UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

|

For the fiscal year ended December 31, 2015

OR

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

|

For the transition period from to

Commission File Number 0-31927

VERIFYME, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Nevada

|

23-3023677

|

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(IRS Employer

Identification No.)

|

12 West 21st, 8th Floor

New York, NY 10010

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (212) 994-7002

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ or No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ or No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x or No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x or No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

¨

|

|

Accelerated filer

|

¨

|

||

|

Non-accelerated filer

|

¨ (Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

x

|

||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ or No x

The aggregate market value of the common stock held by non-affiliates of the registrant was $13,385,345 as of June 30, 2015 based on the price in which the common stock of the registrant was last sold as reported by the OTC Bulletin Board. Shares of common stock held by each current executive officer and director and by each person who is known by the registrant to own 5% or more of the outstanding common stock have been excluded from this computation in that such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not a conclusive determination for other purposes.

The registrant had 6,586,711 shares of common stock outstanding as of the close of business on March 30, 2016.

DOCUMENTS INCORPORATED BY REFERENCE

NONE

VERIFYME, INC.

Year Ended December 31, 2015

|

|

Page

|

|||||

|

PART I

|

|

|||||

|

|

1

|

|

||||

|

|

16

|

|

||||

|

|

16

|

|

||||

|

|

16

|

|

||||

|

|

16

|

|

||||

|

|

16

|

|

||||

|

PART II

|

|

|||||

|

|

17

|

|

||||

|

|

17

|

|

||||

|

|

18

|

|

||||

|

|

24

|

|

||||

|

|

24

|

|

||||

|

|

24

|

|

||||

|

|

24

|

|

||||

|

|

25

|

|

||||

|

PART III

|

|

|||||

|

|

26

|

|

||||

|

|

33

|

|

||||

|

|

36

|

|

||||

|

|

38

|

|

||||

|

|

39

|

|

||||

|

PART IV

|

|

|||||

|

|

40

|

|

||||

PART I

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical facts included or incorporated by reference in this annual report on Form 10-K, including without limitation, statements regarding our future financial position, business strategy, budgets, projected revenues, projected costs and plans and objectives of management for future operations, are forward-looking statements. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expects,” “intends,” “plans,” “projects,” “estimates,” “anticipates,” or “believes” or the negative thereof or any variation thereon or similar terminology or expressions. We have based these forward-looking statements on our current expectations and projections about future events. These forward-looking statements are not guarantees and are subject to known and unknown risks, uncertainties and assumptions about us that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Important factors that could cause actual results to differ materially from our expectations include, but are not limited to: our ability to raise additional capital, our limited revenues generated to date, our ability to attract and retain qualified personnel, the ability to successfully develop licensing programs and generate business, rapid technological change in relevant markets, changes in demand for current and future intellectual property rights, legislative, regulatory and competitive developments, intense competition with larger companies, general economic conditions, and other factors set forth described in “Item 7 — Management’s Discussions and Analysis of Financial Condition and Results of Operation” below.

All subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the foregoing. Except as required by law, we assume no duty to update or revise our forward-looking statements.

Overview

VerifyMe , Inc. (the “Company,” “VerifyMe,” “we,” “us,” or “our”) is a technology pioneer in the anti-counterfeiting industry. This broad market encompasses counterfeiting of physical and material goods and products, as well as counterfeiting of identities in digital transactions. We deliver security solutions for identification and authentication of people, products and packaging in a variety of applications in the security field for both digital and physical transactions. Our products can be used to manage and issue secure credentials, including national identifications, passports, driver licenses and access control credentials, as well as comprehensive authentication security software to secure physical and logical access to facilities, computer networks, internet sites and mobile applications.

The challenges associated with digital access control and identity theft are problems that are highly relevant in the world today. Consumers, citizens, employees, governments and employers demand comprehensive solutions that are reliable but not intrusive. The current widespread use of passwords and personal identification numbers, or PINs for authentication has proven to be unsecure and inadequate. Individuals increasingly expect anywhere-anytime experiences—whether they are making purchases, crossing borders, accessing services or logging into online accounts or corporate resources. They expect those experiences to ensure the protection of their privacy and to provide uncompromising confidentiality.

We believe that the digital technologies we own will enable businesses and consumers to reconstruct their overall approaches to security—from identity and authentication to the management of legacy passwords and PINs. We empower our customers to take advantage of the full capabilities of smart mobile devices and provide solutions that are both simple to use and deliver the highest level of security. These solutions can be applied to corporate networks, financial services, e-gov services, digital wallets, mobile payments, entertainment, subscription services, and social media.

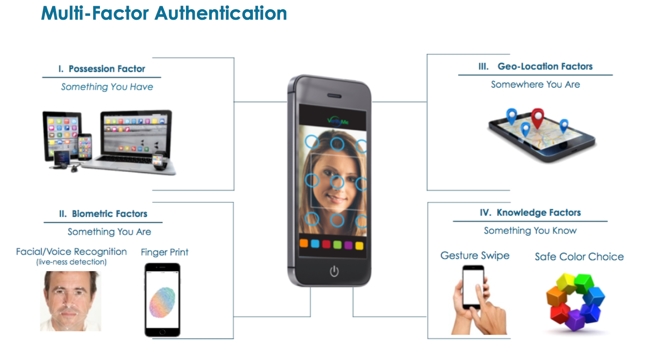

Our digital technologies involve the utilization of multiple authentication mechanisms, some of which we own and some of which we license. These mechanisms include biometric factors, knowledge factors, possession factors and location factors. Biometric factors include facial recognition with liveness detection, finger print and voice recognition. Knowledge factors include a personal gesture swipe and a safe and panic color choice. Possession factor includes devices that the user has in their possession such as a smartphone, smart watch, and other wearable computing devices. The location factor geo-locates the user during a secure login. We surround these authentication mechanisms with proprietary systems that improve the usability and the security of the solutions. Our solutions allow the assessment and quantification of risk using a sophisticated heuristic scoring mechanism. We have specialized systems that perform ‘liveness’ detection to insure the subject of authentication is in fact a live human being. We have systems that introduce learning capabilities into our solutions to improve the ease of use and flexibility.

We believe that the physical technologies we own will enable businesses and consumers to reconstruct their overall approaches to security—from counterfeit identification to employee or customer monitoring. Potential applications of our technologies are available in different types of products and industries—e.g., gaming, apparel, tobacco, fragrances, pharmaceuticals, event and transportation tickets, driver’s licenses, insurance cards, passports, computer software, and credit cards. We generate sales through licenses of our technology and through direct sales of our technology.

Our physical technologies involve the utilization of invisible and/or color shifting/changing inks, which are compatible with today’s printing machines. The inks may be used with certain printing systems such as offset, flexographic, silkscreen, gravure, and laser. Based upon our experience, we believe that the ink technologies may be incorporated into existing manufacturing processes. We believe that some of our patents may have non-security applications, and we are attempting to commercialize these opportunities.

Anti-Counterfeiting Technologies and Products

Recent developments in copying and printing technologies have made it easier to counterfeit a wide variety of documents and products. Currency, lottery tickets, credit cards, event and transportation tickets, casino slot tickets, and travelers’ checks are all susceptible to counterfeiting. We believe that losses from such counterfeiting have increased substantially with improvements in counterfeiting technology. Counterfeiting has long caused losses to manufacturers of brand name products, and we believe that these losses have increased as the counterfeiting of labeling and packaging has become easier.

We believe that our physical and material goods anti-counterfeit technologies may be useful to businesses desiring to authenticate a wide variety of materials and products. Our technologies include (1) a technology utilizing invisible ink that can be revealed by use of laser light for authentication purposes, (2) an inkjet ink technology, which allows invisible codes to be printed and (3) a color shifting technology that is activated by certain types of lights. All of those technologies are intended to be substantially different than pen systems that are currently in the marketplace. Pen systems also rely on invisible ink that is activated by a special marker. If the item is an original and not an invisible print, then the ink will be activated and show a visible mark as a different color than on an illegitimate copy. We believe that our technologies are superior to the pen system technology because, in the case of its laser and color shifting technologies, it will not result in a permanent mark on the merchandise. Permanent marks generally lead to the disposal of the merchandise or its sale as a “second” rather than best-quality product. In the case of rubbed ink technology, no special tools are required to distinguish the counterfeit. Other possible variations of our laser based technology involve multiple color responses from a common laser, visible marks of one color that turn another color with a second laser, or visible and invisible marks that turn into a multicolored image. These technologies provide users with the ability to authenticate products and detect counterfeit documents. Applications include the authentication of documents having intrinsic value, such as currency, checks, travelers’ checks, gift certificates and event tickets, and the authentication of product labeling and packaging. When applied to product labeling and packaging, our technologies can be used to detect counterfeit products with labels and/or in packaging that do not contain the authenticating marks invisibly printed on the packaging or labels of legitimate products, as well as to combat product diversion (i.e., the sale of legitimate products through unauthorized distribution channels or in unauthorized markets). We believe that our technologies also could be used in a manner that permits manufacturers and distributors to track the movement of products from production to ultimate consumption when coupled with proprietary software.

In the past, we have focused on the widespread problem of counterfeiting in the gaming industry. We have incorporated our technology into traditional gaming accessories such as playing cards, casino chips, and dice as well as gaming-based machinery such as slot machines with cashless gaming systems. This is accomplished during the regular manufacturing and printing processes. Our products use ink that is incorporated into dice and casino chips that can be viewed with a laser to reveal the authenticity of the item.

Physical and Material Goods Anti-Counterfeit Industry — Overview

Currency, passports, ID cards and other high-value documents have historically been subject to counterfeiting and forgery and continue to be today. Many consumer industries such as pharmaceutical, luxury goods and auto parts are also subject to significant counterfeiting. In the last 15 years, the counterfeiting of goods has increased significantly on a global basis and has become a major threat to brand owners in most industries. Major brands, whether national or multinational, are being systematically attacked by sophisticated criminals and terrorists. Furthermore, counterfeiting and forgery have filtered down to the level of lone criminals due to the availability of digital scanning and copying technologies.

The U.S. is projected to remain the largest single consumer of security services and products in the world. One of the most important new areas of expansion is in the area of authentication, which is the act of confirming that objects such as currency, passports, casino chips, credit cards, stock certificates, pharmaceuticals, stamps, identification cards, lottery tickets, and so forth, are real and not forgeries. With the advent of the digital age, including the color copier and other new technologies and templates available on the web, thieves and forgers have been able to make near identical copies of almost any printed item, which has resulted in major financial losses to business and, importantly, has compromised security at critical installations. One particular problem is that criminal and civil penalties for forgery, fraud, and counterfeiting are relatively light, and many of those engaging in such activities are overseas and far from the reach of U.S. law enforcement.

While some currency and credit cards have introduced holograms, seals, and embedded strips in order to add a level of protection, most such methodologies are expensive and, in some cases, time-consuming in the production process. In other instances, such as when printing cigarette tax stamps or hundreds of millions of pieces used in a popular restaurant chain’s contest game pieces, the authentication process must be extremely inexpensive and easy to use or it will be rejected. There is no commercially fiscal way, for example, that a hologram, costing around five cents a copy, can be introduced to verify tax stamps. Moreover, more than half the national currencies in the world lack even one layer of protection and can easily be counterfeited.

Counterfeiting, product diversion, piracy, forgery, identity theft, and unauthorized intrusion into websites, physical locations and databases create significant and growing problems to companies in a wide range of industries as well as governments and individuals worldwide. Counterfeiting is a global problem, and it is a problem that appears to be increasing. According to the 2012 Global Report on Counterfeiting: Anti-Counterfeiting and The Apparel Industry — February 2012, revenues generated from counterfeit product sales are estimated to have grown by more than 400% since the early 1990s, while sales of legitimate brands grew just 50% over the same timeframe. In February 2011, the International Chamber of Commerce (“ICC”) issued an updated report on counterfeiting and piracy that states that the global economic and social impacts of counterfeiting and piracy could reach $1.7 trillion by 2015.

Counterfeiting is one of the fastest growing economic crimes of modern times. It presents companies, governments and individuals with a unique set of problems. What was once a cottage industry has now become a highly sophisticated network of organized crime that has the capacity to threaten the very fabric of national economies, endanger safety and frequently kill. It devalues corporate reputations, hinders investment, funds terrorism, and costs hundreds of thousands of people their livelihood every year.

The anti-counterfeiting industry is segmented into four general categories: (i) Optical technologies - use of light, i.e. holograms; (ii) Electronic - magnetic strips and smart cards; (iii) Biotechnologies - uses characteristics of biological proteins such as antibodies, enzymes and DNA; and (iv) Chemical technologies - includes photochromic (or light-reactive) and thermochromic (or heat-reactive) inks.

We operate in the chemical technologies and security ink sectors of the industry. Products in this industry change color when exposed to either heat or light and revert to their original color when exposed again. Generally, the effect is reversible as often as required. Inks have also been developed that are invisible to the human eye but which can be read by bar-code scanners. These have been used in the fragrance and pharmaceutical industries to authenticate products. Other reactive inks change color when brought into contact with specific substances, such as ink from a felt-tipped pen.

Recent developments in printing technologies have made it easier to counterfeit a wide variety of documents. Lottery tickets, gift certificates, event and transportation tickets and travelers’ checks are all susceptible to counterfeiting, and we believe that losses from such counterfeiting have increased substantially due to improvements in technology. Counterfeiting has long caused losses to manufacturers of brand name products, and we believe that these losses have increased as the counterfeiting of labeling and packaging has become easier.

In April 2010, the United States Government Accountability Office (“GAO”) issued a report to Congress entitled, “INTELLECTUAL PROPERTY: Observations on Efforts to Quantify the Economic Effects of Counterfeit and Pirated Goods.” In this report, the GAO estimated that the total economic value of intellectual property seizures by Customs and Border Protection during 2004 to 2009 was $1.12 billion. This was based only on imported goods and not goods produced in the United States.

The Organization for Economic Cooperation and Development estimates that the value of counterfeiting is approximately $250 billion per year. They also conclude that millions of consumers are risking their lives by using unsafe and ineffective counterfeit products unknowingly.

Identification Cards and Secure Documents

Governments are increasingly vulnerable to counterfeiting, terrorism and other security threats at least in part because currencies, identity and security cards and other official documents can be counterfeited with relative ease. For instance, Havocscope, a company that collects black market intelligence and identifies security threats, reports that the value of counterfeit identification and passports is currently $100 million. Governments must also enforce the various anti-counterfeiting and anti-piracy regimes of their respective jurisdictions which becomes increasingly difficult with the continued expansion of global trade. To highlight the size of the problem, in April 2012 the European Parliament estimated that of the 6.5 million biometric passports in circulation in France, between 500,000 and one million are ‘false,’ having been obtained using counterfeit documents. Our overt and covert ink pigment platform can provide secure, forensic, and cost-effective anti-counterfeiting, anti-piracy and identification solutions to local, state, and federal governments as well as the defense contractors and the other companies that do business with them. Our pigment solution cans be used for all types of identification and official documents, such as:

|

|

·

|

passports;

|

|

|

·

|

permanent resident, or “green” cards and visas;

|

|

|

·

|

drivers’ licenses;

|

|

|

·

|

Social Security cards;

|

|

|

·

|

military identification cards;

|

|

|

·

|

national transportation cards;

|

|

|

·

|

security cards for access to sensitive physical locations; and

|

|

|

·

|

other important identity cards, official documents and security-related cards.

|

Pharmaceuticals

The pharmaceutical industry faces major problems relative to counterfeit, diluted, or falsely labeled drugs that make their way through healthcare systems worldwide, posing a health threat to patients and a financial threat to producers and distributors. Counterfeit prescription pharmaceuticals are a growing trend, widely recognized as a public health risk and a serious concern to public health officials, private companies, and consumers. The National Association of Boards of Pharmacy estimates that counterfeit drugs account for 1–2% of all drugs sold in the United States. The World Health Organization (“WHO”) estimates the annual worldwide “take” from counterfeit drugs to be £13 billion (approximately $20 billion USD), a figure that is expected to double by the end of this decade. In some countries, counterfeit prescription drugs comprise as much as 70% of the drug supply and have been responsible for thousands of deaths, according to the WHO. Counterfeit pharmaceuticals are estimated to be a billion-dollar industry, though some estimate it to be much larger. In 2012, the WHO reported that in over 50% of cases, medicines purchased over the Internet from illegal sites that conceal their physical address have been found to be counterfeit. According to the WHO, counterfeiting can apply to both branded and generic products and counterfeit pharmaceuticals may include products with the correct ingredients but fake packaging, with the wrong ingredients, without active ingredients or with insufficient active ingredients.

Based on this growing threat, many countries have started to address vulnerabilities in the supply chain by enacting legislation which, among other things, requires the implementation of a comprehensive system designed to combat counterfeit, diluted or falsely labelled pharmaceuticals. These systems are often referred to as serialization, or in the United States as e-Pedigree (electronic pedigree). One jurisdiction that has enacted such regulations is California, which passed legislation requiring that 50% of all “dangerous drugs” (defined as all prescription drugs) that are distributed in California must be serialized and have an electronic pedigree by January 1, 2015; 100% of all dangerous drugs must have an electronic pedigree by January 1, 2016.

We believe that ePedigree and serialization requirements will likely be implemented in all aspects of the pharmaceutical supply chain, from the manufacturer to the packager, wholesaler, distributor and final dispensing entity. The ePedigree provides an “audit trail,” or documented evidence, to help to identify and catch counterfeiting and diversion. Serialization requires manufacturers, or third-party packagers in some virtual supply chains, to establish and apply to the smallest saleable unit package or immediate container a “unique identification number.” In some cases, drug makers are spending as much as 8-10% of a medicine pack’s total production cost only on solutions to protect it from duplication and counterfeiting, according to company executives. Our unique pigments embedded in the ink of a unique serialized barcode can provide a layered security foundation for a customer solution in this market.

Consumer Products

Counterfeit items are a significant and growing problem with all kinds of consumer packaged goods, especially in the luxury retail and apparel industries. According to the World Customs Organization, European clothing and footwear companies lose an estimated €7.5 billion per year to counterfeiting; Havocscope values the counterfeit clothing market at $12 billion. Our unique ink pigments can be incorporated in dyes and used by manufacturers in these industries to combat counterfeiting and piracy of actual physical goods. Our pigments expressed as inks can also be used on packaging, as well to track products that have been lost in transit, whether misplaced or stolen.

Food and Beverage

Counterfeit food threats are becoming more common as supply chains become more global and as imaging and manufacturing technology become more accessible. Numerous reports of counterfeit foods have been reported, including long-grain rice labelled and sold as basmati rice, Spanish olive oil bottled and sold as Italian olive oil, and mixtures of industrial solvents and alcohol sold as vodka. Although many of these stories have emerged from the U.K. and Europe, the fake-food problem is also relevant in the United States.

The National Center for Food Protection and Defense estimates that Americans pay $10 billion to $15 billion annually for fake food — often due to product laundering, dilution and intentionally false labeling. We believe our pigments and authentication tools can help in the battle against counterfeit foods and beverages.

Printing and Packaging

Counterfeiting in packaging has greatly intensified in recent years, causing concerns for consumers and financial concern for businesses worldwide. As a result, the global anti-counterfeit packaging market is estimated to reach approximately $128.6 billion by the year 2019, according to MarketsandMarkets. Billions of dollars per year are at stake for companies as they seek ways to ensure that the products sold with their logos and branding are authorized and authentic. The proliferation of counterfeiting requires brand owners and their converter/printer partners to work together to create a multi-layered protection plan so that their packaging and labels protect their brands and deter those trying to profit at their (and their reputation’s) expense.

Counterfeiters have become so good at their unlawful activity that spotting the difference between legitimate and counterfeit products can be daunting. Counterfeiters have many ways to subvert legitimate brands. These may include taking an out-of-date product and selling it in packaging and labels that have been forged; sometimes, the packaging, labels and product itself are all counterfeited. Counterfeiters might also use legitimate packaging coupled with fake products. We believe our pigment security systems are a cost-effective solution for printer and packagers and are easily integrated into their existing manufacturing process.

The Opportunity

As counterfeiting continues to increase and losses to manufacturers and others continue to escalate, we believe that those entities will seek better technologies to minimize their exposure. These technologies, however, must also be cost-effective, easy to integrate, and highly resistant to counterfeiting themselves.

Our Solutions

In the areas of authentication and serialization of physical goods, we offer clients the following products as anti-counterfeit systems:

|

|

·

|

RainbowSecure™;

|

|

|

·

|

SecureLight™;

|

|

|

·

|

SecureLight+™; and

|

|

|

·

|

Authentication tools.

|

RainbowSecureTM technology was our first technology to be patented. It combines an invisible ink with a proprietary tuned laser to enable counterfeit products to be exposed. It has been widely accepted in the gaming industry, where the technology has been used by casinos to protect their chips, dice, and playing cards from fraud. The technology also features a unique double layer of security which remains entirely covert at all times and provides licensees with additional protection. RainbowSecure™ is particularly well-suited to closed and controlled environments, such as casinos that want to verify transactions within a specific area, and are not interested in outside public verification by consumers. The technology is also appropriate for anti-counterfeit protection of tags and labels in the apparel industry, where it can be applied to a variety of different materials in the form of dyes.

SecureLightTM technology was developed as a result of our investment in new proprietary color shifting inks that could penetrate broader markets and result in far greater revenues. During the past nine years, we have refined our technologies and their applications, and now have what we believe to be the easiest, most cost effective and efficient authentication technologies available in the world today. Our technology, known as SecureLight™, takes advantage of the new ubiquitous energy efficient fluorescent lighting to change the color of ink, resulting in hundreds of new applications ranging from credit cards to driver’s licenses, passports, stock certificates, clothing labels, currency, ID cards, and tax stamps. The technologies can also be used to protect apparel, pharmaceuticals, and virtually any other physical product.

SecureLight+TM technology combines the covert characteristics of RainbowSecure and the overt characteristics of SecureLight. This provides a solution which can be authenticated in two different ways - by proprietary tuned laser devices, and also by anyone with fluorescent lighting including end consumers.

Authentication tools have been developed which we sell to customers in conjunction with pigments and are tuned to authenticate the unique frequency of each batch. This allow for customers to instantly authenticate items with a customized beeper which will only positively identify a product bearing their unique anti-counterfeit solution. This authentication is provided in the form of an LED indicator and audible ‘beep’.

Raw Material Suppliers

Our security pigments are manufactured from naturally occurring inorganic materials. The manufacturing process includes both chemical and mechanical elements. In many cases, we produce pigments that are unique to a particular customer or product line. This uniqueness can be achieved through a variety of techniques, including custom formulation or combination of our proprietary pigments and/or incorporation of other specialized taggants.

There are many manufacturers of these types of specialized pigments and we intend to maintain multiple simultaneous relationships to ensure ample sources of supply.

Distribution

We currently distribute pigments directly to our customers. We are in discussions with an existing channel partner regarding an arrangement to use their secure facilities to house inventory and fulfill customer orders. We provide pigment mixing instructions for the specific uses of each client based on their existing equipment and processes. We maintain policies and procedures to monitor, track and log access to and disposition of all pigment. Our customers are also required to agree to and implement these policies and procedures.

The company has also developed relationships with ink suppliers for formulation and mixing of inks and coatings, which can be provided directly to customers. Typically, inks and coatings are formulated and mixed individually for specific printing equipment and applications for different substrates. We have worked with ink suppliers to optimize the formulation of inks and coatings incorporating our pigments. Our ready supply of finished inks and coatings allows for customers to easily utilize our solutions.

Digital Authentication Technologies and Products

We believe accurate identification of human beings in electronic transactions, also known as Digital Identity Management, will continue to be a large and rapidly growing market. As more electronic transactions incorporate the exchange of value and money, the verification of the unique identity of human beings participating in those transactions becomes more important. In general, every electronic transaction has a least two actors – a subject and a relying party. The relying party has a business need to eliminate or reduce risk associated with the identification of the subject.

Electronic financial theft and electronic theft of private information make headlines almost every day - according to a 2015 Identity Fraud Study released by Javelin Strategy & Research, in 2014, $16 billion was stolen from 12.7 million U.S. consumers. The majority of this harm can be traced to weak authentication systems, such as Username/Password, yet these weak systems continue to be used in most of the world’s transactional systems.

Historically, stronger authentication solutions, such as biometric, two-factor and multi-factor solutions have been difficult to use and expensive to deploy and operate. The extraordinary proliferation of smart phones and tablets provide an infrastructure for disruptive solutions that leverage the mobile nature of these devices and the multi-sensor computing capabilities.

VerifyMe Authenticator is a digital identity management platform that provides extensible authentication mechanisms that can be dynamically invoked to achieve a specified degree of identity assurance. The Authenticator platform incorporates a risk engine that associates individual risk parameters and scores with every unique authentication mechanism. The risk engine then generates aggregate risk scores based on the specific combination of individual authentication mechanisms used to confirm the identity of the human being.

Digital Authentication Industry Background

The growth in internet banking and internet commerce and the increasing use and reliance upon proprietary or confidential information that is remotely accessible by many users by businesses, government and educational institutions, has made information security a paramount concern. We believe that enterprises are seeking solutions that will continue to allow them to expand access to data and financial assets while maintaining network security.

A vendor in the user authentication market delivers on-premises software/hardware or a cloud-based service that makes real-time authentication decisions for users who utilize an arbitrary endpoint device (that is, not just Windows PCs or Macs) to access one or more applications, systems or services in a variety of use cases. Where appropriate to the authentication methods supported, a vendor in this market also delivers client-side software or hardware that end users utilize to make those real-time authentication decisions.

The market is mature, with several vendors offering products that have been continuously offered during the past three decades (although ownership has changed over that time). However, new methods and vendors continue to emerge, with the most rapid growth occurring within the past decade in response to the changing market needs for different trade-offs among trust, user experience (“UX”) and total cost of ownership (“TCO”). The greater adoption of user authentication over a wider variety of use cases, the impact of mobile, cloud and big data analytics, and the emergence of innovative methods continue to be disruptive.

While over 100 authentication vendors currently operate in the market, the vast majority deliver two-factor authentication solutions. Even the few vendors that market biometric solutions simply combine them with a password for two-factor security.

Internet and Enterprise Security. With the advent of personal computers and distributed information systems in the form of wide area networks, intranets, local area networks and the Internet, as well as other direct electronic links, many organizations have implemented applications to enable their workforce and third parties, including vendors, suppliers and customers, to access and exchange data and perform electronic transactions. As a result of the increased number of users having direct and remote access to such enterprise applications, data and financial assets have become increasingly vulnerable to unauthorized access and misuse.

Individual User Security. In addition to the need for enterprise-wide security, the proliferation of personal computers, personal digital assistants and mobile telephones in both the home and office settings, combined with widespread access to the Internet, have created significant opportunities for electronic commerce by individual users such as electronic bill payment, home banking and home shopping.

The continued reliance by most enterprises on passwords and PINs has resulted in daily identity theft and data breaches, with massive attacks being announced almost every week. The companies that have been attacked and compromised private data include top brands in finance, retail, entertainment, technology and governments.

Strong Authentication Market

A strong authentication market has emerged, initially led by two-factor authentication solutions. Two-factor authentication solutions combine a password with a second factor, which typically involves proving possession of some object, which may include a one-time password token that generates rotating secret codes, a telephone via a callback or a SMS message, or an email address via emailing a secret code.

The global multifactor authentication (“MFA”) market is predicted to reach more than $10 billion by 2017 as three-, four- and five-factor authentication systems gain prominence. Part of this growth can be attributed to the rise of biometric security services, such as fingerprint, retina and facial scanning. A recent report found that all authentication methods using more than two factors included some form of biometric scanning.

Currently, 90% of the MFA market belongs to two-factor authentication. These “standard” methods include passwords, hardware tokens and PINs, although some systems do employ a secondary biometric scan. With a predicated compound annual growth rate of 19.67 percent over the next three years, however, it’s clear that the other 10 percent — and the biometric technology needed to support them — will play a large role. As it stands, three-factor authentication is mostly used in bank lockers and immigration, while four- and five-step methods only make an appearance in high-level government operations. Part of the problem is cost since it’s often prohibitive for a small business to roll out full facial recognition or install high-level fingerprint scanners.

Password Manager/Digital Wallet Market

2012 was the year of password theft, according to SecurityCoverage. The security software company says that in the first six months of 2012, online password breaches increased 300% over the same period in 2011. Since then, this growth rate has continued. In the case of the recent data breach of dating service Ashley Madison, it is expected that the exposed personally identifiable information of over 30 million people will directly lead to the compromise of other password based accounts and services.

Until companies figure out a better way to protect their data in the cloud, we believe that the best solution is to enforce higher security with password managers. Password managers provide tools to encrypt text files that can store passwords that are not Web based, such as Windows and Outlook passwords, Lotus Notes passwords, administration passwords including local and domain accounts, BIOS passwords, encrypted hard drive passwords, cell phone and voicemail passwords and iPad and iPhone passwords. Password managers promise greater security while improving the user experience.

The best password managers sync to the cloud across all dominant platforms and require multi-factor authentication. There are currently no password managers that utilize more than two-factor authentication and none that incorporate additional biometric mechanisms.

The Opportunity

As identity theft and data breaches continue to increase and losses to service providers and individuals continue to escalate, we see both enterprises and consumers seeking better solutions to protect their interests. These solutions must be cost effective, easy to integrate, and simple to use.

Any transaction or action which requires authentication of an individual is a potential opportunity for a strong multi-factor solution such as VerifyMe Authenticator. This is a very large market opportunity, within which we are focused on four specific segments:

|

|

·

|

Subscription services market, where revenue is commonly lost due to multiple individuals sharing user credentials to access information and services;

|

|

|

·

|

Online gaming market, where financial transactions are performed and also geo-location is very important to comply with state/country regulations;

|

|

|

·

|

Financial services market, where there is a large financial risk to identity theft and fraud; and

|

|

|

·

|

Physical access control market, where the identity of individuals is key to allow access to buildings.

|

Our Solution

VerifyMe Authenticator delivers an electronic authentication solution for identifying individual human beings. When a subject attempts to access an internet resource and asserts an identity, VerifyMe Authenticator attempts to authenticate the asserted identity. It does this utilizing multiple strong authentication mechanisms, involving at least three independent factors. VerifyMe Authenticator can deliver identity assurance consistent with National Institute of Standards and Technology (NIST) Level 4 authentication requirements as specified in Special Publication 800-63-1.

VerifyMe Authenticator is based around mobile apps that incorporate a password manager and single sign on (“SSO”) capability. In addition to facilitating strong authentication during the logon process to the enterprise resource or service, VerifyMe Authenticator also lets the user conveniently integrate and protect all of their legacy username and passwords.

Fast and Easy to Use

VerifyMe Authenticator replaces passwords and PINs with a quick, intuitive and user-friendly interface. Our customers are able to authenticate end users in multiple ways (multi-factor) in the same timeframe as a conventional password login. The Service is platform agnostic (available for IOS, Android, Mac and PC), and scalable for use on wearable personal devices.

Support for Any Authentication Method

VerifyMe Authenticator has the ability to authenticate individuals using facial recognition, fingerprint, voice scanning, retina scanning, swipe pattern recognition, location detection and approved IP detection. We believe that Authenticator can provide the highest levels of confidence, security and account protection to a businesses’ customers, all within seconds. VerifyMe Authenticator are not limited to specific authentication factors. Our platform can support any available authentication mechanism, including those that require policy-driven mechanisms. We are continuing to add new authentication mechanisms , including mechanisms suitable for wearable devices and new biometrics.

Multi-Factor Confidence Scores

Depending on the desired level of confidence, different online and mobile application accounts can require varying quality scores. As the desired level of security increases, so does the required quality score to complete a sign-in transaction. As the quality score increases, additional authentication factors are added to the sign-in process.

Secure Platform, Easy to Integrate

VerifyMe Authenticator can be delivered either as managed service from our secure cloud or as licensed software which can be operated with existing infrastructure. VerifyMe Authenticator also features the following benefits:

|

|

·

|

Available to be white-labeled and integrated into existing digital platforms;

|

|

|

·

|

Non-Stop, audited, monitored, private cloud service;

|

|

|

·

|

Three independent, fault tolerant, redundant data centers (“Rackspace”);

|

|

|

·

|

Global load balancing and traffic management;

|

|

|

·

|

High level commercial API’s can be integrated in hours; and

|

|

|

·

|

Complete audit information, including fresh biometrics.

|

The three factors VerifyMe Authenticator utilize include, but are not limited to, the following:

Factor 1 – Something you have – a possession device – typically this is a registered mobile device, which we can authenticate either via SMS or email round robin protocol.

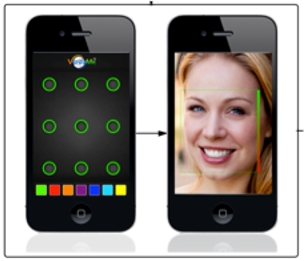

Factor 2 – Something you know – a knowledge factor – we currently utilize a color gesture swipe. This requires the subject to confirm their secret color and appropriately connect dots on a matrix consistent with their registered gesture pattern.

Factor 3 – Something you are – we utilize facial recognition to authenticate images captured in real-time using the registered device’s built in camera, with images that were stored in the subject’s profile during registration.

Our platform can be distinguished from competitors in that it is not limited to any of the above authentication mechanisms; VerifyMe Authenticator currently supports many more authentication mechanisms and we intend to continue expanding this list. For example, our platform is not limited to facial recognition as a biometric mechanism. It currently supports voice, fingerprint and other mechanisms.

In addition, VerifyMe Authenticator includes a risk-scoring engine that is able to enforce complex, customer specific authentication policies and shield them from the underlying complexity of evaluating multiple, independent authentication mechanisms. This risk engine allows us to constantly add new authentication mechanisms as they emerge. We see the emerging market of wearable devices as providing new authentication mechanisms that will be very simple and reliable for the end-user. Because our risk engine insulates the enterprise from the complexity of having to interface with all these different platforms, they are available to benefit from and insure their customers can utilize these devices to their full potential.

VerifyMe Authenticator is platform agnostic (available for IOS, Android, Mac, Linux and Windows) and scalable for use on wearable personal devices. The digital platform is an enterprise solution, which combines multiple independent authentication factors and can also determine geo-location utilizing a number of mechanisms including GPS, cell tower triangulation and IP/WIFI address. Because the service utilizes biometrics and liveness detection, it eliminates the possibility that users might share their authentication credentials, or that user accounts can be accessed by other individuals. The combination of biometrics and geo-location provides extremely strong transactional evidence, making it nearly impossible for an end-user to refute having been part of a transaction.

Our Technology

We have attempted to achieve sufficient flexibility in our products and technologies so as to provide cost-effective solutions to a wide variety of counterfeiting problems. We intend to generate revenues primarily by selling pigment to manufacturers who incorporate our technologies into their manufacturing processes and their products as well as through licensing fees where we are providing unique or custom solutions.

Our Intellectual Property

Intellectual property is important to our business. Our current patent portfolio consists of ten granted patents and six applications pending. While some of our granted patents are commercially ready, we believe that others may have commercial application in the future but will require additional capital and/or a strategic partner in order to reach the potential markets. All of our patents are related to the inventions described above. Our patents begin to expire between the years 2019 and 2031.

We continue to develop new anti-counterfeiting technologies and to apply for patent protection for these technologies wherever possible. When a new product or process is developed, we may seek to preserve the economic benefit of the product or process by applying for a patent in each jurisdiction in which the product or process is likely to be exploited.

The granting of a patent does not prevent a third party from seeking a judicial determination that the patent is invalid. Such challenges to the validity of a patent are not uncommon and are occasionally successful. There can be no assurance that a challenge will not be filed to one or more of our patents, if granted, and that if filed, such a challenge will not be successful.

Research and Development

We have been involved in research and development since our inception and intend to continue our research and development activities, funds permitting. Until January 1, 2013, our research and development focused on pigment technologies. Since January 1, 2013, we have allocated research and development efforts between digital and pigment technologies. We hope to expand our technology into new areas of implementation and to develop unique customer applications. We spent approximately $2.4 million and $10.6 million on research and development during the years ended December 31, 2015 and 2014.

Our Revenue Model

To date, we have not generated significant revenue. We believe that creating demand for our products and services will require a marketing program that effectively reaches potential customers. In developing our most recent marketing approach, we have attempted to achieve sufficient flexibility in our products and technologies so as to provide cost-effective solutions to a wide variety of counterfeiting problems. We intend to generate revenues primarily by collecting license fees from manufacturers who incorporate our technologies into their manufacturing processes and user authentication protocols, as well as through the sale of pigments to be incorporated in inks and dyes and the sale of authentication tools.

Sales and Marketing Strategy

We plan to direct our sales and marketing strategy at multiple target groups as follows:

|

Consumer Product Security

|

· Pharmaceuticals

· Luxury goods

· Tobacco

· Alcohol

· Auto parts

· Aviation parts

· Any other packaging requirements

|

|

Documents of Value

|

· Currency

· Stock certificates and bonds

· Event tickets

· Lottery tickets

|

|

Homeland Security

|

· Passports

· ID cards

· Driver’s licenses

· Visas

· Container seals

· Pallet security

|

|

Gaming

|

· Online gaming sites

· Casino chips

· Dice

· Playing cards

· E-proms/critical memory devices

· Lottery tickets

|

|

Product Diversion Tracking

|

· Pharmaceuticals

· Apparel/licensed merchandise

· Cosmetics and fragrances

· Watches and jewelry

|

|

Financial Services and Products

|

· Consumer login credentials

· Online transaction approval

· Credit cards

· Bank checks

· Financial documents/promissory notes

|

We plan for our sales and marketing strategy to include an outreach program and sales programs that tailor the product to the governmental body or merchant, as well as key partnerships with authorities and merchants whose products or audiences can be complementary to our own. In particular, we will focus on building relationship with key partners who can deliver our products to their existing and prospective customers in target markets - i.e., printer/packagers, plastic card manufacturers and financial services intermediaries.

Competition

The market for protection from counterfeiting, diversion, theft and forgery is a mature 25-year-old industry dominated by a number of large, well-established companies, particularly in the area of traditional overt security technologies. This is due to the fact that security printing for currency production, for example, began in Europe over a century ago and has resulted in the establishment of old-line security printers which have branched out into brand and product protection as well. In North America, brand protection products, such as tamper-resistant packaging, security labels, and anti-theft devices are readily available and utilized on a widespread basis. In recent years, however, demand has increased for more sophisticated overt and covert security technologies. Competitors can be segregated into the following groups: (i) Security Ink Manufacturers. These are generally well-established companies such as SICPA and Sun Chemical, whose core business is printing inks; (ii) System Integrators. These companies have often evolved from other sectors in the printing industry, mainly security printing manufacturers, technology providers, or packaging and label manufacturers. These companies offer a range of security solutions, enabling them to provide a complete suite of solutions tailored to the customer’s specific needs and requirements. The companies in this space include 3M, DuPont, Honeywell, and Avery Dennison; (iii) System Consultancy Groups. These companies offer a range of technologies from several different providers and tailor specific solutions to end-users; (iv) Traditional Authentication Technology Providers. These purveyors include American Banknote Holographics and Digimarc, which provide holograms and digital watermarking, respectively; (iv) Product Diversion Tracking Providers. Next-Generation Technology Providers LLC falls into this group, along with several companies such as Applied DNA Sciences, Authentix, DNA Technologies, and Identif, which provide on-product and in-product tagging technologies; (v) Traditional Security Printers. This group includes traditional security printers such as Thomas de la Rue and Portals, whose core products are printing the world’s currencies; and (vi) Biometric Solution Providers. These companies offer biometric authentication capabilities to be integrated with existing mobile device authentication, such as ImageWare Systems.

To compete effectively, we expect that we will need to expend significant resources in technology and marketing. Each of our competitors has substantially greater financial, human and other resources than we have. As a result, we may not have sufficient resources to develop and market our services to the market effectively, if at all.

We expect competition with our products and services to continue and intensify in the future. We believe competition in our principal markets is primarily driven by:

|

|

·

|

product performance, features and liability;

|

|

|

·

|

price;

|

|

|

·

|

timing of product introductions;

|

|

|

·

|

ability to develop, maintain and protect proprietary products and technologies;

|

|

|

·

|

sales and distribution capabilities;

|

|

|

·

|

technical support and service;

|

|

|

·

|

brand loyalty;

|

|

|

·

|

applications support; and

|

|

|

·

|

breadth of product line.

|

If a competitor develops superior technology or cost-effective alternatives to our products, our business, financial condition and results of operations could be significantly harmed.

Major Customers/Vendors

During the years ended December 31, 2015 and 2014, three customers accounted for 100% of total revenue. Generally, a substantial percentage of our revenue has been to a small number of customers and is typically on an open account basis.

During the years ended December 31, 2015 and 2014, we purchased 100% of our pigment from one vendor.

Facilities

Our principal offices are located in temporary office space at 12 West 21st Street, New York, NY10010 where we lease and occupy approximately 300 square feet of space. The lease for our office is month-to-month.

We believe that our office is suitable and adequate for our current needs but we do anticipate seeking more permanent office facilities in New York City.

Employees

As of December 31, 2015, we had five full time employees. None of our employees are represented by a union or covered by a collective bargaining agreement. We believe that our relations with our employees, consultants and contractors are good.

Not required.

None.

Our principal offices are currently located at 12 West 21st Street, New York, NY 10010.

None.

Not applicable.

PART II

Our common stock is quoted on the OTC Bulletin Board under the trading symbol “VRME”. The following table sets forth the range of high and low bid prices of our common stock for the periods indicated as reported by the OTC Bulletin Board, Inc. Until recently, there was only sporadic and intermittent trading activity of our common stock. The quoted prices represent only prices between dealers on each trading day as submitted from time to time by certain of the securities dealers wishing to trade in our common stock, do not reflect retail mark-ups, mark-downs or commissions, and may differ substantially from prices in actual transactions.

|

Fiscal Year Ended December 31, 2014

|

|

High

|

|

Low

|

||||

|

Quarter ended March 31, 2014

|

|

$

|

8.50

|

|

|

$

|

4.25

|

|

|

Quarter ended June 30, 2014

|

|

$

|

8.50

|

|

|

$

|

3.40

|

|

|

Quarter ended September 30, 2014

|

|

$

|

10.20

|

|

|

$

|

3.40

|

|

|

Quarter ended December 31, 2014

|

|

$

|

4.25

|

|

|

$

|

0.85

|

|

|

Fiscal Year Ended December 31, 2015

|

|

High

|

|

Low

|

||||

|

Quarter ended March 31, 2015

|

|

$

|

3.74

|

|

|

$

|

0.85

|

|

|

Quarter ended June 30, 2015

|

|

$

|

8.08

|

|

|

$

|

0.54

|

|

|

Quarter ended September 30, 2015

|

|

$

|

6.20

|

|

|

$

|

2.10

|

|

|

Quarter ended December 31, 2015

|

|

$

|

1.95

|

|

|

$

|

0.85

|

|

Common Stockholders

As of March 30, 2016, our shares of common stock were held by approximately 1,324 stockholders of record.

Dividend Policy

We have never declared or paid a cash dividend. At this time, we do not anticipate paying dividends in the foreseeable future. The declaration and payment of dividends is subject to the discretion of our board of directors (the “Board”) and will depend upon our earnings (if any), our financial condition, and our capital requirements.

Recent Sales of Unregistered Securities

On February 9, 2016, the Company issued to certain accredited investors 2,587,500 shares of 0% Series C Convertible Preferred Stock, par value $0.001 per share (“Series C Preferred Stock”) at a purchase price of $0.40 per share with gross proceeds to the Company of $1,035,000.00. In connection with the sale of the Series C Preferred Stock, the Company issued to the purchasers warrants to purchase in the aggregate 2,587,500 shares of the Company’s common stock at an exercise price of $0.40 per share. Further, as a part of the same offering, on February 29, 2016, the Company issued 500,000 shares of Series C Preferred Stock, at a purchase price of $0.40 per share with gross proceeds to the Company of $200,000. In connection with the sale of the Series C Preferred Stock, the Company issued to the purchasers warrants to purchase in the aggregate 500,000 shares of the Company’s common stock at an exercise price of $0.40 per share. Each share of Series C Preferred Stock is convertible into one share of common stock, subject to adjustment. The Company used the proceeds of these offerings to pay general and administrative expenses, research and development costs and reduce accounts payable. Of the amount raised, the Company has approximately $670,000 remaining.

The foregoing issuances of the securities were exempt from the registration requirements of the Securities Act of 1933 by virtue of Section 4(a)(2) as transactions not involving a public offering.

Not applicable.

This Management’s Discussion and Analysis of Financial Condition and Results of Operation and other parts of this Annual Report on Form 10-K contain forward-looking statements that involve risks and uncertainties. All forward-looking statements included in this Annual Report on Form 10-K are based on information available to us on the date hereof, and except as required by law, we assume no obligation to update any such forward-looking statements. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of various factors. The following should be read in conjunction with our annual financial statements contained elsewhere in this report.

Overview

VerifyMe is a technology pioneer in the anti-counterfeiting industry. This broad market encompasses counterfeiting of physical and material goods and products, as well as counterfeiting of identity in digital transactions. We deliver security solutions for identification and authentication of people, products and packaging in a variety of applications in the security field for both digital and physical transactions. Our products can be used to manage and issue secure credentials, including national identifications, passports, driver licenses and access control credentials, as well as comprehensive authentication security software to secure physical and logical access to facilities, computer networks, internet sites and mobile applications.

The challenges associated with digital access control and identity theft are problems that are highly relevant in the world today. Consumers, citizens, employees, governments and employers demand comprehensive solutions that are reliable but not intrusive. The current widespread use of passwords or PINs for authentication has been proven insecure and inadequate. Individuals increasingly expect anywhere-anytime experiences—whether they are making purchases, crossing borders, accessing services or logging into online accounts or corporate resources. They expect those experiences to ensure the protection of their privacy and to provide uncompromising confidentiality.

We believe that the digital technologies we own will enable businesses and consumers to reconstruct their overall approaches to security—from identity and authentication to the management of legacy passwords and PINs. We empower our customers to take advantage of the full capabilities of smart mobile devices and provide solutions that are both simple to use and deliver the highest level of security. These solutions can be applied to corporate networks, financial services, e-gov services, digital wallets, mobile payments, entertainment, subscription services, and social media.

Brand owners, government agencies, professional associations, and others all share in the challenge of responding to counterfeit goods and product protection issues. Counterfeit goods span across multiple industries including from currency, passports, ID cards, pharmaceuticals, apparel, accessories, music, software, food, beverages, tobacco, automobile and airplane parts, consumer goods, toys and electronics. Described by the U.S. Federal Bureau of Investigation as the crime of the twenty-first century, product counterfeiting accounts for an estimated 5% of global trade and wreaks dire global health, safety and economic consequences on individuals, corporations, government and society.

We believe that the physical technologies we own will enable businesses and consumers to reconstruct their overall approaches to security—from counterfeit identification to employee or customer monitoring. Potential applications of our technologies are available in different types of products and industries—e.g., gaming, apparel, tobacco, fragrances, pharmaceuticals, event and transportation tickets, driver’s licenses, insurance cards, passports, computer software, and credit cards. We generate sales through licenses of our technology or through direct sales of our technology.

Our physical technologies involve the utilization of invisible and/or color shifting/changing inks, which are compatible with today’s printing machines. The inks may be used with certain printing systems such as offset, flexographic, silkscreen, gravure, and laser. Based upon our experience, we believe that the ink technologies may be incorporated into existing manufacturing processes. We believe that some of our patents may have non-security applications, and we are attempting to commercialize these opportunities.

Our digital technologies involve the utilization of multiple authentication mechanisms, some of which we own and some of which we license. These mechanisms include biometric factors, knowledge factors, possession factors and location factors. Biometric factors include facial recognition with liveness detection, finger print and voice recognition. Knowledge factors include a personal gesture swipe and a safe and [panic] color choice. Possession factor includes devices that the user has in their possession such as a smartphone, smart watch, and other wearable computing devices. The location factor geo-locates the user during a secure login. We surround these authentication mechanisms with proprietary systems that improve the usability and the security of the solutions. Our solutions allow the assessment and quantification of risk using a sophisticated heuristic scoring mechanism. We have specialized systems that perform ‘liveness’ detection to insure the subject of authentication is in fact a live human being. We have systems that introduce learning capabilities into our solutions to improve the ease of use and flexibility.

Results of Operations

Comparison of the Years Ended December 31, 2015 and 2014

The following discussion analyzes our results of operations for the years ended December 31, 2015 and 2014. The following information should be considered together with our financial statements for such periods and the accompanying notes thereto.

Revenue/Net Loss

We have not generated significant revenue since our inception. For the years ended December 31, 2015 and 2014, we generated revenues of $217,268 and $124,598. Our net loss was $2,301,885 for the year ended December 31, 2015, a decrease of $5,616,610 from a net loss of $7,918,495 for the year ended December 31, 2014, primarily as a result of closing our Washington, D.C. office , a reduction in share-based compensation and other cost conservation measures.

Cost of Sales

For the years ended December 31, 2015 and 2014, we incurred proprietary technology costs of sales of $65,723 and $113,024. Cost of sales is significantly lower for the year end December 31, 2015, since we receive a commission on the number of units produced and our customer was able to produce more units with less of our product.

General and Administrative Expenses

General and administrative expenses were $449,483 for the year ended December 31, 2015 compared to $811,916 for the year ended December 31, 2014, a decrease of $362,433. The decrease is attributable to the closing of the office in Washington, D.C., the reduction in staff and associated costs as well as a concentrated effort to contain costs. However the Company incurred additional cost during the year ended December 31, 2015, including, bad debt write off of $62,125 of receivables and increases in public company filing costs.

Legal and Accounting

Legal and accounting fees increased $113,898 to $458,801 for the year ended December 31, 2015 from $344,903 for the year ended December 31, 2014. The increase in legal and accounting fees between the periods was related to the Recapitalization Transaction in June, 2015, and the settlement of old accounts payable.

Payroll Expenses

Payroll expenses increased to $1,875,488 for the year ended December 31, 2015 from $1,611,376 for the year ended December 31, 2014, an increase of $264,112. The majority of the increase was the expense of the fair market value of options issued to the Board and the officers of the Company aggregating approximately $1,260,000 in 2015, compared to $860,000 in 2014.

Research and Development

Research and development expenses decreased $8,177,438 to $2,412,833 for the year ended December 31, 2015 from $10,590,271 for the year ended December 31, 2014. The decrease in research and development expenses was due to warrants and shares issued, with a fair value of $10,236,089 for the year ended December 31, 2014 related to the Patent and Technology License Agreement entered into on December 31, 2012 as compared to $2,000,000 in 2015.

Sales and Marketing

Sales and marketing expenses for the year ended December 31, 2015 were $197,430 as compared to $218,443 for the year ended December 31, 2014, a decrease of $21,013. The Company has reduced expenditures such as sales related travel and certain advertising programs that it has concluded were not generating revenue.

Interest Expense

During the year ended December 31, 2015, we incurred interest expense of $61,438, as compared to $199,364 for the year ended December 31, 2014, a decrease of $137,926. The decrease in interest expense relates to the conversion of notes payable and accrued interest into common stock as part of the restructuring transaction in June 2015.

Gain (Loss) on Extinguishment of Debt

The gain from extinguishment of debt was $332,523 for the year ended December 31, 2015, compared to a loss of $82,000 for the year ended December 31, 2014. The gain on extinguishment of debt was a result of the excess fair value of the notes payable and accrued interest over the value of the common stock issued, and accrued interest thereon, that were part of the restructuring transaction in June 2015.

Change in Fair Value of Warrants

During the year ended December 31, 2015, the Company incurred a change in the fair value of warrants of $2,669,520 as compared to $5,128,204 for the year ended December 31, 2014. The change resulted from the re-valuation of warrants associated with the Investment Agreement entered into on December 31, 2012, the Subscription Agreement entered into on January 31, 2013 and the notes payable issued during 2014. The value of the warrant liability has decreased because most of the warrants were converted to common stock as part of the restructuring transaction in June 2015. Additionally, as part of the Recapitalization Transaction, certain warrants were converted to shares of Common Stock and the associated liability of $1,867,417 was reclassified to additional paid-in capital.

Change in Fair Value Embedded Derivative Liability

During the year ended December 31, 2015, the Company incurred $0 for the change in fair value of the embedded derivative liability as compared to a gain of $800,000 for the year ended December 31, 2014. The change derived from the Common Stock price decreasing below the value of the conversion option associated with the Subscription Agreement entered into on January 31, 2013 for the year ended December 31, 2014. Because the Series A Preferred Stock was converted into shares of Common Stock with the Recapitalization Transaction, the embedded derivative liability no longer exists and no valuation or adjustment will be needed in the future as a result.

Liquidity and Capital Resources

Net cash used in operating activities decreased $524,702 to $1,495,315 for the year ended December 31, 2015 as compared to $2,020,017 for the year ended December 31, 2014. The decrease resulted primarily from reductions in accounts payable.

Net cash used in investing activities was $2,532 for the year ended December 31, 2015, materially unchanged from $0 for the year ended December 31, 2014.

Net cash provided by financing activities increased by $640,043 to $1,438,043 for the year ended December 31, 2015 from $798,000 for the year ended December 31, 2014. Cash provided by financing activities during the year ended December 31, 2015, consisted of our Series A Preferred Stock offering and Common Stock offering which raised $1,328,501 in June 2015.

Since our inception, we have focused on developing and implementing our business plan. Our business plans are dependent on our ability to raise capital through private placements of our common stock and/or preferred stock, through the possible exercise of outstanding options and warrants, through debt financing and/or through future public offering of our securities. In June 2015, as part of the restructuring transaction we raised approximately $1,328,000 as described in detail below. On February 9, 2016, the Company issued 2,587,500 shares of 0% Series C Convertible Preferred Stock, par value $0.001 per share (“Series C Preferred Stock”) at a purchase price of $0.40 per share with gross proceeds to the Company of $1,035,000. In connection with the sale of the Series C Preferred Stock, the Company issued to the purchasers warrants to purchase in the aggregate 2,587,500 shares of the Company’s common stock at an exercise price of $0.40 per share. Further, as a part of the same offering, on February 29, 2016, the Company issued 500,000 shares of Series C Preferred Stock, at a purchase price of $0.40 per share with gross proceeds to the Company of $200,000. In connection with the sale of the Series C Preferred Stock, the Company issued to the purchasers warrants to purchase in the aggregate 500,000 shares of the Company’s common stock at an exercise price of $0.40 per share. Each share of Series C Preferred Stock is convertible into one share of common stock, subject to adjustment.

Even with this infusion of capital, we do not believe that our existing cash resources will be sufficient to sustain our operations during the next twelve months, and we may need to raise additional funds in the future. We intend to raise such financing through private placements and/or the sale of debt and equity securities, of which there is no assurance. The issuance of additional equity would result in dilution to our existing shareholders. If we are unable to obtain additional funds when they are needed or if such funds cannot be obtained on terms favorable to us, we may be unable to execute upon our business plan or pay our costs and expenses as they are incurred, which could have a material, adverse effect on our business, financial condition and results of operations.