Execution Version

PLATINUM GROUP METALS LTD.

as the Corporation

and

COMPUTERSHARE TRUST COMPANY OF CANADA

as the Warrant Agent

| SUPPLEMENTAL WARRANT INDENTURE |

| Dated as of December 13, 2018 |

THIS SUPPLEMENTAL WARRANT INDENTURE (the “Supplemental Indenture”) is made as of the 13th day of December, 2018.

BETWEEN:

PLATINUM GROUP METALS LTD., a corporation existing under the laws of the Province of British Columbia (the “Corporation”)

- and -

COMPUTERSHARE TRUST COMPANY OF CANADA, a trust company existing under the laws of Canada and authorized to carry on business in all provinces of Canada (the “Warrant Agent”)

WHEREAS:

A. The Corporation and Warrant Agent entered into a common share purchase warrant indenture dated May 15, 2018 (the “Warrant Indenture”) providing for the issuance of up to 131,100,000 common share purchase warrants (the “Warrants”) and pursuant to which the Warrant Agent holds all rights, interests and benefits contained therein for and on behalf of those persons who from time to time become holders of Warrants issued pursuant to the Warrant Indenture;

B. Effective as of 9:00 a.m. (New York time) on December 13, 2018 (the “Effective Date”), the outstanding common shares of the Corporation (the “Common Shares”) were consolidated on a ten (10) old Common Shares for one (1) new Common Share basis. As a result, in accordance with the provisions of Article 4 of the Warrant Indenture, the exercise price of the Warrants is increased from US$0.17 to US$1.70 (US$0.17 x 10) (the “Exercise Price”) and the exchange rate is adjusted to 0.10 (1 x 0.17/1.70) (the “Exchange Rate”). Therefore, the Corporation has determined to amend the Warrant Indenture to reflect the adjustment of the Exercise Price and Exchange Rate of the Warrants issuable under the Warrant Indenture;

C. Section 8.1 of the Warrant Indenture provides that the Corporation and the Warrant Agent may execute and deliver an indenture supplemental to the Warrant Indenture setting forth any adjustments resulting from the application of Article 4 of the Warrant Indenture; and

D. Recital B is made as representations and statements of fact by the Corporation and not by the Warrant Agent.

- 2 -

NOW THEREFORE, the parties hereto agree as follows:

Amendment to Warrant Indenture

| 1. |

The Warrant Indenture is hereby amended as follows: | |

| a. |

deleting the definition of “Exercise Price” in section 1.1 and replacing it with the following: | |

|

“Exercise Price” at any time means the price at which a whole Common Share may be purchased by the exercise of Warrants, which is initially US$1.70 per Common Share, payable in immediately available United States funds, subject to adjustment in accordance with the provisions of this Indenture; | ||

| b. |

deleting section 2.2(1) and replacing it with the following: | |

| (1) |

Subject to the applicable conditions for exercise set out in Article 3 having been satisfied and subject to adjustment in accordance herewith, each ten (10) Warrants shall entitle each Warrantholder thereof, upon exercise at any time after the Issue Date and prior to the Expiry Time, to acquire one (1) Common Share upon payment of the Exercise Price; |

| c. |

deleting section 3.1 and replacing it with the following: |

Subject to the provisions hereof, each Registered Warrantholder may exercise the right conferred on such holder to subscribe for and purchase one (1) Common Share for each ten (10) Warrants after the Issue Date and prior to the Expiry Time and in accordance with the conditions herein.

| d. |

deleting Schedule “A” and Schedule “B” and replacing it with Schedule “A” and Schedule “B” attached hereto. |

Effect of Amendments

2. The Warrants issued and outstanding shall be deemed to include the amendments as set forth herein, without any further action of the Registered Warrantholders or surrender or exchange of their warrant certificates.

3. The parties confirm that the Warrant Indenture, as amended by this Supplemental Indenture, remains in full force and effect. From the date hereof, the Warrant Indenture and this Supplemental Indenture shall be read together to the extent reasonably possible as though all of the terms of both documents were contained in one instrument.

- 3 -

Counterparts and Formal Date

4. This Supplemental Indenture may be executed in several counterparts, each of which when so executed shall be deemed to be an original and such counterparts together shall constitute one and the same instrument and notwithstanding their date of execution they shall be deemed to be dated as of the date hereof.

Capitalized Terms

5. Capitalized terms that are used herein shall, unless otherwise defined herein, have the meanings ascribed thereto in the Warrant Indenture.

IN WITNESS WHEREOF the parties hereto have executed this Supplemental Indenture as of the date first written above.

PLATINUM GROUP METALS LTD.

| By: | /s/ Frank Hallam | |

| Name: Frank Hallam | ||

| Title: CFO |

COMPUTERSHARE TRUST COMPANY OF CANADA

| By: | /s/ Alice Kollen | |

| Name: Alice Kollen | ||

| Title: Corporate Trust Officer | ||

| By: | /s/ Ellis Amabel | |

| Name: Ellis Amabel | ||

| Title: Associate Trust Officer |

A-1

SCHEDULE “A”

FORM OF WARRANT

WARRANT

To acquire Common Shares of

PLATINUM GROUP METALS LTD.

(existing pursuant to the laws of the Province of British Columbia)

| Warrant | Certificate for ___________________________ |

| Certificate No. __________ | Warrants, each ten (10) Warrants entitling the |

| holder to acquire one (1) Common Share | |

| (subject to adjustment as provided for in the | |

| Warrant Indenture (as defined below) | |

| CUSIP 72765Q155 / ISIN CA72765Q1550 |

THIS IS TO CERTIFY THAT, for value received,

___________________________________________________________________________________________________

(the

“Warrantholder”) is the registered holder of the number of common share

purchase warrants (the “Warrants”) of Platinum Group Metals Ltd. (the

“Corporation”) specified above, and is entitled, on exercise of these

Warrants upon and subject to the terms and conditions set forth herein and in

the Warrant Indenture, to purchase at any time before 4:00 p.m. (Vancouver time)

(the “Expiry Time”) on November 15, 2019 (the “Expiry Date”), for

each ten (10) Warrants one (1) fully paid and non-assessable common share

without par value in the capital of the Corporation as constituted on the date

hereof (a “Common Share”) for each Warrant subject to adjustment in

accordance with the terms of the Warrant Indenture.

The right to purchase Common Shares may only be exercised by the Warrantholder within the time set forth above by:

| (a) |

duly completing and executing the exercise form (the “Exercise Form”) attached hereto; and |

| (b) |

surrendering this warrant certificate (the “Warrant Certificate”), with the Exercise Form to the Warrant Agent at the principal office of the Warrant Agent, in the city of Vancouver, together with a certified cheque, bank draft or money order in the lawful money of the United States of America payable to or to the order of the Corporation in an amount equal to the purchase price of the Common Shares so subscribed for. |

The surrender of this Warrant Certificate, the duly completed Exercise Form and payment as provided above will be deemed to have been effected only on personal delivery thereof to, or if sent by mail or other means of transmission on actual receipt thereof by, the Warrant Agent at its principal office as set out above.

A-2

Subject to adjustment thereof in the events and in the manner set forth in the Warrant Indenture hereinafter referred to, the exercise price payable for each Common Share upon the exercise of Warrants shall be US$1.70 per Common Share (the “Exercise Price”).

Certificates for the Common Shares subscribed for will be mailed to the persons specified in the Exercise Form at their respective addresses specified therein or, if so specified in the Exercise Form, delivered to such persons at the office where this Warrant Certificate is surrendered. If fewer Common Shares are purchased than the number that can be purchased pursuant to this Warrant Certificate, the holder hereof will be entitled to receive without charge a new Warrant Certificate in respect of the balance of the Common Shares not so purchased. No fractional Common Shares will be issued upon exercise of any Warrant.

This Warrant Certificate evidences Warrants of the Corporation issued or issuable under the provisions of a warrant indenture (which indenture together with all other instruments supplemental or ancillary thereto is herein referred to as the “Warrant Indenture”) dated as of May 15, 2018 between the Corporation and Computershare Trust Company of Canada, as Warrant Agent, to which Warrant Indenture reference is hereby made for particulars of the rights of the holders of Warrants, the Corporation and the Warrant Agent in respect thereof and the terms and conditions on which the Warrants are issued and held, all to the same effect as if the provisions of the Warrant Indenture were herein set forth, to all of which the holder, by acceptance hereof, assents. The Corporation will furnish to the holder, on request and without charge, a copy of the Warrant Indenture.

On presentation at the principal office of the Warrant Agent as set out above, subject to the provisions of the Warrant Indenture and on compliance with the reasonable requirements of the Warrant Agent, one or more Warrant Certificates may be exchanged for one or more Warrant Certificates entitling the holder thereof to purchase in the aggregate an equal number of Common Shares as are purchasable under the Warrant Certificate(s) so exchanged.

The Warrant Indenture contains provisions for the adjustment of the Exercise Price payable for each Common Share upon the exercise of Warrants and the number of Common Shares issuable upon the exercise of Warrants in the events and in the manner set forth therein.

The Warrant Indenture also contains provisions making binding on all holders of Warrants outstanding thereunder resolutions passed at meetings of holders of Warrants held in accordance with the provisions of the Warrant Indenture and instruments in writing signed by holders of Warrants entitled to purchase a specific majority of the Common Shares that can be purchased pursuant to such Warrants.

Pursuant to Section 3.3 of the Warrant Indenture, if at any time following the initial effectiveness of a shelf registration statement filed with the United States Securities and Exchange Commission under the U.S. Securities Act of 1933, as amended, registering the Common Shares issuable upon exercise of the Warrants (a “Registration Statement”) and prior to the Expiry Time, the Corporation determines that no Registration Statement filed with the United States Securities and Exchange Commission is effective, or the use of any such Registration Statement is suspended, the Corporation shall promptly provide written notice of such determination to the Warrant Agent. Upon receipt of such notice, the Warrant Agent shall provide a copy thereof to each Warrantholder, and confirm in writing that the then outstanding Warrants may, until the earlier of (x) a Registration Statement becoming effective or ceasing to be suspended and any prospectus supplement necessary thereto having been filed, or (y) the Expiry Time, if the Current Market Price exceeds the Exercise Price, also be exercised by means of a “cashless exercise” in which the Warrantholder shall be entitled to surrender a Warrant to the Corporation in exchange for the issuance of the number of Common Shares equal to the quotient obtained by dividing [(A-B) (X)] by (A), where: (a) (A) equals the Current Market Price on the trading day immediately preceding the date of the receipt by the Warrant Agent of the notice of exercise; (b) (B) equals the Exercise Price per Common Share of such Warrant, as adjusted; and (c) (X) equals the number of Common Shares that would otherwise be issuable upon exercise of such Warrant in accordance with its terms by means of a cash exercise rather than a cashless exercise. The issue price for each such Common Share to be issued pursuant to the cashless exercise of a Warrant will be equal to (B), as defined above, and the total issue price for the aggregate number of Common Shares issued pursuant to the cashless exercise of a Warrant will be paid and satisfied in full by the surrender to the Corporation of such Warrant.

A-3

In addition, if the Corporation determines at any time prior to the Expiry Date that U.S. state securities laws are not pre-empted with respect to exercises of the Warrants, the Corporation may by written notice to the Warrant Agent elect to permit exercises of Warrants that are subject to the laws of one or more U.S. jurisdictions to be exercised on a “cashless exercise” basis, pursuant to the cashless exercise formula set forth above. Upon the receipt of such notice, the Warrant Agent shall provide a copy thereof to each Registered Warrantholder, and confirm the Corporation’s determination in writing.

Nothing contained in this Warrant Certificate, the Warrant Indenture or elsewhere shall be construed as conferring upon the holder hereof any right or interest whatsoever as a holder of Common Shares or any other right or interest except as herein and in the Warrant Indenture expressly provided. In the event of any discrepancy between anything contained in this Warrant Certificate and the terms and conditions of the Warrant Indenture, the terms and conditions of the Warrant Indenture shall govern.

Warrants may only be transferred in compliance with the conditions of the Warrant Indenture on the register to be kept by the Warrant Agent in Vancouver, or such other registrar as the Corporation, with the approval of the Warrant Agent, may appoint at such other place or places, if any, as may be designated, upon surrender of this Warrant Certificate to the Warrant Agent or other registrar accompanied by a written instrument of transfer in form and execution satisfactory to the Warrant Agent or other registrar and upon compliance with the conditions prescribed in the Warrant Indenture and with such reasonable requirements as the Warrant Agent or other registrar may prescribe and upon the transfer being duly noted thereon by the Warrant Agent or other registrar. Time is of the essence hereof.

This Warrant Certificate will not be valid for any purpose until it has been countersigned by or on behalf of the Warrant Agent from time to time under the Warrant Indenture.

A-4

The parties hereto have declared that they have required that these presents and all other documents related hereto be in the English language. Les parties aux présentes déclarent qu’elles ont exigé que la présente convention, de même que tous les documents s’y rapportant, soient rédigés en anglais.

Any capitalized term in this Warrant Certificate that is not otherwise defined herein, shall have the meaning ascribed thereto in the Warrant Indenture.

IN WITNESS WHEREOF the Corporation has caused this Warrant Certificate to be duly executed as of ______________________, 20_____

.

PLATINUM GROUP METALS LTD.

| By ___________________________________________ | |

| Authorized Signatory |

Countersigned and Registered by:

COMPUTERSHARE TRUST COMPANY OF CANADA

| By ___________________________________________ |

| Authorized Signatory |

A-5

FORM OF TRANSFER

To: Computershare Trust Company of Canada

FOR VALUE RECEIVED the undersigned hereby sells, assigns and

transfers to

______________________________________________________________________________

______________________________________________________________________________

(print

name and address) the Warrants represented by this Warrant Certificate and

hereby irrevocably constitutes and appoints ____________________ as its attorney

with full power of substitution to transfer the said securities on the

appropriate register of the Warrant Agent.

DATED this ____ day of_________________, 20____.

| SPACE FOR GUARANTEES OF | ) | |

| SIGNATURES (BELOW) | ) | |

| ) | Signature of Transferor | |

| ) | ||

| ) | ||

| Guarantor’s Signature/Stamp | ) | Name of Transferor |

| ) |

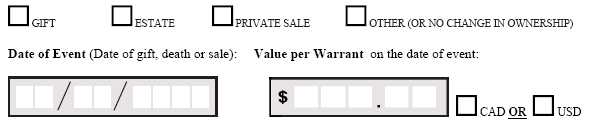

REASON FOR TRANSFER – For US Residents only (where the individual(s) or corporation receiving the securities is a US resident). Please select only one (see instructions below).

CERTAIN REQUIREMENTS RELATING TO TRANSFERS – READ CAREFULLY

The signature(s) of the transferor(s) must correspond with the name(s) as written upon the face of this certificate(s), in every particular, without alteration or enlargement, or any change whatsoever. All securityholders or a legally authorized representative must sign this form. The signature(s) on this form must be guaranteed in accordance with the transfer agent’s then current guidelines and requirements at the time of transfer. Notarized or witnessed signatures are not acceptable as guaranteed signatures. As at the time of closing, you may choose one of the following methods (although subject to change in accordance with industry practice and standards):

A-6

-

Canada and the USA: A Medallion Signature Guarantee obtained from a member of an acceptable Medallion Signature Guarantee Program (STAMP, SEMP, NYSE, MSP). Many commercial banks, savings banks, credit unions, and all broker dealers participate in a Medallion Signature Guarantee Program. The Guarantor must affix a stamp bearing the actual words “Medallion Guaranteed”, with the correct prefix covering the face value of the certificate.

-

Canada: A Signature Guarantee obtained from an authorized officer of the Royal Bank of Canada, Scotia Bank or TD Canada Trust. The Guarantor must affix a stamp bearing the actual words “Signature Guaranteed”, sign and print their full name and alpha numeric signing number. Signature Guarantees are not accepted from Treasury Branches, Credit Unions or Caisse Populaires unless they are members of a Medallion Signature Guarantee Program. For corporate holders, corporate signing resolutions, including certificate of incumbency, are also required to accompany the transfer, unless there is a “Signature & Authority to Sign Guarantee” Stamp affixed to the transfer (as opposed to a “Signature Guaranteed” Stamp) obtained from an authorized officer of the Royal Bank of Canada, Scotia Bank or TD Canada Trust or a Medallion Signature Guarantee with the correct prefix covering the face value of the certificate.

-

Outside North America: For holders located outside North America, present the certificates(s) and/or document(s) that require a guarantee to a local financial institution that has a corresponding Canadian or American affiliate which is a member of an acceptable Medallion Signature Guarantee Program. The corresponding affiliate will arrange for the signature to be over-guaranteed.

OR

The signature(s) of the transferor(s) must correspond with the name(s) as written upon the face of this certificate(s), in every particular, without alteration or enlargement, or any change whatsoever. The signature(s) on this form must be guaranteed by an authorized officer of Royal Bank of Canada, Scotia Bank or TD Canada Trust whose sample signature(s) are on file with the transfer agent, or by a member of an acceptable Medallion Signature Guarantee Program (STAMP, SEMP, NYSE, MSP). Notarized or witnessed signatures are not acceptable as guaranteed signatures. The Guarantor must affix a stamp bearing the actual words: “SIGNATURE GUARANTEED”, “MEDALLION GUARANTEED” OR “SIGNATURE & AUTHORITY TO SIGN GUARANTEE”, all in accordance with the transfer agent’s then current guidelines and requirements at the time of transfer. For corporate holders, corporate signing resolutions, including certificate of incumbency, will also be required to accompany the transfer unless there is a “SIGNATURE & AUTHORITY TO SIGN GUARANTEE” Stamp affixed to the Form of Transfer obtained from an authorized officer of the Royal Bank of Canada, Scotia Bank or TD Canada Trust or a “MEDALLION GUARANTEED” Stamp affixed to the Form of Transfer, with the correct prefix covering the face value of the certificate.

REASON FOR TRANSFER – FOR US RESIDENTS ONLY

Consistent with US IRS regulations, Computershare is required to request cost basis information from US securityholders. Please indicate the reason for requesting the transfer as well as the date of event relating to the reason. The event date is not the day in which the transfer is finalized, but rather the date of the event which led to the transfer request (i.e. date of gift, date of death of the securityholder, or the date the private sale took place).

SCHEDULE “B”

EXERCISE FORM

| TO: | Platinum Group Metals Ltd. |

| AND TO: | Computershare Trust Company of Canada |

| 3rd Floor, 510 Burrard Street | |

| Vancouver, BC V6C 2B9 |

The undersigned holder of the Warrants evidenced by this Warrant Certificate hereby exercises the right to acquire: [Please complete (a) or (b) below.]

(a) ____________Common Shares of Platinum Group Metals Ltd. pursuant to the right of such holder to be issued, and hereby subscribes for, the Common Shares that are issuable pursuant to the exercise of such Warrants on the terms specified in such Warrant Certificate and in the Indenture for an aggregate exercise price of _________________; or

(b) ____________ Common Shares of Platinum Group Metals Ltd., if permitted pursuant to Section 3.3 of the Warrant Indenture, by means of a “cashless exercise” in which the Warrantholder shall be entitled to receive a certificate for the number of Common Shares equal to the quotient obtained by dividing [(A-B) (X)] by (A), where (i) (A) equals the Current Market Price on the trading day immediately preceding the date of the receipt by the Warrant Agent of the notice of exercise; (ii) (B) equals the Exercise Price per Common Share of each Warrant, as adjusted; and (iii) (X) equals the number of Common Shares that would otherwise be issuable upon exercise of the Warrants in accordance with their terms by means of a cash exercise rather than a cashless exercise, and the undersigned hereby agrees that the issue price for each such Common Share pursuant to this cashless exercise of such Warrants is equal to (B), as defined above, and the undersigned hereby surrenders all such Warrants to Platinum Group Metals Ltd. in full payment and satisfaction of the total issue price for such Common Shares pursuant to this cashless exercise of such Warrants.

The undersigned hereby acknowledges that the undersigned is aware that the Common Shares received on exercise may be subject to restrictions on resale under applicable securities legislation.

Any capitalized term in this Warrant Certificate that is not otherwise defined herein, shall have the meaning ascribed thereto in the Warrant Indenture.

The undersigned hereby irrevocably directs that the said Common Shares be issued, registered and delivered as follows:

| Name(s) in Full and | Address(es) | Number of | ||

| Social Insurance | Common Shares | |||

| Number(s) | ||||

| (if applicable) | ||||

Please print full name in which certificates representing the Common Shares are to be issued. If Common Shares are to be issued to a person or persons other than the registered holder, the registered holder must pay to the Warrant Agent all eligible transfer taxes or other government charges, if and the Form of Transfer must be duly executed.

Once completed and executed, this Exercise Form must be mailed or delivered to Computershare Trust Company of Canada, c/o General Manager, Corporate Trust.

DATED this ____day of _____, 20__.

| ) | ||

| ) | ||

| Witness | ) | (Signature of Warrantholder, to be the same as |

| ) | appears on the face of this Warrant Certificate) | |

| ) | ||

| ) | Name of Registered Warrantholder | |

| ) |

[ ] Please check if the certificates representing the Common Shares are to be delivered at the office where this Warrant Certificate is surrendered, failing which such certificates will be mailed to the address set out above. Certificates will be delivered or mailed as soon as practicable after the surrender of this Warrant Certificate to the Warrant Agent.