UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Annual Period Ended

or

| | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission file number

QUALYS, INC.

(Exact name of registrant as specified in its charter)

| |

| |

| (State or other jurisdiction of |

| (I.R.S. Employer |

| incorporation or organization) |

| Identification Number) |

(Address of principal executive offices, including zip code)

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of exchange on which registered |

| | | |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | ☒ |

| Accelerated filer | ☐ |

| Non-accelerated filer | ☐ |

| Smaller reporting company | |

|

|

|

|

|

|

|

|

|

| Emerging growth company | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of June 30, 2021, the aggregate market value of voting shares of common stock held by non-affiliates of the registrant was $

The number of shares of the registrant's common stock outstanding as of February 16, 2022 was

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's Proxy Statement for its 2022 Annual Meeting of Stockholders are incorporated by reference in Part III of this Annual Report on Form 10-K where indicated. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of the registrant's fiscal year ended December 31, 2021.

TABLE OF CONTENTS

|

|

|

Page |

| Risk Factor Summary | 3 | |

| Note Regarding Forward-Looking Statements | 4 | |

| Item 1. |

||

| Item 1A. |

||

| Item 1B. |

||

| Item 2. |

||

| Item 3. |

||

| Item 4. |

||

| Item 5. |

||

| Item 6. |

||

| Item 7. |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

|

| Item 7A. |

||

| Item 8. |

||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

| Item 9A. |

||

| Item 9B. |

||

| Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | |

| Item 10. |

||

| Item 11. |

||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

|

| Item 14. |

||

| Item 15. |

||

Our business is subject to significant risks and uncertainties that make an investment in us speculative and risky. Below we summarize what we believe are the principal risk factors but these risks are not the only ones we face, and you should carefully review and consider the full discussion of our risk factors in the section titled “Risk Factors,” together with the other information in this Annual Report on Form 10-K. If any of the following risks actually occurs (or if any of those listed elsewhere in this Annual Report on Form 10-K occur), our business, reputation, financial condition, results of operations, revenue, and future prospects could be seriously harmed. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that adversely affect our business.

| • | The continued spread of Coronavirus Disease 2019 (COVID-19), or any similar widespread infectious disease outbreak, could harm our business, financial condition and results of operations. |

|

| • | Our quarterly operating results may vary from period to period, which could result in our failure to meet expectations with respect to operating results and cause the trading price of our stock to decline. |

|

| • |

If we do not successfully anticipate market needs and opportunities or are unable to enhance our solutions and develop new solutions that meet those needs and opportunities on a timely or cost-effective basis, we may not be able to compete effectively and our business and financial condition may be harmed. |

|

| • |

If we fail to continue to effectively scale and adapt our platform to meet the performance and other requirements of our customers, our operating results and our business would be harmed. |

|

| • |

If we are unable to renew existing subscriptions for our IT, security and compliance solutions, sell additional subscriptions for our solutions and attract new customers, our operating results would be harmed. |

|

| • |

If the market for cloud solutions for IT, security and compliance does not evolve as we anticipate, our revenues may not grow and our operating results would be harmed. |

|

| • |

Our current research and development efforts may not produce successful products or enhancements to our platform that result in significant revenue, cost savings or other benefits in the near future. |

|

| • |

Our platform, website and internal systems may be subject to intentional disruption or other security incidents that could result in liability and adversely impact our reputation and future sales. |

|

| • |

Our sales cycle can be long and unpredictable, and our sales efforts require considerable time and expense. As a result, revenues may vary from period to period, which may cause our operating results to fluctuate and could harm our business. |

|

| • |

Adverse economic conditions or reduced IT spending may adversely impact our business. |

|

| • |

Our IT, security and compliance solutions are delivered from eleven shared cloud platforms, and any disruption of service at these facilities would interrupt or delay our ability to deliver our solutions to our customers which could reduce our revenues and harm our operating results. | |

| • |

We face competition in our markets, and we may lack sufficient financial or other resources to maintain or improve our competitive position. |

|

| • |

If our solutions fail to detect vulnerabilities or incorrectly detect vulnerabilities, our brand and reputation could be harmed, which could have an adverse effect on our business and results of operations. |

|

| • |

If we are unable to continue the expansion of our sales force, sales of our solutions and the growth of our business would be harmed. |

|

| • |

We rely on third-party channel partners to generate a substantial amount of our revenues, and if we fail to expand and manage our distribution channels, our revenues could decline and our growth prospects could suffer. |

|

| • |

A significant portion of our customers, channel partners and employees are located outside of the United States, which subjects us to a number of risks associated with conducting international operations, and if we are unable to successfully manage these risks, our business and operating results could be harmed. |

|

| • |

Our business and operations have experienced significant growth, and if we do not appropriately manage any future growth, or are unable to improve our systems and processes, our operating results may be negatively affected. |

|

| • |

A portion of our revenues are generated by sales to government entities, which are subject to a number of challenges and risks. |

|

| • |

Undetected software errors or flaws in our solutions could harm our reputation, decrease market acceptance of our solutions or result in liability. |

|

| • |

Our solutions could be used to collect and store personal information of our customers’ employees or customers, and therefore privacy and other data handling concerns could result in additional cost and liability to us or inhibit sales of our solutions. |

|

| • |

Our solutions contain third-party open source software components, and our failure to comply with the terms of the underlying open source software licenses could restrict our ability to sell our solutions. |

|

| • |

We use third-party software and data that may be difficult to replace or cause errors or failures of our solutions that could lead to lost customers or harm to our reputation and our operating results. |

|

| • |

Failure to protect our proprietary technology and intellectual property rights could substantially harm our business and operating results. |

|

| • |

Assertions by third parties of infringement or other violations by us of their intellectual property rights could result in significant costs and harm our business and operating results. |

NOTE REGARDING Forward-Looking Statements

In addition to historical information, this Annual Report on Form 10-K contains "forward-looking" statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, it is possible to identify forward-looking statements because they contain words such as "anticipates," "believes," "contemplates," "continue," "could," "estimates," "expects," "future," "intends," "likely," "may," "plans," "potential," "predicts," "projects," "seek," "should," "target," or "will," or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. Forward-looking statements contained in this Annual Report on Form 10-K include, but are not limited to, statements about:

| • |

our financial performance, including our revenues, costs, expenditures, growth rates, operating expenses and ability to generate positive cash flow to fund our operations and sustain profitability; |

| • |

anticipated technology trends, such as the use of cloud solutions; |

| • |

our ability to adapt to changing market conditions; |

| • | the impact of the ongoing COVID-19 pandemic and related public health measures on our business; | |

| • |

economic and financial conditions, including volatility in foreign exchange rates; |

| • |

our ability to diversify our sources of revenues, including selling additional solutions to our existing customers and our ability to pursue new customers; |

| • |

the effects of increased competition in our market; |

| • |

our ability to innovate and enhance our cloud solutions and platform and introduce new solutions; |

| • |

our ability to effectively manage our growth; |

| • |

our anticipated investments in sales and marketing, our infrastructure, new solutions, research and development, and acquisitions; |

| • |

maintaining and expanding our relationships with channel partners; |

| • |

our ability to maintain, protect and enhance our brand and intellectual property; |

| • |

costs associated with defending intellectual property infringement and other claims; |

| • |

our ability to attract and retain qualified employees and key personnel, including sales and marketing personnel; |

| • |

our ability to successfully enter new markets and manage our international expansion; |

| • |

our expectations, assumptions and conclusions related to our income tax provision, our deferred tax assets and our effective tax rate; and |

| • |

other factors discussed in this Annual Report on Form 10-K in the sections titled "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Business." |

We have based the forward-looking statements contained in this Annual Report on Form 10-K primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, results of operations and prospects. The results, events and circumstances reflected in these forward-looking statements are subject to risks, uncertainties, assumptions, and other factors including those described in Part I, Item 1A (Risk Factors) of this Annual Report and those discussed in other documents we file with the U.S. Securities and Exchange Commission (SEC). Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements used herein. We cannot provide assurance that the results, events, and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements.

You should not rely on forward-looking statements as predictions of future events. Except as required by law, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements, and we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements.

Qualys, the Qualys logo and other trademarks and service marks of Qualys appearing in this Annual Report on Form 10-K are the property of Qualys. This Annual Report on Form 10-K also contains trademarks and trade names of other businesses that are the property of their respective holders. We have omitted the ® and ™ designations, as applicable, for the trademarks used in this Annual Report on Form 10-K.

| Business |

Overview

We are a pioneer and leading provider of a cloud-based platform delivering information technology (IT), security and compliance solutions. Our integrated suite of IT, security and compliance solutions delivered on our Qualys Cloud Platform enables our customers to: 1) identify and manage their IT assets across on-premises, endpoints, cloud, containers, and mobile environments; 2) collect and analyze large amounts of IT security data; 3) discover and prioritize vulnerabilities; 4) recommend and implement remediation actions; and 5) verify the implementation of such actions. This helps organizations protect their systems and applications from ever-evolving cyber-attacks and helps achieve compliance with internal policies and external regulations.

Our cloud solutions address the growing IT, security and compliance complexities and risks that are amplified by the dissolving boundaries between internal and external IT infrastructures and web environments, the rapid adoption of cloud computing, containers and serverless IT models, and the proliferation of geographically dispersed IT assets. Organizations use our integrated suite of solutions to cost-effectively obtain a unified view of their IT asset inventory as well as security and compliance posture across globally-distributed IT infrastructures as our solution offers a single platform for information technology, information security, application security, endpoint, developer security and cloud teams.

IT infrastructures are more complex and globally-distributed today than ever before, as organizations of all sizes increasingly rely upon a myriad of interconnected information systems and related IT assets, such as servers, databases, web applications, routers, switches, desktops, laptops, other physical and virtual infrastructure, and numerous external networks and cloud services. In this environment, new and evolving digital technologies intended to improve organizations’ operations can also increase vulnerability to cyber-attacks, which can expose sensitive data, damage IT and physical infrastructures, and result in serious financial or reputational consequences. In addition, the rapidly increasing amount of data and devices in IT environments makes it more difficult to identify and remediate vulnerabilities in a timely manner. The predominant approach to IT security has been to implement multiple disparate security products that can be costly and difficult to deploy, integrate and manage and may not adequately protect organizations. As a result, we believe there is a large and growing opportunity for comprehensive cloud-based IT, security and compliance solutions delivered in a single platform.

We designed our Qualys Cloud Platform to transform the way organizations secure and protect their IT infrastructures and applications. Our cloud platform offers an integrated suite of solutions that automates the lifecycle of asset discovery and management, security assessments, and compliance management for an organization’s IT infrastructure and assets, whether such infrastructure and assets reside inside the organization, on their network perimeter, on endpoints or in the cloud. Since inception, our solutions have been designed to be delivered through the cloud and to be easily and rapidly deployed on a global scale, enabling faster implementation and lower total cost of ownership than traditional on-premises enterprise software products. Our customers, ranging from some of the largest global organizations to small businesses, are served from our globally-distributed cloud platform, enabling us to rapidly deliver new solutions, enhancements and security updates.

We believe that our cloud platform provides our customers with unique advantages, including:

| • |

No hardware to buy or manage. There is no infrastructure or software to buy and maintain thus reducing our customers’ operating costs; all services are accessible in the cloud via web interface. Qualys operates and maintains the platform. |

| • |

Real-time visibility in one place, anytime and anywhere. Our customers can conveniently see their security and compliance posture across their global IT asset inventory in one browser window, without plugins or a virtual private network (VPN), whenever and wherever Internet access is available. |

| • |

Easy global scanning. Our customers can easily perform scans on geographically distributed and segmented networks at the perimeter, behind the firewall, on dynamic cloud environments and on endpoints. |

| • |

Seamless scaling. Our cloud platform is a scalable, comprehensive, and end-to-end solution for the IT, security and compliance needs of our customers. Our customers can seamlessly add new coverage, users and services after they have deployed our platform. |

| • |

Up to date resources. Qualys has one of the largest knowledge bases of vulnerability signatures in the industry. All security updates are made in real-time. |

| • |

Data stored securely. Data is securely stored and processed in a multi-tiered architecture of load-balanced servers. Our encrypted databases are physically and logically secured. |

We were founded and incorporated in December 1999 with a vision of transforming the way organizations secure and protect their IT infrastructure and applications and initially launched our first cloud solution, Vulnerability Management (VM), in 2000. As VM gained acceptance, we introduced additional solutions to help customers manage increasing IT, security and compliance requirements. Today, the suite of solutions that we offer on our cloud platform and refer to as the Qualys Cloud Apps helps our customers protect a range of assets across on-premises, endpoints, cloud, containers, and mobile environments. These Cloud Apps address and include:

| • |

IT Security: Vulnerability Management (VM), Vulnerability Management, Detection and Response (VMDR), Threat Protection (TP), Continuous Monitoring (CM), Patch Management (PM), Multi-Vector Endpoint Detection and Response (EDR), Certificate Assessment (CRA), SaaS Detection and Response (SaaSDR), Secure Enterprise Mobility (SEM); |

| • |

Compliance: Policy Compliance (PC), Security Configuration Assessment (SCA), PCI Compliance (PCI), File Integrity Monitoring (FIM), Security Assessment Questionnaire (SAQ), Out of-Band Configuration Assessment (OCA); |

| • |

Web Application Security: Web Application Scanning (WAS), Web Application Firewall (WAF); |

| • |

Asset Management: Global Asset View (GAV), Cybersecurity Asset Management (CSAM), Certificate Inventory (CRI); and |

| • |

Cloud/Container Security: Cloud Inventory (CI), Cloud Security Assessment (CSA), Container Security (CS). |

We provide our solutions through a software-as-a-service model, primarily with renewable annual subscriptions. These subscriptions require customers to pay a fee in order to access each of our cloud solutions. We generally invoice our customers for the entire subscription amount at the start of the subscription term, and the invoiced amounts are treated as deferred revenues and are recognized ratably over the term of each subscription. We continue to experience revenue growth from our existing customers as they renew and purchase additional subscriptions, as well as from the addition of new customers to our cloud platform.

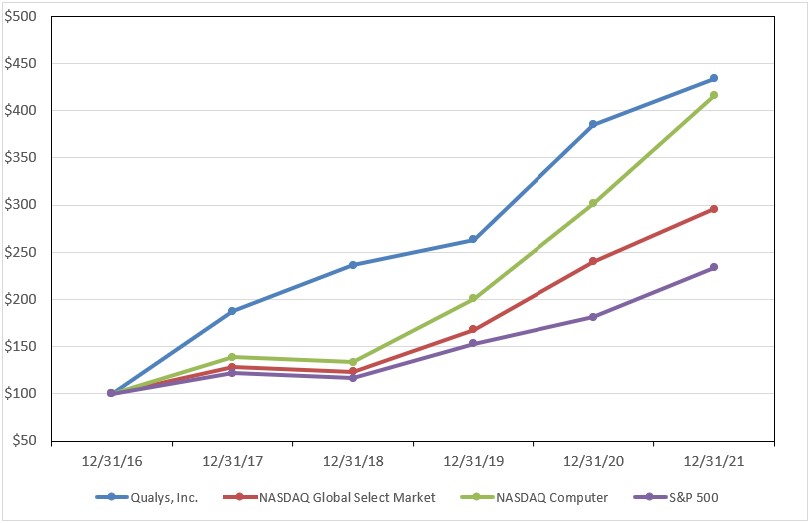

Our Qualys Cloud Platform is currently used by over 10,000 customers worldwide, including a majority of each of the Forbes Global 100 and Fortune 100. Our revenues increased to $411.2 million in 2021 from $363.0 million in 2020 and $321.6 million in 2019.

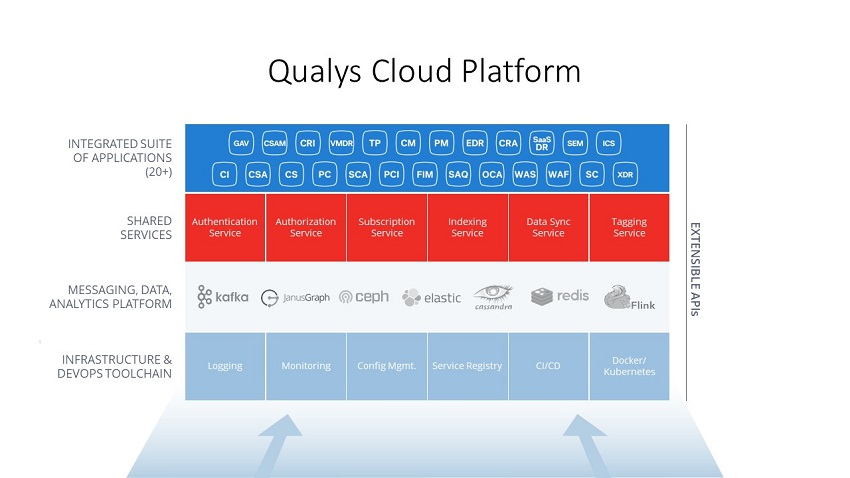

Our Platform

Our cloud platform consists of a suite of IT security, compliance, web application security, asset management and cloud and container security solutions, which we refer to as the Qualys Cloud Apps, that leverages our shared and extensible core services and our highly scalable multi-tenant cloud infrastructure. We also provide open application program interfaces, or APIs, and other developer tools that allow third parties to embed our technology into their solutions and build applications on our cloud platform.

Our cloud platform utilizes physical and virtual sensors, and cloud agents that provide our customers with continuous visibility enabling customers to respond to threats immediately. Customers can extend visibility to all known IT infrastructure using our Out-of-Band Configuration Assessment sensor for systems that are air-gapped or otherwise difficult to assess.

The Qualys Cloud Platform automatically gathers and analyzes security and compliance data in a scalable, state-of-the-art backend. The technology underlying our cloud infrastructure enables us to ingest, process, analyze and store a high volume of sensor data coming from our agents, scanners and passive analyzers, and correlate information at very high speeds in a distributed manner for millions of devices.

Our cloud platform is delivered to our customers via our eleven global shared cloud platforms, or via our private platform offering, Qualys Private Cloud Platform (PCP), for customers or partners that want the platform to reside within the customer's data center. The PCP is a standalone version of our multi-layer, multi-tenant services architecture and is a fully integrated turnkey solution, making it more scalable, cost effective and faster to deploy within a customer's data center. Solutions delivered through our PCP are typically on the same subscription basis as solutions delivered through our shared platform. Our PCP utilizes hardware and software owned by us and is physically located on the customer's premises. The customer is not permitted to take possession of the software or access the software code. We also offer our PCP as a subscription-based platform services to the customer using a virtual version of our software. This virtualized PCP allows us to extend our security and compliance solutions without the complexity and cost associated with deploying traditional enterprise software. We also offer Private Cloud Platform Appliance (PCPA), an on-premises IT, security and compliance solution packaged in a form-factor for medium-sized companies.

Qualys Core Services

Our core services enable integrated workflows, management and real-time analysis and reporting across all of our IT, security and compliance solutions for our customers inside their organizations, on the perimeter, on endpoints or in the cloud.

Our core services constitute dynamic and customizable dashboards and centrally managed, self-updating integrated Cloud Apps, through a natively integrated unified platform. Our interactive, dynamic dashboards and cloud platform allow our customers to aggregate and correlate all of their IT, security and compliance data in one place, drill down into details, and generate reports customized for different audiences. Our cloud platform’s powerful Elasticsearch clusters enable customers to instantly find detailed data on any asset.

Our core services include:

| • |

Asset Tagging and Management. Enables customers to easily identify, categorize and manage large numbers of assets in highly dynamic IT environments and automates the process of inventory management and hierarchical organization of IT assets. Built on top of this core service is the Qualys GAV framework, which is a global asset inventory service enabling our customers to search for information on any IT asset, scaling to millions of assets for customers of all sizes, helping IT and security personnel to search IT assets and maintain an up-to-date inventory on a continuous basis. |

| • |

Reporting and Dashboards. A highly configurable reporting engine that provides customers with reports and dashboards based on their roles and access privileges. |

| • |

Questionnaires and Collaboration. A configurable workflow engine that enables customers to easily build questionnaires and capture existing business processes and workflows to evaluate controls and gather evidence to validate and document compliance. |

| • |

Remediation and Workflow. An integrated workflow engine that allows customers to automatically generate helpdesk tickets for remediation and to manage compliance exceptions based on customer-defined policies, enabling subsequent review, commentary, tracking and escalation. This engine automatically distributes remediation tasks to IT administrators upon scan completion, tracks remediation progress and closes open tickets once patches are applied and remediation is verified in subsequent scans. |

| • |

Big Data Correlation and Analytics Engine. Provides Elasticsearch capabilities for indexing, searching and correlating large amounts of security and compliance data with other security incidents and third-party security intelligence data. Embedded workflows enable customers to quickly assess risk and access information for remediation, incident analysis and forensic investigations. |

| • |

Alerts and Notifications. Creates email notifications to alert customers of new vulnerabilities, malware infections, scan completion, open trouble tickets and system updates. |

Qualys Cloud Apps

Many organizations have an array of heterogeneous point tools that do not interoperate well and are difficult and costly to maintain and integrate, making it difficult for Chief Information Officers (CIOs) and Chief Information Security Officers (CISOs) to obtain a single, unified view of their organization’s security and compliance posture. The Qualys Cloud Platform and its Cloud Apps help organizations escape this tool-fragmentation dilemma by drastically simplifying their security stacks and regaining unimpeded visibility across their IT environment.

The Cloud Apps are self-updating, centrally managed and tightly integrated, and cover a broad range of functionality in areas such as IT security, compliance, web application security, asset management and cloud and container security solutions.

From inception through December 31, 2020, we have added the following Cloud Apps: VM, PC, PCI, WAS, WAF, CM, SAQ, TP, FIM, GAV (including a free version), SCA, CS, CI, CSA, CRI, CRA, OCA, PM, VMDR, and EDR. In 2021, we introduced SaaSDR, SEM, and CSAM.

We believe that our applications are easy to use and provide our customers with a high level of control because our applications are part of one platform, share a common user interface, utilize the same scanners and agents, access the same collected data, and leverage the same user permissions.

Our customers can subscribe to one or more of our IT, security and compliance Apps based on their initial needs and expand their subscriptions over time to new areas within their organization or to additional Qualys solutions. For VMDR, we offer four editions of our Qualys Cloud App: Enterprise for large enterprises, Express for medium-sized businesses, Express Lite for small-sized businesses, and Scan-on-Behalf for Scan-on-Behalf customers. For all other Qualys Cloud Apps, we offer four editions: Enterprise for large enterprises, Express for medium-sized businesses, Express Lite for small-sized businesses, and Consulting Edition for consultants, consulting organizations and Managed Service Providers (MSPs).

Many of our customers use multiple Cloud Apps to develop a more complete understanding of their respective environment’s IT, security and compliance posture. The Qualys Cloud Platform currently provides the following Cloud Apps to our customers:

IT Security

Vulnerability Management (VM): VM is an industry leading and award-winning solution that automates network auditing and vulnerability management across an organization, including network discovery and mapping, asset management, vulnerability reporting and remediation tracking. Driven by our comprehensive knowledge base of known vulnerabilities, VM enables cost-effective protection against vulnerabilities without substantial resource deployment.

Vulnerability Management, Detection and Response (VMDR): VMDR enables organizations to automatically discover every asset in their environment, including unmanaged assets appearing on the network, inventory all hardware and software, and classify and tag critical assets. VMDR continuously assesses these assets for the latest vulnerabilities and applies the latest threat intel analysis to prioritize actively exploitable vulnerabilities. Finally, VMDR automatically detects the latest superseding patch for the vulnerable asset and easily deploys it for remediation. By delivering all this in a single app workflow, VMDR automates the entire process and significantly accelerates an organization’s ability to respond to threats, thus preventing possible exploitation.

Threat Protection (TP): Thousands of new vulnerabilities are disclosed annually. With TP, customers can pinpoint their most critical threats and identify what they need to remediate first. TP continuously correlates external threat information against a customer's vulnerabilities and IT asset inventory, so customers know which threats pose the greatest risk to their organization at any given time. As Qualys engineers continuously validate and rate new threats from internal and external sources, TP’s live feed displays the latest vulnerability disclosures and maps them to customers’ impacted IT assets. Customers can see the assets affected by each threat, and drill down into details.

Continuous Monitoring (CM): Built on top of VM, CM is a next-generation cloud service that can detect network threats and unexpected changes before they turn into breaches. Whenever CM spots an anomaly in a network, it immediately sends targeted, informative alerts to the right people for each situation and each machine. CM tracks what happens throughout public perimeters, internal networks, and cloud environments - anywhere in the world.

Patch Management (PM): PM provides automated patch deployment capabilities by correlating vulnerabilities and patches. It continuously gathers and uploads telemetry about installed software, open vulnerabilities and missing patches to the Qualys Cloud Platform. The resulting shared visibility of assets and their posture enables IT and security teams to collaborate using common vulnerability-centric terminology and provides a consistent data set to analyze, prioritize, deploy and verify patches more efficiently.

Multi-Vector Endpoint Detection and Response (EDR): Traditional endpoint detection and response solutions focus only on endpoint activity to detect attacks. As a result, they lack the full context to analyze attacks accurately. This leads to an incomplete picture and a high rate of false positives and negatives, requiring organizations to use multiple point solutions and large incident response teams. Qualys fills the gaps by bringing a new multi-vector approach and the unifying power of its highly scalable Cloud Platform to EDR, providing vital context and comprehensive visibility to the entire attack chain, from prevention to detection to response. EDR unifies different context vectors like asset discovery, rich normalized software inventory, end-of-life visibility, vulnerabilities and exploits, misconfigurations, in-depth endpoint telemetry, and network reachability with a powerful backend to correlate it all for accurate assessment, detection and response.

Certificate Assessment (CRA): CRA assesses digital certificates and Transport Layer Security (TLS) configurations. CRA generates certificate instance grades using a straightforward methodology that allows administrators to assess often overlooked server SSL/TLS configurations without having to become SSL experts. It also identifies out-of-policy certificates with weak signatures or key length and shows how many unique Certificate Authorities were found in the environment and how many certificates each one issued.

SaaS Detection and Response (SaaSDR): SaaSDR leverages the Qualys Cloud platform to provide continuous visibility into SaaS applications such as Office 365, Salesforce and Zoom for configuration posture management, activity monitoring and data security insights.

Secure Enterprise Mobility (SEM): SEM extends the power of VMDR for in-depth inventory of mobile devices and their data, real time vulnerability and misconfiguration detection, and built-in remediation with patch orchestration for all Android and iOS/iPadOS devices across the enterprise.

Compliance

Policy Compliance (PC): PC performs automated security configuration assessments on IT systems throughout a network, helping to reduce risk and continuously ensure compliance with internal policies and external regulations. PC leverages out-of-the-box library content to fast-track compliance assessments using industry-recommended best practices. PC also provides a centralized, interactive console for specifying baseline standards for different hosts. By automating requirement evaluation against multiple standards for operating systems, network devices, databases and server applications, PC enables the quick identification of security issues and works to prevent configuration drift. PC works to prioritize and track remediation and exceptions, while demonstrating a repeatable auditable process for compliance management.

Security Configuration Assessment (SCA): SCA provides automatic assessment of IT assets’ configurations using the latest Center for Internet Security (CIS) Benchmarks for operating systems, databases, applications and network devices. SCA provides intuitive workflows for assessing, monitoring, reporting and remediating security-related configuration issues. SCA’s CIS assessments are provided via a web-based user interface and delivered from the Qualys Cloud Platform, enabling centralized management with minimal deployment overhead. SCA users can automatically create downloadable reports and view dashboards.

PCI Compliance (PCI): PCI streamlines and automates compliance with PCI DSS (Payment Card Industry Data Security Standard) requirements for protecting the collection, storage, processing and transmission of cardholder data. As an Approved Scanning Vendor, Qualys has been authorized by the PCI Security Standards Council to conduct the required quarterly scans. PCI scans all Internet-facing networks and systems with Six Sigma (99.9996%) accuracy, generates reports and provides detailed patching instructions. An auto-submission feature completes the compliance process once remediation is completed.

File Integrity Monitoring (FIM): FIM logs and centrally tracks file change events on common enterprise operating systems in organizations of all sizes. FIM provides customers with a simple way to achieve centralized cloud-based visibility of activity resulting from normal patching and administrative tasks, change control exceptions or violations, or malicious activity - then reports on that system activity as part of compliance mandates. FIM collects the critical details needed to quickly identify changes and root out activity that violates policy or is potentially malicious. FIM helps customers to comply with change control policy enforcement and change monitoring requirements.

Security Assessment Questionnaire (SAQ): SAQ automates and streamlines third-party and internal risk assessment processes, obviating the need to perform such processes manually via email and spreadsheets. SAQ easily designs surveys to assess procedural controls of IT and security policies and practices. SAQ automates the launch and monitoring of assessment campaigns, making the process agile, accurate, comprehensive, centralized, scalable and uniform across an organization. SAQ also provides tools for displaying, analyzing and acting on collected data, enabling the assessment of compliance with industry standards, regulations and internal policies of third parties, like vendors and partners, and of employees.

Out-of-Band Configuration Assessment (OCA): The OCA sensor and Cloud App allows customers to achieve complete visibility of all known IT infrastructure by pushing vulnerability and configuration data to the Qualys Cloud Platform from systems that are otherwise difficult to assess, such as highly locked-down systems, systems on disconnected or “air gap” networks, or in environments that are highly sensitive to scans. OCA’s expanded data collection approach significantly broadens the types of technologies supported by the Qualys Cloud Platform and provides deeper assessment of configuration so that customers have better visibility into potentially critical vulnerabilities and misconfigurations across their entire environment.

Web Application Security

Web Application Scanning (WAS): WAS continuously discovers and catalogs web applications – including new and unknown ones – and detects vulnerabilities and misconfigurations in web apps and APIs. Scaling to thousands of scans, it conducts incisive, thorough and precise testing of browser-based web apps, mobile app backends, and Internet of things (IoT) services. Its seamless integration with the Qualys Web Application Firewall (WAF) enables verification of attack protection, ticket creation and one click mitigation of vulnerabilities. WAS' powerful API enables integration with other systems and allows teams to detect issues within DevOps environments early in the application development process. Bundled malware detection capability with WAS uses reputational, behavioral, antivirus, and heuristic analyses to identify and alert on malware infecting a user's websites. By Integrating WAS with manual testing tools and bug bounty solutions, customers can build a comprehensive web application vulnerability testing program.

Web Application Firewall (WAF): WAF permits the reduction of application security cost and complexity with a unified platform to prevent any attempt to exploit vulnerabilities. Simple, scalable and adaptive, WAF enables the quick blocking of attacks, prevents disclosure of sensitive information, and controls when and where customer applications are accessed. WAF and WAS work together seamlessly. Customers scan web apps with WAS, deploy one-click virtual patches if needed in WAF, and manage it all from a centralized cloud-based portal. WAF can be deployed in minutes on prem or in the cloud, as a virtual machine or a container, supports load-balancing as well as TLS offloading, and does not require special hardware.

Asset Management

Global Asset View (GAV): GAV constantly gathers information on all assets, including system and hardware details, running services, open ports, installed software and user accounts. Asset discovery and inventory collection is done through a combination of Qualys network scanners, Cloud Agents and passive scanners, which together collect comprehensive data from on-premises or cloud infrastructure as well as remote endpoints. In order to create consistent and uniform asset data, GAV normalizes raw discovery data to standardize every manufacturer name, product name, model and software version using Qualys’ ever-evolving technology catalog as a reference. This catalog automatically extends IT asset inventory with non-discoverable metadata such as hardware and software release dates, end of life dates, and license categories. This new data layer allows teams to detect issues such as unauthorized software, outdated hardware or end-of-life software, which can help properly tag, support, and secure business-critical assets. Additionally, customers can sync their asset information with ServiceNow CMDB.

Cybersecurity Asset Management (CSAM): CSAM is an all-in-one solution that leverages the power of the Qualys Cloud Platform with its multiple native sensors and CMDB synchronization to continuously inventory known and unknown assets, discover installed applications, and overlay business and risk context to establish asset criticality. It identifies unauthorized or end-of-life and end-of-service software and the absence of required security tools, and assesses the health of the attack surface. Further, CSAM enables response options with threat alerts and software removal and delivers regulatory reporting in support of FedRAMP, PCI-DSS and other mandates.

Certificate Inventory (CRI): CRI continuously scans global IT assets from a single console to discover internal and external certificates issued from any certificate authority across all enterprise IT assets, both on premise and in the cloud. As a result, certificates can be renewed before they expire, which stops certificate-related outages and improves availability. It collects all certificate, vulnerability and configuration data required for certificate inventory and analysis. CRI also reveals how many certificates are out of compliance or do not follow organizational policies for key length, for signature algorithms or for the use of trusted and approved Certificate Authorities through the use of highly customizable dashboards and provides users a comprehensive overview of Qualys SSL Labs-caliber certificate grades for internal and externally facing certificates.

Cloud / Container Security

Cloud Inventory (CI): CI delivers continuous visibility into public cloud accounts. In one single-pane view, it inventories virtual machines, storage buckets, databases, security groups, Access Control Lists (ACLs), Elastic Load Balancers (ELBs) and users – across all regions, multiple accounts and multiple cloud platforms. CI continuously tracks assets and enables users to quickly understand the topography of their cloud environment and uncover the root cause of incidents.

Cloud Security Assessment (CSA): CSA provides a continuous assessment of the security posture of an organization’s cloud resources against misconfigurations, malicious behavior, and nonstandard deployments. CSA evaluates resources against CIS benchmarks and best practices to identify misconfigured storage buckets, security groups, Relational Database Service, exposing data and the resource for public exploitation. CSA correlates host vulnerabilities and compliance data into intelligent insights which allow users to quickly detect risks throughout their complex cloud environments. With CSA, users gain real-time visibility into their up-to-date security and compliance posture of public clouds in one single-pane view.

Container Security (CS): CS delivers container-native visibility and protection throughout the entire lifecycle of containerized applications. It incorporates scanning of container images for software composition and enforcement of hardened container stack configurations for continuous policy compliance, whether the images are on the build machines, in the container registries or in the runtime cluster nodes. CS uses a unique 'layered-in' approach to provide deep visibility into all the application activities and automatically creates a behavior profile, which is enforced on each container for runtime protection. By integrating with continuous integration and continuous delivery pipelines and toolchains, CS enables DevSecOps processes and transparent enforcement of security and compliance without compromising the speed and agility of containers and serverless deployment models. This leads to significant cost benefits for enterprises compared to certain legacy security solutions.

Free Services

We also offer organizations of all sizes free security and compliance services based on the Qualys Cloud Platform:

| • |

Qualys Global Asset View app automatically creates a continuous, real-time inventory of known and unknown assets throughout a user's global IT footprint across on-premises, endpoints, multi-cloud, mobile, containers, operational technology and IoT. The app also automatically normalizes and categorizes assets to ensure clean, reliable, and consistent data. In-depth asset details provide fine-grained visibility on the system, services, installed software, network, and users. It also detects any device that connects to a user's networks, via passive scanning technology. Upon an unknown device detection, users can install a light-weight Qualys self-updating agent (3MB) to turn the device into a managed device or launch a vulnerability scan. |

| • |

Qualys Community Edition automatically gathers and analyzes security and compliance data from hybrid IT environments to provide a complete, continuously updated, and instant view of monitored IT assets on-premises or in the cloud, as well as web apps, from a single-pane-of-glass interface. The Community Edition is limited to one user with data retention for three months. |

| • |

Qualys CloudView continuously discovers and tracks assets and resources across public cloud deployments to provide users both real-time and historical views of cloud inventory. It collects metadata about cloud assets and resources to help users understand the relationships between public cloud assets and resources across different dimensions and then discover their threat posture based on those attributes and relationships. CloudView is limited to three accounts per public cloud platform. |

| • |

Qualys CertView inventories and assesses all Internet-facing certificates to generate SSL/TLS configuration grades, identifies the certificate issuer and tracks certificate expirations to help stop expired and expiring certificates from interrupting critical business functions. |

Our Growth Strategy

We intend to strengthen our leadership position as a trusted provider of cloud-based IT, security and compliance solutions. The key elements of our growth strategy are:

| • |

Continue to innovate and enhance our cloud platform and suite of solutions. We intend to continue to make significant investments in research and development to extend our cloud platform’s functionality by developing new security solutions and capabilities and further enhancing our existing suite of solutions. From inception through December 31, 2020, we have added the following Cloud Apps: PC, PCI, WAS, WAF, CM, SAQ, TP, FIM, GAV (including a free version), SCA, CS, CI, CSA, CRI, CRA, OCA, PM, VMDR, and EDR. In 2021, we introduced SaaSDR, SEM, and CSAM. |

| • |

Expand the use of our suite of solutions by our large and diverse customer base. With more than 10,000 customers, across many industries and geographies, we believe we have a significant opportunity to sell additional solutions to our customers and expand their use of our suite of solutions. Because our customers typically initially deploy one or two of our solutions in select parts of their IT infrastructures, our existing customers serve as a strong source of new sales as they expand their scope and increase their subscriptions or choose to adopt additional solutions from our integrated suite of IT, security and compliance offerings. In this regard, we continue to expand our sales execution and marketing functions to increase adoption of our newly developed solutions among our existing customers. |

| • |

Drive new customer growth and broaden our global reach. We are pursuing new customers by targeting key accounts, releasing free IT, security and compliance services and expanding both our sales and marketing organization and network of channel partners. We will continue to seek to make significant investments to encourage organizations to replace their existing security products with our cloud solutions. We intend to expand our relationships with key security consulting organizations, managed security service providers and value-added resellers to accelerate the adoption of our cloud platform. We seek to strengthen existing relationships as well as establish new relationships to increase the distribution and market awareness of our cloud platform and target new geographic regions. We also plan to partner with such security providers that can host our private cloud offering within their data centers, helping us expand our reach in new markets and new geographies. |

| • |

Selectively pursue technology acquisitions to bolster our capabilities and leadership position. We may explore acquisitions that are complementary to and can expand the functionality of our cloud platform. We may also seek to acquire development teams to supplement our own personnel and acquire technology to increase the breadth of our cloud-based IT, security and compliance solutions. In 2021, we acquired certain intangible assets of Kandor Soft Labs Private Ltd. (TotalCloud), strengthening our cloud security solution by allowing customers to build user-defined workflows for custom policies and execute them on-demand for simplified security and compliance. In 2020, we acquired certain intangible assets of Spell Security Private Limited (Spell Security), expanding our endpoint behavior detection, threat hunting, malware research and multi-layered response capabilities for our EDR application. In 2019, we acquired Adya Inc. (Adya), enabling us to provide companies of all sizes with the ability to consolidate administration of their Software as a Service (SaaS) applications into one console, manage license costs across SaaS applications, set and enforce security policies in one place and report and audit on all activity with a single tool. |

Our Customers

We market and sell our solutions to enterprises, government entities and small and medium-sized businesses across a broad range of industries, including education, financial services, government, healthcare, insurance, manufacturing, media, retail, technology and utilities. As of December 31, 2021, we had over 10,000 customers worldwide, including a majority of each of the Forbes Global 100 and Fortune 100. In each of 2021, 2020 and 2019, no one customer accounted for more than 10% of our revenues. In 2021, 2020 and 2019, 61%, 63% and 64%, respectively, of our revenues were derived from customers in the United States based on our customers' billing addresses. We sell our solutions to enterprises and government entities primarily through our field sales force and to small and medium-sized businesses through our inside sales force. We generate a significant portion of sales through our channel partners, including managed security service providers, value-added resellers and consulting firms in the United States and internationally.

Sales and Marketing

Sales

We market and sell our IT, security and compliance solutions to customers directly through our sales teams as well as indirectly through our network of channel partners.

Our global sales force is organized into a field sales team, which focuses on enterprises, generally including organizations with more than 5,000 employees, and an inside sales team, which focuses on small to medium-sized businesses, which generally include organizations with less than 5,000 employees. Both our field and inside sales teams are divided into three geographic regions, the Americas; Europe, Middle East and Africa; and Asia-Pacific. We also further assign each of our sales teams into groups that focus on adding new customers or managing relationships with existing customers.

Our channel partners maintain relationships with their customers throughout the territories in which they operate and provide their customers with services and third-party solutions to help meet those customers’ evolving security and compliance requirements. As such, these partners offer our IT, security and compliance solutions in conjunction with one or more of their own products or services and act as a conduit through which we can connect with these prospective customers to offer our solutions. Our channel partners include security consulting organizations, managed service providers and resellers, such as Accenture, BT Managed Security, Cognizant Technology Solutions, Deutsche Telekom, DXC Technology, Fujitsu, Hindustan Computers Limited (HCL) Technologies, International Business Machines (IBM), Infosys, Nippon Telegraph and Telephone Corporation (NTT), Optiv, SecureWorks, Tata Communications, Verizon, Wipro and TD SYNNEX Corporation (TD SYNNEX). Qualys has also established strategic partnerships with leading cloud providers like Amazon Web Services, Microsoft Azure and the Google Cloud Platform.

For sales involving a channel partner, the channel partner engages with the prospective customer directly and involves our sales team as needed to assist in developing and closing an order. When a channel partner secures a sale, we sell the associated subscription to the channel partner who in turn resells the subscription to the customer, with the channel partner earning a fee based on the total value of the order. Once the order is completed, we provide these customers with direct access to our solutions and other associated back-office applications, enabling us to establish a direct relationship as part of ensuring customer satisfaction with our solutions. At the end of the subscription term, the channel partner engages with the customer to execute a renewal order, with our sales team providing assistance as required. In 2021, 2020 and 2019, 41%, 42% and 42%, respectively, of our revenues were generated by channel partners.

Marketing

Our marketing programs include a variety of online marketing, advertising, conferences, events, public relations activities and web-based seminar campaigns targeted at key decision makers within our prospective customers.

We have a number of marketing initiatives to build awareness and encourage customer adoption of our solutions. We offer free trials and services to allow prospective customers to experience the quality of our solutions, to learn in detail about the features and functionality of our cloud platform, and to quantify the potential benefits of our solutions.

Customer Support

Qualys Support delivers 24x7x365 day customer technical support from global centers located in Foster City, California; Raleigh, North Carolina; and Pune, India. We recruit senior level technical personnel and trained subject matter experts who work closely with engineering and operations personnel to resolve issues quickly. Our IT, security and compliance solutions can be deployed easily and are designed to be implemented and operated without the need for significant professional services. We also offer various training programs as part of our subscriptions to all of our customers. In addition, we leverage the insights drawn from our customers to further improve the functionality of our IT, security and compliance solutions. Our mission is to ensure customer satisfaction and play a critical role in retaining and expanding our customer base.

Research and Development and Operations

We devote significant resources to maintain, enhance and add new functionality to our Qualys Cloud Platform and the integrated suite of solutions that we offer. Our development organization consists of agile engineering teams with substantial security expertise in specific areas of our solutions. In addition to our development teams, we also built a sophisticated research team focused on identifying threats and developing signatures for vulnerabilities and compliance checks so that we can provide our customers with daily updates and enable them to scan their assets for the latest threats. We conduct our research and development in the United States, France and India, which gives us access to some of the best research and engineering talent in the world. Our focus remains to attract engineering talent as we continue to add new solutions and improve existing ones.

Our development team works closely with our customers and partners to gain valuable insights into their environments and gather feedback for threat research, product development and innovations. We typically release updates to our solutions, including enhancements and new features multiple times a year, and we measure the quality of our scan results on a frequent basis in an effort to maintain the highest level of scan accuracy.

The modular architecture of our cloud platform enables our engineering teams to simultaneously work on different features, accelerating the delivery of new functionalities to customers. Our research and development team also works collaboratively with our technical support team to ensure customer satisfaction and with our sales team to accelerate the adoption of our solutions.

Manufacturing Agreement

Our physical appliances are provided by TD SYNNEX, pursuant to a manufacturing services agreement dated March 1, 2011. Under this agreement, TD SYNNEX manufactures, assembles and tests our physical scanner appliances. This agreement is automatically renewed annually, unless terminated (i) at any time upon the mutual written agreement of us and TD SYNNEX, (ii) by either party upon 90 days or more written notice, (iii) upon written notice, subject to applicable cure periods, if the other party has materially breached its obligations under the agreement or (iv) by either party upon the other party seeking an order for relief under the bankruptcy laws of the United States or similar laws of any other jurisdiction, a composition with or assignment for the benefit of creditors, or dissolution or liquidation.

Shared Cloud Platform Agreements

Our shared cloud platform operations are provided by large third-party vendors and are located in the United States, Canada, Switzerland, the Netherlands, United Arab Emirates, Australia, United Kingdom and India. Our shared cloud platform agreements have varying terms through 2025.

Competition

The expanding capabilities of our IT, security and compliance solutions have enabled us to address a growing array of opportunities in the cloud IT, security and compliance market. We compete with a large and broad array of established and emerging vulnerability management vendors, compliance vendors and data security vendors in a highly fragmented and competitive environment.

We compete with large and small public companies, such as Belden (Tripwire), Broadcom (Symantec Enterprise Security), CrowdStrike, Palo Alto Networks, Rapid7, and Tenable Holdings, as well as privately held security providers including Axonius, Checkmarx, Flexera, Ivanti, Netsparker, Tanium, Trustwave Holdings and Veracode. We also seek to replace IT, security and compliance solutions that organizations have developed internally. As we continue to extend our cloud platform’s functionality by further developing IT, security and compliance solutions, such as web application scanning and firewalls, we expect to face additional competition in these new markets. Our competitors may also attempt to further expand their presence in the IT, security and compliance market and compete more directly against one or more of our solutions.

We believe that the principal competitive factors affecting our markets include product functionality, breadth of offerings, flexibility of delivery models, ease of deployment and use, total cost of ownership, scalability and performance, customer support and extensibility of platform. We believe that our suite of solutions generally competes favorably with respect to these factors. However, many of our primary competitors have greater name recognition, longer operating histories, more established customer relationships, larger marketing budgets and significantly greater resources than we do.

Intellectual Property

We rely on a combination of trade secrets, copyrights, patents and trademarks, as well as contractual protections, to establish and protect our intellectual property rights and protect our proprietary technology. As of December 31, 2021, we have twenty-six issued patents, which expire from 2029 to 2039, several pending U.S. patent applications and an exclusive license to four U.S. patents. The inbound license remains in effect until the licensed patents are no longer enforceable, unless the applicable license agreement is first terminated by us or terminated by the licensor for a breach of the agreement or if we undergo certain bankruptcy events. The licenses are currently exclusive and will remain exclusive so long as we make an appropriately-timed written election and pay an annual fixed royalty for ten years thereafter. These exclusive licenses are subject to the licensor’s reservation of certain rights in the patents and subject to the U.S. government’s reserved rights in the technology. We have a number of registered and unregistered trademarks. We require our employees, consultants and other third parties to enter into confidentiality and proprietary rights agreements and control access to software, documentation and other proprietary information. We view our trade secrets and know-how as a significant component of our intellectual property assets, as we have spent years designing and developing the Qualys Cloud Platform, which we believe differentiates us from our competitors.

We expect that software and other solutions in our industry may be subject to third-party infringement claims as the number of competitors grows and the functionality of products in different industry segments overlaps. Any of these third parties might make a claim of infringement against us at any time.

Human Capital Resources

We take a holistic approach to our human capital management strategy, striving to create a culture where talented people want to come to work, develop their careers, become leaders, and make a difference for all our stakeholders and communities. Doing the right thing for our people, our communities and our environment upholds the trust of our customers, partners, employees, and stockholders, enabling us to grow our business profitably and meet the diverse needs of our constituents.

As of December 31, 2021, we had 1,823 full-time employees, including 941 in research and development, 308 in sales and marketing, 402 in operations and customer support, and 172 in general and administrative. As of December 31, 2021, approximately 75% of our employees were located outside of the United States, with 67% of our employees located in Pune, India. None of our U.S. employees are covered by collective bargaining agreements. Employees in certain European countries and Brazil have collective bargaining arrangements at the national level. We believe our employee relations are good, and we have not experienced any work stoppages.

Diversity and Inclusion

We are proud to be a leader in the promotion and practice of diversity and inclusion. In addition to having offices and employees all over the world, we take pride in our cultural diversity. Qualys searches the globe for top talent in an effort to recruit and hire diverse individuals with a variety of skills, experiences, and backgrounds. Our objective is to continue to improve our hiring, development, advancement, and retention of diverse talent and to foster an inclusive environment.

Our board of directors and executive team are highly diverse. Three out of our current eight member board of directors are women, one is a man from an underrepresented community, and the board of directors seeks to identify strong candidates who provide a wide range of perspectives, competencies, and knowledge to complement the skills, diversity and experiences of the board of directors. Further, our executive team is gender and ethnically diverse, with more than 50% of the executive team from underrepresented communities.

Health and Safety

We recognize that a healthy environment and safe workplaces are critical to our business, strategy, and communities. We address environmental issues in an integrated manner to encompass protection of the environment as well as the health and safety of our workforce. For example, in response to COVID-19 and the significant increases in remote workforces in March 2020, we mandated a work from home policy to protect our employees and our communities. We also released a free cloud-based remote endpoint protection solution for 60 days that allowed IT and security teams to protect the computers of remote employees and support the health and safety of our communities.

With the ongoing COVID-19 pandemic, our workforce continues to operate remotely, and our top priority remains providing support for our employees, partners, and customers. We are fortunate that the nature of our business allows us to successfully operate in this dynamic work-from-home environment. We have been able to successfully adapt to the current challenges and deliver results despite the pandemic while continuing to protect the health and safety of our workforce and customers.

We require our employees and managers to participate in myriad training programs directed at maintaining a harassment-free, diverse, and secure workplace. With our diverse employee population, we uphold the rights to work in an environment that promotes equal opportunity and prohibits discriminatory practices against race, color, national origin, ancestry, medical condition, religious creed (including religious dress and grooming practices), marital status, registered domestic partner status, sex, sexual orientation, gender identity and expression, genetic characteristics and information, age, veteran status, or any other protected characteristic. Creating a respectful workplace and preventing harassment to our employees remain our on-going commitment.

Compensation and Benefits

We provide robust compensation and benefits to our employees. In addition to competitive base salaries, all qualified employees are eligible for variable pay and equity awards.

To support the health and wellness of our workforce, we offer premium health coverage with minimal out-of-pocket contributions for our global employees.

Training and Development

We have experience with managing and developing a rapidly growing employee base. We believe every employee makes a difference, so we empower them in their roles and support them for maximum professional growth. We assist employees in achieving their career goals by helping them improve their skillsets and transition to other challenging roles. To support career growth inside and outside Qualys, we offer free self-paced or instructor-led certified training on core Qualys topics giving employees and non-employees an opportunity to achieve certifications.

Available Information

Our principal executive offices are located at 919 E. Hillsdale Blvd., 4th Floor, Foster City, California 94404. The telephone number of our principal executive offices is (650) 801-6100, and our main corporate website is www.qualys.com. Information contained on, or that can be accessed through, our website, does not constitute part of this Annual Report on Form 10-K and inclusion of our website address in this Annual Report on Form 10-K is an inactive textual reference only.

We make available our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934, as amended, free of charge on our website, www.qualys.com as soon as reasonably practicable after they are electronically filed with or furnished to the SEC. Additionally, copies of materials filed by us with the SEC may be accessed at the SEC's website, www.sec.gov.

| Risk Factors |

An investment in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, and all other information contained in this Annual Report on Form 10-K, including our consolidated financial statements and the related notes, before making a decision to invest in our common stock. Our business, operating results, financial condition, or prospects could be materially and adversely affected by any of these risks and uncertainties. In that case, the trading price of our common stock could decline, and you might lose all or part of your investment. In addition, the risks and uncertainties discussed below are not the only ones we face. Our business, operating results, financial performance or prospects could also be harmed by risks and uncertainties not currently known to us or that we currently do not believe are material.

Risks Related to Our Business and Industry

The continued spread of COVID-19, or any similar widespread infectious disease outbreak, could harm our business, financial condition and results of operations.

In December 2019, an outbreak of COVID-19 originated in Wuhan, China and has since spread to countries around the world. On March 11, 2020, the World Health Organization characterized COVID-19 as a pandemic. The continued spread of COVID-19 and the resurgence of infection rates in certain regions has resulted in authorities imposing, and businesses and individuals implementing, numerous unprecedented measures to try to contain the virus, such as travel bans and restrictions, quarantines, shelter-in-place/stay-at-home and social distancing orders, and shutdowns. These measures have impacted and may further impact our workforce and operations, the operations of our customers, and those of our respective vendors, suppliers, and partners. The pandemic has significantly increased economic and demand uncertainty and disrupted the global supply chain. It is possible that the pandemic could cause an economic slowdown or a global recession, which could decrease demand for our solutions and negatively impact our operating results. There is a significant degree of uncertainty and lack of visibility as to the extent and duration of any such slowdown or recession.

The ultimate extent of the impact of COVID-19 on our business, financial position, results of operations and cash flows will depend on future developments, which are highly uncertain and cannot be predicted at this time, including but not limited to, the duration of the pandemic, its severity, the actions to contain the virus or treat its impact, future spikes of COVID-19 infections resulting in additional preventative measures to contain or mitigate the spread of the virus, the effectiveness, distribution and acceptance of COVID-19 vaccines, including the vaccines’ efficacy against emerging COVID-19 variants, and how quickly and to what extent normal economic and operating conditions can resume. These impacts, individually or in the aggregate, could have a material and adverse effect on our business, financial position, results of operations and cash flows. Such effect may be exacerbated in the event the pandemic and the measures taken in response to it persist for an extended period of time. Under any of these circumstances, the resumption of normal business operations may be delayed or hampered by lingering effects of COVID-19 on our operations, partners, and customers.

Our quarterly operating results may vary from period to period, which could result in our failure to meet expectations with respect to operating results and cause the trading price of our stock to decline.

Our operating results have historically varied from period to period, and we expect that they will continue to do so as a result of a number of factors, many of which are outside of our control, including:

| • |

the level of demand for our solutions; |

| • |

publicity regarding security breaches generally and the level of perceived threats to IT security; |

| • |

expenses associated with our existing and new products and services; |

| • |

changes in customer renewals of our solutions; |

| • |

the extent to which customers subscribe for additional solutions; |

| • |

seasonal buying patterns of our customers; |

| • |

actual or perceived security breaches, technical difficulties or interruptions with our service; |

| • |

changes in the growth rate of the IT, security and compliance market; |

| • |

the timing and success of new product or service introductions by us or our competitors or any other changes in the competitive landscape of our industry, including consolidation among our competitors; |

| • |

the introduction or adoption of new technologies that compete with our solutions; |

| • |

decisions by potential customers to purchase IT, security and compliance products or services from other vendors; |

| • |

the amount and timing of operating costs and capital expenditures related to the operations and expansion of our business; |

| • |

the timing of sales commissions relative to the recognition of revenues; |

| • |

the announcement or adoption of new regulations and policy mandates or changes to existing regulations and policy mandates; |

| • |

failure of our products and services to operate as designed; |

| • |

price competition; |

| • |

the length of our sales cycle for our products and services; |

| • |

insolvency or credit difficulties confronting our customers, affecting their ability to purchase or pay for our solutions; |

| • |

timely invoicing or changes in billing terms of customers; |

| • |

timing of deals signed within the quarter; |

| • |

pace and cost of hiring employees; |

| • |

changes in foreign currency exchange rates; |

| • |

general economic conditions, both domestically and in the foreign markets in which we sell our solutions; |

| • |

future accounting pronouncements or changes in our accounting policies; |

| • |

our ability to integrate any products or services that we may acquire in the future into our product suite or migrate existing customers of any companies that we may acquire in the future to our products and services; |

| • |

our effective tax rate, changes in tax rules, tax effects of infrequent or unusual transactions, and tax audit settlements; |

| • |

the amount and timing of income tax that we recognize resulting from stock-based compensation; |

| • |

the timing of expenses related to the development or acquisition of technologies, services or businesses; and |

| • |

potential goodwill and intangible asset impairment charges associated with acquired businesses. |

Further, the interpretation and application of international laws and regulations in many cases is uncertain, and our legal and regulatory obligations in foreign jurisdictions are subject to frequent and unexpected changes, including the potential for various regulatory or other governmental bodies to enact new or additional laws or regulations or to issue rulings that invalidate prior laws or regulations.