UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

For

the fiscal year ended

OR

For the transition period from to

Commission

file number:

(Exact name of Registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s

telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes ☐

Indicate

by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report Yes ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ☐ No

The aggregate market value of the voting shares held by non-affiliates of the Registrant was approximately $ million as of June 30, 2021.

The

number of shares outstanding of the Registrant’s ordinary shares (as of February 28, 2022): Ordinary Shares —

Documents Incorporated By Reference

None

Table of Contents

i

Special Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K (the “Annual Report”) contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Exchange Act of 1934 (the “Exchange Act”). These forward-looking statements reflect our current views about future events and are subject to risks, uncertainties, and assumptions. These statements concern expectations, beliefs, projections, plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. We urge you to consider that statements which use the terms “anticipate,” “believe,” “expect,” “plan,” “intend,” “estimate”, “will” and similar expressions are intended to identify forward-looking statements. Specifically, this Annual Report contains forward-looking statements regarding:

| ● | our expectations regarding our future profitability and revenue growth; |

| ● | our expectations regarding increases in cost of revenue and operating expenses, including as a result of our anticipated investments in R&D; |

| ● | our expectation to lower the rate of R&D investment as a percentage of revenue in the future and to drive more revenue from existing solutions rather than by adding new solutions; |

| ● | our expectations regarding reducing the historical rate of headcount growth and its resulting impact on our gross and operating margins over time; |

| ● | our expectations regarding growth of our enterprise business and its expected impact on our business, including its contribution to our cash flow and return on investment; |

| ● | our expectations regarding our ability to raise additional capital or issue more debt; |

| ● | our expectations regarding our capital expenditures for 2022; |

| ● | our belief regarding the adequacy of our existing capital resources and other future measures to satisfy our expected liquidity requirements; |

| ● | our beliefs regarding our competitive position in the market in which we operate; |

| ● | our expectations regarding the regulatory environment of data privacy in the EU; |

| ● | our anticipated significant investments in R&D and promotion of our brand; |

| ● | our expectations regarding trends in the market for internet security and technology industry; |

| ● | our expectations regarding existing and new threats, key challenges and opportunities in our industry and their impact on our business, including the impact of innovations in the technology industry; |

| ● | our expectations regarding the increase in utilization of our cloud infrastructure and the resulting impact on our gross margins; |

| ● | our expectations regarding continued and future customers that will contribute to our revenue, and the solutions we provide to such customers; |

| ● | our beliefs regarding factors that make our vision compelling to the IT security market; | |

| ● | our expectations regarding the locations where we conduct our business; |

ii

| ● | our belief regarding passive foreign investment company status; |

| ● | our expectations regarding the impact of litigation; |

| ● | our beliefs regarding our net operating loss carry-forwards; and |

| ● | our expectations and estimates regarding certain tax and accounting matters, including the impact on our financial statements. |

Risk Factor Summary

We are subject to various risks that could have a material adverse impact on our financial position, results of operations or cash flows. We wish to caution readers that certain important factors may have affected and could affect our future results and could cause actual results to differ significantly from those expressed in any forward-looking statement. The following is a summary of our principal risks, as set forth in the section entitled “Item 1A. Risk Factors,” that could prevent us from achieving our goals, and cause the assumptions underlying forward-looking statements and the actual results to differ materially from those expressed in or implied by those forward-looking statements to include, but not limited to, the following:

| ● | our ability to continue as a going concern; |

| ● | our ability to execute our business strategy; |

| ● | our ability to successfully enhance our existing products and introduce new products; |

| ● | the commercial success of our products; |

| ● | lack of demand for our products, including actual or perceived decreases in levels of cyber attacks; |

| ● | our ability to manage our costs, indebtedness and avoid unanticipated liabilities and achieve profitability; |

| ● | our ability to grow our revenues, including the ability of existing products to drive sufficient revenue; |

| ● | our ability to raise additional capital or debt; |

| ● | our ability to attract new customers and increase revenue from existing customers; |

| ● | market acceptance of our existing and new products; |

| ● | our ability to adapt to changing technological requirements and shifting preferences of our customers; |

| ● | the impact of COVID-19; |

| ● | our ability to remain listed on The Nasdaq Stock Market (“Nasdaq”); |

| ● | loss of any of our large customers or contracts; |

| ● | adverse conditions in the national and global financial markets; |

| ● | the impact of currency fluctuations; |

| ● | political and other conditions that may limit our R&D activities; |

iii

| ● | increased competition or our ability to anticipate or effectively react to competitive challenges; |

| ● | the ability of our brand awareness strategies to enhance our brand recognition; |

| ● | our ability to retain key personnel; |

| ● | performance of our OEM partners, service providers and resellers; |

| ● | our ability to successfully estimate the impact of regulatory matters; |

| ● | our ability to comply with applicable laws and regulations and the impact of changes in applicable laws and regulations, including tax legislation or policies; |

| ● | economic, regulatory, and political risks associated with our international operations; |

| ● | the impact of cyber attacks or a security breach of our systems; |

| ● | our ability to protect our brand name and intellectual property rights; and |

| ● | our ability to successfully estimate the impact of certain accounting and tax matters, including the effect on our company of adopting certain accounting pronouncements. |

The foregoing list of important factors does not include all such factors, nor necessarily present them in order of importance. In addition, you should consult other disclosures made by the Company (such as in our other filings with the SEC or in company press releases) for other factors that may cause actual results to differ materially from those projected by the Company. Please refer to Part I. Item 1A. Risk Factors, of this Annual Report for additional information regarding factors that could affect our results of operations, financial condition, and liquidity. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Except as required by applicable law, including the securities laws of the United States, we undertake no obligation to update or revise any forward-looking statements to reflect new information, future events, or circumstances, or otherwise after the date hereof.

iv

PART I

ITEM 1. BUSINESS

Unless otherwise indicated, all references in this document to “Cyren”, “the Company,” “we,” “us” or “our” are to Cyren Ltd., and its consolidated subsidiaries, namely Cyren Inc., Cyren Iceland hf, Cyren UK Ltd., and Cyren Gesellschaft GmbH.

General

We were incorporated as a private company under the laws of the State of Israel on February 10, 1991 and our legal form is a company limited by shares. We became a public company on July 15, 1999 under the name Commtouch Software Ltd. In January 2014, we changed our legal name to Cyren Ltd.

Cyren was an early pioneer and is a provider of cloud delivered Software-as-a-Service (SaaS) cybersecurity solutions that protect businesses, their employees, and customers against threats from email, files, and the web.

Our security solutions are architected around the fundamental belief that cybersecurity is a race against time – and the cloud best enables the speed, sophistication and advanced automation needed to detect and block threats as they emerge on the internet around the globe. As more and more businesses move their data and applications to the cloud, they need a security provider that is able to keep pace.

1

Security threats are more prevalent and stealthier than ever. As cybercrime has become more sophisticated, every malware, phishing and ransomware variant is unique, making it more difficult to detect. While organizations have traditionally protected their users with security at their network perimeter, more frequent and evasive attacks combined with a more distributed and virtual workforce are reducing the effectiveness of this approach. Traditional approaches may lack the real-time threat intelligence and processing power to detect emerging threats, and the growth of mobile devices and an increasingly distributed workforce mean that more and more business is conducted outside of the traditional network perimeter. As a result, when new attacks appear in a matter of seconds, legacy cybersecurity products can leave companies vulnerable for hours, days or even weeks.

Our Offerings

Cyren’s cloud security products and services fall into three categories:

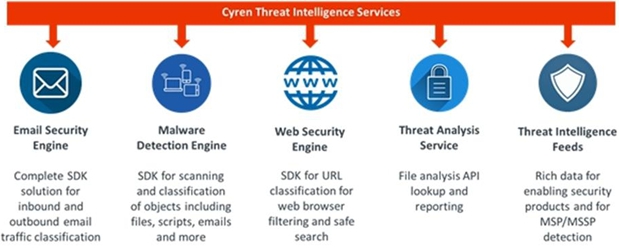

| ● | Cyren Threat Detection Services – these services detect a variety of threats in email, files and from the web, and are embedded into products from the world’s leading email, cybersecurity vendors and managed service providers (MSPs). Cyren Threat Detection Services include our Email Security Detection Engine, Malware Detection Engine, Web Security Engine, and Threat Analysis Service. |

| ● | Cyren Threat Intelligence Data – Cyren’s Threat Intelligence Data products provide valuable threat intelligence that can be used by enterprise or OEM customers to support threat detection, threat hunting and incident response. Cyren’s Threat Intelligence Data offerings include IP Reputation Intelligence, Phishing Intelligence, Malware Intelligence and Zombie Intelligence. |

| ● | Cyren Enterprise Email Security Products – these include cloud-based solutions designed for enterprise customers, and are sold either directly or through channel partners. Cyren Enterprise Email Security products include Cyren Email Security, a cloud-based secure email gateway and Cyren Inbox Security, an anti-phishing and remediation product for Microsoft 365. |

All of Cyren’s cybersecurity products are powered by Cyren GlobalView, Cyren’s global security cloud that identifies emerging threats on a global basis, in real-time. GlobalView analyzes billions of security transactions each day and rapidly detects a variety of threats in email, files and from the web. By inspecting internet traffic in the cloud, Cyren identifies threats as they emerge, stopping them before they reach users.

Cyren GlobalView

With a massive volume of customer traffic flowing through it every day, GlobalView is able to identify emerging threats on the internet within seconds. The key to GlobalView’s detection capabilities include:

| (i) | Massive Security Data Flow – Every day, Cyren’s GlobalView processes billions of security transactions generated by over 1.3 billion users worldwide to detect cyber threats as they emerge – including thousands of new IP addresses, phishing sites, and URLs. As a result, Cyren is able to identify new and emerging threats in seconds. |

| (ii) | Comprehensive Detection Technologies – Cyren’s family of proprietary detection engines leverage big data analytics, advanced heuristics, Recurrent Pattern Detection (RPD), and behavioral sandboxing, all tied together in a single-pass streaming architecture that applies these detection techniques in parallel. Distributed, massively scalable, and fault tolerant, this approach delivers fully automated real-time threat identification across email, files, and web. |

| (iii) | Advanced Cyber Intelligence – Real-time, actionable cyber intelligence services are used by major email providers and cybersecurity vendors including Google, Microsoft, and Check Point. The breadth and accuracy of our GlobalView security cloud identifies millions of threats each day, and enables protection from malicious messages, hosts, and websites. |

2

Figure 1: Cyren Threat Detection and Intelligence Services include threat detection engines, threat intelligence data, and our threat analysis services which are connected through the GlobalView security cloud.

Threat Detection Services

Used and trusted by many of the world’s leading email providers, cybersecurity vendors and MSPs, Cyren Threat Detection Services empower technology companies with the real-time threat detection capabilities enabled by our threat detection engines and our GlobalView threat intelligence network, backed by a dedicated technical and commercial support model. Our globally comprehensive and unique insights into current and emerging threats are provided as individual cyber intelligence services:

Email Security Engine – Our embedded email security includes a complete set of protection that can be deployed in a wide range of configurations. Suitable as a core security offering or as a complementary layer, the flexible engine easily integrates into existing platforms, minimizing costs without affecting performance. Available services include:

| ● | Anti-Spam Inbound Service |

| ● | Anti-Spam Outbound Service |

| ● | IP Reputation Service for Email |

| ● | Virus Outbreak Detection for Email |

Malware Detection Engine – Our malware detection capabilities are used to detect the latest viruses, malware, ransomware, and advanced threats that are used by hackers to infiltrate an enterprise’s network. Our SDK can scan and classify objects including files, scripts, emails, and web-based threats, and use cases include email scanning, UTM and firewall appliances, and anti-malware software applications. Cyren’s Malware Detection Engine is used primarily to protect email applications.

Web Security Engine – Our Web Security Engine is used by customers to provide URL classification for web browser filtering and safe search capabilities. Cyren provides dozens of URL categories and classifications, with a unique capability for security-based URL classifications. Use cases for Cyren web security engine include UTM and firewall appliances, endpoint filtering software applications, and cloud-based web filtering.

3

Threat Analysis Service – Cyren’s Threat Analysis Service delivers outstanding detection of the most advanced cyber threats. Cyren’s technology uses a patented, cloud-based, multi-sandbox array which includes multi-stage hash threat lookup, file analysis, and full sandbox detonation. Threat Analysis Services include file analysis and threat reporting on an individual file or aggregate basis and can be used by OEMs as well as enterprise customers.

Cyren Threat Intelligence Data Products

Cyren’s Threat Detection Services generate billions of security transactions each day within the GlobalView network. OEM partners and enterprise customers can benefit from the millions of unique threats that are detected each day by subscribing to Cyren’s real-time Threat Intelligence Data feeds to supplement their security solutions and improve their overall threat posture. Cyren’s Threat Intelligence Data feeds include the following discrete offerings:

| ● | Real-Time Phishing Intelligence |

| ● | Real-Time Malware File Intelligence |

| ● | Real-Time IP Reputation Intelligence |

| ● | Real-Time Malware URL Intelligence |

| ● | Real Time Zombie Host Intelligence |

Cyren Enterprise Security Products

Cyren historically provided SMB and enterprise customers a set of internet security services from a common integrated platform called Cyren Cloud Security (CCS). CCS applications included Cyren Web Security (a SaaS secure web gateway), Cyren Email Security (a SaaS secure email gateway), Cyren DNS Security (a SaaS DNS web filtering solution), and Cyren Cloud Sandboxing (an advanced threat protection service integrated into Cyren Web Security and Cyren Email Security, and also available as a standalone service).

During 2019, Cyren revised its enterprise product strategy to focus on email security solutions, threat detection services and threat intelligence data products.

Cyren’s current Enterprise Security products include:

Cyren Email Security (CES) – a cloud-based secure email gateway that works well with both on premise and cloud-based business email, Cyren Email Security filters an organization’s inbound and outbound email to protect users from security threats and spam. Inbound email security protects against malware, phishing, business email compromise, and more, with advanced threat protection from cloud sandboxing, malware outbreak protection and time-of-click analysis. Support for SPF (Sender Policy Framework) provides sender validation to prevent email spoofing, while policy-based encryption protects sensitive email communications. Outbound protections block botnet-infected devices from sending malware or spam from a customer’s domain.

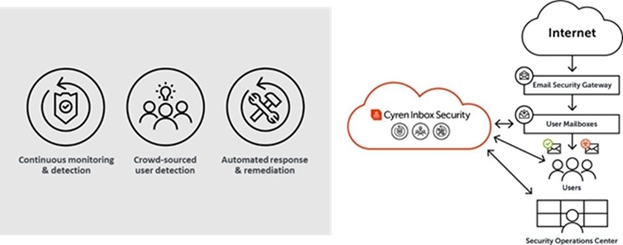

Cyren Inbox Security (CIS) – Cyren developed an anti-phishing solution targeted at enterprise customers using the Microsoft 365 email platform that was launched in the second quarter of 2020.

By utilizing the native API integration offered by Microsoft 365, Cyren Inbox Security is able to detect email-based phishing threats on a continuous basis, as well as provide powerful remediation capabilities to identify and mitigate the types of phishing attacks that legacy perimeter defenses find challenging to stop, including:

| ● | Phishing emails utilizing evasive techniques, like delayed URL activation, URLs hidden in attachments, use of strong encryption, use of real and valid SSL certificates, etc.; |

4

| ● | Spoofed spear phishing messages impersonating employees or trusted partners; |

| ● | BEC and CEO fraud and other targeted social engineering attacks; and |

| ● | New zero-day phishing campaigns and account takeovers. |

Figure 2: Cyren Inbox Security offers advanced phishing security for Microsoft 365 – continuously monitors, detects, and remediates user inboxes for today’s evasive phishing attacks.

Sales and Marketing

Cyren’s cloud security solutions are sold into two markets:

| ● | OEM/Embedded Security (Security product vendors, email providers, MSPs/MMSPs) |

| ◌ | In this market segment, our customers embed Cyren Threat Detection Services and Threat Intelligence Data into their infrastructure and/or products to protect their customers. |

| ● | Enterprise |

| ◌ | In this market segment, Cyren provides enterprise customers Email Security products, including secure email gateway and anti-phishing solutions, to protect their employees, data, and IP. |

OEM/Embedded Security Market

Sales

We target two primary segments to sell our Threat Detection Services and Threat Intelligence Data:

| ● | Service providers. Organizations offering internet access or email services that need to protect their customers from internet threats. For these partners, we offer carrier-class email security, web security, and advanced threat protection services that can be integrated into their large-scale, high performance infrastructures. |

| ● | Cyber Security vendors. Network equipment and security vendors offering endpoint, gateway, and cloud-based solutions that need to augment their security capabilities or integrate third party best-of-breed internet security capabilities into their products. For these partners, we offer cloud-based APIs and SDKs for email security, web security, endpoint protection, and advanced threat protection that can be integrated into their on-premise appliances or cloud solutions. |

Our sales team for these segments are organized by geographic regions, including Europe, the Middle East and Africa (EMEA), North America, and Asia Pacific. The sales process for these segments entails consultative, technical business development engagements working with partner product management and engineering teams to architect and integrate our solutions into their products.

5

Enterprise Market

Sales

Our sales and marketing programs are organized by geographic regions, including EMEA and North America.

We sell through both direct and indirect channels, including distributors, value added resellers and managed service providers:

| ● | Direct sales. We market and sell our solutions to enterprise customers directly through our direct sales teams, as well as indirectly through channels where our sales organization actively works with our network of distributors and resellers. Our sales personnel are located in North America and EMEA. |

| ● | Indirect channel. We engage value-added resellers directly or via a two-tier distribution model, where resellers purchase Cyren services through a distribution partner, as opposed to directly from us, and distributors provide sales support services such as technical support, education, training, and financial services. Our reseller partners maintain relationships with their customers throughout the territories in which they operate, providing them with services and third-party solutions to help meet their evolving security requirements. As such, these partners act as a direct conduit through which we can connect with these prospective customers to offer our solutions. |

| ● | Managed service providers. Unlike many other security products on the market today, Cyren’s platform is architected as an integrated platform offering multi-tenant cloud services and delegated administration. This enables MSPs to operate our services on behalf of multiple customers, allowing them to deliver turnkey internet security services to their customer bases. |

Marketing

We execute marketing programs to build awareness, generate demand and encourage customer adoption of our solutions. Our marketing programs include a variety of digital marketing, advertising, conferences, events, public relations activities, and web-based seminar campaigns targeted at key users and decision makers within our prospective customers. We offer free product trials to allow prospective customers to experience the capabilities of our products, to learn in detail about the features of our products and to quantify the potential benefits.

6

Intellectual Property

We regard our patented and patent pending anti-spam and antivirus technology, copyrights, service marks, trademarks, trade secrets and similar intellectual property as critical to our success, and rely on patent, trademark and copyright law, trade secret protection and confidentiality and/or license agreements with our employees, customers, partners and others to protect our proprietary rights.

In 2004, we purchased a United States patent, U.S. Patent No. 6,330,590 that relates to the Recurrent Pattern Detection (RPD) technology used in many of our security solutions. During 2006, we filed a provisional patent application in the United States relating to the prevention of spam in streaming systems or, in other words, unwanted conversational media sessions (i.e., voice and video related). This provisional application was converted to a full patent application and that application was then divided into three applications. The United States Patent and Trademark Office granted the original application as United States Patent No. 7,849,186. The three divisional patents were also subsequently granted as United States Patent No. 7,991,919, United States Patent No. 8,190,737, and United States Patent No. 8,195,795, all of which have a term concurrent with US Patent No. 7,849,186. In 2016, we filed a provisional patent application in the United States relating to a multi-sandbox array that utilizes unique intellectual property we developed in support of our cyber threat protection capabilities. In February 2017, we converted this provisional application into full patent applications for the multi-sandbox array in the United States, Europe, and Israel. The resulting US patent No. 10,482,243 was granted in November 2019, Israel patent 250797 was granted in July 2020, and European patent EP3211558 was granted in September 2021. In July 2018 we filed a provisional patent application in the United States relating to phishing detection systems and methods we developed in support of our anti-phishing capabilities. In July 2019, we converted this provisional application into full patent applications for phishing detection in the United States, Europe, and Israel. In September 2021, we filed a continuation patent application in the United States covering our phishing protection solutions for mobile devices. In 2019 U.S. Patent No. 6,330,590 expired after completion of its full 20-year term. We may seek to patent certain additional software or other technology in the future.

We have registered trademarks for our company name “Cyren” in the US and Europe and we are also maintaining our registered trademark for “Commtouch” in the U.S. Through acquisition, we also acquired registered trademarks such as “FRISK”, “F-PROT”, “eleven”, “Expurgate” and “Command Anti-malware”. We may allow certain of these trademarks to lapse over time. Since at least September 2003, we have claimed common law trademark rights in “RPD” and “Recurrent Pattern Detection”, as applicable to our messaging security solutions. We have also been claiming common law trademark rights in “Zero-Hour” in relation to our virus outbreak detection product (and more recently one of our web security products) and “GlobalView” in relation to our Internet Protocol, or IP, reputation and web security products, as well as our “cloud computing” network infrastructure.

It may be possible for unauthorized third parties to copy or reverse engineer certain portions of our products or obtain and use information that we regard as proprietary. In addition, the laws of some foreign countries do not protect proprietary rights to the same extent as do the laws of the United States. There can be no assurance that our means of protecting our proprietary rights in the United States, Europe or elsewhere will be adequate or that competing companies will not independently develop similar technology.

Other parties may assert infringement claims against us. We may also be subject to legal proceedings and claims from time to time in the ordinary course of our business, including claims of alleged infringement by us and/or our customers of the trademarks and other intellectual property rights of third parties. Our customer agreements typically include indemnity provisions so we may be obligated to defend against third party intellectual property rights infringement claims on behalf of our customers. Such claims, even if not meritorious, could result in the expenditure of significant financial and managerial resources.

Government Programs

Under the R&D Law, research and development programs approved by the Research Committee (the “Research Committee”) of the Israeli Innovation Authority (the “IIA”) are eligible for “Benefits” which include grants, loans, exemptions, discounts, guarantees and additional means of assistance, but with the exclusion of purchase of shares, provided under various tracks promulgated by the Council Body (the “Tracks”). Most Tracks require the repayment of the Benefits in the form of the payment of royalties from the sale of the product developed in accordance with the published Track guidelines and subject to other restrictions. Once a project is approved, the IIA awards grants of up to 50% of the project’s expenditures in return for royalties, usually at the rate of 3% of sales of products developed with such grants. For projects approved after January 1, 1999, the amount of royalties payable was up to a dollar-linked amount equal to 100% of such grants plus interest at LIBOR. The total amount of grants received as of December 31, 2021 (none received since 2018) is approximately $6.4. Our total commitment for royalties payable with respect to future sales, based on IIA participations received, net of royalties paid or accrued, is approximately $2.6 million as of December 31, 2021.

7

The terms of these grants prohibit the manufacturing outside of Israel of the product developed in accordance with the program without the prior consent of the Research Committee. Such approval is generally subject to an increase in the total amount to be repaid to the IIA to between 120% and 300% of the amount granted, depending on the extent of the manufacturing that is conducted outside of Israel.

The R&D Law, also provides that know-how from the research and development and any derivatives thereof, cannot be transferred or licensed to Israeli third parties without the approval of the Research Committee. The R&D Law stresses that it is not just transfer of know-how that was prohibited, but also transfer of any rights in such know-how. Approval of the transfer and/or license could be granted only if the Israeli transferee undertook to abide by all of the provisions of the R&D Law and regulations promulgated thereunder, including the restrictions on the transfer of know-how and the obligation to pay royalties, if applicable.

The know-how from the research and development and any derivatives thereof, cannot be transferred or licensed to non-Israeli third parties without the approval of the Research Committee, which approval is generally contingent on payment of a significant penalty of up to six times the grant amount plus LIBOR and minus any royalties paid. Such restriction does not apply to exports from Israel of final products developed with such technologies. On May 7, 2017, the IIA published the Rules for Granting Authorization for Use of Know-How Outside of Israel (the “Licensing Rules”). The Licensing Rules enable the approval of out-licensing arrangements and other arrangements for granting of an authorization to an entity outside of Israel to use know-how developed under research and development programs funded by the IIA and any derivatives thereof. Subject to payment of a “License Fee” to the IIA, at a rate that will be determined by the IIA in accordance with the Licensing Rules, the IIA may now approve arrangements for the license of know-how outside of Israel. This allows companies that have received IIA support to commercialize know-how in a manner which was not previously available.

Government Regulation

Laws aimed at curtailing the spread of spam have been adopted by the United States federal government, i.e., the CAN-SPAM Act, and certain individual U.S. states, with the CAN-SPAM Act superseding some state laws or certain elements thereof. The Israel government has also adopted an amendment to the Communications Law, 1982, aimed at curtailing the spread of spam transmittal of commercial advertisements by email, fax, SMS, or automated dialing systems without the consent of the recipient. Such laws may impact our marketing activities. The law sets punitive fines for advertisers of spam, who may also be subject to civil lawsuits and class actions.

The propagation of email viruses, whether through email or websites, which are aimed at destroying or stealing third party data, is illegal under standard state and federal law outlawing theft, misappropriation, conversion, etc., without the need for special legislation prohibiting such activities on the internet. Despite the existence of these laws, sources for internet viruses continue to spread multi-variant viruses seemingly without much fear of recrimination. New laws providing for more stringent penalties could be adopted in various jurisdictions, but it is unclear what, if any, affect these would have on the antivirus industry in general and our solutions in particular.

The EU enacted the General Data Protection Regulation (GDPR), which took effect on May 25, 2018 and carries with it significantly increased responsibilities and potential penalties for companies that process EU personal data. In connection with GDPR, we expect increased regulatory and customer attention surrounding data privacy in the EU. In connection with GDPR, we experience increased customer attention surrounding data privacy in the EU. In February 2016, the U.S. and E.U. announced an agreement on framework for transatlantic data flows entitled the EU-US Privacy Shield (“Privacy Shield”) which we had previously relied in part as a mechanism to transfer personal data from the EU to the U.S. However, on July 16, 2020, the European Court of Justice (the “CJEU”) invalidated the Privacy Shield (which took effect immediately). In addition, the CJEU made clear that while it upheld the adequacy of the EU Standard Contractual Clauses (“SCCs”) issued by the European Commission for the transfer of personal data to data processors established outside of the EU, reliance on SCCs alone may not necessarily be sufficient in all circumstances and that their use must be assessed on a case-by-case basis. The Company is currently evaluating what additional mechanisms may be required to establish adequate safeguards for the further transfer of personal data, in addition to the SCC. If we are unable to transfer personal data between and among countries and regions in which we operate, or if we are restricted from sharing personal data among our products and services, it could affect the manner in which we provide our services. Furthermore, outside of the EU, we continue to see increased regulation of data privacy and security, including the adoption of more stringent state privacy laws, national laws regulating the collection and use of data, and security and data breach obligations. We have invested heavily in data sovereignty features to ensure that Cyren customer data is handled in accordance with applicable law.

We will continue to monitor legal requirements and will follow additional legal requirements for customer data privacy as they evolve.

8

Segments

We conduct our business on the basis of one reportable segment.

Research and Development

We invest substantial resources in research and development to enhance our products and services, build new products and improve our core technology. We invest heavily in our cloud infrastructure and new product offerings such as Cyren Inbox Security. Our engineering team has deep security expertise and works closely with customers to identify their current and future needs. In addition to our focus on hardware and software, our research and development team is focused on research into next-generation threats, which is required to respond to the rapidly changing threat landscape. We plan to continue to invest in resources to conduct our research and development effort.

Customers

As of December 31, 2021, we had customers of all sizes across a wide variety of industries. During the year ended December 31, 2021, one customer accounted for approximately 19% of total revenue. No other individual customer accounted for more than 10% of total revenue. During the year ended December 31, 2020, the same customer accounted for approximately 23% of total revenue.

Competitive Landscape

The markets in which Cyren competes are intensely competitive and rapidly changing.

The principal competitive factors in our industry include price, product functionality, product integration, platform coverage and ability to scale, worldwide sales infrastructure and global technical support. Some of our competitors have greater financial, technical, sales, marketing, and other resources than we do, as well as greater name recognition and a larger installed customer base. Additionally, some of these competitors have more significant research and development capabilities that may allow them to develop new or improved products that may compete with product lines and services we market and distribute, possibly at a lower cost. Our success will depend on our ability to adapt to these competing forces, to develop more advanced products more rapidly and less expensively than our competitors and/or to purchase new products by way of strategic acquisitions, and to educate potential OEM customers as to the benefits of using our products rather than developing their own products.

In the market for email security solutions, there are sophisticated offerings that compete with our solutions. Email security providers offering forms of Software-as-a-Service email gateways, multi-functional appliances, and managed service solutions and which may be viewed as both competitors and potential customers to Cyren include Google, Symantec, McAfee, Cisco, Proofpoint, and Mimecast. Email security providers offering solutions on an OEM basis similar to Cyren’s business model, and which may be viewed as direct competitors, include Proofpoint (via the Cloudmark acquisition), Sophos, Mailshell and Vade Secure.

The market for real-time virus protection products is also constantly evolving, as those designing and proliferating viruses and other malware seek new vulnerabilities and distribution techniques, and also continue to leverage email distribution as a cost-effective medium for accurately targeting broad, numerous potential victims. Cyren’s real-time offering differs from traditional antivirus solutions by leveraging our global footprint and detection technology to rapidly detect outbreaks, often hours or days before traditional anti-malware solutions; it thereby offers a complementary solution to signature and heuristic-based antivirus engines. For this reason, our virus outbreak detection engine has been deployed by many security companies and service providers.

9

In the market for anti-malware solutions, there are vendors offering reasonably effective solutions using various technologies based on signatures, emulation, and heuristics. Cyren has a targeted OEM/service provider focus, plus an increasing focus on heuristics and zero-day effectiveness. Most companies in this space provide endpoint products and, in some cases, make software development kits available on an OEM basis. Competitors to Cyren include Sophos, Bitdefender, Kaspersky, McAfee, Symantec, and open source software such as Clam-AV (now part of Cisco).

In the market for anti-phishing solutions targeted at enterprise customers, Gartner has defined a category for providers of cloud delivered supplementary email security solutions such as Cyren Inbox Security(1). Although this is an early stage market, Gartner has identified several competitors to Cyren such as, Avanan, GreatHorn, Inky, Ironscales and Vade Secure.

We expect that the markets for internet security solutions will continue to become more consolidated, with companies increasing their presence in this market or entering ancillary markets by acquiring or forming strategic alliances with our competitors or business partners. See also disclosure under “Risk Factors—Business Risks— we face intense competition and could lose market share to our competitors, which could adversely affect our business, financial condition and results of operations.”

Threat Landscape

The last several years have possibly experienced the greatest amount of dramatic global incidents directly related to malware and cyber threats since the advent of the internet. From election hacks to global ransomware attacks, malware threats are at an all-time high. As long as these activities prove lucrative, we expect these incidents to get worse.

In this “cyber-war”, with respect specifically to malware, three battlefronts stand out: ransomware, hyper-evasive malware, and malware distribution via HTTPS.

Ransomware has become especially lucrative for cybercriminals. Massive scale ransomware attacks have spread extremely quickly around the globe targeting governments, corporations, and private citizens. With hyper-evasive malware, cybercriminals are using codes designed to specifically detect and evade conventional sandbox detection and analysis.

It has become clear that cybercriminals know the weak points in standard corporate defenses and are optimizing their attacks to leverage these security gaps in every possible way.

Today, no item or user connected to the internet is immune to attack. While many businesses are still studying what security measures might be necessary, cybercriminals are “all in”, creating dangerous new tools to target companies, governments, and private citizens. We need to be mindful that the world has changed, hyper-evasive malware and threat distribution via HTTPS are growing rapidly; mobile devices— both Android and Apple—are increasingly targets.

| (1) | Gartner Market Guide for Email Security (Neil Wynne, Peter Firstbrook, Published 6 June 2019). |

10

Cloud and Mobility

Businesses are going through a massive change in their IT strategies as they look to drive more business value, agility, and better customer experiences.

| ● | Business internet traffic continues to increase every year – executives, employees, partners, contractors, and customers are accustomed to transacting online. As a result, individuals are far more comfortable opening emails, clicking on links and providing sensitive data and information without questioning the authenticity of the applicable request. The simple organic growth in this usage of the internet is taxing existing legacy appliance solutions that have built-in capacity restrictions limiting their ability to scale. |

| ● | Data and applications are increasingly moving to the cloud – where we used to protect the servers, data and applications we ran in our data centers behind an appliance-based security perimeter, today these apps and data have moved outside of this security perimeter and into the cloud. |

| ● | More and more users are working remotely — users have left the perimeter, and are working from home offices, airports, hotels, and coffee shops, accessing the internet without protection from our perimeter security appliances. |

As organizations go through this transition, many are finding it increasingly difficult to protect their users, data, and networks with traditional on-premise security solutions.

| ● | Buyers continue to move away from traditional on-premise solutions — preference for service-based security solutions are growing, driven by innovations, increasing need for security beyond the perimeter, and lower total cost of ownership. |

| ● | Mature and legacy on premise deployments are reaching end of life — and these are increasingly being replaced by SaaS alternatives. |

| ● | IT security staffing shortages – driving products with lower management overhead, as well as some outsourcing to key technology partners. |

| ● | Increasingly fast, sophisticated, expensive, and high-profile attacks target organizations of all sizes – attacks are increasingly focused on small companies, less-regulated and less-security aware industries, dictating increased security investment. |

| ● | Compliance and regulatory mandates are creating increased concern among buyers, especially as the cost of failure becomes more painful. Continued, large-scale breaches — themselves a driver for security purchases — will bring about even more stringent levels of regulation. |

| ● | Heightened cybercrime activity among commercial enterprises and nation states – political and economic motivations are driving cyberattacks of both private enterprises and government entities. |

| ● | Automation is increasingly considered critical to accelerating detection and protection, and to countering IT talent shortages. |

These reasons explain why Cyren’s vision for 100% cloud security is compelling to IT security teams looking to protect their businesses in today’s cloud-centric mobile-first world.

Human Capital Resources

Effective management of our human capital is essential to the success of our Company. It is vital that we recruit, train, develop, motivate, and retain employees with the skills to execute our strategy and tactical plans across the Company.

11

As of December 31, 2021, the Company employed 200 employees. As of December 31, 2021, our employee population is dispersed across the globe with 35% in Israel, 21% in Germany, 19% in the United States, 18% in Iceland, and 7% in the United Kingdom. During 2021, our cost of revenue headcount decreased from 36 to 32 employees, R&D headcount decreased from 117 to 108 employees, sales and marketing headcount decrease from 37 to 33 and general and administrative headcount decreased from 32 to 28 employees.

Except for our employees in Iceland, which in accordance with standard local practices are represented by labor unions, none of our employees are represented by a labor union and are not subject to a collective bargaining agreement. We believe our employee relations are good and we have not experienced any work stoppages.

Approximately 54% of our employees were part of our research and development teams, with the remainder of our employees comprising our sales and marketing, operations and customer support, and administrative teams.

In addition to our employees, we engage independent contractors who primarily provide services to the R&D team in order to meet staffing needs, as it is more cost-effective. As of December 31, 2021, we engaged approximately 40 contractors on a full-time equivalency.

Work Environment

We are committed to a safe work environment for our employees, whether in person or virtually. We adhere and expect all of our employees to adhere to our Code of Business Conduct, which, among other things, sets forth numerous policies designed to provide a safe, ethical, respectful, and compliant work environment. In response to the COVID-19 pandemic, we made significant decisions that we determined were in the best interest of the Company and are vital to protect our employees, including restricting travel and directing most of our employees to work from home. For employees continuing critical on-site work, we have implemented additional safety measures such as limiting the number of people present each day on-site, social distancing, use of face masks, and frequent disinfection of shared spaces. We continue to monitor the impact of the pandemic on our employees and contractors and to track national and local conditions and governmental guidance where our employees are located, thus ensuring that we make decisions that are aimed at promoting their health and safety based upon each specific locality. We have been very encouraged by the way our employees have responded to the challenges caused by the COVID-19 pandemic. Our employees and contractors have generally maintained their productivity under virtual working conditions.

We believe that we offer a competitive and varied selection of compensation and benefits programs to support our employees. We are committed to their overall well-being and to providing programs that are competitive in our industry. Our compensation programs consist primarily of base salary, and dependent upon level, may include a corporate bonus, and equity awards. We periodically conduct pay equity surveys to ensure our compensation programs are applied equitably for all our employees. Consistent with local practices, we generally offer benefits programs that consist of comprehensive health, dental, and welfare benefits, and where applicable, retirement savings and life insurance options.

Communication and Engagement

We believe that our success depends upon our employees’ understanding of how their work results contribute to our overall strategy and plans. To this end, we communicate with our workforce through a variety of channels and encourage open and direct communication, including periodic Company-wide CEO update meetings which include a variety of topics of interest and frequent email corporate communications.

Diversity and Inclusion

We strive to promote and advance diversity and inclusion across the Company. We value diverse perspectives and life experiences. We believe that everyone deserves respect and equal treatment, regardless of gender, race, ethnicity, age, disability, sexual orientation, gender identity, cultural background, or religious belief. As of December 31, 2021, approximately 30% of our employees were female and across all management roles, approximately 26% of leadership is female.

Corporate Information

We were incorporated as a private company under the laws of the State of Israel on February 10, 1991 and our legal form is a company limited by shares. We became a public company on July 15, 1999 under the name Commtouch Software Ltd. In January 2014, we changed our legal name to Cyren Ltd. Our website is https://www.cyren.com. The SEC maintains an internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. Our filings under the Exchange Act are available on our website and are also available electronically from the website maintained by the SEC at www.sec.gov.

Our principal executive offices are located at 10 Ha-Menofim St., 5th Floor, Herzliya, Israel 4672561, where our telephone number is +972–9–863–6888.

12

ITEM 1A. RISK FACTORS

Business and Financial Condition Risks

We may not be able to continue as a going concern.

As of December 31, 2021, we had an accumulated deficit of $271.6 million, cash and cash equivalents of $4.3 million, current liabilities of $12.7 million and generated a net loss of $23.0 million. We have incurred losses since inception and expect to continue to incur losses for the foreseeable future. As of December 31, 2021, our cash and cash equivalents balance is not sufficient to fund our planned operations for at least a year beyond the date of the financial statements included in this report. These factors raise doubt about our ability to continue as a going concern and therefore it may be more difficult for us to attract investors. The ability to continue as a going concern is dependent upon our ability to obtain the necessary financing to meet our obligations and repay our liabilities arising from normal business operations when they become due. Despite our ability to secure capital in the past, we cannot assure you that we will be able to obtain additional debt or equity financing on favorable terms, if at all. Furthermore, if we raise additional equity financing, our shareholders may experience significant dilution of their ownership interests. If we engage in debt financing, we may be required to accept terms that restrict our ability to incur additional indebtedness, force us to maintain specified liquidity or other ratios or restrict our ability to pay dividends or make acquisitions.

We have a history of losses and may not be able to achieve or maintain profitability.

We have a history of incurring net losses, including net losses of $23.0 million and $17.3 million in 2021 and 2020, respectively. As a result, we had an accumulated deficit of $271.6 million as of December 31, 2021. Achieving profitability will require us to increase revenue, manage our cost structure, and avoid unanticipated liabilities. We have made and expect to continue to make significant expenditures to develop and expand our business and we do not expect to be profitable in the near term. Revenue growth may slow or revenue may decline for a number of possible reasons, including slowing demand for our solutions, increasing competition, expense reductions, a decrease in the growth of our overall market, the impact of the COVID-19 pandemic, or if we fail for any reason to continue to capitalize on growth opportunities. Any failure by us to obtain and sustain profitability, or to continue our revenue growth, could cause the price of our ordinary shares to decline significantly.

We may be adversely affected by the effects of inflation.

Inflation has the potential to adversely affect our business, results of operations, financial position and liquidity by increasing our overall cost structure, particularly if we are unable to achieve commensurate increases in the prices we charge our customers. The existence of inflation in the economy has the potential to result in higher interest rates and capital costs, supply shortages, increased costs of labor and other similar effects. As a result of inflation, we have experienced and may continue to experience, increases in our costs associated with operating our business including labor, equipment and other inputs. Although we may take measures to mitigate the impact of this inflation through pricing actions and efficiency gains, if these measures are not effective our business, results of operations, financial position and liquidity could be materially adversely affected. Even if such measures are effective, there could be a difference between the timing of when these beneficial actions impact our results of operations and when the cost inflation is incurred. Additionally, the pricing actions we take could result in a decrease in market share.

13

Our indebtedness may have an adverse effect on our business or limit our ability to take advantage of business, strategic or financing opportunities; our debt instruments contain certain events of default which, if triggered, may result in acceleration of our debt.

On March 19, 2020, we issued $10.25 million aggregate principal amount of our 5.75% convertible debentures due March 19, 2024 (the “Convertible Debentures”). Our Convertible Debentures contain certain covenants with which we must comply and events of default which, if triggered, may result in the Convertible Debentures becoming immediately due and payable. These events of default include, but are not limited to, failure to pay interest and principal when due, failure to perform any term, covenant or agreement contained in the Convertible Debentures, certain events of bankruptcy, insolvency or reorganization, and certain defaults on our obligations under other debt instruments. In addition, as long as the Convertible Debentures are outstanding, we must obtain consent of the holders in order to take the following actions as required by the respective debt instruments:

| ● | incur certain additional indebtedness or guarantee indebtedness; |

| ● | create certain liens; |

| ● | sell certain assets; |

| ● | make certain amendments to our charter documents; |

| ● | repay, repurchase, or acquire ordinary shares or indebtedness except under certain circumstances; |

| ● | pay cash dividends or distributions on any equity securities; or |

| ● | enter into transactions with affiliates, with certain exceptions. |

These consent requirements could restrict us from taking any of the above actions that we believe to be in our best interests and could adversely affect our ability to obtain additional financing, engage in certain business activities, take advantage of business opportunities, or otherwise execute our business strategies. In addition, our ability to comply with the terms of the Convertible Debentures may be affected by general economic conditions, industry conditions, and other events beyond our control. As a result, we cannot assure you that we will be able to comply with these terms. Failure to comply with the terms of the Convertible Debentures could result in a default under these debt instruments, upon which the outstanding debt would become immediately due and payable. This could have serious consequences to our financial condition and results of operations. We cannot assure you that our assets or cash flow would be sufficient to repay our obligations under the Convertible Debentures if accelerated upon an event of default, or that we would be able to borrow sufficient funds to refinance these debt instruments.

If the internet security market does not accept our cloud-based product offerings, our sales will not grow as quickly as anticipated, or at all, and our business, results of operations and financial condition would be harmed.

Our success will depend to a substantial extent on the willingness of enterprises to increase their acceptance and use of cloud computing services. The market for email security solutions delivered as a service is still at an early stage relative to on-premise solutions, and these applications may not achieve and sustain high levels of demand and market acceptance. In particular, there is no assurance that our recently released Cyren Inbox Security will generate a high level of demand or achieve market acceptance.

Historically, companies have used appliance-based security products, such as firewalls, intrusion prevention systems, or IPS, anti-virus, or AV, and web and messaging gateways, for their IT security. These enterprises may be hesitant to purchase our cloud-based security offering if they believe that signature-based products, or our competitors’ products, are more cost-effective, provide substantially the same functionality or otherwise provide a sufficient level of IT security. Many enterprises have invested substantial personnel and financial resources to integrate traditional enterprise software or hardware appliances for these applications into their businesses, and currently, most enterprises have not allocated a fixed portion of their budgets to protect against next-generation advanced cyber attacks. As a result, to expand our customer base, we need to convince potential customers to allocate a portion of their discretionary budgets to purchase our products and services. If we do not succeed in convincing customers that our offerings should be an integral part of their overall approach to IT security, our sales will not grow as quickly as anticipated, or at all, which would have an adverse impact on our business, results of operations and financial condition.

In addition, many enterprises may be reluctant or unwilling to use cloud computing services because they have concerns regarding the risks associated with its reliability and security, among other things, of this delivery model, or its ability to help them comply with applicable laws and regulations. If enterprises do not perceive the benefits of this delivery model, then the market for our services and our sales would not grow as quickly as we anticipate or at all and our business, results of operations and financial condition would be harmed.

14

If the market does not continue to respond favorably to our traditional Threat Intelligence Service security solutions, including our Threat Detection Services and Threat Intelligence Feeds, or future services do not gain acceptance, we will fail to generate sufficient revenues.

Our success depends on the continued acceptance and use of our Threat Intelligence Service security solutions by current and new businesses, Original Equipment Manufacturers (“OEMs”), and service provider customers, plus the interest of such customers in our newest offerings. As the markets for email, antivirus and web security products continue to mature and consolidate, we are seeing increasing competitive pressures and demands for even higher quality products at lower prices. This increasing demand comes at a time when internet security threats are more varied and intensive, challenging top end solutions to keep their performance at an industry-acceptable level of accuracy. If our solutions do not continue to evolve to meet market demand, or newer products on the market prove more effective, our business could fail. Also, if growth in the markets for these solutions begins to slow, our business, results of operations and financial condition will suffer dramatically.

If we are unable to effectively integrate future investments and acquisitions, our business operations and financial results will suffer.

Our success will depend, in part, on our ability to expand our service and product offerings and grow our business in response to changing technologies, customer demands and competitive pressures. In some circumstances, we may decide to do so through the acquisition of complementary businesses and technologies rather than through internal development.

If we encounter further difficulties or unforeseen expenditures in integrating the business, technologies, products, personnel, or operations of any company that we acquire, the revenue and operating results of the combined company could be adversely affected. The risks we face in connection with acquisitions include:

| ● | disruption of our ongoing business, diversion of resources, increased expenses, and distraction of our management from operating our business to addressing acquisition integration challenges; |

| ● | additional legal and regulatory compliance; |

| ● | cultural challenges associated with integrating employees from the acquired companies into our organization; |

| ● | inability to retain key employees from the acquired companies; |

| ● | inability to strengthen our competitive position, achieve our strategic goals, generate sufficient financial return to offset acquisition costs or realize the expected benefits of the acquisition; |

| ● | failure to identify significant problems or liabilities, including liabilities resulting from the acquired companies’ pre-acquisition failure to comply with applicable laws, during our pre-acquisition due diligence; |

| ● | difficulties related to our entry into geographic or business markets in which we have little or no prior experience or where competitors have stronger market positions; |

| ● | difficulties in, or inability to, successfully sell any acquired products or services; |

| ● | difficulties with the coordination of research and development, sales and marketing, accounting, human resources, and other general and administrative systems; |

| ● | changes in relationships with strategic partners as a result of product acquisitions or strategic positioning resulting from the acquisitions; |

| ● | liability for activities of the acquired companies before the acquisition, including intellectual property infringement claims, violations of laws, commercial disputes, tax liabilities and litigation; and |

| ● | unanticipated write-offs or charges. |

The occurrence of any of these risks could have a material adverse effect on our business operations and financial results.

15

We face intense competition and could lose market share to our competitors, which could adversely affect our business, financial condition, and results of operations.

The market for security products and services is intensely competitive and characterized by rapid changes in technology, customer requirements, industry standards and frequent new product introductions and improvements. We anticipate continued challenges from current competitors as well as by new entrants into the industry. If we are unable to anticipate or effectively react to these competitive challenges, our competitive position could weaken, and we could experience a decline in our revenue that could adversely affect our business and results of operations.

Many of our existing competitors have, and some of our potential competitors could have, substantial competitive advantages such as:

| ● | greater name recognition and larger customer bases; |

| ● | larger sales and marketing budgets and resources; |

| ● | broader distribution and established relationships with channel and distribution partners and customers; |

| ● | greater customer support resources; |

| ● | lower labor and research and development costs; and |

| ● | substantially greater financial, technical, and other resources. |

In addition, some of our larger competitors have substantially broader product offerings and may be able to leverage their relationships with distribution partners and customers based on other products or incorporate functionality into existing products to gain business in a manner that may discourage users from purchasing our products, subscriptions and services, including by selling at zero or negative margins, product bundling or offering closed technology platforms.

Potential customers may also prefer to purchase from their existing suppliers rather than a new supplier regardless of product performance or features. As a result, even if the features of our offerings are superior, customers may not purchase our services or products. In addition, innovative start-up companies, and larger companies that are making significant investments in research and development, may invent similar or superior products and technologies that compete with our product and services. Our current and potential competitors may also establish cooperative relationships among themselves or with third parties that may further enhance their resources. If we are unable to compete successfully, or if competing successfully requires us to take costly actions in response to the actions of our competitors, our business, financial condition, and results of operations could be adversely affected.

Some of our competitors have acquired businesses that may allow them to offer more directly competitive and comprehensive solutions than they had previously offered. As a result of such acquisitions, our current or potential competitors might be able to adapt more quickly to new technologies and end user needs, devote greater resources to the promotion or sale of their products and services, initiate or withstand substantial price competition, take advantage of acquisitions or other opportunities more readily, or develop and expand their product and service offerings more quickly than we can. Due to various reasons, organizations may be more willing to incrementally add solutions to their existing security infrastructure from competitors than to replace it with our solutions. These competitive pressures in our market or our failure to compete effectively may result in price reductions, fewer orders, reduced revenue and gross margins, and loss of market share. Any failure to meet and address these factors could seriously harm our business and operating results.

Also, many of our smaller competitors that specialize in providing protection from a single type of business security threat may deliver these specialized business security products to the market more quickly than we can or may introduce innovative new products or enhancements before we do. Conditions in our markets could change rapidly and significantly as a result of technological advancements.

16

If we are unable to enhance our existing products and develop new products, our growth will be impeded.

Our ability to attract new customers and increase revenue from existing customers will depend in large part on our ability to enhance and improve our existing products and to introduce new products. The success of any enhancement or new product depends on several factors, including the timely completion, introduction and market acceptance of the enhancement or new product. Any enhancement or new product we develop or acquire may not be introduced in a timely or cost-effective manner and may not achieve the broad market acceptance necessary to generate significant revenue. If we are unable to successfully develop or acquire new products or enhance our existing products to meet customer requirements, we may not grow as expected.

We cannot be certain that our development activities will be successful or that we will not incur delays or cost overruns. Furthermore, we may not have sufficient financial resources to identify and develop new technologies and bring enhancements or new products to market in a timely and cost-effective manner. New technologies and enhancements could be delayed or cost more than we expect, and we cannot ensure that any of these products will be commercially successful if and when they are introduced.

A loss of any of our large customers could have a material adverse effect on our financial condition and results of operations.

In the year ended December 31, 2021, our three largest customers accounted for approximately 29% of our annual revenues (including our largest customer that accounted for approximately 19% of total revenue). A significant reduction in revenue in the future from these major customers could have a material adverse effect on our financial condition, results of operations and cash flow. In addition, if one or more of our major customers were to develop competing technology or to experience economic difficulties, changes in purchasing policies or difficulties in fulfilling their obligations to us, our financial condition could be materially and adversely affected.

Adverse conditions in the national and global financial markets could have a material adverse effect on our business, operating results, and financial condition.

Our financial performance depends, in part, on the state of the economy, which may deteriorate in the future including, as a result of the spread or fear of spread of contagious diseases (such as the COVID-19 pandemic). Challenging economic conditions worldwide have from time to time contributed, and may continue to contribute, to slowdowns in the information technology industry, resulting in reduced demand for our solutions as a result of continued constraints on IT-related capital spending by our customers and increased price competition for our solutions. Additionally, concerns regarding uncertainties related to changes in public policies such as domestic and international regulations, taxes or international trade agreements as well as geopolitical turmoil and other disruptions to global and regional economies and markets in many parts of the world, have and may continue to put pressure on global economic conditions and overall spending on IT security.

If the economies of countries in which our customers and potential customers are located weaken, our customers may reduce or postpone their spending significantly. This could result in reductions in sales of our services and longer sales cycles, slower adoption of new technologies and increased price competition. In addition, weakness in the end user market could negatively affect the cash flow of our OEM and service provider partners, distributors and resellers who could, in turn, delay paying their obligations to us. This would increase our credit risk exposure and cause delays in our recognition of revenues on future sales to these customers. Specific economic trends, such as declines in the demand for PCs, servers, and other computing devices, or weakness in corporate information technology spending, could have a more direct impact on our business. Any of these events would likely harm our business, operating results, and financial condition.

The outbreak of COVID-19 and its international spread has affected how we operate our business, and the duration and the extent to which it will impact future results of operations and overall financial performance is unknown.

Pandemics and epidemics, such as the current COVID-19 outbreak, or other widespread public health problems could negatively impact our business. The current outbreak of COVID-19 has had widespread impacts on the overall economy, buying patterns of partners and potential customers, and business operations and continues to present concerns that may dramatically affect our ability to conduct our business effectively, including, but not limited to, our inability to travel to various destinations due to travel restrictions and quarantine requirements, attend certain industry-related conferences and effectively maintain ongoing sales operations. For employees continuing critical on-site work, we have implemented additional safety measures such as limiting the number of people present each day on-site, social distancing, and the use of personal protective equipment or PPE. Any additional precautionary measures may negatively impact our sales, operating results and business.

17

A significant reduction in global economic activity may result in reduced IT budgets, including for cyber security software. The global impact of the COVID-19 pandemic may continue to endure for an unknown period of time. While the ultimate impact of the COVID-19 outbreak is uncertain and subject to change, a significant duration of the COVID-19 outbreak and related government actions will impact many aspects of our business. Additionally, if the COVID-19 pandemic has had or continues to have a substantial impact on our partners and customers, our overall financial performance and operations may be negatively impacted. If a significant percentage of our workforce is unable to work, either because of illness or travel or government restrictions in connection with the COVID-19 outbreak, our operations may be negatively impacted.

If the perceived general level of advanced cyber attacks declines, demand for our solutions may decrease, our cost of doing business may increase and our business could be harmed.

Our business is substantially dependent on enterprises recognizing that advanced cyber attacks are pervasive and are not effectively prevented by legacy security solutions. High visibility attacks on prominent enterprises and governments have increased market awareness of the problem of advanced cyber attacks and help to provide an impetus for enterprises to devote resources to protecting against advanced cyber attacks, such as purchasing our services and products and broadly deploying our services and products within their organizations. If advanced cyber attacks were to decline, or enterprises perceived that the general level of advanced cyber attacks have declined, our ability to attract new customers and expand our offerings within existing customers could be materially and adversely affected and harm our business, results of operations and financial condition.

In addition, various state legislatures have enacted laws aimed at regulating the distribution of unsolicited email. These and similar legal measures, both in the United States and worldwide, may have the effect of reducing the amount of unsolicited email and malicious software that is distributed and hence diminish the need for our internet security solutions. Any such developments would have an adverse impact on our revenues.

We depend upon our OEM customers for the majority of our revenue and if our OEM customers do not renew existing subscriptions or buy additional services, our operating results will be harmed.

We expect to continue to be dependent upon OEM partners and service providers for a significant portion of our revenues.

Our operating results and financial condition may be materially adversely affected if:

| ● | anticipated orders or payments from these partners fail to materialize; |

| ● | our partners cease the promotion of our business or begin to promote solutions other than ours; |

| ● | our partners are acquired by larger companies who may have other relationships or technologies that lead to the displacement or termination of Cyren contracts; |