UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30,

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission File Number

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or | (I.R.S. Employer Identification No.) | |

organization) |

(Address of principal executive offices) | (Zip Code) |

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class: |

| Trading Symbol |

| Name of each exchange on which registered: |

The Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | ☒ | |||

Non-accelerated filer ☐ | Smaller reporting company | |||

Emerging Growth Company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of November 2, 2023, there were

RIGEL PHARMACEUTICALS, INC.

QUARTERLY REPORT ON FORM 10-Q

FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 2023

INDEX

2

PART I. FINANCIAL INFORMATION

Item 1.Financial Statements

RIGEL PHARMACEUTICALS, INC.

CONDENSED BALANCE SHEETS

(In thousands)

As of | |||||||

September 30, 2023 |

| December 31, 2022 (1) | |||||

(unaudited) | |||||||

Assets | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | $ | | ||||

Short-term investments |

|

| | ||||

Accounts receivable, net |

| |

| | |||

Inventories | |

| | ||||

Prepaid and other current assets |

|

| | ||||

Total current assets |

|

| |||||

Property and equipment, net |

|

| | ||||

Intangible asset, net | | ||||||

Operating lease right-of-use assets | | ||||||

Other assets |

|

| | ||||

Total assets | $ | $ | |||||

Liabilities and stockholders’ deficit | |||||||

Current liabilities: | |||||||

Accounts payable | $ | $ | | ||||

Accrued compensation |

|

| | ||||

Accrued research and development |

|

| | ||||

Revenue reserves and refund liability | | ||||||

Other accrued liabilities |

|

| | ||||

Lease liabilities, current portion | | | |||||

Deferred revenue | | | |||||

Other long-term liabilities, current portion | | | |||||

Total current liabilities |

|

| |||||

Long-term portion of lease liabilities |

| |

| | |||

Loans payable, net of discount | | | |||||

Other long-term liabilities |

| |

| | |||

Total liabilities | | | |||||

Commitments | |||||||

Stockholders’ deficit: | |||||||

Preferred stock |

|

| |||||

Common stock |

|

| | ||||

Additional paid-in capital |

|

| | ||||

Accumulated other comprehensive loss |

| ( |

| ( | |||

Accumulated deficit |

| ( |

| ( | |||

Total stockholders’ deficit |

| ( |

| ( | |||

Total liabilities and stockholders’ deficit | $ | $ | |||||

| (1) | The balance sheet as of December 31, 2022 has been derived from the audited financial statements included in Rigel’s Annual Report on Form 10-K for the year ended December 31, 2022 filed with the Securities and Exchange Commission (SEC) on March 7, 2023. |

See Accompanying Notes to Condensed Financial Statements

3

RIGEL PHARMACEUTICALS, INC.

CONDENSED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts)

(unaudited)

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||

| 2023 |

| 2022 |

| 2023 |

| 2022 | |||||

Revenues: | ||||||||||||

Product sales, net | $ | | $ | | $ | | $ | | ||||

Contract revenues from collaborations | | | | | ||||||||

Government contract | — | | | | ||||||||

Total revenues | | | | | ||||||||

Costs and expenses: | ||||||||||||

Cost of product sales | | | | | ||||||||

Research and development |

| |

| | |

| | |||||

Selling, general and administrative |

| |

| | |

| | |||||

Total costs and expenses |

|

|

|

| ||||||||

Loss from operations |

| ( |

| ( |

| ( |

| ( | ||||

Interest income |

| |

| |

| |

| | ||||

Interest expense | ( | ( | ( | ( | ||||||||

Net loss | $ | ( | $ | ( | $ | ( | $ | ( | ||||

Net loss per share, basic and diluted | ( | ( | ( | ( | ||||||||

Weighted average shares used in computing net loss per share, basic and diluted | | | | | ||||||||

See Accompanying Notes to Condensed Financial Statements

4

RIGEL PHARMACEUTICALS, INC.

CONDENSED STATEMENTS OF COMPREHENSIVE LOSS

(In thousands)

(unaudited)

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||

| 2023 |

| 2022 |

| 2023 |

| 2022 | |||||

Net loss | $ | ( | $ | ( | $ | ( | $ | ( | ||||

Other comprehensive gain (loss): | ||||||||||||

Net unrealized gain (loss) on short-term investments |

| |

| |

| |

| ( | ||||

Comprehensive loss | $ | ( | $ | ( | $ | ( | $ | ( | ||||

See Accompanying Notes to Condensed Financial Statements

5

RIGEL PHARMACEUTICALS, INC.

CONDENSED STATEMENTS OF STOCKHOLDERS’ (DEFICIT) EQUITY

(In thousands, except share amounts)

(unaudited)

Additional | Accumulated Other | Total | |||||||||||||||

Common Stock | Paid-in | Comprehensive | Accumulated | Stockholders’ | |||||||||||||

| Shares |

| Amount |

| Capital |

| Loss |

| Deficit |

| Deficit | ||||||

Balance as of January 1, 2023 |

| | $ | | $ | | $ | ( | $ | ( | $ | ( | |||||

Net loss |

| — | — | — | — | ( |

| ( | |||||||||

Net change in unrealized gain on short-term investments |

| — | — | — | | — |

| | |||||||||

Issuance of common stock upon exercise of options |

| | — | | — | — |

| | |||||||||

Issuance of common stock upon vesting of restricted stock units (RSUs) | | — | — | — | — | — | |||||||||||

Stock-based compensation expense |

| — | — | | — | — |

| | |||||||||

Balance as of March 31, 2023 |

| | | | ( | ( | ( | ||||||||||

Net loss |

| — | — | — | — | ( | ( | ||||||||||

Net change in unrealized gain on short-term investments |

| — | — | — | | — | | ||||||||||

Issuance of common stock upon exercise of options and participation in Purchase Plan |

| | | | — | — | | ||||||||||

Issuance of common stock upon vesting of RSUs | | — | — | — | — | — | |||||||||||

Stock-based compensation expense |

| — | — | | — | — | | ||||||||||

Balance as of June 30, 2023 | | $ | | $ | | $ | ( | $ | ( | $ | ( | ||||||

Net loss |

| — | — | — | — | ( | ( | ||||||||||

Net change in unrealized gain on short-term investments |

| — | — | — | | — | | ||||||||||

Issuance of common stock upon exercise of options |

| | — | | — | — | | ||||||||||

Stock-based compensation expense |

| — | — | | — | — | | ||||||||||

Balance as of September 30, 2023 |

| | $ | | $ | | $ | ( | $ | ( | $ | ( | |||||

Additional | Accumulated Other | Total | |||||||||||||||

Common Stock | Paid-in | Comprehensive | Accumulated | Stockholders’ | |||||||||||||

| Shares |

| Amount |

| Capital |

| Loss |

| Deficit |

| Equity (Deficit) | ||||||

Balance as of January 1, 2022 |

| | $ | | $ | | $ | ( | $ | ( | $ | | |||||

Net loss |

| — | — | — | — | ( |

| ( | |||||||||

Net unrealized loss on short-term investments |

| — | — | — | ( | — |

| ( | |||||||||

Issuance of common stock upon exercise of options |

| | — | | — | — |

| | |||||||||

Issuance of common stock upon vesting of RSUs | | — | — | — | — | — | |||||||||||

Stock-based compensation expense |

| — | — | | — | — |

| | |||||||||

Balance as of March 31, 2022 |

| | | | ( | ( | | ||||||||||

Net loss |

| — | — | — | — | ( | ( | ||||||||||

Net unrealized loss on short-term investments |

| — | — | — | ( | — | ( | ||||||||||

Issuance of common stock upon exercise of options and participation in Purchase Plan |

| | | | — | — | | ||||||||||

Issuance of common stock upon vesting of RSUs | | — | — | — | — | — | |||||||||||

Stock-based compensation expense |

| — | — | | — | — | | ||||||||||

Balance as of June 30, 2022 | | $ | | $ | | $ | ( | $ | ( | $ | ( | ||||||

Net loss |

| — | — | — | — | ( | ( | ||||||||||

Net unrealized gain on short-term investments |

| — | — | — | | — | | ||||||||||

Stock-based compensation expense |

| — | — | | — | — | | ||||||||||

Balance as of September 30, 2022 |

| | $ | | $ | | $ | ( | $ | ( | $ | ( | |||||

See Accompanying Notes to Condensed Financial Statements

6

RIGEL PHARMACEUTICALS, INC.

CONDENSED STATEMENTS OF CASH FLOWS

(In thousands)

(unaudited)

Nine Months Ended September 30, | |||||||

2023 |

| 2022 | |||||

Operating activities | |||||||

Net loss | $ | ( | $ | ( | |||

Adjustments to reconcile net loss to net cash used in operating activities: | |||||||

Stock-based compensation expense |

| ||||||

Loss (gain) on sale and disposal of fixed assets | | ( | |||||

Depreciation and amortization |

| ||||||

Non-cash interest expense | — | | |||||

Net amortization and accretion of discount on short-term investments and term loan | ( | ||||||

Changes in assets and liabilities: | |||||||

Accounts receivable, net |

| | ( | ||||

Inventories | ( | ( | |||||

Prepaid and other current assets |

| | |||||

Other assets |

| | |||||

Right-of-use assets |

| | |||||

Accounts payable |

| | ( | ||||

Accrued compensation |

| ( | ( | ||||

Accrued research and development |

| ( | ( | ||||

Revenue reserves and refund liability | | ||||||

Other accrued liabilities |

| ( | |||||

Lease liability | ( | ( | |||||

Deferred revenue | ( | ( | |||||

Other current and long-term liabilities |

| ( |

| ||||

Net cash provided by (used in) operating activities |

|

| ( | ||||

Investing activities | |||||||

Maturities of short-term investments |

| ||||||

Purchases of short-term investments |

| ( | ( | ||||

Purchases of intangible asset |

| ( | — | ||||

Proceeds from sale of property and equipment | | ||||||

Purchases of property and equipment |

| — | ( | ||||

Net cash provided by investing activities |

|

| |||||

Financing activities | |||||||

Net proceeds from term loan financing | | ||||||

Net proceeds from issuances of common stock upon exercise of options and participation in Purchase Plan |

| | |||||

Cost share payments to a collaboration partner | ( | ( | |||||

Net cash provided by financing activities |

|

| |||||

Net increase in cash and cash equivalents |

| |

| ||||

Cash and cash equivalents at beginning of period |

| ||||||

Cash and cash equivalents at end of period | $ | $ | |||||

Supplemental disclosure of cash flow information | |||||||

Interest paid | $ | | $ | | |||

See Accompanying Notes to Condensed Financial Statements

7

Rigel Pharmaceuticals, Inc.

Notes to Condensed Financial Statements

(unaudited)

In this report, “Rigel,” “we,” “us” and “our” refer to Rigel Pharmaceuticals, Inc.

1. | Organization and Summary of Significant Accounting Policies |

Description of Business

We are a biotechnology company dedicated to discovering, developing and providing novel therapies that significantly improve the lives of patients with hematologic disorders and cancer. We focus on products that address signaling pathways that are critical to disease mechanisms.

Our first product approved by the US Food and Drug Administration (FDA) is TAVALISSE® (fostamatinib disodium hexahydrate) tablets, the only approved oral spleen tyrosine kinase (SYK) inhibitor for the treatment of adult patients with chronic immune thrombocytopenia (ITP) who have had an insufficient response to a previous treatment. The product is also commercially available in Europe and the United Kingdom (UK) (as TAVLESSE), and in Canada, Israel and Japan (as TAVALISSE) for the treatment of chronic ITP in adult patients.

Our second FDA approved product is REZLIDHIA® (olutasidenib) capsules for the treatment of adult patients with relapsed or refractory (R/R) acute myeloid leukemia (AML) with a susceptible isocitrate dehydrogenase-1 (IDH1) mutation as detected by an FDA-approved test. We began our commercialization of REZLIDHIA in December 2022. We in-licensed olutasidenib from Forma Therapeutics, Inc. (now Novo Nordisk), with exclusive, worldwide rights for its development, manufacturing and commercialization.

We continue to advance the development of our interleukin receptor-associated kinase (IRAK) 1/4 inhibitor program, in an open-label, Phase 1b trial to determine the tolerability and preliminary efficacy of the drug in patients with lower-risk myelodysplastic syndrome (MDS) who are refractory or resistant to prior therapies.

We have a receptor-interacting serine/threonine-protein kinase 1 (RIPK1) inhibitor program in clinical development with our partner Eli Lilly and Company (Lilly). We also have product candidates in clinical development with partners BerGenBio ASA (BerGenBio) and Daiichi Sankyo (Daiichi).

Basis of Presentation

Our accompanying unaudited condensed financial statements have been prepared in accordance with United States generally accepted accounting principles (US GAAP), for interim financial information and pursuant to the instructions to Form 10-Q and Article 10 of Regulation S-X of the Securities Act of 1933, as amended (Securities Act). Accordingly, they do not include all the information and notes required by US GAAP for complete financial statements. These unaudited condensed financial statements include only normal and recurring adjustments that we believe are necessary to fairly state our financial position and the results of our operations and cash flows. Interim-period results are not necessarily indicative of results of operations or cash flows for a full-year or any subsequent interim period. The balance sheet as of December 31, 2022 has been derived from audited financial statements at that date but does not include all disclosures required by US GAAP for complete financial statements. Because certain disclosures required by US GAAP for complete financial statements are not included herein, these interim unaudited condensed financial statements and the notes accompanying them should be read in conjunction with our audited financial statements and the notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC on March 7, 2023.

8

Use of Estimates

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances. Actual results could differ from these estimates.

Significant Accounting Policies

Our significant accounting policies are described in “Note 1 – Description of Business and Summary of Significant Accounting Policies” to our “Notes to Financial Statements” contained in “Part II, Item 8, Financial Statements and Supplementary Data” of our Annual Report on Form 10-K for the year ended December 31, 2022. There have been no material changes to these accounting policies.

Liquidity

As of September 30, 2023, we had approximately $

Based on our current operating plan, we believe that our existing cash, cash equivalents, and short-term investments will be sufficient to fund our expenses and capital expenditure requirements for at least the next 12 months from the date of issuance of this Form 10-Q.

Recently Issued Accounting Standards

Recently issued accounting guidance is either not applicable or did not have, or is not expected to have, a material impact to us.

2. | Net Loss Per Share |

Basic net loss per share is computed by dividing net loss by the weighted-average number of shares of common stock outstanding during the period. Diluted net loss per share is computed by dividing net loss by the weighted-average number of shares of common stock outstanding during the period and the number of additional shares of common stock that would have been outstanding if potentially dilutive securities had been issued. Potentially dilutive securities include stock options, RSUs and shares issuable under our Employee Stock Purchase Plan (Purchase Plan). The dilutive effect of these potentially dilutive securities is reflected in diluted earnings per share using the treasury stock method. Under the treasury stock method, an increase in the fair market value of our common stock can result in a greater dilutive effect from potentially dilutive securities.

The potential shares of common stock that were excluded from the computation of diluted net loss per share for the periods presented because including them would have been antidilutive are as follows (in thousands):

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||

2023 |

| 2022 | 2023 |

| 2022 | |||||||

Outstanding stock options | ||||||||||||

RSUs | ||||||||||||

Purchase Plan | ||||||||||||

Total | ||||||||||||

9

3. | Revenues |

Revenues disaggregated by category were as follows (in thousands):

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||

2023 |

| 2022 | 2023 |

| 2022 | |||||||

Product sales: | ||||||||||||

Gross product sales | $ | $ | $ | |||||||||

Discounts and allowances | ( | ( | ( | ( | ||||||||

Total product sales, net | | | | | ||||||||

Revenues from collaborations: | ||||||||||||

License revenues | — | — | — | | ||||||||

Development milestones | | — | | | ||||||||

Royalty, delivery of drug supplies and others | ||||||||||||

Total revenues from collaborations | | | | | ||||||||

Government contract | — | | | | ||||||||

Total revenues | $ | | $ | | $ | | $ | | ||||

Revenue from product sales are related to sales of our commercial products, TAVALISSE and REZLIDHIA, to our specialty distributors. For detailed discussions of our revenues from collaboration and government contract, see “Note 4 – Sponsored Research and License Agreements and Government Contract.”

Our net product sales include gross product sales, net of chargebacks, discounts and fees, government and other rebates and returns. Of the total discounts and allowances from gross product sales for the nine months ended September 30, 2023 and 2022, $

Chargebacks, | Government | |||||||||||

Discounts and | and Other | |||||||||||

Fees | Rebates | Returns | Total | |||||||||

Balance as of January 1, 2023 |

| $ | | $ | | $ | | $ | | |||

Provision related to current period sales | | | | | ||||||||

Credit or payments made during the period | ( | ( | ( | ( | ||||||||

Balance as of September 30, 2023 |

| $ | | $ | | $ | | $ | | |||

Chargebacks, | Government | |||||||||||

Discounts and | and Other | |||||||||||

Fees | Rebates | Returns | Total | |||||||||

Balance as of January 1, 2022 |

| $ | | $ | | $ | | $ | | |||

Provision related to current period sales | | | | | ||||||||

Credit or payments made during the period | ( | ( | ( | ( | ||||||||

Balance as of September 30, 2022 |

| $ | | $ | | $ | | $ | | |||

The following table summarizes the percentages of revenues from each of our customers who individually accounted for 10% or more (wherein * denotes less than 10%) of the total net product sales and revenues from collaborations:

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||

2023 |

| 2022 | 2023 |

| 2022 | ||||||||

McKesson Specialty Care Distribution Corporation | |||||||||||||

Cardinal Healthcare | |||||||||||||

ASD Healthcare and Oncology Supply | |||||||||||||

Kissei | * | * | * | ||||||||||

10

4. | Sponsored Research and License Agreements and Government Contract |

Sponsored Research and License Agreements

We conduct research and development programs independently and in connection with our corporate collaborators. As of September 30, 2023, we are a party to collaboration agreements with Lilly to develop and commercialize R552, a RIPK1 inhibitor, for the treatment of non-central nervous system (non-CNS) diseases and collaboration aimed at developing additional RIPK1 inhibitors for the treatment of central nervous system (CNS) diseases; with Grifols S.A. (Grifols) to commercialize fostamatinib for human diseases in all indications, including chronic ITP and autoimmune hemolytic anemia (AIHA), in Grifols territory which includes Europe, the UK, Turkey, the Middle East, North Africa and Russia (including Commonwealth of Independent States); with Kissei Pharmaceutical Co., Ltd. (Kissei) to develop and commercialize fostamatinib in Kissei territory which includes Japan, China, Taiwan and the Republic of Korea; with Medison Pharma Trading AG (Medison Canada) and Medison Pharma Ltd. (Medison Israel and, together with Medison Canada, Medison) to commercialize fostamatinib in all indications, including chronic ITP and AIHA, in Medison territory which includes Canada and Israel; and with Knight Therapeutics International SA (Knight) to commercialize fostamatinib in all indications, including chronic ITP and AIHA, in Knight territory which includes Latin America, consisting of Mexico, Central and South America, and the Caribbean (Knight territory).

Further, we are also a party to collaboration agreements, but do not have ongoing performance obligations with BerGenBio for the development and commercialization of AXL receptor tyrosine kinase (AXL) inhibitors in oncology, and with Daiichi to pursue research related to murine double minute 2 (MDM2) inhibitors, a novel class of drug targets called ligases.

Under the above existing agreements that we entered into in the ordinary course of business, we received or may be entitled to receive upfront cash payments, payments contingent upon specified events achieved by such partners and royalties on any net sales of products sold by such partners under the agreements. As of September 30, 2023, total future contingent payments to us under all of the above existing agreements, excluding terminated agreements, could exceed $

Global Exclusive License Agreement with Lilly

We have a global exclusive license agreement and strategic collaboration with Lilly (Lilly Agreement) entered in February 2021, which became effective on March 27, 2021, upon clearance under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, to develop and commercialize R552 for the treatment of non-CNS diseases. In addition, the collaboration is aimed at developing additional RIPK1 inhibitors for the treatment of CNS diseases. Pursuant to the terms of the Lilly Agreement, we granted Lilly the exclusive rights to develop and commercialize R552 and related RIPK1 inhibitors in all indications worldwide. The parties’ collaboration is governed through a joint governance committee and appropriate subcommittees.

Under the terms of the Lilly Agreement, we were entitled to receive a non-refundable and non-creditable upfront cash payment amounting to $

11

payments on net sales of CNS disease products up to low-double digits, subject to certain standard reductions and offsets.

Under the Lilly Agreement, we are responsible for performing and funding initial discovery and identification of CNS disease development candidates. Following candidate selection, Lilly will be responsible for performing and funding all future development and commercialization of the CNS disease development candidates. We are responsible for

On September 28, 2023, we entered into an amendment to the Lilly Agreement which provides, among others that if we exercise our first opt-out right, we have the right to opt-in to the co-funding of R552 development, upon us providing notice to Lilly within

On September 29, 2023, we provided the first opt-out notice to Lilly. We will continue to fund our share of the R552 development activities up to $

We accounted for this agreement under ASC 606 and identified the following distinct performance obligations at inception of the agreement: (a) granting of the license rights over the non-CNS penetrant intellectual property (IP), and (b) granting of the license rights over the CNS penetrant IP which will be delivered to Lilly upon completion of the additional research and development efforts specified in the agreement. We concluded that each of these performance obligations is distinct. We based our assessment on the assumption that Lilly can benefit from each of the licenses on its own by developing and commercializing the underlying product using its own resources.

At the inception of the Lilly Agreement, given our rights to opt-out from the development of R552, we believed at the minimum, we had a commitment to fund the development costs up to $

At the inception, we allocated the net transaction price of $

12

candidate. As such, we recognized the remaining outstanding deferred revenue in the second quarter of 2022. For the three and nine months ended September 30, 2022, we recognized

The remaining future variable consideration related to future milestone payments as discussed above were fully constrained because we cannot conclude that it is probable that a significant reversal of the amount of cumulative revenue recognized will not occur, given the inherent uncertainty of success with these future milestones. For sales-based milestones and royalties, we determined that the license is the predominant item to which the royalties or sales-based milestones relate. Accordingly, we will recognize revenue at the later of (i) when the related sales occur, or (ii) when the performance obligation to which some or all of the royalty has been allocated has been satisfied (or partially satisfied). We will re-evaluate the transaction price in each reporting period and as uncertain events are resolved or other changes in circumstances occur.

Grifols License Agreement

We have an exclusive commercialization license agreement with Grifols entered in January 2019 with exclusive rights to commercialize fostamatinib for human diseases, including chronic ITP and AIHA, and non-exclusive rights to develop fostamatinib in Grifols territory. Under the agreement, we received an upfront payment of $

In January 2020, the European Commission (EC) granted a centralized Marketing Authorization (MA) for fostamatinib valid throughout the European Union (EU) and in the UK after the departure of the UK from the EU for the treatment of chronic ITP in adult patients who are refractory to other treatments. With this approval, in February 2020, we received $

We accounted for this agreement under ASC 606 and identified the following distinct performance obligations at inception of the agreement: (a) granting of the license, (b) performance of research and regulatory services related to our long-term open-label extension study on patients with ITP, and (c) performance of research services related to our Phase 3 study in AIHA. We allocated the transaction price to the distinct performance obligations in our collaboration agreement based on our best estimate of the relative standalone selling price, and recognized the corresponding revenue in the periods we satisfied the performance obligations. As of September 30, 2023, there was

The remaining variable consideration related to future regulatory and commercial milestones were fully constrained because we cannot conclude that it is probable that a significant reversal in the amount of cumulative revenue recognized will not occur, given the inherent uncertainty of success with these future milestones. We are recognizing revenues related to the research and regulatory services throughout the term of the respective clinical programs using the input method. For sales-based milestones and royalties, we determined that the license is the predominant item to which the royalties or sales-based milestones relate. Accordingly, we will recognize revenue at the later of (i) when the related sales occur, or (ii) when the performance obligation to which some or all of the royalty has been allocated has been satisfied (or partially satisfied). We will re-evaluate the transaction price in each reporting period and as uncertain events are resolved or other changes in circumstances occur.

13

We entered into a Commercial Supply Agreement with Grifols in October 2020 to supply and sell our drug product priced at a certain markup specified in the agreement, in quantities Grifols order from us pursuant to and in accordance with the agreement. Prior to the Commercial Supply Agreement, we had a Drug Product Purchase Agreement with Grifols entered in December 2019. During the three and nine months ended September 30, 2023, we recognized no revenue and $

We began recognizing royalty revenue from Grifols included within contract revenues from collaboration beginning in the third quarter of 2022. For the three and nine months ended September 30, 2023, we recognized $

Kissei License Agreement

We have an exclusive license and supply agreement with Kissei entered in October 2018, to develop and commercialize fostamatinib in all current and potential indications in Kissei’s territory. Kissei is responsible for performing and funding all development activities for fostamatinib in the above-mentioned territories. We received an upfront cash payment of $

We accounted for this agreement under ASC 606 and identified the following distinct performance obligations at inception of the agreement: (a) granting of the license, (b) supply of fostamatinib for clinical use and (c) material right associated with discounted fostamatinib that is supplied for use other than clinical or commercial. In addition, we will provide commercial product supply if the product is approved in the licensed territory. We concluded that each of these performance obligations is distinct. We determined that the upfront fee of $

For the three and nine months ended September 30, 2022, we recognized an immaterial amount of revenue and $

In April 2022, Kissei announced that an NDA was submitted to Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) for fostamatinib in chronic ITP. With this milestone event, we received $

The remaining variable consideration related to future development and regulatory milestones was fully constrained because we cannot conclude that it is probable that a significant reversal in the amount of cumulative revenue recognized will not occur, given the inherent uncertainty of success with these future milestones. For sales-based milestones and tiered, escalated net sales-based payments for the supply of fostamatinib, we determined that the license is the predominant item to which the sales-based milestones relate to. Accordingly, we will recognize revenue at the later of (i) when the related sales occur, or (ii) when the performance obligation to which some or all of the allocated costs for the tiered, escalated net sales-based payments has been satisfied (or partially satisfied). We will re-evaluate the transaction price in each reporting period and as uncertain events are resolved or other changes in circumstances occur.

14

Medison Commercial and License Agreements

We have

The decision to exercise the buyback option is dependent on many factors including management’s cost and benefit assessments and the success of obtaining regulatory approval for the treatment of AIHA in Canada. In June 2022, we reported the top-line results from our Phase 3 trial of fostamatinib in warm autoimmune hemolytic anemia (wAIHA) which showed that the trial did not demonstrate statistical significance in the primary efficacy endpoint in the overall study population. We also announced in early October 2022 that we will not file a supplemental new drug application (sNDA) for wAIHA indication considering the top-line data results and the guidance received from the FDA. With these developments, we assessed our options path forward, including our buyback option right with regards to the Medison license agreement. Based on management’s assessment, the likelihood of exercising the buy-back option right was remote. As such, during the fourth quarter of 2022, we relieved the outstanding financing liability to Medison amounting to $

During the three and nine months ended September 30, 2023, we recognized $

Knight Commercial License and Supply Agreement

We have commercial license and supply agreements with Knight entered in May 2022 for the commercialization of fostamatinib for approved indications in Knight territory. Pursuant to such commercial license agreement, we received a $

15

Government Contract - US Department of Defense’s JPEO-CBRND

In January 2021, we were awarded up to $

License and Transition Services Agreement with Forma (now Novo Nordisk)

We have a license and transition services agreement with Forma (now Novo Nordisk) entered in July 2022, for an exclusive license to develop, manufacture and commercialize olutasidenib, a proprietary inhibitor of mutated IDH1 (mIDH1), for any uses worldwide, including for the treatment of AML and other malignancies. Forma became a wholly owned subsidiary of Novo Nordisk following the closing of its acquisition by Novo Nordisk in October 2022. Pursuant to the terms of the license and transition services agreement, we paid an upfront fee of $

The transaction was accounted for as an acquisition of asset under ASC 730, Research and Development. In accordance with the guidance, in a transaction accounted for as an asset acquisition, any acquired IPR&D that does not have alternative future use is charged to expense at the acquisition date. At the acquisition date, the acquired license asset was accounted for as IPR&D, and we anticipated no other economic benefit to be derived from such acquired licensed asset other than the primary indications. As such, we accounted for the upfront fee of $

Under the accounting guidance, we account for contingent cash payments when it is probable that a liability is incurred and the amount can be reasonably estimated. We account for milestone payment obligations incurred at development stage and prior to a regulatory approval of an indication associated with the acquired licensed asset as research and development expense when the event requiring payment of the milestone occurs. Milestone payment obligations incurred upon and after a regulatory approval of an indication associated with the acquired licensed asset, and at the commercial stage, are recorded as intangible asset when the event requiring payment of the milestones occurs. The amount recorded as intangible asset is amortized over the estimated useful life of the acquired licensed asset. Royalty payments related to the acquired licensed asset is recorded as cost of sales when incurred. Prior to the FDA approval of REZLIDHIA in December 2022, we achieved certain regulatory milestone which entitled Forma (now Novo Nordisk) to receive a $

16

December 31, 2022 and included within accounts payable in our condensed balance sheet. Such amount was paid in the first quarter of .

During the three and nine months ended September 30, 2023, we recognized amortization of intangible asset of $

5. | Stock-Based Compensation |

Stock-based compensation for the periods presented was as follows (in thousands):

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||

2023 |

| 2022 | 2023 |

| 2022 | |||||||

Selling, general and administrative | $ | | $ | | $ | | $ | | ||||

Research and development | | | | | ||||||||

Total stock-based compensation expense | $ | | $ | | $ | | $ | | ||||

Stock-based compensation expense within research and development in the nine months ended September 30, 2023 include an incremental charge of approximately $

During the nine months ended September 30, 2023, we granted stock options to purchase

The fair value of each option award is estimated on the date of grant using the Black-Scholes option pricing model. The following table summarizes the weighted-average assumptions relating to options granted pursuant to our Equity Incentive Plans (2018 Equity Incentive Plan and Inducement Plan) for the periods presented:

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||

| 2023 |

| 2022 |

|

| 2023 |

| 2022 |

| |

Risk-free interest rate | % | % | % | % | ||||||

Expected term (in years) | ||||||||||

Dividend yield | % | % | % | % | ||||||

Expected volatility | % | % | % | % | ||||||

During the nine months ended September 30, 2023, we granted

As of September 30, 2023, there was approximately $

17

In April 2023 and July 2023, our Board of Directors approved additional

Employee Stock Purchase Plan

Our Purchase Plan provides for a -month offering period comprises

Our previous -month offering period under our Purchase Plan ended on June 30, 2022, and a new 24-month offering period started on July 1, 2022. The fair value of awards under our Purchase Plan is estimated on the date of our new offering period using the Black-Scholes option pricing model, which is being amortized over the requisite service periods. As of September 30, 2023, unrecognized stock-based compensation cost related to our Purchase Plan amounted to $

During the nine months ended September 30, 2023, there were

6. | Inventories |

Inventories for the periods presented consist of the following (in thousands):

As of | ||||||

September 30, 2023 |

| December 31, 2022 | ||||

Raw materials | $ | $ | ||||

Work in process | ||||||

Finished goods | ||||||

Total | $ | $ | ||||

Reported as: | ||||||

Inventories | $ | | $ | | ||

Other assets | | — | ||||

Total | $ | $ | ||||

Inventories as of September 30, 2023 and December 31, 2022 include inventories acquired from Forma (now Novo Nordisk) pursuant to the license and transition agreement. As of September 30, 2023 and December 31, 2022, zero and $

We provide reserves for potential excess, dated or obsolete inventories based upon assumptions about future demand and market conditions, as well as product shelf life. There were no material inventory reserves as of September 30, 2023 and December 31, 2022. Inventories that are not expected to be consumed beyond our normal operating cycle are classified as non-current inventories and included within other assets in the condensed balance sheet. Non-current inventories primarily consist of active pharmaceutical ingredient classified as raw materials, which have multi-year shelf life.

18

7.Cash, Cash Equivalents and Short-Term Investments

Cash, cash equivalents and short-term investments for the periods presented consist of the following (in thousands):

As of | ||||||

September 30, 2023 |

| December 31, 2022 | ||||

Cash | $ | $ | | |||

Money market funds |

|

| | |||

US treasury bills |

| |

| | ||

Government-sponsored enterprise securities |

|

| | |||

Corporate bonds and commercial paper |

|

| | |||

$ | $ | | ||||

Reported as: | ||||||

Cash and cash equivalents | $ | $ | | |||

Short-term investments |

|

| | |||

$ | $ | |||||

Cash equivalents and short-term investments include the following securities with gross unrealized gains and losses (in thousands):

|

| Gross |

| Gross |

|

| |||||||

Amortized | Unrealized | Unrealized |

| ||||||||||

As of September 30, 2023 | Cost | Gains | Losses | Fair Value |

| ||||||||

US treasury bills | $ | | $ | | $ | ( | $ | | |||||

Government-sponsored enterprise securities | | | ( | $ | | ||||||||

Corporate bonds and commercial paper |

| |

| |

| ( |

| | |||||

Total | $ | | $ | | $ | ( | $ | | |||||

|

| Gross |

| Gross |

|

| |||||||

Amortized | Unrealized | Unrealized |

| ||||||||||

As of December 31, 2022 | Cost | Gains | Losses | Fair Value |

| ||||||||

US treasury bills | $ | | $ | — | $ | ( | $ | | |||||

Government-sponsored enterprise securities | | | ( | | |||||||||

Corporate bonds and commercial paper |

| |

| — |

| ( |

| | |||||

Total | $ | | $ | | $ | ( | $ | | |||||

As of September 30, 2023 and December 31, 2022, our cash equivalents and short-term investments had a weighted-average time to maturity of approximately

The following table shows the fair value and gross unrealized losses of our investments in individual securities that are in an unrealized loss position, aggregated by investment category (in thousands):

As of September 30, 2023 |

| Fair Value |

| Unrealized Losses |

| ||

US treasury bills | $ | | $ | ( | |||

Government-sponsored enterprise securities | | ( | |||||

Corporate bonds and commercial paper | | ( | |||||

Total | $ | | $ | ( | |||

19

8. | Fair Value |

The table below summarizes the fair value of our cash equivalents and short-term investments measured at fair value on a recurring basis, and are categorized based upon the lowest level of significant input to the valuations (in thousands):

Assets at Fair Value as of September 30, 2023 | ||||||||||||

| Level 1 |

| Level 2 |

| Level 3 |

| Total | |||||

Money market funds | $ | | $ | — | $ | — | $ | | ||||

US treasury bills | — | | — | | ||||||||

Government-sponsored enterprise securities |

| — |

| |

| — |

| | ||||

Corporate bonds and commercial paper |

| — |

| |

| — |

| | ||||

Total | $ | | $ | | $ | — | $ | | ||||

Assets at Fair Value as of December 31, 2022 | ||||||||||||

| Level 1 |

| Level 2 |

| Level 3 |

| Total | |||||

Money market funds | $ | | $ | — | $ | — | $ | | ||||

US treasury bills | — | | — | | ||||||||

Government-sponsored enterprise securities |

| — |

| |

| — |

| | ||||

Corporate bonds and commercial paper |

| — |

| |

| — |

| | ||||

Total | $ | | $ | | $ | — | $ | | ||||

9.Debt

We have a Credit and Security Agreement (Credit Agreement) with MidCap Financial Trust (MidCap) entered on September 27, 2019 (Closing Date) and amended on March 29, 2021 (First Amendment), February 11, 2022 (Second Amendment) and July 27, 2022 (Third Amendment). The Credit Agreement provides for a $

The First Amendment to the Credit Agreement extended the period through which Tranche 3 was available to us. The Second Amendment to the Credit Agreement, among other things, amended the applicable funding conditions, applicable commitments and certain other terms relating to available credit facilities (Tranches 3 and 4), added additional term loan credit facility (Tranche 5), and revised certain terms related to the financial covenants.

Following the Third Amendment, the maturity date for the term loans is on September 1, 2026, and the interest-only period is through October 1, 2024. The interest rate applicable to the term loans under the amended Credit Agreement is the sum of one-month Secured Overnight Financing Rate (SOFR), plus an adjustment of

We may make voluntary prepayments, in whole or in part, subject to certain prepayment premiums and additional interest payments. The Credit Agreement also contains certain provisions, such as event of default and change in control provisions, which, if triggered, would require us to make mandatory prepayments on the term loan, which are subject to certain prepayment premiums and additional interest payments. The obligations under the amended Credit Agreement are secured by a perfected security interest in all of our assets including our intellectual property.

Debt issuance costs are recorded as a direct deduction from the outstanding principal balance of the term loan. As of September 30, 2023 and December 31, 2022, the unamortized issuance costs and debt discounts amounted to $

20

Interest expense, including amortization of the debt discount and accretion of the final fees related to the Credit Agreement for the three months ended September 30, 2023 and 2022 was $

The following table presents the future minimum principal payments of the outstanding loan as of September 30, 2023 (in thousands):

Remainder of 2023 | $ | — | |

2024 | | ||

2025 | | ||

2026 | | ||

Principal amount (Tranches 1, 2, 3 and 4) | $ | |

The amended Credit Agreement contains certain covenants which, among others, require us to deliver financial reports at designated times of the year and maintain minimum unrestricted cash and trailing net revenues. As of September 30, 2023, we were not in violation of any covenants.

10.Leases

We have a sublease agreement with Atara Biotherapeutics, Inc. (Atara) entered in October 2022 to sublease an office space located in South San Francisco, California. Subject to the terms of the sublease agreement, the lease term commenced in November 2022 and shall expire in May 2025. This leased facility is currently held as our new headquarters following the expiration of our previously leased facility in January 2023. The weighted average remaining term of our leases as of September 30, 2023 was years.

We previously leased our prior headquarter space located in South San Francisco, California with Healthpeak Properties, Inc. (formerly known as HCP BTC, LLC), and had a sublease agreement with an unrelated third-party to sublet a portion of the leased facility. Both leases expired in January 2023.

The components of our operating lease expense were as follows (in thousands):

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||

2023 | 2022 | 2023 | 2022 | |||||||||

Fixed operating lease expense |

| $ | |

| $ | | $ | |

| $ | | |

Variable operating lease expense | | | | | ||||||||

Total operating lease expense |

| $ | |

| $ | | $ | |

| $ | | |

Supplemental information related to our operating lease were as follow (in thousands):

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||

2023 | 2022 | 2023 | 2022 | |||||||||

Cash payments included in the measurement of operating lease liabilities | $ | | $ | | $ | | $ | | ||||

Supplemental information related to our operating sublease was as follow (in thousands):

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||

2023 | 2022 | 2023 | 2022 | |||||||||

Fixed sublease expense |

| $ | — |

| $ | | $ | |

| $ | | |

Variable sublease expense | — | | | | ||||||||

Sublease income | — | ( | ( | ( | ||||||||

Net |

| $ |

| $ | $ |

| $ | |||||

21

The following table presents the future lease payments as of September 30, 2023 (in thousands):

Remainder of 2023 | $ | | |

2024 | | ||

2025 | | ||

Total minimum payments required | $ | |

Item 2.Management’s Discussion and Analysis of Financial Condition and Results of Operations

This discussion and analysis should be read in conjunction with our financial statements and the accompanying notes included in this report and the audited financial statements and accompanying notes included in our Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC on March 7, 2023. Our financial results for the three and nine months ended September 30, 2023 are not necessarily indicative of results that may occur in future interim periods or for the full fiscal year.

This Quarterly Report on Form 10-Q contains statements indicating expectations about future performance and other forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act) and Section 21E of the Securities Exchange Act of 1934, as amended (Exchange Act), that involve risks and uncertainties. We usually use words such as “may,” “will,” “would,” “should,” “could,” “expect,” “plan,” “anticipate,” “might,” “believe,” “estimate,” “predict,” “intend,” or the negative of these terms or similar expressions to identify these forward-looking statements. These statements appear throughout this Quarterly Report on Form 10-Q and are statements regarding our current expectations, beliefs or intent, primarily with respect to our operations and related industry developments. Examples of these statements include, but are not limited to: our expectations regarding the impact of the global pandemic; our business and scientific strategies; risks and uncertainties associated with the commercialization and marketing of our products in the US and outside the US; risks that the FDA, EMA, the Medicines and Healthcare Products Regulatory Agency (MHRA) or other regulatory authorities may make adverse decisions regarding our products; the progress of our and our collaborators’ product development programs, including clinical testing, and the timing of results thereof; our corporate collaborations and revenues that may be received from our collaborations and the timing of those potential payments; our expectations with respect to regulatory submissions and approvals; our drug discovery technologies; our research and development expense; protection of our intellectual property and our intention to vigorously enforce our intellectual property rights; sufficiency of our cash and capital resources and the need for additional capital; and our operations and legal risks. You should not place undue reliance on these forward-looking statements. Our actual results could differ materially from those anticipated in these forward-looking statements for many reasons, including as a result of the risks and uncertainties discussed under the heading “Risk Factors” in Item 1A of Part II of this Quarterly Report on Form 10-Q. Any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as required by applicable law. New factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

22

Overview

We are a biotechnology company dedicated to discovering, developing and providing novel therapies that significantly improve the lives of patients with hematologic disorders and cancer. We focus on products that address signaling pathways that are critical to disease mechanisms.

Our first product approved by the FDA is TAVALISSE (fostamatinib disodium hexahydrate) tablets, the only approved oral SYK inhibitor for the treatment of adult patients with chronic ITP who have had an insufficient response to a previous treatment. The product is also commercially available in Europe and the UK (as TAVLESSE), and in Canada, Israel and Japan (as TAVALISSE) for the treatment of chronic ITP in adult patients.

Our second FDA approved product is REZLIDHIA (olutasidenib) capsules for the treatment of adult patients with R/R AML with a susceptible IDH1 mutation as detected by an FDA-approved test. We began our commercialization of REZLIDHIA in December 2022. We in-licensed olutasidenib from Forma (now Novo Nordisk), with exclusive, worldwide rights for its development, manufacturing and commercialization.

We continue to advance the development of our IRAK 1/4 inhibitor program, in an open-label, Phase 1b trial to determine the tolerability and preliminary efficacy of the drug in patients with lower-risk MDS who are refractory or resistant to prior therapies.

We have a RIPK1 inhibitor program in clinical development with our partner Lilly. We also have product candidates in clinical development with partners BerGenBio and Daiichi.

Business Updates

TAVALISSE IN ITP

For the nine months ended September 30, 2023, net product sales of TAVALISSE were $68.1 million, a 26% increase compared to the same period in 2022. The increase in our TAVALISSE net product sales was primarily driven by the increase in quantities sold as a result of increased number of patients under therapy, and increase in price per bottle, partly offset by the increase in revenue reserves mainly due to higher government rebates. Our first quarter net sales are typically impacted by the first quarter reimbursement issues such as the resetting of co-pays and the Medicare donut hole.

REZLIDHIA in R/R AML with mIDHI

For the nine months ended September 30, 2023, we recognized $6.7 million of net product sales of REZLIDHIA. We began the commercialization of REZLIDHIA in December 2022 following the FDA approval. On December 1, 2022, the FDA approved REZLIDHIA capsules for the treatment of adult patients with R/R AML with a susceptible IDH1 mutation as detected by an FDA-approved test. Our commercial efforts focus on targeting healthcare professionals (HCPs) who manage patients with R/R AML. For further discussions and other updates including recent publications on REZLIDHIA, refer to “Commercial Products – REZLIDHIA in R/R AML with mIDH1” section below.

We in-licensed olutasidenib from Forma (now Novo Nordisk), with exclusive, worldwide rights for development, manufacturing and commercialization of olutasidenib for any uses, including for the treatment of AML and other malignancies. In accordance with the terms of the license and transition services agreement, we paid an upfront fee of $2.0 million, with the potential to pay up to $67.5 million additional payments upon achievement of specified development and regulatory milestones and up to $165.5 million additional payments upon achievement of certain commercial milestones. In addition, subject to the terms and conditions of the license and transition services agreement, Forma (now Novo Nordisk) would be entitled to tiered royalty payments on net sales of licensed products at percentages ranging from low-teens to mid-thirties, as well as certain portions of our sublicensing revenue, subject to certain standard reductions and offsets. During the year ended December 31, 2022, certain milestones were met which entitled Forma (now Novo Nordisk) to receive a $17.5 million milestone payments. No new milestone was met during the nine months ended September 30, 2023. For further discussions, see “Note 4 - Sponsored Research and License Agreements and Government Contract” to our “Notes to Condensed Financial Statements” contained in Part I, Item 1 of this Quarterly Report on Form 10-Q.

23

R289, an Oral IRAK1/4 Inhibitor for Hematology-Oncology, Autoimmune, and Inflammatory Diseases

We continue to advance the development of our IRAK 1/4 inhibitor program, completing the evaluation of a new pro-drug formulation of R835, R289, in single-ascending and multiple ascending dose studies with positive safety results in 2021. In January 2022, we received clearance from the FDA on our clinical trial design to explore R289 in lower-risk MDS. The open-label, Phase 1b trial will determine the tolerability and preliminary efficacy of R289 in patients with lower-risk MDS who are refractory or resistant to prior therapies. In December 2022, we announced that we dosed the first patient in our Phase 1b trial of R289. The Phase 1b trial of R289 is expected to enroll approximately 22 patients. The primary objective of the trial is safety, with secondary and exploratory objectives to assess preliminary efficacy and characterize the pharmacokinetic and pharmacodynamic profile of R289. The safety and efficacy data from this Phase 1b trial, along with the safety and pharmacokinetic/pharmacodynamic data from the completed first-in-human study in heathy volunteers, are intended to be used to determine the recommended Phase 2 dose for future clinical development of R289 targeting lower-risk MDS. To date, target enrollment in the second cohort of the trial has been completed and we are currently enrolling patients in the third cohort. Preliminary results are expected by mid-year 2024.

Global Strategic Partnership with Lilly

Lilly is continuing to advance R552, an investigational, potent and selective RIPK1 inhibitor. Lilly has initiated the Phase 2a trial studying R552 in adult patients with moderately to severely active rheumatoid arthritis. The trial plans to enroll 100 patients globally. RIPK1 is implicated in a broad range of key inflammatory cellular processes and plays a key role in tumor necrosis factor signaling, especially in the induction of pro-inflammatory necroptosis. The program also includes RIPK1 compounds that cross the blood-brain barrier (CNS-penetrants) to address neurodegenerative diseases such as Alzheimer’s disease and amyotrophic lateral sclerosis.

Under the Lilly Agreement, we are responsible for 20% of the development costs for R552 in the US, Europe, and Japan, up to a specified cap. Lilly is responsible for funding the remainder of all development activities for R552 and other non-CNS disease development candidates. Under the Lilly Agreement (prior to an amendment as discussed below), we have the right to opt-out of co-funding the R552 development activities in the US, Europe and Japan at two different specified times and as a result receive lesser royalties from sales. Prior to us providing our first opt-out notice as discussed below, under the Lilly Agreement, we were required to fund our share of the R552 development activities in the US, Europe, and Japan up to a maximum funding commitment of $65.0 million through April 1, 2024. On September 28, 2023, we entered into an amendment to the Lilly Agreement which provides, among others, that if we exercise our first opt-out right, we have the right to opt-in to co-funding of R552 development, upon us providing notice to Lilly within 30 days of certain events, as specified in the Lilly Agreement. If we decide to exercise our opt-in right, we will be required to continue to share in global development costs, and if we later exercise our second opt-out right (no later than April 1, 2025), our share in global development costs will be up to a specified cap through December 31, 2025, as provided for in the Lilly Agreement. On September 29, 2023, we provided the first opt-out notice to Lilly. We will continue to fund our share of the R552 development activities up to $22.6 million through April 1, 2024 as provided for in the amended Lilly Agreement. Through September 30, 2023, Lilly billed us $17.7 million of the funding development costs and the amounts were fully paid as of September 30, 2023.

Fostamatinib in Hospitalized COVID-19 patients

We previously announced in November 2022 the top-line results from the FOCUS Phase 3 clinical trial to evaluate the safety and efficacy of fostamatinib in hospitalized COVID-19 patients without respiratory failure that have certain high-risk prognostic factors did not meet statistical significance in the primary efficacy endpoint of the number of days on oxygen through Day 29. Upon further analysis, we discovered an error by the contract research organization (CRO) in the application of a statistical stratification factor. The contracted programming CRO misinterpreted receipt of prior COVID-19 treatment of interest 14 days before randomization (regardless of continuation post randomization), as those medications taken 14 days before the date of randomization and ended prior to the day of randomization. After correcting for this statistical error, the primary endpoint of the study was met; those who received fostamatinib had lower mean days on oxygen than those who received placebo (4.8 vs. 7.6 days, p=0.0136). Further, fostamatinib showed significance or trend towards significance in all secondary endpoints of reducing mortality and morbidity compared to placebo after correcting for the error. The results were recently presented at the IDWeek 2023 held on October 11-15, 2023 in Boston, Massachusetts. During our continued analysis regarding fostamatinib in hospitalized COVID-19

24

patients, we provided the updated analysis to the FDA and our partner, the US Department of Defense. Given the end of the federal COVID-19 Public Health Emergency (PHE) in May 2023, and based on feedback from the FDA, US Department of Defense and other advisors regarding the program’s regulatory requirements, costs, timeline and potential for success, we decided not to submit an Emergency Use Authorization (EUA) or sNDA.

The Accelerating COVID-19 Therapeutic Inventions and Vaccines Phase 2/3 trial (ACTIV-4 Host Tissue Trial), conducted and sponsored by the National Institute of Health (NIH)/National Heart, Lung, and Blood Institute (NHLBI), is a randomized, placebo-controlled trial of therapies, including fostamatinib, targeting the host response to COVID-19 in hospitalized patients. The ACTIV-4 Host Tissue Trial evaluated fostamatinib in a targeted population of approximately 600 hospitalized patients with COVID-19, 300 fostamatinib versus 300 placebo. During the first quarter of 2023, an interim analysis of the trial was completed by the Data and Safety Monitoring Board (DSMB) with a recommendation for the trial to continue. In September 2023, the DSMB recommended that the fostamatinib study arm of the ACTIV-4 Host Tissue Trial platform cease enrollment. Based on the DSMB’s review of a conditional power analysis, the DSMB determined that there was an extremely low likelihood of fostamatinib providing benefits related to the primary outcome (oxygen free days) or other secondary outcomes in patients hospitalized and on oxygen therapy for COVID-19. No safety concerns were identified. The NIH/NHLBI concurs with the DSMBs recommendation and has asked the trial investigators to cease enrollment, complete follow-up for participants already enrolled, and complete study closeout. The full study data will be analyzed and disseminated as previously planned.

Update on Current and Potential Future Impact of COVID-19 on our Business

The COVID-19 pandemic has adversely impacted our business and operations. Although the World Health Organization declared the end of COVID-19 PHE in May 2023, the degree to which another global pandemic may affect our business and operations and financial condition in the future will depend on developments that are highly uncertain and beyond our knowledge or control. As such, we cannot ascertain the full extent of the future impacts it may have on our business. See also “Part I, Item 1A, Risk Factors” of this Quarterly Report on Form 10-Q for additional information on risks and uncertainties related to the COVID-19 pandemic.

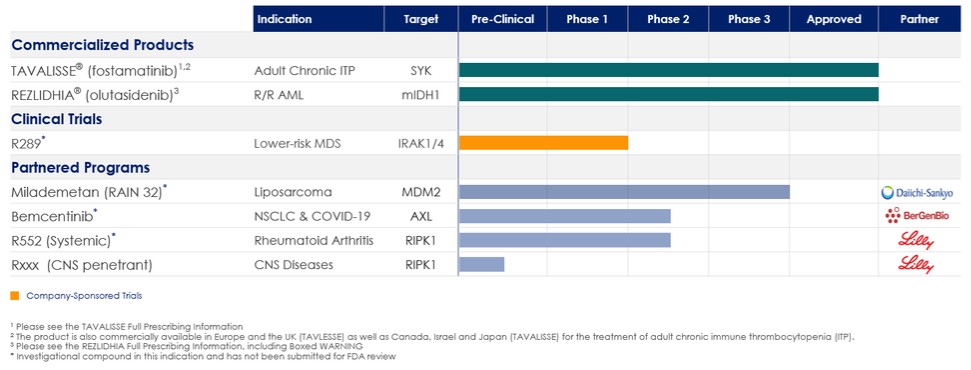

Our Product Portfolio

The following table summarizes our portfolio:

25

Commercial Products

TAVALISSE/Fostamatinib in ITP

Chronic ITP affects an estimated 81,300 adult patients in the US. In patients with ITP, the immune system attacks and destroys the body’s own blood platelets, which play an active role in blood clotting and healing. ITP patients can suffer extraordinary bruising, bleeding and fatigue as a result of low platelet counts. Current therapies for ITP include steroids, blood platelet production boosters that imitate thrombopoietin (TPO) and splenectomy.

Taken in tablet form, fostamatinib blocks the activation of SYK inside immune cells. ITP is typically characterized by the body producing antibodies that attach to healthy platelets in the blood stream. Immune cells recognize these antibodies and affix to them, which activates the SYK enzyme inside the immune cell, and triggers the destruction of the antibody and the attached platelet. When SYK is inhibited by fostamatinib, it interrupts this immune cell function and allows the platelets to escape destruction. The results of our Phase 2 clinical trial, in which fostamatinib was orally administered to 16 adults with chronic ITP, published in Blood, showed that fostamatinib significantly increased the platelet counts of certain ITP patients, including those who had failed other currently available agents.

Our Fostamatinib for Immune Thrombocytopenia (FIT) Phase 3 clinical program had a total of 150 ITP patients which were randomized into two identical multi-center, double-blind, placebo-controlled clinical trials. The patients were diagnosed with persistent or chronic ITP, and had blood platelet counts consistently below 30,000 per microliter of blood. Two-thirds of the subjects received fostamatinib orally at 100 mg twice daily (bid) and the other third received placebo on the same schedule. Subjects were expected to remain on treatment for up to 24 weeks. At week four of treatment, subjects who failed to meet certain platelet counts and met certain tolerability thresholds could have their dosage of fostamatinib (or corresponding placebo) increased to 150 mg bid. The primary efficacy endpoint of this program was a stable platelet response by week 24 with platelet counts at or above 50,000 per microliter of blood for at least four of the final six qualifying blood draws. In August 2016, we announced the results of the first FIT study, reporting that fostamatinib met the study’s primary efficacy endpoint. The study showed that 18% of patients receiving fostamatinib achieved a stable platelet response compared to none receiving a placebo control. In October 2016, we announced the results of the second FIT study, reporting that the response rate (16% in the treatment group, versus 4% in the placebo group) was consistent with the first study, although the difference was not statistically significant. In the ITP double-blind studies, the most commonly reported adverse reactions occurring in at least 5% of patients treated with TAVALISSE were diarrhea, hypertension, nausea, dizziness, increased alanine aminotransferase, increased aspartate aminotransferase, respiratory infection, rash, abdominal pain, fatigue, chest pain, and neutropenia. Serious adverse drug reactions occurring in at least 1% of patients treated with TAVALISSE in the ITP double-blind studies were febrile neutropenia, diarrhea, pneumonia, and hypertensive crisis. A post-hoc analysis from our Phase 3 clinical program in adult patients with chronic ITP, highlighting the potential benefit of using TAVALISSE in earlier lines of therapy, was published in the British Journal of Haematology in July 2020. In addition, a report describing the long-term safety and durable efficacy of TAVALISSE with up to 5 years of treatment was published in Therapeutic Advances in Hematology in 2021.

TAVALISSE was approved by the FDA in April 2018 for the treatment of ITP in adult patients who have had an insufficient response to a previous treatment, and successfully launched in the US in May 2018. The FDA granted orphan drug designation for fostamatinib for the treatment of ITP in August 2015.

In January 2020, the EC granted a centralized MA for fostamatinib (TAVLESSE) valid throughout the European Union (EU) and in the UK after the departure of the UK from the EU for the treatment of chronic ITP in adult patients who are refractory to other treatments. In December 2022, Japan’s PMDA approved the NDA for fostamatinib in chronic ITP.

26

Competitive landscape for TAVALISSE

Our industry is intensely competitive and subject to rapid and significant technological change. TAVALISSE is competing with other existing therapies. In addition, a number of companies are pursuing the development of pharmaceuticals that target the same diseases and conditions that we are targeting. For example, there are existing therapies and drug candidates in development for the treatment of ITP that may be alternative therapies to TAVALISSE.

Currently, corticosteroids remain the most common first line therapy for ITP, occasionally in conjunction with intravenous immunoglobulin (IVIg) or anti-Rh(D) to help further augment platelet count recovery, particularly in emergency situations. However, it has been estimated that frontline agents lead to durable remissions in only a small percentage of newly diagnosed adults with ITP. Moreover, concerns with steroid-related side effects often restrict therapy to approximately four weeks. As such, many patients progress to persistent or chronic ITP, requiring other forms of therapeutic intervention. In long-term treatment of chronic ITP, patients are often cycled through several therapies over time in order to maintain a sufficient response to the disease.

Other approaches to treat ITP are varied in their mechanism of action, and there is no consensus about the sequence of their use. Options include splenectomy, thrombopoietin receptor agonists (TPO-RAs) and various immunosuppressants (such as rituximab). The response rate criteria of the above-mentioned options vary, precluding a comparison of response rates for individual therapies.

Even with the above treatment options, a significant number of patients remain severely thrombocytopenic for long durations and are subject to risk of spontaneous or trauma-induced hemorrhage. The addition of fostamatinib to the currently available treatment options could be beneficial because it has a different mechanism of action than any of the therapies that are currently available. Fostamatinib is a potent and relatively selective SYK inhibitor, and its inhibition of Fc receptors and B-cell receptors of signaling pathways make it a potentially broad immunomodulatory agent.

Other products in the US that are approved by the FDA to increase platelet production through binding to TPO receptors on megakaryocyte precursors include PROMACTA® (Novartis International AG (Novartis)), Nplate® (Amgen, Inc.) and DOPTELET® (Swedish Orphan Biovitrum AB). In the longer term, we may eventually face competition from potential manufacturers of generic versions of our marketed products, including the proposed generic version of TAVALISSE that is the subject of an Abbreviated New Drug Application (ANDA) submitted to the FDA by Annora Pharma Private Limited (Annora), which, if approved and allowed to enter the market, it could result in significant decreases in the revenue derived from sale of TAVALISSE and thereby materially harm our business and financial condition.

Commercial activities, including sales and marketing

Our marketing and sales efforts are focused on hematologists and hematologist-oncologists in the US who manage chronic adult ITP patients. We have a fully integrated commercial team consisting of sales, marketing, market access, and commercial operations functions. Our sales team promotes our products in the US using customary pharmaceutical company practices, and we concentrate our efforts on hematologists and hematologist-oncologists. Our products are sold initially through third-party wholesale distribution and specialty pharmacy channels and group purchasing organizations before being ultimately prescribed to patients. To facilitate our commercial activities in the US, we also enter into arrangements with various third parties, including advertising agencies, market research firms and other sales-support-related services as needed. We believe that our commercial team and distribution practices are adequate to ensure that our marketing efforts reach relevant customers and deliver our products to patients in a timely and compliant fashion. Also, to help ensure that all eligible patients in the US have appropriate access to our products, we have established a reimbursement and patient support program called Rigel OneCare (ROC). Through ROC, we provide co-pay assistance to qualified, commercially insured patients to help minimize out-of-pocket costs and provide free product to uninsured or under-insured patients who meet certain established clinical and financial eligibility criteria. In addition, ROC is designed to provide reimbursement support, such as information related to prior authorizations, benefits investigations and appeals.

27

We have entered into various license and commercial agreements to commercialize fostamatinib globally, but we retain the global rights to fostamatinib outside of the respective territories under such license and commercial agreements. Our collaborative partner Grifols has launched TAVLESSE in the UK and certain countries in Europe including Germany, France, Italy and Spain, and continues a phased rollout across the rest of Europe. Our collaborative partner Medison has also launched TAVALISSE in Canada and Israel. Further, our collaborative partner Kissei has also recently launched TAVALISSE in Japan.

Fostamatinib in Europe/Turkey

We have a commercialization license agreement with Grifols entered in January 2019, for an exclusive rights to commercialize fostamatinib for human diseases, including chronic ITP and AIHA, and non-exclusive rights to develop, fostamatinib in their territory. Grifols territory includes Europe, the UK, Turkey, the Middle East, North Africa and Russia (including Commonwealth of Independent States).

We are responsible for performing and funding certain development activities for fostamatinib for ITP and AIHA and Grifols is responsible for all other development activities for fostamatinib in such territories. We remain responsible for the manufacturing and supply of fostamatinib for all development and commercialization activities under the agreement. Under the terms of the agreement, we received an upfront cash payment of $30.0 million and will be eligible to receive regulatory and commercial milestones of up to $297.5 million. In January 2020, the EC granted a MA for fostamatinib for the treatment of chronic ITP in adult patients who are refractory to other treatments. With this approval, we received a $20.0 million non-refundable milestone payment, consisted of a $17.5 million payment due upon MAA approval by the EMA of fostamatinib for the first indication and a $2.5 million creditable advance royalty payment due upon EMA approval of fostamatinib in the first indication. We are also entitled to receive stepped double-digit royalty payments based on tiered net sales which may reach 30% of net sales.

Fostamatinib in Japan/Asia

We have an exclusive license and supply agreement with Kissei entered in October 2018, to develop and commercialize fostamatinib in all current and potential indications in Kissei’s territory which includes Japan, China, Taiwan and the Republic of Korea. Kissei is a Japan-based pharmaceutical company addressing patients’ unmet medical needs through its research, development and commercialization efforts, as well as through collaborations with partners.

Under the terms of the agreement, we received an upfront cash payment of $33.0 million, with the potential for an additional $147.0 million in development and commercial milestone payments, and will receive product transfer price payments in the mid to upper twenty percent range based on tiered net sales for the exclusive supply of fostamatinib. Kissei receives exclusive rights to fostamatinib in ITP and all future indications in Kissei’s territory.