form10k.htm

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM 10-K

(Mark One)

|

T

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2011

OR

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission file number 001-34375

CYTORI THERAPEUTICS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

DELAWARE

|

33-0827593

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

(I.R.S. Employer Identification No.)

|

| |

|

|

3020 CALLAN ROAD, SAN DIEGO, CALIFORNIA

|

92121

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (858) 458-0900

Securities registered pursuant to Section 12(b) of the Act:

Common stock, par value $0.001

Warrants, exercisable for common stock, par value $0.001

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act.

Yes o No T

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes o No T

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes T No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes T No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. T

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one).

|

Large Accelerated Filer o

|

Accelerated Filer T

|

Non-Accelerated Filer o

|

Smaller reporting company o

|

| |

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No T

The aggregate market value of the common stock of the registrant held by non-affiliates of the registrant on June 30, 2011, the last business day of the registrant’s most recently completed second fiscal quarter, was $227,294,414 based on the closing sales price of the registrant’s common stock on June 30, 2011 as reported on the Nasdaq Global Market, of $4.79 per share.

As of February 29, 2012, there were 57,928,606 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A in connection with the registrant’s 2012 Annual Meeting of Stockholders, within 120 days after the registrant’s fiscal year end of December 31, 2011, are incorporated by reference in Part III, Items 10, 11, 12, 13 and 14 of this Form 10-K.

|

PART I

|

| |

|

|

|

|

Item 1.

|

|

|

4 |

| |

|

|

|

|

Item 1A.

|

|

|

10 |

| |

|

|

|

|

Item 1B.

|

|

|

18 |

| |

|

|

|

|

Item 2.

|

|

|

18 |

| |

|

|

|

|

Item 3.

|

|

|

18 |

| |

|

|

|

|

Item 4.

|

|

|

19 |

| |

|

|

|

|

PART II

|

| |

|

|

|

|

Item 5.

|

|

|

20 |

| |

|

|

|

|

Item 6.

|

|

|

21 |

| |

|

|

|

|

Item 7.

|

|

|

23 |

| |

|

|

|

|

Item 7A.

|

|

|

38 |

| |

|

|

|

|

Item 8.

|

|

|

40 |

| |

|

|

|

|

Item 9.

|

|

|

74 |

| |

|

|

|

|

Item 9A.

|

|

|

74 |

| |

|

|

|

|

Item 9B.

|

|

|

75 |

| |

|

|

|

|

PART III

|

| |

|

|

|

|

Item 10.

|

|

|

76 |

| |

|

|

|

|

Item 11.

|

|

|

76 |

| |

|

|

|

|

Item 12.

|

|

|

76 |

| |

|

|

|

|

Item 13.

|

|

|

76 |

| |

|

|

|

|

Item 14.

|

|

|

76 |

| |

|

|

|

|

PART IV

|

| |

|

|

|

|

Item 15.

|

|

|

77 |

PART I

General

Cytori Therapeutics, Inc. is developing cell therapies based on autologous adipose-derived stem and regenerative cells (ADRCs) to treat cardiovascular disease and repair soft tissue defects. Our scientific data suggest ADRCs improve blood flow, moderate the immune response and keep tissue at risk of dying alive. As a result, we believe these cells can be applied across multiple “ischemic” conditions. These therapies are made available by our proprietary device, the Celution® System, which automates the extraction and preparation of clinical grade ADRCs at the point-of-care.

Clinical Pipeline: Cardiovascular Disease

The most advanced therapeutic application in our clinical pipeline is for cardiovascular disease. We are pursuing applications for ADRCs in chronic myocardial ischemia (heart failure) and acute myocardial infarction (heart attacks).

We completed our PRECISE clinical trial in patients with chronic myocardial ischemia, a severe form of coronary artery disease. Primary six-month outcomes and longer-term 18-month data showing safety and sustained improvement in cardiac functional capacity (mVO2) were reported in 2010. Based on this data, in 2011 we applied for approval in Europe to expand the Celution® CE Mark (currently approved for general processing, breast reconstruction and other soft tissue claims) to include patients with no-option chronic myocardial ischemia (CMI). We anticipate a regulatory body decision on that application in 2012.

In December 2011, Cytori filed an Investigational Device Exemption (IDE) application with the Food and Drug Administration (FDA) for the ATHENA U.S. safety and feasibility trial for no-option CMI patients. Subsequent to the end of the year, we received approval to initiate the trial. The ATHENA trial is a multi-center, randomized, double blind, placebo controlled, safety and feasibility trial that will enroll up to 45 patients.

In 2011, we received approval for and initiated ADVANCE, our European trial for acute heart attack patients. ADVANCE is a prospective, randomized, placebo controlled, double-blind clinical trial that will enroll up to 360 patients with myocardial infarction in up to 35 treatment centers, predominately in Europe. It was designed based on the results of our APOLLO safety and feasibility trial for a similar patient population. Long-term, 18-month data from the APOLLO trial demonstrated safety and sustained improvement in infarct size and perfusion.

Commercial Business

Soft Tissue:

Commercial efforts are focused primarily on breast reconstruction. Our RESTORE-2 partial mastectomy reconstruction trial demonstrated high level of patient and physician satisfaction with treatment outcomes at 6-months that were sustained at 12-months. Blinded analysis of MRI images by an independent core laboratory confirmed objective improvements in breast shape and defect shape after treatment.

Our primary focus is to obtain reimbursement for the Celution® System consumable for cell-enriched breast reconstruction. These efforts are most advanced in the UK, while efforts to target other G5 countries are also underway. Additionally we are seeking both approval and reimbursement in Japan. Securing reimbursement will allow us optimal conditions to formally launch our product in the respective countries.

In Europe, the Celution® 800 System has CE Mark approval for certain soft tissue procedures including breast reconstruction. The System is currently offered on a pre-launch basis within the EU and select countries in Europe and Asia through a combination of direct sales and distributor-based sales channels.

Research:

We sell our products to researchers at academic centers and hospitals to fulfill the demand for access to stem and regenerative cells at the point-of-care. Certain researchers have chosen to study patient outcomes in specific indications to understand the benefit of these cells under their own independently sponsored studies. Our customers are investigating a broad array of applications including stress urinary incontinence, wound healing, fistula repair, burn, facial wasting, liver insufficiency, radiation injury, bone regeneration, kidney disease, spinal disc injury, periodontal disease, vocal cord paralysis and peripheral vascular disease.

Cell & Tissue Banking

We currently sell our StemSource® Banking line, encompassing three product configurations, to hospitals, plastic surgery clinics, tissue banks, and stem cell banking companies worldwide (outside the U.S.). Customers can purchase banks that enable ADRC banking, ADRC and adipose tissue banking, or tissue banking alone.

We market StemSource® Banks worldwide through a combination of distributors and direct sales. We remain responsible for manufacturing and sourcing all necessary equipment, including but not limited to cryopreservation chambers, cooling and thawing devices, cell banking protocols and the proprietary software and database application.

Other Products

Cytori is also commercializing products to meet the demand for best-in-class autologous fat grafting. Our Puregraft® System is designed to streamline the fat graft preparation process by selectively washing and filtering the tissue to remove contaminants in a closed, sterile field. Puregraft® was cleared for sale in the U.S. and approved for sale in the EU in January and July 2010, respectively, and is currently being sold for and used in fat grafting procedures in both reconstructive and cosmetic procedures.

We offer a range of ancillary products designed to optimize tissue harvest and graft delivery. Among the offerings is the Celbrush®, a surgical instrument for precise delivery of micro droplets that was launched in 2009. Sold separately and in combination with other items, the Celbrush® is sold to reconstructive and cosmetic surgeons worldwide and may be used for both autologous fat grafting and cell-enriched fat grafting procedures. We also offer instrumentation to optimize tissue harvest.

Manufacturing and Raw Materials

The majority of our products are manufactured at the company’s headquarters in San Diego, CA. Our internal manufacturing capabilities are expected to enable us to meet anticipated demand in 2012. Exceptions include Celution® One, one of our next-generation devices, which will be used in our cardiovascular disease clinical development and components of our Puregraft® System and ancillary supplies. Celution® One is manufactured through a joint venture arrangement between Cytori and Olympus Corporation (Olympus), a global optics and life science company. The manufacture of our products are, and the manufacture of any future cell-related therapeutic products would be, subject to periodic inspection by regulatory authorities and distribution partners. The manufacture of devices and products for human use is subject to regulation and inspection from time to time by the FDA for compliance with the FDA’s Quality System Regulation, or QSR, requirements, as well as equivalent requirements and inspections by state and non-U.S. regulatory authorities.

Raw materials required to manufacture the Celution® System family of products and disposables are commonly available from multiple sources, and we have identified and executed supply agreements with our preferred vendors. Some specialty components are custom made for us, and we are dependent on the ability of these suppliers to deliver functioning parts or materials in a timely manner to meet the ongoing demand for our products. There can be no assurance that we will be able to obtain adequate quantities of the necessary raw materials supplies within a reasonable time or at commercially reasonable prices. Interruptions in supplies due to price, timing, or availability or other issues with our suppliers could have a negative impact on our ability to manufacture products.

Competition

The field of regenerative medicine is expanding rapidly, in large part through the development of cell-based therapies or devices designed to isolate cells from human tissues. Most efforts involve cell sources such as bone marrow, placental tissue, umbilical cord and peripheral blood, and skeletal muscle. We work exclusively with adult stem and regenerative cells from adipose tissue.

Many companies are working in this field. We compete across several areas, including equity and capital, clinical trial sites, enrollment of patients in clinical trials, corporate partnerships, and eventually anticipate competing for commercial market share. Some of our competitors and potential competitors have substantially greater financial, technological, research and development, marketing, and personnel resources than we do. We cannot with any accuracy forecast when or if these companies are likely to bring cell therapies to market for indications that we are also pursuing.

Some of our competitors work with adipose-derived cells. To the best of our knowledge, none of these companies are currently conducting prospective, controlled human clinical trials nor do any of these companies have regulatory clearance for their product in Europe (under the medical device directive) or in the United States. In addition, we are aware of several surgeons who are performing autologous fat transfers using manual methods, some of whom enrich the fat with autologous adipose-derived cells.

Companies researching and developing cell-based therapies for cardiovascular disease include, among others Aastrom, Athersys, Baxter, Capricor, Cytomedix, Mesoblast, NeoStem, and Osiris. These companies are in various stages of clinical development in the U.S. and Europe, investigating their respective cell therapies for acute myocardial infarction (heart attack), chronic myocardial ischemia or other forms of coronary artery disease, as well as certain vascular conditions.

Research and Development

Research and development expenses were $10,904,000, $9,687,000 and $12,231,000 for the years ended December 31, 2011, 2010 and 2009, respectively. These expenses have supported the basic research, product development and clinical activities necessary to bring our products to market.

Our research and development efforts in 2011 focused predominantly on the following areas:

|

·

|

Made preparations for a prospective, multi-center safety and feasibility study (ATHENA Trial) in the US for the treatment of chronic myocardial ischemia. Prepared and filed Investigational Device Exemption (IDE) application with the FDA following a Pre-IDE meeting. In January 2012, Cytori received approval from the FDA to begin the ATHENA trial;

|

|

·

|

Initiated the ADVANCE multi-center clinical trial for acute heart attack patients in the EU; identified trial centers, sought hospital and country approvals, and began patient enrollment;

|

|

·

|

Prepared and submitted an application to our notified body in the EU to expand our CE Mark claims for the Celution® System to include no-option chronic myocardial ischemia patients and have maintained ongoing dialogue;

|

|

·

|

Continued patient follow-up from the APOLLO heart attack and PRECISE no-options chronic myocardial ischemia trials;

|

|

·

|

Reported final outcomes of RESTORE-2 lumpectomy defect reconstruction studies demonstrating high rate of patient and physician satisfaction with treatment results;

|

|

·

|

Obtained CE Mark claims for the next generation Celution® One System;

|

|

·

|

Prepared and submitted multiple regulatory filings in the United States, Europe, and Japan related to various cell and tissue processing systems under development;

|

|

·

|

Continued to optimize and develop the Celution® System family of products and next-generation devices, single-use consumables and related instrumentation;

|

Customers

Cytori has established a network of distributors who offer our Puregraft® System and Celution® System, instrumentation and consumables to surgeons and hospitals throughout Europe. These distributors purchase the products from Cytori at a contractually agreed-upon transfer price. We also market our Celution® System directly to customers in select countries within Europe. In addition, we offer the StemSource® 900/MB as research laboratory equipment or as part of the StemSource® Cell Bank (a comprehensive suite of products to allow hospitals or tissue banks to cryopreserve adipose-derived stem and regenerative cells) directly to customers. In Asia, Australia, Europe and India, we sell the Celution® System directly to customers, many of whom are academic hospitals, who are sponsoring and funding their own independent, investigator-led clinical studies using the product. Puregraft® and the StemSource adipose-only banks are sold directly to customers in the United States.

Sales by Geographic Region

For the years ended December 31, 2011, 2010 and 2009, product revenue came from sales of Puregraft®, the Celution®800/CRS System, related instrumentation and consumables to the European and Asia-Pacific cosmetic and reconstructive surgery markets, as well as from sales of the StemSource® laboratory and banking equipment in the U.S. and Asia.

Planned Capital Expenditures

We expect to spend approximately $1 million on capital equipment purchases in 2012. These may be paid with our available cash, or financed if appropriate.

Intellectual Property

Our success depends in large part on our ability to protect our proprietary technology, including the Celution® System product platform, and to operate without infringing on the proprietary rights of third parties. We rely on a combination of patent, trade secret, copyright and trademark laws, as well as confidentiality agreements, licensing agreements and other agreements, to establish and protect our proprietary rights. Our success also depends, in part, on our ability to avoid infringing patents issued to others. If we were judicially determined to be infringing on any third party patent, we could be required to pay damages, alter our products or processes, obtain licenses or cease certain activities.

To protect our proprietary medical technologies, including the Celution® System platform and other scientific discoveries, Cytori has 43 issued patents worldwide. We have 14 issued U.S. patents and 29 issued international patents. Of the 14 issued U.S. patents, 2 were issued in 2011 and 2 were issued in 2012 thus far. Of the 29 issued international patents, 10 were issued in 2011 and none so far in 2012. In addition, we have over 100 patent applications pending worldwide related to our technology. We are seeking additional patents on methods and systems for processing adipose-derived stem and regenerative cells, on the use of adipose-derived stem and regenerative cells for a variety of therapeutic indications, including their mechanisms of actions, on compositions of matter that include adipose-derived stem and regenerative cells, and on other scientific discoveries. We are also the exclusive, worldwide licensee of the Regents of the University of California’s rights to a portfolio related to isolated adipose derived stem cells.

We cannot assure that any of our pending patent applications will be issued, that we will develop additional proprietary products that are patentable, that any patents issued to us will provide us with competitive advantages or will not be challenged by any third parties or that the patents of others will not prevent the commercialization of products incorporating our technology. Furthermore, we cannot assure that others will not independently develop similar products, duplicate any of our products or design around our patents. U.S. patent applications are not immediately made public, so we might be surprised by the grant to someone else of a patent on a technology we are actively using.

There is a risk that any patent applications that we file and any patents that we hold or later obtain could be challenged by third parties and declared invalid or infringing of third party claims. A patent interference proceeding may be instituted with the U.S. Patent and Trademark Office (the “USPTO”) when more than one person files a patent application covering the same technology, or if someone wishes to challenge the validity of an issued patent. At the completion of the interference proceeding, the USPTO will determine which competing applicant is entitled to the patent, or whether an issued patent is valid. Patent interference proceedings are complex, highly contested legal proceedings, and the USPTO’s decision is subject to appeal. This means that if an interference proceeding arises with respect to any of our patent applications, we may experience significant expenses and delay in obtaining a patent, and if the outcome of the proceeding is unfavorable to us, the patent could be issued to a competitor rather than to us. In addition to interference proceedings, the USPTO can reexamine issued patents at the request of a third party seeking to have the patent invalidated. All patents are subject to requests for reexamination by third parties. This means that patents owned or licensed by us may be subject to reexamination and may be lost, or some or all claims may require amendment or cancellation, if the outcome of the reexamination is unfavorable to us. Patent reexamination proceedings are long and complex proceedings and could result in a reduction or loss of patent rights.

Patent law outside the United States is uncertain and in many countries is currently undergoing review and revisions. The laws of some countries may not protect our proprietary rights to the same extent as the laws of the United States. Third parties may attempt to oppose the issuance of patents to us in foreign countries by initiating opposition proceedings. One of our granted European Patents is under opposition. We do not yet know what effects, if any, the opposition will have on this granted patent. Opposition proceedings against any of our patent filings in a foreign country could have an adverse effect on our corresponding patents that are issued or pending in the U.S. It may be necessary or useful for us to participate in proceedings to determine the validity of our patents or our competitors’ patents that have been issued in countries other than the United States. This could result in substantial costs, divert our efforts and attention from other aspects of our business, and could have a material adverse effect on our results of operations and financial condition. We currently have pending patent applications and issued patents in Europe, Brazil, Mexico, India, Russia, Australia, Japan, Canada, China, Korea, and Singapore, among others.

In addition to patent protection, we rely on unpatented trade secrets and proprietary technological expertise. We cannot assure you that others will not independently develop or otherwise acquire substantially equivalent techniques, somehow gain access to our trade secrets and proprietary technological expertise or disclose such trade secrets, or that we can ultimately protect our rights to such unpatented trade secrets and proprietary technological expertise. We rely, in part, on confidentiality agreements with our marketing partners, employees, advisors, vendors and consultants to protect our trade secrets and proprietary technological expertise. We cannot assure you that these agreements will not be breached, that we will have adequate remedies for any breach or that our unpatented trade secrets and proprietary technological expertise will not otherwise become known or be independently discovered by competitors.

Government Regulation

As medical devices that yield cells with therapeutic potential, our products must receive regulatory clearances or approvals from the European Union, the FDA and, from other applicable governments prior to their sale. Our current and future Celution® Systems are or will be subject to stringent government regulation in the United States by the FDA under the Federal Food, Drug and Cosmetic Act. The FDA regulates the design/development process, clinical testing, manufacture, safety, labeling, sale, distribution, and promotion of medical devices and drugs. Included among these regulations are pre-market clearance and pre-market approval requirements, design control requirements, and the Quality System Regulations/Good Manufacturing Practices. Other statutory and regulatory requirements govern, among other things, registration and inspection, medical device listing, prohibitions against misbranding and adulteration, labeling and post-market reporting.

The Celution® System family of products must also comply with the government regulations of each individual country in which the products are to be distributed and sold. These regulations vary in complexity and can be as stringent, and on occasion even more stringent, than FDA regulations in the United States. International government regulations vary from country to country and region to region. For example, regulations in some parts of the world only require product registration while other regions / countries require a complex product approval process. Due to the fact that there are new and emerging cell therapy and cell banking regulations that have recently been drafted and/or implemented in various countries around the world, the application and subsequent implementation of these new and emerging regulations have little to no precedence. Therefore, the level of complexity and stringency is not always precisely understood today for each country, creating greater uncertainty for the international regulatory process. Furthermore, government regulations can change with little to no notice and may result in up-regulation of our product(s), thereby, creating a greater regulatory burden for our cell processing and cell banking technology products.

Worldwide, the regulatory process can be lengthy, expensive, and uncertain with no guarantee of approval. Before any new medical device may be introduced to the U.S. market, the manufacturer generally must obtain FDA clearance or approval through either the 510(k) pre-market notification process or the lengthier pre-market approval application (PMA) process, which requires clinical trials to generate clinical data supportive of safety and efficacy. Approval of a PMA could take four or more years from the time the process is initiated. Our core Celution® System processing device products under development are generally subject to the lengthier PMA process for many specific applications. Failure to comply with applicable requirements can result in application integrity proceedings, fines, recalls or seizures of products, injunctions, civil penalties, total or partial suspensions of production, withdrawals of existing product approvals or clearances, refusals to approve or clear new applications or notifications, and criminal prosecution.

Specifically, regulation of the Celution® System in Europe and the U.S. for use in cardiovascular disease requires that we conduct clinical trials to collect safety and efficacy data to support marketing approvals. We have completed a pilot study in Europe for acute myocardial infarction and have since commenced a larger study intended to seek approval. We completed a pilot study for chronic myocardial ischemia in Europe and based on the data are seeking a limited approval in Europe. And in the U.S., we received IDE approval from the FDA and are now commencing a safety and feasibility trial for chronic myocardial ischemia under the device regulations via the PMA pathway.

We continue to pursue additional indications through the 510(k) and humanitarian use device (HUD) pathways for various indications-for-use.

Summary of Celution®System Family Regulatory Status

|

Region

|

Clinical Applications

|

Regulatory Status

|

| |

|

|

|

Japan

|

Cell Banking

|

Approved

|

| |

|

|

|

Europe

|

Celution® 800 and Celution One: Cell Processing for re-implantation or re-infusion into same patient (General Processing)

|

CE Mark

|

|

Celution® 800 and Celution One: Breast reconstruction, healing of Crohn’s wounds and other cosmetic procedures

|

CE Mark

|

|

Celution® 800 Chronic myocardial ischemia

|

CE Mark submission for expanded claims under review

|

|

Acute Heart Attack

|

In clinical trial

|

|

Multiple specific surgical claims

|

Pre-clinical

|

|

Cell Concentration

|

CE Mark

|

|

Celution® One cosmetic and reconstructive surgery claims

|

CE Mark

|

| |

|

|

|

U.S.

|

No option chronic myocardial ischemia

|

IDE/PMA safety and feasibility trial approved; to initiate in 2012

|

Our Puregraft® family of products and the Celbrush® are cleared in the U.S. and CE Mark approved in Europe we are seeking approval in other countries around the world. These product lines are complementary to our core Celution® and cell therapy business.

Medical devices are also subject to post-market reporting requirements for deaths or serious injuries when the device may have caused or contributed to the death or serious injury, and for certain device malfunctions that would be likely to cause or contribute to a death or serious injury if the malfunction were to recur. If safety or effectiveness problems occur after the product reaches the market, the FDA may take steps to prevent or limit further marketing of the product. Additionally, the FDA actively enforces regulations prohibiting marketing and promotion of devices for indications or uses that have not been cleared or approved by the FDA. In addition, modifications or enhancements of products that could affect the safety or effectiveness or effect a major change in the intended use of a device that was either cleared through the 510(k) process or approved through the PMA process may require further FDA review through new 510(k) or PMA submissions.

Lastly, the FDA is currently considering modifications to the 510(k) and HUD process. The extent and effect of these potential modifications are not currently known. Moreover, the effect these changes may have on our ability to obtain future 510(k) clearances and HUD approvals is also not currently clear. Regardless of the lack of current specificity regarding the potential effect, it is relatively well accepted that these changes to the FDA 510(k) and HUD system will almost certainly result in a more rigorous approval process.

We must comply with extensive regulations from foreign jurisdictions regarding safety, manufacturing processes and quality. These regulations, including the requirements for marketing authorization and may differ from the FDA regulatory scheme in the United States. Specifically, in regard to our Thin Film product line in Japan (to be distributed by Senko once approved), we have been seeking marketing authorization from the Japanese Ministry of Health, Labour and Welfare (MHLW), but have not obtained approvals yet.

Employees

As of December 31, 2011, we had 128 employees, including part-time and full-time employees. These employees are comprised of 17 employees in manufacturing, 47 employees in research and development, 30 employees in sales and marketing and 34 employees in management, finance and administration. From time to time, we also employ independent contractors to support our operations. Our employees are not represented by any collective bargaining agreements and we have never experienced an organized work stoppage.

Corporate Information and Web Site Access to SEC Filings

We were initially formed as a California general partnership in July 1996, and incorporated in the State of Delaware in May 1997. We were formerly known as MacroPore Biosurgery, Inc., and before that as MacroPore, Inc. Our corporate offices are located at 3020 Callan Road, San Diego, CA 92121. Our telephone number is (858) 458-0900. We maintain an Internet website at www.cytori.com. Through this site, we make available free of charge our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) of the Securities Exchange Act of 1934 as soon as reasonably practicable after we electronically file such material with, or furnish it to, the U.S. Securities and Exchange Commission (SEC). In addition, we publish on our website all reports filed under Section 16(a) of the Securities Exchange Act by our directors, officers and 10% stockholders. These materials are accessible via the Investor Relations section of our website within the “SEC Filings” link. Some of the information is stored directly on our website, while other information can be accessed by selecting the provided link to the section on the SEC website, which contains filings for our company and its insiders.

In analyzing our company, you should consider carefully the following risk factors together with all of the other information included in this annual report on Form 10-K. Factors that could adversely affect our business, operating results, and financial condition, as well as adversely affect the value of an investment in our common stock, include those discussed below, as well as those discussed above in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere throughout this annual report on Form 10-K.

We are subject to the following significant risks, among others:

We will likely need to raise more cash in the future

We have almost always had negative cash flows from operations. Our business will continue to result in a substantial requirement for research and development expenses for several years, during which we may not be able to bring in sufficient cash and/or revenues to offset these expenses. We will likely be required to raise capital from one or more sources in the future to continue funding our operations to profitability. We do not currently believe that our cash balance and the revenues from our operations will be sufficient to fund the development and marketing efforts required to reach profitability without raising additional capital from accessible sources of financing in the future. In addition, our Amended and Restated Loan and Security Agreement with General Electric Capital Corporation, Silicon Valley Bank and Oxford Finance Corporation requires us to maintain certain minimum cash requirements, and if our cash reserves fall below those minimum requirements, then we could be in default under our loan agreement and subject to potential adverse remedies by the lenders, which would have a substantial and material adverse effect on our business, financial condition, results of operations, the value of our common stock and warrants and our ability to raise capital. There is no guarantee that adequate funds will be available when needed from additional debt or equity financing, arrangements with development and commercialization partners, increased results of operations, or from other sources, or on terms attractive to us. Our inability to obtain sufficient additional funds in the future would, at a minimum, require us to delay, scale back, or eliminate some or all of our research or product development, manufacturing operations, clinical or regulatory activities, which could have a substantial negative effect on our results of operations and financial condition.

Continued turmoil in the economy could harm our business

Negative trends in the general economy, including trends resulting from an actual or perceived recession, tightening credit markets, increased cost of commodities, including oil, actual or threatened military action by the United States and threats of terrorist attacks in the United States and abroad, could cause a reduction of investment in and available funding for companies in certain industries, including ours and our customers. Our ability to raise capital has been and may in the future be adversely affected by downturns in current credit conditions, financial markets and the global economy.

We have never been profitable on an operational basis and expect significant operating losses for the next few years

We have incurred net operating losses in each year since we started business. As our focus on the Celution® System platform and development of therapeutic applications for its cellular output has increased, losses have resulted primarily from expenses associated with research and development activities and general and administrative expenses. While we work continuously to implement cost reduction measures where possible, we nonetheless expect to continue operating in a loss position on a consolidated basis and that recurring operating expenses will be at high levels for the next several years, in order to perform clinical trials, additional pre-clinical research, product development, and marketing. As a result of our historic losses, we have been, and are likely to continue to be, reliant on raising outside capital to fund our operations.

Our business strategy is high-risk

We are focusing our resources and efforts primarily on development of the Celution® System family of products and the therapeutic applications of its cellular output, which requires extensive cash needs for research, development, and commercialization activities. This is a high-risk strategy because there is no assurance that our future products will ever become commercially viable (commercial risk), that we will prevent other companies from depriving us of market share and profit margins by selling products based on our inventions and developments (legal risk), that we will successfully manage a company in a new area of business (regenerative medicine) and on a different scale than we have operated in the past (operational risk), that we will be able to achieve the desired therapeutic results using stem and regenerative cells (scientific risk), or that our cash resources will be adequate to develop our products until we become profitable, if ever (financial risk). We are using our cash in one of the riskiest industries in the economy (strategic risk). This may make our stock an unsuitable investment for many investors.

Our joint venture and relationship with Olympus are important to us

Our business depends in part on keeping our business relationship with Olympus Corporation and our joint venture collaboration with them operating smoothly and efficiently. We have given Olympus-Cytori, Inc. an exclusive license to manufacture future generation Celution® System devices. If Olympus-Cytori, Inc. does not successfully develop and manufacture these devices, we may experience disruptions and/or delays of our commercialization of these devices into the market. Any significant disruption of our relationship or our business activity with Olympus could affect our operations and commercialization efforts (clinical, regulatory and/or commercial sales), and be harmful to our business.

We and Olympus must overcome contractual and cultural barriers. Although our relationship is formally measured by a set of complex contracts, many aspects of the relationship will be non-contractual and must be worked out between the parties and the responsible individuals. The joint venture is intended to have a long life, and it is difficult to maintain cooperative relationships over a long period of time in the face of various kinds of change. Cultural differences, including language barrier to some degree, may affect the efficiency of the relationship.

Olympus-Cytori, Inc. is 50% owned by us and 50% owned by Olympus. By contract, each side must consent before any of a wide variety of important business actions can occur. This situation possesses a risk of potentially time-consuming and difficult negotiations which could at some point delay the joint venture from pursuing its business strategies.

Olympus is entitled to designate the joint venture's chief executive officer and a majority of its board of directors, which means that day-to-day decisions which are not subject to a contractual veto will essentially be controlled by Olympus. In addition, Olympus-Cytori, Inc. may require more money than its current capitalization in order to complete development and production of future generation devices. If we are unable to help provide future financing for Olympus-Cytori, Inc., our relative equity interest in Olympus-Cytori, Inc. may decrease.

Furthermore, under a License/Joint Development Agreement among Olympus-Cytori, Inc., Olympus, and us, Olympus may have a significant role in the development of Olympus-Cytori, Inc.’s next generation devices. Although Olympus has extensive experience in developing medical devices, this arrangement has resulted in a reduction of our control over the development and manufacturing of the next generation devices. Any significant disruption of activity by Olympus in connection with our business relationship and/or the development of Olympus-Cytori’s next generation devices and our joint venture could be harmful to our business.

In 2011 Olympus experienced issues which have led to a significant change in the management structure at Olympus. We believe that these changes will continue to develop in 2012 and that it is possible that they could affect our Joint Venture relationship. If the Joint Venture is materially impacted by such changes in a manner that significantly disrupts our operations and commercialization efforts (clinical, regulatory and/or commercial sales), then our business could be harmed.

We have a limited operating history; operating results and stock price can be volatile like many life science companies

Our prospects must be evaluated in light of the risks and difficulties frequently encountered by emerging companies and particularly by such companies in rapidly evolving and technologically advanced biotech and medical device fields. From time to time, we have tried to update our investors’ expectations as to our operating results by periodically announcing financial guidance. However, we have in the past been forced to revise or withdraw such guidance due to lack of visibility and predictability of product demand. Our stock price has a history of significant volatility, which may harm our ability to raise additional capital and may cause an investment in Cytori to be unsuitable for some investors.

We are vulnerable to competition and technological change, and also to physicians’ inertia

We compete with many domestic and foreign companies in developing our technology and products, including biotechnology, medical device, and pharmaceutical companies. Many current and potential competitors have substantially greater financial, technological, research and development, marketing, and personnel resources. There is no assurance that our competitors will not succeed in developing alternative products that are more effective, easier to use, or more economical than those which we have developed or are in the process of developing, or that would render our products obsolete and non-competitive. In general, we may not be able to prevent others from developing and marketing competitive products similar to ours or which perform similar functions.

Competitors may have greater experience in developing therapies or devices, conducting clinical trials, obtaining regulatory clearances or approvals, manufacturing and commercialization. It is possible that competitors may obtain patent protection, approval, or clearance from the FDA or achieve commercialization earlier than we can, any of which could have a substantial negative effect on our business. Finally, Olympus and our other partners might pursue parallel development of other technologies or products, which may result in a partner developing additional products competitive with ours.

We compete against cell-based therapies derived from alternate sources, such as bone marrow, umbilical cord blood and potentially embryos. Doctors historically are slow to adopt new technologies like ours, regardless of the perceived merits, when older technologies continue to be supported by established providers. Overcoming such inertia often requires very significant marketing expenditures or definitive product performance and/or pricing superiority.

We expect physicians’ inertia and skepticism to also be a significant barrier as we attempt to gain market penetration with our future products. We believe we will continue to need to finance lengthy time-consuming clinical studies to provide evidence of the medical benefit of our products and resulting therapies in order to overcome this inertia and skepticism particularly in reconstructive surgery, cell preservation, the cardiovascular area and many other indications.

Most potential applications of our technology are pre-commercialization, which subjects us to development and marketing risks

We are in a relatively early stage of the path to commercialization with many of our products. We believe that our long-term viability and growth will depend in large part on our ability to develop commercial quality cell processing devices and useful procedure-specific consumables, and to establish the safety and efficacy of our therapies through clinical trials and studies. With our Celution® System platform, we are pursuing new approaches for reconstructive surgery, preservation of stem and regenerative cells for potential future use, therapies for cardiovascular disease, soft tissue defects, and other conditions. There is no assurance that our development programs will be successfully completed or that required regulatory clearances or approvals will be obtained on a timely basis, if at all.

There is no proven path for commercializing the Celution® System platform in a way to earn a durable profit commensurate with the medical benefit. Although we began to commercialize our reconstructive surgery products in Europe and certain Asian markets, and our cell banking products in Japan, Europe, and certain Asian markets in 2008, additional market opportunities for many of our products and/or services may not materialize for a number of years.

Successful development and market acceptance of our products is subject to developmental risks, including failure of inventive imagination, ineffectiveness, lack of safety, unreliability, failure to receive necessary regulatory clearances or approvals, high commercial cost, preclusion or obsolescence resulting from third parties’ proprietary rights or superior or equivalent products, competition from copycat products, and general economic conditions affecting purchasing patterns. There is no assurance that we or our partners will successfully develop and commercialize our products, or that our competitors will not develop competing technologies that are less expensive or superior. Failure to successfully develop and market our products would have a substantial negative effect on our results of operations and financial condition.

Market acceptance of new technology such as ours can be difficult to obtain

New and emerging cell therapy and cell banking technologies, such as those provided by the Celution® System family of products, may have difficulty or encounter significant delays in obtaining market acceptance in some or all countries around the world due to the novelty of our cell therapy and cell banking technologies. Therefore, the market adoption of our cell therapy and cell banking technologies may be slow and lengthy with no assurances that significant market adoption will be successful. The lack of market adoption or reduced or minimal market adoption of our cell therapy and cell banking technologies may have a significant impact on our ability to successfully sell our product(s) into a country or region.

Future clinical trial results may differ significantly from our expectations

While we have proceeded incrementally with our clinical trials in an effort to gauge the risks of proceeding with larger and more expensive trials, we cannot guarantee that we will not experience negative results larger and much more expensive clinical trials than we have conducted to date, such as the new ADVANCE acute heart attack trial in Europe. Poor results in our clinical trials could result in substantial delays in commercialization, substantial negative effects on the perception of our products, and substantial additional costs. These risks are increased by our reliance on third parties in the performance of many of the clinical trial functions, including the clinical investigators, hospitals, and other third party service providers.

We have limited manufacturing experience

We have limited experience in manufacturing the Celution® System platform or its consumables at a commercial level. With respect to our Joint Venture, although Olympus is a highly capable and experienced manufacturer of medical devices, there can be no guarantee that the Olympus-Cytori Joint Venture will be able to successfully develop and manufacture the next generation Celution® System in a manner that is cost-effective or commercially viable, or that development and manufacturing capabilities might not take much longer than currently anticipated to be ready for the market.

Although we have been manufacturing the the Celution® 800 System and the StemSource® 900-based Cell Bank since 2008, we cannot assure that we will be able to manufacture sufficient numbers of such products to meet the demand, or that we will be able to overcome unforeseen manufacturing difficulties for these sophisticated medical devices.

In the event that the Olympus-Cytori Joint Venture is not successful in the development and manufacture of the next generation Celution® One System, Cytori may not have the resources or ability to self-manufacture sufficient numbers of devices and consumables to meet market demand, and this failure may substantially extend the time it would take for us to bring a more advanced commercial device to market. This makes us significantly dependant on the continued dedication and skill of Olympus for the successful development of future generation Celution® Systems.

We may not be able to protect our proprietary rights

Our success depends in part on whether we can maintain our existing patents, obtain additional patents, maintain trade secret protection, and operate without infringing on the proprietary rights of third parties.

There can be no assurance that any of our pending patent applications will be approved or that we will develop additional proprietary products that are patentable. There is also no assurance that any patents issued to us will not become the subject of a re-examination, will provide us with competitive advantages, will not be challenged by any third parties, or that the patents of others will not prevent the commercialization of products incorporating our technology. Furthermore, there can be no guarantee that others will not independently develop similar products, duplicate any of our products, or design around our patents.

Our commercial success will also depend, in part, on our ability to avoid infringing on patents issued to others. If we were judicially determined to be infringing on any third-party patent, we could be required to pay damages, alter our products or processes, obtain licenses, or cease certain activities. If we are required in the future to obtain any licenses from third parties for some of our products, there can be no guarantee that we would be able to do so on commercially favorable terms, if at all. U.S. patent applications are not immediately made public, so we might be surprised by the grant to someone else of a patent on a technology we are actively using. As noted above and in the case of the University of Pittsburgh lawsuit, even patents issued to us or our licensors might be judicially determined to belong in full or in part to third parties.

Litigation, which would result in substantial costs to us and diversion of effort on our part, may be necessary to enforce or confirm the ownership of any patents issued or licensed to us, or to determine the scope and validity of third-party proprietary rights. If our competitors claim technology also claimed by us and prepare and file patent applications in the United States, we may have to participate in interference proceedings declared by the U.S. Patent and Trademark Office or a foreign patent office to determine priority of invention, which could result in substantial costs to and diversion of effort, even if the eventual outcome is favorable to us. Any such litigation or interference proceeding, regardless of outcome, could be expensive and time-consuming.

Successful challenges to our patents through oppositions, reexamination proceedings or interference proceedings could result in a loss of patent rights in the relevant jurisdiction. If we are unsuccessful in actions we bring against the patents of other parties and it is determined that we infringe the patents of third-parties, we may be subject to litigation, or otherwise prevented from commercializing potential products in the relevant jurisdiction, or may be required to obtain licenses to those patents or develop or obtain alternative technologies, any of which could harm our business. Furthermore, if such challenges to our patent rights are not resolved in our favor, we could be delayed or prevented from entering into new collaborations or from commercializing certain products, which could adversely affect our business and results of operations.

Competitors or third parties may infringe our patents. We may be required to file patent infringement claims, which can be expensive and time-consuming. In addition, in an infringement proceeding, a court may decide that a patent of ours is not valid or is unenforceable, or that the third party’s technology does not in fact infringe upon our patents. An adverse determination of any litigation or defense proceedings could put one or more of our patents at risk of being invalidated or interpreted narrowly and could put our related pending patent applications at risk of not issuing. Litigation may fail and, even if successful, may result in substantial costs and be a distraction to our management. We may not be able to prevent misappropriation of our proprietary rights, particularly in countries outside the U.S. where patent rights may be more difficult to enforce. Furthermore, because of the substantial amount of discovery required in connection with intellectual property litigation, there is a risk that some of our confidential or sensitive information could be compromised by disclosure in the event of litigation. In addition, during the course of litigation there could be public announcements of the results of hearings, motions or other interim proceedings or developments. If securities analysts or investors perceive these results to be negative, it could have a substantial adverse effect on the price of our common stock.

In addition to patents, which alone may not be able to protect the fundamentals of our business, we also rely on unpatented trade secrets and proprietary technological expertise. Some of our intended future cell-related therapeutic products may fit into this category. We rely, in part, on confidentiality agreements with our partners, employees, advisors, vendors, and consultants to protect our trade secrets and proprietary technological expertise. There can be no guarantee that these agreements will not be breached, or that we will have adequate remedies for any breach, or that our unpatented trade secrets and proprietary technological expertise will not otherwise become known or be independently discovered by competitors.

Our amended regenerative cell technology license agreement with the Regents of the University of California (UC) which includes issued U.S. patent number 7,470,537, contains certain developmental milestones, which if not achieved could result in the loss of exclusivity or loss of the license rights. The loss of such rights could impact our ability to develop certain regenerative cell technology products. Also, our power as licensee to successfully use these rights to exclude competitors from the market is untested.

Failure to obtain or maintain patent protection, or protect trade secrets, for any reason (or third-party claims against our patents, trade secrets, or proprietary rights, or our involvement in disputes over our patents, trade secrets, or proprietary rights, including involvement in litigation), could have a substantial negative effect on our results of operations and financial condition.

We may not be able to protect our intellectual property in countries outside the United States

Intellectual property law outside the United States is uncertain and in many countries is currently undergoing review and revisions. The laws of some countries do not protect our patent and other intellectual property rights to the same extent as United States laws. This is particularly relevant to us as most of our current commercial product sales and clinical trials are outside of the United States. Third parties may attempt to oppose the issuance of patents to us in foreign countries by initiating opposition proceedings. Opposition proceedings against any of our patent filings in a foreign country could have an adverse effect on our corresponding patents that are issued or pending in the United States. It may be necessary or useful for us to participate in proceedings to determine the validity of our patents or our competitors’ patents that have been issued in countries other than the U.S. This could result in substantial costs, divert our efforts and attention from other aspects of our business, and could have a material adverse effect on our results of operations and financial condition. We currently have pending patent applications in Europe, Australia, Japan, Canada, China, Korea, and Singapore, among others.

We and our Olympus-Cytori, Inc. joint venture are subject to FDA regulation

As medical devices, the Celution® System family of products, Puregraft ® family of products and the Celbrush® must receive regulatory clearances or approvals from the FDA and, in many instances, from non-U.S. and state governments prior to their sale. The Celution® System family of products is subject to stringent government regulation in the United States by the FDA under the Federal Food, Drug and Cosmetic Act. The FDA regulates the design/development process, clinical testing, manufacture, safety, labeling, sale, distribution, and promotion of medical devices and drugs. Included among these regulations are pre-market clearance and pre-market approval requirements, design control requirements, and the Quality System Regulations/Good Manufacturing Practices. Other statutory and regulatory requirements govern, among other things, establishment registration and inspection, medical device listing, prohibitions against misbranding and adulteration, labeling and post-market reporting.

The regulatory process can be lengthy, expensive, and uncertain. Before any new medical device may be introduced to the U.S. market, the manufacturer generally must obtain FDA clearance or approval through either the 510(k) pre-market notification process or the lengthier pre-market approval application, or PMA, process. It generally takes from three to 12 months from submission to obtain 510(k) pre-market clearance, although it may take longer. Approval of a PMA could take four or more years from the time the process is initiated. The 510(k) and PMA processes can be expensive, uncertain, and lengthy, and there is no guarantee of ultimate clearance or approval. We expect that some of our products under development today or in the future, as well as Olympus-Cytori’s, will be subject to the lengthier PMA process. Securing FDA clearances and approvals may require the submission of extensive clinical data and supporting information to the FDA, and there can be no guarantee of ultimate clearance or approval. Failure to comply with applicable requirements can result in application integrity proceedings, fines, recalls or seizures of products, injunctions, civil penalties, total or partial suspensions of production, withdrawals of existing product approvals or clearances, refusals to approve or clear new applications or notifications, and criminal prosecution.

Medical devices are also subject to post-market reporting requirements for deaths or serious injuries when the device may have caused or contributed to the death or serious injury, and for certain device malfunctions that would be likely to cause or contribute to a death or serious injury if the malfunction were to recur. If safety or effectiveness problems occur after the product reaches the market, the FDA may take steps to prevent or limit further marketing of the product. Additionally, the FDA actively enforces regulations prohibiting marketing and promotion of devices for indications or uses that have not been cleared or approved by the FDA.

There can be no guarantee that we will be able to obtain the necessary 510(k) clearances or PMA approvals to market and manufacture our other products in the United States for their intended use on a timely basis, if at all. Delays in receipt of or failure to receive such clearances or approvals, the loss of previously received clearances or approvals, or failure to comply with existing or future regulatory requirements could have a substantial negative effect on our results of operations and financial condition.

To sell in international markets, we will be subject to regulation in foreign countries

In cooperation with our distribution partners, we intend to market our current and future products both domestically and in many foreign markets. A number of risks are inherent in international transactions. In order for us to market our products in Europe, Canada, Japan and certain other non-U.S. jurisdictions, we need to obtain and maintain required regulatory approvals or clearances and must comply with extensive regulations regarding safety, manufacturing processes and quality. For example, we still have not obtained regulatory approval for our Thin Film products in Japan. These regulations, including the requirements for approvals or clearances to market, may differ from the FDA regulatory scheme. International sales also may be limited or disrupted by political instability, price controls, trade restrictions and changes in tariffs. Additionally, fluctuations in currency exchange rates may adversely affect demand for our products by increasing the price of our products in the currency of the countries in which the products are sold.

There can be no assurance that we will obtain regulatory approvals or clearances in all of the countries where we intend to market our products, or that we will not incur significant costs in obtaining or maintaining foreign regulatory approvals or clearances, or that we will be able to successfully commercialize current or future products in various foreign markets. Delays in receipt of approvals or clearances to market our products in foreign countries, failure to receive such approvals or clearances or the future loss of previously received approvals or clearances could have a substantial negative effect on our results of operations and financial condition.

Changing, new and/or emerging government regulations may adversely affect us

Government regulations can change without notice. Given the fact that Cytori operates in various international markets, our access to such markets could change with little to no warning due to a change in government regulations that suddenly up-regulate our product(s) and create greater regulatory burden for our cell therapy and cell banking technology products.

Due to the fact that there are new and emerging cell therapy and cell banking regulations that have recently been drafted and/or implemented in various countries around the world, the application and subsequent implementation of these new and emerging regulations have little to no precedence. Therefore, the level of complexity and stringency is not known and may vary from country to country, creating greater uncertainty for the international regulatory process.

Anticipated or unanticipated changes in the way or manner in which the FDA regulates products or classes/groups of products can delay, further burden, or alleviate regulatory pathways that were once available to other products. There are no guarantees that such changes in FDA’s approach to the regulatory process will not deleteriously affect some or all of our products or product applications.

We do not know if the current FDA proposed changes to the 510(k) system will have any material effect on any of our current or future 510(k) applications. Depending on if and how these proposed changes are ultimately adopted and implemented, our current or future applications for FDA approval for our products may be adversely affected and our business could be harmed as a result.

We may have difficulty obtaining health insurance reimbursement for our products

New and emerging cell therapy and cell banking technologies, such as those provided by the Celution® System family of products, may have difficulty or encounter significant delays in obtaining health care reimbursement in some or all countries around the world due to the novelty of our cell therapy and cell banking technology and subsequent lack of existing reimbursement schemes / pathways. Therefore, the creation of new reimbursement pathways may be complex and lengthy with no assurances that such reimbursements will be successful. The lack of health insurance reimbursement or reduced or minimal reimbursement pricing may have a significant impact on our ability to successfully sell our cell therapy and cell banking technology product(s) into a county or region, which would negatively impact our operating results.

Our concentration of sales in Japan may enhance the negative effects on our business of any crisis in that region

We have a significant concentration of sales in Japan, the United States, and Europe given our early stage of commercialization. As a result of this regional concentration of sales, changes in the regulatory environment in these countries, or any other countries in which we have a significant concentration of sales, could adversely impact our sales. If the government of any of these countries significantly curtailed or prohibited the sale of our products, our revenues would be adversely affected. Recently, the earthquake, tsunami and subsequent problems affecting nuclear power plants in Japan have dramatically impacted Japan’s manufacturing capacity and business activities. The long-term effect of these issues is still uncertain. While we expect that the situation has stabilized and will improve, if it does not, these circumstances could be harmful to our business since the Celution ® One device is manufactured in Japan, and a substantial portion of our sales have come from Japan.

Our global operations expose us to additional risk and uncertainties.

We have operations in a number of regions around the world, including the United States, Japan, and Europe. Our global operations may be subject to risks that may limit our ability to operate our business. We sell our products globally, which exposes us to a number of risks that can arise from international trade transactions, local business practices and cultural considerations, including:

|

|

·

|

political unrest, terrorism and economic or financial instability;

|

|

|

·

|

unexpected changes and uncertainty in regulatory requirements and systems related

|

|

|

·

|

nationalization programs that may be implemented by foreign governments;

|

|

|

·

|

import-export regulations;

|

|

|

·

|

difficulties in enforcing agreements and collecting receivables;

|

|

|

·

|

difficulties in ensuring compliance with the laws and regulations of multiple jurisdictions;

|

|

|

·

|

changes in labor practices, including wage inflation, labor unrest and unionization policies;

|

|

|

·

|

longer payment cycles by international customers;

|

|

|

·

|

currency exchange fluctuations;

|

|

|

·

|

disruptions of service from utilities or telecommunications providers, including electricity shortages;

|

|

|

·

|

difficulties in staffing foreign branches and subsidiaries and in managing an expatriate workforce, and differing employment practices and labor issues;

|

|

|

·

|

potentially adverse tax consequences;

|

We also face risks associated with currency exchange and convertibility, inflation and repatriation of earnings as a result of our foreign operations. We are also vulnerable to appreciation or depreciation of foreign currencies against the U.S. dollar. Although we have significant operations in Asia, a substantial portion of transactions are denominated in U.S. dollars. As appreciation against the U.S. dollar increases, it will result in an increase in the cost of our business expenses abroad. Conversely, downward fluctuations in the value of foreign currencies relative to the U.S. dollar may make our products less price competitive than local solutions. From time to time, we may engage in currency hedging activities, but such activities may not be able to limit the risks of currency fluctuations.

We and our joint venture with Olympus have to maintain quality assurance certification and manufacturing approvals

The manufacture of our products are, and the manufacture of any future cell-related therapeutic products would be, subject to periodic inspection by regulatory authorities and distribution partners. The manufacture of devices and products for human use is subject to regulation and inspection from time to time by the FDA for compliance with the FDA’s Quality System Regulation, or QSR, requirements, as well as equivalent requirements and inspections by state and non-U.S. regulatory authorities. There can be no guarantee that the FDA or other authorities will not, during the course of an inspection of existing or new facilities, identify what they consider to be deficiencies in our compliance with QSRs or other requirements and request, or seek remedial action.

Failure to comply with such regulations or a potential delay in attaining compliance may adversely affect our manufacturing activities and could result in, among other things, injunctions, civil penalties, FDA refusal to grant pre-market approvals or clearances of future or pending product submissions, fines, recalls or seizures of products, total or partial suspensions of production, and criminal prosecution. There can be no assurance after such occurrences that we will be able to obtain additional necessary regulatory approvals or clearances on a timely basis, if at all. Delays in receipt of or failure to receive such approvals or clearances, or the loss of previously received approvals or clearances could have a substantial negative effect on our results of operations and financial condition.

We depend on a few key officers

Our performance is substantially dependent on the performance of our executive officers and other key scientific and sales staff, including Christopher J. Calhoun, our Chief Executive Officer, and Marc Hedrick, MD, our President. We rely upon them for strategic business decisions and guidance. We believe that our future success in developing marketable products and achieving a competitive position will depend in large part upon whether we can attract and retain additional qualified management and scientific personnel. Competition for such personnel is intense, and there can be no assurance that we will be able to continue to attract and retain such personnel. The loss of the services of one or more of our executive officers or key scientific staff, or the inability to attract and retain additional personnel and develop expertise as needed could have a substantial negative effect on our results of operations and financial condition.

We may not have enough product liability insurance

The testing, manufacturing, marketing, and sale of our regenerative cell products involve an inherent risk that product liability claims will be asserted against us, our distribution partners, or licensees. There can be no guarantee that our clinical trial and commercial product liability insurance is adequate or will continue to be available in sufficient amounts or at an acceptable cost, if at all. A product liability claim, product recall, or other claim, as well as any claims for uninsured liabilities or in excess of insured liabilities, could have a substantial negative effect on our results of operations and financial condition. Also, well-publicized claims could cause our stock to fall sharply, even before the merits of the claims are decided by a court.

Our charter documents contain anti-takeover provisions and we have adopted a Stockholder Rights Plan to prevent hostile takeovers

Our Amended and Restated Certificate of Incorporation and Bylaws contain certain provisions that could prevent or delay the acquisition of Cytori by means of a tender offer, proxy contest, or otherwise. They could discourage a third party from attempting to acquire control of Cytori, even if such events would be beneficial to the interests of our stockholders. Such provisions may have the effect of delaying, deferring, or preventing a change of control of Cytori and consequently could adversely affect the market price of our shares. Also, in 2003 we adopted a Stockholder Rights Plan of the kind often referred to as a poison pill. The purpose of the Stockholder Rights Plan is to prevent coercive takeover tactics that may otherwise be utilized in takeover attempts. The existence of such a rights plan may also prevent or delay a change in control of Cytori, and this prevention or delay adversely affect the market price of our shares.

We pay no dividends

We have never paid cash dividends in the past, and currently do not intend to pay any cash dividends in the foreseeable future. This could make an investment in our company inappropriate for some investors, and may serve to narrow our potential sources of additional capital.

Item 1B. Unresolved Staff Comments

Not applicable.

We lease 77,585 square feet at 3020 and 3030 Callan Road, San Diego, California that we use for our corporate headquarters. The related lease agreement, as amended, bears monthly rent at a rate of $1.80 per square foot, with annual increase of $0.05 per square foot. The lease term is 88 months, commencing on July 1, 2010 and expiring on October 31, 2017. We will receive a 50% rent abatement for the additional 17,467 square feet over the next two years, and we will receive a tenant improvement allowance as well. Additionally, we’ve entered into several lease agreements for international office locations and corporate housing for our employees on international assignments. For these properties, we pay an aggregate of approximately $156,000 in rent per month.

Item 3. Legal Proceedings

From time to time, we have been involved in routine litigation incidental to the conduct of our business. As of December 31, 2011, we were not a party to any material legal proceeding.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

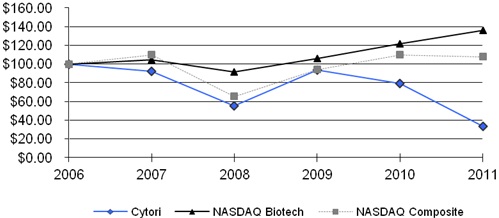

Market Prices