Table of Contents

As filed with the Securities and Exchange Commission on October 7, 2019

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

THE WALT DISNEY COMPANY

(Exact name of registrant as specified in its charter)

| Delaware | 83-0940635 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification Number) |

500 South Buena Vista Street

Burbank, California 91521

(818) 560-1000

(Address, including zip code and telephone number, including area code, of registrant’s principal executive offices)

Jolene E. Negre, Esq.

Associate General Counsel and Assistant Secretary

The Walt Disney Company

500 South Buena Vista Street

Burbank, California 91521

(818) 560-1000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

TWDC ENTERPRISES 18 CORP.

(Exact name of registrant as specified in its charter)

| Delaware | 95-4545390 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

500 South Buena Vista Street

Burbank, California 91521

(818) 560-1000

(Address, including zip code and telephone number, including area code, of registrant’s principal executive offices)

Jolene E. Negre , Esq.

Assistant Secretary

TWDC Enterprises 18 Corp.

500 South Buena Vista Street

Burbank, California 91521

(818) 560-1000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a Copy to:

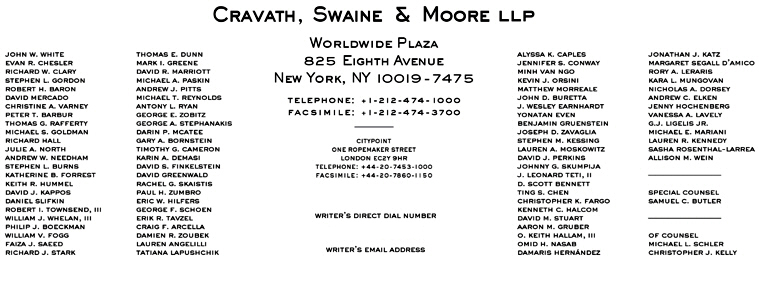

Nicholas A. Dorsey, Esq.

Cravath, Swaine & Moore LLP

Worldwide Plaza

825 Eighth Avenue

New York, New York 10019-7475

(212) 474-1000

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after the effective date of this registration statement.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box: ☐

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ☐

Table of Contents

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of each class of securities to be registered |

Amount to be registered |

Proposed maximum per unit(1) |

Proposed maximum aggregate |

Amount of registration fee(2) | ||||

| 5.650% Notes due 2020 |

$370,982,000 | 100% | $370,982,000 | $48,153 | ||||

| Guarantee of the 5.650% Notes due 2020 |

— | — | — | —(3) | ||||

| 4.500% Notes due 2021 |

$863,324,000 | 100% | $863,324,000 | $112,059 | ||||

| Guarantee of the 4.500% Notes due 2021 |

— | — | — | —(3) | ||||

| 3.000% Notes due 2022 |

$921,824,000 | 100% | $921,824,000 | $119,653 | ||||

| Guarantee of the 3.000% Notes due 2022 |

— | — | — | —(3) | ||||

| 8.875% Notes due 2023 |

$198,404,000 | 100% | $198,404,000 | $25,753 | ||||

| Guarantee of the 8.875% Notes due 2023 |

— | — | — | —(3) | ||||

| 4.000% Notes due 2023 |

$284,844,000 | 100% | $284,844,000 | $36,973 | ||||

| Guarantee of the 4.000% Notes due 2023 |

— | — | — | —(3) | ||||

| 7.750% Notes due January 2024 |

$186,329,000 | 100% | $186,329,000 | $24,186 | ||||

| Guarantee of the 7.750% Notes due January 2024 |

— | — | — | —(3) | ||||

| 7.750% Notes due February 2024 |

$68,112,000 | 100% | $68,112,000 | $8,841 | ||||

| Guarantee of the 7.750% Notes due February 2024 |

— | — | — | —(3) | ||||

| 9.500% Notes due 2024 |

$192,745,000 | 100% | $192,745,000 | $25,018 | ||||

| Guarantee of the 9.500% Notes due 2024 |

— | — | — | —(3) | ||||

| 3.700% Notes due 2024 |

$577,316,000 | 100% | $577,316,000 | $74,936 | ||||

| Guarantee of the 3.700% Notes due 2024 |

— | — | — | —(3) | ||||

| 8.500% Notes due 2025 |

$186,242,000 | 100% | $186,242,000 | $24,174 | ||||

| Guarantee of the 8.500% Notes due 2025 |

— | — | — | —(3) | ||||

| 3.700% Notes due 2025 |

$592,298,000 | 100% | $592,298,000 | $76,880 | ||||

| Guarantee of the 3.700% Notes due 2025 |

— | — | — | —(3) | ||||

| 7.700% Notes due 2025 |

$238,084,000 | 100% | $238,084,000 | $30,903 | ||||

| Guarantee of the 7.700% Notes due 2025 |

— | — | — | —(3) | ||||

| 7.430% Notes due 2026 |

$229,499,000 | 100% | $229,499,000 | $29,789 | ||||

| Guarantee of the 7.430% Notes due 2026 |

— | — | — | —(3) | ||||

| 3.375% Notes due 2026 |

$436,340,000 | 100% | $436,340,000 | $56,637 | ||||

| Guarantee of the 3.375% Notes due 2026 |

— | — | — | —(3) | ||||

| 7.125% Notes due 2028 |

$194,125,000 | 100% | $194,125,000 | $25,197 | ||||

| Guarantee of the 7.125% Notes due 2028 |

— | — | — | —(3) | ||||

| 7.300% Notes due 2028 |

$195,582,000 | 100% | $195,582,000 | $25,387 | ||||

| Guarantee of the 7.300% Notes due 2028 |

— | — | — | —(3) | ||||

| 7.280% Notes due 2028 |

$195,100,000 | 100% | $195,100,000 | $25,324 | ||||

| Guarantee of the 7.280% Notes due 2028 |

— | — | — | —(3) | ||||

| 7.625% Notes due 2028 |

$187,789,000 | 100% | $187,789,000 | $24,375 | ||||

| Guarantee of the 7.625% Notes due 2028 |

— | — | — | —(3) | ||||

| 6.550% Notes due 2033 |

$342,347,000 | 100% | $342,347,000 | $44,437 | ||||

| Guarantee of the 6.550% Notes due 2033 |

— | — | — | —(3) | ||||

| 8.450% Notes due 2034 |

$194,866,000 | 100% | $194,866,000 | $25,294 | ||||

| Guarantee of the 8.450% Notes due 2034 |

— | — | — | —(3) | ||||

| 6.200% Notes due 2034 |

$984,222,000 | 100% | $984,222,000 | $127,752 | ||||

| Guarantee of the 6.200% Notes due 2034 |

— | — | — | —(3) | ||||

| 6.400% Notes due 2035 |

$973,196,000 | 100% | $973,196,000 | $126,321 | ||||

| Guarantee of the 6.400% Notes due 2035 |

— | — | — | —(3) | ||||

| 8.150% Notes due 2036 |

$239,786,000 | 100% | $239,786,000 | $31,124 | ||||

| Guarantee of the 8.150% Notes due 2036 |

— | — | — | —(3) | ||||

| 6.150% Notes due 2037 |

$321,934,000 | 100% | $321,934,000 | $41,787 | ||||

| Guarantee of the 6.150% Notes due 2037 |

— | — | — | —(3) | ||||

| 6.650% Notes due 2037 |

$1,234,237,000 | 100% | $1,234,237,000 | $160,204 | ||||

| Guarantee of the 6.650% Notes due 2037 |

— | — | — | —(3) | ||||

| 6.750% Notes due 2038 |

$141,229,000 | 100% | $141,229,000 | $18,332 | ||||

| Guarantee of the 6.750% Notes due 2038 |

— | — | — | —(3) | ||||

| 7.850% Notes due 2039 |

$111,283,000 | 100% | $111,283,000 | $14,445 | ||||

| Guarantee of the 7.850% Notes due 2039 |

— | — | — | —(3) | ||||

| 6.900% Notes due 2039 |

$236,418,000 | 100% | $236,418,000 | $30,687 | ||||

| Guarantee of the 6.900% Notes due 2039 |

— | — | — | —(3) | ||||

| 6.150% Notes due 2041 |

$631,871,000 | 100% | $631,871,000 | $82,017 | ||||

| Guarantee of the 6.150% Notes due 2041 |

— | — | — | —(3) | ||||

| 5.400% Notes due 2043 |

$683,836,000 | 100% | $683,836,000 | $88,762 | ||||

| Guarantee of the 5.400% Notes due 2043 |

— | — | — | —(3) | ||||

| 4.750% Notes due 2044 |

$588,724,000 | 100% | $588,724,000 | $76,416 | ||||

| Guarantee of the 4.750% Notes due 2044 |

— | — | — | —(3) | ||||

| 4.950% Notes due 2045 |

$399,301,000 | 100% | $399,301,000 | $51,829 | ||||

| Guarantee of the 4.950% Notes due 2045 |

— | — | — | —(3) | ||||

| 7.750% Notes due 2045 |

$324,985,000 | 100% | $324,985,000 | $42,183 | ||||

| Guarantee of the 7.750% Notes due 2045 |

— | — | — | —(3) | ||||

| 4.750% Notes due 2046 |

$399,892,000 | 100% | $399,892,000 | $51,906 | ||||

| Guarantee of the 4.750% Notes due 2046 |

— | — | — | —(3) | ||||

| 7.900% Notes due 2095 |

$93,955,000 | 100% | $93,955,000 | $12,195 | ||||

| Guarantee of the 7.900% Notes due 2095 |

— | — | — | —(3) | ||||

| 8.250% Notes due 2096 |

$77,418,000 | 100% | $77,418,000 | $10,049 | ||||

| Guarantee of the 8.250% Notes due 2096 |

— | — | — | —(3) | ||||

| Total |

$14,098,439,000 | N/A | $14,098,439,000 | $1,829,977 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Estimated in accordance with Rule 457(f) under the Securities Act of 1933, as amended (the “Securities Act”), solely for purposes of calculating the registration fee. |

| (2) | Determined in accordance with Section 6(b) of the Securities Act at a rate equal to $129.80 per $1,000,000 of the proposed maximum aggregate offering price. |

| (3) | Pursuant to Rule 457(n) under the Securities Act, no additional registration fee is payable with respect to the guarantee. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with the provisions of section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to section 8(a), may determine.

Table of Contents

The information in this prospectus may be changed. We may not complete the exchange offer and issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO CHANGE, DATED OCTOBER 7, 2019

PRELIMINARY PROSPECTUS

TWDC ENTERPRISES 18 CORP.

Offer to Exchange

This is an offer by The Walt Disney Company, a Delaware corporation (the “Issuer” or “Disney”), to exchange:

(1) up to $370,982,000 5.650% Notes due 2020 (“Original 5.650% 2020 Notes”) for a like principal amount of 5.650% Notes due 2020, which have been registered under the Securities Act of 1933, as amended (the “Securities Act”) (“Exchange 5.650% 2020 Notes”);

(2) up to $863,324,000 4.500% Notes due 2021 (“Original 4.500% 2021 Notes”) for a like principal amount of 4.500% Notes due 2021, which have been registered under the Securities Act (“Exchange 4.500% 2021 Notes”);

(3) up to $921,824,000 3.000% Notes due 2022 (“Original 3.000% 2022 Notes”) for a like principal amount of 3.000% Notes due 2022, which have been registered under the Securities Act (“Exchange 3.000% 2022 Notes”);

(4) up to $198,404,000 8.875% Notes due 2023 (“Original 8.875% 2023 Notes”) for a like principal amount of 8.875% Notes due 2023, which have been registered under the Securities Act (“Exchange 8.875% 2023 Notes”);

(5) up to $284,844,000 4.000% Notes due 2023 (“Original 4.000% 2023 Notes”) for a like principal amount of 4.000% Notes due 2023, which have been registered under the Securities Act (“Exchange 4.000% 2023 Notes”);

(6) up to $186,329,000 7.750% Notes due January 2024 (“Original 7.750% January 2024 Notes”) for a like principal amount of 7.750% Notes due January 2024, which have been registered under the Securities Act (“Exchange 7.750% January 2024 Notes”);

(7) up to $68,112,000 7.750% Notes due February 2024 (“Original 7.750% February 2024 Notes”) for a like principal amount of 7.750% Notes due February 2024, which have been registered under the Securities Act (“Exchange 7.750% February 2024 Notes”);

(8) up to $192,745,000 9.500% Notes due 2024 (“Original 9.500% 2024 Notes”) for a like principal amount of 9.500% Notes due 2024, which have been registered under the Securities Act (“Exchange 9.500% 2024 Notes”);

(9) up to $577,316,000 3.700% Notes due 2024 (“Original 3.700% 2024 Notes”) for a like principal amount of 3.700% Notes due 2024, which have been registered under the Securities Act (“Exchange 3.700% 2024 Notes”);

(10) up to $186,242,000 8.500% Notes due 2025 (“Original 8.500% 2025 Notes”) for a like principal amount of 8.500% Notes due 2025, which have been registered under the Securities Act (“Exchange 8.500% 2025 Notes”);

(11) up to $592,298,000 3.700% Notes due 2025 (“Original 3.700% 2025 Notes”) for a like principal amount of 3.700% Notes due 2025, which have been registered under the Securities Act (“Exchange 3.700% 2025 Notes”);

(12) up to $238,084,000 7.700% Notes due 2025 (“Original 7.700% 2025 Notes”) for a like principal amount of 7.700% Notes due 2025, which have been registered under the Securities Act (“Exchange 7.700% 2025 Notes”);

(13) up to $229,499,000 7.430% Notes due 2026 (“Original 7.430% 2026 Notes”) for a like principal amount of 7.430% Notes due 2026, which have been registered under the Securities Act (“Exchange 7.430% 2026 Notes”);

(14) up to $436,340,000 3.375% Notes due 2026 (“Original 3.375% 2026 Notes”) for a like principal amount of 3.375% Notes due 2026, which have been registered under the Securities Act (“Exchange 3.375% 2026 Notes”);

(15) up to $194,125,000 7.125% Notes due 2028 (“Original 7.125% 2028 Notes”) for a like principal amount of 7.125% Notes due 2028, which have been registered under the Securities Act (“Exchange 7.125% 2028 Notes”);

(16) up to $195,582,000 7.300% Notes due 2028 (“Original 7.300% 2028 Notes”) for a like principal amount of 7.300% Notes due 2028, which have been registered under the Securities Act (“Exchange 7.300% 2028 Notes”);

(17) up to $195,100,000 7.280% Notes due 2028 (“Original 7.280% 2028 Notes”) for a like principal amount of 7.280% Notes due 2028, which have been registered under the Securities Act (“Exchange 7.280% 2028 Notes”);

(18) up to $187,789,000 7.625% Notes due 2028 (“Original 7.625% 2028 Notes”) for a like principal amount of 7.625% Notes due 2028, which have been registered under the Securities Act (“Exchange 7.625% 2028 Notes”);

(19) up to $342,347,000 6.550% Notes due 2033 (“Original 6.550% 2033 Notes”) for a like principal amount of 6.550% Notes due 2033, which have been registered under the Securities Act (“Exchange 6.550% 2033 Notes”);

(20) up to $194,866,000 8.450% Notes due 2034 (“Original 8.450% 2034 Notes”) for a like principal amount of 8.450% Notes due 2034, which have been registered under the Securities Act (“Exchange 8.450% 2034 Notes”);

(21) up to $984,222,000 6.200% Notes due 2034 (“Original 6.200% 2034 Notes”) for a like principal amount of 6.200% Notes due 2034, which have been registered under the Securities Act (“Exchange 6.200% 2034 Notes”);

(22) up to $973,196,000 6.400% Notes due 2035 (“Original 6.400% 2035 Notes”) for a like principal amount of 6.400% Notes due 2035, which have been registered under the Securities Act (“Exchange 6.400% 2035 Notes”);

(23) up to $239,786,000 8.150% Notes due 2036 (“Original 8.150% 2036 Notes”) for a like principal amount of 8.150% Notes due 2036, which have been registered under the Securities Act (“Exchange 8.150% 2036 Notes”);

(24) up to $321,934,000 6.150% Notes due 2037 (“Original 6.150% 2037 Notes”) for a like principal amount of 6.150% Notes due 2037, which have been registered under the Securities Act (“Exchange 6.150% 2037 Notes”);

(25) up to $1,234,237,000 6.650% Notes due 2037 (“Original 6.650% 2037 Notes”) for a like principal amount of 6.650% Notes due 2037, which have been registered under the Securities Act (“Exchange 6.650% 2037 Notes”);

(26) up to $141,229,000 6.750% Notes due 2038 (“Original 6.750% 2038 Notes”) for a like principal amount of 6.750% Notes due 2038, which have been registered under the Securities Act (“Exchange 6.750% 2038 Notes”);

(27) up to $111,283,000 7.850% Notes due 2039 (“Original 7.850% 2039 Notes”) for a like principal amount of 7.850% Notes due 2039, which have been registered under the Securities Act (“Exchange 7.850% 2039 Notes”);

(28) up to $236,418,000 6.900% Notes due 2039 (“Original 6.900% 2039 Notes”) for a like principal amount of 6.900% Notes due 2039, which have been registered under the Securities Act (“Exchange 6.900% 2039 Notes”);

(29) up to $631,871,000 6.150% Notes due 2041 (“Original 6.150% 2041 Notes”) for a like principal amount of 6.150% Notes due 2041, which have been registered under the Securities Act (“Exchange 6.150% 2041 Notes”);

Table of Contents

(30) up to $683,836,000 5.400% Notes due 2043 (“Original 5.400% 2043 Notes”) for a like principal amount of 5.400% Notes due 2043, which have been registered under the Securities Act (“Exchange 5.400% 2043 Notes”);

(31) up to $588,724,000 4.750% Notes due 2044 (“Original 4.750% 2044 Notes”) for a like principal amount of 4.750% Notes due 2044, which have been registered under the Securities Act (“Exchange 4.750% 2044 Notes”);

(32) up to $399,301,000 4.950% Notes due 2045 (“Original 4.950% 2045 Notes”) for a like principal amount of 4.950% Notes due 2045, which have been registered under the Securities Act (“Exchange 4.950% 2045 Notes”);

(33) up to $324,985,000 7.750% Notes due 2045 (“Original 7.750% 2045 Notes”) for a like principal amount of 7.750% Notes due 2045, which have been registered under the Securities Act (“Exchange 7.750% 2045 Notes”);

(34) up to $399,892,000 4.750% Notes due 2046 (“Original 4.750% 2046 Notes”) for a like principal amount of 4.750% Notes due 2046, which have been registered under the Securities Act (“Exchange 4.750% 2046 Notes”);

(35) up to $93,955,000 7.900% Notes due 2095 (“Original 7.900% 2095 Notes”) for a like principal amount of 7.900% Notes due 2095, which have been registered under the Securities Act (“Exchange 7.900% 2095 Notes”); and

(36) up to $77,418,000 8.250% Notes due 2096 (“Original 8.250% 2096 Notes” and, together with the Original 5.650% 2020 Notes, Original 4.500% 2021 Notes, Original 3.000% 2022 Notes, Original 8.875% 2023 Notes, Original 4.000% 2023 Notes, Original 7.750% January 2024 Notes, Original 7.750% February 2024 Notes, Original 9.500% 2024 Notes, Original 3.700% 2024 Notes, Original 8.500% 2025 Notes, Original 3.700% 2025 Notes, Original 7.700% 2025 Notes, Original 7.430% 2026 Notes, Original 3.375% 2026 Notes, Original 7.125% 2028 Notes, Original 7.300% 2028 Notes, Original 7.280% 2028 Notes, Original 7.625% 2028 Notes, Original 6.550% 2033 Notes, Original 8.450% 2034 Notes, Original 6.200% 2034 Notes, Original 6.400% 2035 Notes, Original 8.150% 2036 Notes, Original 6.150% 2037 Notes, Original 6.650% 2037 Notes, Original 6.750% 2038 Notes, Original 7.850% 2039 Notes, Original 6.900% 2039 Notes, Original 6.150% 2041 Notes, Original 5.400% 2043 Notes, Original 4.750% 2044 Notes, Original 4.950% 2045 Notes, Original 7.750% 2045 Notes, Original 4.750% 2046 Notes and Original 7.900% 2095 Notes, the “original notes”)

for a like principal amount of 8.250% Notes due 2096, which have been registered under the Securities Act (“Exchange 8.250% 2096 Notes” and, together with the Exchange 5.650% 2020 Notes, Exchange 4.500% 2021 Notes, Exchange 3.000% 2022 Notes, Exchange 8.875% 2023 Notes, Exchange 4.000% 2023 Notes, Exchange 7.750% January 2024 Notes, Exchange 7.750% February 2024 Notes, Exchange 9.500% 2024 Notes, Exchange 3.700% 2024 Notes, Exchange 8.500% 2025 Notes, Exchange 3.700% 2025 Notes, Exchange 7.700% 2025 Notes, Exchange 7.430% 2026 Notes, Exchange 3.375% 2026 Notes, Exchange 7.125% 2028 Notes, Exchange 7.300% 2028 Notes, Exchange 7.280% 2028 Notes, Exchange 7.625% 2028 Notes, Exchange 6.550% 2033 Notes, Exchange 8.450% 2034 Notes, Exchange 6.200% 2034 Notes, Exchange 6.400% 2035 Notes, Exchange 8.150% 2036 Notes, Exchange 6.150% 2037 Notes, Exchange 6.650% 2037 Notes, Exchange 6.750% 2038 Notes, Exchange 7.850% 2039 Notes, Exchange 6.900% 2039 Notes, Exchange 6.150% 2041 Notes, Exchange 5.400% 2043 Notes, Exchange 4.750% 2044 Notes, Exchange 4.950% 2045 Notes, Exchange 7.750% 2045 Notes, Exchange 4.750% 2046 Notes and Exchange 7.900% 2095 Notes, the “exchange notes”).

We are conducting the exchange offers (the “exchange offers”) in order to provide you with an opportunity to exchange your original notes for exchange notes that have been registered under the Securities Act. The original notes and the exchange notes are sometimes referred to in this prospectus together as the “notes”.

Material Terms of the Exchange Offers:

| • | The Issuer will exchange all original notes that are validly tendered and not validly withdrawn for an equal principal amount of exchange notes that are freely tradable. |

| • | You may withdraw tenders of original notes at any time prior to the expiration of the relevant exchange offer. |

| • | Each exchange offer will expire at 5:00 p.m., New York City time, on , 2019 (the “expiration date”), unless extended. We do not currently intend to extend the expiration date unless required to do so by applicable law as described under “The Exchange Offers—Expiration Date; Extensions; Amendments”. |

| • | The original notes may only be tendered in an amount equal to $2,000 in principal amount or in integral multiples of $1,000 in excess thereof. |

| • | To exchange your original notes, you are required to make certain representations to us. See “The Exchange Offers—Procedures for Tendering” for more information. |

| • | We will not receive any proceeds from the exchange offers. |

The Exchange Notes:

| • | The terms of the exchange notes to be issued in the exchange offers are substantially identical to the terms of the corresponding series of original notes, except that the exchange notes will be registered under the Securities Act and the transfer restrictions, registration rights and additional interest provisions applicable to the original notes will not apply to the exchange notes. The exchange notes will represent the same debt as the original notes, and the Issuer will issue the exchange notes under the same indenture that governs the applicable series of original notes. |

| • | The exchange notes will be fully, unconditionally, jointly and severally guaranteed on an unsecured unsubordinated basis by the same entity that guarantees the original notes, specifically TWDC Enterprises 18 Corp. (the “Guarantor” or “TWDC Enterprises”). The guarantee constitutes a separate security that is being offered by the Guarantor. See “Description of Notes—The Guarantee”. |

| • | The exchange notes will not be listed on any securities exchange or any automated dealer quotation system and there is currently no market for the exchange notes. |

All untendered original notes will continue to be subject to the restrictions on transfer set forth in the original notes and in the indenture governing the applicable series of original notes. In general, the original notes may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, registration under the Securities Act. Other than in connection with the exchange offers, the Issuer does not currently anticipate that it will register any series of the original notes under the Securities Act.

Each broker-dealer that receives exchange notes for its own account pursuant to an exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. The letter of transmittal states that, by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for original notes where such original notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. The Issuer has agreed that it will furnish to each broker-dealer who has delivered the notice to the Issuer required by and in accordance with the registration rights agreement (as defined herein), without charge, as many copies of this prospectus and any amendment and supplement hereto, as such participating broker-dealer may reasonably request in connection with its resale of such exchange notes. See “Plan of Distribution”.

Investing in the exchange notes involves risks. See “Risk Factors ” beginning on page 16 for a discussion of certain factors you should consider in connection with the exchange offers and an investment in the exchange notes.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2019.

Table of Contents

You should rely only on the information contained in this prospectus and the documents incorporated by reference herein. We have not authorized any person to provide you with any information or represent anything about us or the exchange offers that is not contained in this prospectus or incorporated by reference herein. If given or made, any such other information or representation should not be relied upon as having been authorized by us. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

We are not making the exchange offers to, nor will we accept surrenders for exchange from, holders of outstanding original notes in any jurisdiction in which the applicable exchange offer would not be in compliance with the securities or blue sky laws of such jurisdiction or where it is otherwise unlawful.

| Page | ||||

| ii | ||||

| iii | ||||

| iv | ||||

| v | ||||

| 1 | ||||

| 16 | ||||

| 19 | ||||

| 20 | ||||

| 22 | ||||

| 34 | ||||

| 58 | ||||

| 61 | ||||

| 62 | ||||

| 66 | ||||

| 67 | ||||

This prospectus incorporates business and financial information about us that is not included in or delivered with this prospectus. We will provide without charge to each person, including any beneficial owner, to whom a copy of this prospectus has been delivered, on the written or oral request of that person, a copy of any or all of the documents which have been or may be incorporated by reference in this prospectus other than exhibits to these documents, unless the exhibits are also specifically incorporated by reference herein. Requests for copies should be directed to The Walt Disney Company, 500 South Buena Vista Street, Burbank, California 91521, Attention: Senior Vice President, Investor Relations; telephone number (818) 560-1000. You should not assume that the information in this prospectus or any document incorporated by reference herein is accurate as of any date other than the respective dates of those documents. Our business, financial condition, results of operations and prospects may have changed since such dates. The information relating to us contained in this prospectus does not purport to be complete and should be read together with the information contained in the documents incorporated or deemed to be incorporated by reference in this prospectus.

In order to ensure timely delivery of the requested documents, requests should be made no later than , 2019, which is five business days before the date the exchange offers expire.

See “Where You Can Find More Information” and “Incorporation of Certain Information By Reference”.

i

Table of Contents

On March 20, 2019, pursuant to the Amended and Restated Agreement and Plan of Merger, dated as of June 20, 2018, among TFCF Corporation (formerly known as Twenty-First Century Fox, Inc.) (“TFCF”), TWDC Enterprises 18 Corp. (formerly known as The Walt Disney Company), which we refer to as the “Guarantor” or “TWDC Enterprises”, The Walt Disney Company (formerly known as TWDC Holdco 613 Corp.), which we refer to as “Disney” or “Issuer”, WDC Merger Enterprises I, Inc. and WDC Merger Enterprises II, Inc., Disney acquired all of the outstanding shares of TFCF through a transaction in which: (i) WDC Merger Enterprises I, Inc. merged with and into the Guarantor, with the Guarantor surviving such merger as a 100% owned subsidiary of Disney (the “Disney Merger”) and (ii) WDC Merger Enterprises II, Inc. merged with and into TFCF, with TFCF surviving such merger as a 100% owned subsidiary of Disney (the “TFCF Merger” and, together with the Disney Merger, the “Mergers”). As a result of the Mergers, among other things, Disney became the ultimate parent of the Guarantor, TFCF and their respective subsidiaries. Effective as of the effective time of the Disney Merger, which occurred at 12:01 a.m., Eastern Time, on March 20, 2019, Disney changed its name to “The Walt Disney Company” and the Guarantor changed its name to “TWDC Enterprises 18 Corp”.

When we refer to “The Walt Disney Company”, the “Company”, “we”, “our” and “us” in this prospectus under the headings “Where You Can Find More Information”, “Cautionary Statement Concerning Forward-Looking Statements” and “Prospectus Summary—The Walt Disney Company”, we mean The Walt Disney Company and its subsidiaries, including TWDC Enterprises, through which various businesses are actually conducted. When such terms are used elsewhere in this prospectus, we refer only to The Walt Disney Company unless the context otherwise requires or as otherwise indicated. When we refer to our Annual Report on Form 10-K for the fiscal year ended September 29, 2018 and Quarterly Report on Form 10-Q for the quarterly period ended December 29, 2018, we mean the Annual Report on Form 10-K and Quarterly Report on Form 10-Q for such periods filed by TWDC Enterprises.

ii

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-4 under the Securities Act with respect to the exchange offers. This prospectus does not contain all of the information contained in the registration statement and the exhibits to the registration statement. You should refer to the registration statement, including the exhibits, for further information about the exchange notes being offered hereby. Copies of our SEC filings, including the exhibits to the registration statement, are available through us or from the SEC through the SEC’s website.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains an Internet website that contains reports, proxy and information statements, and other information regarding issuers, including The Walt Disney Company, that file electronically with the SEC. The public can obtain any documents that we file electronically with the SEC at http://www.sec.gov. Our SEC filings and other information about The Walt Disney Company are also available at our website at www.thewaltdisneycompany.com. Except for documents filed with the SEC and incorporated by reference into this prospectus, no information contained in, or that can be accessed through, our website is to be considered part of this prospectus.

This prospectus constitutes part of a registration statement on Form S-4 that we filed with the SEC under the Securities Act. As permitted by the rules and regulations of the SEC, this prospectus omits some of the information, exhibits and undertakings included in the registration statement. For further information, you should refer to the registration statement and its exhibits.

Statements contained in this prospectus or in any document incorporated by reference herein as to the contents of any contract or other document referred to herein or therein are not necessarily complete, and, in each instance, reference is made to the copy of the contract or other document filed as an exhibit to, or incorporated by reference in, the registration statement, each statement being qualified in all respects by such reference.

iii

Table of Contents

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

We and TWDC Enterprises have elected to “incorporate by reference” certain information into this prospectus. By incorporating by reference, we and TWDC Enterprises can disclose important information to you by referring you to another document we have filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, except for information incorporated by reference that is superseded by information contained in this prospectus or any document we subsequently file with the SEC that is incorporated or deemed to be incorporated by reference in this prospectus. Likewise, any statement in this prospectus or any document which is incorporated or deemed to be incorporated by reference herein will be deemed to have been modified or superseded to the extent that any statement contained in any document that we subsequently file with the SEC that is incorporated or deemed to be incorporated by reference herein modifies or supersedes that statement. We and TWDC Enterprises incorporate by reference the following documents that we and TWDC Enterprises have previously filed with the SEC (other than information in such documents that is deemed not to be filed):

| (a) | TWDC Enterprises’s Annual Report on Form 10-K for the fiscal year ended September 29, 2018, filed on November 21, 2018 (the financial statements and the related audit opinion have been superseded by the financial statements and audit report in TWDC Enterprises’s Current Report on Form 8-K filed on February 15, 2019 and The Walt Disney Company’s Current Report on Form 8-K filed on August 14, 2019); |

| (b) | TWDC Enterprises’s Quarterly Report on Form 10-Q for the quarterly period ended December 29, 2018, filed on February 5, 2019 (the financial statements have been superseded by the financial statements in The Walt Disney Company’s Current Report on Form 8-K filed on August 14, 2019); |

| (c) | the information in TWDC Enterprises’s proxy statement filed on January 11, 2019, but only to the extent such information is incorporated by reference in TWDC Enterprises’s Annual Report on Form 10-K for the fiscal year ended September 29, 2018; |

| (d) | TWDC Enterprises’s Current Reports on Form 8-K filed on October 5, 2018, October 15, 2018, October 22, 2018, October 29, 2018, November 27, 2018, November 30, 2018, December 3, 2018, December 4, 2018, December 26, 2018, January 8, 2019, January 18, 2019 (first filing only), January 25, 2019, January 29, 2019, January 30, 2019, February 6, 2019, February 15, 2019, February 21, 2019, March 1, 2019, March 4, 2019, March 5, 2019, March 8, 2019, March 8, 2019, March 12, 2019, March 18, 2019 and March 20, 2019; |

| (e) | The Walt Disney Company’s Quarterly Report on Form 10-Q for the quarterly period ended March 30, 2019, filed on May 8, 2019 and Quarterly Report on Form 10-Q for the quarterly period ended June 29, 2019, filed on August 6, 2019; and |

| (f) | The Walt Disney Company’s Current Reports on Form 8-K filed on March 20, 2019, on Form 8-K12B filed on March 20, 2019, on Form 8-K/A filed on March 27, 2019 and on Form 8-K filed on May 3, 2019, May 14, 2019, August 14, 2019, August 29, 2019, September 3, 2019, September 6, 2019, September 17, 2019 and October 1, 2019. |

We also are incorporating by reference all future documents that we file with the SEC pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of the offering of the notes made hereby (in each case other than information in and exhibits to such documents that are deemed not to be filed). The most recent information that we file with the SEC automatically updates and, to the extent inconsistent with prior information, supersedes more dated information.

Except as incorporated by reference herein from TWDC Enterprises’s filings with the SEC, this prospectus omits financial statements for TWDC Enterprises, as permitted by the SEC in Rule 3-10(e) of Regulation S-X. TWDC Enterprises is our 100% owned subsidiary, and the notes issued under this prospectus will be fully and unconditionally guaranteed by TWDC Enterprises.

iv

Table of Contents

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated or deemed to be incorporated by reference herein contain or may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. We have based these forward-looking statements on our current expectations about future events. These forward-looking statements, including, without limitation, those relating to future actions, new projects, strategies, future performance and the outcome of contingencies such as future financial results, in each case, wherever they appear in this prospectus or the documents incorporated or deemed to be incorporated by reference herein, are necessarily estimates reflecting the best judgment of the management of The Walt Disney Company and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. These forward-looking statements should, therefore, be considered in light of various important factors, including those factors described in more detail in our Annual Report on Form 10-K for the year ended September 29, 2018 and in any subsequent Quarterly Reports on Form 10-Q (including, for the avoidance of doubt, the Quarterly Report on Form 10-Q for the quarterly period ended December 29, 2018 filed by TWDC Enterprises) and Annual Reports on Form 10-K under Item 1A, “Risk Factors” as well as in any subsequent periodic or current reports filed with the Securities and Exchange Commission under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that include “Risk Factors” or that discuss risks to us.

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this prospectus or, in the case of documents incorporated or deemed to be incorporated by reference herein, as of the date of those documents. The Walt Disney Company does not undertake any obligation to publicly update or release any revisions to these forward-looking statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events, except as required by law.

v

Table of Contents

This summary highlights certain information about our business and the exchange offers. This is a summary of information contained elsewhere in this prospectus, the accompanying letter of transmittal or incorporated by reference herein and does not contain all of the information that you should consider before investing in the exchange notes. For a more complete understanding of this offering and our business, you should read this entire prospectus, including the section entitled “Risk Factors”, the accompanying letter of transmittal and all documents incorporated by reference herein.

The Walt Disney Company

The Walt Disney Company, together with its subsidiaries through which businesses are conducted, is a diversified worldwide entertainment company with operations in four business segments: Media Networks; Parks, Experiences and Products; Studio Entertainment; and Direct-to-Consumer & International. The Walt Disney Company is a Delaware corporation having its principal executive offices at 500 South Buena Vista Street, Burbank, California 91521, and its telephone number is (818) 560-1000.

On March 20, 2019, the Company acquired TFCF. Prior to the acquisition, TFCF and a newly-formed subsidiary of TFCF (“New Fox”) entered into a separation agreement, pursuant to which TFCF transferred to New Fox a portfolio of TFCF’s news, sports and broadcast businesses and certain other assets. TFCF retained all of the assets and liabilities not transferred to New Fox, including the Twentieth Century Fox film and television studios, certain cable networks and TFCF’s international TV businesses; these remaining assets and businesses are held directly or indirectly by the acquired TFCF entity.

As part of the acquisition, the Company agreed to sell TFCF’s Regional Sports Networks, which was completed in August 2019, and certain sport media operations in Brazil and Mexico. In addition, as a result of the TFCF acquisition the Company’s ownership interest in Hulu LLC (“Hulu”) increased to 60% (67% as of June 29, 2019). The acquired TFCF businesses are generally branded Fox, FX, National Geographic and Star.

To find out how to obtain more information regarding us and our business, you should read the documents incorporated and deemed to be incorporated by reference in this prospectus that are described in the section of this prospectus entitled “Where You Can Find More Information.”

Media Networks

| • | Significant operations: |

| • | Disney, ESPN (80% ownership interest), Freeform, FX and National Geographic (73% ownership interest) branded domestic cable networks |

| • | ABC branded broadcast television network and eight owned domestic television stations |

| • | Television production and distribution |

| • | National Geographic magazine business |

| • | A 50% equity investment in A+E Television Networks (“A+E”), which operates a variety of cable networks including A&E, HISTORY and Lifetime |

1

Table of Contents

Parks, Experiences and Products

| • | Significant operations: |

| • | Parks & Experiences: |

| • | Theme parks and resorts, which include: Walt Disney World Resort in Florida; Disneyland Resort in California; Disneyland Paris; Hong Kong Disneyland Resort (47% ownership interest); and Shanghai Disney Resort (43% ownership interest), all of which are consolidated in our results. Additionally, the Company licenses our intellectual property to a third party to operate Tokyo Disney Resort. |

| • | Disney Cruise Line, Disney Vacation Club, Disney and National Geographic (73% ownership interest) branded travel businesses, and Aulani, a Disney Resort & Spa in Hawaii |

| • | Consumer Products: |

| • | Licensing of our trade names, characters, visual, literary and other intellectual properties to various manufacturers, game developers, publishers and retailers throughout the world |

| • | Sale of branded merchandise through retail, online and wholesale businesses, and development and publishing of books, magazines (excluding National Geographic, which is reported in Media Networks) and comic books |

Studio Entertainment

| • | Significant operations: |

| • | Motion picture production and distribution under the Walt Disney Pictures, Twentieth Century Fox, Marvel, Lucasfilm, Pixar, Fox Searchlight Pictures and Blue Sky Studios banners |

| • | Development, production and licensing of live entertainment events on Broadway and around the world (stage plays) |

| • | Music production and distribution |

| • | Post-production services including visual and audio effects through Industrial Light & Magic and Skywalker Sound banners |

Direct-to-Consumer & International

| • | Significant operations: |

| • | Disney, ESPN, Fox, FX, National Geographic and Star branded international television networks and channels |

| • | Direct-to-consumer streaming services distributed digitally to internet-connected devices, including Disney+, which we plan to launch in the U.S. and selected countries in November 2019 with ongoing global launch anticipated throughout 2020 and 2021, ESPN+, Hotstar and Hulu |

| • | BAMTech LLC (“BAMTech”) (owned 75% by the Company since September 2017), which provides streaming technology services |

2

Table of Contents

| • | Equity investments: |

| • | A 50% ownership interest in Endemol Shine Group, which is a multi-platform content provider with creative operations across the world’s major markets |

| • | A 27% effective ownership interest in Vice Group Holdings, Inc. (“Vice”), which is a media company that targets millennial audiences. Vice operates Viceland, which is owned 50% by Vice and 50% by A+E. |

TWDC Enterprises 18 Corp.

TWDC Enterprises is a Delaware corporation and a direct, 100% owned subsidiary of The Walt Disney Company. Its principal executive offices are located at 500 South Buena Vista Street, Burbank, California 91521, and its telephone number is (818) 560-1000.

3

Table of Contents

Summary of the Terms of the Exchange Offers

| Background |

On March 20, 2019 the Issuer completed its offers to (i) “qualified institutional buyers” (within the meaning of Rule 144A under the Securities Act) and (ii) non-“U.S. persons” outside of the United States (within the meaning of Regulation S under the Securities Act) to exchange (the “prior private exchange offers”) any and all outstanding notes issued by 21st Century Fox America, Inc. (the “21CFA Notes”) for the original notes and cash. In connection with each of the prior private exchange offers, on March 20, 2019, the Issuer and the Guarantor entered into a registration rights agreement (the “registration rights agreement”) with the dealer managers in which the Issuer agreed, among other things, to complete the exchange offers. On October 3, 2019, the Issuer completed cash tender offers (the “Tender Offers”) to purchase certain outstanding notes of the Issuer as described in the Amended and Restated Offer to Purchase dated as of September 3, 2019 (as amended by the press release dated September 17, 2019) and related Letter of Transmittal (as amended by the press release dated September 17, 2019). The exchange offers pursuant to this prospectus are in respect of the original notes that remain outstanding following such Tender Offers. See “The Exchange Offers—Purpose of the Exchange Offers; Registration Rights”. |

| The Exchange Offers |

The Issuer is offering to exchange: |

| • | the unregistered Original 5.650% 2020 Notes for an equivalent amount of the Exchange 5.650% 2020 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 4.500% 2021 Notes for an equivalent amount of the Exchange 4.500% 2021 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 3.000% 2022 Notes for an equivalent amount of the Exchange 3.000% 2022 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 8.875% 2023 Notes for an equivalent amount of the Exchange 8.875% 2023 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 4.000% 2023 Notes for an equivalent amount of the Exchange 4.000% 2023 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 7.750% January 2024 Notes for an equivalent amount of the Exchange 7.750% January 2024 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 7.750% February 2024 Notes for an equivalent amount of the Exchange 7.750% February 2024 Notes, which have been registered under the Securities Act; |

4

Table of Contents

| • | the unregistered Original 9.500% 2024 Notes for an equivalent amount of the Exchange 9.500% 2024 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 3.700% 2024 Notes for an equivalent amount of the Exchange 3.700% 2024 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 8.500% 2025 Notes for an equivalent amount of the Exchange 8.500% 2025 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 3.700% 2025 Notes for an equivalent amount of the Exchange 3.700% 2025 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 7.700% 2025 Notes for an equivalent amount of the Exchange 7.700% 2025 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 7.430% 2026 Notes for an equivalent amount of the Exchange 7.430% 2026 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 3.375% 2026 Notes for an equivalent amount of the Exchange 3.375% 2026 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 7.125% 2028 Notes for an equivalent amount of the Exchange 7.125% 2028 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 7.300% 2028 Notes for an equivalent amount of the Exchange 7.300% 2028 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 7.280% 2028 Notes for an equivalent amount of the Exchange 7.280% 2028 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 7.625% 2028 Notes for an equivalent amount of the Exchange 7.625% 2028 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 6.550% 2033 Notes for an equivalent amount of the Exchange 6.550% 2033 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 8.450% 2034 Notes for an equivalent amount of the Exchange 8.450% 2034 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 6.200% 2034 Notes for an equivalent amount of the Exchange 6.200% 2034 Notes, which have been registered under the Securities Act; |

5

Table of Contents

| • | the unregistered Original 6.400% 2035 Notes for an equivalent amount of the Exchange 6.400% 2035 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 8.150% 2036 Notes for an equivalent amount of the Exchange 8.150% 2036 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 6.150% 2037 Notes for an equivalent amount of the Exchange 6.150% 2037 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 6.650% 2037 Notes for an equivalent amount of the Exchange 6.650% 2037 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 6.750% 2038 Notes for an equivalent amount of the Exchange 6.750% 2038 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 7.850% 2039 Notes for an equivalent amount of the Exchange 7.850% 2039 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 6.900% 2039 Notes for an equivalent amount of the Exchange 6.900% 2039 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 6.150% 2041 Notes for an equivalent amount of the Exchange 6.150% 2041 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 5.400% 2043 Notes for an equivalent amount of the Exchange 5.400% 2043 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 4.750% 2044 Notes for an equivalent amount of the Exchange 4.750% 2044 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 4.950% 2045 Notes for an equivalent amount of the Exchange 4.950% 2045 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 7.750% 2045 Notes for an equivalent amount of the Exchange 7.750% 2045 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 4.750% 2046 Notes for an equivalent amount of the Exchange 4.750% 2046 Notes, which have been registered under the Securities Act; |

| • | the unregistered Original 7.900% 2095 Notes for an equivalent amount of the Exchange 7.900% 2095 Notes, which have been registered under the Securities Act; and |

6

Table of Contents

| • | the unregistered Original 8.250% 2096 Notes for an equivalent amount of the Exchange 8.250% 2096 Notes, which have been registered under the Securities Act. |

| The original notes may only be tendered in an amount equal to $2,000 in principal amount or in integral multiples of $1,000 in excess thereof. See “The Exchange Offers—Terms of the Exchange Offers”. |

| In order to exchange an Original Note, you must follow the required procedures, and the Issuer must accept the Original Note for exchange. The Issuer will exchange all original notes validly tendered and not validly withdrawn prior to the expiration date. See “The Exchange Offers”. |

| Resale of Exchange Notes |

Based on interpretations of the SEC staff, as described in previous no-action letters issued to third parties, we believe that the exchange notes you receive pursuant to the exchange offers in exchange for the original notes may be offered for resale, resold and otherwise transferred without compliance with the registration and prospectus delivery provisions of the Securities Act, provided that: |

| • | you are acquiring the exchange notes issued in the exchange offers in the ordinary course of your business; |

| • | you have not engaged in, do not intend to engage in, and have no arrangement or understanding with any person to participate in the distribution, as defined in the Securities Act, of the exchange notes you will receive in the exchange offers; and |

| • | you are not an “affiliate” of the Issuer or the Guarantor, as defined in Rule 405 of the Securities Act. |

| By tendering your original notes as described in “The Exchange Offers—Procedures for Tendering”, you will be making representations to this effect. If you fail to satisfy any of these conditions, you cannot rely on the position of the SEC set forth in the no-action letters referred to above and you must comply with the registration and prospectus delivery requirements of the Securities Act in connection with a resale of the exchange notes. |

| We base our belief on interpretations by the SEC staff in no-action letters issued to other issuers in exchange offers like ours. We cannot guarantee that the SEC would make a similar decision about our exchange offers. If our belief is wrong, you could incur liability under the Securities Act. We will not protect you against any loss incurred as a result of this liability under the Securities Act. |

| Each broker-dealer that receives exchange notes for its own account in exchange for original notes, where such original notes were acquired by such broker-dealer as a result of market-making activities or other trading activities, must acknowledge that it will deliver a prospectus meeting the requirements of the Securities Act in |

7

Table of Contents

| connection with any resale of the exchange notes. The Issuer has agreed that it will furnish to each broker-dealer who has delivered the notice to the Issuer required by and in accordance with the registration rights agreement, without charge, as many copies of this prospectus and any amendment and supplement hereto, as such participating broker-dealer may reasonably request in connection with its resale of such exchange notes. See “Plan of Distribution”. |

| Consequences if You Do Not Exchange Your Original Notes |

Original notes that are not tendered in the exchange offers or are not accepted for exchange will continue to be subject to transfer restrictions. You will not be able to offer or sell such original notes unless you are able to rely on an exemption from the requirements of the Securities Act or the original notes are registered under the Securities Act. |

| After the exchange offers are completed, the Issuer will no longer have an obligation to register the original notes, except under limited circumstances. To the extent that original notes are tendered and accepted in the exchange offers, the market for any remaining original notes will be adversely affected. See “Risk Factors—Risks Relating to the Exchange Offers—If you fail to exchange your original notes, they will continue to be restricted securities and may become less liquid”. |

| Expiration Date |

Each exchange offer expires at 5:00 p.m., New York City time, on , 2019, subject to our right to extend the expiration date for any exchange offer. See “The Exchange Offers—Expiration Date; Extensions; Amendments”. |

| Issuance of Exchange Notes |

The Issuer will issue exchange notes in exchange for original notes tendered and accepted in the exchange offers promptly following the applicable expiration date (unless amended as described in this prospectus). See “The Exchange Offers—Terms of the Exchange Offers”. |

| Conditions to the Exchange Offers |

The exchange offers are subject to certain customary conditions, which we may amend or waive. The exchange offers are not conditioned upon any minimum principal amount of outstanding original notes being tendered. See “The Exchange Offers—Conditions to the Exchange Offers”. |

| Special Procedures for Beneficial Holders |

If you beneficially own original notes which are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender in the exchange offers, you should contact the registered holder promptly and instruct such person to tender on your behalf. If you wish to tender in the exchange offers on your own behalf, you must, prior to completing and executing the letter of transmittal and delivering your original notes, either arrange to have the original notes registered in your name or obtain a properly |

8

Table of Contents

| completed bond power from the registered holder. The transfer of registered ownership may take a considerable amount of time. See “The Exchange Offers—Procedures for Tendering”. |

| Withdrawal Rights |

You may withdraw your tender of original notes at any time before the expiration date for the applicable exchange offer. See “The Exchange Offers—Withdrawal of Tenders”. |

| Accounting Treatment |

We will not recognize any gain or loss for accounting related to the exchange offers. We will record the expenses of the exchange offers as incurred. See “The Exchange Offers—Accounting Treatment”. |

| Federal Income Tax Consequences |

The exchange of original notes for exchange notes pursuant to the exchange offers generally will not be a taxable event for U.S. federal income tax purposes. See “Material U.S. Federal Income Tax Considerations”. |

| Use of Proceeds |

We will not receive any proceeds from the issuance of exchange notes in connection with the exchange offers. |

| Exchange Agent |

Global Bondholder Services Corporation (“GBSC”) is serving as exchange agent in connection with the exchange offers. The address and telephone number of the exchange agent are set forth under “The Exchange Offers—Exchange Agent”. |

9

Table of Contents

Summary of the Terms of the Exchange Notes

The summary below describes the principal terms of the exchange notes. Certain of the terms described below are subject to important limitations and exceptions. The “Description of Notes” section of this prospectus contains a more detailed description of the terms of the exchange notes. Other than the restrictions on transfer, registration rights and additional interest provisions, the exchange notes will have the same financial terms and covenants as the original notes.

| Issuer |

The Walt Disney Company, a Delaware corporation. |

| Guarantor |

TWDC Enterprises 18 Corp., a Delaware corporation. |

| Securities Offered |

Up to $14,098,439,000 aggregate principal amount of notes, consisting of up to: |

| • | $370,982,000 aggregate principal amount of 5.650% Notes due 2020, |

| • | $863,324,000 aggregate principal amount of 4.500% Notes due 2021, |

| • | $921,824,000 aggregate principal amount of 3.000% Notes due 2022, |

| • | $198,404,000 aggregate principal amount of 8.875% Notes due 2023, |

| • | $284,844,000 aggregate principal amount of 4.000% Notes due 2023, |

| • | $186,329,000 aggregate principal amount of 7.750% Notes due January 2024, |

| • | $68,112,000 aggregate principal amount of 7.750% Notes due February 2024, |

| • | $192,745,000 aggregate principal amount of 9.500% Notes due 2024, |

| • | $577,316,000 aggregate principal amount of 3.700% Notes due 2024, |

| • | $186,242,000 aggregate principal amount of 8.500% Notes due 2025, |

| • | $592,298,000 aggregate principal amount of 3.700% Notes due 2025, |

| • | $238,084,000 aggregate principal amount of 7.700% Notes due 2025, |

| • | $229,499,000 aggregate principal amount of 7.430% Notes due 2026, |

| • | $436,340,000 aggregate principal amount of 3.375% Notes due 2026, |

| • | $194,125,000 aggregate principal amount of 7.125% Notes due 2028, |

10

Table of Contents

| • | $195,582,000 aggregate principal amount of 7.300% Notes due 2028, |

| • | $195,100,000 aggregate principal amount of 7.280% Notes due 2028, |

| • | $187,789,000 aggregate principal amount of 7.625% Notes due 2028, |

| • | $342,347,000 aggregate principal amount of 6.550% Notes due 2033, |

| • | $194,866,000 aggregate principal amount of 8.450% Notes due 2034, |

| • | $984,222,000 aggregate principal amount of 6.200% Notes due 2034, |

| • | $973,196,000 aggregate principal amount of 6.400% Notes due 2035, |

| • | $239,786,000 aggregate principal amount of 8.150% Notes due 2036, |

| • | $321,934,000 aggregate principal amount of 6.150% Notes due 2037, |

| • | $1,234,237,000 aggregate principal amount of 6.650% Notes due 2037, |

| • | $141,229,000 aggregate principal amount of 6.750% Notes due 2038, |

| • | $111,283,000 aggregate principal amount of 7.850% Notes due 2039, |

| • | $236,418,000 aggregate principal amount of 6.900% Notes due 2039, |

| • | $631,871,000 aggregate principal amount of 6.150% Notes due 2041, |

| • | $683,836,000 aggregate principal amount of 5.400% Notes due 2043, |

| • | $588,724,000 aggregate principal amount of 4.750% Notes due 2044, |

| • | $399,301,000 aggregate principal amount of 4.950% Notes due 2045, |

| • | $324,985,000 aggregate principal amount of 7.750% Notes due 2045, |

| • | $399,892,000 aggregate principal amount of 4.750% Notes due 2046, |

| • | $93,955,000 aggregate principal amount of 7.900% Notes due 2095 and |

| • | $77,418,000 aggregate principal amount of 8.250% Notes due 2096. |

11

Table of Contents

| Interest Rates; Interest Payment Dates; Maturity Dates |

Each new series of exchange notes will have the same interest rate, maturity date, redemption terms and interest payment dates as the corresponding series of original notes for which they are being offered in exchange. With respect to each series of exchange notes, (a) interest will accrue on such exchange notes from the most recent date to which interest on the respective original notes has been paid or, if no interest has been paid, from the issue date of the respective original notes and (b) if the regular record date for the first interest payment date would be a date prior to the settlement date of the related exchange offer, the record date for such first interest payment date will be the day immediately preceding such first interest payment date. |

| Interest Rates and Maturity Dates |

Semi-Annual Interest Payment | |

| 5.650% Notes due August 15, 2020 |

February 15 and August 15 | |

| 4.500% Notes due February 15, 2021 |

February 15 and August 15 | |

| 3.000% Notes due September 15, 2022 |

March 15 and September 15 | |

| 8.875% Notes due April 26, 2023 |

April 26 and October 26 | |

| 4.000% Notes due October 1, 2023 |

April 1 and October 1 | |

| 7.750% Notes due January 20, 2024 |

January 20 and July 20 | |

| 7.750% Notes due February 1, 2024 |

February 1 and August 1 | |

| 9.500% Notes due July 15, 2024 |

January 15 and July 15 | |

| 3.700% Notes due September 15, 2024 |

March 15 and September 15 | |

| 8.500% Notes due February 23, 2025 |

February 23 and August 23 | |

| 3.700% Notes due October 15, 2025 |

April 15 and October 15 | |

| 7.700% Notes due October 30, 2025 | April 30 and October 30 | |

| 7.430% Notes due October 1, 2026 |

April 1 and October 1 | |

| 3.375% Notes due November 15, 2026 |

May 15 and November 15 | |

| 7.125% Notes due April 8, 2028 |

April 8 and October 8 | |

| 7.300% Notes due April 30, 2028 |

April 30 and October 30 | |

| 7.280% Notes due June 30, 2028 |

June 30 and December 30 | |

| 7.625% Notes due November 30, 2028 |

May 30 and November 30 | |

| 6.550% Notes due March 15, 2033 |

March 15 and September 15 | |

| 8.450% Notes due August 1, 2034 |

February 1 and August 1 | |

| 6.200% Notes due December 15, 2034 |

June 15 and December 15 | |

| 6.400% Notes due December 15, 2035 |

June 15 and December 15 | |

| 8.150% Notes due October 17, 2036 |

April 17 and October 17 | |

| 6.150% Notes due March 1, 2037 |

March 1 and September 1 | |

| 6.650% Notes due November 15, 2037 |

May 15 and November 15 | |

| 6.750% Notes due January 9, 2038 |

January 9 and July 9 | |

| 7.850% Notes due March 1, 2039 |

March 1 and September 1 | |

| 6.900% Notes due August 15, 2039 |

February 15 and August 15 | |

| 6.150% Notes due February 15, 2041 |

February 15 and August 15 | |

| 5.400% Notes due October 1, 2043 |

April 1 and October 1 | |

| 4.750% Notes due September 15, 2044 |

March 15 and September 15 | |

| 4.950% Notes due October 15, 2045 |

April 15 and October 15 | |

| 7.750% Notes due December 1, 2045 |

June 1 and December 1 | |

| 4.750% Notes due November 15, 2046 |

May 15 and November 15 | |

| 7.900% Notes due December 1, 2095 |

June 1 and December 1 | |

| 8.250% Notes due October 17, 2096 |

April 17 and October 17 |

12

Table of Contents

| Optional Redemption |

Each series of exchange notes will have the same redemption terms as the corresponding series of original notes. |

| The Disney Redeemable Notes (as defined below) may be redeemed, in whole or in part, at the option of the Issuer, at any time or from time to time prior to their respective final maturity dates, at the applicable redemption prices set forth under “Description of Notes—Optional Redemption”. “Disney Redeemable Notes” means the Exchange 5.650% 2020 Notes, Exchange 4.500% 2021 Notes, Exchange 3.000% 2022 Notes, Exchange 4.000% 2023 Notes, Exchange 3.700% 2024 Notes, Exchange 3.700% 2025 Notes, Exchange 3.375% 2026 Notes, Exchange 6.400% 2035 Notes, Exchange 6.150% 2037 Notes, Exchange 6.650% 2037 Notes, Exchange 7.850% 2039 Notes, Exchange 6.900% 2039 Notes, Exchange 6.150% 2041 Notes, Exchange 5.400% 2043 Notes, Exchange 4.750% 2044 Notes, Exchange 4.950% 2045 Notes and Exchange 4.750% 2046 Notes (collectively, the “Exchange Redeemable Notes”) and the corresponding series of original notes. |

| On and after the Par Call Date (as defined in “Description of Notes”), the Disney Par Call Notes (as defined below) are redeemable at the Issuer’s option in whole at any time or in part from time to time, at a redemption price equal to 100% of the principal amount of the Disney Par Call Notes to be redeemed, plus accrued and unpaid interest on the principal amount of such Disney Par Call Notes being redeemed to such date of redemption. “Disney Par Call Notes” means the Exchange 3.700% 2024 Notes, Exchange 3.700% 2025 Notes, Exchange 3.375% 2026 Notes, Exchange 4.750% 2044 Notes, Exchange 4.950% 2045 Notes and Exchange 4.750% 2046 Notes (collectively, the “Exchange Par Call Notes”) and the corresponding series of original notes. |

| The Disney Non-Redeemable Notes (as defined below) may not be redeemed prior to their respective final maturity dates. “Disney Non-Redeemable Notes” means the Exchange 8.875% 2023 Notes, Exchange 7.750% January 2024 Notes, Exchange 7.750% February 2024 Notes, Exchange 9.500% 2024 Notes, Exchange 8.500% 2025 Notes, Exchange 7.700% 2025 Notes, Exchange 7.430% 2026 Notes, Exchange 7.125% 2028 Notes, Exchange 7.300% 2028 Notes, Exchange 7.280% 2028 Notes, Exchange 7.625% 2028 Notes, Exchange 6.550% 2033 Notes, Exchange 8.450% 2034 Notes, Exchange 6.200% 2034 Notes, Exchange 8.150% 2036 Notes, Exchange 6.750% 2038 Notes, Exchange 7.750% 2045 Notes, Exchange 7.900% 2095 Notes and Exchange 8.250% 2096 Notes (collectively, the “Exchange Non-Redeemable Notes”) and the corresponding series of original notes. |

| For additional information, see “Description of Notes—Optional Redemption”. |

13

Table of Contents

| Certain Covenants |

The Issuer will issue the exchange notes under the indenture (as defined in “Description of Notes”), which is the same indenture as that governing the original notes. The indenture covenants include a merger covenant and a reporting covenant. Each covenant is subject to a number of important exceptions, limitations and qualifications that are described under “Description of Notes—Certain Covenants”. |

| Ranking |

The exchange notes will be the Issuer’s senior unsecured indebtedness and will rank pari passu with each other and with all of the Issuer’s other unsecured and unsubordinated indebtedness from time to time outstanding and will be effectively subordinated to any secured indebtedness to the extent of the value of the assets securing such indebtedness. |

| The Guarantor will fully and unconditionally guarantee the full and punctual payment of the principal of, premium, if any, interest on, and all other amounts payable under the exchange notes when the same becomes due and payable. |

| The guarantee will be the Guarantor’s senior unsecured obligation and will rank pari passu with all of its other unsecured and unsubordinated indebtedness from time to time outstanding and will be effectively subordinated to any secured indebtedness to the extent of the value of the assets securing such indebtedness. |

| See “Risk Factors—Risks Relating to the Notes—The Walt Disney Company is a holding company, and the notes will be structurally subordinated to the indebtedness and other liabilities of our subsidiaries, other than the Guarantor. The guarantee will be structurally subordinated to the indebtedness and other liabilities of the Guarantor’s subsidiaries”. |

| Form and Denomination |

The exchange notes of each series will be issued in fully registered form in denominations of $2,000 and in integral multiples of $1,000 in excess thereof. |

| DTC Eligibility |

The exchange notes of each series will be represented by global certificates deposited with, or on behalf of, DTC or its nominee. See “Book-Entry; Delivery and Form”. |

| No Trading Market |

Each series of exchange notes constitutes a new issue of securities, for which there is no existing trading market. In addition, the Issuer does not intend to apply to list any of the exchange notes on any securities exchange or for quotation on any automated quotation system. The Issuer cannot provide you with any assurance regarding whether trading markets for any series of the exchange notes will develop, the ability of holders of the exchange notes to sell their notes or the prices at which holders may be able to sell their notes. If no active trading markets develop, you may be unable to resell the exchange notes at their fair market value or at all. |

14

Table of Contents

| Governing Law |

The indenture, including the Guarantor’s guarantee, is, and the exchange notes will be, governed by, and construed in accordance with, the laws of the State of New York. |

| Trustee, Paying Agent, Transfer Agent and Security Registrar |

Citibank, N.A. is the trustee with respect to the original notes and will be the trustee with respect to the exchange notes. Citibank, N.A. maintains various commercial and investment banking relationships with the Issuer and its affiliates. Citibank, N.A. will initially act as paying agent, transfer agent, authenticating agent and security registrar for the exchange notes, acting through its corporate trust office currently located at 388 Greenwich Street, New York, NY 10013. |

| Risk Factors |

For certain risks related to the exchange notes and the exchange offers, please read the section entitled “Risk Factors” beginning on page 16 of this prospectus. |

15

Table of Contents

You should carefully consider all the information set forth in this prospectus and incorporated by reference herein before deciding to participate in the exchange offers. Your investment in the notes involves certain risks. In consultation with your own financial, tax and legal advisors, you should carefully consider, among other matters, the following discussion of risks before deciding whether an investment in the notes is suitable for you. The notes are not an appropriate investment for you if you are unsophisticated with respect to their significant components.

General

For an enterprise as large and complex as The Walt Disney Company and its subsidiaries are, a wide range of factors could materially affect future developments and performance. The most significant factors affecting the operations of The Walt Disney Company together with its subsidiaries include those set out in “Risk Factors” in our Annual Report on Form 10-K for the year ended September 29, 2018 and in any subsequent Quarterly Reports on Form 10-Q (including, for the avoidance of doubt, the Quarterly Report on Form 10-Q for the quarterly period ended December 29, 2018 filed by TWDC Enterprises) and Annual Reports on Form 10-K under Item 1A, “Risk Factors” as well as in any subsequent periodic or current reports filed with the SEC under the Exchange Act that include “Risk Factors” or that discuss risks to us. Before making an investment decision, you should carefully consider these risks, as well as any other information that we include or incorporate by reference in this prospectus. Additional factors relevant to the exchange offers and the notes include the following.

Risks Relating to the Exchange Offers

If you fail to exchange your original notes, they will continue to be restricted securities and may become less liquid.

Original notes that you do not tender or the Issuer does not accept will, following the exchange offers, continue to be restricted securities, and may not be offered or sold except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and applicable state securities laws.

Because we anticipate that most holders of original notes will elect to exchange their original notes, we expect that the liquidity of the market for any original notes remaining after the completion of the exchange offers will be substantially limited. Any original notes tendered and exchanged in the exchange offers will reduce the aggregate principal amount of the original notes of the applicable series outstanding. Following the exchange offers, if you do not tender your original notes you generally will not have any further registration rights, and your original notes will continue to be subject to certain transfer restrictions. Accordingly, the liquidity of the market for the original notes could be adversely affected.

If you are a broker-dealer, your ability to transfer the exchange notes may be restricted.

A broker-dealer that acquired the original notes for its own account as a result of market-making activities or other trading activities must comply with the prospectus delivery requirements of the Securities Act in connection with any resale of the exchange notes. The Issuer’s obligation to make this prospectus available to broker-dealers is limited. Consequently, we cannot guarantee that a proper prospectus will be available to broker-dealers wishing to resell their exchange notes.

There may not be any trading market for the exchange notes; many factors affect the trading and market value of the exchange notes.