00011108052021FYfalse3P1YP1YP1YP1YP1Y305http://fasb.org/us-gaap/2021-01-31#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2021-01-31#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2021-01-31#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2021-01-31#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2021-01-31#DebtCurrenthttp://fasb.org/us-gaap/2021-01-31#DebtCurrenthttp://fasb.org/us-gaap/2021-01-31#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2021-01-31#LongTermDebtAndCapitalLeaseObligations13.7581.10.872$31.73 per Series D Preferred Unit plus any unpaid Series D distributions plus the Series D Partial Period Distributions$30.46 per Series D Preferred Unit plus any unpaid Series D distributions plus the Series D Partial Period Distributions$29.19 per Series D Preferred Unit plus any unpaid Series D distributions plus the Series D Partial Period DistributionsEach holder of Series D Preferred Units may convert all or any portion of its Series D Preferred Units into common units on a one-for-one basis (plus any unpaid Series D distributions), subject to anti-dilution adjustments, at any time, but not more than once per quarter, so long as any conversion is for at least $50.0 million based on the Series D Preferred Unit Purchase Price (or such lesser amount representing all of a holder’s Series D Preferred Units).The Partnership may redeem all or any portion of the Series D Preferred Units, in an amount not less than $50.0 million for cash at a redemption price equal to, as applicable: (i) $31.73 per Series D Preferred Unit at any time on or after June 29, 2023 but prior to June 29, 2024; (ii) $30.46 per Series D Preferred Unit at any time on or after June 29, 2024 but prior to June 29, 2025; (iii) $29.19 per Series D Preferred Unit at any time on or after June 29, 2025; plus, in each case, the sum of any unpaid distributions on the applicable Series D Preferred Unit plus the distributions prorated for the number of days elapsed (not to exceed 90) in the period of redemption (Series D Partial Period Distributions). The holders have the option to convert the units prior to such redemption as discussed above. Additionally, at any time on or after June 29, 2028, each holder of Series D Preferred Units will have the right to require the Partnership to redeem all of the Series D Preferred Units held by such holder at a redemption price equal to $29.19 per Series D Preferred Unit plus any unpaid Series D distributions plus the Series D Partial Period Distributions. If a holder of Series D Preferred Units exercises its redemption right, the Partnership may elect to pay up to 50% of such amount in common units (which shall be valued at 93% of a volume-weighted average trading price of the common units); provided, that the common units to be issued do not, in the aggregate, exceed 15% of NuStar Energy’s common equity market capitalization at the time.The Series D Preferred Units include redemption provisions at the option of the holders of the Series D Preferred Units and upon a Series D Change of Control (as defined in the partnership agreement), which are outside the Partnership’s control. Therefore, the Series D Preferred Units are presented in the mezzanine section of the consolidated balance sheets. The Series D Preferred Units have been recorded at their issuance date fair value, net of issuance costs. We reassess the presentation of the Series D Preferred Units in our consolidated balance sheets on a quarterly basis. The Series D Preferred Units are subject to accretion from their carrying value at the issuance date to the redemption value, which is based on the redemption right of the Series D Preferred Unit holders that may be exercised at any time on or after June 29, 2028, using the effective interest method over a period of ten years. In the calculation of net income per unit, the accretion is treated in the same manner as a distribution and deducted from net income to arrive at net income attributable to common units.00011108052021-01-012021-12-310001110805ns:CommonLimitedPartnerMember2021-01-012021-12-310001110805ns:SeriesAPreferredLimitedPartnerMember2021-01-012021-12-310001110805ns:SeriesBPreferredLimitedPartnerMember2021-01-012021-12-310001110805ns:SeriesCPreferredLimitedPartnerMember2021-01-012021-12-3100011108052021-06-30iso4217:USD00011108052022-01-31xbrli:shares00011108052021-12-3100011108052020-12-310001110805ns:SeriesAPreferredLimitedPartnerMember2021-12-310001110805ns:SeriesAPreferredLimitedPartnerMember2020-12-310001110805ns:SeriesBPreferredLimitedPartnerMember2020-12-310001110805ns:SeriesBPreferredLimitedPartnerMember2021-12-310001110805ns:SeriesCPreferredLimitedPartnerMember2020-12-310001110805ns:SeriesCPreferredLimitedPartnerMember2021-12-310001110805us-gaap:ServiceMember2021-01-012021-12-310001110805us-gaap:ServiceMember2020-01-012020-12-310001110805us-gaap:ServiceMember2019-01-012019-12-310001110805us-gaap:ProductMember2021-01-012021-12-310001110805us-gaap:ProductMember2020-01-012020-12-310001110805us-gaap:ProductMember2019-01-012019-12-3100011108052020-01-012020-12-3100011108052019-01-012019-12-31iso4217:USDxbrli:shares00011108052019-12-3100011108052018-12-310001110805ns:PreferredLimitedPartnerMember2018-12-310001110805ns:CommonLimitedPartnerMember2018-12-310001110805us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310001110805ns:PreferredLimitedPartnerMember2019-01-012019-12-310001110805ns:CommonLimitedPartnerMember2019-01-012019-12-310001110805us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001110805ns:SeriesDPreferredLimitedPartnerMember2019-01-012019-12-310001110805ns:PreferredLimitedPartnerMember2019-12-310001110805ns:CommonLimitedPartnerMember2019-12-310001110805us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001110805ns:PreferredLimitedPartnerMember2020-01-012020-12-310001110805ns:CommonLimitedPartnerMember2020-01-012020-12-310001110805us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001110805ns:SeriesDPreferredLimitedPartnerMember2020-01-012020-12-310001110805ns:PreferredLimitedPartnerMember2020-12-310001110805ns:CommonLimitedPartnerMember2020-12-310001110805us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001110805ns:PreferredLimitedPartnerMember2021-01-012021-12-310001110805ns:CommonLimitedPartnerMember2021-01-012021-12-310001110805us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001110805ns:SeriesDPreferredLimitedPartnerMember2021-01-012021-12-310001110805ns:PreferredLimitedPartnerMember2021-12-310001110805ns:CommonLimitedPartnerMember2021-12-310001110805us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-31xbrli:pure0001110805ns:PipelineSegmentMemberns:CentralWestRefinedProductsPipelinesMember2021-12-31utr:mi0001110805ns:PipelineSegmentMemberns:CrudeOilPipelinesMember2021-12-31utr:bbl0001110805ns:EastandNorthPipelinesMemberns:PipelineSegmentMember2021-12-310001110805ns:PipelineSegmentMemberns:AmmoniaPipelineMember2021-12-310001110805ns:StorageSegmentMember2021-12-310001110805srt:ScenarioForecastMember2022-02-112022-02-110001110805ns:StorageSegmentMembersrt:ScenarioForecastMember2022-02-110001110805ns:LogisticsRevolvingCreditAgreementMember2021-12-310001110805ns:AmendedReceivablesFinancingAgreementMember2021-12-3100011108052021-10-082021-10-080001110805us-gaap:FairValueInputsLevel2Member2021-10-082021-10-080001110805ns:AssetImpairmentLossesMember2021-07-012021-09-3000011108052021-07-012021-09-300001110805ns:AssetImpairmentLossesMemberns:PipelineSegmentMemberns:SouthernSectionOfHoustonPipelineMember2021-07-012021-09-300001110805ns:LogisticsNotesDue2022Member2021-10-310001110805ns:LogisticsNotesdue2021Member2021-01-3100011108052019-10-152019-10-1500011108052019-10-012019-12-310001110805ns:BusinessInterruptionLossfromSelbyCaliforniaFireMemberus-gaap:OperatingExpenseMember2021-01-012021-12-310001110805ns:BusinessInterruptionLossfromSelbyCaliforniaFireMemberus-gaap:OperatingExpenseMember2020-01-012020-12-310001110805ns:BusinessInterruptionLossfromSelbyCaliforniaFireMemberus-gaap:OperatingExpenseMember2019-01-012019-12-310001110805ns:OtherIncomeExpenseNetMember2021-01-012021-12-310001110805us-gaap:SubsequentEventMember2022-01-012022-01-3100011108052020-12-072020-12-070001110805ns:LogisticsNotesDue2025Member2020-09-140001110805ns:LogisticsNotesDue2030Member2020-09-1400011108052020-09-142020-09-140001110805ns:LogisticsNotesDue2025AndLogisticsNotesDue2030Member2020-09-140001110805ns:LogisticsNotesDue2020Member2020-08-310001110805ns:UnsecuredTermLoanCreditAgreementMember2020-04-2100011108052020-07-012020-09-3000011108052019-07-292019-07-290001110805ns:IncomeLossFromDiscontinuedOperationsNetOfTaxMember2019-01-012019-12-310001110805us-gaap:OtherNoncurrentAssetsMember2020-12-310001110805us-gaap:OtherNoncurrentAssetsMember2021-12-3100011108052021-10-012021-10-0100011108052020-10-012020-10-010001110805us-gaap:LondonInterbankOfferedRateLIBORMember2021-12-310001110805ns:StorageSegmentMember2021-10-080001110805ns:EasternTerminalOperationsMember2021-08-010001110805ns:EasternTerminalOperationsMember2021-09-300001110805ns:AssetImpairmentLossesMemberns:IntangibleAssetsMember2021-07-012021-09-300001110805ns:HoustonPipelineMember2021-07-012021-09-300001110805ns:PipelineSegmentMemberns:SouthernSectionOfHoustonPipelineMember2021-09-300001110805ns:AssetImpairmentLossesMemberns:PipelineSegmentMemberns:NorthernSectionOfHoustonPipelineMember2021-07-012021-09-300001110805ns:IncomeLossFromDiscontinuedOperationsNetOfTaxMember2019-01-012019-03-310001110805ns:IncomeLossFromDiscontinuedOperationsNetOfTaxMember2019-04-012019-06-300001110805ns:St.EustatiusBunkersMemberns:IncomeLossFromDiscontinuedOperationsNetOfTaxMember2019-01-012019-03-310001110805ns:St.EustatiusBunkersMember2019-03-310001110805us-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMember2019-01-012019-12-310001110805us-gaap:OtherCurrentAssetsMember2020-12-310001110805us-gaap:AccruedLiabilitiesMember2020-12-310001110805us-gaap:OtherCurrentAssetsMember2019-12-310001110805us-gaap:AccruedLiabilitiesMember2019-12-310001110805us-gaap:OtherCurrentAssetsMember2018-12-310001110805us-gaap:AccruedLiabilitiesMember2018-12-310001110805ns:AssetsHeldforSaleMember2020-12-310001110805ns:LiabilitiesHeldforSaleMember2020-12-310001110805ns:AssetsHeldforSaleMember2019-12-310001110805ns:LiabilitiesHeldforSaleMember2019-12-310001110805ns:AssetsHeldforSaleMember2018-12-310001110805ns:LiabilitiesHeldforSaleMember2018-12-310001110805us-gaap:OtherCurrentAssetsMember2021-12-310001110805us-gaap:AccruedLiabilitiesMember2021-12-3100011108052022-01-012021-12-3100011108052023-01-012021-12-3100011108052024-01-012021-12-3100011108052025-01-012021-12-3100011108052026-01-012021-12-3100011108052027-01-012021-12-310001110805ns:PipelineSegmentMemberns:CrudeOilPipelinesMember2021-01-012021-12-310001110805ns:PipelineSegmentMemberns:CrudeOilPipelinesMember2020-01-012020-12-310001110805ns:PipelineSegmentMemberns:CrudeOilPipelinesMember2019-01-012019-12-310001110805ns:PipelineSegmentMemberns:RefinedProductsandAmmoniaPipelinesMember2021-01-012021-12-310001110805ns:PipelineSegmentMemberns:RefinedProductsandAmmoniaPipelinesMember2020-01-012020-12-310001110805ns:PipelineSegmentMemberns:RefinedProductsandAmmoniaPipelinesMember2019-01-012019-12-310001110805ns:PipelineSegmentMember2021-01-012021-12-310001110805ns:PipelineSegmentMember2020-01-012020-12-310001110805ns:PipelineSegmentMember2019-01-012019-12-310001110805ns:ThroughputTerminalMemberns:StorageSegmentMember2021-01-012021-12-310001110805ns:ThroughputTerminalMemberns:StorageSegmentMember2020-01-012020-12-310001110805ns:ThroughputTerminalMemberns:StorageSegmentMember2019-01-012019-12-310001110805ns:StorageSegmentMemberns:StorageTerminalMember2021-01-012021-12-310001110805ns:StorageSegmentMemberns:StorageTerminalMember2020-01-012020-12-310001110805ns:StorageSegmentMemberns:StorageTerminalMember2019-01-012019-12-310001110805ns:StorageSegmentMember2021-01-012021-12-310001110805ns:StorageSegmentMember2020-01-012020-12-310001110805ns:StorageSegmentMember2019-01-012019-12-310001110805ns:FuelsMarketingSegmentMember2021-01-012021-12-310001110805ns:FuelsMarketingSegmentMember2020-01-012020-12-310001110805ns:FuelsMarketingSegmentMember2019-01-012019-12-310001110805us-gaap:IntersegmentEliminationMember2021-01-012021-12-310001110805us-gaap:IntersegmentEliminationMember2020-01-012020-12-310001110805us-gaap:IntersegmentEliminationMember2019-01-012019-12-310001110805srt:MinimumMemberus-gaap:LandBuildingsAndImprovementsMember2021-01-012021-12-310001110805us-gaap:LandBuildingsAndImprovementsMembersrt:MaximumMember2021-01-012021-12-310001110805us-gaap:LandBuildingsAndImprovementsMember2021-12-310001110805us-gaap:LandBuildingsAndImprovementsMember2020-12-310001110805srt:MinimumMemberns:PipelinesAndStorageAssetsMember2021-01-012021-12-310001110805ns:PipelinesAndStorageAssetsMembersrt:MaximumMember2021-01-012021-12-310001110805ns:PipelinesAndStorageAssetsMember2021-12-310001110805ns:PipelinesAndStorageAssetsMember2020-12-310001110805srt:MinimumMemberns:RightsOfWayMember2021-01-012021-12-310001110805ns:RightsOfWayMembersrt:MaximumMember2021-01-012021-12-310001110805ns:RightsOfWayMember2021-12-310001110805ns:RightsOfWayMember2020-12-310001110805us-gaap:ConstructionInProgressMember2021-12-310001110805us-gaap:ConstructionInProgressMember2020-12-310001110805us-gaap:CustomerContractsMember2021-01-012021-12-310001110805us-gaap:CustomerContractsMember2021-12-310001110805us-gaap:CustomerContractsMember2020-12-310001110805us-gaap:OtherIntangibleAssetsMember2021-01-012021-12-310001110805us-gaap:OtherIntangibleAssetsMember2021-12-310001110805us-gaap:OtherIntangibleAssetsMember2020-12-310001110805ns:PipelineSegmentMember2019-12-310001110805ns:StorageSegmentMember2019-12-310001110805ns:PipelineSegmentMemberns:CrudeOilPipelinesMember2020-01-012020-12-310001110805ns:PipelineSegmentMemberns:CrudeOilPipelinesMember2020-12-072020-12-070001110805ns:StorageSegmentMember2020-12-072020-12-070001110805ns:PipelineSegmentMember2020-12-310001110805ns:StorageSegmentMember2020-12-310001110805ns:PipelineSegmentMember2021-12-310001110805ns:PipelineSegmentMemberns:CrudeOilPipelinesMember2020-01-012020-03-310001110805ns:LogisticsRevolvingCreditAgreementMember2020-12-310001110805ns:LogisticsNotesdue2021Member2020-12-310001110805ns:LogisticsNotesDue2022Member2020-12-310001110805ns:LogisticsNotesDue2025Member2021-12-310001110805ns:LogisticsNotesDue2025Member2020-12-310001110805ns:LogisticsNotesdue2026Member2021-12-310001110805ns:LogisticsNotesdue2026Member2020-12-310001110805ns:LogisticsNotesDue2027Member2021-12-310001110805ns:LogisticsNotesDue2027Member2020-12-310001110805ns:LogisticsNotesDue2030Member2021-12-310001110805ns:LogisticsNotesDue2030Member2020-12-310001110805ns:LogisiticsNotesDue2043Member2021-12-310001110805ns:LogisiticsNotesDue2043Member2020-12-310001110805ns:GozoneBondsMember2021-12-310001110805ns:GozoneBondsMember2020-12-310001110805ns:AmendedReceivablesFinancingAgreementMember2020-12-310001110805ns:LogisticsRevolvingCreditAgreementMember2021-01-012021-12-310001110805us-gaap:SubsequentEventMemberns:LogisticsRevolvingCreditAgreementMember2022-01-282022-01-280001110805us-gaap:SubsequentEventMemberns:LogisticsRevolvingCreditAgreementMember2022-01-280001110805ns:LogisticsRevolvingCreditAgreementMember2019-12-310001110805ns:LogisticsNotesdue2026Member2019-05-220001110805ns:LogisticsNotesdue2026Member2019-05-222019-05-220001110805ns:LogisticsNotesDue2025Member2021-01-012021-12-310001110805ns:LogisticsNotesDue2030Member2021-01-012021-12-310001110805ns:LogisticsNotesDue2027Member2021-01-012021-12-310001110805ns:LogisticsNotesdue2026Member2021-01-012021-12-310001110805ns:LogisiticsNotesDue2043Member2021-01-012021-12-310001110805ns:LogisiticsNotesDue2043Member2018-01-152018-01-150001110805ns:GozoneBondsMember2019-12-310001110805ns:GozoneBondsMember2020-03-042020-03-040001110805ns:GoZoneBondsDueJune2038Member2021-01-012021-12-310001110805ns:GoZoneBondsDueJune2038Member2021-12-310001110805ns:GoZoneBondsDueJuly2040Member2021-01-012021-12-310001110805ns:GoZoneBondsDueJuly2040Member2021-12-310001110805ns:GoZoneBondsDueOctober2040Member2021-01-012021-12-310001110805ns:GoZoneBondsDueOctober2040Member2021-12-310001110805ns:GoZoneBondsDueDecember2040Member2021-01-012021-12-310001110805ns:GoZoneBondsDueDecember2040Member2021-12-310001110805ns:GoZoneBondsDueAugust2041Member2021-01-012021-12-310001110805ns:GoZoneBondsDueAugust2041Member2021-12-310001110805ns:GozoneBondsMember2021-01-012021-12-310001110805ns:AmendedReceivablesFinancingAgreementMember2020-09-020001110805ns:AmendedReceivablesFinancingAgreementMember2021-01-012021-12-310001110805ns:UnsecuredTermLoanCreditAgreementMember2020-09-150001110805ns:EarlyRepaymentPremiumsMember2020-09-162020-09-160001110805ns:UnamortizedDebtIssuanceCostsUnamortizedDiscountAndCommitmentFeeMember2020-09-162020-09-160001110805ns:UnsecuredTermLoanCreditAgreementMember2020-04-212021-04-190001110805ns:UnsecuredTermLoanCreditAgreementMember2021-04-190001110805ns:GozoneBondsMember2020-06-032020-06-030001110805ns:LandAndDockLeasesMember2021-01-012021-12-310001110805srt:MaximumMemberns:LandAndDockLeasesMember2021-01-012021-12-310001110805srt:MaximumMemberns:LandAndDockLeasesMember2021-12-310001110805ns:MarineVesselLeasesMember2021-01-012021-12-310001110805ns:MarineVesselLeasesMember2020-12-31utr:Rate00011108052017-01-010001110805ns:StorageSegmentMemberns:ServicerevenuesMember2021-01-012021-12-310001110805ns:StorageSegmentMemberns:ServicerevenuesMember2020-01-012020-12-310001110805ns:StorageSegmentMemberns:ServicerevenuesMember2019-01-012019-12-310001110805us-gaap:InterestRateContractMemberus-gaap:CashFlowHedgingMember2020-05-012020-05-310001110805us-gaap:InterestRateContractMemberus-gaap:CashFlowHedgingMember2020-05-312020-05-3100011108052020-06-012020-06-300001110805ns:ReclassificationDueToEarlyRepaymentOf2500Million475SeniorNotesMemberus-gaap:InterestRateContractMemberus-gaap:InterestExpenseMember2021-10-012021-12-310001110805ns:LongTermDebtLessCurrentPortionMember2021-12-310001110805ns:LongTermDebtLessCurrentPortionMember2020-12-310001110805us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001110805us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001110805us-gaap:OtherComprehensiveIncomeMemberus-gaap:InterestRateContractMember2021-01-012021-12-310001110805us-gaap:OtherComprehensiveIncomeMemberus-gaap:InterestRateContractMember2020-01-012020-12-310001110805us-gaap:OtherComprehensiveIncomeMemberus-gaap:InterestRateContractMember2019-01-012019-12-310001110805us-gaap:InterestRateContractMemberus-gaap:InterestExpenseMember2021-01-012021-12-310001110805us-gaap:InterestRateContractMemberus-gaap:InterestExpenseMember2020-01-012020-12-310001110805us-gaap:InterestRateContractMemberus-gaap:InterestExpenseMember2019-01-012019-12-3100011108052018-06-290001110805ns:SeriesDPreferredLimitedPartnerMember2018-06-2900011108052018-07-130001110805ns:SeriesDPreferredLimitedPartnerMember2018-07-130001110805ns:PreferredStockDistributionsPeriodJune292018toJune282020Memberns:SeriesDPreferredLimitedPartnerMember2021-01-012021-12-310001110805ns:PreferredStockDistributionsPeriodJune292020toJune282023Memberns:SeriesDPreferredLimitedPartnerMember2021-01-012021-12-310001110805ns:PreferredStockDistributionsPeriodJune292023andthereafterMemberns:SeriesDPreferredLimitedPartnerMember2021-01-012021-12-310001110805us-gaap:SubsequentEventMemberns:SeriesDPreferredLimitedPartnerMember2022-01-012022-03-310001110805ns:PreferredStockIssuerRedemptionOptionPeriodJune292023andthereafterMemberns:SeriesDPreferredLimitedPartnerMember2021-01-012021-12-310001110805ns:PreferredStockHolderRedemptionOptionPeriodJune292028andthereafterMemberns:SeriesDPreferredLimitedPartnerMember2021-01-012021-12-310001110805ns:SeriesDPreferredLimitedPartnerMember2018-07-202018-07-200001110805srt:MinimumMemberns:PreferredStockDistributionsPeriodJune292023andthereafterMemberns:SeriesDPreferredLimitedPartnerMember2021-01-012021-12-310001110805ns:PreferredStockIssuerRedemptionOptionPeriodJune292023toJune282024Memberns:SeriesDPreferredLimitedPartnerMember2021-01-012021-12-310001110805ns:PreferredStockIssuerRedemptionOptionPeriodJune292024toJune282025Memberns:SeriesDPreferredLimitedPartnerMember2021-01-012021-12-310001110805ns:PreferredStockIssuerRedemptionOptionPeriodJune292025andthereafterMemberns:SeriesDPreferredLimitedPartnerMember2021-01-012021-12-310001110805ns:PreferredStockConversionPeriodJune292020andthereafterMemberns:SeriesDPreferredLimitedPartnerMember2021-01-012021-12-310001110805ns:SeriesAPreferredLimitedPartnerMember2016-11-250001110805ns:SeriesBPreferredLimitedPartnerMember2017-04-280001110805ns:SeriesCPreferredLimitedPartnerMember2017-11-300001110805ns:SeriesAPreferredLimitedPartnerMember2016-11-252016-11-250001110805ns:SeriesAPreferredLimitedPartnerMember2016-11-252021-12-140001110805ns:SeriesBPreferredLimitedPartnerMember2017-04-282017-04-280001110805ns:SeriesBPreferredLimitedPartnerMember2021-01-012021-12-310001110805ns:SeriesCPreferredLimitedPartnerMember2017-11-302017-11-300001110805ns:SeriesCPreferredLimitedPartnerMember2021-01-012021-12-310001110805us-gaap:SubsequentEventMemberns:SeriesAPreferredLimitedPartnerMember2021-12-152022-03-140001110805ns:SeriesAPreferredLimitedPartnerMember2021-01-012021-12-310001110805ns:CommonLimitedPartnerMember2019-11-262019-11-260001110805ns:CommonLimitedPartnerMember2019-11-2600011108052019-11-262019-11-2600011108052021-10-012021-12-310001110805ns:CommonLimitedPartnerMember2021-10-012021-12-310001110805ns:CommonLimitedPartnerMember2021-07-012021-09-3000011108052021-04-012021-06-300001110805ns:CommonLimitedPartnerMember2021-04-012021-06-3000011108052021-01-012021-03-310001110805ns:CommonLimitedPartnerMember2021-01-012021-03-310001110805us-gaap:AccumulatedTranslationAdjustmentMember2018-12-310001110805us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2018-12-310001110805us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-12-310001110805us-gaap:ParentMember2018-12-310001110805us-gaap:AccumulatedTranslationAdjustmentMember2019-01-012019-12-310001110805us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-01-012019-12-310001110805us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-01-012019-12-310001110805us-gaap:ParentMember2019-01-012019-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedTranslationAdjustmentMemberus-gaap:OtherIncomeMember2019-01-012019-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:OtherIncomeMember2019-01-012019-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:OtherIncomeMember2019-01-012019-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ParentMemberus-gaap:OtherIncomeMember2019-01-012019-12-310001110805us-gaap:AccumulatedTranslationAdjustmentMemberus-gaap:InterestExpenseMember2019-01-012019-12-310001110805us-gaap:InterestExpenseMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-01-012019-12-310001110805us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:InterestExpenseMember2019-01-012019-12-310001110805us-gaap:InterestExpenseMemberus-gaap:ParentMember2019-01-012019-12-310001110805us-gaap:AccumulatedTranslationAdjustmentMember2019-12-310001110805us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-12-310001110805us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-12-310001110805us-gaap:ParentMember2019-12-310001110805us-gaap:AccumulatedTranslationAdjustmentMember2020-01-012020-12-310001110805us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-01-012020-12-310001110805us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-01-012020-12-310001110805us-gaap:ParentMember2020-01-012020-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedTranslationAdjustmentMemberus-gaap:OtherIncomeMember2020-01-012020-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:OtherIncomeMember2020-01-012020-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:OtherIncomeMember2020-01-012020-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ParentMemberus-gaap:OtherIncomeMember2020-01-012020-12-310001110805us-gaap:AccumulatedTranslationAdjustmentMemberus-gaap:InterestExpenseMember2020-01-012020-12-310001110805us-gaap:InterestExpenseMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-01-012020-12-310001110805us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:InterestExpenseMember2020-01-012020-12-310001110805us-gaap:InterestExpenseMemberus-gaap:ParentMember2020-01-012020-12-310001110805us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310001110805us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-12-310001110805us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-12-310001110805us-gaap:ParentMember2020-12-310001110805us-gaap:AccumulatedTranslationAdjustmentMember2021-01-012021-12-310001110805us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-01-012021-12-310001110805us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-12-310001110805us-gaap:ParentMember2021-01-012021-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedTranslationAdjustmentMemberus-gaap:OtherIncomeMember2021-01-012021-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:OtherIncomeMember2021-01-012021-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:OtherIncomeMember2021-01-012021-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ParentMemberus-gaap:OtherIncomeMember2021-01-012021-12-310001110805us-gaap:AccumulatedTranslationAdjustmentMemberus-gaap:InterestExpenseMember2021-01-012021-12-310001110805us-gaap:InterestExpenseMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-01-012021-12-310001110805us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:InterestExpenseMember2021-01-012021-12-310001110805us-gaap:InterestExpenseMemberus-gaap:ParentMember2021-01-012021-12-310001110805us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310001110805us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-12-310001110805us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310001110805us-gaap:ParentMember2021-12-310001110805us-gaap:CashAndCashEquivalentsMember2021-12-310001110805us-gaap:CashAndCashEquivalentsMember2020-12-310001110805us-gaap:PensionPlansDefinedBenefitMember2020-12-310001110805us-gaap:PensionPlansDefinedBenefitMember2019-12-310001110805us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-12-310001110805us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-12-310001110805us-gaap:PensionPlansDefinedBenefitMember2021-01-012021-12-310001110805us-gaap:PensionPlansDefinedBenefitMember2020-01-012020-12-310001110805us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-01-012021-12-310001110805us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-01-012020-12-310001110805us-gaap:PensionPlansDefinedBenefitMember2021-12-310001110805us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberns:ExcessPensionPlanAndOtherPostretirementBenefitPlansMember2021-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberns:ExcessPensionPlanAndOtherPostretirementBenefitPlansMember2020-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberns:ExcessPensionPlanMember2020-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberns:ExcessPensionPlanMember2021-12-310001110805us-gaap:PensionPlansDefinedBenefitMember2019-01-012019-12-310001110805us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-01-012019-12-310001110805us-gaap:DefinedBenefitPlanEquitySecuritiesMember2021-12-310001110805us-gaap:FixedIncomeFundsMember2021-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CashAndCashEquivalentsMember2021-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMember2021-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel3Member2021-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMember2021-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ExchangeTradedFundsMember2021-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ExchangeTradedFundsMemberus-gaap:FairValueInputsLevel2Member2021-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ExchangeTradedFundsMemberus-gaap:FairValueInputsLevel3Member2021-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ExchangeTradedFundsMember2021-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EquityFundsMember2021-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel2Member2021-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel3Member2021-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:EquityFundsMember2021-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel1Member2021-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel2Member2021-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel3Member2021-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeFundsMember2021-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2021-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2021-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2021-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CashAndCashEquivalentsMember2020-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMember2020-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel3Member2020-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CashAndCashEquivalentsMember2020-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ExchangeTradedFundsMember2020-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ExchangeTradedFundsMemberus-gaap:FairValueInputsLevel2Member2020-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ExchangeTradedFundsMemberus-gaap:FairValueInputsLevel3Member2020-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ExchangeTradedFundsMember2020-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:EquityFundsMember2020-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel2Member2020-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel3Member2020-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:EquityFundsMember2020-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel1Member2020-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel2Member2020-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel3Member2020-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeFundsMember2020-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2020-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2020-12-310001110805us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2020-12-310001110805ns:UnitBasedCompensation2019PlanAmendedAndRestatedIn2021Member2021-04-290001110805ns:UnitBasedCompensation2019PlanAmendedAndRestatedIn2021Member2021-12-310001110805ns:RestrictedUnitsEmployeesMember2021-12-310001110805ns:RestrictedUnitsEmployeesMember2020-12-310001110805ns:RestrictedUnitsEmployeesMember2019-12-310001110805ns:RestrictedUnitsEmployeesMember2021-01-012021-12-310001110805ns:RestrictedUnitsEmployeesMember2020-01-012020-12-310001110805ns:RestrictedUnitsEmployeesMember2019-01-012019-12-310001110805ns:RestrictedUnitsNonEmployeeDirectorsMember2021-12-310001110805ns:RestrictedUnitsNonEmployeeDirectorsMember2020-12-310001110805ns:RestrictedUnitsNonEmployeeDirectorsMember2019-12-310001110805ns:RestrictedUnitsNonEmployeeDirectorsMember2021-01-012021-12-310001110805ns:RestrictedUnitsNonEmployeeDirectorsMember2020-01-012020-12-310001110805ns:RestrictedUnitsNonEmployeeDirectorsMember2019-01-012019-12-310001110805ns:RestrictedUnitsCertainInternationalEmployeesMember2021-12-310001110805ns:RestrictedUnitsCertainInternationalEmployeesMember2020-12-310001110805ns:RestrictedUnitsCertainInternationalEmployeesMember2019-12-310001110805ns:RestrictedUnitsCertainInternationalEmployeesMember2021-01-012021-12-310001110805ns:RestrictedUnitsCertainInternationalEmployeesMember2020-01-012020-12-310001110805ns:RestrictedUnitsCertainInternationalEmployeesMember2019-01-012019-12-310001110805us-gaap:PerformanceSharesMember2021-12-310001110805us-gaap:PerformanceSharesMember2020-12-310001110805us-gaap:PerformanceSharesMember2019-12-310001110805us-gaap:PerformanceSharesMember2021-01-012021-12-310001110805us-gaap:PerformanceSharesMember2020-01-012020-12-310001110805us-gaap:PerformanceSharesMember2019-01-012019-12-310001110805us-gaap:StockCompensationPlanMember2021-12-310001110805us-gaap:StockCompensationPlanMember2020-12-310001110805us-gaap:StockCompensationPlanMember2019-12-310001110805us-gaap:StockCompensationPlanMember2021-01-012021-12-310001110805us-gaap:StockCompensationPlanMember2020-01-012020-12-310001110805us-gaap:StockCompensationPlanMember2019-01-012019-12-310001110805ns:RestrictedunitsemployeesandnonemployeedirectorsNEDsMember2018-12-310001110805ns:RestrictedunitsemployeesandnonemployeedirectorsNEDsMember2019-01-012019-12-310001110805ns:RestrictedunitsemployeesandnonemployeedirectorsNEDsMember2019-12-310001110805ns:RestrictedunitsemployeesandnonemployeedirectorsNEDsMember2020-01-012020-12-310001110805ns:RestrictedunitsemployeesandnonemployeedirectorsNEDsMember2020-12-310001110805ns:RestrictedunitsemployeesandnonemployeedirectorsNEDsMember2021-01-012021-12-310001110805ns:RestrictedunitsemployeesandnonemployeedirectorsNEDsMember2021-12-310001110805us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001110805us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001110805us-gaap:RestrictedStockUnitsRSUMember2019-01-012019-12-310001110805us-gaap:RestrictedStockUnitsRSUMember2021-12-310001110805us-gaap:PerformanceSharesMember2018-12-310001110805ns:PerformanceCashAwardsMember2020-01-012020-12-310001110805ns:PerformanceCashAwardsMember2020-12-310001110805ns:PerformanceCashAwardsMember2021-01-012021-12-310001110805ns:PerformanceCashAwardsMember2021-12-310001110805us-gaap:SubsequentEventMemberns:PerformanceCashAwardsAndPerformanceUnitAwardsMember2022-01-272022-01-270001110805us-gaap:StockCompensationPlanMemberus-gaap:SubsequentEventMember2022-02-012022-02-280001110805us-gaap:StockCompensationPlanMemberns:CommonLimitedPartnerMemberus-gaap:SubsequentEventMember2022-02-012022-02-280001110805us-gaap:StockCompensationPlanMember2020-02-012020-03-310001110805us-gaap:StockCompensationPlanMemberns:CommonLimitedPartnerMember2020-02-012020-03-310001110805us-gaap:DomesticCountryMember2021-12-310001110805us-gaap:ForeignCountryMember2021-12-310001110805ns:AfterDecember312017Memberus-gaap:DomesticCountryMember2021-12-310001110805us-gaap:DomesticCountryMember2021-01-012021-12-310001110805us-gaap:ForeignCountryMember2021-01-012021-12-310001110805ns:PipelineSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001110805ns:PipelineSegmentMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001110805ns:PipelineSegmentMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001110805us-gaap:OperatingSegmentsMemberns:StorageSegmentMember2021-01-012021-12-310001110805us-gaap:OperatingSegmentsMemberns:StorageSegmentMember2020-01-012020-12-310001110805us-gaap:OperatingSegmentsMemberns:StorageSegmentMember2019-01-012019-12-310001110805us-gaap:OperatingSegmentsMember2021-01-012021-12-310001110805us-gaap:OperatingSegmentsMember2020-01-012020-12-310001110805us-gaap:OperatingSegmentsMember2019-01-012019-12-310001110805us-gaap:CorporateNonSegmentMember2021-01-012021-12-310001110805us-gaap:CorporateNonSegmentMember2020-01-012020-12-310001110805us-gaap:CorporateNonSegmentMember2019-01-012019-12-310001110805ns:FuelsMarketingSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001110805ns:FuelsMarketingSegmentMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001110805ns:FuelsMarketingSegmentMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001110805country:US2021-01-012021-12-310001110805country:US2020-01-012020-12-310001110805country:US2019-01-012019-12-310001110805ns:ForeignGeographicAreaMember2021-01-012021-12-310001110805ns:ForeignGeographicAreaMember2020-01-012020-12-310001110805ns:ForeignGeographicAreaMember2019-01-012019-12-310001110805ns:ValeroEnergyCorporationMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-310001110805ns:ValeroEnergyCorporationMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001110805ns:ValeroEnergyCorporationMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310001110805ns:ValeroEnergyCorporationMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001110805ns:ValeroEnergyCorporationMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2019-01-012019-12-310001110805ns:ValeroEnergyCorporationMemberus-gaap:SalesRevenueNetMember2019-01-012019-12-310001110805country:US2021-12-310001110805country:US2020-12-310001110805ns:ForeignGeographicAreaMember2021-12-310001110805ns:ForeignGeographicAreaMember2020-12-310001110805ns:PipelineSegmentMemberus-gaap:OperatingSegmentsMember2021-12-310001110805ns:PipelineSegmentMemberus-gaap:OperatingSegmentsMember2020-12-310001110805us-gaap:OperatingSegmentsMemberns:StorageSegmentMember2021-12-310001110805us-gaap:OperatingSegmentsMemberns:StorageSegmentMember2020-12-310001110805ns:FuelsMarketingSegmentMemberus-gaap:OperatingSegmentsMember2021-12-310001110805ns:FuelsMarketingSegmentMemberus-gaap:OperatingSegmentsMember2020-12-310001110805us-gaap:OperatingSegmentsMember2021-12-310001110805us-gaap:OperatingSegmentsMember2020-12-310001110805us-gaap:CorporateNonSegmentMember2021-12-310001110805us-gaap:CorporateNonSegmentMember2020-12-310001110805srt:MinimumMembersrt:ScenarioForecastMember2022-02-112022-02-110001110805srt:MaximumMembersrt:ScenarioForecastMember2022-02-112022-02-11

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2021

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 1-16417

NuStar Energy L.P.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 74-2956831 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

19003 IH-10 West

San Antonio, Texas 78257

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (210) 918-2000

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common units | | NS | | New York Stock Exchange |

| Series A Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Units | | NSprA | | New York Stock Exchange |

| Series B Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Units | | NSprB | | New York Stock Exchange |

| Series C Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Units | | NSprC | | New York Stock Exchange |

Securities registered pursuant to 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | þ | | Accelerated filer | | ☐ |

| | | |

| Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

| | | | | | |

| | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

The aggregate market value of the common units held by non-affiliates was approximately $1.8 billion based on the last sales price quoted as of June 30, 2021, the last business day of the registrant’s most recently completed second quarter.

The number of common units outstanding as of January 31, 2022 was 110,101,839.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the Proxy Statement for the registrant’s 2022 annual meeting of unitholders, expected to be filed within 120 days after the end of the fiscal year covered by this Form 10-K, are incorporated by reference into Part III to the extent described therein.

NUSTAR ENERGY L.P.

FORM 10-K

TABLE OF CONTENTS

| | | | | | | | |

| PART I |

| Items 1., 2. & 7 | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 1A. | | |

| | |

| Item 1B. | | |

| | |

| Item 3. | | |

| | |

| Item 4. | | |

|

| PART II |

| Item 5. | | |

| | |

| Item 6. | | |

| | |

| Item 7A. | | |

| | |

| Item 8. | | |

| | |

| Item 9. | | |

| | |

| Item 9A. | | |

| | |

| Item 9B. | | |

|

| Item 9C. | | |

| | |

| PART III |

| Item 10. | | |

| | |

| Item 11. | | |

| | |

| Item 12. | | |

| | |

| Item 13. | | |

| | |

| Item 14. | | |

|

| PART IV |

| Item 15. | | |

| |

| Item 16. | | |

| |

| |

PART I

Unless otherwise indicated, the terms “NuStar Energy,” “the Partnership,” “we,” “our” and “us” are used in this report to refer to NuStar Energy L.P., to one or more of our consolidated subsidiaries or to all of them taken as a whole.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION AND OTHER DISCLAIMERS

In this Form 10-K, we make certain forward-looking statements, such as statements regarding our plans, strategies, objectives, expectations, estimates, predictions, projections, assumptions, intentions, resources and the future impact of the coronavirus, or COVID-19, the responses thereto, economic activity and the actions by oil-producing nations on our business. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested in this report. These forward-looking statements can generally be identified by the words “anticipates,” “believes,” “expects,” “plans,” “intends,” “estimates,” “forecasts,” “budgets,” “projects,” “will,” “could,” “should,” “may” and similar expressions. These statements reflect our current views with regard to future events and are subject to various risks, uncertainties and assumptions, which may cause actual results to differ materially. Please read Item 1A. “Risk Factors” for a discussion of certain of those risks, uncertainties and assumptions.

If one or more of these risks or uncertainties materialize, or if the underlying assumptions prove incorrect, our actual results may vary materially from those described in any forward-looking statement. Other unknown or unpredictable factors could also have material adverse effects on our future results. Readers are cautioned not to place undue reliance on this forward-looking information, which is as of the date of this Form 10-K. We do not intend to update these statements unless we are required by the securities laws to do so, and we undertake no obligation to publicly release the result of any revisions to any such forward-looking statements that may be made to reflect events or circumstances after the date of this report or to reflect the occurrence of unanticipated events.

This Form 10-K contains trade names, trademarks and service marks of others, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this Form 10-K appear without the ® or ™ symbols.

ITEMS 1., 2. and 7. BUSINESS, PROPERTIES AND MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

OVERVIEW

NuStar Energy L.P. (NuStar Energy) is a Delaware limited partnership. Our principal executive offices are located at 19003 IH-10 West, San Antonio, Texas 78257, and our telephone number is (210) 918-2000. Our business is managed under the direction of the board of directors of NuStar GP, LLC, the general partner of our general partner, Riverwalk Logistics, L.P., both of which are wholly owned subsidiaries of ours. Our limited partner interests consist of the following:

•common units (NYSE: NS);

•8.50% Series A fixed-to-floating rate cumulative redeemable perpetual preferred units (NYSE: NSprA);

•7.625% Series B fixed-to-floating rate cumulative redeemable perpetual preferred units (NYSE: NSprB);

•9.00% Series C fixed-to-floating rate cumulative redeemable perpetual preferred units (NYSE: NSprC); and

•Series D cumulative convertible preferred units.

We are primarily engaged in the transportation, terminalling and storage of petroleum products and renewable fuels and the transportation of anhydrous ammonia. We also market petroleum products. The term “throughput” as used in this document generally refers to barrels of crude oil, refined product or renewable fuels or tons of ammonia, as applicable, that pass through our pipelines, terminals or storage tanks.

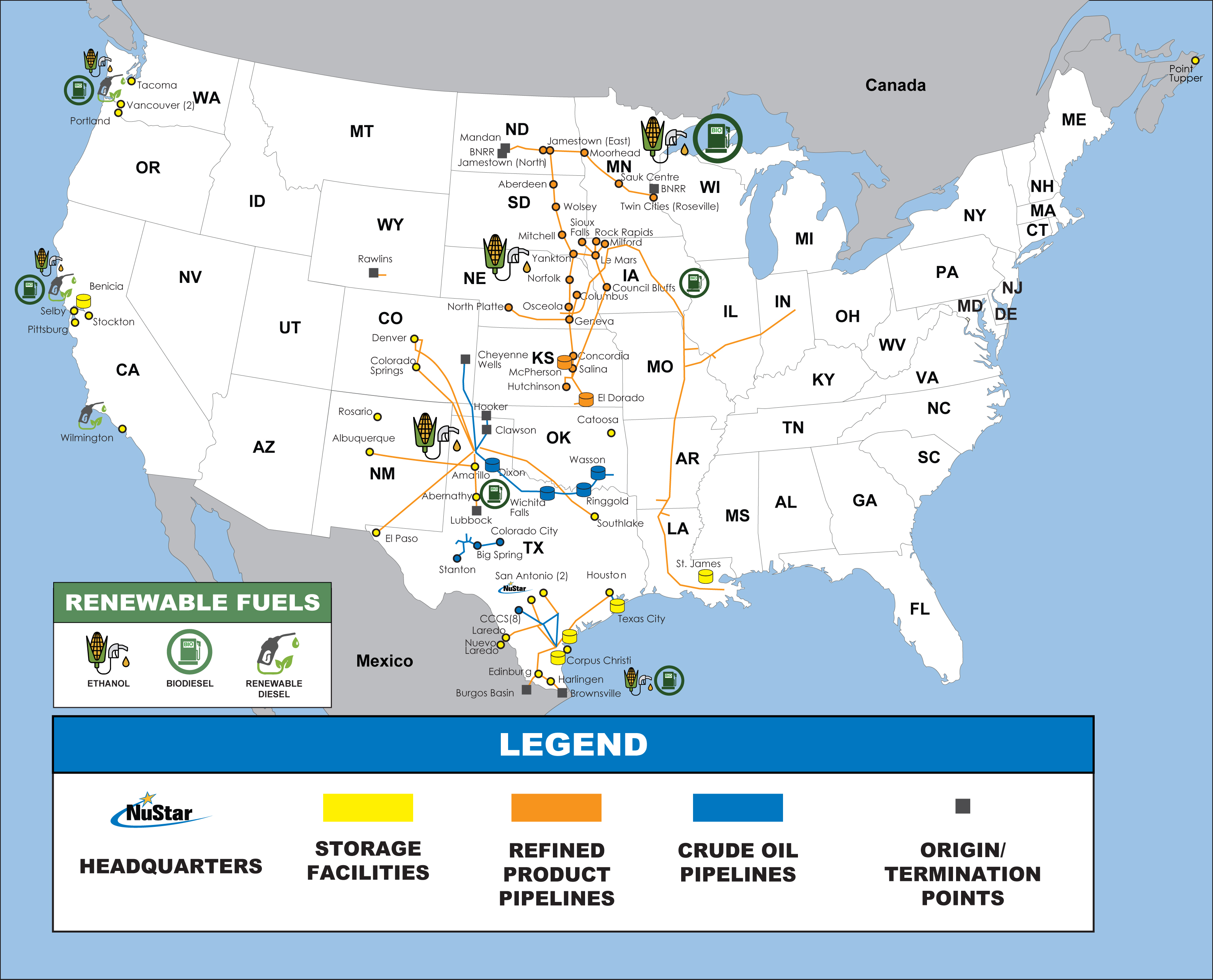

We divide our operations into the following three reportable business segments: pipeline, storage and fuels marketing. As of December 31, 2021, our assets included 9,935 miles of pipeline and 64 terminal and storage facilities, which provide approximately 57 million barrels of storage capacity. We conduct our operations through our wholly owned subsidiaries, primarily NuStar Logistics, L.P. (NuStar Logistics) and NuStar Pipeline Operating Partnership L.P. (NuPOP). We generate revenue primarily from:

•tariffs for transportation through our pipelines;

•fees for the use of our terminal and storage facilities and related ancillary services; and

•sales of petroleum products.

We are focused on:

•maintaining safe, reliable operations, continuing our strong safety and environmental stewardship, and controlling costs;

•improving our existing assets through strategic internal growth projects, including renewable fuel enhancements;

•continuing to self-fund our spending with internally generated cash flows; and

•reducing our leverage metrics to further strengthen our balance sheet.

The following factors affect our results of operations:

•economic factors and price volatility;

•industry factors, such as changes in the prices of petroleum products that affect demand or production, or regulatory changes that could increase costs or impose restrictions on operations;

•factors that affect our customers and the markets they serve, such as utilization rates and maintenance turnaround schedules of our refining company customers and drilling activity by our crude oil production customers;

•company-specific factors, such as facility integrity issues, maintenance requirements and outages that impact the throughput rates of our assets; and

•seasonal factors that affect the demand for products transported by and/or stored in our assets and the demand for products we sell.

Please read Item 1A. “Risk Factors” for additional discussion on how these factors could affect our operations.

The following map depicts our assets at December 31, 2021:

RECENT DEVELOPMENTS

In 2021, we prioritized protecting our employees, maintaining safe, reliable operations, executing our capital projects and exercising fiscal discipline, as we continued to take steps to reduce our leverage metrics and further strengthen our balance sheet. Our recent steps in 2021 include the sale of our Eastern U.S. Terminal Operations, as described below, and the early repayment of our senior notes, which addressed our near-term debt maturity and improved our debt metrics. In 2021, we met our goal of funding all our expenses, distribution requirements and capital expenditures using internally generated cash flows as well as our promise to publish our inaugural Sustainability Report. In January 2022, we also extended the maturity of our $1.0 billion unsecured revolving credit agreement to April 27, 2025. By repaying our senior notes and extending our credit agreement, we now have no debt maturing until 2025.

Point Tupper Terminal Sale Agreement. On February 11, 2022, we entered into an agreement to sell the equity interests in our wholly owned subsidiaries that own our Point Tupper terminal facility to EverWind Fuels for $60.0 million. The terminal facility has a storage capacity of 7.8 million barrels and is included in the storage segment. We expect to complete the sale in the first half of 2022 and will utilize the sales proceeds to improve our debt metrics.

Debt Amendments and Repayments. On January 28, 2022, we amended and restated our $1.0 billion unsecured revolving credit agreement to extend the maturity to April 27, 2025, replace the LIBOR-based interest rate and modify other terms. Also on January 28, 2022, we amended our $100.0 million receivables financing agreement to extend the scheduled termination date to January 31, 2025, replace the LIBOR-based interest rate and modify other terms. On November 1, 2021, we repaid our $250.0 million of 4.75% senior notes due February 1, 2022 with proceeds from the Eastern U.S. Terminals Disposition, as defined below. We repaid our $300.0 million of 6.75% senior notes due February 1, 2021 at maturity with borrowings under our revolving credit agreement. Please see Note 12 of the Notes to Consolidated Financial Statements in Item 8. “Financial Statements and Supplementary Data” for additional information.

Eastern U.S. Terminals Disposition. On October 8, 2021, we completed the sale of nine U.S. terminal and storage facilities, including all our North East Terminals and one terminal in Florida (the Eastern U.S. Terminal Operations) to Sunoco LP for $250.0 million in cash (the Eastern U.S. Terminals Disposition) and utilized the proceeds from the sale to reduce debt and improve our debt metrics. The terminals had an aggregate storage capacity of 14.8 million barrels and were included in the storage segment. We recorded a non-cash asset impairment loss of $95.7 million and a non-cash goodwill impairment loss of $34.1 million in the third quarter of 2021, which are reported in “Asset impairment losses” and “Goodwill impairment losses,” respectively, on the consolidated statement of income for the year ended December 31, 2021. Please refer to Note 4 of the Notes to Consolidated Financial Statements in Item 8. “Financial Statements and Supplementary Data” for additional information.

Houston Pipeline Impairment. In the third quarter of 2021, we recorded a non-cash asset impairment charge of $59.2 million within our pipeline segment related to our refined product pipeline extending from Mt. Belvieu, Texas to Corpus Christi, Texas (the Houston Pipeline). Please refer to Note 4 of the Notes to Consolidated Financial Statements in Item 8. “Financial Statements and Supplementary Data” for additional information.

COVID-19. The coronavirus, or COVID-19, had a severe negative impact on global economic activity in 2020, which significantly reduced global demand for petroleum products and increased the volatility of crude oil prices, beginning in March 2020. While a number of countries, including the United States, made significant progress during 2021 deploying COVID-19 vaccines, which has improved the economic conditions and outlook in those nations, many more continue to struggle to obtain and/or disseminate vaccinations to their populace, which continues to frustrate widespread global economic recovery. Even in the United States, if a sufficient proportion of people are not vaccinated, or as variants emerge, we may continue to face surges in COVID-19 cases in some regions, which could slow the pace of domestic economic improvement and undermine demand in the markets our assets serve. We continue to closely monitor each of our locations to ensure the safety of our employees as well as the operational functionality of each location.

Ongoing uncertainty surrounding the COVID-19 pandemic, including its duration and lingering impacts to the economy have caused and may continue to cause volatility and could have a significant impact on management’s estimates and assumptions in 2022 and beyond.

TRENDS AND OUTLOOK

As America continues to recover from the impact of COVID-19 and returns to normal activity and growth, we continue to see signs of stabilization and improvement, across the U.S. and in NuStar’s footprint. U.S. refined product demand outlook has improved as COVID-19 vaccinations have continued to allow more people to return to normal day-to-day activities and to begin traveling. However, variants may emerge that could significantly increase COVID-19 case counts, which may further impact the overall demand recovery in 2022.

Refined product demand on NuStar’s pipeline systems rebounded in 2021 to pre-pandemic levels or higher. We expect our refined products pipeline systems to perform at or above 100% of our pre-pandemic levels for 2022. Steady recovery in refined product demand has increased U.S. refiners’ demand for crude oil, which has contributed to increased throughputs on certain of our crude oil pipelines. Rebounding crude demand in the U. S. and abroad, has, in turn, contributed to higher global crude prices, which has in turn improved demand for U.S. shale production, particularly in the Permian Basin. We believe the Permian Basin, and our system in particular, has geological advantages over other shale plays, including lower production costs and higher product quality, that have benefited and will continue to benefit our assets in 2022 as crude demand, price and production continue to recover. Sustained healthy U.S. shale production growth, when combined with improving global demand, drives U.S. export growth over time; however, global demand has yet to rebound to pre-pandemic levels, which impacts crude volumes on our Corpus Christi Crude System, as well as our St. James terminal. In addition, we continue to expect to benefit from the growth of our renewable fuels distribution system on the West Coast. We expect to provide an increasing share of California’s renewable fuels as we complete our planned tank conversion projects.

The COVID-19 pandemic continues to have lingering impacts that, when combined with other factors, can ripple through the U.S. economy, including rising inflation rates and supply chain issues that affected certain industries and geographic areas to varying degrees during 2021 and, may continue or worsen in 2022. For 2022 and in response to rising inflation, we expect interest rates to increase, which will increase the interest expense related to our variable rate debt; however, we also expect many of our pipelines to benefit from tariff rate increases. We plan to continue to manage our operations with fiscal discipline in this turbulent environment and remain committed to improving our debt metrics. We expect to continue to fund all of our expenses, distribution requirements and capital expenditures for the full-year 2022 using internally generated cash flows.

Our outlook for the partnership, both overall and for any of our segments, may change, as we base our expectations on our continuing evaluation of several factors, many of which are outside our control. These factors include, but are not limited to, uncertainty surrounding the COVID-19 pandemic, including its duration and lingering impacts to the economy; uncertainty surrounding future production decisions by the Organization of Petroleum Exporting Countries and other oil-producing nations (OPEC+); the state of the economy and the capital markets; changes to our customers’ refinery maintenance schedules and unplanned refinery downtime; crude oil prices; the supply of and demand for petroleum products, renewable fuels and anhydrous ammonia; demand for our transportation and storage services; the availability and costs of personnel, equipment, supplies and services essential to our operations; the ability to obtain timely permitting approvals; and changes in laws and regulations affecting our operations.

CONSOLIDATED RESULTS OF OPERATIONS

The following discussion of our results of operations should be read in conjunction with Item 8. “Financial Statements and Supplementary Data” included in this report, which also contains additional detailed financial information about our segments in Note 24 of the Notes to Consolidated Financial Statements. A comparative discussion of our 2020 to 2019 results of operations can be found in Items 1., 2., and 7. “Business, Properties and Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in our Annual Report on Form 10-K for the year ended December 31, 2020 filed with the Securities and Exchange Commission (SEC) on February 25, 2021.

The following table presents our consolidated financial results for the year ended December 31, 2021, compared to the year ended December 31, 2020:

| | | | | | | | | | | | | | | | | |

| | Year Ended December 31, | | |

| | 2021 | | 2020 | | Change |

| (Thousands of Dollars, Except Per Unit Data) |

| Statement of Income Data: | | | |

| Revenues: | | | | | |

| Service revenues | $ | 1,157,410 | | | $ | 1,205,494 | | | $ | (48,084) | |

| Product sales | 461,090 | | | 276,070 | | | 185,020 | |

| Total revenues | 1,618,500 | | | 1,481,564 | | | 136,936 | |

| | | | | |

| Costs and expenses: | | | | | |

| Costs associated with service revenues | 654,666 | | | 680,055 | | | (25,389) | |

| Cost associated with product sales | 417,413 | | | 256,066 | | | 161,347 | |

| Asset impairment losses | 154,908 | | | — | | | 154,908 | |

| Goodwill impairment losses | 34,060 | | | 225,000 | | | (190,940) | |

| General and administrative expenses | 113,207 | | | 102,716 | | | 10,491 | |

| Other depreciation and amortization expense | 7,792 | | | 8,625 | | | (833) | |

| | | | | |

| | | | | |

| Total costs and expenses | 1,382,046 | | | 1,272,462 | | | 109,584 | |

| | | | | |

| Operating income | 236,454 | | | 209,102 | | | 27,352 | |

| | | | | |

| Interest expense, net | (213,985) | | | (229,054) | | | 15,069 | |

| | | | | |

| Loss on extinguishment of debt | — | | | (141,746) | | | 141,746 | |

| Other income (expense), net | 19,644 | | | (34,622) | | | 54,266 | |

| Income (loss) before income tax expense | 42,113 | | | (196,320) | | | 238,433 | |

| Income tax expense | 3,888 | | | 2,663 | | | 1,225 | |

| | | | | |

| | | | | |

| Net income (loss) | $ | 38,225 | | | $ | (198,983) | | | $ | 237,208 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Basic and diluted net loss per common unit: | $ | (0.99) | | | $ | (3.15) | | | $ | 2.16 | |

Overview

We recorded net income of $38.2 million for the year ended December 31, 2021, which includes non-cash asset and goodwill impairment losses related to our Eastern U.S. Terminal Operations of $95.7 million and $34.1 million, respectively, and a non-cash asset impairment loss of $59.2 million on our Houston Pipeline, as well as a gain of $14.9 million for insurance recoveries related to the 2019 fire at our Selby terminal.

For the year ended December 31, 2020, the net loss of $199.0 million is mainly due to a non-cash goodwill impairment charge of $225.0 million in the first quarter of 2020 related to our crude oil pipelines reporting unit, a loss on extinguishment of debt of $141.7 million, primarily resulting from the early repayment of $500.0 million of borrowings outstanding under our $750.0 million unsecured term loan credit agreement in the third quarter of 2020, and a loss of $34.7 million on the sale of our Texas City terminals in December 2020 (the Texas City Sale).

Operating income increased $27.4 million for the year ended December 31, 2021, compared to the year ended December 31, 2020, primarily due to higher operating income from our pipeline segment due to a rebound in demand across most of our pipelines in 2021. Partially offsetting the increase were the following: (i) the impacts of a winter storm in the first quarter of 2021; (ii) the continuing effects of the COVID-19 global pandemic; and (iii) lower operating income from our storage segment in 2021 due to the Eastern U.S. Terminals Disposition and the Texas City Sale and lower demand at certain terminal facilities.

Corporate Items

General and administrative expenses increased $10.5 million for the year ended December 31, 2021, compared to the year ended December 31, 2020, mainly due to higher compensation costs.

Interest expense, net decreased $15.1 million for the year ended December 31, 2021, compared to the year ended December 31, 2020, mainly due to lower overall debt balances following the repayment of outstanding debt with the proceeds from our October 2021 and December 2020 asset sales described above. In addition, interest expense was lower in 2021 due to the repayment of the $750.0 million unsecured term loan credit agreement in September 2020 and senior note repayments in 2021, which more than offset the interest expense from the September 2020 issuance of $1.2 billion of senior notes.

We recorded other income, net of $19.6 million for the year ended December 31, 2021, compared to other expense, net of $34.6 million for the year ended December 31, 2020, mainly due to a gain of $14.9 million for insurance recoveries in 2021 related to the 2019 Selby terminal fire and a non-cash loss of $34.7 million related to the Texas City Sale in 2020.

SEGMENTS AND RESULTS OF OPERATIONS

PIPELINE SEGMENT

Our pipeline operations consist of the transportation of refined products, crude oil and anhydrous ammonia. As of December 31, 2021, we owned and operated:

•refined product pipelines with an aggregate length of 3,205 miles and crude oil pipelines with an aggregate length of 2,230 miles in Texas, Oklahoma, Kansas, Colorado and New Mexico (collectively, the Central West System);

•a 2,050-mile refined product pipeline originating in southern Kansas and terminating at Jamestown, North Dakota, with a western extension to North Platte, Nebraska and an eastern extension into Iowa (the East Pipeline);

•a 450-mile refined product pipeline originating at Marathon Petroleum Corporation’s (Marathon) Mandan, North Dakota refinery and terminating in Minneapolis, Minnesota (the North Pipeline); and

•a 2,000-mile anhydrous ammonia pipeline originating in the Louisiana delta area and then running north through the Midwestern United States to Missouri before forking east and west to terminate in Indiana and Nebraska (the Ammonia Pipeline).

The following table lists information about our pipeline assets:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of December 31, 2021 | | Throughput

For the year ended December 31, |

| Region / Pipeline System | Length | | Terminals | | Tank Capacity | | 2021 | | 2020 |

| (Miles) | | | | (Barrels) | | (Barrels/Day) |

| Central West System: | | | | | | | | | |

| McKee Refined Product System | 2,276 | | | — | | | — | | | 167,029 | | | 146,379 | |

| Three Rivers System | 373 | | | — | | | — | | | 106,526 | | | 94,892 | |

| Valley Pipeline System | 271 | | | — | | | | | 55,790 | | | 52,513 | |

| Other | 285 | | | — | | | — | | | 18,362 | | | 7,600 | |

| Central West Refined Products Pipelines | 3,205 | | | — | | | — | | | 347,707 | | | 301,384 | |

| Corpus Christi Crude Pipeline System | 538 | | | 8 | | | 2,157,000 | | | 423,528 | | | 439,852 | |

| McKee Crude System | 598 | | | — | | | 1,039,000 | | | 146,248 | | | 126,323 | |

| Ardmore System | 119 | | | — | | | 824,000 | | | 81,609 | | | 81,569 | |

| Permian Crude System | 975 | | | 3 | | | 1,583,000 | | | 630,183 | | | 590,013 | |

| Central West Crude Oil Pipelines | 2,230 | | | 11 | | | 5,603,000 | | | 1,281,568 | | | 1,237,757 | |

| Total Central West System | 5,435 | | | 11 | | | 5,603,000 | | | 1,629,275 | | | 1,539,141 | |

| | | | | | | | | |

| Central East System: | | | | | | | | | |

| East Pipeline | 2,050 | | | 18 | | | 5,905,000 | | | 155,610 | | | 146,397 | |

| North Pipeline | 450 | | | 4 | | | 1,502,000 | | | 50,365 | | | 47,128 | |

| Ammonia Pipeline | 2,000 | | | — | | | — | | | 31,507 | | | 29,933 | |

| Total Central East System | 4,500 | | | 22 | | | 7,407,000 | | | 237,482 | | | 223,458 | |

| | | | | | | | | |

| Total | 9,935 | | | 33 | | | 13,010,000 | | | 1,866,757 | | | 1,762,599 | |

Description of Pipelines

Central West System. The Central West System covers a total of 5,435 miles, including refined product and crude oil pipelines. The refined product pipelines have an aggregate length of 3,205 miles (Central West Refined Products Pipelines) and transport gasoline, distillates (including diesel and jet fuel), renewable fuels, natural gas liquids and other products produced at the refineries to which they are connected, including Valero Energy Corporation’s (Valero Energy) McKee, Corpus Christi and Three Rivers refineries.

The crude oil pipelines have an aggregate length of 2,230 miles (Central West Crude Oil Pipelines) and transport crude oil and other feedstocks to the refineries to which they are connected, including Valero Energy’s McKee, Three Rivers and Ardmore refineries, or from the Permian Basin and Eagle Ford Shale regions to our North Beach marine export terminal or to third-party refineries in Corpus Christi, Texas. Our Corpus Christi Crude Pipeline System is comprised of pipelines that transport crude oil from the Eagle Ford region to Corpus Christi, Texas, including eight terminals along those pipelines, with aggregate storage capacity of 2.2 million barrels. In addition, the Corpus Christi Crude Pipeline System is connected to third-party long-haul pipelines that transport crude oil from the Permian Basin region to Corpus Christi, Texas.

Our Permian Crude System consists of crude oil transportation, pipeline connection and storage assets located in the Midland Basin of West Texas, that aggregate receipts from wellhead connection lines into intra-basin trunk lines for delivery to regional hubs and to connections with third-party mainline takeaway pipelines. The system consists of 975 miles of pipelines and covers approximately 500,000 dedicated acres controlled by producers, with approximately 320 receipt points. The Permian Crude System also includes three terminals in Texas, at Big Spring, Stanton and Colorado City, as well as several truck stations and other operational storage facilities, with an aggregate storage capacity of 1.6 million barrels.

Central East System. The Central East System covers a total of 4,500 miles and consists of the East Pipeline, the North Pipeline and the Ammonia Pipeline.

The East Pipeline covers 2,050 miles and transports refined products and natural gas liquids north via pipelines to our terminals and third-party terminals along the system and to receiving pipeline connections in Kansas. Shippers on the East Pipeline obtain

refined products from refineries in Kansas, Oklahoma and Texas. The East Pipeline includes 18 truck-loading terminals, with storage capacity of 4.5 million barrels and two tank farms with storage capacity of 1.4 million barrels at McPherson and El Dorado, Kansas.

The North Pipeline originates at Marathon’s Mandan, North Dakota refinery and runs from west-to-east for approximately 450 miles to its termination in Minneapolis, Minnesota. The North Pipeline includes four truck-loading terminals with storage capacity of 1.5 million barrels.

The 2,000-mile Ammonia Pipeline originates in the Louisiana delta area, where it connects to three third-party marine terminals and three anhydrous ammonia plants located along the Mississippi River. The line then runs north through Louisiana and Arkansas into Missouri, where, at Hermann, Missouri, it splits into two branches, one of which goes east into Illinois and Indiana, while the other branch continues north into Iowa and then turns west into Nebraska. The Ammonia Pipeline is connected to multiple third-party-owned terminals, which include industrial facility delivery locations. Product is supplied to the pipeline from anhydrous ammonia plants in Louisiana and imported product delivered through the marine terminals. Anhydrous ammonia is primarily used as agricultural fertilizer. It is also used as a feedstock to produce other nitrogen derivative fertilizers and explosives.

Pipeline Operations

We charge tariffs on a per-barrel basis for transporting refined products, crude oil and other feedstocks in our refined product and crude oil pipelines and on a per-ton basis for transporting anhydrous ammonia in the Ammonia Pipeline. Fees related to storage facilities included with these pipeline systems predominately relate to the volumes transported on the pipelines and are included in the respective pipeline tariff. As a result, these storage facilities are included in this segment instead of the storage segment.

In general, shippers on our crude oil and refined product pipelines deliver petroleum products to our pipelines for transport to/from: (i) refineries that connect to our pipelines, (ii) third-party pipelines or terminals and (iii) our terminals for further delivery to marine vessels or pipelines. We charge our shippers tariff rates based on transportation from the origination point on the pipeline to the point of delivery.

Our pipelines are regulated by one or more of the following federal governmental agencies: the Federal Energy Regulatory Commission (the FERC), the Surface Transportation Board (the STB), the Department of Transportation (the DOT), the Environmental Protection Agency (the EPA) and the Department of Homeland Security. In addition, our pipelines are subject to the respective jurisdictions of the states those lines traverse. See “Rate Regulation” and “Environmental, Health, Safety and Security Regulation” below for additional discussion.

The majority of our pipelines are deemed to be “common carrier” lines. Common carrier activities are those for which transportation is available to any shipper who requests such services and satisfies the conditions and specifications for transportation. Published tariffs for our petroleum product pipeline shipments are (i) filed with the FERC for interstate pipeline shipments and (ii) filed with the relevant state authority for intrastate pipeline shipments.

We operate our pipelines remotely through an operational technology system called the Supervisory Control and Data Acquisition, or SCADA, system.

Demand for and Sources of Refined Products and Crude Oil

Throughput activity on our Central West Refined Product Pipelines and the East and North Pipelines depends on the level of demand for refined products and other products in the markets served by those pipelines, as well as the ability and willingness of the refiners and marketers with access to the pipelines to supply that demand through our pipelines. Demand for renewable products handled by our pipeline systems, such as biodiesel and ethanol, is driven by the overall level of demand for refined products mentioned above, as well as regulatory requirements and our customers’ goals to increase their use of renewable fuels.

The majority of the refined products delivered through the Central West Refined Product Pipelines and the North Pipeline are gasoline and diesel fuel that originate at refineries connected to our pipelines. Demand for motor fuels fluctuates as prices for these products fluctuate. Prices fluctuate for a variety of reasons, including the overall balance in supply and demand, which is affected by general economic conditions, among other factors. Prices for gasoline and diesel fuel usually increase in the warm weather months when people tend to drive automobiles more often and for longer distances.

Much of the refined products and natural gas liquids delivered through the East Pipeline, and a portion of volumes on the North Pipeline, are ultimately used as fuel for railroads, ethanol denaturant or in agricultural operations, including fuel for farm equipment, irrigation systems, trucks used for transporting crops and crop-drying facilities. Demand for refined products for agricultural use, and the relative mix of products required is affected by weather conditions in the markets served by the East and North Pipelines. The agricultural sector is also affected by government agricultural policies and crop commodity prices.

Although periods of drought suppress agricultural demand for some refined products, particularly those used for fueling farm equipment, the demand for fuel to power irrigation systems often increases during such times. The mix of refined products delivered for agricultural use varies seasonally, with gasoline demand peaking in early summer, diesel fuel demand peaking in late summer and propane demand highest in the fall.

Our refined product pipelines are also dependent upon adequate levels of production of refined products by refineries connected to the pipelines, directly or through connecting pipelines. The refineries are, in turn, dependent upon adequate supplies of suitable grades of crude oil. Certain of our Central West Refined Products Pipelines are connected directly to Valero Energy refineries and are subject to long-term throughput agreements with Valero Energy. If operations at one of these refineries were discontinued or significantly reduced, it could have a material adverse effect on our operations, although we would endeavor to minimize the impact by seeking alternative customers for those pipelines.

The North Pipeline is heavily dependent on Marathon’s Mandan, North Dakota refinery, which primarily runs North Dakota crude oil (although it has the ability to process other crude oils), and an interruption in operations at the Marathon refinery could have a material adverse effect on our operations. In addition, the North Pipeline receives refined products from the Laurel, Montana refinery operated by CHS Inc. The majority of the refined products transported through the East Pipeline are produced at three refineries located at McPherson and El Dorado, Kansas and Ponca City, Oklahoma, which are operated by CHS Inc., HollyFrontier Corporation and Phillips 66, respectively. The East Pipeline also has access to Gulf Coast supplies of products through third-party connecting pipelines that receive products originating from Gulf Coast refineries.