UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended

OR

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___ to ____

Commission file number

(Exact name of Registrant as specified in its charter)

| ||

(State or other jurisdiction of |

| (IRS Employer |

(Address of principal executive offices) | ||

Registrant’s telephone number, including area code: ( | ||

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading |

| Name of each exchange on which registered |

No securities registered pursuant to Section 12(g) of the Act.

Indicate by check mark:

If the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days.

Whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registration was required to submit such files).

Whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

| ☐ |

| Accelerated filer |

| ☐ |

| ☒ |

| Smaller reporting company |

| ||

Emerging growth company |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Whether the Registrant is a shell Company (as defined in Rule 12b-2 of the Exchange Act). Yes

The aggregate market value of the 1.6 million shares of voting stock held by nonaffiliates of CompX International Inc. as of June 30, 2023 (the last business day of the Registrant’s most recently completed second fiscal quarter) approximated $

As of February 21, 2024, registrant had

Documents incorporated by reference

The information required by Part III is incorporated by reference from the Registrant’s definitive proxy statement to be filed with the Commission pursuant to Regulation 14A not later than 120 days after the end of the fiscal year covered by this report.

PART I

ITEM 1.BUSINESS

General

CompX International Inc. (NYSE American: CIX), incorporated in Delaware in 1993, is a leading manufacturer of security products used in the postal, recreational transportation, office and institutional furniture, cabinetry, tool storage, healthcare and a variety of other industries. We are also a leading manufacturer of wake enhancement systems, stainless steel exhaust systems, gauges, throttle controls and trim tabs for the recreational marine industry. Our products are principally designed for use in medium to high-end product applications where design, quality and durability are valued by our customers.

At December 31, 2023, NL Industries, Inc. (NYSE: NL) owns approximately 87% of our outstanding common stock, Valhi, Inc. (NYSE: VHI) owns approximately 83% of NL’s outstanding common stock and a subsidiary of Contran Corporation owns approximately 91% of Valhi’s outstanding common stock. As discussed in Note 1 to our Consolidated Financial Statements, a majority of Contran’s outstanding voting stock is held directly by Lisa K. Simmons, Thomas C. Connelly (the husband of Ms. Simmons’ late sister), and various family trusts established for the benefit of Ms. Simmons, Mr. Connelly and their children and for which Ms. Simmons or Mr. Connelly, as applicable, serve as trustee (collectively, the “Other Trusts”). With respect to the Other Trusts for which Mr. Connelly serves as trustee, he is required to vote the shares of Contran voting stock held in such trusts in the same manner as Ms. Simmons. Such voting rights of Ms. Simmons last through April 22, 2030 and are personal to Ms. Simmons. The remainder of Contran’s outstanding voting stock is held by another trust (the “Family Trust”), which was established for the benefit of Ms. Simmons and her late sister and their children and for which a third-party financial institution serves as trustee. Consequently, at December 31, 2023, Ms. Simmons and the Family Trust may be deemed to control Contran, and therefore may be deemed to indirectly control the wholly-owned subsidiary of Contran, Valhi, NL and us.

Our corporate offices are located at Three Lincoln Centre, 5430 LBJ Freeway, Suite 1700, Dallas, Texas 75240. Our telephone number is (972) 448-1400. We maintain a website at www.compxinternational.com.

Unless otherwise indicated, references in this report to “we,” “us,” or “our” refer to CompX International Inc. and its subsidiaries taken as a whole.

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Statements in this Annual Report that are not historical facts are forward-looking in nature and represent management’s beliefs and assumptions based on currently available information. In some cases, you can identify forward-looking statements by the use of words such as “believes,” “intends,” “may,” “should,” “could,” “anticipates,” “expects” or comparable terminology, or by discussions of strategies or trends. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we do not know if these expectations will be correct. Such statements by their nature involve substantial risks and uncertainties that could significantly impact expected results. Actual future results could differ materially from those predicted. The factors that could cause actual future results to differ materially from those described herein are the risks and uncertainties discussed in this Annual Report and those described from time to time in our other filings with the U.S. Securities and Exchange Commission (the “SEC”) and include, but are not limited to, the following:

| ● | Future demand for our products, |

| ● | Changes in our raw material and other operating costs (such as zinc, brass, aluminum, steel and energy costs) and our ability to pass those costs on to our customers or offset them with reductions in other operating costs, |

| ● | Price and product competition from low-cost manufacturing sources (such as China), |

| ● | The impact of pricing and production decisions, |

| ● | Customer and competitor strategies including substitute products, |

- 2 -

| ● | Uncertainties associated with the development of new products and product features, |

| ● | Future litigation, |

| ● | Our ability to protect or defend our intellectual property rights, |

| ● | Potential difficulties in integrating future acquisitions, |

| ● | Decisions to sell operating assets other than in the ordinary course of business, |

| ● | Environmental matters (such as those requiring emission and discharge standards for existing and new facilities), |

| ● | The ultimate outcome of income tax audits, tax settlement initiatives or other tax matters, including future tax reform, |

| ● | Government laws and regulations and possible changes therein including new environmental, health, safety, sustainability or other regulations, |

| ● | General global economic and political conditions that disrupt our supply chain, reduce demand or perceived demand for component products or impair our ability to operate our facilities (including changes in the level of gross domestic product in various regions of the world, natural disasters, terrorist acts, global conflicts and public health crises), |

| ● | Operating interruptions (including, but not limited to, labor disputes, leaks, natural disasters, fires, explosions, unscheduled or unplanned downtime, transportation interruptions, certain regional and world events or economic conditions and public health crises), |

| ● | Technology related disruptions (including, but not limited to, cyber attacks; software implementation, upgrades or improvements; technology processing failures; or other events) related to our technology infrastructure that could impact our ability to continue operations, or at key vendors which could impact our supply chain, or at key customers which could impact their operations and cause them to curtail or pause orders; and |

| ● | Possible disruption of our business or increases in the cost of doing business resulting from terrorist activities or global conflicts. |

Should one or more of these risks materialize or if the consequences worsen, or if the underlying assumptions prove incorrect, actual results could differ materially from those currently forecasted or expected. We disclaim any intention or obligation to update or revise any forward-looking statement whether as a result of changes in information, future events or otherwise.

Industry Overview

We manufacture engineered components utilized in a variety of applications and industries. We manufacture mechanical and electrical cabinet locks and other locking mechanisms used in postal, recreational transportation, office and institutional furniture, cabinetry, tool storage and healthcare applications. We also manufacture wake enhancement systems, stainless steel exhaust systems, gauges, throttle controls, trim tabs and related hardware and accessories for the recreational marine and other industries. We continuously seek to diversify into new markets and identify new applications and features for our products, which we believe provide a greater potential for higher rates of earnings growth as well as diversification of risk. See also Item 7 – “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Business Segments

We have two operating business segments – Security Products and Marine Components. For additional information regarding our segments, see “Part II – Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 2 to the Consolidated Financial Statements.

- 3 -

Manufacturing, Operations and Products

Security Products. Our Security Products segment manufactures mechanical and electrical cabinet locks and other locking mechanisms used in a variety of applications including mailboxes, ignition systems, file cabinets, desk drawers, tool storage cabinets, high security medical cabinetry, integrated inventory and access control secured narcotics boxes, electronic circuit panels, storage compartments, gas station security, vending and cash containment machines. Our Security Products segment has one manufacturing facility in Mauldin, South Carolina and one in Grayslake, Illinois which is shared with Marine Components. We believe we are a North American market leader in the manufacture and sale of cabinet locks and other locking mechanisms. These products include:

| ● | disc tumbler locks which provide moderate security and generally represent the lowest cost lock we produce; |

| ● | pin tumbler locks which are more costly to produce and are used in applications requiring higher levels of security, including KeSet® and System 64® (which each allow the user to change the keying on a single lock 64 times without removing the lock from its enclosure), TuBar® and Turbine™; and |

| ● | our innovative CompX eLock® and StealthLock® electronic locks which provide stand-alone or networked security and audit trail capability for drug storage and other valuables through the use of a proximity card, magnetic stripe, radio frequency or other keypad credential. |

A substantial portion of our Security Products’ sales consist of products with specialized adaptations to an individual customer’s specifications, some of which are listed above. We also have a standardized product line suitable for many customers, which is offered through a North American distribution network to locksmith and smaller original equipment manufacturer (“OEM”) distributors via our STOCK LOCKS® distribution program.

Marine Components. Our Marine Components segment manufactures and distributes wake enhancement systems, stainless steel exhaust components, gauges, throttle controls, trim tabs and related hardware and accessories primarily for ski/wakeboard boats (tow boats) and performance boats. Our Marine Components segment has a facility in Neenah, Wisconsin and a facility in Grayslake, Illinois which is shared with Security Products. Our specialty Marine Component products are high precision components designed to operate within tight tolerances in the highly demanding marine environment. These products include:

| ● | wake enhancement devices, trim tabs, steering wheels and billet aluminum accessories; |

| ● | original equipment and aftermarket stainless steel exhaust headers, exhaust pipes, mufflers and other exhaust components; |

| ● | high performance gauges such as GPS speedometers and tachometers; |

| ● | mechanical and electronic controls and throttles; |

| ● | dash panels, LED indicators, and wire harnesses; and |

| ● | grab handles, pin cleats and other accessories. |

For information regarding our three principal manufacturing facilities, see “Item 2 – Properties.”

Raw Materials

Our primary raw materials are:

| ● | Security Products - zinc and brass (for the manufacture of locking mechanisms). |

| ● | Marine Components - stainless steel (for the manufacture of exhaust headers and pipes and wake enhancement systems), aluminum (for the manufacture of throttles and trim tabs) and other components. |

- 4 -

These raw materials are purchased from several suppliers, are readily available from numerous sources and accounted for approximately 13% of our total cost of sales for 2023. Total material costs, including purchased components, represented approximately 48% of our cost of sales in 2023.

We occasionally enter into short-term commodity-related raw material supply arrangements to mitigate the impact of future price increases in commodity-related raw materials, including zinc, brass, aluminum and stainless steel. These arrangements generally provide for stated unit prices based upon specified purchase volumes, which help us to stabilize our commodity-related raw material costs to a certain extent. At other times we may make spot market buys of larger quantities of raw materials to take advantage of favorable pricing or volume-based discounts. After increasing in 2021 and the first half of 2022, prices for the primary commodity-related raw materials used in the manufacture of our locking mechanisms, primarily zinc and brass, generally began to stabilize in the latter half of 2022 and into 2023 and generally began to soften in the latter half of 2023. Prices for aluminum and stainless steel, the primary raw material used for the manufacture of marine components, including marine exhaust headers and pipes, wake enhancement systems, throttles and trim tabs, experienced significant volatility during 2021 and 2022 but were more stable in 2023. Although raw commodity costs declined during 2023 from elevated levels experienced in 2021 and 2022, in most cases materials we purchase also include processing and conversion costs such as alloying, extrusion and rolling, which continue to be elevated due to costs of labor, transportation and energy. Based on current economic conditions, we expect the prices for zinc, brass, aluminum, stainless steel and other manufacturing materials in 2024 to be relatively stable. When purchased on the spot market, each of these raw materials may be subject to sudden and unanticipated price increases. When possible, we seek to mitigate the impact of fluctuations in these raw material costs on our margins through improvements in production efficiencies or other operating cost reductions. In the event we are unable to offset raw material cost increases with other cost reductions, it may be difficult to recover those cost increases through increased product selling prices or raw material surcharges due to the competitive nature of the markets in which we compete. Consequently, overall operating margins can be negatively affected by commodity-related raw material cost pressures. Commodity market prices are cyclical, reflecting overall economic trends, specific developments in consuming industries and speculative investor activities.

Patents and Trademarks

We hold a number of patents relating to our component products, certain of which we believe to be important to us and our continuing business activity. Patents generally have a term of 20 years, and our patents have remaining terms ranging from less than 1 year to 17 years at December 31, 2023.

Our major trademarks and brand names in addition to CompX® include:

Security Products |

| Security Products |

| Marine Components |

CompX® Security Products™ | Lockview® | CompX Marine® | ||

National Cabinet Lock® | System 64® | Custom Marine® | ||

Fort Lock® | SlamCAM® | Livorsi® Marine | ||

Timberline® Lock | RegulatoR® | Livorsi II® Marine | ||

Chicago Lock® | CompXpress® | CMI Industrial® | ||

STOCK LOCKS® | GEM® | Custom Marine® Stainless Exhaust | ||

KeSet® | Turbine™ | The #1 Choice in Performance Boating® | ||

TuBar® | NARC iD® | Mega Rim® | ||

StealthLock® | NARC® | Race Rim® | ||

ACE® | ecoForce® | Vantage View® | ||

ACE® II | Pearl® | GEN-X® | ||

CompX eLock® |

Sales, Marketing and Distribution

A majority of our component sales are direct to large OEM customers through our factory-based sales and marketing professionals supported by engineers working in concert with field salespeople and independent manufacturer’s

- 5 -

representatives. We select manufacturer’s representatives based on special skills in certain markets or relationships with current or potential customers.

In addition to sales to large OEM customers, a substantial portion of our Security Products sales are made through distributors. We have a significant North American market share of cabinet lock security product sales as a result of the locksmith distribution channel. We support our locksmith distributor sales with a line of standardized products used by the largest segments of the marketplace. These products are packaged and merchandised for easy availability and handling by distributors and end users.

We sell to a diverse customer base with only one customer representing 10% or more of our sales in 2023 (United States Postal Service representing 24% of which 11% related to a pilot project). Our largest ten customers accounted for approximately 52% of our sales in 2023.

Competition

The markets in which we participate are highly competitive. We compete primarily on the basis of product design, including space utilization and aesthetic factors, product quality and durability, price, on-time delivery, service and technical support. We focus our efforts on the middle and high-end segments of the market, where product design, quality, durability and service are valued by the customer. Our Security Products segment competes against a number of domestic and foreign manufacturers. Our Marine Components segment competes with small domestic manufacturers and is minimally affected by foreign competitors.

Environmental, Social and Governance (“ESG”)

We seek to operate our business in line with sound ESG principles that include corporate governance, social responsibility, sustainability and cybersecurity. We believe ESG means conducting operations with high standards of environmental and social responsibility, practicing exemplary ethical standards, focusing on safety as a top priority, respecting human rights and supporting our local communities, and continuously developing our employees. At our facilities, we undertake various environmental sustainability programs, and we promote social responsibility and volunteerism through programs designed to support and give back to the local communities in which we operate. Each of our locations maintains site-specific safety programs and disaster response and business continuity plans. All manufacturing facilities have detailed, site-specific emergency response procedures that we believe adequately address regulatory compliance, vulnerability to potential hazards, emergency response and action plans, employee training, alarms and warning systems and crisis communication.

In an effort to align our non-employee directors’ financial interests with those of our stockholders, our board of directors established share ownership guidelines for our non-management directors.

Regulatory and Environmental Matters

We have a history of incorporating environmental management and compliance in our operations and decision making. We operate three low-emission manufacturing facilities and our production processes requiring waste-water discharge are consolidated at our Mauldin, South Carolina facility. This facility has received a ReWa Compliance Excellence Award multiple years for its exemplary performance from Renewable Water Resources, an organization which sets regulatory and water policies for the Mauldin facility’s geographic region. In addition, we operate extensive scrap metal recycling programs to reduce landfill waste.

Our operations are subject to federal, state and local laws and regulations relating to the use, storage, handling, generation, transportation, treatment, emission, discharge, disposal, remediation of and exposure to hazardous and non-hazardous substances, materials and wastes. Our operations also are subject to federal, state and local laws and regulations relating to worker health and safety. We believe we are in substantial compliance with all such laws and regulations. To date, the costs of maintaining compliance with such laws and regulations have not significantly impacted our results. We currently do not anticipate any significant costs or expenses relating to such matters; however, it is possible future laws and regulations may require us to incur significant additional expenditures.

- 6 -

Human Capital Resources

Employees – Our operating results depend in part on our ability to successfully manage our human capital resources, including attracting, identifying, and retaining key talent. We have a well-trained labor force with a substantial number of long-tenured employees. We provide competitive compensation and benefits to our employees. In addition to salaries, these programs can include annual bonuses, a defined contribution plan with employer matching, a profit sharing plan, healthcare and insurance benefits, health savings and flexible spending accounts, paid time off, family leave, family care resources, employee assistance programs and tuition assistance.

As of December 31, 2023, we employed 555 people, all in the United States. We believe our labor relations are good.

Health and Safety – Protecting the health and safety of our workforce, our customers, our business partners and the natural environment is one of our core values. We are committed to maintaining a strong safety culture where all workers meet or exceed required industry performance standards, and we continuously seek to improve occupational and process safety performance. We conduct our business in ways that provide all personnel with a safe and healthy work environment and have established safety and environmental programs and goals to achieve these results. We expect our manufacturing facilities to produce our products safely and in compliance with local regulations, policies, standards and practices intended to protect the environment and our people, and we have established policies designed to promote compliance. We require our employees to comply with such requirements. We provide our workers with the tools and training necessary to make the appropriate decisions to prevent accidents and injuries. Each of our operating facilities develops, maintains and implements safety programs encompassing key aspects of their operations. In addition, management reviews and evaluates safety performance throughout the year. We monitor conditions that could lead to a safety incident and keep track of injuries through reporting systems in accordance with laws in the jurisdictions in which we operate. We track this data to assess the quality of our safety performance, and we use lost time incidents as a key measure of worker safety. We define lost time incidents as work-related accidents where a worker sustains an injury that results in time away from work. We had one lost time incident in 2021, three in 2022 and one in 2023.

Diversity and Inclusion – We recognize that everyone deserves respect and equal treatment. We embrace diversity and collaboration in our workforce and our business initiatives. We are an equal opportunity employer and we base employment decisions on merit, competence and qualifications, without regard to race, color, national origin, gender, age, religion, disability, sex, sexual orientation or other characteristics protected by applicable law in the jurisdictions in which we operate. We promote a respectful, diverse and inclusive workplace in which all individuals are treated with respect and dignity.

Website and Available Information

Our fiscal year end is always the Sunday closest to December 31, and our operations are reported on a 52 or 53-week fiscal year. For presentation purposes, annual information in this Form 10-K is presented as ended on December 31. The actual date of our fiscal years ended December 31, 2021, 2022 and 2023 are January 2, 2022, January 1, 2023, and December 31, 2023, respectively. Each of the years ending December 31, 2021, 2022, and 2023 consisted of 52 weeks. We furnish our stockholders with annual reports containing audited financial statements. In addition, we file annual, quarterly and current reports; proxy and information statements and other information with the SEC. We also make our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all related amendments, available free of charge through our website at www.compxinternational.com as soon as reasonably practical after they have been filed with the SEC. We also provide to anyone, without charge, copies of the documents upon written request. Requests should be directed to the attention of the Corporate Secretary at our address on the cover page of this Form 10-K.

Additional information, including our Audit Committee Charter, our Code of Business Conduct and Ethics and our Corporate Governance Guidelines, can also be found on our website. Information contained on our website is not a part of this Annual Report.

We are an electronic filer. The SEC maintains an internet website at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers, such as us, that file electronically with the SEC.

- 7 -

ITEM 1A.RISK FACTORS

Listed below are certain risk factors associated with us and our businesses. In addition to the potential effect of these risk factors discussed below, any risk factor which could result in reduced earnings, operating losses, or reduced liquidity, could in turn adversely affect our ability to service our liabilities or pay dividends on our common stock or adversely affect the quoted market prices for our securities.

Operational Risk Factors

We operate in mature and highly competitive markets, resulting in pricing pressure and the need to continuously reduce costs.

Many of the markets we serve are highly competitive, with a number of competitors offering similar products. We focus our efforts on the middle and high-end segment of the market where we feel that we can compete due to the importance of product design, quality and durability to the customer. However, our ability to effectively compete is impacted by a number of factors. The occurrence of any of these factors could result in reduced earnings or operating losses.

| ● | Competitors may be able to drive down prices for our products beyond our ability to adjust costs because their costs are lower than ours, especially products sourced from Asia. |

| ● | Competitors’ financial, technological and other resources may be greater than our resources, which may enable them to more effectively withstand changes in market conditions. |

| ● | Competitors may be able to respond more quickly than we can to new or emerging technologies and changes in customer requirements. |

| ● | A reduction of our market share with one or more of our key customers, or a reduction in one or more of our key customers’ market share for their end-use products, may reduce demand for our products. |

| ● | New competitors could emerge by modifying their existing production facilities to manufacture products that compete with our products. |

| ● | We may not be able to sustain a cost structure that enables us to be competitive. |

| ● | Customers may no longer value our product design, quality or durability over the lower cost products of our competitors. |

Our development of innovative features for current products is critical to sustaining and growing our sales.

Historically, our ability to provide value-added custom engineered products that address requirements of technology and space utilization has been a key element of our success. We spend a significant amount of time and effort to refine, improve and adapt our existing products for new customers and applications. Since expenditures for these types of activities are not considered research and development expense under accounting principles generally accepted in the United States of America (“GAAP”), the amount of our research and development expenditures, which is not significant, is not indicative of the overall effort involved in the development of new product features. The introduction of new product features requires the coordination of the design, manufacturing and marketing of the new product features with current and potential customers. The ability to coordinate these activities with current and potential customers may be affected by factors beyond our control. While we will continue to emphasize the introduction of innovative new product features that target customer-specific opportunities, we do not know if any new product features we introduce will achieve the same degree of success that we have achieved with our existing products. At times we work with new and existing customers on specific product innovations. Sometimes we have a cost sharing arrangement for development efforts although we may also fully bear the development costs. If a customer were to ultimately reject or abandon custom product innovation efforts, we may not be able to recover our development costs.

- 8 -

Higher costs or limited availability of our raw materials could negatively impact our financial results.

Certain raw materials used in our products are commodities that are subject to significant fluctuations in price in response to world-wide supply and demand as well as speculative investor activity. Zinc and brass are the principal raw materials used in the manufacture of security products. Stainless steel and aluminum are the major raw materials used in the manufacture of marine components. These raw materials are purchased from several suppliers and are generally readily available from numerous sources. We occasionally enter into short-term raw material supply arrangements to mitigate the impact of future increases in commodity-related raw material costs and ensure supply. Materials purchased outside of these arrangements are sometimes subject to unanticipated and sudden price increases.

Certain components used in our products are manufactured by foreign suppliers located in China and elsewhere. Global economic and political conditions, including natural disasters, terrorist acts, transportation disruptions, global conflicts and public health crises such as pandemics, could prevent our vendors from being able to supply these components. Should our vendors not be able to meet their supply obligations or should we be otherwise unable to obtain necessary raw materials or components, we may incur higher supply costs or may be required to reduce production levels, either of which may decrease our liquidity or negatively impact our financial condition or results of operations as we may be unable to offset the higher costs with increases in our selling prices or reductions in other operating costs.

Legal, Compliance and Regulatory Risk Factors

Failure to protect our intellectual property rights or claims by others that we infringe their intellectual property rights could substantially harm our business.

We rely on patent, trademark and trade secret laws in the United States and similar laws in other countries to establish and maintain our intellectual property rights in our technology and designs. Despite these measures, any of our intellectual property rights could be challenged, invalidated, circumvented or misappropriated. Third parties may independently discover our trade secrets and proprietary information, and in such cases we could not assert any trade secret rights against such parties. Further, we do not know if any of our pending trademark or patent applications will be approved. Costly and time-consuming litigation could be necessary to enforce and determine the scope of our intellectual property rights. In addition, the laws of certain countries do not protect intellectual property rights to the same extent as the laws of the United States. Therefore, in certain jurisdictions, we may be unable to protect our technology and designs adequately against unauthorized third party use, which could adversely affect our competitive position.

Third parties may claim that we or our customers are infringing upon their intellectual property rights. Even if we believe that such claims are without merit, they can be time-consuming and costly to defend and distract our management’s and technical staff’s attention and resources. Claims of intellectual property infringement might also require us to redesign affected technology, enter into costly settlement or license agreements or pay costly damage awards, or face a temporary or permanent injunction prohibiting us from marketing or selling certain of our technology. If we cannot or do not license the infringed technology on reasonable pricing terms or at all, or substitute similar technology from another source, our business could be adversely impacted.

Climate change laws and regulations could negatively impact our financial results or limit our ability to operate our businesses.

All of our production facilities are located in the United States and each requires energy, including electricity and natural gas in order to conduct operations. The U.S. government has determined that the consumption of energy derived from fossil fuels is a major contributor to climate change and is contemplating regulatory changes in response to the potential impact of climate change, including laws and regulations regarding carbon emission costs, Green House Gas (“GHG”) emissions and renewable energy targets. To date, laws and regulatory actions related to climate change have not had a material adverse effect on our financial results. Until the timing, scope and extent of any new or future regulation becomes known, we cannot predict the effect on our business, results of operations or financial condition. However, if new laws or regulations or regulatory actions related to climate change were to be enacted or implemented, it could negatively impact our future results from operations through increased costs of production, particularly as it relates to our energy requirements. If such increased costs of production were to materialize, we may be unable to pass price increases

- 9 -

on to our customers to compensate for increased production costs, which may decrease our liquidity, operating income and results of operations. In addition, any adopted future climate change laws and regulations could negatively impact our ability (or that of our customers and suppliers) to compete with companies situated in areas not subject to such limitations.

General Risk Factors

Technology failures or cybersecurity breaches could have a material adverse effect on our operations.

We rely on information technology systems to manage, process and analyze data, as well as to facilitate the manufacture and distribution of our products to and from our facilities. We receive, process and ship orders, manage the billing of and collections from our customers, and manage the accounting for and payment to our vendors. Although we have systems and procedures in place to protect our information technology systems, there can be no assurance that such systems and procedures will be sufficiently effective. Therefore, any of our information technology systems may be susceptible to outages, disruptions or destruction from power outages, telecommunications failures, employee error, cybersecurity breaches or attacks and other similar events. This could result in a disruption of our business operations, injury to people, harm to the environment or our assets, and/or the inability to access our information technology systems and could adversely affect our results of operations and financial condition. We have in the past experienced, and we expect to continue to experience, cyber-attacks, including phishing, and other attempts to breach or gain unauthorized access to our systems. To date we have not suffered breaches in our systems, either directly or through a trusted third-party vendor, which have led to material losses. Due to the increase in global cybersecurity incidents it has become increasingly difficult to obtain insurance coverage on reasonable pricing terms to mitigate some risks associated with technology failures or cybersecurity breaches, and we are experiencing such difficulties in obtaining insurance coverage.

Physical impacts of climate change could have a material adverse effect on our costs and operations.

Climate change may increase both the frequency and severity of extreme weather conditions and natural disasters such as hurricanes, thunderstorms, tornadoes, drought and snow or ice storms. Extreme weather conditions may increase our costs or cause damage to our facilities, and any damage resulting from extreme weather may not be fully insured. Furthermore, periods of extended inclement weather may inhibit our facility operations and delay or hinder shipments of our products to customers. Any such events could have a material adverse effect on our costs or results of operations.

ITEM 1B.UNRESOLVED STAFF COMMENTS

None.

ITEM 1C.CYBERSECURITY

We recognize the importance of assessing, identifying and managing material risks associated with cybersecurity threats. These risks include, among other things: operational risks, intellectual property theft, fraud, extortion, harm to employees or customers and violation of data privacy or security laws. Our cybersecurity programs are built on operations and compliance foundations. Operations focus on continuous detection, prevention, measurement, analysis and response to cybersecurity alerts and incidents, and on emerging threats. Compliance establishes oversight of our cybersecurity programs by creating risk-based controls to protect the integrity, confidentiality, accessibility and availability of company data stored, processed or transferred. Our cybersecurity program is integrated within our overall risk management processes.

Our cybersecurity program is led by our director of information technology (IT), who is responsible for our overall information security strategy, policy, security engineering, operations and cyber threat detection and response. Our director of IT has extensive information technology and program management experience and leads a team that has many years of experience with our organization. Our director of IT reports to our vice president in charge of coordinating operational activities within our business segments. Our cybersecurity risks are also reviewed and tested annually through third party assessments and internal and external information technology audits. Our information technology team reviews enterprise risk management level cybersecurity risks annually.

- 10 -

We continually enhance our security structure with the ultimate goal of preventing cybersecurity incidents to the extent feasible, while simultaneously increasing our system resilience in an effort to minimize the business impact should an incident occur. Third parties also play a role in our cybersecurity. We engage third-party services to conduct evaluations of our security controls through penetration testing, consulting on best practices and to address new challenges. These evaluations include testing both the design and operational effectiveness of security controls. All employees are required to complete cybersecurity training at least once a year and have access to more frequent cybersecurity training through online updates. We also require employees in certain roles to complete additional role-based, specialized cybersecurity training.

We have a Cybersecurity Incident Disclosure and Controls Committee (CIDAC) which is central to the response and evaluation of cybersecurity incidents. Our CIDAC is comprised of our director of IT, the Contran chief information officer (who provides services to us under our intercorporate services agreement with Contran), and senior executives including our chief executive officer, chief financial officer and general counsel. Security events and data incidents are evaluated, ranked by severity and prioritized for response and remediation. The IT team is responsible for categorizing cybersecurity incidents, with incidents evaluated to be high or critical security risks brought to our CIDAC for review and evaluation. Incidents are evaluated to determine materiality as well as operational and business impact. Our CIDAC performs simulations and tabletop exercises at a management level to evaluate our readiness and response to cybersecurity incidents. External resources and advisors are incorporated as needed.

Our board of directors oversees management’s processes for identifying and mitigating risks, including cybersecurity risks, to help align our risk exposure with our strategic objectives. Senior leadership, including our chief executive officer and chief financial officer, regularly briefs the board of directors on our cybersecurity and information security posture, and our board of directors is apprised of cybersecurity incidents deemed to have a high or critical business impact, even if immaterial to us. The board has delegated some of its primary risk oversight to board committees, including that our audit committee facilitates the board’s process of oversight of our overall risk management approach. Our full board retains oversight of cybersecurity because of its importance to us and visibility with our customers.

In the event of an incident, we intend to follow our detailed incident response playbook, which outlines the steps to be followed from incident detection to mitigation, recovery and notification, including notifying functional areas (such as legal), senior leadership and the board, as appropriate.

We face a number of cybersecurity risks. To date, such risks have not materially affected us, including our business strategy, results of operations or financial condition. While we have not experienced any breaches, we have encountered occasional attempts, albeit of minor significance, targeting our data and systems, including instances of malware and computer virus infiltration. Thus far all such incidents have been minor. For more information about the cybersecurity risks we face, see the risk factor entitled “Technology failures or cybersecurity breaches could have a material adverse effect on our operations.” in Item 1A- Risk Factors.

ITEM 2.PROPERTIES

Our principal executive offices are located in leased space at 5430 LBJ Freeway, Dallas, Texas 75240. The following table sets forth the location, size and business operating segment for each of our principal operating facilities.

| Business |

|

| Size | ||

Facility Name | Segment | Location | (square feet) | |||

Owned Facilities: |

|

|

|

|

|

|

National (1) |

| SP |

| Mauldin, SC |

| 198,000 |

Grayslake(1) |

| SP/MC |

| Grayslake, IL |

| 133,000 |

Custom(1) |

| MC |

| Neenah, WI |

| 95,000 |

SP – Security Products business segment

MC – Marine Components business segment

| (1) | ISO-9001 registered facilities |

We believe all of our facilities are well maintained and satisfactory for their intended purposes.

- 11 -

ITEM 3.LEGAL PROCEEDINGS

We are involved, from time to time, in various environmental, contractual, product liability, patent (or intellectual property), employment and other claims and disputes incidental to our business. See Note 11 to our Consolidated Financial Statements. We currently believe the disposition of all claims and disputes, individually or in the aggregate, should not have a material adverse effect on our consolidated financial condition, results of operations or liquidity.

ITEM 4.MINE SAFETY DISCLOSURES

Not applicable.

- 12 -

PART II

ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Common Stock and Dividends. Our Class A common stock is listed and traded on the NYSE American (symbol: CIX). As of February 21, 2024, there were approximately 16 holders of record of CompX Class A common stock.

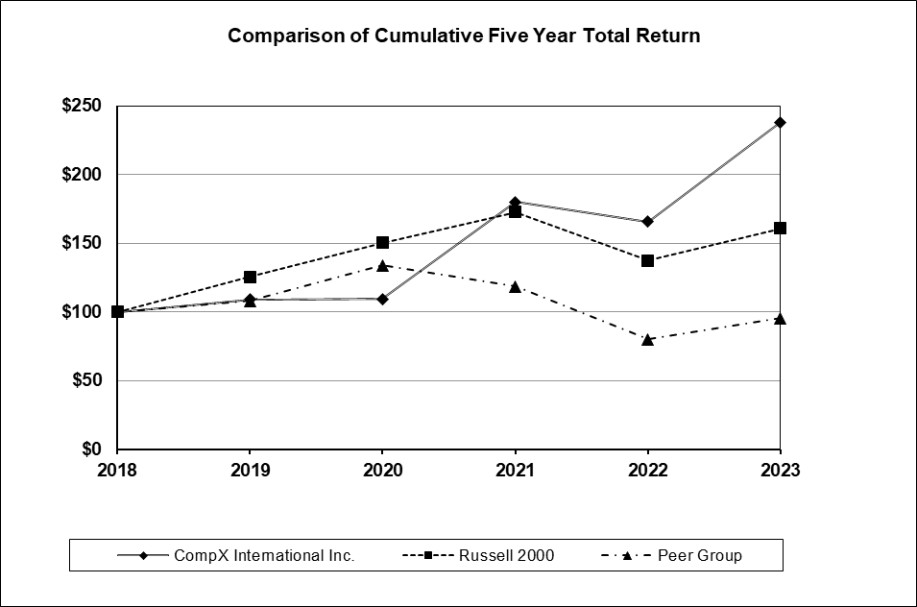

Performance Graph. Set forth below is a line graph comparing the yearly change in our cumulative total stockholder returns on our Class A common stock against the cumulative total return of the Russell 2000 Index and an index of a self-selected peer group of companies for the period from December 31, 2018 through December 31, 2023. The peer group index is comprised of The Eastern Company and Strattec Security Corporation. The graph shows the value at December 31 of each year assuming an original investment of $100 at December 31, 2018 and reinvestment of dividends.

| December 31, | |||||||||||||||||

| 2018 |

| 2019 |

| 2020 |

| 2021 |

| 2022 |

| 2023 | |||||||

CompX International Inc. | $ | 100 | $ | 109 | $ | 110 | $ | 180 | $ | 166 | $ | 238 | ||||||

Russell 2000 Index |

| 100 |

| 126 |

| 151 |

| 173 |

| 138 |

| 161 | ||||||

Peer Group |

| 100 |

| 108 |

| 134 |

| 119 |

| 80 |

| 96 | ||||||

The information contained in the performance graph shall not be deemed “soliciting material” or “filed” with the SEC, or subject to the liabilities of Section 18 of the Securities Exchange Act, except to the extent we specifically request that the material be treated as soliciting material or specifically incorporate this performance graph by reference into a document filed under the Securities Act or the Securities Exchange Act.

Equity compensation plan information. We have a share based incentive compensation plan, approved by our stockholders, pursuant to which an aggregate of 200,000 shares of our Class A common stock can be awarded to non-employee members of our board of directors. At December 31, 2023, 124,450 shares are available for award under this plan. See Note 9 to the Consolidated Financial Statements.

- 13 -

ITEM 6.RESERVED

ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Business Overview

We are a leading manufacturer of engineered components utilized in a variety of applications and industries. Through our Security Products segment we manufacture mechanical and electrical cabinet locks and other locking mechanisms used in postal, recreational transportation, office and institutional furniture, cabinetry, tool storage and healthcare applications. We also manufacture wake enhancement systems, stainless steel exhaust systems, gauges, throttle controls, trim tabs and related hardware and accessories for the recreational marine and other industries through our Marine Components segment.

Operating Income Overview

We reported operating income of $25.4 million in each of 2023 and 2022 and $20.5 million in 2021. Operating income in 2023 was comparable to 2022 as lower Marine Components sales were offset by higher Security Products sales and higher gross margin percentages across both segments. The increase in operating income in 2022 over 2021 is primarily due to higher Marine Components sales and to a lesser extent higher Security Products sales. See results of operations discussion below.

Our product offerings consist of a large number of products that have a wide variation in selling price and manufacturing cost, which results in certain practical limitations on our ability to quantify the impact of changes in individual product sales quantities and selling prices on our net sales, cost of sales and gross margin. In addition, small variations in period-to-period net sales, cost of sales and gross margin can result from changes in the relative mix of our products sold.

Results of Operations - 2023 Compared to 2022 and 2022 Compared to 2021

| Years ended December 31, | % Change |

| |||||||||||

2021 |

| 2022 |

| 2023 |

| 2021-22 |

| 2022-23 |

| |||||

(In millions) |

| |||||||||||||

Net sales | $ | 140.8 | $ | 166.6 | $ | 161.3 |

| 18 | % | (3) | % | |||

Cost of sales |

| 98.1 |

| 117.8 |

| 112.1 |

| 20 |

| (5) | ||||

Gross margin |

| 42.7 |

| 48.8 |

| 49.2 |

| 14 |

| 1 | ||||

Operating costs and expenses |

| 22.2 |

| 23.4 |

| 23.8 |

| 5 |

| 2 | ||||

Operating income | $ | 20.5 | $ | 25.4 | $ | 25.4 |

| 24 |

| — | ||||

Percent of net sales: |

|

|

|

|

|

|

|

|

|

| ||||

Cost of sales |

| 69.7 | % |

| 70.7 | % |

| 69.5 | % |

| ||||

Gross margin |

| 30.3 |

| 29.3 |

| 30.5 |

|

|

|

| ||||

Operating costs and expenses |

| 15.8 |

| 14.0 |

| 14.7 |

|

|

|

| ||||

Operating income |

| 14.6 |

| 15.3 |

| 15.8 |

|

|

|

| ||||

Net Sales. Net sales decreased $5.3 million in 2023 compared to 2022 due to lower Marine Components sales primarily to the towboat market, partially offset by higher Security Products sales largely in the fourth quarter of 2023.

Net sales increased $25.8 million in 2022 compared to 2021 due to higher Marine Components sales primarily to the towboat market and, to a lesser extent, higher Security Products sales across a variety of markets.

- 14 -

Cost of Sales and Gross Margin. Cost of sales decreased in 2023 compared to 2022 primarily due to the effects of lower production costs at both Security Products and Marine Components as well as lower Marine Components sales. Gross margin as a percentage of sales increased over the same period primarily due to the factors affecting cost of sales.

Cost of sales increased in 2022 compared to 2021 primarily due to the effects of the higher sales, as well as increased production costs at both Security Products and Marine Components. Gross margin as a percentage of sales decreased over the same period primarily due to the decrease in the Security Products gross margin percentage.

Operating Costs and Expenses. Operating costs and expenses consist primarily of sales and administrative-related personnel costs, sales commissions and advertising expenses directly related to product sales and administrative costs relating to business unit and corporate management activities, as well as gains and losses on sales of property and equipment. Operating costs and expenses increased in 2023 compared to 2022 predominantly due to higher salary and benefit costs at Security Products which increased by $.6 million. As a percentage of sales, operating costs and expenses increased in 2023 compared to 2022 primarily due to the effect of the increased operating costs and expenses on lower sales.

Operating costs and expenses increased in 2022 compared to 2021 predominantly due to higher salary and employment related costs which increased by $.7 million. As a percentage of sales, operating costs and expenses decreased in 2022 compared to 2021 primarily due to the effect of higher sales.

Operating Income. As a percentage of net sales, operating income increased in 2023 compared to 2022 and increased in 2022 compared to 2021. Operating margins were primarily impacted by the factors impacting net sales, cost of sales, gross margin and operating costs discussed above.

General. Our profitability primarily depends on our ability to utilize our production capacity effectively, which is affected by, among other things, the demand for our products and our ability to control our manufacturing costs, primarily comprised of labor costs and materials. The materials used in our products consist of purchased components and raw materials some of which are subject to fluctuations in the commodity markets such as zinc, brass, aluminum and stainless steel. Total material costs represented approximately 48% of our cost of sales in 2023, with commodity-related raw materials representing approximately 13% of our cost of sales. After increasing in 2021 and the first half of 2022, prices for the primary commodity-related raw materials used in the manufacture of our locking mechanisms, primarily zinc and brass, generally began to stabilize in the latter half of 2022 and into 2023 and generally began to soften in the latter half of 2023. Prices for aluminum and stainless steel, the primary raw material used for the manufacture of marine exhaust headers and pipes, wake enhancement systems, throttles and trim tabs experienced significant volatility during 2021 and 2022 but were more stable in 2023. Although raw commodity costs declined during 2023 from elevated levels experienced in 2021 and 2022, in most cases materials we purchase also include processing and conversion costs such as alloying, extrusion and rolling which continue to be elevated due to costs of labor, transportation and energy. Based on current economic conditions, we expect the prices for zinc, brass, aluminum, stainless steel and other manufacturing materials in 2024 to be relatively stable.

We occasionally enter into short-term commodity-related raw material supply arrangements to mitigate the impact of future increases in commodity related raw material costs. See Item 1 - “Business- Raw Materials.”

Interest Income. Interest income increased in 2023 compared to 2022 and increased in 2022 compared to 2021. The increase for both comparative periods is primarily due to higher interest rates and increased investment balances, partially offset by lower average loan balances on our loan to an affiliate. See Notes 3 and 10 to our Consolidated Financial Statements.

Income tax expense. A tabular reconciliation of our actual tax provision to the U.S. federal statutory income tax rate of 21% is included in Note 8 to the Consolidated Financial Statements. As a member of the group of companies consolidated for U.S. federal income tax purposes with Contran, the parent of our consolidated U.S. federal income tax group, we compute our provision for income taxes on a separate company basis, using the tax elections made by Contran.

- 15 -

Our effective income tax rate was 24% in each of 2021, 2022 and 2023. See Notes 8 and 11 to our Consolidated Financial Statements. We currently expect our effective income tax rate for 2024 to be comparable to our effective income tax rate for 2023.

Segment Results

The key performance indicator for our segments is the level of their operating income (see discussion below). For additional information regarding our segments refer to Note 2 to our Consolidated Financial Statements.

| Years ended December 31, | % Change |

| |||||||||||

2021 |

| 2022 |

| 2023 |

| 2021-22 |

| 2022-23 |

| |||||

(In millions) |

| |||||||||||||

Security Products: |

|

|

|

|

|

|

|

|

|

| ||||

Net sales | $ | 105.1 | $ | 114.5 | $ | 121.2 |

| 9 | % | 6 | % | |||

Cost of sales |

| 71.5 |

| 79.1 |

| 82.8 |

| 11 |

| 5 | ||||

Gross margin |

| 33.6 |

| 35.4 |

| 38.4 |

| 5 |

| 8 | ||||

Operating costs and expenses |

| 12.0 |

| 12.7 |

| 13.5 |

| 5 |

| 6 | ||||

Operating income | $ | 21.6 | $ | 22.7 | $ | 24.9 |

| 5 |

| 10 | ||||

Gross margin |

| 32.0 | % |

| 31.0 | % |

| 31.7 | % |

|

| |||

Operating income margin |

| 20.6 |

| 19.9 |

| 20.6 |

|

|

|

| ||||

Security Products. Security Products net sales increased 6% to $121.2 million in 2023 compared to $114.5 million in 2022 primarily due to higher sales related to a pilot project for a government security customer. Relative to prior year, sales were $8.3 million higher to the government security market and $1.5 million higher to distributors, partially offset by $1.7 million lower sales to the office furniture market and $.7 million lower sales to the gas station security market. Gross margin as a percentage of net sales for 2023 increased as compared to 2022 primarily due to lower production costs (including lower material, overtime and shipping costs) and increased coverage of fixed costs on higher sales, primarily in the fourth quarter. Operating income margin increased for 2023 compared to 2022 primarily due to the factors impacting gross margin, as well as increased coverage of operating costs and expenses from higher sales, partially offset by increased operating costs and expenses, including higher employee salaries and benefit costs of $.6 million.

Security Products net sales increased 9% to $114.5 million in 2022 compared to $105.1 million in 2021 due to increased sales across a variety of markets. Relative to prior year, sales were $3.8 million higher to the government security market, $1.8 million higher to the office furniture market, $1.5 million higher to distributors, $1.0 million higher to the tool storage market and $.9 million higher to the gas station security market. Gross margin as a percentage of net sales for 2022 decreased as compared to 2021 primarily due to higher cost of sales, most significantly in the third and fourth quarters of 2022, as price increases and surcharges did not fully offset higher cost inventory sold in the latter half of the year. Operating income margin decreased for 2022 compared to 2021 primarily due to the factors impacting gross margin, as well as increased operating costs and expenses, resulting from higher salaries and employment related costs, partially offset by increased coverage of operating costs and expenses from higher sales.

- 16 -

| Years ended December 31, | % Change |

| |||||||||||

2021 |

| 2022 |

| 2023 |

| 2021-22 |

| 2022-23 |

| |||||

(In millions) |

| |||||||||||||

Marine Components: |

|

|

|

|

|

|

|

|

|

| ||||

Net sales | $ | 35.7 | $ | 52.1 | $ | 40.1 |

| 46 | % | (23) | % | |||

Cost of sales |

| 26.6 |

| 38.7 |

| 29.3 |

| 45 |

| (24) | ||||

Gross margin |

| 9.1 |

| 13.4 |

| 10.8 |

| 47 |

| (19) | ||||

Operating costs and expenses |

| 3.5 |

| 3.8 |

| 3.6 |

| 9 |

| (5) | ||||

Operating income | $ | 5.6 | $ | 9.6 | $ | 7.2 |

| 71 |

| (25) | ||||

Gross margin |

| 25.4 | % |

| 25.6 | % |

| 27.0 | % | |||||

Operating income margin |

| 15.7 |

| 18.4 |

| 18.0 |

|

|

|

| ||||

Marine Components. Marine Components net sales decreased 23% in 2023 as compared to 2022. Relative to prior year, sales were $12.8 million lower to the towboat market (primarily to original equipment boat manufacturers) and $2.0 million lower to the engine builder market, partially offset by $1.2 million higher industrial sales and $.8 million higher sales to the center console boat market. Gross margin as a percentage of sales increased in 2023 compared to 2022 primarily due to lower raw material costs (primarily stainless steel and aluminum), lower supplies costs driven by lower volume, lower shipping costs and lower labor costs from reduced employee overtime due to lower sales volumes, partially offset by decreased coverage of fixed costs as a result of lower sales. Operating income as a percentage of net sales decreased slightly in 2023 compared to 2022 primarily due to the factors impacting gross margin, as well as decreased coverage of operating costs and expenses from lower sales.

Marine Components net sales increased 46% in 2022 as compared to 2021. Relative to prior year, sales were $11.5 million higher to the towboat market (primarily to original equipment boat manufacturers), $2.1 million higher to the engine builder market, and $2.0 million higher to the industrial market. Gross margin as a percentage of sales increased slightly in 2022 compared to 2021 with increased sales due to price increases and surcharges more than offsetting higher production costs, as well as increased coverage of cost of sales from higher sales. Operating income as a percentage of net sales increased in 2022 compared to 2021 primarily due to the factors impacting gross margin, as well as increased coverage of operating costs and expenses from higher sales.

Outlook. In 2023, Security Products achieved record sales as a result of increased sales to the government security market, including a pilot project to a government security customer. Absent this project, Security Products sales would have declined compared to the prior year due to sluggish demand in many of the other markets Security Products serves. At Marine Components, the strong demand experienced in 2021 and 2022 carried into the first quarter of 2023 when the towboat market began experiencing softening demand that accelerated as the year progressed. Labor markets have become favorable in each of the regions we operate, and material prices have either stabilized or, in the case of certain commodity raw materials, started to decline slightly. Our supply chains are stable and transportation and logistical delays are minimal. We have adjusted our labor force and production rates at our facilities to reflect the stability of our raw material supplies and near-term demand levels.

We expect Security Products sales in 2024 will be lower than 2023 as the sluggishness we observed across a variety of the markets Security Products served during 2023 will continue with customers expressing uncertainty regarding sustained consumer demand. We do not currently have additional orders with regard to the 2023 pilot project, and we have no knowledge of any future orders. After implementing aggressive price increases over the last several years to maintain operating margins, we believe our customers will accept only modest price increases in the current environment. Overall, we expect Security Products gross margin will be comparable in 2024, although we expect operating income as a percentage of sales to decline due to our limited pricing power along with reduced coverage of selling, general and administrative costs as a result of lower expected sales. We expect Marine Components net sales in 2024 to also be lower as compared to 2023 because we believe demand in the towboat market will further decline, and expected increases in sales to the industrial and center console boat markets will not fully offset reduced towboat demand. The recreational marine industry faces strong headwinds due to higher interest rates and broader market weakness. Several original equipment boat manufacturers, including certain of our customers, have publicly announced reductions to production schedules for 2024. Overall, we expect Marine Components gross margin as a percentage of net sales for 2024 to be lower

- 17 -

than 2023 due to lower coverage of fixed overhead as a result of lower expected sales, and operating income as a percentage of net sales will similarly be lower as a result of reduced coverage of selling, general and administrative expenses due to lower expected sales. We ended the year with elevated inventory balances at our Marine Components segment as a result of increased orders of certain raw materials due to previously long lead times coupled with the rapidly changing towboat demand which created a misalignment of our raw materials with near term demand. We expect inventory balances to be in alignment with current demand by mid-year 2024.

Our expectations for our operations and the markets we serve are based on a number of factors outside our control. We have experienced global and domestic supply chain challenges, and any future impacts on our operations will depend on, among other things, any future disruption in our operations or our suppliers’ operations, the impact of economic conditions and geopolitical events on demand for our products or our customers’ and suppliers’ operations, all of which remain uncertain and cannot be predicted.

Critical Accounting Policies and Estimates

Our significant accounting policies are more fully described in Note 1 to our Consolidated Financial Statements. Our Consolidated Financial Statements have been prepared in conformity with accounting principles generally accepted in the United States of America, or GAAP. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the reporting period. On an ongoing basis we evaluate our estimates, including those related to the recoverability of long-lived assets, the realization of deferred income tax assets, income tax and other contingencies. We base our estimates on historical experience and on various other assumptions which we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the reported amounts of assets, liabilities, revenues and expenses. Actual results may differ significantly from previously-estimated amounts under different assumptions or conditions.

We believe the most critical accounting policies and estimates involving significant judgment primarily relate to the considerations in the impairment assessments for goodwill and certain long-lived assets. We have discussed the development, selection and disclosure of our critical accounting estimates with the audit committee of our board of directors.

| ● | Goodwill – Our goodwill totaled $23.7 million at December 31, 2023, all relating to our Security Products reporting unit, which corresponds to our Security Products operating segment. Goodwill is required to be tested annually or at other times whenever an event occurs or circumstances change that would more-likely-than-not reduce the fair value of a reporting unit below its carrying value. We perform our annual goodwill impairment test in the third quarter of each year, or at other times whenever an event occurs or circumstances change that would more-likely-than-not reduce the fair value of a reporting unit below its carrying value. Such events or circumstances may include: adverse industry or economic trends, lower projections of profitability, or a sustained decline in our market capitalization. These events or circumstances, among other items, may be indications of potential impairment issues which are triggering events requiring the testing of an asset’s carrying value for recoverability. An entity may first assess qualitative factors to determine whether it is necessary to complete a quantitative impairment test using a more-likely-than-not criteria. If an entity believes it is more-likely-than-not the fair value of a reporting unit is greater than its carrying value, including goodwill, the quantitative impairment test can be bypassed. Alternatively, an entity has an unconditional option to bypass the qualitative assessment and proceed directly to performing the quantitative impairment test. |

When performing a qualitative assessment, considerable management judgment is necessary to evaluate the qualitative impact of events and circumstances on the fair value of a reporting unit. Events and circumstances considered in our impairment evaluations, such as historical profits and stability of the markets served, are consistent with factors utilized with our internal projections and operating plan. However, future events and circumstances could result in materially different findings which could result in the recognition of a material goodwill impairment.

- 18 -

Evaluations of possible impairment utilizing the quantitative impairment test require us to estimate, among other factors: forecasts of future operating results, revenue growth, operating margin, tax rates, capital expenditures, depreciation, working capital, weighted average cost of capital, long-term growth rates, risk premiums, terminal values, and fair values of our reporting units and assets. The goodwill impairment test is subject to uncertainties arising from such events as changes in competitive conditions, the current general economic environment, material changes in growth rate assumptions that could positively or negatively impact anticipated future operating conditions and cash flows, changes in the discount rate, and the impact of strategic decisions. If any of these factors were to materially change, such change may require revaluation of our goodwill. Changes in estimates or the application of alternative assumptions could produce significantly different results.

In 2023, we used the qualitative assessment for our annual impairment test and determined it was not necessary to perform the quantitative goodwill impairment test, as we concluded it is more-likely-than-not the fair value of the Security Products reporting unit exceeded its carrying amount. See Notes 1 and 6 to our Consolidated Financial Statements.

| ● | Long-lived assets – The net book value of our property and equipment totaled $25.9 million at December 31, 2023. We assess property and equipment for impairment only when circumstances indicate an impairment may exist. Our determination is based upon, among other things, our estimates of the amount of future net cash flows to be generated by the long-lived asset (Level 3 inputs) and our estimates of the current fair value of the asset. |

Significant judgment is required in estimating such cash flows. Adverse changes in such estimates of future net cash flows or estimates of fair value could result in an inability to recover the carrying value of the long-lived asset, thereby possibly requiring an impairment charge to be recognized in the future. We do not assess our property and equipment for impairment unless certain impairment indicators are present. We did not evaluate any long-lived assets for impairment during 2023 because no such impairment indicators were present.

Liquidity and Capital Resources

Summary

Our primary source of liquidity on an on-going basis is our cash flow from operating activities, which is generally used to (i) fund capital expenditures, (ii) repay short-term or long-term indebtedness incurred primarily for capital expenditures, business combinations or buying back shares of our outstanding stock and (iii) provide for the payment of dividends (if declared). From time-to-time, we may incur indebtedness to fund capital expenditures, business combinations or other investment activities. In addition, from time-to-time, we may also sell assets outside the ordinary course of business, the proceeds of which are generally used to repay indebtedness (including indebtedness which may have been collateralized by the assets sold) or to fund capital expenditures or business combinations.

Consolidated cash flows

Operating activities. Trends in cash flows from operating activities, excluding changes in assets and liabilities, for the last three years have generally been similar to the trends in our earnings. Depreciation and amortization were comparable in each of 2023, 2022 and 2021. See Note 1 to our Consolidated Financial Statements.

Changes in assets and liabilities result primarily from the timing of production, sales and purchases. Such changes in assets and liabilities generally tend to even out over time. However, year-to-year relative changes in assets and liabilities can significantly affect the comparability of cash flows from operating activities. Cash provided by operating activities was $25.8 million in 2023 compared to $16.9 million in 2022. The $8.9 million increase in cash provided by operating activities was primarily the result of:

| ● | A higher amount of net cash provided by relative changes in inventories, receivables, payables and non-tax accruals of $7.8 million, |

| ● | A $.5 million decrease in cash paid for taxes in 2023 due to the relative timing of tax payments, and |

- 19 -

| ● | A $.5 million increase in interest received in 2023 due to higher interest rates and increased investment balances, partially offset by lower average loan balances on our loan to an affiliate. |

Cash provided by operating activities was $16.9 million in 2022 compared to $10.5 million in 2021. The $6.4 million increase in cash provided by operating activities was primarily the net result of:

| ● | A $4.9 million increase in operating income in 2022, |

| ● | A lower amount of net cash used by relative changes in inventories, receivables, payables and non-tax accruals of $3.9 million, |

| ● | A $3.1 million increase in cash paid for taxes in 2022 due to higher operating income, and |

| ● | A $.7 million increase in interest received in 2022 due to higher interest rates and increased investment balances, partially offset by lower average loan balances on our loan to an affiliate. |

Relative changes in working capital can have a significant effect on cash flows from operating activities. As shown below, the total average days sales outstanding decreased from December 31, 2022 to December 31, 2023 and is primarily impacted by the timing of sales and collections in the last month of the year. For comparative purposes, we have provided 2021 numbers below.

December 31, |

| December 31, |

| December 31, | ||

Days Sales Outstanding: | 2021 | 2022 | 2023 | |||

Security Products | 46 Days |

| 45 Days |

| 37 Days | |

Marine Components | 30 Days |

| 30 Days |

| 31 Days | |

Consolidated CompX | 42 Days |

| 41 Days |

| 36 Days |

As shown below, our average number of days in inventory decreased from December 31, 2022 to December 31, 2023 primarily due to the decrease at Security Products due to the fulfillment and shipping of a significant order during the fourth quarter of 2023. Days in inventory for Marine Components increased due to lower sales and increased inventory balances as a result of prior orders of certain raw materials with longer lead times discussed in Outlook above. For comparative purposes, we have provided 2021 numbers below.

December 31, |

| December 31, |

| December 31, | ||

Days in Inventory: | 2021 | 2022 | 2023 | |||

Security Products | 95 Days |

| 101 Days |

| 77 Days | |

Marine Components | 97 Days |

| 95 Days |

| 175 Days | |

Consolidated CompX | 96 Days |

| 99 Days |

| 95 Days |