U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended May 31, 2016

Commission file number: 0--32919

PATRIOT GOLD CORP.

(Exact name of registrant as specified in its charter)

| Nevada | 86-0947048 | |

| (State of incorporation) | (I.R.S. Employer Identification No.) |

3651 Lindell Road, Suite D165

Las Vegas, Nevada, 89103

(Address of principal executive offices)

702-456-9565

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act:

None

Securities registered pursuant to Section 12(g) of the Exchange Act:

Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o |

| Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller Reporting Company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The issuer’s revenues for its most recent fiscal year were $Nil

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the average bid and asked price of such common equity as of November 30, 2015 was approximately $3,455,459.

The number of shares of the issuer’s common stock issued and outstanding as of August 31, 2016 was 55,877,604 shares.

TABLE OF CONTENTS

| Page | |||

| Glossary of Mining Terms | 3 | ||

| PART I | |||

| Item 1 | Business | 6 | |

| Item 1A | Risk Factors | 10 | |

| Item 1B | Unresolved Staff Comments | 12 | |

| Item 2 | Properties | 12 | |

| Item 3 | Legal Proceedings | 22 | |

| Item 4 | Mine Safety Disclosures | 22 | |

| PART II | |||

| Item 5 | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 23 | |

| Item 6 | Selected Financial Data | 24 | |

| Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 24 | |

| Item 7A | Quantitative and Qualitative Disclosures About Market Risk | 26 | |

| Item 8 | Financial Statements and Supplementary Data | 26 | |

| Item 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 26 | |

| Item 9A | Controls and Procedures | 26 | |

| Item 9B | Other Information | 27 | |

| PART III | |||

| Item 10 | Directors, Executive Officers and Corporate Governance | 28 | |

| Item 11 | Executive Compensation | 29 | |

| Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 31 | |

| Item 13 | Certain Relationships and Related Transactions, and Director Independence | 31 | |

| Item 14 | Principal Accountant Fees and Services | 32 | |

| PART IV | |||

| Item 15 | Exhibits, Financial Statement Schedules | 32 | |

| SIGNATURES | 49 | ||

| 2 |

Glossary of Mining Terms

Adit(s). Historic working driven horizontally, or nearly so into a hillside to explore for and exploit ore.

Adularia. A potassium-rich alteration mineral – a form of orthoclase.

Air track holes. Drill hole constructed with a small portable drill rig using an air-driven hammer.

BLEG sampling. Bulk leach sampling. A large sample of soil or rock that is leached using cyanide to determine gold and silver content down to a detection limit of as little as 1.0 parts per billion.

CSMT Survey. A Controlled Source Magneto-telluric geophysical method used to map the variation of the Earth’s resistance to conduct electricity by measuring naturally occurring electric and magnetic fields at the Earth’s surface.

Controlled Source Magneto-telluric Survey (CSMT). The recording of variations in a generated electrical field using sophisticated geophysical survey methods.

Core holes. A hole in the ground that is left after the process where a hollow drill bit with diamond chip teeth is used to drill into the ground. The center of the hollow drill fills with the core of the rock that is being drilled into, and when the drill is extracted, a hole is left in the ground.

Felsic Tertiary Volcanic Rocks. Quartz-rich rocks derived from volcanoes and deposited between two and sixty-five million years ago.

Geochemical sampling. Sample of soil, rock, silt, water or vegetation analyzed to detect the presence of valuable metals or other metals which may accompany them. For example, arsenic may indicate the presence of gold.

Geologic mapping. Producing a plan and sectional map of the rock types, structure and alteration of a property.

Geophysical survey. Electrical, magnetic, gravity and other means used to detect features, which may be associated with mineral deposits.

Ground magnetic survey. Recording variations in the earth’s magnetic field and plotting same.

Ground radiometric survey. A survey of radioactive minerals on the land surface.

Leaching. Leaching is a cost effective process where ore is subjected to a chemical liquid that dissolves the mineral component from ore, and then the liquid is collected and the metals extracted from it.

Level(s). Main underground passage driven along a level course to afford access to stopes or workings and provide ventilation and a haulage way for removal of ore.

Magnetic lows. An occurrence that may be indicative of a destruction of magnetic minerals by later hydrothermal (hot water) fluids that have come up along faults. These hydrothermal fluids may in turn have carried and deposited precious metals such as gold and/or silver.

Patented or Unpatented Mining Claims. In this Annual Report, there are references to “patented” mining claims and “unpatented” mining claims. A patented mining claim is one for which the United States government has passed its title to the claimant, giving that person title to the land as well as the minerals and other resources above and below the surface. The patented claim is then treated like any other private land and is subject to local property taxes. An unpatented mining claim on United States government lands establishes a claim to the locatable minerals (also referred to as stakeable minerals) on the land and the right of possession solely for mining purposes. No title to the land passes to the claimant. If a proven economic mineral deposit is developed, provisions of federal mining laws permit owners of unpatented mining claims to patent (to obtain title to) the claim. If one purchases an unpatented mining claim that is later declared invalid by the United States government, one could be evicted.

Plug. A vertical pipe-like body of magma representing a volcanic vent similar to a dome.

Quartz Monzonite. A medium to coarse crystalline rock composed primarily of the minerals quartz, plagioclase and orthoclase.

| 3 |

Quartz Stockworks. A multi-directional system of quartz veinlets.

RC holes. Short form for Reverse Circulation Drill holes. These are holes are left after the process of Reverse Circulation Drilling.

Reserve. That part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves are customarily stated in terms of "ore" when dealing with metalliferous minerals; when other materials such as coal, oil, shale, tar, sands, limestone, etc. are involved, an appropriate term such as "recoverable coal" may be substituted.

Resource. An estimate of the total tons and grade of a mineral deposit defined by surface sampling, drilling and occasionally underground sampling of historic diggings when available.

Reverse circulation drilling. A less expensive form of drilling than coring that does not allow for the recovery of a tube or core of rock. The material is brought up from depth as a series of small chips of rock that are then bagged and sent in for analysis. This is a quicker and cheaper method of drilling, but does not give as much information about the underlying rocks.

Rhyolite plug dome. A domal feature formed by the extrusion of viscous quartz-rich volcanic rocks.

Scintillometer survey. A survey of radioactive minerals using a scintillometer, a hand-held, highly accurate measuring device.

Scoping Study. A detailed study of the various possible methods to mine a deposit.

Silicic dome. A convex landform created by extruding quartz-rich volcanic rocks.

Stope(s). An excavation from which ore has been removed from sub-vertical openings above or below levels.

Tertiary. That portion of geologic time that includes abundant volcanism in the western U.S.

Trenching. A cost effective way of examining the structure and nature of mineral ores beneath gravel cover. It involves digging long usually shallow trenches in carefully selected areas to expose unweathered rock and allow sampling.

Volcanic center. Origin of major volcanic activity

Volcanoclastic. Coarse, unsorted sedimentary rock formed from erosion of volcanic debris.

| 4 |

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking information. Forward-looking information includes statements relating to future actions, prospective products, future performance or results of current or anticipated products, sales and marketing efforts, costs and expenses, interest rates, outcome of contingencies, financial condition, results of operations, liquidity, business strategies, cost savings, objectives of management of Patriot Gold Corp. (hereinafter referred to as the “Company,” “Patriot Gold” or “we”) and other matters. Forward-looking information may be included in this Annual Report on Form 10-K or may be incorporated by reference from other documents filed with the Securities and Exchange Commission (the “SEC”) by the Company. One can find many of these statements by looking for words including, for example, “believes,” “expects,” “anticipates,” “estimates” or similar expressions in this Annual Report on Form 10-K or in documents incorporated by reference in this Annual Report on Form 10-K. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events.

The Company has based the forward-looking statements relating to the Company’s operations on management’s current expectations, estimates and projections about the Company and the industry in which it operates. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that we cannot predict. In particular, we have based many of these forward-looking statements on assumptions about future events that may prove to be inaccurate. Accordingly, the Company’s actual results may differ materially from those contemplated by these forward-looking statements. Any differences could result from a variety of factors, including, but not limited to general economic and business conditions, competition, and other factors.

| 5 |

PART I

Item 1. Description of Business

We are engaged in natural resource exploration and anticipate acquiring, exploring, and developing natural resource properties. Currently we are undertaking programs in Arizona and Nevada.

Development of Business

We were incorporated in the State of Nevada on November 30, 1998. The Company was originally organized to engage in the business of breeding, raising and marketing meat and by-products to the wholesale and retail markets, and operated from November 30, 1998 through approximately May 31, 2000 when it ceased all operations due to lack of capital.

In June, 2003, the Company filed Amended and Restated Articles of Incorporation with the Secretary of State of the State of Nevada changing its name to Patriot Gold Corp. and moving the Company into its current business of natural resource exploration and mining. On June 17, 2003, the Company adopted a new trading symbol - PGOL- to reflect the name change. The Company has been in the resource exploration and mining business since June, 2003.

On April 16, 2010, we caused the incorporation of our wholly owned subsidiary, Provex Resources Inc. (“Provex”) under the laws of Nevada.

On April 16, 2010, the Company entered into an Assignment Agreement with Provex to assign the exclusive option to an undivided right, title and interest in the Bruner and Vernal properties and the Bruner Expansion property to Provex. Pursuant to the Assignment Agreements, Provex assumed the rights, and agreed to perform all of the duties and obligations, of the Company arising under the Bruner and Vernal Property Option Agreement and the Bruner Property Expansion Option Agreement. Provex’s only assets are the aforementioned agreements and it does not have any liabilities.

On May 28, 2010, Provex entered into an exclusive right and option agreement with Canamex Resources Corp. (“Canamex”) whereby Canamex could earn up to 75% in the Bruner and the Bruner Property Expansion. Canamex agreed to spend an aggregate total of US $6 million on exploration and related expenditures over the ensuing seven years whereupon Provex agreed to grant the right and option to earn a vested seventy percent (70%) and an additional five percent (5%) upon delivery of a bankable feasibility study.

On February 28, 2011, the Company entered into an Exploration and Option to Enter Joint Venture Agreement with Idaho State Gold Company, LLC, (“ISGC”) whereby the Company granted the option and right to earn a vested seventy percent (70%) interest in the property and the right and option to form a joint venture for the management and ownership of the property called the Moss Mine Property, Mohave County, Arizona (the "Moss Property" or "Moss Mine Property"). Upon execution of the agreement ISGC paid the Company $500,000 USD and agreed to spend an aggregate total of $8,000,000 USD on exploration and related expenditures over the ensuing five years. Subsequent to exercise of the earn-in, ISGC and the Company agreed to form a 70/30 joint venture.

In March, 2011, ISGC transferred its rights to the Exploration and Option to Enter Joint Venture Agreement dated February 28, 2011, to Northern Vertex Capital Inc. (“Northern Vertex”).

On May 12, 2016, the Company entered into a material definitive Agreement for Purchase and Sale of Mining Claims and Escrow Instructions (the “Purchase and Sale Agreement”) with Golden Vertex Corp., an Arizona corporation (“Golden Vertex,” a wholly-owned Subsidiary of Northern Vertex) whereby Golden Vertex agreed to purchase the Company’s remaining 30% working interest in the Moss Gold/Silver Mine for C$1,500,000 (the “Purchase Price”) plus the retention by Patriot of a 3% net smelter returns royalty. Specifically, the Company conveyed all of its right, title and interest in those certain patented and unpatented lode mining claims situated in the Oatman Mining District, Mohave County, Arizona (the “Claims”) together with all extralateral and other associated rights, water rights, tenements, hereditaments and appurtenances belonging or appertaining thereto, and all rights-of-way, easements, rights of access and ingress to and egress from the Claims appurtenant thereto and in which Seller had any interest (collectively, the “Property”). The Purchase Price consisted of C$1,200,000 in cash payable at closing and the remaining C$300,000 was paid by the issuance of Northern Vertex common shares to the Company valued at $0.35 (857,140 shares), issued pursuant to the terms and provisions of an investment agreement (the “Investment Agreement”) entered between the Company and Northern Vertex contemporaneous to the Purchase and Sale Agreement. The Investment Agreement prohibits the resale of the shares during the four month period following the date of issuance and thereafter, the Company will not sell the shares in an amount exceeding 100,000 shares per month.

| 6 |

Business Operations

We are a natural resource exploration and mining company with an objective of acquiring, exploring, and developing natural resource properties. Our primary focus in the natural resource sector is gold.

The search for valuable natural resources as a business is extremely risky. We can provide investors with no assurance that the properties we have either optioned or purchased in Nevada and Arizona contain commercially exploitable reserves. Exploration for mineral reserves is a speculative venture involving substantial risk. Few properties that are explored are ultimately developed into producing commercially feasible reserves. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan and any money spent on exploration would be lost.

Natural resource exploration and development requires significant capital and our assets and resources are limited. Therefore, we anticipate participating in the natural resource industry through the selling or partnering of our properties, the purchase of small interests in producing properties, the purchase of properties where feasibility studies already exist or by the optioning of natural resource exploration and development projects. To date, we have three (3) gold projects located in the southwest United States. In May 2016, we sold our interest in the Moss Mine project, leaving our project inventory to consist of the Bruner project, the Vernal project, and the Windy Peak project. Our Bruner Property is now jointly owned with Canamex which has earned 70% of the project having now fulfilled the terms of its option agreement with us; the project is still in the exploration and development stage, and further technical work will be required before final evaluation of the economic and legal feasibility of the projects can be determined. We have neither drilled nor developed exploration plans for our Vernal and recently acquired Windy Peak Property interests.

Financing

There was $552,008 of financing activities undertaken by the Company during the fiscal year ended May 31, 2016 through the issuance of common stock and warrants, and checks written in excess of cash. Management estimates that the Company will require approximately $350,000 to fund the Company’s planned operations for the next twelve months. Therefore, management believes current cash on hand is not sufficient to fund planned operations for 2017 after payment of outstanding checks written in-excess of cash and accounts payable outstanding at May 31, 2016. Our policy is to pay all operational expenses when due, provided that the vendor, in the normal course of business, has satisfied all necessary conditions for payment. Management plans to seek the additional capital through private placements and public offerings of its common stock but there can be no assurance that management would be successful in its attempt to raise the additional funds.

Competition

The mineral exploration industry, in general, is intensely competitive and even if commercial quantities of ore are discovered, a ready market may not exist for sale of same. Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in our not receiving an adequate return on invested capital.

Compliance with Government Regulation and Regulatory Matters

Mining Control and Reclamation Regulations

The Surface Mining Control and Reclamation Act of 1977 ("SMCRA") is administered by the Office of Surface Mining Reclamation and Enforcement ("OSM") and establishes mining, environmental protection and reclamation standards for all aspects of U.S. surface mining, as well as many aspects of underground mining. Mine operators must obtain SMCRA permits and permit renewals for mining operations from the OSM. Although state regulatory agencies have adopted federal mining programs under SMCRA, the state becomes the regulatory authority. States in which we expect to have active future mining operations have achieved primary control of enforcement through federal authorization.

SMCRA permit provisions include requirements for prospecting including mine plan development, topsoil removal, storage and replacement, selective handling of overburden materials, mine pit backfilling and grading, protection of the hydrologic balance, subsidence control for underground mines, surface drainage control, mine drainage and mine discharge control and treatment and re-vegetation.

| 7 |

The U.S. mining permit application process is initiated by collecting baseline data to adequately characterize the pre-mining environmental condition of the permit area. We will develop mine and reclamation plans by utilizing this geologic data and incorporating elements of the environmental data. Our mine and reclamation plans incorporate the provisions of SMCRA, state programs and complementary environmental programs which impact mining. Also included in the permit application are documents defining ownership and agreements pertaining to minerals, oil and gas, water rights, rights of way and surface land and documents required of the OSM’s Applicant Violator System, including the mining and compliance history of officers, directors and principal stockholders of the applicant.

Once a permit application is prepared and submitted to the regulatory agency, it goes through a completeness and technical review. Public notice of the proposed permit is given for a comment period before a permit can be issued. Some SMCRA mine permit applications take over a year to prepare, depending on the size and complexity of the mine and often take six months to two years to be issued. Regulatory authorities have considerable discretion in the timing of the permit issuance and the public has the right to comment on, and otherwise engage in, the permitting process including public hearings and intervention by the courts.

Surface Disturbance

All mining activities governed by the Bureau of Land Management ("BLM") require reasonable reclamation. The lowest level of mining activity, “casual use,” is designed for the miner or weekend prospector who creates only negligible surface disturbance (for example, activities that do not involve the use of earth-moving equipment or explosives may be considered casual use). These activities would not require either a notice of intent to operate or a plan of operation. For further information regarding surface management terms, please refer to 43 CFR Chapter II Subchapter C, Subpart 3809.

The second level of activity, where surface disturbance is 5 acres or less per year, requires a notice advising the BLM of the anticipated work 15 days prior to commencement. This notice must be filed with the appropriate field office. No approval is needed although bonding is required. State agencies must be notified to ensure all requirements are met.

For operations involving more than 5 acres total surface disturbance on lands subject to 43 CFR 3809, a detailed plan of operation must be filed with the appropriate BLM field office. Bonding is required to ensure proper reclamation. An Environmental Assessment (EA) is to be prepared for all plans of operation to determine if an Environmental Impact Statement is required. A National Environmental Policy Act review is not required for casual use or notice level operations unless those operations involve occupancy as defined by 43 CFR 3715. Most occupancies at the casual use and notice level in Arizona are covered by a programmatic EA.

An activity permit is required when use of equipment is utilized for the purpose of land stripping, earthmoving, blasting (except blasting associated with an individual source permit issued for mining), trenching or road construction.

Future legislation and regulations are expected to become increasingly restrictive and there may be more rigorous enforcement of existing and future laws and regulations and we may experience substantial increases in equipment and operating costs and may experience delays, interruptions or termination of operations. Failure to comply with these laws and regulations may result in the assessment of administrative, civil and criminal fines or penalties, the acceleration of cleanup and site restoration costs, the issuance of injunctions to limit or cease operations and the suspension or revocation of permits and other enforcement measures that could have the effect of limiting production from our future operations.

Trespassing

The BLM will prevent abuse of public lands while recognizing valid rights and uses under the mining laws. The BLM will take appropriate action to eliminate invalid uses, including unauthorized residential occupancy. The Interior Board of Land Appeals (IBLA) has found that a claim may be declared void by the BLM when it has been located and held for purposes other than the mining of minerals. The issuance of a notice of trespass may occur if an unpatented claim/site is:

| (1) | used for a home site, place of business, or for other purposes not reasonably related to mining or milling activities; |

| (2) | used for the mining and sale of leasable minerals or mineral materials, such as sand, gravel and certain types of building stone; or |

| (3) | located on lands that for any reason have been withdrawn from location after the effective date of the withdrawal. |

Trespass actions are taken by the BLM Field Office.

| 8 |

Environmental Laws

We may become subject to various federal and state environmental laws and regulations that will impose significant requirements on our operations. The cost of complying with current and future environmental laws and regulations and our liabilities arising from past or future releases of, or exposure to, hazardous substances, may adversely affect our business, results of operations or financial condition. In addition, environmental laws and regulations, particularly relating to air emissions, can reduce our profitability. Numerous federal and state governmental permits and approvals are required for mining operations. When we apply for these permits or approvals, we may be required to prepare and present to federal or state authorities data pertaining to the effect or impact that a proposed exploration for, or production or processing of, may have on the environment. Compliance with these requirements can be costly and time-consuming and can delay exploration or production operations. A failure to obtain or comply with permits could result in significant fines and penalties and could adversely affect the issuance of other permits for which we may apply.

Clean Water Act

The U.S. Clean Water Act and corresponding state and local laws and regulations affect mining operations by restricting the discharge of pollutants, including dredged or fill materials, into waters of the United States. The Clean Water Act provisions and associated state and federal regulations are complex and subject to amendments, legal challenges and changes in implementation. As a result of court decisions and regulatory actions, permitting requirements have increased and could continue to increase the cost and time we expend on compliance with water pollution regulations. These and other regulatory requirements, which have the potential to change due to legal challenges, Congressional actions and other developments increase the cost of, or could even prohibit, certain current or future mining operations. Our operations may not always be able to remain in full compliance with all Clean Water Act obligations and permit requirements. As a result, we may be subject to compliance orders and private party litigation seeking fines, penalties or changes to our operations.

Clean Water Act requirements that may affect our operations include the following:

Section 404

Section 404 of the Clean Water Act requires mining companies to obtain U.S. Army Corps of Engineers (“ACOE”) permits to place material in streams for the purpose of creating slurry ponds, water impoundments, refuse areas, valley fills or other mining activities.

Our construction and mining activities, including our surface mining operations, will frequently require Section 404 permits. ACOE issues two types of permits pursuant to Section 404 of the Clean Water Act: nationwide (or “general”) and “individual” permits. Nationwide permits are issued to streamline the permitting process for dredging and filling activities that have minimal adverse environmental impacts. An individual permit typically requires a more comprehensive application process, including public notice and comment; however, an individual permit can be issued for ten years (and may be extended thereafter upon application).

The issuance of permits to construct valley fills and refuse impoundments under Section 404 of the Clean Water Act, whether general permits commonly described as the Nationwide Permit 21 (NWP 21) or individual permits, has been the subject of many recent court cases and increased regulatory oversight. The results may materially increase our permitting and operating costs, permitting delays, suspension of current operations and/or prevention of opening new mines.

Employees

Currently, we have no full time employees. Our officers and directors provide planning and organizational services for us on a part-time basis. All field work is tendered out and completed by service providers and/or exploration partners.

Subsidiaries

On April 16, 2010, we caused the incorporation of our wholly owned subsidiary, Provex Resources, Inc., under the laws of Nevada. On April 16, 2010, the Company entered into an Assignment Agreement to assign the exclusive option to an undivided right, title and interest in the Bruner and Vernal property; and the Bruner Property Expansion to Provex. Pursuant to the Assignment Agreement, Provex assumed the rights, and agreed to perform all of the duties and obligations, of the Company arising under the Bruner and Vernal Property Option Agreement; and the Bruner Property Expansion Option Agreement. Provex’s only assets are the aforementioned agreements and it does not have any liabilities.

On May 28, 2010, Provex Resources, Inc. entered into an exclusive right and option agreement with Canamex Resources Corp. (“Canamex”) whereby Canamex could earn up to a 75% undivided interest in the Bruner and the Bruner Property Expansion. Canamex agreed to spend an aggregate total of US $6 million on exploration and related expenditures over the ensuing seven years whereupon the Company agreed togrant the right and option to earn a vested seventy percent (70%) and an additional five percent (5%) upon delivery of a bankable feasibility study.

| 9 |

Item 1A. Risk Factors

Factors that May Affect Future Results

1. We will require additional funds to achieve our current business strategy and our inability to obtain funding will cause our business to fail.

We expect to incur operating losses in future periods. This will happen because there are expenses associated with the acquisition, exploration and development of natural resource properties. We will need to raise additional funds in the future through public or private debt or equity sales in order to fund our future operations and fulfill contractual obligations. These financings may not be available when needed. Even if these financings are available, it may be on terms that we deem unacceptable or are materially adverse to your interests with respect to dilution of book value, dividend preferences, liquidation preferences, or other terms. Our inability to obtain financing would have an adverse effect on our ability to implement our current exploration and as a result, could require us to diminish or suspend our operations and possibly cease our existence. Obtaining additional financing would be subject to a number of factors, including the market prices for gold, silver and other minerals. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us.

2. Because our Directors serve as officers and directors of other companies engaged in mineral exploration, a potential conflict of interest could negatively impact our ability to acquire properties to explore and to run our business.

Our Directors and Officers may work for other mining and mineral exploration companies. Due to time demands placed on our Directors and Officers, and due to the competitive nature of the exploration business, the potential exists for conflicts of interest to occur from time to time that could adversely affect our ability to conduct our business. The Officers and Directors’ employment and affiliations with other entities limit the amount of time they can dedicate to us. Also, our Directors and Officers may have a conflict of interest in helping us identify and obtain the rights to mineral properties because they may also be considering the same properties. To mitigate these risks, we work with several geologists in order to ensure that we are not overly reliant on any one of our Officers and Directors to provide us with geological services. However, we cannot be certain that a conflict of interest will not arise in the future. To date, there have not been any conflicts of interest between any of our Directors or Officers and the Company.

3. Because of the speculative nature of exploration and development, there is a substantial risk that our business will fail.

The search for valuable natural resources as a business is extremely risky. We can provide investors with no assurance that the properties in Arizona and Nevada contain commercially exploitable reserves. Exploration for natural reserves is a speculative venture involving substantial risk. Few properties that are explored are ultimately developed into producing commercially feasible reserves. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan.

4. Because we are in the early stages of business operations, we face a high risk of business failure due to our inability to predict the success of our business.

We are in the early stages of exploration and development of our mineral claims and thus have no way to evaluate the likelihood that we will be able to operate our business successfully. We have not earned any revenues as of the date of this report.

5. Because of the unique difficulties and uncertainties inherent in mineral exploration and the mining business, we face a high risk of business failure.

Potential investors should be aware of the difficulties normally encountered by early-stage mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates.

In addition, the search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. The payment of such liabilities may have a material adverse effect on our financial position.

| 10 |

6. Because we anticipate our operating expenses will increase prior to our earning revenues, we may never achieve profitability.

We anticipate that we may continue to incur increased operating expenses without realizing any revenues. Therefore, we expect to incur potentially significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the exploration of our mineral claims we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, we would be unable to complete our business plan.

7. Because access to our mineral claims may be restricted by inclement weather, we may be delayed in our exploration.

Access to our mineral properties may be restricted through some of the year due to weather in the area. As a result, any attempt to test or explore the property is largely limited to the times when weather permits such activities. These limitations can result in significant delays in exploration efforts. Such delays can have a significant negative effect on our results of operations.

8. Because our President has only agreed to provide his services on a part-time basis, he may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail.

Because we are in the early stages of our business, Mr. Newton will not be spending all of his time working for the Company. Mr. Newton will expend enough time to undertake the work programs that have been approved by the Company. Later, if the demands of our business require additional time from Mr. Newton, he is prepared to adjust his timetable to devote more time to our business. However, it still may not be possible for Mr. Newton to devote sufficient time to the management of our business, as and when needed, especially if the demands of Mr. Newton’s other interests increase. Competing demands on Mr. Newton’s time may lead to a divergence between his interests and the interests of our shareholders.

9. Because of the speculative nature of exploration of mineral properties, there is substantial risk that no economic mineral deposits will be developed.

The search for valuable minerals as a business is extremely risky. Exploration for minerals is a speculative venture involving substantial risk. The expenditures to be made by us in the exploration of the mineral claims may not result in the discovery of economic mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan.

10. If we do not complete required option payments and capital expenditure requirements mandated in any prospective agreements, we will lose our interest in that respective property.

If we do not make all of the property payments or incur the required expenditures in accordance with any prospective property option agreements, we will lose our option to purchase the respective property for which we have not made the payments and may not be able to continue to execute our business objectives if we are unable to find an alternate exploration interest. Our payment obligations are non-refundable and if we do not make required payments, we will lose all amounts previously paid and all our rights to the prospective property.

11. Because the search for viable natural resources is extremely risky, no assurance can be made that we will obtain financing which will likely have a negative impact on our financial condition.

We are a natural resource exploration and development company with an objective of acquiring, exploring, and developing natural resource properties. The search for viable natural resources is extremely risky. A critical component of our operating plan is the ability to obtain additional capital through equity and/or debt financing. Since inception, we have financed our cash flow requirements through private placement issuances of common stock. No assurance can be made that such financing will be available, and if available it may take either the form of debt or equity, and may have a negative impact on our financial condition.

12. Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. The payment of such liabilities may have a material adverse effect on our financial position.

| 11 |

13. We are heavily dependent on our CEO and President.

Our success depends heavily upon the continued contributions of our CEO and President, whose knowledge, leadership and technical expertise would be difficult to replace. Our success is also dependent on our ability to retain and attract experienced engineers, geoscientists and other technical and professional staff. We do not maintain key man insurance. If we were to lose our CEO and President, our ability to execute our business plan could be harmed.

Risks Related to Legal Uncertainties and Regulations

14. As we undertake exploration and development of our mineral claims, we will be subject to compliance with government regulation that may increase the anticipated cost of our exploration programs.

There are several governmental regulations that materially restrict mineral exploration. We will be subject to the federal, state and local laws as we carry out our exploration program. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these laws. While our planned exploration and development program budgets for regulatory compliance, there is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration and development programs.

Item 1B. Unresolved Staff Comments

There are no unresolved staff comments.

Item 2. Description of Properties.

We do not lease or own any real property for our corporate offices. We currently maintain our corporate office on a month-to-month basis at 3651 Lindell Road, Suite D165, Las Vegas, Nevada 89103. Management believes that our office space is suitable for our current needs.

Our property holdings as of May 31, 2016 consist of:

| · | Bruner, Bruner Expansion and Vernal Properties |

| · | Windy Peak Property |

| 12 |

Bruner, Bruner Expansion and Vernal Properties

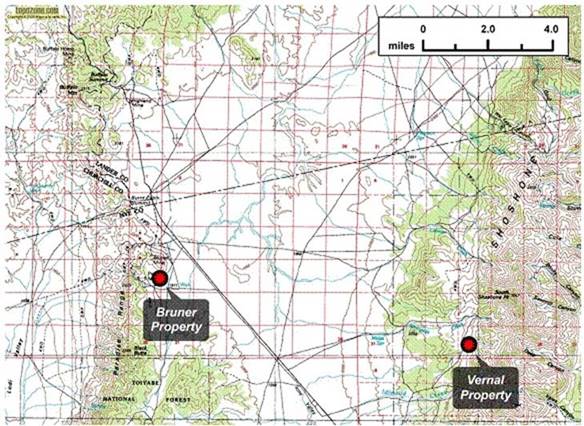

Map showing the location of our Bruner and Vernal properties located in Central Western Nevada.

Acquisition of Interests - Bruner, Bruner Expansion and Vernal properties

Pursuant to a Property Option Agreement (the “BV Agreement”), dated as of July 25, 2003, with MinQuest, Inc., a Nevada Company (“MinQuest”), we acquired the option to earn a 100% interest in the Bruner and Vernal mineral exploration properties located in Nevada. Together, these two properties originally consisted of 28 unpatented mining claims on a total of 560 acres in the northwest trending Walker Lane located in western central Nevada. The Bruner position was subsequently expanded from 16 unpatented mining claims to 80 unpatented mining claims bringing the total at Bruner to approximately 1,653 acres. Any additional claims agreed by the Company to be staked by MinQuest within 2 miles from the existing perimeter of the Property boundaries shall form part of the BV Agreement.

In order to earn a 100% interest in these two properties, option payments totaling $92,500 and an additional $500,000 in exploration expenditures were required. All mining interests in the property are subject to MinQuest retaining a 3% royalty of the aggregate proceeds from any smelter or other purchaser of any ores, concentrates, metals or other material of commercial value produced from the property, minus the cost of transportation of the ores, concentrates or metals, including related insurance, and smelting and refining charges.

Pursuant to the BV Agreement, we have a one-time option to purchase a portion of MinQuest’s royalty interest at a rate of $1,000,000 for each 1%. We may exercise our option 90 days following completion of a bankable feasibility study of the Bruner and Vernal properties, which, as it relates to a mineral resource or reserve, is an evaluation of the economics for the extraction (mining), processing and marketing of a defined ore reserve that would justify financing from a banking or financing institution for putting the mine into production.

To date, the Company has paid the option payments totaling $92,500, and has accumulated approximately $625,070 and $79,760 of exploration expenditures on the Bruner and Vernal properties, respectively. These expenditures have satisfied the requirements of the BV Agreement and 100% interest in these two properties has been transferred to Patriot, subject to MinQuest retaining a 3% royalty.

On April 16, 2010, the Company entered into an Assignment Agreement with its wholly owned subsidiary, Provex Resources, Inc., a Nevada Company, to assign the exclusive option to an undivided right, title and interest in the Bruner, Bruner Expansion and Vernal properties to Provex. Pursuant to the Agreement, Provex assumed the rights, and agreed to perform all of the duties and obligations, of the Company arising under the original property option agreements.

| 13 |

On May 28, 2010 Provex entered into an exclusive right and option agreement (“Bruner Option Agreement”) with Canamex Resources Corp. (“Canamex”) whereby Canamex may earn a 70% (or up to 75% if a bankable feasibility study is performed) undivided interest in the Bruner and Bruner Expansion properties, herein after collectively referred to as the “Bruner Property”. Upon the completion of the terms of the Bruner Option Agreement by Canamex, and upon earning its’ initial interest, the parties agreed to negotiate a definitive joint venture agreement in good faith which will supersede the current Bruner Option Agreement.

On April 1, 2009, the Company entered into a Property Option Agreement (the “AIV Agreement”) with American International Ventures Inc. (“AIV”), to acquire the exclusive option to an undivided right, title and interest in 28 patented Federal mining claims and millsites located in Nye County, Nevada. Simultaneous with the execution and delivery of the AIV Agreement, the Company paid AIV $30,000. In order to earn its option in the Property, the Company agreed to make annual property option payments each year on April 1 consisting of $35,000 in 2010, $40,000 in 2011, $45,000 in 2012, $50,000 in 2013, $55,000 in 2014, $60,000 in 2015, and $1,185,000 in 2016. Following said payments, the Company would be deemed to have exercised its option under the AIV Agreement and be entitled to an undivided 100% right, title and interest in and to the Bruner Property Expansion subject to a 1.5% Net Smelter Return (“NSR”) royalty payable to AIV and a 2% NSR payable to the former Property owner. The 2% NSR royalty may be purchased by the Company for a total payment of $500,000 and 1% of AIV’s 1.5% NSR royalty can be purchased by the Company for an additional payment of $500,000 at any time up to 30 days after beginning mine construction. The claims optioned under the agreement with AIV are contiguous with the Company’s existing Bruner property claims and therefore are also subject to the terms and conditions of the original BV Agreement with MinQuest.

In November 2015, Canamex announced that it had completed the purchase of the patented claims from AIV for US$760,000, securing ownership of those claims for the joint venture (in anticipation of Canamex earning 70% of the Bruner project) and saving the joint venture US$425,000. Canamex purchased the claims directly from American International Ventures Inc. (“AIV”), subject to Patriot Gold’s rights under an Option Agreement dated April 1, 2009 that gives Patriot Gold the ability to purchase those patented claims by making a final payment of US$1,185,000 on or before April 1, 2016. Both Canamex and Patriot Gold expect, however, that those patented claims will be conveyed to the joint venture once the more comprehensive joint venture agreement has been executed.

During the first half of 2016 it was determined by the company that Canamex had successfully earned a 70% interest in the Bruner Property according to the terms of the Bruner Option Agreement, and the parties began working to negotiate the terms of a definitive joint venture agreement. This joint venture agreement is still being negotiated.

Bruner Property

Description and Location of the Bruner Property

The Bruner Property (“Bruner”) is located approximately 130 miles east-southeast of Reno, Nevada at the northern end of the Paradise Range. Access from Fallon, the closest town of any size, is by 50 miles of paved highway and 16 miles of gravel roads. There is no mining plant or equipment located within the property boundaries. Currently, there is no power or water supply to the mineral claims; however, a subsurface water right has been granted by the Nevada Division of Water Resources. The water right approval, for mining purposes, allows for a 78 cubic feet per second or 350 gallons per minute well on the west side of the Bruner Property.

The Bruner consists of 27 patented claims (for an area of approximately 500 acres) and 230 unpatented lode claims, (for an area in excess of 3,000 acres). Included in the unpatented claims are new claims acquired by Canamex which are part of the Company’s May 28, 2010 option agreement with Canamex and the area of interest. The Bruner presently has a 43-101 compliant resource and Preliminary Economic Assessment.

Exploration History of the Bruner Property

The Bruner mining district is underlain by a sequence of intermediate to felsic Tertiary volcanic rocks, including ash flow tuffs, tuffaceous sediments, and flows. A volcanic center, the origin of major volcanic activity, is thought to underlie the district, with associated silicic domes (a convex landform created by extruding quartz-rich volcanic rocks) and plugs (landform similar to a dome, but smaller) intruding the volcanic section. The exposed stratigraphic section measures over 2,500 feet in thickness. The “Duluth Tuff”, a variably crystal rich ash flow tuff, is the host for gold and silver mineralization. Flow banded silicic volcanics, volcanoclastics (coarse, unsorted sedimentary rock formed from volcanic rocks) and andesite underlie the tuff and flow-banded rhyolite overlies the host unit. Two generations of intrusive rocks have been described within the district. Ore in the Bruner district is hosted by vuggy, fractured, quartz-adularia (potassium-rich alteration mineral) veined and/or stockworked tuff. Mineralization is primarily fault controlled, although some disseminated values do occur.

| 14 |

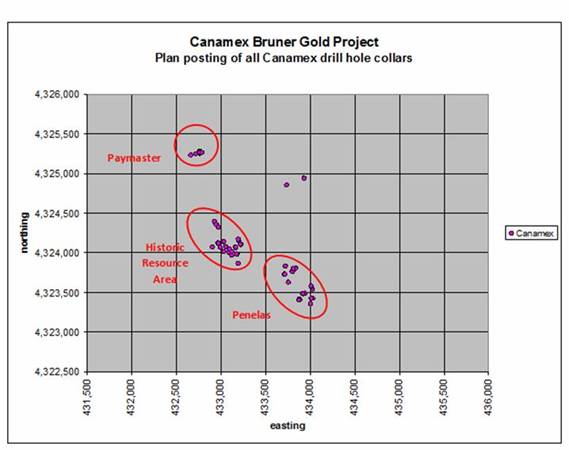

The original operators at the Bruner Property were varied. Prospecting at the property began in the early 1900’s and underground mining began in 1920. Mining on several of the veins located within the property occurred up to 1949. The patented claims contain the Duluth set of workings on the south end of the claim group comprising over 1,000 feet of workings in 3 shafts and numerous stopes. Past production from the Duluth was reported from 1935 to 1944 but is not able to be verified. The Paymaster mine is located on the north end of the patented claim group. It has a 375-foot shaft with 2,000 feet of workings on three levels. The Paymaster has no recorded production.

The unpatented claims contain the Penelas workings with 1000 feet of shaft and 4,000 feet of crosscuts on nine levels. Past production of gold and silver from the Penelas was recorded from 1935 to 1942 but is not able to be verified. Other historic workings include the Bruner adit with over 1,000 feet of workings and several shafts, and the Derelict mine with a 300 foot shaft and small open pit.

Modern exploration of the Bruner Property began in 1979 and included the following work:

In 1983, Kennecott Minerals Company drilled fifteen RC (reverse circulation drilling) holes on the property.

In 1988-1990, Newmont Exploration Ltd. drilled approximately 10 RC holes; conducted detailed geologic mapping (producing a plan map of the rock types, structure and alteration), geochemical surveys (which is sampling of rocks or soil and determination of the abundances of elements), air and ground magnetic surveys (recording variations in the earth’s magnetic field and plotting same), and ground radiometric surveys (a survey of radioactive materials on the land surface).

In 1990-1995, Miramar Mining Corp. (“Miramar”) drilled 5 RC holes and conducted BLEG (bulk leach extractable gold) sampling and air photo interpretation. BLEG sampling involves a large sample of soil or rock that is leached using cyanide to determine the metallurgy and parameters required to recover the gold and silver content from the sample material. In their 1991 Annual Report, Miramar reported 82% extraction of gold in 56 days from a column test run on unagglomerated -3/8 inch particle size material from the historic resource area, with low cyanide consumption. The head grade was unreported.

In July 2003, members of our Board of Directors and geology team made an onsite inspection of the Bruner Property. From this visit, an exploration plan was determined and a schedule to begin work on the Property was organized to commence in the month of September 2003. The Company completed an exploration program consisting of geologic mapping, surface geochemical sampling, a Global Positioning System (GPS) survey of grid based magnetic survey, drill holes and cultural features, and a CSMT geophysical survey (electrical, magnetic and other means used to detect features, which may be associated with mineral deposits) was also conducted. Such a survey measures the magnetic variations within the underlying rocks.

Since then, a ground magnetics survey and detailed mapping and rock sampling of the western portion of the claim block on the Bruner Property has been completed. The rock sampling is a collection of a series of rock chips over a measured distance, which is then submitted for assays, a chemical analysis to determine the metallic content over the sampled interval. The magnetics indicate the presence of northwesterly and northerly trending faults under the pediment cover that may host gold mineralization. Faults, which are breaks in the rock along which the movement has taken place, are often the sites for the deposition of metallic rich fluids. A pediment cover is a broad, gently sloping surface at the base of a steeper slope. Geologic mapping of rocks exposed in the western portion of our claims shows several small quartz bearing structures trending northwest and dipping steeply to the northeast. These small structures are thought to be related to a much larger vein system, often filled with quartz, and contained within a fault or break in the rock (a fault-hosted vein system) under gravel cover in the broad valley south of the mapping. Approximately one square mile of ground magnetics was completed at Bruner. The survey was conducted on 50 meter spaced lines, running north-south, using a GPS controlled Geometrics magnetometer, which is the geophysical instrument used in collecting magnetic data with an attached GPS that allows the operator to more precisely determine the location of each station where the magnetic signature is taken.

The interpretation shows numerous northwest and north-south trending magnetic lows associated with faults. Magnetic lows are an occurrence that may be indicative of a destruction of magnetic minerals by later hydrothermal (hot water) fluids that have come up along these faults. These hydrothermal fluids may in turn have carried and deposited precious metals such as gold and/or silver. A much more continuous northwest trending feature that has not been drill tested is located to the southeast, under gravel cover (where there is no exposure of rock at the surface). Data were sufficiently encouraging that an expanded CSMT survey was conducted to trace these structures in the third dimension.

In October 2004, the Company received the approval of a Notice of Intent for Exploration Drilling and an environmental bond filed with the Nevada office of the Bureau of Land Management. A total of 18 drill sites were located to target both extensions of the gold intercepts in previous drilling and in geophysical anomalies found by a CSMT survey. With the proper approvals in place, the Company began drilling on the Bruner Property on December 20, 2004. This drilling program was completed in March 2005 at a total cost of approximately $153,800, with a total of 3,200 feet of reverse circulation (RC) drilling in 7 holes. The depths of the holes ranged from 300 to 750 feet. The Company has received assays for all holes and the results were encouraging enough that additional drilling was conducted.

| 15 |

Because of the favorable drilling results from the drilling program which began on December 20, 2004, the Company decided to conduct additional drill testing on the Bruner Property, including both reverse circulation and core drilling. In April 2005, the Company filed an amended drilling plan with the Bureau of Land Management that allowed three fences of drill holes with the fences spaced 400 feet apart along the apparent trend of the mineralization. This program was completed in the fall of 2005 with 11 holes totaling 4,205 feet being drilled.

In 2007 the Board of Directors approved an exploration budget of approximately $120,000 for the Bruner Property. In November 2007, the Company drilled three holes at Bruner to test deeper targets within the gold-bearing tuffaceous host rocks. The holes were drilled using an RC drill rig and totaled 3,240 feet. The holes were spaced roughly 400 feet apart on a line running east-northeast. All holes were angled steeply to the north to cut projected, south-dipping shear zones. Drill hole B-18 and B-19 were drilled to a depth of 1,000 and B-20 was drilled 1,240 feet deep. All three holes contained intermittent gold at various depths. The results show a distinct increase in gold grade from the southwest (B-18) to the northeast (B-20). Only hole B-20 contained significant gold grades over any significant width. Further drilling north and east of B-20 may be warranted to vector in on the strongest part of the gold system. The drill program confirmed that gold mineralization continues at depth and is hosted by tuffaceous rocks.

The compilation of patented claims identified at least four viable drill targets separate from the Company’s original target. These targets include the Duluth, Penelas, Paymaster and Bruno which have seen moderate to intense drill programs in the past due to surface mineralization and alteration consistent with large precious metals systems located in other parts of the Great Basin.

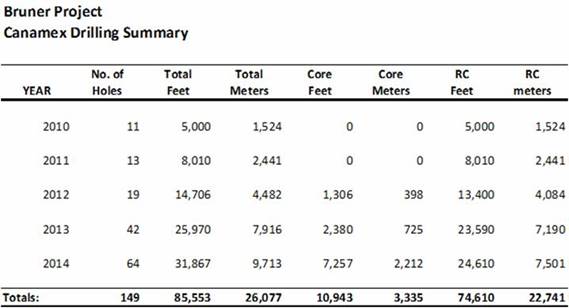

In late 2010, shortly after entering into an option agreement regarding the Bruner Property with Canamex Resources Corp., Canamex drilled 11 RC holes totaling 4,800 feet/1,463 meters.

In October 2011, a two phase gold-silver drilling program totaling approximately 9,150 meters (30,000 feet) in 57 drill holes was initiated. Phase I was designed to consist of 12 holes testing high - grade veins that were mined historically the first half of the 20th century but largely ignored by exploration drilling in the second half of the century. In March 2012, the final geochemical results from this program which consisted of 2,434 meters (7,985 feet) in 13 angled RC drill holes were announced. A total of 2 of the first 3 holes drilled into the Penelas East Vein System intersected gold. Drill hole B-1115 penetrated a vein nearly 400 feet below the surface and 400 feet south of the historic drill intercepts in BRU-085 and BRU-105.

In May 2012, column leach test work was initiated on a bulk sample from underground on the Bruner Property. Approximately 650 kilograms (1500 lbs.) of minus 6-inch material collected from the Upper Adit at the Bruner gold-silver project were delivered to a metallurgical test facility which specializes in cyanidation tests for heap leaching. The final cyanide column leach results showed a +85% gold extraction in 83 days on the sample with +80% extractions in both -3 inch and -3/4 inch crush sizes in 40 days.

In May 2012, Phase II drilling was proposed to test the extensions to the high-grade gold-silver intersected in the Penelas East vein in drill hole B-1115. The drilling was intended to test the strike extension and the dip extension of the intercept in B-1115 between 30-60 meters (100-200 feet) along strike to the north and to the south and 30-60 meters (100- 200 feet) below the elevation of the intercept in B-1115 to evaluate the potential for continuity along strike and increased potential with depth per the epithermal vein model.

The 2012 drilling program concluded with a total of 17 RC holes totaling 13,400 feet/4084 meters and two core holes totaling 1,306 feet/398 meters, all drilled about 1,000 feet/300 meters southeast of the old Penelas mine workings and where significant gold intercepts were encountered in the last hole in the 2011 drilling program. Hole B-1201, the first hole in 2012, intersected 360 feet (110 meters) and the remainder of the 2012 drill holes focused on drilling around this intercept in B-1201. The geology in the vicinity of hole B-1201 is mostly covered by 30-50 feet (10-15 meters) of alluvium, and the geology and geometry of the mineralized zone cannot be gleaned by surface mapping or sampling, requiring close-spaced drilling to ascertain the orientation of the significant gold intercepts encountered in 2012.

In March 2013, a Reverse Circulation ("RC") drill program of 22,000 feet was announced and scheduled to commence at the Bruner Property. The drilling phase will begin on the west side of the northern extension of the former producing July-Duluth mine sites and then move east to the Penelas East discovery area, where drilling in 2012 encountered a mineralized interval of 360 feet. Metallurgical test work was underway on drill samples from the Penelas East discovery deposit area with results to be reported shortly.

| 16 |

The 2013 drill program concluded with a total of 39 RC holes totaling 23,590 feet/7,190 meters and 3 core holes totaling 2,380 feet/725 meters being drilled between January and November. Of the total, seven RC holes were drilled at the north end of the Bruner vein target with disappointing results, although sufficient gold was encountered with increasing depth to indicate further drilling is warranted to chase this vein system to greater depths. Of the 35 holes drilled at the Penelas East discovery area, all but 5 holes intersected significant gold intercepts that help define the gold mineral system there. The 5 holes that failed to intersect significant gold intervals were drilled south of all other holes completed to date, encountered intense clay alteration which is generally indicative of being outside of the precious metal and proximal alteration of silica + adularia, and may be located on the opposite side of a fault that terminates or truncates the gold-silver mineral system at the Penelas East discovery area. The last hole of 2013 was drilled in the historic resource area to test a concept that high-grade gold was ponded beneath prominent silica + adularia spires that were mapped in detail during the summer of 2013.

In April 2014, a 53 hole drill program for both the Historic Resource and Penelas East discovery areas was announced. The program was to consist of approximately 1000 meters (3,280 feet) of core drilling and 9,000 meters (29,500 feet) of reverse circulation (RC) drilling. Core drilling in the Historic Resource area to start with an offset of RC hole B-1340, which tested at 93%-97% gold extraction levels after bottle roll cyanidation tests on hole composites were performed in early 2014. A total of 5 core holes and 24 RC holes are planned to test this high-grade feeder zone. Drilling at the Penelas East discovery area will focus on testing the prominent VLF-EM current density and coincident gold-in-soil anomalies. A total of 24 holes are planned in the Penelas East discovery area, which will expand the total number of holes drilled in this area to 62.

In April 2014, the Company reported the acquisition of an additional 20 acre patented mining claim known as the Elk Lode claim. The Elk Lode claim complements the Company’s existing holdings at the Bruner site.

The 2014 drilling program concluded with a total of 51 RC holes were drilled totaling 24,610 feet/7,501 meters and 13 core holes totaling 7,257feet/2,212 meters.

Ten (10) RC holes totaling 2,870 feet/875 meters were drilled at the Paymaster hill/mine area where previous sampling of old underground workings, currently inaccessible, indicated the presence of high-grade gold associated with the intersection of steeply dipping structures a generally flat lying volcaniclastic sediments immediately overlying a basement of unaltered andesite flows. These holes were very successful and additional drilling at the Paymaster hill/mine target is warranted.

Twelve (12) RC holes totaling 7,785 feet/2,373 meters were drilled to test VLF-EM current density anomalies detected north and northwest of the Penelas East discovery area. Sufficient gold was intersected in these holes to suggest the VLF-EM method may be seeing mineralized structures and thus deserve further drilling to assess this apparent correlation further.

Three (3) RC holes totaling 1,935 feet/590 meters and 2 core holes totaling 1,865 feet/568 meters were drilled at the northern open extension of the Penelas East discovery area to test deep high-grade intercepts encountered there in 2013. All of these holes intersected significant gold intercepts both near the surface and at depth to warrant additional drilling of the open northern extension to the Penelas East discovery area.

The majority of the drilling in 2014 was concentrated in the historic resource area in order to provide sufficient modern geologic and controlled assay data. A total of 27 RC holes totaling 12,456 feet/3,797 meters and 10 core holes totaling 4,956 feet/1,510 meters were completed in the historic resource area. The data from these holes flush out the core mineralized zone of the historic resource area and provide the detailed understanding of the host geology and the distribution of grade to be able to properly model the deposit and the entire assay set.

| 17 |

The table below summarizes Canamex’s exploration drilling at the Bruner Property.

The collar locations of the drilling on the Bruner Property are shown below.

Canamex has informed Patriot (and Patriot has agreed) that Canamex has incurred the expenditures required for it to earn an undivided 70% interest in the Bruner gold project. Patriot and Canamex are negotiating a definitive joint venture agreement that will supersede the 2010 agreement and govern the joint venture going forward.

Although a 43-101 compliant resource estimate has been developed for the Bruner as well as a Preliminary Economic Assessment, to date no mineral reserves have been reported for the Bruner.

| 18 |

Vernal Property

Description and Location of the Vernal Property

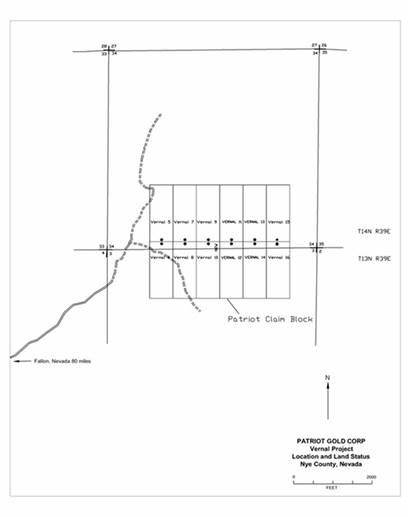

The Vernal Property is located approximately 140 miles east-southeast of Reno, Nevada on the west side of the Shoshone Mountains. Access from Fallon, the closest town of any size, is by 50 miles of paved highway and 30 miles of gravel roads. The Company holds the property via 12 unpatented mining claims (approximately 248 acres).

Exploration History of the Vernal Property

Historical work includes numerous short adits constructed on the Vernal Property between 1907 and 1936. There appears to have been little or no mineral production.

The Vernal Property is underlain by a thick sequence of Tertiary age rhyolitic volcanic rocks including tuffs, flows and intrusives. A volcanic center is thought to underlie the district, with an intruding rhyolite plug dome (a domal feature formed by the extrusion of viscous quartz-rich volcanic rocks) thought to be closely related to mineralization encountered by the geologists of Amselco, the U.S. subsidiary of a British company, who explored the Vernal Property back in the 1980’s, and who in 1983 mapped, sampled and drilled the Vernal Property. Amselco has not been involved with the Vernal Property over the last 20 years and is not associated with our option on the Vernal Property or the exploration work being done. A 225 foot wide zone of poorly outcropping quartz stockworks (a multi-directional quartz veinlet system) and larger veining trends exist northeast from the northern margin of the plug. The veining consists of chalcedony containing 1-5% pyrite. Clay alteration of the host volcanics is strong. Northwest trending veins are also present but very poorly exposed. Both directions carry gold values. Scattered vein float is found over the plug. The most significant gold values in rock chips come from veining in tuffaceous rocks north of the nearly east-west contact of the plug. This area has poor exposure, but sampling of old dumps and surface workings show an open-ended gold anomaly that measures 630 feet by 450 feet.

| 19 |

The Vernal Property claims presently do not have any known mineral reserves. The property that is the subject of our mineral claims is undeveloped and does not contain any commercial scale open-pits. Numerous shallow underground excavations occur within the central portion of the property. No reported historic production is noted for the property. There is no mining plant or equipment located on the property that is the subject of the mineral claim. Currently, there is no power supply to the mineral claims. Although drill holes are present within the property boundary, there is no known drilled reserve on our claims.

In July 2003, members of our Board of Directors and geology team made an onsite inspection of the Vernal property. Mapping (the process of laying out a grid on the land for area identification where samples are taken) and sampling (the process of taking small quantities of soil and rock for analysis) have been completed. In March 2005, the Company initiated the process to secure the proper permits for trenching and geochemical sampling from the U.S. Forest Service.

Our exploration of the Vernal Property to date has consisted of geologic mapping, trenching and rock chip geochemical sampling. The Board of Directors approved a budget of approximately $55,000 (including the refundable bond of $900) for the Vernal property. An exploration program was conducted in November, 2008. The program consisted of 200 feet of trenching, sampling and mapping, and opening, mapping and sampling of an underground workings consisting of approximately 275 feet of workings. The Company is currently evaluating the results of the program at the Vernal Property.

Planned Exploration

The Company’s current objectives are to assess the geological merits and if warranted and feasible establish an exploration program to identify the potential for economically viable mineralization. The cost of an exploration plan has not yet been determined therefore estimated exploration expenditures are not available at this time. The Company recognizes that the Vernal Property is an early-stage exploration opportunity and there are currently no proven or probable reserves.

Windy Peak Property

Acquisition of Interest

In May 2015, after a review of historical records and information available regarding a potential mineral property interest in Churchill County, Nevada, the Company acquired the Windy Peak Property, (referred to herein as the “Windy Peak Property,” "Windy Peak” or the “Property”). This early-stage exploration project was secured through the completion of an Assignment and Assumption Agreement. Windy Peak has not been visited by any current officers or directors of the Company.

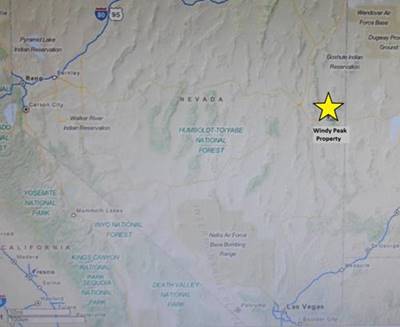

The Windy Peak Property Location in Nevada

| 20 |

Description and Location of the Windy Peak Property

The Windy Peak Property consists of 79 unpatented mineral claims covering approximately 1,630 acres, 3 miles NNE of the Bell Mountain and 7 miles east of the Fairview mining district in southwest Nevada. Windy Peak is approximately 45 miles southeast of Fallon and 6 miles SSW of Middlegate in sections 4,5,8,9,28,32,33 of T15 &16N R35E, Nevada. The Property is divided into 2 non-contiguous claim blocks with the northern claim block being adjacent to Hill 6483 in the Windy Fault.

Access to the Windy Peak Property is from U.S. Highway 50, thence south via Highway 361 to an unmarked dirt road that heads west along the south side of an unnamed wash referred to as Windy Wash. The dirt road exits Highway 95 near the border of Sections 27 & 34. The Bell Mountain quadrangle (dated 1972) shows an older dirt road that follows the floor of the wash. About 2 miles along the dirt road, trenching and cutting of trails to access various portions of the Property have extensively disturbed the hill. The dirt road is in good condition, however the steeper trails near Windy Peak will require a 4-wheel-drive for access. There is no plant, equipment, water source nor power currently on site. Power could be provided by portable diesel-powered generators. Non potable water may be source able on site for drilling, mining and milling purposes.

The Property claims are held as unpatented federal land claims administered under the Department of Interior, BLM and Department of Agriculture, Forest Service (“USFS”) under the Federal Land Policy and Management Act of 1976. In order to acquire an unpatented mineral claim the land must be open to mineral entry. Federal law specifies that a claim must be located or “staked” and site boundaries be distinctly and clearly marked to be readily identifiable on the ground in addition to filing the appropriate state and or federal documentation such as Location Notice, Claim Map, Notice of Non-liability for Labor and Materials Furnished, Notice of Intent to Hold Mining Claims, Maintenance Fee Payment and fees to secure the claim. The State may also establish additional requirements regarding the manner in which mining claims and sites are located and recorded. An unpatented mining claim on U.S. government lands establishes a claim to the locatable minerals (also referred to as stakeable minerals) on the land and the right of possession solely for mining purposes. No title to the land passes to the claimant. If a proven economic mineral deposit is developed, provisions of federal mining laws permit owners of unpatented mining claims to patent (to obtain title to) the claim. The Property surface estate and mineral rights are federally owned and subject to BLM regulations. None of the Property claims have been legally surveyed. Although our legal access to unpatented Federal claims cannot be denied, staking or operating a mining claim does not provide the claim holder exclusive rights to the surface resources (unless a right was determined under Public Law 84-167), establish residency or block access to other users. Regulations managing the use and occupancy of the public lands for development of locatable mineral deposits by limiting such use or occupancy to that which is reasonably incident is found in 43 CFR 3715. These Regulations apply to public lands administered by the BLM.

The Property claims were located and recorded along with the necessary payments being filed in March 2013. Annual maintenance fees of $155 per claim paid to the BLM and recording fees of approximately $15 per claim must be paid to the respective county on or before September 1 of each year to keep the claims in good standing, provided the filings are kept current these claims can be kept in perpetuity.

Past Exploration in the Windy Peak Area

Fairview District

The Windy Peak area has been considered to be part of, or at least an extension of, the Fairview District, which, is located on Fairview Peak about 6 miles WNW of Hill 6483. Both areas are within the Fairview Peak caldera of Henry but their geochemical differences indicate they are not related.

Windy Peak