Table of Contents

As filed with the Securities and Exchange Commission on January 31, 2014

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Coupons.com Incorporated

(Exact name of Registrant as specified in its charter)

| Delaware | 7310 | 77-0485123 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) | ||

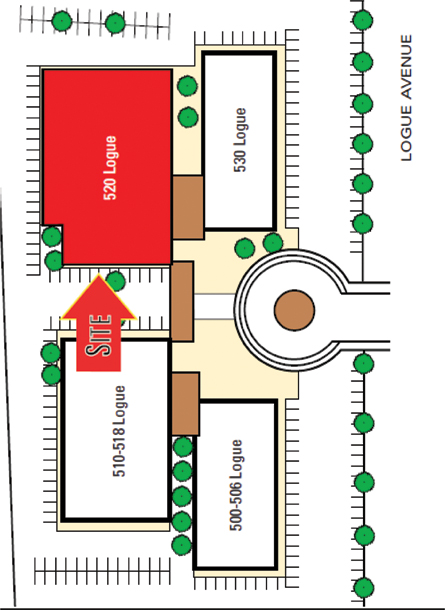

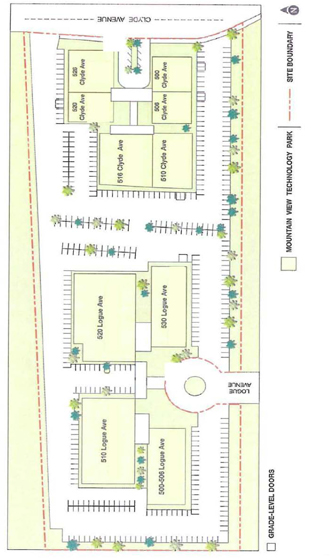

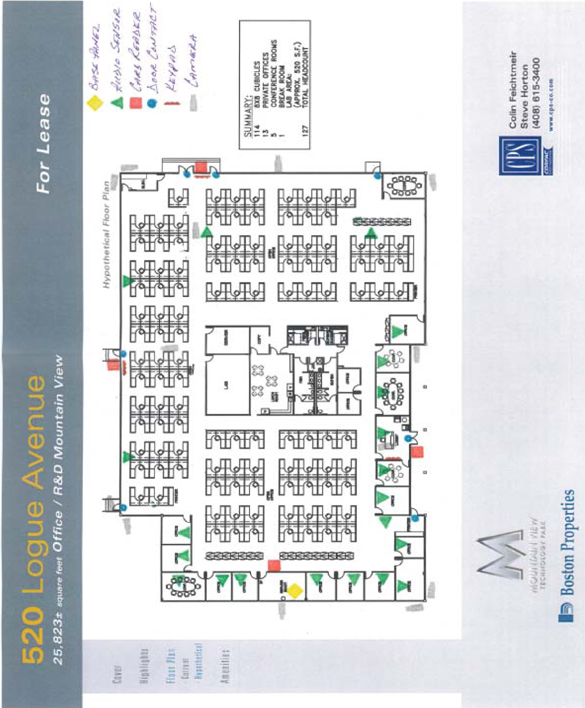

| 400 Logue Avenue Mountain View, California 94043 (650) 605-4600 |

||||

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Steven R. Boal

President and Chief Executive Officer

Coupons.com Incorporated

400 Logue Avenue

Mountain View, California 94043

(650) 605-4600

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||||

| Peter M. Astiz, Esq. Michael J. Torosian, Esq. DLA Piper LLP (US) 2000 University Avenue East Palo Alto, California 94303-2215 (650) 833-2000 |

Richard Hornstein, Esq. Coupons.com Incorporated General Counsel 400 Logue Avenue Mountain View, California 94043 (650) 605-4600 |

Eric C. Jensen, Esq. John T. McKenna, Esq. Cooley LLP 3175 Hanover Street Palo Alto, California 94304-1130 (650) 843-5000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Security to be Registered | Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee | ||

| Common Stock, par value $0.00001 per share |

$100,000,000.00 | $12,880.00 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes the aggregate offering price of additional shares that the underwriters have the right to purchase from us. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject To Completion. Dated January 31, 2014.

Shares

Coupons.com Incorporated

Common Stock

This is an initial public offering of shares of common stock of Coupons.com Incorporated. All of the shares of common stock are being sold by us.

Prior to this offering, there has been no public market for the common stock. It is currently estimated that the initial public offering price per share will be between $ and $ . We intend to list the common stock on the New York Stock Exchange under the symbol “COUP.”

We are an “emerging growth company” as defined under the federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements for future filings.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 13 to read about factors you should consider before buying shares of the common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discount |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

To the extent that the underwriters sell more than shares of common stock, the underwriters have the option to purchase up to an additional shares from us at the initial public offering price less the underwriting discount.

The underwriters expect to deliver the shares against payment in New York, New York on , 2014.

| Goldman, Sachs & Co. | Allen & Company LLC | BofA Merrill Lynch | RBC Capital Markets |

Prospectus dated , 2014

Table of Contents

Table of Contents

Prospectus

| 1 | ||||

| 13 | ||||

| 38 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 45 | ||||

| 47 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

50 | |||

| 78 | ||||

| 92 | ||||

| 98 | ||||

| 110 | ||||

| 114 | ||||

| 116 | ||||

| 124 | ||||

| Material U.S. Federal Tax Consequences for Non-U.S. Holders of Common Stock |

126 | |||

| 130 | ||||

| 136 | ||||

| 136 | ||||

| 136 | ||||

| F-1 |

Through and including , 2014 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We do not take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

Table of Contents

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes included elsewhere in this prospectus, before making an investment decision. Unless the context otherwise requires, the terms “Coupons,” “the company,” “we,” “us” and “our” in this prospectus refer to Coupons.com Incorporated and its consolidated subsidiaries.

Overview

We operate a leading digital promotion platform that connects great brands and retailers with consumers. Over 2,000 brands from more than 700 consumer packaged goods companies, or CPGs, and many of the leading grocery, drug and mass merchandise retailers use our promotion platform to engage consumers at the critical moments when they are choosing which products they will buy and where they will shop. We deliver digital coupons to consumers, including coupons and coupon codes, and display advertising through our platform which includes our web, mobile and social channels, as well as those of our CPGs, retailers, and our extensive network of approximately 30,000 third-party websites, or publishers, that display our coupon and advertising offerings on their websites. During the nine months ended September 30, 2013, we generated revenue from over 940 million transactions in which consumers selected a digital coupon or redeemed a coupon code offered through our platform, an increase of 49% over the same period in 2012.

In 2012, 305 billion total coupons were distributed, representing an aggregate discount value of $467 billion, with 2.9 billion redeemed representing an aggregate discount value of $3.7 billion, according to an annual industry report by NCH Marketing Services, Inc., or NCH, a provider of coupon audit and settlement services. Increasingly, CPGs and retailers are directing a greater proportion of their spending to digital promotions.

Our platform serves three key constituencies:

| Ÿ | more than 700 CPGs representing over 2,000 brands; |

| Ÿ | retailers operating approximately 58,000 store locations in North America; and |

| Ÿ | consumers who (i) made an average of approximately 17 million monthly unique visits to Coupons.com and our other sites during 2013, (ii) visited the sites of our CPGs, retailers and publishers, and (iii) downloaded our mobile apps more than seven million times. |

The combination of our CPGs, retailers, publishers and consumers, all served by our promotion platform, has resulted in powerful network effects, which we believe to be a significant competitive advantage. Our large and growing base of retailers integrated into our platform has allowed us to attract, retain and grow the digital promotion spending of leading CPGs. The breadth of our offerings from these leading brands enables us to attract and retain a growing and more diverse range of retailers, publishers and consumers. Additional offerings on our platform, in particular point of sale solutions, increase consumer engagement and retailer integration, which enhance the value offered to CPGs.

We generate revenues primarily from digital promotion transactions. Each time a consumer selects a digital coupon on our platform by either printing it for physical redemption at a retailer or saving it to a retailer online account for automatic digital redemption, we are paid a fee which is not

1

Table of Contents

dependent on the digital coupon being redeemed. For coupon codes, we are paid a fee when a consumer makes a purchase using a coupon code from our platform. If we deliver a digital coupon or coupon code on a retailer’s website or through its loyalty reward program, or the website of a publisher, we generally pay a distribution fee to the retailer or publisher which is included in our cost of revenues. We also generate advertising revenues through the placement of online advertisements from CPGs and retailers which are displayed with our coupon offerings on our websites and those of our publishers. We are paid a fee for the display of advertisements on a per impression or a per click basis. Advertising placements are generally sold as part of insertion orders for coupons as an integrated sale and not as a separate transaction.

Our CPG customers include many of the leading food, beverage, drug, personal and household product manufacturers. We primarily generate revenue from CPGs through coupons offered through our platform and to a lesser degree, through the sale of advertising. Our retailers include leading grocery, drug and mass market retailers which distribute and accept coupons offered through our platform. Our retailers also include a broad range of specialty stores, including clothing, electronics, home improvement and many others which offer codes through our platform.

In 2012, we generated revenues of $112.1 million, representing 23% growth over 2011, a net loss of $59.2 million, representing an increase of 158% over 2011, and an Adjusted EBITDA loss of $47.3 million, representing an increase of 233% over 2011. During the nine months ended September 30, 2013, we generated revenues of $115.3 million, representing 51% growth over the same period in 2012, a net loss of $12.8 million, representing a decrease of 75% over the same period in 2012, and an Adjusted EBITDA loss of $3.5 million, representing a decrease of 91% over the same period in 2012. For information on how we define and calculate Adjusted EBITDA, and a reconciliation of net loss to Adjusted EBITDA, see the section titled “—Summary Consolidated Financial and Other Data—Non-GAAP Financial Measures” below.

Industry Overview

Since Coca-Cola introduced a coupon in the late 1800s, CPGs and retailers have used coupons and other promotions as a core tool to increase sales and drive awareness of their products. Newspapers and direct mail have traditionally been the primary channels for distributing coupons, but particularly with the decline in newspaper readership, the effectiveness of traditional channels has declined. In contrast to traditional promotions, digital coupons are redeemed at higher rates and are more effective. According to an annual industry report by NCH, in 2012, digital coupons (including print-at-home and paperless coupons) represented less than 1% of total U.S. CPG coupon distribution volume, but accounted for almost 7% of total U.S. CPG coupon redemptions, illustrating the greater effectiveness of digital coupons. We believe that the simplicity of digital coupons is broadening the demographic reach and driving the increased use of digital coupons. According to a study by eMarketer, Inc., a market research company, 97 million U.S. adults will use digital coupons in 2013. Many of the digital coupons are offered through grocery store loyalty programs. According to the 2013 Colloquy Loyalty Census from LoyaltyOne, a provider of loyalty program services, total memberships in grocery-store loyalty programs totaled approximately 172.4 million in 2012.

The combination of continued CPG and retailer promotion spending, strong consumer demand for digital coupons and the greater effectiveness of digital coupons will offer significant opportunities for a solution that can effectively bring together CPGs, retailers and consumers on a digital promotion platform that addresses the challenges that each face, further accelerating the shift from traditional to digital promotions.

2

Table of Contents

Challenges for CPGs and Brands

| Ÿ | difficulty engaging consumers at scale; |

| Ÿ | difficulty coordinating promotional channels that are optimized to their retail distribution channels; |

| Ÿ | complexity of reaching consumers at the moments critical to influencing their purchase decisions; |

| Ÿ | difficulty of integrating with retailer promotion efforts; |

| Ÿ | inability to measure and improve the effectiveness of promotions; and |

| Ÿ | lack of security. |

Challenges for Retailers

| Ÿ | coordinating CPG promotional spending to drive benefits to the retailer; |

| Ÿ | difficulty in engaging digitally savvy consumers with retailer promotions; and |

| Ÿ | improving the efficiency of redeeming all forms of coupons. |

Challenges for Consumers

| Ÿ | traditional and digital coupons may not be available in the form that a consumer finds easiest to use; |

| Ÿ | difficulty in finding coupons for preferred brands and retailers; and |

| Ÿ | lack of personalization. |

Our Solution

We offer a comprehensive digital promotion platform that allows us to connect CPGs and retailers with consumers.

Why CPGs and their Brands Choose Us

Our platform’s increasing effectiveness has driven growth in the use of our platform by CPGs. The cohort of all CPGs that used our platform during the nine months ended September 30, 2011 increased their promotion spending with us two years later during the nine months ended September 30, 2013 by 44% over the amount spent by such cohort during the nine months ended September 30, 2011. Such revenue represented 75% of our total revenues in the nine months ended September 30, 2013 as compared to 91% of our total revenues in the nine months ended September 30, 2011. During the nine months ended September 30, 2013, we generated 25% of our revenue, or $28.8 million, from customers who were not CPGs which had used our platform during the nine months ended September 30, 2011.

Broad and effective reach. We generated revenue from over 940 million transactions pursuant to which consumers selected a coupon or redeemed a code offered through our platform during the nine months ended September 30, 2013.

Multi-channel engagement with consumers at key purchasing decision moments. Our platform allows CPGs to better engage with consumers by enabling multiple touchpoints during a consumer’s

3

Table of Contents

shopping experience. For example, a consumer can use our mobile app while they are walking through the aisle of a retailer, find a coupon for their favorite detergent, save the coupon directly to the retailer’s loyalty program and receive the discount automatically at the point of sale without the need to present a physical coupon.

Advertising solutions integrated with digital promotions. Because consumers are focused on engaging with brands and products when they visit our websites, mobile applications and other consumer touchpoints, integrated advertising solutions enable CPGs to promote their brand and drive consumer loyalty at each decision point.

Ability to quickly deploy focused promotion spending for the benefit of specific brands. Our ability to deploy promotions in days rather than weeks or months provides brands the ability to strategically allocate promotion spending to drive increased sales of their products.

Data-driven optimization of promotions. We offer integrated measurement tools for campaign planning, and pre-campaign and post-campaign development and analysis. Through our Campaign iQ product, CPGs are able to track and analyze activations, inventory levels, redemption rates and volumes, distribution methods, buying rates, aggregated buyer demographics, and campaign effectiveness statistics.

Proven and secure technology. We have proven technology, systems and processes that enable us to securely manage promotions within our CPGs’ objectives. The risk of counterfeiting is a potential barrier to CPGs’ adoption and use of digital coupons. Our proprietary security technology differentiates our solution for CPGs who want to prevent fraudulent use of coupons.

Why Retailers Choose Us

We enable retailers to effectively capture the benefits of promotion spending.

Use CPG promotion content to increase retailer sales. Retailers can integrate promotions from our platform into their point of sale systems, retailer-branded websites, retailer loyalty/rewards programs, mobile applications and social media programs. By offering CPG promotions from our platform through their own digital channels, retailers are able to increase sales of the CPG promoted product at their locations and increase consumer loyalty.

Digital promotion distribution fee. Retailers receive a distribution fee from us when we generate revenues from a digital promotion transaction on the retailer’s website or through its loyalty reward program. Retailers benefit from an additional source of revenues not available with traditional coupons, in addition to driving purchases of the CPG products at their stores. We believe this is one of the reasons why retailer partners have directed their CPG partners to increase their use of our platform or to begin using our platform.

Integration with retailer point of sale systems. By enabling automatic redemption of coupons at the point of sale without requiring the consumer to present a physical coupon, our integration promotes consumer purchase of the promoted product at the retailer, strengthens consumer loyalty to the retailer, enables faster and more efficient check-out, improves the consumer’s experience in using promotions and simplifies the processing of coupons with the CPG issuer.

Platform offering manufacturer and retailer specific promotions. We enable retailers to offer coupon codes on our website and mobile app and those of our publisher network which bring consumers directly to retailers’ websites. Our solution simplifies the shopping process for consumers, increases engagement and allows a retailer to directly drive additional traffic to its stores.

4

Table of Contents

Why Consumers Choose Us

We provide consumers with a robust platform of digital promotions.

Widely available. Our digital coupons are widely available to consumers and delivered or redeemed through the point of sale and through our web, mobile and social channels and those of our CPGs, retailers and extensive network of publishers.

Easy to use in their preferred format. Through our website and mobile applications and those of our publishers, consumers can browse or search for coupons, create shopping lists, download coupons to retailer loyalty cards, print coupons for use in-store, or use a coupon code for web and mobile commerce.

Broad selection of quality coupons. We generated revenue from over 940 million transactions pursuant to which consumers selected a coupon or redeemed a code offered through our platform in the nine months ended September 30, 2013. These transactions represent a broad selection of product categories and variety within each category.

Personalized promotions. Our point of sale solutions and mobile applications help consumers save time and money by optimizing and personalizing the presentation of promotions. A consumer using these products will be presented with a set of optimized promotions based on their prior coupon selections, geography and other demographic and behavioral attributes.

Our Strengths

| Ÿ | Powerful network effects. The large and growing base of retailers using our platform has allowed us to attract, retain and grow the digital promotion spending of leading CPGs. The breadth of our offerings from these leading brands enables us to attract and retain a growing and more diverse range of retailers, publishers and consumers. Additional offerings on our platform, in particular point of sale solutions, increase consumer engagement and retailer integration, which enhance the value offered to CPGs. |

| Ÿ | Deep integration with retailers. Our platform provides the promotion content for the web, mobile sites and applications, loyalty rewards and/or point-of-sale systems of our retail partners. Utilizing our integrated platform, CPGs and retailers can closely coordinate trade promotion spending to most effectively engage consumers with their products. |

| Ÿ | Extensive Publisher Network. Our publisher network of approximately 30,000 publishers multiplies the reach of our promotion platform to consumers and increases the value of our platform to our CPGs and retailers. We enable these publishers to monetize their web and mobile traffic and drive user engagement. |

| Ÿ | Secure, proven and proprietary technology for digital coupons. Our best-in-class technology has proven to meet the complex technical and operational requirements of CPGs and retailers, reflecting the cumulative investments that we have made over the past 15 years. |

| Ÿ | Proprietary data on consumer behavior from intent to purchase. We use the insights from our significant differentiated data to enable highly effective promotions and advertising by CPGs and retailers, and in turn provide personalized user experiences to consumers on our platform and on our publisher network. |

| Ÿ | Experienced and specialized sales, integration, campaign management and customer support. We have a team of dedicated specialists with skills and capabilities focused on CPGs, retailers, publishers and consumers. |

5

Table of Contents

| Ÿ | Attractive business model. We have invested in the technology, organization and process capabilities required to operate our business at significantly greater scale. Our platform already includes more than 2,000 brands and many of the retailers that are most important to the CPGs that own those brands. As a result, we believe that there is significant operating leverage in our business. Revenues grew from $27.2 million in the quarter ended September 30, 2012 to $39.7 million in the quarter ended September 30, 2013 while operating expenses declined from $33.1 million to $29.0 million and net loss declined from $16.6 million to $1.6 million over the same period. We believe that there will be further economies of scale as we further penetrate the CPGs and brands on our platform and deepen our integration with retailers. |

Growth Strategy

We intend to grow our platform and our business through the following key strategies:

Increase revenues from CPGs already on our platform. Based on our experience to date, we believe we have opportunities to continue increasing revenues from our existing CPG customer base through:

| Ÿ | increasing our share of CPG spending on overall trade promotions and digital coupons; |

| Ÿ | increasing the number of brands that are using our platform within each CPG; |

| Ÿ | increasing media advertising spending on our platform; and |

| Ÿ | maximizing lifetime value of consumers across all products. |

Deepen integration of retailers with our platforms. We intend to continue to invest in technologies and product offerings that further integrate digital promotions into retailers’ in-store and point of sale systems.

Grow our current core CPG and retailer customer base and add new manufacturers and retailers from additional industry segments. We believe we can significantly grow the number of CPGs and retailers that we serve. In addition, we intend to continue growing our business with other manufacturers and retailers in new industry segments.

Continue to grow consumer use of our digital promotion offerings. We plan to continue to invest in our point of sale and mobile solutions. We believe that CPG spending on digital promotions will continue to grow as point of sale and mobile channels offer new opportunities to engage consumers from intent to purchase of their products.

Grow international operations. We believe that we can opportunistically grow our operations and offerings in existing international markets and partner with our existing clients to enter new geographies in which they operate.

Selectively pursue strategic acquisitions. We may expand our business through selective acquisitions.

Risks Associated with Our Business

Our business is subject to a number of risks and uncertainties, including those highlighted in the section titled “Risk Factors” immediately following this prospectus summary. Some of these risks include:

| Ÿ | We have incurred net losses since inception and we may not be able to generate sufficient revenues to achieve or subsequently maintain profitability; |

6

Table of Contents

| Ÿ | We may not maintain our recent revenue growth; |

| Ÿ | If we are unable to successfully respond to changes in the digital promotions market and continue to grow the market, our business could be harmed; |

| Ÿ | We expect a number of factors to cause our operating results to fluctuate on a quarterly and annual basis, which may make it difficult to predict our future performance; |

| Ÿ | If we fail to attract and retain CPGs, retailers and publishers and expand our relationships with them, our revenues and business will be harmed; |

| Ÿ | If the distribution fees that we pay as a percentage of our revenues increases, our gross profit and business will be harmed; |

| Ÿ | If we fail to maintain and expand the use by consumers of digital coupons on our platform, our revenues and business will be harmed; |

| Ÿ | We are dependent on third-party advertising agencies as intermediaries, and if we fail to maintain these relationships, our business may be harmed; |

| Ÿ | Competition presents an ongoing threat to the success of our business; |

| Ÿ | If we fail to effectively manage our growth, our business and financial performance may suffer; and |

| Ÿ | We may expend substantial funds in connection with tax liabilities that arise upon the initial settlement of restricted stock units, or RSUs, in connection with this offering, and the manner in which we fund that expenditure may have an adverse effect on our financial condition. |

In addition, we are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or the JOBS Act, enacted in April 2012, and therefore we may take advantage of certain exemptions from various public company reporting requirements, including not being required to have our internal control over financial reporting audited by our independent registered public accounting firm pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and any golden parachute payments not previously approved. We may take advantage of these exemptions for up to five years after our initial public offering or until we are no longer an “emerging growth company.”

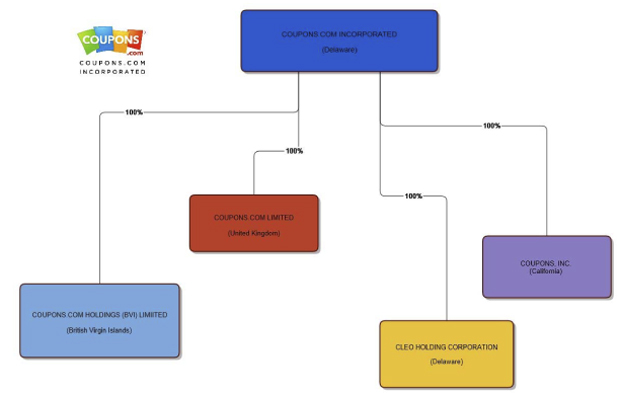

Corporate Information

Coupons was incorporated in California in May 1998 and reincorporated in Delaware in June 2009. Our principal executive offices are located at 400 Logue Avenue, Mountain View, California 94043, and our telephone number is (650) 605-4600. Our corporate website address is www.couponsinc.com. Information contained on, or that can be accessed through, our website does not constitute part of this prospectus and inclusions of our website address in this prospectus are inactive textual references only.

The Coupons logo and our other registered or common law trademarks, service marks or trade names appearing in this prospectus are the property of Coupons. Other trademarks and trade names referred to in this prospectus are the property of their respective owners.

7

Table of Contents

THE OFFERING

| Common stock offered by us |

shares | |

| Common stock to be outstanding after this offering |

shares | |

| Option to purchase additional shares of common stock |

shares | |

| Use of proceeds |

We estimate that the net proceeds to us from this offering will be approximately $ million, assuming an initial public offering price of $ per share, which is the midpoint of the range set forth on the cover page of this prospectus, and after deducting the underwriting discount and estimated offering expenses payable by us. We intend to use the net proceeds to us from this offering for general corporate purposes, including working capital, sales and marketing activities, general and administrative matters and capital expenditures. Additionally, we may also use a portion of the net proceeds for the acquisition of, or investment in, technologies, solutions or businesses that complement our business, although we have no present commitments or agreements to enter into any acquisitions or investments at this time. We also may use a portion of the net proceeds to satisfy our anticipated tax withholding and remittance obligations related to the settlement of our outstanding RSUs. See the section titled “Use of Proceeds” for additional information. | |

| Proposed NYSE symbol |

“COUP” | |

The number of shares of our common stock that will be outstanding after completion of this offering is based on 156,673,820 shares outstanding as of December 31, 2013, and excludes:

| Ÿ | 31,589,360 shares of common stock issuable upon the exercise of options outstanding as of December 31, 2013, at a weighted average exercise price of $2.35 per share; |

| Ÿ | 11,302,950 shares of common stock issuable upon the vesting of RSUs outstanding as of December 31, 2013; |

| Ÿ | 1,000,000 shares of common stock reserved for issuance upon the exercise of a warrant outstanding as of December 31, 2013, at an exercise price of $1.61 per share; |

| Ÿ | 5,088,303 shares of common stock reserved for issuance under our stock option plans as of December 31, 2013; |

| Ÿ | 10,000,000 shares of common stock reserved for future issuance under our 2013 Equity Incentive Plan, which will become effective upon the completion of this offering; |

8

Table of Contents

| Ÿ | 3,000,000 shares of our common stock reserved for future issuance under our 2013 Employee Stock Purchase Plan, which will become effective upon the completion of this offering; and |

| Ÿ | 2,500,000 shares of our common stock issued in connection with our acquisition of a privately-held company in January 2014. |

Unless otherwise noted, the information in this prospectus reflects and assumes the following:

| Ÿ | a -for- reverse split of our outstanding common stock and preferred stock to be effected prior to the completion of this offering; |

| Ÿ | the conversion of all outstanding shares of our preferred stock into an aggregate of 103,951,153 shares of common stock immediately prior to the completion of this offering; |

| Ÿ | the filing of our amended and restated certificate of incorporation in connection with the completion of this offering; and |

| Ÿ | no exercise by the underwriters of their option to purchase up to an additional shares of common stock from us. |

9

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL AND OTHER DATA

The following tables summarize our consolidated financial and other data. You should read this summary consolidated financial and other data together with the sections titled “Selected Consolidated Financial and Other Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus.

The summary consolidated statements of operations data for the years ended December 31, 2011 and 2012 are derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary consolidated statements of operations data for the nine months ended September 30, 2012 and 2013 and the consolidated balance sheet data as of September 30, 2013 are derived from our unaudited consolidated financial statements included elsewhere in this prospectus. The unaudited consolidated financial statements were prepared on a basis consistent with our audited consolidated financial statements and include, in our opinion, all adjustments, consisting only of normal recurring adjustments that we consider necessary for a fair presentation of the financial information set forth in those statements. Our historical results are not necessarily indicative of the results that may be expected in the future, and our interim results are not necessarily indicative of the results to be expected for the full year or any other period.

| Year Ended December 31, |

Nine Months Ended September 30, |

|||||||||||||||

| 2011 | 2012 | 2012 | 2013 | |||||||||||||

| (in thousands, except per share data) | ||||||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||

| Revenues |

$ | 91,325 | $ | 112,127 | $ | 76,340 | $ | 115,295 | ||||||||

| Cost of revenues |

27,841 | 41,745 | 29,757 | 37,845 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

63,484 | 70,382 | 46,583 | 77,450 | ||||||||||||

| Operating expenses: |

||||||||||||||||

| Sales and marketing |

44,834 | 63,526 | 47,337 | 43,574 | ||||||||||||

| Research and development |

21,824 | 40,236 | 31,340 | 30,123 | ||||||||||||

| General and administrative |

18,996 | 25,999 | 18,357 | 15,912 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

85,654 | 129,761 | 97,034 | 89,609 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(22,170 | ) | (59,379 | ) | (50,451 | ) | (12,159 | ) | ||||||||

| Interest expense |

(698 | ) | (212 | ) | (11 | ) | (646 | ) | ||||||||

| Other income (expense), net |

(220 | ) | 92 | 106 | 34 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss before benefit from income taxes |

(23,088 | ) | (59,499 | ) | (50,356 | ) | (12,771 | ) | ||||||||

| Benefit from income taxes |

(118 | ) | (265 | ) | (234 | ) | — | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

$ | (22,970 | ) | $ | (59,234 | ) | $ | (50,122 | ) | $ | (12,771 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Deemed dividend to investors in relation to tender offer |

6,933 | — | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss attributable to common stockholders |

$ | (29,903 | ) | $ | (59,234 | ) | $ | (50,122 | ) | $ | (12,771 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Basic and diluted net loss per share attributable to common stockholders(1) |

$ | (0.86 | ) | $ | (1.49 | ) | $ | (1.28 | ) | $ | (0.27 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Basic and diluted weighted-average shares used to compute net loss per share attributable to common stockholders(1) |

34,859 | 39,816 | 39,270 | 47,991 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Basic and diluted pro forma net loss per share attributable to common stockholders(1) |

$ | (0.41 | ) | $ | (0.08 | ) | ||||||||||

|

|

|

|

|

|||||||||||||

| Other Data: |

||||||||||||||||

| Adjusted EBITDA(2) |

$ | (14,174 | ) | $ | (47,255 | ) | $ | (41,260 | ) | $ | (3,542 | ) | ||||

| Transactions(3) |

710,043 | 916,724 | 631,625 | 940,178 | ||||||||||||

| (1) | See Note 13 to our notes to consolidated financial statements for a description of the method used to compute basic and diluted net loss per share attributable to common stockholders and pro forma basic and diluted net loss per share. |

10

Table of Contents

| (2) | Adjusted EBITDA is a non-GAAP financial measure. We define Adjusted EBITDA as net loss adjusted for interest expense, other income (expense), net, benefit from income taxes, depreciation and amortization, and stock-based compensation. Please see “—Non-GAAP Financial Measures–Adjusted EBITDA” below for more information as to the limitations of using non-GAAP measures and for the reconciliation of Adjusted EBITDA to net loss, the most directly comparable financial measure calculated in accordance with GAAP. |

| (3) | A transaction is the distribution of a digital coupon through our platform that generates revenues. We present transactions as we believe that our ability to increase the number of transactions using our platform is an important indicator of our ability to grow our revenues. |

The stock-based compensation expense included above was as follows:

| Year Ended December 31, |

Nine Months Ended September 30, |

|||||||||||||||

| 2011 | 2012 | 2012 | 2013 | |||||||||||||

| (in thousands) | ||||||||||||||||

| Cost of revenues |

$ | 295 | $ | 378 | $ | 290 | $ | 252 | ||||||||

| Sales and marketing |

849 | 1,880 | 1,455 | 1,008 | ||||||||||||

| Research and development |

962 | 1,532 | 1,239 | 798 | ||||||||||||

| General and administrative |

2,464 | 1,778 | 1,364 | 1,496 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total stock-based compensation |

$ | 4,570 | $ | 5,568 | $ | 4,348 | $ | 3,554 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| As of September 30, 2013 | ||||||||||||

| Actual | Pro Forma(1) |

Pro

Forma As Adjusted(2) |

||||||||||

| (in thousands) | ||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents |

$ | 43,249 | $ | 43,249 | $ | |||||||

| Working capital |

34,597 | 34,597 | ||||||||||

| Property and equipment, net |

28,965 | 28,965 | ||||||||||

| Deferred revenues |

7,461 | 7,461 | ||||||||||

| Total liabilities |

60,907 | 60,907 | ||||||||||

| Debt obligations |

22,863 | 22,863 | ||||||||||

| Redeemable convertible preferred stock |

270,262 | — | ||||||||||

| Total stockholders’ equity (deficit) |

(207,421 | ) | 62,841 | |||||||||

| (1) | The pro forma column reflects the conversion of all outstanding shares of preferred stock into 103,951,153 shares of common stock and stock-based compensation expense of $9.6 million associated with restricted stock units. Please see Note 2 to our notes to consolidated financial statements included elsewhere in this prospectus for further information related to this expense. |

| (2) | The pro forma as adjusted column further reflects the sale by us of shares of common stock offered by this prospectus at an assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, after deducting the underwriting discount and estimated offering expenses payable by us. A $1.00 increase (decrease) in the assumed initial public offering price of $ per share would increase (decrease) each of the amount of our pro forma as adjusted cash and cash equivalents, working capital and total stockholders’ equity by $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting the underwriting discount. Each increase (decrease) of 1,000,000 shares in the number of shares offered by us would increase (decrease) each of the amount of our pro forma as adjusted cash and cash equivalents, working capital and total stockholders’ equity by $ million, assuming that the initial public offering price remains the same and after deducting the underwriting discount. The pro forma as adjusted information presented in the summary consolidated balance sheet data is illustrative only and will change based on the actual initial public offering price and other terms of this offering determined at pricing. |

11

Table of Contents

Non-GAAP Financial Measures

Adjusted EBITDA

To provide investors with additional information regarding our financial results, we have presented Adjusted EBITDA, a non-GAAP financial measure. We define Adjusted EBITDA as net loss adjusted for interest expense, other income (expense), net, benefit from income taxes, depreciation and amortization, and stock-based compensation. We have provided below a reconciliation of Adjusted EBITDA to net loss, the most directly comparable GAAP financial measure for each of the periods presented.

| Year Ended December 31, |

Nine Months Ended September 30, |

|||||||||||||||

| 2011 | 2012 | 2012 | 2013 | |||||||||||||

| (in thousands) | ||||||||||||||||

| Reconciliation of Adjusted EBITDA: |

||||||||||||||||

| Net loss |

$ | (22,970 | ) | $ | (59,234 | ) | $ | (50,122 | ) | $ | (12,771 | ) | ||||

| Adjustments: |

||||||||||||||||

| Interest expense |

698 | 212 | 11 | 646 | ||||||||||||

| Other income (expense), net |

220 | (92 | ) | (106 | ) | (34 | ) | |||||||||

| Benefit from income taxes |

(118 | ) | (265 | ) | (234 | ) | — | |||||||||

| Depreciation and amortization |

3,426 | 6,556 | 4,843 | 5,063 | ||||||||||||

| Stock-based compensation |

4,570 | 5,568 | 4,348 | 3,554 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total adjustments |

8,796 | 11,979 | 8,862 | 9,229 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted EBITDA |

$ | (14,174 | ) | $ | (47,255 | ) | $ | (41,260 | ) | $ | (3,542 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

We have presented Adjusted EBITDA in this prospectus because it is a key measure used by our management and board of directors to understand and evaluate our core operating performance and trends, to prepare and approve our annual budget, to develop short and long-term operational plans, and to determine bonus payouts. In particular, we believe that the exclusion of the expenses eliminated in calculating Adjusted EBITDA can provide a useful measure for period-to-period comparisons of our core business. Additionally, Adjusted EBITDA is a key financial measure used by the compensation committee of our board of directors in connection with the determination of compensation for our executive officers. Accordingly, we believe that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors.

Our use of Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our financial results as reported under GAAP. Some of these limitations are:

| Ÿ | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements; |

| Ÿ | Adjusted EBITDA does not reflect: (i) changes in, or cash requirements for, our working capital needs; (ii) the potentially dilutive impact of equity-based compensation; or (iii) tax payments that may represent a reduction in cash available to us; and |

| Ÿ | other companies, including companies in our industry, may calculate Adjusted EBITDA or similarly titled measures differently, which reduces its usefulness as a comparative measure. |

Because of these and other limitations, you should consider Adjusted EBITDA along with other GAAP-based financial performance measures, including various cash flow metrics, net income or loss, and our other GAAP financial results.

12

Table of Contents

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and all of the other information contained in this prospectus before deciding whether to purchase our common stock. Our business, prospects, financial condition or operating results could be materially and adversely affected by any of these risks, as well as other risks not currently known to us or that we currently consider immaterial. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment. In assessing the risks described below, you should also refer to the other information contained in this prospectus, including our consolidated financial statements and the related notes, before deciding to purchase any shares of our common stock.

Risks Related to Our Business

We have incurred net losses since inception and we may not be able to generate sufficient revenues to achieve or subsequently maintain profitability.

We have incurred net losses of $23.0 million, $59.2 million and $12.8 million in 2011, 2012 and the nine months ended September 30, 2013, respectively, and had an accumulated deficit of $170.3 million as of September 30, 2013. We anticipate that our costs and expenses will increase in the foreseeable future as we continue to invest in:

| Ÿ | sales and marketing; |

| Ÿ | research and development, including new product development; |

| Ÿ | our technology infrastructure; |

| Ÿ | general administration, including legal and accounting expenses related to our growth and being a public company; |

| Ÿ | efforts to expand into new markets; and |

| Ÿ | strategic opportunities, including commercial relationships and acquisitions. |

For example, we have incurred and expect to continue to incur significant expenses developing our new point of sale solution. These efforts may prove more expensive than we currently anticipate, and we may not succeed in increasing our revenues sufficiently to offset these expenses. If we are unable to gain efficiencies in our operating costs, our business could be adversely impacted. We cannot be certain that we will be able to attain or maintain profitability on a quarterly or annual basis. If we are unable to effectively manage these risks and difficulties as we encounter them, our business, financial condition and results of operations may suffer.

We may not maintain our recent revenue growth.

Our revenues have increased significantly quarter over quarter since the quarter ended September 30, 2012. We may not be able to maintain our recent rate of revenue growth, and we may not be able to generate sufficient revenues to achieve profitability. In addition, historically the growth rate of our business, and as a result, our revenue growth, has varied from quarter-to-quarter and year-to-year, and we expect that variability to continue. For example, our revenue growth was adversely affected in the first half of 2012 because as we scaled our technology infrastructure to support our growth, our technology for securely identifying unique users and devices inadvertently prevented our personalization algorithms from optimally displaying our digital coupons to consumers. In addition, our revenues may fluctuate due to changes in promotional spending budgets of CPGs and retailers and

13

Table of Contents

the timing of their promotional spending. Decisions by major CPGs or retailers to delay or reduce their promotional spending or divert spending away from digital promotions could slow our revenue growth or reduce our revenues. We believe that our continued revenue growth will depend on increasing the number of transactions on our platform, and, in particular, on our ability to:

| Ÿ | increase our share of CPG spending on overall trade promotions, increase the number of brands that are using our platform within each CPG, increase media advertising spending on our platform, increase our share of retailer spending on coupon codes and maximize the lifetime value of our consumers across all of our products; |

| Ÿ | further integrate our digital promotions into retailers’ in-store and point of sale systems; |

| Ÿ | grow the number of CPGs and retailers in our current customer base and add new industry segments such as convenience, specialty/franchise retail, restaurants and entertainment; |

| Ÿ | expand the use by consumers of our newest digital promotion offerings and broaden the selection and use of digital coupons; |

| Ÿ | obtain high quality coupons and increase the number of CPG-authorized activations; |

| Ÿ | expand the number, variety and relevance of digital coupons available on our web, mobile and social channels, as well as those of our CPGs, retailers and network of publishers; |

| Ÿ | increase the awareness of our brand and earn and preserve our reputation; |

| Ÿ | hire, integrate and retain talented personnel; |

| Ÿ | effectively manage growth in our personnel and operations; and |

| Ÿ | successfully compete with existing and new competitors. |

However, we cannot assure you that we will successfully implement any of these actions. Failure to do so could harm our business and cause our operating results to suffer.

If we are unable to successfully respond to changes in the digital promotions market and continue to grow the market, our business could be harmed.

As consumer demand for digital coupons has increased, promotion spending has shifted from traditional coupons through traditional channels, such as newspapers and direct mail, to digital coupons. However, it is difficult to predict whether the pace of transition from traditional to digital coupons will continue at the same rate and whether the growth of the digital promotions market will continue. In order to expand our business, we must appeal to and attract consumers who historically have used traditional promotions to purchase goods or may prefer alternatives to our offerings, such as those of our competitors. If the demand for digital coupons does not continue to grow as we expect, or if we fail to successfully address this demand, our business will be harmed. For example, the continued growth of our revenues will require increasing the number of brands that are using our platform within each CPG and further integrating our digital promotions into retailers’ in-store and point of sale systems. We expect that the market will evolve in ways which may be difficult to predict. It is also possible that digital coupon offerings generally could lose favor with CPGs, retailers or consumers. In the event of these or any other changes to the market, our continued success will depend on our ability to successfully adjust our strategy to meet the changing market dynamics. In addition, we will need to continue to grow demand for our digital promotions platform by CPGs, retailers and consumers. If we are unable to grow or successfully respond to changes in the digital promotions market, our business could be harmed and our results of operations could be negatively impacted.

14

Table of Contents

We expect a number of factors to cause our operating results to fluctuate on a quarterly and annual basis, which may make it difficult to predict our future performance.

Historically, our revenue growth has varied from quarter-to-quarter and year-to-year, and we expect that variability to continue. In addition, our operating costs and expenses have fluctuated in the past, and we anticipate that our costs and expenses will increase over time as we continue to invest in growing our business and incur additional costs of being a public company.

Our operating results could vary significantly from quarter-to-quarter and year-to-year as a result of these and other factors, many of which are outside of our control, and as a result we have a limited ability to forecast the amount of future revenues and expenses, which may adversely affect our ability to predict financial results accurately, and our operating results may vary from quarter-to-quarter and may fall below our estimates or the expectations of public market analysts and investors. Fluctuations in our quarterly operating results may lead analysts to change their long-term models for valuing our common stock, cause us to face short-term liquidity issues, impact our ability to retain or attract key personnel or cause other unanticipated issues, all of which could cause our stock price to decline. As a result of the potential variations in our quarterly revenues and operating results, we believe that quarter-to-quarter comparisons of our net revenues and operating results may not be meaningful and the results of any one quarter or historical patterns should not be considered indicative of our future sales activity, expenditure levels or performance.

In addition to other factors discussed in this section, factors that may contribute to the variability of our quarterly and annual results include:

| Ÿ | our ability to continue to grow our revenues by increasing our share of CPG spending and the number of brands using our platform within each CPG, increasing media advertising spending on our platform, further integrating with our retailers and increasing the use of retailer coupon codes by consumers, adding new CPGs and retailers to our network and growing our core current customer base and expanding into new industry segments such as convenience, specialty/franchise retail, restaurants and entertainment; |

| Ÿ | our ability to successfully respond to changes in the digital promotions market and continue to grow the market and demand for our platform; |

| Ÿ | our ability to grow consumer selection and use of our digital promotion offerings and attract new consumers to our platform; |

| Ÿ | the amount and timing of digital promotions by CPGs, which are affected by budget cycles, economic conditions and other factors; |

| Ÿ | the impact of global business or macroeconomic conditions, including the resulting effects on the level of trade promotion spending by CPGs and spending by consumers; |

| Ÿ | the impact of competitors or competitive products and services, and our ability to compete in the digital promotions market; |

| Ÿ | our ability to obtain high quality coupons and increase the number of CPG-authorized activations; |

| Ÿ | changes in consumer behavior with respect to digital promotions and how consumers access digital coupons and our ability to develop applications that are widely accepted and generate revenues; |

| Ÿ | the costs of investing in and maintaining and enhancing our technology infrastructure; |

| Ÿ | the costs of developing new products and solutions and enhancements to our platform; |

| Ÿ | our ability to manage our growth; |

15

Table of Contents

| Ÿ | the success of our sales and marketing efforts; |

| Ÿ | government regulation of e-commerce and m-commerce and requirements to comply with security and privacy laws and regulations affecting our business, and changes in government regulation affecting our business or our becoming subject to new government regulation; |

| Ÿ | our ability to deal effectively with fraudulent transactions or customer disputes; |

| Ÿ | the attraction and retention of qualified employees and key personnel; |

| Ÿ | the effectiveness of our internal controls; and |

| Ÿ | changes in U.S. generally accepted accounting principles or tax laws. |

If we fail to attract and retain CPGs, retailers and publishers and expand our relationships with them, our revenues and business will be harmed.

The success of our business depends in part on our ability to increase our share of CPG spending on overall trade promotions, increase media advertising spending on our platform, increase the number of brands that are using our platform within each CPG, increase our share of retailer spending on coupon codes, and maximize the lifetime value of our consumers across all of our products. It also depends on our ability to further integrate our digital promotions into retailers’ in-store and point of sale systems. In addition, we must acquire new CPGs and retailers in our current customer base and add new industry segments such as convenience, specialty/franchise retail, restaurants and entertainment. If CPGs and retailers do not find that offering digital promotions on our platform enables them to reach consumers and sufficiently increase sales with the scale and effectiveness that is compelling to them, CPGs and retailers may not increase their distribution of digital promotions on our platform, or they may decrease them or stop offering them altogether, and new CPGs and retailers may decide not to use our platform.

For example, if CPGs decide that utilizing our platform provides a less effective means of connecting with consumers, we may not be able to increase our prices or CPGs may pay us less. Likewise if retailers decide that our platform is less effective at increasing sales to and loyalty of existing and new consumers, retailers may demand a higher percentage of the total proceeds from each digital promotion that is activated or demand minimum guaranteed payments. In addition, we expect to face increased competition, and competitors may accept lower payments from CPGs to attract and acquire new CPGs, or provide retailers and publishers a higher distribution fee than we currently offer to attract and acquire new retailers and publishers. In addition, we may experience attrition in our CPGs, retailers and publishers in the ordinary course of business resulting from several factors, including losses to competitors, changes in CPG budgets, and decisions by CPGs, retailers and publishers to offer digital coupons through their own websites or other channels without using a third-party platform such as ours. If we are unable to retain and expand our relationships with existing CPGs, retailers and publishers or if we fail to attract new CPGs, retailers and publishers to the extent sufficient to grow our business, or if too many CPGs, retailers and publishers are unwilling to offer digital coupons with compelling terms through our platform, we may not increase the number of transactions on our platform and our revenues, gross margin and operating results will be adversely affected.

If the distribution fees that we pay as a percentage of our revenues increases, our gross profit and business will be harmed.

When we deliver a digital coupon on a retailer’s website or through its loyalty reward program, or the website of a publisher, we generally pay a distribution fee to the retailer or publisher. Such fees have increased as a percentage of our revenues in recent periods. If such fees as a percentage of our revenues continue to increase, our cost of revenues as a percentage of revenues could increase and our operating results would be adversely affected.

16

Table of Contents

If we fail to maintain and expand the use by consumers of digital coupons on our platform, our revenues and business will be harmed.

We must continue to maintain and expand the use by consumers of digital coupons in order to increase the attractiveness of our platform to CPGs and retailers and to increase revenues and achieve profitability. If consumers do not perceive that we offer a broad selection of personalized and high quality digital coupons, we may not be able to attract or retain consumers on our platform. If we are unable to maintain and expand the use by consumers of digital coupons on our platform and do so to a greater extent than our competitors, CPGs may find that offering digital promotions on our platform does not reach consumers with the scale and effectiveness that is compelling to them. Likewise retailers may find that using our platform does not increase sales of the promoted products and consumer loyalty to the retailer to the extent they expect, the revenues we generate may not increase to the extent we expect or may decrease. Either of these would adversely affect our operating results.

We depend in part on third-party advertising agencies as intermediaries, and if we fail to maintain these relationships, our business may be harmed.

A portion of our business is conducted indirectly with third-party advertising agencies acting on behalf of CPGs and retailers. Third-party advertising agencies are instrumental in assisting CPGs and retailers to plan and purchase advertising and promotions, and each third-party advertising agency generally allocates advertising and promotion spend from CPGs and retailers across numerous channels. We do not have exclusive relationships with third-party advertising agencies and we depend in part on third-party agencies to work with us as they embark on marketing campaigns for CPGs and retailers. While in most cases we have developed relationships directly with CPGs and retailers, we nevertheless depend in part on third-party advertising agencies to present to their CPG and retailer clients the merits of our platform. Inaccurate descriptions of our platform by third-party advertising agencies, over whom we have no control, negative recommendations regarding use of our service offerings or failure to mention our platform at all could hurt our business. In addition, if a third-party advertising agency is disappointed with our platform on a particular campaign or generally, we risk losing the business of the CPG or retailer for whom the campaign was run, and of other CPGs and retailers represented by that agency. Since many third-party advertising agencies are affiliated with other third-party agencies in a larger corporate structure, if we fail to maintain good relations with one third-party advertising agency in such an organization, we may lose business from the affiliated third-party advertising agencies as well.

Our sales could be adversely impacted by industry changes relating to the use of third-party advertising agencies. For example, if CPGs or retailers seek to bring their campaigns in-house rather than using an agency, we would need to develop direct relationships with the CPGs or retailers, which we might not be able to do and which could increase our sales and marketing expenses. Moreover, to the extent that we do not have a direct relationship with CPGs or retailers, the value we provide to CPGs and retailers may be attributed to the third-party advertising agency rather than to us, further limiting our ability to develop long-term relationships directly with CPG and retailers. CPGs and retailers may move from one third-party advertising agency to another, and we may lose the underlying business. The presence of third-party advertising agencies as intermediaries between us and the CPGs and retailers thus creates a challenge to building our own brand awareness and affinity with the CPGs and retailers that are the ultimate source of our revenues. In addition, third-party advertising agencies conducting business with us may offer their own digital promotion solutions. As such, these third-party advertising agencies are, or may become, our competitors. If they further develop their own capabilities they may be more likely to offer their own solutions to advertisers, and our ability to compete effectively could be significantly compromised and our business, financial condition and operating results could be adversely affected.

17

Table of Contents

Competition presents an ongoing threat to the success of our business.

We expect competition in digital promotions to continue to increase. The market for digital promotions is highly competitive, fragmented and rapidly changing. We compete against a variety of companies with respect to different aspects of our business, including:

| Ÿ | traditional offline coupon and discount services, as well as newspapers, magazines and other traditional media companies that provide coupon promotions and discounts on products and services in free standing inserts or other forms, including Valassis Interactive, Inc., News America Marketing Interactive, Inc. and Catalina Marketing Corporation; |

| Ÿ | providers of digital coupons such as Valassis’ Redplum.com, News America Marketing’s SmartSource and Catalina’s CouponNetwork.com, companies that offer coupon codes such as RetailMeNot, Inc., Exponential Interactive, Inc.’s TechBargains.com, Savings.com, Inc. and Ebates Performance Marketing, Inc., and companies providing other e-commerce based services that allow consumers to obtain direct or indirect discounts on purchases; |

| Ÿ | Internet sites that are focused on specific communities or interests that offer coupons or discount arrangements related to such communities or interests; and |

| Ÿ | companies offering other advertising and promotion related services. |

We believe the principal factors that generally determine a company’s competitive advantage in our market include the following:

| Ÿ | scale and effectiveness of reach in connecting CPGs and retailers to consumers; |

| Ÿ | ability to attract consumers to use digital coupons delivered by it; |

| Ÿ | platform security, scalability, reliability and availability; |

| Ÿ | number of channels by which a company engages with consumers; |

| Ÿ | integration of products and solutions; |

| Ÿ | rapid deployment of products and services for customers; |

| Ÿ | breadth, quality and relevance of the company’s digital coupons; |

| Ÿ | ability to deliver digital coupons that are widely available and easy to use in consumers’ preferred form; |

| Ÿ | integration with retailer applications; |

| Ÿ | brand recognition; |

| Ÿ | quality of tools, reporting and analytics for planning, development and optimization of promotions; and |

| Ÿ | breadth and expertise of the company’s sales organization. |

We are subject to potential competition from large, well-established companies which have significantly greater financial, marketing and other resources than we do and have current offerings that may compete with our platform or may choose to offer digital promotions as an add-on to their core business on their own or in partnership with one of our competitors that would directly compete with ours. Many of our larger potential competitors may have the resources to significantly change the nature of the digital promotions industry to their advantage, which could materially disadvantage us. For example, Google, Yahoo!, Bing and Facebook and online retailers such as Amazon have highly trafficked industry platforms which they could leverage to distribute digital coupons or other digital promotions that could negatively affect our business. In addition, these potential competitors may be

18

Table of Contents

able to respond more quickly than we can to new or emerging technologies and changes in consumer habits. These competitors may engage in more extensive research and development efforts, undertake more far-reaching marketing campaigns and adopt more aggressive pricing policies, which may allow them to attract more consumers and, as a result, more CPGs and retailers, or generate revenues more effectively than we do. Our competitors may offer digital coupons that are similar to the digital coupons we offer or that achieve greater market acceptance than those we offer. We are also subject to potential competition from smaller companies that launch new products and services that we do not offer and that could gain market acceptance.

Our success depends on the effectiveness of our platform in connecting CPGs and retailers with consumers and with attracting consumer use of the digital coupons delivered through our platform. To the extent we fail to provide digital coupons for high quality, relevant products, consumers may become dissatisfied with our platform and decide not to use our digital coupons and elect to use the digital coupons distributed by one of our competitors. As a result of these factors, our CPGs and retailers may not receive the benefits they expect, and CPGs may use the offerings of one of our competitors and retailers may elect to handle coupon codes themselves or exclude us from integrating with their in-store and point of sale systems, and our operating results would be adversely affected.

We also face significant competition for trade promotion spending. We compete against online and mobile businesses, including those referenced above, and traditional advertising outlets, such as television, radio and print, for trade promotion spending. In order to grow our revenues and improve our operating results, we must increase our share of CPG spending on digital coupons and advertising relative to traditional sources and relative to our competitors, many of whom are larger companies that offer more traditional and widely accepted advertising products.

We also directly and indirectly compete with retailers for consumer traffic. Many retailers market and offer their own digital coupons directly to consumers using their own websites, email newsletters and alerts, mobile applications and social media channels. Our retailers could be more successful than we are at marketing their own digital coupons or could decide to terminate their relationship with us.

We may face competition from companies we do not yet know about. If existing or new companies develop, market or offer competitive digital coupon solutions, acquire one of our existing competitors or form a strategic alliance with one of our competitors, our ability to compete effectively could be significantly compromised and our operating results could be harmed.

If we fail to effectively manage our growth, our business and financial performance may suffer.

We have significantly expanded our operations and anticipate expanding further to pursue our growth strategy. Such expansion increases the complexity of our business and places significant demands on our management, operations, technical performance, financial resources and internal control over financial reporting functions. Continued growth could strain our ability to deliver digital coupons on our platform, develop and improve our operational, financial, legal and management controls, and enhance our reporting systems and procedures. For example, our revenue growth was adversely affected in the first half of 2012 because as we scaled our technology infrastructure to support our growth, our technology for securely identifying unique users and devices inadvertently prevented our personalization algorithms from optimally displaying our digital coupons to consumers. Failure to manage our expansion may limit our growth, damage our reputation and negatively affect our financial performance and harm our business.

To effectively manage this growth, we will need to continue to improve our operational, financial and management controls, and our reporting systems and procedures. If we do not effectively manage the growth of our business and operations, the quality and scalability of our platform could suffer.

19

Table of Contents

Our current and planned personnel, systems, procedures and controls may not be adequate to support and effectively manage our future operations. We may not be able to hire, train, retain, motivate and manage required personnel. As we continue to grow, we must effectively integrate, develop and motivate a large number of new employees. We intend to continue to expand our research and development, sales and marketing, and general and administrative organizations, and over time, expand our international operations. To attract top talent, we have had to offer, and believe we will need to continue to offer, highly competitive compensation packages before we can validate the productivity of those employees. If we fail to effectively manage our hiring needs and successfully integrate our new hires, our efficiency and ability to meet our forecasts and our employee morale, productivity and retention could suffer, and our business and operating results could be adversely affected.

Providing our products and services to our CPGs, retailers and consumers is costly and we expect our expenses to continue to increase in the future as we grow our business with existing and new CPGs and retailers and develop new products and services that require enhancements to our technology infrastructure. In addition, our operating expenses, such as our research and development expenses and sales and marketing expenses are expected to continue to grow to support our anticipated future growth. As a public company we will incur significant legal, accounting and other expenses that we did not incur as a private company. Our expenses may grow faster than our revenues, and our expenses may be greater than we anticipate. Managing our growth will require significant expenditures and allocation of valuable management resources. If we fail to achieve the necessary level of efficiency in our organization as it grows, our business, operating results and financial condition would be harmed.

If we do not effectively grow and train our sales team, we may be unable to add new CPGs and retailers or increase sales to our existing CPGs and retailers and our business will be adversely affected.