|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number:

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

(State or Other Jurisdiction of Incorporation or Organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

|

|

|

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

(

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of Each Class |

|

Trading Symbol |

|

Name of Each Exchange on Which Registered |

|

Host Hotels & Resorts, Inc. |

|

shares outstanding as of February 19, 2021) |

|

|

|

|

|

Host Hotels & Resorts, L.P. |

|

None |

|

None |

|

None |

Securities registered pursuant to Section 12(g) of the Act:

|

Host Hotels & Resorts, Inc. |

|

None |

|

|

|

Host Hotels & Resorts, L.P. |

|

Units of limited partnership interest ( |

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

Host Hotels & Resorts, Inc. |

|

|

|

No ☐ |

|

Host Hotels & Resorts, L.P. |

|

Yes ☐ |

|

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

Host Hotels & Resorts, Inc. |

|

Yes ☐ |

|

|

|

Host Hotels & Resorts, L.P. |

|

Yes ☐ |

|

|

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

Host Hotels & Resorts, Inc. |

|

|

|

No ☐ |

|

Host Hotels & Resorts, L.P. |

|

|

|

No ☐ |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

|

Host Hotels & Resorts, Inc. |

|

|

|

No ☐ |

|

Host Hotels & Resorts, L.P. |

|

|

|

No ☐ |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

Host Hotels & Resorts, Inc.

|

|

|

☒ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

|

|

|

|

|

|

|

|

|

Host Hotels & Resorts, L.P.

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

|

|

|

☒ |

|

Smaller reporting company |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

|

|

|

|

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

|

|

||||

|

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. |

|

|

||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

Host Hotels & Resorts, Inc. |

|

Yes |

|

No ☒ |

|

Host Hotels & Resorts, L.P. |

|

Yes |

|

No ☒ |

The aggregate market value of common shares held by non-affiliates of Host Hotels & Resorts, Inc. (based on the closing sale price on the New York Stock Exchange) on June 30, 2020 was $

Documents Incorporated by Reference

EXPLANATORY NOTE

This report combines the annual reports on Form 10-K for the fiscal year ended December 31, 2020 of Host Hotels & Resorts, Inc. and Host Hotels & Resorts, L.P. Unless stated otherwise or the context otherwise requires, references to “Host Inc.” mean Host Hotels & Resorts, Inc., a Maryland corporation, and references to “Host L.P.” mean Host Hotels & Resorts, L.P., a Delaware limited partnership, and its consolidated subsidiaries. We use the terms “we” or “our” or “the company” to refer to Host Inc. and Host L.P. together, unless the context indicates otherwise. We use the term Host Inc. to specifically refer to Host Hotels & Resorts, Inc. and the term Host L.P. to specifically refer to Host Hotels & Resorts, L.P. (and its consolidated subsidiaries) in cases where it is important to distinguish between Host Inc. and Host L.P. Host Inc. owns properties and conducts operations through Host L.P., of which Host Inc. is the sole general partner and of which it holds approximately 99% of the partnership interests (“OP units”) as of December 31, 2020. The remaining partnership interests are owned by various unaffiliated limited partners. As the sole general partner of Host L.P., Host Inc. has the exclusive and complete responsibility for Host L.P.’s day-to-day management and control.

We believe combining the annual reports on Form 10-K of Host Inc. and Host L.P. into this single report results in the following benefits:

|

|

• |

enhances investors’ understanding of Host Inc. and Host L.P. by enabling investors to view the business as a whole in the same manner as management views and operates the business; |

|

|

• |

eliminates duplicative disclosure and provides a more streamlined presentation, since a substantial portion of our disclosure applies to both Host Inc. and Host L.P.; and |

|

|

• |

creates time and cost efficiencies through the preparation of one combined report instead of two separate reports. |

Management operates Host Inc. and Host L.P. as one enterprise. The management of Host Inc. consists of the same members who direct the management of Host L.P. The executive officers of Host Inc. are appointed by Host Inc.’s board of directors, but are employed by Host L.P. Host L.P. employs everyone who works for Host Inc. or Host L.P. As general partner with control of Host L.P., Host Inc. consolidates Host L.P. for financial reporting purposes, and Host Inc. does not have significant assets other than its investment in Host L.P. Therefore, the assets and liabilities of Host Inc. and Host L.P. are the same on their respective financial statements.

There are a few differences between Host Inc. and Host L.P., which are reflected in the disclosure in this report. We believe it is important to understand the differences between Host Inc. and Host L.P. in the context of how Host Inc. and Host L.P. operate as an interrelated consolidated company. Host Inc. is a real estate investment trust, or REIT, and its only material asset is its ownership of partnership interests of Host L.P. As a result, Host Inc. does not conduct business itself, other than acting as the sole general partner of Host L.P., and issuing public equity from time to time, the proceeds of which are contributed to Host L.P. in exchange for OP units. Host Inc. itself does not issue any indebtedness and does not guarantee the debt or obligations of Host L.P. Host L.P. holds substantially all of our assets and holds the ownership interests in our joint ventures. Host L.P. conducts the operations of the business and is structured as a limited partnership with no publicly traded equity. Except for net proceeds from public equity issuances by Host Inc., Host L.P. generates the capital required by our business through Host L.P.’s operations, by Host L.P.’s direct or indirect incurrence of indebtedness, or through the issuance of OP units.

The substantive difference between the filings of Host Inc. and Host L.P. is that Host Inc. is a REIT with public stock, while Host L.P. is a partnership with no publicly traded equity. In the financial statements, this difference primarily is reflected in the equity (or partners’ capital for Host L.P.) section of the consolidated balance sheets and in the consolidated statements of equity (or partners’ capital) and in the consolidated statements of operations and comprehensive income (loss) with respect to the manner in which income or loss is allocated to non-controlling interests. Income or loss allocable to the holders of approximately 1% of the OP units is reflected as income or loss allocable to non-controlling interests at Host Inc. and within net income at Host L.P. Also, earnings per share generally will be slightly less than the earnings per OP unit, as each Host Inc. common share is the equivalent of .97895 OP units (instead of 1 OP unit). Apart from these differences, the financial statements of Host Inc. and Host L.P. are nearly identical.

i

To help investors understand the differences between Host Inc. and Host L.P., this report presents the following separate sections or portions of sections for each of Host Inc. and Host L.P.:

|

|

• |

Part II Item 5 - Market for Registrant’s Common Stock, Related Stockholder Matters and Issuer Purchases of Equity Securities for Host Inc. / Market for Registrant’s Common Units, Related Unitholder Matters and Issuer Purchases of Equity Securities for Host L.P.; |

|

|

• |

Part II Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operations is combined, except for a separate discussion of material differences, if any, in the liquidity and capital resources between Host Inc. and Host L.P.; |

|

|

• |

Part II Item 7A - Quantitative and Qualitative Disclosures about Market Risk is combined, except for separate discussions of material differences, if any, between Host Inc. and Host L.P.; and |

|

|

• |

Part II Item 8 - Financial Statements and Supplementary Data. While the financial statements themselves are presented separately, the notes to the financial statements generally are combined, except for separate discussions of differences between equity of Host Inc. and capital of Host L.P. |

This report also includes separate Item 9A. Controls and Procedures sections and separate Exhibit 31 and 32 certifications for each of Host Inc. and Host L.P. in order to establish that the Chief Executive Officer and the Chief Financial Officer of Host Inc. and the Chief Executive Officer and the Chief Financial Officer of Host Inc. as the general partner of Host L.P. have made the requisite certifications and that Host Inc. and Host L.P. are compliant with Rule 13a-15 or Rule 15d-15 of the Securities Exchange Act of 1934 and 18 U.S.C. §1350.

ii

HOST HOTELS & RESORTS, INC. AND HOST HOTELS & RESORTS, L.P.

|

|

|

Page |

|

|

|

|

|

|

Part I |

|

|

|

|

|

|

Item 1. |

1 |

|

|

Item 1A. |

16 |

|

|

Item 1B. |

29 |

|

|

Item 2. |

29 |

|

|

Item 3. |

29 |

|

|

Item 4. |

29 |

|

|

|

|

|

|

|

Part II |

|

|

|

|

|

|

Item 5. |

31 |

|

|

|

32 |

|

|

Item 6. |

32 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

33 |

|

Item 7A. |

62 |

|

|

Item 8. |

63 |

|

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

104 |

|

Item 9A. |

104 |

|

|

Item 9B. |

104 |

|

|

|

|

|

|

|

Part III |

|

|

|

|

|

|

Item 10. |

105 |

|

|

Item 11. |

105 |

|

|

Item 12. |

105 |

|

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

105 |

|

Item 14. |

105 |

|

|

|

|

|

|

|

Part IV |

|

|

|

|

|

|

Item 15. |

106 |

|

|

Item 16. |

110 |

iii

PART I

Forward Looking Statements

Our disclosure and analysis in this 2020 Annual Report on Form 10-K and in Host Inc.’s 2020 Annual Report to Stockholders contain some forward-looking statements that set forth anticipated results based on management’s plans and assumptions. From time to time, we also provide forward-looking statements in other materials we release to the public. Such statements give our current expectations or forecasts of future events; they do not relate strictly to historical or current facts. We have tried, wherever possible, to identify each such statement by using words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “will,” “target,” “forecast” and similar expressions in connection with any discussion of future operating or financial performance. In particular, these forward-looking statements include those relating to future actions, future acquisitions or dispositions, future capital expenditures plans, future performance or results of current and anticipated expenses, interest rates, foreign exchange rates or the outcome of contingencies, such as legal proceedings.

We cannot guarantee that any future results discussed in any forward-looking statements will be realized, although we believe that we have been prudent in our plans and assumptions. Achievement of future results is subject to risks, uncertainties and potentially inaccurate assumptions, including those discussed in Item 1A “Risk Factors.” Should known or unknown risks or uncertainties materialize, or should underlying assumptions prove inaccurate, actual results could differ materially from past results and those results anticipated, estimated or projected. You should bear this in mind as you consider forward-looking statements.

We undertake no obligation to publicly update forward-looking statements, whether because of new information, future events or otherwise. You are advised, however, to consult any additional disclosures we make or related subjects in our reports on Form 10-Q and Form 8-K that we file with the Securities and Exchange Commission (“SEC”). Also note that, in our risk factors, we provide a cautionary discussion of risks, uncertainties and possibly inaccurate assumptions relevant to our business. These are factors that, individually or in the aggregate, we believe could cause our actual results to differ materially from past results and those results anticipated, estimated or projected. We note these factors for investors as permitted by the Private Securities Litigation Reform Act of 1995. It is not possible to predict or identify all such risk factors. Consequently, you should not consider the discussion of risk factors to be a complete discussion of all the potential risks or uncertainties that could affect our business.

|

Item 1. |

Business |

We are the largest publicly traded lodging REIT, with a geographically diverse portfolio of luxury and upper upscale hotels. As of February 19, 2021, our consolidated lodging portfolio consists of 80 primarily luxury and upper-upscale hotels containing approximately 46,300 rooms, with the majority located in the United States, and with five of the hotels located outside of the U.S. in Brazil and Canada. In addition, we own non-controlling interests in five domestic and one international joint venture that own hotels and in a timeshare joint venture in Hawaii.

Host Inc. was incorporated as a Maryland corporation in 1998 and operates as a self-managed and self-administered REIT. Host Inc. owns properties and conducts operations through Host L.P., of which Host Inc. is the sole general partner and of which it holds approximately 99% of the partnership interests (“OP units”) as of December 31, 2020. The remaining partnership interests are owned by various unaffiliated limited partners. Host Inc. has the exclusive and complete responsibility for Host L.P.’s day-to-day management and control.

Business Strategy

Our goal is to be the preeminent owner of high-quality lodging real estate in growing markets in the U.S. and to generate superior long-term risk adjusted returns for our stockholders throughout all phases of the lodging cycle through a combination of appreciation in asset values, growth in earnings and dividend distributions. The pillars of our strategy to achieve this objective include:

|

|

• |

Geographically diverse portfolio of hotels in the U.S. - Own a diversified portfolio of hotels in the U.S. in major urban and resort destinations. Target markets with diverse demand generators, high barriers to entry, favorable supply and demand dynamics and attractive long-term projected RevPAR growth; |

|

|

• |

Strong scale and integrated platform – Utilize our scale to create value through enterprise analytics, asset management and capital investment initiatives, while aiding external growth by leveraging scale as a competitive advantage to acquire assets befitting our strategy. Allocate and recycle capital to seek returns that exceed our cost of capital and actively return capital to stockholders; |

|

|

• |

Investment grade balance sheet - Maintain a strong and flexible capital structure that allows us to execute our strategy throughout all phases of the lodging cycle; and |

1

|

|

• |

Employer of choice and responsible corporate citizen – Align our organizational structure with our business objectives to be an employer of choice and a responsible corporate citizen. |

Geographically Diverse Portfolio.

We seek to have a geographically diversified portfolio in major markets and premier resort destinations in the U.S. We primarily focus on acquisitions and, occasionally, new development opportunities to enhance our portfolio. We have historically targeted acquisitions in the top twenty-five U.S. markets but also consider hotels in other markets which we believe have high growth potential and diverse demand generators. We focus generally on the following types of assets:

|

|

• |

Resorts in locations with strong airlift and limited supply growth. These assets feature superior amenities and are operated by premier operators; |

|

|

• |

Convention destination hotels that are group oriented in urban and resort markets. These assets feature extensive and high-quality meeting facilities and often are connected to prominent convention centers; and |

|

|

• |

High-end urban hotels that are positioned in prime locations and possess multiple demand drivers for both business and leisure travelers. |

As one of the largest owners of Marriott and Hyatt properties, our hotels primarily are operated under brand names that are among the most respected and widely recognized in the lodging industry. Within these brands, we have focused predominantly on the upper-upscale and luxury chain scales, as we believe these have a broad appeal for both individual and group leisure and business customers. In addition, we own several unbranded or soft-branded hotels that appeal to distinctive customer profiles in certain submarkets.

Strong Scale and an Integrated Platform

Enterprise Analytics Platform. Due to the scale of our asset management and business intelligence platform, we believe we are in a unique position to implement value-added real estate decisions and to assist managers in improving operating performance and profitability. The size and composition of our portfolio and our affiliation with most of the leading brands and operators in the industry allow our enterprise analytics team to benchmark similar hotels and identify revenue-enhancement opportunities and cost efficiencies that can maximize the operating performance, long-term profitability and value of our real estate. We perform independent underwriting of return on investment (“ROI”) projects and potential acquisitions, as well as revenue management analysis of ancillary revenue opportunities. Our goal is to continue to differentiate our assets within their competitive markets, drive operating performance and enhance the overall value of our real estate through the following:

|

|

• |

Enhance operating performance and profitability by using our business intelligence system to benchmark and monitor hotel performance and cost controls. |

|

|

• |

Drive revenue growth by conducting detailed strategic reviews with our managers on markets and business mix to assist them in developing the appropriate group/transient mix, online presence to address a broad customer base, and market share targets for each property. |

|

|

• |

Work with leading brands, such as Marriott and Hyatt, to take advantage of their worldwide presence and lodging infrastructure. We also have a selection of 16 hotels managed by independent operators where we believe these operators have more flexibility to drive revenues and control costs to maximize profits. |

|

|

• |

Improve asset value through the extension or purchase of ground leases or the restructuring of management agreements to increase contract flexibility. |

Disciplined Capital Allocation. Guided by a disciplined approach to capital allocation, we are equipped to make investment decisions that seek to deliver the greatest value and returns to stockholders. Our goal is to allocate capital to enhance and improve our portfolio, while balancing the importance of prudently returning capital to stockholders.

We will continue our disciplined approach to capital allocation. Despite the challenging economic landscape for lodging in 2021, we constantly are evaluating opportunistic acquisitions and dispositions. This may include the sale of assets where we believe the potential for growth is constrained or properties with significant capital expenditure requirements that we do not believe would generate an adequate return.

We may acquire additional properties or dispose of properties through various structures, including transactions involving single assets, portfolios, joint ventures, mergers and acquisitions of the securities or assets of other REITs or distributions of hotel properties to our stockholders. We anticipate that any acquisitions may be funded by, or through a combination of, proceeds from the sales of hotels, equity offerings of Host Inc., issuances of OP units by Host L.P., incurrence of debt (currently restricted as discussed in “Management’s Discussion and Analysis of Financial Condition and Results of Operations”), available cash or advances under our credit facility. We note, however, that the nature and supply of these assets make acquisitions inherently difficult to predict. For these

2

reasons, we can make no assurances that we will be successful in purchasing any one or more hotels that we are reviewing currently, or may in the future review, bid on or negotiate to buy.

We also seek to create and mine value from our existing portfolio through value enhancement initiatives and ROI projects. We believe these investments provide a significant opportunity to achieve returns well in excess of our cost of capital. We work closely with our managers to attempt to schedule these projects to minimize operational disruption and environmental impact. Value enhancement initiatives seek to maximize the value of real estate within our existing portfolio through the highest and best use of our real estate. These projects may include hotel expansion, timeshare, office space or condominium units on excess land, redevelopment or expansion of existing retail space, and the acquisition of development entitlements. ROI projects are designed to improve the positioning of our hotels within their markets and competitive set. These projects include extensive renovations, including guest rooms, lobbies, food and beverage outlets; expansions and/or extensive renovation of ballroom and meeting rooms; major mechanical system upgrades; and green building initiatives and certifications. It also includes projects focused on increasing space profitability or lowering net operating costs, such as converting unprofitable or underutilized space into meeting space, adding guestrooms, and implementing energy and water conservation measures such as LED lighting, high-efficiency mechanical, electrical and plumbing equipment and fixtures, solar power, energy management systems, guestroom water efficient fixtures, and building automation systems.

Renewal and replacement capital expenditures are designed to maintain the quality and competitiveness of our hotels. Typically, renovations occur at intervals of approximately seven to ten years, but the timing may vary based on the type of property, function of area being renovated, hotel occupancy and other factors. These renovations generally are divided into the following types: soft goods, case goods, bathroom and architectural and engineering systems. Soft goods include items such as carpeting, textiles and wall finishes, which may require more frequent updates in order to maintain brand quality standards. Case goods include dressers, desks, couches, restaurant and meeting room tables and chairs, which generally are not replaced as frequently. Bathroom renovations include the refurbishment or replacement of tile, vanity, lighting and plumbing fixtures. Architectural and engineering systems include the physical plant of the hotel, including the roof, elevators/escalators, façade, heating, ventilation, and air conditioning and fire systems.

Throughout the lodging cycle, to the extent that we are unable to find appropriate investment opportunities that meet our return requirements, we will focus on returning capital to stockholders through dividends or common stock repurchases. Significant factors we review to determine the level and timing of the returns to stockholders include our current stock price compared to our determination of the underlying value of our assets, current and forecast operating results and the completion of hotel sales.

Investment Grade Balance Sheet

Our goal is to maintain a flexible capital structure that allows us to execute our strategy throughout the lodging cycle. To maintain its qualification as a REIT, Host Inc. is required to distribute 90% of its taxable income (other than net capital gain) to its stockholders each year and, as a result, generally relies on external sources of capital, as well as cash from operations, to finance growth.

Management believes that a strong balance sheet is a key competitive advantage that affords us a lower cost of debt and positions us for external growth. While we may issue debt at any time, we will target a net debt-to-earnings before interest, taxes, depreciation and amortization (“EBITDA”) ratio, (or “Leverage Ratio,” as defined in our credit facility) that allows us to maintain an investment grade rating on our senior unsecured debt. We believe an investment grade rating will give us the most consistent access to capital throughout the business cycle.

We seek to structure our debt profile to maintain financial flexibility and a staggered maturity schedule with access to different forms of financing, consisting primarily of senior notes and exchangeable debentures, as well as mortgage debt. Generally, we look to minimize the number of assets that are encumbered by mortgage debt, minimize near-term maturities and maintain a staggered maturity schedule. Depending on market conditions, we also may utilize variable rate debt which can provide greater protection during a decline in the lodging industry.

Corporate Responsibility

We are committed to creating long-term value through investing responsibly in our business, environment, people and community. Our corporate responsibility program is centered around the concept of responsible investment—an overarching strategy that guides our focus and actions across our three main themes of Environmental Stewardship, Social Responsibility and Governance:

|

|

• |

Environmental Stewardship: We are investing in solutions that conserve and restore natural capital to assist us in mitigating climate change and biodiversity impacts and achieving best-in-class returns. |

|

|

• |

Social Responsibility: We are committed to advancing health, well-being and opportunity for all of our stakeholders, including investors, employees, partners and communities. |

3

|

|

• |

Governance: Our responsible investment strategies are guided by executive and board-level oversight, our EPIC values and ethical standards, and a disciplined approach to risk management and sustainable value creation. |

The Real Estate Sustainability Accounting Standard issued by the Sustainability Accounting Standards Board (“SASB”) outlines the disclosure topics and accounting metrics for the real estate industry. The energy and water management metrics that best correlate with our industry include total energy consumed (“Total Energy Consumption”) and total water withdrawn (“Total Water Consumption”). The energy and water data we use is collected and reviewed by third-parties who compile the data from property utility statements.

Beginning in 2015, we contracted with a third-party to provide further verification of our energy and water consumption data. The charts below detail our Total Energy Consumption and Total Water Consumption for 2017 through 2019, the last three fiscal years for which data is available(1):

|

|

|

|

(1) |

Energy and water metrics relate to our consolidated hotels owned for the entire year presented. |

Our expanded and interactive 2020 Corporate Responsibility Report, which details our commitment to corporate responsibility along with our results, performance and progress, including full SASB disclosure, was issued in October 2020.

The Lodging Industry

The lodging industry in the United States consists of private and public entities that operate in a diversified market under a variety of brand names. The lodging industry has several key participants:

|

|

• |

Owners—own the hotel and typically enter into an agreement for an independent third-party to manage the hotel. These hotels may be branded and operated under the manager’s brand or branded under a franchise agreement and operated by the franchisee or by an independent hotel manager. The hotels also may be operated as an independent hotel by an independent hotel manager. |

|

|

• |

Owner/Managers—own the hotel and operate the property with their own management team. These hotels may be branded under a franchise agreement, operated as an independent hotel or operated under the owner’s brand. We are prohibited from operating and managing hotels by applicable REIT rules. |

|

|

• |

Franchisors—own a brand or brands and strive to grow their revenues by expanding the number of hotels in their franchise system. Franchisors provide their hotels with brand recognition, marketing support and centralized reservation systems for the franchised hotels. |

|

|

• |

Franchisor/Managers—own a brand or brands and operate hotels on behalf of the hotel owner or franchisee. |

|

|

• |

Managers—operate hotels on behalf of the hotel owner, but do not, themselves, own a brand. The hotels may be operated under a franchise agreement or as an independent hotel. |

The hotel manager is responsible for the day-to-day operations of the hotel, including the employment of hotel staff, the determination of room rates, the development of sales and marketing plans, the preparation of operating and capital expenditures budgets and the preparation of financial reports for the owner. The hotel manager typically receives fees based on the revenues and profitability of the hotel.

Supply and Demand. Our industry is influenced by the cyclical relationship between the supply of and demand for hotel rooms. Lodging demand growth typically is related to the vitality of the overall economy, in addition to local market factors that stimulate

4

travel to specific destinations. Trends in economic indicators such as gross domestic product (“GDP”) growth, business investment, corporate profits and employment growth are key indicators of the relative strength of lodging demand. Lodging demand also will be affected by changes to international travel patterns.

Lodging supply growth generally is driven by overall lodging demand, as extended periods of strong demand growth tend to encourage new development. However, the rate of supply growth also is influenced by several additional factors, including the availability of capital, interest rates, construction costs and unique market considerations. The relatively long lead-time required to complete the development of hotels makes supply growth easier to forecast than demand growth, but increases the volatility of the cyclical behavior of the lodging industry, as new supply may be planned during an upcycle but such supply may open for business in a weaker economy. Therefore, as illustrated in the charts below for the U.S. lodging industry, at different points in the cycle, demand growth may accelerate when supply growth is very low, or supply may accelerate while demand growth is slowing. A recent source of supply for the industry has been the rapid growth of online short-term rentals, including as a flexible option for apartment buildings. Though not reported through official industry statistics, the impact on the hotel industry and the availability of these outlets is more variable than typical changes in supply from hotel construction and tends to be very market specific. Local legislation has the potential to limit supply growth for these online short-term rentals in many top markets, though the growth of professional management for legal rentals remains a key trend.

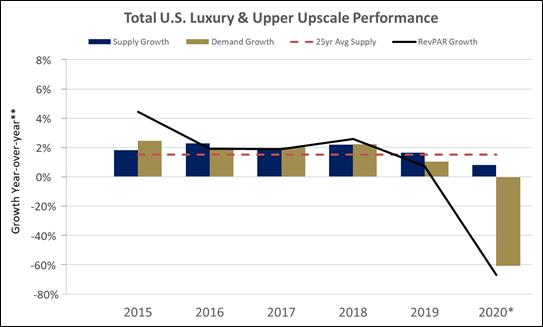

Our portfolio primarily consists of upper upscale and luxury hotels and, accordingly, its performance is best understood in comparison to the luxury and upper upscale categories rather than the entire industry. The charts below detail the historical supply, demand and revenue per available room (“RevPAR”) growth for the U.S. lodging industry and for the U.S. luxury and upper upscale categories for 2016 to 2020. For 2020, RevPAR and demand both suffered unprecedented declines as a result of the COVID-19 pandemic; therefore, as noted in the charts, the negative scale has been truncated for ease of view and the decline in 2020 is not shown to scale:

U.S. Lodging Industry Supply, Demand and RevPAR Growth

Source: STR

*2020 Supply, Demand and RevPAR estimates reflect economic methodology that assumes no temporary hotel closures

**Negative scale adjusted

5

U.S. Luxury and Upper Upscale Supply, Demand and RevPAR Growth

Source: STR

*2020 Supply, Demand and RevPAR estimates reflect economic methodology that assumes no temporary hotel closures

**Negative scale adjusted

Our Customers. Our customers fall into three broad groups: transient business, group business and contract business. Similar to the majority of the lodging industry, we further categorize business within these broad groups based on characteristics they have in common as follows:

Transient business broadly represents individual business or leisure travelers. Business travelers make up the majority of transient demand at our hotels. Therefore, we will be significantly more affected by trends in business travel than trends in leisure demand. The four key subcategories of rates offered to the transient business group are:

|

|

• |

Retail: This is the benchmark rate that a hotel publishes and offers to the public. It typically is the rate charged to travelers that do not have access to negotiated or discounted rates. It includes the “rack rate,” which typically is applied to rooms during high demand periods and is the highest rate category available. Retail room rates will fluctuate more freely depending on anticipated demand levels (e.g., seasonality and weekday vs. weekend stays). |

|

|

• |

Non-Qualified Discount: This category includes special rates offered by the hotels, including packages, advance-purchase discounts and promotional offers. It also includes rooms booked through online travel agencies (OTAs). |

|

|

• |

Special Corporate: This is a negotiated rate offered to companies and organizations that provide significant levels of room night demand to the hotel or to hotel brands generally. These rates typically are negotiated annually at a discount to the anticipated retail rate. In addition, this category includes rates offered at the prevailing per diem for approved government travel. |

|

|

• |

Qualified Discount: This category encompasses all discount programs, such as AAA and AARP discounts, rooms booked through wholesale channels, frequent guest program redemptions, and promotional rates and packages offered by a hotel. |

Group business represents clusters of guestrooms booked together, usually with a minimum of 10 rooms. The three key sub-categories of the group business category are:

|

|

• |

Association: group business related to national and regional association meetings and conventions. |

|

|

• |

Corporate: group business related to corporate meetings (e.g., product launches, training programs, contract negotiations, and presentations). |

|

|

• |

Other: group business predominately related to social, military, education, religious, fraternal and youth and amateur sports teams, otherwise known as SMERF business. |

6

Contract business refers to blocks of rooms sold to a specific company for an extended period at significantly discounted rates. Airline crews are typical generators of contract demand for our airport hotels. Contract rates may be utilized by hotels that are in markets that are experiencing consistently lower levels of demand.

Managers and Operational Agreements

All our hotels are managed by third parties pursuant to management or operating agreements, with some of such hotels also subject to separate franchise or license agreements addressing matters pertaining to operations under the designated brand. Under these agreements, the managers have sole responsibility and exclusive authority for all activities necessary for the day-to-day operation of the hotels, including establishing room rates, securing and processing reservations, procuring inventories, supplies and services, providing periodic inspection and consultation visits to the hotels by the managers’ technical and operational experts and promoting and publicizing the hotels. The managers employ all managerial and other employees for the hotels, review hotel operations with a focus on improving revenues and managing expenses, review the maintenance of the hotels, prepare reports, budgets and projections, and provide other administrative and accounting support services to the hotels. These support services include planning and policy services, divisional financial services, product planning and development, employee staffing and training, corporate executive management and certain in-house legal services. We have certain approval rights over budgets, capital expenditures, significant leases and contractual commitments, and various other matters.

General Terms and Provisions – Agreements governing our hotels that are managed by brand owners (Marriott, Hyatt, Hilton and AccorHotels) typically include the terms described below:

|

|

• |

Term and fees for operational services. The initial term of our management and operating agreements generally is 10 to 25 years, with one or more renewal terms at the option of the manager. The majority of our management agreements condition the manager’s right to exercise options for specified renewal terms upon the satisfaction of specified economic performance criteria. The manager typically receives compensation in the form of a base management fee, which is calculated as a percentage (generally 2-3%) of annual gross revenues, and an incentive management fee, which typically is calculated as a percentage (generally 10-20%) of operating profit after the owner has received a priority return on its investment in the hotel. In the case of our hotels operating under the W®, Westin®, Sheraton®, Luxury Collection® and St. Regis® brands and managed by Marriott following its acquisition of Starwood Hotels & Resorts Worldwide, Inc. on September 23, 2016 (collectively, the “Starwood Hotels”), the base management fee is only 1% of annual gross revenues, but that amount is supplemented by license fees payable under a separate license agreement (as described below). |

|

|

• |

License services. In the case of the Starwood Hotels, operations are governed by separate license agreements addressing matters pertaining to the designated brand, including rights to use trademarks, service marks and logos, matters relating to compliance with certain brand standards and policies, and the provision of certain system programs and centralized services. Although the term of these license agreements generally is coterminous with the corresponding operating agreements, the license agreements contemplate the potential for continued brand affiliation even in the event of a termination of the operating agreement (for instance, in the event the hotel is operated by an independent operator). Licensors receive compensation in the form of license fees (generally 5% of gross revenues attributable to room sales and 2% of gross revenues attributable to food and beverage sales), which amounts supplement the lower base management fee of 1% of gross revenues received by Marriott under the operating agreements, as noted above. |

|

|

• |

Chain or system programs and services. Managers are required to provide chain or system programs and services generally that are furnished on a centralized basis. Such services include the development and operation of certain computer systems and reservation services, regional or other centralized management and administrative services, marketing and sales programs and services, training and other personnel services, and other centralized or regional services as may be determined to be more efficiently performed on a centralized, regional or group basis rather than on an individual hotel basis. Costs and expenses incurred in providing these chain or system programs and services generally are allocated on a cost reimbursement basis among all hotels managed by the manager or its affiliates or that otherwise benefit from these services. |

|

|

• |

Working capital and fixed asset supplies. We are required to maintain working capital for each hotel and to fund the cost of certain fixed asset supplies (for example, linen, china, glassware, silver and uniforms). We also are responsible for providing funds to meet the cash needs for hotel operations if at any time the funds available from working capital are insufficient to meet the financial requirements of the hotels. For certain hotels, the working capital accounts which would otherwise be maintained by the managers for each of such hotels are maintained on a pooled basis, with managers being authorized to make withdrawals from such pooled account as otherwise contemplated with respect to working capital in accordance with the provisions of the management or operating agreements. |

7

|

|

• |

Furniture, fixtures and equipment replacements. We are required to provide the managers with all furniture, fixtures and equipment (“FF&E”) necessary for the operation of the hotels (including funding any required FF&E replacements). On an annual basis, the managers prepare budgets for FF&E to be acquired and certain routine repairs and maintenance to be performed in the next year and an estimate of the necessary funds, which budgets are subject to our review and approval. For purposes of funding such expenditures, a specified percentage (typically 4-5%) of the gross revenues of each hotel is deposited by the manager into an escrow or reserve account in our name, to which the manager has access. For certain hotels, we have negotiated flexibility with the manager that reduces the funding commitment required as follows: |

|

|

o |

For certain of our Marriott-managed hotels, we have entered into an agreement with Marriott to allow for such expenditures to be funded from one pooled reserve account, rather than periodic reserve fund contributions being deposited into separate reserve accounts at each of the subject hotels, with the minimum required balance maintained on an ongoing basis in that pooled reserve account being significantly less than the amount that would have been maintained otherwise in such separate hotel reserve accounts. Upon sale, a hotel-level reserve account would be funded (either by the purchaser or by us, as the seller) in the full amount of the reserve balance associated with the subject hotel. |

|

|

o |

For certain of the Starwood Hotels, periodic reserve fund contributions, which otherwise would be deposited into reserve accounts maintained by managers at each hotel, are distributed to us and we are responsible for providing funding of expenditures which otherwise would be funded from reserve accounts for each of the subject hotels. Upon sale, a hotel-level reserve account would be funded in the amount of the subject hotel’s pro rata share, if any, of the consolidated pooled reserve balance. |

|

|

• |

Building alterations, improvements and renewals. The managers are required to prepare an annual estimate of the expenditures necessary for major repairs, alterations, improvements, renewals and replacements to the structural, mechanical, electrical, heating, ventilating, air conditioning, plumbing and elevators of each hotel, along with alterations and improvements to the hotel as are required, in the manager’s reasonable judgment, to keep the hotel in a competitive, efficient and economical operating condition that is consistent with brand standards. We generally have approval rights over such budgets and expenditures, which we review and approve based on our manager’s recommendations and on our judgment. Expenditures for these major repairs and improvements affecting the hotel building typically are funded directly by owners, although our agreements with Marriott in respect of the Starwood Hotels contemplate that certain such expenditures also may be funded from the FF&E reserve account. |

|

|

• |

Treatment of additional owner funding. As additional owner funding becomes necessary, either for expenditures generally funded from the FF&E replacement funds, or for any major repairs or improvements to the hotel building which may be required to be funded directly by owners, most of our agreements provide for an economic benefit to us through an impact on the calculation of incentive management fees payable to our managers. One approach frequently utilized at some of our Marriott-managed hotels (excluding the Starwood Hotels) is to provide such owner funding through loans which are repaid, with interest, from operational revenues, with the repayment amounts reducing operating profit available for payment of incentive management fees. Another approach that is used at the Starwood Hotels, as well as with certain capital expenditures projects at some of our other hotels, is to treat such owner funding as an increase to our investment in the hotel, resulting in an increase to the owner’s priority return with a corresponding reduction to the amount of operating profit available for payment of incentive management fees. For the hotels that are subject to the pooled arrangement described above, the amount of any additional FF&E reserve account funding is allocated to each of such hotels on a pro rata basis, determined with reference to the net operating income of each hotel and the total net operating income of all such pooled hotels for the most recent operating year. |

|

|

• |

Territorial protections. Certain management and operating agreements impose restrictions for a specified period which limit the manager and its affiliates from owning, operating or licensing a hotel of the same brand within a specified area. The area restrictions vary with each hotel, from city blocks in urban areas to up to a multi-mile radius from the hotel in other areas. |

|

|

• |

Sale of the hotel. Subject to specific agreements as to certain hotels (see below under “Special Termination Rights”), we generally are limited in our ability to sell, lease or otherwise transfer such hotels by the requirement that the transferee assumes the related management agreements and meets specified other conditions, including the condition that the transferee not be a competitor of the manager. |

8

|

|

• |

Performance Termination Rights. In addition to any right to terminate that may arise as a result of a default by the manager, most of our management and operating agreements include reserved rights for us to terminate on the basis of the manager’s failure to meet certain performance-based metrics, typically including a specified threshold return on owner’s investment in the hotel, along with a failure of the hotel to achieve a specified RevPAR performance threshold established with reference to other competitive hotels in the market. Typically, such performance-based termination rights arise in the event the operator fails to achieve these specified performance thresholds over a consecutive two-year period and are subject to the manager’s ability to “cure” and avoid termination by payment to us of specified deficiency amounts (or, in some instances, waiver of the right to receive specified future management fees). We have agreed in the past, and may agree in the future, to waive certain of these termination rights in exchange for consideration from a manager or its affiliates, which consideration may include cash compensation or amendments to management agreements. |

|

|

• |

Special Termination Rights. In addition to any performance-based or other termination rights set forth in our management and operating agreements, we have specific negotiated termination rights as to certain management and operating agreements. While the brand affiliation of a hotel may increase its value, the ability to dispose of a property unencumbered by a management agreement, or even brand affiliation, also can increase the value for prospective purchasers. These termination rights can take several different forms, including termination of agreements upon sale that leave the property unencumbered by any agreement; termination upon sale provided that the property continues to be operated under a license or franchise agreement with continued brand affiliation; or termination without sale or other conditions, which may require the payment of a fee. These termination rights also may restrict the number of agreements that may be terminated over any annual or other period; impose limitations on the number of agreements terminated as measured by EBITDA; require that a certain number of hotels continue to maintain the brand affiliation; or be restricted to a specific pool of assets. |

In addition to hotels managed by brand owners, we have both branded hotels and non-branded hotels operated by independent managers. Our management agreements with independent managers, while similar in operational scope to agreements with our brand managers, typically have shorter initial terms, no renewal rights, more flexible termination rights, and more limited system-wide services. However, while we have additional flexibility with respect to these operators, certain of those hotels remain subject to underlying franchise or licensing agreements. These franchise or licensing agreements allow us to engage independent managers to operate our hotels under the applicable brand names and to participate in the brands’ reservation and loyalty-rewards systems. Under these agreements, we pay the brand owners a franchise or licensing fee equal to a specified percentage of gross room revenues, as well as other system fees and reimbursements. In addition, we are obligated to maintain applicable brand standards at our franchised hotels.

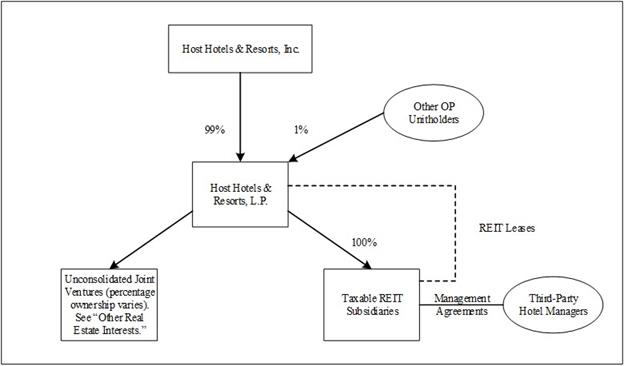

Operating Structure

Host Inc. operates through an umbrella partnership structure in which substantially all its assets are owned by Host L.P., of which Host Inc. is the sole general partner and holds approximately 99% of the OP units as of December 31, 2020. A REIT is a corporation that has elected to be treated as a REIT under the Internal Revenue Code of 1986, as amended (the “Code”), and that meets certain ownership, organizational and operating requirements set forth under the Code. In general, by payments of dividends to stockholders, a REIT is permitted to reduce or eliminate federal income taxes at the corporate level. Each OP unit owned by unaffiliated limited partners other than Host Inc. is redeemable, at the option of the limited partner, for an amount of cash equal to the market value of one share of Host Inc. common stock multiplied by the current conversion factor of 1.021494. Host Inc. has the right to acquire any OP unit offered for redemption directly from the limited partner in exchange for 1.021494 shares of Host Inc. common stock instead of Host L.P. redeeming such OP unit for cash. Additionally, for every share of common stock issued by Host Inc., Host L.P. will issue .97895 OP units to Host Inc. in exchange for the consideration received from the issuance of the common stock. As of December 31, 2020, unaffiliated limited partners owned 7.2 million OP units, which were convertible into 7.3 million Host Inc. common shares. Assuming that all OP units held by unaffiliated limited partners were converted into common shares, there would have been 712.7 million common shares of Host Inc. outstanding at December 31, 2020.

9

Our operating structure is as follows:

As a REIT, certain tax laws limit the amount of “non-qualifying” income that Host Inc. and Host L.P. can earn, including income derived directly from the operation of hotels. As a result, we lease substantially all our consolidated hotels to certain of our subsidiaries designated as taxable REIT subsidiaries (“TRS”) for federal income tax purposes. Our TRS are subject to corporate income tax and are not limited as to the amount of non-qualifying income they can generate, but they are limited in terms of their value as a percentage of the total value of our assets. Our TRS enter into agreements with third parties to manage the operations of the hotels. Our TRS also may own assets engaging in activities that produce non-qualifying income, such as the development of timeshare or condominium units, subject to certain restrictions. The difference between the hotels’ net operating cash flow and the aggregate rents paid to Host L.P. is retained by our TRS as taxable income or loss. Accordingly, the net effect of the TRS leases is that a portion of the net operating cash flow from our hotels is subject to federal, state and, if applicable, foreign corporate income tax.

Our Consolidated Hotel Portfolio

As of February 19, 2021, we owned a portfolio of 80 hotels, of which 75 are in the United States and five are located in Brazil and Canada. Our consolidated hotels located outside the United States collectively have approximately 1,500 rooms. Approximately 1% of our revenues in 2020, and 2% in 2019 and 2018, were attributed to the operations of these five foreign hotels.

The lodging industry is viewed as consisting of six different categories, each of which caters to a discrete set of customer tastes and needs: luxury, upper upscale, upscale, upper midscale, midscale and economy. Our portfolio primarily consists of luxury and upper upscale properties, which are operated under internationally recognized brand names such as Marriott, Westin, Ritz-Carlton, Hyatt and Hilton. There also has been a trend towards specialized, smaller boutique hotels that are customized towards a particular customer profile. Generally, these hotels will be operated by an independent third-party and either will have no brand affiliation, or will be associated with a major brand, while maintaining most of its independent identity (which we refer to as “soft-branded” hotels).

Revenues earned at our hotels consist of three broad categories: rooms, food and beverage, and other revenues. While approximately 60% of our revenues in 2020 are generated from rooms sales, the majority of our properties feature a variety of amenities that help drive demand and profitability. Our hotels typically include meeting and banquet facilities, a variety of restaurants and lounges, swimming pools, exercise facilities and/or spas, gift shops and parking facilities, the combination of which enable them to serve business, leisure and group travelers.

10

Our consolidated portfolio includes 32 hotels that have more than 500 rooms. The average age of our properties is 36 years, although substantially all of them have benefited from significant renovations or major additions, as well as regularly scheduled renewal and replacement expenditures and other capital improvements. In our consolidated portfolio, approximately 88% of our hotels, by room count, are managed by their own brand managers, and 12% are managed by independent managers as a franchise or as an independent brand.

By Brand. The following table details our consolidated hotel portfolio by brand as of February 19, 2021:

|

|

|

Number |

|

|

|

|

|

|

Percentage of |

|

||

|

Brand |

|

of Hotels |

|

|

Rooms |

|

|

Revenues (1) |

|

|||

|

Marriott: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Marriott |

|

|

29 |

|

|

|

19,976 |

|

|

|

33.2 |

% |

|

Ritz-Carlton |

|

|

5 |

|

|

|

1,890 |

|

|

|

12.8 |

|

|

Autograph Collection |

|

|

1 |

|

|

|

277 |

|

|

|

0.7 |

|

|

JW Marriott |

|

|

4 |

|

|

|

1,909 |

|

|

|

2.9 |

|

|

AC Hotels |

|

|

1 |

|

|

|

165 |

|

|

|

— |

|

|

W |

|

|

2 |

|

|

|

729 |

|

|

|

1.3 |

|

|

St. Regis |

|

|

1 |

|

|

|

232 |

|

|

|

0.4 |

|

|

Luxury Collection |

|

|

2 |

|

|

|

1,152 |

|

|

|

6.0 |

|

|

Westin |

|

|

10 |

|

|

|

5,077 |

|

|

|

8.4 |

|

|

Sheraton |

|

|

3 |

|

|

|

3,370 |

|

|

|

3.8 |

|

|

Total Marriott |

|

|

58 |

|

|

|

34,777 |

|

|

|

69.5 |

|

|

Hyatt: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Andaz |

|

|

1 |

|

|

|

301 |

|

|

|

1.9 |

|

|

Grand Hyatt |

|

|

4 |

|

|

|

3,632 |

|

|

|

6.5 |

|

|

Hyatt Place |

|

|

1 |

|

|

|

426 |

|

|

|

0.9 |

|

|

Hyatt Regency |

|

|

5 |

|

|

|

3,409 |

|

|

|

7.5 |

|

|

Total Hyatt |

|

|

11 |

|

|

|

7,768 |

|

|

|

16.8 |

|

|

Hilton: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Curio |

|

|

1 |

|

|

|

391 |

|

|

|

0.8 |

|

|

Hilton |

|

|

1 |

|

|

|

223 |

|

|

|

0.7 |

|

|

Embassy Suites |

|

|

1 |

|

|

|

455 |

|

|

|

0.4 |

|

|

Total Hilton |

|

|

3 |

|

|

|

1,069 |

|

|

|

1.9 |

|

|

AccorHotels: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Swissôtel |

|

|

1 |

|

|

|

662 |

|

|

|

0.8 |

|

|

Fairmont |

|

|

1 |

|

|

|

450 |

|

|

|

2.1 |

|

|

ibis |

|

|

1 |

|

|

|

256 |

|

|

|

— |

|

|

Novotel |

|

|

1 |

|

|

|

149 |

|

|

|

0.1 |

|

|

Total AccorHotels |

|

|

4 |

|

|

|

1,517 |

|

|

|

3.0 |

|

|

Other/Independent |

|

|

4 |

|

|

|

1,176 |

|

|

|

7.8 |

|

|

|

|

|

80 |

|

|

|

46,307 |

|

|

|

99 |

% |

|

___________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

Based on our 2020 revenues; sold hotels accounted for the remaining 1% of our revenues. No individual hotel contributed more than 6% of total revenues in 2020. Hotels that are not considered upper upscale or luxury constitute less than 2% of our revenues. |

11

By Location. The following table details the locations of and number of rooms at our consolidated hotels as of February 19, 2021:

|

Location |

|

Rooms |

|

|

Location |

|

Rooms |

|

||

|

Arizona |

|

|

|

|

|

Louisiana |

|

|

|

|

|

AC Hotel Scottsdale North |

|

|

165 |

|

|

New Orleans Marriott |

|

|

1,333 |

|

|

The Phoenician, A Luxury Collection Resort |

|

|

645 |

|

|

Maryland |

|

|

|

|

|

The Camby Hotel |

|

|

277 |

|

|

Gaithersburg Marriott Washingtonian Center |

|

|

284 |

|

|

The Westin Kierland Resort & Spa |

|

|

732 |

|

|

Massachusetts |

|

|

|

|

|

California |

|

|

|

|

|

Boston Marriott Copley Place (1) |

|

|

1,144 |

|

|

Axiom Hotel, San Francisco |

|

|

152 |

|

|

Sheraton Boston Hotel |

|

|

1,220 |

|

|

Coronado Island Marriott Resort & Spa (1) |

|

|

300 |

|

|

The Westin Waltham Boston |

|

|

351 |

|

|

Grand Hyatt San Francisco |

|

|

668 |

|

|

Minnesota |

|

|

|

|

|

Hyatt Regency San Francisco Airport |

|

|

789 |

|

|

Minneapolis Marriott City Center |

|

|

585 |

|

|

Manchester Grand Hyatt San Diego (1) |

|

|

1,628 |

|

|

New Jersey |

|

|

|

|

|

Marina del Rey Marriott (1) |

|

|

370 |

|

|

Newark Liberty International Airport Marriott (1) |

|

|

591 |

|

|

Marriott Marquis San Diego Marina (1) |

|

|

1,360 |

|

|

Sheraton Parsippany Hotel |

|

|

370 |

|

|

San Francisco Marriott Fisherman’s Wharf |

|

|

285 |

|

|

New York |

|

|

|

|

|

San Francisco Marriott Marquis (1) |

|

|

1,500 |

|

|

New York Marriott Downtown |

|

|

515 |

|

|

San Ramon Marriott (1) |

|

|

368 |

|

|

New York Marriott Marquis |

|

|

1,966 |

|

|

Santa Clara Marriott (1) |

|

|

766 |

|

|

Sheraton New York Times Square Hotel |

|

|

1,780 |

|

|

The Ritz-Carlton, Marina del Rey (1) |

|

|

304 |

|

|

Ohio |

|

|

|

|

|

The Westin Los Angeles Airport (1) |

|

|

747 |

|

|

The Westin Cincinnati (1) |

|

|

456 |

|

|

The Westin South Coast Plaza, Costa Mesa (2) |

|

|

393 |

|

|

Pennsylvania |

|

|

|

|

|

W Hollywood (1) |

|

|

305 |

|

|

Philadelphia Airport Marriott (1) |

|

|

419 |

|

|

Colorado |

|

|

|

|

|

The Logan |

|

|

391 |

|

|

Denver Marriott Tech Center |

|

|

605 |

|

|

Texas |

|

|

|

|

|

Denver Marriott West (1) |

|

|

305 |

|

|

Houston Airport Marriott at George Bush |

|

|

|

|

|

The Westin Denver Downtown |

|

|

430 |

|

|

Intercontinental (1) (3) |

|

|

573 |

|

|

Florida |

|

|

|

|

|

Houston Marriott Medical Center/Museum |

|

|

|

|

|

1 Hotel South Beach, Miami Beach |

|

|

433 |

|

|

District (1) |

|

|

395 |

|

|

Hilton Singer Island Oceanfront/Palm Beaches |

|

|

|

|

|

JW Marriott Houston by the Galleria |

|

|

516 |

|

|

Resort |

|

|

223 |

|

|

San Antonio Marriott Rivercenter (1) |

|

|

1,000 |

|

|

Hyatt Regency Coconut Point Resort and Spa |

|

|

454 |

|

|

San Antonio Marriott Riverwalk |

|

|

512 |

|

|

Miami Marriott Biscayne Bay |

|

|

600 |

|

|

The St. Regis Houston |

|

|

232 |

|

|

Orlando World Center Marriott |

|

|

2,004 |

|

|

Virginia |

|

|

|

|

|

Tampa Airport Marriott (1) |

|

|

298 |

|

|

Hyatt Regency Reston |

|

|

518 |

|

|

The Don CeSar |

|

|

348 |

|

|

The Ritz-Carlton, Tysons Corner (1) |

|

|

398 |

|

|

The Ritz-Carlton, Amelia Island |

|

|

446 |

|

|

Westfields Marriott Washington Dulles |

|

|

336 |

|

|

The Ritz-Carlton, Naples |

|

|

447 |

|

|

Washington |

|

|

|

|

|

The Ritz-Carlton Golf Resort, Naples |

|

|

295 |

|

|

The Westin Seattle |

|

|

891 |

|

|

YVE Hotel Miami |

|

|

243 |

|

|

W Seattle |

|

|

424 |

|

|

Georgia |

|

|

|

|

|

Washington, D.C. |

|

|

|

|

|

Grand Hyatt Atlanta in Buckhead |

|

|

439 |

|

|

Grand Hyatt Washington |

|

|

897 |

|

|

JW Marriott Atlanta Buckhead |

|

|

371 |

|

|

Hyatt Regency Washington on Capitol Hill |

|

|

838 |

|

|

The Westin Buckhead Atlanta |

|

|

365 |

|

|

JW Marriott Washington, DC |

|

|

777 |

|

|

The Whitley, A Luxury Collection Hotel, |

|

|

|

|

|

The Westin Georgetown, Washington D.C. |

|

|

267 |

|

|

Atlanta Buckhead |

|

|

507 |

|

|

Washington Marriott at Metro Center |

|

|

459 |

|

|

Hawaii |

|

|

|

|

|

Brazil |

|

|

|

|

|

Andaz Maui at Wailea Resort |

|

|

301 |

|

|

ibis Rio de Janeiro Parque Olimpico |

|

|

256 |

|

|

Fairmont Kea Lani, Maui |

|

|

450 |

|

|

JW Marriott Hotel Rio de Janeiro |

|

|

245 |

|

|

Hyatt Place Waikiki Beach |

|

|

426 |

|

|

Novotel Rio de Janeiro Parque Olimpico |

|

|

149 |

|

|

Hyatt Regency Maui Resort and Spa |

|

|

810 |

|

|

Canada |

|

|

|

|

|

Illinois |

|

|

|

|

|

Calgary Marriott Downtown Hotel |

|

|

388 |

|

|

Chicago Marriott Suites Downers Grove |

|

|

254 |

|

|

Marriott Downtown at CF Toronto Eaton |

|

|

|

|

|

Embassy Suites by Hilton Chicago Downtown |

|

|

|

|

|

Centre (1) |

|

|

461 |

|

|

Magnificent Mile |

|

|

455 |

|

|

Total |

|

|

46,307 |

|

|

Swissôtel Chicago |

|

|

662 |

|

|

|

|

|

|

|

|

The Westin Chicago River North |

|

|

445 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

The land on which this hotel is built is leased from a third-party under one or more lease agreements. |

|

(2) |

The land, building and improvements are leased from a third-party under a long-term lease agreement. |

|

(3) |

This property is not wholly owned. |

12

By Market Location: With our geographically diverse portfolio, no individual market represents more than 12% of total revenues. The following chart summarizes the composition of our consolidated hotels as of February 19, 2021 by each market location based on its percentage of 2020 revenues:

|

|

|

(1) |

Our sold hotels accounted for the remaining 1% of our 2020 revenues. |

Other Real Estate Interests

We own non-controlling interests in several entities that, as of February 19, 2021, owned, or owned an interest in, 10 hotels. Due to the ownership structure and economic or participating rights of the partners, we do not consolidate the operations of the properties owned by these entities and they are included in equity in earnings in our consolidated results of operations. Our investments in these entities are as follows:

Asia/Pacific Joint Venture. We have a 25% interest in an Asia/Pacific JV with RECO Hotels JV Private Limited, an affiliate of the Government of Singapore Investment Corporation Pte Ltd. The agreement may be terminated by either partner at any time, which would trigger the liquidation of the joint venture. The commitment period for equity contributions to the Asia/Pacific JV has expired. Certain funding commitments remain, however, related to its existing investments in India.

13

As of December 31, 2020, the Asia/Pacific JV has invested approximately $109 million (of which our share is $27 million) in a separate joint venture in India with Accor S.A. and InterGlobe Enterprises Limited, in which it holds a 36% interest. This joint venture owns seven hotels and an office building in Delhi, Bangalore and Chennai, India, totaling approximately 1,720 rooms. The hotels are managed by AccorHotels under the Pullman, ibis and Novotel brands.

Maui Joint Venture. We own a 67% interest in a joint venture with an affiliate of HV Global Group, a subsidiary of Marriott Vacations Worldwide Corporation, that owns a 131-unit vacation ownership development in Maui, Hawaii adjacent to our Hyatt Regency Maui Resort & Spa (the “Maui JV”). Since 2012, we have contributed approximately $87 million to the Maui JV, which includes the contribution of land valued at $36 million.

Hyatt Place Joint Venture. We own a 50% interest in a joint venture with White Lodging Services that owns the 255-room Hyatt Place Nashville Downtown in Tennessee. The joint venture has a $60 million mortgage loan that is non-recourse to us.

Harbor Beach Joint Venture. We own a 49.9% interest in a joint venture with R/V-C Association that owns the 650-room Fort Lauderdale Marriott Harbor Beach Resort & Spa in Florida. The joint venture has approximately $150 million of mortgage debt that is non-recourse to us.

For additional information see Part II Item 8. “Financial Statements and Supplementary Data – Note 4. Investments in Affiliates.”

Competition