UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

Commission File Number:

(Name of registrant in its charter)

| ||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| ||

(Address of principal executive offices) | (Zip Code) |

( |

| |

(Issuer’s telephone number) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

The |

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of “accelerated filer”, “large accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ | |

☒ | Smaller reporting company | |||

Emerging growth company | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

As of November 1, 2021, the Company had

Table of Contents

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

MARKER THERAPEUTICS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| September 30, |

| December 31, | |||

| 2021 | 2020 | ||||

ASSETS | ||||||

Current assets: | ||||||

Cash and cash equivalents | $ | | $ | | ||

Prepaid expenses and deposits |

| |

| | ||

Other receivables | | | ||||

Total current assets |

| |

| | ||

Non-current assets: |

| |||||

Property, plant and equipment, net |

| |

| | ||

Construction in progress | | | ||||

Right-of-use assets, net | | | ||||

Total non-current assets | | | ||||

Total assets | $ | | $ | | ||

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

| ||

Current liabilities: |

|

|

|

| ||

Accounts payable and accrued liabilities | $ | | $ | | ||

Lease liability | | | ||||

Total current liabilities |

| |

| | ||

Non-current liabilities: |

| |||||

Lease liability, net of current portion | | | ||||

Total non-current liabilities | | | ||||

| ||||||

Total liabilities |

| |

| | ||

Commitments and contingencies (see Note 10) |

|

| ||||

Stockholders' equity: |

|

|

| |||

Preferred stock - $ | ||||||

Common stock, $ | | |||||

Additional paid-in capital |

| |

| | ||

Accumulated deficit |

| ( |

| ( | ||

Total stockholders' equity |

| |

| | ||

| ||||||

Total liabilities and stockholders' equity | $ | | $ | | ||

See accompanying notes to these unaudited condensed consolidated financial statements.

1

MARKER THERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| For the Three Months Ended |

| For the Nine Months Ended | |||||||||

September 30, |

| September 30, | ||||||||||

| 2021 |

| 2020 |

| 2021 |

| 2020 | |||||

Revenues: | ||||||||||||

Grant income | $ | — | $ | — | $ | — | $ | | ||||

Total revenues |

| — |

| — |

| — |

| | ||||

Operating expenses: | ||||||||||||

Research and development |

| |

| | | | ||||||

General and administrative |

| |

| |

| |

| | ||||

Total operating expenses |

| |

| |

| |

| | ||||

Loss from operations |

| ( |

| ( |

| ( |

| ( | ||||

Other income: |

|

|

|

| ||||||||

Change in fair value of warrant liabilities |

| |

| |

| |

| | ||||

Arbitration settlement | ( | — | ( | — | ||||||||

Interest income |

| |

| |

| |

| | ||||

Net loss | $ | ( | $ | ( | $ | ( | $ | ( | ||||

Net loss per share, basic and diluted | $ | ( | $ | ( | $ | ( | $ | ( | ||||

Weighted average number of common shares outstanding, basic and diluted |

| |

| |

| |

| | ||||

See accompanying notes to these unaudited condensed consolidated financial statements.

2

MARKER THERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(UNAUDITED)

For the Three Months Ended September 30, 2021 | ||||||||||||||

|

|

|

|

| Total | |||||||||

Common Stock | Additional Paid- | Accumulated | Stockholders’ | |||||||||||

Shares | Par value | in Capital | Deficit | Equity | ||||||||||

Balance at July 1, 2021 |

| | $ | | $ | | $ | ( | $ | | ||||

Stock-based compensation |

| |

| |

| |

| |

| | ||||

Net loss |

| |

| |

| |

| ( |

| ( | ||||

Balance at September 30, 2021 |

| | $ | | $ | | $ | ( | $ | | ||||

For the Nine Months Ended September 30, 2021 | ||||||||||||||

| Total | |||||||||||||

Common Stock | Additional Paid- | Accumulated | Stockholders’ | |||||||||||

| Shares |

| Par value |

| in Capital |

| Deficit |

| Equity | |||||

Balance at January 1, 2021 |

| | $ | | $ | | $ | ( | $ | | ||||

Issuance of common stock for cash (net of offering costs of $ | | | | — | | |||||||||

Stock options exercised for cash | | | | — | | |||||||||

Stock-based compensation | |

| |

| |

| |

| | |||||

Net loss |

| |

| |

| |

| ( |

| ( | ||||

Balance at September 30, 2021 |

| | $ | | $ | | $ | ( | $ | | ||||

For the Three Months Ended September 30, 2020 | ||||||||||||||

Total | ||||||||||||||

Common Stock | Additional Paid- | Accumulated | Stockholders’ | |||||||||||

| Shares |

| Par value |

| in Capital |

| Deficit |

| Equity | |||||

Balance at July 1, 2020 | | $ | | $ | | $ | ( | $ | | |||||

Issuance common stock for cash | | | | — | | |||||||||

Stock-based compensation | — | — | | — | | |||||||||

Net loss | — | — | — | ( | ( | |||||||||

Balance at September 30, 2020 | | $ | | $ | | $ | ( | $ | | |||||

For the Nine Months Ended September 30, 2020 | ||||||||||||||

Total | ||||||||||||||

Common Stock | Additional Paid- | Accumulated | Stockholders’ | |||||||||||

| Shares |

| Par value |

| in Capital |

| Deficit |

| Equity | |||||

Balance at January 1, 2020 | | $ | | $ | | $ | ( | $ | | |||||

Issuance common stock for cash | | | | — | | |||||||||

Warrants exercised for cash | | | | — | | |||||||||

Issuance of common stock as commitment fee for future financing | | | ( | — | — | |||||||||

Stock-based compensation | | | | — | | |||||||||

Net loss | — | — | — | ( | ( | |||||||||

Balance at September 30, 2020 | | $ | | $ | | $ | ( | $ | | |||||

See accompanying notes to these unaudited condensed consolidated financial statements.

3

MARKER THERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

For the Nine Months Ended | ||||||

September 30, | ||||||

| 2021 |

| 2020 | |||

Cash Flows from Operating Activities: | ||||||

Net loss | $ | ( | $ | ( | ||

Reconciliation of net loss to net cash used in operating activities: |

|

|

|

| ||

Depreciation and amortization | | | ||||

Changes in fair value of warrant liabilities |

| |

| ( | ||

Stock-based compensation |

| |

| | ||

Amortization on right-of-use assets |

| |

| | ||

Changes in operating assets and liabilities: |

|

|

|

| ||

Prepaid expenses and deposits |

| ( |

| ( | ||

Other receivables |

| |

| | ||

Accounts payable and accrued expenses |

| |

| | ||

Lease liability | ( | ( | ||||

Net cash used in operating activities |

| ( |

| ( | ||

Cash Flows from Investing Activities: |

|

|

|

| ||

Purchase of property and equipment |

| ( |

| ( | ||

Purchase of construction in progress | ( | ( | ||||

Net cash used in investing activities |

| ( |

| ( | ||

Cash Flows from Financing Activities: |

|

|

|

| ||

Proceeds from issuance of common stock, net |

| |

| | ||

Proceeds from exercise of warrants |

| |

| | ||

Proceeds from exercise of stock options |

| |

| | ||

Net cash provided by financing activities |

| |

| | ||

Net increase (decrease) in cash |

| |

| ( | ||

Cash and cash equivalents at beginning of the period |

| |

| | ||

Cash and cash equivalents at end of the period | $ | | $ | | ||

| For the Nine Months Ended | |||||

September 30, | ||||||

| 2021 |

| 2020 | |||

Supplemental schedule of non-cash financing and investing activities: | ||||||

Reclassifications between construction in progress and fixed assets | $ | | $ | | ||

Capital expenditures included in accounts payable | $ | | $ | | ||

Issuance of common stock as commitment fee for future financing | $ | | $ | | ||

Recognition of right-of-use assets and lease liability from new operating lease agreement | $ | | $ | | ||

See accompanying notes to these unaudited condensed consolidated financial statements.

4

MARKER THERAPEUTICS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2021

(Unaudited)

NOTE 1: NATURE OF OPERATIONS

Marker Therapeutics, Inc., a Delaware corporation (the “Company” or “we”), is a clinical-stage immuno-oncology company specializing in the development and commercialization of novel T cell-based immunotherapies and innovative peptide-based vaccines for the treatment of hematological malignancies and solid tumor indications. The Company’s MultiTAA T cell technology is based on the selective expansion of non-engineered, tumor-specific T cells that recognize tumor associated antigens, which are tumor targets, and kill tumor cells expressing those targets. These T cells are designed to recognize multiple tumor targets to produce broad spectrum anti-tumor activity.

NOTE 2: BASIS OF PRESENTATION

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with the accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information and pursuant to the instructions to Form 10-Q and Article 8 of Regulation S-X of the Securities and Exchange Commission (“SEC”) and on the same basis as the Company prepares its annual audited consolidated financial statements. In the opinion of management, the accompanying unaudited condensed consolidated financial statements reflect all adjustments, consisting of normal recurring adjustments, considered necessary for a fair presentation of such interim results.

The results for the condensed consolidated statement of operations are not necessarily indicative of results to be expected for the year ending December 31, 2021 or for any future interim period. The condensed consolidated balance sheet at September 30, 2021 has been derived from unaudited financial statements; however, it does not include all of the information and notes required by U.S. GAAP for complete financial statements. The accompanying condensed consolidated financial statements should be read in conjunction with the consolidated financial statements for the year ended December 31, 2020 and notes thereto included in the Company’s annual report on Form 10-K filed on March 9, 2021.

NOTE 3: LIQUIDITY AND FINANCIAL CONDITION

As of September 30, 2021, the Company had cash and cash equivalents of approximately $

In August 2021, the Company entered into a Controlled Equity OfferingSM Sales Agreement (the “ATM Agreement”) with Cantor Fitzgerald & Co. and RBC Capital Markets, LLC (the “Sales Agents”), pursuant to which the Company can offer and sell, from time to time at its sole discretion through the Sales Agents, shares of its common stock having an aggregate offering price of up to $

On March 16, 2021, the Company issued an aggregate of

5

The Company expects to continue to incur substantial losses over the next several years during its development phase. To fully execute its business plan, the Company will need to complete certain research and development activities and clinical trials. Further, the Company’s product candidates will require regulatory approval prior to commercialization. These activities will span many years and require substantial expenditures to complete and may ultimately be unsuccessful. Any delays in completing these activities could adversely impact the Company. The Company plans to meet its capital requirements primarily through issuances of debt and equity securities and, in the longer term, revenue from sales of its product candidates, if approved.

In August 2021, the Company received notice of a Product Development Research award totaling approximately $

Based on the Company’s clinical and research and development plans and its timing expectations related to the progress of its programs, the Company expects that its cash and cash equivalents as of September 30, 2021 will enable the Company to fund its operating expenses and capital expenditure requirements into the first quarter of 2023. This expectation does not account for any future funds that the Company may receive from the CPRIT award. The Company has based this estimate on assumptions that may prove to be wrong, and the Company could utilize its available capital resources sooner than it currently expects. Furthermore, the Company’s operating plan may change, and it may need additional funds sooner than planned in order to meet operational needs and capital requirements for product development and commercialization. Because of the numerous risks and uncertainties associated with the development and commercialization of the Company's product candidates and the extent to which the Company may enter into additional collaborations with third parties to participate in their development and commercialization, the Company is unable to estimate the amounts of increased capital outlays and operating expenditures associated with its current and anticipated clinical trials. The Company’s future funding requirements will depend on many factors, as it:

| ● | initiates or continues clinical trials of its product candidates; |

| ● | continues the research and development of its product candidates and seeks to discover additional product candidates; |

| ● | seeks regulatory approvals for any product candidates that successfully complete clinical trials; |

| ● | maintains and enforces intellectual property rights; |

| ● | establishes sales, marketing and distribution infrastructure and scale-up manufacturing capabilities to commercialize any product candidates that may receive regulatory approval; |

| ● | evaluates strategic transactions the Company may undertake; and |

| ● | enhances operational, financial and information management systems and hires additional personnel, including personnel to support development of product candidates and, if a product candidate is approved, commercialization efforts. |

In addition to the foregoing, based on the Company’s current assessment, the Company does not expect any material impact on its long-term liquidity due to the COVID-19 pandemic. However, the Company will continue to assess the effect of the pandemic on its operations, including its clinical programs. The extent to which the COVID-19 pandemic will impact the Company’s business and operations will depend on future developments that are highly uncertain and cannot be predicted with confidence, such as the ultimate geographic spread of the disease, the duration of the outbreak, the emergence of any new variant strains of COVID-19, the duration and effect of business disruptions and the short-term effects and ultimate effectiveness of the travel restrictions, quarantines, social distancing requirements, the timing, distribution, rate of public acceptance and efficacy of vaccines and other treatments, and business closures in the United States and other countries to contain and treat the disease. While the potential economic impact brought by, and the duration of, the COVID-19 pandemic may be difficult to assess or predict, it could result in significant disruption of global financial markets, reducing the Company’s ability to access capital, which could in the future negatively affect the Company’s liquidity. In addition, a recession or market correction resulting from the spread of COVID-19 and any variant strains thereof could materially affect the Company’s business and the value of its common stock.

6

NOTE 4: SIGNIFICANT ACCOUNTING POLICIES

Prior Period Reclassification

Certain reclassifications have been made to reclass certain non-cash capital expenditures on the consolidated statements of cash flows from a cash outflow from investing activity to a non-cash investing activity. The Company has evaluated the materiality of this adjustment and concluded it was not material to the previously issued consolidated financial statements and had no impact to the reported consolidated balance sheets, consolidated statements of operations or net loss per share.

For the year ended December 31, 2020, this immaterial adjustment had the effect of increasing net cash used in operating activities and decreasing net cash used in investing activities by $

Property and equipment - Construction in Progress

During the third quarter of 2021, and in connection with the Company’s manufacturing facility in Houston, Texas, the Company incurred $

Grant Income

The Company recognizes grant income in accordance with the terms stipulated under the grant awarded to the Company’s collaborators at the Mayo Foundation from the U. S. Department of Defense. In various situations, the Company receives certain payments from the Mayo Foundation for reimbursement of clinical supplies. These payments are non-refundable and are not dependent on the Company’s ongoing future performance. The Company has adopted a policy of recognizing these payments when received and as revenue in accordance with Accounting Standards Update No. 2014 09, “Revenue from Contracts with Customers (Topic 606)” issued by the Financial Accounting Standards Board (“FASB”).

Cash received from grants in advance of incurring qualifying costs is recorded as deferred revenue and recognized as revenue when qualifying costs are incurred.

New Accounting Standards

From time to time, new accounting pronouncements are issued by FASB or other standard setting bodies that the Company adopts as of the specified effective date. Unless otherwise discussed, the Company does not believe that the impact of recently issued standards that are not yet effective will have a material impact on its financial position or results of operations upon adoption.

Recent Accounting Standards Adopted in the Year

Income Taxes

In December 2019, the FASB issued ASU No. 2019-12, “Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes (“ASU 2019-12”), which is intended to simplify various aspects related to accounting for income taxes. ASU 2019-12 removes certain exceptions to the general principles in Topic 740 and also clarifies and amends existing guidance to improve consistent application. This guidance is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2020, with early adoption permitted. The Company has adopted the new standard effective January 1, 2021 and has concluded that the adoption of this standard did not have a material impact on its condensed consolidated financial statements and related disclosures.

7

NOTE 5: NET LOSS PER SHARE

Basic loss per common share is computed by dividing net loss by the weighted average number of common shares outstanding during the reporting period. Diluted loss per common share is computed similarly to basic loss per common share except that it reflects the potential dilution that could occur if dilutive securities or other obligations to issue common stock were exercised or converted into common stock.

The following table sets forth the computation of net loss per share for the three and nine months ended September 30, 2021 and 2020, respectively:

| For the Three Months Ended |

| For the Nine Months Ended | |||||||||

September 30, |

| September 30, | ||||||||||

| 2021 |

| 2020 |

| 2021 |

| 2020 | |||||

Numerator: | ||||||||||||

Net loss | $ | ( | $ | ( | $ | ( | $ | ( | ||||

|

|

|

| |||||||||

Denominator: |

|

|

|

|

|

|

|

| ||||

Weighted average common shares outstanding |

| |

| |

| |

| | ||||

|

|

|

| |||||||||

Net loss per share: |

|

|

|

|

|

|

|

| ||||

Basic and diluted | $ | ( | $ | ( | $ | ( | $ | ( | ||||

The following securities, rounded to the nearest thousand, were not included in the diluted net loss per share calculation because their effect was anti-dilutive for the periods presented:

For the Nine Months Ended | ||||

September 30, | ||||

| 2021 |

| 2020 | |

Common stock options |

| |

| |

Common stock purchase warrants |

| |

| |

Potentially dilutive securities |

| |

| |

NOTE 6: OTHER RECEIVABLES

Pursuant to the Company’s lease agreement for its manufacturing facility, the Company incurred and paid for the construction invoices directly for both the structural improvements of the facility and the building of the manufacturing modular cleanroom (i.e. leasehold improvements and manufacturing equipment). In accordance with the agreement, upon completion of the facility’s construction, the Company was owed up to $

8

NOTE 7: PROPERTY AND EQUIPMENT

Property and equipment consist of the following as of September 30, 2021 and December 31, 2020, respectively:

September 30, | December 31, | |||||||

| Estimated Useful Lives |

| 2021 |

| 2020 | |||

Lab and manufacturing equipment | $ | | $ | | ||||

Computers, equipment and software |

| | | |||||

Office furniture |

|

| |

| | |||

Leasehold improvements | Lesser of lease term or estimated useful life | | | |||||

Total |

|

| | | ||||

Less: accumulated depreciation |

|

|

| ( |

| ( | ||

Construction in progress | | | ||||||

Total fixed assets, net |

|

| $ | | $ | | ||

In June 2020, the Company entered into a lease for a manufacturing facility in Houston, Texas. The Company has incurred costs pursuant to an agreement with a vendor to design, engineer, build and eventually install modular cleanrooms in a manufacturing facility. $

During the third quarter of 2021, and in connection with the opening of the Company’s manufacturing facility in Houston, Texas, the Company incurred $

Depreciation expense for the three months ended September 30, 2021 and 2020 was approximately $

NOTE 8: LEASES

The Company leases manufacturing, research and administrative facilities under operating leases. The Company evaluates its contracts to determine if an arrangement is a lease at inception and classify it as a finance or operating lease. Currently, all of the Company’s leases are classified as operating leases. Leased assets and corresponding liabilities are recognized based on the present value of the lease payments over the lease term. The lease terms may include options to extend when it is reasonably certain that the Company will exercise that option.

Topic ASC 842 requires the Company to recognize in the statement of financial position a liability to make lease payments (the lease liability) and a right-of-use asset representing its right to use the underlying asset for the lease term. Right-of-use assets are recorded in other assets on the Company’s condensed consolidated balance sheets. Current and non-current lease liabilities are recorded in other accruals within current liabilities and other non-current liabilities, respectively, on its condensed consolidated balance sheets. Costs associated with operating leases are recognized on a straight-line basis within operating expenses over the term of the lease.

As of September 30, 2021, the Company had total operating lease liabilities of approximately $

Such leases do not require any contingent rental payments, impose any financial restrictions, or contain any residual value guarantees. Certain of the Company’s leases include renewal options and escalation clauses; renewal options have not been included in the calculation of the lease liabilities and right-of-use assets as the Company is not reasonably certain to exercise the options. Variable expenses generally represent the Company’s share of the landlord’s operating expenses. The Company does not act as a lessor or have any leases classified as financing leases.

9

The following summarizes quantitative information about the Company’s operating leases for the three and nine months ended September 30, 2021 and 2020, respectively:

| For the Three Months Ended |

| For the Nine Months Ended |

| |||||||||

September 30, | September 30, | ||||||||||||

| 2021 |

| 2020 |

| 2021 |

| 2020 |

| |||||

Operating lease expense summary: |

|

|

|

|

| ||||||||

Operating lease expense | $ | | $ | | $ | | $ | | |||||

Short-term lease expense |

| — |

| — |

| — |

| | |||||

Variable lease expense |

| |

| |

| |

| | |||||

Total | $ | | $ | | $ | | $ | | |||||

| For the Nine Months Ended | |||||

September 30, | ||||||

2021 | 2020 | |||||

Other information: |

|

|

|

| ||

Operating cash flows - operating leases | $ | | $ | | ||

The weighted-average remaining lease term as of September 30, 2021 and December 31, 2020 was approximately

Maturities of our operating leases, excluding short-term leases, are as follows:

Three months ended December 31, 2021 |

| $ | |

Year ended December 31, 2022 |

| | |

Year ended December 31, 2023 |

| | |

Year ended December 31, 2024 |

| | |

Year ended December 31, 2025 | | ||

Thereafter | | ||

Total | | ||

Less present value discount |

| ( | |

Operating lease liabilities included in the Condensed Consolidated Balance Sheet at September 30, 2021 | $ | |

NOTE 9: ACCOUNTS PAYABLE AND ACCRUED LIABILITIES

Accounts payable and accrued liabilities consist of the following as of September 30, 2021 and December 31, 2020, respectively:

| September 30, |

| December 31, | |||

2021 | 2020 | |||||

Accounts payable | $ | | $ | | ||

Compensation and benefits |

| |

| | ||

Process development expenses | | | ||||

Professional fees |

| |

| | ||

Technology license fees |

| |

| | ||

Arbitration settlement fees |

| |

| — | ||

Other |

| |

| | ||

Total accounts payable and accrued liabilities | $ | | $ | | ||

10

NOTE 10: COMMITMENTS AND CONTINGENCIES

An arbitration proceeding was brought against the Company before the Financial Industry Regulatory Authority, Inc. (“FINRA”) by a broker seeking to be paid compensation for

NOTE 11: STOCKHOLDERS’ EQUITY

Common Stock Transactions

Exercise of Stock Options

During the nine months ended September 30, 2021, certain outstanding options were exercised for

Board Compensation

During the nine months ended September 30, 2021, the Company issued an aggregate of

Underwritten Public Offering

On March 11, 2021, the Company entered into an underwriting agreement with Piper Sandler & Co., as representative of the several underwriters, to issue and sell

Share Purchase Warrants

A summary of the Company’s share purchase warrants as of September 30, 2021 and changes during the period is presented below:

|

| Weighted Average |

| |||||||

Number of | Weighted Average | Remaining Contractual | Total Intrinsic | |||||||

| Warrants |

| Exercise Price |

| Life (in years) |

| Value | |||

Balance - January 1, 2021 |

| | $ | | $ | — | ||||

Expired or cancelled | ( | | — |

| — | |||||

Balance - September 30, 2021 | | $ | | $ | — | |||||

11

NOTE 12: STOCK-BASED COMPENSATION

Stock Options

2021 Equity Incentive Awards

On February 10, 2021, pursuant to the Company’s 2020 Equity Incentive Plan, the compensation committee of the Company’s board of directors approved a total of

On February 11, 2021, upon the recommendation of the compensation committee and pursuant to the Company’s 2020 Equity Incentive Plan, the Company’s board of directors approved a total of

The above awards were in addition to

During the nine months ended September 30, 2021,

A summary of the Company’s stock option activity for the nine months ended September 30, 2021 is as follows:

|

|

| Weighted Average | |||||||

Remaining | ||||||||||

Weighted Average | Total Intrinsic | Contractual | ||||||||

| Number of Shares |

| Exercise Price |

| Value |

| Life (in years) | |||

Outstanding as of January 1, 2021 |

| | $ | | $ | — | ||||

Granted |

| | | — | ||||||

Exercised | ( | | — | — | ||||||

Canceled/Expired |

| ( | | — | — | |||||

Outstanding as of September 30, 2021 |

| | $ | | $ | | ||||

Options vested and exercisable |

| | $ | | $ | | ||||

12

The Black-Scholes option pricing model is used to estimate the fair value of stock options granted under the Company’s share-based compensation plans. The weighted average assumptions used in calculating the fair values of stock options that were granted during the nine months ended September 30, 2021 was as follows:

For the Nine Months Ended | ||||

| September 30, 2021 |

| ||

Exercise price | $ | | ||

Expected term (years) |

| |||

Expected stock price volatility |

| | % | |

Risk-free rate of interest |

| | % | |

Expected dividend rate |

| | % | |

The following table sets forth stock-based compensation expenses recorded during the respective periods:

| For the Three Months Ended |

| For the Nine Months Ended | |||||||||

September 30, |

| September 30, | ||||||||||

| 2021 |

| 2020 |

| 2021 |

| 2020 | |||||

Stock Compensation expenses: |

|

|

|

|

|

|

| |||||

Research and development | $ | | $ | | $ | | $ | | ||||

General and administrative |

| |

| |

| |

| | ||||

Total stock compensation expenses | $ | | $ | | $ | | $ | | ||||

As of September 30, 2021, the total stock-based compensation cost related to unvested awards not yet recognized was $

NOTE 13: RELATED PARTY TRANSACTIONS

The following table sets forth related party transaction expenses recorded for the three and nine months ended September 30, 2021 and 2020, respectively.

For the Three Months Ended |

| For the Nine Months Ended | ||||||||||

September 30, |

| September 30, | ||||||||||

| 2021 |

| 2020 |

| 2021 |

| 2020 | |||||

Baylor College of Medicine | $ | | $ | | $ | | $ | | ||||

Bio-Techne Corporation | | | | | ||||||||

Total Research and development | $ | |

| $ | | $ | |

| $ | | ||

Agreements with The Baylor College of Medicine (“BCM”).

In November 2018, January 2020 and February 2020, the Company entered in Sponsored Research Agreements with BCM, which provided for the conduct of research for the Company by credentialed personnel at BCM’s Center for Cell and Gene Therapy.

In September 2019, May 2020 and July 2021, the Company entered into Clinical Supply Agreements with BCM, which provided for BCM to provide to the Company multi tumor antigen specific products.

In October 2019, the Company entered in a Workforce Grant Agreement with BCM, which provided for BCM to provide to the Company manpower costs of projects for manufacturing, quality control testing and validation run activities.

In August 2020, the Company entered in a Clinical Trial Agreement with BCM, which provided for BCM to provide to the Company investigator-initiated research studies.

13

Purchases from Bio-Techne Corporation.

The Company is currently utilizing Bio-Techne Corporation and two of its brands for the purchases of reagents, primarily cytokines. Mr. David Eansor is a member of the Company’s board of directors and is serving as the President of the Protein Sciences Segment of Bio-Techne Corporation.

14

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 21E of the Securities and Exchange Act of 1934, as amended, that involve risks and uncertainties. All statements other than statements relating to historical matters including statements to the effect that we “believe”, “expect”, “anticipate”, “plan”, “target”, “intend” and similar expressions should be considered forward-looking statements. Our actual results could differ materially from those discussed in the forward-looking statements as a result of a number of important factors, including factors discussed in this section and elsewhere in this Quarterly Report on Form 10-Q, and the risks discussed in our other filings with the SEC. Such risks and uncertainties may be amplified by the COVID-19 pandemic and its potential impact on our business and the global economy. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s analysis, judgment, belief or expectation only as the date hereof. We assume no obligation to update these forward-looking statements to reflect events or circumstance that arise after the date hereof.

As used in this quarterly report: (i) the terms “we”, “us”, “our”, “Marker” and the “Company” mean Marker Therapeutics, Inc. and its wholly owned subsidiaries, Marker Cell Therapy, Inc. and GeneMax Pharmaceuticals Inc. which wholly owns GeneMax Pharmaceuticals Canada Inc., unless the context otherwise requires; (ii) “SEC” refers to the Securities and Exchange Commission; (iii) “Securities Act” refers to the Securities Act of 1933, as amended; (iv) “Exchange Act” refers to the Securities Exchange Act of 1934, as amended; and (v) all dollar amounts refer to United States dollars unless otherwise indicated.

The following should be read in conjunction with our unaudited condensed consolidated interim financial statements and related notes for the nine months ended September 30, 2021 included in this Quarterly Report.

Company Overview

We are a clinical-stage immuno-oncology company specializing in the development and commercialization of novel T cell-based immunotherapies and innovative peptide-based vaccines for the treatment of hematological malignancies and solid tumor indications. We developed our lead product candidates from our MultiTAA-specific T cell technology, which is based on the selective expansion of non-engineered, tumor-specific T cells that recognize tumor associated antigens, or TAAs, which are tumor targets, and then kill tumor cells expressing those targets. These T cells are designed to recognize multiple tumor targets to produce broad spectrum anti-tumor activity. We are advancing two pipelines of product candidates as part of our MultiTAA-specific T cell program: the autologous T cells for the treatment of lymphoma, multiple myeloma, or MM, and selected solid tumors and the allogeneic T cells for the treatment of acute myeloid leukemia, or AML, and acute lymphoblastic leukemia, or ALL. Because we do not genetically engineer the MultiTAA-specific T cell therapies, we believe that our product candidates are easier and less expensive to manufacture, have lower toxicities than current engineered chimeric antigen receptor, or CAR-T, and T cell receptor-based therapies and may provide patients with meaningful clinical benefit. We are also developing innovative peptide-based immunotherapeutic vaccines for the treatment of metastatic solid tumors.

We are pursuing post-transplant AML as the lead indication for our first company-sponsored MultiTAA-specific T cell program. In April 2020, the FDA granted orphan drug designation to MT-401 for the treatment of AML after receiving an allogeneic stem cell transplant. The MultiTAA-specific T cell therapy has been well tolerated in an ongoing Phase 1 clinical trial in AML and myelodysplastic syndrome, or MDS, conducted by our strategic partner Baylor College of Medicine, or BCM. As reported in a recent publication by Lulla et al., 11 of the 17 patients in the adjuvant disease setting dosed with the MultiTAA-specific T cell therapy after receiving an allogeneic hematopoietic stem cell transplant, or HSCT, never relapsed [median leukemia-free survival, or LFS, not reached at a median follow-up of 1.9 years], with 11 of 15 patients remaining alive (estimated two-year overall survival of 77%) at a median follow-up of 1.9 years post-infusion, which compares favorably with HSCT outcomes for risk-matched AML/MDS patients post-HSCT [median LFS of nine to 15 months and two-year survival probability of 42%]. Additionally, eight patients were treated for active disease that was resistant to salvage therapy post-HSCT with a median of five prior lines of therapy (range: four to 10). One of the eight patients crossed over from the adjuvant group, while two patients enrolled twice, but all three patients had active AML that failed another line of salvage therapy after their first MultiTAA-specific T cell infusion. Two of the eight patients achieved objective responses, with one complete response and one partial response, with six patients continuing with stable disease.

15

We submitted an investigational new drug, or IND, application to the United States Food and Drug Administration, or the FDA, to initiate a Phase 2 clinical trial of MultiTAA-specific T cell therapy, which we refer to as MT-401 (zedenoleucel), in post-allogeneic HSCT patients with AML in both the adjuvant and active disease setting. The dose administered in this multicenter trial is currently 100 million cells every two weeks for three doses. In the adjuvant setting, patients will be randomized to either MultiTAA-specific T cell therapy at approximately 90 days post-transplant versus standard of care observation, while the active disease patients will receive MT-401 following relapse post-transplant as part of a single-arm group. We have completed the safety lead-in portion of the trial in June 2021. We initiated the remainder of the Phase 2 trial in July 2021 and plan to complete enrollment of approximately 20 patients and activate additional clinical sites across the United States in the fourth quarter of 2021 in order to report results from the active disease arm of the trial in the first quarter of 2022. We expect to begin manufacturing MT-401 for the Phase 2 trial at our cGMP manufacturing facility in the fourth quarter of 2021, which facility became fully operational in July 2021.

We reported interim data for an ongoing Phase 1/2 clinical trial of the MultiTAA-specific T cell therapy for the treatment of pancreatic adenocarcinoma being conducted by BCM. In this trial, we have observed a clinical benefit correlated with the post-infusion detection of tumor-reactive T cells in patient peripheral blood and within tumor biopsy samples in patients in the tumor-resection arm of the trial. These T cells exhibited activity against both targeted antigens and non-targeted TAAs, indicating induction of antigen spreading. To date, we have not observed any cytokine release syndrome or neurotoxicity in this trial.

We are also evaluating the MultiTAA-specific T cell therapies in a Phase 2 clinical trial for the treatment of breast cancer and in Phase 1 clinical trials for the treatment of ALL, lymphoma, MM and sarcoma, all of which are being conducted by BCM. As of June 2021, the MultiTAA-specific T cell therapies have been generally well tolerated by all of the patients enrolled in clinical trials in hematological and solid tumor indications with no incidents of cytokine release syndrome or neurotoxicity, which are frequently associated with CAR-T therapies. Our ongoing clinical trials may be also affected by the COVID-19 pandemic and the emergence of any new variant strains of COVID-19. Based on our observations in clinical trials in AML, pancreatic cancer, lymphoma, ALL and MM, we believe that the MultiTAA-specific T cell therapies have the potential to mediate a meaningful anti-tumor effect, as well as significant in vivo expansion of T cells. We may initiate additional clinical trials investigating other indications in addition to our planned Phase 2 trial in post-transplant AML patients.

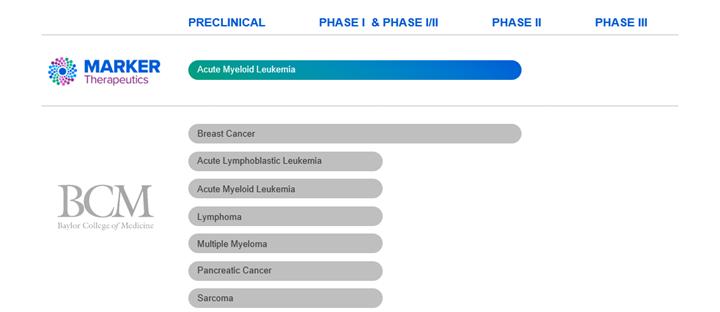

Pipeline

Our clinical-stage pipeline, including clinical trials being conducted by BCM and other partners, is set forth below:

16

Results of Operations

In this discussion of our results of operations and financial condition, amounts in financial tables, other than per-share amounts, have been rounded to the nearest thousand.

Comparison of the Three Months Ended September 30, 2021 and 2020

The following table summarizes the results of our operations for the three months ended September 30, 2021 and 2020:

| For the Three Months Ended |

|

|

|

|

| ||||||

September 30, |

|

| ||||||||||

| 2021 |

| 2020 |

| Change |

| ||||||

Revenues: | ||||||||||||

Grant income | $ | — | $ | — | $ | — | 0 | % | ||||

Total revenues |

| — |

| — |

| — |

| 0 | % | |||

Operating expenses: |

|

|

|

|

| |||||||

Research and development |

| 6,785,000 |

| 4,804,000 |

| 1,981,000 |

| 41 | % | |||

General and administrative |

| 3,239,000 |

| 2,572,000 |

| 667,000 |

| 26 | % | |||

Total operating expenses |

| 10,024,000 |

| 7,376,000 |

| 2,648,000 |

| 36 | % | |||

Loss from operations |

| (10,024,000) |

| (7,376,000) |

| (2,648,000) |

| 36 | % | |||

Other income (expense): |

|

|

|

|

|

|

|

| ||||

Change in fair value of warrant liabilities |

| — |

| — |

| — |

| 0 | % | |||

Loss on settlement | (2,407,000) | — | (2,407,000) | (100) | % | |||||||

Interest income |

| 1,000 |

| 5,000 |

| (4,000) |

| (80) | % | |||

Net loss | $ | (12,429,000) | $ | (7,371,000) | $ | (5,059,000) |

| 69 | % | |||

|

|

|

| |||||||||

Net loss per share, basic and diluted | $ | (0.15) | $ | (0.16) | $ | 0.01 |

| (5) | % | |||

Weighted average number of common shares outstanding, basic and diluted |

| 83,079,000 |

| 46,867,000 |

| 36,212,000 |

| 77 | % | |||

Operating Expenses

Operating expenses incurred during the three months ended September 30, 2021 were $10.0 million compared to $7.4 million during the three months ended September 30, 2020.

Significant changes and expenditures in operating expenses are outlined as follows:

Research and Development Expenses

Research and development expenses increased by 41% to $6.8 million for the three months ended September 30, 2021, compared to $4.8 million for the three months ended September 30, 2020.

The increase of $2.0 million in 2021 was primarily attributable to the following:

| o | increase of $1.0 million in expenses related to our AML clinical trial, |

| o | increase of $0.6 million in headcount-related expenses, |

| o | increase of $0.3 million in sponsored research expenses from BCM agreements, |

| o | increase of $0.1 million in rent and utilities, and |

17

| o | increase of $0.4 million in depreciation expenses primarily attributable to our manufacturing facility and related expenses, offset by |

| o | decrease of $0.2 million in expenses related to our vaccine clinical trials, |

| o | decrease of $0.1 million in process development expenses, and |

| o | decrease of $0.1 million in other expenses. |

General and Administrative Expenses

General and administrative expenses were $3.2 million and $2.6 million for the three months ended September 30, 2021 and 2020, respectively.

The increase of $0.6 million in 2021 was primarily attributable to the following:

| o | increase of $0.3 million in legal fees, |

| o | increase of $0.2 million in headcount-related expenses, and |

| o | increase of $0.1 million in rent and utilities. |

Other Income (Expense)

Arbitration settlement

An arbitration proceeding was brought against us before the FINRA by a broker seeking to be paid compensation for two financing transactions that occurred in 2018, a warrant conversion and a private placement brokered by another broker. The broker’s claims were based on a placement agent agreement for a private placement it brokered in 2017, under which it alleged it was entitled to compensation for the 2018 transactions. The FINRA panel found in favor of the broker and awarded the broker $2.4 million for compensation, interest and attorney fees, which we recorded in the three months ended September 30, 2021. On October 22, 2021, we filed a motion in federal court to vacate the award.

Interest Income

Interest income was $1,000 and $5,000 for the three months ended September 30, 2021 and 2020, respectively, and was attributable to interest income relating to funds that are held in U.S. Treasury notes and U.S. government agency-backed securities.

Net Loss

The increase in our net loss during the three months ended September 30, 2021 compared to the three months ended September 30, 2020 was due to the continued expansion of our research and development activities, increased expenses relating to future clinical trials, and the overall growth of our corporate infrastructure. We anticipate that we will continue to incur net losses in the future as we continue to invest in research and development activities, including clinical development of our MultiTAA T cell product candidates.

18

Comparison of the Nine months ended September 30, 2021 and 2020

The following table summarizes the results of our operations for the nine months ended September 30, 2021 and 2020:

For the Nine Months Ended | ||||||||||||

September 30, |

|

| ||||||||||

| 2021 |

| 2020 |

| Change |

| ||||||

Revenues: |

|

|

|

|

|

|

|

| ||||

Grant income | $ | — | $ | 467,000 | $ | (467,000) |

| (100) | % | |||

Total revenues |

| — |

| 467,000 |

| (467,000) |

| (100) | % | |||

Operating expenses: |

|

|

|

|

|

|

| |||||

Research and development |

| 19,778,000 |

| 12,897,000 |

| 6,881,000 |

| 53 | % | |||

General and administrative |

| 9,936,000 |

| 7,947,000 |

| 1,989,000 |

| 25 | % | |||

Total operating expenses |

| 29,714,000 |

| 20,844,000 |

| 8,870,000 |

| 43 | % | |||

Loss from operations |

| (29,714,000) |

| (20,377,000) |

| (9,337,000) |

| 46 | % | |||

Other income (expense): |

|

|

|

|

|

|

| |||||

Change in fair value of warrant liabilities |

| — |

| 31,000 |

| (31,000) |

| (100) | % | |||

Loss on settlement | (2,407,000) | — | (2,407,000) | (100) | % | |||||||

Interest income |

| 5,000 |

| 147,000 |

| (142,000) |

| (97) | % | |||

Net loss | $ | (32,116,000) | $ | (20,199,000) | $ | (11,917,000) |

| 59 | % | |||

|

|

| ||||||||||

Net loss per share, basic and diluted | $ | (0.43) | $ | (0.43) | $ | 0.00 |

| 0 | % | |||

Weighted average number of common shares outstanding |

| 74,291,000 |

| 46,509,000 |

| 27,782,000 |

| 60 | % | |||

Revenue

Grant income

We did not receive any grant income during the nine months ended September 30, 2021.

During the nine months ended September 30, 2020, we received $0.5 million of a grant awarded to the Mayo Foundation from the U.S. Department of Defense to fund the Phase 2 clinical trial of TPIV100 for the treatment of HER2/neu breast cancer. The portion of the grant we received compensated us for clinical supplies manufactured by us for the clinical trial.

Operating Expenses

Operating expenses incurred during the nine months ended September 30, 2021 were $29.7 million compared to $20.8 million during the nine months ended September 30, 2020.

Significant changes and expenditures in operating expenses are outlined as follows:

Research and Development Expenses

Research and development expenses increased by 53% to $19.8 million for the nine months ended September 30, 2021, compared to $12.9 million for the nine months ended September 30, 2020.

The increase of $6.9 million in 2021 was primarily attributable to the following:

| o | increase of $2.3 million in expenses related to our AML clinical trial, |

| o | increase of $1.9 million in headcount-related expenses, |

| o | increase of $0.4 million in process development expenses, |

19

| o | increase of $1.0 million in sponsored research expenses from BCM agreements, |

| o | increase of $0.7 million in rent and utilities, and |

| o | increase of $1.3 million in depreciation expenses primarily attributable to our manufacturing facility and related expenses, offset by |

| o | decrease of $0.7 million in expenses related to our vaccine clinical trials. |

General and Administrative Expenses

General and administrative expenses were $9.9 million and $7.9 million for the nine months ended September 30, 2021 and 2020, respectively.

The increase of $2.0 million in 2021 was primarily attributable to the following:

| o | increase of $0.2 million in insurance expenses, |

| o | increase of $0.9 million in headcount-related expenses, |

| o | increase of $0.2 million in recruitment expenses, |

| o | increase of $0.4 million in rent and utilities, and |

| o | increase of $0.3 million in legal expenses. |

Other Income (Expense)

Change in Fair Value of Warrant Liabilities

Change in fair value of warrant liabilities for the nine months ended September 30, 2021 was $0 as compared to $31,000 for the nine months ended September 30, 2020.

Arbitration settlement

An arbitration proceeding was brought against us before the FINRA by a broker seeking to be paid compensation for two financing transactions that occurred in 2018, a warrant conversion and a private placement brokered by another broker. The broker’s claims were based on a placement agent agreement for a private placement it brokered in 2017, under which it alleged it was entitled to compensation for the 2018 transactions. The FINRA panel found in favor of the broker and awarded the broker $2.4 million for compensation, interest and attorney fees, which we recorded in the nine months ended September 30, 2021. On October 22, 2021, we filed a motion in federal court to vacate the award.

Interest Income

Interest income was $5,000 and $0.1 million for the nine months ended September 30, 2021 and 2020, respectively, and was attributable to interest income relating to funds that are held in U.S. Treasury notes and U.S. government agency-backed securities. As part of the reaction to the COVID-19 pandemic, the Federal Reserve cut rates in mid-March of 2020 to a range of 0.0% - 0.25%. As such, we recorded lower interest income during the nine months ended September 30, 2021.

20

Net Loss

The increase in our net loss during the nine months ended September 30, 2021 compared to the nine months ended September 30, 2020 was due to the continued expansion of our research and development activities, increased expenses relating to future clinical trials, and the overall growth of our corporate infrastructure. We anticipate that we will continue to incur net losses in the future as we continue to invest in research and development activities, including clinical development of our MultiTAA T cell product candidates.

Liquidity and Capital Resources

We have not generated any revenues from product sales since inception. We have financed our operations primarily through public and private offerings of our debt and equity securities.

The following table sets forth our cash and cash equivalents and working capital as of September 30, 2021 and December 31, 2020:

| September 30, |

| December 31, | |||

2021 | 2020 | |||||

Cash and cash equivalents | $ | 48,705,000 | $ | 21,352,000 | ||

Working capital | $ | 43,180,000 | $ | 18,009,000 | ||

Cash Flows

The following table summarizes our cash flows for the nine months ended September 30, 2021 and 2020:

For the Nine Months Ended | ||||||

September 30, | ||||||

| 2021 |

| 2020 | |||

Net cash provided by (used in): |

|

|

|

| ||

Operating activities | $ | (22,422,000) | $ | (14,530,000) | ||

Investing activities |

| (2,781,000) |

| (5,153,000) | ||

Financing activities |

| 52,556,000 |

| 2,736,000 | ||

Net increase (decrease) in cash and cash equivalents | $ | 27,353,000 | $ | (16,947,000) | ||

Operating Activities

Net cash used in operating activities during the nine months ended September 30, 2021 was $22.4 million compared to $14.5 million for the same period last year. The increase of $7.9 million was primarily attributable to the increased costs in research and development and pre-commercial activities. The changes in cash flow from operating activities during the nine months ended September 30, 2021 were due to $32.1 million of net losses and a $2.9 million increase from changes in operating assets and liabilities. This was in addition to $4.5 million of stock-based compensation, $1.6 million of depreciation expense and $0.8 million right-of-use asset amortization and lease liability accretion.

Investing Activities

Net cash used in investing activities was $2.8 million and $5.2 million for the purchase of property and equipment and construction in progress related to the manufacturing facility during the nine months ended September 30, 2021 and 2020, respectively. The increase mainly relates to purchases of equipment for the manufacturing and research facilities.

Financing Activities

Net cash provided by financing activities was $52.6 million during the nine months ended September 30, 2021, due to the net proceeds received from the underwritten public offering. Net cash provided by financing activities was $2.7 million during the nine months ended September 30, 2020, due to the exercise of $0.5 million in stock warrants and the purchase of $2.2 million in common stock.

21

Future Capital Requirements

To date, we have not generated any revenues from the commercial sale of approved drug products, and we do not expect to generate substantial revenue for at least the next several years. If we fail to complete the development of our product candidates in a timely manner or fail to obtain their regulatory approval, our ability to generate future revenue will be compromised. We do not know when, or if, we will generate any revenue from our product candidates, and we do not expect to generate significant revenue unless and until we obtain regulatory approval of, and commercialize, our product candidates. We expect our expenses to increase in connection with our ongoing activities, particularly as we continue the research and development of, continue or initiate clinical trials of and seek marketing approval for our product candidates. In addition, if we obtain approval for any of our product candidates, we expect to incur significant commercialization expenses related to sales, marketing, manufacturing and distribution. We anticipate that we will need substantial additional funding in connection with our continuing operations. If we are unable to raise capital when needed or on attractive terms, we could be forced to delay, reduce or eliminate our research and development programs or future commercialization efforts.

In August 2021, we entered into a Controlled Equity OfferingSM Sales Agreement, or the ATM Agreement, with Cantor Fitzgerald & Co. and RBC Capital Markets, LLC, or the Sales Agents, pursuant to which we can offer and sell, from time to time at our sole discretion through the Sales Agents, shares of our common stock having an aggregate offering price of up to $75.0 million. Any shares of our common stock sold will be issued pursuant to our shelf registration statement on Form S-3 (File No. 333-258687), which the SEC declared effective on August 19, 2021. The Sales Agents will be entitled to compensation under the Sales Agreement at a commission rate equal to 3.0% of the gross sales price per share sold under the ATM Agreement, and we have provided each of the Sales Agents with indemnification and contribution rights. To date, we have not sold any shares of our common stock under the ATM Agreement.

On March 16, 2021, we issued an aggregate of 32,282,857 shares of our common stock, for net proceeds of $52.6 million pursuant to an underwritten public offering.

As of September 30, 2021, we had working capital of $43.2 million, compared to working capital of $18.0 million as of December 31, 2020. Based on our clinical and research and development plans and our timing expectations related to the progress of our programs, we expect that our cash and cash equivalents as of September 30, 2021 will enable us to fund our operating expenses and capital expenditure requirements into the first quarter of 2023. We have based this estimate on assumptions that may prove to be wrong, and we could utilize our available capital resources sooner than we currently expect. Furthermore, our operating plan may change, and we may need additional funds sooner than planned in order to meet operational needs and capital requirements for product development and commercialization. Because of the numerous risks and uncertainties associated with the development and commercialization of our product candidates and the extent to which we may enter into additional collaborations with third parties to participate in their development and commercialization, we are unable to estimate the amounts of increased capital outlays and operating expenditures associated with our current and anticipated clinical trials. Our future funding requirements will depend on many factors, as we:

| ● | initiate or continue clinical trials of our product candidates; |

| ● | continue the research and development of our product candidates and seek to discover additional product candidates;seek regulatory approvals for our product candidates if they successfully complete clinical trials; |

| ● | establish sales, marketing and distribution infrastructure and scale-up manufacturing capabilities to commercialize any product candidates that may receive regulatory approval; |

| ● | evaluate strategic transactions we may undertake; and |

| ● | enhance operational, financial and information management systems and hire additional personnel, including personnel to support development of our product candidates and, if a product candidate is approved, our commercialization efforts. |

Because all of our product candidates are in the early stages of clinical and preclinical development and the outcome of these efforts is uncertain, we cannot estimate the actual amounts necessary to successfully complete the development and commercialization of product candidates or whether, or when, we may achieve profitability. Until such time, if ever, that we can generate substantial product revenue, we expect to finance our cash needs through a combination of equity or debt financings and collaboration arrangements.

22

We plan to continue to fund our operations and capital funding needs through equity and/or debt financing. We may also consider new collaborations or selectively partner our technology. To the extent that we raise additional capital through the sale of equity or convertible debt securities, the ownership interests of our stockholders will be diluted, and the terms may include liquidation or other preferences that adversely affect the rights of our existing stockholders’ common stock. The incurrence of indebtedness would result in increased fixed payment obligations and could involve certain restrictive covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. If we raise additional funds through strategic partnerships and alliances and licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies or product candidates or grant licenses on terms unfavorable to us. We may also be required to pay damages or have liabilities associated with litigation or other legal proceedings involving our company.

In August 2021, we received notice of a Product Development Research award totaling approximately $13.1 million from the Cancer Prevention and Research Institute of Texas, or CPRIT, to support our Phase 2 clinical trial of its lead MultiTAA-specific T cell product MT-401. The CPRIT award is intended to support the adjuvant arm of our Phase 2 clinical trial evaluating MT-401 when given as an adjuvant therapy to patients with AML following a hematopoietic stem cell transplant. The primary objectives of the adjuvant arm of the trial are to evaluate relapse-free survival after MT-401 treatment when compared with a randomized control group. To date, the Company has not received any funds from the CPRIT grant.

In addition to the foregoing, based on our current assessment, we do not expect any material impact on our long-term liquidity due to the COVID-19 pandemic. However, we will continue to assess the effect of the pandemic on our operations. The extent to which the COVID-19 pandemic will impact our business and operations will depend on future developments that are highly uncertain and cannot be predicted with confidence, such as the ultimate geographic spread of the disease, the duration of the outbreak, the emergence of any new variant strains of COVID-19, the duration and effect of business disruptions and the short-term effects and ultimate effectiveness of the travel restrictions, quarantines, social distancing requirements, the timing, distribution, rate of public acceptance and efficacy of vaccines and other treatments, and business closures in the United States and other countries to contain and treat the disease. While the potential economic impact brought by, and the duration of, the COVID-19 pandemic may be difficult to assess or predict, it could result in significant disruption of global financial markets, reducing our ability to access capital, which could in the future negatively affect our liquidity. In addition, a recession or market correction resulting from the spread of COVID-19 and any variant strains thereof could materially affect our business and the value of our common stock.

Critical Accounting Policies

The condensed consolidated financial statements are prepared in conformity with U.S. GAAP, which require the use of estimates, judgments and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent liabilities at the date of the financial statements, and the reported amounts of expenses in the periods presented. We believe that the accounting estimates employed are appropriate and resulting balances are reasonable; however, due to inherent uncertainties in making estimates, actual results could differ from the original estimates, requiring adjustments to these balances in future periods. The critical accounting estimates that affect the consolidated financial statements and the judgments and assumptions used are consistent with those described under Part II, Item 7 of our Annual Report on Form 10-K for the year ended December 31, 2020.

Off-Balance Sheet Arrangements

We have not entered into any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes of financial condition, revenues, expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

23

Item 4. Controls and Procedures

(a)Evaluation of Disclosure Controls and Procedures

Our management, with the participation of our Chief Executive Officer and our Chief Financial Officer, has evaluated the effectiveness of our disclosure controls and procedures (as such term is defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act) as of the end of the period covered by this report. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed in the reports we file or submit under the Exchange Act is accumulated and communicated to management, including our Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure. Based on such evaluation, our Chief Executive Officer and our Chief Financial Officer have concluded that, as of the end of the period covered by this report, our disclosure controls and procedures are effective in recording, processing, summarizing and reporting, on a timely basis, information required to be disclosed by us in the reports that we file or submit under the Exchange Act.

It should be noted that any system of controls is based in part upon certain assumptions designed to obtain reasonable (and not absolute) assurance as to its effectiveness, and there can be no assurance that any design will succeed in achieving its stated goals.

Management does not expect that our internal control over financial reporting will prevent or detect all errors and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control systems are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in a cost-effective control system, no evaluation of internal control over financial reporting can provide absolute assurance that misstatements due to error or fraud will not occur or that all control issues and instances of fraud, if any, have been or will be detected.

(b)Changes in Internal Control Over Financial Reporting

There have been no changes in our internal controls over financial reporting during the nine months ended September 30, 2021 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART II – OTHER INFORMATION

Item 1.Legal Proceedings

As of September 30, 2021, we were not a party to any legal proceedings that, in the opinion of management, are likely to have a material adverse effect on our business.

Item 1A.Risk Factors

Our business is subject to risks and events that, if they occur, could adversely affect our financial condition and results of operations and the trading price of our securities. In addition to the other information set forth in this quarterly report on Form 10-Q, you should carefully consider the factors described in Part I, Item 1A. “Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, filed with the Securities and Exchange Commission on March 9, 2021. There have been no material changes to the risk factors described in that report.

Item 2.Unregistered Sales of Equity Securities and Use of Proceeds

We did not record any issuances of unregistered securities during the nine months ended September 30, 2021.

Item 3.Defaults Upon Senior Securities

None.

24

25

Item 6.Exhibits

The following exhibits are included with this Quarterly Report on Form 10-Q:

| Incorporated by | |||||||||||

Exhibit |

| Exhibit description |

| Form |

| File no. |

| Exhibit |

| Filing |

| Filed |

3.1 | 8-K | 001-37939 | 3.4 | 10/17/18 | ||||||||

3.2 | 8-K | 001-37939 | 3.6 | 10/17/18 | ||||||||

31.1 | X | |||||||||||

31.2 | X | |||||||||||

32.1* | X | |||||||||||

32.2* | X | |||||||||||

Exhibit 101

101.INS - XBRL Instance Document

101.SCH - XBRL Taxonomy Extension Schema Document

101.CAL - XBRL Taxonomy Extension Calculation Linkbase Document

101.DEF - XBRL Taxonomy Extension Definition Linkbase Document

101.LAB - XBRL Taxonomy Extension Label Linkbase Document

101.PRE - XBRL Taxonomy Extension Presentation Linkbase Document

104 - Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101 filed herewith).

*Furnished herewith and not deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act (whether made before or after the date of the Form 10-Q), irrespective of any general incorporation language contained in such filing.

26

SIGNATURES

In accordance with the requirements of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 10, 2021

MARKER THERAPEUTICS, INC.

/s/ Peter L. Hoang | |

Peter L. Hoang | |

President, Chief Executive Officer and Principal Executive Officer | |

/s/ Anthony Kim | |

Anthony Kim | |

Chief Financial Officer and Principal Financial and Accounting Officer |

27