As filed with the Securities and Exchange Commission on September 19, 2011

Registration No. 333-______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

__________________________________________

DAIS ANALYTIC CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

__________________________________________

__________________________________________

|

New York

|

3990

|

14-1760865

|

||

|

(State or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification Number)

|

|

11552 Prosperous Drive

Odessa, FL 33556

Telephone: (727) 375-8484

Facsimile: (727) 375-8485

|

State of New York – Secretary of State

Department of State

One Commerce Plaza

99 Washington Avenue, 6th Floor

Albany, New York 12231

Telephone: (518) 473-2492

Facsimile: (518) 474-1418

|

|

|

(Address, Including Zip Code, and Telephone Number,

Including Area Code, of Principal Executive Offices)

|

(Name, Address, Including Zip Code and Telephone Number,

Including Area Code, of Agent for Service)

|

Copies to:

Erick Richardson, Esq.

Dorothy Vinsky, Esq.

Edgar D. Park, Esq.

Richardson & Patel LLP

10900 Wilshire Boulevard, Suite 500

Los Angeles, California 90024

(310) 208-1182

APPROXIMATE DATE OF PROPOSED SALE TO THE PUBLIC: From time to time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|||

|

Non-accelerated filer

|

o (Do not check if a smaller reporting company)

|

Smaller reporting company

|

x

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

Amount to be

Registered

|

Proposed

Maximum

Aggregate

Offering Price(1)

|

Amount of

Registration

Fee(6)

|

|||||||||

|

Common stock, $0.01 par value per share(2)

|

4,312,500 | $ | 21,562,500 | $ | 2,503.41 | |||||||

|

Underwriter Warrant(3)(4)(5)

|

1 warrant

|

$ | 100 | — | ||||||||

|

Shares of Common Stock underlying Underwriter’s Warrant

|

431,250 | $ | 2,587,500 | $ | 300.41 | |||||||

|

Amount Paid

|

$ | 2,753.75 | ||||||||||

|

Balance Due

|

$ | 50.07 | ||||||||||

|

(1)

|

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended.

|

|

(2)

|

Includes 562,500 shares of our common stock that the underwriter has the option to purchase to cover over-allotments, if any.

|

|

(3)

|

No registration fee required pursuant to Rule 457(g) under the Securities Act of 1933.

|

|

(4)

|

Pursuant to Rule 416 under the Securities Act of 1933, this registration statement shall be deemed to cover the additional securities (i) to be offered or issued in connection with any provision of any securities purported to be registered hereby to be offered pursuant to terms which provide for a change in the amount of securities being offered or issued to prevent dilution resulting from stock splits, stock dividends, or similar transactions and (ii) of the same class as the securities covered by this registration statement issued or issuable prior to completion of the distribution of the securities covered by this registration statement as a result of a split of, or a stock dividend on, the registered

securities.

|

|

(5)

|

Represents a warrant granted to the underwriter to purchase up to 431,250 shares of common stock.

|

|

(6)

|

Previously paid $2, 753.75

|

__________________________________________

THE COMPANY HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE COMPANY SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933, AS AMENDED, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND WE ARE NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION, DATED SEPTEMBER 19, 2011

PRELIMINARY PROSPECTUS

3,750,000 Shares of Common Stock

PRELIMINARY PROSPECTUS

3,750,000 Shares of Common Stock

_____________________________________________

This is a firm commitment public offering of 3,750,000 shares of our common stock.

The public offering price for the common stock offered hereby is estimated to be between $3.00 and $5.00 per share. Our common stock is quoted on the OTC Bulletin Board under the symbol “DLYT.OB”. On September 15, 2011, the last reported sale price for our common stock was $0 .49 per share. Immediately after the effectiveness of the registration statement of which this prospectus is a part, and prior to closing of this offering, we will effect a reverse stock split anticipated to be on a 10-for-1 basis. The proposed aggregate price of the shares offered hereby assuming a midpoint price of $4.00 per share and excluding shares that may

be sold on exercise of the underwriter’s over- allotment option, is $15,000,000.

We have applied for listing of our common stock on the NYSE AMEX Equities (“AMEX”, formerly known as the American Stock Exchange) under the symbol “DLYT”, which we expect to occur on or immediately prior to the date of this prospectus. No assurance can be given that our application will be approved. If the application is not approved, we will not complete this offering, and the shares of our common stock will continue to be quoted on the OTC Bulletin Board.

___________________________________________________

Investing in our securities involves certain risks, including those set forth in the “Risk Factors” section beginning on page 1 5 of this prospectus as well as those set forth in any prospectus supplement that should be considered in connection with an investment in our securities.

| Per Share | Total | |||||||

|

Public Offering Price per share

|

$ | $ | ||||||

|

Underwriting discounts and commission (1)

|

$ | $ | ||||||

|

Offering Proceeds to Dais, before expenses(2)

|

$ | $ | ||||||

________________

| (1) |

Excludes underwriter expenses of up to $125,000 which would be reimbursable according to the underwriting agreement.

|

| (2) | We estimate that the total expenses of this offering, excluding the underwriter’s discount and commission will be approximately $ . |

We have granted to the underwriter a 45-day option to purchase up to 562,500 additional shares of common stock solely to cover over-allotments, if any. We have also agreed to issue to the underwriter a warrant to purchase up to a total of 431,250 shares of common stock at an exercise price of $ (120% of the public offering price). The underwriter warrant is exercisable at any time, in whole or in part, for five years from the date of effectiveness of the registration statement of which this prospectus is a part, subject to a one year lock-up.

The underwriter expects to deliver our shares to purchasers in the offering on or about , 2011.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

MDB Capital Group LLC

The date of this prospectus is _______, 2011

3

4

TABLE OF CONTENTS

| Page No. | ||||

| 6 | ||||

| 7 | ||||

| 14 | ||||

| 15 | ||||

| Determination of Offering Price | 32 | |||

| 32 | ||||

| 34 | ||||

| 45 | ||||

| 46 | ||||

| 46 | ||||

| Director Compensation | 49 | |||

| 50 | ||||

| 55 | ||||

| 59 | ||||

| 68 | ||||

| 81 | ||||

| Dilution | 83 | |||

| Capitalization | 85 | |||

| 85 | ||||

| 86 | ||||

| 90 | ||||

| 89 | ||||

| 91 | ||||

| 90 | ||||

| 90 | ||||

| 92 | ||||

| 93 | ||||

Unless otherwise stated or the context otherwise requires, the terms “Dais Analytic,” “we,” “us,” “our” and the “Company” refer to Dais Analytic Corporation.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with additional or different information. The information contained in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock.

No dealer, salesperson or any other person is authorized in connection with this offering to give any information or make any representations about us, the securities offered hereby or any matter discussed in this prospectus, other than those contained in this prospectus and, if given or made, the information or representations must not be relied upon as having been authorized by us. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any security other than the securities offered by this prospectus, or an offer to sell or a solicitation of an offer to buy any securities by anyone in any circumstance in which the offer or solicitation is not authorized or is

unlawful.

5

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING STATEMENTS

FORWARD-LOOKING STATEMENTS

This prospectus, including the sections titled “Prospectus Summary”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, “Description of Business”, “Risk Factors” and other sections generally, contains certain statements that constitute “forward-looking statements”. These forward-looking statements include certain statements regarding intent, belief or current expectations about matters (including statements as to “beliefs,” “expectations,” “anticipations,” “intentions” or similar words). Forward-looking statements are also statements that are not

statements of historical fact. Because these statements are based on factors that involve risks and uncertainties, actual results may differ materially from those expressed or implied by the forward-looking statements. These factors include, among others:

|

•

|

our ability to achieve and maintain profitability;

|

|

•

|

the price volatility of the Common Stock;

|

|

•

|

the historically low trading volume of the Common Stock;

|

|

•

|

our ability to manage and fund our growth;

|

|

•

|

our ability to attract and retain qualified personnel;

|

|

•

|

litigation;

|

|

•

|

our ability to compete with current and future competitors;

|

|

•

|

our ability to obtain additional financing;

|

|

•

|

general economic and business conditions;

|

|

•

|

our ability to continue as a going concern;

|

|

•

|

our ability to do business overseas;

|

|

•

|

other risks and uncertainties included in the section of this document titled “Risk Factors”; and

|

|

•

|

other factors discussed in our other filings made with the Commission.

|

The subsequent forward-looking statements relating to the matters described in this document and attributable to us or to persons acting on our behalf are expressly qualified in their entirety by such factors. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Risk Factors” and matters described in this prospectus generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this prospectus will in fact occur. We have no obligation to publicly update or revise these forward-looking

statements to reflect new information, future events, or otherwise, except as required by applicable laws, and we caution you not to place undue reliance on these forward looking statements.

Third Party Data

This prospectus also contains estimates, statistical, industry-related and market-related data, and other information concerning our industry, including market size and growth rates, which are based on industry publications, surveys and forecasts, based on or derived from third party sources which we believe are reliable. This information involves a number of limitations and assumptions which may or may not be or become true, and for the foregoing reasons you are cautioned not to give undue weight to the estimates presented in these third party materials. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors”.

6

|

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus and does not contain all the information that you need to consider in making your investment decision. You should carefully read this entire prospectus before deciding whether to invest in the common stock. You should pay special attention to the “Risk Factors” section of this prospectus to determine whether an investment in the common stock is appropriate for you.

This registration statement, including the exhibits and schedules thereto, contains additional relevant information about us and our capital stock. We file annual, quarterly, and current reports, proxy statements, and other information with the SEC. You may read and copy any document we file at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. 20549. You can also request copies of the documents, upon payment of a duplicating fee, by writing the Public Reference Section of the SEC. Please call the SEC at 1-800-SEC-0330 for further information on the public

reference room. These SEC filings are also available to the public from the SEC’s web site at www.sec.gov.

Unless otherwise indicated, all share amounts and prices assume the consummation of the anticipated 10-for-1 reverse stock split to be effected immediately following the effectiveness of the registration statement of which this prospectus is a part.

About Dais Analytic Corporation

We have developed and are commercializing specialty nano-structured polymer materials (Aqualyte™). Using Aqualyte ™ materials we are creating value added products which are designed to: (i) improve the energy efficiency in Heating, Ventilation and Air Conditioning (HVAC) equipment, (ii) replace the chemical refrigerants used in today’s HVAC systems as well as most all forms of refrigeration systems; (iii) remove impurities in contaminated water (such as waste water and seawater); and (iv) allow the storage of electrical energy in a device called an

“ultracapacitor.”

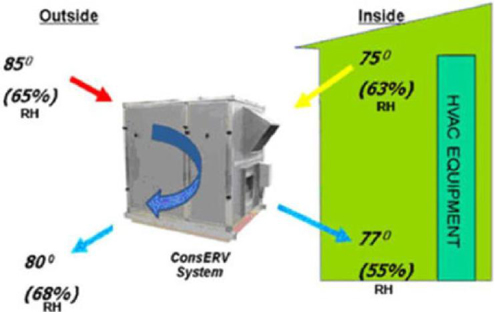

Dais’ first commercial product, ConsERV™, is a fixed plate energy recovery ventilator unit that attaches to most all forms of HVAC equipment. Through use of the Aqualyte™ materials, ConsERV™ assists building and home-owners to increase ventilation thereby improving indoor air quality while saving energy, lowering CO2 emissions, and allowing for smaller HVAC systems to be installed through the management of moisture and temperature content in the

air.

Several applications that use the Aqualyte™ platform are under development. These potential applications include:

|

|

| ● |

NanoAir™, a water based packaged HVAC system that is potentially capable of achieving improvements in energy efficiency over traditional AC and refrigeration systems,

|

| ● |

NanoClear™, a water clean-up process that has been demonstrated to provide parts per billion potable water from most forms of contaminated water, including salt, brackish or wastewater1, and

|

| ● |

NanoCap™, an energy storage device (ultracapacitor) we are currently researching and developing that uses the attributes of the Aqualyte™ material to potentially provide significantly greater energy density and power than conventional capacitors or batteries.

|

|

We are a New York corporation established on April 8, 1993 as Dais Corporation. We subsequently changed our name to Dais Analytic Corporation on December 13, 1999. Our principal executive offices are located at 11552 Prosperous Drive, Odessa, FL 33556. Our telephone number is (727) 375-8484. Our website can be accessed at www.daisanalytic.com and www.conserv.com. Information contained in our website is not a part of this prospectus and the inclusion of our website address in this prospectus is an inactive textual reference only.

Our Proprietary Technologies

We have multiple pending and issued patents in the U.S., China, Hong Kong and Europe, and under the Patent Cooperation Treaty (PCT). In addition, we co-own two PCT applications with Aegis Biosciences LLC, a biomaterials drug delivery technology company. These patents relate to, or are applications of, our nano-structured polymer materials that perform functions such as ion exchange and modification of surface properties. The polymers are selectively permeable to polar materials, such as water, in molecular form. Selective permeability allows these materials to function as a nano-filter in various transfer applications. These materials are made from base

polymer resins available from commercial firms worldwide and possess what we believe to be some unique and controllable properties, such as:

|

|

| ● |

Selectivity: Based on our research, we believe that when the polymer is made there are small channels created that are 5 to 30 nanometers in diameter. There are two types of these channels: hydrophilic (water permeable), and hydrophobic (water impermeable). The channels can be chemically tuned to be selective for the ions or molecules they transfer. The selectivity of the polymer can be adjusted to efficiently transfer water molecules from one face to the other using these channels.

|

|

|

|

7

| ● | High transfer rate: Based on in-house testing protocols and related results, we have found that the channels created when casting the materials into a nano-structured membrane have a transfer rate of water molecules, or flux, greater than 90% of an equivalent area of an open tube. This feature is fundamental to the material’s ability to transfer moisture at the molecular level while substantially allowing or disallowing the transfer of certain other substances at a molecular level. |

| ● | Unique surface characteristics: The materials offer a surface characteristics that we believe inhibit the growth of bacteria, fungus and algae and prevent adhesives from attaching. |

|

The molecular selectivity, transfer rate and surface coating properties, coupled with our ability to produce the nano-structured materials at what we believe is an affordable price, distinguishes our technology and value-added products. By incorporating our nano-structured materials into our products, we strive to address current real-world market needs by offering what we believe to be higher efficiencies and improved price performance, compared to, for example, other energy recovery mechanisms available for HVAC that use coated paper or desiccant materials instead of our nano-structured polymer materials. For further details about our technology, please

refer to our “Description of Business” in this prospectus.

Our Target Markets

We are currently focusing our efforts on applications of our nano-structure polymer technology materials in the following areas:

Energy Recovery Ventilators

ConsERV™ is a heating, ventilation and air conditioning (HVAC) energy conservation product which after reviewing the results of various third party tests, we believe will save an average of up to 30% on HVAC ventilation air operating costs and allow HVAC equipment to be up to 30% smaller, reducing peak energy usage by up to 20% while simultaneously improving indoor air quality by increasing the level of fresh air ventilation. This product makes HVAC systems operate more efficiently, and in many cases results in energy and cost savings. ConsERV™ may be added to most existing HVAC systems, typically in commercial buildings, to

provide ventilation within the structure. It pre-conditions the incoming air by passing the air through our nano-technology polymer which has been formed into a filter, known in the market as a fixed plate core. The nano-technology core uses the stale building air that is simultaneously exhausted to transfer heat and moisture into or out of the incoming air. For summer air conditioning, the core removes some of the heat and humidity from the incoming air, transferring it to the exhaust air stream thereby, under certain conditions, saving energy. For winter heating, the core transfers a portion of the heat and humidity into the incoming air from the exhaust air stream thereby often saving energy.

|

|

8

|

We believe that there is significant demand for energy recovery ventilators in the U.S. and international markets. As reported by Frost and Sullivan in 2007, the North American market for energy recovery ventilators (ERVs) was estimated to be approximately $1.1 billion. Projections made at that time were for 200% growth from that level by 2012. Market drivers behind this growth include higher ventilation standards, greater end user awareness, LEED (Leadership in Energy Efficiency and Design) certification points or incentives , and integration into the products of

original equipment manufacturers (OEMs). Sales of ConsERV ™ in 2010 increased to $2,949,814 from $1,439,041 in 2009. We believe the combination of high efficiency and low maintenance requirement as well as rapid ERV market expansion is driving this sales growth.

Our ConsERV™ product is the primary focus of our resources and commercialization efforts. When compared to similar competitive products and based on test results conducted by the Air-Conditioning, Heating and Refrigeration Institute (AHRI), a leading industry association in 2008, we believe ConsERV™ is twice as effective in managing a combination of latent and sensible heat as other fixed plate cores. This study is publicly available and was not prepared for our benefit or funded by us.

Residential and Commercial Heating, Air-Conditioning and Refrigeration

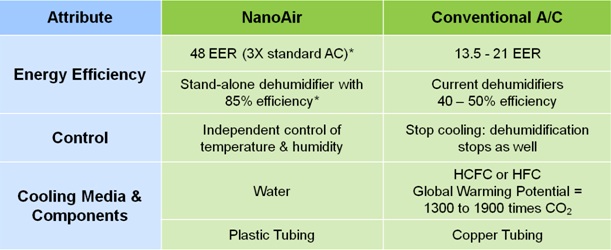

Our water-based packaged HVAC system, NanoAir™, which is in the early beta stage of development, dehumidifies and cools air in warm weather, or humidifies and heats air in cold weather. NanoAir™ may be capable of replacing a traditional refrigerant loop-based heating, cooling, and refrigeration system. We have a number of small prototype units showing fundamental heating, cooling, humidification, and dehumidification operations of this evolving application.

Based on our lab results to date, NanoAir™ may have the potential to reduce energy consumption by up to 50%, and is projected to be up to 3 times more energy efficient than current refrigerant gas-based technologies on the market today. Since heating and cooling costs account for approximately 19% of all energy consumed in the U.S. (second only to transportation), as stated by Dr. Steven Chu of the U.S. Department of Energy in 2010, we believe NanoAir™ may have the ability to provide significant energy

savings . Further, since NanoAir™ uses no ozone-depleting refrigerants such as CFCs and HCFCs, the use of our nano-structured polymer technology may provide additional environmental and health benefits. We believe that there is a substantial market for HVAC systems that conserve energy without the use of conventional refrigerants.

|

|

| *projected

Projected NanoAir ™ Benefit Comparison

NanoAir™ is being partially funded by a $681,322 grant from the U.S. Department of Energy’s Advanced Research Projects Agency – Energy (ARPA-E) awarded to us in September of 2010, and a $254,500 grant from Pasco County, Florida in December of 2010. The grant from Pasco County requires us to pay the county 2% of the gross sales of products using a certain unique pump assembly for 5 years , or a total of $1,000,000 whichever occurs first.

|

9

|

Water Clean-Up

According to water quality evaluated by the Pasco County Technical Services in March 2010, and the China Academy of Environmental Science in December 2010, our NanoClear™ prototype system has demonstrated the ability to remove salt and other impurities from water to produce potable water using what we believe is an environmentally friendly design projected to be more energy efficient, reduce capital costs, and lower operating expenditures up to 50% over the market leading technology in use today (Reverse Osmosis). We have developed a number of functional demonstration units of various

sizes, which highlight the basics of how this system works to produce potable water. These demonstration units are being used as the basis for the application’s next planned inflection point: the construction and operation of a 10 cubic meter (approximately 26,500 gallons per day) pilot plant to be located near our office outside of Tampa, Florida at a Pasco County off-line waste water treatment facility where the local municipal government has granted Dais permission to construct and operate the pilot NanoClear™ facility. The NanoClear™ application is currently in the early stages of beta development.

We believe significant market opportunities for the NanoClear™ process exist in water cleanup including waste water (e.g. pharmaceutical, electronics, and other industrial uses as well as municipal applications), water desalination (salt and brackish water clean-up), and an array of consumer applications. Unlike other water desalination technologies, we believe the NanoClear ™ process may have the ability to handle high concentrations of salt with no lasting damage to the base membrane materials. The benefit of such a technological advancement in the water desalination

industry may mean higher outputs of clean water per volume of contaminated water, and we believe the ability to produce a near zero discharge of contaminants from the process. The world market for water and wastewater amounted to $346.9 billion in 2008. According to 360 Consultancy/Acon AG, World-Wide water market profile dated May 2009, the market is expected to expand further with high growth rates to $374.4 billion by 2009, and $412 billion by 2010. The Central Government of China, on January 30, 2011 announced a $608 billion government-mandated program citing that it is a ‘national priority’ for China to improve water conservation in the next decade. As a part of this initiative the Chinese government also said that it would increase its efforts to improve water quality and irrigation, and that it aims to eradicate the problem of unsafe drinking

water in rural areas by 2015.

Further, based on our projections, we believe certain facility and mechanical layouts of the NanoClear™ process for water clean-up may be able to accomplish 90-95% water capture vs. 40-60% for traditional Reverse Osmosis (RO) systems clean water using NanoClear™ has a projected energy/water cost of $0.25 to $0.33 per cubic meters, (desalination) vs. $0.50-$1 per cubic meters for Reverse Osmosis. 2

Energy Storage

Based on initial material tests conducted by General Electric’s Global Research and Development Center in 2008, and the University of Florida in 2010 and 2011, we believe that by applying a combination of our nano-material in a process which exercises key attributes of the material’s properties, we may be able to construct an energy storage device akin to an ultracapacitor. An ultracapacitor is a device which stores energy similar to a battery but in this case with projected increases in energy density and lifetimes. We call this application NanoCap™. We believe the key application

for NanoCap™ would be in transportation. We signed a research agreement with the University of Florida to conduct materials testing for the time period from July 2010 through September 2011. Although very early in the development path, preliminary results obtained in research by both GE and the University of Florida suggest that a NanoCap™ ultracapacitor, if fully developed, may possess an energy density comparable to that of gasoline.

|

10

|

The market size for ultracapacitors, worldwide, is projected to be $500 million by 2012 as estimated by Greentech Media in January 2010 and includes electric vehicles, various electronics, smart grid and other applications.

Other

We have identified other potential products for our nano-materials and processes. Some have basic data to support additional functionality and market differentiation of a product based on our nano-technology inventions. These other products are based, in part, upon the known functionality of our materials and processes. Management anticipates that many of these other applications will be developed in the future with partners already in a given sales channel or line of business with us, as we grow and are able to internally fund such activities, development, manufacturing, and sales.

We expect ConsERV™ to continue to be the focus of our commercial product sales through 2011 with a growing emphasis on moving the development of the NanoClear™ and NanoAir™ technologies towards commercialization. However, we cannot provide assurance that any of the ongoing projects under development will ultimately be successful or commercially viable.

Proposed Reverse Stock Split and Conversion of Debt

Immediately following the effectiveness of the registration statement which this prospectus is a part of, and prior to closing of this offering , we will effect a 10-for-1 reverse stock split.

In connection with the closing of this offering, we intend to have all convertible notes outstanding in the aggregate principal amount of $2,500,000 plus accrued interest, discharged by conversion or repayment using proceeds from the offering. As of September 12 , 2011 we estimate that approximately $1. 51 million of net proceeds from the offering will be used to repay convertible notes, and that approximately 474,200 shares of common stock will be issued in the conversion of notes.

We have entered into an agreement with our CEO, Tim Tangredi, that provides that upon closing of the offering Mr. Tangredi’s accrued compensation through the closing date in the approximate amount of $1.05 million shall be paid with a combination of (a) cash, which we estimate at this time to be approximately $380,000, which is intended to cover payment of income and other taxes due from the payment of such accrued compensation, and (b) shares of restricted common stock at a price equal to the price per share paid by investors in the public offering, for the remainder (which is assumed for purposes of this calculation to be $4.00

per share after giving effect to the anticipated 10-for-1 reverse stock split, and based on this assumption would consist of approximately 166, 971 shares of common stock). In addition, net proceeds from the offering will be used to pay approximately $358,000 in accrued compensation to two employees, Patricia Tangredi and David Longacre.

For additional details regarding the above, see “Use of Proceeds” below in this prospectus.

Risk Factors

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described under “Risk Factors” beginning on page 1 5 of this prospectus, as well as other information included in this prospectus, including our financial statements and the notes thereto, before making an investment decision.

|

11

|

The Offering

The following summary contains basic information about the offering and our common stock and is not intended to be complete. It does not contain all the information that is important to you. For a more complete understanding of our common stock, please refer to the section of this prospectus entitled “Description of Capital Stock.”

|

||

|

Issuer

|

|

Dais Analytic Corporation, a New York corporation.

|

|

Common stock offered by us

|

|

3,750,000 shares of common stock, par value $0.01 per share. (1)

|

|

Over-allotment option

|

|

We have granted the underwriter an option to purchase up to an additional 562,500 shares of common stock within 45 days of the date of this prospectus in order to cover over-allotments, if any.

|

|

Common Stock outstanding before this offering

|

3,683,474 shares of common stock (1) (2)(3)

|

|

|

Common stock outstanding after this offering

|

|

7,433,474 shares of common stock (1)(2)(3)

|

|

Use of Proceeds

|

|

We intend to use the net proceeds from the sale of our common stock in this offering for working capital, to pay certain outstanding note obligations, to pay accrued salaries, and for general corporate purposes. For additional details concerning the use of proceeds see the section below in the prospectus titled “Use of Proceeds.”

|

|

Market and trading symbol for the common stock

|

|

Our common stock is quoted on the Over-the-Counter Bulletin Board under the symbol “DLYT,” and we have applied to list on AMEX.

|

|

Proposed AMEX listing symbol for our common stock

|

|

“DLYT”

|

|

Underwriter common stock purchase warrant

|

|

In connection with this offering, we have also agreed to grant MDB Capital Group LLC a warrant to purchase up to a number of the shares of common stock equal to 10% of the shares sold in this offering. If this warrant is exercised, each share may be purchased by MDB Capital Group LLC at $ per share (equal to 120% of the price of the shares sold in this offering.)

|

12

| Lockup Agreements | We intend to have each of our officers and directors agree that for a period of 180 days from the date of the underwriting agreement, they will be subject to a lock up prohibiting any sales, transfers or hedging transactions in our securities that are held by them. See section titled “Lockup Agreements” in this prospectus. | |||

| (1) | We have, for purposes of disclosure in this prospectus, assumed consummation of a 10-for-1 reverse stock split immediately following the effectiveness of the registration statement of which this prospectus is a part , and have assumed an offering price of $4.00 per share (which is the midpoint of our expected offering range of $3.00 to $5.00 per share). | |||

| (2) | The number of shares of our common stock outstanding before and after this offering is based on the number of shares outstanding as of September 12 , 2011, after giving effect to the anticipated 10-for-1 reverse stock split, and excludes: | |||

| • | 1,734,609 s hares of our common stock issuable upon exercise of stock options under our stock plans, | |||

| • | 2,782,533 s hares of our common stock reserved for issuance under various outstanding warrant agreements , | |||

| • | Shares of our common stock issuable upon conversion of our convertible promissory notes in the aggregate principal amount of $2,500,000 plus accrued interest as of the closing date of the offering, which (as of September 12 , 2011) if fully converted into shares would result in the issuance of approximately 1,0 55,848 shares. The conversion of these notes are subject to limitations on conversion, and because of these limitations we estimate that as of September 12 , 2011 approximately $1. 51 million of net proceeds from the offering will be used to repay principal and interest under these notes, and that approximately 474,200 shares of common stock will be issued in the conversion of the notes (see sections titled “Use of Proceeds” and “Capitalization” below in this prospectus); | |||

| • | 950,500 s hares of our common stock reserved for future issuance under our stock plans; and , | |||

| • | Shares of our common stock issuable upon conversion of a portion of the accrued salary of our CEO to common stock; as of September 12 , 2011 the CEO’s total accrued unpaid compensation was $1,047,884, which would be converted at the closing date of the offering into approximately 166, 971 shares of common stock (based on an assumed public offering price of $4.00 per share, and assuming $380,000 of such accrued compensation will be paid to the CEO in cash). | |||

| Unless otherwise specifically stated, information throughout this prospectus assumes that none of our outstanding options or warrants to purchase shares of our common stock have been exercised, and that none of our convertible securities have been converted. | ||||

| (3) |

Unless otherwise indicated, the number of shares of common stock presented in this prospectus excludes shares issuable pursuant to the exercise of the underwriter’s over-allotment option and underwriter’s warrant.

|

|||

13

SUMMARY FINANCIAL DATA

The table below includes historical selected financial data for each of the years ended December 31, 2010 and 2009 (as restated), derived from our audited financial statements included elsewhere in this prospectus. The table below also includes historical financial data for the three and

six month periods ending June 30 , 2010 (as restated) and 2011, derived from our unaudited financial statements included elsewhere in this prospectus.

You should read the historical selected financial information presented below in conjunction with the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section and our financial statements and the notes to those financial statements included elsewhere

in this prospectus. Historical results are not necessarily indicative of the results that may be expected for any future period.

|

For the Years Ended December 31,

|

For the Three Months Ended June 30,

|

For the Six Months Ended June 30,

|

||||||||||||||||||||||

|

2010

|

2009

|

2011 | 2010 | 2011 | 2010 | |||||||||||||||||||

|

as restated

|

as restated

|

|

||||||||||||||||||||||

| STATEMENT OF OPERATIONS: | ||||||||||||||||||||||||

|

Revenues

|

$ | 3,342,468 | $ | 1,531,215 | $ | 1,124,079 | $ | 1,010,142 | $ | 1,982,773 | $ | 1,417,454 | ||||||||||||

|

Cost of goods sold

|

(2,290,041 | ) | (1,071,098 | ) | (806,674 | ) | (550,196 | ) | (1,507,564 | ) | (871,522 | ) | ||||||||||||

|

Operating expenses

|

(2,931,274 | ) | (3,224,592 | ) | (803,725 | ) | (1,029,394 | ) | (1,728,058 | ) | (1,588,914 | ) | ||||||||||||

|

Loss from operations

|

(1,878,847 | ) | (2,764,475 | ) | (486,320 | ) | (569,448 | ) | (1,252,849 | ) | (1,042,982 | ) | ||||||||||||

|

Change in fair value of warrant liability

|

618,801 | (3,731,694 | ) | 1,694,170 | 1,835,094 | (657,937 | ) | 327,066 | ||||||||||||||||

|

Interest and other expense

|

(173,547 | ) | (620,907 | ) | (416,265 | ) | (55,233 | ) | (579,774 | ) | (101,736 | ) | ||||||||||||

|

Net loss

|

$ | (1,433,593 | ) | $ | (7,117,076 | ) | $ | 791,585 | $ | 1,210,413 | $ | (2,490,560 | ) | $ | (817,652 | ) | ||||||||

|

Net loss per common share, basic

|

$ | (0.05 | ) | $ | (0.36 | ) | $ | 0.02 | $ | 0.04 | $ | (0.07 | ) | $ | (0.03 | ) | ||||||||

|

Net loss per common share, diluted

|

$ | (0.05 | ) | $ | (0.36 | ) | $ | 0.02 | $ | 0.03 | $ | (0.07 | ) | $ | (0.03 | ) | ||||||||

|

Weighted average common shares

|

||||||||||||||||||||||||

|

outstanding, basic

|

29,985,632 | 19,960,150 | 35,089,169 | 29,800,194 | 34,335,348 | 29,577,797 | ||||||||||||||||||

|

Weighted average common shares

|

||||||||||||||||||||||||

|

outstanding, diluted

|

29,985,632 | 19,960,150 | 56,239,845 | 40,245,491 | 34,335,348 | 29,577,797 | ||||||||||||||||||

|

PROFORMA: *

|

||||||||||||||||||||||||

|

Proforma net loss per common share, basic

|

$ | (0.19 | ) | $ | (1.10 | ) | $ | 0.10 | $ | 0.16 | $ | (0.32 | ) | $ | (0.11 | ) | ||||||||

|

Proforma net loss per common share, diluted

|

$ | (0.19 | ) | $ | (1.10 | ) | $ | 0.08 | $ | 0.14 | $ | (0.32 | ) | $ | (0.11 | ) | ||||||||

|

Proforma weighted average common shares outstanding, basic

|

7,463,702 | 6,461,154 | 7,974,056 | 7,445,158 | 7,898,674 | 7,422,919 | ||||||||||||||||||

|

Proforma weighted average common shares outstanding, diluted

|

7,463,702 | 6,461,154 | 10,089,124 | 8,489,688 | 7,898,674 | 7,422,919 | ||||||||||||||||||

* The impact of a 10-for-1 reverse stock split to be effected immediately after the effectiveness of the registration statement, of which this prospectus is a part, has been applied retroactively in the above proforma calculations.

|

STATEMENT OF FINANCIAL CONDITION:

|

|

|||||||||||||||

|

|

December 31

|

June 30

|

||||||||||||||

|

|

2010

|

2009

|

2011

|

2010

|

||||||||||||

|

as restated

|

as restated

|

|||||||||||||||

|

Working capital

|

|

(2,861,488

|

)

|

(2,265,370

|

)

|

(1,846,593

|

)

|

(3,028,616

|

)

|

|||||||

|

Total assets

|

|

1,970,573

|

|

1,620,746

|

|

2,972,862

|

|

2,070,061

|

|

|||||||

|

Total long-term notes payable, related party, less current installments

|

|

—

|

|

300,000

|

|

—

|

|

—

|

|

|||||||

|

Total shareholders’ deficit

|

|

(6,722,092

|

)

|

(7,256,058

|

)

|

(6,323,185

|

)

|

(3,094,998

|

)

|

|||||||

14

RISK FACTORS

You should carefully consider the risks described below before making an investment decision. Our business, financial condition, results of operations or cash flows could be materially adversely affected by any of the events or circumstances described in these risk factors. The valuation for the Company could also decline due to any of the events or circumstances, and you may lose all or part of your investment. This document also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of several factors, including the risks faced by us described below and elsewhere in this

prospectus. In assessing these risks, you should also refer to the other information contained in this prospectus, including our financial statements and related notes.

Risks Related to Our Business

Our independent registered public accounting firm has issued an unqualified opinion with an explanatory paragraph to the effect that there is substantial doubt about our ability to continue as a going concern.

Our independent registered public accounting firm has issued an unqualified opinion with an explanatory paragraph to the effect that there is substantial doubt about our ability to continue as a going concern. This unqualified opinion with an explanatory paragraph could have a material adverse effect on our business, financial condition, results of operations and cash flows. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources” and Footnotes to our financial statements for the fiscal year ended December 31, 2010, included elsewhere in this prospectus.

We have no committed sources of capital and do not know whether additional financing will be available when needed on terms that are acceptable, if at all. This going concern statement from our independent registered public accounting firm may discourage some investors from purchasing our stock or providing alternative capital financing. The failure to satisfy our capital requirements will adversely affect our business, financial condition, results of operations and prospects.

Unless we raise additional funds, either through the sale of our securities or one or more collaborative arrangements, we will not have sufficient funds to continue operations. Even if we take these actions, they may be insufficient, particularly if our costs are higher than projected or unforeseen expenses arise.

15

We intend to use proceeds from the offering to repay secured and unsecured convertible promissory notes in the aggregate principal amount of $2,500,000. However, if we do not complete the offering, we may be unable to convert, repay or secure an extension of these notes. If we do not complete the offering, and if we are unable to reach an agreement with our note holders regarding conversion, repayment and/or extension of the maturity date of these notes, the note holders could foreclose on our assets, which ultimately could require us to curtail or cease our operations and could ultimately result in the loss of our patent and patent

applications.

We intend to use proceeds from the offering to repay secured and unsecured convertible promissory notes in the aggregate principal amount of $2,500,000. However, if we do not complete the offering, we may be unable to convert, repay or secure an extension of these notes. Apart from proceeds from the contemplated offering, we do not currently have, and do not expect to attain, adequate funds for repayment of the above-mentioned notes from our current operations. Although we intend to continue to finance our operations, including the repayment of these notes, primarily through private sales of debt and equity securities, we may not be able to secure additional financing to repay

the notes on acceptable terms, if at all. Further, our outstanding secured $1.5 million convertible promissory note and the $1.0 million unsecured convertible promissory note contain limitations on the amount of debt we can incur prior to repayment of these notes. Hence, absent completion of the contemplated offering, unless the note holders waive the debt limit we may not be able to avail ourselves of sufficient financing should it be available. Further, the unsecured promissory note and the secured convertible promissory note provide for conversion of the principal and interest into shares of our common stock, upon certain conditions and subject to certain limitations. Any conversion of either of these notes could substantially dilute existing shareholders. Absent completion of the contemplated offering, if we are unable to secure

additional financing to repay the notes we will seek to renegotiate the notes. However, there is no guarantee that the note holders will accept any offer we may make and may request additional concessions from us for any accommodation we do secure. Any terms we may be able to secure may not be favorable to us. Unfavorable terms would adversely impact our business, financial condition and/or results of operations. In the event we are unable to secure such additional financing sufficient to pay the notes prior to their respective maturity dates and we are not able to renegotiate the terms of the note, the note holders will have the option to either convert the principal and interest into shares of our common stock or foreclose on the notes, which would have material adverse consequences on our business operations, financial condition, results of operations and cash

flows and possibly result in the loss of all of our patent rights and the failure of our business.

If we do not repay or convert the principal and interest on the above mentioned $1.5 million 10% interest secured convertible note when due, we may lose all our patents and patent applications.

If we do not repay the $1,500,000 10% secured convertible note currently outstanding when due we could suffer the loss of our patents and patent applications, which secure our payment obligations under this note. Our success depends, to a significant extent, on the technology that is incorporated in our product and the underlying patents and patent applications securing this note. We intend to continue to finance our operations, including the repayment of this note, primarily through sales of debt and equity securities. If the contemplated offering is not completed, we will have to seek alternative financing and may not be able to secure such additional financing to repay the note on acceptable terms, if at all. If we are not able to repay this note there is no guarantee that the note holder will accept any offer we may make with regard to extending or converting this note. Further, the note holder may request additional concessions from us in return for extending or converting the note. Any re-negotiated terms we may be able to secure may not be favorable to us. Unfavorable terms, in either a financing transaction or debt renegotiation, would adversely impact our business, financial condition and/or results of operations. In the event (i) the contemplated offering is not completed and we are unable to secure additional financing sufficient to pay this note, (ii) this note is not converted into shares of our common stock, or (iii) we are not able to renegotiate the terms of this convertible note, the note holder will have the option to foreclose on all of our patents and patent applications securing the notes, which would likely result in the failure of our business.

16

We have a history of operating losses, and we expect our operating losses to continue for the foreseeable future. If we fail to obtain additional financing we will be unable to execute our business plan and/or we may not be able

to continue as a going concern.

We have incurred substantial losses since we were funded in 1993 and have not achieved profitability in any year to date. We have developed a family of nano-structured polymers and

processes and are now marketing our first product application, ConsERV™. We anticipate the other listed applications in this document may take at least 6 to 48 months to develop. We expect our operating losses to continue for the foreseeable future as we continue to expend substantial resources to expand the ConsERV™ business while working to bring the identified applications to the market including research and development, design and testing, obtaining third party validations, identifying and securing collaborative partnerships, executing to enter into strategic relationships, or selling materials or value-added components. Furthermore, even if we achieve our projection of selling a greater number of ConsERV™ units in 2011, we anticipate that we will continue to incur losses until we can cost-effectively produce and sell our products to a wider market. Our

accumulated deficit was $38,128,522 as of June 30 , 2011. It is possible that we will never generate sufficient revenue to achieve and sustain profitability. Even if we achieve profitability, we may not be able to sustain or increase profitability.

We financed our operations since inception primarily through private sales of our common stock and preferred stock, issuance of convertible promissory notes; issuance of unsecured

promissory notes, cash received in connection with exercise of warrants, license fees and the sale of certain fuel cell assets in 2002. As of June 30 , 2011, we had $2,746,359 in current assets.

17

Even if we are successful in raising additional equity capital to fund our operations, we will still be required to raise an additional substantial amount of capital in the future to fund our development initiatives and to achieve profitability. Our ability to fund our future operating requirements will depend on many factors, including the following:

|

•

|

ability to obtain funding from third parties;

|

|

•

|

progress on research and development programs;

|

|

•

|

time and costs required to gain third party approvals;

|

|

•

|

costs of manufacturing, marketing and distributing our products;

|

|

•

|

costs of filing, prosecuting and enforcing patents, patent applications, patent claims and trademarks;

|

|

•

|

status of competing products; and

|

|

•

|

market acceptance and third-party reimbursement of our products, if successfully developed.

|

There are no assurances that future funding will be available on favorable terms or at all. If additional funding is not obtained, we will need to reduce, defer or cancel development programs and planned initiatives, to the extent necessary. The failure to fund our capital requirements would have a material adverse effect on our business, financial condition and results of operations.

Failure to achieve and maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley Act of 2002 could have a material adverse effect on our business and operating results. In addition, current and potential stockholders could lose confidence in our financial reporting, which could have a material adverse effect on our stock price.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. If we cannot provide reliable financial reports or prevent fraud, our operating results could be harmed. We are required to document and test our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act, which requires annual management assessments of the effectiveness of our internal controls over financial reporting. During the course of our testing, we may identify deficiencies which we may not be able to remediate in time for compliance with the requirements of Section 404. In addition, if we fail to maintain the adequacy

of our internal controls, as such standards are modified, supplemented or amended from time to time; we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act. Failure to achieve and maintain an effective internal control environment could also cause investors to lose confidence in our reported financial information, which could have a material adverse effect on our stock price.

Our CEO and CFO identified a material weakness in our internal controls over financial reporting relating to the accounting and disclosure for complex and non-standard common stock warrant transactions, which required us to restate our financial statements for the year ended December 31, 2009 as provided herein. To address our material weakness related to the accounting and disclosure for complex financial instruments, we have enhanced our internal control processes in order to be able to comprehensively review the accounting and disclosure implications of such transactions on a timely basis.

We cannot provide assurance as to the result of these efforts. We cannot be certain that any measures we take will ensure that we implement and maintain adequate internal controls in the future. Any failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm our operating results or cause us to fail to meet our reporting obligations.

18

In the event the lease on our corporate office and production space is terminated, we may not be able to acquire a lease on another suitable property, or a lease on a suitable property at a comparable cost.

Ethos Business Ventures, LLC is our landlord. Our CEO, Mr. Tangredi, is a principal owner of this entity. We note that under the terms of our lease agreement for our corporate office and production space, the lease may be terminated upon 30 days prior written notice by landlord and 90 days prior written notice by us. If this lease is terminated, or if for any reason Mr. Tangredi should become unable to continue to lease this space to us, we may not be able to acquire another lease for another suitable property or a lease on a suitable property at a comparable cost in a timely manner, which could materially disrupt our operations. Even if we are able to

relocate into another suitable property at a comparable cost in a timely manner, we would incur significant moving expenses.

Our future indebtedness could adversely affect our financial health.

We have and may continue to incur a significant amount of indebtedness to finance our operations and growth. Any such indebtedness could result in negative consequences to us, including:

|

•

|

increasing our vulnerability to general adverse economic and industry conditions;

|

|

•

|

requiring a portion of our cash flow from operations be used for the payment of interest on our debt, thereby reducing our ability to use our cash flow to fund working capital, capital expenditures and general corporate requirements;

|

|

•

|

limiting our ability to obtain additional financing to fund future working capital, capital expenditures and general corporate requirements;

|

|

•

|

limiting our flexibility in planning for, or reacting to, changes in our business;

|

|

•

|

placing us at a competitive disadvantage to competitors who have less indebtedness; and

|

|

•

|

as the majority of our assets are pledged under a significant portion of our outstanding debt, the failure to meet the terms and conditions of the debt instruments, or a failure to timely rearrange the current terms and conditions of the notes, if so required, will result in us having no access to our technology.

|

19

The recent economic downturn has affected, and is likely to continue to adversely affect, our operations and financial condition potentially impacting our ability to continue as a going concern.

The recent economic downturn has resulted in a reduction in new construction and less than favorable credit markets, both of which may adversely affect us. Certain vendors from which we currently secure parts for our ConsERV™ product have and may continue to either reduce or eliminate payment terms. Hence, more capital is required to secure parts necessary to produce our products. In addition, our products are often incorporated in new construction which has experienced a marked down turn in project starts over the past year and such trend is expected for 2011. Although the portion of new construction most affected is home sales, which represents a minority of our sales, commercial construction

has also experienced a reduction in starts with some projects being delayed and possibly eliminated. If the commercial construction market stagnates or decreases in volume or project size, our operations and financial condition could be negatively impacted. Various economic stimulus measures by the federal and state governments appear to have targeted energy products. ConsERV™ may qualify under said programs and we may potentially benefit. However, when and if we will experience any increase in sales or investment due to these programs is uncertain. As noted above, we intend to continue to finance operations, including the repayment of all outstanding debt, such as the secured convertible note and unsecured promissory note, primarily through private sales of debt and equity securities. In light of the recent economic downturn we may not be able to secure additional financing on

acceptable terms, if at all. Unfavorable terms for a financing transaction would adversely impact our business, financial condition and/or results of operations. In the event we are unable to secure additional financing our business may fail.

If we fail to successfully address the challenges, risks and uncertainties associated with operating as a public company, our business, results of operations and financial condition would be materially harmed.

We have and will continue to incur a significant increase in costs as a result of operating as a public company, and our management has and will be required to devote substantial time to new compliance initiatives. Until November of 2008 we had never operated as a public company. In preparation for and since reporting as a public company, we have and expect to continue to incur significant legal, accounting and other expenses that we did not incur as a non-reporting company. In addition, the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), as well as new rules subsequently implemented by the Securities and Exchange Commission (the “SEC”) and various stock exchanges, has

imposed many new requirements on public companies, including requiring changes in corporate governance practices. Our management and other personnel have and will continue to devote a substantial amount of time to these new compliance procedures.

As a public company, we are now subject to the reporting requirements of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), the Sarbanes-Oxley Act and the rules promulgated by the SEC and AMEX, if and when accepted, in response to the Sarbanes-Oxley Act. The Exchange Act requires, among other things, that we file annual, quarterly and current reports with respect to our business and financial condition. The Sarbanes-Oxley Act requires, among other things, that we maintain effective disclosure controls and procedures and internal controls for financial reporting.

If we or our independent registered public accounting firm identifies deficiencies in our internal controls that are deemed to be material weaknesses, the market price of our stock could decline and we could be subject to sanctions or investigations by SEC or other regulatory authorities, which would entail expenditure of additional financial and management resources.

These rules and regulations could also make it more difficult for us to attract and retain qualified independent members of our Board of Directors. Additionally, we have found these rules and regulations make it more difficult and more expensive for us to obtain director and officer liability insurance. We have, and may be required once again, to accept reduced policy limits and/or coverage or incur substantially higher costs to obtain the same or similar coverage.

20

Our ConsERV™ product is in small volume production, we have no long term experience manufacturing our products on a commercial basis and may not be able to achieve cost effective large volume production.

Our ConsERV™ product is built in growing volumes. Our ability to expand commercial production of that product is subject to significant uncertainties, including: completion of necessary product automation, developing experience in manufacturing and assembly on a large commercial scale; assuring the availability of raw materials and key component parts from third party suppliers; and developing effective means of marketing and selling our product.

We are in the process of assembling our ConsERV™ product at our facility in Odessa, Florida with overflow being produced by outsourced firms, which limits our capital outlay. Initial production costs of this product line are high with no or a lower than desired profit margin. As a result, we believe we will need to reduce unit production costs, including the nano-structured materials themselves made to our specifications by third parties, over time in order to offer our products at a profitable basis on a commercial scale. Our ability to achieve cost reductions in all areas of nano-structured materials and value added products depends on entering into suitable manufacturing relationships with component

suppliers, as well as increasing sales volumes so that we can achieve economies of scale. A failure to achieve a lower cost structure through economies of scale and improvements in engineering and manufacturing in a timely manner would have a material adverse effect on our business and financial results. There can be no assurance that we will obtain higher production levels or that the anticipated sales prices of our products will ever allow an adequate profit margin.

We may not be able to meet our product development and commercialization milestones.

We have established internal product and commercialization milestones and dates for achieving development goals related to technology and design improvements of our products. To achieve these milestones we must complete substantial additional research, development and testing of our products and technologies. Except for our ConsERV™ product, we anticipate that it will take at least 6 to 36 months to develop and ready our other products for scaled production. Product development and testing are subject to unanticipated and significant delays, expenses and technical or other problems. We cannot guarantee that we will successfully achieve our milestones. Our business strategy depends on

acceptance of our products by key market participants and end-users.

Our plans and ability to achieve profitability depend on acceptance by key market participants, such as vendors and marketing partners, and potential end-users of our products. We continue to educate designers and manufacturers of HVAC equipment with respect to our ConsERV™ product. More generally, the commercialization of our products may also be adversely affected by many factors that are out of our control, including:

|

•

|

willingness of market participants to try a new product and the perceptions of these market participants of the safety, reliability and functionality of our products;

|

|

•

|

emergence of newer, possibly more effective technologies;

|

|

•

|

future cost and availability of the raw materials and components needed to manufacture and use our products;

|

|

•

|

cost competitiveness of our products; and

|

|

•

|

adoption of new regulatory or industry standards which may adversely affect the use or cost of our products.

|

Accordingly, we cannot predict with any certainty that there will be acceptance of our products on a scale sufficient to support development of mass markets for those products.

21

We are dependent on third party suppliers and vendors for the supply of key components for our products.

We are dependent on third parties to manufacture the key components needed for our nano-structured based materials and value added products made with these materials. Accordingly, a supplier’s failure to supply components in a timely manner, or to supply components that meet our quality, quantity and cost requirements, technical specifications, or the inability to obtain alternative sources of these components on a timely basis or on terms acceptable to us, would create delays in production of our products or increase unit costs of production. Certain of the components contain proprietary products of our suppliers, or the processes used by our suppliers to manufacture these components are proprietary.

If we are required to replace any of our suppliers, while we should be able to obtain comparable components from alternative suppliers at comparable costs, this would create a delay in production. If we experience such delays or our third party suppliers and vendors fail to supply us with components that meet our quality, quantity, or cost standards, we may lose our customers or be subject to product liability claims. Our applications require extensive commercial testing and will take long periods of time to commercialize.

Our nano-structured materials and associated applications need to undergo extensive testing before becoming commercial products. Consequently, the commercialization of our products could be delayed significantly or rendered impractical. Moreover, much of the commercial process testing will be dependent on the efforts of others. Any failure in a manufacturing step or an assembly process may render a given application or our nano-structured materials unsuitable or impractical for commercialization. Testing and required development of the manufacturing process will require the expenditure of funds and take time and effort.

We have not devoted any significant resources towards the marketing and sale of our products, we expect to face intense competition in the markets in which we do business, and expect to rely, to a significant extent, on the marketing and sales efforts of third parties that we do not control.

To date, we primarily focused on the sale of ConsERV™ products and, while we have sold increasing quantities of our products, even by adding staff experienced in the industry we continue to experience a learning curve in the marketing and sale of products on a commercial basis. We expect that the marketing and sale of the ConsERV product will continue to be conducted by a combination of independent manufactures representatives, third-party strategic partners, distributors, or OEMs. Consequently, commercial success of our products will depend to a great extent on the efforts of others. We intend to enter into additional strategic marketing and distribution agreements or

other collaborative relationships to market and sell our nano-structured materials and value added product. However, we may not be able to identify or establish appropriate relationships in the future. Even if we enter into these types of relationships, we cannot assure you that the distributors or OEMs with which we form relationships will focus adequate resources on selling our products or will be successful in selling them. In addition, our chosen third-party distributors or OEMs may require us to provide volume price discounts and other allowances, customize our products or provide other concessions which could reduce the potential profitability of these relationships. To the extent any strategic relationships that we establish are exclusive, we may not be able to enter into other arrangements at a time when the distributor with which we form a relationship is not successful in

selling our products or has reduced its commitment to marketing our products. Failure to develop sufficient distribution and marketing relationships in our target markets will adversely affect our commercialization schedule and, to the extent we enter into such relationships, the failure of our distributors and other third parties in assisting us with the marketing and distribution of our products may adversely affect our financial condition and results of operations.

22

We will face intense competition in the markets of our product applications for our nano-structured materials and value-added products. We will compete directly with currently available products, some of which may be less expensive. The companies that make these other products may have

established sales relationships and more name-brand recognition in the market than we do. In addition, some of those companies may have significantly greater financial, marketing, manufacturing and other resources.

Our future results could be harmed by economic, political, regulatory and other risks associated with international sales and

operations.

We intend to market, distribute and service our products on an international basis and expect to derive a significant portion of our revenue in coming years from international sales. If we fail to successfully sell our products internationally, our ability to increase our future revenue and grow our

business would be impaired. We have limited experience developing, and no experience manufacturing, our products to comply with the commercial, regulatory and legal requirements of international markets. Our success in those markets will depend on our ability to secure relationships with foreign resellers and our ability to manufacture products that meet foreign regulatory and commercial requirements. In addition, our planned international operations could be harmed by a variety of factors, including but not limited to:

|

•

|

increased costs associated with maintaining international marketing efforts;

|

|

•

|

compliance with potential United States Department of Commerce export controls;

|

|

•

|

increases in duty rates or other adverse changes in tax laws;

|

|

•

|

trade protection measures and import or export licensing requirements;

|

|

•

|

fluctuations in currency exchange rates;

|

|

•

|

political and economic instability in foreign countries; and

|

|

•

|

difficulties in securing and enforcing intellectual property rights, foreign (where filed and obtained) or domestic, and time and complexities of vetting and establishing relations with foreign resellers or licensees including but not limited to designing, validating and marketing a product geared specifically to a particular market segment.

|

We depend on our intellectual property and failure to protect it could enable competitors to market products with similar features that may reduce demand for our

products.

23

We currently have eight United States patents, nine patent applications and co-own six patent applications, some of which apply to the composition and structure of a family of ion conducting polymers and membranes. These patents and patent applications often make reference to applications

for, and in some instances, are application patents relating to materials we are developing. Our patent applications may or may not mature into issued patents.

Our success depends, to a significant extent, on the technology that is incorporated in our product. Although some of the inventions which we have obtained or applied for patent protection are no longer suitable for use with our planned products, we believe that some of the other inventions covered by the

patents and patent applications are important to the success of our products. If we are unable to protect our intellectual property, competitors could use our intellectual property to market products similar to our products, which could reduce demand for our products. We may be unable to prevent unauthorized parties from attempting to copy or otherwise obtain and use our products or technology. Policing unauthorized use of our technology is difficult, and we may not be able to prevent misappropriation of our technology, particularly in foreign countries where the laws may not protect our intellectual property as fully as those in the United States. Others may circumvent trade secrets, trademarks and copyrights that we own or may own. Any such infringements, or any alleged infringements, could have a material adverse effect on our business, results of operations, and financial

condition.