SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| |

Delaware

|

| |

13-1840497

|

|

| |

(State or other jurisdiction of

incorporation or organization) |

| |

(I.R.S. Employer Identification No.)

|

|

| |

Glenpointe Centre East, 3rd Floor

300 Frank W. Burr Boulevard, Suite 21 Teaneck, New Jersey (Address of Principal Executive Offices) |

| |

07666-6712

(Zip Code) |

|

(Registrant’s telephone number, including area code)

| |

Title of each class

|

| |

Trading Symbol(s)

|

| |

Name of each exchange on which registered

|

|

| |

Class A Common Stock, $0.0001

par value per share |

| |

PAHC

|

| |

Nasdaq Stock Market

|

|

| | Large accelerated filer | | | ☐ | | | | | | Accelerated filer | | | ☒ | |

| | Non-accelerated filer | | | ☐ | | | | | | Smaller reporting company | | | ☐ | |

| | Emerging Growth Company | | | ☐ | | | | | | | | | | |

TABLE OF CONTENTS

| | | |

Page

|

| |||

| | | | | 3 | | | |

| | | | | 4 | | | |

| | | | | 5 | | | |

| PART I | | ||||||

| | | | | 6 | | | |

| | | | | 25 | | | |

| | | | | 50 | | | |

| | | | | 50 | | | |

| | | | | 51 | | | |

| | | | | 51 | | | |

| PART II | | ||||||

| | | | | 52 | | | |

| | | | | 54 | | | |

| | | | | 56 | | | |

| | | | | 78 | | | |

| | | | | 80 | | | |

| | | | | 119 | | | |

| | | | | 119 | | | |

| | | | | 120 | | | |

| PART III | | ||||||

| | | | | 121 | | | |

| | | | | 121 | | | |

| | | | | 121 | | | |

| | | | | 121 | | | |

| | | | | 121 | | | |

| PART IV | | ||||||

| | | | | 122 | | | |

| | | | | 123 | | | |

| | | |

Segments

|

| |

Change

|

| |

Percentage of total

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||

|

For the Year Ended June 30

|

| |

2019

|

| |

2018

|

| |

2017

|

| |

2019/2018

|

| |

2018/2017

|

| |

2019

|

| |

2018

|

| |

2017

|

| ||||||||||||||||||||||||||||||||||||

| | | |

($ in millions)

|

| | | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Animal Health

|

| | | $ | 532 | | | | | $ | 532 | | | | | $ | 498 | | | | | $ | 0 | | | | |

|

0%

|

| | | | $ | 34 | | | | |

|

7%

|

| | | |

|

64%

|

| | | |

|

65%

|

| | | |

|

65%

|

| |

|

Mineral Nutrition

|

| | | | 234 | | | | | | 235 | | | | | | 218 | | | | | | (1) | | | | |

|

(0)%

|

| | | | | 17 | | | | |

|

8%

|

| | | |

|

28%

|

| | | |

|

29%

|

| | | |

|

29%

|

| |

|

Performance Products

|

| | | | 62 | | | | | | 53 | | | | | | 48 | | | | | | 9 | | | | |

|

17%

|

| | | | | 5 | | | | |

|

11%

|

| | | |

|

8%

|

| | | |

|

7%

|

| | | |

|

6%

|

| |

|

Total

|

| | | $ | 828 | | | | | $ | 820 | | | | | $ | 764 | | | | | $ | 8 | | | | |

|

1%

|

| | | | $ | 56 | | | | |

|

7%

|

| | | | | |||||||||||||||

| | | |

Species

|

| |

Change

|

| |

Percentage of total

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||

|

For the Year Ended June 30

|

| |

2019

|

| |

2018

|

| |

2017

|

| |

2019/2018

|

| |

2018/2017

|

| |

2019

|

| |

2018

|

| |

2017

|

| ||||||||||||||||||||||||||||||||||||

| | | |

($ in millions)

|

| | | | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Poultry

|

| | | $ | 316 | | | | | $ | 321 | | | | | $ | 301 | | | | | $ | (5) | | | | |

|

(2)%

|

| | | | $ | 20 | | | | |

|

7%

|

| | | |

|

38%

|

| | | |

|

39%

|

| | | |

|

39%

|

| |

|

Dairy

|

| | | | 170 | | | | | | 177 | | | | | | 157 | | | | | | (7) | | | | |

|

(4)%

|

| | | | | 20 | | | | |

|

13%

|

| | | |

|

21%

|

| | | |

|

22%

|

| | | |

|

21%

|

| |

|

Cattle

|

| | | | 88 | | | | | | 80 | | | | | | 76 | | | | | | 8 | | | | |

|

10%

|

| | | | | 4 | | | | |

|

5%

|

| | | |

|

11%

|

| | | |

|

10%

|

| | | |

|

10%

|

| |

|

Swine

|

| | | | 101 | | | | | | 100 | | | | | | 93 | | | | | | 1 | | | | |

|

1%

|

| | | | | 7 | | | | |

|

8%

|

| | | |

|

12%

|

| | | |

|

12%

|

| | | |

|

12%

|

| |

| Other(1) | | | | | 153 | | | | | | 142 | | | | | | 137 | | | | | | 11 | | | | |

|

8%

|

| | | | | 5 | | | | |

|

4%

|

| | | |

|

18%

|

| | | |

|

17%

|

| | | |

|

18%

|

| |

|

Total

|

| | | $ | 828 | | | | | $ | 820 | | | | | $ | 764 | | | | | $ | 8 | | | | |

|

1%

|

| | | | $ | 56 | | | | |

|

7%

|

| | | | | |||||||||||||||

| | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| | | |

Regions(2)

|

| |

Change

|

| |

Percentage of total

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||

|

For the Year Ended June 30

|

| |

2019

|

| |

2018

|

| |

2017

|

| |

2019/2018

|

| |

2018/2017

|

| |

2019

|

| |

2018

|

| |

2017

|

| ||||||||||||||||||||||||||||||||||||

| | | |

($ in millions)

|

| | | | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

United States

|

| | | $ | 481 | | | | | $ | 491 | | | | | $ | 484 | | | | | $ | (10) | | | | |

|

(2)%

|

| | | | $ | 7 | | | | |

|

1%

|

| | | |

|

58%

|

| | | |

|

60%

|

| | | |

|

63%

|

| |

|

Latin America and Canada

|

| | | | 152 | | | | | | 143 | | | | | | 113 | | | | | | 9 | | | | |

|

6%

|

| | | | | 30 | | | | |

|

27%

|

| | | |

|

18%

|

| | | |

|

17%

|

| | | |

|

15%

|

| |

|

Europe, Middle East and Africa

|

| | | | 105 | | | | | | 110 | | | | | | 96 | | | | | | (5) | | | | |

|

(5)%

|

| | | | | 14 | | | | |

|

15%

|

| | | |

|

13%

|

| | | |

|

13%

|

| | | |

|

13%

|

| |

|

Asia Pacific

|

| | | | 90 | | | | | | 76 | | | | | | 71 | | | | | | 14 | | | | |

|

18%

|

| | | | | 5 | | | | |

|

7%

|

| | | |

|

11%

|

| | | |

|

9%

|

| | | |

|

9%

|

| |

|

Total

|

| | | $ | 828 | | | | | $ | 820 | | | | | $ | 764 | | | | | $ | 8 | | | | |

|

1%

|

| | | | $ | 56 | | | | |

|

7%

|

| | | | | |||||||||||||||

| | | |

Adjusted EBITDA(1)

|

| |

Change

|

| |

Percentage of total(2)

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||

|

For the Year Ended June 30

|

| |

2019

|

| |

2018

|

| |

2017

|

| |

2019/2018

|

| |

2018/2017

|

| |

2019

|

| |

2018

|

| |

2017

|

| ||||||||||||||||||||||||||||||||||||

| | | |

($ in millions)

|

| | | | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Animal Health

|

| | | $ | 136 | | | | | $ | 142 | | | | | $ | 130 | | | | | $ | (6) | | | | |

|

(4)%

|

| | | | $ | 12 | | | | |

|

9%

|

| | | |

|

87%

|

| | | |

|

87%

|

| | | |

|

87%

|

| |

|

Mineral Nutrition

|

| | | | 16 | | | | | | 19 | | | | | | 17 | | | | | | (3) | | | | |

|

(15)%

|

| | | | | 1 | | | | |

|

7%

|

| | | |

|

10%

|

| | | |

|

11%

|

| | | |

|

12%

|

| |

|

Performance Products

|

| | | | 5 | | | | | | 2 | | | | | | 2 | | | | | | 3 | | | | |

|

151%

|

| | | | | (0) | | | | |

|

(9)%

|

| | | |

|

3%

|

| | | |

|

1%

|

| | | |

|

1%

|

| |

|

Corporate

|

| | | | (38) | | | | | | (33) | | | | | | (30) | | | | | | (5) | | | | |

|

*

|

| | | | | (4) | | | | |

|

*

|

| | | | | |||||||||||||||

|

Total

|

| | | $ | 118 | | | | | $ | 129 | | | | | $ | 120 | | | | | $ | (11) | | | | |

|

(8)%

|

| | | | $ | 9 | | | | |

|

7%

|

| | | | | |||||||||||||||

| | | |

Net Identifiable Assets

|

| |

Change

|

| |

Percentage of total

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||

|

As of June 30

|

| |

2019

|

| |

2018

|

| |

2017

|

| |

2019/2018

|

| |

2018/2017

|

| |

2019

|

| |

2018

|

| |

2017

|

| ||||||||||||||||||||||||||||||||||||

| | | |

($ in millions)

|

| | | | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Animal Health

|

| | | $ | 509 | | | | | $ | 456 | | | | | $ | 442 | | | | | $ | 53 | | | | |

|

12%

|

| | | | $ | 14 | | | | |

|

3%

|

| | | |

|

70%

|

| | | |

|

68%

|

| | | |

|

71%

|

| |

|

Mineral Nutrition

|

| | | | 68 | | | | | | 70 | | | | | | 55 | | | | | | (2) | | | | |

|

(3)%

|

| | | | | 15 | | | | |

|

26%

|

| | | |

|

9%

|

| | | |

|

10%

|

| | | |

|

9%

|

| |

|

Performance Products

|

| | | | 33 | | | | | | 24 | | | | | | 24 | | | | | | 9 | | | | |

|

37%

|

| | | | | 0 | | | | |

|

1%

|

| | | |

|

5%

|

| | | |

|

4%

|

| | | |

|

4%

|

| |

|

Corporate

|

| | | | 117 | | | | | | 122 | | | | | | 102 | | | | | | (5) | | | | |

|

(4)%

|

| | | | | 20 | | | | |

|

20%

|

| | | |

|

16%

|

| | | |

|

18%

|

| | | |

|

16%

|

| |

|

Total

|

| | | $ | 727 | | | | | $ | 672 | | | | | $ | 623 | | | | | $ | 54 | | | | |

|

8%

|

| | | | $ | 49 | | | | |

|

8%

|

| | | | | |||||||||||||||

| | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| | | |

Product Groups

|

| |

Change

|

| |

Percentage of total

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||

|

For the Year Ended June 30

|

| |

2019

|

| |

2018

|

| |

2017

|

| |

2019/2018

|

| |

2018/2017

|

| |

2019

|

| |

2018

|

| |

2017

|

| ||||||||||||||||||||||||||||||||||||

| | | |

($ in millions)

|

| | | | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

MFAs and other

|

| | | $ | 350 | | | | | $ | 337 | | | | | $ | 321 | | | | | $ | 13 | | | | |

|

4%

|

| | | | $ | 16 | | | | |

|

5%

|

| | | |

|

66%

|

| | | |

|

63%

|

| | | |

|

65%

|

| |

|

Nutritional specialties

|

| | | | 113 | | | | | | 123 | | | | | | 111 | | | | | | (10) | | | | |

|

(8)%

|

| | | | | 12 | | | | |

|

11%

|

| | | |

|

21%

|

| | | |

|

23%

|

| | | |

|

22%

|

| |

|

Vaccines

|

| | | | 68 | | | | | | 72 | | | | | | 65 | | | | | | (4) | | | | |

|

(5)%

|

| | | | | 7 | | | | |

|

11%

|

| | | |

|

13%

|

| | | |

|

14%

|

| | | |

|

13%

|

| |

|

Animal Health

|

| | | $ | 532 | | | | | $ | 532 | | | | | $ | 498 | | | | | $ | (0) | | | | |

|

(0)%

|

| | | | $ | 34 | | | | |

|

7%

|

| | | | | |||||||||||||||

| | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| | | |

Regions(1)

|

| |

Change

|

| |

Percentage of total

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||

|

For the Years Ended June 30

|

| |

2019

|

| |

2018

|

| |

2017

|

| |

2019/2018

|

| |

2018/2017

|

| |

2019

|

| |

2018

|

| |

2017

|

| ||||||||||||||||||||||||||||||||||||

| | | |

($ in millions)

|

| | | | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

United States

|

| | | $ | 199 | | | | | $ | 220 | | | | | $ | 230 | | | | | $ | (21) | | | | |

|

(10)%

|

| | | | $ | (10) | | | | |

|

(4)%

|

| | | |

|

37%

|

| | | |

|

41%

|

| | | |

|

46%

|

| |

|

Latin America and Canada

|

| | | | 142 | | | | | | 129 | | | | | | 104 | | | | | | 13 | | | | |

|

10%

|

| | | | | 25 | | | | |

|

24%

|

| | | |

|

27%

|

| | | |

|

24%

|

| | | |

|

21%

|

| |

|

Europe, Middle East and Africa

|

| | | | 103 | | | | | | 108 | | | | | | 93 | | | | | | (5) | | | | |

|

(5)%

|

| | | | | 15 | | | | |

|

16%

|

| | | |

|

19%

|

| | | |

|

20%

|

| | | |

|

19%

|

| |

|

Asia Pacific

|

| | | | 88 | | | | | | 75 | | | | | | 71 | | | | | | 13 | | | | |

|

17%

|

| | | | | 4 | | | | |

|

6%

|

| | | |

|

17%

|

| | | |

|

14%

|

| | | |

|

14%

|

| |

|

Total

|

| | | $ | 532 | | | | | $ | 532 | | | | | $ | 498 | | | | | $ | — | | | | |

|

0%

|

| | | | $ | 34 | | | | |

|

7%

|

| | | | | |||||||||||||||

|

Product

|

| |

Active Ingredient

|

| |

Market Entry of

Active Ingredient |

| |

Description

|

|

| Terramycin®/TM-50®/ TM-100™ | | | oxytetracycline | | |

1951

|

| | Antibacterial with multiple applications for a wide number of species | |

| Nicarb® | | | nicarbazin | | |

1954

|

| | Anticoccidial for poultry | |

| amprolium | | | amprolium | | |

1960

|

| | Anticoccidial for poultry and cattle | |

| Bloat Guard® | | | poloxalene | | |

1967

|

| | Anti-bloat treatment for cattle | |

| Banminth® | | | pyrantel tartrate | | |

1972

|

| | Anthelmintic for livestock | |

| Mecadox® | | | carbadox | | |

1972

|

| | Antibacterial for swine to control Salmonellosis and dysentery | |

| Stafac®/Eskalin™/V-Max® | | | virginiamycin | | |

1975

|

| | Antibacterial used to prevent and control diseases in poultry, swine and cattle | |

| Coxistac™/Posistac™ | | | salinomycin | | |

1979

|

| | Anticoccidial for poultry, cattle and swine | |

| Rumatel® | | | morantel tartrate | | |

1981

|

| | Anthelmintic for livestock | |

| Cerditac™/Cerdimix™ | | | oxibendazole | | |

1982

|

| | Anthelmintic for livestock | |

|

Product

|

| |

Active Ingredient

|

| |

Market Entry of

Active Ingredient |

| |

Description

|

|

| Aviax® | | | semduramicin | | |

1995

|

| | Anticoccidial for poultry | |

| Neo-Terramycin®/Neo-TM™ | | | oxytetracycline + neomycin | | |

1999

|

| | Combination of two antibacterials with multiple applications for a wide number of species | |

| Aviax® Plus/Avi-Carb® | | | semduramicin + nicarbazin | | |

2010

|

| | Anticoccidial for poultry | |

|

Product

|

| |

Market

Entry |

| |

Description

|

|

| AB20® | | |

1989

|

| | Natural flow agent that improves overall feed quality | |

| Animate® | | |

1999

|

| | Maintains proper blood calcium levels in dairy cows during critical transition period | |

| Omnigen-AF® | | |

2004

|

| | Optimizes immune status in dairy cows | |

| Provia 6086™ | | |

2013

|

| | Direct fed microbial (B.coagulans) for all classes of livestock | |

| Magni-Phi® | | |

2015

|

| | Proprietary blend that helps to improve immune response and may lead to improved absorption and utilization of nutrients for poultry | |

| Cellerate Yeast Solutions® | | |

2017

|

| | Proprietary yeast culture products for all classes of livestock to help improve digestive health | |

| Provia Prime™ | | |

2019

|

| | 4-way combination direct-fed microbial for optimization of gut health in poultry | |

|

Product

|

| |

Market

Entry |

| |

Description

|

|

| V.H.® | | |

1974

|

| | Live vaccine for the prevention of Newcastle Disease in poultry | |

| Tailor Made® Vaccines | | |

1982

|

| | Autogenous vaccines against either bacterial or viral diseases in poultry, swine and cattle | |

| MVP Adjuvants® | | |

1982

|

| | Components of veterinary vaccines that enhance the immune response to a vaccine | |

| TAbic® M.B. | | |

2004

|

| | Live vaccine for the prevention of Infectious Bursal Disease in poultry | |

| MJPRRS® | | |

2007

|

| | Autogenous vaccine for the prevention of porcine reproductive and respiratory syndrome (“PRRS”) in swine | |

| TAbic® IB VAR | | |

2009

|

| | Live vaccine for the prevention of Infectious Bronchitis variant 1 strain 233A in poultry | |

| TAbic® IB VAR206 | | |

2010

|

| | Live vaccine for the prevention of Infectious Bronchitis variant 206 in poultry | |

| MB-1TM | | |

2017

|

| | Live hatchery vaccine for the prevention of Infections Bursal Disease in poultry | |

| pHi-TechTM | | |

2019

|

| | Portable electronic injection device enabling management and proper delivery of vaccines | |

|

Business Segment(s)

|

| |

Location

|

| |

Owned/Leased

|

| |

Approx. sq.

Footage |

| |

Purpose(s)

|

|

| Animal Health | | | Beit Shemesh, Israel | | | Owned/ land lease | | |

78,000

|

| | Manufacturing and Research | |

| Animal Health | | | Braganca Paulista, Brazil | | | Owned | | |

50,000

|

| | Manufacturing and Administrative | |

| Animal Health | | | Buenos Aires, Argentina | | | Owned | | |

43,000

|

| | Manufacturing and Administrative | |

| Animal Health | | | Chillicothe, Illinois | | | Owned | | |

19,000

|

| | Manufacturing | |

| Animal Health | | | Corvallis, Oregon | | | Owned | | |

5,000

|

| | Research | |

| Animal Health | | | Guarulhos, Brazil | | | Owned | | |

1,294,000

|

| | Manufacturing, Sales, Premixing, Research and Administrative | |

| Animal Health | | | Neot Hovav, Israel | | | Owned/land lease | | |

140,000

|

| | Manufacturing and Research | |

| Mineral Nutrition | | | Omaha, Nebraska | | | Owned | | |

84,000

|

| | Manufacturing | |

| Animal Health | | | Omaha, Nebraska | | | Owned | | |

43,000

|

| | Manufacturing, Sales and Research | |

| Animal Health | | | Petach Tikva, Israel | | | Owned | | |

60,000

|

| | Manufacturing | |

|

Business Segment(s)

|

| |

Location

|

| |

Owned/Leased

|

| |

Approx. sq.

Footage |

| |

Purpose(s)

|

|

| Animal Health and Mineral Nutrition | | | Quincy, Illinois | | | Owned | | |

306,000

|

| | Manufacturing, Sales, Research and Administrative | |

| Performance Products | | |

Santa Fe Springs, California

|

| | Owned | | |

108,000

|

| | Manufacturing | |

| Animal Health | | |

State College, Pennsylvania

|

| | Owned | | |

13,000

|

| | Research | |

| Animal Health | | | St. Paul, Minnesota | | | Leased | | |

5,000

|

| | Research | |

| Corporate | | | Teaneck, New Jersey | | | Leased | | |

50,000

|

| | Corporate and Administrative | |

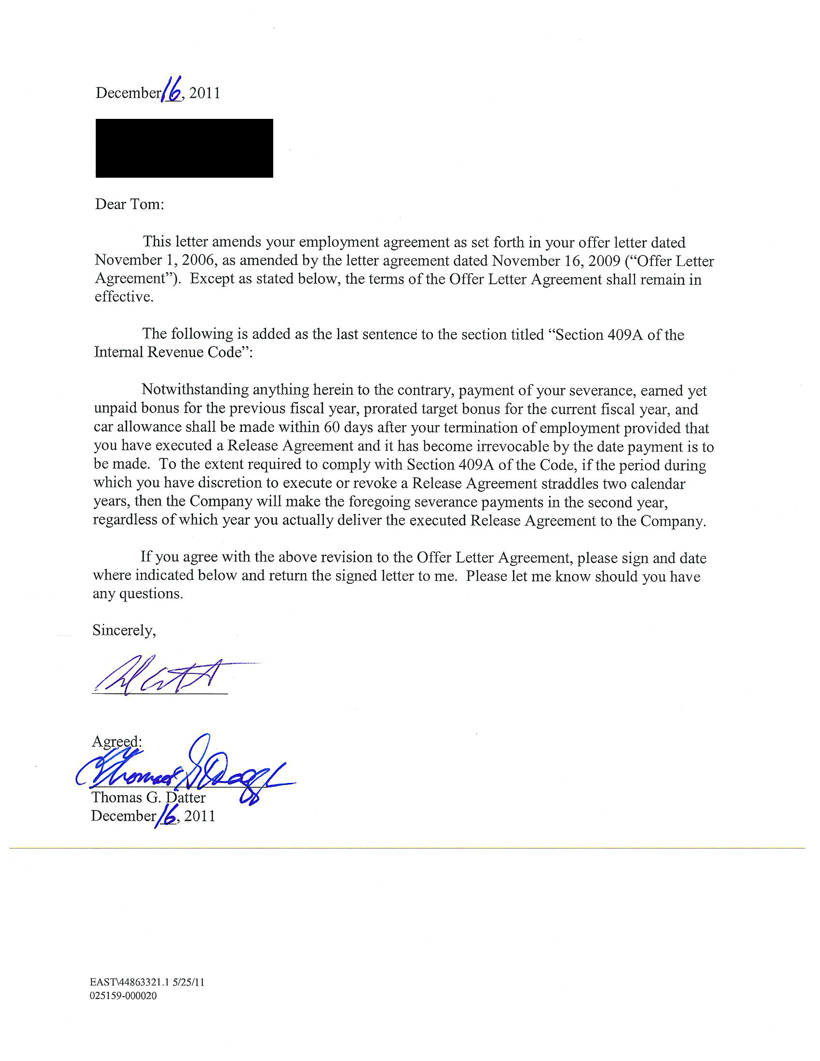

![[MISSING IMAGE: lc_527742stockperform-4c.jpg]](lc_527742stockperform-4c.jpg)

|

For the Year Ended June 30

|

| |

2019

|

| |

2018

|

| |

2017

|

| |

2016

|

| |

2015

|

| |||||||||||||||

| | | |

(in thousands, except per share amounts)

|

| |||||||||||||||||||||||||||

| Results of operations data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net sales

|

| | | $ | 827,995 | | | | | $ | 819,982 | | | | | $ | 764,281 | | | | | $ | 751,526 | | | | | $ | 748,591 | | |

|

Cost of goods sold

|

| | | | 563,371 | | | | | | 553,103 | | | | | | 516,038 | | | | | | 512,494 | | | | | | 515,311 | | |

|

Gross profit

|

| | | | 264,624 | | | | | | 266,879 | | | | | | 248,243 | | | | | | 239,032 | | | | | | 233,280 | | |

|

Selling, general and administrative expenses

|

| | | | 181,398 | | | | | | 167,953 | | | | | | 150,309 | | | | | | 153,288 | | | | | | 145,612 | | |

|

Operating income

|

| | | | 83,226 | | | | | | 98,926 | | | | | | 97,934 | | | | | | 85,744 | | | | | | 87,668 | | |

|

Interest expense, net

|

| | | | 11,776 | | | | | | 11,910 | | | | | | 14,906 | | | | | | 16,592 | | | | | | 14,305 | | |

|

Foreign currency (gains) losses, net

|

| | | | (55) | | | | | | (1,054) | | | | | | (113) | | | | | | (7,609) | | | | | | (5,400) | | |

|

Loss on extinguishment of debt

|

| | | | — | | | | | | — | | | | | | 2,598 | | | | | | — | | | | | | — | | |

|

Income before income taxes

|

| | | | 71,505 | | | | | | 88,070 | | | | | | 80,543 | | | | | | 76,761 | | | | | | 78,763 | | |

|

Provision (benefit) for income taxes

|

| | | | 16,792 | | | | | | 23,187 | | | | | | 15,928 | | | | | | (5,967) | | | | | | 18,483 | | |

|

Net income

|

| | | $ | 54,713 | | | | | $ | 64,883 | | | | | $ | 64,615 | | | | | $ | 82,728 | | | | | $ | 60,280 | | |

| Net income per share | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

basic

|

| | | $ | 1.35 | | | | | $ | 1.61 | | | | | $ | 1.63 | | | | | $ | 2.11 | | | | | $ | 1.55 | | |

|

diluted

|

| | | $ | 1.35 | | | | | $ | 1.61 | | | | | $ | 1.61 | | | | | $ | 2.07 | | | | | $ | 1.51 | | |

| Weighted average common shares outstanding | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

basic

|

| | | | 40,412 | | | | | | 40,181 | | | | | | 39,524 | | | | | | 39,254 | | | | | | 38,969 | | |

|

diluted

|

| | | | 40,523 | | | | | | 40,385 | | | | | | 40,042 | | | | | | 39,962 | | | | | | 39,815 | | |

|

Dividends per share

|

| | | $ | 0.46 | | | | | $ | 0.40 | | | | | $ | 0.40 | | | | | $ | 0.40 | | | | | $ | 0.40 | | |

| Other financial data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Adjusted EBITDA(1)

|

| | | $ | 118,037 | | | | | $ | 128,958 | | | | | $ | 120,119 | | | | | $ | 114,060 | | | | | $ | 110,019 | | |

|

Cash provided by operating activities(2)

|

| | | | 47,169 | | | | | | 70,008 | | | | | | 98,385 | | | | | | 37,218 | | | | | | 68,704 | | |

|

Capital expenditures

|

| | | | 29,891 | | | | | | 18,548 | | | | | | 20,880 | | | | | | 36,352 | | | | | | 20,058 | | |

|

For the Year Ended June 30

|

| |

2019

|

| |

2018

|

| |

2017

|

| |

2016

|

| |

2015

|

| |||||||||||||||

| | | |

(in thousands)

|

| |||||||||||||||||||||||||||

| Balance sheet data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Cash and cash equivalents and short-term investments

|

| | | $ | 81,573 | | | | | $ | 79,168 | | | | | $ | 56,083 | | | | | $ | 33,605 | | | | | $ | 29,216 | | |

|

Working capital(3)

|

| | | | 242,902 | | | | | | 205,651 | | | | | | 198,036 | | | | | | 203,356 | | | | | | 175,988 | | |

|

Total assets

|

| | | | 726,671 | | | | | | 671,679 | | | | | | 623,397 | | | | | | 607,835 | | | | | | 490,250 | | |

|

Total debt(4)

|

| | | | 326,175 | | | | | | 312,381 | | | | | | 313,141 | | | | | | 350,172 | | | | | | 286,450 | | |

|

Long-term debt and other liabilities

|

| | | | 356,429 | | | | | | 343,504 | | | | | | 356,444 | | | | | | 408,578 | | | | | | 349,185 | | |

|

Total stockholders’ equity

|

| | | | 216,015 | | | | | | 184,954 | | | | | | 151,157 | | | | | | 90,480 | | | | | | 29,628 | | |

|

For the Year Ended June 30

|

| |

2019

|

| |

2018

|

| |

2017

|

| |

2016

|

| |

2015

|

| |||||||||||||||

| | | |

(in thousands)

|

| |||||||||||||||||||||||||||

|

Net income

|

| | | $ | 54,713 | | | | | $ | 64,883 | | | | | $ | 64,615 | | | | | $ | 82,728 | | | | | $ | 60,280 | | |

| Plus: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Interest expense, net

|

| | | | 11,776 | | | | | | 11,910 | | | | | | 14,906 | | | | | | 16,592 | | | | | | 14,305 | | |

|

Provision (benefit) for income taxes

|

| | | | 16,792 | | | | | | 23,187 | | | | | | 15,928 | | | | | | (5,967) | | | | | | 18,483 | | |

|

Depreciation and amortization

|

| | | | 27,564 | | | | | | 26,943 | | | | | | 26,001 | | | | | | 23,452 | | | | | | 21,604 | | |

|

EBITDA

|

| | | | 110,845 | | | | | | 126,923 | | | | | | 121,450 | | | | | | 116,805 | | | | | | 114,672 | | |

|

Restructuring costs

|

| | | | 6,281 | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

|

Stock-based compensation

|

| | | | 2,259 | | | | | | 334 | | | | | | — | | | | | | — | | | | | | — | | |

|

Acquisition-related cost of goods sold

|

| | | | — | | | | | | 1,671 | | | | | | — | | | | | | 2,566 | | | | | | — | | |

|

Acquisition-related accrued compensation

|

| | | | — | | | | | | 1,152 | | | | | | 1,680 | | | | | | 1,680 | | | | | | 747 | | |

|

Acquisition-related transaction costs

|

| | | | 213 | | | | | | 400 | | | | | | 1,274 | | | | | | 618 | | | | | | — | | |

|

Acquisition-related other, net

|

| | | | — | | | | | | (468) | | | | | | (972) | | | | | | — | | | | | | — | | |

|

Other

|

| | | | (1,506) | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

|

Pension settlement cost

|

| | | | — | | | | | | — | | | | | | 1,702 | | | | | | — | | | | | | — | | |

|

Gain on insurance settlement

|

| | | | — | | | | | | — | | | | | | (7,500) | | | | | | — | | | | | | — | | |

|

Foreign currency (gains) losses, net

|

| | | | (55) | | | | | | (1,054) | | | | | | (113) | | | | | | (7,609) | | | | | | (5,400) | | |

|

Loss on extinguishment of debt

|

| | | | — | | | | | | — | | | | | | 2,598 | | | | | | — | | | | | | — | | |

|

Adjusted EBITDA

|

| | | $ | 118,037 | | | | | $ | 128,958 | | | | | $ | 120,119 | | | | | $ | 114,060 | | | | | $ | 110,019 | | |

|

For the Year Ended June 30

|

| |

2019

|

| |

2018

|

| |

2017

|

| |

2016

|

| |

2015

|

| |||||||||||||||

| | | |

(in thousands)

|

| |||||||||||||||||||||||||||

|

EBITDA

|

| | | $ | 110,845 | | | | | $ | 126,923 | | | | | $ | 121,450 | | | | | $ | 116,805 | | | | | $ | 114,672 | | |

| Adjustments | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Restructuring costs

|

| | | | 6,281 | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

|

Stock-based compensation

|

| | | | 2,259 | | | | | | 334 | | | | | | — | | | | | | — | | | | | | — | | |

|

Acquisition-related cost of goods sold

|

| | | | — | | | | | | 1,671 | | | | | | — | | | | | | 2,566 | | | | | | — | | |

|

Acquisition-related accrued compensation

|

| | | | — | | | | | | 1,152 | | | | | | 1,680 | | | | | | 1,680 | | | | | | 747 | | |

|

Acquisition-related transaction costs

|

| | | | 213 | | | | | | 400 | | | | | | 1,274 | | | | | | 618 | | | | | | — | | |

|

Acquisition-related other, net

|

| | | | — | | | | | | (468) | | | | | | (972) | | | | | | — | | | | | | — | | |

|

Other

|

| | | | (1,506) | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

|

Pension settlement cost

|

| | | | — | | | | | | — | | | | | | 1,702 | | | | | | — | | | | | | — | | |

|

Gain on insurance settlement

|

| | | | — | | | | | | — | | | | | | (7,500) | | | | | | — | | | | | | — | | |

|

Foreign currency (gains) losses, net

|

| | | | (55) | | | | | | (1,054) | | | | | | (113) | | | | | | (7,609) | | | | | | (5,400) | | |

|

Loss on extinguishment of debt

|

| | | | — | | | | | | — | | | | | | 2,598 | | | | | | — | | | | | | — | | |

|

Interest paid

|

| | | | (12,250) | | | | | | (11,208) | | | | | | (14,600) | | | | | | (14,215) | | | | | | (12,912) | | |

|

Income taxes paid

|

| | | | (16,215) | | | | | | (15,191) | | | | | | (14,762) | | | | | | (16,828) | | | | | | (10,780) | | |

|

Changes in operating assets and liabilities and other items

|

| | | | (42,190) | | | | | | (32,151) | | | | | | 1,402 | | | | | | (45,181) | | | | | | (12,337) | | |

|

Cash provided by/(used for) insurance settlement/(claim)

|

| | | | — | | | | | | — | | | | | | 7,500 | | | | | | — | | | | | | (5,286) | | |

|

Cash used for acquisition-related transaction costs

|

| | | | (213) | | | | | | (400) | | | | | | (1,274) | | | | | | (618) | | | | | | — | | |

|

Net cash provided by operating activities

|

| | | $ | 47,169 | | | | | $ | 70,008 | | | | | $ | 98,385 | | | | | $ | 37,218 | | | | | $ | 68,704 | | |

| | | | | | |

Change

|

| ||||||||||||||||||||||||||||||||||||

|

For the Year Ended June 30

|

| |

2019

|

| |

2018

|

| |

2017

|

| |

2019/2018

|

| |

2018/2017

|

| |||||||||||||||||||||||||||

| | | |

(in thousands, except per share)

|

| |||||||||||||||||||||||||||||||||||||||

|

Net sales

|

| | | $ | 827,995 | | | | | $ | 819,982 | | | | | $ | 764,281 | | | | | $ | 8,013 | | | | |

|

1%

|

| | | | $ | 55,701 | | | | |

|

7%

|

| |

|

Gross profit

|

| | | | 264,624 | | | | | | 266,879 | | | | | | 248,243 | | | | | | (2,255) | | | | |

|

(1)%

|

| | | | | 18,636 | | | | |

|

8%

|

| |

|

Selling, general and administrative expenses

|

| | | | 181,398 | | | | | | 167,953 | | | | | | 150,309 | | | | | | 13,445 | | | | |

|

8%

|

| | | | | 17,644 | | | | |

|

12%

|

| |

|

Operating income

|

| | | | 83,226 | | | | | | 98,926 | | | | | | 97,934 | | | | | | (15,700) | | | | |

|

(16)%

|

| | | | | 992 | | | | |

|

1%

|

| |

|

Interest expense, net

|

| | | | 11,776 | | | | | | 11,910 | | | | | | 14,906 | | | | | | (134) | | | | |

|

(1)%

|

| | | | | (2,996) | | | | |

|

(20)%

|

| |

|

Foreign currency (gains) losses,

net |

| | | | (55) | | | | | | (1,054) | | | | | | (113) | | | | | | 999 | | | | |

|

*

|

| | | | | (941) | | | | |

|

*

|

| |

|

Loss on extinguishment of debt

|

| | | | — | | | | | | — | | | | | | 2,598 | | | | | | — | | | | | | * | | | | | | (2,598) | | | | | | * | | |

|

Income before income taxes

|

| | | | 71,505 | | | | | | 88,070 | | | | | | 80,543 | | | | | | (16,565) | | | | |

|

(19)%

|

| | | | | 7,527 | | | | |

|

9%

|

| |

|

Provision for income taxes

|

| | | | 16,792 | | | | | | 23,187 | | | | | | 15,928 | | | | | | (6,395) | | | | |

|

(28)%

|

| | | | | 7,259 | | | | |

|

46%

|

| |

|

Net income

|

| | | $ | 54,713 | | | | | $ | 64,883 | | | | | $ | 64,615 | | | | | $ | (10,170) | | | | |

|

(16)%

|

| | | | $ | 268 | | | | |

|

0%

|

| |

| Net income per share | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

basic

|

| | | $ | 1.35 | | | | | $ | 1.61 | | | | | $ | 1.63 | | | | | $ | (0.26) | | | | | | | | | | | $ | (0.02) | | | | | | | | |

|

diluted

|

| | | $ | 1.35 | | | | | $ | 1.61 | | | | | $ | 1.61 | | | | | $ | (0.26) | | | | | | | | | | | $ | — | | | | | | | | |

|

Weighted average number of shares

outstanding |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

basic

|

| | | | 40,412 | | | | | | 40,181 | | | | | | 39,524 | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

diluted

|

| | | | 40,523 | | | | | | 40,385 | | | | | | 40,042 | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio to net sales | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Gross profit

|

| | | | 32.0% | | | | | | 32.5% | | | | | | 32.5% | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Selling, general and administrative expenses

|

| | |

|

21.9%

|

| | | |

|

20.5%

|

| | | |

|

19.7%

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

|

Operating income

|

| | | | 10.1% | | | | | | 12.1% | | | | | | 12.8% | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Income before income taxes

|

| | | | 8.6% | | | | | | 10.7% | | | | | | 10.5% | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net income

|

| | | | 6.6% | | | | | | 7.9% | | | | | | 8.5% | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Effective tax rate

|

| | | | 23.5% | | | | | | 26.3% | | | | | | 19.8% | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Change

|

| ||||||||||||||||||||||||||||||||||||

|

For the Year Ended June 30

|

| |

2019

|

| |

2018

|

| |

2017

|

| |

2019/2018

|

| |

2018/2017

|

| |||||||||||||||||||||||||||

| | | |

(in thousands)

|

| |||||||||||||||||||||||||||||||||||||||

| Net sales | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

MFAs and other

|

| | | $ | 350,468 | | | | | $ | 336,666 | | | | | $ | 321,430 | | | | | $ | 13,802 | | | | |

|

4%

|

| | | | $ | 15,236 | | | | |

|

5%

|

| |

|

Nutritional specialties

|

| | | | 113,215 | | | | | | 122,978 | | | | | | 111,282 | | | | | | (9,763) | | | | |

|

(8)%

|

| | | | | 11,696 | | | | |

|

11%

|

| |

|

Vaccines

|

| | | | 68,291 | | | | | | 72,083 | | | | | | 65,033 | | | | | | (3,792) | | | | |

|

(5)%

|

| | | | | 7,050 | | | | |

|

11%

|

| |

|

Animal Health

|

| | | | 531,974 | | | | | | 531,727 | | | | | | 497,745 | | | | | | 247 | | | | |

|

0%

|

| | | | | 33,982 | | | | |

|

7%

|

| |

|

Mineral Nutrition

|

| | | | 233,782 | | | | | | 234,922 | | | | | | 218,298 | | | | | | (1,140) | | | | |

|

(0)%

|

| | | | | 16,624 | | | | |

|

8%

|

| |

|

Performance Products

|

| | | | 62,239 | | | | | | 53,333 | | | | | | 48,238 | | | | | | 8,906 | | | | |

|

17%

|

| | | | | 5,095 | | | | |

|

11%

|

| |

|

Total

|

| | | $ | 827,995 | | | | | $ | 819,982 | | | | | $ | 764,281 | | | | | $ | 8,013 | | | | |

|

1%

|

| | | | $ | 55,701 | | | | |

|

7%

|

| |

| Adjusted EBITDA | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Animal Health

|

| | | $ | 136,049 | | | | | $ | 141,914 | | | | | $ | 130,261 | | | | | $ | (5,865) | | | | |

|

(4)%

|

| | | | $ | 11,653 | | | | |

|

9%

|

| |

|

Mineral Nutrition

|

| | | | 15,712 | | | | | | 18,583 | | | | | | 17,426 | | | | | | (2,871) | | | | |

|

(15)%

|

| | | | | 1,157 | | | | |

|

7%

|

| |

|

Performance Products

|

| | | | 4,728 | | | | | | 1,881 | | | | | | 2,057 | | | | | | 2,847 | | | | |

|

151%

|

| | | | | (176) | | | | |

|

(9)%

|

| |

|

Corporate

|

| | | | (38,452) | | | | | | (33,420) | | | | | | (29,625) | | | | | | (5,032) | | | | |

|

*

|

| | | | | (3,795) | | | | |

|

*

|

| |

|

Total

|

| | | $ | 118,037 | | | | | $ | 128,958 | | | | | $ | 120,119 | | | | | $ | (10,921) | | | | |

|

(8)%

|

| | | | $ | 8,839 | | | | |

|

7%

|

| |

|

Adjusted EBITDA ratio to segment net sales

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Animal Health

|

| | | | 25.6% | | | | | | 26.7% | | | | | | 26.2% | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Mineral Nutrition

|

| | | | 6.7% | | | | | | 7.9% | | | | | | 8.0% | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Performance Products

|

| | | | 7.6% | | | | | | 3.5% | | | | | | 4.3% | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Corporate(1)

|

| | |

|

(4.6)%

|

| | | |

|

(4.1)%

|

| | | |

|

(3.9)%

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

|

Total(1)

|

| | |

|

14.3%

|

| | | |

|

15.7%

|

| | | |

|

15.7%

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Change

|

| ||||||||||||||||||||||||||||||||||||

|

For the Year Ended June 30

|

| |

2019

|

| |

2018

|

| |

2017

|

| |

2019/2018

|

| |

2018/2017

|

| |||||||||||||||||||||||||||

| | | |

(in thousands)

|

| |||||||||||||||||||||||||||||||||||||||

|

Net income

|

| | | $ | 54,713 | | | | | $ | 64,883 | | | | | $ | 64,615 | | | | | $ | (10,170) | | | | |

|

(16)%

|

| | | | $ | 268 | | | | |

|

0%

|

| |

|

Interest expense, net

|

| | | | 11,776 | | | | | | 11,910 | | | | | | 14,906 | | | | | | (134) | | | | |

|

(1)%

|

| | | | | (2,996) | | | | |

|

(20)%

|

| |

|

Provision for income taxes

|

| | | | 16,792 | | | | | | 23,187 | | | | | | 15,928 | | | | | | (6,395) | | | | |

|

(28)%

|

| | | | | 7,259 | | | | |

|

46%

|

| |

|

Depreciation and amortization

|

| | | | 27,564 | | | | | | 26,943 | | | | | | 26,001 | | | | | | 621 | | | | |

|

2%

|

| | | | | 942 | | | | |

|

4%

|

| |

|

EBITDA

|

| | | | 110,845 | | | | | | 126,923 | | | | | | 121,450 | | | | | | (16,078) | | | | |

|

(13)%

|

| | | | | 5,473 | | | | |

|

5%

|

| |

|

Restructuring costs

|

| | | | 6,281 | | | | | | — | | | | | | — | | | | | | 6,281 | | | | |

|

*

|

| | | | | — | | | | |

|

*

|

| |

|

Stock-based compensation

|

| | | | 2,259 | | | | | | 334 | | | | | | — | | | | | | 1,925 | | | | |

|

576%

|

| | | | | 334 | | | | |

|

*

|

| |

|

Acquisition-related cost of goods sold

|

| | | | — | | | | | | 1,671 | | | | | | — | | | | | | (1,671) | | | | |

|

*

|

| | | | | 1,671 | | | | |

|

*

|

| |

|

Acquisition-related accrued compensation

|

| | | | — | | | | | | 1,152 | | | | | | 1,680 | | | | | | (1,152) | | | | |

|

*

|

| | | | | (528) | | | | |

|

(31)%

|

| |

|

Acquisition-related transaction costs

|

| | | | 213 | | | | | | 400 | | | | | | 1,274 | | | | | | (187) | | | | |

|

(47)%

|

| | | | | (874) | | | | |

|

(69)%

|

| |

|

Acquisition-related other, net(1)

|

| | | | — | | | | | | (468) | | | | | | (972) | | | | | | 468 | | | | |

|

*

|

| | | | | 504 | | | | |

|

*

|

| |

|

Other, net

|

| | | | (1,506) | | | | | | — | | | | | | — | | | | | | (1,506) | | | | |

|

*

|

| | | | | — | | | | |

|

*

|

| |

|

Pension settlement expense

|

| | | | — | | | | | | — | | | | | | 1,702 | | | | | | — | | | | |

|

*

|

| | | | | (1,702) | | | | |

|

*

|

| |

|

Gain on insurance settlement

|

| | | | — | | | | | | — | | | | | | (7,500) | | | | | | — | | | | |

|

*

|

| | | | | 7,500 | | | | |

|

*

|

| |

|

Foreign currency (gains) losses,

net |

| | | | (55) | | | | | | (1,054) | | | | | | (113) | | | | | | 999 | | | | |

|

*

|

| | | | | (941) | | | | |

|

*

|

| |

|

Loss on extinguishment of debt

|

| | | | — | | | | | | — | | | | | | 2,598 | | | | | | — | | | | |

|

*

|

| | | | | (2,598) | | | | |

|

*

|

| |

|

Adjusted EBITDA

|

| | | $ | 118,037 | | | | | $ | 128,958 | | | | | $ | 120,119 | | | | | $ | (10,921) | | | | |

|

(8)%

|

| | | | $ | 8,839 | | | | |

|

7%

|

| |

|

For the Year Ended June 30

|

| |

2019

|

| |

2018

|

| ||||||

| | | |

(in thousands, except percentages)

|

| |||||||||

|

Provision for income taxes

|

| | | $ | 16,792 | | | | | $ | 23,187 | | |

|

Effective income tax rate

|

| | | | 23.5% | | | | | | 26.3% | | |

| Certain income tax items | | | | | | | | | | | | | |

|

Benefit from exercised employee stock options

|

| | | $ | (310) | | | | | $ | (3,773) | | |

|

Mandatory toll charge

|

| | | | (360) | | | | | | 403 | | |

|

Reduction of domestic deferred tax assets

|

| | | | — | | | | | | 2,289 | | |

|

Reduction of foreign deferred tax assets

|

| | | | — | | | | | | 1,156 | | |

|

Recognition of federal and foreign tax credits

|

| | | | (1,417) | | | | | | (565) | | |

|

Reclassification from accumulated other comprehensive income

|

| | | | — | | | | | | 527 | | |

|

Release of unrecognized tax benefits

|

| | | | (1,271) | | | | | | (994) | | |

|

Total

|

| | | $ | (3,358) | | | | | $ | (957) | | |

|

Provision for income taxes, excluding certain items

|

| | | $ | 20,150 | | | | | $ | 24,144 | | |

|

Effective income tax rate, excluding certain items

|

| | | | 28.2% | | | | | | 27.4% | | |

|

For the Year Ended June 30

|

| |

2018

|

| |

2017

|

| ||||||

| | | |

(in thousands, except percentages)

|

| |||||||||

|

Provision for income taxes

|

| | | $ | 23,187 | | | | | $ | 15,928 | | |

|

Effective income tax rate

|

| | |

|

26.3%

|

| | | |

|

19.8%

|

| |

| Certain income tax items | | | | | | | | | | | | | |

|

Benefit from exercised employee stock options .

|

| | | $ | (3,773) | | | | | $ | (3,096) | | |

|

Mandatory toll charge

|

| | | | 403 | | | | | | — | | |

|

Reduction of domestic deferred tax assets

|

| | | | 2,289 | | | | | | — | | |

|

Reduction of foreign deferred tax assets

|

| | | | 1,156 | | | | | | — | | |

|

Recognition of foreign tax credits

|

| | | | (565) | | | | | | — | | |

|

Reclassification from accumulated other comprehensive income

|

| | | | 527 | | | | | | — | | |

|

Release of unrecognized tax benefits

|

| | | | (994) | | | | | | (500) | | |

|

Release of foreign valuation allowance

|

| | | | — | | | | | | (4,118) | | |

|

Total

|

| | | $ | (957) | | | | | $ | (7,714) | | |

|

Provision for income taxes, excluding certain items

|

| | | $ | 24,144 | | | | | $ | 23,642 | | |

|

Effective income tax rate, excluding certain items

|

| | |

|

27.4%

|

| | | |

|

29.3%

|

| |

| | | | | | |

Change

|

| ||||||||||||||||||||||||

|

For the Year Ended June 30

|

| |

2019

|

| |

2018

|

| |

2017

|

| |

2019/2018

|

| |

2018/2017

|

| |||||||||||||||

| | | |

(in thousands)

|

| |||||||||||||||||||||||||||

| Cash provided by/(used in): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Operating activities

|

| | | $ | 47,169 | | | | | $ | 70,008 | | | | | $ | 98,385 | | | | | $ | (22,839) | | | | | $ | (28,377) | | |

|

Investing activities

|

| | | | (14,133) | | | | | | (84,612) | | | | | | (21,942) | | | | | | 70,479 | | | | | | (62,670) | | |

|

Financing activities

|

| | | | (4,107) | | | | | | (11,775) | | | | | | (53,738) | | | | | | 7,668 | | | | | | 41,963 | | |

|

Effect of exchange-rate changes on cash and cash equivalents

|

| | | | (524) | | | | | | (536) | | | | | | (227) | | | | | | 12 | | | | | | (309) | | |

|

Net increase/(decrease) in cash and cash equivalents

|

| | | $ | 28,405 | | | | | $ | (26,915) | | | | | $ | 22,478 | | | | | $ | 55,320 | | | | | $ | (49,393) | | |

| | | | | | |

Change

|

| ||||||||||||||||||||||||

|

For the Year Ended June 30

|

| |

2019

|

| |

2018

|

| |

2017

|

| |

2019/2018

|

| |

2018/2017

|

| |||||||||||||||

| | | |

(in thousands)

|

| |||||||||||||||||||||||||||

|

EBITDA

|

| | | $ | 110,845 | | | | | $ | 126,923 | | | | | $ | 121,450 | | | | | $ | (16,078) | | | | | $ | 5,473 | | |

|

Adjustments

|

| | | | | | |||||||||||||||||||||||||

|

Restructuring costs

|

| | | | 6,281 | | | | | | — | | | | | | — | | | | | | 6,281 | | | | | | — | | |

|

Stock-based compensation

|

| | | | 2,259 | | | | | | 334 | | | | | | — | | | | | | 1,925 | | | | | | 334 | | |

|

Acquisition-related cost of goods sold

|

| | | | — | | | | | | 1,671 | | | | | | — | | | | | | (1,671) | | | | | | 1,671 | | |

|

Acquisition-related accrued compensation

|

| | | | — | | | | | | 1,152 | | | | | | 1,680 | | | | | | (1,152) | | | | | | (528) | | |

|

Acquisition-related transaction costs

|

| | | | 213 | | | | | | 400 | | | | | | 1,274 | | | | | | (187) | | | | | | (874) | | |

|

Acquisition-related other, net

|

| | | | — | | | | | | (468) | | | | | | (972) | | | | | | 468 | | | | | | 504 | | |

|

Other, net

|

| | | | (1,506) | | | | | | — | | | | | | — | | | | | | (1,506) | | | | | | — | | |

|

Pension settlement cost

|

| | | | — | | | | | | — | | | | | | 1,702 | | | | | | — | | | | | | (1,702) | | |

|

Gain on insurance settlement

|

| | | | — | | | | | | — | | | | | | (7,500) | | | | | | — | | | | | | 7,500 | | |

|

Foreign currency (gains) losses, net

|

| | | | (55) | | | | | | (1,054) | | | | | | (113) | | | | | | 999 | | | | | | (941) | | |

|

Loss on extinguishment of debt

|

| | | | — | | | | | | — | | | | | | 2,598 | | | | | | — | | | | | | (2,598) | | |

|

Interest paid

|

| | | | (12,250) | | | | | | (11,208) | | | | | | (14,600) | | | | | | (1,042) | | | | | | 3,392 | | |

|

Income taxes paid

|

| | | | (16,215) | | | | | | (15,191) | | | | | | (14,762) | | | | | | (1,024) | | | | | | (429) | | |

|

Changes in operating assets and liabilities and other items

|

| | | | (42,190) | | | | | | (32,151) | | | | | | 1,402 | | | | | | (10,039) | | | | | | (33,553) | | |

|

Cash provided by insurance settlement

|

| | | | — | | | | | | — | | | | | | 7,500 | | | | | | — | | | | | | (7,500) | | |

|

Cash used for acquisition-related transaction costs

|

| | | | (213) | | | | | | (400) | | | | | | (1,274) | | | | | | 187 | | | | | | 874 | | |

|

Net cash provided by operating activities

|

| | | $ | 47,169 | | | | | $ | 70,008 | | | | | $ | 98,385 | | | | | $ | (22,839) | | | | | $ | (28,377) | | |

| | | | | | |

Change

|

| ||||||||||||||||||||||||

|

As of June 30

|

| |

2019

|

| |

2018

|

| |

2017

|

| |

2019/2018

|

| |

2018/2017

|

| |||||||||||||||

| | | |

(in thousands, except ratios)

|

| |||||||||||||||||||||||||||

|

Cash and cash equivalents and short-term investments

|

| | | $ | 81,573 | | | | | $ | 79,168 | | | | | $ | 56,083 | | | | | $ | 2,405 | | | | | $ | 23,085 | | |

|

Working capital

|

| | | | 242,902 | | | | | | 205,651 | | | | | | 198,036 | | | | | | 37,251 | | | | | | 7,615 | | |

|

Ratio of current assets to current liabilities

|

| | | | 2.71:1 | | | | | | 2.57:1 | | | | | | 2.81:1 | | | | | ||||||||||

| | | | | | |

Change

|

| ||||||||||||||||||||||||

|

As of June 30

|

| |

2019

|

| |

2018

|

| |

2017

|

| |

2019/2018

|

| |

2018/2017

|

| |||||||||||||||

| | | |

(in thousands)

|

| |||||||||||||||||||||||||||

|

Accounts receivable–trade

|

| | | $ | 159,022 | | | | | $ | 135,742 | | | | | $ | 125,847 | | | | | $ | 23,280 | | | | | $ | 9,895 | | |

|

DSO

|

| | | | 70 | | | | | | 58 | | | | | | 58 | | | | | ||||||||||

| | | | | | |

Change

|

| ||||||||||||||||||||||||

|

As of June 30

|

| |

2019

|

| |

2018

|

| |

2017

|

| |

2019/2018

|

| |

2018/2017

|

| |||||||||||||||

| | | |

(in thousands)

|

| |||||||||||||||||||||||||||

|

Inventories

|

| | | $ | 198,322 | | | | | $ | 178,170 | | | | | $ | 161,233 | | | | | $ | 20,152 | | | | | $ | 16,937 | | |

| | | |

Years

|

| | ||||||||||||||||||||||||||

| | | |

Within 1

|

| |

Over 1 to 3

|

| |

Over 3 to 5

|

| |

Over 5

|

| |

Total

|

| |||||||||||||||

| | | |

(in thousands)

|

| |||||||||||||||||||||||||||

|

Long-term debt (including current portion)

|

| | | $ | 12,540 | | | | | $ | 218,750 | | | | | $ | — | | | | | $ | — | | | | | $ | 231,290 | | |

|

Revolving credit facility

|

| | | | — | | | | | | 96,000 | | | | | | — | | | | | | — | | | | | | 96,000 | | |

|

Interest payments

|

| | | | 12,100 | | | | | | 22,261 | | | | | | | | | | | | — | | | | | | 34,361 | | |

|

Lease commitments

|

| | | | 5,815 | | | | | | 7,351 | | | | | | 2,309 | | | | | | 765 | | | | | | 16,240 | | |

|

Acquisition-related consideration

|

| | | | 70 | | | | | | 140 | | | | | | 140 | | | | | | 140 | | | | | | 490 | | |

|

Other

|

| | | | 1,990 | | | | | | 792 | | | | | | 198 | | | | | | — | | | | | | 2,980 | | |

|

Total contractual obligations

|

| | | $ | 32,515 | | | | | $ | 345,294 | | | | | $ | 2,647 | | | | | $ | 905 | | | | | $ | 381,361 | | |

| | | |

Quarters

|

| |

Year

|

| ||||||||||||||||||||||||

|

For the Periods Ended

|

| |

September 30,

2018 |

| |

December 31,

2018 |

| |

March 31,

2019 |

| |

June 30,

2019 |

| |

June 30,

2019 |

| |||||||||||||||

| | | |

(in thousands)

|

| |||||||||||||||||||||||||||

| Net sales | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

MFAs and other

|

| | | $ | 87,004 | | | | | $ | 93,054 | | | | | $ | 84,095 | | | | | $ | 86,315 | | | | | $ | 350,468 | | |

|

Nutritional Specialties

|

| | | | 26,970 | | | | | | 29,460 | | | | | | 28,227 | | | | | | 28,558 | | | | | | 113,215 | | |

|

Vaccines

|

| | | | 17,215 | | | | | | 17,048 | | | | | | 16,867 | | | | | | 17,161 | | | | | | 68,291 | | |

|

Animal Health

|

| | | $ | 131,189 | | | | | $ | 139,562 | | | | | $ | 129,189 | | | | | $ | 132,034 | | | | | $ | 531,974 | | |

|

Mineral Nutrition

|

| | | | 54,838 | | | | | | 62,319 | | | | | | 60,653 | | | | | | 55,972 | | | | | | 233,782 | | |

|

Performance Products

|

| | | | 14,126 | | | | | | 16,342 | | | | | | 15,894 | | | | | | 15,877 | | | | | | 62,239 | | |

|

Total net sales

|

| | | | 200,153 | | | | | | 218,223 | | | | | | 205,736 | | | | | | 203,883 | | | | | | 827,995 | | |

|

Cost of goods sold

|

| | | | 134,348 | | | | | | 149,579 | | | | | | 140,864 | | | | | | 138,580 | | | | | | 563,371 | | |

|

Gross profit

|

| | | | 65,805 | | | | | | 68,644 | | | | | | 64,872 | | | | | | 65,303 | | | | | | 264,624 | | |

|

Selling, general and administrative expenses

|

| | | | 42,952 | | | | | | 42,938 | | | | | | 42,304 | | | | | | 53,204 | | | | | | 181,398 | | |

|

Operating income

|

| | | | 22,853 | | | | | | 25,706 | | | | | | 22,568 | | | | | | 12,099 | | | | | | 83,226 | | |

|

Interest expense, net

|

| | | | 2,783 | | | | | | 3,015 | | | | | | 2,931 | | | | | | 3,047 | | | | | | 11,776 | | |

|

Foreign currency (gains) losses, net

|

| | | | (2,635) | | | | | | 2,617 | | | | | | 122 | | | | | | (159) | | | | | | (55) | | |

|

Income before income taxes

|

| | | | 22,705 | | | | | | 20,074 | | | | | | 19,515 | | | | | | 9,211 | | | | | | 71,505 | | |

|

Provision for income taxes

|

| | | | 6,391 | | | | | | 5,326 | | | | | | 4,666 | | | | | | 409 | | | | | | 16,792 | | |

|

Net income

|

| | | $ | 16,314 | | | | | $ | 14,748 | | | | | $ | 14,849 | | | | | $ | 8,802 | | | | | $ | 54,713 | | |

| Net income per share | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

basic

|

| | | $ | 0.40 | | | | | $ | 0.37 | | | | | $ | 0.37 | | | | | $ | 0.22 | | | | | $ | 1.35 | | |

|

diluted

|

| | | $ | 0.40 | | | | | $ | 0.36 | | | | | $ | 0.37 | | | | | $ | 0.22 | | | | | $ | 1.35 | | |

| Adjusted EBITDA | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Animal Health

|

| | | $ | 35,716 | | | | | $ | 35,925 | | | | | $ | 33,241 | | | | | $ | 31,167 | | | | | $ | 136,049 | | |

|

Mineral Nutrition

|

| | | | 2,563 | | | | | | 4,084 | | | | | | 5,287 | | | | | | 3,778 | | | | | | 15,712 | | |

|

Performance Products

|

| | | | 716 | | | | | | 1,514 | | | | | | 1,330 | | | | | | 1,168 | | | | | | 4,728 | | |

|

Corporate

|

| | | | (8,886) | | | | | | (9,918) | | | | | | (9,850) | | | | | | (9,798) | | | | | | (38,452) | | |

|

Adjusted EBITDA

|

| | | $ | 30,109 | | | | | $ | 31,605 | | | | | $ | 30,008 | | | | | $ | 26,315 | | | | | $ | 118,037 | | |

|

Reconciliation of net income to Adjusted EBITDA

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net income

|

| | | $ | 16,314 | | | | | $ | 14,748 | | | | | $ | 14,849 | | | | | $ | 8,802 | | | | | $ | 54,713 | | |

|

Interest expense, net

|

| | | | 2,783 | | | | | | 3,015 | | | | | | 2,931 | | | | | | 3,047 | | | | | | 11,776 | | |

|

Provision for income taxes

|

| | | | 6,391 | | | | | | 5,326 | | | | | | 4,666 | | | | | | 409 | | | | | | 16,792 | | |

|

Depreciation and amortization

|

| | | | 6,691 | | | | | | 6,841 | | | | | | 6,875 | | | | | | 7,157 | | | | | | 27,564 | | |

|

EBITDA

|

| | | | 32,179 | | | | | | 29,930 | | | | | | 29,321 | | | | | | 19,415 | | | | | | 110,845 | | |

|

Restructuring costs

|

| | | | — | | | | | | — | | | | | | — | | | | | | 6,281 | | | | | | 6,281 | | |

|

Stock-based compensation

|

| | | | 565 | | | | | | 564 | | | | | | 565 | | | | | | 565 | | | | | | 2,259 | | |

|

Acquisition-related transaction costs

|

| | | | — | | | | | | — | | | | | | — | | | | | | 213 | | | | | | 213 | | |

|

Other

|

| | | | — | | | | | | (1,506) | | | | | | — | | | | | | — | | | | | | (1,506) | | |

|

Foreign currency (gains) losses, net

|

| | | | (2,635) | | | | | | 2,617 | | | | | | 122 | | | | | | (159) | | | | | | (55) | | |

|

Adjusted EBITDA

|

| | | $ | 30,109 | | | | | $ | 31,605 | | | | | $ | 30,008 | | | | | $ | 26,315 | | | | | $ | 118,037 | | |

| | | |

Quarters

|

| |

Year

|

| ||||||||||||||||||||||||

|

For the Periods Ended

|

| |

September 30,

2017 |

| |

December 31,

2017 |

| |

March 31,

2018 |

| |

June 30,

2018 |

| |

June 30,

2018 |

| |||||||||||||||

| | | |

(in thousands)

|

| |||||||||||||||||||||||||||

| Net sales | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

MFAs and other

|

| | | $ | 79,603 | | | | | $ | 82,018 | | | | | $ | 82,935 | | | | | $ | 92,110 | | | | | $ | 336,666 | | |

|

Nutritional Specialties

|

| | | | 30,777 | | | | | | 32,623 | | | | | | 31,366 | | | | | | 28,212 | | | | | | 122,978 | | |

|

Vaccines

|

| | | | 18,461 | | | | | | 18,204 | | | | | | 18,009 | | | | | | 17,409 | | | | | | 72,083 | | |

|

Animal Health

|

| | | $ | 128,841 | | | | | $ | 132,845 | | | | | $ | 132,310 | | | | | $ | 137,731 | | | | | $ | 531,727 | | |

|

Mineral Nutrition

|

| | | | 52,073 | | | | | | 59,616 | | | | | | 62,938 | | | | | | 60,295 | | | | | | 234,922 | | |

|

Performance Products

|

| | | | 12,498 | | | | | | 13,415 | | | | | | 13,660 | | | | | | 13,760 | | | | | | 53,333 | | |

|

Total net sales

|

| | | | 193,412 | | | | | | 205,876 | | | | | | 208,908 | | | | | | 211,786 | | | | | | 819,982 | | |

|

Cost of goods sold

|

| | | | 130,030 | | | | | | 138,957 | | | | | | 139,839 | | | | | | 144,277 | | | | | | 553,103 | | |

|

Gross profit

|

| | | | 63,382 | | | | | | 66,919 | | | | | | 69,069 | | | | | | 67,509 | | | | | | 266,879 | | |

|

Selling, general and administrative expenses

|

| | | | 40,995 | | | | | | 42,981 | | | | | | 42,577 | | | | | | 41,400 | | | | | | 167,953 | | |

|

Operating income

|

| | | | 22,387 | | | | | | 23,938 | | | | | | 26,492 | | | | | | 26,109 | | | | | | 98,926 | | |

|

Interest expense, net

|

| | | | 3,118 | | | | | | 3,050 | | | | | | 3,064 | | | | | | 2,678 | | | | | | 11,910 | | |

|

Foreign currency (gains) losses, net

|

| | | | 325 | | | | | | (323) | | | | | | (960) | | | | | | (96) | | | | | | (1,054) | | |

|

Income before income taxes

|

| | | | 18,944 | | | | | | 21,211 | | | | | | 24,388 | | | | | | 23,527 | | | | | | 88,070 | | |

|

Provision for income taxes

|

| | | | 3,052 | | | | | | 14,179 | | | | | | 4,548 | | | | | | 1,408 | | | | | | 23,187 | | |

|

Net income

|

| | | $ | 15,892 | | | | | $ | 7,032 | | | | | $ | 19,840 | | | | | $ | 22,119 | | | | | $ | 64,883 | | |

| Net income per share | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

basic

|

| | | $ | 0.40 | | | | | $ | 0.17 | | | | | $ | 0.49 | | | | | $ | 0.55 | | | | | $ | 1.61 | | |

|

diluted

|

| | | $ | 0.39 | | | | | $ | 0.17 | | | | | $ | 0.49 | | | | | $ | 0.55 | | | | | $ | 1.61 | | |

| Adjusted EBITDA | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Animal Health

|

| | | $ | 33,742 | | | | | $ | 35,036 | | | | | $ | 36,292 | | | | | $ | 36,844 | | | | | $ | 141,914 | | |

|

Mineral Nutrition

|

| | | | 3,716 | | | | | | 5,614 | | | | | | 5,375 | | | | | | 3,878 | | | | | | 18,583 | | |

|

Performance Products

|

| | | | 248 | | | | | | 264 | | | | | | 386 | | | | | | 983 | | | | | | 1,881 | | |

|

Corporate

|

| | | | (7,589) | | | | | | (8,436) | | | | | | (8,650) | | | | | | (8,745) | | | | | | (33,420) | | |

|

Adjusted EBITDA

|

| | | $ | 30,117 | | | | | $ | 32,478 | | | | | $ | 33,403 | | | | | $ | 32,960 | | | | | $ | 128,958 | | |

|

Reconciliation of net income to Adjusted EBITDA

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net income

|

| | | $ | 15,892 | | | | | $ | 7,032 | | | | | $ | 19,840 | | | | | $ | 22,119 | | | | | $ | 64,883 | | |

|

Interest expense, net

|

| | | | 3,118 | | | | | | 3,050 | | | | | | 3,064 | | | | | | 2,678 | | | | | | 11,910 | | |

|

Provision for income taxes

|

| | | | 3,052 | | | | | | 14,179 | | | | | | 4,548 | | | | | | 1,408 | | | | | | 23,187 | | |

|

Depreciation and amortization

|

| | | | 6,644 | | | | | | 6,631 | | | | | | 6,751 | | | | | | 6,917 | | | | | | 26,943 | | |

|

EBITDA

|

| | | | 28,706 | | | | | | 30,892 | | | | | | 34,203 | | | | | | 33,122 | | | | | | 126,923 | | |

|

Acquisition-related cost of goods sold

|

| | | | 249 | | | | | | 1,422 | | | | | | — | | | | | | — | | | | | | 1,671 | | |

|

Acquisition-related accrued compensation

|

| | | | 437 | | | | | | 487 | | | | | | 160 | | | | | | 68 | | | | | | 1,152 | | |

|

Acquisition-related transaction costs

|

| | | | 400 | | | | | | — | | | | | | — | | | | | | — | | | | | | 400 | | |

|

Acquisition-related other, net

|

| | | | — | | | | | | — | | | | | | — | | | | | | (468) | | | | | | (468) | | |

|

Stock-based compensation

|

| | | | — | | | | | | — | | | | | | — | | | | | | 334 | | | | | | 334 | | |

|

Foreign currency (gains) losses, net

|

| | | | 325 | | | | | | (323) | | | | | | (960) | | | | | | (96) | | | | | | (1,054) | | |

|

Adjusted EBITDA

|

| | | $ | 30,117 | | | | | $ | 32,478 | | | | | $ | 33,403 | | | | | $ | 32,960 | | | | | $ | 128,958 | | |

| | | | | | 81 | | | |

| | | | | | 83 | | | |

| | | | | | 84 | | | |

| | | | | | 85 | | | |

| | | | | | 86 | | | |

| | | | | | 87 | | | |

| | | | | | 88 | | |

Florham Park, New Jersey

August 27, 2019

We have served as the Company’s auditor since 1998.

|

For the Year Ended June 30

|

| |

2019

|

| |

2018

|

| |

2017

|

| |||||||||

| | | |

(in thousands, except per share amounts)

|

| |||||||||||||||

|

Net sales

|

| | | $ | 827,995 | | | | | $ | 819,982 | | | | | $ | 764,281 | | |

|

Cost of goods sold

|

| | | | 563,371 | | | | | | 553,103 | | | | | | 516,038 | | |

|

Gross profit

|

| | | | 264,624 | | | | | | 266,879 | | | | | | 248,243 | | |

|

Selling, general and administrative expenses

|

| | | | 181,398 | | | | | | 167,953 | | | | | | 150,309 | | |

|

Operating income

|

| | | | 83,226 | | | | | | 98,926 | | | | | | 97,934 | | |

|

Interest expense, net

|

| | | | 11,776 | | | | | | 11,910 | | | | | | 14,906 | | |

|

Foreign currency (gains) losses, net

|

| | | | (55) | | | | | | (1,054) | | | | | | (113) | | |

|

Loss on extinguishment of debt

|

| | | | — | | | | | | — | | | | | | 2,598 | | |

|

Income before income taxes

|

| | | | 71,505 | | | | | | 88,070 | | | | | | 80,543 | | |

|

Provision for income taxes

|

| | | | 16,792 | | | | | | 23,187 | | | | | | 15,928 | | |

|

Net income

|

| | | $ | 54,713 | | | | | $ | 64,883 | | | | | $ | 64,615 | | |

| Net income per share | | | | | | | | | | | | | | | | | | | |

|

basic

|

| | | $ | 1.35 | | | | | $ | 1.61 | | | | | $ | 1.63 | | |

|

diluted

|

| | | $ | 1.35 | | | | | $ | 1.61 | | | | | $ | 1.61 | | |

| Weighted average common shares outstanding | | | | | |||||||||||||||

|

basic

|

| | | | 40,412 | | | | | | 40,181 | | | | | | 39,524 | | |

|

diluted

|

| | | | 40,523 | | | | | | 40,385 | | | | | | 40,042 | | |

|

For the Year Ended June 30

|

| |

2019

|

| |

2018

|

| |

2017

|

| |||||||||

| | | |

(in thousands)

|

| |||||||||||||||

|

Net income

|

| | | $ | 54,713 | | | | | $ | 64,883 | | | | | $ | 64,615 | | |

|

Change in fair value of derivative instruments

|

| | | | (5,580) | | | | | | 2,300 | | | | | | 31 | | |

|

Foreign currency translation adjustment

|

| | | | (4,127) | | | | | | (23,542) | | | | | | (1,652) | | |

|

Unrecognized net pension gains (losses)

|

| | | | (1,837) | | | | | | (154) | | | | | | 12,918 | | |

|

(Provision) benefit for income taxes

|

| | | | 1,846 | | | | | | 350 | | | | | | (4,949) | | |

|

Other comprehensive income (loss)

|

| | | | (9,698) | | | | | | (21,046) | | | | | | 6,348 | | |

|

Comprehensive income

|

| | | $ | 45,015 | | | | | $ | 43,837 | | | | | $ | 70,963 | | |

|

As of June 30

|

| |

2019

|

| |

2018

|

| ||||||

| | | |

(in thousands, except share and per share amounts)

|

| |||||||||

| ASSETS | | | | | | | | | | | | | |

|

Cash and cash equivalents

|

| | | $ | 57,573 | | | | | $ | 29,168 | | |

|

Short-term investments

|

| | | | 24,000 | | | | | | 50,000 | | |

|

Accounts receivable, net

|

| | | | 159,022 | | | | | | 135,742 | | |

|

Inventories, net

|

| | | | 198,322 | | | | | | 178,170 | | |

|

Other current assets

|

| | | | 27,245 | | | | | | 22,381 | | |

|

Total current assets

|

| | | | 466,162 | | | | | | 415,461 | | |

|

Property, plant and equipment, net

|

| | | | 140,235 | | | | | | 130,108 | | |

|

Intangibles, net

|

| | | | 47,478 | | | | | | 51,978 | | |

|

Goodwill

|

| | | | 27,348 | | | | | | 27,348 | | |

|

Other assets

|

| | | | 45,448 | | | | | | 46,784 | | |

|

Total assets

|

| | | $ | 726,671 | | | | | $ | 671,679 | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | | | | | | |

|

Current portion of long-term debt

|

| | | $ | 12,540 | | | | | $ | 12,579 | | |

|

Accounts payable

|

| | | | 73,189 | | | | | | 59,498 | | |

|

Accrued expenses and other current liabilities

|

| | | | 68,498 | | | | | | 71,144 | | |

|

Total current liabilities

|

| | | | 154,227 | | | | | | 143,221 | | |

|

Revolving credit facility

|

| | | | 96,000 | | | | | | 70,000 | | |

|

Long-term debt

|

| | | | 217,635 | | | | | | 229,802 | | |

|

Other liabilities

|

| | | | 42,794 | | | | | | 43,702 | | |

|

Total liabilities

|

| | | | 510,656 | | | | | | 486,725 | | |

| Commitments and contingencies (Note 8) | | | | | | | | | | | | | |

|

Common stock, par value $0.0001 per share; 300,000,000 Class A

shares authorized, 20,287,574 and 19,992,204 shares issued and outstanding at June 30, 2019 and 2018, respectively; 30,000,000 Class B shares authorized, 20,166,034 and 20,365,504 shares issued and outstanding at June 30, 2019 and 2018, respectively |

| | | | 4 | | | | | | 4 | | |

|

Preferred stock, par value $0.0001 per share; 16,000,000 shares authorized, no shares issued and outstanding

|

| | | | — | | | | | | — | | |

|

Paid-in capital

|

| | | | 133,266 | | | | | | 129,873 | | |

|

Retained earnings

|

| | | | 168,926 | | | | | | 131,560 | | |

|

Accumulated other comprehensive income (loss)

|

| | | | (86,181) | | | | | | (76,483) | | |

|

Total stockholders’ equity

|

| | | | 216,015 | | | | | | 184,954 | | |

|

Total liabilities and stockholders’ equity

|

| | | $ | 726,671 | | | | | $ | 671,679 | | |

|

For the Year Ended June 30

|

| |

2019

|

| |

2018

|

| |

2017

|

| |||||||||

| | | |

(in thousands)

|

| |||||||||||||||

| OPERATING ACTIVITIES | | | | | | | | | | | | | | | | | | | |

|

Net income

|

| | | $ | 54,713 | | | | | $ | 64,883 | | | | | $ | 64,615 | | |

|

Adjustments to reconcile net income to net cash provided (used) by operating activities:

|

| | | | | | | | | | | | | | | | | | |

|

Depreciation and amortization

|

| | | | 27,564 | | | | | | 26,943 | | | | | | 26,001 | | |

|