Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 01-14010

Waters Corporation

(Exact name of registrant as specified in its charter)

| Delaware | 13-3668640 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

34 Maple Street

Milford, Massachusetts 01757

(Address, including zip code, of principal executive offices)

(508) 478-2000

(Registrant’s telephone number, including area code)

| Securities registered pursuant to Section 12(b) of the Act: |

Common Stock, par value $0.01 per share | |

| New York Stock Exchange, Inc. | ||

| Series A Junior Participating Preferred Stock, par value $0.01 per share | ||

| New York Stock Exchange, Inc. | ||

| Securities registered pursuant to Section 12(g) of the Act: |

None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or smaller reporting company. See the definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer þ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

State the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of June 29, 2013: $8,523,967,000.

Indicate the number of shares outstanding of the registrant’s common stock as of February 21, 2014: 85,176,112

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for the 2014 Annual Meeting of Stockholders are incorporated by reference in Part III.

Table of Contents

WATERS CORPORATION AND SUBSIDIARIES

ANNUAL REPORT ON FORM 10-K

Table of Contents

PART I

| Item 1: | Business |

General

Waters Corporation (“Waters®” or the “Company”) is an analytical instrument manufacturer that primarily designs, manufactures, sells and services, through its Waters Division, high performance liquid chromatography (“HPLC”), ultra performance liquid chromatography (“UPLC®” and together with HPLC, referred to as “LC”) and mass spectrometry (“MS”) technology systems and support products, including chromatography columns, other consumable products and comprehensive post-warranty service plans. These systems are complementary products that are frequently employed together (“LC-MS”) and sold as integrated instrument systems using a common software platform. Through its TA Division (“TA®”), the Company primarily designs, manufactures, sells and services thermal analysis, rheometry and calorimetry instruments. The Company is also a developer and supplier of software-based products that interface with the Company’s instruments, as well as other manufacturers’ instruments, and are typically purchased by customers as part of the instrument system.

The Company’s products are used by pharmaceutical, life science, biochemical, industrial, nutritional safety, environmental, academic and governmental customers working in research and development, quality assurance and other laboratory applications. The Company’s LC and LC-MS instruments are utilized in this broad range of industries to detect, identify, monitor and measure the chemical, physical and biological composition of materials, as well as to purify a full range of compounds. These instruments are used in drug discovery and development, including clinical trial testing, the analysis of proteins in disease processes (known as “proteomics”), nutritional safety analysis and environmental testing. The Company’s thermal analysis, rheometry and calorimetry instruments are used in predicting the suitability of fine chemicals, pharmaceuticals, water, polymers and viscous liquids for uses in various industrial, consumer goods and healthcare products, as well as for life science research.

Waters, organized as a Delaware corporation in 1991, is a holding company that owns all of the outstanding common stock of Waters Technologies Corporation, its operating subsidiary. Waters became a publicly-traded company with its initial public offering (“IPO”) in November 1995. Since the IPO, the Company has added two significant and complementary technologies to its range of products with the acquisitions of TA Instruments in May 1996 and Micromass Limited (“Micromass®”) in September 1997.

Business Segments

The Company’s business activities, for which discrete financial information is available, are regularly reviewed and evaluated by chief operating decision maker. As a result of this evaluation, the Company determined that it has two operating segments: Waters Division and TA Division. The Company operates in the analytical instruments industry by designing, manufacturing, distributing and servicing instrument systems, columns and other chemistry consumables that can be integrated and used along with other analytical instruments. The Company’s two operating segments, Waters Division and TA Division, have similar economic characteristics; product processes; products and services; types and classes of customers; methods of distribution and regulatory environments. Because of these similarities, the two operating segments have been aggregated into one reporting segment for financial statement purposes.

Information concerning revenues and long-lived assets attributable to each of the Company’s products, services and geographic areas is set forth in Note 15 in the Notes to the Consolidated Financial Statements, which is incorporated herein by reference.

1

Table of Contents

Waters Division

High Performance and Ultra Performance Liquid Chromatography

HPLC is a standard technique used to identify and analyze the constituent components of a variety of chemicals and other materials. The Company believes that HPLC’s performance capabilities enable it to separate and identify approximately 80% of all known chemicals and materials. As a result, HPLC is used to analyze substances in a wide variety of industries for research and development purposes, quality control and process engineering applications.

The most significant end-use markets for HPLC are those served by the pharmaceutical and life science industries. In these markets, HPLC is used extensively to identify new drugs, develop manufacturing methods and assure the potency and purity of new pharmaceuticals. HPLC is also used in a variety of other applications, such as analyses of foods and beverages for nutritional labeling and compliance with safety regulations, the testing of water and air purity within the environmental testing industry, as well as applications in other industries, such as chemical and consumer products. HPLC is also used by universities, research institutions and governmental agencies, such as the United States Food and Drug Administration (“FDA”) and the United States Environmental Protection Agency (“EPA”) and their international counterparts that mandate testing requiring HPLC instrumentation.

Traditionally, a typical HPLC system has consisted of five basic components: solvent delivery system, sample injector, separation column, detector and data acquisition unit. The solvent delivery system pumps solvents through the HPLC system, while the sample injector introduces samples into the solvent flow. The chromatography column then separates the sample into its components for analysis by the detector, which measures the presence and amount of the constituents. The data acquisition unit, usually referred to as the instrument’s software or data system, then records and stores the information from the detector.

In 2004, Waters introduced a novel technology that the Company describes as ultra performance liquid chromatography that utilizes a packing material with small, uniform diameter particles and a specialized instrument, the ACQUITY UPLC®, to accommodate the increased pressure and narrow chromatographic bands that are generated by these small particles. By using the ACQUITY UPLC, researchers and analysts are able to achieve more comprehensive chemical separations and faster analysis times in comparison with many analyses performed by HPLC. In addition, in using ACQUITY UPLC, researchers have the potential to extend the range of applications beyond that of HPLC, enabling them to uncover new levels of scientific information. While offering significant performance advantages, ACQUITY UPLC is also compatible with the Company’s software products and the general operating protocols of HPLC. For these reasons, the Company’s customers and field sales and support organizations are well positioned to utilize this new technology and instrument. In 2011, the Company introduced the ACQUITY UPLC® I-Class instrument system. The ACQUITY UPLC I-Class provides a powerful solution to a critical need by successfully analyzing compounds that are limited in amount or availability amid a complex matrix. The ACQUITY UPLC I-Class system maximizes peak capacity to enhance MS sensitivity; it provides low sample carryover, complementing MS sensitivity and extending MS linear dynamic range; and it has been purposefully engineered for low dispersion. In 2012, the Company introduced UltraPerformance Convergence ChromatographyTM (“UPC2® ”) with the release of the ACQUITY® UPC2® system. This new technology marries the unrealized potential of supercritical fluid chromatography (“SFC”) with the proven UPLC technology, using carbon dioxide as the primary mobile phase. By varying mobile phase strength, pressure, temperature and stationary phase with UPC2, a user can separate, detect and quantify structural analogs, isomers, enantiomeric and diasteriomeric mixtures – all compounds or samples that challenge today’s laboratories. In 2013, the Company introduced the ACQUITY® Advanced Polymer Chromatography® (“APCTM”) system. This system delivers improved polymer peak resolution, particularly for low molecular weight polymers and oligomers, up to 20 times faster than traditional gel permeation chromatography. In 2013, the Company also introduced the ACQUITY® QDaTM Detector, which facilitates obtaining mass spectral measurements from chromatographic separations utilizing a compact and easy to operate detector module.

Waters manufactures LC instruments that are offered in configurations that allow for varying degrees of automation, from component configured systems for academic teaching and research applications to fully

2

Table of Contents

automated systems for regulated testing, and that have a variety of detection technologies, from ultra-violet (“UV”) absorbance to MS, optimized for certain analyses. The Company also manufactures tailored LC systems for the analysis of biologics, as well as an LC detector utilizing evaporative light scattering technology to expand the usage of LC to compounds that are not amenable to UV absorbance detection.

The primary consumable products for LC are chromatography columns. These columns are packed with separation media used in the LC testing process and are typically replaced at regular intervals. The chromatography column contains one of several types of packing material, typically stationary phase particles made from silica. As the sample flows through the column, it is separated into its constituent components.

Waters HPLC columns can be used on Waters-branded and competitors’ LC systems. The Company believes that it is one of the few suppliers in the world that processes silica, packs columns and distributes its own products. In doing so, the Company believes it can better ensure product consistency, a key attribute for its customers in quality control laboratories, and can react quickly to new customer requirements. The Company believes that its ACQUITY UPLC lines of columns are used primarily on its ACQUITY UPLC instrument systems and, furthermore, that its ACQUITY UPLC instruments primarily use ACQUITY UPLC columns. In 2013, the Company introduced the CORTECSTM family of 1.6 micron solid-core UPLC columns to further extend the application range and performance of its UPLC offerings.

The Company’s chemistry consumable products also include environmental and nutritional safety testing products. Environmental laboratories use these products for quality control and proficiency testing and also purchase product support services required to help with their federal and state mandated accreditation requirements or with quality control over critical pharmaceutical analysis. In addition, the Company provides tests to identify and quantify mycotoxins (biological contaminants) in various agricultural commodities. These test kits provide reliable, quantitative detection of particular mycotoxins through the choice of fluorimetry, HPLC or LC-MS.

Mass Spectrometry and Liquid Chromatography-Mass Spectrometry

MS is a powerful analytical technology that is used to identify unknown compounds, to quantify known materials and to elucidate the structural and chemical properties of molecules by measuring the masses of individual molecules that have been converted into ions.

The Company believes it is a technology and market leader in the development, manufacture, sale and distribution of MS instruments. These instruments are typically integrated and used along with other complementary analytical instruments and systems, such as LC, chemical electrophoresis, chemical electrophoresis chromatography and gas chromatography. A wide variety of instrumental designs fall within the overall category of MS instrumentation, including devices that incorporate quadrupole, ion trap, time-of-flight (“Tof”), magnetic sector and ion mobility technologies. Furthermore, these technologies are often used in tandem to maximize the efficacy of certain experiments.

Currently, the Company offers a wide range of MS instrument systems utilizing various combinations of quadrupole, Tof, ion mobility and magnetic sector designs. These instrument systems are used in drug discovery and development, as well as for environmental, clinical and nutritional safety testing. The majority of mass spectrometers sold by the Company are designed to utilize an LC system as the sample introduction device. These products supply a diverse market with a strong emphasis on the life science, pharmaceutical, biomedical, clinical, food and beverage and environmental market segments worldwide.

MS is an increasingly important detection technology for LC. The Company’s smaller-sized mass spectrometers, such as the single quadrupole detector (“SQD”) and the tandem quadrupole detector (“TQD”), are often referred to as LC “detectors” and are typically sold as part of an LC system or as an LC system upgrade. In 2013, the Company introduced the ACQUITY QDa Detector, a compact and easy to operate mass spectrometric module that further supports the broader usage of mass detection for routine LC applications. Larger quadrupole

3

Table of Contents

systems, such as the Xevo® TQ and Xevo® TQ-S instruments, are used primarily for experiments performed for late-stage drug development, including clinical trial testing. Quadrupole time-of-flight (“Q-TofTM”) instruments, such as the Company’s SYNAPT® G2-S, are often used to analyze the role of proteins in disease processes, an application sometimes referred to as “proteomics”. In 2011, the Company introduced the SYNAPT® G2-S HDMS instrument system. The SYNAPT G2-S incorporates both high sensitivity Waters StepWaveTM ion transfer optics and Triwave® ion mobility technologies along with a suite of new informatics tools to enhance qualitative and quantitative high resolution performance. In 2012, the Company introduced the Xevo® G2-S Q-TofTM and Xevo® G2-S Tof mass spectrometers, bringing StepWave ion technology to its bench-top time-of-flight mass spectrometers. In 2013, the Company introduced the SYNAPT G2-Si, which combines the unique power of travelling wave (“T-WaveTM”) ion mobility separations with new data acquisition and informatics technologies, and collision cross-section measurements.

LC and MS are typically embodied within an analytical system tailored for either a dedicated class of analyses or as a general purpose analytical device. An increasing percentage of the Company’s customers are purchasing LC and MS components simultaneously and it has become common for LC and MS instrumentation to be used within the same laboratory and operated by the same user. The descriptions of LC and MS above reflect the historical segmentation of these analytical technologies and the historical categorization of their respective practitioners. Increasingly in today’s instrument market, this segmentation and categorization is becoming obsolete as a high percentage of instruments used in the laboratory embody both LC and MS technologies as part of a single device. In response to this development and to further promote the high utilization of these hybrid instruments, the Company has organized its Waters Division to develop, manufacture, sell and service integrated LC-MS systems.

Based upon reports from independent marketing research firms and publicly-disclosed sales figures from competitors, the Company believes that it is one of the world’s largest manufacturers and distributors of LC and LC-MS instrument systems, chromatography columns and other consumables and related services. The Company also believes that it has the leading combined LC and LC-MS market share in the United States, Europe and Asia (excluding Japan), and believes it may have a market share position in Japan that ranks second to an established domestic supplier.

The Company has been a developer and supplier of software-based products that interface with the Company’s instruments, as well as other manufacturers’ instruments. The Company recently introduced a new UNIFI® software platform. The UNIFI Scientific Information System is the culmination of a multi-year effort to substantially bring all of Waters’ preexisting, disparate software systems under one operating system. UNIFI joins Waters’ suite of informatics products – Empower®, Chromatography Data Software, MassLynx® Mass Spectrometry Software and NuGenesis® Scientific Data Management System, each of which is used daily to support innovations within world-leading institutions. UNIFI is the industry’s first comprehensive software that seamlessly integrates UPLC chromatography, mass spectrometry, and informatics data workflows.

In July 2012, the Company acquired Blue Reference, Inc. (“Blue Reference”), a U.S.-based developer and distributor of software products used for the real-time mining and analysis of multiple-application scientific databases, for $14 million in cash. The Company has integrated the Blue Reference technology into software product platforms to further differentiate its offerings by providing customers with a more efficient scientific information assessment process, where there is an ongoing need for immediacy and interactivity of multiple scientific databases.

In August 2013, the Company acquired Nonlinear Dynamics Ltd. (“Nonlinear Dynamics”), a developer of proteomics and metabolomics software, for approximately $23 million in cash. Waters and Nonlinear Dynamics collaborated on the development of the Company’s TransOmics™ Informatics, a scalable solution for proteomics, metabolomics, and lipidomics analysis, which was introduced in 2012. The Company will integrate the Nonlinear Dynamics technology into current and future software product platforms.

4

Table of Contents

Waters Division Service

Services provided by Waters enable customers to maximize technology productivity, support customer compliance activities and provide transparency into enterprise resource management efficiencies. The customer benefits from improved budget control, data-driven technology adoption and accelerated workflow at a site or on a global perspective. The Company considers its service offerings to be highly differentiated from our competition, as evidenced by the consistent increase in service revenues each year. Our principal competitors in the service market include PerkinElmer, Inc., Agilent Technologies, Inc., Thermo Fisher Scientific Inc. and General Electric Company. These competitors can provide services on Waters instruments to varying degrees and always present competitive risk.

The servicing and support of instruments, software and accessories is an important source of revenue and represents over 25% of sales for the Waters Division. These revenues are derived primarily through the sale of support plans, demand services, spare parts, customer training and performance validation services. Support plans typically involve scheduled instrument maintenance and an agreement to promptly repair a non-functioning instrument in return for a fee described in a contract that is priced according to the configuration of the instrument.

TA Division

Thermal Analysis, Rheometry and Calorimetry

Thermal analysis measures the physical characteristics of materials as a function of temperature. Changes in temperature affect several characteristics of materials, such as their physical state, weight, dimension and mechanical and electrical properties, which may be measured by one or more thermal analysis techniques, including calorimetry. Consequently, thermal analysis techniques are widely used in the development, production and characterization of materials in various industries, such as plastics, chemicals, automobiles, pharmaceuticals and electronics.

Rheometry instruments complement thermal analyzers in characterizing materials. Rheometry characterizes the flow properties of materials and measures their viscosity, elasticity and deformation under different types of “loading” or other conditions. The information obtained under such conditions provides insight into a material’s behavior during processing, packaging, transport, usage and storage.

Thermal analysis and rheometry instruments are heavily used in material testing laboratories and, in many cases, provide information useful in predicting the suitability of fine chemicals, polymers and viscous liquids for various industrial, consumer goods and healthcare products, as well as for life science research. As with systems offered through the Waters Division, a range of instrument configurations is available with increasing levels of sample handling and information processing automation. In addition, systems and accompanying software packages can be tailored for specific applications. For example, the Q-SeriesTM family of differential scanning calorimeters includes a range of instruments, from basic dedicated analyzers to more expensive systems that can accommodate robotic sample handlers and a variety of sample cells and temperature control features for analyzing a broad range of materials. In 2011, TA introduced the Discovery DSC, Discovery TGA and Discovery Hybrid Rheometer, which provide unmatched measurement performance in the fields of differential scanning calorimetry and rheometry.

In July 2011, the Company acquired the net assets of Anter Corporation (“Anter”), a manufacturer of thermal analyzers used to measure thermal expansion and shrinkage, thermal conductivity and resistivity, thermal diffusivity and specific heat capacity of a wide range of materials, especially materials used in high temperature applications, for $11 million in cash. Anter systems provide critical information to scientists that develop and characterize ceramics, metals and glasses for use in a wide range of industries, including electronics, energy and aerospace.

5

Table of Contents

In January 2012, the Company acquired Baehr Thermoanalyse GmbH (“Baehr”), a German manufacturer of a wide range of thermal analyzers, for $12 million in cash, including the assumption of $1 million of debt. Key products developed by Baehr include horizontal, optical and quenching dilatometer systems that measure thermal expansion to high temperatures with high precision, high temperature viscometers, and high temperature TGA/DTA systems. Baehr systems provide critical information to researchers that develop materials for use in a wide range of industries, including electronics, energy, automotive, and aerospace.

In July 2013, the Company acquired Scarabaeus Mess-und Prodktionstechnik GmbH (“Scarabaeus”), a manufacturer of rheometers for the rubber and elastomer markets, for approximately $4 million in cash. Key products developed by Scarabaeus include a Mooney Viscometer, Moving Die Rheometer (MDR), Rubber Process Analyzer (RPA) and automated density and hardness testers. The RPA includes many test features and analysis functions that are being used in the latest research and development efforts for rubber and materials technology.

In December 2013, the Company acquired Expert Systems Solutions S.r.l. (“ESS”), a manufacturer of advanced thermal analysis instruments, for approximately $3 million in cash. ESS manufactures a variety of heating microscopes, optical dilatometers and optical fleximeters, with a particular focus on the ceramics industry.

In December 2013, the Company acquired the net assets of LaserComp Inc. (“LaserComp”), a manufacturer of thermal conductivity measurement instruments, for approximately $12 million in cash. LaserComp’s FOX line of durable thermal conductivity test instruments is used by many of the world’s leading insulation manufacturers.

In January 2014, the Company acquired ULSP B.V. (“ULSP”), a manufacturer of solutions for ultra low temperature applications, for approximately $3 million in cash. ULSP’s core business is the manufacturing and servicing of high quality low temperature coolers for thermal analysis and rheology applications.

TA Service

Similar to the Waters Division, the servicing and support of TA’s instruments is an important source of revenue and represents approximately 25% of sales for the TA Division. TA sells, supports and services TA’s product offerings through its headquarters in New Castle, Delaware. TA operates independently from the Waters Division, though most of its overseas offices are situated in Waters Division’s facilities to achieve operational efficiencies. TA has dedicated field sales and service operations. Service sales are primarily derived from the sale of support plans, replacement parts and billed labor fees associated with the repair, maintenance and upgrade of installed systems.

Customers

The Company typically has a broad and diversified customer base that includes pharmaceutical accounts, other industrial accounts, universities and governmental agencies. Purchase of the Company’s instrument systems is often dependent on its customers’ capital spending, or funding as in the cases of governmental, academic and research institutions, which often fluctuate from year to year. The pharmaceutical segment represents the Company’s largest sector and includes multinational pharmaceutical companies, generic drug manufacturers, contract research organizations (CROs) and biotechnology companies. The Company’s other industrial customers include chemical manufacturers, polymer manufacturers, food and beverage companies and environmental testing laboratories. The Company also sells to leading universities and governmental agencies worldwide. The Company’s technical support staff works closely with its customers in developing and implementing applications that meet their full range of analytical requirements. During 2013, 52% of the Company’s sales were to pharmaceutical accounts, 33% to other industrial accounts and 15% to governmental agencies and academic institutions.

6

Table of Contents

The Company typically experiences an increase in sales in the fourth quarter, as a result of purchasing habits for capital goods of many customers who tend to exhaust their spending budgets by calendar year end. The Company does not rely on any single customer for a material portion of its sales. During fiscal years 2013, 2012 and 2011, no single customer accounted for more than 2% of the Company’s net sales.

Sales and Service

The Company has one of the largest direct sales and service organizations focused exclusively on the technologies offered by the Company. Across these product technologies, using respective specialized sales and service forces, the Company serves its customer base with 93 sales offices throughout the world as of December 31, 2013 and approximately 3,000 field representatives in 2013, 2012 and 2011. This investment in sales and service personnel serves to maintain and expand the Company’s installed base of instruments. The Company’s sales representatives have direct responsibility for account relationships, while service representatives work in the field to install instruments, train customers and minimize instrument downtime. In-house, technical support representatives work directly with customers, providing them assistance with applications and procedures on Company products. The Company provides customers with comprehensive information through various corporate and regional internet websites and product literature, and also makes consumable products available through electronic ordering facilities and a dedicated catalog.

Manufacturing and Distribution

The Company provides high product quality by overseeing each stage of the production of its instruments, columns and chemical reagents.

The Company currently assembles a portion of its LC instruments at its facility in Milford, Massachusetts, where it performs machining, assembly and testing. The Milford facility maintains quality management and environmental management systems in accordance with the requirements of ISO 9001:2008, ISO 13485:2003 and ISO 14001:2004, and adheres to applicable regulatory requirements (including the FDA Quality System Regulation and the European In-Vitro Diagnostic Directive). The Company outsources manufacturing of certain electronic components, such as computers, monitors and circuit boards, to outside vendors that can meet the Company’s quality requirements. In addition, the Company outsources the manufacturing of certain LC instrument systems and components to well-established contract manufacturing firms in Singapore. The Company’s Singapore entity manages all Asian outsourced manufacturing as well as the distribution of all products from Asia. The Company continues to pursue outsourcing opportunities as they may arise but believes it maintains adequate supply chain and manufacturing capabilities in the event of disruption or natural disasters.

The Company manufactures certain SFC/SFE products in its facility in Pittsburgh, Pennsylvania. The Pittsburgh facility is aligned with the policies and procedures for product manufacturing and distribution as adhered to in the Milford, Massachusetts facility and is under the same structural leadership organization.

The Company primarily manufactures and distributes its LC columns at its facilities in Taunton, Massachusetts and Wexford, Ireland, where it processes, sizes and treats silica and polymeric media that are packed into columns, solid phase extraction cartridges and bulk shipping containers. The Wexford facility also manufactures and distributes certain data, instruments and software components for the Company’s LC, MS and TA product lines. The Company’s Taunton facility is certified to ISO 9001:2008. The Wexford facility is certified to ISO 9001:2008 and ISO 13485:2003. VICAM® manufactures antibody resin and magnetic beads that are packed into columns and kits in Milford, Massachusetts and Nixa, Missouri. Environmental Resource Associates manufactures environmental proficiency kits in Golden, Colorado.

The Company manufactures and distributes its MS products at its facilities in Cheshire, England, Manchester, England, Wilmslow, England and Wexford, Ireland. In early 2014, the Company completed the construction of its new facility in Wilmslow, England and is in the process of consolidating and moving its Cheshire and Manchester facilities to this new location. Certain components or modules of the Company’s MS instruments are manufactured by long-standing outside contractors. Each stage of this supply chain is closely

7

Table of Contents

monitored by the Company to maintain high quality and performance standards. The instruments, components or modules are then returned to the Company’s facilities, where its engineers perform final assembly, calibrations to customer specifications and quality control procedures. The Company’s MS facilities are certified to ISO 9001:2008 and ISO 13485:2003.

TA’s thermal analysis, rheometry and calorimetry products are manufactured and distributed at the Company’s New Castle, Delaware, Saugus, MA, Lindon, Utah, Huellhorst, Germany, Wetzlar, Germany and Modena, Italy facilities. Similar to MS, elements of TA’s products are manufactured by outside contractors and are then returned to the Company’s facilities for final assembly, calibration and quality control. The Company’s New Castle facility is certified to ISO 9001:2008 standards.

Raw Materials

The Company purchases a variety of raw materials, primarily consisting of high temperature alloy sheet metal and castings, forgings, pre-plated metals and electrical components from various vendors. The materials used by the Company’s operations are generally available from a number of sources and in sufficient quantities to meet current requirements subject to normal lead times. The Company is subject to rules of the Securities and Exchange Commission (“SEC”) under the Dodd-Frank Wall Street Reform and Consumer Protection Act, requiring disclosure as to whether certain materials (tantalum, tin, gold and tungsten), known as conflict minerals, which may be contained in the Company’s products, are mined from the Democratic Republic of the Congo and adjoining countries. These rules are likely to impose additional costs and may introduce new risks related to the Company’s ability to verify the origin of any conflict minerals contained in its products.

Research and Development

The Company maintains an active research and development program focused on the development and commercialization of products that both complement and update its existing product offering. The Company’s research and development expenditures for 2013, 2012 and 2011 were $101 million, $96 million and $92 million, respectively. Nearly all of the Company’s current LC products are developed at the Company’s main research and development center located in Milford, Massachusetts, with input and feedback from the Company’s extensive field organizations and customers. The majority of the Company’s MS products are developed at facilities in England and most of the Company’s current materials characterization products are developed at the Company’s research and development center in New Castle, Delaware. At December 31, 2013, 2012 and 2011, there were 824, 777 and 741 employees, respectively, involved in the Company’s research and development efforts. The Company has increased research and development expenses from its continued commitment to invest significantly in new product development and existing product enhancements, and as a result of acquisitions. Despite the Company’s active research and development programs, there can be no assurances that the Company’s product development and commercialization efforts will be successful or that the products developed by the Company will be accepted by the marketplace.

Employees

The Company employed approximately 6,000, 5,900 and 5,700 employees at December 31, 2013, 2012 and 2011, respectively, with approximately 43% of the Company’s employees located in the United States. The Company believes its employee relations are generally good. The Company’s employees are not unionized or affiliated with any internal or external labor organizations. The Company firmly believes that its future success largely depends upon its continued ability to attract and retain highly skilled employees.

Competition

The analytical instrument systems, supplies and services market is highly competitive. The Company encounters competition from several worldwide manufacturers and other companies in both domestic and foreign markets for each of its three primary technologies. The Company competes in its markets primarily on the basis of

8

Table of Contents

product performance, reliability, service and, to a lesser extent, price. Competitors continuously introduce new products and have instrument businesses that are generally more diversified than the Company’s business. Some competitors have greater financial resources and broader distribution than the Company’s.

In the markets served by the Waters Division, the Company’s principal competitors include: Agilent Technologies, Inc., Shimadzu Corporation, Bruker Corporation, Danaher Corporation and Thermo Fisher Scientific Inc. In the markets served by the TA Division, the Company’s principal competitors include: PerkinElmer, Inc., Mettler-Toledo International Inc., NETZSCH-Geraetebau GmbH, Thermo Fisher Scientific Inc., Malvern Instruments Ltd., Anton-Paar and General Electric Company.

The market for consumable LC products, including separation columns, is highly competitive and generally more fragmented than the analytical instruments market. The Company encounters competition in the consumable columns market from chemical companies that produce column sorbents and small specialized companies that primarily pack purchased sorbents into columns and subsequently package and distribute columns. The Company believes that it is one of the few suppliers that processes silica, packs columns and distributes its own products. The Company competes in this market on the basis of reproducibility, reputation, performance and, to a lesser extent, price. The Company’s principal competitors for consumable products include: Phenomenex, Inc., Sigma Aldrich, Agilent Technologies, Inc., General Electric Company, Thermo Fisher Scientific Inc. and Merck and Co., Inc. The ACQUITY UPLC instrument is designed to offer a predictable level of performance when used with ACQUITY UPLC columns and the Company believes that the expansion of the ACQUITY UPLC instrument base will enhance its chromatographic column business because of the high level of synergy between ACQUITY UPLC columns and the ACQUITY UPLC instruments.

Patents, Trademarks and Licenses

The Company owns a number of United States and foreign patents and has patent applications pending in the United States and abroad. Certain technology and software has been acquired or is licensed from third parties. The Company also owns a number of trademarks. The Company’s patents, trademarks and licenses are viewed as valuable assets to its operations. However, the Company believes that no one patent or group of patents, trademark or license is, in and of itself, essential to the Company such that its loss would materially affect the Company’s business as a whole.

Environmental Matters and Climate Change

The Company is subject to federal, state and local laws, regulations and ordinances that (i) govern activities or operations that may have adverse environmental effects, such as discharges to air and water as well as handling and disposal practices for solid and hazardous wastes, and (ii) impose liability for the costs of cleaning up and certain damages resulting from sites of past spills, disposals or other releases of hazardous substances. The Company believes that it currently conducts its operations and has operated its business in the past in substantial compliance with applicable environmental laws. From time to time, Company operations have resulted or may result in noncompliance with environmental laws or liability for cleanup pursuant to environmental laws. The Company does not currently anticipate any material adverse effect on its operations, financial condition or competitive position as a result of its efforts to comply with environmental laws.

The Company is sensitive to the growing global debate with respect to climate change. An internal sustainability working group develops increasingly robust data with respect to the Company’s utilization of carbon producing substances in an effort to continuously reduce the Company’s carbon footprint. In 2012, the Company published a sustainability report identifying the various actions and behaviors the Company has adopted concerning its commitment to both the environment and the broader topic of social responsibility. See Item 1A, Risk Factors – The effects of climate change could harm the Company’s business, for more information on the potential significance of climate change legislation. See also Note 15 in the Notes to the Consolidated Financial Statements for financial information about geographic areas.

9

Table of Contents

Available Information

The Company files or furnishes all required reports with the SEC. The public may read and copy any materials the Company files or furnishes with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

The Company is an electronic filer and the SEC maintains a website that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. The address of the SEC electronic filing website is http://www.sec.gov. The Company also makes available, free of charge on its website, its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. The website address for Waters Corporation is http://www.waters.com and SEC filings can be found under the caption “Investors”.

Forward-Looking Statements

Certain of the statements in this Form 10-K and the documents incorporated herein, may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), with respect to future results and events, including statements regarding, among other items, anticipated trends or growth in the Company’s business, including, but not limited to, development of products by acquired businesses; the growth rate of sales and research and development expenses; the impact of new product launches and the associated costs, such as the amortization expense related to UNIFI; geographic sales mix of business; anticipated expenses, including interest expense, capitalized software costs and effective tax rates; the impact of foreign currency translation on financial results; the impact and outcome of the Company’s various ongoing tax audit examinations; the achievement of contractual milestones to preserve foreign tax rates; the impact and outcome of litigation matters; the impact of the loss of intellectual property protection; the impact of new accounting standards and pronouncements; the adequacy of the Company’s supply chain and manufacturing capabilities and facilities; the impact of regulatory compliance; the Company’s expected cash flow, borrowing capacity, debt repayment and refinancing; the Company’s ability to fund working capital, capital expenditures, service debt, repay outstanding lines of credit, make authorized share repurchases, fund potential acquisitions and pay any adverse litigation or tax audit liabilities, particularly in the U.S.; future impairment charges; the Company’s contributions to defined benefit plans; the Company’s expectations regarding changes to its financial position; compliance with applicable environmental laws; and the impact of recent acquisitions on sales and earnings.

Many of these statements appear, in particular, under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 of this Form 10-K. Statements that are not statements of historical fact may be deemed forward-looking statements. You can identify these forward-looking statements by the use of the words “feels”, “believes”, “anticipates”, “plans”, “expects”, “may”, “will”, “would”, “intends”, “suggests”, “appears”, “estimates”, “projects”, “should” and similar expressions, whether in the negative or affirmative. These statements are subject to various risks and uncertainties, many of which are outside the control of the Company, including, and without limitation:

| • | The risks inherent in succession planning, as the Company’s chief executive officer has announced his intention to retire by the end of 2015 and the Company’s former chief financial officer has transitioned to a reduced workload and resigned as the Company’s chief financial officer as of February 1, 2014. |

| • | Current global economic, sovereign and political conditions and uncertainties, particularly regarding the European debt crisis and the overall stability of the Euro and its suitability as a single currency; the Company’s ability to access capital and maintain liquidity in volatile market conditions of customers; changes in timing and demand by the Company’s customers and various market sectors, particularly if they should reduce capital expenditures or are unable to obtain funding, as in the cases of governmental, academic and research institutions; the effect of mergers and acquisitions on customer demand; and the Company’s ability to sustain and enhance service. |

10

Table of Contents

| • | Negative industry trends; introduction of competing products by other companies and loss of market share; pressures on prices from customers or resulting from competition; regulatory, economic and competitive obstacles to new product introductions; lack of acceptance of new products; expansion of our business in developing markets; spending by certain end-markets and ability to obtain alternative sources for components and modules. |

| • | Foreign exchange rate fluctuations that could adversely affect translation of the Company’s future sales, financial operating results and the condition of its non-U.S. operations, especially when a currency weakens against the U.S. dollar. |

| • | Increased regulatory burdens as the Company’s business evolves, especially with respect to the FDA and EPA, among others, as well as regulatory, environmental and logistical obstacles affecting the distribution of the Company’s products, completion of purchase order documentation by our customers and ability of customers to obtain letters of credit or other financing alternatives. |

| • | Risks associated with lawsuits, particularly involving claims for infringement of patents and other intellectual property rights. |

| • | The impact and costs incurred from changes in accounting principles and practices or tax rates; shifts in taxable income in jurisdictions with different effective tax rates; and the outcome of and costs associated with ongoing and future tax audit examinations or changes in respective country legislation affecting the Company’s effective rates. |

Certain of these and other factors are further described below in Item 1A, Risk Factors, of this Form 10-K. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements, whether because of these factors or for other reasons. All forward-looking statements speak only as of the date of this annual report on Form 10-K and are expressly qualified in their entirety by the cautionary statements included in this report. The Company does not assume any obligation to update any forward-looking statements.

| Item 1A: | Risk Factors |

The Company is subject to risks common to companies in the analytical instrument industry, including, but not limited to, the following:

Global economic conditions may decrease demand for the Company’s products and harm the Company’s financial results.

The Company is a global business that may be adversely affected by changes in global economic conditions. These changes in global economic conditions may affect the demand for the Company’s products and services and may result in a decline in sales in the future. There can be no assurance regarding demand for the Company’s products and services in the future.

The Company’s financial results are subject to changes in customer demand, which may decrease for a number of reasons, many beyond the Company’s control.

The demand for the Company’s products is dependent upon the size of the markets for its LC, LC-MS, thermal analysis, rheometry and calorimetry products; the timing and level of capital spending and expenditures of the Company’s customers; changes in governmental regulations, particularly affecting drug, food and drinking water testing; funding available to governmental, academic and research institutions; general economic conditions and the rate of economic growth in the Company’s major markets; and competitive considerations. The Company typically experiences an increase in sales in its fourth quarter as a result of purchasing habits for capital goods by customers that tend to exhaust their spending budgets by calendar year end. There can be no assurance that the Company’s results of operations or financial condition will not be adversely impacted by a change in any of the factors listed above or the continuation of uncertain global economic conditions.

11

Table of Contents

Additionally, the analytical instrument market may, from time to time, experience low sales growth. Approximately 52% and 53% of the Company’s net sales in 2013 and 2012, respectively, were to the worldwide pharmaceutical and biotechnology industries, which may be periodically subject to unfavorable market conditions and consolidations. Unfavorable industry conditions could have a material adverse effect on the Company’s results of operations or financial condition.

Disruption in worldwide financial markets could adversely impact the Company’s access to capital and financial condition.

Financial markets in the U.S., Europe and Asia have experienced times of extreme disruption in recent years, including, among other things, sharp increases in the cost of new capital, credit rating downgrades and bailouts, severely diminished capital availability and severely reduced liquidity in money markets. Financial and banking institutions have also experienced disruptions, resulting in large asset write-downs, higher costs of capital, rating downgrades and reduced desire to lend money. There can be no assurance that there will not be future deterioration or prolonged disruption in financial markets or financial institutions. Any future deterioration or prolonged disruption in financial markets or financial institutions in which the Company participates may impair the Company’s ability to access its existing cash, utilize its existing syndicated bank credit facility funded by such financial institutions, and impair its ability to access sources of new capital. The Company’s cost of any new capital raised and interest expense would increase if this were to occur.

Competitors may introduce more effective or less expensive products than the Company’s, which could result in decreased sales.

The analytical instrument market and, in particular, the portion related to the Company’s HPLC, UPLC, LC-MS, thermal analysis, rheometry and calorimetry product lines, is highly competitive and subject to rapid changes in technology. The Company encounters competition from several international instrument manufacturers and other companies in both domestic and foreign markets. Some competitors have instrument businesses that are generally more diversified than the Company’s business, but are typically less focused on the Company’s chosen markets. There can be no assurance that the Company’s competitors will not introduce more effective and less costly products than those of the Company or that the Company will be able to increase its sales and profitability from new product introductions. There can be no assurance that the Company’s sales and marketing forces will compete successfully against the Company’s competitors in the future.

The Company’s financial condition and results of operations could be adversely affected if the Company is unable to maintain a sufficient level of cash flow in the U.S.

The Company had approximately $1,323 million in debt and $1,804 million in cash, cash equivalents and investments as of December 31, 2013. As of December 31, 2013, the Company also had the ability to borrow an additional $483 million from its existing, committed credit facilities. Most of the Company’s debt is in the U.S. There is a substantial cash requirement in the U.S. to fund operations and capital expenditures, service debt interest obligations, finance potential U.S. acquisitions and continue authorized stock repurchase programs in the U.S. A majority of the Company’s cash is generated from foreign operations, with $1,738 million of the Company’s cash held by foreign subsidiaries, and may be subject to material tax effects on distribution to U.S. legal entities. The Company’s financial condition and results of operations could be adversely impacted if the Company is unable to maintain a sufficient level of cash flow in the U.S. to address these requirements through (1) cash from U.S. operations, (2) efficient, cost-effective and timely distribution of cash from non-U.S. subsidiaries, (3) the Company’s ability to access its existing cash and revolving credit facility and (4) other sources of capital obtained at an acceptable cost.

Debt covenants, and the Company’s failure to comply with them, could negatively impact the Company’s capital and financial results.

The Company’s debt is subject to restrictive debt covenants that limit the Company’s ability to engage in certain activities that could otherwise benefit the Company. These debt covenants include restrictions on the Company’s ability to enter into certain contracts or agreements that may limit the Company’s ability to make dividend or other payments, secure other indebtedness, enter into transactions with affiliates and consolidate, merge or

12

Table of Contents

transfer all or substantially all of the Company’s assets. The Company is also required to meet specified financial ratios under the terms of the Company’s debt agreements. The Company’s ability to comply with these financial restrictions and covenants is dependent on the Company’s future performance, which is subject to, but not limited to, prevailing economic conditions and other factors, including factors that are beyond the Company’s control, such as foreign exchange rates, interest rates, changes in technology and changes in the level of competition.

Disruption of operations at the Company’s manufacturing facilities could harm the Company’s financial condition.

The Company manufactures LC instruments at facilities in Milford, Massachusetts and through a subcontractor in Singapore; chemistry separation columns at its facilities in Taunton, Massachusetts and Wexford, Ireland; MS products at its facilities in Cheshire, England, Manchester, England, Wilmslow, England and Wexford, Ireland; thermal analysis and rheometry products at its facilities in New Castle, Delaware and other instruments and consumables at various other locations as a result of the Company’s acquisitions. In early 2014, the Company completed the construction of its new facility in Wilmslow, England and is in the process of consolidating and moving its Cheshire and Manchester facilities to this new location. Any prolonged disruption to the operations at any of these facilities, whether due to labor difficulties, destruction of or damage to any facility or other reasons, could have a material adverse effect on the Company’s results of operations or financial condition.

The Company’s international operations may be negatively affected by foreign political and regulatory changes, related to either a specific country or a larger region. Currency and economic disruptions and foreign currency exchange rate fluctuations could have a material adverse effect on the Company’s results of operations or financial condition.

Approximately 71% of the Company’s net sales in both 2013 and 2012 were outside of the United States and were primarily denominated in foreign currencies. In addition, the Company has considerable manufacturing operations in Ireland and the United Kingdom, as well as significant subcontractors located in Singapore. As a result, a significant portion of the Company’s sales and operations are subject to certain risks, including adverse developments in the foreign political, regulatory and economic environment, in particular, the financial difficulties and debt burden experienced by a number of European countries; the instability and possible dissolution of the Euro as a single currency; sudden movements in a country’s foreign exchange rates due to a change in a country’s sovereign risk profile or foreign exchange regulatory practices; tariffs and other trade barriers; difficulties in staffing and managing foreign operations; and associated adverse operational, contractual and tax consequences.

Additionally, the U.S. dollar value of the Company’s net sales, cost of sales, operating expenses, interest, taxes and net income varies with currency exchange rate fluctuations. Significant increases or decreases in the value of the U.S. dollar relative to certain foreign currencies, particularly the Euro, Japanese yen and British pound, could have a material adverse effect or benefit on the Company’s results of operations or financial condition.

The loss of key members of management and the risks inherent in succession planning could adversely affect the Company’s results of operations or financial condition.

The operation of the Company requires managerial and operational expertise. None of the Company’s key management employees have an employment contract with the Company and there can be no assurance that such individuals will remain with the Company. In August 2013, the Company’s chief executive officer announced his intention to retire as chief executive officer of the Company by the end 2015. In addition, the Company’s former chief financial officer has transitioned to a reduced workload and resigned as the Company’s chief financial officer as of February 1, 2014. If, for any reason, other such key personnel do not continue to be active in management, the Company’s results of operations or financial condition could be adversely affected.

13

Table of Contents

Failure to adequately protect intellectual property could have materially adverse effects on the Company’s results of operations or financial condition.

The Company vigorously protects its intellectual property rights and seeks patent coverage on all developments that it regards as material and patentable. However, there can be no assurance that any patents held by the Company will not be challenged, invalidated or circumvented or that the rights granted thereunder will provide competitive advantages to the Company. Conversely, there could be successful claims against the Company by third-party patent holders with respect to certain Company products that may infringe the intellectual property rights of such third parties. The Company’s patents, including those licensed from others, expire on various dates. If the Company is unable to protect its intellectual property rights, it could have an adverse and material effect on the Company’s results of operations or financial condition.

The Company’s business would suffer if the Company were unable to acquire adequate sources of supply.

Most of the raw materials, components and supplies purchased by the Company are available from a number of different suppliers; however, a number of items are purchased from limited or single sources of supply and disruption of these sources could have, at a minimum, a temporary adverse effect on shipments and the financial results of the Company. A prolonged inability to obtain certain materials or components could have an adverse effect on the Company’s financial condition or results of operations and could result in damage to its relationships with its customers and, accordingly, adversely affect the Company’s business.

The Company’s sales would deteriorate if the Company’s outside contractors fail to provide necessary components or modules.

Certain components or modules of the Company’s LC and MS instruments are manufactured by outside contractors, including the manufacturing of LC instrument systems and related components by contract manufacturing firms in Singapore. Disruptions of service by these outside contractors could have an adverse effect on the supply chain and the financial results of the Company. A prolonged inability to obtain these components or modules could have an adverse effect on the Company’s financial condition or results of operations.

The Company’s financial results are subject to unexpected shifts in pre-tax income between tax jurisdictions and changing application of tax law.

The Company is subject to rates of income tax that range from 0% to in excess of 35% in various jurisdictions in which it conducts business. In addition, the Company typically generates a substantial portion of its income in the fourth quarter of each fiscal year. Geographical shifts in income from previous quarters’ projections caused by factors including, but not limited to, changes in volume and product mix and fluctuations in foreign currency translation rates, could therefore have potentially significant favorable or unfavorable effects on the Company’s income tax expense, effective tax rate and results of operations. In addition, governments in the jurisdictions in which the Company operates implement changes to tax laws and regulations from time to time. Any changes in corporate income tax rates or regulations regarding transfer pricing or repatriation of dividends or capital, as well as changes in the interpretation of existing tax laws and regulations, in the jurisdictions in which the Company operates could adversely affect the Company’s cash flow and lead to increases in its overall tax burden, which would negatively affect the Company’s profitability.

Disruption, cyber attack or unforeseen problems with the security, maintenance or upgrade of the Company’s information and web-based systems could have an adverse effect on the Company’s operations and financial condition.

The Company relies on its technology infrastructure and that of its software and banking partners, among other functions, to interact with suppliers, sell products and services, fulfill contract obligations, ship products, collect and make electronic wire and check based payments and otherwise conduct business. The Company’s technology infrastructure may be vulnerable to damage or interruption from, but not limited to, natural disasters, power loss, telecommunication failures, terrorist attacks, computer viruses, unauthorized access to customer or employee

14

Table of Contents

data, unauthorized access to and funds transfers from Company bank accounts and other attempts to harm the Company’s systems. Any prolonged disruption to the Company’s technology infrastructure, at any of its facilities, could have a material adverse effect on the Company’s results of operations or financial condition.

The effects of climate change could harm the Company’s business.

The Company’s manufacturing processes for certain of its products involve the use of chemicals and other substances that are regulated under various international, federal, state and local laws governing the environment. In the event that any future climate change legislation would require that stricter standards be imposed by domestic or international environmental regulatory authorities with respect to the use and/or levels of possible emissions from such chemicals and/or other substances, the Company may be required to make certain changes and adaptations to its manufacturing processes. Any such changes could have a material adverse effect on the financial statements of the Company.

Another potential effect of climate change is an increase in the severity of global weather conditions. The Company’s manufacturing facilities are located in the United States, United Kingdom and Ireland. In addition, the Company manufactures a growing percentage of its HPLC, UPLC and MS products in both Singapore and Ireland. Severe weather conditions, including earthquakes, hurricanes and/or tsunamis, could potentially cause significant damage to the Company’s manufacturing facilities in each of these countries. The effects of such damage and the resulting disruption of manufacturing operations could have a material adverse impact on the financial results of the Company.

Compliance failures could harm the Company’s business.

The Company is subject to regulation by various federal, state and foreign governments and agencies in areas including, among others, health and safety, import/export, the Foreign Corrupt Practices Act and environmental laws and regulations. A portion of the Company’s operations are subject to regulation by the FDA and similar foreign regulatory agencies. These regulations are complex and govern an array of product activities, including design, development, labeling, manufacturing, promotion, sales and distribution. Any failure by the Company to comply with applicable governmental regulations could result in product recalls, the imposition of fines, restrictions on the Company’s ability to conduct or expand its operations or the cessation of all or a portion of its operations.

Some of the Company’s operations are subject to domestic and international laws and regulations with respect to the manufacturing, handling, use or sale of toxic or hazardous substances. This requires the Company to devote substantial resources to maintain compliance with those applicable laws and regulations. If the Company fails to comply with such requirements in the manufacturing or distribution of its products, it could face civil and/or criminal penalties and potentially be prohibited from distributing or selling such products until they are compliant.

Some of the Company’s products are also subject to the rules of certain industrial standards bodies, such as the International Standards Organization. The Company must comply with these rules, as well as those of other agencies, such as the United States Occupational Health and Safety Administration. Failure to comply with such rules could result in the loss of certification and/or the imposition of fines and penalties which could have a material adverse effect on the Company’s operations.

The Company is subject to the rules of the SEC under the Dodd-Frank Wall Street Reform and Consumer Protection Act, requiring disclosure as to whether certain materials (tantalum, tin, gold and tungsten), known as conflict minerals, which may be contained in the Company’s products, are mined from the Democratic Republic of the Congo and adjoining countries. These rules are likely to impose additional costs and may introduce new risks related to the Company’s ability to verify the origin of any conflict minerals contained in its products.

15

Table of Contents

| Item 1B: | Unresolved Staff Comments |

None.

| Item 2: | Properties |

Waters operates 23 United States facilities and 78 international facilities, including field offices. In early 2014, the Company completed the construction of its new facility in Wilmslow, England and is in the process of consolidating and moving its Cheshire, England and Manchester, England facilities to this new location. This new facility will consolidate existing primary MS research, manufacturing and distribution locations and the Company believes that this new building and its other existing facilities are suitable and adequate for its current production level and for reasonable growth over the next several years. The Company’s primary facilities are summarized in the table below.

Primary Facility Locations

| Location |

Function (1) |

Owned/Leased | ||

| Golden, CO |

M, R, S, D, A | Leased | ||

| New Castle, DE |

M, R, S, D, A | Owned | ||

| Milford, MA |

M, R, S, D, A | Owned | ||

| Saugus, MA |

M, R, S, D, A | Leased | ||

| Taunton, MA |

M, R | Owned | ||

| Nixa, MO |

M, S, D, A | Leased | ||

| Pittsburgh, PA |

M, R, S, D, A | Leased | ||

| Lindon, UT |

M, R, S, D, A | Leased | ||

| Cheshire, England |

M, R, D, A | Leased | ||

| Manchester, England |

M, R, S, A | Leased | ||

| Wilmslow, England |

M, R, S, D, A | Owned | ||

| St. Quentin, France |

S, A | Leased | ||

| Huellhorst, Germany |

M, R, S, D, A | Owned | ||

| Wetzlar, Germany |

M, R, S, D, A | Leased | ||

| Wexford, Ireland |

M, R, D, A | Owned | ||

| Modena, Italy |

M, R, S, D, A | Leased | ||

| Etten-Leur, Netherlands |

S, D, A | Owned | ||

| Brasov, Romania |

R, A | Leased | ||

| Singapore |

R, S, D, A | Leased |

| (1) | M = Manufacturing; R = Research; S = Sales and Service; D = Distribution; A = Administration |

16

Table of Contents

The Company operates and maintains 14 field offices in the United States and 64 field offices abroad in addition to sales offices in the primary facilities listed above. The Company’s field office locations are listed below.

Field Office Locations (2)

| United States |

International |

|||||

| Irvine, CA |

Australia | Japan | ||||

| Pleasanton, CA |

Austria | Korea | ||||

| Schaumburg, IL |

Belgium | Mexico | ||||

| Wood Dale, IL |

Brazil | Netherlands | ||||

| Columbia, MD |

Canada | Norway | ||||

| Beverly, MA |

Czech Republic | People’s Republic of China | ||||

| Ann Arbor, MI |

Denmark | Portugal | ||||

| Durham, NC |

Finland | Poland | ||||

| Morrisville, NC |

France | Puerto Rico | ||||

| Parsippany, NJ |

Germany | Spain | ||||

| Westlake, OH |

Hungary | Sweden | ||||

| Plymouth Meeting, PA |

India | Switzerland | ||||

| Bellaire, TX |

Ireland | Taiwan | ||||

| Spring, TX |

Israel | United Kingdom | ||||

| Italy | ||||||

| (2) | The Company operates more than one field office within certain states and foreign countries. |

| Item 3: | Legal Proceedings |

From time to time, the Company and its subsidiaries are involved in various litigation matters arising in the ordinary course of business. The Company believes it has meritorious arguments in its current litigation matters and believes any outcome, either individually or in the aggregate, will not be material to the Company’s financial position or results of operations.

The Company has been engaged in ongoing patent litigation with Agilent Technologies GmbH (“Agilent”) in Germany. In July 2005, Agilent brought an action against the Company alleging that certain features of the Alliance pump continued to infringe certain of its patents. In August 2006, following a trial in this action, the German court ruled that the Company did not infringe the patents. Agilent filed an appeal in this action. A hearing on this appeal was held in January 2008. The appeals court affirmed the finding of the trial court that the Company did not infringe and Agilent appealed this finding to the German Federal Court of Justice. In December 2012, Agilent won this appeal and the Company recorded a $4 million provision for damages and fees estimated to be incurred in connection with this litigation.

| Item 4: | Mine Safety Disclosures |

Not applicable.

EXECUTIVE OFFICERS OF THE REGISTRANT

Officers of the Company are elected annually by the Board of Directors and hold office at the discretion of the Board of Directors. The following persons serve as executive officers of the Company:

Douglas A. Berthiaume, 65, has served as Chairman of the Board of Directors of the Company since February 1996 and has served as Chief Executive Officer and a Director of the Company since August 1994. Mr. Berthiaume also served as President of the Company from August 1994 to January 2002. In March 2003,

17

Table of Contents

Mr. Berthiaume once again became President of the Company. From 1990 to 1994, Mr. Berthiaume served as President of the Waters Chromatography Division of Millipore. Mr. Berthiaume is the Chairman of the Children’s Hospital Trust Board and a Trustee of the Children’s Hospital Medical Center and The University of Massachusetts Amherst Foundation. In August 2013, Mr. Berthiaume communicated his intention to retire as Chief Executive Officer of the Company by the end of 2015.

Arthur G. Caputo, 62, has been Executive Vice President since March 2003 and President of the Waters Division since January 2002. Previously, he was the Senior Vice President, Worldwide Sales and Marketing of the Company since August 1994. He joined Millipore in October 1977 and held a number of positions in sales. Previous roles include Senior Vice President and General Manager of Millipore’s North American Business Operations responsible for establishing the Millipore North American Sales Subsidiary and General Manager of Waters’ North American field sales, support and marketing functions.

Mark T. Beaudouin, 59, has been Vice President, General Counsel and Secretary of the Company since April 2003. Prior to joining Waters, he served as Senior Vice President, General Counsel and Secretary of PAREXEL International Corporation, a bio/pharmaceutical services company, from January 2000 to April 2003. Previously, from May 1985 to January 2000, Mr. Beaudouin served in several senior legal management positions, including Vice President, General Counsel and Secretary of BC International, Inc., a development stage biotechnology company, First Senior Vice President, General Counsel and Secretary of J. Baker, Inc., a diversified retail company, and General Counsel and Secretary of GenRad, Inc., a high technology test equipment manufacturer.

Eugene G. Cassis, 57, was elected by the Board of Directors of the Company to serve as the interim Chief Financial Officer, effective February 1, 2014. Mr. Cassis most recently served as Corporate Vice President of Worldwide Business Development and Investor Relations and has been with the Company for 33 years. Mr. Cassis has an extensive background in many financial, operational and technical areas of the Company and has held several senior positions with Waters, including President of Nihon Waters K.K., Tokyo, Japan and Liquid Chromatography — Mass Spectrometry (LC-MS) Business Unit Manager.

Elizabeth B. Rae, 56, has been Vice President of Human Resources since October 2005 and Vice President of Worldwide Compensation and Benefits since January 2002. She joined Waters in January 1996 as Director of Worldwide Compensation. Prior to joining Waters she held senior human resources positions in retail, healthcare and financial services companies.

18

Table of Contents

PART II

| Item 5: | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

The Company’s common stock is registered under the Exchange Act, and is listed on the New York Stock Exchange under the symbol WAT. As of February 22, 2014, the Company had 146 common stockholders of record. The Company has not declared or paid any dividends on its common stock in its past three fiscal years and does not plan to pay dividends in the immediate future. The Company has not made any sales of unregistered equity securities in the years ended December 31, 2013, 2012 or 2011.

Securities Authorized for Issuance under Equity Compensation Plans

Equity compensation plan information is incorporated by reference from Part III, Item 12, Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters, of this document and should be considered an integral part of this Item 5.

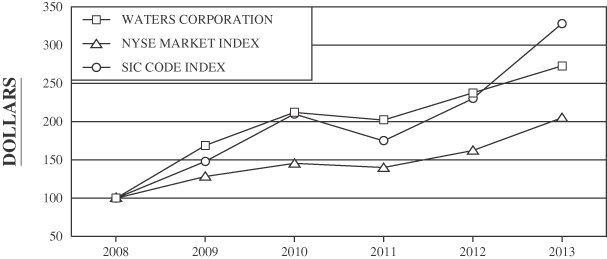

Stock Price Performance Graph

The following performance graph and related information shall not be deemed to be “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent that the Company specifically incorporates it by reference into such filing.