SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X]ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 30, 2017

OR

[ ]TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________to_________

Commission File Number 1-5039

WEIS MARKETS, INC.

(Exact name of registrant as specified in its charter)

|

PENNSYLVANIA

1000 S. Second Street |

24-0755415 |

|

Sunbury, Pennsylvania Registrant's telephone number, including area code: (570) 286-4571

|

17801-0471 Registrant's web address: www.weismarkets.com |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

Title of each class Common stock, no par value Securities registered pursuant to Section 12(g) of the Act: None |

Name of each exchange on which registered New York Stock Exchange

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer [ ] |

Accelerated filer [X] |

|

|

Non-accelerated filer [ ] |

(Do not check if a smaller reporting company) |

Smaller reporting company [ ] |

|

|

Emerging growth company [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

The aggregate market value of Common Stock held by non-affiliates of the Registrant is approximately $464,000,000 as of July 1, 2017 the last business day of the most recently completed second fiscal quarter.

Shares of common stock outstanding as of March 15, 2018 - 26,898,443.

DOCUMENTS INCORPORATED BY REFERENCE: Selected portions of the Weis Markets, Inc. definitive proxy statement dated March 15, 2018 are incorporated by reference in Part III of this Form 10-K.

WEIS MARKETS, INC.

PART I

Weis Markets, Inc. is a Pennsylvania business founded by Harry and Sigmund Weis in 1912 and incorporated in 1924. The Company is engaged principally in the retail sale of food in Pennsylvania and surrounding states. There was no material change in the nature of the Company's business during fiscal 2017. The Company’s stock has been traded on the New York Stock Exchange since 1965 under the symbol “WMK.” The Weis family currently owns approximately 65% of the outstanding shares. Jonathan H. Weis serves as Chairman of the Board of Directors, President and Chief Executive Officer.

The Company's retail food stores sell groceries, dairy products, frozen foods, meats, seafood, fresh produce, floral, pharmacy services, deli products, prepared foods, bakery products, beer and wine, fuel and general merchandise items, such as health and beauty care and household products. The store product selection includes national, local and private brands including natural, gluten-free and organic varieties. The Company advertises its products and promotes its brand through weekly newspaper circulars; radio ads; e-mail blasts; and on-line via its web site, social media and mobile applications. Printed circulars are used extensively on a weekly basis to advertise featured items. The Company promotes by using Everyday Lower Price, Low Price Guarantee and utilizes a loyalty marketing program, “Weis Club Preferred Shopper,” which enables customers to receive discounts, promotions and fuel rewards. The Company currently owns and operates 205 retail food stores many of which have on-line order and pick up customer service. The Company’s operations are reported as a single reportable segment. The majority of the Company’s revenues are generally not seasonal in nature. However, revenues tend to be higher during the major holidays throughout the year. Additionally, significant inclement weather systems, particularly winter storms, tend to affect sales trends.

The following table provides additional detail on the percentage of consolidated net sales contributed by product category for fiscal years 2017, 2016 and 2015, respectively:

|

|

||||||

|

|

||||||

|

|

2017 |

2016 |

2015 |

|||

|

Center Store (1) |

57.2 |

% |

57.0 |

% |

57.5 |

% |

|

Fresh (2) |

30.5 | 30.3 | 29.7 | |||

|

Pharmacy Services |

8.9 | 9.5 | 9.4 | |||

|

Fuel |

3.2 | 3.0 | 3.2 | |||

|

Other |

0.2 | 0.2 | 0.2 | |||

|

Consolidated net sales |

100.0 |

% |

100.0 |

% |

100.0 |

% |

____________________

(1) Consists primarily of groceries, dairy products, frozen foods, beer and wine, and general merchandise items, such as health and beauty care and household products.

(2) Consists primarily of meats, seafood, fresh produce, floral, deli products, prepared foods and bakery products.

In 2016, Weis Markets acquired five Mars Super Market locations in Baltimore County, MD, 38 Food Lion stores throughout Maryland, Virginia and Delaware, and a Nell's Family Market in East Berlin, PA. The completion of these individual acquisitions expanded the Company's footprint into Virginia and Delaware, and increased its store count by 25 percent. Beginning August 1, 2016, the Company converted the 44 stores to Weis Markets stores in 96 days ending in November, during which it interviewed and hired more than 2,000 associates who were previously employed at the acquired locations. In 2017, the acquired store group is providing a positive cash flow for the Company as management continues to develop the stores using its business model. Although there are no pending acquisitions, the Company continues to investigate acquisition opportunities as well as grow its existing store base organically.

On March 9, 2017, the Company opened its new 65,000 square-foot prototype store next to a major competitor in Enola, PA. Designated the “Community Market” format, the store features a brand new store layout and unique features to elevate the shopping experience including a pub, grill and ice cream parlor, featuring the Company’s own ice cream. The store contains a Pennsylvania foods section and more than 1,900 organic and gluten-free products, along with a mix-and-match pick K-cup 12-packs section and a Chobani Yogurt Bar. The Company plans to review the success of the new features and utilize them where appropriate in other stores.

At the end of 2017, Weis Markets, Inc. operated 4 stores in Delaware, 51 stores in Maryland, 5 stores in New Jersey, 9 stores in New York, 121 stores in Pennsylvania, 13 stores in Virginia and 2 stores in West Virginia, for a total of 205 retail food stores operating under the Weis Markets trade name.

1

Item 1.Business: (continued)

All retail food store locations operate as conventional supermarkets. The retail food stores range in size from 8,000 to 70,000 square feet, with an average size of approximately 48,000 square feet. The Company’s store fleet includes a variety of sizes with a few locations in operation since the 1950’s; all stores are branded Weis Markets and provide the same basic offerings scaled to the size of each store. The new Weis prototype averages approximately 65,000 square feet. The following summarizes the number of stores by size categories as of year-end:

|

|

||||||||

|

|

2017 |

2017 |

2016 |

2016 |

||||

|

Square feet |

Number of stores |

% of Total |

Number of stores |

% of Total |

||||

|

55,000 to 70,000 |

60 | 29% | 58 | 28% | ||||

|

45,000 to 54,999 |

70 | 34% | 70 | 34% | ||||

|

35,000 to 44,999 |

53 | 26% | 53 | 26% | ||||

|

25,000 to 34,999 |

17 | 8% | 18 | 9% | ||||

|

Under 25,000 |

5 | 3% | 5 | 3% | ||||

|

Total |

205 | 100% | 204 | 100% | ||||

The Company believes that new stores and remodeling current stores are vital for future Company growth. The location and appearance of its stores are important components of attracting new and retaining current customers. On an average basis, the Company has five to eight new stores in the process of being developed and dedicates a quarter of its capital budget to new stores annually, excluding acquisitions. Generally, another fifteen to twenty percent of the capital budget is dedicated to store remodels while the remainder is attributable to smaller in-store sales-driven projects, store maintenance and store support function expenditures. See the “Liquidity and Capital Resources” section included in “Item 7. Management’s Discussion and Analysis of the Financial Condition and Results of Operations” for more details regarding the Company’s capital expenditures.

The following schedule shows the changes in the number of retail food stores, total square footage and store additions/remodels as of year-end:

|

|

||||||||||

|

|

2017 |

2016 |

2015 |

2014 |

2013 |

|||||

|

Beginning store count |

204 | 163 | 163 | 165 | 163 | |||||

|

New stores (1) |

2 | 44 |

--- |

1 | 4 | |||||

|

Opened relocated stores |

--- |

--- |

1 | 1 |

--- |

|||||

|

Closed stores |

(1) | (3) |

--- |

(3) | (2) | |||||

|

Closed relocated stores |

--- |

--- |

(1) | (1) |

--- |

|||||

|

Ending store count |

205 | 204 | 163 | 163 | 165 | |||||

|

Total square feet (000’s), at year-end |

9,867 | 9,777 | 8,215 | 8,202 | 8,211 | |||||

|

Additions/major remodels |

4 | 9 | 16 | 8 | 12 | |||||

____________________

(1) In the second half of 2016, Weis Markets acquired five former Mars Super Market stores located in Baltimore County, Maryland; 38 former Food Lion Supermarket stores located in Maryland, Virginia and Delaware; and one former Nell’s Family Market store located in East Berlin, Pennsylvania.

Utilizing its own centrally located distribution center and transportation fleet, Weis Markets self distributes approximately 67% of product with the remaining being supplied by direct store vendors. In addition, the Company has three manufacturing facilities which process milk, ice cream and fresh meat products. The corporate offices are located in Sunbury, PA.

The Company strives to be good stewards of the environment and makes this an important part of its overall mission. Its sustainability strategy operates under four key pillars: green design, natural resource conservation, food and agricultural impact and social responsibility. The goal of the sustainability strategy is to reduce the Company’s overall carbon footprint by reducing greenhouse gas emissions and reducing the impact on climate change. The Company set a goal in 2008 to reduce its carbon footprint by 20% by the year 2020. In 2016, the company exceeded this goal with a carbon reduction of 22%. The Company continues to be a member of the EPA GreenChill program for advancing environmentally beneficial refrigerant management systems and has ten stores registered under this program. Additional corporate sustainability goals are: reducing energy usage by 2% each year, replacing 50% of the truck fleet with fuel efficient tractors within three years and increasing recycling 5% each year. In 2017, the Company recycled 73,000 tons of materials, representing a corporate wide recycling rate of 66%.

2

Item 1. Business: (continued)

The Company operates in a highly competitive market place. The number and the variety of competitors vary by market. The Company’s principal competition consists of international, national, regional and local food chains, as well as independent food stores. The Company also faces substantial competition from convenience stores, membership warehouse clubs, specialty retailers, supercenters and large-scale drug and pharmaceutical chains. The Company continues to effectively compete by offering a strong combination of value, quality and service.

The Company currently employs approximately 23,000 full-time and part-time associates.

Trade Names and Trademarks. The Company has invested significantly in the development and protection of “Weis Markets” both as a trade name and a trademark and considers it to be an important asset. The Company is the exclusive licensee of nearly 100 trademarks registered and/or pending in the United States Patent and Trademark Office from WMK Holdings, Inc., including trademarks for its product lines and promotions such as Weis, Weis 2 Go, Weis Wonder Chicken, Weis Great Meals Start Here, Weis Gas-n-Go and Weis Nutri-Facts. Each trademark registration is for an initial period of 10 years and may be renewed so long as it is in continued use in commerce.

The Company considers its trademarks to be of material importance to its business and actively defends and enforces its rights.

The Company maintains a corporate web site at www.weismarkets.com. The Company makes available, free of charge, on the “Financial” page of the “Corporate Information” section of its web site, its Annual Reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after the Company electronically files such material or furnishes it to the U.S. Securities and Exchange Commission (SEC) by clicking on the “SEC Information” link.

The Company’s Corporate Governance materials can be found on the”Governance” page of the “Corporate Information” section of its web site. These materials include the Corporate Governance Guidelines; the Charters of the Audit, Compensation and Disclosure Committees; and both the Code of Business Conduct and Ethics and the Code of Ethics for the CEO and CFO. A copy of the foregoing corporate governance materials is available upon written request to the Company’s principal executive offices.

In addition to risks and uncertainties in the ordinary course of business common to all businesses, important factors are listed below specific to the Company and its industry, which could materially impact its future performance.

The Company’s industry is highly competitive. If the Company is unable to compete effectively, the Company’s financial condition and results of operations could be materially affected.

The retail food industry is intensely price competitive, and the competition the Company encounters may have a negative impact on product retail prices. The operating environment continues to be characterized by aggressive expansion, entry of non-traditional competitors, market consolidation and increasing fragmentation of retail and online formats. The financial results may be adversely impacted by a competitive environment that could cause the Company to reduce retail prices without a reduction in its product cost to maintain market share; thus reducing sales and gross profit margins.

The trade area of the Company is located within a region and is subject to the economic, social and climate variables of that region.

The majority of the Company’s stores are concentrated in central and northeast Pennsylvania, central Maryland, suburban Washington, DC and Baltimore regions and New York’s Southern Tier. Changes in economic and social conditions in the Company’s operating regions, including fluctuations in the inflation rate along with changes in population and employment and job growth rates, affect customer shopping habits. These changes may negatively impact sales and earnings. Business disruptions due to weather and catastrophic events historically have been few. The Company’s geographic regions could receive an extreme variance in the amount of annual snowfall that may materially affect sales and expense results.

The Company may be unable to retain key management personnel.

The Company's success depends to a significant degree upon the continued contributions of senior management. The loss of any key member of management may prevent the Company from implementing its business plans in a timely manner. In addition, employment conditions specifically may affect the Company’s ability to hire and train qualified associates.

3

Item 1a. Risk Factors: (continued)

Food safety issues could result in the loss of consumer confidence in the Company.

Customers count on the Company to provide them with safe and wholesome food products. Concerns regarding the safety of food products sold in its stores could cause shoppers to avoid purchasing certain products from the Company, or to seek alternative sources of supply for all of their food needs, even if the basis for the concern is outside of the Company’s control. A loss in confidence on the part of its customers would be difficult and costly to reestablish. As such, any issue regarding the safety of any food items sold by the Company, regardless of the cause, could have a substantial and adverse effect on operations.

The failure to execute expansion plans could have a material adverse effect on the Company's business and results of its operations.

Circumstances outside the Company’s control could negatively impact anticipated capital investments in store, distribution and manufacturing projects, information technology and equipment. The Company cannot determine with certainty whether its new or acquired stores will meet expected benefits including, among other things, operating efficiencies, procurement savings, innovation, sharing of best practices and increased market share that may allow for future growth. Achieving the anticipated benefits may be subject to a number of significant challenges and uncertainties, including, without limitation, the possibility of imprecise assumptions underlying expectations regarding potential synergies and the integration process, unforeseen expenses and delays diverting management’s time and attention and competitive factors in the marketplace.

Disruptions or security breaches in the Company’s information technology systems could adversely affect results.

The Company’s business is highly dependent on complex information technology systems that are vital to its continuing operations. If the Company was to experience difficulties maintaining existing systems or implementing new systems, significant losses could be incurred due to disruptions in its operations. Additionally, these systems contain valuable proprietary data as well as receipt and storage of personal information about its associates and customers, in particular electronic payment data and personal health information that, if breached, would have an adverse effect on the Company. Such an occurrence could adversely affect the Company’s reputation with its customers, associates, and vendors, as well as the Company’s operations, results of operations, financial condition and liquidity, and could result in litigation against the Company or the imposition of penalties.

The Company is affected by certain operating costs which could increase or fluctuate considerably.

Associate expenses contribute to the majority of the Company’s operating costs. The Company's financial performance is potentially affected by increasing wage and benefit costs, a competitive labor market, regulatory wage increases and the risk of unionized labor disruptions of its non-union workforce. The Company's profit is particularly sensitive to the cost of oil. Oil prices directly affect the Company's product transportation costs, as well as its utility and petroleum-based supply costs. It also affects the costs of its suppliers, which impacts its cost of goods.

Various aspects of the Company’s business are subject to federal, state and local laws and regulations.

The Company is subject to various federal, state and local laws, regulations and administrative practices that affect the Company’s business. The Company must comply with numerous provisions regulating health and sanitation standards, food labeling, equal employment opportunity, minimum wages and licensing for the sale of food, drugs and alcoholic beverages. The Company’s compliance with these regulations may require additional capital expenditures and could adversely affect the Company’s ability to conduct the Company’s business as planned. Management cannot predict either the nature of future laws, regulations, interpretations or applications, or the effect either additional government regulations or administrative orders, when and if promulgated, or disparate federal, state, and local regulatory schemes would have on the Company’s future business. They could, however, require the reformulation of certain products to meet new standards, the recall or discontinuance of certain products not able to be reformulated, additional record keeping, expanded documentation of the properties of certain products, expanded or different labeling and/or scientific substantiation. Any or all of such requirements could have an adverse effect on the Company’s results of operations and financial condition.

4

Item 1a. Risk Factors: (continued)

Unexpected factors affecting self-insurance claims and reserve estimates could adversely affect the Company.

The Company uses a combination of insurance and self-insurance to provide for potential liabilities for workers' compensation, general liability, vehicle accident, property and associate medical benefit claims. Management estimates the liabilities associated with the risks retained by the Company, in part, by considering historical claims experience, demographic and severity factors and other actuarial assumptions which, by their nature, are subject to a high degree of variability. Any projection of losses concerning workers’ compensation and general liability is subject to a high degree of variability. Among the causes of this variability are unpredictable external factors affecting future inflation rates, discount rates, litigation trends, legal interpretations, benefit level changes and claim settlement patterns.

Changes in tax laws may result in higher income tax.

The Company's future effective tax rate may increase from current rates due to changes in laws and the status of pending items with various taxing authorities. Currently, the Company benefits from a combination of its corporate structure and certain state tax laws.

The Company’s investment portfolio may suffer losses from changes in market interest rates and changes in market conditions which could adversely affect results of income or liquidity.

The Company’s marketable securities consist of municipal bonds and equity securities. The municipal bond investments are subject to general credit, liquidity, market and interest rate risks. Substantially all of these securities are subject to interest rate and credit risk and will decline in value if interest rates increase or one of the issuers’ credit ratings is reduced. As a result, the Company may experience a reduction in value or loss of liquidity from investments, which may have a negative impact on the Company’s results of operations, liquidity and financial condition.

The Company is a controlled Company due to the common stock holdings of the Weis family.

The Weis family’s share ownership represents approximately 65% of the combined voting power of the Company’s common stock as of December 30, 2017. As a result, the Weis family has the power to elect a majority of the Company’s directors and approve any action requiring the approval of the shareholders of the Company, including adopting certain amendments to the Company’s charter and approving mergers or sales of substantially all of the Company’s assets. Currently, one of the Company’s five directors is a member of the Weis family.

Changes in vendor promotions or allowances, including the way vendors target their promotional spending, and the Company's ability to effectively manage these programs could significantly impact margins and profitability.

The Company cooperatively engages in a variety of promotional programs with its vendors. As the parties assess the results of specific promotions and plan for future promotions, the nature of these programs and the allocation of dollars among them changes over time. The Company manages these programs to maintain or improve margins while at the same time increasing sales. A reduction in overall promotional spending or a shift by vendors in promotional spending away from certain types of promotions that the Company and its customers have historically utilized could have a significant impact on profitability.

Item 1b. Unresolved Staff Comments:

There are no unresolved staff comments.

5

As of December 30, 2017, the Company owned and operated 94 of its retail food stores and leased and operated 111 stores under operating leases that expire at various dates through 2033. The Company owns all trade fixtures and equipment in its stores and several parcels of vacant land, which are available as locations for possible future stores or other expansion.

The Company owns and operates one distribution center in Milton, Pennsylvania of approximately 1.3 million square feet, and one in Northumberland, Pennsylvania totaling approximately 76,000 square feet. The Company also owns one warehouse complex in Sunbury, Pennsylvania totaling approximately 541,000 square feet. The Company utilizes 258,000 square feet of its Sunbury location to operate its ice cream plant, meat processing plant and milk processing plant.

Neither the Company nor any subsidiary is presently a party to, nor is any of their property subject to, any pending legal proceedings, other than routine litigation incidental to the business that would not have a material adverse effect on the financial results. The Company estimates any exposure to these legal proceedings and establishes accruals for the estimated liabilities, where it is reasonably possible to estimate and where an adverse outcome is probable.

6

Executive Officers of the Registrant

The following sets forth the names and ages of the Company’s executive officers as of March 15, 2018, indicating all positions held during the past five years:

|

Name |

Age |

Title |

|

|

||

|

Jonathan H. Weis (a) |

50 |

Chairman of the Board, President and Chief Executive Officer |

|

Kurt A. Schertle (b) |

46 |

Chief Operating Officer |

|

Wayne S. Bailey (c) |

59 |

Senior Vice President of Supply Chain and Logistics |

|

Scott F. Frost (d) |

55 |

Senior Vice President, Chief Financial Officer and Treasurer |

|

David W. Gose II (e) |

51 |

Senior Vice President of Operations |

|

Harold G. Graber (f) |

62 |

Senior Vice President of Real Estate and Development, Secretary |

|

Richard A. Gunn (g) |

53 |

Senior Vice President of Merchandising and Marketing |

|

James E. Marcil (h) |

59 |

Senior Vice President of Human Resources |

|

(a) |

Jonathan H. Weis. The Company has employed Mr. Weis since 1989. Mr. Weis served the Company as Vice President of Property Management and Development from 1996 until April 2002, at which time he was appointed as Vice President and Secretary. In January of 2004, the Board appointed Mr. Weis as Vice Chairman and Secretary. Mr. Weis became the Company's interim President and Chief Executive Officer in September 2013 and was appointed as President and Chief Executive Officer in February 2014. The Board elected Mr. Weis as Chairman of the Board in April 2015. |

|

(b) |

Kurt A. Schertle. The Company hired Mr. Schertle on March 1, 2009 as its Vice President of Sales and Merchandising, which included the responsibility of overseeing the Marketing Department. In February 2010, Mr. Schertle was promoted to Senior Vice President of Sales and Merchandising. In July 2012, Mr. Schertle was promoted to Executive Vice President of Sales and Merchandising at which time, he assumed the additional responsibility of overseeing the Company’s Supply Chain. In September 2013, Mr. Schertle assumed the additional responsibility of overseeing Store Operations and Mr. Schertle was promoted to Chief Operating Officer in March 2014. |

|

(c) |

Wayne S. Bailey. Mr. Bailey joined the Company full-time in 1979 and he has held several positions since then, including but not limited to, Grocery Manager, Store Manager, District Manager, Director of Merchandising and Sales and Vice President of Operational Administration. In January 2011, Mr. Bailey became a Regional Vice President and in January 2013 he assumed the role of Vice President of Supply Chain and Logistics. In June 2016, Mr. Bailey was promoted to Senior Vice President of Supply Chain and Logistics. |

|

(d) |

Scott F. Frost. Mr. Frost joined the Company full-time in 1984 and he has held various positions since then, including but not limited to, Controller, Assistant Secretary, Assistant Treasurer and Acting Chief Financial Officer. The Company appointed Mr. Frost as Vice President, Chief Financial Officer and Treasurer in October 2009. In January 2011, Mr. Frost was promoted to Senior Vice President, Chief Financial Officer and Treasurer. |

|

(e) |

David W. Gose II. Mr. Gose joined the Company in May 2014 as Senior Vice President of Operations. Prior to joining the Company, Mr. Gose was Senior Director and Regional General Manager of Walmart Ohio, a retail store SuperCenter, from February 2010 until May 2014. Walmart Ohio consisted of 92 stores that geographically included all stores South of Toledo, Cleveland, Akron and Youngstown. |

|

(f) |

Harold G. Graber. Mr. Graber joined the Company in October 1989 as the Director of Real Estate. Mr. Graber, who served the Company as Vice President for Real Estate since 1996, was promoted to Senior Vice President of Real Estate and Development in February 2010. Mr. Graber was appointed as Secretary of the Company in February 2014. |

|

(g) |

Richard A. Gunn. Mr. Gunn joined the Company in May 2015 as the Senior Vice President of Merchandising and Marketing. Prior to joining the Company, Mr. Gunn was employed by K-VA-T Food Stores, Inc. from May 1999 through April 2015 and most recently served as Executive Vice President of Merchandising and Marketing. K-VA-T Food Stores, Inc. is a regional supermarket chain and distribution center operating in Virginia, Kentucky and Tennessee. |

|

(h) |

James E. Marcil. Mr. Marcil joined the Company in September 2002 as Vice President of Human Resources. In February 2010, Mr. Marcil was promoted to Senior Vice President of Human Resources. |

7

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities:

The Company's stock is traded on the New York Stock Exchange (ticker symbol WMK). The approximate number of shareholders, including individual participants in security position listings on March 14, 2018 was 6,493. High and low stock prices and dividends paid per share for the last two fiscal years were:

|

|

||||||||||||||||||

|

|

2017 |

2016 |

||||||||||||||||

|

|

Stock Price |

Dividend |

Stock Price |

Dividend |

||||||||||||||

|

Quarter |

High |

Low |

Per Share |

High |

Low |

Per Share |

||||||||||||

|

First |

$ |

68.88 |

$ |

55.34 |

$ |

0.30 |

$ |

46.64 |

$ |

37.14 |

$ |

0.30 | ||||||

|

Second |

62.88 | 46.05 | 0.30 | 53.59 | 42.77 | 0.30 | ||||||||||||

|

Third |

49.44 | 41.30 | 0.30 | 55.49 | 48.01 | 0.30 | ||||||||||||

|

Fourth |

45.68 | 31.26 | 0.30 | 68.40 | 51.56 | 0.30 | ||||||||||||

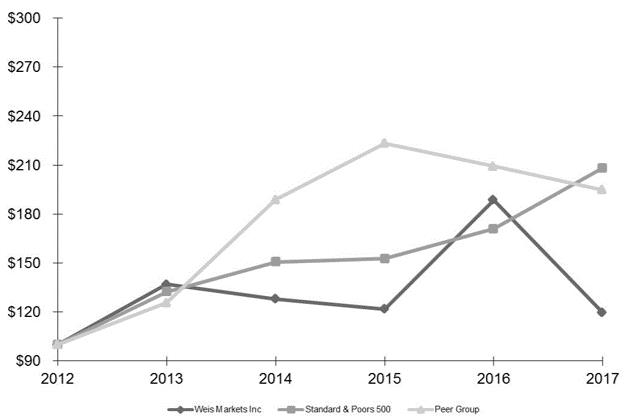

The following line graph compares the yearly percentage change in the cumulative total shareholder return on the Company’s common stock against the cumulative total return of the S&P Composite-500 Stock Index and the cumulative total return of a published group index for the Retail Grocery Stores Industry (“Peer Group”), provided by Value Line, Inc., for the period of five years. The graph depicts $100 invested at the close of trading on the last trading day preceding the first day of the fifth preceding year in Weis Markets, Inc. common stock, S&P 500, and the Peer Group. The cumulative total return assumes reinvestment of dividends.

Comparative Five-Year Total Returns

|

|

||||||||||||

|

|

||||||||||||

|

|

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

||||||

|

Weis Markets, Inc. |

100.00 | 136.95 | 127.95 | 121.81 | 188.49 | 119.53 | ||||||

|

S&P 500 |

100.00 | 132.39 | 150.51 | 152.60 | 170.85 | 208.15 | ||||||

|

Peer Group |

100.00 | 125.60 | 188.67 | 223.35 | 209.14 | 194.77 | ||||||

8

Item 6. Selected Financial Data:

The following selected historical financial information has been derived from the Company's audited Consolidated Financial Statements. This information should be read in connection with the Company's Consolidated Financial Statements and the Notes thereto, as well as "Management's Discussion and Analysis of Financial Condition and Results of Operations," included in Item 7.

Five Year Review of Operations

|

|

||||||||||||||

|

|

52 Weeks |

53 Weeks |

52 Weeks |

52 Weeks |

52 Weeks |

|||||||||

|

(dollars in thousands, except shares, |

Ended |

Ended |

Ended |

Ended |

Ended |

|||||||||

|

per share amounts and store information) |

Dec. 30, 2017 |

Dec. 31, 2016 |

Dec. 26, 2015 |

Dec. 27, 2014 |

Dec. 28, 2013 |

|||||||||

|

Net sales |

$ |

3,466,807 |

$ |

3,136,720 |

$ |

2,876,748 |

$ |

2,776,683 |

$ |

2,692,588 | ||||

|

Costs and expenses |

3,390,382 | 3,038,395 | 2,785,969 | 2,695,308 | 2,578,916 | |||||||||

|

Income from operations |

76,425 | 98,325 | 90,779 | 81,375 | 113,672 | |||||||||

|

Investment income and interest expense |

2,598 | 2,457 | 1,552 | 2,287 | 4,684 | |||||||||

|

Gain on bargain purchase |

0 | 23,879 |

- |

- |

- |

|||||||||

|

Income before provision for income taxes |

79,023 | 124,661 | 92,331 | 83,662 | 118,356 | |||||||||

|

Provision for income taxes |

(19,391) | 37,499 | 33,001 | 29,281 | 45,170 | |||||||||

|

Net income |

98,414 | 87,162 | 59,330 | 54,381 | 73,186 | |||||||||

|

Retained earnings, beginning of year |

1,062,778 | 1,007,894 | 980,842 | 958,739 | 917,831 | |||||||||

|

|

1,161,192 | 1,095,056 | 1,040,172 | 1,013,120 | 991,017 | |||||||||

|

Other comprehensive income tax reform adjustment |

1,042 |

- |

- |

- |

- |

|||||||||

|

Cash dividends |

32,278 | 32,278 | 32,278 | 32,278 | 32,278 | |||||||||

|

Retained earnings, end of year |

$ |

1,127,872 |

$ |

1,062,778 |

$ |

1,007,894 |

$ |

980,842 |

$ |

958,739 | ||||

|

Weighted-average shares outstanding, diluted |

26,898,443 | 26,898,443 | 26,898,443 | 26,898,443 | 26,898,443 | |||||||||

|

Cash dividends per share |

$ |

1.20 |

$ |

1.20 |

$ |

1.20 |

$ |

1.20 |

$ |

1.20 | ||||

|

Basic and diluted earnings per share |

$ |

3.66 |

$ |

3.24 |

$ |

2.21 |

$ |

2.02 |

$ |

2.72 | ||||

|

Working capital |

$ |

208,972 |

$ |

207,700 |

$ |

232,722 |

$ |

229,595 |

$ |

215,802 | ||||

|

Total assets |

$ |

1,441,739 |

$ |

1,431,304 |

$ |

1,235,959 |

$ |

1,191,119 |

$ |

1,148,242 | ||||

|

Shareholders’ equity |

$ |

992,844 |

$ |

926,722 |

$ |

871,747 |

$ |

844,763 |

$ |

821,770 | ||||

|

Number of grocery stores |

205 | 204 | 163 | 163 | 165 | |||||||||

9

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations:

Overview

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) is intended to help the reader understand Weis Markets, Inc., its operations and its present business environment. The MD&A is provided as a supplement to and should be read in conjunction with the Consolidated Financial Statements and the accompanying notes thereto contained in “Item 8. Financial Statements and Supplementary Data” of this report. The following analysis should also be read in conjunction with the Financial Statements included in the Quarterly Reports on Form 10-Q and the Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission, as well as the cautionary statement captioned “Forward-Looking Statements” immediately following this analysis. This overview summarizes the MD&A, which includes the following sections:

• Company Overview - a general description of the Company’s business and strategic imperatives.

• Results of Operations - an analysis of the Company’s consolidated results of operations for the three years presented in the Company’s Consolidated Financial Statements.

• Liquidity and Capital Resources - an analysis of cash flows, aggregate contractual obligations, and off-balance sheet arrangements.

• Critical Accounting Policies and Estimates - a discussion of accounting policies that require critical judgments and estimates.

Company Overview

General

Weis Markets is a conventional supermarket chain that operates 205 retail stores with over 23,000 associates located in Pennsylvania and six surrounding states: Delaware, Maryland, New Jersey, New York, Virginia, and West Virginia. Its products sold include groceries, dairy products, frozen foods, meats, seafood, fresh produce, floral, pharmacy services, deli products, prepared foods, bakery products, beer and wine, fuel, and general merchandise items, such as health and beauty care and household products. The store product selection includes national, local and private brands and the Company promotes by using Everyday Lower Price, Low Price Guarantee and Loyalty programs. The Loyalty program includes fuel rewards that may be redeemed at the Company’s fuel stations or one of its third-party fuel station partners.

Utilizing its own centrally located distribution center and transportation fleet, Weis Markets self distributes approximately 67% of product with the remaining being supplied by direct store vendors. In addition, the Company has three manufacturing facilities which process milk, ice cream and fresh meat products. The corporate offices are located in Sunbury, PA where the Company was founded in 1912. The Company’s operations are reported as a single reportable segment.

10

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations: (continued)

Company Overview, (continued)

Strategic Imperatives

The following strategic imperatives continue to be focused upon by the Company to attempt to ensure the success of the Company in the coming years:

|

· |

Establish a Sales Driven Culture – The Company continues to focus on sales and profits growth, improved operating practices, increased productivity and positive cash flow. The Company believes disciplined growth will increase its market share and operating profits, resulting in enhanced shareholder value. The Company’s method of driving sales includes focused preparation and execution of sales programs, investing in new stores and remodels, and strategic acquisitions. Communicating clear executable standards and aligning performance measures across the organization will help to instill a sales-driven operating environment. |

|

· |

Build and Support Human Resources – The Company is committed to creating a sustainable competitive advantage through the selection, development and promotion of the best people. The Company believes that establishing a learning culture will both support its commitment to be an employer of choice and will drive customer engagement with its associates. Improvements in the Company’s human capital communication and support structures will facilitate internal career opportunities which will improve retention of top talent. The Company continues to grow leaders at every level throughout the organization by creating a culture of mentoring, coaching and leveraging on-the-job assignments for continued development. The Company believes that a strong employment brand is necessary to build associate engagement and directly impacts its ability to compete and execute strategic plans. The Company will continue to assess and upgrade underlying technologies to support human capital development as a strategic imperative for future growth. |

|

· |

Become More Relevant to Consumers – Understanding the consumer is crucial to the Company’s strategic plan. The Company will develop and cultivate a culture where it’s continually “on trend” with its consumers at the current time and where they are going next. The Company researches and studies the wants and needs of core consumers and casual consumers. It measures customer satisfaction and shares insights across the organization to improve communication between management and its consumers. The Company uses consumer data to measure the value of programs offered and support consumer attraction and retention. The Company believes that private brand products exceed consumer expectations and will focus on the value and attribute messaging to drive organic growth. |

|

· |

Create Meaningful Differentiation – The Company recognizes the need to offer a compelling reason for customers to choose them over other channels. The Company has identified product pricing and promotion, customer shopping experience, and merchandising strategies as critical components of future success. The Company recognizes that the core of the strategy will focus on alignment of merchandising programs that foster customer engagement supported by a shopping experience that delivers the customer’s needs. As part of this strategy, management is committed to offering its customers a strong combination of quality, service and value. |

|

· |

Develop and Align Organizational Capabilities – The Company will elevate organizational capacity to support decision effectiveness and deliver consistent execution. To support this strategy the Company will assess organizational capacity to support the Company’s strategic direction. The Company will align business functions and processes to enhance key capabilities and to support scalability of operations. Continued investments in information technology systems to improve associate engagement, increase productivity, and provide valuable insight into customer behavior/shopping trends will remain a focus of the Company. The Company believes these systems will continue to play a key role in the measurement of the Company’s strategic decisions and financial returns. |

|

· |

Focus on Sustainability Strategies – The Company strives to be good stewards of the environment and makes this an important part of its overall mission. Its sustainability strategy operates under four key pillars: green design, natural resource conservation, food and agricultural impact and social responsibility. The goal of the sustainability strategy is to reduce the Company’s overall carbon footprint by reducing greenhouse gas emissions and reducing the impact on climate change. |

11

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations: (continued)

Results of Operations

|

|

||||||||||||||||

|

Analysis of Consolidated Statements of Income |

||||||||||||||||

|

|

||||||||||||||||

|

(dollars in thousands except per share amounts) |

Percentage Changes |

|||||||||||||||

|

For the Fiscal Years Ended December 30, 2017, |

2017 |

2016 |

2015 |

2017 vs. |

2016 vs. |

|||||||||||

|

December 31, 2016 and December 26, 2015 |

(52 Weeks) |

(53 Weeks) |

(52 Weeks) |

2016 |

2015 |

|||||||||||

|

Net sales |

$ |

3,466,807 |

$ |

3,136,720 |

$ |

2,876,748 |

10.5 |

% |

9.0 |

% |

||||||

|

Cost of sales, including warehousing and distribution expenses |

2,540,348 | 2,264,565 | 2,090,016 |

12.2 |

8.4 |

|||||||||||

|

Gross profit on sales |

926,459 | 872,155 | 786,732 |

6.2 |

10.9 |

|||||||||||

|

Gross profit margin |

26.7 |

% |

27.8 |

% |

27.3 |

% |

||||||||||

|

Operating, general and administrative expenses |

850,034 | 773,830 | 695,953 |

9.8 |

11.2 |

|||||||||||

|

O, G & A, percent of net sales |

24.5 |

% |

24.7 |

% |

24.2 |

% |

||||||||||

|

Income from operations |

76,425 | 98,325 | 90,779 |

(22.3) |

8.3 |

|||||||||||

|

Operating margin |

2.2 |

% |

3.1 |

% |

3.2 |

% |

||||||||||

|

Investment income and interest expense |

2,598 | 2,457 | 1,552 |

5.7 |

58.3 |

|||||||||||

|

Investment income and interest expense, percent of net sales |

0.1 |

% |

0.1 |

% |

0.1 |

% |

||||||||||

|

Gain on bargain purchase |

- |

23,879 |

- |

(100.0) |

100.0 |

|||||||||||

|

Gain on bargain purchase, percent of net sales |

- |

% |

0.8 |

% |

- |

% |

||||||||||

|

Income before provision for income taxes |

79,023 | 124,661 | 92,331 |

(36.6) |

35.0 |

|||||||||||

|

Income before provision for income taxes, percent of net sales |

2.3 |

% |

4.0 |

% |

3.2 |

% |

||||||||||

|

Provision for income taxes |

(19,391) | 37,499 | 33,001 |

(151.7) |

13.6 |

|||||||||||

|

Effective income tax rate |

(24.5) |

% |

30.1 |

% |

35.7 |

% |

||||||||||

|

Net income |

$ |

98,414 |

$ |

87,162 |

$ |

59,330 |

12.9 |

% |

46.9 |

% |

||||||

|

Net income, percent of net sales |

2.8 |

% |

2.8 |

% |

2.1 |

% |

||||||||||

|

Basic and diluted earnings per share |

$ |

3.66 |

$ |

3.24 |

$ |

2.21 |

13.0 |

% |

46.6 |

% |

||||||

Net Sales

|

(dollars in thousands except per share amounts) |

||||||

|

For the Fiscal Years Ended December 30, 2017, |

Percentage Changes |

|||||

|

December 31, 2016 and December 26, 2015 |

2017 vs 2016 |

2016 vs 2015 |

||||

|

Net sales |

10.5 |

% |

9.0 |

% |

||

|

Net sales, excluding fuel sales |

10.4 |

9.3 |

||||

|

Net sales, adjusted for the additional week in 2016 |

12.8 |

6.9 |

||||

|

Net sales, adjusted for the additional week in 2016, excluding fuel sales |

12.6 |

7.0 |

||||

|

Comparable store sales, adjusted for the additional week in 2016 |

1.6 |

2.9 |

||||

|

Comparable store sales, adjusting for the additional week in 2016, excluding fuel sales |

1.2 |

% |

2.9 |

% |

||

____________________

(1) The 2017 and 2015 years were comprised of 52 weeks where the 2016 year was comprised of 53 weeks. Due to the Company’s 2016 fiscal year being comprised of 53 weeks, the first quarter of 2017 did not include a New Year holiday sales week. Management estimates the incremental holiday sales impact was approximately $3.0 million in 2016. The $3.0 million holiday impact has been removed from the 2016 comparable sales numbers above.

When calculating the percentage change in comparable store sales, the Company defines a new store to be comparable when it has been in operation for five full quarters. Relocated stores and stores with expanded square footage are included in comparable store sales since these units are located in existing markets and are open during construction. Planned store dispositions are excluded from the calculation. The Company only includes retail food stores in the calculation.

12

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations: (continued)

Results of Operations (continued)

Net Sales (continued)

According to the latest U.S. Bureau of Labor Statistics’ report, the annual Seasonally Adjusted Food-at-Home Consumer Price Index decreased 0.2% and 1.3% in 2017 and 2016 respectively but increased 1.1% in 2015. Even though the U.S. Bureau of Labor Statistics’ index rates may be reflective of a trend, it will not necessarily be indicative of the Company’s actual results. According to the U.S. Department of Energy, the 52-week average price of gasoline in the Central Atlantic States increased 13.1%, or $0.31 per gallon, in 2017 compared to the 53-week average in 2016. The 53-week average price of gasoline in the Central Atlantic States, according to the U.S. Department of Energy, decreased 10.1%, or $0.26 per gallon, in 2016 compared to the 52-week average in 2015.

The Company attributes the increased net sales primarily to the acquisition of 44 locations in the second half of 2016. Comparable store sales increased for all years presented. The Company was able to achieve this through targeted, tactical marketing programs in key regional markets along with its chain wide sales-driving promotional programs such as its loyalty card. In conjunction with its marketing initiatives the Company continues to add additional product offerings and customer conveniences such as “Click and Collect.” “Click and Collect” allows the customer to order on-line and then pick their order up at a drive thru location at the store. With the aforementioned offerings and programs, the Company was able to offset substantial deflationary pressures in its fresh departments most notably meat and produce. Pharmacy sales volume increased as a result of the Affordable Care Act and increased immunizations. Fuel sales benefited from inflation as comparable fuel sales rose 12.2% during 2017.

Although the Company experienced retail inflation and deflation in various commodities for the years presented, management cannot accurately measure the full impact of inflation or deflation on retail pricing due to changes in the types of merchandise sold between periods, shifts in customer buying patterns and the fluctuation of competitive factors. Management remains confident in its ability to generate sales growth in a highly competitive environment, but also understands some competitors have greater financial resources and could use these resources to take measures which could adversely affect the Company's competitive position.

Cost of Sales and Gross Profit

Cost of sales consists of direct product costs (net of discounts and allowances), distribution center and transportation costs, as well as manufacturing facility operations. Almost all of the increase in cost of sales in 2017 as compares to 2016 is due to the increased sales volume in 2017. Both direct product cost and distribution cost increase when sales volume increases.

Gross profit rate was 26.7% in 2017, 27.8% in 2016 and 27.3% in 2015. The decline in gross profit margin in 2017 can be attributed to lower than average winter sales volume due to lack of winter weather events in the first quarter of 2017. Decreased sales volume negatively impacts the gross profit margin by increasing inventory shrinkage and fixed distribution costs comparative rates. In the third quarter of 2017 retail deflation combined with cost inflation, decreased sales volume, competitive pricing and inventory management challenges in some of the recently acquired stores significantly reduced profits as a percent of sales for the produce, deli/food service, bakery, seafood and floral departments. The 2016 increase in gross profit rate as compared to 2015 was driven by a shift in sales mix from fuel to grocery sales which carry a higher profit margin.

The Company experienced non-cash LIFO inventory valuation adjustment income of $1.1 million and $2.2 million for 2017 and 2016, respectively, and adjustment expense of $1.4 million for 2015.

Although the Company experienced product cost inflation and deflation in various commodities in 2017, 2016 and 2015, management cannot accurately measure the full impact of inflation or deflation on retail pricing due to changes in the types of merchandise sold between periods, shifts in customer buying patterns and the fluctuation of competitive factors.

13

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations: (continued)

Results of Operations (continued)

Operating, General and Administrative Expenses

The majority of the expenses were driven by increased sales volume.

Employee-related costs such as wages, employer paid taxes, health care benefits and retirement plans, comprise approximately 60% of the total “Operating, general and administrative expenses.” As a percent of sales, direct store labor decreased 0.2% in 2017 compared to 2016 and increased 0.2% in 2016 compared to 2015. The percent of sales increase in 2016 is due to the labor involved in opening the 44 acquisition stores in the second half of 2016. State and local minimum wage laws continue to be a challenge for the Company however, management continues to monitor store labor efficiencies and develop labor standards to reduce costs while maintaining the Company’s customer service expectations to offset their impact.

The Company’s self-insured health care benefit expenses increased by 4.2% in 2017 compared to 2016 and increased by 15.4% in 2016 compared to 2015 and as a percent of sales were 0.9%, 1.0% and 0.9% for 2017, 2016 and 2015, respectively. The increase in 2017 from 2016 is mainly attributed to the increase in participants for a full year from the acquired stores. The increase in 2016 from 2015 is mainly attributed to an increase in participants from the acquired locations as well as overall group health costs. The Company remains concerned about the impact that The Patient Protection and Affordable Care Act (ACA) will have on its future operating expenses.

Depreciation and amortization expense charged to “Operating, general and administrative expenses” was $77.4 million, or 2.2% of net sales, for 2017 compared to $69.8 million, or 2.2% of net sales, for 2016 and $63.3 million, or 2.2% of net sales, for 2015. The decrease in depreciation and amortization expense in 2017 compared to 2016 and increase in 2016 compared to 2015 was the impact of opening the 44 acquisition stores in the second half of 2016. See the Liquidity and Capital Resources section for further information regarding the Company’s capital expansion program.

In 2016, the Company determined that the asset value of one property was impaired. As a result, the Company recognized a pre-tax impairment loss of $894,000. See Note 1(l) to the Consolidated Financial Statements included in this Annual Report on Form 10-K for more information on the Company's impairment charges. The Company recognized pre-tax gains of $751,000 in 2015 from the sale of two properties.

|

A breakdown of the material increases (decreases) as a percent of sales in "Operating, general and administrative expenses" is as follows: |

||||

|

|

||||

|

|

2017 vs. 2016 |

|||

|

|

Increase |

Increase (Decrease) |

||

|

(dollars in thousands) |

(Decrease) |

as a % of sales |

||

|

Employee-related expenses |

$ |

38,808 | (0.3) |

% |

|

Rent expense |

7,152 | 0.1 | ||

The dollar amount increase in rent is primarily driven by the acquisition of five former Mars Super Market stores, 38 former Food Lion stores and a former Nell’s Family Market store in the second half of 2016. The Company expects the percent of sales to decrease over time as it develops the acquisition stores’ sales.

|

|

||||

|

|

2016 vs. 2015 |

|||

|

|

Increase |

Increase (Decrease) |

||

|

(dollars in thousands) |

(Decrease) |

as a % of sales |

||

|

Employee-related expenses |

$ |

41,174 | 0.1 |

% |

|

Acquisition-related expenses |

$ |

14,166 | 0.5 |

% |

Employee related expenses increased in 2016 for the reasons noted above and due to a 25% increase in associates related the acquisition of five former Mars stores, 38 former Food Lion stores and a former Nell’s Family Market store. This increase in associates contributed to increased wages, benefits and retirement expenses.

Acquisition-related expenses, excluding the expenses mentioned above, primarily consisted of store operating expenses, travel expenses and contracted labor for store resets.

14

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations: (continued)

Results of Operations (continued)

Provision for Income Taxes

The effective income tax rate was (24.5)%, 30.1% and 35.7% in 2017, 2016 and 2015, respectively. On December 22, 2017, the U.S. Government enacted the Tax Cuts and Jobs Act (the ”Tax Reform”). The Tax Reform significantly impacted the Company’s effective income tax rate by reducing the U.S. federal corporate tax rate from 35% to 21% effective January 1, 2018 and allowing immediate expensing of qualified assets placed into service after September 27, 2017. Other elements of the Tax Reform have minor impacts, however the above mentioned decreased deferred income tax by $49.3 million. The effective income tax rate decreased in 2016 due to the impact of the bargain purchase gain on the 38 locations being included in the overall gain calculation and not in income tax expense. The effective tax rate excluding the bargain purchase gain was 37.2%.

Liquidity and Capital Resources

The primary sources of cash are cash flows generated from operations and borrowings under the revolving credit agreement the Company entered into on September 1, 2016 with Wells Fargo Bank, NA. The Company’s revolving credit agreement has a principal amount of $100.0 million with an additional discretionary availability of $50.0 million. As of December 30, 2017, the Company’s unused availability under the revolving credit agreement was $46.8 million with $35.0 million of borrowings outstanding and $18.2 million of letters of credit outstanding. The letters of credit are maintained primarily to support performance, payment, deposit or surety obligations of the Company. The Company does not anticipate drawing on any of them.

The Company’s investment portfolio consists of high grade municipal bonds with maturity dates between one and 10 years and large capitalized public company equity securities. The portfolio totaled $63.7 million as of December 30, 2017. Management anticipates maintaining the investment portfolio, but has the ability to liquidate if needed. See “Item 7a. Quantitative and Qualitative Disclosures about Market Risk” for more details regarding the Company’s market risk.

The Company’s capital expansion program includes the construction of new superstores, the expansion and remodeling of existing units, the acquisition of sites for future expansion, new technology purchases and the continued upgrade of the Company’s distribution facilities and transportation fleet. Management currently plans to invest approximately $85.5 million in its capital expansion program in 2018.

The Board of Directors’ 2004 resolution authorizing the repurchase of up to one million shares of the Company’s common stock has a remaining balance of 752,468 shares.

Quarterly Cash Dividends

Total cash dividend payments on common stock, on a per share basis, amounted to $1.20 in 2017, 2016 and 2015. The Company expects to continue paying regular cash dividends on a quarterly basis. However, the Board of Directors reconsiders the declaration of dividends quarterly. The Company pays these dividends at the discretion of the Board of Directors and the continuation of these payments and the amount of the dividends depends upon the results of operations, the financial condition of the Company and other factors which the Board of Directors deems relevant.

15

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations: (continued)

Liquidity and Capital Resources (Continued)

Cash Flow Information

|

(dollars in thousands) |

|||||||||||||||

|

For the Fiscal Years Ended December 30, 2017, |

2017 |

2016 |

2015 |

2017 vs. |

2016 vs. |

||||||||||

|

December 31, 2016 and December 26, 2015 |

(52 Weeks) |

(53 weeks) |

(52 weeks) |

2016 |

2015 |

||||||||||

|

Net cash provided by (used in): |

|||||||||||||||

|

Operating activities |

$ |

165,814 |

$ |

151,593 |

$ |

136,733 |

$ |

14,221 |

$ |

14,860 |

|||||

|

Investing activities |

(97,396) |

(186,734) |

(109,845) |

89,338 |

(76,889) |

||||||||||

|

Financing activities |

(61,766) |

32,198 |

(32,278) |

(93,964) |

64,476 |

||||||||||

Operating

Cash flows from operating activities increased in 2017 as compared to 2016 and in 2016 as compared to 2015 primarily related to the Company’s recent acquisitions. The acquisitions are summarized in Note 9 of the Notes to the Consolidated Financial Statements included in this Annual Report on Form 10-K. In addition, in 2017 the negative impact of first quarter long-term incentive payments of $11.8 million were offset by a reduction of $17.1 million of cash paid for income taxes during the year.

Investing

Property and equipment purchases totaled $95.9 million in 2017, compared to $142.1 million in 2016 and $90.2 million in 2015. In the second half of 2016, the Company paid $24.6 million for the purchase of five former Mars Super Market locations in the Baltimore County, MD region; $29.4 million for the purchase of 38 former Food Lion Supermarket locations throughout Virginia, Maryland and Delaware and $9.6 million for the purchase of a former Nell’s Family Market location in East Berlin, PA. The Company paid $7.9 million for the property and equipment related to the purchase of a store in Hanover, PA in the third quarter of 2015. As a percentage of sales, capital expenditures, including the 2016 acquisitions, were 2.8% in 2017, 7.0% in 2016, and 3.1% in 2015. In 2016, the Company sold $42.5 million of marketable securities as it prepared to finance future acquisitions. In 2017, the Company plans to maintain its marketable securities portfolio at its current level.

Financing

The Company paid dividends of $32.3 million in 2017, 2016 and 2015. In 2017, payments on the revolving credit agreement increased net cash used in financing activities by $29.5 million. In 2016, the funds provided by the revolving credit agreement increased net cash flow provided by financing activities by $64.5 million. The Company anticipates payments on the revolving credit agreement to continue throughout 2018.

Contractual Obligations

The following table represents scheduled maturities of the Company’s long-term contractual obligations as of December 30, 2017.

|

|

||||||||||

|

|

Payments due by period |

|||||||||

|

|

Less than |

More than |

||||||||

|

(dollars in thousands) |

Total |

1 year |

1-3 years |

3-5 years |

5 years |

|||||

|

Operating leases |

$ |

245,494 |

$ |

43,820 |

$ |

73,765 |

$ |

48,017 |

$ |

79,892 |

|

Long-term Debt |

34,988 |

- |

34,988 |

- |

- |

|||||

|

Total |

$ |

280,482 |

$ |

43,820 |

$ |

108,753 |

$ |

48,017 |

$ |

79,892 |

16

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations: (continued)

Off-Balance Sheet Arrangements

The Company is not a party to any off-balance sheet arrangements that have, or are reasonably likely to have, a current or future effect on the Company’s financial condition, results of operations or cash flows, except for the Company's lease commitments to be recognized on the balance sheet related to operating leases for its store facilities and transportation equipment, which will be required for annual periods beginning after December 15, 2018 per the Financial Accounting Standards Board (“FASB”) Accounting Standards Update (“ASU”) 2016-02, Leases (Topic 842). See Note 1(v) Summary of Significant Accounting Policies, to the Consolidated Financial Statements included in this Annual Report on Form 10-K for more information on ASU 2016-02.

Critical Accounting Policies and Estimates

The Company has chosen accounting policies that it believes are appropriate to accurately and fairly report its operating results and financial position, and the Company applies those accounting policies in a consistent manner. The Significant Accounting Policies are summarized in Note 1 to the Consolidated Financial Statements.

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires that the Company makes estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses. These estimates and assumptions are based on historical and other factors believed to be reasonable under the circumstances. The Company evaluates these estimates and assumptions on an ongoing basis and may retain outside consultants, lawyers and actuaries to assist in its evaluation. The Company believes the following accounting policies are the most critical because they involve the most significant judgments and estimates used in preparation of its Consolidated Financial Statements.

Inventories

Inventories are valued at the lower of cost or net realizable value, using both the last-in, first-out (LIFO) for center store and pharmacy inventories and average cost methods for fresh inventories. Under the LIFO method, inventory is stated at cost, which is determined by applying a cost-to-retail to each similar merchandise category’s ending retail value. The Company’s fresh inventories are valued using average cost. The Company evaluates inventory shortages throughout the year based on actual physical counts in its facilities. Allowances for inventory shortages are recorded based on the results of these counts and to provide for estimated shortages from the last physical count to the financial statement date.

Vendor Allowances

Vendor allowances related to the Company's buying and merchandising activities are recorded as a reduction of cost of sales as they are earned, in accordance with the underlying agreement. Off-invoice and bill-back allowances are used to reduce direct product costs upon the receipt of goods. Promotional rebates and credits are accounted for as a reduction in the cost of inventory and recognized when the related inventory is sold. Volume incentive discounts are realized as a reduction of cost of sales at the time it is deemed probable and reasonably estimable that the incentive target will be reached. Long-term contract incentives, which require an exclusive vendor relationship, are allocated over the life of the contract. Promotional allowance funds for specific vendor-sponsored programs are recognized as a reduction of cost of sales as the program occurs and the funds are earned per the agreement. Cash discounts for prompt payment of invoices are realized in cost of sales as invoices are paid. Warehouse and back-haul allowances provided by suppliers for distributing their product through the Company’s distribution system are recorded in cost of sales as the required performance is completed. Warehouse rack and slotting allowances are recorded in cost of sales when new items are initially set up in the Company's distribution system, which is when the related expenses are incurred and performance under the agreement is complete. Swell allowances for damaged goods are realized in cost of sales as provided by the supplier, helping to offset product shrink losses also recorded in cost of sales.

17

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations: (continued)

Critical Accounting Policies and Estimates (continued)

Store Closing Costs

The Company provides for closed store liabilities relating to the estimated post-closing lease liabilities and related other exit costs associated with the store closing commitments. As of December 30, 2017, the remaining closed store has a lease term of approximately eight months, and the liabilities associated with the closed store lease are paid over the term of the lease. Closed store lease liabilities totaled $39,000 and $105,000 as of December 30, 2017 and December 31, 2016, respectively. The Company estimates the lease liabilities, net of estimated sublease income, using the undiscounted rent payments of closed stores. Other exit costs include estimated real estate taxes, common area maintenance, insurance and utility costs to be incurred after the store closes over the remaining lease term. Store closings are generally completed within one year after the decision to close. Adjustments to closed store liabilities and other exit costs primarily relate to changes in sublease income and actual exit costs differing from original estimates. Adjustments are made for changes in estimates in the period in which the changes become known. Any excess store closing liability remaining upon settlement of the obligation is reversed to income in the period that such settlement is determined. Store closing liabilities are reviewed quarterly to ensure that any accrued amount that is not a sufficient estimate of future costs, or that is no longer needed for its originally intended purpose, is adjusted to income in the proper period. Inventory write-downs, if any, in connection with store closings, are classified in cost of sales. Costs to transfer inventory and equipment from closed stores are expensed as incurred.

Self-Insurance

The Company is self-insured for a majority of its workers’ compensation, general liability, vehicle accident and associate medical benefit claims. The self-insurance liability for most of the medical benefit claims is determined based on historical data and an estimate of claims incurred but not reported. The other self-insurance liabilities including workers’ compensation are determined actuarially, based on claims filed and an estimate of claims incurred but not yet reported. The Company was liable for associate health claims up to an annual maximum of $2,000,000 per member prior to March 1, 2014 and an unlimited amount per member as of March 1, 2014. As of March 1, 2014, the Company purchased stop loss insurance which carries a $500,000 specific deductible with a $250,000 aggregating deductible. The Company is liable for workers' compensation claims up to $2,000,000 per claim. Property and casualty insurance coverage is maintained with outside carriers at deductible or retention levels ranging from $100,000 to $1,000,000. Significant assumptions used in the development of the actuarial estimates include reliance on the Company’s historical claims data including average monthly claims and average lag time between incurrence and reporting of the claim.

Forward-Looking Statements

In addition to historical information, this Annual Report may contain forward-looking statements, which are included pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Any forward-looking statements contained herein are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected. For example, risks and uncertainties can arise with changes in: general economic conditions, including their impact on capital expenditures; business conditions in the retail industry; the regulatory environment; rapidly changing technology and competitive factors, including increased competition with regional and national retailers; and price pressures. Readers are cautioned not to place undue reliance on forward-looking statements, which reflect management's analysis only as of the date hereof. The Company undertakes no obligation to publicly revise or update these forward-looking statements to reflect events or circumstances that arise after the date hereof. Readers should carefully review the risk factors described in other documents the Company files periodically with the Securities and Exchange Commission.

18

Item 7a. Quantitative and Qualitative Disclosures about Market Risk:

|

|

||||||||||||||||||||||||

|

(dollars in thousands) |

Expected Maturity Dates |

Fair Value |

||||||||||||||||||||||

|

December 30, 2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

Thereafter |

Total |

Dec. 30, 2017 |

||||||||||||||||

|

Rate sensitive assets: |

||||||||||||||||||||||||

|

Fixed interest rate securities |

$ |

13,341 |

$ |

5,774 |

$ |

4,519 |

$ |

7,475 |

$ |

6,024 |

$ |

19,407 |

$ |

56,540 |

$ |

54,833 | ||||||||

|

Average interest rate |

2.04 |

% |

1.63 |

% |

2.15 |

% |

2.09 |

% |

2.51 |

% |

2.37 |

% |

2.16 |

% |

||||||||||

Other Relevant Market Risks

The Company’s equity securities at December 30, 2017 had a cost basis of $1,198,000 and a fair value of $8,832,000. The dividend yield realized on these equity investments was 4.86% in 2017. By their nature, both the fixed interest rate securities and the equity investments inherently expose the holders to market risk. The extent of the Company’s interest rate and other market risk is not quantifiable or predictable with precision due to the variability of future interest rates and other changes in market conditions. However, the Company believes that its exposure in this area is not material.

The Company’s revolving credit agreement is exposed to interest rate fluctuations to the extent of changes in the LIBOR rate. The Company believes this exposure is not material due to availability of liquid assets to eliminate the outstanding credit facility

19

Item 8. Financial Statements and Supplementary Data:

WEIS MARKETS, INC.

CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

(dollars in thousands) |

|

|

|

|

|