|

Exhibit 99.1

INTERIM CONSOLIDATED FINANCIAL STATEMENTS

|

|

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF FINANCIAL

POSITION

(Unaudited -

Expressed in thousands of Canadian dollars (“CAD”)

except for share amounts)

|

||||||

|

|

|

|

|

At March

31

2019

|

|

At December

31

2018

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

Current

|

|

|

|

|

|

|

|

Cash and cash

equivalents (note 5)

|

|

|

$

|

19,027

|

$

|

23,207

|

|

Trade and other

receivables (note 6)

|

|

|

|

4,157

|

|

4,072

|

|

Inventories (note

7)

|

|

|

|

3,520

|

|

3,584

|

|

Prepaid expenses

and other

|

|

|

|

632

|

|

843

|

|

|

|

|

|

27,336

|

|

31,706

|

|

Non-Current

|

|

|

|

|

|

|

|

Inventories-ore

in stockpiles (note 7)

|

|

|

|

2,098

|

|

2,098

|

|

Investments (note

8)

|

|

|

|

2,132

|

|

2,255

|

|

Investments in

associates (note 9)

|

|

|

|

5,305

|

|

5,582

|

|

Restricted cash

and investments (note 10)

|

|

|

|

12,552

|

|

12,255

|

|

Property, plant

and equipment (note 11)

|

|

|

|

258,241

|

|

258,291

|

|

Total

assets

|

|

|

$

|

307,664

|

$

|

312,187

|

|

|

|

|

|

|

|

|

|

LIABILITIES

|

|

|

|

|

|

|

|

Current

|

|

|

|

|

|

|

|

Accounts payable

and accrued liabilities

|

|

|

$

|

7,338

|

$

|

5,554

|

|

Current portion

of long-term liabilities:

|

|

|

|

|

|

|

|

Deferred revenue

(note 12)

|

|

|

|

4,580

|

|

4,567

|

|

Post-employment

benefits (note 13)

|

|

|

|

150

|

|

150

|

|

Reclamation

obligations (note 14)

|

|

|

|

863

|

|

877

|

|

Other liabilities

(note 15)

|

|

|

|

280

|

|

1,337

|

|

|

|

|

|

13,211

|

|

12,485

|

|

Non-Current

|

|

|

|

|

|

|

|

Deferred revenue

(note 12)

|

|

|

|

32,684

|

|

33,160

|

|

Post-employment

benefits (note 13)

|

|

|

|

2,123

|

|

2,145

|

|

Reclamation

obligations (note 14)

|

|

|

|

29,360

|

|

29,187

|

|

Other liabilities

(note 15)

|

|

|

|

654

|

|

-

|

|

Deferred income

tax liability

|

|

|

|

12,114

|

|

12,963

|

|

Total

liabilities

|

|

|

|

90,146

|

|

89,940

|

|

|

|

|

|

|

|

|

|

EQUITY

|

|

|

|

|

|

|

|

Share capital

(note 16)

|

|

|

|

1,331,214

|

|

1,331,214

|

|

Share purchase

warrants (note 17)

|

|

|

|

435

|

|

435

|

|

Contributed

surplus (note 18)

|

|

|

|

64,237

|

|

63,634

|

|

Deficit

|

|

|

|

(1,179,498)

|

|

(1,174,163)

|

|

Accumulated other

comprehensive income (note 19)

|

|

|

|

1,130

|

|

1,127

|

|

Total

equity

|

|

|

|

217,518

|

|

222,247

|

|

Total

liabilities and equity

|

|

|

$

|

307,664

|

$

|

312,187

|

|

|

|

|

|

|

|

|

|

Issued and

outstanding common shares (note 16)

|

|

|

589,128,908

|

|

589,175,086

|

|

|

Contingencies

(note 25)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying

notes are integral to the condensed interim consolidated financial

statements

|

||||||

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

|

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF INCOME (LOSS) AND

COMPREHENSIVE INCOME (LOSS)

|

||||||||

|

(Unaudited -

Expressed in thousands of CAD dollars except for share and per

share amounts)

|

||||||||

|

|

|

|

|

Three

Months Ended

March

31

|

||||

|

|

|

|

|

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REVENUES (note 21)

|

|

|

|

|

$

|

3,976

|

$

|

3,573

|

|

|

|

|

|

|

|

|

|

|

|

EXPENSES

|

|

|

|

|

|

|

|

|

|

Operating

expenses (note 20, 21)

|

|

|

|

|

|

(3,262)

|

|

(3,593)

|

|

Exploration and

evaluation (note 21)

|

|

|

|

|

|

(4,229)

|

|

(6,254)

|

|

General and

administrative (note 21)

|

|

|

|

|

|

(2,366)

|

|

(1,832)

|

|

Impairment

reversal (note 21)

|

|

|

|

|

|

-

|

|

11

|

|

Other income

(expense) (note 20)

|

|

|

|

|

|

(353)

|

|

(3,456)

|

|

|

|

|

|

|

|

(10,210)

|

|

(15,124)

|

|

Loss

before finance charges, equity accounting

|

|

|

|

|

|

(6,234)

|

|

(11,551)

|

|

Finance expense

(note 20)

|

|

|

|

|

|

(1,010)

|

|

(711)

|

|

Equity share of

loss of associate (note 9)

|

|

|

|

|

|

(277)

|

|

(643)

|

|

Loss before

taxes

|

|

|

|

|

|

(7,521)

|

|

(12,905)

|

|

Income tax

recovery (note 23)

|

|

|

|

|

|

|

|

|

|

Deferred

|

|

|

|

|

|

2,186

|

|

5,937

|

|

Net loss for the

period

|

|

|

|

|

$

|

(5,335)

|

$

|

(6,968)

|

|

|

|

|

|

|

|

|

|

|

|

Other

comprehensive income (loss) (note 19):

|

|

|

|

|

|

|

|

|

|

Items that may be

reclassified to income (loss):

|

|

|

|

|

|

|

|

|

|

Foreign currency

translation change

|

|

|

|

|

|

3

|

|

(4)

|

|

Comprehensive

loss for the period

|

|

|

|

|

$

|

(5,332)

|

$

|

(6,972)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

net loss per share:

|

|

|

|

|

|

|

|

|

|

All

operations

|

|

|

|

|

$

|

(0.01)

|

$

|

(0.01)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average

number of shares outstanding (in thousands):

|

|

|

|

|

||||

|

Basic and

diluted

|

|

|

|

|

|

589,129

|

|

559,183

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying

notes are integral to the condensed interim consolidated financial

statements

|

||||||||

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

|

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CHANGES IN

EQUITY

|

||||||||

|

(Unaudited -

Expressed in thousands of CAD dollars)

|

||||||||

|

|

|

|

|

Three

Months Ended

March

31

|

||||

|

|

|

|

|

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share capital

|

|

|

|

|

|

|

|

|

|

Balance-beginning

of period

|

|

|

|

|

$

|

1,331,214

|

$

|

1,310,473

|

|

Balance-end of

period

|

|

|

|

|

|

1,331,214

|

|

1,310,473

|

|

|

|

|

|

|

|

|

|

|

|

Share purchase warrants

|

|

|

|

|

|

|

|

|

|

Balance-beginning

of period

|

|

|

|

|

|

435

|

|

435

|

|

Balance-end of

period

|

|

|

|

|

|

435

|

|

435

|

|

|

|

|

|

|

|

|

|

|

|

Contributed surplus

|

|

|

|

|

|

|

|

|

|

Balance-beginning

of period

|

|

|

|

|

|

63,634

|

|

61,799

|

|

Share-based

compensation expense (note 18)

|

|

|

|

|

|

603

|

|

363

|

|

Balance-end of

period

|

|

|

|

|

|

64,237

|

|

62,162

|

|

|

|

|

|

|

|

|

|

|

|

Deficit

|

|

|

|

|

|

|

|

|

|

Balance-beginning

of period

|

|

|

|

|

|

(1,174,163)

|

|

(1,144,086)

|

|

Net

loss

|

|

|

|

|

|

(5,335)

|

|

(6,968)

|

|

Balance-end of

period

|

|

|

|

|

|

(1,179,498)

|

|

(1,151,054)

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated other comprehensive income

|

|

|

|

|

|

|

|

|

|

Balance-beginning

of period

|

|

|

|

|

|

1,127

|

|

1,140

|

|

Foreign currency

translation

|

|

|

|

|

|

3

|

|

(4)

|

|

Balance-end of

period

|

|

|

|

|

|

1,130

|

|

1,136

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Equity

|

|

|

|

|

|

|

|

|

|

Balance-beginning

of period

|

|

|

|

|

|

222,247

|

|

229,761

|

|

Balance-end of

period

|

|

|

|

|

$

|

217,518

|

$

|

223,152

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying

notes are integral to the condensed interim consolidated financial

statements

|

||||||||

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

|

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CASH FLOW

|

||||||||

|

(Unaudited -

Expressed in thousands of CAD dollars)

|

||||||||

|

|

|

|

|

Three

Months Ended

March

31

|

||||

|

CASH PROVIDED BY (USED IN):

|

|

|

|

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Net loss for the

period

|

|

|

|

|

$

|

(5,335)

|

$

|

(6,968)

|

|

Items not

affecting cash and cash equivalents:

|

|

|

|

|

|

|

|

|

|

Depletion,

depreciation, amortization and accretion

|

|

|

|

|

|

2,236

|

|

2,186

|

|

Impairment

reversal

|

|

|

|

|

|

-

|

|

(11)

|

|

Share-based

compensation (note 18)

|

|

|

|

|

|

603

|

|

363

|

|

Recognition

of deferred revenue (note 12)

|

|

|

|

|

|

(1,263)

|

|

(780)

|

|

Gains on

property, plant and equipment disposals (note 20)

|

|

|

|

-

|

|

(36)

|

||

|

Losses on

investments (note 8)

|

|

|

|

238

|

|

3,405

|

||

|

Equity loss

of associate (note 9)

|

|

|

|

275

|

|

663

|

||

|

Dilution loss

(gain) of associate (note 9)

|

|

|

|

2

|

|

(20)

|

||

|

Deferred income

tax recovery

|

|

|

|

|

|

(2,186)

|

|

(5,937)

|

|

Foreign exchange

losses

|

|

|

|

|

|

-

|

|

3

|

|

Post-employment

benefits (note 13)

|

|

|

|

|

|

(39)

|

|

(24)

|

|

Reclamation

obligations (note 14)

|

|

|

|

|

|

(181)

|

|

(189)

|

|

Change in

non-cash working capital items (note 20)

|

|

|

|

|

|

1,971

|

|

2,644

|

|

Net

cash used in operating activities

|

|

|

|

|

|

(3,679)

|

|

(4,701)

|

|

|

|

|

|

|

|

|

|

|

|

INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Sale of

investments (note 8)

|

|

|

|

|

|

-

|

|

37,500

|

|

Purchase of

investments (note 8)

|

|

|

|

|

|

(115)

|

|

-

|

|

Expenditures on

property, plant and equipment (note 11)

|

|

|

|

(21)

|

|

(83)

|

||

|

Proceeds

on sale of property, plant and equipment

|

|

|

|

|

|

-

|

|

47

|

|

Increase

in restricted cash and investments

|

|

|

|

(297)

|

|

(631)

|

||

|

Net

cash provided by (used in) investing activities

|

|

|

|

|

|

(433)

|

|

36,833

|

|

|

|

|

|

|

|

|

|

|

|

FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Payment

of lease obligations

|

|

|

|

|

|

(68)

|

|

-

|

|

Net

cash used in financing activities

|

|

|

|

|

|

(68)

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

Increase

(decrease) in cash and cash equivalents

|

|

|

|

|

|

(4,180)

|

|

32,132

|

|

Cash

and cash equivalents, beginning of period

|

|

|

|

|

|

23,207

|

|

3,636

|

|

Cash

and cash equivalents, end of period

|

|

|

|

|

$

|

19,027

|

$

|

35,768

|

|

|

||||||||

|

The accompanying

notes are integral to the condensed interim consolidated financial

statements

|

||||||||

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

|

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2019

|

|

|

(Unaudited -

Expressed in CAD dollars except for shares and per share

amounts)

|

|

1.

NATURE OF

OPERATIONS

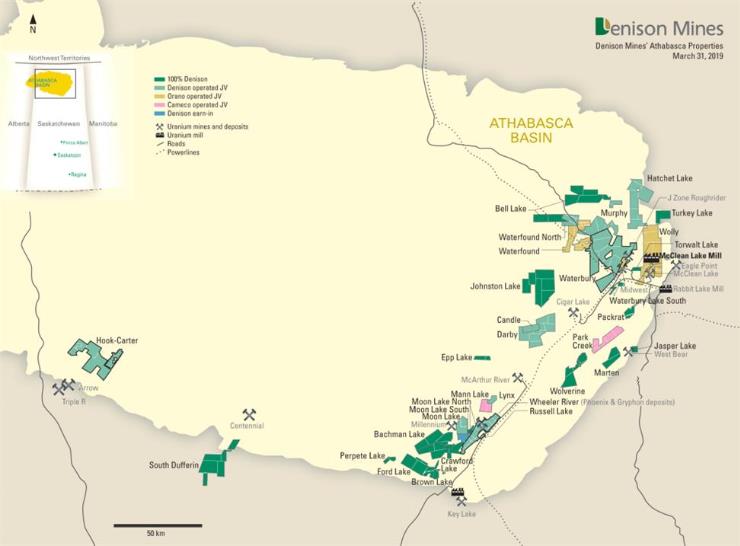

Denison Mines

Corp. (“DMC”) and its subsidiary companies and joint

arrangements (collectively, “Denison” or the

“Company”) are engaged in uranium mining related

activities, which can include acquisition, exploration and

development of uranium bearing properties, extraction, processing

and selling of uranium.

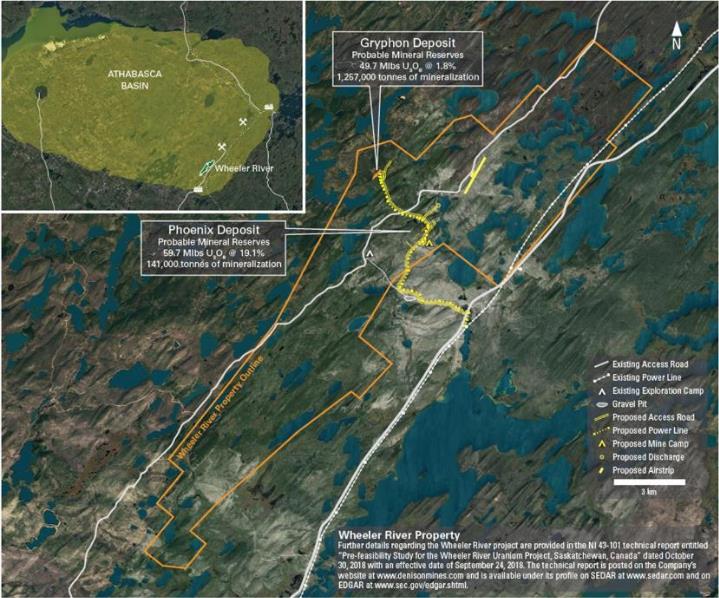

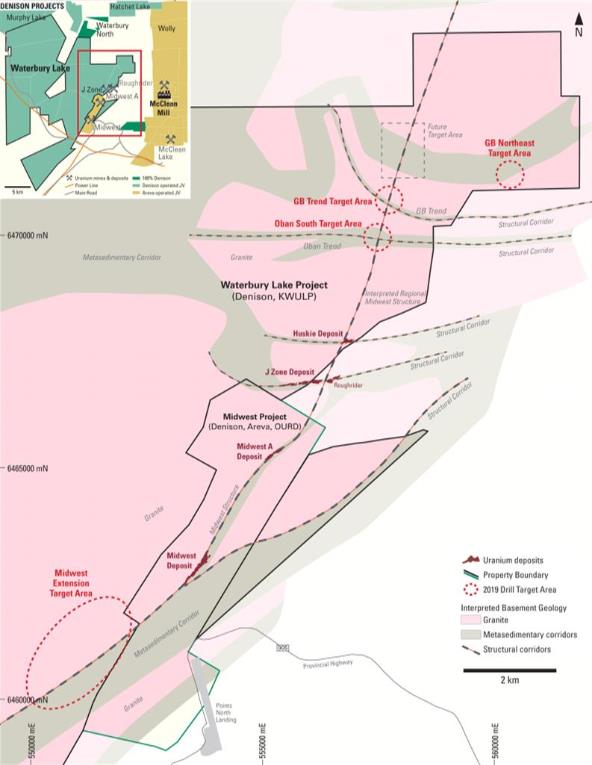

The Company has a

90.00% interest in the Wheeler River Joint Venture

(“WRJV”), a 65.92% interest in the Waterbury Lake

Limited Partnership (“WLULP”), a 22.50% interest in the

McClean Lake Joint Venture (“MLJV”) (which includes the

McClean Lake mill) and a 25.17% interest in the Midwest Joint

Venture (“MWJV”), each of which are located in the

eastern portion of the Athabasca Basin region in northern

Saskatchewan, Canada. The McClean Lake mill provides toll milling

services to the Cigar Lake Joint Venture (“CLJV”) under

the terms of a toll milling agreement between the parties (see note

12). In addition, the Company has varying ownership interests in a

number of other development and exploration projects located in

Canada.

The Company

provides mine decommissioning and environmental consulting services

(collectively “environmental services”) to third

parties through its Denison Environmental Services

(“DES”) division and is also the manager of Uranium

Participation Corporation (“UPC”), a publicly-listed

investment holding company formed to invest substantially all of

its assets in uranium oxide concentrates (“U3O8”) and

uranium hexafluoride (“UF6”). The

Company has no ownership interest in UPC but receives fees for

management services and commissions from the purchase and sale of

U3O8 and

UF6 by

UPC.

DMC is

incorporated under the Business Corporations Act (Ontario) and

domiciled in Canada. The address of its registered head office is

40 University Avenue, Suite 1100, Toronto, Ontario, Canada, M5J

1T1.

2.

STATEMENT

OF COMPLIANCE

These condensed

interim consolidated financial statements have been prepared in

accordance with International Financial Reporting Standards

(“IFRS”) as issued by the International Accounting

Standards Board (“IASB”) applicable to the preparation

of interim financial statements, including IAS 34, Interim

Financial Reporting. The condensed interim consolidated financial

statements should be read in conjunction with the audited annual

consolidated financial statements for the year ended December 31,

2018. The Company’s presentation currency is Canadian

dollars.

These financial

statements were approved by the board of directors for issue on May

1, 2019.

3.

ACCOUNTING

POLICIES AND ACCOUNTING CHANGES

Significant

Accounting Policies and Accounting Changes in Fiscal

2019

The significant

accounting policies followed in these condensed interim

consolidated financial statements are consistent with those applied

in the Company’s audited annual consolidated financial

statements for the year ended December 31, 2018, with the exception

of the Company’s accounting for leases.

On January 1,

2019, Denison adopted the provisions of IFRS 16 Leases (“IFRS

16”) using the modified retrospective approach. As such,

comparative information has not been restated and continues to be

reported under International Accounting Standard 17 Leases

(“IAS 17”) and International Financial Reporting

Interpretation Committee 4 Determining Whether an Arrangement

Contains a Lease (“IFRIC 4”). The transitional impact

of the change in accounting policy is disclosed in note 4 and

additional disclosures related to Denison’s IFRS 16

right-of-use assets and lease liabilities are disclosed in notes 11

and 15, respectively. Denison’s new accounting policy for

leases is as follows:

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

A.

Leases

At the inception

of a contract, the Company assesses whether a contract is, or

contains, a lease. A contract is, or contains, a lease if the

contract conveys the right to control the use of an identified

asset for a period of time in exchange for consideration. To assess

whether a contract conveys the right to control the use of an

identified asset, the Company assesses whether:

●

the contract involves the use

of an identified asset – this may be specified explicitly or

implicitly and should be physically distinct or represent

substantially all of the capacity of a physically distinct asset.

If the supplier has a substantive substitution right, then the

asset is not identified;

●

the Company has the right to

obtain substantially all of the economic benefits from the use of

the asset throughout the period of use; and

●

the Company has the right to

direct the use of the asset. The Company has this right when it has

the decision-making rights that are most relevant to changing how

and for what purpose the asset is used. In rare cases where the

decision about how and for what purpose the asset is used is

predetermined, the Company has the right to direct the use of the

asset if either: (a) the Company has the right to operate the

asset; or (b) the Company designed the asset in a way that

predetermines how and for what purpose it will be

used.

If the contract

contains a lease, a right-of-use asset and a corresponding lease

liability are set-up at the date at which the leased asset is

available for use by the Company. The lease payments are discounted

using either the interest rate implicit in the lease, if available,

or the Company’s incremental borrowing rate. Each lease

payment is allocated between the liability and the finance cost

(i.e. accretion) so as to produce a constant rate of interest on

the remaining lease liability balance. The Company accounts for the

lease and non-lease components separately. The right-of-use asset

is depreciated over the shorter of the asset’s useful life

and the lease term on a straight-line basis.

4.

ADOPTION

OF NEW ACCOUNTING STANDARDS – IMPACT ON FINANCIAL

STATEMENTS

As noted above,

Denison adopted the provisions of IFRS 16 on January 1, 2019 using

the modified retrospective approach. On transition to IFRS 16, the

Company recognized an additional $944,000 of right-of-use assets

(reported within “Property, Plant and Equipment”

– see note 11) and an additional $944,000 of lease

liabilities (reported within “Other Liabilities”

– see note 15).

The underlying

lease payments have been discounted using the Company’s

incremental borrowing rate on January 1, 2019 of 8.50%. In applying

IFRS 16 for the first time, Denison has used the following

practical expedients permitted by the standard: a) leases with a

term of less than 12 months remaining at January 1, 2019 have been

accounted for as short-term leases; and b) initial direct costs for

the measurement of the right-of-use asset at the date of initial

application have been excluded.

A reconciliation

of Denison’s December 31, 2018 lease commitments to its

opening lease liabilities amount recognized under IFRS 16 is as

follows:

|

|

|

|

At January

1

|

|

(in thousands of

CAD dollars)

|

|

|

2019

|

|

|

|

|

|

|

Operating lease

and other commitments per Denison’s December 31, 2018 annual

financial statements

|

|

$

|

1,259

|

|

Adjustments to

IFRS 16:

|

|

|

|

|

Recognition

exemption for short-term leases

|

|

|

(13)

|

|

Other

|

|

|

(75)

|

|

Lease liabilities

- undiscounted

|

|

|

1,171

|

|

Present value

discount adjustment

|

|

|

(227)

|

|

Lease liabilities

on transition to IFRS 16

|

|

$

|

944

|

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

5.

CASH AND

CASH EQUIVALENTS

The cash and cash

equivalent balance consists of:

|

|

|

|

|

At March

31

|

|

At December

31

|

|

(in thousands of

CAD dollars)

|

|

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

|

|

Cash

|

|

|

$

|

1,390

|

$

|

1,152

|

|

Cash in MLJV and

MWJV

|

|

|

|

1,488

|

|

654

|

|

Cash

equivalents

|

|

|

|

16,149

|

|

21,401

|

|

|

|

|

$

|

19,027

|

$

|

23,207

|

6.

TRADE AND

OTHER RECEIVABLES

The trade and

other receivables balance consists of:

|

|

|

|

|

At March

31

|

|

At December

31

|

|

|

(in thousands of

CAD dollars)

|

|

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

|

Trade

receivables

|

|

|

$

|

3,542

|

$

|

2,952

|

|

|

Receivables in

MLJV and MWJV

|

|

|

|

197

|

|

571

|

|

|

Sales tax

receivables

|

|

|

|

142

|

|

98

|

|

|

Sundry

receivables

|

|

|

|

26

|

|

201

|

|

|

Loan receivable

(note 22)

|

|

|

|

250

|

|

250

|

|

|

|

|

|

$

|

4,157

|

$

|

4,072

|

|

7.

INVENTORIES

The inventories

balance consists of:

|

|

|

|

|

At March

31

|

|

At December

31

|

|

(in thousands of

CAD dollars)

|

|

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

|

|

Uranium

concentrates

|

|

|

$

|

526

|

$

|

526

|

|

Inventory of ore

in stockpiles

|

|

|

|

2,098

|

|

2,098

|

|

Mine and mill

supplies in MLJV

|

|

|

|

2,994

|

|

3,058

|

|

|

|

|

$

|

5,618

|

$

|

5,682

|

|

|

|

|

|

|

|

|

|

Inventories-by

balance sheet presentation:

|

|

|

|

|

|

|

|

Current

|

|

|

$

|

3,520

|

$

|

3,584

|

|

Long-term-ore in

stockpiles

|

|

|

|

2,098

|

|

2,098

|

|

|

|

|

$

|

5,618

|

$

|

5,682

|

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

8.

INVESTMENTS

The investments

balance consists of:

|

|

|

|

|

At March

31

|

|

At December

31

|

|

(in thousands of

CAD dollars)

|

|

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

|

|

Investments:

|

|

|

|

|

|

|

|

Equity

instruments

|

|

|

$

|

2,132

|

$

|

2,255

|

|

|

|

|

$

|

2,132

|

$

|

2,255

|

|

|

|

|

|

|

|

|

|

Investments-by

balance sheet presentation:

|

|

|

|

|

|

|

|

Current

|

|

|

$

|

-

|

$

|

-

|

|

Long-term

|

|

|

|

2,132

|

|

2,255

|

|

|

|

|

$

|

2,132

|

$

|

2,255

|

The investments

continuity summary is as follows:

|

(in thousands of

CAD dollars)

|

|

|

|

|

|

Three

Months

Ended

March

31,

2019

|

|

|

|

|

|

|

|

|

|

Balance-beginning

of period

|

|

|

|

|

$

|

2,255

|

|

Purchases

|

|

|

|

|

|

|

|

Equity

instruments

|

|

|

|

|

|

115

|

|

Fair value loss

to profit and loss

|

|

|

|

|

|

(238)

|

|

Balance-end of

period

|

|

|

|

|

$

|

2,132

|

9.

INVESTMENT

IN ASSOCIATES

The investment in

associates balance consists of the Company’s investment in

GoviEx Uranium Inc (“GoviEx”). A summary of the

investment in GoviEx is as follows:

|

(in thousands of

CAD dollars except share amounts)

|

|

|

|

Number

of Common Shares

|

|

|

|

|

|

|

|

|

|

|

|

Balance-December

31, 2018

|

|

|

|

65,144,021

|

$

|

5,582

|

|

Equity share of

net income (loss)

|

|

|

|

-

|

|

(275)

|

|

Dilution gain

(loss)

|

|

|

|

-

|

|

(2)

|

|

Balance-March 31,

2019

|

|

|

|

65,144,021

|

$

|

5,305

|

GoviEx is a

mineral resource company focused on the exploration and development

of its uranium properties located in Africa. GoviEx maintains a

head office located in Canada and is a public company listed on the

TSX Venture Exchange. At March 31, 2019, Denison holds an

approximate 16.20% interest in GoviEx based on publicly available

information (December 31, 2018: 16.21%) and has one director

appointed to the GoviEx board of directors. Through the extent of

its share ownership interest and its seat on the board of

directors, Denison has the ability to exercise significant

influence over GoviEx and accordingly, is using the equity method

to account for this investment.

The trading price

of GoviEx on March 31, 2019 was $0.16 per share which corresponds

to a quoted market value of $10,423,000 (December 31, 2018:

$9,772,000) for the Company’s investment in GoviEx common

shares.

The following

table is a summary of the consolidated financial information of

GoviEx on a 100% basis taking into account adjustments made by

Denison for equity accounting purposes for fair value adjustments

and differences in accounting policy. Denison records its equity

investment entries in GoviEx one quarter in arrears (due to the

information not yet being publicly available), adjusted for any

material publicly disclosed share issuance transactions that have

occurred. A reconciliation of GoviEx’s summarized information

to Denison’s investment carrying value is also

included.

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

|

|

|

|

|

At March

31

|

|

At December

31

|

|

(in thousands of

USD dollars)

|

|

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

|

|

Total current

assets

|

|

|

$

|

4,116

|

$

|

4,800

|

|

Total non-current

assets

|

|

|

|

32,426

|

|

32,432

|

|

Total current

liabilities

|

|

|

|

(8,719)

|

|

(8,315)

|

|

Total net

assets

|

|

|

$

|

27,823

|

$

|

28,917

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 Months

Ended

|

|

12 Months

Ended

|

|

|

|

|

|

March

31

|

|

December

31

|

|

(in thousands of

USD dollars)

|

|

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

|

$

|

-

|

$

|

-

|

|

Net

loss

|

|

|

|

(1,277)

|

|

(1,892)

|

|

Comprehensive

loss

|

|

|

$

|

(1,277)

|

$

|

(1,892)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in

thousands)

|

|

|

|

|

|

|

|

Reconciliation of

GoviEx net assets to Denison investment carrying

value:

|

|

|

||||

|

Net assets of

GoviEx-beginning of period-USD

|

|

|

$

|

28,917

|

$

|

23,604

|

|

Share issue

proceeds

|

|

|

|

(76)

|

|

6,654

|

|

Contributed

surplus change

|

|

|

|

86

|

|

74

|

|

Share-based

payment reserve change

|

|

|

|

173

|

|

477

|

|

Net

loss

|

|

|

|

(1,277)

|

|

(1,892)

|

|

Net assets of

GoviEx–end of period-USD

|

|

|

$

|

27,823

|

$

|

28,917

|

|

Denison ownership

interest

|

|

|

|

16.20%

|

|

16.21%

|

|

Denison share of

net assets of GoviEx

|

|

|

|

4,507

|

|

4,687

|

|

Other

adjustments

|

|

|

|

(311)

|

|

(283)

|

|

Investment in

GoviEx–USD

|

|

|

|

4,196

|

|

4,404

|

|

At historical

exchange rate

|

|

|

|

1.2645

|

|

1.2675

|

|

Investment in

GoviEx–CAD

|

|

|

$

|

5,305

|

$

|

5,582

|

10.

RESTRICTED

CASH AND INVESTMENTS

The restricted

cash and investments balance consists of:

|

|

|

|

|

At March

31

|

|

At December

31

|

|

(in thousands of

CAD dollars)

|

|

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

|

|

Cash and cash

equivalents

|

|

|

$

|

3,417

|

$

|

85

|

|

Investments

|

|

|

|

9,135

|

|

12,170

|

|

|

|

|

$

|

12,552

|

$

|

12,255

|

|

|

|

|

|

|

|

|

|

Restricted cash

and investments-by item:

|

|

|

|

|

|

|

|

Elliot Lake

reclamation trust fund

|

|

|

$

|

3,417

|

$

|

3,120

|

|

Letters of credit

facility pledged assets

|

|

|

|

9,000

|

|

9,000

|

|

Letters of credit

additional collateral

|

|

|

|

135

|

|

135

|

|

|

|

|

$

|

12,552

|

$

|

12,255

|

At March 31,

2019, investments consist of guaranteed investment certificates

with maturities of more than 90 days.

Elliot

Lake Reclamation Trust Fund

During the three

months ended March 31, 2019, the Company deposited an additional

$453,000 into the Elliot Lake Reclamation Trust Fund and withdrew

$175,000.

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

Letters of

Credit Facility Pledged Assets

As at March 31,

2019, the Company had on deposit $9,000,000 with the Bank of Nova

Scotia (“BNS”) as pledged restricted cash and

investments pursuant to its obligations under an amended and

extended letters of credit facility (see notes 14 and

15).

Letters of

Credit Additional Collateral

As at March 31,

2019, the Company had on deposit an additional $135,000 of cash

collateral with BNS in respect of the portion of its issued

reclamation letters of credit in excess of the collateral available

under its letters of credit facility (see notes 14 and

15).

11.

PROPERTY,

PLANT AND EQUIPMENT

The property,

plant and equipment (“PP&E”) continuity summary is

as follows:

|

|

|

Plant

and Equipment

|

|

Mineral

|

|

Total

|

||

|

(in thousands of

CAD dollars)

|

|

Owned

|

|

Right-of-Use

|

|

Properties

|

|

PP&E

|

|

|

|

|

|

|

|

|

|

|

|

Cost:

|

|

|

|

|

|

|

|

|

|

Balance –

December 31, 2018

|

$

|

103,430

|

$

|

-

|

$

|

178,947

|

$

|

282,377

|

|

Adoption of IFRS

16 (note 4)

|

|

-

|

|

944

|

|

-

|

|

944

|

|

Additions

|

|

8

|

|

38

|

|

13

|

|

59

|

|

Balance

– March 31, 2019

|

$

|

103,438

|

$

|

982

|

$

|

178,960

|

$

|

283,380

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated

amortization, depreciation:

|

|

|

|

|

|

|

|

|

|

Balance –

December 31, 2018

|

$

|

(24,086)

|

$

|

-

|

$

|

-

|

$

|

(24,086)

|

|

Amortization

|

|

(53)

|

|

-

|

|

-

|

|

(53)

|

|

Depreciation

|

|

(942)

|

|

(58)

|

|

-

|

|

(1,000)

|

|

Balance

– March 31, 2019

|

$

|

(25,081)

|

$

|

(58)

|

$

|

-

|

$

|

(25,139)

|

|

|

|

|

|

|

|

|

|

|

|

Carrying

value:

|

|

|

|

|

|

|

|

|

|

Balance –

December 31, 2018

|

$

|

79,344

|

$

|

-

|

$

|

178,947

|

$

|

258,291

|

|

Balance –

March 31, 2019

|

$

|

78,357

|

$

|

924

|

$

|

178,960

|

$

|

258,241

|

Plant and

Equipment – Owned

The Company has a

22.50% interest in the McClean Lake mill through its ownership

interest in the MLJV. The carrying value of the mill, comprised of

various infrastructure, building and machinery assets, represents

$70,477,000, or 89.9%, of the March 2019 total carrying value

amount.

Plant and

Equipment – Right-of-Use

In conjunction

with the adoption of IFRS 16, the Company has included the cost of

various right-of-use (“ROU”) assets within its PP&E

carrying value amount. These assets consist of building, vehicle

and office equipment leases. The majority of the value is

attributable to the building lease assets which represent the

Company’s office and / or warehousing space located in

Toronto, Saskatoon and Sudbury.

Mineral

Properties

As at March 31,

2019, the Company has various interests in development, evaluation

and exploration projects located in Canada which are either held

directly or through option or various contractual agreements. The

properties with significant carrying values, being Wheeler River,

Waterbury Lake, Midwest, Mann Lake, Wolly, Johnston Lake and

McClean Lake, represent $161,883,000, or 90.5%, of the March 2019

total mineral property carrying amount. Significant updates from

the December 31, 2018 year-end are listed below.

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

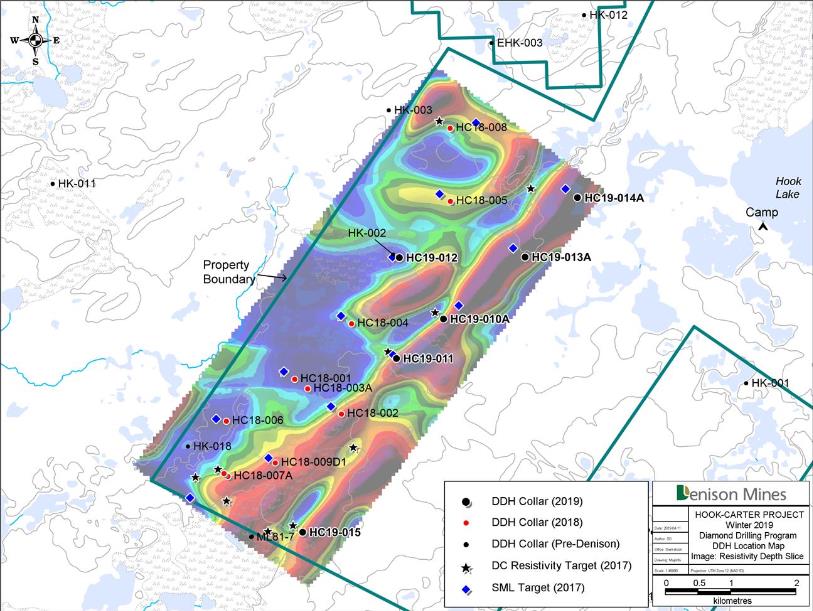

Hook

Carter

In November 2016,

Denison completed the purchase of an 80% interest in the

Hook-Carter property from ALX Uranium Corp (“ALX”).

Under terms in the agreement, Denison has agreed to provide ALX

with a carried interest on the first $12,000,000 in expenditures.

As at March 31, 2019, the Company has spent $6,564,000 on the

project, since acquisition.

12. DEFERRED

REVENUE

The deferred

revenue balance consists of:

|

|

|

|

|

At March

31

|

|

At December

31

|

|

(in thousands of

CAD dollars)

|

|

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

|

|

Deferred revenue

– CLJV toll milling – APG

|

|

|

$

|

37,264

|

$

|

37,727

|

|

|

|

|

$

|

37,264

|

$

|

37,727

|

|

|

|

|

|

|

|

|

|

Deferred

revenue-by balance sheet presentation:

|

|

|

|

|

|

|

|

Current

|

|

|

$

|

4,580

|

$

|

4,567

|

|

Non-current

|

|

|

|

32,684

|

|

33,160

|

|

|

|

|

$

|

37,264

|

$

|

37,727

|

The deferred

revenue liability continuity summary is as follows:

|

(in thousands of

CAD dollars)

|

|

|

|

|

|

Three

Months

Ended

March

31,

2019

|

|

|

|

|

|

|

|

|

|

Balance-beginning

of period

|

|

|

|

|

$

|

37,727

|

|

Revenue

recognized during the period

|

|

|

|

|

|

(1,263)

|

|

Accretion

|

|

|

|

|

|

800

|

|

Balance-end of

period

|

|

|

|

|

$

|

37,264

|

Arrangement

with Anglo Pacific Group (“APG”) PLC

In February 2017,

Denison closed an arrangement with APG under which Denison received

an upfront payment in exchange for its right to receive specified

future toll milling cash receipts from the MLJV under the current

toll milling agreement with the CLJV from July 1, 2016 onwards. The

APG Arrangement represents a contractual obligation of Denison to

pay onward to APG any cash proceeds of future toll milling revenue

earned by the Company related to the processing of specified Cigar

Lake ore through the McClean Lake mill.

In the three

months ended March 31, 2019, the Company has recognized $1,263,000

of toll milling revenue from the draw-down of deferred revenue,

based on Cigar Lake toll milling production of 4,863,000 pounds

U308 (100% basis). The

drawdown for the three months includes a retroactive $26,000

increase in revenue resulting from changes in estimates to the toll

milling drawdown rate in the first quarter of 2019.

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

13. POST-EMPLOYMENT

BENEFITS

The

post-employment benefits balance consists of:

|

|

|

|

|

At March

31

|

|

At December

31

|

|

(in thousands of

CAD dollars)

|

|

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

|

|

Accrued benefit

obligation

|

|

|

$

|

2,273

|

$

|

2,295

|

|

|

|

|

$

|

2,273

|

$

|

2,295

|

|

|

|

|

|

|

|

|

|

Post-employment

benefits-by balance sheet presentation:

|

|

|

|

|

||

|

Current

|

|

|

$

|

150

|

$

|

150

|

|

Non-current

|

|

|

|

2,123

|

|

2,145

|

|

|

|

|

$

|

2,273

|

$

|

2,295

|

The

post-employment benefits continuity summary is as

follows:

|

(in thousands of

CAD dollars)

|

|

|

|

|

|

Three

Months

Ended

March

31,

2019

|

|

|

|

|

|

|

|

|

|

Balance-beginning

of period

|

|

|

|

|

$

|

2,295

|

|

Accretion

|

|

|

|

|

|

17

|

|

Benefits

paid

|

|

|

|

|

|

(39)

|

|

Balance-end of

period

|

|

|

|

|

$

|

2,273

|

14. RECLAMATION

OBLIGATIONS

The reclamation

obligations balance consists of:

|

|

|

|

|

At March

31

|

|

At December

31

|

|

(in thousands of

CAD dollars)

|

|

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

|

|

Reclamation

obligations-by location:

|

|

|

|

|

|

|

|

Elliot

Lake

|

|

|

$

|

17,233

|

$

|

17,205

|

|

McClean and

Midwest Joint Ventures

|

|

|

|

12,968

|

|

12,837

|

|

Other

|

|

|

|

22

|

|

22

|

|

|

|

|

$

|

30,223

|

$

|

30,064

|

|

|

|

|

|

|

|

|

|

Reclamation

obligations-by balance sheet presentation:

|

|

|

|

|

||

|

Current

|

|

|

$

|

863

|

$

|

877

|

|

Non-current

|

|

|

|

29,360

|

|

29,187

|

|

|

|

|

$

|

30,223

|

$

|

30,064

|

The reclamation

obligations continuity summary is as follows:

|

(in thousands of

CAD dollars)

|

|

|

|

|

|

Three

Months

Ended

March

31,

2019

|

|

|

|

|

|

|

|

|

|

Balance-beginning

of period

|

|

|

|

|

$

|

30,064

|

|

Accretion

|

|

|

|

|

|

340

|

|

Expenditures

incurred

|

|

|

|

|

|

(181)

|

|

Balance-end of

period

|

|

|

|

|

$

|

30,223

|

Site

Restoration: Elliot Lake

Spending on

restoration activities at the Elliot Lake site is funded from

monies in the Elliot Lake Reclamation Trust fund (see note

10).

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

Site

Restoration: McClean Lake Joint Venture and Midwest Joint

Venture

Under the Mineral

Industry Environmental Protection Regulations (1996), the Company

is required to provide its pro-rata share of financial assurances

to the province of Saskatchewan relating to future decommissioning

and reclamation plans that have been filed and approved by the

applicable regulatory authorities. As at March 31, 2019, the

Company has provided irrevocable standby letters of credit, from a

chartered bank, in favour of the Saskatchewan Ministry of

Environment, totalling $24,135,000 which relate to the most

recently filed reclamation plan dated March 2016.

15. OTHER

LIABILITIES

The other

liabilities balance consists of:

|

|

|

|

|

At March

31

|

|

At December

31

|

|

(in thousands of

CAD dollars)

|

|

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

|

|

Debt

obligations:

|

|

|

|

|

|

|

|

Lease

liabilities

|

|

|

$

|

934

|

$

|

-

|

|

Flow-through

share premium obligation (note 16)

|

|

|

|

-

|

|

1,337

|

|

|

|

|

$

|

934

|

$

|

1,337

|

|

|

|

|

|

|

|

|

|

Other long-term

liabilities-by balance sheet presentation:

|

|

|

|

|

||

|

Current

|

|

|

$

|

280

|

$

|

1,337

|

|

Non-current

|

|

|

|

654

|

|

-

|

|

|

|

|

$

|

934

|

$

|

1,337

|

Letters of

Credit Facility

In January 2019,

the Company entered into an amending agreement for its letters of

credit facility with BNS (the “2019 facility”). Under

the amendment, the maturity date of the 2019 facility has been

extended to January 31, 2020. All other terms of the 2019 facility

(tangible net worth covenant, pledged cash, investment amounts and

security for the facility) remain unchanged from those of the 2018

facility. The 2019 facility continues to provide the Company with

access to credit up to $24,000,000 (the use of which is restricted

to non-financial letters of credit in support of reclamation

obligations) subject to letter of credit and standby fees of 2.40%

(0.40% on the first $9,000,000) and 0.75%

respectively.

At March 31,

2019, the Company is in compliance with its facility covenants and

$24,000,000 (December 31, 2018: $24,000,000) of the facility is

being utilized as collateral for letters of credit issued in

respect of the reclamation obligations for the MLJV and MWJV.

During the three months ended March 31, 2019, the Company incurred

letter of credit fees of $98,000.

Debt

Obligations

At March 31,

2019, the Company’s debt obligations are comprised entirely

of lease liabilities associated with the new accounting required

under IFRS 16. The lease liabilities continuity summary is as

follows:

|

(in thousands of

CAD dollars)

|

|

|

|

|

|

Three

Months

Ended

March

31,

2019

|

|

|

|

|

|

|

|

|

|

Balance-beginning

of period

|

|

|

|

|

$

|

-

|

|

Adoption of IFRS

16 (note 4)

|

|

|

|

|

|

944

|

|

Accretion

|

|

|

|

|

|

20

|

|

Additions

|

|

|

|

|

|

38

|

|

Repayments

|

|

|

|

|

|

(68)

|

|

Balance-end of

period

|

|

|

|

|

$

|

934

|

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

Debt

Obligations – Scheduled Maturities

The following

table outlines the Company’s scheduled maturities of its debt

obligations as at March 31, 2019:

|

(in thousands of

CAD dollars)

|

|

|

|

|

|

Lease

Liabilities

|

|

|

|

|

|

|

|

|

|

Maturity analysis

– contractual undiscounted cash flows:

|

|

|

|

|

||

|

Next 12

months

|

|

|

|

|

$

|

280

|

|

One to five

years

|

|

|

|

|

|

698

|

|

More than five

years

|

|

|

|

|

|

173

|

|

Total obligation

– end of period – undiscounted

|

|

|

|

|

|

1,151

|

|

Present value

discount adjustment

|

|

|

|

|

|

(217)

|

|

Total obligation

– end of period - discounted

|

|

|

|

|

$

|

934

|

16. SHARE

CAPITAL

Denison is

authorized to issue an unlimited number of common shares without

par value. A continuity summary of the issued and outstanding

common shares and the associated dollar amounts is presented

below:

|

|

Number

of

|

|

|

|

|

Common

|

|

|

|

(in thousands of

CAD dollars except share amounts)

|

Shares

|

|

|

|

|

|

|

|

|

Balance-December

31, 2018

|

589,175,086

|

$

|

1,331,214

|

|

|

|

|

|

|

Share

cancellations

|

(46,178)

|

|

-

|

|

|

(46,178)

|

|

-

|

|

Balance-March 31,

2019

|

589,128,908

|

$

|

1,331,214

|

Share

Cancellations

In February 2019,

46,178 shares were cancelled in connection with the January 2013

acquisition of JNR Resources Inc (“JNR”). JNR

shareholders were entitled to exchange their JNR shares for shares

of Denison in accordance with the share exchange ratio established

for the acquisition. In January 2019, this right expired and the

un-exchanged shares for which shareholders had not elected to

exercise their exchange rights were subsequently

cancelled.

Flow-Through

Share Issues

The Company

finances a portion of its exploration programs through the use of

flow-through share issuances. Canadian income tax deductions

relating to these expenditures are claimable by the investors and

not by the Company.

As at March 31,

2019, the Company estimates that it has incurred $3,965,000 of its

obligation to spend $5,000,000 on eligible exploration expenditures

as a result of the issuance of flow-through shares in November

2018. The Company renounced the income tax benefits of this issue

in February 2019, with an effective date of renunciation to its

subscribers of December 31, 2018. In conjunction with the

renunciation, the flow-through share premium liability at December

31, 2018 has been extinguished and a deferred tax recovery has been

recognized in the first quarter of 2019 (see notes 15 and

23).

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

17. SHARE

PURCHASE WARRANTS

A continuity

summary of the issued and outstanding share purchase warrants in

terms of common shares of the Company and the associated dollar

amounts is presented below:

|

|

|

|

|

Weighted

|

|

|

|

|

|

|

|

|

|

Average

|

|

Number

of

|

|

|

|

|

|

|

|

Exercise

|

|

Common

|

|

Fair

|

|

|

|

|

|

Price

Per

|

|

Shares

|

|

Value

|

|

(in

thousands of CAD dollars except share amounts)

|

|

Share

(CAD)

|

|

Issuable

|

|

Amount

|

||

|

|

|

|

|

|

|

|

|

|

|

Balance-December

31, 2018 and March 31, 2019

|

$

|

1.27

|

|

1,673,077

|

$

|

435

|

||

The warrants

noted above were issued in February 2017 and expire on February 14,

2020.

18. SHARE-BASED

COMPENSATION

The

Company’s share based compensation arrangements include stock

options, restricted share units (“RSUs”) and

performance share units (“PSUs”).

A summary of

share based compensation expense recognized in the statement of

income (loss) is as follows:

|

|

|

|

|

Three

Months Ended

March

31

|

||||

|

(in thousands of

CAD dollars)

|

|

|

|

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

|

Share based

compensation expense for:

|

|

|

|

|

|

|

|

|

|

Stock

options

|

|

|

|

|

$

|

(270)

|

$

|

(363)

|

|

RSUs

|

|

|

|

|

|

(181)

|

|

-

|

|

PSUs

|

|

|

|

|

|

(152)

|

|

-

|

|

Share

based compensation expense

|

|

|

|

|

$

|

(603)

|

$

|

(363)

|

As at March 31,

2019, an additional $3,042,000 in share-based compensation expense

remains to be recognized up until April 2023.

Stock

Options

A continuity

summary of the stock options granted under the Company’s

stock-based compensation plan is presented below:

|

|

|

|

|

|

|

|

|

|

Weighted-

|

|

|

|

|

|

|

|

|

|

|

Average

|

|

|

|

|

|

|

|

|

|

|

Exercise

|

|

|

|

|

|

|

|

|

Number

of

|

|

Price

per

|

|

|

|

|

|

|

|

|

Common

|

|

Share

|

|

|

|

|

|

|

|

|

Shares

|

|

(CAD)

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock options

outstanding – December 31, 2018

|

|

|

|

13,865,193

|

$

|

0.83

|

|||

|

Granted

|

|

|

|

|

|

|

2,691,000

|

|

0.68

|

|

Expiries

|

|

|

|

|

|

|

(855,000)

|

|

1.82

|

|

Forfeitures

|

|

|

|

|

|

|

(58,500)

|

|

0.64

|

|

Stock options

outstanding – March 31, 2019

|

|

|

|

15,642,693

|

$

|

0.75

|

|||

|

Stock options

exercisable – March 31, 2019

|

|

|

|

11,195,921

|

$

|

0.80

|

|||

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

A summary of the

Company’s stock options outstanding at March 31, 2019 is

presented below:

|

|

|

|

|

|

Weighted

|

|

|

|

Weighted-

|

|

|

|

|

|

|

Average

|

|

|

|

Average

|

|

|

|

|

|

|

Remaining

|

|

|

|

Exercise

|

|

Range of

Exercise

|

|

|

|

|

Contractual

|

|

Number

of

|

|

Price

per

|

|

Prices per

Share

|

|

|

|

|

Life

|

|

Common

|

|

Share

|

|

(CAD)

|

|

|

|

|

(Years)

|

|

Shares

|

|

(CAD)

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock options

outstanding

|

|

|

|

|

|

|

|||

|

$ 0.50 to $

0.74

|

|

3.72

|

|

8,262,293

|

$

|

0.63

|

|||

|

$ 0.75 to $

0.99

|

|

|

|

|

2.95

|

|

6,167,400

|

|

0.85

|

|

$ 1.00 to $

1.39

|

|

|

|

|

0.94

|

|

1,213,000

|

|

1.09

|

|

Stock options

outstanding - end of period

|

|

|

|

3.20

|

|

15,642,693

|

$

|

0.75

|

|

Options

outstanding at March 31, 2019 expire between May 2019 and March

2024.

The fair value of

each option granted is estimated on the date of grant using the

Black-Scholes option pricing model. The following table outlines

the assumptions used in the model to determine the fair value of

options granted:

|

|

|

|

|

Three Months

Ended

|

|

|

|

|

|

|

March 31,

2019

|

|

|

|

|

|

|

|

|

|

Risk-free

interest rate

|

|

|

|

1.65%

|

|

|

Expected stock

price volatility

|

|

|

|

49.46%

|

|

|

Expected

life

|

|

|

|

3.5

years

|

|

|

Expected dividend

yield

|

|

|

|

-

|

|

|

Fair value

per share under options granted

|

|

|

CAD$0.26

|

||

Share

Units

The Company has a

share unit plan which provides for the granting of share unit

awards to directors, officers and employees of the Company. Under

the plan, all share unit grants, vesting periods and performance

conditions therein are approved by the Company’s board of

directors. Share unit grants are either in the form of RSUs or

PSUs. RSUs granted in 2018 and 2019 to-date, vest ratably over a

period of three years. PSUs granted in 2018 vest ratably over a

period of five years, based upon the achievement of the performance

vesting conditions – no PSUs had been granted in 2019 as at

March 31, 2019.

A continuity

summary of the RSUs and PSUs of the Company granted under the share

unit plan is presented below:

|

|

|

RSUs

|

|

PSUs

|

||||

|

|

|

|

|

Weighted

|

|

|

|

Weighted

|

|

|

|

|

|

Average

|

|

|

|

Average

|

|

|

|

Number

of

|

|

Fair

Value

|

|

Number

of

|

|

Fair

Value

|

|

|

|

Common

|

|

Per

RSU

|

|

Common

|

|

Per

PSU

|

|

|

|

Shares

|

|

(CAD)

|

|

Shares

|

|

(CAD)

|

|

|

|

|

|

|

|

|

|

|

|

Units outstanding

– December 31, 2018

|

|

1,200,432

|

$

|

0.65

|

|

2,200,000

|

$

|

0.65

|

|

Granted

|

|

1,914,000

|

|

0.73

|

|

-

|

|

-

|

|

Units outstanding

– March 31, 2019

|

|

3,114,432

|

$

|

0.70

|

|

2,200,000

|

$

|

0.65

|

|

Units

vested – March 31, 2019

|

|

-

|

$

|

-

|

|

-

|

$

|

-

|

|

INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

|

19. ACCUMULATED

OTHER COMPREHENSIVE INCOME (LOSS)

The accumulated

other comprehensive income (loss) balance consists of:

|

|

|

|

|

At March

31

|

|

At December

31

|

|

(in thousands of

CAD dollars)

|

|

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

|

|

Cumulative

foreign currency translation

|

|

|

$

|

406

|

$

|

403

|

|

Unamortized

experience gain-post employment liability

|

|

|

|

|

||

|

Gross

|

|

|

|

983

|

|

983

|

|

Tax

effect

|

|

|

|

(259)

|

|

(259)

|

|

|

|

|

$

|

1,130

|

$

|

1,127

|

20. SUPPLEMENTAL

FINANCIAL INFORMATION

The components of