0001091667--12-312021FYFALSE172,741,236193,730,992http://fasb.org/us-gaap/2021-01-31#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2021-01-31#AccountsPayableAndAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#AccountsPayableAndAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrent1000010916672021-01-012021-12-3100010916672021-06-30iso4217:USD0001091667us-gaap:CommonClassAMember2021-12-31xbrli:shares0001091667us-gaap:CommonClassBMember2021-12-3100010916672021-12-3100010916672020-12-31iso4217:USDxbrli:shares0001091667us-gaap:CommonClassAMember2020-12-310001091667us-gaap:CommonClassBMember2020-12-3100010916672020-01-012020-12-3100010916672019-01-012019-12-310001091667us-gaap:CommonClassAMemberus-gaap:CommonStockMember2018-12-310001091667us-gaap:CommonClassBMemberus-gaap:CommonStockMember2018-12-310001091667us-gaap:AdditionalPaidInCapitalMember2018-12-310001091667us-gaap:RetainedEarningsMember2018-12-310001091667us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310001091667us-gaap:ParentMember2018-12-310001091667us-gaap:NoncontrollingInterestMember2018-12-3100010916672018-12-310001091667us-gaap:CommonClassAMemberus-gaap:CommonStockMember2019-01-012019-12-310001091667us-gaap:CommonClassBMemberus-gaap:CommonStockMember2019-01-012019-12-310001091667us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001091667us-gaap:RetainedEarningsMember2019-01-012019-12-310001091667us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001091667us-gaap:ParentMember2019-01-012019-12-310001091667us-gaap:NoncontrollingInterestMember2019-01-012019-12-310001091667us-gaap:CommonClassAMemberus-gaap:CommonStockMember2019-12-310001091667us-gaap:CommonClassBMemberus-gaap:CommonStockMember2019-12-310001091667us-gaap:AdditionalPaidInCapitalMember2019-12-310001091667us-gaap:RetainedEarningsMember2019-12-310001091667us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001091667us-gaap:ParentMember2019-12-310001091667us-gaap:NoncontrollingInterestMember2019-12-3100010916672019-12-310001091667us-gaap:CommonClassAMemberus-gaap:CommonStockMember2020-01-012020-12-310001091667us-gaap:CommonClassBMemberus-gaap:CommonStockMember2020-01-012020-12-310001091667us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001091667us-gaap:RetainedEarningsMember2020-01-012020-12-310001091667us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001091667us-gaap:ParentMember2020-01-012020-12-310001091667us-gaap:NoncontrollingInterestMember2020-01-012020-12-310001091667us-gaap:CommonClassAMemberus-gaap:CommonStockMember2020-12-310001091667us-gaap:CommonClassBMemberus-gaap:CommonStockMember2020-12-310001091667us-gaap:AdditionalPaidInCapitalMember2020-12-310001091667us-gaap:RetainedEarningsMember2020-12-310001091667us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001091667us-gaap:ParentMember2020-12-310001091667us-gaap:NoncontrollingInterestMember2020-12-310001091667us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-01-012021-12-310001091667us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-01-012021-12-310001091667us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001091667us-gaap:RetainedEarningsMember2021-01-012021-12-310001091667us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001091667us-gaap:ParentMember2021-01-012021-12-310001091667us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001091667us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-12-310001091667us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-12-310001091667us-gaap:AdditionalPaidInCapitalMember2021-12-310001091667us-gaap:RetainedEarningsMember2021-12-310001091667us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001091667us-gaap:ParentMember2021-12-310001091667us-gaap:NoncontrollingInterestMember2021-12-310001091667chtr:CableDistributionSystemsMembersrt:MinimumMember2021-01-012021-12-310001091667srt:MaximumMemberchtr:CableDistributionSystemsMember2021-01-012021-12-310001091667chtr:CustomerEquipmentAndInstallationsMembersrt:MinimumMember2021-01-012021-12-310001091667chtr:CustomerEquipmentAndInstallationsMembersrt:MaximumMember2021-01-012021-12-310001091667srt:MinimumMemberchtr:VehiclesAndEquipmentMember2021-01-012021-12-310001091667srt:MaximumMemberchtr:VehiclesAndEquipmentMember2021-01-012021-12-310001091667srt:MinimumMemberus-gaap:BuildingAndBuildingImprovementsMember2021-01-012021-12-310001091667srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2021-01-012021-12-310001091667srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2021-01-012021-12-310001091667srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2021-01-012021-12-310001091667chtr:ResidentialInternetProductLineMember2021-01-012021-12-310001091667chtr:ResidentialInternetProductLineMember2020-01-012020-12-310001091667chtr:ResidentialInternetProductLineMember2019-01-012019-12-310001091667chtr:ResidentialVideoProductLineMember2021-01-012021-12-310001091667chtr:ResidentialVideoProductLineMember2020-01-012020-12-310001091667chtr:ResidentialVideoProductLineMember2019-01-012019-12-310001091667chtr:ResidentialVoiceProductLineMember2021-01-012021-12-310001091667chtr:ResidentialVoiceProductLineMember2020-01-012020-12-310001091667chtr:ResidentialVoiceProductLineMember2019-01-012019-12-310001091667chtr:ResidentialProductLineMember2021-01-012021-12-310001091667chtr:ResidentialProductLineMember2020-01-012020-12-310001091667chtr:ResidentialProductLineMember2019-01-012019-12-310001091667chtr:CommercialSmallandMediumBusinessProductLineMember2021-01-012021-12-310001091667chtr:CommercialSmallandMediumBusinessProductLineMember2020-01-012020-12-310001091667chtr:CommercialSmallandMediumBusinessProductLineMember2019-01-012019-12-310001091667chtr:CommercialEnterpriseProductLineMember2021-01-012021-12-310001091667chtr:CommercialEnterpriseProductLineMember2020-01-012020-12-310001091667chtr:CommercialEnterpriseProductLineMember2019-01-012019-12-310001091667chtr:CommercialProductLineMember2021-01-012021-12-310001091667chtr:CommercialProductLineMember2020-01-012020-12-310001091667chtr:CommercialProductLineMember2019-01-012019-12-310001091667chtr:AdvertisingsalesMember2021-01-012021-12-310001091667chtr:AdvertisingsalesMember2020-01-012020-12-310001091667chtr:AdvertisingsalesMember2019-01-012019-12-310001091667chtr:MobileMember2021-01-012021-12-310001091667chtr:MobileMember2020-01-012020-12-310001091667chtr:MobileMember2019-01-012019-12-310001091667chtr:OtherServicesMember2021-01-012021-12-310001091667chtr:OtherServicesMember2020-01-012020-12-310001091667chtr:OtherServicesMember2019-01-012019-12-31xbrli:pure0001091667chtr:CableDistributionSystemsMember2021-12-310001091667chtr:CableDistributionSystemsMember2020-12-310001091667chtr:CustomerEquipmentAndInstallationsMember2021-12-310001091667chtr:CustomerEquipmentAndInstallationsMember2020-12-310001091667chtr:VehiclesAndEquipmentMember2021-12-310001091667chtr:VehiclesAndEquipmentMember2020-12-310001091667us-gaap:BuildingAndBuildingImprovementsMember2021-12-310001091667us-gaap:BuildingAndBuildingImprovementsMember2020-12-310001091667us-gaap:FurnitureAndFixturesMember2021-12-310001091667us-gaap:FurnitureAndFixturesMember2020-12-310001091667us-gaap:CustomerRelationshipsMembersrt:MinimumMember2021-01-012021-12-310001091667srt:MaximumMemberus-gaap:CustomerRelationshipsMember2021-01-012021-12-310001091667us-gaap:LicensingAgreementsMember2020-01-012020-12-310001091667us-gaap:FranchiseRightsMember2021-12-310001091667us-gaap:FranchiseRightsMember2020-12-310001091667us-gaap:LicensingAgreementsMember2021-12-310001091667us-gaap:LicensingAgreementsMember2020-12-310001091667us-gaap:TrademarksMember2021-12-310001091667us-gaap:TrademarksMember2020-12-310001091667us-gaap:CustomerRelationshipsMember2021-12-310001091667us-gaap:CustomerRelationshipsMember2020-12-310001091667us-gaap:OtherIntangibleAssetsMember2021-12-310001091667us-gaap:OtherIntangibleAssetsMember2020-12-310001091667us-gaap:MortgagesMember2021-12-310001091667us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-12-310001091667us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2020-12-310001091667us-gaap:MortgagesMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-12-310001091667us-gaap:MortgagesMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2020-12-310001091667chtr:A4.000SeniorNotesDueMarch12023Memberchtr:CcoHoldingsMember2021-12-310001091667chtr:A4.000SeniorNotesDueMarch12023Memberchtr:CcoHoldingsMember2020-12-310001091667chtr:A5.750SeniorNotesDueFebruary152026Memberchtr:CcoHoldingsMember2021-12-310001091667chtr:A5.750SeniorNotesDueFebruary152026Memberchtr:CcoHoldingsMember2020-12-310001091667chtr:CcoHoldingsMemberchtr:A5.500SeniorNotesDueMay12026Member2021-12-310001091667chtr:CcoHoldingsMemberchtr:A5.500SeniorNotesDueMay12026Member2020-12-310001091667chtr:CcoHoldingsMemberchtr:A5.875seniornotesdueMay12027Member2021-12-310001091667chtr:CcoHoldingsMemberchtr:A5.875seniornotesdueMay12027Member2020-12-310001091667chtr:CcoHoldingsMemberchtr:A5.125SeniorNotesDueMay12027Member2021-12-310001091667chtr:CcoHoldingsMemberchtr:A5.125SeniorNotesDueMay12027Member2020-12-310001091667chtr:CcoHoldingsMemberchtr:A5.000SeniorNotesDueFebruary12028Member2021-12-310001091667chtr:CcoHoldingsMemberchtr:A5.000SeniorNotesDueFebruary12028Member2020-12-310001091667chtr:A5.375seniornotesdueJune12029Memberchtr:CcoHoldingsMember2021-12-310001091667chtr:A5.375seniornotesdueJune12029Memberchtr:CcoHoldingsMember2020-12-310001091667chtr:CcoHoldingsMemberchtr:A4.750seniornotesdueMarch12030Member2021-12-310001091667chtr:CcoHoldingsMemberchtr:A4.750seniornotesdueMarch12030Member2020-12-310001091667chtr:A4500SeniorNotesDueAugust152030Memberchtr:CcoHoldingsMember2021-12-310001091667chtr:A4500SeniorNotesDueAugust152030Memberchtr:CcoHoldingsMember2020-12-310001091667chtr:CcoHoldingsMemberchtr:A4250SeniorNotesDueFebruary12031Member2021-12-310001091667chtr:CcoHoldingsMemberchtr:A4250SeniorNotesDueFebruary12031Member2020-12-310001091667chtr:A4500SeniorNotesDueMay12032Memberchtr:CcoHoldingsMember2021-12-310001091667chtr:A4500SeniorNotesDueMay12032Memberchtr:CcoHoldingsMember2020-12-310001091667chtr:CcoHoldingsMemberchtr:A4500SeniorNotesDueJune12033Member2021-12-310001091667chtr:CcoHoldingsMemberchtr:A4500SeniorNotesDueJune12033Member2020-12-310001091667chtr:A4250SeniorNotesDueJanuary152034Memberchtr:CcoHoldingsMember2021-12-310001091667chtr:A4250SeniorNotesDueJanuary152034Memberchtr:CcoHoldingsMember2020-12-310001091667chtr:A4.464SeniorNotesDueJuly232022Memberchtr:CharterOperatingMember2021-12-310001091667chtr:A4.464SeniorNotesDueJuly232022Memberchtr:CharterOperatingMember2020-12-310001091667chtr:SeniorFloatingRateNotesdueFebruary12024Memberchtr:CharterOperatingMember2021-12-310001091667chtr:SeniorFloatingRateNotesdueFebruary12024Memberchtr:CharterOperatingMember2020-12-310001091667chtr:A4.500SeniorNotesdueFebruary12024Memberchtr:CharterOperatingMember2021-12-310001091667chtr:A4.500SeniorNotesdueFebruary12024Memberchtr:CharterOperatingMember2020-12-310001091667chtr:A4.908SeniorNotesDueJuly232025Memberchtr:CharterOperatingMember2021-12-310001091667chtr:A4.908SeniorNotesDueJuly232025Memberchtr:CharterOperatingMember2020-12-310001091667chtr:A3.750SeniorNotesDueFebruary152028Memberchtr:CharterOperatingMember2021-12-310001091667chtr:A3.750SeniorNotesDueFebruary152028Memberchtr:CharterOperatingMember2020-12-310001091667chtr:A4.200SeniorNotesDueMarch152028Memberchtr:CharterOperatingMember2021-12-310001091667chtr:A4.200SeniorNotesDueMarch152028Memberchtr:CharterOperatingMember2020-12-310001091667chtr:A2250SeniorNotesDueJanuary152029Memberchtr:CharterOperatingMember2021-12-310001091667chtr:A2250SeniorNotesDueJanuary152029Memberchtr:CharterOperatingMember2020-12-310001091667chtr:A5.050SeniorNotesdueMarch302029Memberchtr:CharterOperatingMember2021-12-310001091667chtr:A5.050SeniorNotesdueMarch302029Memberchtr:CharterOperatingMember2020-12-310001091667chtr:A2800SeniorNotesDueApril12031Memberchtr:CharterOperatingMember2021-12-310001091667chtr:A2800SeniorNotesDueApril12031Memberchtr:CharterOperatingMember2020-12-310001091667chtr:CharterOperatingMemberchtr:A2300SeniorNotesDueFebruary12032Member2021-12-310001091667chtr:CharterOperatingMemberchtr:A2300SeniorNotesDueFebruary12032Member2020-12-310001091667chtr:A6.384SeniorNotesDueOctober232035Memberchtr:CharterOperatingMember2021-12-310001091667chtr:A6.384SeniorNotesDueOctober232035Memberchtr:CharterOperatingMember2020-12-310001091667chtr:A5.375SeniorNotesdueApril12038Memberchtr:CharterOperatingMember2021-12-310001091667chtr:A5.375SeniorNotesdueApril12038Memberchtr:CharterOperatingMember2020-12-310001091667chtr:A3500SeniorNotesDueJune12041Memberchtr:CharterOperatingMember2021-12-310001091667chtr:A3500SeniorNotesDueJune12041Memberchtr:CharterOperatingMember2020-12-310001091667chtr:A3500SeniorNotesDueMarch12042Memberchtr:CharterOperatingMember2021-12-310001091667chtr:A3500SeniorNotesDueMarch12042Memberchtr:CharterOperatingMember2020-12-310001091667chtr:A6.484SeniorNotesDueOctober232045Memberchtr:CharterOperatingMember2021-12-310001091667chtr:A6.484SeniorNotesDueOctober232045Memberchtr:CharterOperatingMember2020-12-310001091667chtr:A5.375SeniorNotesDueMay12047Memberchtr:CharterOperatingMember2021-12-310001091667chtr:A5.375SeniorNotesDueMay12047Memberchtr:CharterOperatingMember2020-12-310001091667chtr:A5.750SeniorNotesdueApril12048Memberchtr:CharterOperatingMember2021-12-310001091667chtr:A5.750SeniorNotesdueApril12048Memberchtr:CharterOperatingMember2020-12-310001091667chtr:A5.125SeniorNotesdueJuly12049Memberchtr:CharterOperatingMember2021-12-310001091667chtr:A5.125SeniorNotesdueJuly12049Memberchtr:CharterOperatingMember2020-12-310001091667chtr:A4.800seniornotesdueMarch12050Memberchtr:CharterOperatingMember2021-12-310001091667chtr:A4.800seniornotesdueMarch12050Memberchtr:CharterOperatingMember2020-12-310001091667chtr:A3700SeniorNotesDueApril12051Memberchtr:CharterOperatingMember2021-12-310001091667chtr:A3700SeniorNotesDueApril12051Memberchtr:CharterOperatingMember2020-12-310001091667chtr:A3900SeniorNotesDueJune12052Memberchtr:CharterOperatingMember2021-12-310001091667chtr:A3900SeniorNotesDueJune12052Memberchtr:CharterOperatingMember2020-12-310001091667chtr:A6.834SeniorNotesDueOctober232055Memberchtr:CharterOperatingMember2021-12-310001091667chtr:A6.834SeniorNotesDueOctober232055Memberchtr:CharterOperatingMember2020-12-310001091667chtr:A3850SeniorNotesDueApril12061Memberchtr:CharterOperatingMember2021-12-310001091667chtr:A3850SeniorNotesDueApril12061Memberchtr:CharterOperatingMember2020-12-310001091667chtr:A4400SeniorNotesDueDecember12061Memberchtr:CharterOperatingMember2021-12-310001091667chtr:A4400SeniorNotesDueDecember12061Memberchtr:CharterOperatingMember2020-12-310001091667chtr:A3950SeniorNotesDueJune302062Memberchtr:CharterOperatingMember2021-12-310001091667chtr:A3950SeniorNotesDueJune302062Memberchtr:CharterOperatingMember2020-12-310001091667chtr:CreditFacilitiesMemberchtr:CharterOperatingMember2021-12-310001091667chtr:CreditFacilitiesMemberchtr:CharterOperatingMember2020-12-310001091667chtr:A4.000SeniorNotesDueSeptember12021Memberchtr:TimeWarnerCableLLCMember2021-12-310001091667chtr:A4.000SeniorNotesDueSeptember12021Memberchtr:TimeWarnerCableLLCMember2020-12-310001091667chtr:TimeWarnerCableLLCMemberchtr:A5.750SterlingSeniorNotesDueJune22031Member2021-12-310001091667chtr:TimeWarnerCableLLCMemberchtr:A5.750SterlingSeniorNotesDueJune22031Member2020-12-310001091667chtr:TimeWarnerCableLLCMemberchtr:A6.550SeniorDebenturesDueMay12037Member2021-12-310001091667chtr:TimeWarnerCableLLCMemberchtr:A6.550SeniorDebenturesDueMay12037Member2020-12-310001091667chtr:TimeWarnerCableLLCMemberchtr:A7.300SeniorDebenturesDueJuly12038Member2021-12-310001091667chtr:TimeWarnerCableLLCMemberchtr:A7.300SeniorDebenturesDueJuly12038Member2020-12-310001091667chtr:TimeWarnerCableLLCMemberchtr:A6.750SeniorDebenturesDueJune152039Member2021-12-310001091667chtr:TimeWarnerCableLLCMemberchtr:A6.750SeniorDebenturesDueJune152039Member2020-12-310001091667chtr:A5.875SeniorDebenturesDueNovember152040Memberchtr:TimeWarnerCableLLCMember2021-12-310001091667chtr:A5.875SeniorDebenturesDueNovember152040Memberchtr:TimeWarnerCableLLCMember2020-12-310001091667chtr:TimeWarnerCableLLCMemberchtr:A5.500SeniorDebenturesDueSeptember12041Member2021-12-310001091667chtr:TimeWarnerCableLLCMemberchtr:A5.500SeniorDebenturesDueSeptember12041Member2020-12-310001091667chtr:A5.250SterlingSeniorNotesDueJuly152042Memberchtr:TimeWarnerCableLLCMember2021-12-310001091667chtr:A5.250SterlingSeniorNotesDueJuly152042Memberchtr:TimeWarnerCableLLCMember2020-12-310001091667chtr:TimeWarnerCableLLCMemberchtr:A4.500SeniorDebenturesDueSeptember152042Member2021-12-310001091667chtr:TimeWarnerCableLLCMemberchtr:A4.500SeniorDebenturesDueSeptember152042Member2020-12-310001091667chtr:A8.375SeniorDebenturesDueMarch152023Memberchtr:TimeWarnerCableEnterprisesLLCMember2021-12-310001091667chtr:A8.375SeniorDebenturesDueMarch152023Memberchtr:TimeWarnerCableEnterprisesLLCMember2020-12-310001091667chtr:A8.375SeniorDebenturesDueJuly152033Memberchtr:TimeWarnerCableEnterprisesLLCMember2021-12-310001091667chtr:A8.375SeniorDebenturesDueJuly152033Memberchtr:TimeWarnerCableEnterprisesLLCMember2020-12-310001091667chtr:A4.000SeniorNotesDueSeptember12021Memberchtr:CharterOperatingMember2021-12-310001091667chtr:A4.000SeniorNotesDueSeptember12021Memberchtr:CharterOperatingMember2020-12-31iso4217:GBP0001091667us-gaap:RevolvingCreditFacilityMemberchtr:CharterOperatingMember2021-12-310001091667chtr:CcoHoldingsMember2021-12-310001091667chtr:CharterOperatingMember2021-12-310001091667us-gaap:SubsequentEventMemberchtr:CcoHoldingsMemberchtr:A4750SeniorNotesDueFebruary12032Member2022-01-010001091667chtr:CcoHoldingsMember2021-01-012021-12-310001091667chtr:CcoHoldingsMember2020-01-012020-12-310001091667chtr:CcoHoldingsMember2019-01-012019-12-310001091667chtr:TimeWarnerCableLLCMember2021-01-012021-12-310001091667chtr:TimeWarnerCableLLCMember2020-01-012020-12-310001091667chtr:TimeWarnerCableLLCMember2019-01-012019-12-310001091667chtr:CharterOperatingMember2021-01-012021-12-310001091667chtr:CharterOperatingMember2020-01-012020-12-310001091667chtr:CharterOperatingMember2019-01-012019-12-310001091667srt:MaximumMemberchtr:CcoHoldingsMember2021-12-310001091667chtr:CcoHoldingsMembersrt:MinimumMember2021-12-310001091667chtr:TermLoanA2Memberchtr:CharterOperatingMember2021-12-310001091667chtr:TermLoanA2Memberchtr:CharterOperatingMember2021-01-012021-12-310001091667chtr:TermLoanA4Memberchtr:CharterOperatingMember2021-12-310001091667chtr:TermLoanA4Memberchtr:CharterOperatingMember2021-01-012021-12-310001091667chtr:TermLoanB1Memberchtr:CharterOperatingMember2021-12-310001091667chtr:TermLoanB1Memberchtr:CharterOperatingMember2021-01-012021-12-310001091667chtr:TermLoanB2Memberchtr:CharterOperatingMember2021-12-310001091667chtr:TermLoanB2Memberchtr:CharterOperatingMember2021-01-012021-12-310001091667chtr:Revolvingcreditfacilitymaturingin2023Memberchtr:CharterOperatingMember2021-12-310001091667chtr:Revolvingcreditfacilitymaturingin2025Memberchtr:CharterOperatingMember2021-12-310001091667chtr:Revolvingcreditfacilitymaturingin2023Memberchtr:CharterOperatingMember2021-01-012021-12-310001091667chtr:Revolvingcreditfacilitymaturingin2025Memberchtr:CharterOperatingMember2021-01-012021-12-310001091667chtr:TimeWarnerCableLLCMemberchtr:SterlingSeniorNotesMember2021-01-012021-12-310001091667us-gaap:CommonClassAMember2018-12-310001091667us-gaap:CommonClassBMember2018-12-310001091667us-gaap:CommonClassAMember2019-01-012019-12-310001091667us-gaap:CommonClassBMember2019-01-012019-12-310001091667us-gaap:CommonClassAMember2019-12-310001091667us-gaap:CommonClassBMember2019-12-310001091667us-gaap:CommonClassAMember2020-01-012020-12-310001091667us-gaap:CommonClassBMember2020-01-012020-12-310001091667us-gaap:CommonClassAMember2021-01-012021-12-310001091667us-gaap:CommonClassBMember2021-01-012021-12-310001091667chtr:TreasuryStockAcquiredSharesWithheldRestrictedStockAndRestrictedStockUnitVestingMember2021-01-012021-12-310001091667chtr:TreasuryStockAcquiredSharesWithheldRestrictedStockAndRestrictedStockUnitVestingMember2020-01-012020-12-310001091667chtr:TreasuryStockAcquiredSharesWithheldRestrictedStockAndRestrictedStockUnitVestingMember2019-01-012019-12-310001091667chtr:TreasuryStockAcquiredSharesWithheldStockOptionExerciseCostsMember2021-01-012021-12-310001091667chtr:TreasuryStockAcquiredSharesWithheldStockOptionExerciseCostsMember2020-01-012020-12-310001091667chtr:TreasuryStockAcquiredSharesWithheldStockOptionExerciseCostsMember2019-01-012019-12-310001091667chtr:TreasuryStockAcquiredSharesRepurchasedMemberchtr:LibertyBroadbandMember2021-01-012021-12-310001091667chtr:TreasuryStockAcquiredSharesRepurchasedMemberus-gaap:SubsequentEventMemberchtr:LibertyBroadbandMember2022-01-012022-01-310001091667chtr:LibertyBroadbandMember2020-01-012020-12-310001091667chtr:ANMember2020-01-012020-12-310001091667srt:MaximumMemberchtr:CharterMember2021-12-310001091667chtr:PreferredNoncontrollingInterestMemberchtr:ANMember2021-06-180001091667chtr:PreferredNoncontrollingInterestMember2021-06-180001091667chtr:CommonNoncontrollingInterestMemberchtr:ANMember2021-06-180001091667chtr:PreferredNoncontrollingInterestMember2021-01-012021-06-180001091667chtr:PreferredNoncontrollingInterestMember2021-01-012021-12-310001091667chtr:PreferredNoncontrollingInterestMember2019-01-012019-12-310001091667chtr:PreferredNoncontrollingInterestMember2020-01-012020-12-310001091667chtr:CommonNoncontrollingInterestMemberchtr:ANMember2021-12-310001091667chtr:CommonNoncontrollingInterestMemberchtr:ANMember2020-12-310001091667chtr:CommonNoncontrollingInterestMemberchtr:ANMember2019-12-310001091667chtr:CommonNoncontrollingInterestMember2021-01-012021-12-310001091667chtr:CommonNoncontrollingInterestMember2020-01-012020-12-310001091667chtr:CommonNoncontrollingInterestMember2019-01-012019-12-310001091667chtr:CommonNoncontrollingInterestMemberus-gaap:NoncontrollingInterestMember2021-01-012021-12-310001091667chtr:CommonNoncontrollingInterestMemberus-gaap:NoncontrollingInterestMember2020-01-012020-12-310001091667chtr:CommonNoncontrollingInterestMemberus-gaap:NoncontrollingInterestMember2019-01-012019-12-310001091667chtr:CommonNoncontrollingInterestMemberus-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001091667chtr:CommonNoncontrollingInterestMemberus-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001091667chtr:CommonNoncontrollingInterestMemberus-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-3100010916672021-06-180001091667us-gaap:CurrencySwapMember2021-12-310001091667us-gaap:CurrencySwapMember2021-01-012021-12-310001091667us-gaap:FairValueInputsLevel2Memberus-gaap:CurrencySwapMember2021-12-310001091667us-gaap:FairValueInputsLevel2Memberus-gaap:CurrencySwapMember2020-12-310001091667chtr:EquipmentInstallmentPlanReceivableMember2021-12-310001091667chtr:EquipmentInstallmentPlanReceivableMember2020-12-310001091667chtr:SeniorNotesAndDebenturesMember2021-12-310001091667chtr:SeniorNotesAndDebenturesMemberus-gaap:FairValueInputsLevel1Member2021-12-310001091667chtr:SeniorNotesAndDebenturesMember2020-12-310001091667chtr:SeniorNotesAndDebenturesMemberus-gaap:FairValueInputsLevel1Member2020-12-310001091667chtr:CreditFacilitiesMember2021-12-310001091667us-gaap:FairValueInputsLevel2Memberchtr:CreditFacilitiesMember2021-12-310001091667chtr:CreditFacilitiesMember2020-12-310001091667us-gaap:FairValueInputsLevel2Memberchtr:CreditFacilitiesMember2020-12-310001091667us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001091667us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001091667us-gaap:RestrictedStockMember2021-01-012021-12-310001091667us-gaap:EmployeeStockOptionMember2021-12-310001091667us-gaap:RestrictedStockMember2021-12-310001091667us-gaap:RestrictedStockUnitsRSUMember2021-12-310001091667us-gaap:RestrictedStockMember2020-12-310001091667us-gaap:RestrictedStockMember2019-12-310001091667us-gaap:RestrictedStockMember2018-12-310001091667us-gaap:RestrictedStockMember2020-01-012020-12-310001091667us-gaap:RestrictedStockMember2019-01-012019-12-310001091667us-gaap:RestrictedStockUnitsRSUMember2020-12-310001091667us-gaap:RestrictedStockUnitsRSUMember2019-12-310001091667us-gaap:RestrictedStockUnitsRSUMember2018-12-310001091667us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001091667us-gaap:RestrictedStockUnitsRSUMember2019-01-012019-12-310001091667us-gaap:ValuationAllowanceOperatingLossCarryforwardsMember2021-12-310001091667us-gaap:ValuationAllowanceOperatingLossCarryforwardsMember2020-12-310001091667chtr:ValuationAllowanceStateOperatingLossCarryforwardsAndOtherMember2021-12-310001091667chtr:ValuationAllowanceStateOperatingLossCarryforwardsAndOtherMember2020-12-310001091667us-gaap:InternalRevenueServiceIRSMember2021-12-310001091667us-gaap:StateAndLocalJurisdictionMember2021-12-310001091667us-gaap:CommonClassCMember2021-12-310001091667srt:MaximumMember2020-01-012020-12-310001091667srt:MaximumMember2019-01-012019-12-310001091667srt:MaximumMember2021-01-012021-12-310001091667us-gaap:EquityMethodInvesteeMember2021-01-012021-12-310001091667us-gaap:EquityMethodInvesteeMember2020-01-012020-12-310001091667us-gaap:EquityMethodInvesteeMember2019-01-012019-12-310001091667chtr:ProgrammingMinimumCommitmentsMember2021-12-310001091667chtr:OtherContractualObligationsMember2021-12-310001091667chtr:RuralDigitalOpportunityFundMember2021-12-310001091667us-gaap:QualifiedPlanMember2021-12-310001091667us-gaap:QualifiedPlanMember2020-12-310001091667us-gaap:NonqualifiedPlanMember2021-12-310001091667us-gaap:NonqualifiedPlanMember2020-12-310001091667us-gaap:SubsequentEventMember2022-01-012022-12-310001091667chtr:ReturnSeekingSecuritiesMember2021-12-310001091667chtr:ReturnSeekingSecuritiesMember2020-12-310001091667chtr:LiabilityMatchingSecuritiesMember2021-12-310001091667chtr:LiabilityMatchingSecuritiesMember2020-12-310001091667us-gaap:OtherInvestmentsMember2021-12-310001091667us-gaap:OtherInvestmentsMember2020-12-310001091667us-gaap:CashAndCashEquivalentsMember2021-12-310001091667us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Member2021-12-310001091667us-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMember2021-12-310001091667us-gaap:CashAndCashEquivalentsMember2020-12-310001091667us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Member2020-12-310001091667us-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMember2020-12-310001091667chtr:CommingledBondFundsMember2021-12-310001091667chtr:CommingledBondFundsMemberus-gaap:FairValueInputsLevel1Member2021-12-310001091667us-gaap:FairValueInputsLevel2Memberchtr:CommingledBondFundsMember2021-12-310001091667chtr:CommingledBondFundsMember2020-12-310001091667chtr:CommingledBondFundsMemberus-gaap:FairValueInputsLevel1Member2020-12-310001091667us-gaap:FairValueInputsLevel2Memberchtr:CommingledBondFundsMember2020-12-310001091667us-gaap:EquityFundsMember2021-12-310001091667us-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel1Member2021-12-310001091667us-gaap:FairValueInputsLevel2Memberus-gaap:EquityFundsMember2021-12-310001091667us-gaap:EquityFundsMember2020-12-310001091667us-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel1Member2020-12-310001091667us-gaap:FairValueInputsLevel2Memberus-gaap:EquityFundsMember2020-12-310001091667chtr:CollectiveTrustFundsMember2021-12-310001091667chtr:CollectiveTrustFundsMemberus-gaap:FairValueInputsLevel1Member2021-12-310001091667us-gaap:FairValueInputsLevel2Memberchtr:CollectiveTrustFundsMember2021-12-310001091667chtr:CollectiveTrustFundsMember2020-12-310001091667chtr:CollectiveTrustFundsMemberus-gaap:FairValueInputsLevel1Member2020-12-310001091667us-gaap:FairValueInputsLevel2Memberchtr:CollectiveTrustFundsMember2020-12-310001091667us-gaap:FairValueInputsLevel1Member2021-12-310001091667us-gaap:FairValueInputsLevel2Member2021-12-310001091667us-gaap:FairValueInputsLevel1Member2020-12-310001091667us-gaap:FairValueInputsLevel2Member2020-12-310001091667us-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2021-12-310001091667us-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2020-12-310001091667us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:HedgeFundsMultistrategyMember2021-12-310001091667us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:HedgeFundsMultistrategyMember2020-12-310001091667us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FixedIncomeFundsMember2021-12-310001091667us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FixedIncomeFundsMember2020-12-310001091667us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:CommercialRealEstateMember2021-12-310001091667us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:CommercialRealEstateMember2020-12-310001091667chtr:A401kPlanMember2021-01-012021-12-310001091667chtr:A401kPlanMember2020-01-012020-12-310001091667chtr:A401kPlanMember2019-01-012019-12-310001091667chtr:RetirementAccumulationPlanMember2021-01-012021-12-310001091667chtr:RetirementAccumulationPlanMember2020-01-012020-12-310001091667chtr:RetirementAccumulationPlanMember2019-01-012019-12-310001091667srt:ParentCompanyMember2021-12-310001091667srt:ParentCompanyMember2020-12-310001091667srt:ParentCompanyMember2021-01-012021-12-310001091667srt:ParentCompanyMember2020-01-012020-12-310001091667srt:ParentCompanyMember2019-01-012019-12-310001091667srt:ParentCompanyMember2019-12-310001091667srt:ParentCompanyMember2018-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

FORM 10-K

______________

(Mark One) | | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2021

or | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period From to

Commission File Number: 001-33664

Charter Communications, Inc.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | |

Delaware | | 84-1496755 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

400 Washington Blvd. | Stamford | Connecticut | 06902 |

(Address of Principal Executive Offices) | (Zip Code) |

(203) 905-7801

(Registrant's telephone number, including area code)

Securities registered pursuant to section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock $.001 Par Value | CHTR | NASDAQ Global Select Market |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrants have submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrants were required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.:

Large accelerated filer x Accelerated filer o Non-accelerated filer o Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No x

The aggregate market value of the registrant of outstanding Class A common stock held by non-affiliates of the registrant at June 30, 2021 was approximately $90.2 billion, computed based on the closing sale price as quoted on the NASDAQ Global Select Market on that date. For purposes of this calculation only, directors, executive officers and the principal controlling shareholders or entities controlled by such controlling shareholders of the registrant are deemed to be affiliates of the registrant.

There were 172,741,236 shares of Class A common stock outstanding as of December 31, 2021. There was 1 share of Class B common stock outstanding as of the same date.

Documents Incorporated By Reference

Information required by Part III is incorporated by reference from Registrant’s proxy statement or an amendment to this Annual Report on Form 10-K to be filed no later than 120 days after the end of the Registrant's fiscal year ended December 31, 2021.

CHARTER COMMUNICATIONS, INC.

FORM 10-K — FOR THE YEAR ENDED DECEMBER 31, 2021

This annual report on Form 10-K is for the year ended December 31, 2021. The United States Securities and Exchange Commission (“SEC”) allows us to “incorporate by reference” information that we file with the SEC, which means that we can disclose important information to you by referring you directly to those documents. Information incorporated by reference is considered to be part of this annual report. In addition, information that we file with the SEC in the future will automatically update and supersede information contained in this annual report. In this annual report, “Charter,” “we,” “us” and “our” refer to Charter Communications, Inc. and its subsidiaries.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS:

This annual report includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), regarding, among other things, our plans, strategies and prospects, both business and financial including, without limitation, the forward-looking statements set forth in Part I. Item 1. under the heading “Business” and in Part II. Item 7. under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this annual report. Although we believe that our plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, we cannot assure you that we will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions, including, without limitation, the factors described in Part I. Item 1A. under “Risk Factors” and in Part II. Item 7. under the heading, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this annual report. Many of the forward-looking statements contained in this annual report may be identified by the use of forward-looking words such as “believe,” “expect,” “anticipate,” “should,” “planned,” “will,” “may,” “intend,” “estimated,” “aim,” “on track,” “target,” “opportunity,” “tentative,” “positioning,” “designed,” “create,” “predict,” “project,” “initiatives,” “seek,” “would,” “could,” “continue,” “ongoing,” “upside,” “increases,” “grow,” “focused on” and “potential,” among others. Important factors that could cause actual results to differ materially from the forward-looking statements we make in this annual report are set forth in this annual report and in other reports or documents that we file from time to time with the SEC, and include, but are not limited to:

•our ability to sustain and grow revenues and cash flow from operations by offering Internet, video, voice, mobile, advertising and other services to residential and commercial customers, to adequately meet the customer experience demands in our service areas and to maintain and grow our customer base, particularly in the face of increasingly aggressive competition, the need for innovation and the related capital expenditures;

•the impact of competition from other market participants, including but not limited to incumbent telephone companies, direct broadcast satellite ("DBS") operators, wireless broadband and telephone providers, digital subscriber line (“DSL”) providers, fiber to the home providers and providers of video content over broadband Internet connections;

•general business conditions, unemployment levels and the level of activity in the housing sector and economic uncertainty or downturn, including the impacts of the Novel Coronavirus (“COVID-19”) pandemic to sales opportunities from residential move activity, our customers, our vendors and local, state and federal governmental responses to the pandemic;

•our ability to obtain programming at reasonable prices or to raise prices to offset, in whole or in part, the effects of higher programming costs (including retransmission consents and distribution requirements);

•our ability to develop and deploy new products and technologies including consumer services and service platforms;

•any events that disrupt our networks, information systems or properties and impair our operating activities or our reputation;

•the effects of governmental regulation on our business including subsidies to consumers, subsidies and incentives for competitors, costs, disruptions and possible limitations on operating flexibility related to, and our ability to comply with, regulatory conditions applicable to us;

•the ability to hire and retain key personnel;

•our ability to procure necessary services and equipment from our vendors in a timely manner and at reasonable costs;

•the availability and access, in general, of funds to meet our debt obligations prior to or when they become due and to fund our operations and necessary capital expenditures, either through (i) cash on hand, (ii) free cash flow, or (iii) access to the capital or credit markets; and

•our ability to comply with all covenants in our indentures and credit facilities, any violation of which, if not cured in a timely manner, could trigger a default of our other obligations under cross-default provisions.

All forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by this cautionary statement. We are under no duty or obligation to update any of the forward-looking statements after the date of this annual report.

PART I

Item 1. Business.

Introduction

We are a leading broadband connectivity company and cable operator serving more than 32 million customers in 41 states through our Spectrum brand. Over an advanced high-capacity, two-way telecommunications network, we offer a full range of state-of-the-art residential and business services including Spectrum Internet®, TV, Mobile and Voice. For small and medium-sized companies, Spectrum Business® delivers the same suite of broadband products and services coupled with special features and applications to enhance productivity, while for larger businesses and government entities, Spectrum Enterprise provides highly customized, fiber-based solutions. Spectrum Reach® delivers tailored advertising and production for the modern media landscape. We also distribute award-winning news coverage, sports and high-quality original programming to our customers through Spectrum Networks and Spectrum Originals.

Our network, which we own and operate, passes over 54 million households and small and medium businesses ("SMBs") across the United States. Our core strategy is to use our network to deliver high quality products at competitive prices, combined with outstanding customer service. This strategy, combined with simple, easy to understand pricing and packaging, is central to our goal of growing our customer base while selling more of our core connectivity services, which include both fixed and mobile Internet, video and voice services, to each customer. We execute this strategy by managing our operations in a consumer-friendly, efficient and cost-effective manner. Our operating strategy includes insourcing nearly all of our customer care and field operations workforces, which results in higher quality customer service. While an insourced operating model can increase the field operations and customer care costs associated with individual service transactions, the higher quality nature of insourced labor service transactions significantly reduces the volume of service transactions per customer, more than offsetting the higher investment made in each insourced service transaction. As we reduce the number of service transactions and recurring costs per customer relationship, we continue to provide our customers with products and prices that we believe provide more value than what our competitors offer. The combination of offering high quality, competitively priced products and outstanding service, allows us to both increase the number of customers we serve over our fully deployed network, and to increase the number of products we sell to each customer. This combination also reduces the number of service transactions we perform per relationship, yielding higher customer satisfaction and lower customer churn, resulting in lower costs to acquire and serve customers and greater profitability.

We have enhanced our service operations to allow our customers to (1) more frequently interact with us through our customer website and My Spectrum application, online chat and social media, (2) have their services installed at the time and in the manner of their own choosing, including self-installation, and (3) receive a variety of video packages on an increasing number of connected devices including those owned by us and those owned by the customer. By offering our customers growing levels of choices in how they receive and install their services and how they interact with us, we are driving higher overall levels of customer satisfaction and reducing our operating costs and capital expenditures per customer relationship. Ultimately, our operating strategy enables us to offer high quality, competitively priced services profitably, while continuing to invest in new products and services.

The capability and functionality of our network continues to grow in a number of areas, especially with respect to wireless connectivity. Our Internet service offers consumers the ability to wirelessly connect to our network using WiFi technology. We estimate that over 400 million devices are wirelessly connected to our network through WiFi. In addition, we extend Internet connectivity to our customers beyond the home via our Spectrum Mobile™ product through our mobile virtual network operator (“MVNO”) partnership agreement with Verizon Communications Inc. ("Verizon"). We intend to use Citizens Broadband Radio Service (“CBRS”) Priority Access Licenses (“PALs”) that we purchased in 2020, along with unlicensed CBRS spectrum, to build our own fifth generation ("5G") mobile data-only network on our existing infrastructure in targeted geographies where there is high outdoor cellular traffic volume. This effort, in combination with our expanding WiFi network and continued 5G enhancements within the MVNO partnership agreement, should position our mobile product for continued customer experience and cost structure improvements.

Our principal executive offices are located at 400 Washington Blvd., Stamford, Connecticut 06902. Our telephone number is (203) 905-7801, and we have a website accessible at ir.charter.com. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and all amendments thereto, are available on our website free of charge as soon as reasonably practicable after they have been filed. The information posted on our website is not incorporated into this annual report.

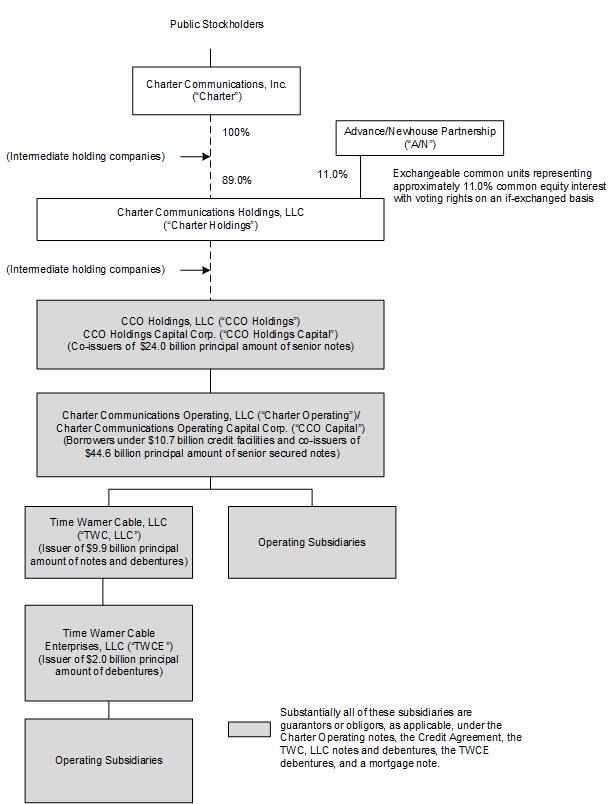

Corporate Entity Structure

The chart below sets forth our entity structure and that of our direct and indirect subsidiaries. The chart does not include all of our affiliates and subsidiaries and, in some cases, we have combined separate entities for presentation purposes. The equity ownership percentages shown below are approximations. Indebtedness amounts shown below are principal amounts as of December 31, 2021. See Note 9 to the accompanying consolidated financial statements contained in “Part II. Item 8. Financial Statements and Supplementary Data,” which also includes the accreted values of the indebtedness described below.

Footprint

We operate in geographically diverse areas which are managed centrally on a consolidated level. The map below highlights our footprint as of December 31, 2021.

Products and Services

We offer our customers subscription-based Internet services, video services, and mobile and voice services. Our services are offered to residential and commercial customers on a subscription basis, with prices and related charges based on the types of service selected, whether the services are sold as a “bundle” or on an individual basis, and based on the equipment necessary to receive our services. Bundled services are available to substantially all of our passings, and approximately 53% of our residential customers subscribe to a bundle of services including some combination of our Internet, video and/or voice products.

The following table summarizes our customer statistics for Internet, video, voice and mobile as of December 31, 2021 and 2020 (in thousands except per customer data and footnotes).

| | | | | | | | | | | |

| Approximate as of |

| December 31, |

| 2021 (a) | | 2020 (a) |

Customer Relationships (b) | | | |

| Residential | 29,926 | | | 29,079 | |

| SMB | 2,143 | | | 2,051 | |

| Total Customer Relationships | 32,069 | | | 31,130 | |

| | | |

Monthly Residential Revenue per Residential Customer (c) | $ | 113.61 | | | $ | 111.15 | |

Monthly SMB Revenue per SMB Customer (d) | $ | 165.50 | | | $ | 165.60 | |

| | | |

| Internet | | | |

| Residential | 28,137 | | | 27,023 | |

| SMB | 1,952 | | | 1,856 | |

| Total Internet Customers | 30,089 | | | 28,879 | |

| | | |

| Video | | | |

| Residential | 15,216 | | | 15,639 | |

| SMB | 617 | | | 561 | |

| Total Video Customers | 15,833 | | | 16,200 | |

| | | |

| Voice | | | |

| Residential | 8,621 | | | 9,215 | |

| SMB | 1,282 | | | 1,224 | |

| Total Voice Customers | 9,903 | | | 10,439 | |

| | | |

| Mobile Lines | | | |

| Residential | 3,448 | | | 2,320 | |

| SMB | 116 | | | 55 | |

| Total Mobile Lines | 3,564 | | | 2,375 | |

| | | |

Enterprise Primary Service Units ("PSUs") (e) | 272 | | | 259 | |

(a)We calculate the aging of customer accounts based on the monthly billing cycle for each account. On that basis, as of December 31, 2021 and 2020, customers include approximately 150,700 and 168,400 customers, respectively, whose accounts were over 60 days past due, approximately 39,900 and 17,800 customers, respectively, whose accounts were over 90 days past due, and approximately 43,500 and 11,100 customers, respectively, whose accounts were over 120 days past due. The increase in the past due accounts is predominately due to pre-existing balances for customers participating in the Emergency Broadband Benefit program through which a customer's monthly payment is subsidized by the federal government.

(b)Customer relationships include the number of customers that receive one or more levels of service, encompassing Internet, video and voice services, without regard to which service(s) such customers receive. Customers who reside in residential multiple dwelling units (“MDUs”) and that are billed under bulk contracts are counted based on the number of billed units within each bulk MDU. Total customer relationships exclude enterprise and mobile-only customer relationships.

(c)Monthly residential revenue per residential customer is calculated as total residential annual revenue divided by twelve divided by average residential customer relationships during the respective year and excludes mobile revenue and customers.

(d)Monthly SMB revenue per SMB customer is calculated as total SMB annual revenue divided by twelve divided by average SMB customer relationships during the respective year and excludes mobile revenue and customers.

(e)Enterprise PSUs represent the aggregate number of fiber service offerings counting each separate service offering at each customer location as an individual PSU.

Residential Services

Connectivity Services

We provide our customers with a suite of connectivity services including fixed Internet, WiFi and mobile Internet which when bundled together provides our customers with a differentiated Internet connectivity experience while saving consumers and businesses money.

Our standard entry level fixed Internet download speed is at least 200 megabits per second (“Mbps”) in 85% of our footprint and 100 Mbps across the remainder of our footprint, which among other things, allows several people within a single household to stream high definition (“HD”) video content while simultaneously using our Internet service for other purposes. Additionally, leveraging DOCSIS 3.1 technology, we offer Spectrum Internet Gig speed service (Internet speeds up to 1 gigabit per second ("Gbps")) across our footprint.

We also offer an in-home WiFi product that provides our Internet customers with high performance wireless routers and a managed WiFi service to maximize their fixed wireless Internet experience. During 2021, we completed our roll out of the Advanced Home WiFi (“AHW”) service which is now available across nearly all of our residential footprint along with the deployment of WiFi 6 routers capable of delivering speeds over 1 Gbps. With AHW, customers enjoy a cloud-optimized WiFi connection and have the ability to view and control their WiFi network through our Spectrum application (“My Spectrum App”). The service enables parental control schedules to be set for children’s devices or limit access entirely to unknown devices attempting to access the network. Customers also have the option to add Spectrum WiFi pods to AHW. WiFi pods are small, discreet and powerful access points that plug into electrical outlets in the home, providing broader and more consistent WiFi coverage. In 2022, we will begin rolling out Spectrum Security Shield across the residential footprint which protects all devices in the home using network-based security. This free security suite provides end point protection to computers in the home, enabling protection against computer viruses, spyware and threats from malicious actors across the Internet.

In 2021, we brought the capabilities of the AHW service to MDUs as Advanced Community WiFi (“ACW”). With ACW, tenants will receive the same visibility and control over their apartment’s WiFi networks through the My Spectrum App, while building managers will be able to see and manage the entire building’s network through a purpose-built property service portal.

Our Spectrum Mobile service is offered to customers subscribing to our fixed Internet service, and runs on Verizon’s mobile network, combined with Spectrum WiFi. We offer nationwide 5G service at no incremental cost to our mobile customers enabling them to stream content several times faster and reducing latency when connecting to apps or webpages where 5G coverage exists. In addition, we continue to focus on improving the customer experience and integrating our mobile and fixed Internet products, providing greater WiFi access, speeds and performance using more than 500,000 of our out of home WiFi access points across our footprint combined with over 20 million out of home WiFi access points of our industry partners providing near nationwide coverage.

We provide wireline voice communications services using voice over Internet protocol ("VoIP") technology to transmit digital voice signals over our network. Our voice services include unlimited local and long distance calling to the United States, Canada, Mexico and Puerto Rico, voicemail, call waiting, caller ID, call forwarding and other features and offers international calling either by the minute, or through packages of minutes per month. For customers that subscribe to both our voice and video offerings, caller ID on TV is also available in most areas. In early 2021, we launched Call Guard, a new advanced caller ID and robocall blocking solution, for our residential and SMB voice customers. Call Guard reduces customer frustration and improves security by blocking malicious calls while ensuring our customers continue to receive the legitimate automated calls they need from schools or healthcare providers.

Video Services

We provide our customers with a choice of video programming services on a variety of platforms including through a digital set-top box or an Internet Protocol ("IP") device. Video customers have access to a variety of programming packages with over 375 channels of in home and approximately 350 channels out of home allowing our customers to access the programming they want, when they want it, on any device. Our video customers also have access to programmer authenticated applications such as Fox Now, Showtime and ESPN and direct to consumer applications such as Netflix, YouTube and HBO Max on certain set-top boxes. Our video service also includes access to an interactive programming guide with parental controls and in virtually all of our footprint, video on demand (“VOD”) or pay-per-view services. VOD service allows customers to select from approximately 80,000 titles at any time including original content which is exclusive for a period of time through Spectrum

Originals such as Joe Pickett and Temple. VOD programming options may be accessed at no additional cost if the content is associated with a customer’s linear subscription, or for a fee on a transactional basis. VOD services are also offered on a subscription basis included in a digital tier premium channel subscription or for a monthly fee. Pay-per-view channels allow customers to pay on a per-event basis to view a single showing of a one-time special sporting event, music concert, or similar event on a commercial-free basis. We also offer digital video recorder (“DVR”) service that enables customers to digitally record programming and to pause and rewind live programming on set-top boxes and cloud DVR service, which allows customers to schedule, record and watch their favorite programming anytime from connected IP devices as well as SpectrumTV.com.

Customers are increasingly accessing their subscription video content through our highly rated Spectrum TV® application via connected IP devices via our IP network. Access to the Spectrum TV application is included in all Spectrum TV video plans and allows users to stream content across a growing number of platforms as well as accessing their full TV lineup, watching on demand content and the ability to program their DVR from anywhere. Customers are also able to purchase their video services within the Spectrum TV application.

Commercial Services

We offer scalable broadband communications solutions for businesses and carrier organizations of all sizes, selling Internet access, data networking, fiber connectivity to cellular towers and office buildings, video entertainment services and business telephone services.

Small and Medium Business

Spectrum Business offers Internet, voice and video services to SMBs over our hybrid fiber coaxial network. In addition, we offer our Spectrum Mobile service to SMB customers. Spectrum Business includes a full range of video programming and entry-level Internet speeds of 200 Mbps downstream and 10 Mbps upstream in virtually all of our markets. Additionally, customers can upgrade their Internet speeds by purchasing Internet Ultra (600 Mbps downstream) or Internet Gig. Spectrum Business also includes a set of business services including static IP and business WiFi, e-mail and security, and multi-line telephone services with more than 35 business features including web-based service management, that are generally not available to residential customers. We also offer Wireless Internet Backup to our SMB customers throughout our footprint. Wireless Internet Backup is designed to enhance and protect Internet service for SMBs in the event of a network disruption.

Enterprise

Spectrum Enterprise offers tailored communications products and managed service solutions to larger businesses and government entities (local, state and federal), as well as high-capacity last-mile network connectivity services to mobile and wireline carriers on a wholesale basis. The Spectrum Enterprise product portfolio includes connectivity services such as Internet Access (fiber, wireless and coax delivered); Wide Area Network ("WAN") solutions (Ethernet, SD-WAN and cloud connectivity) that privately and securely connect geographically dispersed customer locations and cloud service providers; and Managed Services which address a wide range of enterprise networking (e.g. routing, WiFi) and security (e.g. firewall, DDoS protection) challenges. To meet the communications needs of these more sophisticated customers, Spectrum Enterprise also offers an array of voice trunking services and unified messaging, communications and collaboration solutions. In addition, for industries such as hospitality, education and healthcare where specialized video solutions are demanded, Spectrum Enterprise offers a wide range of solutions designed to meet those requirements. Spectrum Enterprise serves businesses nationally by combining its large serviceable footprint with a robust portfolio of fiber lit buildings and a significant wholesale partner network. As a result, these customers benefit by obtaining advanced solutions from a single provider who is committed to an exceptional customer experience and who delivers compelling value by simplifying procurement and offering competitive pricing potentially reducing their costs.

Advertising Services

Our advertising sales division, Spectrum Reach, offers local, regional and national businesses the opportunity to advertise in individual and multiple service areas on cable television networks, various streaming services and numerous advanced advertising platforms. We receive revenues from the sale of local advertising across various platforms for networks such as TBS, CNN and ESPN and on our Spectrum TV application. We insert local advertising on up to 100 channels in over 90 markets. Our large footprint provides opportunities for advertising customers to address broader regional audiences from a single provider and thus reach more customers with a single transaction. Our size also provides scale to invest in new technology to create more targeted and addressable advertising capabilities.

Available advertising time is generally sold by our advertising sales force. In some service areas, we have formed advertising interconnects or entered into representation agreements with other video distributors, including, among others, Verizon, AT&T Inc. (“AT&T”) and Comcast Corporation, under which we sell advertising on behalf of those operators. In other service areas, we enter into representation agreements under which another operator in the area will sell advertising on our behalf. These arrangements enable us and our partners to deliver linear commercials across wider geographic areas, replicating the reach of local broadcast television stations to the extent possible. In addition, we enter into interconnect agreements from time to time with other cable operators, which, on behalf of a number of video operators, sells advertising time to national and regional advertisers in individual or multiple service areas.

Additionally, we sell the advertising inventory of our owned and operated local sports and news channels, of our regional sports networks that carry Los Angeles Lakers’ basketball games and other sports programming and of SportsNet LA, a regional sports network that carries Los Angeles Dodgers’ baseball games and other sports programming.

In 2021, we continued to expand our deployment of household addressability ("HHA"), which allows for more precise targeting within various parts of our footprint. Additionally, in conjunction with other MVPDs, Spectrum Reach enables affiliated cable networks to deploy HHA on their own inventory in our footprint, charging them an enablement fee. We also continue to further enhance our Ad Portal, which allows small businesses to purchase local cable advertising and/or creative services via our web portal with no sales personnel interaction at a price within their budgets. Our fully deployed Audience App, which uses our proprietary set-top box viewership data (all anonymized and aggregated), allows us to create data-driven linear TV campaigns for local advertisers. Streaming TV, which is largely comprised of Spectrum TV application impressions, as well as those from numerous over-the-top streaming content providers, is part of our suite of advanced advertising products available to the marketplace. Finally, Spectrum Reach is now employing multi-screen deterministic attribution services for television and streaming services that lets advertisers know the effectiveness of their advertising on Spectrum Reach’s platform.

Other Services

Regional Sports Networks

We have an agreement with the Los Angeles Lakers for rights to distribute all locally available Los Angeles Lakers’ games through 2033. We broadcast those games on our regional sports network, Spectrum SportsNet. American Media Productions, LLC ("American Media Productions"), an unaffiliated third party, owns SportsNet LA, a regional sports network carrying the Los Angeles Dodgers’ baseball games and other sports programming. In accordance with agreements with American Media Productions, we act as the network’s exclusive affiliate and advertising sales representative and have certain branding and programming rights with respect to the network. In addition, we provide certain production and technical services to American Media Productions. The affiliate, advertising, production and programming agreements continue through 2038. We also own 26.8% of Sterling Entertainment Enterprises, LLC (doing business as SportsNet New York), a New York City-based regional sports network that carries New York Mets’ baseball games as well as other regional sports programming.

News Networks

We manage 34 local news channels, including Spectrum News NY1® and LA1, 24-hour news channels focused on New York City and Los Angeles, respectively. Our local news channels connect the diverse communities and neighborhoods we serve providing 24/7 hyperlocal content, focusing on news, programming and storytelling that addresses the deeper needs and interests of our customers. We also provide the Spectrum News application where customers can read, watch and listen to news stories by our Spectrum News journalists and local partner publications on their mobile device.

Pricing of Our Products and Services

Our revenues are principally derived from the monthly fees customers pay for the services we provide. We typically charge a one-time installation fee which is sometimes waived or discounted in certain sales channels during certain promotional periods.

Our Spectrum pricing and packaging ("SPP") generally offers a standardized price for each tier of service, bundle of services, and add-on service in a service area. We believe SPP:

•offers a higher quality and more value-based set of services relative to our competitors, including fast Internet speeds, hundreds of HD channels and a transparent pricing structure;

•offers simplicity for customers to understand our offers, and for our employees in service delivery;

•drives our ability to package more services at the time of sale, thus increasing revenue per customer;

•drives higher customer satisfaction, lower service calls and churn; and

•allows for gradual price increases at the end of promotional periods.

We also have specialized offerings to enhance affordability of our Internet product for qualified low-income households which include our Spectrum Internet Assist product which offers a 30 Mbps service and a free modem for a low cost. In addition, some of our customers are eligible for a subsidy through the Federal Communications Commission's ("FCC") Affordable Connectivity Program which provides eligible low-income households with up to $30 per month towards Internet service.

Our mobile customers can choose one of two simple ways to pay for data. Customers can choose from unlimited or by-the-gig data usage plans and can easily switch between mobile data plans during the month. All plans include 5G service, free nationwide talk and text, and simple pricing that includes all taxes and fees. In October 2021, we implemented new multi-line unlimited data plans at lower prices for customers with two or more lines, at least one of which is an unlimited line. Customers can also purchase mobile devices and accessory products and have the option to pay for devices under interest-free monthly installment plans. Our device portfolio includes 5G models from Apple, Google and Samsung and we offer trade-in options along with a bring-your-own-device (“BYOD”) program which lowers the costs for our customers switching to Spectrum Mobile from other mobile operators.

Our Network Technology

Our network includes three key components: a national backbone, regional/metro networks and a “last-mile” network. Both our national backbone and regional/metro network components utilize a redundant IP ring/mesh architecture. The national backbone component provides connectivity from regional demarcation points to nationally centralized content, connectivity and services. The regional/metro network components provide connectivity between the regional demarcation points and headends within a specific geographic area and enable the delivery of content and services between these network components.

Our last-mile network utilizes a hybrid fiber coaxial cable (“HFC”) architecture, which combines the use of fiber optic cable with coaxial cable. In most systems, we deliver our signals via fiber optic cable from the headend to a group of nodes, and use coaxial cable to deliver the signal from individual nodes to the homes served by that node. For our Spectrum Enterprise customers, fiber optic cable is extended to the customer’s site. For certain new build and MDU sites, we increasingly bring fiber to the customer site. Our design standard allows spare fiber strands to each node to be utilized for additional residential traffic capacity, and enterprise customer needs as they arise. We believe that this hybrid network design provides high capacity and signal quality.

HFC architecture benefits include:

•bandwidth capacity to enable traditional and two-way video and broadband services;

•dedicated bandwidth for two-way services;

•signal quality and high service reliability;

•a powered network enabling WiFi and our future 5G small cell access points; and

•the ability to upgrade capacity at a lower incremental capital cost relative to our competitors.

Our systems provide a two-way all-digital platform, leveraging DOCSIS 3.1 technology and bandwidth of 750 megahertz or greater, to approximately 100% of our estimated passings. This bandwidth-rich network enables us to offer a large selection of HD channels and Spectrum Internet Gig and encrypted signals facilitate self-installs resulting in lower installation costs and truck rolls. We believe as demand for data continues to grow, with our deployed DOCSIS 3.1 technology, we have the ability to increase speeds and reliability by allocating more of our plant bandwidth to both upstream and downstream IP services in a variety of ways, including moving our video services to MPEG-4 compression, moving more HD video content to switched digital video and more efficiently packaging our traditional linear video services. We are also evaluating additional network enhancements to increase the capacity of our network for next generation products and services that give us the ability to offer multi-gigabit downstream speeds and up to one Gbps upstream speeds all in advance of migrating towards the next standard, DOCSIS 4.0, which we are currently developing with key vendors and industry participants. In 2022, we will continue to deploy high splits in our service areas which are a capital efficient means of enhancing our network, as they use current DOCSIS 3.1 customer premise equipment and reduce the need for node splits, which were required as average consumer bandwidth utilization increased.

We own 210 CBRS PALs and intend to use these licenses along with unlicensed CBRS spectrum to build our own 5G data-only mobile network on targeted 5G small cell sites leveraging our HFC network to provide power and data connectivity to the majority of the sites. These 5G small cells, combined with improving WiFi capabilities, increase speed and reliability along

with improving our cost structure. We are focused on scaling our systems to actively manage traffic on Spectrum Mobile devices using our MVNO network through WiFi and future 5G mobile network. In addition, we plan on deploying some targeted 5G small cell sites which will help us learn how to pace our broader multi-year 5G mobile network buildout based on disciplined cost reduction targets.

In 2021, we continued our rural broadband construction initiative in which we intend to expand our network and offer reliable broadband services of up to one Gbps to more than one million estimated passings in unserved areas in states where we currently operate. We expect to invest over $5 billion over the next several years, a portion of which we expect to offset with government funding including $1.2 billion of support won in the Rural Digital Opportunity Fund (“RDOF”) auction and other federal, state and municipal grants that are available or that we expect to become available. In addition to construction in areas subsidized by various government grants, which could be material, we expect to continue rural construction in areas near our current plant and in areas surrounding subsidized construction where synergies can be achieved. These investments will allow us to generate long-term infrastructure-style returns by further taking advantage of the efficiencies of the scale and quality of our network and construction capabilities while offering our high quality products and services to more homes and businesses. We expect these newly-served homes will be enabled to engage in distance learning, remote work, telemedicine and other bandwidth-heavy applications that require high speed broadband connectivity. Newly-served rural areas will also benefit from our high-value SPP structure including our voice and mobile offerings, as well as our comprehensive selection of video products. The successful and timely execution of such fiber-based construction is dependent on a variety of external factors, including the make-ready and utility pole permitting processes. With fewer homes and businesses in these areas, broadband providers need to access multiple poles per home, as opposed to multiple homes per pole in higher-density settings. As a result, pole applications, pole replacement rules and their affiliated issue resolution processes are all factors that can have a significant impact on construction timing and speed to completion. The RDOF auction rules and other subsidy grants establish construction milestones for the build-out utilizing subsidized funding. Failure to meet those milestones could subject the company to financial penalties.

Management, Customer Operations and Marketing

Our operations are centralized, with senior executives responsible for coordinating and overseeing operations, including establishing company-wide strategies, policies and procedures. Sales and marketing, field operations, customer operations, network operations, engineering, advertising sales, human resources, legal, government relations, information technology and finance are all directed at the corporate level. Regional and local field operations are responsible for customer premise service transactions and maintaining and constructing that portion of our network which is located outdoors. Our field operations strategy includes completing a significant portion of our activity with our employees which we find drives consistent and higher quality services. In 2021, our in-house field operations workforce handled approximately 80% of our customer premise service transactions.

We continue to focus on improving the customer experience through enhanced product offerings, reliability of services, and delivery of quality customer service. As part of our operating strategy, we insource most of our customer operations workload. Our in-house call centers handle nearly all of our total customer service calls. We manage our customer service call centers centrally to ensure a consistent, high quality customer experience. In addition, we route calls by call type to specific agents that only handle such call types, enabling agents to become experts in addressing specific customer needs, creating a better customer experience. Service from our call centers continues to become more efficient as a result of new tool enhancements that give our front-line customer service agents more context and real-time information about the customer and their services which allows them to more effectively troubleshoot and resolve issues. Our call center agent desktop interface tool enables virtualization of all call centers thereby better serving our customers. Virtualization allows calls to be routed across our call centers regardless of the location origin of the call, reducing call wait times, and saving costs. We continue to migrate our call centers to full virtualization and expect all our call centers to be fully virtualized by late 2022.

We also provide customers with the opportunity to interact with us in the manner they choose through self-service options on our customer website and mobile device applications, or via telephonic communication, online chat and social media. Our customer websites and mobile applications enable customers to pay their bills, manage their accounts, order and activate new services and utilize self-service help and support. In addition, our self-install program has enabled product installations to continue despite COVID-19 social distancing challenges and has been beneficial for customers who need flexibility in the timing of their installation.

We sell our residential and commercial services using national brand platforms known as Spectrum, Spectrum Business, Spectrum Enterprise and Spectrum Reach. These brands reflect our comprehensive approach to industry-leading products, driven by speed, performance and innovation. Our marketing strategy emphasizes the sale of our bundled services through

targeted direct response marketing programs to existing and potential customers, and increases awareness and the value of the Spectrum brand. Our marketing organization creates and executes marketing programs intended to grow customer relationships, increase the number of services we sell per relationship, retain existing customers and cross-sell additional products to current customers. We monitor the effectiveness of our marketing efforts, customer perception, competition, pricing, and service preferences, among other factors, in order to increase our responsiveness to our customers and to improve our sales and customer retention. The marketing organization manages all residential and SMB sales channels including inbound, direct sales, on-line, outbound telemarketing and stores.

Programming

We believe that offering a wide variety of video programming choices influences a customer’s decision to subscribe to and retain our cable video services. We obtain basic and premium programming, usually pursuant to written contracts from a number of suppliers. Media corporation and broadcast station group consolidation has, however, resulted in fewer suppliers and additional selling power on the part of programming suppliers.

Programming is usually made available to us for a license fee, which is generally paid based on the number of customers to whom we make that programming available. Programming license fees may include “volume” discounts and financial incentives to support the launch of a channel and/or ongoing marketing support, as well as discounts for channel placement or service penetration. For home shopping channels, we typically receive a percentage of the revenue attributable to our customers’ purchases. We also offer VOD and pay-per-view channels of movies and events that are subject to a revenue split with the content provider. Although an insignificant amount of our programming budget, recently we have begun entering into agreements to co-produce or exclusively license original content which give us the right to provide our customers with certain exclusive content for a period of time.