000109980012/312022Q2false00010998002022-01-012022-06-3000010998002022-07-26xbrli:shares00010998002022-06-30iso4217:USD00010998002021-12-31iso4217:USDxbrli:shares00010998002022-04-012022-06-3000010998002021-04-012021-06-3000010998002021-01-012021-06-3000010998002020-12-3100010998002021-06-300001099800us-gaap:CommonStockMember2021-12-310001099800us-gaap:TreasuryStockCommonMember2021-12-310001099800us-gaap:AdditionalPaidInCapitalMember2021-12-310001099800us-gaap:RetainedEarningsMember2021-12-310001099800us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001099800us-gaap:RetainedEarningsMember2022-01-012022-03-3100010998002022-01-012022-03-310001099800us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-310001099800us-gaap:CommonStockMember2022-01-012022-03-310001099800us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310001099800us-gaap:TreasuryStockCommonMember2022-01-012022-03-310001099800us-gaap:CommonStockMember2022-03-310001099800us-gaap:TreasuryStockCommonMember2022-03-310001099800us-gaap:AdditionalPaidInCapitalMember2022-03-310001099800us-gaap:RetainedEarningsMember2022-03-310001099800us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-3100010998002022-03-310001099800us-gaap:RetainedEarningsMember2022-04-012022-06-300001099800us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-300001099800us-gaap:CommonStockMember2022-04-012022-06-300001099800us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300001099800us-gaap:TreasuryStockCommonMember2022-04-012022-06-300001099800us-gaap:CommonStockMember2022-06-300001099800us-gaap:TreasuryStockCommonMember2022-06-300001099800us-gaap:AdditionalPaidInCapitalMember2022-06-300001099800us-gaap:RetainedEarningsMember2022-06-300001099800us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300001099800us-gaap:CommonStockMember2020-12-310001099800us-gaap:TreasuryStockCommonMember2020-12-310001099800us-gaap:AdditionalPaidInCapitalMember2020-12-310001099800us-gaap:RetainedEarningsMember2020-12-310001099800us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001099800us-gaap:RetainedEarningsMember2021-01-012021-03-3100010998002021-01-012021-03-310001099800us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-03-310001099800us-gaap:CommonStockMember2021-01-012021-03-310001099800us-gaap:AdditionalPaidInCapitalMember2021-01-012021-03-310001099800us-gaap:TreasuryStockCommonMember2021-01-012021-03-310001099800us-gaap:CommonStockMember2021-03-310001099800us-gaap:TreasuryStockCommonMember2021-03-310001099800us-gaap:AdditionalPaidInCapitalMember2021-03-310001099800us-gaap:RetainedEarningsMember2021-03-310001099800us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-3100010998002021-03-310001099800us-gaap:RetainedEarningsMember2021-04-012021-06-300001099800us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-04-012021-06-300001099800us-gaap:CommonStockMember2021-04-012021-06-300001099800us-gaap:AdditionalPaidInCapitalMember2021-04-012021-06-300001099800us-gaap:TreasuryStockCommonMember2021-04-012021-06-300001099800us-gaap:CommonStockMember2021-06-300001099800us-gaap:TreasuryStockCommonMember2021-06-300001099800us-gaap:AdditionalPaidInCapitalMember2021-06-300001099800us-gaap:RetainedEarningsMember2021-06-300001099800us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-06-300001099800us-gaap:BankTimeDepositsMember2022-06-300001099800us-gaap:BankTimeDepositsMember2021-12-310001099800us-gaap:CommercialPaperMember2022-06-300001099800us-gaap:CommercialPaperMember2021-12-310001099800us-gaap:USTreasuryAndGovernmentMember2022-06-300001099800us-gaap:USTreasuryAndGovernmentMember2021-12-310001099800us-gaap:AssetBackedSecuritiesMember2022-06-300001099800us-gaap:AssetBackedSecuritiesMember2021-12-310001099800us-gaap:CorporateDebtSecuritiesMember2022-06-300001099800us-gaap:CorporateDebtSecuritiesMember2021-12-310001099800us-gaap:MunicipalBondsMember2022-06-300001099800us-gaap:MunicipalBondsMember2021-12-310001099800us-gaap:LimitedLiabilityCompanyMember2022-06-30xbrli:pure0001099800us-gaap:LimitedLiabilityCompanyMember2022-01-012022-06-300001099800us-gaap:OtherNonoperatingIncomeExpenseMember2022-06-300001099800us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberew:MedtechCompanyMember2022-04-012022-06-300001099800us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberew:MedtechCompanyMember2021-01-012021-12-310001099800us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberew:MedtechCompanyMember2022-06-300001099800ew:MedicalDeviceCompanyMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2022-04-012022-06-300001099800ew:MedicalDeviceCompanyMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2022-06-300001099800us-gaap:FairValueInputsLevel2Member2022-06-300001099800us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-06-300001099800us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2022-06-300001099800us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-06-300001099800us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2022-06-300001099800us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-06-300001099800us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-06-300001099800us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-06-300001099800us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-06-300001099800us-gaap:AssetBackedSecuritiesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-06-300001099800us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2022-06-300001099800us-gaap:AssetBackedSecuritiesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-06-300001099800us-gaap:AssetBackedSecuritiesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2022-06-300001099800us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-06-300001099800us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMember2022-06-300001099800us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-06-300001099800us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMember2022-06-300001099800us-gaap:MunicipalBondsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-06-300001099800us-gaap:FairValueInputsLevel2Memberus-gaap:MunicipalBondsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2022-06-300001099800us-gaap:MunicipalBondsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-06-300001099800us-gaap:MunicipalBondsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2022-06-300001099800us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001099800us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001099800us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001099800us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001099800us-gaap:BankTimeDepositsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001099800us-gaap:FairValueInputsLevel2Memberus-gaap:BankTimeDepositsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001099800us-gaap:BankTimeDepositsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001099800us-gaap:BankTimeDepositsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001099800us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001099800us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001099800us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001099800us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001099800us-gaap:AssetBackedSecuritiesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001099800us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001099800us-gaap:AssetBackedSecuritiesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001099800us-gaap:AssetBackedSecuritiesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001099800us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001099800us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001099800us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001099800us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001099800us-gaap:CommercialPaperMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001099800us-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001099800us-gaap:CommercialPaperMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001099800us-gaap:CommercialPaperMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001099800us-gaap:MunicipalBondsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001099800us-gaap:FairValueInputsLevel2Memberus-gaap:MunicipalBondsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001099800us-gaap:MunicipalBondsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001099800us-gaap:MunicipalBondsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001099800ew:ContingentConsiderationLiabilityMember2021-12-310001099800us-gaap:OtherLiabilitiesMember2021-12-310001099800ew:ContingentConsiderationLiabilityMember2022-01-012022-06-300001099800us-gaap:OtherLiabilitiesMember2022-01-012022-06-300001099800ew:ContingentConsiderationLiabilityMember2022-06-300001099800us-gaap:OtherLiabilitiesMember2022-06-300001099800ew:ContingentConsiderationLiabilityMember2020-12-310001099800us-gaap:OtherLiabilitiesMember2020-12-310001099800ew:ContingentConsiderationLiabilityMember2021-01-012021-06-300001099800us-gaap:OtherLiabilitiesMember2021-01-012021-06-300001099800ew:ContingentConsiderationLiabilityMember2021-06-300001099800us-gaap:OtherLiabilitiesMember2021-06-300001099800us-gaap:MeasurementInputDiscountRateMembersrt:MinimumMemberus-gaap:FairValueInputsLevel3Member2022-06-300001099800us-gaap:MeasurementInputDiscountRateMembersrt:MaximumMemberus-gaap:FairValueInputsLevel3Member2022-06-300001099800us-gaap:MeasurementInputDiscountRateMembersrt:WeightedAverageMemberus-gaap:FairValueInputsLevel3Member2022-06-300001099800ew:MeasurementInputProbabilityOfMilestoneAchievementMembersrt:MinimumMemberus-gaap:FairValueInputsLevel3Member2022-06-300001099800ew:MeasurementInputProbabilityOfMilestoneAchievementMembersrt:MaximumMemberus-gaap:FairValueInputsLevel3Member2022-06-300001099800ew:MeasurementInputProbabilityOfMilestoneAchievementMembersrt:WeightedAverageMemberus-gaap:FairValueInputsLevel3Member2022-06-300001099800srt:MinimumMemberew:MeasurementInputVolatilityOfFutureRevenueMemberus-gaap:FairValueInputsLevel3Member2022-06-300001099800srt:MaximumMemberew:MeasurementInputVolatilityOfFutureRevenueMemberus-gaap:FairValueInputsLevel3Member2022-06-300001099800srt:WeightedAverageMemberew:MeasurementInputVolatilityOfFutureRevenueMemberus-gaap:FairValueInputsLevel3Member2022-06-300001099800us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-06-300001099800us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-12-310001099800us-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-06-300001099800us-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-12-310001099800us-gaap:OtherCurrentAssetsMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-06-300001099800us-gaap:OtherCurrentAssetsMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-12-310001099800us-gaap:OtherNoncurrentAssetsMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-06-300001099800us-gaap:OtherNoncurrentAssetsMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-12-310001099800us-gaap:AccountsPayableAndAccruedLiabilitiesMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-06-300001099800us-gaap:AccountsPayableAndAccruedLiabilitiesMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-12-310001099800us-gaap:ForeignExchangeContractMember2022-06-300001099800us-gaap:CurrencySwapMember2022-06-300001099800us-gaap:ForeignExchangeContractMember2021-12-310001099800us-gaap:CurrencySwapMember2021-12-310001099800us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-04-012022-06-300001099800us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-04-012021-06-300001099800us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CostOfSalesMember2022-04-012022-06-300001099800us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CostOfSalesMember2021-04-012021-06-300001099800us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-04-012022-06-300001099800us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-04-012021-06-300001099800us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-01-012022-06-300001099800us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-01-012021-06-300001099800us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CostOfSalesMember2022-01-012022-06-300001099800us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CostOfSalesMember2021-01-012021-06-300001099800us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-01-012022-06-300001099800us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-01-012021-06-300001099800us-gaap:NetInvestmentHedgingMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-04-012022-06-300001099800us-gaap:NetInvestmentHedgingMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-04-012021-06-300001099800us-gaap:NetInvestmentHedgingMemberus-gaap:InterestIncomeMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-04-012022-06-300001099800us-gaap:NetInvestmentHedgingMemberus-gaap:InterestIncomeMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-04-012021-06-300001099800us-gaap:NetInvestmentHedgingMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-01-012022-06-300001099800us-gaap:NetInvestmentHedgingMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-01-012021-06-300001099800us-gaap:NetInvestmentHedgingMemberus-gaap:InterestIncomeMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-01-012022-06-300001099800us-gaap:NetInvestmentHedgingMemberus-gaap:InterestIncomeMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-01-012021-06-300001099800us-gaap:NetInvestmentHedgingMemberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-06-30iso4217:EUR0001099800us-gaap:FairValueHedgingMemberus-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-04-012022-06-300001099800us-gaap:FairValueHedgingMemberus-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-04-012021-06-300001099800us-gaap:FairValueHedgingMemberus-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-01-012022-06-300001099800us-gaap:FairValueHedgingMemberus-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-01-012021-06-300001099800us-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeContractMember2022-04-012022-06-300001099800us-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeContractMember2021-04-012021-06-300001099800us-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeContractMember2022-01-012022-06-300001099800us-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeContractMember2021-01-012021-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:CostOfSalesMember2022-04-012022-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2022-04-012022-06-300001099800us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeContractMember2022-04-012022-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:CostOfSalesMember2022-01-012022-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-06-300001099800us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeContractMember2022-01-012022-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:CostOfSalesMember2021-04-012021-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2021-04-012021-06-300001099800us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeContractMember2021-04-012021-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:CostOfSalesMember2021-01-012021-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-06-300001099800us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeContractMember2021-01-012021-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CostOfSalesMember2021-04-012021-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-04-012021-06-300001099800us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-04-012021-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CostOfSalesMember2021-01-012021-06-300001099800us-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-01-012021-06-300001099800us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-01-012021-06-300001099800us-gaap:CostOfSalesMember2022-04-012022-06-300001099800us-gaap:CostOfSalesMember2021-04-012021-06-300001099800us-gaap:CostOfSalesMember2022-01-012022-06-300001099800us-gaap:CostOfSalesMember2021-01-012021-06-300001099800us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-04-012022-06-300001099800us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-04-012021-06-300001099800us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-06-300001099800us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-06-300001099800us-gaap:ResearchAndDevelopmentExpenseMember2022-04-012022-06-300001099800us-gaap:ResearchAndDevelopmentExpenseMember2021-04-012021-06-300001099800us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-06-300001099800us-gaap:ResearchAndDevelopmentExpenseMember2021-01-012021-06-300001099800us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-06-300001099800ew:MarketBasedRestrictedStockUnitsMember2022-01-012022-06-300001099800ew:MarketBasedRestrictedStockUnitsRelatedToPreviousYearsGrantMember2022-01-012022-06-300001099800ew:MarketBasedRestrictedStockUnitsMembersrt:MinimumMember2022-01-012022-06-300001099800ew:MarketBasedRestrictedStockUnitsMembersrt:MaximumMember2022-01-012022-06-300001099800ew:MarketBasedRestrictedStockUnitsMember2021-01-012021-06-300001099800ew:EmployeeAndNonemployeeStockOptionsMember2022-04-012022-06-300001099800ew:EmployeeAndNonemployeeStockOptionsMember2021-04-012021-06-300001099800ew:EmployeeAndNonemployeeStockOptionsMember2022-01-012022-06-300001099800ew:EmployeeAndNonemployeeStockOptionsMember2021-01-012021-06-300001099800us-gaap:EmployeeStockMember2022-04-012022-06-300001099800us-gaap:EmployeeStockMember2021-04-012021-06-300001099800us-gaap:EmployeeStockMember2022-01-012022-06-300001099800us-gaap:EmployeeStockMember2021-01-012021-06-300001099800ew:InitialDeliveryOfSharesSettledFebruary2021Member2021-02-280001099800ew:InitialDeliveryOfSharesSettledFebruary2021Member2021-02-012021-02-280001099800ew:February2021StockRepurchaseProgramSharesSoldInMarch2021Member2021-03-012021-03-310001099800ew:InitialDeliveryOfSharesSettledJanuary2022Member2022-01-310001099800ew:InitialDeliveryOfSharesSettledJanuary2022Member2022-01-012022-01-310001099800ew:January2022StockRepurchaseProgramSharesSoldInFebruary2022Member2022-02-012022-02-28ew:lawsuit0001099800us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310001099800us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-12-310001099800us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-12-310001099800us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310001099800us-gaap:AccumulatedTranslationAdjustmentMember2022-01-012022-03-310001099800us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-012022-03-310001099800us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-01-012022-03-310001099800us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-03-310001099800us-gaap:AccumulatedTranslationAdjustmentMember2022-03-310001099800us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-03-310001099800us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-03-310001099800us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-03-310001099800us-gaap:AccumulatedTranslationAdjustmentMember2022-04-012022-06-300001099800us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-04-012022-06-300001099800us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-04-012022-06-300001099800us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-04-012022-06-300001099800us-gaap:AccumulatedTranslationAdjustmentMember2022-06-300001099800us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-06-300001099800us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-06-300001099800us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-06-300001099800us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310001099800us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-12-310001099800us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-12-310001099800us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-12-310001099800us-gaap:AccumulatedTranslationAdjustmentMember2021-01-012021-03-310001099800us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-01-012021-03-310001099800us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-01-012021-03-310001099800us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-03-310001099800us-gaap:AccumulatedTranslationAdjustmentMember2021-03-310001099800us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-03-310001099800us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-03-310001099800us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-03-310001099800us-gaap:AccumulatedTranslationAdjustmentMember2021-04-012021-06-300001099800us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-04-012021-06-300001099800us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-04-012021-06-300001099800us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-04-012021-06-300001099800us-gaap:AccumulatedTranslationAdjustmentMember2021-06-300001099800us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-06-300001099800us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-06-300001099800us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-06-300001099800us-gaap:AccumulatedTranslationAdjustmentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-300001099800us-gaap:AccumulatedTranslationAdjustmentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2021-04-012021-06-300001099800us-gaap:AccumulatedTranslationAdjustmentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2022-01-012022-06-300001099800us-gaap:AccumulatedTranslationAdjustmentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2021-01-012021-06-300001099800us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-300001099800us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2021-04-012021-06-300001099800us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2022-01-012022-06-300001099800us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2021-01-012021-06-300001099800us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-300001099800us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2021-04-012021-06-300001099800us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2022-01-012022-06-300001099800us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2021-01-012021-06-300001099800us-gaap:StockCompensationPlanMember2022-04-012022-06-300001099800us-gaap:StockCompensationPlanMember2021-04-012021-06-300001099800us-gaap:StockCompensationPlanMember2022-01-012022-06-300001099800us-gaap:StockCompensationPlanMember2021-01-012021-06-3000010998002021-10-012021-12-310001099800ew:UnitedStatesSegmentMemberus-gaap:OperatingSegmentsMember2022-04-012022-06-300001099800ew:UnitedStatesSegmentMemberus-gaap:OperatingSegmentsMember2021-04-012021-06-300001099800ew:UnitedStatesSegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-06-300001099800ew:UnitedStatesSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-06-300001099800ew:EuropeSegmentMemberus-gaap:OperatingSegmentsMember2022-04-012022-06-300001099800ew:EuropeSegmentMemberus-gaap:OperatingSegmentsMember2021-04-012021-06-300001099800ew:EuropeSegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-06-300001099800ew:EuropeSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-06-300001099800ew:JapanSegmentMemberus-gaap:OperatingSegmentsMember2022-04-012022-06-300001099800ew:JapanSegmentMemberus-gaap:OperatingSegmentsMember2021-04-012021-06-300001099800ew:JapanSegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-06-300001099800ew:JapanSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-06-300001099800ew:RestOfWorldSegmentMemberus-gaap:OperatingSegmentsMember2022-04-012022-06-300001099800ew:RestOfWorldSegmentMemberus-gaap:OperatingSegmentsMember2021-04-012021-06-300001099800ew:RestOfWorldSegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-06-300001099800ew:RestOfWorldSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-06-300001099800us-gaap:OperatingSegmentsMember2022-04-012022-06-300001099800us-gaap:OperatingSegmentsMember2021-04-012021-06-300001099800us-gaap:OperatingSegmentsMember2022-01-012022-06-300001099800us-gaap:OperatingSegmentsMember2021-01-012021-06-300001099800us-gaap:MaterialReconcilingItemsMember2022-04-012022-06-300001099800us-gaap:MaterialReconcilingItemsMember2021-04-012021-06-300001099800us-gaap:MaterialReconcilingItemsMember2022-01-012022-06-300001099800us-gaap:MaterialReconcilingItemsMember2021-01-012021-06-300001099800us-gaap:CorporateNonSegmentMember2022-04-012022-06-300001099800us-gaap:CorporateNonSegmentMember2021-04-012021-06-300001099800us-gaap:CorporateNonSegmentMember2022-01-012022-06-300001099800us-gaap:CorporateNonSegmentMember2021-01-012021-06-300001099800country:US2022-04-012022-06-300001099800country:US2021-04-012021-06-300001099800country:US2022-01-012022-06-300001099800country:US2021-01-012021-06-300001099800srt:EuropeMember2022-04-012022-06-300001099800srt:EuropeMember2021-04-012021-06-300001099800srt:EuropeMember2022-01-012022-06-300001099800srt:EuropeMember2021-01-012021-06-300001099800country:JP2022-04-012022-06-300001099800country:JP2021-04-012021-06-300001099800country:JP2022-01-012022-06-300001099800country:JP2021-01-012021-06-300001099800ew:RestOfWorldMember2022-04-012022-06-300001099800ew:RestOfWorldMember2021-04-012021-06-300001099800ew:RestOfWorldMember2022-01-012022-06-300001099800ew:RestOfWorldMember2021-01-012021-06-300001099800ew:TranscatheterAorticValveReplacementMember2022-04-012022-06-300001099800ew:TranscatheterAorticValveReplacementMember2021-04-012021-06-300001099800ew:TranscatheterAorticValveReplacementMember2022-01-012022-06-300001099800ew:TranscatheterAorticValveReplacementMember2021-01-012021-06-300001099800ew:TranscatheterMitralAndTricuspidTherapiesMember2022-04-012022-06-300001099800ew:TranscatheterMitralAndTricuspidTherapiesMember2021-04-012021-06-300001099800ew:TranscatheterMitralAndTricuspidTherapiesMember2022-01-012022-06-300001099800ew:TranscatheterMitralAndTricuspidTherapiesMember2021-01-012021-06-300001099800ew:SurgicalHeartValveTherapyMember2022-04-012022-06-300001099800ew:SurgicalHeartValveTherapyMember2021-04-012021-06-300001099800ew:SurgicalHeartValveTherapyMember2022-01-012022-06-300001099800ew:SurgicalHeartValveTherapyMember2021-01-012021-06-300001099800ew:CriticalCareMember2022-04-012022-06-300001099800ew:CriticalCareMember2021-04-012021-06-300001099800ew:CriticalCareMember2022-01-012022-06-300001099800ew:CriticalCareMember2021-01-012021-06-300001099800us-gaap:SubsequentEventMemberew:CreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2022-07-012022-07-310001099800us-gaap:SubsequentEventMemberew:CreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2022-07-310001099800us-gaap:SubsequentEventMemberew:CreditAgreementMemberus-gaap:RevolvingCreditFacilityMembersrt:MinimumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-07-012022-07-310001099800us-gaap:SubsequentEventMemberew:CreditAgreementMembersrt:MaximumMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-07-012022-07-310001099800us-gaap:SubsequentEventMemberew:CreditAgreementMemberus-gaap:RevolvingCreditFacilityMembersrt:MinimumMember2022-07-012022-07-310001099800us-gaap:SubsequentEventMemberew:CreditAgreementMembersrt:MaximumMemberus-gaap:RevolvingCreditFacilityMember2022-07-012022-07-310001099800us-gaap:SubsequentEventMemberew:CreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2022-07-290001099800us-gaap:SubsequentEventMember2022-07-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended June 30, 2022

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-15525

EDWARDS LIFESCIENCES CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Delaware | | 36-4316614 | |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) | |

One Edwards Way

Irvine, California 92614

(Address of principal executive offices and zip code)

(949) 250-2500

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $1.00 per share | EW | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares outstanding of the registrant's common stock, $1.00 par value, as of July 26, 2022 was 619,943,068.

EDWARDS LIFESCIENCES CORPORATION

FORM 10-Q

For the quarterly period ended June 30, 2022

TABLE OF CONTENTS

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. We intend the forward-looking statements contained in this report to be covered by the safe harbor provisions of such Acts. Some statements other than statements of historical fact in this report or referred to or incorporated by reference into this report are "forward-looking statements" for purposes of these sections. These statements include, among other things, the expected impact of COVID-19 on our business, any predictions, opinions, expectations, plans, strategies, objectives and any statements of assumptions underlying any of the foregoing relating to the company's current and future business and operations, including, but not limited to, financial matters, development activities, clinical trials and regulatory matters, manufacturing and supply operations, and product sales and demand. These statements can sometimes be identified by the use of the forward-looking words such as "may," "believe," "will," "expect," "project," "estimate," "should," "anticipate," "plan," "goal," "continue," "seek," "pro forma," "forecast," "intend," "guidance," "optimistic," "aspire," "confident," other forms of these words or similar words or expressions or the negative thereof. Statements of past performance, efforts, or results about which inferences or assumptions may be made can also be forward-looking statements and are not indicative of future performance or results; these statements can be identified by the use of words such as "preliminary," "initial," diligence," "industry-leading," "compliant," "indications," or "early feedback" or other forms of these words or similar words or expressions or the negative thereof. These forward-looking statements are subject to substantial risks and uncertainties that could cause our results or future business, financial condition, results of operations or performance to differ materially from our historical results or experiences or those expressed or implied in any forward-looking statements contained in this report. These risks and uncertainties include, but are not limited to: uncertainties regarding the severity and duration of the COVID-19 pandemic and its impact on our business and the economy generally, clinical trial or commercial results or new product approvals and therapy adoption; inability or failure to comply with regulations; unpredictability of product launches; competitive dynamics; changes to reimbursement for the company's products; the company’s success in developing new products and avoiding manufacturing and quality issues; the impact of currency exchange rates; the timing or results of research and development and clinical trials; unanticipated actions by the United States Food and Drug Administration and other regulatory agencies; unexpected impacts or expenses of litigation or internal or government investigations; and other risks detailed under “Risk Factors” in our annual report on Form 10-K for the year ended December 31, 2021, as such risks and uncertainties may be amended, supplemented or superseded from time to time by our subsequent reports on Forms 10-Q and 8-K we file with the Securities and Exchange Commission. These forward-looking statements speak only as of the date on which they are made and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of the statement. If we do update or correct one or more of these statements, investors and others should not conclude that we will make additional updates or corrections.

Unless otherwise indicated or otherwise required by the context, the terms "we," "our," "it," "its," "Company," "Edwards," and "Edwards Lifesciences" refer to Edwards Lifesciences Corporation and its subsidiaries.

Part I. Financial Information

Item 1. Financial Statements

EDWARDS LIFESCIENCES CORPORATION

CONSOLIDATED CONDENSED BALANCE SHEETS

(in millions, except par value; unaudited)

| | | | | | | | | | | | | | |

| | June 30,

2022 | | December 31,

2021 | |

| ASSETS | | | | |

| Current assets | | | | |

| Cash and cash equivalents | $ | 1,198.1 | | | $ | 862.8 | | |

| Short-term investments (Note 3) | 317.7 | | | 604.0 | | |

Accounts receivable, net of allowances of $8.6 and $9.3, respectively | 636.4 | | | 582.2 | | |

| Other receivables | 42.8 | | | 82.7 | | |

| Inventories (Note 2) | 740.0 | | | 726.7 | | |

| | | | |

| Prepaid expenses | 79.3 | | | 85.2 | | |

| Other current assets | 248.8 | | | 237.1 | | |

| Total current assets | 3,263.1 | | | 3,180.7 | | |

| Long-term investments (Note 3) | 1,490.8 | | | 1,834.2 | | |

| Property, plant, and equipment, net | 1,559.9 | | | 1,546.6 | | |

| Operating lease right-of-use assets | 84.2 | | | 92.1 | | |

| Goodwill | 1,164.1 | | | 1,167.9 | | |

| Other intangible assets, net | 320.7 | | | 323.6 | | |

| Deferred income taxes | 307.6 | | | 246.7 | | |

| Other assets (Note 4) | 234.7 | | | 110.8 | | |

| Total assets | $ | 8,425.1 | | | $ | 8,502.6 | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | |

| Current liabilities | | | | |

| Accounts payable | $ | 162.5 | | | $ | 204.5 | | |

| Accrued and other liabilities (Note 2) | 783.3 | | | 802.3 | | |

| Operating lease liabilities | 23.3 | | | 25.5 | | |

| | | | |

| | | | |

Total current liabilities | 969.1 | | | 1,032.3 | | |

| Long-term debt | 596.0 | | | 595.7 | | |

| Contingent consideration liabilities (Note 5) | 38.2 | | | 62.0 | | |

| Taxes payable | 142.9 | | | 190.0 | | |

| Operating lease liabilities | 63.5 | | | 69.1 | | |

| Uncertain tax positions | 282.4 | | | 259.0 | | |

| Litigation settlement accrual (Note 2) | 167.2 | | | 191.3 | | |

| Other liabilities | 222.2 | | | 267.3 | | |

| Total liabilities | 2,481.5 | | | 2,666.7 | | |

| Commitments and contingencies (Note 9) | | | | |

| Stockholders' equity | | | | |

Preferred stock, $0.01 par value, authorized 50.0 shares, no shares outstanding | — | | | — | | |

Common stock, $1.00 par value, 1,050.0 shares authorized, 645.0 and 642.0 shares issued, and 619.8 and 624.1 shares outstanding, respectively | 645.0 | | | 642.0 | | |

| Additional paid-in capital | 1,852.5 | | | 1,700.4 | | |

| Retained earnings | 6,848.1 | | | 6,068.1 | | |

| Accumulated other comprehensive loss (Note 10) | (224.4) | | | (157.7) | | |

Treasury stock, at cost, 25.2 and 17.9 shares, respectively | (3,177.6) | | | (2,416.9) | | |

| Total stockholders' equity | 5,943.6 | | | 5,835.9 | | |

| Total liabilities and stockholders' equity | $ | 8,425.1 | | | $ | 8,502.6 | | |

The accompanying notes are an integral part of these

consolidated condensed financial statements.

EDWARDS LIFESCIENCES CORPORATION

CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS

(in millions, except per share information; unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2022 | | 2021 | | 2022 | | 2021 |

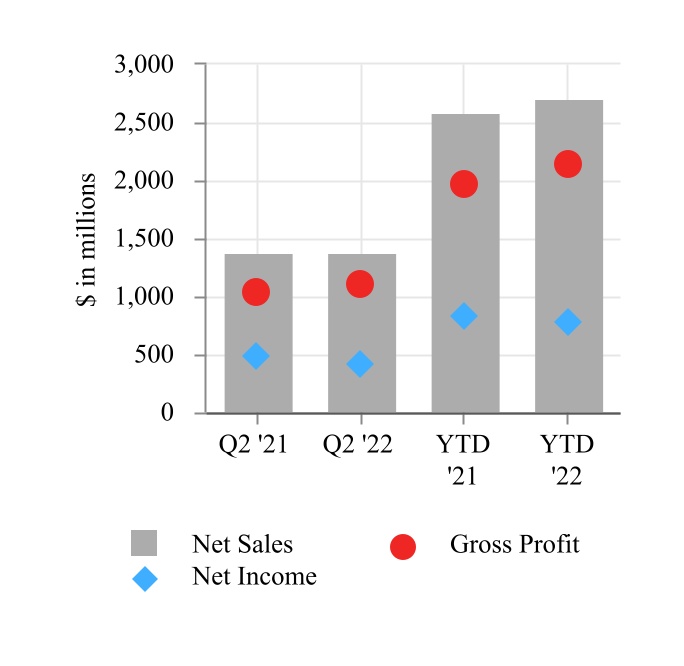

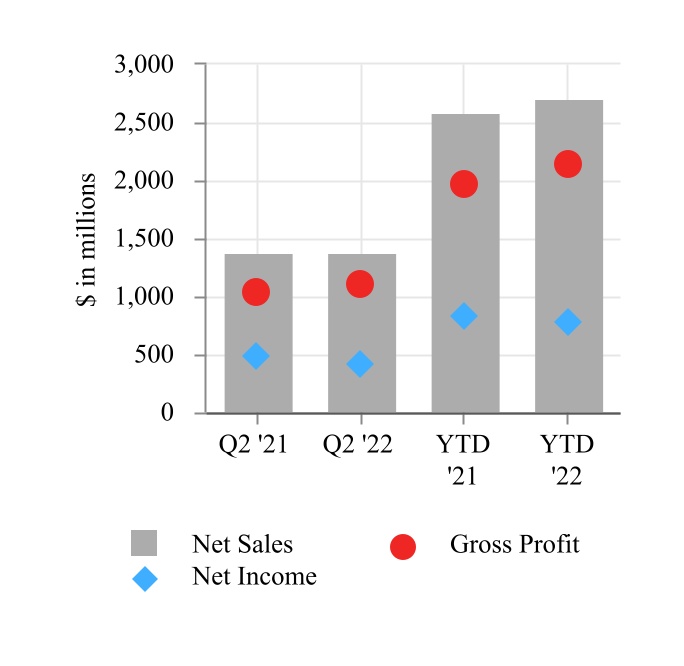

| Net sales | $ | 1,373.9 | | | $ | 1,376.0 | | | $ | 2,715.1 | | | $ | 2,592.6 | |

| Cost of sales | 269.4 | | | 334.3 | | | 568.7 | | | 627.7 | |

| Gross profit | 1,104.5 | | | 1,041.7 | | | 2,146.4 | | | 1,964.9 | |

| Selling, general, and administrative expenses | 409.0 | | | 374.5 | | | 779.3 | | | 705.3 | |

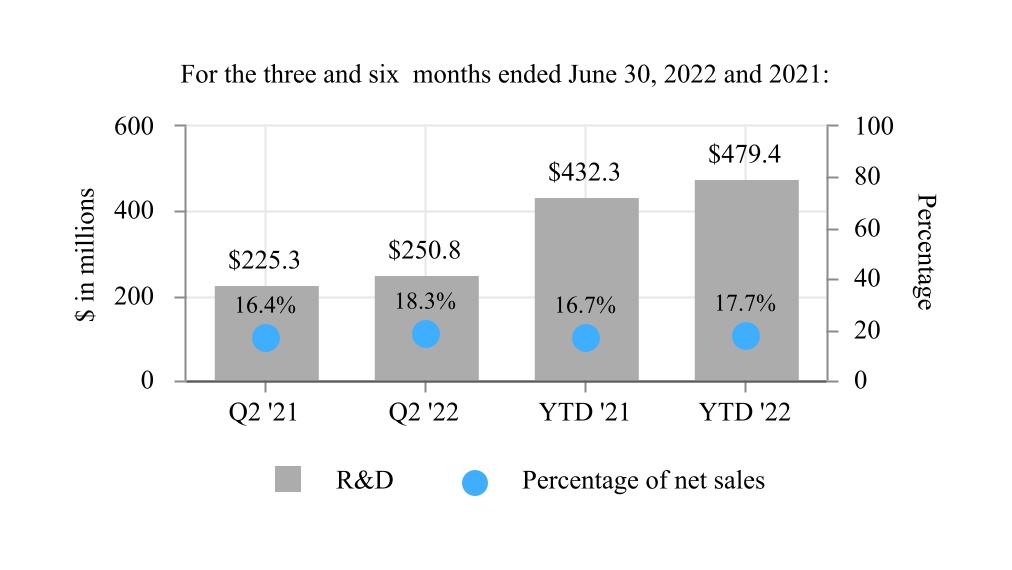

| Research and development expenses | 250.8 | | | 225.3 | | | 479.4 | | | 432.3 | |

| Intellectual property litigation expenses, net | 6.1 | | | 2.4 | | | 13.2 | | | 8.8 | |

| Change in fair value of contingent consideration liabilities, net (Note 5) | (20.9) | | | (102.6) | | | (23.8) | | | (107.1) | |

| | | | | | | |

| | | | | | | |

| Operating income | 459.5 | | | 542.1 | | | 898.3 | | | 925.6 | |

| Interest (income) expense, net | (0.9) | | | 1.0 | | | (1.5) | | | 0.7 | |

| | | | | | | |

| Other income, net | (4.3) | | | (4.4) | | | (1.0) | | | (9.9) | |

| Income before provision for income taxes | 464.7 | | | 545.5 | | | 900.8 | | | 934.8 | |

| Provision for income taxes | 58.3 | | | 56.0 | | | 120.8 | | | 107.1 | |

| Net income | $ | 406.4 | | | $ | 489.5 | | | $ | 780.0 | | | $ | 827.7 | |

| | | | | | | |

Share information (Note 11) | | | | | | | |

| Earnings per share: | | | | | | | |

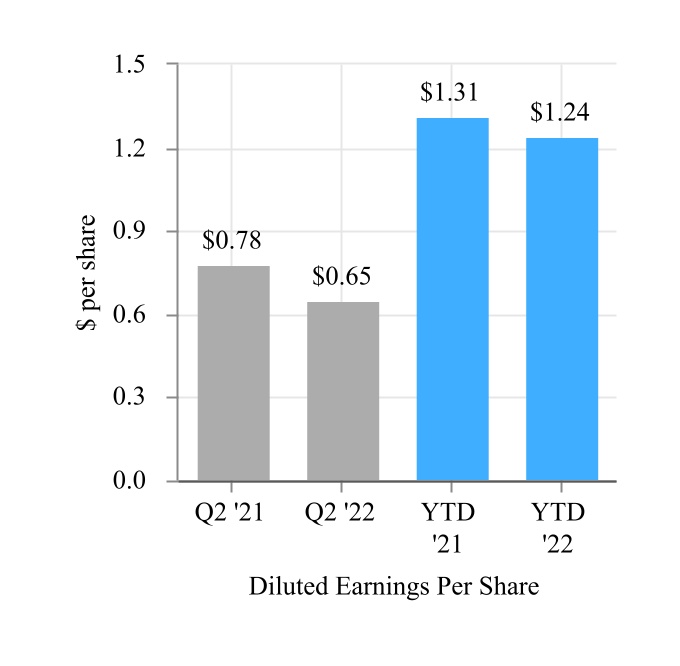

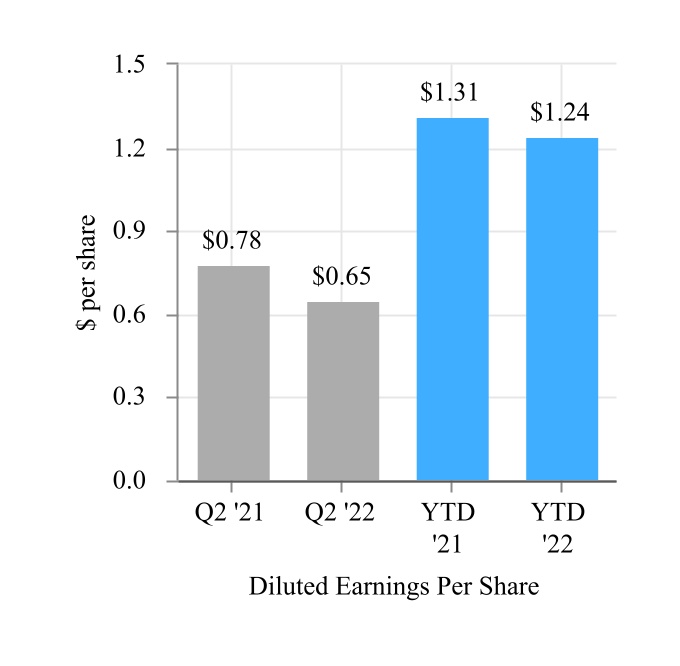

| Basic | $ | 0.65 | | | $ | 0.79 | | | $ | 1.26 | | | $ | 1.33 | |

| Diluted | $ | 0.65 | | | $ | 0.78 | | | $ | 1.24 | | | $ | 1.31 | |

| Weighted-average number of common shares outstanding: | | | | | | | |

| Basic | 620.9 | | | 622.3 | | | 621.5 | | | 622.7 | |

| Diluted | 626.7 | | | 629.9 | | | 628.1 | | | 630.6 | |

The accompanying notes are an integral part of these

consolidated condensed financial statements.

EDWARDS LIFESCIENCES CORPORATION

CONSOLIDATED CONDENSED STATEMENTS OF COMPREHENSIVE INCOME

(in millions; unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2022 | | 2021 | | 2022 | | 2021 |

| Net income | $ | 406.4 | | | $ | 489.5 | | | $ | 780.0 | | | $ | 827.7 | |

| Other comprehensive (loss) income, net of tax (Note 10): | | | | | | | |

| Foreign currency translation adjustments | (43.2) | | | 10.5 | | | (53.2) | | | (21.7) | |

| Unrealized gain on hedges | 31.3 | | | 2.4 | | | 44.7 | | | 26.9 | |

| Unrealized pension (costs) credits | (0.1) | | | (0.2) | | | (0.1) | | | 0.1 | |

| Unrealized loss on available-for-sale investments | (30.9) | | | (1.0) | | | (68.0) | | | (5.8) | |

| Reclassification of net realized investment loss to earnings | 5.1 | | | 1.1 | | | 9.9 | | | 2.0 | |

| Other comprehensive (loss) income | (37.8) | | | 12.8 | | | (66.7) | | | 1.5 | |

| Comprehensive income | $ | 368.6 | | | $ | 502.3 | | | $ | 713.3 | | | $ | 829.2 | |

The accompanying notes are an integral part of these

consolidated condensed financial statements.

EDWARDS LIFESCIENCES CORPORATION

CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS

(in millions; unaudited) | | | | | | | | | | | |

| | Six Months Ended

June 30, |

| | 2022 | | 2021 |

| Cash flows from operating activities | | | |

| Net income | $ | 780.0 | | | $ | 827.7 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 68.8 | | | 68.2 | |

| Non-cash operating lease cost | 13.9 | | | 14.3 | |

| Stock-based compensation (Note 7) | 68.6 | | | 58.5 | |

| | | |

| | | |

| Change in fair value of contingent consideration liabilities, net (Note 5) | (23.8) | | | (107.1) | |

| Loss (gain) on investments, net | 38.2 | | | (16.9) | |

| Deferred income taxes | (102.4) | | | 16.2 | |

| | | |

| Other | 4.2 | | | 3.7 | |

| Changes in operating assets and liabilities: | | | |

| Accounts and other receivables, net | (77.7) | | | (135.9) | |

| Inventories | (85.8) | | | 17.5 | |

| Accounts payable and accrued liabilities | (81.7) | | | 84.8 | |

| Income taxes | 49.7 | | | 23.2 | |

| Prepaid expenses and other current assets | 25.7 | | | 0.4 | |

| Litigation settlement accrual | (19.7) | | | 3.7 | |

| Other | (32.5) | | | (31.7) | |

| Net cash provided by operating activities | 625.5 | | | 826.6 | |

| Cash flows from investing activities | | | |

| Capital expenditures | (115.8) | | | (175.3) | |

| Purchases of held-to-maturity investments (Note 3) | (180.7) | | | (35.0) | |

| Proceeds from held-to-maturity investments (Note 3) | 277.5 | | | 50.0 | |

| Purchases of available-for-sale investments (Note 3) | (114.3) | | | (376.5) | |

| Proceeds from available-for-sale investments (Note 3) | 584.1 | | | 168.5 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Payment for acquisition options | (55.5) | | | (5.7) | |

| Issuances of notes receivable | (45.5) | | | (3.6) | |

| Collections of notes receivable | 18.0 | | | 10.0 | |

| Other | (8.7) | | | (11.6) | |

| Net cash provided by (used in) investing activities | 359.1 | | | (379.2) | |

| Cash flows from financing activities | | | |

| Proceeds from issuance of debt | — | | | 14.0 | |

| Payments on debt and finance lease obligations | (0.1) | | | (15.6) | |

| Purchases of treasury stock | (760.7) | | | (414.5) | |

| | | |

| Proceeds from stock plans | 86.5 | | | 85.8 | |

| | | |

| Other | (1.9) | | | (3.0) | |

| Net cash used in financing activities | (676.2) | | | (333.3) | |

| Effect of currency exchange rate changes on cash, cash equivalents, and restricted cash | 27.1 | | | 11.6 | |

| Net increase in cash, cash equivalents, and restricted cash | 335.5 | | | 125.7 | |

| Cash, cash equivalents, and restricted cash at beginning of period | 867.4 | | | 1,200.2 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 1,202.9 | | | $ | 1,325.9 | |

| | | |

The accompanying notes are an integral part of these

consolidated condensed financial statements.

EDWARDS LIFESCIENCES CORPORATION

CONSOLIDATED CONDENSED STATEMENTS OF STOCKHOLDERS' EQUITY

(in millions; unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Treasury Stock | | | | | | | | |

| | Shares | | Par Value | | Shares | | Amount | | Additional Paid-in Capital | | Retained Earnings | | Accumulated Other Comprehensive Loss | | Total Stockholders' Equity |

| Balance at December 31, 2021 | 642.0 | | | $ | 642.0 | | | 17.9 | | | $ | (2,416.9) | | | $ | 1,700.4 | | | $ | 6,068.1 | | | $ | (157.7) | | | $ | 5,835.9 | |

| Net income | | | | | | | | | | | 373.6 | | | | | 373.6 | |

| Other comprehensive loss, net of tax | | | | | | | | | | | | | (28.9) | | | (28.9) | |

| Common stock issued under stock plans | 0.9 | | | 0.9 | | | | | | | 36.6 | | | | | | | 37.5 | |

| Stock-based compensation expense | | | | | | | | | 32.4 | | | | | | | 32.4 | |

| | | | | | | | | | | | | | | |

| Purchases of treasury stock | | | | | 3.6 | | | (405.6) | | | | | | | | | (405.6) | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Balance at March 31, 2022 | 642.9 | | | $ | 642.9 | | | 21.5 | | | $ | (2,822.5) | | | $ | 1,769.4 | | | $ | 6,441.7 | | | $ | (186.6) | | | $ | 5,844.9 | |

| Net income | | | | | | | | | | | 406.4 | | | | | 406.4 | |

| Other comprehensive loss, net of tax | | | | | | | | | | | | | (37.8) | | | (37.8) | |

Common stock issued under equity plans | 2.1 | | | 2.1 | | | | | | | 46.9 | | | | | | | 49.0 | |

| Stock-based compensation expense | | | | | | | | | 36.2 | | | | | | | 36.2 | |

| | | | | | | | | | | | | | | |

| Purchases of treasury stock | | | | | 3.7 | | | (355.1) | | | | | | | | | (355.1) | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Balance at June 30, 2022 | 645.0 | | | $ | 645.0 | | | 25.2 | | | $ | (3,177.6) | | | $ | 1,852.5 | | | $ | 6,848.1 | | | $ | (224.4) | | | $ | 5,943.6 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these

consolidated condensed financial statements.

EDWARDS LIFESCIENCES CORPORATION

CONSOLIDATED CONDENSED STATEMENTS OF STOCKHOLDERS' EQUITY

(in millions; unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Treasury Stock | | | | | | | | |

| | Shares | | Par Value | | Shares | | Amount | | Additional Paid-in Capital | | Retained Earnings | | Accumulated Other Comprehensive Loss | | Total Stockholders' Equity |

| Balance at December 31, 2020 | 636.4 | | | $ | 636.4 | | | 12.1 | | | $ | (1,904.1) | | | $ | 1,438.1 | | | $ | 4,565.0 | | | $ | (161.1) | | | $ | 4,574.3 | |

| Net income | | | | | | | | | | | 338.2 | | | | | 338.2 | |

| Other comprehensive loss, net of tax | | | | | | | | | | | | | (11.3) | | | (11.3) | |

| Common stock issued under stock plans | 1.1 | | | 1.1 | | | | | | | 30.5 | | | | | | | 31.6 | |

| Stock-based compensation expense | | | | | | | | | 28.2 | | | | | | | 28.2 | |

| | | | | | | | | | | | | | | |

| Purchases of treasury stock | | | | | 3.6 | | | (302.6) | | | | | | | | | (302.6) | |

| | | | | | | | | | | | | | | |

Balance at March 31, 2021 | 637.5 | | | $ | 637.5 | | | 15.7 | | | $ | (2,206.7) | | | $ | 1,496.8 | | | $ | 4,903.2 | | | $ | (172.4) | | | $ | 4,658.4 | |

| Net income | | | | | | | | | | | 489.5 | | | | | 489.5 | |

| Other comprehensive income, net of tax | | | | | | | | | | | | | 12.8 | | | 12.8 | |

Common stock issued under equity plans | 2.6 | | | 2.6 | | | | | | | 51.6 | | | | | | | 54.2 | |

| Stock-based compensation expense | | | | | | | | | 30.3 | | | | | | | 30.3 | |

| | | | | | | | | | | | | | | |

| Purchases of treasury stock | | | | | 1.3 | | | (111.9) | | | | | | | | | (111.9) | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Balance at June 30, 2021 | 640.1 | | | $ | 640.1 | | | 17.0 | | | $ | (2,318.6) | | | $ | 1,578.7 | | | $ | 5,392.7 | | | $ | (159.6) | | | $ | 5,133.3 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these

consolidated condensed financial statements.

1. BASIS OF PRESENTATION

The accompanying interim consolidated condensed financial statements and related disclosures have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission ("SEC") and should be read in conjunction with the consolidated financial statements and notes included in Edwards Lifesciences' Annual Report on Form 10-K for the year ended December 31, 2021. Certain information and footnote disclosures normally included in financial statements prepared in accordance with generally accepted accounting principles in the United States of America ("GAAP") have been condensed or omitted.

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements. Actual results could differ from those estimates. In particular, the COVID-19 pandemic has adversely impacted, and may further adversely impact, nearly all aspects of the Company's business and markets, including its workforce and the operations of its customers, suppliers, and business partners. The full extent to which the pandemic will directly or indirectly impact the Company's business, results of operations and financial condition, including sales, expenses, manufacturing, clinical trials, research and development costs, reserves and allowances, fair value measurements, asset impairment charges, contingent consideration obligations, and the effectiveness of the Company's hedging instruments, will depend on future developments that are highly uncertain and difficult to predict. These developments include, but are not limited to, the duration and spread of the outbreak (including new and more contagious

variants of COVID-19), its severity, the actions to contain the virus or address its impact, the timing, distribution, public acceptance and efficacy of vaccines and other treatments, and the associated impact on economic and operating conditions.

In the opinion of management, the interim consolidated condensed financial statements reflect all adjustments necessary for a fair statement of the results for the interim periods presented. All such adjustments are of a normal, recurring nature. The results of operations for the interim periods are not necessarily indicative of the results of operations to be expected for the full year.

There have been no material changes to the Company's significant accounting policies from those described in the Company's Annual Report on Form 10-K for the year ended December 31, 2021.

Recently Adopted Accounting Standards

The Company evaluates all new accounting pronouncements issued by the Financial Accounting Standards Board ("FASB") for applicability to the Company's consolidated condensed financial statements. Unless otherwise discussed below, the Company has not identified any other recently issued standards that are relevant to the Company's condensed consolidated financial statements or disclosures.

In November 2021, the FASB issued an amendment to the accounting guidance on government assistance. The guidance requires certain disclosures about transactions with a government that are accounted for by applying a grant or contribution model. The guidance was effective for annual periods beginning after December 15, 2021. The adoption of this guidance was applied prospectively and did not have a material impact on the Company's consolidated financial statements.

2. OTHER CONSOLIDATED FINANCIAL STATEMENT DETAILS

Composition of Certain Financial Statement Captions

(in millions)

Components of selected captions in the consolidated condensed balance sheets consisted of the following:

| | | | | | | | | | | |

| June 30, 2022 | | December 31, 2021 |

| Inventories | | | |

| Raw materials | $ | 140.9 | | | $ | 132.8 | |

| Work in process | 165.9 | | | 164.3 | |

| Finished products | 433.2 | | | 429.6 | |

| $ | 740.0 | | | $ | 726.7 | |

At June 30, 2022 and December 31, 2021, $108.1 million and $125.8 million, respectively, of the Company's finished products inventories were held on consignment.

| | | | | | | | | | | |

| June 30, 2022 | | December 31, 2021 |

| Accrued and other liabilities | | | |

| | | |

| Employee compensation and withholdings | $ | 256.0 | | | $ | 319.7 | |

| Taxes payable | 94.1 | | | 30.6 | |

| Property, payroll, and other taxes | 55.8 | | | 68.9 | |

| Research and development accruals | 57.0 | | | 58.2 | |

| Accrued rebates | 89.6 | | | 77.0 | |

| Fair value of derivatives | 2.0 | | | 3.9 | |

| Accrued marketing expenses | 16.5 | | | 20.1 | |

Legal and insurance (a) | 83.2 | | | 79.1 | |

| Accrued relocation costs | 26.5 | | | 26.2 | |

| Accrued professional services | 11.1 | | | 11.9 | |

| Accrued realignment reserves | 13.2 | | | 19.1 | |

| | | |

| Other accrued liabilities | 78.3 | | | 87.6 | |

| $ | 783.3 | | | $ | 802.3 | |

_______________________________________

(a) On July 12, 2020, the Company reached an agreement with Abbott Laboratories and its direct and indirect subsidiaries to, among other things, settle all outstanding patent disputes between the companies in cases related to transcatheter mitral and tricuspid repair products. As of June 30, 2022, $54.4 million was accrued in "Accrued and other liabilities" and $167.2 million was accrued in "Litigation settlement accrual" on the consolidated condensed balance sheet.

Supplemental Cash Flow Information

(in millions)

| | | | | | | | | | | |

| Six Months Ended

June 30, |

| 2022 | | 2021 |

| Cash paid during the year for: | | | |

| Income taxes | $ | 173.0 | | | $ | 66.6 | |

| Amounts included in the measurement of lease liabilities: | | | |

Operating cash flows from operating leases | $ | 14.5 | | | $ | 16.3 | |

| Non-cash investing and financing transactions: | | | |

| | | |

| | | |

| | | |

| Right-of-use assets obtained in exchange for new lease liabilities | $ | 10.6 | | | $ | 5.4 | |

| Capital expenditures accruals | $ | 24.6 | | | $ | 25.1 | |

| | | |

| Conversion of notes receivable to equity investment | $ | — | | | $ | 21.5 | |

Cash, Cash Equivalents, and Restricted Cash

(in millions)

| | | | | | | | | | | | | | |

| June 30, 2022 | | December 31, 2021 | |

| Cash and cash equivalents | $ | 1,198.1 | | | $ | 862.8 | | |

| Restricted cash included in other current assets | 1.8 | | | 1.5 | | |

| Restricted cash included in other assets | 3.0 | | | 3.1 | | |

| Total cash, cash equivalents, and restricted cash | $ | 1,202.9 | | | $ | 867.4 | | |

Amounts included in restricted cash primarily represent funds placed in escrow related to litigation.

3. INVESTMENTS

Debt Securities

Investments in debt securities at the end of each period were as follows (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | June 30, 2022 | | December 31, 2021 |

| Held-to-maturity | Amortized Cost | | Gross Unrealized Gains | | Gross Unrealized Losses | | Fair Value | | Amortized Cost | | Gross Unrealized Gains | | Gross Unrealized Losses | Fair Value |

| Bank time deposits | $ | 65.2 | | | $ | — | | | $ | — | | | $ | 65.2 | | | $ | 162.0 | | | $ | — | | | $ | — | | | $ | 162.0 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Available-for-sale | | | | | | | | | | | | | | | |

| Bank time deposits | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 2.5 | | | $ | — | | | $ | — | | | $ | 2.5 | |

| Commercial paper | — | | | — | | | — | | | — | | | 127.7 | | | — | | | — | | | 127.7 | |

| United States government and agency securities | 109.5 | | | — | | | (4.7) | | | 104.8 | | | 147.4 | | | 0.6 | | | (0.7) | | | 147.3 | |

| | | | | | | | | | | | | | | |

| Asset-backed securities | 419.3 | | | — | | | (13.7) | | | 405.6 | | | 515.2 | | | 0.3 | | | (2.9) | | | 512.6 | |

| Corporate debt securities | 1,179.4 | | | — | | | (49.0) | | | 1,130.4 | | | 1,397.1 | | | 2.0 | | | (8.3) | | | 1,390.8 | |

| Municipal securities | 2.8 | | | — | | | (0.2) | | | 2.6 | | | 2.8 | | | — | | | — | | | 2.8 | |

| Total | $ | 1,711.0 | | | $ | — | | | $ | (67.6) | | | $ | 1,643.4 | | | $ | 2,192.7 | | | $ | 2.9 | | | $ | (11.9) | | | $ | 2,183.7 | |

The cost and fair value of investments in debt securities, by contractual maturity, as of June 30, 2022, were as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Held-to-Maturity | | Available-for-Sale |

| | Amortized Cost | | Fair Value | | Amortized Cost | | Fair Value |

| | (in millions) |

| Due in 1 year or less | $ | 62.5 | | | $ | 62.5 | | | $ | 258.2 | | | $ | 255.2 | |

| Due after 1 year through 5 years | 2.7 | | | 2.7 | | | 974.4 | | | 926.7 | |

| Due after 5 years through 10 years | — | | | — | | | 7.3 | | | 7.0 | |

| | | | | | | |

Instruments not due at a single maturity date (a) | — | | | — | | | 471.1 | | | 454.5 | |

| $ | 65.2 | | | $ | 65.2 | | | $ | 1,711.0 | | | $ | 1,643.4 | |

_______________________________________

(a) Consists primarily of asset-backed securities.

Actual maturities may differ from the contractual maturities due to call or prepayment rights.

The following tables present gross unrealized losses and fair values for those investments that were in an unrealized loss position as of June 30, 2022 and December 31, 2021, aggregated by investment category and the length of time that individual securities have been in a continuous loss position (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| June 30, 2022 |

| Less than 12 Months | | 12 Months or Greater | | Total |

| Fair Value | | Gross Unrealized Losses | | Fair Value | | Gross Unrealized Losses | | Fair Value | | Gross Unrealized Losses |

| | | | | | | | | | | |

| | | | | | | | | | | |

| United States government and agency securities | $ | 90.5 | | | $ | (4.0) | | | $ | 14.0 | | | $ | (0.7) | | | $ | 104.5 | | | $ | (4.7) | |

| | | | | | | | | | | |

| Asset-backed securities | 385.5 | | | (13.3) | | | 15.8 | | | (0.4) | | | 401.3 | | | (13.7) | |

| Corporate debt securities | 1,062.8 | | | (44.6) | | | 51.8 | | | (4.4) | | | 1,114.6 | | | (49.0) | |

| Municipal securities | 2.6 | | | (0.2) | | | — | | | — | | | 2.6 | | | (0.2) | |

| $ | 1,541.4 | | | $ | (62.1) | | | $ | 81.6 | | | $ | (5.5) | | | $ | 1,623.0 | | | $ | (67.6) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| December 31, 2021 |

| Less than 12 Months | | 12 Months or Greater | | Total |

| Fair Value | | Gross Unrealized Losses | | Fair Value | | Gross Unrealized Losses | | Fair Value | | Gross Unrealized Losses |

| | | | | | | | | | | |

| | | | | | | | | | | |

| United States government and agency securities | $ | 85.1 | | | $ | (0.7) | | | $ | — | | | $ | — | | | $ | 85.1 | | | $ | (0.7) | |

| | | | | | | | | | | |

| Asset-backed securities | 433.3 | | | (2.9) | | | — | | | — | | | 433.3 | | | (2.9) | |

| Corporate debt securities | 1,114.1 | | | (8.3) | | | — | | | — | | | 1,114.1 | | | (8.3) | |

| | | | | | | | | | | |

| $ | 1,632.5 | | | $ | (11.9) | | | $ | — | | | $ | — | | | $ | 1,632.5 | | | $ | (11.9) | |

The Company reviews its investments in debt securities to determine if there has been an other-than-temporary decline in fair value. Consideration is given to 1) the length of time and the extent to which the security's fair value has been below cost, 2) the financial condition and near term prospects of the issuer, including the credit quality of the security's issuer, 3) the Company's intent to sell the security, and 4) whether it is more likely than not the Company will have to sell the security before recovery of its amortized cost. The decline in fair value of the debt securities was largely due to changes in interest rates, not credit quality, and as of June 30, 2022, the Company did not intend to sell the securities, and it was not more likely than not that it will be required to sell the securities, before recovery of the unrealized losses.

Investments in Unconsolidated Entities

The Company has a number of equity investments in unconsolidated entities. These investments are recorded in "Long-term Investments" on the consolidated condensed balance sheets, and are as follows:

| | | | | | | | | | | |

| | June 30,

2022 | | December 31,

2021 |

| | (in millions) |

| Equity method investments | | | |

| Carrying value of equity method investments | $ | 14.6 | | | $ | 8.4 | |

| Equity securities | | | |

| Carrying value of non-marketable equity securities | 85.3 | | | 84.1 | |

| Total investments in unconsolidated entities | $ | 99.9 | | | $ | 92.5 | |

During the six months ended June 30, 2022, the Company made $6.8 million of equity investments in limited liability companies that invest in qualified community development entities ("CDEs") through the New Markets Tax Credit ("NMTC") program. The NMTC program provides federal tax incentives to investors to make investments in distressed communities and promotes economic improvements through the development of successful businesses in these communities. The NMTC is equal to 39% of the qualified investment and is taken over seven years. These limited liability companies are variable interest entities ("VIEs"). However, the Company determined that it is not the primary beneficiary of the VIEs because it does not have the power to direct the activities that most significantly impact the economic performance of the VIEs.

Non-marketable equity securities consist of investments in privately held companies without readily determinable fair values, and are reported at cost minus impairment, if any, plus or minus changes resulting from observable price changes in orderly transactions for the identical or similar investment of the same issuer. As of June 30, 2022, the Company had recorded cumulative upward adjustments of $8.0 million based on observable price changes, and cumulative downward adjustments of $2.6 million due to impairments and observable price changes.

During the three and six months ended June 30, 2022, the gross realized gains or losses from sales of available-for-sale investments were not material.

4. INVESTMENTS IN VARIABLE INTEREST ENTITIES

Edwards has relationships with various variable interest entities that it does not consolidate as Edwards lacks the power to direct the activities that significantly impact the economic success of these entities.

In the second quarter of 2022, the Company entered into an option agreement with a medtech company. Under the option agreement, Edwards paid $60.0 million, of which $10 million was paid in 2021 as a deposit, for an option to acquire the medtech company. The $60.0 million option is included in "Other Assets" on the consolidated condensed balance sheet.

In the second quarter of 2022, the Company entered into a convertible promissory note and amended its existing warrant agreement with a medical device company. Under the convertible promissory note agreement, the Company has agreed to loan the medical device company up to $47.5 million, of which $32.5 million has been advanced as of June 30, 2022. In addition, the Company amended its warrant agreement under which the Company had previously paid $35.0 million for an option to acquire the medical device company. The amendment extends the warrant right period. The $35.0 million warrant and the $32.5 million note receivable are included in "Other Assets" on the consolidated condensed balance sheet.

5. FAIR VALUE MEASUREMENTS

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. The Company prioritizes the inputs used to determine fair values in one of the following three categories:

Level 1—Quoted market prices in active markets for identical assets or liabilities.

Level 2—Inputs, other than quoted prices in active markets, that are observable, either directly or indirectly.

Level 3—Unobservable inputs that are not corroborated by market data.

In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, the level in the fair value hierarchy within which the fair value measurement in its entirety falls has been determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The consolidated condensed financial statements include financial instruments for which the fair market value of such instruments may differ from amounts reflected on a historical cost basis. Financial instruments of the Company consist of cash deposits, accounts and other receivables, investments, accounts payable, certain accrued liabilities, and borrowings under a revolving credit agreement. The carrying value of these financial instruments generally approximates fair value due to their short-term nature.

Financial instruments also include notes payable. As of June 30, 2022, the fair value of the notes payable, based on Level 2 inputs, was $586.3 million.

Assets and Liabilities Measured at Fair Value on a Recurring Basis

The following table summarizes the Company's financial instruments which are measured at fair value on a recurring basis (in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| June 30, 2022 | Level 1 | | Level 2 | | Level 3 | | Total |

| Assets | | | | | | | |

| Cash equivalents | $ | 17.6 | | | $ | 3.5 | | | $ | — | | | $ | 21.1 | |

| Available-for-sale investments: | | | | | | | |

| | | | | | | |

Corporate debt securities | — | | | 1,130.4 | | | — | | | 1,130.4 | |

Asset-backed securities | — | | | 405.6 | | | — | | | 405.6 | |

| United States government and agency securities | 5.8 | | | 99.0 | | | — | | | 104.8 | |

| | | | | | | |

| | | | | | | |

Municipal securities | — | | | 2.6 | | | — | | | 2.6 | |

| | | | | | | |

| Investments held for deferred compensation plans | 105.4 | | | — | | | — | | | 105.4 | |

| Derivatives | — | | | 115.4 | | | — | | | 115.4 | |

| $ | 128.8 | | | $ | 1,756.5 | | | $ | — | | | $ | 1,885.3 | |

| Liabilities | | | | | | | |

| Derivatives | $ | — | | | $ | 2.0 | | | $ | — | | | $ | 2.0 | |

| Deferred compensation plans | 106.6 | | | — | | | — | | | 106.6 | |

| Contingent consideration liabilities | — | | | — | | | 38.2 | | | 38.2 | |

| Other liability | — | | | — | | | 14.0 | | | 14.0 | |

| $ | 106.6 | | | $ | 2.0 | | | $ | 52.2 | | | $ | 160.8 | |

| December 31, 2021 | | | | | | | |

| Assets | | | | | | | |

| Cash equivalents | $ | 15.2 | | | $ | 30.7 | | | $ | — | | | $ | 45.9 | |

| Available-for-sale investments: | | | | | | | |

Bank time deposits | — | | | 2.5 | | | — | | | 2.5 | |

Corporate debt securities | — | | | 1,390.8 | | | — | | | 1,390.8 | |

Asset-backed securities | — | | | 512.6 | | | — | | | 512.6 | |

| United States government and agency securities | 28.4 | | | 118.9 | | | — | | | 147.3 | |

| | | | | | | |

Commercial paper | — | | | 127.7 | | | — | | | 127.7 | |

Municipal securities | — | | | 2.8 | | | — | | | 2.8 | |

| | | | | | | |

| Investments held for deferred compensation plans | 130.7 | | | — | | | — | | | 130.7 | |

| Derivatives | — | | | 55.3 | | | — | | | 55.3 | |

| $ | 174.3 | | | $ | 2,241.3 | | | $ | — | | | $ | 2,415.6 | |

| Liabilities | | | | | | | |

| Derivatives | $ | — | | | $ | 3.9 | | | $ | — | | | $ | 3.9 | |

| Deferred compensation plans | 130.9 | | | — | | | — | | | 130.9 | |

| Contingent consideration liabilities | — | | | — | | | 62.0 | | | 62.0 | |

| Other liability | — | | | — | | | 14.0 | | | 14.0 | |

| $ | 130.9 | | | $ | 3.9 | | | $ | 76.0 | | | $ | 210.8 | |

The following tables summarize the changes in fair value of the contingent consideration and the other liability (in millions):

| | | | | | | | | | | | | | | | | |

| | Contingent Consideration | | Other liability | | Total |

Balance at December 31, 2021 | $ | 62.0 | | | $ | 14.0 | | | $ | 76.0 | |

| | | | | |

| | | | | |

| Changes in fair value | (23.8) | | | — | | | (23.8) | |

| | | | | |

| Balance at June 30, 2022 | $ | 38.2 | | | $ | 14.0 | | | $ | 52.2 | |

| | | | | |

| Contingent Consideration | | Other liability | | Total |

Balance at December 31, 2020 | $ | 186.1 | | | $ | — | | | $ | 186.1 | |

| Additions | — | | | 14.0 | | | 14.0 | |

| | | | | |

| Changes in fair value | (107.1) | | | — | | | (107.1) | |

| | | | | |

| Balance at June 30, 2021 | $ | 79.0 | | | $ | 14.0 | | | $ | 93.0 | |

The contingent consideration liabilities related to certain of the Company's previous business acquisitions was reduced in the three months ended June 30, 2022 and 2021 by $19.2 million and $105.2 million, respectively, due to changes in the projected probabilities and timing of milestone achievements and the projected timing of cash inflows.

Cash Equivalents and Available-for-sale Investments