UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

OR | |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended | |

OR | |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

OR | |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

Date of event requiring this shell company report . . . . . . . . . . . . . . . . . . .

For the transition period from ___________ to __________

Commission file number :

(Exact name of Registrant as specified in its charter) |

N/A |

(Translation of Registrant’s name into English) |

(Jurisdiction of incorporation or organization) |

(Address of principal executive offices) |

Phone ( Email |

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of Each Class | Trading Symbol(s) | Name of Each Exchange On Which Registered |

Ordinary shares, par value US$0.0001 per share | 9999 | The Stock Exchange of Hong Kong Limited |

*Not for trading, but only in connection with the listing of American depositary shares on the NASDAQ Global Select Market.

Securities registered or to be registered pursuant to Section 12(g) of the Act:

NONE |

(Title of Class) |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

NONE |

(Title of Class) |

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or (15) (d) of the Securities Exchange Act of 1934.

☐ Yes ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Accelerated filer ☐ | Non-accelerated filer ☐ | Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| International Financial Reporting Standards as issued |

| Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐ Yes

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

☐ Yes ☐ No

TABLE OF CONTENTS

Page | ||

1 | ||

5 | ||

5 | ||

5 | ||

5 | ||

68 | ||

121 | ||

153 | ||

160 | ||

170 | ||

171 | ||

171 | ||

186 | ||

187 | ||

191 | ||

191 | ||

Material Modifications to the Rights of Security Holders and Use of Proceeds | 191 | |

191 | ||

191 | ||

191 | ||

192 | ||

192 | ||

Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 193 | |

193 | ||

194 | ||

194 | ||

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | 194 | |

194 | ||

194 | ||

194 | ||

195 | ||

i

INTRODUCTION

This annual report on Form 20-F includes our audited consolidated financial statements as of December 31, 2021 and 2022 and for the years ended December 31, 2020, 2021 and 2022. Translations in this annual report of amounts from RMB into U.S. dollars for the convenience of the reader were calculated at the noon buying rate of US$1.00: RMB6.8972 on the last trading day of 2022 (December 30, 2022) as set forth in the H.10 statistical release of the U.S. Federal Reserve Board.

Conventions that Apply to This Annual Report on Form 20-F

Unless the context otherwise requires, references in this annual report on Form 20-F to:

| ● | “2009 RSU Plan” are to our 2009 Restricted Share Unit Plan adopted in November 2009; |

| ● | “2019 Share Plan” are to our Amended and Restated 2019 Share Incentive Plan adopted in October 2019 and amended and restated in February 2023; |

| ● | “ADSs” are to the American depositary shares, each of which represents five ordinary shares; |

| ● | “Boguan” are to Guangzhou Boguan Telecommunication Technology Co., Ltd., a company established under PRC laws; |

| ● | “CAC” are to the Cyberspace Administration of China; |

| ● | “CBIRC” are to the China Banking and Insurance Regulatory Commission; |

| ● | “CBRC” are to the China Banking Regulatory Commission; |

| ● | “CCASS” are to the Central Clearing and Settlement System established and operated by Hong Kong Securities Clearing Company Limited, a wholly-owned subsidiary of Hong Kong Exchange and Clearing Limited; |

| ● | “CCGs” are to collectible card games; |

| ● | “China” or the “PRC” are to the People’s Republic of China; and only in the context of describing PRC rules, laws, regulations, regulatory authority and other legal or tax matters in this annual report, excludes Taiwan, Hong Kong, and Macau (also referred to as “China mainland” or “Chinese mainland” in this annual report); |

| ● | “Cloud Music” are to Cloud Music Inc. (formerly named Cloud Village Inc.), a company incorporated under Cayman Islands laws, and listed on the Hong Kong Stock Exchange under the stock code “9899” in December 2021 and a majority-controlled subsidiary of our company; |

| ● | “CSRC” are to the China Securities Regulatory Commission; |

| ● | “GAPP” are to the General Administration of Press and Publication of China, currently known as the NPPA; |

| ● | “Guangzhou NetEase” are to Guangzhou NetEase Computer System Co., Ltd., a company established under PRC laws; |

| ● | “Hangzhou Leihuo” are to Hangzhou NetEase Leihuo Technology Co., Ltd. (formerly named Hangzhou NetEase Leihuo Network Co., Ltd.), a company established under PRC laws; |

| ● | “Hangzhou NetEase Cloud Music” are to Hangzhou NetEase Cloud Music Technology Co., Ltd., a company established under PRC laws; |

| ● | “Hangzhou Yuedu” are to Hangzhou Yuedu Technology Co., Ltd., a company established under PRC laws; |

| ● | “HK$” or “HK dollars” are to the legal currency of Hong Kong; |

1

| ● | “HNTEs” are to High and New Technology Enterprises; |

| ● | “Hong Kong Listing Rules” are to the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited, as amended or supplemented from time to time; |

| ● | “Hong Kong Stock Exchange” are to The Stock Exchange of Hong Kong Limited; |

| ● | “Hong Kong NetEase” are to Hong Kong NetEase Interactive Entertainment Limited, a company incorporated under Hong Kong laws; |

| ● | “ICP(s)” are to internet content provider(s); |

| ● | “in-house developed games” are primarily to games developed solely by our game development teams as well as, in some instances, games co-developed with our collaboration partners; |

| ● | “MAUs” for Cloud Music’ online music services are to the monthly average number of users in a given period that have accessed the NetEase Cloud Music application at least once in a given month through mobile devices or PC devices, as the case may be; duplicate access is eliminated from the calculation based on our estimates by user account; |

| ● | “MAUs” for Youdao are to the average of the monthly number of unique mobile or PC devices, as the case may be, through which such product and service is accessed at least once in that month (duplicate access to different products and services is not eliminated from the calculation) for a specific period with respect to each of Youdao’s products and services (except for smart devices). MAUs for Youdao are calculated using internal company data, treating each distinguishable device as a separate MAU even though some users may access Youdao’s products and services using more than one device and multiple users may access our services using the same device; |

| ● | “MMORPGs” are to massively multi-player online role-playing games; |

| ● | “MII” and later “MIIT” are to the Ministry of Information Industry of China, which later became the Ministry of Industry and Information Technology of China; |

| ● | “MOBA” are to multi-player online battle arena; |

| ● | “MOC” and later “MOCT” are to the Ministry of Culture of China which later became the Ministry of Culture and Tourism of China; |

| ● | “MOF” are to the Ministry of Finance of China; |

| ● | “MOFCOM” are to the Ministry of Commerce of China; |

| ● | “NCIIC” are to the Ministry of Public Security’s National Citizen Identity Information Center of China; |

| ● | “NDRC” are to the National Development and Reform Commission of China; |

| ● | “NetEase Hangzhou” are to NetEase (Hangzhou) Network Co., Ltd., a company established under PRC laws; |

| ● | “NMT” are to neural machine translation; |

| ● | “NPPA” are to the National Press and Publication Administration of China; |

| ● | “NRTA” are to the National Radio and Television Administration of China; |

| ● | “OCR” are to optical character recognition; |

2

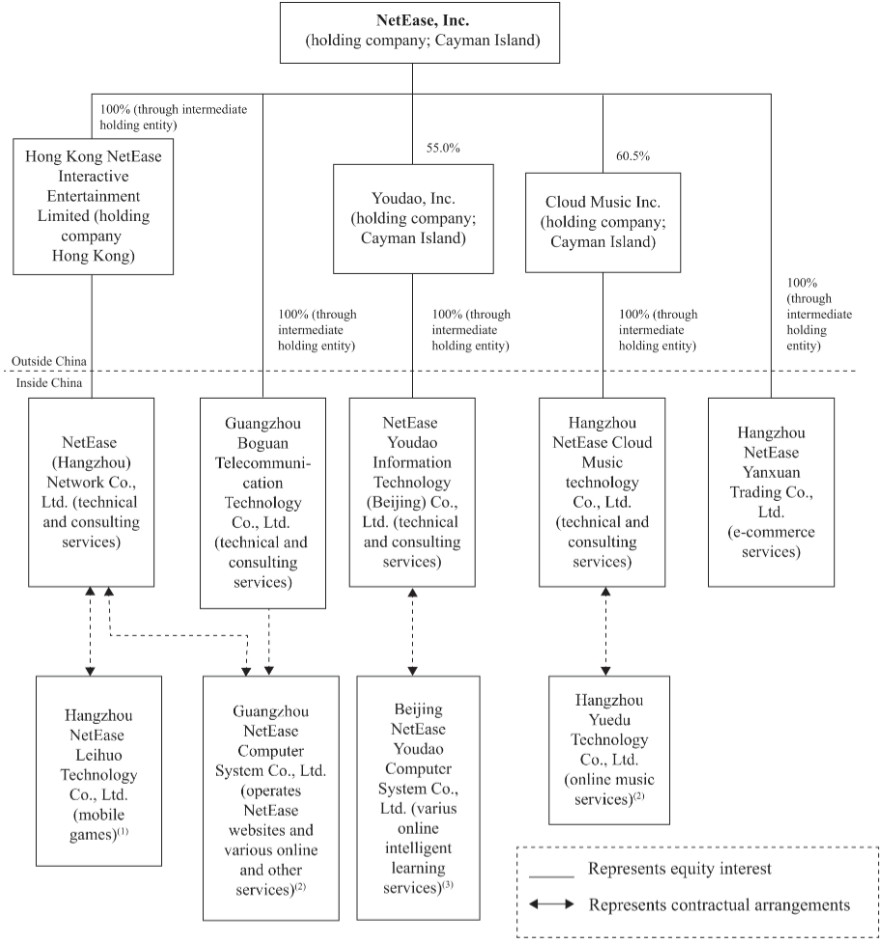

| ● | “our company” are to NetEase, Inc., which is not a PRC operating company but a Cayman Islands holding company with operations primarily conducted through (i) our China mainland subsidiaries and (ii) contractual arrangements with the variable interest entities, or the VIEs, based in China mainland. This structure entails unique risks to investors, see Item 3.D. “Key Information—Risk Factors—Risks Related to Our Corporate Structure” for additional information; |

| ● | “R&D” are to research and development; |

| ● | “RMB” or “Renminbi” are to the legal currency of the People’s Republic of China; |

| ● | “RPGs” are to role-playing games; |

| ● | “PBOC” are to the People’s Bank of China; |

| ● | “SAFE” are to the State Administration of Foreign Exchange of China; |

| ● | “SAIC” are to the State Administration for Industry and Commerce of China, currently known as SAMR; |

| ● | “SAMR” are to the State Administration for Market Regulation of China; |

| ● | “SAPPRFT” are to State Administration of Press, Publication, Radio, Film and Television of China, formerly the General Administration of Press and Publication of China and the State Administration of Radio, Film and Television of China, and since March 2018 has been reformed and became the National Radio and Television Administration and the National Press and Publication Administration (National Copyright Administration); |

| ● | “SCIO” are to the State Council Information Office of China; |

| ● | “SEC” are to the United States Securities and Exchange Commission; |

| ● | “SFO” are to the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong), as amended or supplemented from time to time; |

| ● | “shareholder(s)” are to holder(s) of shares and, where the context requires, ADSs; |

| ● | “share(s)” or “ordinary share(s)” are to ordinary share(s) of our company with par value of US$0.0001 per share; |

| ● | “SLGs” are to simulation games; |

| ● | “STA” are to the State Taxation Administration of China; |

| ● | “State Council” are to the State Council of China; |

| ● | “US$,” “dollars” and “U.S. dollars” are to the legal currency of the United States; |

| ● | “U.S. Exchange Act” are to the United States Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder; |

| ● | “U.S. GAAP” are to accounting principles generally accepted in the United States; |

| ● | “we,” “us,” “our,” “NetEase” or “NetEase group” are to NetEase, Inc., its subsidiaries, and, in the context of describing our operations and consolidated financial information, the variable interest entities in China mainland, including, but not limited to, Guangzhou NetEase, Hangzhou Leihuo, Youdao Computer and Hangzhou Yuedu; all of the variable interest entities are domestic companies incorporated in China mainland in which we do not have any equity ownership but whose financial results have been consolidated into our consolidated financial statements based solely on contractual arrangements in accordance with U.S. GAAP. See Item 4.B. “Information on the Company—Business Overview—Our Organizational Structure” for an illustrative diagram of our corporate structure; |

3

| ● | “Youdao” are to Youdao, Inc., a company incorporated under Cayman Islands laws, and listed on The New York Stock Exchange under the symbol “DAO” in October 2019 and a majority-controlled subsidiary of our company; |

| ● | “Youdao Computer” are to Beijing NetEase Youdao Computer System Co., Ltd., a company established under PRC laws; and |

| ● | “Youdao Information” are to NetEase Youdao Information Technology (Beijing) Co., Ltd., a company established under PRC laws. |

Trademarks and Service Marks

We own or have been licensed the rights to trademarks, service marks and trade names for use in connection with the operation of our business. All other trademarks, service marks or trade names appearing in this annual report that are not identified as marks owned by us are the property of their respective owners.

Solely for convenience, some trademarks, service marks and trade names referred to in this annual report are listed without the ®, (TM) and (sm) symbols, but we will assert, to the fullest extent under applicable law, our applicable rights in these trademarks, service marks and trade names.

Forward-Looking Information

This annual report on Form 20-F contains statements of a forward-looking nature. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. You can identify these forward-looking statements by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates” and similar statements. The accuracy of these statements may be impacted by a number of business risks and uncertainties that could cause actual results to differ materially from those projected or anticipated, including:

| ● | the risk that the online game market, including mobile games and PC games, will not continue to grow or that we will not be able to maintain our leading position in that market, which could occur if, for example, our new online games or expansion packs and other improvements to such existing games do not become as popular as management anticipates; |

| ● | the risk that we will not be successful in our product diversification efforts, including the expansion of our mobile and other games into overseas markets, our entry into strategic licensing arrangements and the expansion of our streaming music offerings and online education services; |

| ● | the risk of changes in Chinese government regulation of the online game, online education, online music, live streaming, e-commerce or online advertising markets that limit future growth of our revenues or cause our revenues to decline; |

| ● | the risk that we may not be able to continuously develop new and creative online services or that we will not be able to set, or follow in a timely manner, trends in the market; |

| ● | the risk that we will not be able to control our expenses in future periods; |

| ● | the risk related to governmental uncertainties (including possible changes in the effective tax rates applicable to us and our subsidiaries and affiliates and our ability to receive and maintain approvals of the preferential tax treatments), general competition and price pressures in the marketplace; |

| ● | the risk related to economic uncertainty and capital market disruption, which are significantly impacted by rising inflation and geopolitical instability; |

| ● | the risk related to the expansion of our businesses and operations internationally; |

| ● | the risk that fluctuations in the value of the Renminbi with respect to other currencies could adversely affect our business and financial results; and |

| ● | other risks outlined in our filings with the SEC. |

We do not undertake any obligation to update this forward-looking information, except as required under applicable law.

4

PART I.

Item 1. Identity of Directors, Senior Management and Advisors

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

Our Corporate Structure and Contractual Arrangements with the Variable Interest Entities

NetEase, Inc. is not a PRC operating company but a Cayman Islands holding company with operations primarily conducted through (i) our subsidiaries incorporated in China mainland, or China mainland subsidiaries, and (ii) contractual arrangements with the variable interest entities based in China mainland. Our online games, music streaming, online intelligent learning services and internet content services businesses in China mainland have been conducted through the applicable VIEs in order to comply with the laws and regulations of China mainland, which restrict and impose conditions on foreign direct investment in companies involved in the provision of such businesses. Accordingly, we operate these businesses in China mainland through the variable interest entities, and rely on contractual arrangements among NetEase, Inc., our China mainland subsidiaries, the variable interest entities and their nominee shareholders to control the business operations of the variable interest entities. In 2020, 2021 and 2022, the amount of revenues generated by the VIEs accounted for 84.4%, 85.9% and 86.4%, respectively, of our total net revenues. As of December 31, 2021 and 2022, total assets of the VIEs, excluding amounts due from other companies in the NetEase group, represented 8.5% and 7.1% of our consolidated total assets as of the same dates, respectively. As used in this annual report, “our company” refers to NetEase, Inc., whereas “we,” “us,” “our,” “NetEase” or “NetEase group” refers to NetEase, Inc., its subsidiaries, and, in the context of describing our operations and consolidated financial information, the variable interest entities in China mainland. All of the variable interest entities are domestic companies incorporated in China mainland in which we do not have any equity ownership, but their financial results have been consolidated into our consolidated financial statements based solely on contractual arrangements in accordance with U.S. GAAP. Investors in our ADSs or ordinary shares are not purchasing equity interest in the variable interest entities in China mainland but instead are purchasing equity interest in a holding company incorporated in the Cayman Islands.

Our subsidiaries, the variable interest entities and their nominee shareholders have entered into a series of contractual agreements. These contractual arrangements:

| ● | enable us to receive the economic benefits that could potentially be significant to the variable interest entities in consideration for the services provided by our subsidiaries; and |

| ● | effectively assigned all of the voting rights underlying the nominee shareholders’ equity interest in the variable interest entities to us. |

These contractual arrangements among NetEase, Inc., our subsidiaries, the variable interest entities and their nominee shareholders generally include shareholder voting rights trust agreements, loan agreements, operating agreements or cooperation agreements, license agreements and purchase and equity pledge agreements, as the case may be. For additional information on these contractual arrangements, see Item 7.B. “Major Shareholders and Related Party Transactions—Related Party Transactions—Material VIE Agreements.” As a result of the contractual arrangements, the shareholders of the variable interest entities effectively assigned all of their voting rights underlying their equity interest in the variable interest entities to the primary beneficiaries of these companies, which gives our company or its subsidiaries the power to direct the activities that most significantly impact the variable interest entities’ economic performance. However, the contractual arrangements may not be as effective as direct ownership in providing us with control over the variable interest entities, and we may incur substantial costs to enforce the terms of the arrangements. If the variable interest entities or the nominee shareholders fail to perform their respective obligations under the contractual arrangements, we could be limited in our ability to enforce the contractual arrangements that effectively assigned us the voting rights in the variable interest entities. As of the date of the filing of this annual report, to the best knowledge of NetEase, our directors and management, the contractual arrangements with the VIEs have not been tested in a court of law in China mainland. Furthermore, if we are unable to maintain such effective assignment, we would not be able to continue to consolidate the financial results of these entities in our financial statements. See Item 3.D. “Key Information—Risk Factors—Risks Related to Our Corporate Structure.”

5

There are also substantial uncertainties regarding the interpretation and application of current and future laws, regulations and rules of China mainland regarding the status of the rights of our Cayman Islands holding company with respect to its contractual arrangements with the variable interest entities and their nominee shareholders. It is uncertain whether any new laws or regulations of China mainland relating to variable interest entity structures will be adopted or if adopted, what they would provide. If we or any of the variable interest entities is found to be in violation of any existing or future laws or regulations of China mainland, or fail to obtain or maintain any of the required permits or approvals, the relevant PRC regulatory authorities would have broad discretion in accordance with the applicable laws and regulations to take action in dealing with such violations or failures. See Item 3.D. “Key Information—Risk Factors—Risks Related to Our Corporate Structure—There are substantial uncertainties regarding the interpretation and application of current and future PRC laws, regulations, and rules relating to the agreements that establish the VIE structure for our operations in China, including potential future actions by the PRC government, which could affect the enforceability of our contractual arrangements with the VIEs and, consequently, significantly affect the financial condition and results of operations performance of NetEase. If the PRC government finds such agreements non-compliant with relevant PRC laws, regulations, and rules, or if these laws, regulations, and rules or the interpretation thereof change in the future, we could be subject to severe penalties or be forced to relinquish our interests in the VIEs.”

Although the Foreign Investment Law of the China mainland does not explicitly classify contractual arrangements as a form of foreign investment, the definition of “foreign investment” thereunder is relatively wide and contains a catch-all provision which includes investments made by foreign investors through means stipulated in laws or administrative regulations or other methods prescribed by the State Council. Therefore, there is no assurance that foreign investment via contractual arrangement would not be interpreted as a type of indirect foreign investment activities in the future. If any of the variable interest entities were deemed as a foreign-invested enterprise under any such future laws, administrative regulations or provisions and any of our business would be included in any negative list or other form of restrictions on foreign investment, we may need to take further actions to comply with such future laws, administrative regulations or provisions. Such actions may have a material and adverse impact on our business, financial condition, result of operations and prospects. In addition, if the PRC regulatory authorities were to find our legal structure and contractual arrangements to be in violation of any laws, administrative regulations or provisions of China mainland, we are uncertain what impact of above PRC regulatory authorities’ actions would have on us and our ability to consolidate the variable interest entities in the consolidated financial statements. For more details, see Item 3.D. “Key Information—Risk Factors—Risks Related to Our Corporate Structure— Substantial uncertainties exist with respect to how the 2019 Foreign Investment Law may impact the viability of our current corporate structure, corporate governance and business operations.”

The necessary licenses to conduct many of our businesses in China mainland, including to operate our online games, music streaming, online intelligent learning services and internet content services businesses, are held by the variable interest entities and, as noted above, a significant part of our revenues are generated by the variable interest entities. An event that results in the deconsolidation of the variable interest entities would have a material effect on our operations and result in the value of the securities of our company diminishing substantially or even become worthless. Our company, our China mainland subsidiaries and the variable interest entities, and investors of our company face uncertainty about potential future actions by the PRC government that could affect the enforceability of the contractual arrangements with the variable interest entities and, consequently, significantly affect the financial performance of the variable interest entities and our company as a whole. NetEase, Inc. may not be able to repay its indebtedness, and the ADSs or ordinary shares of our company may decline in value or become worthless, if we are unable to assert our contractual control rights over the assets of our China mainland subsidiaries and the variable interest entities that conduct a major portion of our operations. For a detailed description of the risks associated with our corporate structure, please refer to risks disclosed under Item 3.D. “Key Information—Risk Factors—Risks Related to Our Corporate Structure.”

6

The PRC government has significant authority to exert influence on the ability of a China-based company, like us, to conduct its business, accept foreign investments or be listed on a U.S. stock exchange. We also face risks associated with recent statements and regulatory actions by the PRC government, including those related to regulatory approvals of offshore securities offerings, anti-monopoly regulatory investigations and actions, cybersecurity and data privacy compliance. For example, the PRC government has recently indicated an intent to exert more oversight over overseas securities offerings and published a series of laws and regulations to regulate such transactions. If the CSRC, CAC or other PRC regulatory agencies determine that prior approval is required for any of our offerings of securities overseas or maintenance of the trading status of our ADSs or ordinary shares, we cannot guarantee that we will be able to obtain such approval in a timely manner, or at all. The CSRC, CAC or other PRC regulatory agencies may also take actions requiring us, or making it advisable for us, not to proceed with such offering or maintain the trading status of our ADSs or ordinary shares. If we proceed with any of such offering or maintain the trading status of our ADSs or ordinary shares without obtaining the CSRC’s, CAC’s or other PRC regulatory agencies’ approval to the extent it is required, or if we are unable to comply with any new approval requirements which might be adopted for offerings that we have completed, we may face regulatory actions or other sanctions from the CSRC, CAC or other PRC regulatory agencies. These regulatory agencies may impose fines and penalties on our operations in China, limit our ability to pay dividends outside of China or accept foreign investments, delay or restrict the repatriation of the proceeds from offering of securities overseas into China or take other actions that could have a material adverse effect on our business, financial condition, results of operations and prospects, as well as the trading price of our ordinary shares or ADSs.

The PRC government may also intervene with or influence our operations as it deems appropriate to further regulatory, political and societal goals. The PRC government has recently published new policies that affected various industries, including industries in which we operate in, and we cannot rule out the possibility that it will in the future release regulations or policies regarding our industry that could adversely affect our business, financial condition and results of operations. Any such action, once taken by the PRC government, could cause the value of our securities to significantly decline or become worthless.

For more information on the permissions required from the PRC authorities for our operations and offerings, please also see Item 4.B. “Information on the Company—Business Overview—Permissions Required from the PRC Authorities for Our Operations and Offerings.”

For information on transfers of funds within the NetEase group, certain financial information of NetEase, Inc., its subsidiaries and the VIEs and the restrictions on foreign exchange and the ability to transfer cash between entities, across borders and to U.S. investors, see Item 5.B. “Operating and Financial Review and Prospects—Liquidity and Capital Resources—Transfer of Funds” and “Operating and Financial Review and Prospects—Liquidity and Capital Resources—Management of Capital Resources,” Item 10.E. “Additional Information—Taxation” and Item 10.D. “Additional Information—Exchange Controls.”

7

The Holding Foreign Companies Accountable Act

Pursuant to the Holding Foreign Companies Accountable Act, if the SEC determines that we have filed audit reports issued by a registered public accounting firm that has not been subject to inspections by the PCAOB for two consecutive years, the SEC will prohibit our shares or the ADSs from being traded on a national securities exchange or in the over-the-counter trading market in the United States. On December 16, 2021, the PCAOB issued a report to notify the SEC of its determination that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in China mainland and Hong Kong, including our auditor. In May 2022, the SEC conclusively listed us as a Commission-Identified Issuer under the HFCAA following the filing of our annual report on Form 20-F for the fiscal year ended December 31, 2021. On December 15, 2022, the PCAOB issued a report that vacated its December 16, 2021 determination and removed China mainland and Hong Kong from the list of jurisdictions where it is unable to inspect or investigate completely registered public accounting firms. For this reason, we do not expect to be identified as a Commission-Identified Issuer under the HFCAA after we file this annual report on Form 20-F. Each year, the PCAOB will determine whether it can inspect and investigate completely audit firms in China mainland and Hong Kong, among other jurisdictions. If the PCAOB determines in the future that it no longer has full access to inspect and investigate completely accounting firms in China mainland and Hong Kong and we continue to use an accounting firm headquartered in one of these jurisdictions to issue an audit report on our financial statements filed with the Securities and Exchange Commission, we would be identified as a Commission-Identified Issuer following the filing of the annual report on Form 20-F for the relevant fiscal year. There can be no assurance that we would not be identified as a Commission-Identified Issuer for any future fiscal year, and if we were so identified for two consecutive years, we would become subject to the prohibition on trading under the HFCAA. See Item 3.D. “Key Information—Risk Factors—Risks related to Our ADSs and Shares—The PCAOB had historically been unable to inspect our auditor in relation to their audit work performed for our financial statements and the inability of the PCAOB to conduct inspections of our auditor in the past has deprived our investors with the benefits of such inspections.” and Item 3.D. “Key Information—Risk Factors—Risks related to Our ADSs and Shares—Our ADSs may be prohibited from trading in the United States under the Holding Foreign Companies Accountable Act, or the HFCAA, in the future if the PCAOB is unable to inspect or fully investigate auditors located in China. The delisting of our ADSs, or the threat of their being delisted, may materially and adversely affect the value of your investment.”

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Summary of Risk Factors

An investment in our ADSs or ordinary shares involves significant risks. Below is a summary of material risks we face, organized under relevant headings. All the operational risks associated with being based in and having operations in China mainland also apply to operations in Hong Kong. With respect to the legal risks associated with being based in and having operations in China mainland, the laws, regulations and the discretion of China mainland governmental authorities discussed in this annual report are expected to apply to China mainland entities and businesses, rather than entities or businesses in Hong Kong which operate under a different set of laws from China mainland. These risks are discussed more fully in Item 3.D. “Key Information—Risk Factors.”

Risks Related to Our Business and Industry

| ● | Risks Related to Our Games and Related Value-added Services |

| ● | Risks relating to developing new online games and growing the popularity of existing online games |

| ● | Risks relating to claims regarding our gaming contents resulting in negative publicity or a governmental response |

8

| ● | Risks relating to additional restrictions to limit online game playing by the Chinese government |

| ● | Risks relating to uncertainties in obtaining approval for new games |

| ● | Risks relating to laws, regulations policies and guidelines applicable to the live streaming and online entertainment industries |

| ● | Risks relating to international operations of our online games |

| ● | Risks relating to third-party platforms that distribute our mobile games and collect payments |

| ● | Risks relating to maintaining our existing licenses of game or intellectual property |

| ● | Risks relating to illegal game servers, acts of cheating by players and sales and purchases by players of our game accounts and virtual items through third-party auction websites |

| ● | Risks Related to Our Other Businesses |

| ● | Risks relating to changes in Youdao’s business strategies and offerings |

| ● | Risks relating to Youdao business’s compliance with the Opinions on Further Alleviating the Burden of Homework and After-School Tutoring for Students in Compulsory Education and the implementation measures |

| ● | Risks relating to changes in user acceptance of Youdao, and market trend of integration of technology and learning, and the development and application of our technologies to support and expand Youdao’s product and services |

| ● | Risks relating to obtaining legal and regulatory approvals, licenses or permits of our intelligent learning, music streaming, e-commerce, advertising and other innovative businesses |

| ● | Risks relating to obtaining licenses for the music content necessary to provide our music streaming services, and our ability to attract and retain users |

| ● | Risks relating to generating and maintaining significant advertising revenue |

| ● | Risks relating to growing our e-commerce business |

| ● | Risks Related to Our Operations Overall |

| ● | Risks relating to competing successfully against new entrants and established industry competitors and keeping up with rapid changes in technologies and user behavior and innovating and exploring new areas of operations |

| ● | Risks relating to gross profit margin and profitability affected by changes in our mix of revenues |

| ● | Risks relating to credit risk on our accounts receivable |

| ● | Risks relating to a prolonged slowdown in the PRC or global economy |

| ● | Risks relating to economic uncertainty and capital market disruptions caused by rising inflation and geopolitical instability |

| ● | Risks relating to compliance with laws and other obligations regarding data protection in China and outside of China |

| ● | Risks relating to breaches of our information technology systems and system failure or performance inadequacy that causes interruptions of our services |

9

| ● | Risks relating to our ability to retain our existing key employees and to add and retain senior officers to our management |

| ● | Risks relating to natural disasters, widespread public health problems, other outbreaks and epidemics and other events |

| ● | Risks relating to the expansion of our businesses and operations internationally |

Risks Related to Our Corporate Structure

| ● | Risks relating to regulatory changes relating to the contractual arrangements with the VIEs and the viability of our current corporate structure, corporate governance and business operations |

| ● | Risks relating to maintaining operational control of the VIEs through contractual arrangements |

| ● | Risks relating to the shareholders who have significant influence over our company and the variable interest entities |

| ● | Risks relating to our arrangements with the variable interest entities |

Risks Related to Doing Business in China

| ● | Risks relating to China’s political and economic policies |

| ● | Risks relating to compliance with and changes in PRC laws and regulations relating to telecommunications, internet, foreign investment, tax, online games, virtual asset property rights, consumer protection and financial transactions |

| ● | Risks relating to claims and liabilities based on the information and content on our platforms |

| ● | Risks relating to uncertainties with respect to the interpretation and implementation of the anti-monopoly related laws in the field of internet platforms |

| ● | Risks relating to our ability to protect our intellectual property from being infringed |

| ● | Risks relating to currency exchange rates |

Risks Related to Our ADSs and Shares

| ● | Risks relating to being prohibited from trading on Nasdaq under the Holding Foreign Companies Accountable Act if the PCAOB cannot continue to inspect our independent registered public accounting firm for two consecutive years |

| ● | Risks relating to the volatility of the trading price of our ADSs and shares |

| ● | Risks relating to the different listing rules and regulations that apply to us |

| ● | Risks relating to the limitation of the voting, inspection and other rights of holders of ADSs |

You should carefully consider the following risk factors in addition to the other information set forth in this annual report. If any of the following risks were actually to occur, our business, financial condition and results of operations prospects could be adversely affected and the value of our ADSs and shares would likely suffer.

10

RISKS RELATED TO OUR BUSINESS AND INDUSTRY

Risks Related to Our Games and Related Value-added Services

If we fail to develop and introduce popular, high-quality online games in a timely and successful manner, we will not be able to compete effectively and our ability to generate revenues will suffer.

We operate in a highly competitive, quickly changing environment, and player preferences for online games are difficult to predict. Our future success depends not only on the popularity of our existing online games but also on our ability to develop new high-quality online games and expand our game portfolio with games in a variety of genres that are in line with market trends and to successfully monetize such games. The development of successful new online games can be challenging and requires high levels of innovation, a deep understanding of the online game industry in China and the other markets where our games are published (including with respect to evolving business models), and an ability to anticipate and effectively respond to changing interests and preferences of game players in a timely manner. Moreover, each of our new games requires long periods of time for research and development and testing, and also typically experiences a long ramp-up period as players become familiar with the game. If we are unsuccessful at developing and introducing new online games that are appealing to players with acceptable pricing and terms, our business, financial condition and results of operations will be negatively impacted because we would not be able to compete effectively and our ability to generate revenues would suffer.

In addition, new technologies in online game programming or operations could render our current online titles or games in development obsolete or unattractive to our players, thereby limiting our ability to recover development costs and potentially adversely affecting our future revenues and profitability. For example, in the past, when the gaming industry was transitioning to mobile games, we began devoting significant resources to developing games that can be operated on mobile devices. As of December 31, 2022, we had commercially launched over 100 mobile games, including the Fantasy Westward Journey mobile game, Westward Journey Online mobile game, Onmyoji, the mobile version of New Ghost, Invincible, Knives Out, Identity V, LifeAfter, Sky, Revelation mobile game, Harry Potter: Magic Awakened, Diablo® ImmortalTM and Eggy Party. While we continue to invest in mobile games, the market for mobile games is rapidly evolving with games in an expanding range of genres being introduced by us and our competitors, and we cannot guarantee that we will be able to effectively compete in the mobile game market. In June 2022, we further launched Naraka: Bladepoint on Xbox Series X and S and plan to launch numerous additional console games in the future. We will also need to continue investing in the development of new technologies, such as virtual reality, and bring new features and functionalities to our games, as well as enhance the user experience on our various platforms.

We are not able to predict if or when we will commercially launch additional new games and the pace at which our new games will penetrate the online game market in China or elsewhere, if at all. A number of factors, including technical difficulties, lack of sufficient game development capabilities, personnel and other resources and failure to obtain or delays in obtaining relevant governmental authorities’ approvals could result in delayed launching of our new games or the cancellation of the development of our pipeline games. Any delays in product releases or problems arising following the commercial release of one or more new online games such as programming errors, or “bugs,” could negatively impact our business and reputation and could cause our results of operations to be materially different from expectations. We believe that expectations of players regarding the quality, performance and integrity of our online games and services are high, and if any of these issues occurs, players may stop playing our online games and may be less likely to return to such games as often in the future, which may negatively impact our business.

11

If we are unable to continue to extend the life of existing online games that will encourage continued engagement with the games through the addition of new features or functionalities, our business may be negatively impacted.

To prolong the lifespan of our online games, we need to continually improve and update them on a timely basis with new features and functionalities that appeal to existing game players, attract new game players and improve overall player loyalty to such games. As a result, we have devoted, and expect to continue to devote, significant resources to maintain and raise the popularity of our online games through the release of new versions and/or expansion packs on a periodic basis. Developing successful updates and expansion packs for our existing games depends on our ability to anticipate market trends in the online game industry. We must also collect and analyze player behavior data and feedback from our online community in a timely manner, and we must utilize this information to effectively incorporate features into our updates and expansion packs to improve the variety and attractiveness of our gameplay and any virtual items sold within the games.

In the course of operating online games, including the release of updates and expansion packs to existing games, certain game features may periodically be introduced, changed or removed. We cannot assure you that the introduction, change or removal of any game feature will be well received by our game players, who may decide to reduce or eliminate their playing time in response to any such introduction, change or removal. As a result, any introduction, change or removal of game features may adversely impact our business, financial condition and results of operations.

We are unable to predict whether these activities will be successful or adversely affect our profitability given the significant resources required. Moreover, because of the rapidly evolving nature of the online games market in China and elsewhere, we cannot estimate the total life cycle of any of our games, particularly our more recently launched mobile or PC games, and changes in players’ tastes or in the overall market for online games in China and elsewhere could alter the life cycle of each version or upgrade or even cause our players to stop playing our games altogether.

The Chinese government has taken steps to limit online game playing time for all minors and to otherwise control the content and operation of online games. These and any other new restrictions on online games may materially and adversely impact our business, financial conditions and results of operations.

As part of its anti-addiction online game policy, the Chinese government has taken several steps to discourage minors under the age of 18 from continuously playing online games once they exceed a set number of hours of continuous play. For example, in April 2007, GAPP and several other government authorities jointly promulgated the Notice Concerning the Protection of Minors’ Physical and Mental Well-being and Implementation of Anti-addiction System on Online Games, or the Anti-Addiction Notice, which confirmed the real-name verification proposal and required online game operators to develop and test their anti-addiction systems from April 2007 to July 2007, after which no online games can be registered or operated without an anti-addiction system in accordance with the Anti-Addiction Notice. Accordingly, we implemented our anti-addiction system to comply with the Anti-Addiction Notice. Since its implementation, we have not experienced a significant negative impact on our business as a result of the Anti-Addiction Notice. The Law of the PRC on the Protection of Minors (“Minors Protection Law”) issued by the National People’s Congress Standing Committee on September 4, 1991 was amended on October 17, 2020 and became effective on June 1, 2021, pursuant to which online game service providers are required to classify the game products in accordance with relevant regulations and standards, give age-appropriate tips and take technical measures to prevent minors from contacting improper game or game function. Violation of the Minors Protection Law could result in rectification, confiscation of illegal gains and penalties. In 2019, the GAPP restricted play of online gamers under 18 years old to 90 minutes on weekdays and three hours on weekends. In September 2021, the Chinese government and regulatory authorities further limited the play of online gamers under 18 by prohibiting play on weekdays and limiting playing for one hour a day on Fridays, Saturdays and Sundays.

12

To identify that a game player is a minor and thus subject to the online game anti-addiction system, a real-name registration system must be adopted to require players to register their real identity information before playing online games. Pursuant to the Notice Regarding the Initiation of Work on the Online Games Real-Name Verification System to Prevent Online Gaming Addiction, or the Commencement of Real-Name Authentication Notice, issued by eight government authorities on July 1, 2011, online game (excluding mobile game) operators must submit the identity information of game players which needs to be further verified to the National Citizen Identity Information Center, a subordinate public institution of the Ministry of Public Security, for verification since October 1, 2011, in an effort to prevent minors from using an adult’s ID to play online games. Violation of the Anti-addiction Notice and the Commencement of Real-name Authentication Notice could result in the termination of the operation of online games. On August 30, 2018, the Implementation Scheme on Comprehensive Prevention and Control of Adolescent Myopia, or the Implementation Scheme, was issued jointly by eight PRC regulatory authorities at the national level, including the NPPA and the NRTA. The Implementation Scheme provides that as a part of the plan to prevent myopia among children, the NPPA will control the number of new online games and take steps to restrict the amount of time children spend on playing online games. On October 25, 2019, the NPPA promulgated the Notice on Preventing Minors from Indulging in Online Games, according to which the length of minors’ use of online games should be strictly controlled. It requires all online game users to register their identification information. The total length of time for minors to access online games must be limited on a daily basis. Every day from 10:00 pm to 8:00 am the next day, online game companies are not permitted to provide game services to minors in any form. Game services provided to minors must not exceed three hours per day on public holidays and 1.5 hours on other days. In addition, online transactions are capped monthly at RMB200 or RMB400, depending on a minor’s age. On August 30, 2021, the NPPA issued the Notice on Further Strict Administration to Prevent Minors from Indulging in Online Games, which provides that online game operators may only provide one-hour online game services to minors from 8:00 p.m. to 9:00 p.m. on every Friday, Saturday, Sunday or PRC statutory holiday. In addition, the notice sets forth that all the online games must be connected to the real-name verification system for anti-addiction to online games operated by the NPPA, and online game operators may not provide game services in any form to any users without real-name registration and login. We have updated our anti-addiction systems accordingly to comply with the above-mentioned requirements. We do not believe that the Implementation Scheme has had or will have any material impact on our gaming operations because minors comprise only a small percentage of our total user base, but we cannot assure you that any future regulations or restrictive rules will not adversely affect our operations.

On July 10, 2019, the MOCT announced the abolishment of the Interim Measures for the Administration of Online Games, or the Online Games Measures, which had previously regulated activities related to the online game industry, including requirements that game operators follow new registration procedures, publicize information about the content and suitability of their games, prevent access by minors to inappropriate games, avoid certain types of content in games targeted to minors, avoid game content that compels players to kill other players, manage virtual currency in certain ways and register users with their real identities. As of the date of the filing of this annual report, no laws and regulations had been promulgated or published to replace the Online Games Measures. We cannot be sure if or when any future regulations or restrictive rules in this regard will be promulgated and whether they would negatively impact our operations, including by increasing our compliance costs and negatively impacting our ability to launch and operate new games.

Any difficulties or delays in receiving approval from the relevant government authorities for our new games or new expansion packs for, or material changes to, our existing games could adversely affect such games’ popularity and profitability.

All games we release in China require government approvals. Moreover, even after certain games have received government approvals, certain expansion packs with material changes to the content and additions to the descriptions of those games may require further government approvals. We cannot be certain of the duration of any necessary approval processes, and any delay in receiving such government approvals may adversely affect the profitability and popularity of such games. In particular, game approvals experienced certain delays from March 29, 2018 to December 28, 2018 and again from July 23, 2021 to April 10, 2022 respectively, during which periods the PRC game regulatory authority, the NPPA, did not release any new domestic online game approvals. We are not certain of the cause of the delays. In addition, no laws, regulations or official clarifications had been promulgated or published in relation to such delay and resumption of the assessment and pre-approval procedures. The approval process returned to normal from April 11, 2022, but we cannot predict whether there will be any similar delays in the future, and the effect any future delay in approvals may have on our results of operations. Moreover, we are required to have an Online Publishing Service License issued by the NPPA in order to obtain any such approvals. Our current license has expired, and we are in the process of renewing it, although we cannot be certain if or when such renewal will be granted. During this renewal period, our operations have not been materially affected.

13

According to several news reports in December 2018, PRC regulators established the Online Games Ethics Committee for the purpose of reviewing online games, and based on the assessment conducted by the Online Games Ethics Committee, PRC regulators reviewed and rejected nine of an initial batch of 20 games. As of the date of the filing of this annual report, no official laws and regulations had been promulgated or published in relation to the assessment criteria and procedures of the Online Games Ethics Committee. However, the formation of the Online Games Ethics Committee and its assessment criteria and procedures could impact our ability to launch and publish new games in China mainland going forward, and require us to spend more time and costs in preparing and receiving the approvals necessary to launch our games. In addition, our games that have already received the relevant pre-approval may also be subject to further review by the Online Games Ethics Committee, and we may be required to modify the content of our games, which will further add to our regulatory compliance costs and expenses.

We are subject to laws related to live streaming and online entertainment industries. Any failure to comply with or any changes in the applicable laws, regulations, policies and guidelines may adversely impact the prospects and results of operations of our services in such industries.

The business and services of live streaming and online entertainment must comply with numerous laws, regulations, policies and guidelines promulgated by PRC authorities. For example, platforms providing show live streaming should have registered their information and business operations by November 30, 2020, and live streaming platforms that provide network audio-visual program services must hold an Audio and Video Service Permission (the “AVSP”) or complete the registration in the National Network Audio-visual Platform Information Registration Management System. For more information, see Item 4.B. “Information on the Company—Business Overview—Government Regulations—Regulations on Internet Live Streaming Services.”

Regulatory authorities in China have been heightening their oversight of live streaming businesses. Pursuant to applicable PRC laws and regulations, users who have not registered with their real names or who are minors are prohibited from engaging in virtual gifting. Also, live broadcasting service providers are not allowed to register online live broadcasting publisher accounts for minors under the age of 16, and must obtain the consent from parents or guardians and verify the identity of the minors before allowing minors aged 16 or above to register live broadcasting publisher accounts. On August 30, 2021, the MOCT published the Online Performance Brokerage Agencies Measures. According to the Online Performance Brokerage Agencies Measures, online performance brokerage agencies cannot provide online performance brokerage services to minors under the age of 16 and, if online performance brokerage services are provided to minors over the age of 16, identity information of the minors must be verified and written consent must be obtained from their guardians. On May 7, 2022, the Office of the Central Guidance Commission on Building Spiritual Civilization, MOCT, NRTA and CAC jointly issued the Opinions on Regulating Online Live Streaming Virtual Gifting and Strengthening the Protection of Minors, or the Live Streaming Opinions, which reiterate the requirements for live streaming platforms in respect of strengthening real-name registration, restrictions on minors from virtual gifting and prohibition on providing live streaming services to minors. The PRC government may further tighten the account registration and identity verification requirements for minors or impose a higher standard with respect to the registration and identity verification for all users on our platforms in the future, which may require us to upgrade our system, purchase additional services from third-party service providers and incur additional costs. Any such event may deter potential users from registering with our platforms, which may in turn adversely affect the growth of our user base and business prospects.

In addition, the Notice on Strengthening the Administration of Online Show Live and E-commerce Live Streaming, or the Notice 78, Online Performance Brokerage Agencies Measures and the Live Streaming Opinions set forth certain restrictions on inducing users to spend or to promote performers on their platform. For detailed information, please refer to Item 4.B. “Information on the Company—Business Overview—Government Regulations —Regulations on Internet Live Streaming Services.” The Notice 78, the Online Performance Brokerage Agencies Measures and the Live Streaming Opinions are relatively new, and the interpretation and enforcement of these regulations involve uncertainties. We cannot guarantee that new rules or regulations promulgated in the future will not impose any additional restrictions on live streaming, especially on virtual gifting. Any limits or restrictions on live streaming ultimately imposed may adversely affect our business, financial conditions and results of operations.

14

Reports of violence and crimes related to online games or any claims of our gaming contents to be, among others, obscene, superstitious, defamatory or impairing public interest, may result in negative publicity or a governmental response that could have a material and adverse impact on our business, financial conditions and results of operations.

The media in China has reported incidents of violent crimes allegedly inspired by online games and theft of virtual items between users in online games. While we believe that such events were not related to our online games, it is possible that our reputation, as one of the leading online game providers in China, could be adversely affected by such behavior. In response to the media reports, in August 2005 the Chinese government enacted regulations to prohibit all minors under the age of 18 from playing online games in which players are allowed to kill other players, an activity that has been termed Player Kills, or PK. The Chinese government has also taken steps to limit online game playing time for all minors under the age of 18. See “—The Chinese government has taken steps to limit online game playing time for all minors and to otherwise control the content and operation of online games. These and any other new restrictions on online games may materially and adversely impact our business, financial conditions and results of operations.” above. If the Chinese government determines that online games have a negative impact on society, it may impose certain additional restrictions on the online game industry, which could in turn have a material and adverse effect on our business and results of operations.

In addition, the Chinese government and regulatory authorities prohibit any internet content that, among other things, violates PRC laws and regulations, endangers the national security of China, or is obscene, superstitious, violent or defamatory. When internet content providers and internet publishers, including online game operators, find that information falling within the above-mentioned scope is transmitted on their websites or is stored in their electronic bulletin service systems, they are required to terminate the transmission of such information or delete such information immediately, keep records, and report to relevant authorities. Failure to comply with these requirements could result in the revocation of our internet content provider, or ICP, license and other required licenses to operate our business. Internet content providers like us may also be held liable for prohibited information displayed on, retrieved from or linked to their websites. In addition, any claim of us failing to comply with these prohibitions may result in negative publicity and government actions, which in turn could have a material and adverse impact on our business.

Because our long-term growth strategy involves further expansion of our online games to players outside of China, our business will be susceptible to risks associated with international operations.

An important component of our growth strategy involves the further expansion of our online games and game player base internationally. In particular, we have launched our popular games Knives Out, LifeAfter and Identity V in Japan, North America and other markets across the globe, MARVEL Super War in several Southeast Asia markets, The Lord of the Rings: Rise to War in Europe, the Americas, Oceania and Southeast Asia and Naraka: Bladepoint globally. In the future, we plan to continue to launch our online games in various international markets. The expansion of our online games to markets outside of China will involve a variety of risks, including:

15

In addition, unlike large portion of game players in China mainland who access games through PCs and mobile devices, many game players in international markets play games predominantly via consoles such as Xbox and PlayStation. We launched Naraka: Bladepoint on console in June 2022 and plan to release numerous additional console game releases in the future. We have, however, limited experience developing and marketing console games, and the popularity of such games may not meet our expectations or be as profitable as our PC and mobile games.

Our limited experience in operating our business outside of China increases the risk that any potential future expansion efforts that we may undertake will not be successful. If we invest substantial time and resources to expand our international operations and are unable to do so successfully and in a timely manner, our business and results of operations will suffer.

We rely on third-party platforms to distribute our mobile games and collect payments. If we fail to maintain our relationships with these platforms, or if our revenue-sharing arrangements with these platforms change to our detriment, our mobile games business may be adversely affected.

In addition to our proprietary distribution channels, we publish our mobile games through the Apple iOS app store and other mobile application stores or platforms owned and operated by third parties. We rely on these third parties to promote and distribute our mobile games, record gross billings, maintain the security of their platforms to prevent fraudulent activities, provide certain user services and, in some instances, process payments from users. Further, we believe that our games benefit from the strong brand recognition, large user base and the stickiness of these mobile platforms.

We are subject to these third parties’ standard terms and conditions for application developers, which govern the promotion, distribution and operation of games and other applications on their platforms. If we violate, or if a platform provider believes that we have violated, its terms and conditions, the particular platform provider may discontinue or limit our access to that platform, which could harm our business. Our business could also be harmed if these platforms decline in popularity with users or modify their discovery mechanisms for games, the communication channels available to developers, their terms of service or other policies such as distribution fees, how they label free-to-play games or payment methods for in-app purchases. These platforms’ operators could also develop their own competitive offerings that could compete with our mobile games.

Furthermore, a few of these third-party platforms dominate the mobile application distribution channels. Any changes in the revenue-sharing, payment or other arrangements that we have with any of the major third-party application distribution platforms may materially impact our revenue and profitability. Failure to renew any revenue-sharing agreement or any other material agreement with these major third-party distribution platforms may result in discontinued or limited access to such distribution platforms, which could harm our business. In addition, changes in the credit period or the settlement cycle terms of these third-party platforms may materially and adversely affect our cash flow. Disputes with third-party platforms, such as disputes relating to intellectual property rights, distribution fee arrangements and billing issues, may also arise from time to time and we cannot assure you that we will be able to resolve such disputes in a timely manner or at all. If our collaboration with a major third-party platform terminates for any reason, we may not be able to find a replacement in a timely manner or at all and the distribution of our games may be adversely affected. Any failure on our part to maintain good relationships with a sufficient number of popular platforms for the distribution of our games could cause the number of our game downloads and activations to decrease, which will have a material adverse effect on our business, financial condition and results of operations.

16

Our business, financial condition and results of operations depend in part on the overall growth of the online game industry in China and the other markets where our games are operated, the growth of which is subject to a number of factors that are beyond our control.

Our business, financial condition and results of operations depend in part on continued growth of the online game industry in China and other markets where our games are published, particularly the Asia-Pacific region and North America. The online game industry is affected by a number of factors that are beyond our control, including:

| ● | the availability and popularity of other forms of interactive entertainment, particularly games on console systems which are more popular in North America, Europe and Japan but which we have only recently begun offering, and other leisure activities; |

| ● | evolving PC, smartphone and tablet technologies; |

| ● | changes in game player demographics and public tastes and preferences; |

| ● | any government restrictions on the playing of online games; and |

| ● | the availability and popularity of alternative gameplay models such as cloud-gaming services. |

There is no assurance that the online game industry will continue to grow in future periods at any particular rate or at all.

We may not be successful in making our mobile games profitable, and our profits from mobile games may be relatively lower than the profits we have enjoyed historically for PC games.

In our games and related value-added services segment, which include both the operation of online games as well as other related or ancillary services to the games, net revenues from the operation of online games accounted for 93.0%, 92.6% and 92.5% for the years ended December 31, 2020, 2021 and 2022, respectively. We generate a large portion of revenue in our operation of online games from our mobile games. Our profits from our mobile games, even if the games are successful, are generally lower than our profits generated from PC games, because, in order to gain access to our games on mobile application stores, which are the primary distribution channel for our mobile games, we must enter into revenue-sharing arrangements that result in lower profit margins compared with those of our PC games. In addition, our mobile games tend to cover a wider variety of genres, some of which have historically had relatively lower profitability than that of our PC games. Furthermore, we are releasing more of our mobile games overseas, which may involve additional marketing and distribution costs and further impact the profitability of our mobile games.

We have devoted and expect to continue to devote a significant amount of resources to the development of our mobile games, but the relatively lower profit margins and other uncertainties make it difficult to predict whether we will continue to succeed in making our mobile game operations profitable. If we do not succeed in doing so, our business, financial condition and results of operations will be adversely affected.

A significant portion of our revenue from games and related value-added services is generated from the sale of virtual items within the games, and if we do not develop desirable virtual items and properly price them or if this revenue model ceases to be successful, our business, financial condition and results of operations may be materially and adversely affected.

17

All of our mobile games and many of our PC games currently utilize the item-based revenue model. Under this revenue model, our game players are able to play the games for free, but are charged for the purchase of virtual items in the games. We believe that this attracts a wider audience of players and increases the number of potential paying users. However, the success of this business model largely depends on whether we can attract game players to play our games and whether we can successfully encourage more players to purchase virtual items. Game players will only pay for virtual items if they are perceived to provide value and enhance their playing experience, and we must closely monitor and analyze in-game consumption patterns and player preferences to understand what items will be appealing and the appropriate price for them. Moreover, we must offer sufficient in-game purchasing opportunities to make our games profitable, while ensuring that the games are fun to play including for players who purchase no virtual items. We might fail to accurately identify and introduce new and popular virtual items or price them properly or may not be able to market our virtual items effectively. In addition, the item-based revenue model may not continue to be commercially successful and in the future, we may need to change our revenue model to a time-based or other revenue model. Any change in revenue model could result in disruption of our game operations and a decrease in the number of our game players and thereby materially and adversely affect our business, financial condition and results of operations.

Providing a high level of customer service for our players is crucial to maintaining and growing the popularity of our online games, and any failure to do so could harm our reputation and our business.

We devote significant resources to provide high quality customer services to our game players 24 hours a day, seven days a week, through telephone and online support. We also maintain a team of highly trained “Game Masters” which supervise the activities within our games to provide assistance to players as needed and stop any cheating or unfair behavior to ensure the game has an atmosphere of fun and fair play. These activities are crucial to retaining our existing game players and attracting new players who expect a high-quality playing experience from our online games. In addition, our license agreements with third-party developers may also require us to provide specified minimum levels of customer support, and any breach of such obligations could result in the developer terminating our license agreement with them and other damages.

If we underestimate the popularity of certain games or an unexpected event occurs with respect to the operation of a game, we might receive increased complaints asserting that we were unprepared and did not provide adequate customer service. If we fail to maintain effective player support which meets the expectations of players, it could harm our reputation and the popularity of our online games, which may materially and adversely affect our business, financial condition and results of operations.

We may not be able to maintain stable relationships with our existing game licensors and co-developers, and we may experience difficulties in the operation of the online games licensed from them.

Several mobile and PC games we offer are licensed from third-party developers, which accounted for 9.1%, 9.5% and 9.5% of our total net revenues in 2020, 2021 and 2022, respectively. If we are unable to maintain stable relationships with our existing game licensors, or if any of our licensors establishes similar or more favorable relationships with our competitors in violation of its contractual arrangements with us or otherwise, we may not be able to ensure the smooth operation of these licensed online games, and our licensors could terminate or fail to renew the license agreements with us, which could affect our business, financial conditions and results of operations. For example, the licenses covering the publication of several titles of Blizzard Entertainment, Inc. (together with its affiliated companies, referred to as “Blizzard” in this annual report) in Chinese mainland expired in accordance with their terms on January 23, 2023.