00010205692020FYFALSEus-gaap:AccountingStandardsUpdate201409Memberus-gaap:AccountingStandardsUpdate201602Memberus-gaap:AccountsPayableAndAccruedLiabilitiesCurrentus-gaap:AccountsPayableAndAccruedLiabilitiesCurrentP5YP1YP1Yus-gaap:AccountsPayableAndAccruedLiabilitiesCurrentus-gaap:AccountsPayableAndAccruedLiabilitiesCurrentus-gaap:PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationus-gaap:PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationus-gaap:LongTermDebtAndCapitalLeaseObligationsCurrentus-gaap:LongTermDebtAndCapitalLeaseObligationsCurrentus-gaap:LongTermDebtAndCapitalLeaseObligationsus-gaap:LongTermDebtAndCapitalLeaseObligationsP1Y33364.37565.3755.7533.8755.3754.8755.2554.8755.254.55.625404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404040404000010205692020-01-012020-12-31iso4217:USD00010205692020-06-30xbrli:shares00010205692021-02-1900010205692020-12-3100010205692019-12-31iso4217:USDxbrli:shares00010205692019-01-012019-12-3100010205692018-01-012018-12-3100010205692017-12-310001020569us-gaap:CommonStockMember2017-12-310001020569us-gaap:AdditionalPaidInCapitalMember2017-12-310001020569us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2017-12-310001020569us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-12-310001020569us-gaap:NoncontrollingInterestMember2017-12-310001020569irm:RedeemableNoncontrollingInterestsMember2017-12-3100010205692017-01-012017-12-310001020569srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2017-12-310001020569srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2017-12-310001020569us-gaap:CommonStockMember2018-01-012018-12-310001020569us-gaap:AdditionalPaidInCapitalMember2018-01-012018-12-310001020569us-gaap:OverAllotmentOptionMember2018-01-012018-12-310001020569us-gaap:CommonStockMemberus-gaap:OverAllotmentOptionMember2018-01-012018-12-310001020569us-gaap:AdditionalPaidInCapitalMemberus-gaap:OverAllotmentOptionMember2018-01-012018-12-310001020569irm:AtTheMarketATMEquityProgramMember2018-01-012018-12-310001020569us-gaap:CommonStockMemberirm:AtTheMarketATMEquityProgramMember2018-01-012018-12-310001020569us-gaap:AdditionalPaidInCapitalMemberirm:AtTheMarketATMEquityProgramMember2018-01-012018-12-310001020569irm:RedeemableNoncontrollingInterestsMember2018-01-012018-12-310001020569us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2018-01-012018-12-310001020569us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310001020569us-gaap:NoncontrollingInterestMember2018-01-012018-12-3100010205692018-12-310001020569us-gaap:CommonStockMember2018-12-310001020569us-gaap:AdditionalPaidInCapitalMember2018-12-310001020569us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2018-12-310001020569us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310001020569us-gaap:NoncontrollingInterestMember2018-12-310001020569irm:RedeemableNoncontrollingInterestsMember2018-12-310001020569srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-12-310001020569srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2018-12-310001020569us-gaap:CommonStockMember2019-01-012019-12-310001020569us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001020569irm:RedeemableNoncontrollingInterestsMember2019-01-012019-12-310001020569us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2019-01-012019-12-310001020569us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001020569us-gaap:NoncontrollingInterestMember2019-01-012019-12-310001020569us-gaap:CommonStockMember2019-12-310001020569us-gaap:AdditionalPaidInCapitalMember2019-12-310001020569us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2019-12-310001020569us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001020569us-gaap:NoncontrollingInterestMember2019-12-310001020569irm:RedeemableNoncontrollingInterestsMember2019-12-310001020569us-gaap:CommonStockMember2020-01-012020-12-310001020569us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001020569irm:RedeemableNoncontrollingInterestsMember2020-01-012020-12-310001020569us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2020-01-012020-12-310001020569us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001020569us-gaap:NoncontrollingInterestMember2020-01-012020-12-310001020569us-gaap:CommonStockMember2020-12-310001020569us-gaap:AdditionalPaidInCapitalMember2020-12-310001020569us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2020-12-310001020569us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001020569us-gaap:NoncontrollingInterestMember2020-12-310001020569irm:RedeemableNoncontrollingInterestsMember2020-12-310001020569us-gaap:AllowanceForCreditLossMember2019-12-310001020569us-gaap:AllowanceForCreditLossMember2020-01-012020-12-310001020569us-gaap:AllowanceForCreditLossMember2020-12-310001020569us-gaap:AllowanceForCreditLossMember2018-12-310001020569us-gaap:AllowanceForCreditLossMember2019-01-012019-12-310001020569us-gaap:AllowanceForCreditLossMember2017-12-310001020569us-gaap:AllowanceForCreditLossMember2018-01-012018-12-31irm:fundirm:bankxbrli:pure0001020569irm:InvestmentInSingleMutualFundMemberus-gaap:CreditConcentrationRiskMember2020-01-012020-12-310001020569us-gaap:BuildingAndBuildingImprovementsMembersrt:MinimumMember2020-01-012020-12-310001020569srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2020-01-012020-12-310001020569srt:MinimumMemberus-gaap:LeaseholdImprovementsMember2020-01-012020-12-310001020569srt:MaximumMemberus-gaap:LeaseholdImprovementsMember2020-01-012020-12-310001020569irm:RackingMembersrt:MinimumMember2020-01-012020-12-310001020569srt:MaximumMemberirm:RackingMember2020-01-012020-12-310001020569srt:MinimumMemberirm:WarehouseEquipmentAndVehiclesMember2020-01-012020-12-310001020569srt:MaximumMemberirm:WarehouseEquipmentAndVehiclesMember2020-01-012020-12-310001020569srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2020-01-012020-12-310001020569srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2020-01-012020-12-310001020569irm:ComputerHardwareAndSoftwareMembersrt:MinimumMember2020-01-012020-12-310001020569srt:MaximumMemberirm:ComputerHardwareAndSoftwareMember2020-01-012020-12-310001020569us-gaap:LandMember2020-12-310001020569us-gaap:LandMember2019-12-310001020569us-gaap:BuildingAndBuildingImprovementsMember2020-12-310001020569us-gaap:BuildingAndBuildingImprovementsMember2019-12-310001020569us-gaap:LeaseholdImprovementsMember2020-12-310001020569us-gaap:LeaseholdImprovementsMember2019-12-310001020569irm:RackingMember2020-12-310001020569irm:RackingMember2019-12-310001020569irm:WarehouseEquipmentAndVehiclesMember2020-12-310001020569irm:WarehouseEquipmentAndVehiclesMember2019-12-310001020569us-gaap:FurnitureAndFixturesMember2020-12-310001020569us-gaap:FurnitureAndFixturesMember2019-12-310001020569irm:ComputerHardwareAndSoftwareMember2020-12-310001020569irm:ComputerHardwareAndSoftwareMember2019-12-310001020569us-gaap:ConstructionInProgressMember2020-12-310001020569us-gaap:ConstructionInProgressMember2019-12-310001020569srt:MinimumMember2020-12-310001020569srt:MaximumMember2020-12-31irm:renewal_option0001020569irm:VehicleAndEquipmentMembersrt:MinimumMember2020-12-310001020569srt:MaximumMemberirm:VehicleAndEquipmentMember2020-12-310001020569srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201602Member2019-01-01irm:lease00010205692020-10-012020-12-310001020569irm:A14FacilitiesInTheUnitedStatesMember2020-10-012020-12-31irm:facility0001020569irm:A14FacilitiesInTheUnitedStatesMember2020-07-012020-09-300001020569irm:FrankfurtJVMember2020-10-012020-12-310001020569irm:IronMountainIronCloudMember2019-01-012019-12-3100010205692018-10-012018-12-3100010205692020-01-012020-03-310001020569irm:GlobalRecordsandInformationManagementBusinessMemberirm:NorthAmericanRecordsAndInformationManagementMember2019-12-310001020569irm:GlobalRecordsandInformationManagementBusinessMemberirm:WesternEuropeMember2019-12-310001020569irm:GlobalRecordsandInformationManagementBusinessMembersrt:LatinAmericaMember2019-12-310001020569irm:GlobalRecordsandInformationManagementBusinessMemberirm:AustraliaNewZealandAndSouthAfricaMember2019-12-310001020569irm:GlobalRecordsandInformationManagementBusinessMemberirm:AsiaReportingUnitMember2019-12-310001020569irm:GlobalDataCenterMemberirm:GlobalDataCenterBusinessMember2019-12-310001020569irm:FineArtsMemberus-gaap:CorporateAndOtherMember2019-12-310001020569irm:EntertainmentServicesMemberus-gaap:CorporateAndOtherMember2019-12-310001020569irm:TechnologyEscrowServicesMemberus-gaap:CorporateAndOtherMember2019-12-310001020569irm:GlobalRecordsandInformationManagementBusinessMemberirm:NorthAmericanRecordsAndInformationManagementMember2020-12-310001020569irm:GlobalRecordsandInformationManagementBusinessMemberirm:WesternEuropeMember2020-12-310001020569irm:GlobalRecordsandInformationManagementBusinessMembersrt:LatinAmericaMember2020-12-310001020569irm:GlobalRecordsandInformationManagementBusinessMemberirm:AustraliaNewZealandAndSouthAfricaMember2020-12-310001020569irm:GlobalRecordsandInformationManagementBusinessMemberirm:AsiaReportingUnitMember2020-12-310001020569irm:GlobalDataCenterMemberirm:GlobalDataCenterBusinessMember2020-12-310001020569irm:FineArtsMemberus-gaap:CorporateAndOtherMember2020-12-310001020569irm:EntertainmentServicesMemberus-gaap:CorporateAndOtherMember2020-12-310001020569irm:TechnologyEscrowServicesMemberus-gaap:CorporateAndOtherMember2020-12-310001020569irm:GlobalRecordsandInformationManagementBusinessMember2018-12-310001020569irm:GlobalDataCenterBusinessMember2018-12-310001020569us-gaap:CorporateAndOtherMember2018-12-310001020569irm:GlobalRecordsandInformationManagementBusinessMember2019-01-012019-12-310001020569irm:GlobalDataCenterBusinessMember2019-01-012019-12-310001020569us-gaap:CorporateAndOtherMember2019-01-012019-12-310001020569irm:GlobalRecordsandInformationManagementBusinessMember2019-12-310001020569irm:GlobalDataCenterBusinessMember2019-12-310001020569us-gaap:CorporateAndOtherMember2019-12-310001020569irm:GlobalRecordsandInformationManagementBusinessMember2020-01-012020-12-310001020569irm:GlobalDataCenterBusinessMember2020-01-012020-12-310001020569us-gaap:CorporateAndOtherMember2020-01-012020-12-310001020569irm:GlobalRecordsandInformationManagementBusinessMember2020-12-310001020569irm:GlobalDataCenterBusinessMember2020-12-310001020569us-gaap:CorporateAndOtherMember2020-12-310001020569us-gaap:CustomerRelationshipsMembersrt:MinimumMember2020-01-012020-12-310001020569us-gaap:CustomerRelationshipsMembersrt:MaximumMember2020-01-012020-12-310001020569irm:CustomerInducementsCurrentRecordManagementVendorOrPaymentsToCustomersMembersrt:MinimumMember2020-01-012020-12-310001020569irm:CustomerInducementsCurrentRecordManagementVendorOrPaymentsToCustomersMembersrt:MaximumMember2020-01-012020-12-310001020569us-gaap:CustomerRelationshipsMember2020-12-310001020569us-gaap:CustomerRelationshipsMember2019-12-310001020569irm:CustomerInducementsMember2020-12-310001020569irm:CustomerInducementsMember2019-12-310001020569irm:DataCenterMember2020-12-310001020569irm:DataCenterMember2019-12-310001020569irm:CommissionsMember2020-12-310001020569irm:CommissionsMember2019-12-310001020569us-gaap:CustomerRelatedIntangibleAssetsMember2020-01-012020-12-310001020569us-gaap:CustomerRelatedIntangibleAssetsMember2019-01-012019-12-310001020569us-gaap:CustomerRelatedIntangibleAssetsMember2018-01-012018-12-310001020569irm:LeasesAcquiredInPlaceandTenantRelationshipsMember2020-01-012020-12-310001020569irm:LeasesAcquiredInPlaceandTenantRelationshipsMember2019-01-012019-12-310001020569irm:LeasesAcquiredInPlaceandTenantRelationshipsMember2018-01-012018-12-310001020569irm:CommissionsMember2020-01-012020-12-310001020569irm:CommissionsMember2019-01-012019-12-310001020569irm:CommissionsMember2018-01-012018-12-310001020569irm:PermanentWithdrawalFeesMember2020-01-012020-12-310001020569irm:PermanentWithdrawalFeesMember2019-01-012019-12-310001020569irm:PermanentWithdrawalFeesMember2018-01-012018-12-310001020569irm:AmortizationExpenseIncludedInDepreciationAndAmortizationMember2020-12-310001020569irm:AmortizationExpenseChargedToRevenuesMemberirm:PermanentWithdrawalFeesMember2020-12-310001020569us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001020569us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001020569us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001020569us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-310001020569us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:BankTimeDepositsMember2020-12-310001020569us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:BankTimeDepositsMember2020-12-310001020569us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:BankTimeDepositsMember2020-12-310001020569us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:BankTimeDepositsMember2020-12-310001020569us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001020569us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001020569us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001020569us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-310001020569us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001020569us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001020569us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001020569us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-310001020569us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001020569us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001020569us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001020569us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-310001020569us-gaap:AccumulatedTranslationAdjustmentMember2017-12-310001020569irm:AccumulatedGainLossNetDerivativesParentMember2017-12-310001020569us-gaap:AccumulatedTranslationAdjustmentMember2018-01-012018-12-310001020569irm:AccumulatedGainLossNetDerivativesParentMember2018-01-012018-12-310001020569us-gaap:AccumulatedTranslationAdjustmentMember2018-12-310001020569irm:AccumulatedGainLossNetDerivativesParentMember2018-12-310001020569us-gaap:AccumulatedTranslationAdjustmentMember2019-01-012019-12-310001020569irm:AccumulatedGainLossNetDerivativesParentMember2019-01-012019-12-310001020569us-gaap:AccumulatedTranslationAdjustmentMember2019-12-310001020569irm:AccumulatedGainLossNetDerivativesParentMember2019-12-310001020569us-gaap:AccumulatedTranslationAdjustmentMember2020-01-012020-12-310001020569irm:AccumulatedGainLossNetDerivativesParentMember2020-01-012020-12-310001020569us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310001020569irm:AccumulatedGainLossNetDerivativesParentMember2020-12-310001020569irm:IntakeCostsMember2020-12-310001020569irm:CommissionsMember2020-12-310001020569irm:IntakeCostsMember2020-12-310001020569irm:IntakeCostsMember2019-12-310001020569irm:CommissionsMember2020-12-310001020569irm:CommissionsMember2019-12-310001020569irm:IntakeCostsMember2020-01-012020-12-310001020569irm:IntakeCostsMember2019-01-012019-12-310001020569irm:IntakeCostsMember2018-01-012018-12-310001020569irm:CommissionsMember2020-01-012020-12-310001020569irm:CommissionsMember2019-01-012019-12-310001020569irm:CommissionsMember2018-01-012018-12-310001020569irm:GlobalDataCenterBusinessMember2018-01-012018-12-310001020569irm:GlobalDataCenterBusinessMemberirm:StorageRentalPowerAndConnectivityMember2020-01-012020-12-310001020569irm:GlobalDataCenterBusinessMemberirm:StorageRentalPowerAndConnectivityMember2019-01-012019-12-310001020569irm:GlobalDataCenterBusinessMemberirm:StorageRentalPowerAndConnectivityMember2018-01-012018-12-310001020569irm:DataCenterMember2020-12-310001020569irm:ThreeYearVestingOptionMember2020-01-012020-12-310001020569irm:StockAndCashIncentivePlan2014Member2020-12-310001020569irm:EmployeeAndNonEmployeesStockOptionMember2020-01-012020-12-310001020569irm:EmployeeAndNonEmployeesStockOptionMember2019-01-012019-12-310001020569irm:EmployeeAndNonEmployeesStockOptionMember2018-01-012018-12-310001020569irm:EmployeeAndNonEmployeesStockOptionMember2019-12-310001020569irm:EmployeeAndNonEmployeesStockOptionMember2020-12-310001020569irm:RestrictedStockAndRestrictedStockUnitsMember2020-01-012020-12-310001020569us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001020569us-gaap:RestrictedStockUnitsRSUMember2019-01-012019-12-310001020569us-gaap:RestrictedStockUnitsRSUMember2018-01-012018-12-310001020569irm:RestrictedStockAndRestrictedStockUnitsMember2019-12-310001020569irm:RestrictedStockAndRestrictedStockUnitsMember2020-12-310001020569irm:PredefinedTargetsOfRevenueAndReturnOnInvestedCapitalOrAdjustedEBITDAMembersrt:MinimumMemberus-gaap:PerformanceSharesMember2020-12-310001020569irm:PredefinedTargetsOfRevenueAndReturnOnInvestedCapitalOrAdjustedEBITDAMembersrt:MaximumMemberus-gaap:PerformanceSharesMember2020-12-310001020569us-gaap:PerformanceSharesMember2020-01-012020-12-310001020569srt:MinimumMemberirm:ShareholderReturnOfCommonStockMemberus-gaap:PerformanceSharesMember2020-12-310001020569srt:MaximumMemberirm:ShareholderReturnOfCommonStockMemberus-gaap:PerformanceSharesMember2020-12-310001020569us-gaap:PerformanceSharesMember2019-02-202019-02-200001020569irm:PerformanceUnitsOriginalAwardsMember2019-01-012019-12-310001020569irm:PerformanceUnitsOriginalAwardsMember2018-01-012018-12-310001020569irm:TwoThousandSixteenMemberMemberus-gaap:PerformanceSharesMember2020-12-310001020569irm:TwoThousandSeventeenMemberus-gaap:PerformanceSharesMember2019-12-310001020569irm:TwoThousandEighteenMemberus-gaap:PerformanceSharesMember2018-12-310001020569us-gaap:PerformanceSharesMember2019-01-012019-12-310001020569us-gaap:PerformanceSharesMember2018-01-012018-12-310001020569irm:PerformanceUnitsOriginalAwardsMember2019-12-310001020569irm:PerformanceUnitsAdjustmentsMember2019-12-310001020569us-gaap:PerformanceSharesMember2019-12-310001020569irm:PerformanceUnitsOriginalAwardsMember2020-01-012020-12-310001020569irm:PerformanceUnitsAdjustmentsMember2020-01-012020-12-310001020569irm:PerformanceUnitsOriginalAwardsMember2020-12-310001020569irm:PerformanceUnitsAdjustmentsMember2020-12-310001020569us-gaap:PerformanceSharesMember2020-12-31irm:offering_period0001020569us-gaap:EmployeeStockMember2020-12-310001020569us-gaap:EmployeeStockMember2020-01-012020-12-310001020569us-gaap:EmployeeStockMember2019-01-012019-12-310001020569us-gaap:EmployeeStockMember2018-01-012018-12-310001020569irm:RevenueGrowthAndReturnOnInvestedCapitalMemberus-gaap:PerformanceSharesMember2020-01-012020-12-310001020569irm:OSGInvestmentMember2020-01-080001020569irm:OSGAcquisitionMember2020-01-090001020569irm:OSGAcquisitionMember2020-01-092020-01-090001020569irm:OSGInvestmentMember2020-01-012020-03-310001020569irm:StorageRecordsManagementAndArtStorageCompaniesMember2020-02-172020-02-17irm:company0001020569irm:StorageandDataManagementCompanyMember2019-01-012019-12-310001020569irm:ArtStorageCompanyMember2019-01-012019-12-310001020569irm:StorageRecordsManagementAndArtStorageCompaniesMember2019-01-012019-12-310001020569irm:StorageRecordsManagementAndArtStorageCompaniesMembersrt:MinimumMember2019-01-012019-12-310001020569irm:StorageRecordsManagementAndArtStorageCompaniesMembersrt:MaximumMember2019-01-012019-12-31irm:data_center0001020569irm:IODataCenterLLCMember2018-01-100001020569irm:IODataCenterLLCMember2018-01-102018-01-100001020569irm:IODataCenterLLCMember2019-02-012019-02-28iso4217:EUR0001020569irm:EvoSwitchMember2018-05-252018-05-250001020569irm:EvoSwitchMember2018-05-250001020569irm:CreditSuisseDataCenterAcquisitionMember2018-03-08iso4217:GBP0001020569irm:CreditSuisseDataCenterAcquisitionMember2018-03-082018-03-08iso4217:SGD0001020569irm:StorageandDataManagementCompanyMember2018-01-012018-12-310001020569irm:ArtStorageCompanyMember2018-01-012018-12-310001020569irm:Other2018IndividuallyImmaterialBusinessAcquisitionsMember2018-01-012018-12-310001020569irm:Other2018IndividuallyImmaterialBusinessAcquisitionsMembersrt:MinimumMember2018-01-012018-12-310001020569irm:Other2018IndividuallyImmaterialBusinessAcquisitionsMembersrt:MaximumMember2018-01-012018-12-310001020569us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2020-01-012020-12-310001020569us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2019-01-012019-12-310001020569irm:IODataCenterLLCMember2018-01-012018-12-310001020569us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2018-01-012018-12-310001020569irm:SeriesofIndividuallyImmaterialBusinessAcquisitionsandIODCMember2018-01-012018-12-310001020569us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2020-12-310001020569us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2019-12-310001020569irm:IODataCenterLLCMember2018-12-310001020569us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2018-12-310001020569irm:SeriesofIndividuallyImmaterialBusinessAcquisitionsandIODCMember2018-12-310001020569irm:SeriesofIndividuallyImmaterialBusinessAcquisitionsandIODCMember2020-01-012020-12-310001020569irm:SeriesofIndividuallyImmaterialBusinessAcquisitionsandIODCMember2019-01-012019-12-310001020569irm:EvoSwitchMember2018-01-012018-12-310001020569us-gaap:CustomerRelationshipsMember2020-01-012020-12-310001020569us-gaap:CustomerRelationshipsMember2019-01-012019-12-310001020569us-gaap:CustomerRelationshipsMember2018-01-012018-12-310001020569us-gaap:LeasesAcquiredInPlaceMember2018-01-012018-12-310001020569irm:DataCenterCustomerRelationshipsMember2018-01-012018-12-310001020569irm:DataCenterAboveMarketLeasesMember2018-01-012018-12-310001020569irm:DataCenterBelowMarketLeasesMember2018-01-012018-12-31utr:sqft0001020569irm:FrankfurtJVMemberirm:AGCEquityPartnersMember2020-10-31utr:MW0001020569irm:FrankfurtJVMember2020-10-310001020569irm:FrankfurtJVMember2020-10-012020-10-310001020569irm:FrankfurtJVMembersrt:ScenarioForecastMember2021-04-012021-06-300001020569irm:FrankfurtJVMember2020-12-310001020569irm:MakeSpaceJVMember2020-06-300001020569irm:MakeSpaceJVMember2020-12-310001020569irm:MakeSpaceJVMember2019-12-310001020569us-gaap:CorporateJointVentureMemberirm:MakespaceMember2019-03-012019-03-310001020569us-gaap:CorporateJointVentureMemberirm:MakespaceMember2019-03-310001020569irm:ConsumerStorageMemberus-gaap:DisposalGroupNotDiscontinuedOperationsMember2019-01-012019-03-310001020569us-gaap:InterestRateSwapMember2019-12-310001020569us-gaap:InterestRateSwapMember2020-12-310001020569us-gaap:InterestRateSwapMember2019-07-310001020569us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:NetInvestmentHedgingMember2019-08-310001020569us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:NetInvestmentHedgingMember2020-09-300001020569us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMember2020-12-310001020569us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMember2019-12-310001020569us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2020-12-310001020569us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2019-12-310001020569us-gaap:NetInvestmentHedgingMemberirm:August2023CrossCurrencySwapAgreementsMember2020-12-310001020569us-gaap:NetInvestmentHedgingMemberirm:August2023CrossCurrencySwapAgreementsMember2019-12-310001020569irm:February2026CrossCurrencySwapAgreementsMemberus-gaap:NetInvestmentHedgingMember2020-12-310001020569irm:February2026CrossCurrencySwapAgreementsMemberus-gaap:NetInvestmentHedgingMember2019-12-310001020569us-gaap:NetInvestmentHedgingMember2020-12-310001020569us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-01-012020-12-310001020569us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-01-012019-12-310001020569us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2018-01-012018-12-310001020569us-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberirm:August2023CrossCurrencySwapAgreementsMember2020-01-012020-12-310001020569us-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberirm:August2023CrossCurrencySwapAgreementsMember2019-01-012019-12-310001020569us-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberirm:August2023CrossCurrencySwapAgreementsMember2018-01-012018-12-310001020569irm:February2026CrossCurrencySwapAgreementsMemberus-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-01-012020-12-310001020569irm:February2026CrossCurrencySwapAgreementsMemberus-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-01-012019-12-310001020569irm:February2026CrossCurrencySwapAgreementsMemberus-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2018-01-012018-12-310001020569us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMember2020-01-012020-12-310001020569us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMember2019-01-012019-12-310001020569us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMember2018-01-012018-12-310001020569us-gaap:ForeignExchangeForwardMember2020-01-012020-12-310001020569us-gaap:ForeignExchangeForwardMember2019-01-012019-12-310001020569us-gaap:ForeignExchangeForwardMember2018-01-012018-12-310001020569irm:EuroNotesMemberus-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001020569irm:EuroNotesMemberus-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-12-310001020569irm:EuroNotesMemberus-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2018-12-310001020569irm:EuroNotesMemberus-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-01-012020-12-310001020569irm:NewCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2020-12-310001020569irm:NewCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2019-12-310001020569irm:TermLoanFacilityMemberirm:TermLoanAMember2020-12-310001020569irm:TermLoanFacilityMemberirm:TermLoanAMember2019-12-310001020569irm:TermLoanFacilityMemberirm:TermLoanBMember2020-12-310001020569irm:TermLoanFacilityMemberirm:TermLoanBMember2019-12-310001020569irm:AustralianDollarTermLoanMember2020-12-310001020569irm:AustralianDollarTermLoanMember2019-12-310001020569irm:UKBilateralRevolvingCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2020-12-310001020569irm:UKBilateralRevolvingCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2019-12-310001020569us-gaap:SeniorNotesMemberirm:SeniorNotes4.375Percentdue2021Member2020-12-310001020569us-gaap:SeniorNotesMemberirm:SeniorNotes4.375Percentdue2021Member2019-12-310001020569irm:SeniorNotes6Percentdue2023Memberus-gaap:SeniorNotesMember2020-12-310001020569irm:SeniorNotes6Percentdue2023Memberus-gaap:SeniorNotesMember2019-12-310001020569us-gaap:SeniorNotesMemberirm:CADSeniorNotes5.375Percentdue2023Member2020-12-310001020569us-gaap:SeniorNotesMemberirm:CADSeniorNotes5.375Percentdue2023Member2019-12-310001020569irm:SeniorSubordinatedNotes5.75PercentDue2024Memberus-gaap:SeniorNotesMember2020-12-310001020569irm:SeniorSubordinatedNotes5.75PercentDue2024Memberus-gaap:SeniorNotesMember2019-12-310001020569irm:EuroSeniorNotes3Percentdue2025Member2020-12-310001020569irm:EuroSeniorNotes3Percentdue2025Member2019-12-310001020569irm:GBPSeniorNotes3.875Percentdue2025Member2020-12-310001020569irm:GBPSeniorNotes3.875Percentdue2025Member2019-12-310001020569irm:SeniorNotes5.375Percentdue2026Member2020-12-310001020569irm:SeniorNotes5.375Percentdue2026Member2019-12-310001020569irm:SeniorNotes4.875Percentdue2027Member2020-12-310001020569irm:SeniorNotes4.875Percentdue2027Member2019-12-310001020569irm:SeniorNotes5.25Percentdue2028Member2020-12-310001020569irm:SeniorNotes5.25Percentdue2028Member2019-12-310001020569irm:SeniorNotes5PercentDue2028MemberMember2020-12-310001020569irm:SeniorNotes5PercentDue2028MemberMember2019-12-310001020569irm:SeniorNotes4.875PercentDue2029Member2020-12-310001020569irm:SeniorNotes4.875PercentDue2029Member2019-12-310001020569irm:SeniorNotes525PercentDue2030Member2020-12-310001020569irm:SeniorNotes525PercentDue2030Member2019-12-310001020569irm:SeniorNotes45PercentDue2031Member2020-12-310001020569irm:SeniorNotes45PercentDue2031Member2019-12-310001020569irm:SeniorNotes5625PercentDue2032Member2020-12-310001020569irm:SeniorNotes5625PercentDue2032Member2019-12-310001020569irm:RealEstateMortgagesFinanceLeaseLiabilitiesAndOtherMember2020-12-310001020569irm:RealEstateMortgagesFinanceLeaseLiabilitiesAndOtherMember2019-12-310001020569irm:AccountsReceivablesSecuritizationProgramMember2020-12-310001020569irm:AccountsReceivablesSecuritizationProgramMember2019-12-310001020569us-gaap:LineOfCreditMember2020-12-310001020569us-gaap:MortgagesMember2020-12-310001020569us-gaap:MortgagesMember2019-12-310001020569irm:OtherNotesAndObligationsMember2020-12-310001020569irm:OtherNotesAndObligationsMember2019-12-310001020569irm:MortgageSecuritizationProgramMember2020-12-310001020569irm:MortgageSecuritizationProgramMember2019-12-310001020569us-gaap:CapitalLeaseObligationsMember2020-12-310001020569us-gaap:CapitalLeaseObligationsMember2019-12-310001020569irm:TermLoanFacilityMemberirm:NewCreditAgreementMember2020-12-310001020569irm:TermLoanFacilityMemberirm:NewCreditAgreementMember2020-01-012020-12-310001020569irm:NewCreditAgreementMembersrt:MinimumMember2020-01-012020-12-310001020569irm:NewCreditAgreementMembersrt:MaximumMember2020-01-012020-12-310001020569us-gaap:RevolvingCreditFacilityMember2020-12-310001020569us-gaap:RevolvingCreditFacilityMember2020-01-012020-12-310001020569irm:NewCreditAgreementMember2020-12-310001020569irm:NewCreditAgreementMember2019-12-310001020569us-gaap:LoansPayableMemberirm:TermLoanBMemberirm:TermLoanFacilityMember2020-12-310001020569us-gaap:LoansPayableMemberirm:TermLoanBMemberirm:TermLoanFacilityMember2020-01-012020-12-310001020569us-gaap:LoansPayableMemberirm:TermLoanBMemberus-gaap:LondonInterbankOfferedRateLIBORMemberirm:TermLoanFacilityMember2020-01-012020-12-310001020569us-gaap:LoansPayableMemberirm:TermLoanBMemberirm:TermLoanFacilityMember2019-12-310001020569us-gaap:SeniorNotesMemberirm:GBPNotesdue20253.875PercentMember2020-12-310001020569us-gaap:SeniorNotesMemberirm:SeniorNotes4.875Percentdue2027Member2020-12-310001020569us-gaap:SeniorNotesMemberirm:SeniorNotesdue20285.25PercentMember2020-12-310001020569us-gaap:SeniorNotesMemberirm:SeniorNotes5PercentDue2028MemberMember2020-12-310001020569us-gaap:SeniorNotesMemberirm:SeniorNotes4.875PercentDue2029Member2020-12-310001020569us-gaap:SeniorNotesMemberirm:SeniorNotes525PercentDue2030Member2020-12-310001020569us-gaap:SeniorNotesMemberirm:SeniorNotes45PercentDue2031Member2020-12-310001020569us-gaap:SeniorNotesMemberirm:SeniorNotes5625PercentDue2032Member2020-12-310001020569us-gaap:SeniorNotesMember2020-01-012020-12-310001020569us-gaap:SeniorNotesMemberirm:SeniorNotes5PercentDue2028MemberMember2020-06-220001020569us-gaap:SeniorNotesMemberirm:SeniorNotesdue20285.25PercentMember2020-06-220001020569us-gaap:SeniorNotesMemberirm:SeniorNotes5625PercentDue2032Member2020-06-220001020569us-gaap:SeniorNotesMember2020-06-222020-06-220001020569us-gaap:SeniorNotesMemberirm:SeniorNotes4.375Percentdue2021Member2020-06-292020-06-290001020569irm:SeniorNotes6Percentdue2023Memberus-gaap:SeniorNotesMember2020-06-292020-06-290001020569irm:SeniorNotes6Percentdue2023Memberus-gaap:SeniorNotesMember2020-06-290001020569us-gaap:SeniorNotesMember2020-04-012020-06-300001020569irm:SeniorNotes6Percentdue2023Memberus-gaap:SeniorNotesMember2020-06-300001020569irm:SeniorSubordinatedNotes5.75PercentDue2024Memberus-gaap:SeniorNotesMember2020-07-022020-07-020001020569irm:SeniorSubordinatedNotes5.75PercentDue2024Memberus-gaap:SeniorNotesMember2020-07-012020-09-300001020569us-gaap:SeniorNotesMemberirm:SeniorNotes45PercentDue2031Member2020-08-180001020569us-gaap:SeniorNotesMemberirm:SeniorNotes45PercentDue2031Member2020-08-182020-08-18iso4217:CAD0001020569irm:SeniorCADNotesMemberus-gaap:SeniorNotesMember2020-08-212020-08-210001020569us-gaap:SeniorNotesMemberirm:SeniorEuroNotesMember2020-08-212020-08-210001020569us-gaap:SeniorNotesMemberirm:CADSeniorNotes5.375Percentdue2023Member2020-08-212020-08-210001020569us-gaap:SeniorNotesMember2020-07-012020-09-30iso4217:AUD0001020569irm:AustralianDollarTermLoanMember2020-01-012020-12-310001020569irm:AustralianDollarTermLoanMemberirm:BBSYMember2020-01-012020-12-310001020569irm:AustralianDollarTermLoanMemberirm:BBSYMember2020-12-310001020569irm:AustralianDollarTermLoanMemberirm:BBSYMember2019-12-310001020569irm:UKBilateralRevolvingCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2020-01-012020-12-310001020569irm:UKBilateralRevolvingCreditFacilityMember2020-12-310001020569irm:UKBilateralRevolvingCreditFacilityMember2019-12-310001020569irm:AccountsReceivablesSecuritizationProgramMember2019-12-310001020569irm:AccountsReceivablesSecuritizationProgramMember2020-03-310001020569irm:AccountsReceivablesSecuritizationProgramMemberus-gaap:SecuredDebtMember2020-12-310001020569irm:AccountsReceivablesSecuritizationProgramMemberus-gaap:SecuredDebtMember2019-12-310001020569irm:AccountsReceivablesSecuritizationProgramMemberus-gaap:SecuredDebtMember2020-01-012020-12-31irm:cash_pool0001020569irm:QRSCashPoolMember2020-12-310001020569irm:TRSCashPoolMember2020-12-310001020569irm:QRSCashPoolMember2020-01-012020-12-310001020569irm:QRSCashPoolMember2019-12-310001020569irm:TRSCashPoolMember2019-12-310001020569us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2020-12-3100010205692018-02-142018-02-1400010205692018-03-152018-03-1500010205692018-05-242018-05-2400010205692018-06-152018-06-1500010205692018-07-242018-07-2400010205692018-09-172018-09-1700010205692018-10-252018-10-2500010205692018-12-172018-12-1700010205692019-02-072019-02-0700010205692019-03-152019-03-1500010205692019-05-222019-05-2200010205692019-06-172019-06-1700010205692019-07-262019-07-2600010205692019-09-162019-09-1600010205692019-10-312019-10-3100010205692019-12-162019-12-1600010205692020-02-132020-02-1300010205692020-03-162020-03-1600010205692020-05-052020-05-0500010205692020-06-152020-06-1500010205692020-08-052020-08-0500010205692020-09-152020-09-1500010205692020-11-042020-11-0400010205692020-12-152020-12-150001020569us-gaap:SubsequentEventMember2021-02-242021-02-240001020569irm:NonqualifiedOrdinaryDividendsMember2020-01-012020-12-310001020569irm:NonqualifiedOrdinaryDividendsMember2019-01-012019-12-310001020569irm:NonqualifiedOrdinaryDividendsMember2018-01-012018-12-310001020569irm:QualifiedOrdinaryDividendsMember2020-01-012020-12-310001020569irm:QualifiedOrdinaryDividendsMember2019-01-012019-12-310001020569irm:QualifiedOrdinaryDividendsMember2018-01-012018-12-310001020569irm:CapitalGainsMember2020-01-012020-12-310001020569irm:CapitalGainsMember2019-01-012019-12-310001020569irm:CapitalGainsMember2018-01-012018-12-310001020569irm:ReturnOfCapitalMember2020-01-012020-12-310001020569irm:ReturnOfCapitalMember2019-01-012019-12-310001020569irm:ReturnOfCapitalMember2018-01-012018-12-310001020569irm:EquityOfferingMember2017-12-122017-12-120001020569us-gaap:OverAllotmentOptionMember2018-01-012018-01-310001020569us-gaap:OtherNoncurrentAssetsMember2020-12-310001020569us-gaap:OtherNoncurrentAssetsMember2019-12-310001020569us-gaap:ForeignCountryMember2020-12-310001020569us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-12-310001020569us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-01-012020-12-310001020569us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-12-310001020569us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2018-12-310001020569us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-01-012019-12-310001020569us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2017-12-310001020569us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2018-01-012018-12-31irm:segmentirm:offeringirm:country0001020569irm:RecordsManagementMember2020-12-31irm:market0001020569irm:ConsumerStorageMember2020-01-012020-12-310001020569country:USirm:GlobalDataCenterBusinessMember2020-01-012020-12-310001020569us-gaap:NonUsMemberirm:GlobalDataCenterBusinessMember2020-01-012020-12-310001020569irm:GlobalRecordsandInformationManagementBusinessMember2018-01-012018-12-310001020569us-gaap:CorporateAndOtherMember2018-01-012018-12-310001020569us-gaap:CostOfSalesMember2020-01-012020-12-310001020569us-gaap:SellingGeneralAndAdministrativeExpensesMember2020-01-012020-12-310001020569country:US2020-01-012020-12-310001020569country:US2019-01-012019-12-310001020569country:US2018-01-012018-12-310001020569country:GB2020-01-012020-12-310001020569country:GB2019-01-012019-12-310001020569country:GB2018-01-012018-12-310001020569country:CA2020-01-012020-12-310001020569country:CA2019-01-012019-12-310001020569country:CA2018-01-012018-12-310001020569country:AU2020-01-012020-12-310001020569country:AU2019-01-012019-12-310001020569country:AU2018-01-012018-12-310001020569irm:OtherInternationalMember2020-01-012020-12-310001020569irm:OtherInternationalMember2019-01-012019-12-310001020569irm:OtherInternationalMember2018-01-012018-12-310001020569country:US2020-12-310001020569country:US2019-12-310001020569country:US2018-12-310001020569country:GB2020-12-310001020569country:GB2019-12-310001020569country:GB2018-12-310001020569country:CA2020-12-310001020569country:CA2019-12-310001020569country:CA2018-12-310001020569country:AU2020-12-310001020569country:AU2019-12-310001020569country:AU2018-12-310001020569irm:OtherInternationalMember2020-12-310001020569irm:OtherInternationalMember2019-12-310001020569irm:OtherInternationalMember2018-12-310001020569irm:GlobalRecordsandInformationManagementBusinessMemberirm:RecordsManagementMember2020-01-012020-12-310001020569irm:RecordsManagementMemberirm:GlobalDataCenterBusinessMember2020-01-012020-12-310001020569irm:RecordsManagementMemberus-gaap:CorporateAndOtherMember2020-01-012020-12-310001020569irm:RecordsManagementMember2020-01-012020-12-310001020569irm:GlobalRecordsandInformationManagementBusinessMemberirm:DataManagementMember2020-01-012020-12-310001020569irm:DataManagementMemberirm:GlobalDataCenterBusinessMember2020-01-012020-12-310001020569us-gaap:CorporateAndOtherMemberirm:DataManagementMember2020-01-012020-12-310001020569irm:DataManagementMember2020-01-012020-12-310001020569irm:GlobalRecordsandInformationManagementBusinessMemberirm:InformationDestructionMember2020-01-012020-12-310001020569irm:InformationDestructionMemberirm:GlobalDataCenterBusinessMember2020-01-012020-12-310001020569irm:InformationDestructionMemberus-gaap:CorporateAndOtherMember2020-01-012020-12-310001020569irm:InformationDestructionMember2020-01-012020-12-310001020569irm:GlobalRecordsandInformationManagementBusinessMemberirm:DataCenterMember2020-01-012020-12-310001020569irm:DataCenterMemberirm:GlobalDataCenterBusinessMember2020-01-012020-12-310001020569irm:DataCenterMemberus-gaap:CorporateAndOtherMember2020-01-012020-12-310001020569irm:DataCenterMember2020-01-012020-12-310001020569irm:GlobalRecordsandInformationManagementBusinessMemberirm:RecordsManagementMember2019-01-012019-12-310001020569irm:RecordsManagementMemberirm:GlobalDataCenterBusinessMember2019-01-012019-12-310001020569irm:RecordsManagementMemberus-gaap:CorporateAndOtherMember2019-01-012019-12-310001020569irm:RecordsManagementMember2019-01-012019-12-310001020569irm:GlobalRecordsandInformationManagementBusinessMemberirm:DataManagementMember2019-01-012019-12-310001020569irm:DataManagementMemberirm:GlobalDataCenterBusinessMember2019-01-012019-12-310001020569us-gaap:CorporateAndOtherMemberirm:DataManagementMember2019-01-012019-12-310001020569irm:DataManagementMember2019-01-012019-12-310001020569irm:GlobalRecordsandInformationManagementBusinessMemberirm:InformationDestructionMember2019-01-012019-12-310001020569irm:InformationDestructionMemberirm:GlobalDataCenterBusinessMember2019-01-012019-12-310001020569irm:InformationDestructionMemberus-gaap:CorporateAndOtherMember2019-01-012019-12-310001020569irm:InformationDestructionMember2019-01-012019-12-310001020569irm:GlobalRecordsandInformationManagementBusinessMemberirm:DataCenterMember2019-01-012019-12-310001020569irm:DataCenterMemberirm:GlobalDataCenterBusinessMember2019-01-012019-12-310001020569irm:DataCenterMemberus-gaap:CorporateAndOtherMember2019-01-012019-12-310001020569irm:DataCenterMember2019-01-012019-12-310001020569irm:GlobalRecordsandInformationManagementBusinessMemberirm:RecordsManagementMember2018-01-012018-12-310001020569irm:RecordsManagementMemberirm:GlobalDataCenterBusinessMember2018-01-012018-12-310001020569irm:RecordsManagementMemberus-gaap:CorporateAndOtherMember2018-01-012018-12-310001020569irm:RecordsManagementMember2018-01-012018-12-310001020569irm:GlobalRecordsandInformationManagementBusinessMemberirm:DataManagementMember2018-01-012018-12-310001020569irm:DataManagementMemberirm:GlobalDataCenterBusinessMember2018-01-012018-12-310001020569us-gaap:CorporateAndOtherMemberirm:DataManagementMember2018-01-012018-12-310001020569irm:DataManagementMember2018-01-012018-12-310001020569irm:GlobalRecordsandInformationManagementBusinessMemberirm:InformationDestructionMember2018-01-012018-12-310001020569irm:InformationDestructionMemberirm:GlobalDataCenterBusinessMember2018-01-012018-12-310001020569irm:InformationDestructionMemberus-gaap:CorporateAndOtherMember2018-01-012018-12-310001020569irm:InformationDestructionMember2018-01-012018-12-310001020569irm:GlobalRecordsandInformationManagementBusinessMemberirm:DataCenterMember2018-01-012018-12-310001020569irm:DataCenterMemberirm:GlobalDataCenterBusinessMember2018-01-012018-12-310001020569irm:DataCenterMemberus-gaap:CorporateAndOtherMember2018-01-012018-12-310001020569irm:DataCenterMember2018-01-012018-12-310001020569irm:FrankfurtJVMember2020-01-012020-12-310001020569irm:MakespaceMember2020-01-012020-12-310001020569irm:MakespaceMember2019-01-012019-12-310001020569irm:ProjectSummitMembersrt:ScenarioForecastMember2019-10-012021-12-31irm:employee0001020569irm:ProjectSummitMember2020-12-310001020569us-gaap:EmployeeSeveranceMember2020-01-012020-12-310001020569us-gaap:EmployeeSeveranceMember2019-01-012019-12-310001020569us-gaap:EmployeeSeveranceMember2019-10-012020-12-310001020569irm:AccruedProfessionalFeesMember2020-01-012020-12-310001020569irm:AccruedProfessionalFeesMember2019-01-012019-12-310001020569irm:AccruedProfessionalFeesMember2019-10-012020-12-3100010205692019-10-012020-12-310001020569irm:GlobalRecordsandInformationManagementBusinessMember2019-10-012020-12-310001020569irm:GlobalDataCenterBusinessMember2019-10-012020-12-310001020569us-gaap:CorporateAndOtherMember2019-10-012020-12-310001020569irm:ProjectSummitMemberus-gaap:EmployeeSeveranceMember2019-09-300001020569irm:ProjectSummitMemberirm:AccruedProfessionalFeesMember2019-09-300001020569irm:ProjectSummitMember2019-09-300001020569irm:ProjectSummitMemberus-gaap:EmployeeSeveranceMember2019-10-012019-12-310001020569irm:ProjectSummitMemberirm:AccruedProfessionalFeesMember2019-10-012019-12-310001020569irm:ProjectSummitMember2019-10-012019-12-310001020569irm:ProjectSummitMemberus-gaap:EmployeeSeveranceMember2019-12-310001020569irm:ProjectSummitMemberirm:AccruedProfessionalFeesMember2019-12-310001020569irm:ProjectSummitMember2019-12-310001020569irm:ProjectSummitMemberus-gaap:EmployeeSeveranceMember2020-01-012020-12-310001020569irm:ProjectSummitMemberirm:AccruedProfessionalFeesMember2020-01-012020-12-310001020569irm:ProjectSummitMember2020-01-012020-12-310001020569irm:ProjectSummitMemberus-gaap:EmployeeSeveranceMember2020-12-310001020569irm:ProjectSummitMemberirm:AccruedProfessionalFeesMember2020-12-310001020569irm:BirminghamAl140OxmoorCtMembercountry:US2020-01-012020-12-310001020569irm:BirminghamAl140OxmoorCtMembercountry:US2020-12-310001020569country:USirm:GilbertAz1420NorthFiestaBlvdMember2020-01-012020-12-310001020569country:USirm:GilbertAz1420NorthFiestaBlvdMember2020-12-310001020569irm:PhoenixAz4802EastVanBurenMembercountry:US2020-01-012020-12-310001020569irm:PhoenixAz4802EastVanBurenMembercountry:US2020-12-310001020569country:USirm:PhoenixAz615North48thStreetMember2020-01-012020-12-310001020569country:USirm:PhoenixAz615North48thStreetMember2020-12-310001020569irm:PhoenixAz2955S.18thPlaceMembercountry:US2020-01-012020-12-310001020569irm:PhoenixAz2955S.18thPlaceMembercountry:US2020-12-310001020569country:USirm:PhoenixAz4449South36thStMember2020-01-012020-12-310001020569country:USirm:PhoenixAz4449South36thStMember2020-12-310001020569country:USirm:ScottsdaleAz851PrincessDriveMember2020-01-012020-12-310001020569country:USirm:ScottsdaleAz851PrincessDriveMember2020-12-310001020569country:USirm:FullertonCa600BurningTreeRdMember2020-01-012020-12-310001020569country:USirm:FullertonCa600BurningTreeRdMember2020-12-310001020569irm:HaywardCa21063ForbesStMembercountry:US2020-01-012020-12-310001020569irm:HaywardCa21063ForbesStMembercountry:US2020-12-310001020569irm:LosAngelesCa1025NorthHighlandAveMembercountry:US2020-01-012020-12-310001020569irm:LosAngelesCa1025NorthHighlandAveMembercountry:US2020-12-310001020569irm:LosAngelesCa1006NorthMansfieldMembercountry:US2020-01-012020-12-310001020569irm:LosAngelesCa1006NorthMansfieldMembercountry:US2020-12-310001020569country:USirm:OaklandCa1350WestGrandAveMember2020-01-012020-12-310001020569country:USirm:OaklandCa1350WestGrandAveMember2020-12-310001020569country:USirm:OrangeCa1760NorthSaintThomasCircleMember2020-01-012020-12-310001020569country:USirm:OrangeCa1760NorthSaintThomasCircleMember2020-12-310001020569country:USirm:SantaAnaCa1915SouthGrandAveMember2020-01-012020-12-310001020569country:USirm:SantaAnaCa1915SouthGrandAveMember2020-12-310001020569irm:SouthGateCa2680SequoiaDrMembercountry:US2020-01-012020-12-310001020569irm:SouthGateCa2680SequoiaDrMembercountry:US2020-12-310001020569country:USirm:SouthSanFranciscoCa336OysterPointBlvdMember2020-01-012020-12-310001020569country:USirm:SouthSanFranciscoCa336OysterPointBlvdMember2020-12-310001020569irm:TracyCa25250SouthSchulteRdMembercountry:US2020-01-012020-12-310001020569irm:TracyCa25250SouthSchulteRdMembercountry:US2020-12-310001020569country:USirm:AuroraCo3576N.MolineMember2020-01-012020-12-310001020569country:USirm:AuroraCo3576N.MolineMember2020-12-310001020569irm:DenverCo5151E.46thAveMembercountry:US2020-01-012020-12-310001020569irm:DenverCo5151E.46thAveMembercountry:US2020-12-310001020569irm:DenverCo11333E53rdAvenueMembercountry:US2020-01-012020-12-310001020569irm:DenverCo11333E53rdAvenueMembercountry:US2020-12-310001020569country:USirm:DenverCo4300BrightonBoulevardMember2020-01-012020-12-310001020569country:USirm:DenverCo4300BrightonBoulevardMember2020-12-310001020569irm:EastHartfordCt20EasternParkRdMembercountry:US2020-01-012020-12-310001020569irm:EastHartfordCt20EasternParkRdMembercountry:US2020-12-310001020569irm:BennettRdSuffieldConnecticutMembercountry:US2020-01-012020-12-310001020569irm:BennettRdSuffieldConnecticutMembercountry:US2020-12-310001020569irm:KennedyRoadWindsorConnecticutMembercountry:US2020-01-012020-12-310001020569irm:KennedyRoadWindsorConnecticutMembercountry:US2020-12-310001020569irm:WinsdorLocksCt293EllaGrassoRdMembercountry:US2020-01-012020-12-310001020569irm:WinsdorLocksCt293EllaGrassoRdMembercountry:US2020-12-310001020569irm:WilmingtonDe150200ToddsLnMembercountry:US2020-01-012020-12-310001020569irm:WilmingtonDe150200ToddsLnMembercountry:US2020-12-310001020569irm:JacksonvilleFl13280VantageWayMembercountry:US2020-01-012020-12-310001020569irm:JacksonvilleFl13280VantageWayMembercountry:US2020-12-310001020569irm:LargoFl12855StarkeyRdMembercountry:US2020-01-012020-12-310001020569irm:LargoFl12855StarkeyRdMembercountry:US2020-12-310001020569irm:MiramarFl7801RivieraBlvdMembercountry:US2020-01-012020-12-310001020569irm:MiramarFl7801RivieraBlvdMembercountry:US2020-12-310001020569irm:OrlandoFl10002SatelliteBlvdMembercountry:US2020-01-012020-12-310001020569irm:OrlandoFl10002SatelliteBlvdMembercountry:US2020-12-310001020569irm:WestPalmBeachFl3501ElectronicsWayMembercountry:US2020-01-012020-12-310001020569irm:WestPalmBeachFl3501ElectronicsWayMembercountry:US2020-12-310001020569irm:AtlantaGa1890MacarthurBlvdMembercountry:US2020-01-012020-12-310001020569irm:AtlantaGa1890MacarthurBlvdMembercountry:US2020-12-310001020569irm:AtlantaGa3881OldGordonRdMembercountry:US2020-01-012020-12-310001020569irm:AtlantaGa3881OldGordonRdMembercountry:US2020-12-310001020569country:USirm:AtlantaGa5319TulaneDriveSwMember2020-01-012020-12-310001020569country:USirm:AtlantaGa5319TulaneDriveSwMember2020-12-310001020569irm:NorcrossGA6111LiveOakPkwyMembercountry:US2020-01-012020-12-310001020569irm:NorcrossGA6111LiveOakPkwyMembercountry:US2020-12-310001020569country:USirm:SmyrnaGa3150NifdaDrMember2020-01-012020-12-310001020569country:USirm:SmyrnaGa3150NifdaDrMember2020-12-310001020569country:USirm:ChicagoIl2425SouthHalstedStMember2020-01-012020-12-310001020569country:USirm:ChicagoIl2425SouthHalstedStMember2020-12-310001020569irm:ChicagoIl1301S.RockwellStMembercountry:US2020-01-012020-12-310001020569irm:ChicagoIl1301S.RockwellStMembercountry:US2020-12-310001020569irm:ChicagoIl2604West13thStMembercountry:US2020-01-012020-12-310001020569irm:ChicagoIl2604West13thStMembercountry:US2020-12-310001020569irm:ChicagoIl2211W.PershingRdMembercountry:US2020-01-012020-12-310001020569irm:ChicagoIl2211W.PershingRdMembercountry:US2020-12-310001020569country:USirm:ElkGroveIl2255PrattBlvdMember2020-01-012020-12-310001020569country:USirm:ElkGroveIl2255PrattBlvdMember2020-12-310001020569irm:HanoverParkIl4175ChandlerDrOpusNo.CorpMembercountry:US2020-01-012020-12-310001020569irm:HanoverParkIl4175ChandlerDrOpusNo.CorpMembercountry:US2020-12-310001020569country:USirm:A2600BeverlyDriveLincolnIllinoisMember2020-01-012020-12-310001020569country:USirm:A2600BeverlyDriveLincolnIllinoisMember2020-12-310001020569irm:DesMoinesIa6090Ne14thStreetMembercountry:US2020-01-012020-12-310001020569irm:DesMoinesIa6090Ne14thStreetMembercountry:US2020-12-310001020569country:USirm:LouisvilleKy2400South7thStBldgDMember2020-01-012020-12-310001020569country:USirm:LouisvilleKy2400South7thStBldgDMember2020-12-310001020569irm:A26ParkwayDrivefka133PleasantScarboroughMaineMembercountry:US2020-01-012020-12-310001020569irm:A26ParkwayDrivefka133PleasantScarboroughMaineMembercountry:US2020-12-310001020569country:USirm:ColumbiaMd8928McgawCtMember2020-01-012020-12-310001020569country:USirm:ColumbiaMd8928McgawCtMember2020-12-310001020569irm:JessupMd10641IronBridgeRdMembercountry:US2020-01-012020-12-310001020569irm:JessupMd10641IronBridgeRdMembercountry:US2020-12-310001020569country:USirm:BillericaMa96HighStMember2020-01-012020-12-310001020569country:USirm:BillericaMa96HighStMember2020-12-310001020569country:USirm:BostonMa120HampdenStMember2020-01-012020-12-310001020569country:USirm:BostonMa120HampdenStMember2020-12-310001020569irm:BostonMa32GeorgeStMembercountry:US2020-01-012020-12-310001020569irm:BostonMa32GeorgeStMembercountry:US2020-12-310001020569irm:WestonMa14500CaryNorthCarolinaMembercountry:US2020-01-012020-12-310001020569irm:WestonMa14500CaryNorthCarolinaMembercountry:US2020-12-310001020569country:USirm:DightonMa3435SharpsLotRdMember2020-01-012020-12-310001020569country:USirm:DightonMa3435SharpsLotRdMember2020-12-310001020569irm:FranklinMa77ConstitutionBoulevardMembercountry:US2020-01-012020-12-310001020569irm:FranklinMa77ConstitutionBoulevardMembercountry:US2020-12-310001020569country:USirm:StLawrenceMa216CanalMember2020-01-012020-12-310001020569country:USirm:StLawrenceMa216CanalMember2020-12-310001020569country:USirm:NorthboroMa171BearfootRoadMember2020-01-012020-12-310001020569country:USirm:NorthboroMa171BearfootRoadMember2020-12-310001020569country:USirm:A38300PlymouthRoadLivoniaMichiganMember2020-01-012020-12-310001020569country:USirm:A38300PlymouthRoadLivoniaMichiganMember2020-12-310001020569country:USirm:SterlingHeightsMi6601SterlingDrSouthMember2020-01-012020-12-310001020569country:USirm:SterlingHeightsMi6601SterlingDrSouthMember2020-12-310001020569country:USirm:WarrenMi1985BartAveMember2020-01-012020-12-310001020569country:USirm:WarrenMi1985BartAveMember2020-12-310001020569irm:WahlCourtWarrenMichiganMembercountry:US2020-01-012020-12-310001020569irm:WahlCourtWarrenMichiganMembercountry:US2020-12-310001020569irm:WixomMi31155WixomRdMembercountry:US2020-01-012020-12-310001020569irm:WixomMi31155WixomRdMembercountry:US2020-12-310001020569country:USirm:EarthCityMo3140RyderTrailSouthMember2020-01-012020-12-310001020569country:USirm:EarthCityMo3140RyderTrailSouthMember2020-12-310001020569country:USirm:HazelwoodMOMissouriBottomRoadMember2020-01-012020-12-310001020569country:USirm:HazelwoodMOMissouriBottomRoadMember2020-12-310001020569country:USirm:LeavenworthSt18thStOmahaNebraskaMember2020-01-012020-12-310001020569country:USirm:LeavenworthSt18thStOmahaNebraskaMember2020-12-310001020569irm:LasVegasNv4105NorthLambBlvdMembercountry:US2020-01-012020-12-310001020569irm:LasVegasNv4105NorthLambBlvdMembercountry:US2020-12-310001020569irm:MiltonNh17HydroPlantRdMembercountry:US2020-01-012020-12-310001020569irm:MiltonNh17HydroPlantRdMembercountry:US2020-12-310001020569country:USirm:EdisonNJ3003WoodbridgeAveMember2020-01-012020-12-310001020569country:USirm:EdisonNJ3003WoodbridgeAveMember2020-12-310001020569irm:FreeholdNJ811Route33Membercountry:US2020-01-012020-12-310001020569irm:FreeholdNJ811Route33Membercountry:US2020-12-310001020569irm:NewarkNJCourtStreetMembercountry:US2020-01-012020-12-310001020569irm:NewarkNJCourtStreetMembercountry:US2020-12-310001020569irm:A560IrvineTurnerBlvdNewarkNewJerseyMembercountry:US2020-01-012020-12-310001020569irm:A560IrvineTurnerBlvdNewarkNewJerseyMembercountry:US2020-12-310001020569country:USirm:A231JohnsonAveNewarkNewJerseyMember2020-01-012020-12-310001020569country:USirm:A231JohnsonAveNewarkNewJerseyMember2020-12-310001020569irm:SomersetNj650HowardAvenueMembercountry:US2020-01-012020-12-310001020569irm:SomersetNj650HowardAvenueMembercountry:US2020-12-310001020569irm:BuffaloNy100BaileyAveMembercountry:US2020-01-012020-12-310001020569irm:BuffaloNy100BaileyAveMembercountry:US2020-12-310001020569country:USirm:ChesterNy64LeoneLnMember2020-01-012020-12-310001020569country:USirm:ChesterNy64LeoneLnMember2020-12-310001020569irm:FarmingtonNy1368CountyRd8Membercountry:US2020-01-012020-12-310001020569irm:FarmingtonNy1368CountyRd8Membercountry:US2020-12-310001020569irm:CountyRd10LinlithgoNewYorkMembercountry:US2020-01-012020-12-310001020569irm:CountyRd10LinlithgoNewYorkMembercountry:US2020-12-310001020569irm:N.HempsteadNy77SeaviewBlvdMembercountry:US2020-01-012020-12-310001020569irm:N.HempsteadNy77SeaviewBlvdMembercountry:US2020-12-310001020569irm:PawlingNy37HurdsCornerRoadMembercountry:US2020-01-012020-12-310001020569irm:PawlingNy37HurdsCornerRoadMembercountry:US2020-12-310001020569irm:UlsterAveRoute9wPortEwenNewYorkMembercountry:US2020-01-012020-12-310001020569irm:UlsterAveRoute9wPortEwenNewYorkMembercountry:US2020-12-310001020569irm:BinnewaterRdRosendaleNewYorkMembercountry:US2020-01-012020-12-310001020569irm:BinnewaterRdRosendaleNewYorkMembercountry:US2020-12-310001020569country:USirm:SyracuseNy220WavelStMember2020-01-012020-12-310001020569country:USirm:SyracuseNy220WavelStMember2020-12-310001020569irm:A2235CessnaDriveBurlingtonNorthCarolinaMembercountry:US2020-01-012020-12-310001020569irm:A2235CessnaDriveBurlingtonNorthCarolinaMembercountry:US2020-12-310001020569irm:MorrisvileNJ826ChurchStMembercountry:US2020-01-012020-12-310001020569irm:MorrisvileNJ826ChurchStMembercountry:US2020-12-310001020569irm:ClevelandOh1275East40thMembercountry:US2020-01-012020-12-310001020569irm:ClevelandOh1275East40thMembercountry:US2020-12-310001020569irm:ClevelandOh7208EuclidAvenueMembercountry:US2020-01-012020-12-310001020569irm:ClevelandOh7208EuclidAvenueMembercountry:US2020-12-310001020569irm:DublinOh4260TullerRidgeRdMembercountry:US2020-01-012020-12-310001020569irm:DublinOh4260TullerRidgeRdMembercountry:US2020-12-310001020569country:USirm:MiamisburgOH3366SouthTechBlvdMember2020-01-012020-12-310001020569country:USirm:MiamisburgOH3366SouthTechBlvdMember2020-12-310001020569irm:ToledoOh302SouthByrneRdMembercountry:US2020-01-012020-12-310001020569irm:ToledoOh302SouthByrneRdMembercountry:US2020-12-310001020569country:USirm:PortlandOr7530N.LeadbetterRoadMember2020-01-012020-12-310001020569country:USirm:PortlandOr7530N.LeadbetterRoadMember2020-12-310001020569irm:BranchtonRdBoyersPennsylvaniaMembercountry:US2020-01-012020-12-310001020569irm:BranchtonRdBoyersPennsylvaniaMembercountry:US2020-12-310001020569irm:FolcroftPa800CarpentersCrossingsMembercountry:US2020-01-012020-12-310001020569irm:FolcroftPa800CarpentersCrossingsMembercountry:US2020-12-310001020569country:USirm:RioGrandePrLasFloresIndustrialParkMember2020-01-012020-12-310001020569country:USirm:RioGrandePrLasFloresIndustrialParkMember2020-12-310001020569irm:ChepachetRi24SnakeHillRoadMembercountry:US2020-01-012020-12-310001020569irm:ChepachetRi24SnakeHillRoadMembercountry:US2020-12-310001020569country:USirm:ColumbiaSc1061CarolinaPinesRdMember2020-01-012020-12-310001020569country:USirm:ColumbiaSc1061CarolinaPinesRdMember2020-12-310001020569country:USirm:FlorenceSc2301ProsperityWayMember2020-01-012020-12-310001020569country:USirm:FlorenceSc2301ProsperityWayMember2020-12-310001020569irm:MitchellStreetKnoxvilleTennesseeMembercountry:US2020-01-012020-12-310001020569irm:MitchellStreetKnoxvilleTennesseeMembercountry:US2020-12-310001020569country:USirm:NashvilleTn6005DanaWayMember2020-01-012020-12-310001020569country:USirm:NashvilleTn6005DanaWayMember2020-12-310001020569country:USirm:AustinTx11406MetricBlvdMember2020-01-012020-12-310001020569country:USirm:AustinTx11406MetricBlvdMember2020-12-310001020569country:USirm:AustinTx6600MetropolisDriveMember2020-01-012020-12-310001020569country:USirm:AustinTx6600MetropolisDriveMember2020-12-310001020569country:USirm:CarrolltonTxCapitalParkwayMember2020-01-012020-12-310001020569country:USirm:CarrolltonTxCapitalParkwayMember2020-12-310001020569country:USirm:CarrolltonTx1800ColumbianClubDrMember2020-01-012020-12-310001020569country:USirm:CarrolltonTx1800ColumbianClubDrMember2020-12-310001020569irm:CarrolltonTx1905JohnConnallyDrMembercountry:US2020-01-012020-12-310001020569irm:CarrolltonTx1905JohnConnallyDrMembercountry:US2020-12-310001020569country:USirm:DallasTx13425BranchviewLnMember2020-01-012020-12-310001020569country:USirm:DallasTx13425BranchviewLnMember2020-12-310001020569irm:CockrellAveDallasTexasMembercountry:US2020-01-012020-12-310001020569irm:CockrellAveDallasTexasMembercountry:US2020-12-310001020569country:USirm:DallasTx1819S.LamarStMember2020-01-012020-12-310001020569country:USirm:DallasTx1819S.LamarStMember2020-12-310001020569irm:FortWorthTx2000RoboticsPlaceSuiteBMembercountry:US2020-01-012020-12-310001020569irm:FortWorthTx2000RoboticsPlaceSuiteBMembercountry:US2020-12-310001020569country:USirm:GrandPrairieTx1202AveRMember2020-01-012020-12-310001020569country:USirm:GrandPrairieTx1202AveRMember2020-12-310001020569country:USirm:HoustonTx6203BingleRdMember2020-01-012020-12-310001020569country:USirm:HoustonTx6203BingleRdMember2020-12-310001020569country:USirm:HoustonTx3502BissonnetStMember2020-01-012020-12-310001020569country:USirm:HoustonTx3502BissonnetStMember2020-12-310001020569irm:HoustonTx2600CenterStreetBldgMembercountry:US2020-01-012020-12-310001020569irm:HoustonTx2600CenterStreetBldgMembercountry:US2020-12-310001020569irm:HoustonTx5707ChimneyRockMembercountry:US2020-01-012020-12-310001020569irm:HoustonTx5707ChimneyRockMembercountry:US2020-12-310001020569irm:HoustonTx5249GlenmontAveMembercountry:US2020-01-012020-12-310001020569irm:HoustonTx5249GlenmontAveMembercountry:US2020-12-310001020569country:USirm:HempsteadHwy15333HoustonTexasMember2020-01-012020-12-310001020569country:USirm:HempsteadHwy15333HoustonTexasMember2020-12-310001020569irm:HoustonTx5757RoyaltonDrMembercountry:US2020-01-012020-12-310001020569irm:HoustonTx5757RoyaltonDrMembercountry:US2020-12-310001020569irm:HoustonTx9601WestTidwellMembercountry:US2020-01-012020-12-310001020569irm:HoustonTx9601WestTidwellMembercountry:US2020-12-310001020569country:USirm:A7800WestparkHoustonTexasMember2020-01-012020-12-310001020569country:USirm:A7800WestparkHoustonTexasMember2020-12-310001020569country:USirm:Fm182515300PflugervilleTexasMember2020-01-012020-12-310001020569country:USirm:Fm182515300PflugervilleTexasMember2020-12-310001020569country:USirm:SanAntonioTx930AvenueBMember2020-01-012020-12-310001020569country:USirm:SanAntonioTx930AvenueBMember2020-12-310001020569country:USirm:SanAntonioTx931NorthBroadwayMember2020-01-012020-12-310001020569country:USirm:SanAntonioTx931NorthBroadwayMember2020-12-310001020569country:USirm:SaltLakeCityUt1665S.5350WestMember2020-01-012020-12-310001020569country:USirm:SaltLakeCityUt1665S.5350WestMember2020-12-310001020569irm:AshlandVa11052LakeridgePkwyMembercountry:US2020-01-012020-12-310001020569irm:AshlandVa11052LakeridgePkwyMembercountry:US2020-12-310001020569country:USirm:A2301InternationalParkwayFredricksburgVirginiaMember2020-01-012020-12-310001020569country:USirm:A2301InternationalParkwayFredricksburgVirginiaMember2020-12-310001020569irm:A11660HaydenRoadManassasVirginiaMembercountry:US2020-01-012020-12-310001020569irm:A11660HaydenRoadManassasVirginiaMembercountry:US2020-12-310001020569irm:NorfolkVa4555ProgressRoadMembercountry:US2020-01-012020-12-310001020569irm:NorfolkVa4555ProgressRoadMembercountry:US2020-12-310001020569irm:A3725ThirlaneRd.N.W.RoanokeVirginiaMembercountry:US2020-01-012020-12-310001020569irm:A3725ThirlaneRd.N.W.RoanokeVirginiaMembercountry:US2020-12-310001020569irm:SpringfieldVa77007730SouthernDrMembercountry:US2020-01-012020-12-310001020569irm:SpringfieldVa77007730SouthernDrMembercountry:US2020-12-310001020569irm:SterlingVa22445RandolphDrMembercountry:US2020-01-012020-12-310001020569irm:SterlingVa22445RandolphDrMembercountry:US2020-12-310001020569irm:BurienWa307South140thStMembercountry:US2020-01-012020-12-310001020569irm:BurienWa307South140thStMembercountry:US2020-12-310001020569irm:CheneyWa8908W.HallettRdMembercountry:US2020-01-012020-12-310001020569irm:CheneyWa8908W.HallettRdMembercountry:US2020-12-310001020569irm:EverettWa6600HardesonRdMembercountry:US2020-01-012020-12-310001020569irm:EverettWa6600HardesonRdMembercountry:US2020-12-310001020569country:USirm:SeattleWa120N.96thStMember2020-01-012020-12-310001020569country:USirm:SeattleWa120N.96thStMember2020-12-310001020569irm:SpokaneWa4330SouthGroveRdMembercountry:US2020-01-012020-12-310001020569irm:SpokaneWa4330SouthGroveRdMembercountry:US2020-12-310001020569irm:WauwatsaWi12021WestBluemoundRoadMembercountry:US2020-01-012020-12-310001020569irm:WauwatsaWi12021WestBluemoundRoadMembercountry:US2020-12-310001020569irm:BedfordOneCommandCourtHalifaxMembercountry:CA2020-01-012020-12-310001020569irm:BedfordOneCommandCourtHalifaxMembercountry:CA2020-12-310001020569irm:Brampton195SummerleaRoadMembercountry:CA2020-01-012020-12-310001020569irm:Brampton195SummerleaRoadMembercountry:CA2020-12-310001020569irm:Brampton10TilburyCourtMembercountry:CA2020-01-012020-12-310001020569irm:Brampton10TilburyCourtMembercountry:CA2020-12-310001020569irm:Burnaby8825NorthbrookCourtMembercountry:CA2020-01-012020-12-310001020569irm:Burnaby8825NorthbrookCourtMembercountry:CA2020-12-310001020569irm:Burnaby8088GlenwoodDriveMembercountry:CA2020-01-012020-12-310001020569irm:Burnaby8088GlenwoodDriveMembercountry:CA2020-12-310001020569irm:Calgary581126thStreetS.e.Membercountry:CA2020-01-012020-12-310001020569irm:Calgary581126thStreetS.e.Membercountry:CA2020-12-310001020569irm:Edmonton3905101StreetMembercountry:CA2020-01-012020-12-310001020569irm:Edmonton3905101StreetMembercountry:CA2020-12-310001020569irm:Kingston68GrantTimminsDriveMembercountry:CA2020-01-012020-12-310001020569irm:Kingston68GrantTimminsDriveMembercountry:CA2020-12-310001020569irm:Lachine3005Boul.JeanBaptisteDeschampsMembercountry:CA2020-01-012020-12-310001020569irm:Lachine3005Boul.JeanBaptisteDeschampsMembercountry:CA2020-12-310001020569irm:Laval1655FleetwoodMembercountry:CA2020-01-012020-12-310001020569irm:Laval1655FleetwoodMembercountry:CA2020-12-310001020569irm:Montreal4005RichelieuMembercountry:CA2020-01-012020-12-310001020569irm:Montreal4005RichelieuMembercountry:CA2020-12-310001020569irm:Ottawa1209AlgomaRdMembercountry:CA2020-01-012020-12-310001020569irm:Ottawa1209AlgomaRdMembercountry:CA2020-12-310001020569irm:Ottawa1650ComstockRdMembercountry:CA2020-01-012020-12-310001020569irm:Ottawa1650ComstockRdMembercountry:CA2020-12-310001020569irm:Saskatoon235EdsonStreetMembercountry:CA2020-01-012020-12-310001020569irm:Saskatoon235EdsonStreetMembercountry:CA2020-12-310001020569irm:Scarborough640CoronationDriveMembercountry:CA2020-01-012020-12-310001020569irm:Scarborough640CoronationDriveMembercountry:CA2020-12-310001020569irm:Windsor610SprucewoodAveMembercountry:CA2020-01-012020-12-310001020569irm:Windsor610SprucewoodAveMembercountry:CA2020-12-310001020569srt:NorthAmericaMember2020-01-012020-12-310001020569srt:NorthAmericaMember2020-12-310001020569irm:ViennaGewerbeparkstr.3Membersrt:EuropeMember2020-01-012020-12-310001020569irm:ViennaGewerbeparkstr.3Membersrt:EuropeMember2020-12-310001020569srt:EuropeMemberirm:DiegemWoluwelaan147Member2020-01-012020-12-310001020569srt:EuropeMemberirm:DiegemWoluwelaan147Member2020-12-310001020569srt:EuropeMemberirm:Stupnikeipkovine62Member2020-01-012020-12-310001020569srt:EuropeMemberirm:Stupnikeipkovine62Member2020-12-310001020569srt:EuropeMemberirm:NicosiaCyprusIndustrialDistrictMember2020-01-012020-12-310001020569srt:EuropeMemberirm:NicosiaCyprusIndustrialDistrictMember2020-12-310001020569irm:LimassolCyprusAgiosSylasIndustrialAreaMembersrt:EuropeMember2020-01-012020-12-310001020569irm:LimassolCyprusAgiosSylasIndustrialAreaMembersrt:EuropeMember2020-12-310001020569irm:Birmingham65EgertonRoadMembersrt:EuropeMember2020-01-012020-12-310001020569irm:Birmingham65EgertonRoadMembersrt:EuropeMember2020-12-310001020569irm:Corby278LongCroftRoadMembersrt:EuropeMember2020-01-012020-12-310001020569irm:Corby278LongCroftRoadMembersrt:EuropeMember2020-12-310001020569irm:OtterhamQuayLaneGillinghamUnitedKingdomMembersrt:EuropeMember2020-01-012020-12-310001020569irm:OtterhamQuayLaneGillinghamUnitedKingdomMembersrt:EuropeMember2020-12-310001020569srt:EuropeMemberirm:PennineWayHemelHempsteadUnitedKingdomMember2020-01-012020-12-310001020569srt:EuropeMemberirm:PennineWayHemelHempsteadUnitedKingdomMember2020-12-310001020569srt:EuropeMemberirm:KembleSiteD1KembleIndustrialParkMember2020-01-012020-12-310001020569srt:EuropeMemberirm:KembleSiteD1KembleIndustrialParkMember2020-12-310001020569irm:GaytonRoadKingsLynnUnitedKingdomMembersrt:EuropeMember2020-01-012020-12-310001020569irm:GaytonRoadKingsLynnUnitedKingdomMembersrt:EuropeMember2020-12-310001020569srt:EuropeMemberirm:CodyRoadLondonUnitedKingdomMember2020-01-012020-12-310001020569srt:EuropeMemberirm:CodyRoadLondonUnitedKingdomMember2020-12-310001020569srt:EuropeMemberirm:Oldham17BroadgateMember2020-01-012020-12-310001020569srt:EuropeMemberirm:Oldham17BroadgateMember2020-12-310001020569irm:SopleyHarpwayLaneMembersrt:EuropeMember2020-01-012020-12-310001020569irm:SopleyHarpwayLaneMembersrt:EuropeMember2020-12-310001020569irm:SwindonUnit1aBroadmoorRoadMembersrt:EuropeMember2020-01-012020-12-310001020569irm:SwindonUnit1aBroadmoorRoadMembersrt:EuropeMember2020-12-310001020569irm:JeumontSchneiderChampagneSurSeineFranceMembersrt:EuropeMember2020-01-012020-12-310001020569irm:JeumontSchneiderChampagneSurSeineFranceMembersrt:EuropeMember2020-12-310001020569irm:CoignieresFranceBatIVIIRuedeOsiersMembersrt:EuropeMember2020-01-012020-12-310001020569irm:CoignieresFranceBatIVIIRuedeOsiersMembersrt:EuropeMember2020-12-310001020569irm:FergersheimFrance26RuedeIIndustrieMembersrt:EuropeMember2020-01-012020-12-310001020569irm:FergersheimFrance26RuedeIIndustrieMembersrt:EuropeMember2020-12-310001020569irm:GuedeLongroiFranceBatABC1C2C3RueImperialeMembersrt:EuropeMember2020-01-012020-12-310001020569irm:GuedeLongroiFranceBatABC1C2C3RueImperialeMembersrt:EuropeMember2020-12-310001020569irm:MingieresFranceLePetitCourtinSitedeDoisGueslinMembersrt:EuropeMember2020-01-012020-12-310001020569irm:MingieresFranceLePetitCourtinSitedeDoisGueslinMembersrt:EuropeMember2020-12-310001020569srt:EuropeMemberirm:MorangisFranceZIdesSablesMember2020-01-012020-12-310001020569srt:EuropeMemberirm:MorangisFranceZIdesSablesMember2020-12-310001020569irm:SaintPriestFrance45RuedeSavoieManissieuxMembersrt:EuropeMember2020-01-012020-12-310001020569irm:SaintPriestFrance45RuedeSavoieManissieuxMembersrt:EuropeMember2020-12-310001020569irm:HamburgGermanyGutenbergstrabe55Membersrt:EuropeMember2020-01-012020-12-310001020569irm:HamburgGermanyGutenbergstrabe55Membersrt:EuropeMember2020-12-310001020569srt:EuropeMemberirm:WipshausenBrommerWeg1Member2020-01-012020-12-310001020569srt:EuropeMemberirm:WipshausenBrommerWeg1Member2020-12-310001020569irm:CorkWarehouseAndOffices4SpringhillMembersrt:EuropeMember2020-01-012020-12-310001020569irm:CorkWarehouseAndOffices4SpringhillMembersrt:EuropeMember2020-12-310001020569srt:EuropeMemberirm:CragTerrace17DublinIrelandMember2020-01-012020-12-310001020569srt:EuropeMemberirm:CragTerrace17DublinIrelandMember2020-12-310001020569srt:EuropeMemberirm:DublinDamastownIndustrialParkMember2020-01-012020-12-310001020569srt:EuropeMemberirm:DublinDamastownIndustrialParkMember2020-12-310001020569irm:Portsmuiden46AmsterdamTheNetherlandsMembersrt:EuropeMember2020-01-012020-12-310001020569irm:Portsmuiden46AmsterdamTheNetherlandsMembersrt:EuropeMember2020-12-310001020569irm:Schepenbergweg1AmsterdamTheNetherlandsMembersrt:EuropeMember2020-01-012020-12-310001020569irm:Schepenbergweg1AmsterdamTheNetherlandsMembersrt:EuropeMember2020-12-310001020569srt:EuropeMemberirm:Vareseweg130RotterdamTheNetherlandsMember2020-01-012020-12-310001020569srt:EuropeMemberirm:Vareseweg130RotterdamTheNetherlandsMember2020-12-310001020569irm:AberdeenScotlandHowemossDrMembersrt:EuropeMember2020-01-012020-12-310001020569irm:AberdeenScotlandHowemossDrMembersrt:EuropeMember2020-12-310001020569irm:TraquairRdInnerleithenScotlandMembersrt:EuropeMember2020-01-012020-12-310001020569irm:TraquairRdInnerleithenScotlandMembersrt:EuropeMember2020-12-310001020569srt:EuropeMemberirm:LivingstonScotlandHoustonIndustrialEstateMember2020-01-012020-12-310001020569srt:EuropeMemberirm:LivingstonScotlandHoustonIndustrialEstateMember2020-12-310001020569srt:EuropeMemberirm:AlcaladeHenaresSpainMember2020-01-012020-12-310001020569srt:EuropeMemberirm:AlcaladeHenaresSpainMember2020-12-310001020569srt:EuropeMemberirm:ChilechesSpainCalleBronceMember2020-01-012020-12-310001020569srt:EuropeMemberirm:ChilechesSpainCalleBronceMember2020-12-310001020569irm:MadridCtraM.118Km.3Parcela3Membersrt:EuropeMember2020-01-012020-12-310001020569irm:MadridCtraM.118Km.3Parcela3Membersrt:EuropeMember2020-12-310001020569srt:EuropeMemberirm:AbantoCiervavaSpainMember2020-01-012020-12-310001020569srt:EuropeMemberirm:AbantoCiervavaSpainMember2020-12-310001020569srt:EuropeMember2020-01-012020-12-310001020569srt:EuropeMember2020-12-310001020569srt:LatinAmericaMemberirm:BuenosAiresAmancioAlcorta2396Member2020-01-012020-12-310001020569srt:LatinAmericaMemberirm:BuenosAiresAmancioAlcorta2396Member2020-12-310001020569srt:LatinAmericaMemberirm:BuenosAiresAzara1245Member2020-01-012020-12-310001020569srt:LatinAmericaMemberirm:BuenosAiresAzara1245Member2020-12-310001020569srt:LatinAmericaMemberirm:SpegazziniEzeizaBuenosAiresArgentinaMember2020-01-012020-12-310001020569srt:LatinAmericaMemberirm:SpegazziniEzeizaBuenosAiresArgentinaMember2020-12-310001020569srt:LatinAmericaMemberirm:BairroFimdoCampoJarinuBrazilAvErnestdeMoraes815Member2020-01-012020-12-310001020569srt:LatinAmericaMemberirm:BairroFimdoCampoJarinuBrazilAvErnestdeMoraes815Member2020-12-310001020569srt:LatinAmericaMemberirm:JundiaiBrazilRuaPeri80Member2020-01-012020-12-310001020569srt:LatinAmericaMemberirm:JundiaiBrazilRuaPeri80Member2020-12-310001020569srt:LatinAmericaMemberirm:FranciscoDeSouzaEMeloRioDeJanerioBrazilMember2020-01-012020-12-310001020569srt:LatinAmericaMemberirm:FranciscoDeSouzaEMeloRioDeJanerioBrazilMember2020-12-310001020569srt:LatinAmericaMemberirm:HortolandiaSaoPauloBrazilMember2020-01-012020-12-310001020569srt:LatinAmericaMemberirm:HortolandiaSaoPauloBrazilMember2020-12-310001020569srt:LatinAmericaMemberirm:ElTaqueral99SantiagoChileMember2020-01-012020-12-310001020569srt:LatinAmericaMemberirm:ElTaqueral99SantiagoChileMember2020-12-310001020569srt:LatinAmericaMemberirm:PanamericanaNorte18900SantiagoChileMember2020-01-012020-12-310001020569srt:LatinAmericaMemberirm:PanamericanaNorte18900SantiagoChileMember2020-12-310001020569srt:LatinAmericaMemberirm:AvenidaProlongacionDelColli1104GuadalajaraMexicoMember2020-01-012020-12-310001020569srt:LatinAmericaMemberirm:AvenidaProlongacionDelColli1104GuadalajaraMexicoMember2020-12-310001020569srt:LatinAmericaMemberirm:GuadalajaraPrivadaLasFloresNo.25G3Member2020-01-012020-12-310001020569srt:LatinAmericaMemberirm:GuadalajaraPrivadaLasFloresNo.25G3Member2020-12-310001020569irm:HuehuetocaMexicoTulaKMParquedeLasMembersrt:LatinAmericaMember2020-01-012020-12-310001020569irm:HuehuetocaMexicoTulaKMParquedeLasMembersrt:LatinAmericaMember2020-12-310001020569srt:LatinAmericaMemberirm:MonterreyCarreteraPesqueriaKm2.5M3Member2020-01-012020-12-310001020569srt:LatinAmericaMemberirm:MonterreyCarreteraPesqueriaKm2.5M3Member2020-12-310001020569srt:LatinAmericaMemberirm:TolucaLote2ManzanaT2T3Member2020-01-012020-12-310001020569srt:LatinAmericaMemberirm:TolucaLote2ManzanaT2T3Member2020-12-310001020569srt:LatinAmericaMemberirm:TolucaProlongacionDeLaCalle7T4Member2020-01-012020-12-310001020569srt:LatinAmericaMemberirm:TolucaProlongacionDeLaCalle7T4Member2020-12-310001020569srt:LatinAmericaMemberirm:PanamericanaSurKm57.5LimaPeruMember2020-01-012020-12-310001020569srt:LatinAmericaMemberirm:PanamericanaSurKm57.5LimaPeruMember2020-12-310001020569srt:LatinAmericaMemberirm:Av.ElmerFaucett3462LimaPeruMember2020-01-012020-12-310001020569srt:LatinAmericaMemberirm:Av.ElmerFaucett3462LimaPeruMember2020-12-310001020569srt:LatinAmericaMemberirm:CalleLosClavelesSeccion3LimaPeruMember2020-01-012020-12-310001020569srt:LatinAmericaMemberirm:CalleLosClavelesSeccion3LimaPeruMember2020-12-310001020569srt:LatinAmericaMember2020-01-012020-12-310001020569srt:LatinAmericaMember2020-12-310001020569irm:ShanghaiWarehouseNo4Membersrt:AsiaPacificMember2020-01-012020-12-310001020569irm:ShanghaiWarehouseNo4Membersrt:AsiaPacificMember2020-12-310001020569irm:BogorIndonesiaJalanKarangganMembersrt:AsiaPacificMember2020-01-012020-12-310001020569irm:BogorIndonesiaJalanKarangganMembersrt:AsiaPacificMember2020-12-310001020569irm:A1SerangoonNorthAvenue6Membersrt:AsiaPacificMember2020-01-012020-12-310001020569irm:A1SerangoonNorthAvenue6Membersrt:AsiaPacificMember2020-12-310001020569irm:Singapore2YungHoRdMembersrt:AsiaPacificMember2020-01-012020-12-310001020569irm:Singapore2YungHoRdMembersrt:AsiaPacificMember2020-12-310001020569irm:Singapore26ChinBeeDriveMembersrt:AsiaPacificMember2020-01-012020-12-310001020569irm:Singapore26ChinBeeDriveMembersrt:AsiaPacificMember2020-12-310001020569irm:BangkokThailandIC169Moo2Membersrt:AsiaPacificMember2020-01-012020-12-310001020569irm:BangkokThailandIC169Moo2Membersrt:AsiaPacificMember2020-12-310001020569srt:AsiaPacificMember2020-01-012020-12-310001020569srt:AsiaPacificMember2020-12-310001020569irm:AustinsFerry8WhitestoneDriveMembercountry:AU2020-01-012020-12-310001020569irm:AustinsFerry8WhitestoneDriveMembercountry:AU2020-12-310001020569irm:A6NorwichStreetSouthLauncestonAustraliaMembercountry:AU2020-01-012020-12-310001020569irm:A6NorwichStreetSouthLauncestonAustraliaMembercountry:AU2020-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

| | | | | |

| (Mark One) |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2020 |

| or |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

Commission File Number 1-13045

_________________________________________________________

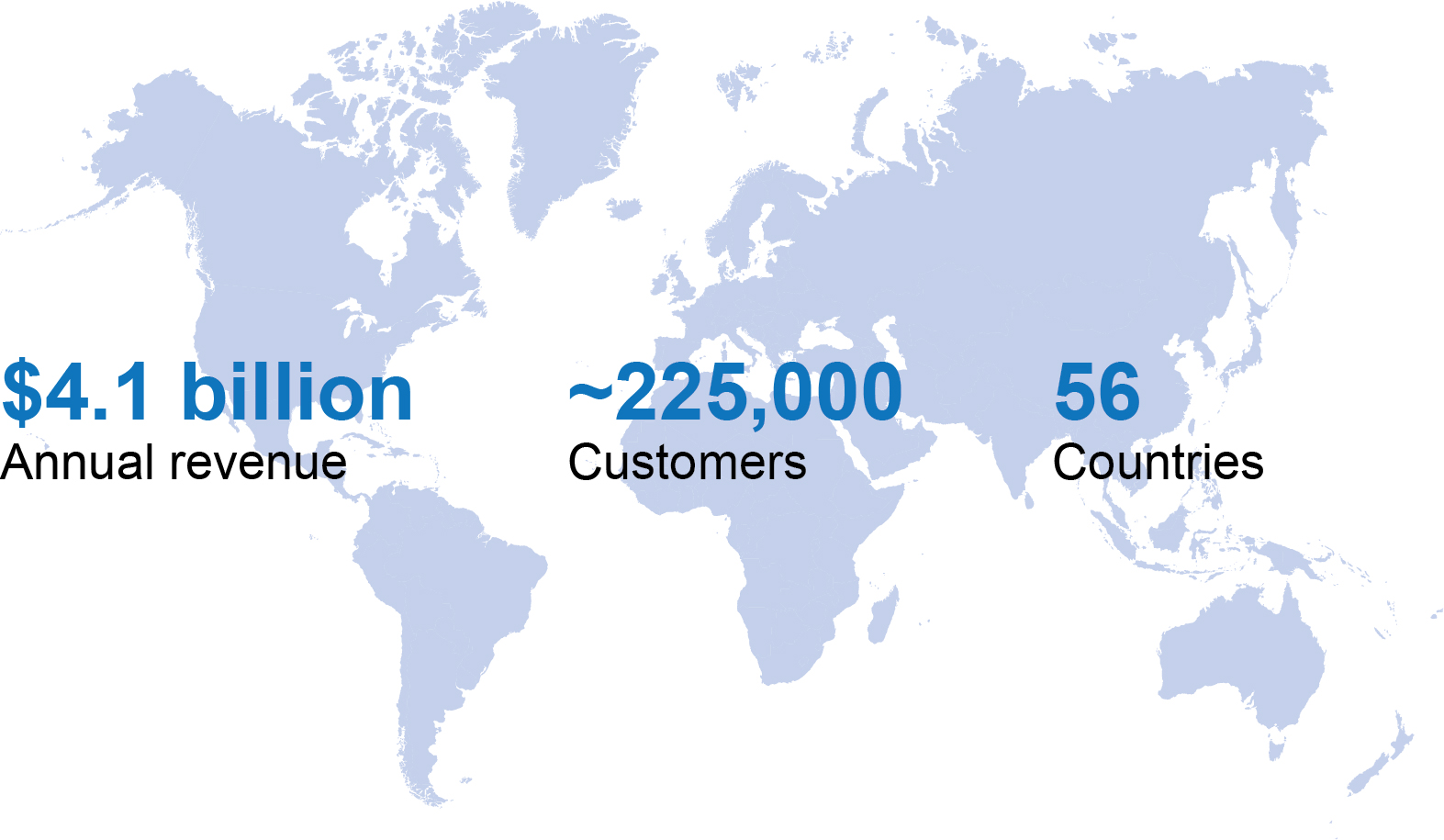

IRON MOUNTAIN INCORPORATED

(Exact name of Registrant as Specified in Its Charter)

Delaware

(State or other jurisdiction of incorporation)

One Federal Street, Boston, Massachusetts

(Address of principal executive offices)

23-2588479

(I.R.S. Employer Identification No.)

02110

(Zip Code)

617-535-4766

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbols(s) | | Name of Exchange on Which Registered |

| Common Stock, $.01 par value per share | | IRM | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| Emerging growth company | ☐ | | |