00011449802021FYfalseP20YP19YP19YP20Yhttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2021-01-31#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2021-01-31#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2021-01-31#LongTermDebtAndCapitalLeaseObligationsCurrenthttp://fasb.org/us-gaap/2021-01-31#LongTermDebtAndCapitalLeaseObligationsCurrenthttp://fasb.org/us-gaap/2021-01-31#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2021-01-31#LongTermDebtAndCapitalLeaseObligationsP3YP3YP3YP3YP3YP3YP3YP3YP3YP3Y00011449802022-01-012022-12-3100011449802022-06-30iso4217:USD00011449802023-02-23xbrli:shares00011449802022-12-3100011449802021-12-31iso4217:USDxbrli:shares0001144980us-gaap:CommonStockMember2022-12-310001144980us-gaap:TreasuryStockMember2022-12-310001144980abg:NewvehicleMember2022-01-012022-12-310001144980abg:NewvehicleMember2021-01-012021-12-310001144980abg:NewvehicleMember2020-01-012020-12-310001144980abg:UsedVehiclesMember2022-01-012022-12-310001144980abg:UsedVehiclesMember2021-01-012021-12-310001144980abg:UsedVehiclesMember2020-01-012020-12-310001144980abg:PartsandservicesMember2022-01-012022-12-310001144980abg:PartsandservicesMember2021-01-012021-12-310001144980abg:PartsandservicesMember2020-01-012020-12-3100011449802021-01-012021-12-3100011449802020-01-012020-12-310001144980us-gaap:CommonStockMember2019-12-310001144980us-gaap:AdditionalPaidInCapitalMember2019-12-310001144980us-gaap:RetainedEarningsMember2019-12-310001144980us-gaap:TreasuryStockMember2019-12-310001144980us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-3100011449802019-12-310001144980us-gaap:RetainedEarningsMember2020-01-012020-12-310001144980us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001144980us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001144980us-gaap:CommonStockMember2020-01-012020-12-310001144980us-gaap:TreasuryStockMember2020-01-012020-12-310001144980us-gaap:CommonStockMember2020-12-310001144980us-gaap:AdditionalPaidInCapitalMember2020-12-310001144980us-gaap:RetainedEarningsMember2020-12-310001144980us-gaap:TreasuryStockMember2020-12-310001144980us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-3100011449802020-12-310001144980us-gaap:RetainedEarningsMember2021-01-012021-12-310001144980us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001144980us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001144980us-gaap:CommonStockMember2021-01-012021-12-310001144980us-gaap:TreasuryStockMember2021-01-012021-12-310001144980us-gaap:CommonStockMember2021-12-310001144980us-gaap:AdditionalPaidInCapitalMember2021-12-310001144980us-gaap:RetainedEarningsMember2021-12-310001144980us-gaap:TreasuryStockMember2021-12-310001144980us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001144980us-gaap:RetainedEarningsMember2022-01-012022-12-310001144980us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001144980us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001144980us-gaap:CommonStockMember2022-01-012022-12-310001144980us-gaap:TreasuryStockMember2022-01-012022-12-310001144980us-gaap:AdditionalPaidInCapitalMember2022-12-310001144980us-gaap:RetainedEarningsMember2022-12-310001144980us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-31abg:franchiseabg:VehicleBrandsabg:dealership_locationabg:statesabg:CollisionRepairCentersabg:businessabg:reportableSegment0001144980us-gaap:BuildingAndBuildingImprovementsMembersrt:MinimumMember2022-01-012022-12-310001144980srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2022-01-012022-12-310001144980srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2022-01-012022-12-310001144980srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2022-01-012022-12-310001144980us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2022-01-012022-12-310001144980srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2022-01-012022-12-310001144980abg:CompanyVehiclesMembersrt:MinimumMember2022-01-012022-12-310001144980srt:MaximumMemberabg:CompanyVehiclesMember2022-01-012022-12-310001144980abg:LHMMember2021-12-170001144980us-gaap:SubsequentEventMember2023-01-260001144980srt:MinimumMember2022-01-012022-12-310001144980srt:MaximumMember2022-01-012022-12-310001144980us-gaap:SeniorNotesMemberabg:FourPointFiveZeroPercentSeniorNotesdue2028Member2022-12-31xbrli:pure0001144980us-gaap:SeniorNotesMemberabg:FourPointSevenFivePercentSeniorNotesdue2030Member2022-12-310001144980us-gaap:SeniorNotesMemberabg:FourPointSixTwoFivePercentSeniorNotesDue2029Member2022-12-310001144980abg:FivePointZeroZeroPercentPercentSeniorNotesDue2029Memberus-gaap:SeniorNotesMember2022-12-310001144980abg:ToyotaMotorSalesU.S.A.Inc.ToyotaandLexusMemberabg:NewVehiclesMember2022-01-012022-12-310001144980abg:StellantisNVChryslerDodgeJeepRamAndFiatMemberabg:NewVehiclesMember2022-01-012022-12-310001144980abg:AmericanHondaMotorCo.Inc.HondaandAcuraMemberabg:NewVehiclesMember2022-01-012022-12-310001144980abg:FordMotorCompanyFordandLincolnMemberabg:NewVehiclesMember2022-01-012022-12-310001144980abg:MercedesBenzUSALLCMercedesBenzSmartandSprinterMemberabg:NewVehiclesMember2022-01-012022-12-310001144980abg:HyundaiMotorNorthAmericaHyundaiAndGenesisMemberabg:NewVehiclesMember2022-01-012022-12-310001144980abg:GeneralMotorsCompanyChevroletBuickAndGMCMemberabg:NewVehiclesMember2022-01-012022-12-310001144980abg:NissanNorthAmericaInc.NissanandInfinitiMemberabg:NewVehiclesMember2022-01-012022-12-310001144980abg:NewandusedvehicleMemberabg:NewvehicleMember2022-01-012022-12-310001144980abg:NewandusedvehicleMemberabg:NewvehicleMember2021-01-012021-12-310001144980abg:NewandusedvehicleMemberabg:NewvehicleMember2020-01-012020-12-310001144980abg:NewandusedvehicleMemberabg:UsedvehicleretailMember2022-01-012022-12-310001144980abg:NewandusedvehicleMemberabg:UsedvehicleretailMember2021-01-012021-12-310001144980abg:NewandusedvehicleMemberabg:UsedvehicleretailMember2020-01-012020-12-310001144980abg:NewandusedvehicleMemberabg:UsedvehiclewholesaleMember2022-01-012022-12-310001144980abg:NewandusedvehicleMemberabg:UsedvehiclewholesaleMember2021-01-012021-12-310001144980abg:NewandusedvehicleMemberabg:UsedvehiclewholesaleMember2020-01-012020-12-310001144980abg:NewandusedvehicleMember2022-01-012022-12-310001144980abg:NewandusedvehicleMember2021-01-012021-12-310001144980abg:NewandusedvehicleMember2020-01-012020-12-310001144980abg:PartsandservicesMemberabg:SaleofvehiclepartsandaccessoriesMember2022-01-012022-12-310001144980abg:PartsandservicesMemberabg:SaleofvehiclepartsandaccessoriesMember2021-01-012021-12-310001144980abg:PartsandservicesMemberabg:SaleofvehiclepartsandaccessoriesMember2020-01-012020-12-310001144980abg:PartsandservicesMemberabg:VehiclerepairandmaintenanceservicesMember2022-01-012022-12-310001144980abg:PartsandservicesMemberabg:VehiclerepairandmaintenanceservicesMember2021-01-012021-12-310001144980abg:PartsandservicesMemberabg:VehiclerepairandmaintenanceservicesMember2020-01-012020-12-310001144980abg:PartsandservicesMember2022-01-012022-12-310001144980abg:PartsandservicesMember2021-01-012021-12-310001144980abg:PartsandservicesMember2020-01-012020-12-310001144980abg:FinanceandinsuranceMember2022-01-012022-12-310001144980abg:FinanceandinsuranceMember2021-01-012021-12-310001144980abg:FinanceandinsuranceMember2020-01-012020-12-310001144980abg:VehiclerepairandmaintenanceservicesMember2020-12-310001144980abg:FinanceandinsuranceMember2020-12-310001144980abg:DeferredCommissionsMember2020-12-310001144980abg:VehiclerepairandmaintenanceservicesMember2021-01-012021-12-310001144980abg:DeferredCommissionsMember2021-01-012021-12-310001144980abg:VehiclerepairandmaintenanceservicesMember2021-12-310001144980abg:FinanceandinsuranceMember2021-12-310001144980abg:DeferredCommissionsMember2021-12-310001144980abg:VehiclerepairandmaintenanceservicesMember2022-01-012022-12-310001144980abg:DeferredCommissionsMember2022-01-012022-12-310001144980abg:VehiclerepairandmaintenanceservicesMember2022-12-310001144980abg:FinanceandinsuranceMember2022-12-310001144980abg:DeferredCommissionsMember2022-12-310001144980abg:RevenueFinanceAndInsuranceMember2022-12-310001144980abg:LHMMember2021-12-172021-12-17abg:collisionCenters0001144980us-gaap:SeniorNotesMemberabg:LHMMember2021-12-172021-12-170001144980us-gaap:RevolvingCreditFacilityMemberabg:LHMMember2021-12-172021-12-170001144980abg:A2021RealEstateFacilityMemberabg:LHMMember2021-12-172021-12-170001144980abg:LHMMemberabg:NewVehicleFloorPlanFacilityMember2021-12-172021-12-170001144980abg:UsedVehicleFloorPlanFacilityMemberabg:LHMMember2021-12-172021-12-170001144980abg:LHMMemberabg:InsuranceMember2022-12-310001144980abg:DealershipsMemberabg:LHMMember2022-12-310001144980abg:LHMMember2022-12-310001144980abg:LHMMember2021-12-182021-12-310001144980abg:LHMMember2022-01-012022-12-310001144980abg:LHMMember2021-01-012021-12-3100011449802020-03-240001144980abg:AssetPurchaseAgreementMember2020-07-06abg:numberOfSubsidiaries00011449802020-07-062020-07-060001144980abg:FourPointZeroZeroPercentPromissoryNoteDueAugust2021Memberabg:SellerNoteMember2020-08-240001144980abg:FourPointZeroZeroPercentPromissoryNoteDueFebruary2022Memberabg:SellerNoteMember2020-08-240001144980abg:AssetPurchaseAgreementMember2021-05-200001144980abg:AssetPurchaseAgreementMember2021-05-202021-05-200001144980abg:AssetPurchaseAgreementMember2022-01-012022-12-310001144980abg:AssetPurchaseAgreementMember2022-12-310001144980abg:AssetPurchaseAgreementMember2020-08-242020-12-310001144980us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMemberstpr:CO2022-01-012022-12-310001144980us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMemberstpr:IN2022-01-012022-12-310001144980us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2022-01-012022-12-310001144980us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMemberstpr:CO2021-01-012021-12-310001144980us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2022-12-310001144980us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2021-12-310001144980stpr:MOus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2022-01-012022-12-310001144980stpr:COus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2022-01-012022-12-31abg:center0001144980stpr:WAus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2022-01-012022-12-310001144980us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberstpr:NM2022-01-012022-12-310001144980stpr:NCus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2022-01-012022-12-310001144980stpr:VAus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2021-01-012021-12-310001144980stpr:VA2021-01-012021-12-310001144980stpr:GAus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2020-01-012020-12-310001144980stpr:MSus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2020-01-012020-12-310001144980us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberstpr:SC2020-01-012020-12-310001144980abg:VehicleReceivablesMember2022-12-310001144980abg:VehicleReceivablesMember2021-12-310001144980abg:ManufacturerReceivablesMember2022-12-310001144980abg:ManufacturerReceivablesMember2021-12-310001144980abg:OtherTradeAccountsReceivableMember2022-12-310001144980abg:OtherTradeAccountsReceivableMember2021-12-310001144980abg:NewVehiclesMember2022-12-310001144980abg:NewVehiclesMember2021-12-310001144980abg:UsedVehiclesMember2022-12-310001144980abg:UsedVehiclesMember2021-12-310001144980abg:PartsAndAccessoriesMember2022-12-310001144980abg:PartsAndAccessoriesMember2021-12-310001144980us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2022-12-310001144980us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2021-12-310001144980abg:NewVehiclesMember2022-01-012022-12-310001144980abg:NewVehiclesMember2021-01-012021-12-310001144980abg:NewVehiclesMember2020-01-012020-12-310001144980abg:RealEstateNotCurrentlyUsedinOperationsMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2022-12-310001144980us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2022-01-012022-12-31abg:property0001144980us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2021-01-012021-12-310001144980abg:RealEstateNotCurrentlyUsedinOperationsMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2021-12-310001144980us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMemberabg:VacantPropertyMember2021-12-310001144980us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberabg:VacantPropertyMember2021-12-310001144980us-gaap:ShortTermInvestmentsMember2022-12-310001144980us-gaap:USTreasurySecuritiesMember2022-12-310001144980us-gaap:MunicipalBondsMember2022-12-310001144980us-gaap:CorporateDebtSecuritiesMember2022-12-310001144980abg:MortgageAndOtherAssetsBackedSecuritiesMember2022-12-310001144980us-gaap:DebtSecuritiesMember2022-12-310001144980us-gaap:CommonStockMember2022-12-310001144980us-gaap:ShortTermInvestmentsMember2021-12-310001144980us-gaap:USTreasurySecuritiesMember2021-12-310001144980us-gaap:MunicipalBondsMember2021-12-310001144980us-gaap:CorporateDebtSecuritiesMember2021-12-310001144980abg:MortgageAndOtherAssetsBackedSecuritiesMember2021-12-310001144980us-gaap:DebtSecuritiesMember2021-12-310001144980us-gaap:CommonStockMember2021-12-310001144980abg:BondsAvailableForSaleMember2021-12-3100011449802021-12-182021-12-310001144980us-gaap:LandMember2022-12-310001144980us-gaap:LandMember2021-12-310001144980us-gaap:BuildingAndBuildingImprovementsMember2022-12-310001144980us-gaap:BuildingAndBuildingImprovementsMember2021-12-310001144980us-gaap:MachineryAndEquipmentMember2022-12-310001144980us-gaap:MachineryAndEquipmentMember2021-12-310001144980us-gaap:FurnitureAndFixturesMember2022-12-310001144980us-gaap:FurnitureAndFixturesMember2021-12-310001144980abg:CompanyVehiclesMember2022-12-310001144980abg:CompanyVehiclesMember2021-12-310001144980us-gaap:ConstructionInProgressMember2022-12-310001144980us-gaap:ConstructionInProgressMember2021-12-310001144980us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2022-12-310001144980us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2021-12-310001144980abg:DealershipsMember2020-12-310001144980abg:TCAMember2020-12-310001144980abg:DealershipsMember2021-01-012021-12-310001144980abg:TCAMember2021-01-012021-12-310001144980abg:DealershipsMember2021-12-310001144980abg:TCAMember2021-12-310001144980abg:DealershipsMember2022-01-012022-12-310001144980abg:TCAMember2022-01-012022-12-310001144980abg:DealershipsMember2022-12-310001144980abg:TCAMember2022-12-3100011449802002-01-012019-12-310001144980us-gaap:FranchiseRightsMember2020-12-310001144980us-gaap:FranchiseRightsMember2021-01-012021-12-310001144980us-gaap:FranchiseRightsMember2022-01-012022-12-310001144980us-gaap:FranchiseRightsMember2021-12-310001144980us-gaap:FranchiseRightsMember2022-12-3100011449802022-01-012022-03-310001144980us-gaap:CashAndCashEquivalentsMember2022-12-310001144980us-gaap:AccountsPayableAndAccruedLiabilitiesMember2022-12-310001144980abg:BankOfAmericaNAMemberabg:A2019SeniorCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2021-10-290001144980abg:BankOfAmericaNAMemberabg:UsedVehicleRevolvingFloorPlanFacilityMemberabg:A2019SeniorCreditFacilityMember2021-10-290001144980abg:BankOfAmericaNAMemberabg:A2019SeniorCreditFacilityMemberabg:NewVehicleFloorPlanMember2021-10-290001144980abg:SeniorCreditFacilityMemberabg:A2019SeniorCreditFacilityMember2022-12-310001144980abg:BankOfAmericaNAMemberus-gaap:StandbyLettersOfCreditMember2022-12-3100011449802022-05-270001144980srt:MinimumMemberabg:A2019BankofAmericaRevolvingCreditFacilityMember2022-09-290001144980srt:MaximumMemberabg:A2019BankofAmericaRevolvingCreditFacilityMember2022-12-310001144980us-gaap:SeniorNotesMemberabg:A2019BankofAmericaRevolvingCreditFacilityMember2022-12-310001144980abg:FederalFundsMemberus-gaap:LineOfCreditMemberabg:A2019SeniorCreditFacilityMember2022-01-012022-12-310001144980abg:BankOfAmericaNAMemberus-gaap:LineOfCreditMemberabg:A2019SeniorCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-01-012022-12-310001144980us-gaap:LineOfCreditMemberabg:A2019SeniorCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-01-012022-12-310001144980abg:BankOfAmericaNAMembersrt:MinimumMemberus-gaap:LineOfCreditMemberabg:RevolvingCreditFacility1Memberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-01-012022-12-310001144980srt:MaximumMemberabg:BankOfAmericaNAMemberus-gaap:LineOfCreditMemberabg:RevolvingCreditFacility1Memberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-01-012022-12-310001144980abg:BankOfAmericaNAMemberus-gaap:BaseRateMembersrt:MinimumMemberus-gaap:LineOfCreditMemberabg:RevolvingCreditFacility1Member2022-01-012022-12-310001144980srt:MaximumMemberabg:BankOfAmericaNAMemberus-gaap:BaseRateMemberus-gaap:LineOfCreditMemberabg:RevolvingCreditFacility1Member2022-01-012022-12-310001144980abg:BankOfAmericaNAMembersrt:MinimumMemberus-gaap:LineOfCreditMemberabg:NewVehicleFloorPlanFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-01-012022-12-310001144980us-gaap:LineOfCreditMemberabg:NewVehicleFloorPlanFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-01-012022-12-310001144980us-gaap:BaseRateMemberus-gaap:LineOfCreditMemberabg:NewVehicleFloorPlanFacilityMember2022-01-012022-12-310001144980abg:BankOfAmericaNAMembersrt:MinimumMemberabg:UsedVehicleFloorPlanFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-01-012022-12-310001144980abg:UsedVehicleFloorPlanFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-01-012022-12-310001144980us-gaap:BaseRateMemberabg:UsedVehicleFloorPlanFacilityMemberus-gaap:LineOfCreditMember2022-01-012022-12-310001144980srt:MinimumMemberus-gaap:LineOfCreditMemberabg:RevolvingCreditFacility1Member2022-01-012022-12-310001144980srt:MaximumMemberus-gaap:LineOfCreditMemberabg:RevolvingCreditFacility1Member2022-01-012022-12-310001144980us-gaap:LineOfCreditMemberabg:NewVehicleandUsedVehicleFloorPlanMember2022-01-012022-12-310001144980abg:UsedVehicleRevolvingFloorPlanFacilityMember2022-01-012022-12-310001144980us-gaap:SeniorNotesMemberabg:FourPointFiveZeroPercentSeniorNotesdue2028Member2021-12-310001144980us-gaap:SeniorNotesMemberabg:FourPointSixTwoFivePercentSeniorNotesDue2029Member2021-12-310001144980us-gaap:SeniorNotesMemberabg:FourPointSevenFivePercentSeniorNotesdue2030Member2021-12-310001144980abg:FivePointZeroZeroPercentPercentSeniorNotesDue2029Memberus-gaap:SeniorNotesMember2021-12-310001144980us-gaap:MortgagesMember2022-12-310001144980us-gaap:MortgagesMember2021-12-310001144980abg:BankOfAmericaNAMemberabg:A2021RealEstateFacilityMember2022-12-310001144980abg:BankOfAmericaNAMemberabg:A2021RealEstateFacilityMember2021-12-310001144980abg:A2021BofARealEstateFacilityMemberabg:WellsFargoBankNationalAssociationMember2022-12-310001144980abg:A2021BofARealEstateFacilityMemberabg:WellsFargoBankNationalAssociationMember2021-12-310001144980abg:BankOfAmericaNAMemberabg:A2018BofARealEstateFacilityMember2022-12-310001144980abg:BankOfAmericaNAMemberabg:A2018BofARealEstateFacilityMember2021-12-310001144980abg:A2018WellsFargoMasterLoanFacilityMemberabg:WellsFargoBankNationalAssociationMember2022-12-310001144980abg:A2018WellsFargoMasterLoanFacilityMemberabg:WellsFargoBankNationalAssociationMember2021-12-310001144980abg:BankOfAmericaNAMemberabg:A2013BofARealEstateFacilityMember2022-12-310001144980abg:BankOfAmericaNAMemberabg:A2013BofARealEstateFacilityMember2021-12-310001144980abg:WellsFargoBankNationalAssociationMemberabg:A2015WellsFargoMasterLoanFacilityMember2022-12-310001144980abg:WellsFargoBankNationalAssociationMemberabg:A2015WellsFargoMasterLoanFacilityMember2021-12-310001144980abg:BankOfAmericaNAMemberabg:A2019SyndicatedRevolvingCreditFacilityMember2022-12-310001144980abg:BankOfAmericaNAMemberabg:A2019SyndicatedRevolvingCreditFacilityMember2021-12-310001144980abg:A2018BofARealEstateFacilityMember2022-12-310001144980us-gaap:SeniorNotesMemberabg:FourPointSixTwoFivePercentSeniorNotesDue2029Member2021-11-190001144980abg:FivePointZeroZeroPercentPercentSeniorNotesDue2029Memberus-gaap:SeniorNotesMember2021-11-190001144980us-gaap:SeniorNotesMember2021-11-190001144980us-gaap:SeniorNotesMemberabg:FourPointSixTwoFivePercentSeniorNotesDue2029Member2021-11-192021-11-190001144980abg:FivePointZeroZeroPercentPercentSeniorNotesDue2029Memberus-gaap:SeniorNotesMember2021-11-192021-11-190001144980us-gaap:SeniorNotesMemberabg:FourPointFiveZeroPercentSeniorNotesdue2028Member2020-02-190001144980us-gaap:SeniorNotesMemberabg:FourPointSevenFivePercentSeniorNotesdue2030Member2020-02-190001144980us-gaap:SeniorNotesMember2020-02-190001144980us-gaap:SeniorNotesMember2020-03-302020-03-300001144980us-gaap:SeniorNotesMember2021-09-300001144980us-gaap:SeniorNotesMemberabg:FourPointFiveZeroPercentSeniorNotesdue2028Member2021-09-300001144980us-gaap:SeniorNotesMemberabg:FourPointFiveZeroPercentSeniorNotesdue2028Member2020-09-012020-09-300001144980us-gaap:SeniorNotesMemberabg:FourPointSevenFivePercentSeniorNotesdue2030Member2021-09-300001144980us-gaap:SeniorNotesMemberabg:FourPointSevenFivePercentSeniorNotesdue2030Member2020-09-012020-09-300001144980us-gaap:SeniorNotesMember2020-09-012020-09-300001144980us-gaap:SeniorSubordinatedNotesMemberabg:SixPointZeroPercentSeniorSubordinatedNotesDue2024Member2022-12-310001144980us-gaap:SeniorSubordinatedNotesMemberabg:SixPointZeroPercentSeniorSubordinatedNotesDue2024Member2020-03-042020-03-040001144980us-gaap:SeniorSubordinatedNotesMemberabg:SixPointZeroPercentSeniorSubordinatedNotesDue2024Member2020-03-040001144980abg:BankOfAmericaNAMemberabg:A2021RealEstateFacilityMember2021-12-170001144980abg:BankOfAmericaNAMemberabg:A2021RealEstateFacilityMembersrt:MinimumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2021-12-172021-12-170001144980srt:MaximumMemberabg:BankOfAmericaNAMemberabg:A2021RealEstateFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2021-12-172021-12-170001144980abg:BankOfAmericaNAMemberus-gaap:BaseRateMemberabg:A2021RealEstateFacilityMembersrt:MinimumMember2021-12-172021-12-170001144980srt:MaximumMemberabg:BankOfAmericaNAMemberus-gaap:BaseRateMemberabg:A2021RealEstateFacilityMember2021-12-172021-12-170001144980abg:BankOfAmericaNAMemberabg:A2021RealEstateFacilityMemberabg:FederalFundsMember2021-12-172021-12-170001144980abg:BankOfAmericaNAMemberabg:A2021RealEstateFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2021-12-172021-12-170001144980abg:BankOfAmericaNAMemberabg:A2021RealEstateFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMember2021-12-172021-12-17abg:numberOfPayments0001144980abg:A2021BofARealEstateFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-05-252022-05-250001144980abg:A2021BofARealEstateFacilityMemberabg:SOFRPlusBasisSpreadMember2022-05-252022-05-250001144980abg:A2021BofARealEstateFacilityMember2022-05-252022-05-250001144980abg:A2021BofARealEstateFacilityMemberabg:BaseRateComponentFederalFundsMembersrt:MinimumMember2022-05-252022-05-250001144980abg:A2021BofARealEstateFacilityMembersrt:MinimumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-05-252022-05-250001144980abg:A2021BofARealEstateFacilityMembersrt:MinimumMember2022-05-252022-05-250001144980abg:A2021BofARealEstateFacilityMemberus-gaap:BaseRateMember2022-05-250001144980abg:BankOfAmericaNAMemberabg:A2021BofARealEstateFacilityMember2021-05-200001144980abg:BankOfAmericaNAMemberabg:A2021BofARealEstateFacilityMembersrt:MinimumMemberus-gaap:LondonInterbankOfferedRateLIBORMember2021-05-202021-05-200001144980abg:BankOfAmericaNAMemberus-gaap:BaseRateMemberabg:A2021BofARealEstateFacilityMembersrt:MinimumMember2021-05-202021-05-200001144980abg:BankOfAmericaNAMemberabg:A2021BofARealEstateFacilityMemberabg:FederalFundsMember2021-05-202021-05-200001144980abg:BankOfAmericaNAMemberabg:A2021BofARealEstateFacilityMemberabg:OneMonthLondonInterbankOfferedRateMember2021-05-202021-05-200001144980abg:A2018BofARealEstateFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-05-252022-05-250001144980abg:A2018BofARealEstateFacilityMemberabg:SOFRPlusBasisSpreadMember2022-05-252022-05-250001144980abg:A2018BofARealEstateFacilityMember2022-05-252022-05-250001144980abg:BaseRateComponentFederalFundsMembersrt:MinimumMemberabg:A2018BofARealEstateFacilityMember2022-05-252022-05-250001144980srt:MinimumMemberabg:A2018BofARealEstateFacilityMemberabg:BaseRateComponentSOFRMember2022-05-252022-05-250001144980srt:MinimumMemberabg:A2018BofARealEstateFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-05-252022-05-250001144980us-gaap:BaseRateMemberabg:A2018BofARealEstateFacilityMember2022-05-250001144980abg:BankOfAmericaNAMemberabg:A2018BofARealEstateFacilityMember2018-11-130001144980abg:BankOfAmericaNAMemberus-gaap:LondonInterbankOfferedRateLIBORMemberabg:A2018BofARealEstateFacilityMember2018-11-132018-11-130001144980abg:BankOfAmericaNAMemberus-gaap:BaseRateMemberabg:A2018BofARealEstateFacilityMember2018-11-132018-11-130001144980abg:BankOfAmericaNAMemberabg:FederalFundsMemberabg:A2018BofARealEstateFacilityMember2018-11-132018-11-130001144980abg:BankOfAmericaNAMemberabg:A2018BofARealEstateFacilityMemberabg:OneMonthLondonInterbankOfferedRateMember2018-11-132018-11-130001144980abg:BankOfAmericaNAMemberabg:A2018BofARealEstateFacilityMember2018-11-132018-11-130001144980abg:A2018WellsFargoMasterLoanFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-06-012022-06-010001144980srt:MinimumMemberabg:A2018WellsFargoMasterLoanFacilityMemberabg:SOFRPlusBasisSpreadMember2022-06-012022-06-010001144980srt:MaximumMemberabg:A2018WellsFargoMasterLoanFacilityMemberabg:SOFRPlusBasisSpreadMember2022-06-012022-06-010001144980abg:A2018WellsFargoMasterLoanFacilityMemberabg:WellsFargoBankNationalAssociationMember2018-11-160001144980srt:MinimumMemberus-gaap:LondonInterbankOfferedRateLIBORMemberabg:A2018WellsFargoMasterLoanFacilityMemberabg:WellsFargoBankNationalAssociationMember2018-11-062018-11-060001144980srt:MaximumMemberus-gaap:LondonInterbankOfferedRateLIBORMemberabg:A2018WellsFargoMasterLoanFacilityMemberabg:WellsFargoBankNationalAssociationMember2018-11-062018-11-06abg:payment0001144980abg:A2018WellsFargoMasterLoanFacilityMemberabg:WellsFargoBankNationalAssociationMember2018-11-062018-11-060001144980abg:A2018WellsFargoMasterLoanFacilityMemberabg:WellsFargoBankNationalAssociationMember2020-06-260001144980abg:A2015WellsFargoMasterLoanFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-06-012022-06-010001144980abg:A2015WellsFargoMasterLoanFacilityMemberabg:SOFRPlusBasisSpreadMember2022-06-012022-06-010001144980abg:WellsFargoBankNationalAssociationMemberabg:A2015WellsFargoMasterLoanFacilityMember2015-02-030001144980us-gaap:LondonInterbankOfferedRateLIBORMemberabg:WellsFargoBankNationalAssociationMemberabg:A2015WellsFargoMasterLoanFacilityMember2015-02-032015-02-030001144980abg:WellsFargoBankNationalAssociationMemberabg:A2015WellsFargoMasterLoanFacilityMember2015-02-032015-02-030001144980abg:A2013BofARealEstateFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-05-252022-05-250001144980abg:A2013BofARealEstateFacilityMemberabg:SOFRPlusBasisSpreadMember2022-05-252022-05-250001144980abg:A2013BofARealEstateFacilityMember2022-05-252022-05-250001144980abg:A2013BofARealEstateFacilityMemberabg:BaseRateComponentFederalFundsMembersrt:MinimumMember2022-05-252022-05-250001144980abg:A2013BofARealEstateFacilityMembersrt:MinimumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-05-252022-05-250001144980abg:A2013BofARealEstateFacilityMembersrt:MinimumMember2022-05-252022-05-250001144980us-gaap:BaseRateMemberabg:A2013BofARealEstateFacilityMember2022-05-250001144980abg:BankOfAmericaNAMemberabg:A2013BofARealEstateFacilityMember2013-09-260001144980abg:BankOfAmericaNAMemberabg:A2013BofARealEstateFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMember2013-09-262013-09-260001144980abg:BankOfAmericaNAMemberus-gaap:BaseRateMemberabg:A2013BofARealEstateFacilityMember2013-09-262013-09-260001144980abg:BankOfAmericaNAMemberabg:A2013BofARealEstateFacilityMemberabg:FederalFundsMember2013-09-262013-09-260001144980abg:BankOfAmericaNAMemberabg:A2013BofARealEstateFacilityMemberabg:OneMonthLondonInterbankOfferedRateMember2013-09-262013-09-260001144980abg:BankOfAmericaNAMemberabg:A2013BofARealEstateFacilityMember2013-09-262013-09-260001144980abg:CaptiveMortgageMemberus-gaap:MortgagesMember2022-12-310001144980abg:CaptiveMortgageMemberus-gaap:MortgagesMember2021-12-310001144980us-gaap:MortgagesMemberabg:OtherMortgageDebtMember2022-12-310001144980us-gaap:MortgagesMemberabg:OtherMortgageDebtMember2021-12-310001144980abg:A2021RealEstateFacilityMemberus-gaap:MortgagesMember2022-12-310001144980abg:A2021RealEstateFacilityMemberus-gaap:MortgagesMember2021-12-310001144980abg:A2021BofARealEstateFacilityMemberus-gaap:MortgagesMember2022-12-310001144980abg:A2021BofARealEstateFacilityMemberus-gaap:MortgagesMember2021-12-310001144980abg:A2018BofARealEstateFacilityMemberus-gaap:MortgagesMember2022-12-310001144980abg:A2018BofARealEstateFacilityMemberus-gaap:MortgagesMember2021-12-310001144980abg:A2018WellsFargoMasterLoanFacilityMemberus-gaap:MortgagesMember2022-12-310001144980abg:A2018WellsFargoMasterLoanFacilityMemberus-gaap:MortgagesMember2021-12-310001144980abg:A2013BofARealEstateFacilityMemberus-gaap:MortgagesMember2022-12-310001144980abg:A2013BofARealEstateFacilityMemberus-gaap:MortgagesMember2021-12-310001144980abg:A2015WellsFargoMasterLoanFacilityMemberus-gaap:MortgagesMember2022-12-310001144980abg:A2015WellsFargoMasterLoanFacilityMemberus-gaap:MortgagesMember2021-12-310001144980srt:MaximumMemberabg:A2019BankofAmericaRevolvingCreditFacilityMember2022-09-290001144980abg:BaseRateComponentFederalFundsMembersrt:MinimumMemberabg:A2019BankofAmericaRevolvingCreditFacilityMember2022-05-252022-05-250001144980srt:MinimumMemberabg:BaseRateComponentSOFRMemberabg:A2019BankofAmericaRevolvingCreditFacilityMember2022-05-252022-05-250001144980srt:MinimumMemberabg:SOFRPlusBasisSpreadMemberabg:A2019BankofAmericaRevolvingCreditFacilityMember2022-05-252022-05-250001144980us-gaap:BaseRateMemberabg:A2019BankofAmericaRevolvingCreditFacilityMember2022-05-250001144980srt:MinimumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberabg:A2019BankofAmericaRevolvingCreditFacilityMember2022-05-252022-05-250001144980srt:MaximumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberabg:A2019BankofAmericaRevolvingCreditFacilityMember2022-05-252022-05-250001144980us-gaap:BaseRateMembersrt:MinimumMemberabg:A2019BankofAmericaRevolvingCreditFacilityMember2022-05-252022-05-250001144980srt:MaximumMemberus-gaap:BaseRateMemberabg:A2019BankofAmericaRevolvingCreditFacilityMember2022-05-252022-05-250001144980abg:A2019BankOfAmericaRevolvingCreditFacilityNewVehiclesMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-05-252022-05-250001144980abg:SOFRPlusBasisSpreadMemberabg:A2019BankOfAmericaRevolvingCreditFacilityNewVehiclesMember2022-05-252022-05-250001144980us-gaap:BaseRateMemberabg:A2019BankOfAmericaRevolvingCreditFacilityNewVehiclesMember2022-05-252022-05-250001144980abg:A2019BankOfAmericaRevolvingCreditFacilityUsedVehiclesMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-05-252022-05-250001144980abg:A2019BankOfAmericaRevolvingCreditFacilityUsedVehiclesMemberabg:SOFRPlusBasisSpreadMember2022-05-252022-05-250001144980abg:A2019BankOfAmericaRevolvingCreditFacilityUsedVehiclesMemberus-gaap:BaseRateMember2022-05-252022-05-250001144980abg:BankOfAmericaNAMemberabg:ReastatedCreditAgreementMember2014-10-160001144980abg:BankOfAmericaNAMemberus-gaap:StandbyLettersOfCreditMember2014-10-160001144980abg:BankOfAmericaNAMemberabg:ReastatedCreditAgreementMemberus-gaap:GuaranteeObligationsMember2022-12-310001144980abg:BankOfAmericaNAMemberabg:ReastatedCreditAgreementMemberus-gaap:GuaranteeObligationsMember2021-12-310001144980abg:BankOfAmericaNAMemberabg:ReastatedCreditAgreementMember2022-12-310001144980abg:BankOfAmericaNAMemberabg:ReastatedCreditAgreementMemberabg:FederalFundsMember2022-12-310001144980abg:BankOfAmericaNAMemberabg:ReastatedCreditAgreementMembersrt:MinimumMemberus-gaap:LondonInterbankOfferedRateLIBORMember2022-12-310001144980srt:MaximumMemberabg:BankOfAmericaNAMemberabg:ReastatedCreditAgreementMemberus-gaap:LondonInterbankOfferedRateLIBORMember2022-12-310001144980abg:BankOfAmericaNAMemberus-gaap:BaseRateMemberabg:ReastatedCreditAgreementMembersrt:MinimumMember2022-12-310001144980srt:MaximumMemberabg:BankOfAmericaNAMemberus-gaap:BaseRateMemberabg:ReastatedCreditAgreementMember2022-12-310001144980abg:BankOfAmericaNAMemberabg:NewVehicleFloorPlanFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMember2022-12-310001144980abg:BankOfAmericaNAMemberus-gaap:BaseRateMemberabg:NewVehicleFloorPlanFacilityMember2022-12-310001144980abg:BankOfAmericaNAMemberabg:UsedVehicleFloorPlanFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMember2022-12-310001144980abg:BankOfAmericaNAMemberus-gaap:BaseRateMemberabg:UsedVehicleFloorPlanFacilityMember2022-12-310001144980srt:MaximumMemberabg:A2019SeniorCreditFacilityMember2022-12-310001144980abg:A2019SeniorCreditFacilityMember2022-12-310001144980us-gaap:SeniorSubordinatedNotesMember2022-01-012022-12-310001144980us-gaap:SeniorSubordinatedNotesMember2022-12-310001144980us-gaap:SeniorSubordinatedNotesMember2021-12-310001144980us-gaap:InterestRateSwapMember2022-12-31abg:numberOfInstruments0001144980us-gaap:InterestRateSwapMember2022-01-310001144980us-gaap:InterestRateSwapMember2021-05-310001144980abg:InterestRateSwapDue2026Member2022-01-310001144980abg:InterestRateSwapDue2026Member2022-12-310001144980abg:InterestRateSwapDue122031Member2022-01-310001144980abg:InterestRateSwapDue122031Member2022-12-310001144980abg:InterestRateSwapDue52031Member2021-05-310001144980abg:InterestRateSwapDue52031Member2022-12-310001144980abg:InterestRateSwapDueDecember2028Member2020-07-310001144980abg:InterestRateSwapDueDecember2028Member2022-12-310001144980abg:InterestRateSwapDueNovember2025Member2020-07-310001144980abg:InterestRateSwapDueNovember2025Member2022-12-310001144980abg:InterestRateSwapDueFebruary2025Member2017-06-300001144980abg:InterestRateSwapDueFebruary2025Member2022-12-310001144980abg:InterestRateSwapDueSeptember2023Member2013-11-300001144980abg:InterestRateSwapDueSeptember2023Member2022-12-310001144980us-gaap:OtherLiabilitiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001144980us-gaap:OtherLiabilitiesMemberus-gaap:FairValueInputsLevel2Member2021-12-310001144980us-gaap:OtherCurrentAssetsMemberus-gaap:InterestRateSwapMember2022-12-310001144980us-gaap:OtherCurrentAssetsMemberus-gaap:InterestRateSwapMember2021-12-310001144980us-gaap:InterestRateSwapMemberus-gaap:OtherCurrentLiabilitiesMember2022-12-310001144980us-gaap:InterestRateSwapMemberus-gaap:OtherCurrentLiabilitiesMember2021-12-310001144980us-gaap:OtherNoncurrentAssetsMemberus-gaap:InterestRateSwapMember2022-12-310001144980us-gaap:OtherNoncurrentAssetsMemberus-gaap:InterestRateSwapMember2021-12-310001144980us-gaap:InterestRateSwapMemberus-gaap:OtherNoncurrentLiabilitiesMember2022-12-310001144980us-gaap:InterestRateSwapMemberus-gaap:OtherNoncurrentLiabilitiesMember2021-12-310001144980us-gaap:InterestRateSwapMember2021-12-310001144980us-gaap:InterestRateSwapMember2022-01-012022-12-310001144980us-gaap:InterestExpenseMemberus-gaap:InterestRateSwapMember2022-01-012022-12-310001144980us-gaap:InterestRateSwapMember2021-01-012021-12-310001144980us-gaap:InterestExpenseMemberus-gaap:InterestRateSwapMember2021-01-012021-12-310001144980us-gaap:InterestRateSwapMember2020-01-012020-12-310001144980us-gaap:InterestExpenseMemberus-gaap:InterestRateSwapMember2020-01-012020-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel12And3Member2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel1Member2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel2Member2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ShortTermInvestmentsMember2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel12And3Memberus-gaap:ShortTermInvestmentsMember2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:USTreasurySecuritiesMember2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMember2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:USTreasurySecuritiesMember2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel12And3Memberus-gaap:USTreasurySecuritiesMember2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MunicipalBondsMember2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:MunicipalBondsMember2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MunicipalBondsMember2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel12And3Memberus-gaap:MunicipalBondsMember2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel12And3Memberus-gaap:CorporateDebtSecuritiesMember2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberabg:MortgageAndOtherAssetsBackedSecuritiesMember2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberabg:MortgageAndOtherAssetsBackedSecuritiesMember2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberabg:MortgageAndOtherAssetsBackedSecuritiesMember2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel12And3Memberabg:MortgageAndOtherAssetsBackedSecuritiesMember2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DebtSecuritiesMemberus-gaap:FairValueInputsLevel12And3Member2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CommonStockMember2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CommonStockMember2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CommonStockMember2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel12And3Memberus-gaap:CommonStockMember2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMember2022-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel12And3Member2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel1Member2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel2Member2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ShortTermInvestmentsMember2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel12And3Memberus-gaap:ShortTermInvestmentsMember2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:USTreasurySecuritiesMember2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMember2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:USTreasurySecuritiesMember2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel12And3Memberus-gaap:USTreasurySecuritiesMember2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MunicipalBondsMember2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:MunicipalBondsMember2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MunicipalBondsMember2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel12And3Memberus-gaap:MunicipalBondsMember2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel12And3Memberus-gaap:CorporateDebtSecuritiesMember2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberabg:MortgageAndOtherAssetsBackedSecuritiesMember2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberabg:MortgageAndOtherAssetsBackedSecuritiesMember2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberabg:MortgageAndOtherAssetsBackedSecuritiesMember2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel12And3Memberabg:MortgageAndOtherAssetsBackedSecuritiesMember2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DebtSecuritiesMemberus-gaap:FairValueInputsLevel12And3Member2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CommonStockMember2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CommonStockMember2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CommonStockMember2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel12And3Memberus-gaap:CommonStockMember2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2021-12-310001144980us-gaap:FairValueMeasurementsRecurringMember2021-12-310001144980us-gaap:OtherCurrentAssetsMember2022-12-310001144980us-gaap:AccountsPayableAndAccruedLiabilitiesMember2021-12-31abg:segment0001144980abg:InsuranceMember2022-12-310001144980abg:InsuranceMember2022-01-012022-12-310001144980us-gaap:IntersegmentEliminationMember2022-01-012022-12-310001144980us-gaap:IntersegmentEliminationMember2022-12-310001144980abg:InsuranceMember2021-01-012021-12-310001144980us-gaap:IntersegmentEliminationMember2021-01-012021-12-310001144980abg:InsuranceMember2021-12-310001144980us-gaap:IntersegmentEliminationMember2021-12-310001144980us-gaap:GuaranteeObligationsMember2022-12-310001144980abg:A2019EquityandIncentiveCompensationPlanMemberus-gaap:CommonStockMember2019-04-170001144980srt:MinimumMemberus-gaap:PerformanceSharesMember2022-01-012022-12-310001144980us-gaap:PerformanceSharesMember2022-01-012022-12-310001144980srt:MaximumMemberus-gaap:PerformanceSharesMember2022-01-012022-12-310001144980us-gaap:PerformanceSharesMember2021-12-310001144980us-gaap:PerformanceSharesMember2022-12-310001144980us-gaap:PerformanceSharesMember2021-01-012021-12-310001144980us-gaap:PerformanceSharesMember2020-01-012020-12-310001144980us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001144980us-gaap:RestrictedStockMember2022-01-012022-12-310001144980us-gaap:RestrictedStockUnitsRSUMember2021-12-310001144980us-gaap:RestrictedStockUnitsRSUMember2022-12-310001144980us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001144980us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001144980us-gaap:RestrictedStockMember2021-12-310001144980us-gaap:RestrictedStockMember2022-12-310001144980us-gaap:RestrictedStockMember2021-01-012021-12-310001144980us-gaap:RestrictedStockMember2020-01-012020-12-310001144980abg:AgeFiftyOrMoreMember2022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-31262

ASBURY AUTOMOTIVE GROUP, INC.

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

| Delaware | | 01-0609375 | |

| (State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) | |

| | | | | |

| 2905 Premiere Parkway, NW, | Suite 300 | | | |

| Duluth, | Georgia | | 30097 | |

| (Address of principal executive offices) | | (Zip Code) | |

(770) 418-8200

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| | Trading | | |

| Title of each class | | Symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.01 par value per share | | ABG | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None.

a

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large Accelerated Filer | ☒ | | Accelerated Filer | ☐ |

| | | | |

| Non-Accelerated Filer | ☐ | | Smaller Reporting Company | ☐ |

| | | | |

| | | Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of

the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.

7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

Based on the closing price of the registrant's common stock as of June 30, 2022, the aggregate market value of the common stock held by non-affiliates of the registrant was $3.72 billion (based upon the assumption, solely for purposes of this computation, that all of the officers and directors of the registrant were affiliates of the registrant).

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date: The number of shares of common stock outstanding as of February 23, 2023 was 21,687,409.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K into which the document is incorporated:

Portions of the registrant's definitive Proxy Statement for the 2023 Annual Meeting of Stockholders, to be filed within 120 days after the end of the registrant's fiscal year, are incorporated by reference into Part III, Items 10 through 14 of this Annual Report on Form 10-K.

ASBURY AUTOMOTIVE GROUP, INC.

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED

DECEMBER 31, 2022

| | | | | | | | |

| | | Page |

| PART I |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| PART II |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| PART III |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| PART IV | |

| | |

| | |

| | |

PART I.

Forward-Looking Information

Certain of the discussions and information included or incorporated by reference in this report may constitute "forward-looking statements" within the meaning of the federal securities laws. Forward-looking statements are statements that are not historical in nature and may include statements relating to our goals, plans and projections regarding industry and general economic trends, our expected financial position, results of operations or market position and our business strategy. Such statements can generally be identified by words such as "may," "target," "could," "would," "will," "should," "believe," "expect," "anticipate," "plan," "intend," "foresee," and other similar words or phrases. Forward-looking statements may also relate to our expectations and assumptions with respect to, among other things:

•the seasonally adjusted annual rate of new vehicle sales in the United States;

•general economic conditions and its expected impact on our revenue and expenses;

•our expected parts and service revenue due to, among other things, improvements in vehicle technology;

•our ability to limit our exposure to regional economic downturns due to our geographic diversity and brand mix;

•manufacturers' continued use of incentive programs to drive demand for their product offerings;

•our capital allocation strategy, including as it relates to acquisitions and divestitures, stock repurchases, dividends and capital expenditures;

•our revenue growth strategy;

•the growth of the brands that comprise our portfolio over the long-term;

•disruptions in the production and supply of vehicles and parts from our vehicle and parts manufacturers and other suppliers due to any ongoing impact of supply issues, including the global semiconductor chip shortage, which can disrupt our operations; and

•our estimated future capital expenditures, which can be impacted by increasing prices and labor shortages and acquisitions and divestitures.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual future results, performance or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. Such factors include, but are not limited to:

•the ability to acquire and successfully integrate acquired businesses into our existing operations and realize expected benefits and synergies from such acquisitions;

•the effects of increased expenses or unanticipated liabilities incurred as a result of, or due to activities related to our acquisitions or divestitures;

•changes in general economic and business conditions, including the current inflationary environment, the current rising interest rate environment, changes in employment levels, consumer confidence levels, consumer demand and preferences, the availability and cost of credit, fuel prices and levels of discretionary personal income;

•our ability to generate sufficient cash flows, maintain our liquidity and obtain any necessary additional funds for working capital, capital expenditures, acquisitions, stock repurchases, debt maturity payments and other corporate purposes, if necessary or desirable;

•significant disruptions in the production and delivery of vehicles and parts for any reason, including supply shortages (including semiconductor chips), the ongoing conflict in Russia and Ukraine, including any government sanctions imposed in connection therewith, natural disasters, severe weather, civil unrest, product recalls, work stoppages or other occurrences that are outside of our control;

•our ability to execute our automotive retailing and service business strategy while operating under restrictions and best practices imposed or encouraged by governmental and other regulatory authorities;

•our ability to successfully attract and retain skilled employees;

•our ability to successfully operate, including our ability to maintain, and obtain future necessary regulatory approvals, for Total Care Auto, Powered by Landcar ("TCA"), our F&I product provider;

•adverse conditions affecting the vehicle manufacturers whose brands we sell, and their ability to design, manufacture, deliver and market their vehicles successfully;

•changes in the mix and total number of vehicles we are able to sell;

•our outstanding indebtedness and our continued ability to comply with applicable covenants in our various financing and lease agreements, or to obtain waivers of these covenants as necessary;

•high levels of competition in our industry, which may create pricing and margin pressures on our products and services;

•our relationships with manufacturers of the vehicles we sell and our ability to renew, and enter into new framework and dealer agreements with vehicle manufacturers whose brands we sell, on terms acceptable to us;

•the availability of manufacturer incentive programs and our ability to earn these incentives;

•failure of our, or those of our third-party service providers, management information systems;

•any data security breaches occurring, including with regard to personally identifiable information ("PII");

•changes in laws and regulations governing the operation of automobile franchises, including trade restrictions, consumer protections, accounting standards, taxation requirements and environmental laws;

•changes in, or the imposition of, new tariffs or trade restrictions on imported vehicles or parts;

•adverse results from litigation or other similar proceedings involving us;

•our ability to consummate planned mergers, acquisitions and dispositions;

•any disruptions in the financial markets, which may impact our ability to access capital;

•our relationships with, and the financial stability of, our lenders and lessors;

•our ability to execute our initiatives and other strategies; and

•our ability to leverage scale and cost structure to improve operating efficiencies across our dealership portfolio.

Many of these factors are beyond our ability to control or predict, and their ultimate impact could be material. Moreover, the factors set forth under "Item 1A. Risk Factors" and "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations" below and other cautionary statements made in this report should be read and considered as forward-looking statements subject to such uncertainties. We urge you to carefully consider those factors.

Forward-looking statements speak only as of the date of this report. We expressly disclaim any obligation to update any forward-looking statement contained herein.

Additional Information

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to such reports filed pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, are made available free of charge on our website at http://www.asburyauto.com as soon as practical after such reports are filed with the U.S. Securities and Exchange Commission (the "Commission"). In addition, the proxy statement that will be delivered to our stockholders in connection with our 2023 Annual Meeting of Stockholders, when filed, will also be available on our website, and at the URL stated in such proxy statement. We also make available on our website copies of our certificate of incorporation, bylaws, and other materials that outline our corporate governance policies and practices, including:

•the respective charters of our audit committee, governance and nominating committee, compensation and human resources committee, and capital allocation and risk management committee;

• our criteria for independence of the members of our board of directors, audit committee, and compensation and human resources committee;

• our Corporate Governance Guidelines; and

• our Code of Business Conduct and Ethics for Directors, Officers, and Employees.

We intend to provide any information required by Item 5.05 of Form 8-K (relating to amendments or waivers of our Code of Business Conduct and Ethics for Directors, Officers, and Employees) by disclosure on our website.

You may also obtain a printed copy of the foregoing materials by sending a written request to: Investor Relations Department, Asbury Automotive Group, Inc., 2905 Premiere Parkway, NW, Suite 300, Duluth, Georgia 30097. In addition, the Commission makes available on its website, free of charge, reports, proxy and information statements, and other information regarding issuers, such as us, that file electronically with the Commission. The Commission's website is http://www.sec.gov. Unless otherwise specified, information contained on our website, available by hyperlink from our website or on the Commission's website, is not incorporated into this report or other documents we file with, or furnish to, the Commission.

Except as the context otherwise requires, "we," "our," "us," "Asbury," and "the Company" refer to Asbury Automotive Group, Inc. and its subsidiaries.

Item 1. BUSINESS

Asbury Automotive Group, Inc., a Delaware corporation organized in 2002, is a Fortune 500 company and one of the largest franchised automotive retailers in the United States with 139 new vehicle dealerships across 14 states. Our mission and vision is to put the guest experience first and follow our "North Star" to be the most guest-centric automotive retailer in the industry. We follow three key principles to guide us: (1) have a fun, supportive and inclusive culture where team members thrive personally while building meaningful bonds with one another; (2) be great brand ambassadors and exceptional stewards of capital for our partners who fuel our mission; and (3) be caring professionals who strive to delight our guests and foster love for the brand. Our strong organizational culture and purposeful mission allow us to continuously deliver best-in-class experiences to our guests. As of December 31, 2022, we owned and operated 186 new vehicle franchises, representing 31 brands of automobiles at 139 dealership locations, 32 collision centers, seven stand-alone used vehicle dealerships, one used vehicle wholesale business, one auto auction, and Total Care Auto, Powered by Landcar ("TCA" or "TCA Business"), our finance and insurance ("F&I") product provider, within 14 states. Our store operations are conducted by our subsidiaries.

We offer an extensive range of automotive products and services fulfilling the entire vehicle ownership lifecycle including new and used vehicles, parts and service, which includes vehicle repair and maintenance services, replacement parts and collision repair services (collectively referred to as "parts and services" or "P&S"), and F&I products, including arranging vehicle financing through third parties and aftermarket products, such as extended service contracts, guaranteed asset protection ("GAP") debt cancellation and prepaid maintenance. We strive for a diversified mix of products, services, brands and geographic locations which allows us to reduce our reliance on any one manufacturer, minimize the impact from changes in customer preference and maintain profitability across fluctuations in new vehicle sales. Our diverse revenue base, along with our commitment to operational excellence across our dealership portfolio, provides a resilient business model and strong profit margins.

Our omni-channel platform is designed to engage with customers where and when they want to interact and to increase our market share through digital innovation. We are focused on providing a high level of customer service and have designed our dealerships’ services to meet the increasingly sophisticated needs of customers throughout the vehicle ownership lifecycle. Our digital capabilities further enhance our physical dealership network and drive additional revenue. Our ability to provide a low friction experience across our omni-channel platform drives customer satisfaction and repeat business across our dealership portfolio.

In December 2020, we introduced Clicklane, the automotive retail industry’s first, end-to-end, 100% online vehicle retail tool. This differentiated platform offers our customers an easy, seamless and transparent approach to completing the purchase or sale of vehicles completely online inclusive of all documentation, loan origination and everything in between. We believe the Clicklane tool will further enhance our physical dealership network and creates a competitive advantage as the vehicle buying process evolves in a digital environment.

Acquisitions

On December 17, 2021, the Company completed the acquisition of the businesses of the Larry H. Miller ("LHM") Dealerships and TCA (collectively, the "LHM acquisition"), thereby acquiring 54 new vehicle dealerships, seven used cars stores, 11 collision centers, a used vehicle wholesale business, the real property related thereto, and the entities comprising the TCA business for a total purchase price of $3.48 billion. The purchase price was financed through a combination of cash, debt, including senior notes, real estate facilities, new and used vehicle floor plan facilities and the proceeds from the issuance of common stock. As a result of the transaction, the Company now operates in two reportable segments, the Dealerships and TCA segments.

In addition to the LHM acquisition, during the year ended December 31, 2021, we acquired the assets of 11 franchises (10 dealership locations) in the Denver, Colorado market and three franchises (one dealership location) in the Indianapolis, Indiana market for a combined purchase price of $485.7 million. We funded these acquisitions with an aggregate of $455.1 million of cash and $9.6 million of floor plan borrowings for the purchase of the related new vehicle inventory. In the aggregate, these acquisitions included purchase price holdbacks of $21.0 million for potential indemnity claims made by us with respect to the acquired franchises.

On August 24, 2020, the Company, through two of its subsidiaries, acquired substantially all of the assets of, and leased the real property related to, 12 new vehicle dealership franchises (eight dealership locations), two collision centers and an auto auction (collectively, the "Park Place acquisition"). The Park Place acquisition was financed through a combination of cash, floor plan facilities and seller financing. The seller financing comprised $150.0 million in aggregate principal amount of a 4.00% promissory note due August 2021 and $50.0 million in aggregate principal amount of a 4.00% promissory note due

February 2022 (collectively, the "Seller Notes"). In September 2020, the Company redeemed the Seller Notes with proceeds from the offering of 4.50% Notes due 2028 and 4.75% Notes due 2030.

In addition to the Park Place acquisition during the year ended December 31, 2020, we acquired the assets of three franchises (one dealership location) in the Denver, Colorado market for a combined purchase price of $63.6 million. We funded this acquisition with an aggregate of $34.5 million of cash and $27.1 million of floor plan borrowings for the purchase of the related new vehicle inventory.

There were no acquisitions during the year ended December 31, 2022.

Divestitures

During the year ended December 31, 2022, we sold one franchise (one dealership location) in St. Louis, Missouri, three franchises (three dealership locations) and one collision center in Denver, Colorado, two franchises (two dealership locations) in Spokane, Washington, one franchise (one dealership location) in Albuquerque, New Mexico and 11 franchises (nine dealership locations) and two collision centers in North Carolina. The Company recorded a pre-tax gain totaling $207.1 million.

During the year ended December 31, 2021, we sold one franchise (one dealership location) in the Charlottesville, Virginia market. The Company recorded a pre-tax gain totaling $8.0 million.

During the year ended December 31, 2020, we sold two franchises (two dealership locations) in the Atlanta, Georgia market, six franchises (five dealership locations) and one collision center in the Jackson, Mississippi market, and one franchise (one dealership location) in the Greenville, South Carolina market. The Company recorded a pre-tax gain totaling $62.3 million.

Four Key Components of Our Business

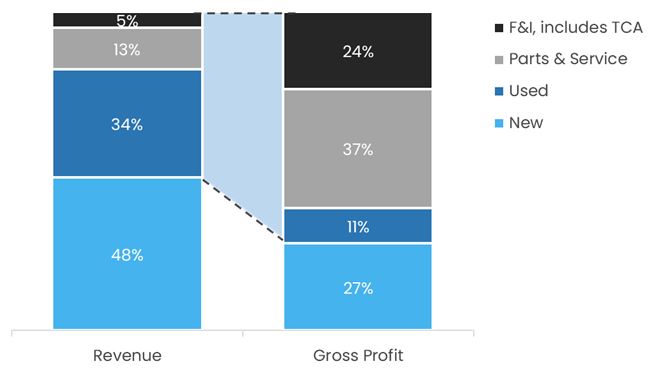

The following chart presents the contribution to total revenue and gross profit by each line of business for the year ended December 31, 2022.

Our new vehicle franchise retail network within our Dealerships segment is made up of dealerships located in 14 states operating primarily under 15 locally branded dealership groups. The following chart provides a detailed breakdown of our states, brand names, and franchises as of December 31, 2022:

| | | | | | | | | | | | | | |

| Dealership Group Brand Name | | State | | Franchise |

| | | | |

| Coggin Automotive Group | | Florida | | Acura, BMW, Buick, Chevrolet, Ford(a), GMC, Honda(d), Hyundai, Mercedes-Benz, Nissan(a), Toyota |

| | | | |

| Courtesy Autogroup | | Florida | | Chrysler, Dodge, Genesis, Honda, Hyundai, Infiniti, Jeep, Kia, Mercedes-Benz, Nissan, Sprinter, Toyota |

| | | | |

| Crown Automotive Company | | South Carolina | | Nissan |

| | Virginia | | Acura, BMW(a), MINI |

| | | | |

| David McDavid Auto Group | | Texas | | Acura, Ford, Honda(a), Lincoln |

| | | | |

| Greenville Automotive Group | | South Carolina | | Jaguar, Land Rover, Porsche, Toyota, Volvo |

| | | | |

| Hare, Bill Estes & Kahlo Automotive Groups | | Indiana | | Buick, Chevrolet(b), Chrysler(a), Dodge(a), Ford, GMC, Honda, Isuzu, Jeep(a), Toyota |

| | | | |

| Larry H. Miller Dealerships | | Arizona | | Chrysler(b), Dodge(c), Fiat, Ford, Genesis, Hyundai, Jeep(b), Nissan, Toyota, Volkswagen(a) |

| | California | | Toyota(a) |

| | Colorado | | Chrysler(a), Dodge(b), Fiat, Ford, Jeep(a), Nissan(b), Volkswagen |

| | Idaho | | Chrysler, Dodge, Honda, Jeep, Subaru |

| | New Mexico | | Chevrolet, Chrysler(a), Dodge, Genesis, Hyundai(a), Jeep(a), Toyota |

| | Utah | | Chevrolet(a), Chrysler(c), Dodge(c), Ford(b), Honda, Jeep(c), Lexus(a), Lincoln(a), Mercedes-Benz, Toyota, Sprinter |

| | Washington | | Honda |

| | | | |

| Mike Shaw, Stevinson & Arapahoe Automotive Groups | | Colorado | | Subaru(a), Chevrolet, Chrysler, Dodge, Hyundai(a), Jaguar, Jeep, Lexus(a), Porsche, Toyota(a) |

| | | | |

| Nalley Automotive Group | | Georgia | | Acura, Audi, Bentley, BMW, Chevrolet, Honda, Hyundai, Infiniti(a), Kia, Lexus(a), Nissan, Toyota(b), Volkswagen |

| | | | |

| Park Place Automotive | | Texas | | Acura, Jaguar, Lexus(a), Land Rover, Mercedes-Benz(b), Porsche, Volvo, Sprinter(b) |

| | | | |

| Plaza Motor Company | | Missouri | | Audi, BMW, Infiniti, Jaguar, Land Rover, Mercedes-Benz(a), Sprinter(a) |

_____________________________

(a)This state has two of these franchises.

(b)This state has three of these franchises.

(c)This state has four of these franchises.

(d)This state has five of these franchises.

Operations

New Vehicle Sales

The following table reflects the number of franchises we owned as of December 31, 2022 and the percentage of new vehicle revenues represented by class and franchise for the year ended December 31, 2022:

| | | | | | | | | | | | | | |

| Class/Franchise | | Number of

Franchises Owned | | % of New

Vehicle Revenues |

| Luxury | | | | |

| Lexus | | 8 | | | 9 | % |

| Mercedes-Benz | | 8 | | | 8 | |

| Acura | | 6 | | | 2 | |

| BMW | | 5 | | | 4 | |

| Genesis | | 3 | | | 1 | |

| Infiniti | | 4 | | | 1 | |

| Jaguar | | 4 | | | * |

| Land Rover | | 3 | | | 1 | |

| Lincoln | | 3 | | | 1 | |

| Porsche | | 3 | | | 2 | |

| Volvo | | 2 | | | 1 | |

| Audi | | 1 | | | 1 | |

| Bentley | | 1 | | | * |

| Total Luxury | | 51 | | | 31 | % |

| Import | | | | |

| Toyota | | 14 | | | 17 | % |

| Honda | | 13 | | | 9 | |

| Nissan | | 9 | | | 4 | |

| Hyundai | | 8 | | | 5 | |

| Sprinter | | 7 | | | * |

| Volkswagen | | 4 | | | 1 | |

| Subaru | | 3 | | | 2 | |

| Fiat | | 2 | | | * |

| Kia | | 2 | | | 2 | |

| MINI | | 1 | | | * |

| Isuzu | | 1 | | | * |

| Total Import | | 64 | | | 40 | % |

| Domestic | | | | |

| Chrysler, Dodge, Jeep, Ram | | 49 | | | 15 | % |

| Ford | | 9 | | | 9 | |

| Chevrolet, Buick, GMC | | 13 | | | 5 | |

| Total Domestic | | 71 | | | 29 | % |

| Total Franchises | | 186 | | | 100 | % |

* Franchise accounted for less than 1% of new vehicle revenues for the year ended December 31, 2022.

Our new vehicle revenues include new vehicle sales and lease transactions arranged by our dealerships with third-party financial institutions. We believe that leasing provides a number of benefits to our other business lines, including the historical customer loyalty to the leasing dealership for repairs and maintenance services and the fact that lessors typically give the leasing dealership the first option to purchase the off-lease vehicle.

Used Vehicle Sales

We sell used vehicles at all our franchised dealership locations, seven stand-alone used vehicle dealerships, one used vehicle wholesale business and one auto auction. Used vehicle sales include the sale of used vehicles to individual retail

customers ("used retail") and the sale of used vehicles to other dealers at auction ("wholesale") (the terms "used retail" and "wholesale" collectively referred to as "used").

Gross profit from the sale of used vehicles depends primarily on our dealerships' ability to obtain a high quality supply of used vehicles and our use of technology to manage our inventory. Our new vehicle operations typically provide our used vehicle operations with a large supply of trade-ins and off-lease vehicles, which we believe are good sources of high quality used vehicles. We also purchase a portion of our used vehicle inventory at "open" auctions and auctions restricted to new vehicle dealers. Additionally, our used vehicle sales benefit from our ability to sell certified pre-owned vehicles from our franchised dealerships.

Parts and Service

We provide vehicle repair and maintenance services, sell replacement parts, and recondition used vehicles at all of our dealerships. In addition, we provide collision repair services at our 32 free-standing collision repair centers that we operate either on the premises of, or in close proximity to, our dealerships. Historically, parts and service revenues have been more stable than those from vehicle sales. Industry-wide, parts and service revenues have consistently increased over time primarily due to the increased cost of maintaining vehicles, the added technical complexity of vehicles, and the increasing number of vehicles on the road.

The automotive parts and service industry tends to be highly fragmented, with franchised dealerships and independent repair shops competing for this business. We believe, however, that the increased use of advanced technology in vehicles is making it difficult for independent repair shops to compete effectively with franchised dealerships as they may not be able to make the investment necessary to perform major or technical repairs. In an effort to maintain the necessary knowledge to service vehicles and further develop our technician staff, we focus on our internal and manufacturer specific training and development programs for new and existing technicians. We believe our parts and service business is also well-positioned to benefit from the service work potentially generated through the sale of extended service contracts to customers who purchase new and used vehicles from us, as historically these customers tend to have their vehicles serviced at the location where they purchased the extended service contract. In addition, our franchised dealerships benefit from manufacturer policies requiring that warranty and recall related repairs be performed at a franchised dealership. We believe our collision repair centers provide us with an attractive opportunity to grow our business due to the high margins provided by collision repair services and the fact that we are able to source original equipment manufacturer parts from our franchised dealerships.

Finance and Insurance

We offer a wide variety of automotive F&I products to our customers. Through the acquisition of TCA in December 2021, we offer extended vehicle service contracts, prepaid maintenance contracts, key replacement contracts, guaranteed asset protection contracts, paintless dent repair contracts, appearance protection contracts, tire and wheel, and lease wear and tear contracts. These F&I products are sold to our customers via our network of dealerships.

In addition to the TCA F&I products, we offer our customers a variety of vehicle protection products through independent third parties in connection with the purchase of vehicles. These products are underwritten and administered by these third parties. Under our arrangements with the providers of these products, we primarily sell the products on a straight commission basis. We are subject to chargebacks for service and other contracts as a result of early termination, default, or prepayment of the contract. In addition, we participate in future profits associated with the performance of the third-party held underlying portfolio for certain products pursuant to retrospective commission arrangements.

We also arrange third-party financing for the sale or lease of vehicles to our customers in exchange for compensation paid to us by the third-party financial institution. We do not directly finance our customers' vehicle purchases or leases, therefore our exposure to losses in connection with those third-party financing arrangements is limited generally to the compensation we receive. The compensation we receive is subject to chargeback, or repayment, to the third-party finance company if a customer defaults or prepays the retail installment contract typically during some limited time period at the beginning of the contract term. We have negotiated agreements with certain lenders pursuant to which we receive additional compensation upon reaching a certain volume of business.

F&I revenue in our Dealerships segment represents the commissions earned from both TCA and independent third parties related to a broad range of F&I products. This F&I revenue is presented net of third-party chargebacks.