Lakes Works within the Flat-Rolled segment. The EGL is increasing our ability to provide industry-leading advanced high strength steels, including Gen 3 grades under development, as well as to provide high quality exposed steel for automotive body and closure applications.

Mon Valley Works consists of the Edgar Thomson Plant, located in Braddock, Pennsylvania; the Irvin Plant, located in West Mifflin, Pennsylvania; the Fairless Plant, located in Fairless Hills, Pennsylvania; and the Clairton Plant, located in Clairton, Pennsylvania. Mon Valley Works has annual raw steel production capability of 2.9 million tons. Facilities at the Edgar Thomson Plant include two blast furnaces, two steelmaking vessels, a vacuum degassing unit and a slab caster. Irvin Plant facilities include a hot strip mill, two pickling lines, a cold reduction mill, three annealing facilities, a temper mill and two hot dip galvanizing lines. The Fairless Plant operates a hot dip galvanizing line. Principal products from Mon Valley Works include hot-rolled, cold-rolled and coated sheets, as well as coke and coke by-products produced at the Clairton Plant.

The Clairton Plant is comprised of ten coke batteries with an annual coke production capacity of 4.3 million tons. Almost all of the coke we produce is consumed by U. S. Steel facilities, or swapped with other domestic steel producers. Coke by-products are sold to the chemicals and raw materials industries.

Granite City Works, located in Granite City, Illinois, has annual raw steel production capability of 2.8 million tons. Granite City’s facilities includes two blast furnaces, two steelmaking vessels, two slab casters, a hot strip mill, a pickling line, a tandem cold reduction mill, a hot dip galvanizing line and a hot dip galvanizing/Galvalume® line. Principal products include hot-rolled and coated sheets. In April 2015, U. S. Steel permanently closed the coke making operations at

31

Granite City Works. In December 2015, U. S. Steel temporarily idled Granite City Works. Gateway Energy and Coke Company LLC (Gateway) constructed a coke plant, which began operating in October 2009 to supply Granite City Works under a 15 year agreement with Suncoke. U. S. Steel owns and operates a cogeneration facility that utilizes by-products from the Gateway coke plant to generate heat and power.

Fairfield Works, located in Fairfield, Alabama, had annual raw steel production capability of 2.4 million tons which included a blast furnace, three steelmaking vessels, a vacuum degassing unit, a slab caster, a rounds caster, a hot strip mill, a pickling line, a cold reduction mill, two temper/skin pass mills, a hot dip galvanizing line and a hot dip galvanizing/Galvalume® line. Principal products included hot-rolled, cold-rolled and coated sheets, and steel rounds for Tubular. In August 2015, the Company permanently shutdown the majority of Fairfield Flat-Rolled operations. The slab and rounds casters remain operational and the #5 coating line continues to operate.

U. S. Steel owns a Research and Technology Center located in Munhall, Pennsylvania (near Pittsburgh) where we carry out a wide range of applied research, development and technical support functions.

U. S. Steel also owns an automotive technical center in Troy, Michigan. This facility brings automotive sales, service, distribution and logistics services, product technology and applications research into one location. Much of U. S. Steel’s work in developing new grades of steel to meet the demands of automakers for high-strength, light-weight and formable materials is carried out at this location.

U. S. Steel has iron ore pellet operations located at Mt. Iron (Minntac) and Keewatin (Keetac), Minnesota with annual iron ore pellet production capability of 22.4 million tons. During 2015, 2014 and 2013, these operations produced 15.5 million, 22.2 million and 21.7 million tons of iron ore pellets, respectively. In May 2015, Keetac was idled as a result of significantly lower steel production.

U. S. Steel participates in a number of additional joint ventures that are included in Flat-Rolled, most of which are conducted through subsidiaries or other separate legal entities. All of these joint ventures are accounted for under the equity method. The significant joint ventures and other investments are described below. For information regarding joint ventures and other investments, see Note 11 to the Consolidated Financial Statements.

U. S. Steel has a 14.7 percent ownership interest in Hibbing Taconite Company (Hibbing), which is based in Hibbing, Minnesota. Hibbing’s rated annual production capability is 9.1 million tons of iron ore pellets, of which our share is about 1.3 million tons.

U. S. Steel has a 15 percent ownership interest in Tilden Mining Company (Tilden), which is based in Ishpeming, Michigan. Tilden’s rated annual production capability is 8.7 million tons of iron ore pellets, of which our share is about 1.3 million tons.

U. S. Steel and POSCO of South Korea participate in a 50-50 joint venture, USS-POSCO Industries (UPI), located in Pittsburg, California. The joint venture markets sheet and tin mill products, principally in the western United States. UPI produces cold-rolled sheets, galvanized sheets, tin plate and tin-free steel from hot bands principally provided by POSCO and U. S. Steel. UPI’s annual production capability is approximately 1.5 million tons.

U. S. Steel and Kobe Steel, Ltd. of Japan participate in a 50-50 joint venture, PRO-TEC Coating Company (PRO-TEC). PRO-TEC owns and operates two hot dip galvanizing lines and a continuous annealing line (CAL) in Leipsic, Ohio, which primarily serve the automotive industry. PRO-TEC’s annual production capability is approximately 1.7 million tons. U. S. Steel's domestic production facilities supply PRO-TEC with cold-rolled sheets and U. S. Steel markets all of its products. PRO-TEC constructed and financed the CAL that began operations during the first quarter of 2013. The CAL produces high strength, lightweight steels that are an integral component in automotive manufacturing as vehicle emission and safety requirements become increasingly stringent.

U. S. Steel and ArcelorMittal participate in the Double G Coatings Company, L.P. a 50-50 joint venture (Double G), which operates a hot dip galvanizing and Galvalume® facility located near Jackson, Mississippi and primarily serves the construction industry. Double G processes steel supplied by each partner and each partner markets the steel it has processed by Double G. Double G’s annual production capability is approximately 315,000 tons.

U. S. Steel and Worthington Industries, Inc. participate in Worthington Specialty Processing (Worthington), a joint venture with locations in Jackson, Canton, and Taylor, Michigan, in which U. S. Steel has a 49 percent interest. Worthington slits, cuts to length, and presses blanks from steel coils to desired specifications. Worthington’s annual production capability is approximately 890,000 tons.

32

Chrome Deposit Corporation (CDC), a 50-50 joint venture between U. S. Steel and Court Holdings, reconditions finishing work rolls, which require grinding, chrome plating and/or texturing. The rolls are used on rolling mills to provide superior finishes on steel sheets. CDC has seven locations across the United States, with all locations near major steel plants.

U. S. Steel holds a 49% interest in Feralloy Processing Company (FPC), a joint venture between U. S. Steel and Feralloy Corporation, which converts coiled hot strip mill plate into sheared and flattened plates. The plant, located in Portage, Indiana, has annual production capability of approximately 275,000 tons.

U. S. Steel and Feralloy Corporation, participate in a joint venture, Acero Prime, S.R.L. de CV (Acero Prime). U. S. Steel has a 40 percent interest. Acero Prime has facilities in San Luis Potosi, Ramos Arizpe, and Toluca, Mexico. Acero Prime provides slitting, warehousing and logistical services. Acero Prime’s annual slitting capability is approximately 385,000 tons.

USSE

USSE consists of USSK and its subsidiaries.

USSK operates an integrated facility in Košice, Slovakia, which has annual raw steel production capability of 5.0 million tons. This facility has two coke batteries, four sintering strands, three blast furnaces, four steelmaking vessels, a vacuum degassing unit, two dual strand casters, a hot strip mill, two pickling lines, two cold reduction mills, three annealing facilities, a temper mill, a temper/double cold reduction mill, three hot dip galvanizing lines, two tin coating lines, three dynamo lines, a color coating line and two spiral welded pipe mills. USSK also has multiple slitting, cutting and other finishing lines for flat products. Principal products include hot-rolled, cold-rolled and coated sheets, tin mill products and spiral welded pipe. USSK also has facilities for manufacturing heating radiators, refractory ceramic materials and has a power plant for internal steam and electricity generation.

In addition, USSK has a research laboratory, which, in conjunction with our Research and Technology Center, supports efforts in cokemaking, electrical steels, design and instrumentation, and ecology.

Tubular

Tubular manufactures seamless and welded OCTG, standard pipe, line pipe and mechanical tubing. During 2015, U. S. Steel adjusted operating levels at several of its tubular operations as declining oil prices and rig counts have significantly reduced demand for OCTG products. Customer order rates will determine the size and duration of any adjustments that we may make at our tubular operations during 2016.

Seamless products are produced at a facility located at Fairfield Works in Fairfield, Alabama, and at two facilities located in Lorain, Ohio. The Fairfield plant has annual production capability of 750,000 tons and has historically been supplied with steel rounds from Flat-Rolled’s Fairfield Works. Subsequent to the shutdown of the hot end at the Fairfield Works, the facility is currently purchasing rounds from third parties. The Fairfield plant has the capability to produce outer diameter (O.D.) sizes from 4.5 to 9.875 inches and has quench and temper, hydrotester, threading and coupling and inspection capabilities. The Lorain facilities have combined annual production capability of 780,000 tons and have historically consumed steel rounds supplied by Fairfield Works and external sources. Subsequent to the shutdown of the hot end at the Fairfield Works, the Company preserved the ability to source rounds from third parties. Lorain #3 facility has the capability to produce O.D. sizes from 10.125 to 26 inches and has quench and temper, hydrotester, cutoff and inspection capabilities. Lorain #4 facility has the capability to produce O.D. sizes from 1.9 to 4.5 inches and has quench and temper, hydrotester, threading and coupling and inspection capabilities for OCTG 6.0 casing and uses Tubular Processing in Houston for oil field production tubing finishing.

Lone Star Tubular, located in Lone Star, Texas, manufactures welded OCTG, standard pipe, line pipe and mechanical tubing products. Lone Star Tubular #1 facility has the capability to produce O.D. sizes from 7 to 16 inches. Lone Star Tubular #2 facility has the capability to produce O.D. sizes from 1.088 to 7.15 inches. Both facilities have quench and temper, hydrotester, threading and coupling and inspection capabilities. Bellville Tubular Operations, in Bellville, Texas, manufactures welded tubular products primarily for OCTG with the capability to produce O.D. sizes from 2.375 to 4.5 inches and uses Tubular Processing in Houston for oil field production tubing finishing. Lone Star Tubular and Bellville Tubular Operations have combined annual production capability of 1.0 million tons and consume hot-rolled bands from Flat-Rolled’s facilities. As of August 3, 2014, the Bellville Tubular operations were indefinitely idled.

33

Welded products are also produced at a facility located in McKeesport, Pennsylvania. McKeesport Tubular Operations has annual production capability of 315,000 tons and consumes hot-rolled bands from Flat-Rolled locations. This facility has the capability to produce, hydrotest, cut to length and inspect O.D. sizes from 8.625 to 20 inches. As of August 31, 2014, the McKeesport Tubular operations were indefinitely idled.

Wheeling Machine Products manufactures couplings used to connect individual sections of oilfield casing and tubing. It produces sizes ranging from 2.375 to 20 inches at two locations: Pine Bluff, Arkansas, and Hughes Springs, Texas.

Tubular Processing, located in Houston, Texas, provides quench and temper and end-finishing services for oilfield production tubing. Offshore Operations, also located in Houston, Texas, provides threading, inspection, accessories and storage services to the OCTG market.

U. S. Steel and Butch Gilliam Enterprises LLC participate in a 50-50 joint venture, Patriot Premium Threading Services located in Midland, Texas, which provides oil country threading, accessory threading, repair services and rig site services to exploration and production companies located principally in the Permian Basin. USSTP is negotiating with our partner, Butch Gilliam Enterprises LLC to amend the joint venture terms.

U. S. Steel also has a 50 percent ownership interest in Apolo Tubulars S.A. (Apolo), a Brazilian supplier of welded casing, tubing, line pipe and other tubular products. Apolo’s annual production capability is approximately 150,000 tons.

U. S. Steel, POSCO and SeAH Steel Corporation, a Korean manufacturer of tubular products, participated in United Spiral Pipe LLC (USP) which owned and operated a spiral weld pipe manufacturing facility in Pittsburg, California. On February 2, 2015, the pipe making assets of USP were sold to a third party.

We have an Innovation & Technology Center in Houston, Texas designed to serve as a training and education center for both internal and external audiences. Research and development for tubular premium connections are performed at this facility.

Other Businesses

U. S. Steel’s Other Businesses include railroad services and real estate operations.

U. S. Steel owns the Gary Railway Company in Indiana; Lake Terminal Railroad Company and Lorain Northern Company in Ohio; Union Railroad Company in Pennsylvania; Fairfield Southern Company, Inc. located in Alabama; Delray Connecting Railroad Company in Michigan and Texas & Northern Railroad Company in Texas; all of which comprise U. S. Steel’s transportation business.

U. S. Steel owns, develops and manages various real estate assets, which include approximately 50,000 acres of surface rights primarily in Alabama, Illinois, Maryland, Michigan, Minnesota and Pennsylvania. In addition, U. S. Steel holds ownership interests in joint ventures that are developing real estate projects in Alabama, Maryland and Illinois. In 2014, U. S. Steel sold land and mineral rights in Alabama for approximately $55 million.

Raw Materials and Energy

As an integrated producer, U. S. Steel’s primary raw materials are iron units in the form of iron ore pellets and sinter ore, carbon units in the form of coal and coke (which is produced from coking coal) and steel scrap. U. S. Steel’s raw materials supply strategy consists of acquiring and expanding captive sources of certain primary raw materials and entering into flexible supply contracts for certain other raw materials at competitive market prices which are subject to fluctuations based on market conditions at the time.

The amounts of such raw materials needed to produce a ton of steel will fluctuate based upon the specifications of the final steel products, the quality of raw materials and, to a lesser extent, differences among steel producing equipment. In broad terms, U. S. Steel consumes approximately 1.4 tons of coal to produce one ton of coke and then it consumes approximately 0.4 tons of coke, 0.3 tons of steel scrap (40 percent of which is internally generated) and 1.3 tons of iron ore pellets to produce one ton of raw steel. At normal operating levels, we also consume approximately 6 mmbtu’s of natural gas per ton produced. While we believe that these estimated consumption amounts are useful for planning purposes, and are presented to give a general sense of raw material and energy consumption related to steel production, substantial variations may occur.

34

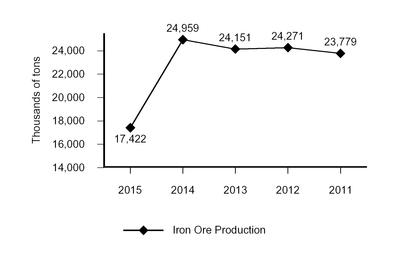

Iron Ore

Iron Ore Production(a)

(a) Includes our share of production from Hibbing and Tilden. The decrease in iron ore

production from 2014 is primarily related to the temporary idling of our Keetac facility.

The iron ore facilities at Minntac and Keetac contain an estimated 897 million short tons of recoverable reserves and our share of recoverable reserves at the Hibbing and Tilden joint ventures is 35 million short tons. Recoverable reserves are defined as the tons of product that can be used internally or delivered to a customer after considering mining and beneficiation or preparation losses. Minntac and Keetac’s annual capability and our share of annual capability for the Hibbing and Tilden joint ventures total approximately 25 million tons. Through our wholly owned operations and our share of joint ventures, we have iron ore pellet production capability that exceeds our steelmaking capability in the U.S.

We sold iron ore pellets in 2015, 2014 and 2013 to third parties. Depending on our production requirements, inventory levels and other factors we may sell additional pellets in the future.

Substantially all of USSE’s iron ore requirements are purchased from outside sources, primarily Russian and Ukrainian mining companies. However, in 2014, 2013 and prior years, USSE also received iron ore from U. S. Steel’s iron ore facilities in North America. We believe that supplies of iron ore adequate to meet USSE’s needs are available at competitive market prices.

Coking Coal

All of U. S. Steel’s coal requirements for our cokemaking facilities are purchased from outside sources. U. S. Steel has entered into multi-year contracts for a portion of Flat-Rolled’s coking coal requirements. Prices for these North American contracts for 2016 are set at what we believe are competitive market prices. Prices in subsequent years will be negotiated in accordance with contractual provisions on an annual basis at prevailing market prices or have fixed prices for a set time frame.

Prices for European contracts are negotiated at defined intervals, usually quarterly.

We believe that supplies of coking coal adequate to meet our needs are available from outside sources at competitive market prices. The main source of coking coal for Flat-Rolled is the United States, and sources for USSE include Poland, the Czech Republic, the United States, Russia, and Ukraine.

35

Coke

Coke Production(a)

(a) The decrease in 2015 coke production from 2014 is due to the permanent shutdown of coke operations

at Gary Works and Granite City Works. The decrease in 2014 coke production from 2013 is primarily due

to the deconsolidation of USSC and the permanent shut down of two coke batteries at Gary Works.

In North America, the Flat-Rolled segment operates a cokemaking facility at the Clairton Plant of Mon Valley Works. In May 2015, U. S. Steel closed the coke making operations at Gary Works and Granite City Works. See Note 24 to the Consolidated Financial Statements for further details. At our Granite City Works, we also have a 15-year coke supply agreement with Gateway which began in 2009. North American coke production also included USSC prior to the CCAA filing on September 16, 2014. Effective December 4, 2014, the Company entered into an arrangement with USSC for the conversion of U. S. Steel's coal into coke at USSC's Hamilton coke battery. This arrangement was terminated as of December 31, 2015. In Europe, the USSE segment operates cokemaking facilities at USSK. Blast furnace injection of coal, natural gas and self-generated coke oven gas is also used to reduce coke usage.

With Flat-Rolled’s cokemaking facilities and the Gateway long-term supply agreement, it has the capability to be self-sufficient with respect to its annual coke requirements at normal operating levels. Coke is purchased from, sold to, or swapped with suppliers and other end-users to adjust for production needs and reduce transportation costs.

USSE is self-sufficient for coke at normal operating levels.

Steel Scrap and Other Materials

We believe supplies of steel scrap and other alloy and coating materials required to fulfill the requirements for Flat-Rolled and USSE are available from outside sources at competitive market prices. Generally, approximately 40 percent of our steel scrap requirements are internally generated through normal operations.

Limestone

All of Flat-Rolled’s and USSE's limestone requirements are purchased from outside sources. We believe that supplies of limestone adequate to meet our needs are readily available from outside sources at competitive market prices.

Zinc and Tin

We believe that supplies of zinc and tin required to fulfill the requirements for Flat-Rolled and USSE are available from outside sources at competitive market prices. We routinely execute fixed-price forward physical purchase contracts for a portion of our expected business needs in order to partially manage our exposure to the volatility of the zinc and tin markets.

Natural Gas

All of U. S. Steel’s natural gas requirements are purchased from outside sources.

36