00011413912020FYfalseP1Yus-gaap:AssetsAbstractus-gaap:AssetsAbstractus-gaap:OtherLiabilitiesCurrentus-gaap:OtherLiabilitiesCurrentus-gaap:OtherLiabilitiesNoncurrentus-gaap:OtherLiabilitiesNoncurrent————00011413912020-01-012020-12-310001141391us-gaap:CommonClassAMember2020-01-012020-12-310001141391ma:OnePointOnePercentNotesDue2022Member2020-01-012020-12-310001141391ma:TwoPointOnePercentNotesDue2027Member2020-01-012020-12-310001141391ma:TwoPointFivePercentNotesDue2030Member2020-01-012020-12-31iso4217:USD00011413912020-06-30xbrli:shares0001141391us-gaap:CommonClassAMember2021-02-090001141391us-gaap:CommonClassBMember2021-02-0900011413912019-01-012019-12-3100011413912018-01-012018-12-31iso4217:USDxbrli:shares00011413912020-12-3100011413912019-12-310001141391us-gaap:CommonClassAMember2020-12-310001141391us-gaap:CommonClassAMember2019-12-310001141391us-gaap:CommonClassBMember2019-12-310001141391us-gaap:CommonClassBMember2020-12-310001141391us-gaap:CommonClassAMember2017-12-310001141391us-gaap:CommonClassBMember2017-12-310001141391us-gaap:AdditionalPaidInCapitalMember2017-12-310001141391us-gaap:TreasuryStockMember2017-12-310001141391us-gaap:RetainedEarningsMember2017-12-310001141391us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-12-310001141391us-gaap:ParentMember2017-12-310001141391us-gaap:NoncontrollingInterestMember2017-12-3100011413912017-12-310001141391srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201409Memberus-gaap:RetainedEarningsMember2017-12-310001141391srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201409Memberus-gaap:ParentMember2017-12-310001141391srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201409Member2017-12-310001141391ma:AccountingStandardsUpdates201616Membersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2017-12-310001141391ma:AccountingStandardsUpdates201616Membersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:ParentMember2017-12-310001141391ma:AccountingStandardsUpdates201616Membersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2017-12-310001141391us-gaap:RetainedEarningsMember2018-01-012018-12-310001141391us-gaap:ParentMember2018-01-012018-12-310001141391us-gaap:NoncontrollingInterestMember2018-01-012018-12-310001141391us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310001141391us-gaap:TreasuryStockMember2018-01-012018-12-310001141391us-gaap:AdditionalPaidInCapitalMember2018-01-012018-12-310001141391us-gaap:CommonClassAMember2018-12-310001141391us-gaap:CommonClassBMember2018-12-310001141391us-gaap:AdditionalPaidInCapitalMember2018-12-310001141391us-gaap:TreasuryStockMember2018-12-310001141391us-gaap:RetainedEarningsMember2018-12-310001141391us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310001141391us-gaap:ParentMember2018-12-310001141391us-gaap:NoncontrollingInterestMember2018-12-3100011413912018-12-310001141391us-gaap:RetainedEarningsMember2019-01-012019-12-310001141391us-gaap:ParentMember2019-01-012019-12-310001141391us-gaap:NoncontrollingInterestMember2019-01-012019-12-310001141391us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001141391us-gaap:TreasuryStockMember2019-01-012019-12-310001141391us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001141391us-gaap:AdditionalPaidInCapitalMember2019-12-310001141391us-gaap:TreasuryStockMember2019-12-310001141391us-gaap:RetainedEarningsMember2019-12-310001141391us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001141391us-gaap:ParentMember2019-12-310001141391us-gaap:NoncontrollingInterestMember2019-12-310001141391us-gaap:RetainedEarningsMember2020-01-012020-12-310001141391us-gaap:ParentMember2020-01-012020-12-310001141391us-gaap:NoncontrollingInterestMember2020-01-012020-12-310001141391us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001141391us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001141391us-gaap:TreasuryStockMember2020-01-012020-12-310001141391us-gaap:AdditionalPaidInCapitalMember2020-12-310001141391us-gaap:TreasuryStockMember2020-12-310001141391us-gaap:RetainedEarningsMember2020-12-310001141391us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001141391us-gaap:ParentMember2020-12-310001141391us-gaap:NoncontrollingInterestMember2020-12-31xbrli:pure0001141391srt:MaximumMemberma:ConsolidatedEntitiesWithLessThan100OwnershipInterestMember2020-12-310001141391us-gaap:OtherIntangibleAssetsMembersrt:MinimumMember2020-01-012020-12-310001141391srt:MaximumMemberus-gaap:OtherIntangibleAssetsMember2020-01-012020-12-310001141391srt:MinimumMember2020-12-310001141391srt:MaximumMember2020-12-310001141391us-gaap:PartnershipMembersrt:MinimumMember2020-12-310001141391srt:MaximumMemberus-gaap:PartnershipMember2020-12-310001141391us-gaap:BuildingMember2020-01-012020-12-310001141391srt:MinimumMemberma:BuildingEquipmentMember2020-01-012020-12-310001141391srt:MaximumMemberma:BuildingEquipmentMember2020-01-012020-12-310001141391us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2020-01-012020-12-310001141391srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2020-01-012020-12-310001141391ma:A2020AcquisitionsMember2020-01-012020-12-310001141391ma:A2020AcquisitionsMember2020-12-310001141391ma:A2019AcquisitionsMember2019-12-310001141391ma:A2020AcquisitionsMemberus-gaap:DevelopedTechnologyRightsMember2020-12-310001141391us-gaap:DevelopedTechnologyRightsMemberma:A2019AcquisitionsMember2019-12-310001141391ma:A2020AcquisitionsMemberus-gaap:DevelopedTechnologyRightsMember2020-01-012020-12-310001141391us-gaap:DevelopedTechnologyRightsMemberma:A2019AcquisitionsMember2019-01-012019-12-310001141391ma:A2020AcquisitionsMemberus-gaap:CustomerRelationshipsMember2020-12-310001141391us-gaap:CustomerRelationshipsMemberma:A2019AcquisitionsMember2019-12-310001141391ma:A2020AcquisitionsMemberus-gaap:CustomerRelationshipsMember2020-01-012020-12-310001141391us-gaap:CustomerRelationshipsMemberma:A2019AcquisitionsMember2019-01-012019-12-310001141391ma:A2020AcquisitionsMemberus-gaap:OtherIntangibleAssetsMember2020-12-310001141391us-gaap:OtherIntangibleAssetsMemberma:A2019AcquisitionsMember2019-12-310001141391ma:A2020AcquisitionsMemberus-gaap:OtherIntangibleAssetsMember2020-01-012020-12-310001141391us-gaap:OtherIntangibleAssetsMemberma:A2019AcquisitionsMember2019-01-012019-12-310001141391ma:A2019AcquisitionsMember2019-01-012019-12-310001141391ma:FinicityCorporationFinicityMember2020-11-180001141391ma:FinicityCorporationFinicityMember2020-11-182020-11-180001141391ma:FinicityCorporationFinicityMember2020-12-31iso4217:EUR0001141391ma:NetsDenmarkASCorporateServicesMember2019-08-012019-08-310001141391ma:NetsDenmarkASCorporateServicesMember2019-08-012020-12-310001141391ma:DomesticAssessmentsMember2020-01-012020-12-310001141391ma:DomesticAssessmentsMember2019-01-012019-12-310001141391ma:DomesticAssessmentsMember2018-01-012018-12-310001141391ma:CrossborderVolumeFeesMember2020-01-012020-12-310001141391ma:CrossborderVolumeFeesMember2019-01-012019-12-310001141391ma:CrossborderVolumeFeesMember2018-01-012018-12-310001141391ma:TransactionProcessingMember2020-01-012020-12-310001141391ma:TransactionProcessingMember2019-01-012019-12-310001141391ma:TransactionProcessingMember2018-01-012018-12-310001141391ma:OtherRevenuesMember2020-01-012020-12-310001141391ma:OtherRevenuesMember2019-01-012019-12-310001141391ma:OtherRevenuesMember2018-01-012018-12-310001141391srt:NorthAmericaMember2020-01-012020-12-310001141391srt:NorthAmericaMember2019-01-012019-12-310001141391srt:NorthAmericaMember2018-01-012018-12-310001141391ma:InternationalMarketsMember2020-01-012020-12-310001141391ma:InternationalMarketsMember2019-01-012019-12-310001141391ma:InternationalMarketsMember2018-01-012018-12-310001141391ma:OtherMarketsMember2020-01-012020-12-310001141391ma:OtherMarketsMember2019-01-012019-12-310001141391ma:OtherMarketsMember2018-01-012018-12-310001141391us-gaap:AccountsReceivableMember2020-12-310001141391us-gaap:AccountsReceivableMember2019-12-310001141391us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2020-12-310001141391us-gaap:OtherAssetsMember2020-12-310001141391us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2019-12-310001141391us-gaap:OtherAssetsMember2019-12-310001141391us-gaap:OtherCurrentLiabilitiesMember2020-12-310001141391us-gaap:OtherLiabilitiesMember2020-12-310001141391us-gaap:OtherCurrentLiabilitiesMember2019-12-310001141391us-gaap:OtherLiabilitiesMember2019-12-3100011413912021-01-01ma:NetworkServicesMember2020-12-310001141391ma:RestrictedCashLitigationSettlementMember2020-12-310001141391ma:RestrictedCashLitigationSettlementMember2019-12-310001141391ma:RestrictedCashSecurityDepositsMember2020-12-310001141391ma:RestrictedCashSecurityDepositsMember2019-12-310001141391ma:RestrictedCashPrepaidExpensesAndOtherCurrentAssetsMember2020-12-310001141391ma:RestrictedCashPrepaidExpensesAndOtherCurrentAssetsMember2019-12-310001141391us-gaap:MunicipalBondsMember2020-12-310001141391us-gaap:MunicipalBondsMember2019-12-310001141391ma:GovernmentsecuritiesMember2020-12-310001141391ma:GovernmentsecuritiesMember2019-12-310001141391us-gaap:FixedIncomeSecuritiesMember2020-12-310001141391us-gaap:FixedIncomeSecuritiesMember2019-12-310001141391us-gaap:AssetBackedSecuritiesMember2020-12-310001141391us-gaap:AssetBackedSecuritiesMember2019-12-310001141391us-gaap:FairValueInputsLevel1Memberus-gaap:MunicipalBondsMember2020-12-310001141391us-gaap:MunicipalBondsMemberus-gaap:FairValueInputsLevel2Member2020-12-310001141391us-gaap:MunicipalBondsMemberus-gaap:FairValueInputsLevel3Member2020-12-310001141391us-gaap:FairValueInputsLevel1Memberus-gaap:MunicipalBondsMember2019-12-310001141391us-gaap:MunicipalBondsMemberus-gaap:FairValueInputsLevel2Member2019-12-310001141391us-gaap:MunicipalBondsMemberus-gaap:FairValueInputsLevel3Member2019-12-310001141391us-gaap:FairValueInputsLevel1Memberma:GovernmentsecuritiesMember2020-12-310001141391ma:GovernmentsecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310001141391ma:GovernmentsecuritiesMemberus-gaap:FairValueInputsLevel3Member2020-12-310001141391us-gaap:FairValueInputsLevel1Memberma:GovernmentsecuritiesMember2019-12-310001141391ma:GovernmentsecuritiesMemberus-gaap:FairValueInputsLevel2Member2019-12-310001141391ma:GovernmentsecuritiesMemberus-gaap:FairValueInputsLevel3Member2019-12-310001141391us-gaap:FairValueInputsLevel1Memberus-gaap:FixedIncomeSecuritiesMember2020-12-310001141391us-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310001141391us-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel3Member2020-12-310001141391us-gaap:FairValueInputsLevel1Memberus-gaap:FixedIncomeSecuritiesMember2019-12-310001141391us-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel2Member2019-12-310001141391us-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel3Member2019-12-310001141391us-gaap:FairValueInputsLevel1Memberus-gaap:AssetBackedSecuritiesMember2020-12-310001141391us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMember2020-12-310001141391us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Member2020-12-310001141391us-gaap:FairValueInputsLevel1Memberus-gaap:AssetBackedSecuritiesMember2019-12-310001141391us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMember2019-12-310001141391us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Member2019-12-310001141391us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignExchangeContractMember2020-12-310001141391us-gaap:ForeignExchangeContractMemberus-gaap:FairValueInputsLevel2Member2020-12-310001141391us-gaap:ForeignExchangeContractMemberus-gaap:FairValueInputsLevel3Member2020-12-310001141391us-gaap:ForeignExchangeContractMember2020-12-310001141391us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignExchangeContractMember2019-12-310001141391us-gaap:ForeignExchangeContractMemberus-gaap:FairValueInputsLevel2Member2019-12-310001141391us-gaap:ForeignExchangeContractMemberus-gaap:FairValueInputsLevel3Member2019-12-310001141391us-gaap:ForeignExchangeContractMember2019-12-310001141391us-gaap:InterestRateContractMemberus-gaap:FairValueInputsLevel1Member2020-12-310001141391us-gaap:InterestRateContractMemberus-gaap:FairValueInputsLevel2Member2020-12-310001141391us-gaap:InterestRateContractMemberus-gaap:FairValueInputsLevel3Member2020-12-310001141391us-gaap:InterestRateContractMember2020-12-310001141391us-gaap:InterestRateContractMemberus-gaap:FairValueInputsLevel1Member2019-12-310001141391us-gaap:InterestRateContractMemberus-gaap:FairValueInputsLevel2Member2019-12-310001141391us-gaap:InterestRateContractMemberus-gaap:FairValueInputsLevel3Member2019-12-310001141391us-gaap:InterestRateContractMember2019-12-310001141391us-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2020-12-310001141391us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310001141391us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel3Member2020-12-310001141391us-gaap:EquitySecuritiesMember2020-12-310001141391us-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2019-12-310001141391us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel2Member2019-12-310001141391us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel3Member2019-12-310001141391us-gaap:EquitySecuritiesMember2019-12-310001141391us-gaap:FairValueInputsLevel1Member2020-12-310001141391us-gaap:FairValueInputsLevel2Member2020-12-310001141391us-gaap:FairValueInputsLevel3Member2020-12-310001141391us-gaap:FairValueInputsLevel1Member2019-12-310001141391us-gaap:FairValueInputsLevel2Member2019-12-310001141391us-gaap:FairValueInputsLevel3Member2019-12-310001141391us-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001141391us-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310001141391us-gaap:LandAndBuildingMember2020-12-310001141391us-gaap:LandAndBuildingMember2019-12-310001141391us-gaap:EquipmentMember2020-12-310001141391us-gaap:EquipmentMember2019-12-310001141391us-gaap:FurnitureAndFixturesMember2020-12-310001141391us-gaap:FurnitureAndFixturesMember2019-12-310001141391us-gaap:LeaseholdImprovementsMember2020-12-310001141391us-gaap:LeaseholdImprovementsMember2019-12-310001141391ma:OperatingLeaseRightofUseAssetsMember2020-12-310001141391ma:OperatingLeaseRightofUseAssetsMember2019-12-310001141391us-gaap:ComputerSoftwareIntangibleAssetMember2020-12-310001141391us-gaap:ComputerSoftwareIntangibleAssetMember2019-12-310001141391us-gaap:CustomerRelationshipsMember2020-12-310001141391us-gaap:CustomerRelationshipsMember2019-12-310001141391us-gaap:OtherIntangibleAssetsMember2020-12-310001141391us-gaap:OtherIntangibleAssetsMember2019-12-31iso4217:GBP0001141391ma:VocalinkPlanMember2020-12-310001141391us-gaap:PensionPlansDefinedBenefitMember2019-12-310001141391us-gaap:PensionPlansDefinedBenefitMember2018-12-310001141391us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-12-310001141391us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2018-12-310001141391us-gaap:PensionPlansDefinedBenefitMember2020-01-012020-12-310001141391us-gaap:PensionPlansDefinedBenefitMember2019-01-012019-12-310001141391us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-01-012020-12-310001141391us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-01-012019-12-310001141391us-gaap:PensionPlansDefinedBenefitMember2020-12-310001141391us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-12-310001141391us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2020-12-310001141391us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2019-12-310001141391us-gaap:PensionPlansDefinedBenefitMemberma:VocalinkPlanMember2020-12-310001141391us-gaap:PensionPlansDefinedBenefitMemberma:VocalinkPlanMember2019-12-310001141391ma:PensionPlansWithBenefitObligationsInExcessOfPlanAssetsMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001141391us-gaap:PensionPlansDefinedBenefitMember2018-01-012018-12-310001141391us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2018-01-012018-12-310001141391us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2020-01-012020-12-310001141391us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2019-01-012019-12-310001141391us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2018-01-012018-12-310001141391us-gaap:PensionPlansDefinedBenefitMemberma:VocalinkPlanMember2020-01-012020-12-310001141391us-gaap:PensionPlansDefinedBenefitMemberma:VocalinkPlanMember2019-01-012019-12-310001141391us-gaap:PensionPlansDefinedBenefitMemberma:VocalinkPlanMember2018-01-012018-12-310001141391ma:NongovernmentfixedincomeMemberma:VocalinkPlanMember2020-12-310001141391ma:VocalinkPlanMemberma:GovernmentsecuritiesMember2020-12-310001141391us-gaap:EquitySecuritiesMemberma:VocalinkPlanMember2020-12-310001141391ma:VocalinkPlanMemberus-gaap:CashAndCashEquivalentsMember2020-12-310001141391ma:VocalinkPlanMemberus-gaap:OtherInvestmentsMember2020-12-310001141391us-gaap:FairValueInputsLevel1Memberus-gaap:CashAndCashEquivalentsMember2020-12-310001141391us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel2Member2020-12-310001141391us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel3Member2020-12-310001141391us-gaap:CashAndCashEquivalentsMember2020-12-310001141391us-gaap:FairValueInputsLevel1Memberus-gaap:CashAndCashEquivalentsMember2019-12-310001141391us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel2Member2019-12-310001141391us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel3Member2019-12-310001141391us-gaap:CashAndCashEquivalentsMember2019-12-310001141391us-gaap:MutualFundMemberus-gaap:FairValueInputsLevel1Member2020-12-310001141391us-gaap:MutualFundMemberus-gaap:FairValueInputsLevel2Member2020-12-310001141391us-gaap:MutualFundMemberus-gaap:FairValueInputsLevel3Member2020-12-310001141391us-gaap:MutualFundMember2020-12-310001141391us-gaap:MutualFundMemberus-gaap:FairValueInputsLevel1Member2019-12-310001141391us-gaap:MutualFundMemberus-gaap:FairValueInputsLevel2Member2019-12-310001141391us-gaap:MutualFundMemberus-gaap:FairValueInputsLevel3Member2019-12-310001141391us-gaap:MutualFundMember2019-12-310001141391us-gaap:FairValueInputsLevel1Memberus-gaap:InvestmentContractsMember2020-12-310001141391us-gaap:InvestmentContractsMemberus-gaap:FairValueInputsLevel2Member2020-12-310001141391us-gaap:InvestmentContractsMemberus-gaap:FairValueInputsLevel3Member2020-12-310001141391us-gaap:InvestmentContractsMember2020-12-310001141391us-gaap:FairValueInputsLevel1Memberus-gaap:InvestmentContractsMember2019-12-310001141391us-gaap:InvestmentContractsMemberus-gaap:FairValueInputsLevel2Member2019-12-310001141391us-gaap:InvestmentContractsMemberus-gaap:FairValueInputsLevel3Member2019-12-310001141391us-gaap:InvestmentContractsMember2019-12-310001141391us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:MutualFundMember2020-12-310001141391us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:MutualFundMember2019-12-310001141391us-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2020-12-310001141391us-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2019-12-310001141391us-gaap:SeniorNotesMemberma:A2027NotesMember2020-12-310001141391us-gaap:SeniorNotesMemberma:A2027NotesMember2019-12-310001141391ma:A2030NotesMemberus-gaap:SeniorNotesMember2020-12-310001141391ma:A2030NotesMemberus-gaap:SeniorNotesMember2019-12-310001141391ma:SeniorNotesDueMarch2050Memberus-gaap:SeniorNotesMember2020-12-310001141391ma:SeniorNotesDueMarch2050Memberus-gaap:SeniorNotesMember2019-12-310001141391ma:A2029NotesMemberus-gaap:SeniorNotesMember2020-12-310001141391ma:A2029NotesMemberus-gaap:SeniorNotesMember2019-12-310001141391us-gaap:SeniorNotesMemberma:A2049NotesMember2020-12-310001141391us-gaap:SeniorNotesMemberma:A2049NotesMember2019-12-310001141391ma:A2025NotesMemberus-gaap:SeniorNotesMember2020-12-310001141391ma:A2025NotesMemberus-gaap:SeniorNotesMember2019-12-310001141391us-gaap:SeniorNotesMemberma:A2028NotesMember2020-12-310001141391us-gaap:SeniorNotesMemberma:A2028NotesMember2019-12-310001141391us-gaap:SeniorNotesMemberma:A2048NotesMember2020-12-310001141391us-gaap:SeniorNotesMemberma:A2048NotesMember2019-12-310001141391us-gaap:SeniorNotesMemberma:A2021NotesMember2020-12-310001141391us-gaap:SeniorNotesMemberma:A2021NotesMember2019-12-310001141391ma:A2026NotesMemberus-gaap:SeniorNotesMember2020-12-310001141391ma:A2026NotesMemberus-gaap:SeniorNotesMember2019-12-310001141391ma:A2046NotesMemberus-gaap:SeniorNotesMember2020-12-310001141391ma:A2046NotesMemberus-gaap:SeniorNotesMember2019-12-310001141391us-gaap:SeniorNotesMemberma:A2022NotesMember2020-12-310001141391us-gaap:SeniorNotesMemberma:A2022NotesMember2019-12-310001141391us-gaap:SeniorNotesMemberma:TwoPointOnePercentNotesDue2027Member2020-12-310001141391us-gaap:SeniorNotesMemberma:TwoPointOnePercentNotesDue2027Member2019-12-310001141391ma:TwoPointFivePercentNotesDue2030Memberus-gaap:SeniorNotesMember2020-12-310001141391ma:TwoPointFivePercentNotesDue2030Memberus-gaap:SeniorNotesMember2019-12-310001141391us-gaap:SeniorNotesMemberma:A2024NotesMember2020-12-310001141391us-gaap:SeniorNotesMemberma:A2024NotesMember2019-12-310001141391us-gaap:SeniorNotesMemberma:A2022NotesMember2015-12-310001141391us-gaap:SeniorNotesMemberma:A2027NotesMember2020-03-310001141391ma:A2030NotesMemberus-gaap:SeniorNotesMember2020-03-310001141391ma:SeniorNotesDueMarch2050Memberus-gaap:SeniorNotesMember2020-03-310001141391us-gaap:SeniorNotesMember2020-03-012020-03-310001141391ma:A2029NotesMemberus-gaap:SeniorNotesMember2019-05-310001141391us-gaap:SeniorNotesMemberma:A2049NotesMember2019-05-310001141391ma:A2019USDNotesMemberus-gaap:SeniorNotesMember2019-12-012019-12-310001141391us-gaap:SeniorNotesMemberma:A2018USDNotesMember2018-01-012018-12-3100011413912019-11-140001141391us-gaap:RevolvingCreditFacilityMember2020-12-310001141391us-gaap:PreferredStockMember2020-12-310001141391us-gaap:PreferredStockMember2019-12-310001141391us-gaap:CommonStockMember2020-01-012020-12-310001141391us-gaap:CommonStockMember2019-01-012019-12-310001141391us-gaap:CommonStockMember2018-01-012018-12-310001141391ma:PublicInvestorsClassStockholdersMember2020-01-012020-12-310001141391ma:PublicInvestorsClassStockholdersMember2019-01-012019-12-310001141391ma:PrincipalOrAffiliateMembersClassBStockholdersMember2020-01-012020-12-310001141391ma:PrincipalOrAffiliateMembersClassBStockholdersMember2019-01-012019-12-310001141391ma:FoundationClassStockholdersMember2020-01-012020-12-310001141391ma:FoundationClassStockholdersMember2019-01-012019-12-310001141391ma:MastercardFoundationMemberus-gaap:CommonClassAMember2006-01-012006-05-310001141391ma:MastercardFoundationMember2006-01-012006-05-310001141391ma:December2020ShareRepurchasePlanMemberus-gaap:CommonClassAMember2020-12-310001141391ma:December2019ShareRepurchasePlanMemberus-gaap:CommonClassAMember2019-12-310001141391us-gaap:CommonClassAMemberma:December2018ShareRepurchasePlanMember2018-12-310001141391ma:December2017ShareRepurchasePlanMemberus-gaap:CommonClassAMember2017-12-310001141391ma:December2016ShareRepurchasePlanMemberus-gaap:CommonClassAMember2016-12-310001141391ma:December2017ShareRepurchasePlanMemberus-gaap:CommonClassAMember2018-01-012018-12-310001141391ma:December2016ShareRepurchasePlanMemberus-gaap:CommonClassAMember2018-01-012018-12-310001141391us-gaap:CommonClassAMember2018-01-012018-12-310001141391ma:December2017ShareRepurchasePlanMemberus-gaap:CommonClassAMember2018-12-310001141391ma:December2016ShareRepurchasePlanMemberus-gaap:CommonClassAMember2018-12-310001141391us-gaap:CommonClassAMemberma:December2018ShareRepurchasePlanMember2019-01-012019-12-310001141391ma:December2017ShareRepurchasePlanMemberus-gaap:CommonClassAMember2019-01-012019-12-310001141391us-gaap:CommonClassAMember2019-01-012019-12-310001141391us-gaap:CommonClassAMemberma:December2018ShareRepurchasePlanMember2019-12-310001141391ma:December2017ShareRepurchasePlanMemberus-gaap:CommonClassAMember2019-12-310001141391ma:December2016ShareRepurchasePlanMemberus-gaap:CommonClassAMember2019-12-310001141391ma:December2019ShareRepurchasePlanMemberus-gaap:CommonClassAMember2020-01-012020-12-310001141391us-gaap:CommonClassAMemberma:December2018ShareRepurchasePlanMember2020-01-012020-12-310001141391ma:December2017ShareRepurchasePlanMemberus-gaap:CommonClassAMember2020-01-012020-12-310001141391ma:December2016ShareRepurchasePlanMemberus-gaap:CommonClassAMember2020-01-012020-12-310001141391ma:December2019ShareRepurchasePlanMemberus-gaap:CommonClassAMember2020-12-310001141391us-gaap:CommonClassAMemberma:December2018ShareRepurchasePlanMember2020-12-310001141391ma:December2017ShareRepurchasePlanMemberus-gaap:CommonClassAMember2020-12-310001141391ma:December2016ShareRepurchasePlanMemberus-gaap:CommonClassAMember2019-01-012019-12-310001141391ma:December2020ShareRepurchasePlanMemberus-gaap:CommonClassAMember2020-12-012020-12-310001141391ma:December2019ShareRepurchasePlanMemberus-gaap:CommonClassAMember2019-12-012020-12-310001141391us-gaap:CommonClassAMemberma:December2018ShareRepurchasePlanMember2018-12-012020-12-310001141391ma:December2017ShareRepurchasePlanMemberus-gaap:CommonClassAMember2017-12-012020-12-310001141391ma:December2016ShareRepurchasePlanMemberus-gaap:CommonClassAMember2016-12-012019-12-310001141391us-gaap:CommonClassAMember2017-12-012020-12-310001141391us-gaap:CommonClassAMemberus-gaap:CommonStockMember2017-12-310001141391us-gaap:CommonStockMemberus-gaap:CommonClassBMember2017-12-310001141391us-gaap:CommonClassAMemberus-gaap:CommonStockMember2018-01-012018-12-310001141391us-gaap:CommonStockMemberus-gaap:CommonClassBMember2018-01-012018-12-310001141391us-gaap:CommonClassAMemberus-gaap:CommonStockMember2018-12-310001141391us-gaap:CommonStockMemberus-gaap:CommonClassBMember2018-12-310001141391us-gaap:CommonClassAMemberus-gaap:CommonStockMember2019-01-012019-12-310001141391us-gaap:CommonStockMemberus-gaap:CommonClassBMember2019-01-012019-12-310001141391us-gaap:CommonClassAMemberus-gaap:CommonStockMember2019-12-310001141391us-gaap:CommonStockMemberus-gaap:CommonClassBMember2019-12-310001141391us-gaap:CommonClassAMemberus-gaap:CommonStockMember2020-01-012020-12-310001141391us-gaap:CommonStockMemberus-gaap:CommonClassBMember2020-01-012020-12-310001141391us-gaap:CommonClassAMemberus-gaap:CommonStockMember2020-12-310001141391us-gaap:CommonStockMemberus-gaap:CommonClassBMember2020-12-310001141391us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2019-12-310001141391us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2020-01-012020-12-310001141391us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2020-12-310001141391ma:AccumulatedTranslationAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2019-12-310001141391ma:AccumulatedTranslationAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2020-01-012020-12-310001141391ma:AccumulatedTranslationAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2020-12-310001141391us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2019-12-310001141391us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2020-01-012020-12-310001141391us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2020-12-310001141391us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2019-12-310001141391us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2020-01-012020-12-310001141391us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2020-12-310001141391us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2019-12-310001141391us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2020-01-012020-12-310001141391us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2020-12-310001141391us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2019-12-310001141391us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2020-12-310001141391us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2018-12-310001141391us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2019-01-012019-12-310001141391ma:AccumulatedTranslationAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2018-12-310001141391ma:AccumulatedTranslationAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2019-01-012019-12-310001141391us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2018-12-310001141391us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2019-01-012019-12-310001141391us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2018-12-310001141391us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2019-01-012019-12-310001141391us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2018-12-310001141391us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2019-01-012019-12-310001141391us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2018-12-3100011413912020-01-012020-03-310001141391us-gaap:CommonClassAMemberma:LongTermIncentivePlanMember2020-12-310001141391us-gaap:StockOptionMember2020-01-012020-12-310001141391ma:VestingperiodforretirementordisabilityMemberus-gaap:StockOptionMember2020-01-012020-12-310001141391us-gaap:StockOptionMember2020-12-310001141391us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001141391us-gaap:PerformanceSharesMember2020-01-012020-12-310001141391us-gaap:PerformanceSharesMemberma:MinimumvestingfromdateofretirementeligibilityMember2020-01-012020-12-310001141391us-gaap:RestrictedStockUnitsRSUMember2019-12-310001141391us-gaap:RestrictedStockUnitsRSUMember2020-12-310001141391us-gaap:PerformanceSharesMember2019-12-310001141391us-gaap:PerformanceSharesMember2020-12-310001141391ma:PerformanceBasedRestrictedStockMember2020-12-310001141391ma:PerformanceBasedRestrictedStockMember2020-01-012020-12-310001141391us-gaap:RestrictedStockUnitsRSUMember2019-01-012019-12-310001141391us-gaap:RestrictedStockUnitsRSUMember2018-01-012018-12-310001141391us-gaap:PerformanceSharesMember2019-01-012019-12-310001141391us-gaap:PerformanceSharesMember2018-01-012018-12-3100011413912010-01-012010-01-010001141391ma:EventInvolvingVisaPartiesMemberBanksAndMastercardMember2011-02-012011-02-280001141391ma:EventInvolvingMemberBanksAndMastercardMember2011-02-012011-02-280001141391ma:USMerchantLawsuitSettlementMember2019-01-012019-06-300001141391srt:MaximumMemberma:USMerchantLitigationClassLitigationMember2019-07-310001141391ma:USMerchantLawsuitSettlementMember2020-12-310001141391ma:USMerchantLawsuitSettlementMember2019-12-310001141391ma:CanadianCompetitionBureauMember2020-01-012020-12-310001141391ma:EuropeanCommissionMember2019-04-012019-04-300001141391ma:EuropeanCommissionMember2018-01-012018-12-310001141391ma:U.K.MerchantLawsuitSettlementMember2012-05-012020-12-31ma:claimant0001141391ma:U.K.MerchantclaimantsMember2017-01-012017-01-310001141391ma:U.K.MerchantclaimantsMemberma:AppealingjudgmentMember2017-01-012019-06-300001141391us-gaap:JudicialRulingMemberma:A2016U.K.MerchantClaimantsDomainus-gaap:UnfavorableRegulatoryActionMember2020-01-012020-12-310001141391ma:U.K.MerchantclaimantsMember2018-07-012018-07-310001141391us-gaap:JudicialRulingMemberus-gaap:UnfavorableRegulatoryActionMemberma:A2017U.K.MerchantClaimantsDomain2018-07-012018-07-310001141391us-gaap:JudicialRulingMemberma:A2017U.K.MerchantClaimantsDomain2018-07-012018-07-310001141391ma:U.K.MerchantClaimantsSentBackToTrialCourtLiabilityAndDamagesIssuesMemberma:U.K.MerchantclaimantsMember2020-12-310001141391ma:U.K.MerchantclaimantsMember2020-12-310001141391ma:U.K.MerchantClaimsSentBackToTrialCourtDamagesIssuesMemberma:U.K.MerchantclaimantsMember2020-12-310001141391ma:U.K.MerchantclaimantsMember2018-01-012018-12-310001141391ma:U.K.MerchantLawsuitSettlementMember2020-01-012020-12-310001141391ma:U.K.MerchantclaimantsMember2020-10-012020-12-310001141391ma:ProposedU.K.InterchangeCollectiveActionMember2020-01-012020-12-31ma:plaintiff0001141391ma:ATMOperatorsComplaintMember2011-10-012011-10-310001141391ma:ATMOperatorsComplaintMember2019-09-012019-09-30ma:fax0001141391ma:UKPrepaidCardsMatterMember2020-10-012020-12-310001141391us-gaap:GuaranteeObligationsMember2020-12-310001141391us-gaap:GuaranteeObligationsMember2019-12-310001141391us-gaap:ForeignExchangeForwardMemberus-gaap:LongMember2020-12-310001141391us-gaap:ForeignExchangeForwardMemberus-gaap:LongMember2019-12-310001141391us-gaap:ForeignExchangeForwardMemberus-gaap:ShortMember2020-12-310001141391us-gaap:ForeignExchangeForwardMemberus-gaap:ShortMember2019-12-310001141391us-gaap:ForeignExchangeOptionMemberus-gaap:ShortMember2020-12-310001141391us-gaap:ForeignExchangeOptionMemberus-gaap:ShortMember2019-12-310001141391us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:ForeignExchangeContractMember2020-01-012020-12-310001141391us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:ForeignExchangeContractMember2019-01-012019-12-310001141391us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:ForeignExchangeContractMember2018-01-012018-12-310001141391us-gaap:NetInvestmentHedgingMember2015-12-310001141391us-gaap:CashFlowHedgingMemberus-gaap:InterestRateRiskMember2019-12-310001141391us-gaap:CashFlowHedgingMemberus-gaap:InterestRateRiskMember2020-01-012020-12-310001141391us-gaap:CashFlowHedgingMemberus-gaap:InterestRateRiskMember2020-01-012020-03-310001141391country:US2020-12-310001141391country:US2019-12-310001141391country:US2018-12-310001141391us-gaap:NonUsMember2020-12-310001141391us-gaap:NonUsMember2019-12-310001141391us-gaap:NonUsMember2018-12-31

| | | | | | | | | | | | | | | | | |

|

| | | | | |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| | | | | |

| | Form | 10-K | | |

| | | | | |

| | | | | |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2020

| | | | | |

| Or |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to |

Commission file number: 001-32877

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| Mastercard Incorporated | |

| (Exact name of registrant as specified in its charter) | |

| | | | | | |

| Delaware | | 13-4172551 | |

| (State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification Number) | |

| | | | | | |

| 2000 Purchase Street | | | | |

| Purchase, | NY | | 10577 | |

| (Address of principal executive offices) | | (Zip Code) | |

(914) 249-2000

(Registrant’s telephone number, including area code)

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol | | Name of each exchange of which registered |

Class A Common Stock, par value $0.0001 per share | | MA | | New York Stock Exchange |

| 1.1% Notes due 2022 | | MA22 | | New York Stock Exchange |

| 2.1% Notes due 2027 | | MA27 | | New York Stock Exchange |

| 2.5% Notes due 2030 | | MA30 | | New York Stock Exchange |

| | | | | | | | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(g) of the Act: | |

| Class B common stock, par value $0.0001 per share | |

| | | | | | | | | | | | | | | | | | | | | | | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | Yes | ☒ | No | ☐ |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | Yes | ☐ | No | ☒ |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | Yes | ☒ | No | ☐ |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). | Yes | ☒ | No | ☐ |

| | | | | | | | | | | | | | | | | | | | | | | |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check One): |

Large accelerated filer | ☒ | | Accelerated filer | ☐ | | | |

Non-accelerated filer | ☐ | (do not check if a smaller reporting company) | Smaller reporting company | ☐ | | | |

| | | Emerging growth company | ☐ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13 (a) of the Exchange Act. | ☐ |

| Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. | ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). | Yes | ☐ | No | ☒ |

The aggregate market value of the registrant’s Class A common stock, par value $0.0001 per share, held by non-affiliates (using the New York Stock Exchange closing price as of June 30, 2020, the last business day of the registrant’s most recently completed second fiscal quarter) was approximately $261.3 billion. There is currently no established public trading market for the registrant’s Class B common stock, par value $0.0001 per share. As of February 9, 2021, there were 985,146,914 shares outstanding of the registrant’s Class A common stock, par value $0.0001 per share and 8,215,424 shares outstanding of the registrant’s Class B common stock, par value $0.0001 per share.

| | |

Portions of the registrant’s definitive proxy statement for the 2021 Annual Meeting of Stockholders are incorporated by reference into Part III hereof. |

|

|

MASTERCARD INCORPORATED FISCAL YEAR 2020 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

| | | | | | | | | | | |

| | | |

PART I | | | |

| | |

| | |

| | |

| | |

| | |

| | | |

| | | |

| | | |

PART II | | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | | |

| | | |

PART III | | | |

| | |

| | |

| | |

| | |

| | | |

| | | |

PART IV | | | |

| | |

| | | |

MASTERCARD 2020 FORM 10-K 3

In this Report on Form 10-K (“Report”), references to the “Company,” “Mastercard,” “we,” “us” or “our” refer to the business conducted by Mastercard Incorporated and its consolidated subsidiaries, including our operating subsidiary, Mastercard International Incorporated, and to the Mastercard brand.

Forward-Looking Statements

This Report contains forward-looking statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts may be forward-looking statements. When used in this Report, the words “believe”, “expect”, “could”, “may”, “would”, “will”, “trend” and similar words are intended to identify forward-looking statements. Examples of forward-looking statements include, but are not limited to, statements that relate to the Company’s future prospects, developments and business strategies.

Many factors and uncertainties relating to our operations and business environment, all of which are difficult to predict and many of which are outside of our control, influence whether any forward-looking statements can or will be achieved. Any one of those factors could cause our actual results to differ materially from those expressed or implied in writing in any forward-looking statements made by Mastercard or on its behalf, including, but not limited to, the following factors:

•regulation directly related to the payments industry (including regulatory, legislative and litigation activity with respect to interchange rates and surcharging)

•the impact of preferential or protective government actions

•regulation of privacy, data, security and the digital economy

•regulation that directly or indirectly applies to us based on our participation in the global payments industry (including anti-money laundering, counter financing of terrorism, economic sanctions and anti-corruption; account-based payment systems; and issuer practice legislation and regulation)

•the impact of changes in tax laws, as well as regulations and interpretations of such laws or challenges to our tax positions

•potential or incurred liability and limitations on business related to any litigation or litigation settlements

•the impact of the global coronavirus (COVID-19) pandemic and containment measures taken in response

•the impact of competition in the global payments industry (including disintermediation and pricing pressure)

•the challenges relating to rapid technological developments and changes

•the challenges relating to operating a real-time account-based payment system and to working with new customers and end users

•the impact of information security incidents, account data breaches or service disruptions

•issues related to our relationships with our customers (including loss of substantial business from significant customers, competitor relationships with our customers and banking industry consolidation), merchants and governments

•exposure to loss or illiquidity due to our role as guarantor and other contractual obligations

•the impact of global economic, political, financial and societal events and conditions, including adverse currency fluctuations and foreign exchange controls

•reputational impact, including impact related to brand perception and lack of visibility of our brands in products and services

•the inability to attract, hire and retain a highly qualified and diverse workforce, or maintain our corporate culture

•issues related to acquisition integration, strategic investments and entry into new businesses

•issues related to our Class A common stock and corporate governance structure

Please see “Risk Factors” in Part I, Item 1A for a complete discussion of these risk factors. We caution you that the important factors referenced above may not contain all of the factors that are important to you. Our forward-looking statements speak only as of the date of this Report or as of the date they are made, and we undertake no obligation to update our forward-looking statements.

4 MASTERCARD 2020 FORM 10-K

Item 1. Business

Overview

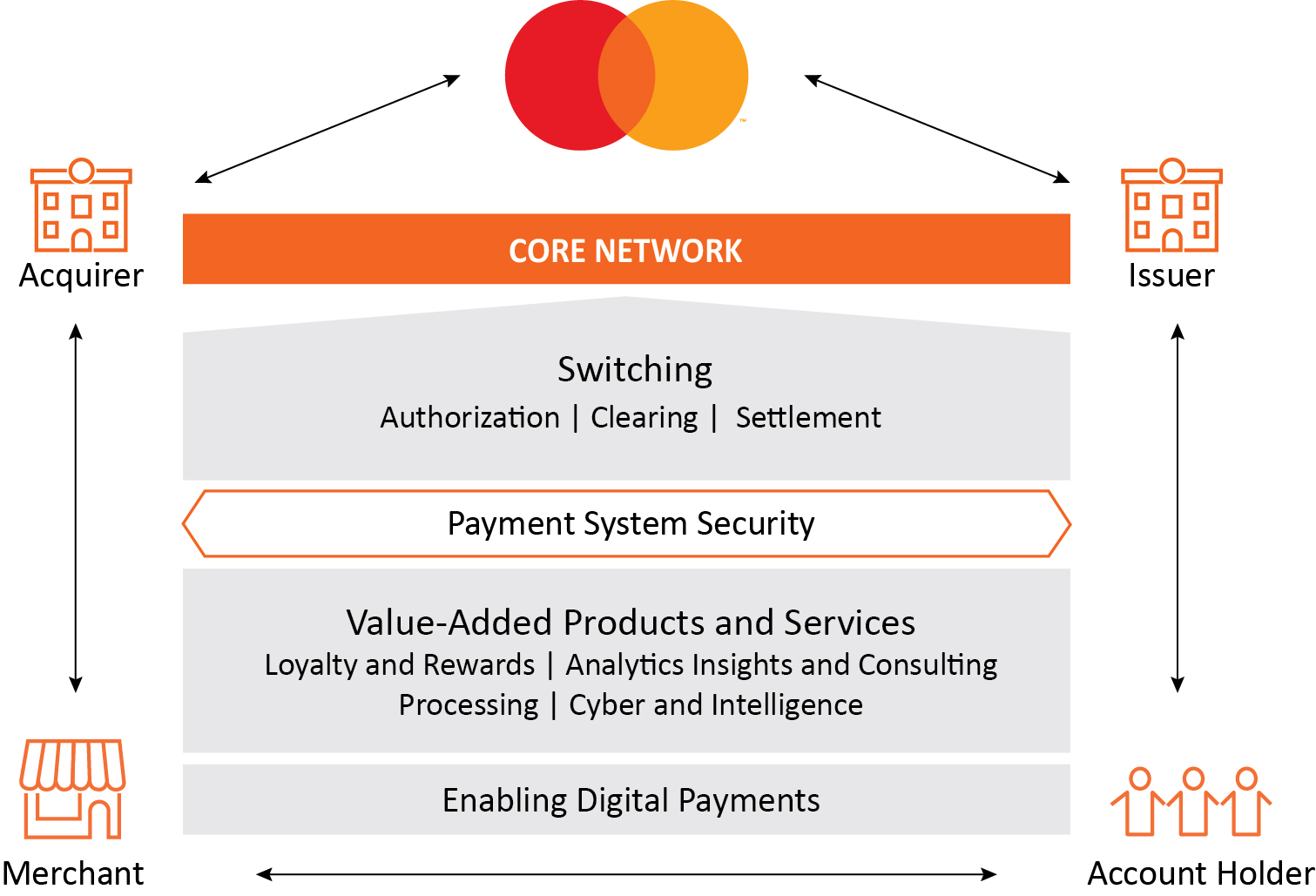

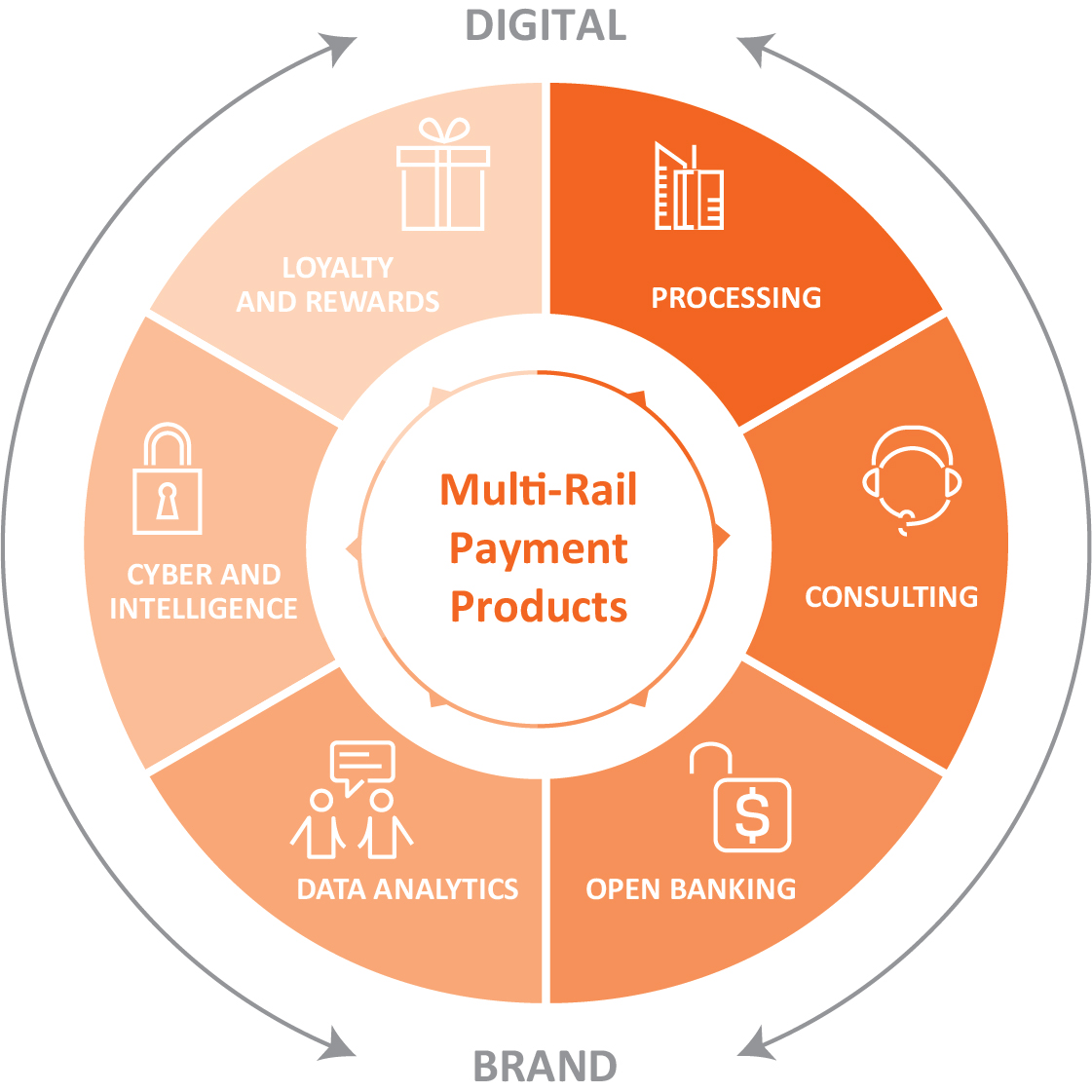

Mastercard is a technology company in the global payments industry that connects consumers, financial institutions, merchants, governments, digital partners, businesses and other organizations worldwide, enabling them to use electronic forms of payment instead of cash and checks. We make payments easier and more efficient by providing a wide range of payment solutions and services using our family of well-known brands, including Mastercard®, Maestro® and Cirrus®. We operate a multi-rail network that offers customers one partner to turn to for their domestic and cross-border payment needs. Through our unique and proprietary global payments network, which we refer to as our core network, we switch (authorize, clear and settle) payment transactions and deliver related products and services. We have additional payment capabilities that include automated clearing house (“ACH”) transactions (both batch and real-time account-based payments). We also provide integrated value-added offerings such as cyber and intelligence products, information and analytics services, consulting, loyalty and reward programs, processing and open banking. Our payment solutions offer customers choice and flexibility and are designed to ensure safety and security for the global payments system.

A typical transaction on our core network involves four participants in addition to us: account holder (a person or entity who holds a card or uses another device enabled for payment), issuer (the account holder’s financial institution), merchant and acquirer (the merchant’s financial institution). We do not issue cards, extend credit, determine or receive revenue from interest rates or other fees charged to account holders by issuers, or establish the rates charged by acquirers in connection with merchants’ acceptance of our products. In most cases, account holder relationships belong to, and are managed by, our customers.

We generate revenues from assessing our customers based on the gross dollar volume (“GDV”) of activity on the products that carry our brands, from the fees we charge to our customers for providing transaction switching and from other payment-related products and services.

For a full discussion of our business, please see page 8.

Our Performance

The following are our key financial and operational highlights for 2020, including growth rates over the prior year:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP |

| | | | | | |

| Net revenue | | | Net income | | | Diluted EPS |

| $15.3B | | | $6.4B | | | $6.37 |

| down 9% | | | down 21% | | | down 20% |

| | | | | | | |

Non-GAAP 1 (currency-neutral) |

| | | | | | |

| Net revenue | | | Adjusted net income | | | Adjusted diluted EPS |

| $15.3B | | | $6.5B | | | $6.43 |

| down 8% | | | down 17% | | | down 16% |

| | | | | | |

| | | | | | |

$6.1B | | | $4.5B | Repurchased shares | | | $7.2B |

in capital returned

to stockholders | | | $1.6B | Dividends paid

| | | cash flows

from operations |

| | | | | | |

| | | | | | | | | |

| Gross dollar volume (growth on a local currency basis) | | | | Cross-border volume growth (on a local currency basis) | | | | Switched transactions |

| $6.3T | | | | down 29% | | | | 90.1B |

| flat | | | | | | | up 3% |

| | | | | | | | | |

1Non-GAAP results exclude the impact of gains and losses on equity investments, Special Items and/or foreign currency. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Financial Results Overview” in Part II, Item 7 for the reconciliation to the most direct comparable GAAP financial measures.

6 MASTERCARD 2020 FORM 10-K

The coronavirus (“COVID-19”) outbreak and its negative impact on the global economy affected our 2020 performance, during which we saw unfavorable trends compared to historical periods. For a full discussion of this impact, see “Management’s Discussion and Analysis of Financial Condition and Results of Operation” in Item II, Part 7.

Our Strategy

We grow, diversify and build our business through a combination of organic and inorganic strategic initiatives. Our ability to grow our business is influenced by:

•personal consumption expenditure (“PCE”) growth

•driving cash and check transactions toward electronic forms of payment

•increasing our share in the payments space

•providing integrated value-added products and services

•providing enhanced payment capabilities to capture new payment flows, such as business to business (“B2B”), person to person (“P2P”), business to consumer (“B2C”) and government payments.

| | | | | | | | | | | | | | |

| | | | |

GROW | | DIVERSIFY | | BUILD |

CORE | | CUSTOMERS AND GEOGRAPHIES | | NEW AREAS |

Credit Debit Commercial Prepaid Digital-Physical Convergence Acceptance | | Financial Inclusion New Markets Businesses Governments Merchants Digital Players Local Schemes/Switches | | Data Analytics Consulting Marketing Services Loyalty Cyber and Intelligence Processing New Payment Flows Open Banking |

| ENABLED BY BRAND, DATA, TECHNOLOGY AND PEOPLE |

Grow. We focus on growing our core business globally, including growing our consumer and commercial products and solutions, as well as increasing the number of payment transactions we switch. We also look to provide effective and efficient payments solutions that cater to the evolving ways people interact and transact in the growing digital economy. This includes expanding merchant access to electronic payments through new technologies in an effort to deliver a better consumer experience, while creating greater efficiencies and security.

Diversify. We diversify our business by:

•working with new customers, including governments, merchants, financial technology companies (fintechs), digital players, mobile providers and other corporate businesses

•scaling our capabilities and business into new geographies, including growing acceptance in markets with limited electronic payments acceptance today

•broadening financial inclusion for the unbanked and underbanked

Build. We build our business by:

•creating and acquiring differentiated products and platforms to provide unique, innovative solutions that we bring to market to support new payment flows and related applications, such as real-time account-based payments and the Mastercard Track™ suite of products

•providing services across data analytics, consulting, marketing services, loyalty, cyber and intelligence, and processing

•providing open banking capabilities to enable the reliable access, transmission and management of consumer-consented data

Strategic Partners. We work with a variety of stakeholders. We provide financial institutions with solutions to help them increase revenue by driving preference for our products and services. We help merchants, financial institutions, governments, and other organizations by delivering data-driven insights and other services that help them grow and create simple and secure customer

MASTERCARD 2020 FORM 10-K 7

experiences. We partner with technology companies such as digital players, fintechs and mobile providers to deliver digital payment solutions powered by our technology, expertise and security protocols. We help national and local governments improve financial inclusion and efficiencies, reduce costs, increase transparency of financial transactions and data to reduce crime and corruption and advance social programs. For consumers, we provide faster, safer and more convenient ways to pay and transfer funds and exchange information to enable services.

Talent and Culture. Our success is driven by the skills, experience, integrity and mindset of the talent we hire. We attract and retain top talent from diverse backgrounds and industries by building a world-class culture based on decency, respect and inclusion where people have opportunities to perform purpose-driven work that impacts customers, communities and co-workers on a global scale. The diversity and skill sets of our people underpin everything we do.

Our Business

Our Operations and Network

We operate a multi-rail network that offers our customers one partner to turn to for their domestic and cross-border needs. Our core network links issuers and acquirers around the globe to facilitate the switching of transactions, permitting account holders to use a Mastercard product at millions of acceptance locations worldwide. Our core network facilitates an efficient and secure means for receiving payments, a convenient, quick and secure payment method for consumers to access their funds and a channel for businesses to receive insight through information that is derived from our network. We enable transactions for our customers through our core network in more than 150 currencies and in more than 210 countries and territories. Our range of capabilities extend beyond our core network into real-time account-based payments and open banking.

Core Network Transactions. Our core network supports what is often referred to as a “four-party” payments network. The following diagram depicts a typical transaction on our core network, and our role in that transaction:

In a typical transaction, an account holder purchases goods or services from a merchant using one of our payment products. After the transaction is authorized by the issuer, the issuer pays the acquirer an amount equal to the value of the transaction, minus the interchange fee (described below), and then posts the transaction to the account holder’s account. The acquirer pays the amount of the purchase, net of a discount (referred to as the “merchant discount” rate), to the merchant.

•Interchange Fees. Interchange fees reflect the value merchants receive from accepting our products and play a key role in balancing the costs and benefits that consumers and merchants derive. Generally, interchange fees are collected from acquirers and paid to issuers to reimburse the issuers for a portion of the costs incurred. These costs are incurred by issuers in providing services that benefit all participants in the system, including acquirers and merchants, whose participation in the network enables increased sales to their existing and new customers, efficiencies in the delivery of existing and new products, guaranteed payments and improved experience for the customers. We (or, alternatively, financial institutions) establish “default interchange fees” that apply when there are no other established settlement terms in place between an issuer and an acquirer. We administer the collection and remittance of interchange fees through the settlement process.

8 MASTERCARD 2020 FORM 10-K

•Additional Four-Party System Fees. The merchant discount rate is established by the acquirer to cover its costs of both participating in the four-party system and providing services to merchants. The rate takes into consideration the amount of the interchange fee which the acquirer generally pays to the issuer. Additionally, acquirers may charge merchants processing and related fees in addition to the merchant discount rate. Issuers may also charge account holders fees for the transaction, including, for example, fees for extending revolving credit.

Switched Transactions

•Authorization, Clearing and Settlement. Through our core network, we enable the routing of a transaction to the issuer for its approval, facilitate the exchange of financial transaction information between issuers and acquirers after a successfully conducted transaction, and help to settle the transaction by facilitating the exchange of funds between parties via settlement banks chosen by us and our customers.

•Cross-Border and Domestic. Our core network switches transactions throughout the world when the merchant country and country of issuance are different (“cross-border transactions”), providing account holders with the ability to use, and merchants to accept, our products and services across country borders. We also provide switched transaction services to customers where the merchant country and the country of issuance are the same (“domestic transactions”). We switch over 55% of all transactions for Mastercard and Maestro-branded cards, including nearly all cross-border transactions. We switch the majority of Mastercard and Maestro-branded domestic transactions in the United States, United Kingdom, Canada, Brazil and a select number of other countries.

Core Network Architecture. Our core network features a globally integrated structure that provides scale for our issuers, enabling them to expand into regional and global markets. It is based largely on a distributed (peer-to-peer) architecture with an intelligent edge that enables the network to adapt to the needs of each transaction. Our core network accomplishes this by performing intelligent routing and applying multiple value-added services (such as fraud scoring, tokenization services, etc.) to appropriate transactions in real time. Our core network’s architecture enables us to connect all parties regardless of where or how the transaction is occurring. It has 24-hour a day availability and world-class response time.

Real-time Account-based Payment Infrastructure and Applications. Augmenting our core network, we offer real-time account-based payment capabilities, enabling payments between bank accounts in real-time in countries in which it has been deployed.

Open Banking. We offer a platform that enables data providers and third parties to reliably access, securely transmit and confidently manage customer-consented data to improve the customer experience.

Payments System Security. Our payment solutions and products are designed to ensure safety and security for the global payments system. Our core network and additional platforms incorporate multiple layers of protection, providing greater resiliency and best-in-class security protection. Our programs are assessed by third parties and incorporate benchmarking and other data from peer companies and consultants. We engage in many efforts to mitigate information security challenges, including maintaining an information security program, an enterprise resilience program and insurance coverage, as well as regularly testing our systems to address potential vulnerabilities. Through the combined efforts of our Security Operations Centers, Fusion Centers and Mastercard Intelligence Center, we work with experts across the organization (as well as through other sources such as public-private partnerships), to monitor and respond quickly to a range of cyber and physical threats.

As part of our multi-layered approach to protect the global payments system, we also work with issuers, acquirers, merchants, governments and payments industry associations to help develop and put in place standards (e.g., EMV) for safe and secure transactions.

Digital Payments. Our network supports and enables our digital payment platforms, products and solutions, reflecting the growing digital economy where consumers are increasingly seeking to use their payment accounts to pay when, where and how they want. For a full discussion of the ways our innovation capabilities enable digital payments, see “Our Products and Services - Digital Enablement” below.

Customer Risk. We guarantee the settlement of many of the transactions from issuers to acquirers to ensure the integrity of our core network. We refer to the amount of this guarantee as our settlement exposure. We do not, however, guarantee payments to merchants by their acquirers or the availability of unspent prepaid account holder account balances.

Our Franchise. We manage an ecosystem of stakeholders who participate in our network. Our franchise creates and sustains a comprehensive series of value exchanges across our ecosystem. We ensure a balanced ecosystem where all participants benefit from the availability, innovation and safety and security of our network. We achieve this through the following key activities:

•Participant Onboarding. We ensure the capability of new customers to use our network, and define the roles and responsibilities for their operations once on the network

MASTERCARD 2020 FORM 10-K 9

•Safety and Security. We establish the core principles, including ensuring consumer protections and integrity, so participants feel confident to transact on the network.

•Operating Standards. We define the operational, technical and financial policies to which network participants are required to adhere.

•Responsible Stewardship. We establish performance standards to support ecosystem growth and optimization and establish proactive monitoring to ensure participant performance.

•Issue Resolution. We operate a framework to enable the resolution of disputes for both customers and consumers.

Our Products and Services

We provide a wide variety of integrated products and services that support products that customers can offer to their account holders and merchants. These offerings facilitate transactions across our multi-rail payment network among account holders, merchants, financial institutions, businesses, governments and other organizations in markets globally.

Core Payment Products

Consumer Credit. We offer a number of products that enable issuers to provide consumers with credit that allow them to defer payment. These programs are designed to meet the needs of our customers around the world and address standard, premium and affluent consumer segments.

Consumer Debit. We support a range of payment products and solutions that allow our customers to provide consumers with convenient access to funds in deposit and other accounts. Our debit and deposit access programs can be used to make purchases and to obtain cash in bank branches, at ATMs and, in some cases, at the point of sale. Our branded debit programs consist of Mastercard (including standard, premium and affluent offerings), Maestro (the only PIN-based solution that operates globally) and Cirrus (our primary global cash access solution).

Prepaid. Prepaid accounts are a type of electronic payment that enables consumers to pay in advance whether or not they previously had a bank account or a credit history. These accounts can be tailored to meet specific program, customer or consumer needs, such as paying bills, sending person-to-person payments or withdrawing cash from an ATM. Our focus ranges from digital accounts (such as fintech and gig economy platforms) to business programs such as employee payroll, health savings accounts and solutions for small business owners). Our prepaid programs also offer opportunities in the private and public sectors to drive financial inclusion of previously unbanked individuals through social security payments, unemployment benefits and salary cards.

10 MASTERCARD 2020 FORM 10-K

We also provide prepaid program management services, primarily outside of the United States, that provide processing and end-to-end services on behalf of issuers or distributor partners such as airlines, foreign exchange bureaus and travel agents.

Commercial Credit and Debit. We offer commercial credit and debit payment products and solutions that meet the payment needs of large corporations, midsize companies, small businesses and government entities. Our solutions streamline procurement and payment processes, manage information and expenses (such as travel and entertainment) and reduce administrative costs. Our card offerings include travel, small business (debit and credit), purchasing and fleet cards. Our SmartData platform provides expense management and reporting capabilities. Our Mastercard In Control™ platform generates virtual account numbers which provide businesses with enhanced controls, more security and better data. Our Mastercard Track Business Payment Service™ (Track BPS) is aimed at improving the way businesses pay and get paid by providing a single connection enabling access to multiple payment rails, greater control and richer data to optimize B2B transactions for both buyers and suppliers.

The following chart provides GDV and number of cards featuring our brands in 2020 for select programs and solutions:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, 2020 | | As of December 31, 2020 |

| | GDV | | Cards |

| | (in billions) | | Growth (Local) | | % of Total GDV | | (in millions) | | Percentage Increase from December 31, 2019 |

Mastercard-branded Programs1,2 | | | | | | | | | | |

| Consumer Credit | | $ | 2,425 | | | (7) | % | | 38 | % | | 894 | | | 2 | % |

| Consumer Debit and Prepaid | | 3,230 | | | 8 | % | | 51 | % | | 1,338 | | | 11 | % |

| Commercial Credit and Debit | | 682 | | | (6) | % | | 11 | % | | 102 | | | 22 | % |

1Excludes Maestro and Cirrus cards and volume generated by those cards.

2Prepaid includes both consumer and commercial prepaid.

New Payment Products and Open Banking

In addition to the switching capabilities of our core network, we offer platforms with payment capabilities that support new payment flows and related applications:

•We offer real-time account-based payments for ACH transactions. This platform enables payments between bank accounts in real time and provides enhanced data and messaging capabilities.

•We offer applications including those that make it easier for consumers to view, manage and pay their bills either with cards or real-time and batch ACH payments from their bank accounts, and that enable consumers, businesses, governments and merchants to send and receive money beyond borders with greater speed and ease.

•We offer an open banking platform that allows data providers and third parties to reliably access, securely transmit and confidently manage customer-consented data to improve the customer experience.

Value-Added Products and Services

Cyber and Intelligence. We offer integrated products and services to prevent, detect and respond to fraud and cyber-attacks and to ensure the safety of transactions made using Mastercard products. We do this using a multi-layered safety and security strategy:

•The “Prevent” layer protects infrastructure, devices and data from attacks. We have continued to grow global usage of EMV chip and contactless security technology, helping to reduce fraud. Greater usage of this technology has increased the number of EMV cards issued and the transaction volume on EMV cards.

•The “Identify” layer allows us to help banks and merchants verify the authenticity of consumers during the payment process using various biometric technologies, including fingerprint, face and iris scanning technology to verify online purchases on mobile devices, as well as a card with biometric technology built in.

•The “Detect” layer spots fraudulent behavior and cyber-attacks and takes action to stop these activities once detected. Our offerings in this space include alerts when accounts are exposed to data breaches or security incidents, fraud scoring technology that scans billions of dollars of money flows each day while increasing approvals and reducing false declines, and network-level monitoring on a global scale to help identify the occurrence of widespread fraud attacks when the customer (or their processor) may be unable to detect or defend against them.

•The “Experience” layer improves the security experience for our stakeholders in areas from the speed of transactions, enhancing approvals for online and card-on-file payments, to the ability to differentiate legitimate consumers from fraudulent ones. Our offerings in this space include solutions for consumer alerts and controls and a suite of digital token services. We also offer an e-

MASTERCARD 2020 FORM 10-K 11

commerce fraud and dispute management network that enables merchants to stop delivery when a fraudulent or disputed transaction is identified, and issuers to refund the cardholder to avoid the chargeback process. Moreover, we use our AI and data analytics, along with our cyber risk assessment capabilities, to help financial institutions, merchants, corporations and governments secure their digital assets

We have also worked with our customers to provide products to consumers globally with increased confidence through the benefit of “zero liability”, where the consumer bears no responsibility for counterfeit or lost card losses in the event of fraud.

Loyalty and Rewards. We have built a scalable rewards platform that enables customers to provide consumers with a variety of benefits and services, such as personalized offers and rewards, access to a global airline lounge network, concierge services, insurance services, emergency card replacement, emergency cash advances and a 24-hour account holder service center. For merchants, we provide campaigns with targeted offers and rewards, management services for publishing offers, and accelerated points programs for co-brand and rewards program members. We also provide a loyalty platform that enables stronger relationships with retailers, restaurants, airlines and consumer packaged goods companies by creating experiences that drive loyalty and impactful consumer engagement.

Processing. We extend our processing capabilities in the payments value chain in various regions and across the globe with an expanded suite of offerings, including:

•Issuer solutions designed to provide customers with a complete processing solution to help them create differentiated products and services and allow quick deployment of payments portfolios across banking channels.

•Payment gateways that offer a single interface to provide e-commerce merchants with the ability to process secure online and in-app payments and offer value-added solutions, including outsourced electronic payments, fraud prevention and alternative payment options.

•Mobile gateways that facilitate transaction routing and processing for mobile-initiated transactions.

Data Analytics and Consulting. We provide proprietary analysis, data-driven consulting and marketing services solutions to help clients optimize, streamline and grow their businesses, as well as deliver value to consumers.

Our capabilities incorporate payments expertise and analytical and executional skills to create end-to-end solutions which are increasingly delivered via platforms embedded in our customers’ day-to-day operations. By observing patterns of payments behavior based on billions of transactions switched globally, we leverage anonymized and aggregated information and a consultative approach to help our customers make better business decisions. Our executional skills such as marketing, digital implementation and program management allow us to assist customers to implement actions based on these insights.

We utilize our expertise and tools to collaborate with, and increasingly drive, innovation at financial institutions, merchants and governments. Through our global innovation and development arm, Mastercard Labs, we offer “Launchpad,” a five-day app prototyping workshop, as well as other customized innovation programs such as in-lab usability testing and concept design. Through our Test & Learn software as a service platform, we can help our customers conduct disciplined business experiments for in-market tests to drive more profitable decision making.

Digital Enablement

Our innovation capabilities enable broader reach to scale digital payment services beyond cards to multiple channels, including mobile devices, and our standards, services and governance model help us to serve as the connection that allows financial institutions, fintechs and technology companies to interoperate and enable consumers to engage through digital channels:

•Delivering better digital experiences everywhere. We are using our technologies and security protocols to develop solutions to make digital shopping and selling experiences, such as on smartphones and other connected devices, simpler, faster and safer for both consumers and merchants. We also offer products that make it easier for merchants to accept payments and expand their customer base, as well as products and practices to facilitate acceptance via mobile devices.

•Securing more transactions. We are leveraging tokenization, biometrics and machine learning technologies in our push to secure every transaction. These efforts include driving EMV-level security and benefits through all our payment channels.

•Digitizing personal and business payments. We provide solutions that enable our customers to offer consumers the ability to send and receive money quickly and securely domestically and around the world. These solutions allow our customers to address new payment flows from any funding source, such as cash, card, bank account or mobile money account, to any destination globally, securely and often in real time.

•Simplifying access to, and integration of, our digital assets. Our Mastercard Developer platform makes it easy for customers and partners to leverage our many digital assets and services. By providing a single access point with tools and capabilities to find what we believe are some of the best-in-class Application Program Interfaces (“APIs”) across a broad range of Mastercard services, we enable easy integration of our services into new and existing solutions.

12 MASTERCARD 2020 FORM 10-K

•Identifying and experimenting with future technologies, start-ups and trends. Through Mastercard Labs, we continue to bring customers and partners access to thought leadership, innovation methodologies, new technologies and relevant early-stage fintech players.

Brand

Our family of well-known brands includes Mastercard, Maestro and Cirrus. We manage and promote our brands and brand identities (including our sonic brand identity) through advertising, promotions and sponsorships, as well as digital, mobile and social media initiatives, in order to increase people’s preference for our brands and usage of our products. We sponsor a variety of sporting, entertainment and charity-related marketing properties to align with consumer segments important to us and our customers. Our advertising plays an important role in building brand visibility, preference and overall usage among account holders globally. Our “Priceless®” advertising campaign, which has run in more than 50 languages and in more than 120 countries worldwide, promotes Mastercard usage benefits and acceptance, markets Mastercard payment products and solutions and provides Mastercard with a consistent, recognizable message that supports our brand around the globe.

Human Capital Management

As of December 31, 2020, we employed approximately 21,000 persons globally.

We are dedicated to supporting our workforce during the global COVID-19 pandemic:

•We had no COVID-19 related layoffs in 2020

•We introduced a COVID-19 global employee benefit providing up to 10 business days of additional paid leave for sick, childcare or eldercare related needs

•We covered 100% of the costs associated with COVID-19 testing for all employees and provided access to free COVID-related telemedicine consultations for our U.S. employees

•We provided employees with flexibility for how and where they get work done and put precautionary health and safety measures in place at each office location

Management regularly reviews our people strategy and culture, as well as related risks, with our Human Resources and Compensation Committee, and reviews this annually with our Board of Directors. Our strategy focuses on recruitment, development, succession and retention, including:

•Attracting top talent with the strength of our talent brand, which includes our culture of being a “force for good”

•Developing our depth of talent through acquisitions and recruitment

•Strong development and succession planning for key roles, including talent and leadership programs across various levels that:

◦Embed our culture principles

◦Focus on diverse populations and

◦Aim to develop talent and people managers through personalized and group executive development programs

•Using learning to drive innovation and growth, including a focus on scaling digital fluency globally, product training certification, creating an environment for employees to drive their own learning, and focusing on developing capability in key skill areas

•Retaining and growing an inclusive workforce, including:

◦Ongoing development conversations and personalized development plans

◦A focus on talent movement, including career moves and rotations and

◦Competitive and differentiated pay and benefits, including pay equity on the basis of gender and (in the U.S.) race and ethnicity, as well as a flexible work model

As an organization, we are focused on maintaining a world-class culture, built on a foundation of decency:

•We are mindful of the health of our culture, looking at retention of critical roles, our external brand reputation, internal levels of engagement, and diverse representation

MASTERCARD 2020 FORM 10-K 13

•We are committed to providing a safe and respectful workplace built on a culture of decency and a focus on the well-being of our employees, as well as monitoring for potential disruptions to our culture and reputation - especially with respect to such events as the COVID-19 pandemic

•We are focused on providing and supporting a culture of volunteering

•We have established a culture of high ethical business practices and compliance standards, grounded in honesty, decency, trust and personal accountability. It is driven by “tone at the top,” reinforced with regular training, fostered in a speak-up environment, and measured by a risk culture and climate survey

Diversity and inclusion underpin everything we do:

•We look at our recruitment, development, succession and retention practices (including global attrition rates) with a focus on gender, race (in the U.S.) and generational mix of our employee population

•We have developed regional and functional action plans to identify priorities and actions that will help us make more progress for diversity and inclusion, including balance and inclusion in gender and racial representation

•As part of our commitment to racial justice, we have committed to our “In Solidarity” initiative, which focuses on people, market and society to harness our culture of decency and build on our efforts to advance inclusion and equality

We encourage you to review our Sustainability Report (located on our website) for more detailed information regarding our people strategy.

Recent Developments

We are focused on helping individuals and businesses weather the challenges presented by the COVID-19 pandemic by ensuring our network remains secure, resilient and reliable. We are applying our technology, philanthropy, and data and cybersecurity expertise to help rebuild communities, ensure that economic growth is inclusive and help address new challenges facing governments, small businesses and consumers.