Document

NEOGENOMICS, INC.

AND

U.S. BANK NATIONAL ASSOCIATION,

as Trustee

INDENTURE

Dated as of January 11, 2021

0.25% Convertible Senior Notes due 2028

TABLE OF CONTENTS

EXHIBIT

Exhibit A Form of Note A-1

INDENTURE, dated as of January 11, 2021, between NEOGENOMICS, INC., a Nevada corporation, as issuer (the “Company”, as more fully set forth in Section 1.01) and U.S. BANK NATIONAL ASSOCIATION, a national banking association, as trustee (the “Trustee”, as more fully set forth in Section 1.01).

W I T N E S S E T H:

WHEREAS, for its lawful corporate purposes, the Company has duly authorized the issuance of its 0.25% Convertible Senior Notes due 2028 (the “Notes”), initially in an aggregate principal amount not to exceed $300,000,000 (or $345,000,000 if the Underwriters exercise their over-allotment option in accordance with the Underwriting Agreement in full), and in order to provide the terms and conditions upon which the Notes are to be authenticated, issued and delivered, the Company has duly authorized the execution and delivery of this Indenture; and

WHEREAS, the Form of Note, the certificate of authentication to be borne by each Note, the Form of Notice of Conversion, the Form of Fundamental Change Repurchase Notice and the Form of Assignment and Transfer to be borne by the Notes are to be substantially in the forms hereinafter provided; and

WHEREAS, all acts and things necessary to make the Notes, when executed by the Company and authenticated and delivered by the Trustee or a duly authorized authenticating agent, as in this Indenture provided, the valid, binding and legal obligations of the Company, and this Indenture a valid agreement according to its terms, have been done and performed, and the execution of this Indenture and the issuance hereunder of the Notes have in all respects been duly authorized.

NOW, THEREFORE, THIS INDENTURE WITNESSETH:

That in order to declare the terms and conditions upon which the Notes are, and are to be, authenticated, issued and delivered, and in consideration of the premises and of the purchase and acceptance of the Notes by the Holders thereof, the Company covenants and agrees with the Trustee for the equal and proportionate benefit of the respective Holders from time to time of the Notes (except as otherwise provided below), as follows:

Article 1DEFINITIONS

Section 1.01. Definitions. The terms defined in this Section 1.01 (except as herein otherwise expressly provided or unless the context otherwise requires) for all purposes of this Indenture and of any indenture supplemental hereto shall have the respective meanings specified in this Section 1.01. The words “herein,” “hereof,” “hereunder,” and words of similar import refer to this Indenture as a whole and not to any particular Article, Section or other subdivision. The terms defined in this Article include the plural as well as the singular.

“Additional Interest” means all amounts, if any, payable pursuant to Section 6.03.

“Additional Shares” shall have the meaning specified in Section 14.03(a).

“Affiliate” of any specified Person means any other Person directly or indirectly controlling or controlled by or under direct or indirect common control with such specified Person. For the purposes of this definition, “control,” when used with respect to any specified Person means the power to direct or cause the direction of the management and policies of such Person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise; and the terms “controlling” and “controlled” have meanings correlative to the foregoing. Notwithstanding anything to the contrary herein, the determination of whether one Person is an “Affiliate” of another Person for purposes of this Indenture shall be made based on the facts at the time such determination is made or required to be made, as the case may be, hereunder.

“Bid Solicitation Agent” means the Company or the Person appointed by the Company to solicit bids for the Trading Price of the Notes in accordance with Section 14.01(b)(i). The Company shall initially act as the Bid Solicitation Agent.

“Board of Directors” means the board of directors of the Company or a committee of such board duly authorized to act for it hereunder.

“Board Resolution” means a copy of a resolution certified by the Secretary or an Assistant Secretary of the Company to have been duly adopted by the Board of Directors, and to be in full force and effect on the date of such certification, and delivered to the Trustee.

“Business Day” means, with respect to any Note, any day other than a Saturday, a Sunday or a day on which the Federal Reserve Bank of New York is authorized or required by law or executive order to close or be closed.

“Capital Stock” means, for any entity, any and all shares, interests, rights to purchase, warrants, options, participations or other equivalents of or interests in (however designated) stock issued by that entity.

“Cash Settlement” shall have the meaning specified in Section 14.02(a).

“Clause A Distribution” shall have the meaning specified in Section 14.04(c).

“Clause B Distribution” shall have the meaning specified in Section 14.04(c).

“Clause C Distribution” shall have the meaning specified in Section 14.04(c).

“close of business” means 5:00 p.m. (New York City time).

“Combination Settlement” shall have the meaning specified in Section 14.02(a).

“Commission” means the U.S. Securities and Exchange Commission.

“Common Equity” of any Person means Capital Stock of such Person that is generally entitled (a) to vote in the election of directors of such Person or (b) if such Person is not a

corporation, to vote or otherwise participate in the selection of the governing body, partners, managers or others that will control the management or policies of such Person.

“Common Stock” means the common stock of the Company, par value $0.001 per share, at the date of this Indenture, subject to Section 14.07.

“Company” shall have the meaning specified in the first paragraph of this Indenture, and subject to the provisions of Article 11, shall include its successors and assigns.

“Company Order” means a written order of the Company, signed by the Company’s Chief Executive Officer, Chief Financial Officer, any President or Vice President (whether or not designated by a number or numbers or word or words added before or after the title “President” or “Vice President”) or the Company’s Treasurer, and delivered to the Trustee.

“Conversion Agent” shall have the meaning specified in Section 4.02.

“Conversion Consideration” shall have the meaning specified in Section 14.12(a).

“Conversion Date” shall have the meaning specified in Section 14.02(c).

“Conversion Obligation” shall have the meaning specified in Section 14.01(a).

“Conversion Price” means as of any time, $1,000, divided by the Conversion Rate as of such time.

“Conversion Rate” shall have the meaning specified in Section 14.01(a).

“Corporate Trust Office” means the designated office of the Trustee at which at any time this Indenture shall be administered, which office at the date hereof is located at 1420 Fifth Ave, Seattle, WA 98101, Attention: R. Krupske (NeoGenomics, Inc.) or such other address as the Trustee may designate from time to time by notice to the Holders and the Company, or the designated corporate trust office of any successor trustee (or such other address as such successor trustee may designate from time to time by notice to the Holders and the Company).

“Custodian” means the Trustee, as custodian for The Depository Trust Company, with respect to the Global Notes, or any successor entity thereto.

“Daily Conversion Value” means, for each of the 30 consecutive Trading Days during the relevant Observation Period, one-thirtieth (1/30) of the product of (a) the Conversion Rate on such Trading Day and (b) the Daily VWAP on such Trading Day.

“Daily Measurement Value” means the Specified Dollar Amount (if any), divided by 30.

“Daily Settlement Amount,” for each of the 30 consecutive Trading Days during the relevant Observation Period, shall consist of:

(a) cash in an amount equal to the lesser of (i) the Daily Measurement Value and (ii) the Daily Conversion Value on such Trading Day; and

(b) if the Daily Conversion Value on such Trading Day exceeds the Daily Measurement Value, a number of shares of Common Stock equal to (i) the difference between the Daily Conversion Value and the Daily Measurement Value, divided by (ii) the Daily VWAP for such Trading Day.

“Daily VWAP” means the per share volume-weighted average price as displayed under the heading “Bloomberg VWAP” on Bloomberg page “NEO <equity> AQR” (or its equivalent successor if such page is not available) in respect of the period from the scheduled open of trading until the scheduled close of trading of the primary trading session on such Trading Day (or if such volume-weighted average price is unavailable, the market value of one share of the Common Stock on such Trading Day determined, using a volume-weighted average method, by a nationally recognized independent investment banking firm retained for this purpose by the Company). The “Daily VWAP” shall be determined without regard to after-hours trading or any other trading outside of the regular trading session trading hours.

“Default” means any event that is, or after notice or passage of time, or both, would be, an Event of Default.

“Defaulted Amounts” means any amounts on any Note (including, without limitation, the Redemption Price, the Fundamental Change Repurchase Price, principal and interest) that are payable but are not punctually paid or duly provided for.

“Default Settlement Method” means, initially, Combination Settlement with a Specified Dollar Amount of $1,000 per $1,000 principal amount of Notes; provided that the Company may, from time to time prior to September 15, 2027, change the Default Settlement Method by sending notice of the new Default Settlement Method to the Holders, the Trustee and the Conversion Agent (if other than the Trustee), all in accordance with, and subject to, the last paragraph of Section 14.02(a)(iii).

“delivered” with respect to any notice to be delivered, given or mailed to a Holder pursuant to this Indenture, shall mean notice (x) given to the Depositary (or its designee) pursuant to the standing instructions from the Depositary or its designee, including by electronic mail in accordance with accepted practices or procedures at the Depositary (in the case of a Global Note) or (y) mailed to such Holder by first class mail, postage prepaid, at its address as it appears on the Note Register, in each case in accordance with Section 17.03. Notice so “delivered” shall be deemed to include any notice to be “mailed” or “given,” as applicable, under this Indenture.

“Depositary” means, with respect to each Global Note, the Person specified in Section 2.05(c) as the Depositary with respect to such Notes, until a successor shall have been appointed and become such pursuant to the applicable provisions of this Indenture, and thereafter, “Depositary” shall mean or include such successor.

“Designated Institution” shall have the meaning specified in Section 14.12(a).

“Distributed Property” shall have the meaning specified in Section 14.04(c).

“Effective Date” shall have the meaning specified in Section 14.03(c), except that, as used in Section 14.04 and Section 14.05, “Effective Date” means the first date on which shares of the Common Stock trade on the applicable exchange or in the applicable market, regular way, reflecting the relevant share split or share combination, as applicable.

“Event of Default” shall have the meaning specified in Section 6.01.

“Ex-Dividend Date” means the first date on which shares of the Common Stock trade on the applicable exchange or in the applicable market, regular way, without the right to receive the issuance, dividend or distribution in question, from the Company or, if applicable, from the seller of the Common Stock on such exchange or market (in the form of due bills or otherwise) as determined by such exchange or market.

“Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“Exchange Election” shall have the meaning specified in Section 14.12(a).

“Form of Assignment and Transfer” shall mean the “Form of Assignment and Transfer” attached as Attachment 3 to the Form of Note attached hereto as Exhibit A.

“Form of Fundamental Change Repurchase Notice” shall mean the “Form of Fundamental Change Repurchase Notice” attached as Attachment 2 to the Form of Note attached hereto as Exhibit A.

“Form of Note” shall mean the “Form of Note” attached hereto as Exhibit A.

“Form of Notice of Conversion” shall mean the “Form of Notice of Conversion” attached as Attachment 1 to the Form of Note attached hereto as Exhibit A.

“Fundamental Change” shall be deemed to have occurred at the time after the Notes are originally issued if any of the following occurs prior to the Maturity Date:

(a) a “person” or “group” within the meaning of Section 13(d) of the Exchange Act, other than the Company, its Wholly Owned Subsidiaries and the employee benefit plans of the Company and its Wholly Owned Subsidiaries, files a Schedule TO or any schedule, form or report under the Exchange Act disclosing that such person or group has become the direct or indirect “beneficial owner,” as defined in Rule 13d-3 under the Exchange Act, of the Common Stock representing more than 50% of the voting power of the Common Stock;

(b) the consummation of (A) any recapitalization, reclassification or change of the Common Stock (other than changes resulting from a subdivision or combination) as a

result of which the Common Stock would be converted into, or exchanged for, stock, other securities, other property or assets; (B) any share exchange, consolidation or merger of the Company pursuant to which the Common Stock will be converted into cash, securities or other property or assets; or (C) any sale, lease or other transfer in one transaction or a series of transactions of all or substantially all of the consolidated assets of the Company and its Subsidiaries, taken as a whole, to any Person other than one of the Company’s Wholly Owned Subsidiaries; provided, however, that a transaction described in clause (B) in which the holders of all classes of the Company’s Common Equity immediately prior to such transaction own, directly or indirectly, more than 50% of all classes of Common Equity of the continuing or surviving corporation or transferee or the parent thereof immediately after such transaction in substantially the same proportions (relative to each other) as such ownership immediately prior to such transaction shall not be a Fundamental Change pursuant to this clause (b);

(c) the stockholders of the Company approve any plan or proposal for the liquidation or dissolution of the Company; or

(d) the Common Stock ceases to be listed or quoted on any of The Nasdaq Capital Market, The Nasdaq Global Select Market, The Nasdaq Global Market or The New York Stock Exchange (or any of their respective successors);

provided, however, that a transaction or transactions described in clause (a) or (b) above shall not constitute a Fundamental Change if at least 90% of the consideration received or to be received by the common stockholders of the Company, excluding cash payments for fractional shares and cash payments made in respect of dissenters’ statutory appraisal rights, in connection with such transaction or transactions consists of shares of common stock that are listed or quoted on any of The Nasdaq Capital Market, The Nasdaq Global Select Market, The Nasdaq Global Market or The New York Stock Exchange (or any of their respective successors) or will be so listed or quoted when issued or exchanged in connection with such transaction or transactions and as a result of such transaction or transactions the Notes become convertible into such consideration, excluding cash payments for fractional shares and cash payments made in respect of dissenters’ statutory appraisal rights (subject to the provisions of Section 14.07). If any transaction in which the Common Stock is replaced by the securities of another entity occurs, following completion of any related Make-Whole Fundamental Change Period (or, in the case of a transaction that would have been a Fundamental Change or a Make-Whole Fundamental Change but for the proviso in the immediately preceding paragraph, following the effective date of such transaction) references to the Company in this definition shall instead be references to such other entity.

For purposes of this definition of “Fundamental Change,” any transaction that constitutes a Fundamental Change pursuant to both clause (a) and clause (b) (excluding the proviso to such clause (b)) of such definition shall be deemed a Fundamental Change solely under clause (b) of such definition (subject to such proviso).

“Fundamental Change Company Notice” shall have the meaning specified in Section 15.02(c).

“Fundamental Change Repurchase Date” shall have the meaning specified in Section 15.02(a).

“Fundamental Change Repurchase Notice” shall have the meaning specified in Section 15.02(b)(i).

“Fundamental Change Repurchase Price” shall have the meaning specified in Section 15.02(a).

“Global Note” shall have the meaning specified in Section 2.05(b).

“Holder,” as applied to any Note, or other similar terms, shall mean any Person in whose name at the time a particular Note is registered on the Note Register.

“Indenture” means this instrument as originally executed or, if amended or supplemented as herein provided, as so amended or supplemented.

“Interest Payment Date” means each January 15 and July 15 of each year, beginning on July 15, 2021.

“Last Reported Sale Price” of the Common Stock on any date means the closing sale price per share (or if no closing sale price is reported, the average of the bid and ask prices or, if more than one in either case, the average of the average bid and the average ask prices) on that date as reported in composite transactions for the principal U.S. national or regional securities exchange on which the Common Stock is traded. If the Common Stock is not listed for trading on a U.S. national or regional securities exchange on the relevant date, the “Last Reported Sale Price” shall be the last quoted bid price for the Common Stock in the over-the-counter market on the relevant date as reported by OTC Markets Group Inc. or a similar organization. If the Common Stock is not so quoted, the “Last Reported Sale Price” shall be the average of the mid-point of the last bid and ask prices for the Common Stock on the relevant date from each of at least three nationally recognized independent investment banking firms selected by the Company for this purpose. The “Last Reported Sale Price” shall be determined without regard to after-hours trading or any other trading outside of regular trading session hours.

“Make-Whole Fundamental Change” means any transaction or event that constitutes a Fundamental Change (as defined above and determined after giving effect to any exceptions to or exclusions from such definition, but without regard to the proviso in clause (b) of the definition thereof).

“Make-Whole Fundamental Change Period” shall have the meaning specified in Section 14.03(a).

“Market Disruption Event” means, for the purposes of determining amounts due upon conversion (a) a failure by the primary U.S. national or regional securities exchange or market on which the Common Stock is listed or admitted for trading to open for trading during its regular trading session or (b) the occurrence or existence prior to 1:00 p.m., New York City time, on any

Scheduled Trading Day for the Common Stock for more than one half-hour period in the aggregate during regular trading hours of any suspension or limitation imposed on trading (by reason of movements in price exceeding limits permitted by the relevant stock exchange or otherwise) in the Common Stock or in any options contracts or futures contracts traded on any U.S. exchange relating to the Common Stock.

“Maturity Date” means January 15, 2028.

“Measurement Period” shall have the meaning specified in Section 14.01(b)(i).

“Merger Event” shall have the meaning specified in Section 14.07(a).

“Note” or “Notes” shall have the meaning specified in the first paragraph of the recitals of this Indenture.

“Note Register” shall have the meaning specified in Section 2.05(a).

“Note Registrar” shall have the meaning specified in Section 2.05(a).

“Notice of Conversion” shall have the meaning specified in Section 14.02(b).

“Observation Period” with respect to any Note surrendered for conversion means: (i) subject to clause (ii), if the relevant Conversion Date occurs prior to September 15, 2027, the 30 consecutive Trading Day period beginning on, and including, the second Trading Day immediately succeeding such Conversion Date; (ii) subject to clause (iii), if the relevant Conversion Date occurs during a Redemption Period pursuant to Section 16.02, the 30 consecutive Trading Days beginning on, and including, the 31st Scheduled Trading Day immediately preceding the relevant Redemption Date; and (iii) if the relevant Conversion Date occurs on or after September 15, 2027, the 30 consecutive Trading Days beginning on, and including, the 31st Scheduled Trading Day immediately preceding the Maturity Date.

“Officer” means, with respect to the Company, the Chief Executive Officer, the Chief Financial Officer, the Chief Accounting Officer, the Treasurer, the Secretary, or any President or Vice President (whether or not designated by a number or numbers or word or words added before or after the title “President” or “Vice President”).

“Officer’s Certificate,” when used with respect to the Company, means a certificate that is delivered to the Trustee and that is signed by an Officer of the Company. Each such certificate shall include the statements provided for in Section 17.05 if and to the extent required by the provisions of such Section. The Officer giving an Officer’s Certificate pursuant to Section 4.08 shall be the principal executive, financial or accounting officer of the Company.

“open of business” means 9:00 a.m. (New York City time).

“Opinion of Counsel” means an opinion in writing signed by legal counsel, who may be an employee of or counsel to the Company, or other counsel who is reasonably acceptable to the Trustee, that is delivered to the Trustee, which opinion may contain customary exceptions and

qualifications as to the matters set forth therein. Each such opinion shall include the statements provided for in Section 17.05 if and to the extent required by the provisions of such Section 17.05.

“Optional Redemption” shall have the meaning specified in Section 16.01.

“outstanding,” when used with reference to Notes, shall, subject to the provisions of Section 8.04, mean, as of any particular time, all Notes authenticated and delivered by the Trustee under this Indenture, except:

(a) Notes theretofore canceled by the Trustee or accepted by the Trustee for cancellation;

(b) Notes, or portions thereof, that have become due and payable and in respect of which monies in the necessary amount shall have been deposited in trust with the Trustee or with any Paying Agent (other than the Company) or shall have been set aside and segregated in trust by the Company (if the Company shall act as its own Paying Agent);

(c) Notes that have been paid pursuant to Section 2.06 or Notes in lieu of which, or in substitution for which, other Notes shall have been authenticated and delivered pursuant to the terms of Section 2.06 unless proof satisfactory to the Trustee is presented that any such Notes are held by protected purchasers in due course;

(d) Notes converted pursuant to Article 14 and required to be canceled pursuant to Section 2.08;

(e) Notes redeemed pursuant to Article 16; and

(f) Notes repurchased by the Company pursuant to the penultimate sentence of Section 2.10 and delivered to the Trustee for cancellation in accordance with the ultimate sentence of such Section 2.10.

“Paying Agent” shall have the meaning specified in Section 4.02.

“Person” means an individual, a corporation, a limited liability company, an association, a partnership, a joint venture, a joint stock company, a trust, an unincorporated organization or a government or an agency or a political subdivision thereof.

“Physical Notes” means permanent certificated Notes in registered form issued in minimum denominations of $1,000 principal amount and multiples in excess thereof.

“Physical Settlement” shall have the meaning specified in Section 14.02(a).

“Predecessor Note” of any particular Note means every previous Note evidencing all or a portion of the same debt as that evidenced by such particular Note; and, for the purposes of this definition, any Note authenticated and delivered under Section 2.06 in lieu of or in exchange for

a mutilated, lost, destroyed or stolen Note shall be deemed to evidence the same debt as the mutilated, lost, destroyed or stolen Note that it replaces.

“Prospectus” means the preliminary prospectus dated January 5, 2021, as supplemented by the related pricing term sheet dated January 6, 2021, relating to the offering and sale of the Notes.

“Record Date” means, with respect to any dividend, distribution or other transaction or event in which the holders of Common Stock (or other applicable security) have the right to receive any cash, securities or other property or in which the Common Stock (or such other security) is exchanged for or converted into any combination of cash, securities or other property, the date fixed for determination of holders of the Common Stock (or such other security) entitled to receive such cash, securities or other property (whether such date is fixed by the Company, by statute, by contract or otherwise).

“Redemption Date” shall have the meaning specified in Section 16.02(a).

“Redemption Notice” shall have the meaning specified in Section 16.02(a).

“Redemption Notice Date” means the date on which a Redemption Notice is delivered pursuant to Section 16.02.

“Redemption Period” means the period from, and including, the relevant Redemption Notice Date until the close of business on the Scheduled Trading Day immediately preceding the related Redemption Date (or, if the Company defaults in the payment of the Redemption Price, such later date on which the Redemption Price has been paid or duly provided for).

“Redemption Price” means, for any Notes to be redeemed pursuant to Section 16.01, 100% of the principal amount of such Notes, plus accrued and unpaid interest, if any, to, but excluding, the Redemption Date (unless the Redemption Date falls after a Regular Record Date but on or prior to the immediately succeeding Interest Payment Date, in which case interest accrued to the Interest Payment Date will be paid to Holders of record of such Notes on such Regular Record Date, and the Redemption Price will be equal to 100% of the principal amount of such Notes).

“Reference Property” shall have the meaning specified in Section 14.07(a).

“Regular Record Date,” with respect to any Interest Payment Date, shall mean the January 1 or July 1 (whether or not such day is a Business Day) immediately preceding the applicable January 15 or July 15 Interest Payment Date, respectively.

“Reporting Obligations” shall have the meaning specified in Section 6.03.

“Responsible Officer” means, when used with respect to the Trustee, any officer within the corporate trust department of the Trustee, including any vice president, assistant vice president, assistant secretary, assistant treasurer, trust officer or any other officer of the Trustee who customarily performs functions similar to those performed by the Persons who at the time

shall be such officers, respectively, or to whom any corporate trust matter relating to this Indenture is referred because of such person’s knowledge of and familiarity with the particular subject and who, in each case, shall have direct responsibility for the administration of this Indenture.

“Scheduled Trading Day” means a day that is scheduled to be a Trading Day on the principal U.S. national or regional securities exchange or market on which the Common Stock is listed or admitted for trading. If the Common Stock is not so listed or admitted for trading, “Scheduled Trading Day” means a Business Day.

“Securities Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Settlement Amount” has the meaning specified in Section 14.02(a)(iv).

“Settlement Method Election Deadline” has the meaning specified in Section 14.02(a)(iii).

“Settlement Method” means, with respect to any conversion of Notes, Physical Settlement, Cash Settlement or Combination Settlement, as elected (or deemed to have been elected) by the Company.

“Settlement Notice” has the meaning specified in Section 14.02(a)(iii).

“Significant Subsidiary” for purposes of Section 6.01(g)-(i), means a Subsidiary of the Company that meets the definition of “significant subsidiary” in Article 1, Rule 1-02 of Regulation S-X promulgated by the Commission (or any successor rule).

“Specified Dollar Amount” means the maximum cash amount per $1,000 principal amount of Notes to be received upon conversion as specified in the Settlement Notice related to any converted Notes (or deemed specified pursuant to Section 14.02(a)).

“Spin-Off” shall have the meaning specified in Section 14.04(c).

“Stock Price” shall have the meaning specified in Section 14.03(c).

“Subsidiary” means, with respect to any Person, any corporation, association, partnership or other business entity of which more than 50% of the total voting power of shares of Capital Stock or other interests (including partnership interests) entitled (without regard to the occurrence of any contingency) to vote in the election of directors, managers, general partners or trustees thereof is at the time owned or controlled, directly or indirectly, by (i) such Person; (ii) such Person and one or more Subsidiaries of such Person; or (iii) one or more Subsidiaries of such Person.

“Successor Company” shall have the meaning specified in Section 11.01(a).

“Trading Day” means, except for determining amounts due upon conversion as set forth below, a day on which (i) trading in the Common Stock (or other security for which a closing sale price must be determined) generally occurs on The Nasdaq Capital Market or, if the Common Stock (or such other security) is not then listed on The Nasdaq Capital Market, on the principal other U.S. national or regional securities exchange on which the Common Stock (or such other security) is then listed or, if the Common Stock (or such other security) is not then listed on a U.S. national or regional securities exchange, on the principal other market on which the Common Stock (or such other security) is then traded and (ii) a Last Reported Sale Price for the Common Stock (or closing sale price for such other security) is available on such securities exchange or market; provided that if the Common Stock (or such other security) is not so listed or traded, “Trading Day” means a Business Day; and provided, further, that for purposes of determining amounts due upon conversion only, “Trading Day” means a day on which (x) there is no Market Disruption Event and (y) trading in the Common Stock generally occurs on The Nasdaq Capital Market or, if the Common Stock is not then listed on The Nasdaq Capital Market, on the principal other U.S. national or regional securities exchange on which the Common Stock is then listed or, if the Common Stock is not then listed on a U.S. national or regional securities exchange, on the principal other market on which the Common Stock is then listed or admitted for trading, except that if the Common Stock is not so listed or admitted for trading, “Trading Day” means a Business Day.

“Trading Price” of the Notes on any date of determination means the average of the secondary market bid quotations obtained by the Bid Solicitation Agent for $2,000,000 principal amount of Notes at approximately 3:30 p.m., New York City time, on such determination date from three independent nationally recognized securities dealers the Company selects for this purpose; provided that if three such bids cannot reasonably be obtained by the Bid Solicitation Agent but two such bids are obtained, then the average of the two bids shall be used, and if only one such bid can reasonably be obtained by the Bid Solicitation Agent, that one bid shall be used. If the Bid Solicitation Agent cannot reasonably obtain at least one bid for $2,000,000 principal amount of Notes from a nationally recognized securities dealer on any determination date, then the Trading Price per $1,000 principal amount of Notes on such determination date shall be deemed to be less than 98% of the product of the Last Reported Sale Price of the Common Stock and the Conversion Rate.

“transfer” shall have the meaning specified in Section 2.05(c).

“Trigger Event” shall have the meaning specified in Section 14.04(c).

“Trust Indenture Act” means the Trust Indenture Act of 1939, as amended, as it was in force at the date of execution of this Indenture; provided, however, that in the event the Trust Indenture Act of 1939 is amended after the date hereof, the term “Trust Indenture Act” shall mean, to the extent required by such amendment, the Trust Indenture Act of 1939, as so amended.

“Trustee” means the Person named as the “Trustee” in the first paragraph of this Indenture until a successor trustee shall have become such pursuant to the applicable provisions

of this Indenture, and thereafter “Trustee” shall mean or include each Person who is then a Trustee hereunder.

“Underwriters” means the several underwriters named in Schedule A to the Underwriting Agreement.

“Underwriting Agreement” means the underwriting agreement dated as of January 6, 2021 between the Company and BofA Securities, Inc., Morgan Stanley & Co. LLC and Goldman Sachs & Co. LLC, as representatives of the several Underwriters.

“unit of Reference Property” shall have the meaning specified in Section 14.07(a).

“Valuation Period” shall have the meaning specified in Section 14.04(c).

“Wholly Owned Subsidiary” means, with respect to any Person, any Subsidiary of such Person, except that, solely for purposes of this definition, the reference to “more than 50%” in the definition of “Subsidiary” shall be deemed replaced by a reference to “100%”.

Section 1.02. References to Interest. Unless the context otherwise requires, any reference to interest on, or in respect of, any Note in this Indenture shall be deemed to include Additional Interest if, in such context, Additional Interest is, was or would be payable pursuant to Section 6.03. Unless the context otherwise requires, any express mention of Additional Interest in any provision hereof shall not be construed as excluding Additional Interest in those provisions hereof where such express mention is not made.

Section 1.03. Incorporation by Reference of Trust Indenture Act. Each provision of the Trust Indenture Act that is required to be part of this Indenture by virtue of its qualification under the Trust Indenture Act is incorporated by reference in and made a part of this Indenture. All terms used in this Indenture that are defined by the Trust Indenture Act, defined by Trust Indenture Act reference to another statute or defined by Commission rule under the Trust Indenture Act and not otherwise defined herein are used herein as so defined. None of the provisions of this Indenture to be qualified were inserted pursuant to Sections 310 through 318(a) of the Trust Indenture Act since those provisions have not required such insertion since the effective date of the Trust Indenture Reform Act of 1990.

Section 1.04. Conflicts with the Trust Indenture Act. If any provision hereof limits, qualifies or conflicts with another provision hereof that is required to be included in this Indenture by any of the provisions of the Trust Indenture Act, such required provision shall control. If any provision hereof limits, qualifies or conflicts with the duties imposed by section 318(c) of the Trust Indenture Act, such imposed duties shall control. If any provision hereof limits, qualifies or conflicts with a provision of the Trust Indenture Act that is required under the Trust Indenture Act to be a part of and govern this Indenture, such provision of the Trust Indenture Act shall control. If any provision hereof modifies or excludes any provision of the Trust Indenture Act that may be so modified or excluded, the latter provision shall be deemed to apply to this Indenture as such provision of the Trust Indenture Act is so modified or excluded, as the case may be.

ARTICLE 2 ISSUE, DESCRIPTION, EXECUTION, REGISTRATION AND EXCHANGE OF NOTES

Section 2.01. Designation and Amount. The Notes shall be designated as the “0.25% Convertible Senior Notes due 2028.” The aggregate principal amount of Notes that may be authenticated and delivered under this Indenture is initially limited to $300,000,000 (or $345,000,000 if the Underwriters exercise their over-allotment option in accordance with the Underwriting Agreement in full), subject to Section 2.10 and except for Notes authenticated and delivered upon registration or transfer of, or in exchange for, or in lieu of other Notes to the extent permitted hereunder.

Section 2.02. Form of Notes. The Notes and the Trustee’s certificate of authentication to be borne by such Notes shall be substantially in the respective forms set forth in Exhibit A, the terms and provisions of which shall constitute, and are hereby expressly incorporated in and made a part of this Indenture. To the extent applicable, the Company and the Trustee, by their execution and delivery of this Indenture, expressly agree to such terms and provisions and to be bound thereby. In the case of any conflict between this Indenture and a Note, the provisions of this Indenture shall control and govern to the extent of such conflict.

Any Global Note may be endorsed with or have incorporated in the text thereof such legends or recitals or changes not inconsistent with the provisions of this Indenture as may be required by the Custodian or the Depositary, or as may be required to comply with any applicable law or any regulation thereunder or with the rules and regulations of any securities exchange or automated quotation system upon which the Notes may be listed or traded or designated for issuance or to conform with any usage with respect thereto, or to indicate any special limitations or restrictions to which any particular Notes are subject.

Any of the Notes may have such letters, numbers or other marks of identification and such notations, legends or endorsements as the Officer executing the same may approve (execution thereof to be conclusive evidence of such approval) and as are not inconsistent with the provisions of this Indenture, or as may be required to comply with any law or with any rule or regulation made pursuant thereto or with any rule or regulation of any securities exchange or automated quotation system on which the Notes may be listed or designated for issuance, or to conform to usage or to indicate any special limitations or restrictions to which any particular Notes are subject.

Each Global Note shall represent such principal amount of the outstanding Notes as shall be specified therein and shall provide that it shall represent the aggregate principal amount of outstanding Notes from time to time endorsed thereon and that the aggregate principal amount of outstanding Notes represented thereby may from time to time be increased or reduced to reflect redemptions, repurchases, cancellations, conversions, transfers or exchanges permitted hereby. Any endorsement of a Global Note to reflect the amount of any increase or decrease in the amount of outstanding Notes represented thereby shall be made by the Trustee or the Custodian, at the direction of the Trustee, in such manner and upon instructions given by the Holder of such Notes in accordance with this Indenture. Payment of principal (including the Redemption Price and the Fundamental Change Repurchase Price, if applicable) of, and accrued and unpaid interest

on, a Global Note shall be made to the Holder of such Note on the date of payment, unless a record date or other means of determining Holders eligible to receive payment is provided for herein.

Section 2.03. Date and Denomination of Notes; Payments of Interest and Defaulted Amounts. (a) The Notes shall be issuable in registered form without coupons in minimum denominations of $1,000 principal amount and multiples in excess thereof. Each Note shall be dated the date of its authentication and shall bear interest from the date specified on the face of such Note. Accrued interest on the Notes shall be computed on the basis of a 360-day year composed of twelve 30-day months and, for partial months, on the basis of the number of days actually elapsed in a 30-day month.

(b) The Person in whose name any Note (or its Predecessor Note) is registered on the Note Register at the close of business on any Regular Record Date with respect to any Interest Payment Date shall be entitled to receive the interest payable on such Interest Payment Date. The principal amount of any Note (x) in the case of any Physical Note, shall be payable at the office or agency of the Company designated by the Company for such purposes in the contiguous United States of America, which shall initially be the Corporate Trust Office and (y) in the case of any Global Note, shall be payable by wire transfer of immediately available funds to the account of the Depositary or its nominee. The Company shall pay (or cause the Paying Agent to pay to the extent funded by the Company) interest (i) on any Physical Notes (A) to Holders holding Physical Notes having an aggregate principal amount of $5,000,000 or less, by check mailed to the Holders of these Notes at their address as it appears in the Note Register and (A) to Holders holding Physical Notes having an aggregate principal amount of more than $5,000,000, either by check mailed to each such Holder or, upon written application by such a Holder to the Note Registrar (containing the requisite information for the Trustee or Paying Agent to make such wire transfer) not later than the relevant Regular Record Date, by wire transfer in immediately available funds to that Holder’s account within the United States of America, which application shall remain in effect until the Holder notifies, in writing, the Note Registrar to the contrary or (A) on any Global Note by wire transfer of immediately available funds to the account of the Depositary or its nominee.

(c) Any Defaulted Amounts shall forthwith cease to be payable to the Holder on the relevant payment date but shall accrue interest per annum at the rate borne by the Notes from, and including, such relevant payment date, and such Defaulted Amounts together with such interest thereon shall be paid by the Company, at its election in each case, as provided in clause (i) or (ii) below:

(i) The Company may elect to make payment of any Defaulted Amounts to the Persons in whose names the Notes (or their respective Predecessor Notes) are registered at the close of business on a special record date for the payment of such Defaulted Amounts, which shall be fixed in the following manner. The Company shall notify the Trustee in writing of the amount of the Defaulted Amounts proposed to be paid on each Note and the date of the proposed payment (which shall be not less than 25 days after the receipt by the Trustee of such notice, unless the Trustee shall consent to an

earlier date), and at the same time the Company shall deposit with the Trustee an amount of money equal to the aggregate amount to be paid in respect of such Defaulted Amounts or shall make arrangements satisfactory to the Trustee for such deposit on or prior to the date of the proposed payment, such money when deposited to be held in trust for the benefit of the Persons entitled to such Defaulted Amounts as in this clause provided. Thereupon the Company shall fix a special record date for the payment of such Defaulted Amounts which shall be not more than 15 days and not less than 10 days prior to the date of the proposed payment, and not less than 10 days after the receipt by the Trustee of the notice of the proposed payment (provided, that the Trustee has received such notice at least two Business Days prior to the date such notice is to be sent (or such shorter period as shall be acceptable to the Trustee)). The Company shall promptly notify the Trustee in writing of such special record date and the Trustee, in the name and at the expense of the Company, shall cause notice of the proposed payment of such Defaulted Amounts and the special record date therefor to be delivered to each Holder at its address as it appears in the Note Register, or by electronic means to the Depositary in the case of Global Notes, not less than 10 days prior to such special record date. Notice of the proposed payment of such Defaulted Amounts and the special record date therefor having been so delivered, such Defaulted Amounts shall be paid to the Persons in whose names the Notes (or their respective Predecessor Notes) are registered at the close of business on such special record date and shall no longer be payable pursuant to the following clause (ii) of this Section 2.03(c). The Trustee shall have no responsibility whatsoever for the calculation of the Defaulted Amounts.

(ii) The Company may make payment of any Defaulted Amounts in any other lawful manner not inconsistent with the requirements of any securities exchange or automated quotation system on which the Notes may be listed or designated for issuance, and upon such notice as may be required by such exchange or automated quotation system, if, after written notice given by the Company to the Trustee of the proposed payment pursuant to this clause, such manner of payment shall be deemed practicable by the Trustee.

Section 2.04. Execution, Authentication and Delivery of Notes. The Notes shall be signed in the name and on behalf of the Company by the manual or facsimile or other electronic signature of any of its Chief Executive Officer, President, Chief Financial Officer, Treasurer, Secretary or any of its Executive or Senior Vice Presidents.

At any time and from time to time after the execution and delivery of this Indenture, the Company may deliver Notes executed by the Company to the Trustee for authentication, together with a Company Order for the authentication and delivery of such Notes, and the Trustee in accordance with such Company Order shall authenticate and deliver such Notes, without any further action by the Company hereunder; provided that the Trustee shall be entitled to receive an Officer’s Certificate and an Opinion of Counsel of the Company with respect to the issuance, authentication and delivery of such Notes.

Only such Notes as shall bear thereon a certificate of authentication substantially in the form set forth on the Form of Note attached as Exhibit A hereto, executed manually by an authorized signatory of the Trustee (or an authenticating agent appointed by the Trustee as provided by Section 17.10), shall be entitled to the benefits of this Indenture or be valid or obligatory for any purpose. Such certificate by the Trustee (or such an authenticating agent) upon any Note executed by the Company shall be conclusive evidence that the Note so authenticated has been duly authenticated and delivered hereunder and that the Holder is entitled to the benefits of this Indenture.

In case any Officer of the Company who shall have signed any of the Notes shall cease to be such Officer before the Notes so signed shall have been authenticated and delivered by the Trustee, or disposed of by the Company, such Notes nevertheless may be authenticated and delivered or disposed of as though the Person who signed such Notes had not ceased to be such Officer of the Company; and any Note may be signed on behalf of the Company by such persons as, at the actual date of the execution of such Note, shall be the Officers of the Company, although at the date of the execution of this Indenture any such Person was not such an Officer.

Section 2.05. Exchange and Registration of Transfer of Notes; Depositary. (a) The Company shall cause to be kept at the Corporate Trust Office a register (the register maintained in such office or in any other office or agency of the Company designated pursuant to Section 4.02, the “Note Register”) in which, subject to such reasonable regulations as it may prescribe, the Company shall provide for the registration of Notes and of transfers of Notes. Such register shall be in written form or in any form capable of being converted into written form within a reasonable period of time. The Trustee is hereby initially appointed the “Note Registrar” for the purpose of registering Notes and transfers of Notes as herein provided. The Company may appoint one or more co-Note Registrars in accordance with Section 4.02.

Upon surrender for registration of transfer of any Note to the Note Registrar or any co-Note Registrar, and satisfaction of the requirements for such transfer set forth in this Section 2.05, the Company shall execute, and the Trustee shall authenticate and deliver, in the name of the designated transferee or transferees, one or more new Notes of any authorized denominations and of a like aggregate principal amount and bearing such legends as may be required by this Indenture.

Notes may be exchanged for other Notes of any authorized denominations and of a like aggregate principal amount, upon surrender of the Notes to be exchanged at any such office or agency maintained by the Company pursuant to Section 4.02. Whenever any Notes are so surrendered for exchange, the Company shall execute, and the Trustee shall authenticate and deliver, the Notes that the Holder making the exchange is entitled to receive, bearing registration numbers not contemporaneously outstanding.

All Notes presented or surrendered for registration of transfer or for exchange, repurchase or conversion shall (if so required by the Company, the Trustee, the Note Registrar or any co-Note Registrar) be duly endorsed, or be accompanied by a written instrument or instruments of transfer in form satisfactory to the Company and duly executed, by the Holder thereof or its attorney-in-fact duly authorized in writing.

No service charge shall be imposed by the Company, the Trustee, the Note Registrar, any co-Note Registrar or the Paying Agent for any exchange or registration of transfer of Notes, but the Company may require a Holder to pay a sum sufficient to cover any documentary, stamp or similar issue or transfer tax or other similar governmental charge required in connection therewith as a result of the name of the Holder of new Notes issued upon such exchange or registration of transfer being different from the name of the Holder of the old Notes surrendered for exchange or registration of transfer or otherwise required by law.

None of the Company, the Trustee, the Note Registrar or any co-Note Registrar shall be required to exchange or register a transfer of (i) any Notes surrendered for conversion or, if a portion of any Note is surrendered for conversion, such portion thereof surrendered for conversion, (ii) any Notes, or a portion of any Note, surrendered for repurchase (and not withdrawn) in accordance with Article 15 or (iii) any Notes selected for redemption in accordance with Article 16, except the unredeemed portion of any Note being redeemed in part or (iv) any Notes between a Regular Record Date and corresponding Interest Payment Date.

All Notes issued upon any registration of transfer or exchange of Notes in accordance with this Indenture shall be the valid obligations of the Company, evidencing the same debt, and entitled to the same benefits under this Indenture as the Notes surrendered upon such registration of transfer or exchange.

(b) So long as the Notes are eligible for book-entry settlement with the Depositary, unless otherwise required by law, subject to the fourth paragraph from the end of Section 2.05(c) all Notes shall be represented by one or more Notes in global form (each, a “Global Note”) registered in the name of the Depositary or the nominee of the Depositary. The transfer and exchange of beneficial interests in a Global Note that does not involve the issuance of a Physical Note shall be effected through the Depositary (but not the Trustee or the Custodian) in accordance with this Indenture and the procedures of the Depositary therefor.

(c) Notwithstanding any other provisions of this Indenture (other than the provisions set forth in this Section 2.05(c)), a Global Note may not be transferred as a whole or in part except (i) by the Depositary to a nominee of the Depositary or by a nominee of the Depositary to the Depositary or another nominee of the Depositary or by the Depositary or any such nominee to a successor Depositary or a nominee of such successor Depositary and (ii) for exchange of a Global Note or a portion thereof for one or more Physical Notes in accordance with the second immediately succeeding paragraph.

The Depositary shall be a clearing agency registered under the Exchange Act. The Company initially appoints The Depository Trust Company to act as Depositary with respect to each Global Note. Initially, each Global Note shall be issued to the Depositary, registered in the name of Cede & Co., as the nominee of the Depositary, and deposited with the Trustee as custodian for Cede & Co.

If (i) the Depositary notifies the Company at any time that the Depositary is unwilling or unable to continue as depositary for the Global Notes and a successor depositary is not appointed within 90 days, (ii) the Depositary ceases to be registered as a clearing agency under the

Exchange Act and a successor depositary is not appointed within 90 days or (iii) an Event of Default with respect to the Notes has occurred and is continuing and, subject to the Depositary’s applicable procedures, a beneficial owner of any Note requests that its beneficial interest therein be issued as a Physical Note, the Company shall execute, and the Trustee, upon receipt of an Officer’s Certificate and a Company Order for the authentication and delivery of Notes, shall authenticate and deliver (x) in the case of clause (iii), a Physical Note to such beneficial owner in a principal amount equal to the principal amount of such Note corresponding to such beneficial owner’s beneficial interest and (y) in the case of clause (i) or (ii), Physical Notes to each beneficial owner of the related Global Notes (or a portion thereof) in an aggregate principal amount equal to the aggregate principal amount of such Global Notes in exchange for such Global Notes, and upon delivery of the Global Notes to the Trustee such Global Notes shall be canceled.

Physical Notes issued in exchange for all or a part of the Global Note pursuant to this Section 2.05(c) shall be registered in such names and in such authorized denominations as the Depositary, pursuant to instructions from its direct or indirect participants or otherwise, or, in the case of clause (iii) of the immediately preceding paragraph, the relevant beneficial owner, shall instruct the Trustee. Upon execution and authentication, the Trustee shall deliver such Physical Notes to the Persons in whose names such Physical Notes are so registered.

At such time as all interests in a Global Note have been converted, canceled, redeemed, repurchased or transferred, such Global Note shall be, upon receipt thereof, canceled by the Trustee in accordance with standing procedures and existing instructions between the Depositary and the Custodian. At any time prior to such cancellation, if any interest in a Global Note is exchanged for Physical Notes, converted, canceled, redeemed, repurchased or transferred to a transferee who receives Physical Notes therefor or any Physical Note is exchanged or transferred for part of such Global Note, the principal amount of such Global Note shall, in accordance with the standing procedures and instructions existing between the Depositary and the Custodian, be appropriately reduced or increased, as the case may be, and an endorsement shall be made on such Global Note, by the Trustee or the Custodian, at the direction of the Trustee, to reflect such reduction or increase.

None of the Company, the Trustee, the Paying Agent, the Conversion Agent or any other agent of the Company or the Trustee shall have any responsibility or liability for the payment of amounts to owners of beneficial interest in a Global Note, for any aspect of the records relating to or payments made on account of those interests by the Depositary, or for maintaining, supervising or reviewing any records of the Depositary relating to such beneficial ownership those interests.

(d) Neither the Trustee nor any agent shall have any responsibility or liability for any actions taken or not taken by the Depositary.

Section 2.06. Mutilated, Destroyed, Lost or Stolen Notes. In case any Note shall become mutilated or be destroyed, lost or stolen, the Company in its discretion may execute, and upon its written request the Trustee or an authenticating agent appointed by the Trustee shall authenticate and deliver, a new Note, bearing a registration number not contemporaneously outstanding, in

exchange and substitution for the mutilated Note, or in lieu of and in substitution for the Note so destroyed, lost or stolen. In every case the applicant for a substituted Note shall furnish to the Company, to the Trustee and, if applicable, to such authenticating agent such security or indemnity as may be required by them to save each of them harmless from any loss, liability, cost or expense caused by or connected with such substitution, and, in every case of destruction, loss or theft, the applicant shall also furnish to the Company, to the Trustee and, if applicable, to such authenticating agent evidence to their satisfaction of the destruction, loss or theft of such Note and of the ownership thereof.

The Trustee or such authenticating agent may authenticate any such substituted Note and deliver the same upon the receipt of such security or indemnity as the Trustee, the Company and, if applicable, such authenticating agent may require. No service charge shall be imposed by the Company, the Trustee, the Note Registrar, any co-Note Registrar or the Paying Agent upon the issuance of any substitute Note, but the Company may require a Holder to pay a sum sufficient to cover any documentary, stamp or similar issue or transfer tax or other similar governmental charge required in connection therewith as a result of the name of the Holder of the new substitute Note being different from the name of the Holder of the old Note that became mutilated or was destroyed, lost or stolen. In case any Note that has matured or is about to mature or has been surrendered for required repurchase or is about to be converted in accordance with Article 14 shall become mutilated or be destroyed, lost or stolen, the Company may, in its sole discretion, instead of issuing a substitute Note, pay or authorize the payment of or convert or authorize the conversion of the same (without surrender thereof except in the case of a mutilated Note), as the case may be, if the applicant for such payment or conversion shall furnish to the Company, to the Trustee and, if applicable, to such authenticating agent such security or indemnity as may be required by them to save each of them harmless for any loss, liability, cost or expense caused by or connected with such substitution, and, in every case of destruction, loss or theft, evidence satisfactory to the Company, the Trustee and, if applicable, any Paying Agent or Conversion Agent of the destruction, loss or theft of such Note and of the ownership thereof.

Every substitute Note issued pursuant to the provisions of this Section 2.06 by virtue of the fact that any Note is destroyed, lost or stolen shall constitute an additional contractual obligation of the Company, whether or not the destroyed, lost or stolen Note shall be found at any time, and shall be entitled to all the benefits of (but shall be subject to all the limitations set forth in) this Indenture equally and proportionately with any and all other Notes duly issued hereunder. To the extent permitted by law, all Notes shall be held and owned upon the express condition that the foregoing provisions are exclusive with respect to the replacement, payment, conversion, redemption or repurchase of mutilated, destroyed, lost or stolen Notes and shall preclude any and all other rights or remedies notwithstanding any law or statute existing or hereafter enacted to the contrary with respect to the replacement, payment, conversion, redemption or repurchase of negotiable instruments or other securities without their surrender.

Section 2.07. Temporary Notes. Pending the preparation of Physical Notes, the Company may execute and the Trustee or an authenticating agent appointed by the Trustee shall, upon written request of the Company, authenticate and deliver temporary Notes (printed or lithographed). Temporary Notes shall be issuable in any authorized denomination, and

substantially in the form of the Physical Notes but with such omissions, insertions and variations as may be appropriate for temporary Notes, all as may be determined by the Company. Every such temporary Note shall be executed by the Company and authenticated by the Trustee or such authenticating agent upon the same conditions and in substantially the same manner, and with the same effect, as the Physical Notes. Without unreasonable delay, the Company shall execute and deliver to the Trustee or such authenticating agent Physical Notes (other than any Global Note) and thereupon any or all temporary Notes (other than any Global Note) may be surrendered in exchange therefor, at each office or agency maintained by the Company pursuant to Section 4.02 and the Trustee or such authenticating agent shall authenticate and deliver in exchange for such temporary Notes an equal aggregate principal amount of Physical Notes upon the written request of the Company. Such exchange shall be made by the Company at its own expense and without any charge therefor. Until so exchanged, the temporary Notes shall in all respects be entitled to the same benefits and subject to the same limitations under this Indenture as Physical Notes authenticated and delivered hereunder.

Section 2.08. Cancellation of Notes Paid, Converted, Etc. The Company shall cause all Notes surrendered for payment, redemption, repurchase, registration of transfer or exchange or conversion, if surrendered to any Person other than the Trustee (including any of the Company’s agents, Subsidiaries or Affiliates), to be delivered to the Trustee for cancellation. All Notes delivered to the Trustee shall be canceled promptly by it, and no Notes shall be authenticated in exchange therefor except as expressly permitted by any of the provisions of this Indenture. The Trustee shall dispose of canceled Notes in accordance with its customary procedures and, after such disposition, shall deliver a certificate of such disposition to the Company upon the Company’s written request in a Company Order.

Section 2.09. CUSIP Numbers. The Company in issuing the Notes may use “CUSIP” numbers (if then generally in use), and, if so, the Trustee shall use “CUSIP” numbers in all notices issued to Holders as a convenience to such Holders; provided that any such notice may state that no representation is made as to the correctness of such numbers either as printed on the Notes or on such notice and that reliance may be placed only on the other identification numbers printed on the Notes. The Company shall promptly notify the Trustee in writing of any change in the “CUSIP” numbers.

Section 2.10. Additional Notes; Repurchases. The Company may, without the consent of or notice to the Holders and notwithstanding Section 2.01, reopen this Indenture and issue additional Notes hereunder with the same terms as the Notes initially issued hereunder (other than differences in the issue date, the issue price, interest accrued prior to the issue date of such additional Notes and, if applicable, restrictions on transfer in respect of such additional Notes) in an unlimited aggregate principal amount; provided that if any such additional Notes are not fungible with the Notes initially issued hereunder for U.S. federal income tax purposes, such additional Notes shall have one or more separate CUSIP numbers. Any additional Notes will be treated as a single series for all purposes under this Indenture except as set forth in the first sentence of this Section 2.10. Prior to the issuance of any such additional Notes, the Company shall deliver to the Trustee a Company Order, an Officer’s Certificate and an Opinion of Counsel, such Officer’s Certificate and Opinion of Counsel to cover such matters required by

Section 17.05. In addition, the Company may, to the extent permitted by law, and directly or indirectly (regardless of whether such Notes are surrendered to the Company), repurchase Notes in the open market or otherwise, whether by the Company or its Subsidiaries or through a private or public tender or exchange offer or through counterparties to private agreements, including by cash-settled swaps or other derivatives, in each case, without prior written notice to Holders. The Company shall cause any Notes so repurchased (other than Notes repurchased pursuant to cash-settled swaps or other derivatives) to be surrendered to the Trustee for cancellation in accordance with Section 2.08 and such Notes shall no longer be considered outstanding under this Indenture upon their repurchase and cancellation and, upon receipt of a Company Order and an Officer’s Certificate, the Trustee shall cancel all Notes so surrendered.

ARTICLE 3 SATISFACTION AND DISCHARGE

Section 3.01. Satisfaction and Discharge. This Indenture shall upon request of the Company contained in an Officer’s Certificate cease to be of further effect, and the Trustee, at the expense of the Company, shall execute such instruments reasonably requested by the Company acknowledging satisfaction and discharge of this Indenture, when (A) (i) all Notes theretofore authenticated and delivered (other than (x) Notes which have been destroyed, lost or stolen and which have been replaced, paid or converted as provided in Section 2.06 and (y) Notes for whose payment money has theretofore been deposited in trust or segregated and held in trust by the Company and thereafter repaid to the Company or discharged from such trust, as provided in Section 4.04(d)) have been delivered to the Trustee for cancellation; or (ii) the Company has deposited with the Trustee or delivered to Holders, as applicable, after the Notes have become due and payable, whether on the Maturity Date, any Redemption Date, any Fundamental Change Repurchase Date, upon conversion or otherwise, cash or cash, shares of Common Stock or a combination thereof, as applicable, solely to satisfy the Conversion Obligation, sufficient, without consideration of reinvestment, to pay all of the outstanding Notes and all other sums due and payable under this Indenture by the Company; and (A) the Company has delivered to the Trustee an Officer’s Certificate and an Opinion of Counsel, each stating that all conditions precedent herein provided for relating to the satisfaction and discharge of this Indenture have been complied with. Notwithstanding the satisfaction and discharge of this Indenture, the obligations of the Company to the Trustee under Section 7.06 shall survive.

ARTICLE 4 PARTICULAR COVENANTS OF THE COMPANY

Section 4.01. Payment of Principal and Interest. The Company covenants and agrees that it will cause to be paid the principal (including the Redemption Price, the Fundamental Change Repurchase Price, if applicable) of, and accrued and unpaid interest on, each of the Notes at the places, at the respective times and in the manner provided herein and in the Notes.

Notwithstanding anything to the contrary contained in this Indenture, the Company may, to the extent it is required to do so by law, deduct or withhold income or other similar taxes imposed by the United States of America from principal, premium or interest (including any Additional Interest) payments hereunder

Section 4.02. Maintenance of Office or Agency. The Company will maintain in the contiguous United States of America an office or agency where the Notes may be presented for registration of transfer or exchange or for payment or repurchase (“Paying Agent”) or for conversion (“Conversion Agent”) and where notices and demands to or upon the Company in respect of the Notes and this Indenture may be served. The Company will give prompt written notice to the Trustee of the location, and any change in the location, of such office or agency. If at any time the Company shall fail to maintain any such required office or agency or shall fail to furnish the Trustee with the address thereof, such presentations, surrenders, notices and demands may be made or served at the Corporate Trust Office in the United States of America as a place where Notes may be presented for payment or for registration of transfer.

The Company may also from time to time designate as co-Note Registrars one or more other offices or agencies where the Notes may be presented or surrendered for any or all such purposes and may from time to time rescind such designations; provided that no such designation or rescission shall in any manner relieve the Company of its obligation to maintain an office or agency in the contiguous United States of America so designated by the Trustee as a place for such purposes. The Company will give prompt written notice to the Trustee of any such designation or rescission and of any change in the location of any such other office or agency. The terms “Paying Agent” and “Conversion Agent” include any such additional or other offices or agencies, as applicable.

The Company hereby initially designates the Trustee as the Paying Agent, Note Registrar, Custodian and Conversion Agent and the Corporate Trust Office as the office or agency in the contiguous United States of America where Notes may be presented for registration of transfer or exchange or for payment or repurchase or for conversion and where notices and demands to or upon the Company in respect of the Notes and this Indenture may be served; provided that no office of the Trustee shall be a place for service of legal process on the Company.

Section 4.03. Appointments to Fill Vacancies in Trustee’s Office. The Company, whenever necessary to avoid or fill a vacancy in the office of Trustee, will appoint, in the manner provided in Section 7.09, a Trustee, so that there shall at all times be a Trustee hereunder.

Section 4.04. Provisions as to Paying Agent. (A) If the Company shall appoint a Paying Agent other than the Trustee, the Company will cause such Paying Agent to execute and deliver to the Trustee an instrument in which such agent shall agree with the Trustee, subject to the provisions of this Section 4.04:

(i) that it will hold all sums held by it as such agent for the payment of the principal (including the Redemption Price, the Fundamental Change Repurchase Price, if applicable) of, and accrued and unpaid interest on, the Notes in trust for the benefit of the Holders of the Notes;

(ii) that it will give the Trustee prompt written notice of any failure by the Company to make any payment of the principal (including the Redemption Price, the

Fundamental Change Repurchase Price, if applicable) of, and accrued and unpaid interest on, the Notes when the same shall be due and payable; and

(iii) that at any time during the continuance of an Event of Default, upon request of the Trustee, it will forthwith pay to the Trustee all sums so held in trust.

The Company shall, on or before each due date of the principal (including the Redemption Price, the Fundamental Change Repurchase Price, if applicable) of, or accrued and unpaid interest on, the Notes, deposit with the Paying Agent a sum in immediately available U.S. Dollars sufficient to pay such principal (including the Redemption Price, the Fundamental Change Repurchase Price, if applicable) or accrued and unpaid interest, and (unless such Paying Agent is the Trustee) the Company will promptly notify the Trustee in writing of any failure to take such action; provided that if such deposit is made on the due date, such deposit must be received by the Paying Agent by 11:00 a.m., New York City time, on such date.

(b) If the Company shall act as its own Paying Agent, it will, on or before each due date of the principal (including the Redemption Price, the Fundamental Change Repurchase Price, if applicable) of, and accrued and unpaid interest on, the Notes, set aside, segregate and hold in trust for the benefit of the Holders of the Notes a sum sufficient to pay such principal (including the Redemption Price, the Fundamental Change Repurchase Price, if applicable) and accrued and unpaid interest so becoming due and will promptly notify the Trustee in writing of any failure to take such action and of any failure by the Company to make any payment of the principal (including the Redemption Price, the Fundamental Change Repurchase Price, if applicable) of, or accrued and unpaid interest on, the Notes when the same shall become due and payable.

(c) Anything in this Section 4.04 to the contrary notwithstanding, the Company may, at any time, for the purpose of obtaining a satisfaction and discharge of this Indenture, or for any other reason, pay, cause to be paid or deliver to the Trustee all sums or amounts held in trust by the Company or any Paying Agent hereunder as required by this Section 4.04, such sums or amounts to be held by the Trustee upon the trusts herein contained and upon such payment or delivery by the Company or any Paying Agent to the Trustee, the Company or such Paying Agent shall be released from all further liability but only with respect to such sums or amounts. Upon the occurrence of any event specified in Section 6.01(h) or Section 6.01(i), the Trustee shall automatically become the Paying Agent.

(d) Subject to applicable escheatment laws, any money or property deposited with the Trustee or any Paying Agent, or then held by the Company, in trust for the payment of the principal (including the Redemption Price, the Fundamental Change Repurchase Price, if applicable) of, accrued and unpaid interest on and the consideration due upon conversion of any Note and remaining unclaimed for two years after such principal (including the Redemption Price, the Fundamental Change Repurchase Price, if applicable), interest or consideration due upon conversion has become due and payable shall be paid to the Company on request of the Company contained in an Officer’s Certificate, or (if then held by the Company) shall be discharged from such trust and the Trustee shall have no further liability with respect to such funds; and the Holder of such Note shall thereafter, as an unsecured general creditor, look only to

the Company for payment thereof, and all liability of the Trustee or such Paying Agent with respect to such trust money and shares of Common Stock, and all liability of the Company as trustee thereof, shall thereupon cease.

Section 4.05. Existence. Subject to Article 11, the Company shall do or cause to be done all things necessary to preserve and keep in full force and effect its corporate existence.

Section 4.06. Annual Reports. (a) The Company shall file with the Trustee, within 15 days after the same are required to be filed with the Commission (giving effect to any grace period provided by Rule 12b-25 (or any successor rule) under the Exchange Act), copies of any documents or reports that the Company is required to file with the Commission pursuant to Section 13 or 15(d) of the Exchange Act (excluding any such information, documents or reports, or portions thereof, subject to confidential treatment and any correspondence with the Commission). Any such document or report that the Company files with the Commission via the Commission’s EDGAR system (or any successor thereto) shall be deemed to be filed with the Trustee for purposes of this Section 4.06 at the time such documents are filed via the EDGAR system (or any successor thereto), it being understood that the Trustee shall not be responsible for determining whether such filings have been made.

(b) Delivery of the reports and documents described in subsection (a) above to the Trustee is for informational purposes only, and the Trustee’s receipt of such shall not constitute actual or constructive notice of any information contained therein or determinable from information contained therein, including the Company’s compliance with any of its covenants hereunder (as to which the Trustee is entitled to conclusively rely on an Officer’s Certificate).

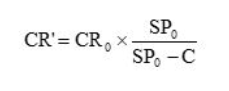

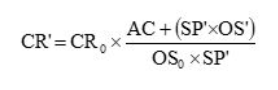

Section 4.07. Stay, Extension and Usury Laws. The Company covenants (to the extent that it may lawfully do so) that it shall not at any time insist upon, plead, or in any manner whatsoever claim or take the benefit or advantage of, any stay, extension or usury law or other law that would prohibit or forgive the Company from paying all or any portion of the principal of or interest on the Notes as contemplated herein, wherever enacted, now or at any time hereafter in force, or that may affect the covenants or the performance of this Indenture; and the Company (to the extent it may lawfully do so) hereby expressly waives all benefit or advantage of any such law, and covenants that it will not, by resort to any such law, hinder, delay or impede the execution of any power herein granted to the Trustee, but will suffer and permit the execution of every such power as though no such law had been enacted.