UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number

(Exact name of Registrant as specified in its Charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

The |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

☒ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES

As of June 25, 2021, the last business day of the registrant’s most recently completed second quarter, the aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant was $

As of February 17, 2022 there were

Table of Contents

|

|

Page |

PART I |

|

|

Item 1. |

4 |

|

Item 1A. |

14 |

|

Item 1B. |

49 |

|

Item 2. |

49 |

|

Item 3. |

49 |

|

Item 4. |

49 |

|

|

|

|

PART II |

|

|

Item 5. |

50 |

|

Item 6. |

51 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

52 |

Item 7A. |

79 |

|

Item 8. |

80 |

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

123 |

Item 9A. |

123 |

|

Item 9B. |

123 |

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

123 |

|

|

|

PART III |

|

|

Item 10. |

124 |

|

Item 11. |

130 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

156 |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

159 |

Item 14. |

160 |

|

|

|

|

PART IV |

|

|

Item 15. |

162 |

|

Item 16 |

166 |

i

Cautionary Note Regarding Forward-Looking Statements

The discussion below contains forward-looking statements, which are subject to safe harbors under the Securities Act of 1933, as amended (the Securities Act) and the Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements include references to our ability to utilize our deferred tax assets, as well as statements including words such as “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “goal,” “intent,” “momentum,” “projects,” and similar expressions. In addition, projections of our future financial performance; anticipated growth and trends in our businesses and in our industries; the anticipated impacts of acquisitions, restructurings, stock repurchases, and investment activities; the outcome or impact of pending litigation, claims or disputes; statements regarding any future dividends; plans for and anticipated benefits of our solutions; matters arising out of the ongoing U.S. Securities and Exchange Commission (the “SEC”) investigation; the impact of the Covid-19 pandemic on our business operations and target markets; and other characterizations of future events or circumstances are forward-looking statements. These statements are only predictions, based on our current expectations about future events and may not prove to be accurate. We do not undertake any obligation to update these forward-looking statements to reflect events occurring or circumstances arising after the date of this report. These forward-looking statements involve risks and uncertainties, and our actual results, performance, or achievements could differ materially from those expressed or implied by the forward-looking statements on the basis of several factors.

We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not rely on our forward-looking statements in making your investment decision. Actual results or events could differ materially from the plans, intentions, and expectations disclosed in the forward-looking statements we make. Important factors that could cause actual results and events to differ materially from those indicated in the forward-looking statements include, among others, the following:

1

SUMMARY OF RISKS ASSOCIATED WITH OUR BUSINESS

Our business is subject to a number of risks, which are discussed more fully under the heading “Risk Factors” in this Annual Report on Form 10-K. These risks include the following:

2

3

PART I

Item 1. Business.

ORGANIZATION

McAfee Corp. (the “Corporation”) (or “we,” “us” or “our”) was incorporated in Delaware on July 19, 2019. The Corporation was formed for the purpose of completing an initial public offering (“IPO”) and related transactions in order to carry on the business of Foundation Technology Worldwide LLC (“FTW”) and its consolidated subsidiaries (the Corporation, FTW and its subsidiaries are collectively the “Company”). On October 21, 2020, the Corporation became the sole managing member and holder of 100% of the voting power of FTW due to the Reorganization Transactions. With respect to the Corporation and the Company, each entity owns only the respective entities below it in the corporate structure and each entity has no other material operations, assets, or liabilities. See Note 1 to the Consolidated Financial Statements in Part II, Item 8 for a detailed discussion of the Reorganization Transactions, as defined in that footnote, and the IPO.

AGREEMENT AND PLAN OF MERGER; PROPOSED MERGER

On November 5, 2021, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Condor BidCo, Inc., a Delaware corporation (“Parent”), and Condor Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of Parent (“Merger Subsidiary”), pursuant to which Merger Subsidiary will merge with and into the Company whereupon the separate corporate existence of Merger Subsidiary will cease and the Company will be the surviving corporation in the Merger and will continue as a wholly owned subsidiary of Parent (the “Merger”). Parent has obtained equity financing and debt financing commitments for the purpose of financing the transactions contemplated by the Merger Agreement. Affiliates of funds advised by each of Advent International Corporation, Permira Advisers LLC, Crosspoint Capital Partners L.P., Abu Dhabi Investment Authority, and Canada Pension Plan Investment Board and GIC Private Ltd. have committed to capitalize Parent at the Closing with an aggregate equity contribution equal to $5.2 billion on the terms and subject to the conditions set forth in signed equity commitment letters. On February 3, 2022, Merger Subsidiary received commitments of $5,160 million under a proposed U.S. dollar term loan facility and Euro-equivalent $1,800 million under a proposed Euro term loan facility. On February 17, 2022, Merger Subsidiary closed its offering of $2,020 million 7.375% senior notes due 2030. Under the terms of the Merger Agreement, the Company’s stockholders will receive $26.00 in cash for each share of Class A common stock they hold on the transaction closing date. The transaction’s closing is subject to customary closing conditions, including, among others, approval by the Company’s stockholders, the expiration or early termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”), the receipt of other regulatory approvals, and clearance by the Committee on Foreign Investment in the United States. On December 20, 2021 at 11:59 p.m., the waiting period under the HSR Act expired. On February 9, 2022, the Company’s stockholders approved the Merger at a special meeting of stockholders. On February 22, 2022, the Committee on Foreign Investment in the United States closed its review and cleared the transactions contemplated by the Merger Agreement. Pursuant to the terms of the Merger Agreement, the completion of the Merger remains subject to various customary conditions, including (1) the absence of an order, injunction or law prohibiting the Merger, (2) the receipt of antitrust approval in the European Union and Switzerland, (3) the accuracy of each party’s representations and warranties, subject to certain materiality standards set forth in the Merger Agreement, (4) compliance in all material respects with each party’s obligations under the Merger Agreement, and (5) no Company Material Adverse Effect (as defined in the Merger Agreement) having occurred since the date of the Merger Agreement.

For a summary of the transaction, please refer to our Form 8-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on November 8, 2021.

OVERVIEW

McAfee has been a pioneer and leader in protecting consumers from cyberattacks with integrated security, privacy, identity and trust solutions. For over 30 years, consumers have turned to McAfee as a leader in cybersecurity services. We built our platform through a deep, rich history of innovation and have established a leading global brand. When securing the digital experience of a consumer who is increasingly living life online, McAfee is singularly committed to one mission: to protect our subscribers' digital presence through leading-edge cybersecurity.

4

We live in a digital world. Consumers are increasingly mobile, interacting through multiple devices, networks and platforms, while leveraging technology as they work, socialize, consume and transact. Remote and increasing work and study from home arrangements are driving a pronounced convergence of professional and personal life. This lifestyle shift has been accompanied by a more advanced cyberthreat landscape and a proliferation of points of vulnerability, risking individuals’ privacy, identity, personal data, sensitive information and other vital resources. This challenge has heightened the importance of securing the consumers’ converged digital life.

We have a differentiated ability to secure the consumers’ digital experience against cyberthreats, using our proprietary advanced artificial intelligence and machine learning capabilities combined with our real-time threat intelligence that leverages the scale and diversity of our threat sensor network. Our network of over 600 million customer devices generates massive amounts of telemetry that we translate into actionable, real-time insights. As of 2020, our vast and dynamic data set and advanced analytics capabilities enabled us to provide defense for advanced zero-day threats by training machine learning models on the over 60 billion threat queries. McAfee simplifies the complexity of threat detection and response by correlating events, detecting new threats, reducing false positives, and guiding consumers through remediation. Protecting our subscribers has been the foundation of our success, enabling us to maintain an industry-leading reputation among our subscribers and partners.

Our Personal Protection Service provides holistic digital protection for an individual or family at home, on the go, and on the web. Our platform includes device security, privacy and safe Wi-Fi, online protection, and identity protection, creating a seamless and integrated digital moat. With a single interface, simple set up and ease of use, consumers obtain immediate time-to-value whether on a computer, smartphone or tablet, and across multiple operating systems.

Our broad and digitally-led omni-channel go-to-market strategy reaches the consumer at crucial moments in their cybersecurity purchase lifecycle resulting in the protection of over 600 million devices. We acquire customers through our extensive direct channel (McAfee.com). This includes traffic driven through Search Engine Marketing (“SEM”), Affiliate, Social and organic traffic. We have longstanding exclusive partnerships with many of the leading PC original equipment manufacturers (“OEMs”). We also increasingly have partnerships as the consumer security provider to mobile and internet service providers (“ISPs”) as the demand for mobile security protection increases. Through many of these relationships, our consumer security software is pre-installed on devices on a trial basis until conversion to a paid subscription. Our go-to-market channel also includes some of the largest retailers globally. We operate a global business, with 39% of our fiscal 2021 net revenue earned outside of the United States.

SALE OF OUR ENTERPRISE BUSINESS

On July 27, 2021, we completed the sale of our Enterprise Business to STG, pursuant to a Contribution and Equity Purchase Agreement (the “Purchase Agreement”) entered in on March 6, 2021 between McAfee, LLC (“US Seller”) and McAfee Security UK LTD (“UK Seller” and together with US Seller, the “Seller Entities”) and Magenta Buyer LLC, organized by a consortium led by STG, in exchange for (i) $4,000,000,000 in cash consideration and (ii) the assumption of certain liabilities of the Enterprise Business as specified in the Purchase Agreement. We believe this transaction allows McAfee to singularly focus on our Consumer business and to accelerate our strategy to be a leader in personal security for consumers.

In connection with the closing of the sale, the Seller Entities and Buyer entered into a Transition Services Agreement, Transitional Trademark License Agreement, Intellectual Property Matters Agreement and Commercial Services Agreement, under which each party granted certain licenses to the other party with respect to certain intellectual property rights and technology transferred by us in the Enterprise Sale and retained by us after the consummation of the sale of our Enterprise Business. We also agreed not to compete with the Enterprise Business for four years following the closing of the transaction. In addition, we and Buyer agreed to indemnify each other for losses arising from certain covenant breaches under the Purchase Agreement and certain liabilities expressly assumed or retained by the relevant indemnifying party.

FINANCIAL SUMMARY

For the year ended December 25, 2021 compared to the year ended December 26, 2020 we delivered the following:

5

See “Non-GAAP Financial Measures” for a description of adjusted EBITDA, and adjusted EBITDA margin, and a reconciliation of these measures to the nearest financial measure calculated in accordance with generally accepted accounting principles (“GAAP”).

INDUSTRY BACKGROUND

We live in an increasingly digitally interconnected and mobile world that is driving profound changes for consumers, causing them to react to the following trends:

Adoption of online lifestyle is global and continues to grow. According to IDC, there were over 4 billion Internet users in 2020, of which the number of mobile-only Internet users is expected to grow at an approximate 8% compound annual growth rate (“CAGR”) from 2020 to 2024. Furthermore, Frost & Sullivan estimates there were over 6 billion Internet-connected devices worldwide in 2020. This significant growth in the mobile install base is driving the ubiquity of the Internet and online browsing.

Consumers everywhere are living more of their everyday lives online, thereby expanding their digital footprint. Consumers are more comfortable engaging in critical transactions, including financial transactions and medical consultations, on mobile devices and their PCs. At the same time, they are rapidly expanding their social interactions and media consumption online, while shifting data storage to cloud-based solutions to store personal photos and large amounts of private data that is accessible across any connected endpoint device. Per eMarketer, the average U.S. adult spent over 7.8 hours per day consuming digital media in 2020, representing 55% of total media consumption and an increase of 12% over the prior year. On average, one single users owns 300 online accounts, and each smartphone has 90 apps downloaded. The COVID-19 pandemic has accelerated digital transformation even further. According to Statista, eCommerce accounts for 20% of total retail sales in 2021, and digital transformation and mobile payments is expected to be $8.2 trillion in 2024. While unlocking consumers’ digital life allows for convenience, using an ever-increasing number of online applications and web services increases the attach surface area that cybercriminals can use to obtain, misuse, corrupt, destroy or otherwise exploit consumers’ data.

Increased attack surface combined with more organized cybercriminal heightens risk of being hacked and personal data used for profit. Cyberattacks have evolved from rudimentary malware into highly sophisticated and large-scale attacks. According to RiskBased Security, during 2020, nearly 4,000 data breaches were reported, resulting in over 37 billion records being exposed. Increasing ransomware attacks have generated billions of dollars in payments to cybercriminals and inflicted significant damage and expenses for consumers. In the fourth quarter of 2021, McAfee Labs observed an average of 354 threats per minute.

There is a need for integrated online protection solutions that secure consumers in a connected world by offering the following:

6

KEY BENEFITS OF OUR SOLUTIONS

We protect consumers with our differentiated ability to detect, analyze, and manage responses to adversarial threats. Our subscribers trust us to protect and defend their families, data, network and online experience whether it is on a device or in the cloud, at home or on the go.

Our products are multi-faceted privacy protection solutions that provide consumers security in their everyday lives. Our Personal Protection Service is designed to provide a comprehensive suite of features that protect consumers and their families across their digital life. Our products provide cross-device identity protection, online privacy, and device security against virus, malware, spyware and ransomware attacks that are pervasive across all digital devices. Personal Protection Service allows consumers to have mobile and PC antivirus protection across all of their devices, provides spam filtering capabilities, has the ability to securely encrypt sensitive files on public networks, and erases digital footprints that could be used to compromise their data, identity and privacy.

Our solutions provide a seamless and user friendly experience. From working on laptops, to accessing social media on phones, or accessing online videos, our Personal Protection Service provides unified multi-device protection for the modern connected family. With a single McAfee Total Protection subscription, our subscribers can protect multiple devices without impeding the consumer experience via cloud-based online and offline protection across devices to enjoy security at home and on the go. McAfee Total Protection comes with performance-enhancing features that allow for more productivity and entertainment by automatically assigning more dedicated processor power to the apps consumers are actively using. With a single interface, simple set up and intuitive user experience, consumers obtain immediate value from our solutions once installed. Our security, privacy and trust solutions provide a seamless and convenient experience, and an integrated digital moat. We are one of the few scaled cybersecurity companies with integrated data protection and threat defense capabilities built into technologies and solutions that span the digital ecosystem.

Our solutions have comprehensive features that provide consumers peace of mind that their online experience is protected. Our Personal Protection Service is designed to be a holistic digital protection of consumers and their families. Personal Protection Service encompasses data and device security and identity protection through our suite of products while delivering an experience that is equally easy to use whether on a PC, a mobile smartphone or a tablet and across multiple operating system platforms.

Our solutions are supported by our global real-time threat intelligence network, which is bolstered by artificial intelligence, machine learning, and deep learning to increase efficacy and efficiency. As of December 25, 2021, our portfolio leverages over 600 million telemetry sensors across multiple domains that feed our threat intelligence and insights engines. As of 2020, McAfee’s Global Threat Intelligence (“GTI”) supplies threat intelligence to over 2.3 trillion threat queries each year. By leveraging artificial intelligence, machine learning, and deep learning, we use complex threat detection and response algorithms that collect data from our vast customer base to correlate events, detect new threats, reduce false positives, and customers through remediation.

MARKET OPPORTUNITY

According to Frost & Sullivan, the global consumer endpoint security market (comprised of endpoint protection and prevention and consumer privacy and identity protection) addressed by our solutions was expected to reach nearly $13.1 billion in 2020, growing to $18.7 billion in 2024 (9% CAGR). The consumer endpoint security market has remained strong throughout the COVID-19 pandemic and did not show signs of waning during 2021. While the COVID-19 pandemic may have accelerated the market for consumer endpoint security solutions, we believe there continues to be a robust market for consumer personal protection, including mobile solution and broader consumer protection offerings as consumers continue to increase their digital footprint. We believe Consumer Digital Protection represents a large and underpenetrated market opportunity with less than five percent of current global internet users using paid cyber safety solutions, resulting in a greater than ninety five percent whitespace opportunity.

COMPETITIVE STRENGTHS

Our competitive strengths include:

7

OUR GROWTH STRATEGY

Our strategy is to maintain and extend our technology leadership in consumer cybersecurity solutions by driving frictionless and secure digital experiences as a privately-held company. The following are key elements of our growth strategy:

8

OUR PRODUCTS

We believe we have one of the industry's most comprehensive cybersecurity portfolios protecting consumers’ digital life.

Our Personal Protection Service provides holistic online protection of the individual and family across their entire digital life. It encompasses device security, privacy, and safe Wi-Fi, and identity protection through a trusted brand with an intuitive experience that is equally easy to use whether on a PC, a mobile smartphone or a tablet and across multiple operating system platforms. Our Personal Protection Service delivers a simple user interface with no performance trade-offs, and with a focus on proactive, intelligent, and seamless protection during a consumer’s digital experience. Our platform frees consumers to work on sensitive documents, videoconference their friends and coworkers, and have their kids go on social media platforms while having peace of mind that our Personal Protection Service is keeping their data and files encrypted, proactively alerting them when they are at risk, and helping them to resolve security threats. We achieve this by integrating the following solutions and capabilities within our Personal Protection Service:

We also provide these services to consumers who want to complement their existing protection in the form of individual products, as well as to consumers who want to protect their complete digital life through our Total Protection and LiveSafe portfolio brands.

In addition, we extended our protection services to small business owners and the gamer community. Our Small Business Security package helps small businesses keep their businesses and customer data safe by leveraging our award-winning multi-device protection and privacy capabilities, enhanced with our 24/7 technical support and virus removal service. Our Gamer Security package delivers anti-malware functionality while enhancing gaming performance. By offloading threat detection to the cloud, keeping necessary virus definitions locally, and optimizing system resources like the central processing unit, graphics processing unit, and random-access memory by pausing background services, we deliver a smoother and safer gaming experience.

OUR TECHOLOGY

We deploy the latest technologies to maintain our competitive advantage in our product offerings as well as to design a personalized digital experience for consumers that drive customer engagement, satisfaction, and retention.

9

Quality of Our Protection and Artificial Intelligence/Machine Learning

Our solutions seek to defend against a wide range of threats by using technology that leverages a combination of threat intelligence, artificial intelligence and machine learning. Unlike other alternatives that rely only on artificial intelligence, our approach minimizes false positives while detecting a wide range of threats, including new zero-day threats.

Our solutions are enhanced by our Global Threat Intelligence Telemetry from detected events across the product portfolio in addition to structural and behavioral feature vectors from telemetry collected through our network of threat sensors. This telemetry enables McAfee to understand the blueprint of threats for which we do not necessarily possess the sample but can identify based on behavioral and structural vectors which improves our efficacy in detecting zero-day threats.

Our Machine Learning Scanner provides two options for performing automated analysis—on the device or in the cloud. The former uses machine learning on customer systems to determine whether existing and incoming files match known malware. Our cloud-based machine learning scanner collects and sends file attributes and behavioral information to the machine-learning system in the cloud for malware analysis, without transmitting personally identifiable information.

Anti-Malware Engine

Our anti-malware engine is the core component of our award-winning products. Using patented technology, the engine analyzes potentially malicious code to detect and block Trojans, viruses, worms, adware, spyware, ransomware and other threats. The engine scans files at particular points, processes, and pattern-matches malware definitions with data it finds within scanned files, decrypts, and runs malware code in an emulated environment, applies heuristic techniques to recognize new malware, and removes infectious code from legitimate files.

Consumer Experience Innovation

We continuously improve the digital experience for consumers through the following technologies:

SALES AND MARKETING

Our go-to-market engine consists of a digitally-led omni-channel approach to reach the consumer at crucial moments in their purchase lifecycle including direct-to-consumer online sales, acquisition through trial pre-loads on PC OEM devices, and other indirect modes via additional partners such as mobile providers, ISPs, electronics retailers, eCommerce sites, and search providers.

10

Our omni-channel approach and strong partnerships work together to increase our presence at key moments of purchase and security engagement for consumers, allowing us to drive customer engagement and acquisition of new subscribers.

INTELLECTUAL PROPERTY

Our intellectual property is an important and vital asset of the company that enables us to develop, market, and sell our products and services and enhance our competitive position. We rely on trademarks, patents, copyrights, trade secrets, license agreements, intellectual property assignment agreements, confidentiality procedures, non-disclosure agreements, and employee non-disclosure and invention assignment agreements to establish and protect our proprietary rights.

We maintain an internal patent program to identify inventions that provide the basis for new patent applications in areas of importance to our business. As of December 25, 2021, we had approximately 1,235 issued U.S. patents, in addition to approximately 735 issued foreign patents, which generally relate to inventive aspects of our products and technology. The duration of our issued patents is determined by the laws of the issuing country. Although we have patent applications pending, there can be no assurance that patents will issue from pending applications or that claims allowed on any future issued patents will be sufficiently broad to protect our technology. Also, these protections may not preclude competitors from independently developing products with functionality or features similar to our products.

In certain cases, we license intellectual property from third parties for use in our products and generally must rely on those third parties to protect the licensed rights. This can include open source software, which is subject to limited proprietary rights. While the ability to maintain and protect our intellectual property rights is important to our success, we believe our business is not materially dependent on any individual patent, copyright, trademark, trade secret, license, or other intellectual property right. For information on the risks associated with our intellectual property, please see “Risk Factors” in Item 1A.

THIRD-PARTY SERVICE PROVIDERS

We are heavily reliant on our technology and infrastructure to provide our products and services to our customers. For example, we host many of our products using third-party data center facilities, and we do not control the operation of these facilities. In addition, we rely on certain technology that we license from third parties, including third-party commercial software and open source software, which is used with certain of our solutions. For information on the risks associated with our dependence on such third-party service providers, please see “Risk Factors” in Item 1A.

11

GOVERNMENTAL REGULATION

We collect, use, store or disclose an increasingly high volume, variety, and velocity of personal information, including from employees and customers, in connection with the operation of our business, particularly, in relation to our identity and information protection offerings, which rely on large data repositories of personal information and consumer transactions. The personal information we process is subject to an increasing number of federal, state, local, and foreign laws regarding privacy and data security. For information on the risks associated with complying with privacy and data security laws, please see “Risk Factors” in Item 1A.

EMPLOYEE & HUMAN CAPITAL

Protecting all that matters demands constant innovation. Doing our job well requires building a workplace that embraces individuality, encourages different perspectives, and welcomes a range of experiences to boost real innovation, creativity, and strategic problem-solving. But it’s not just the right thing to do for business—it’s about every person’s innate right to be their true self and belong.

Building a more inclusive, sustainable world starts within our walls. We believe that when we mirror the varying perspectives of the outside world, we are stronger, more innovative, and better positioned to solve tomorrow’s toughest cybersecurity challenges. Our approach starts with our hiring and interview practices, but representation isn’t enough. Once people walk through our open door, we ensure all life experiences are not just valued, but accepted and encouraged. Only when people feel a deep sense of belonging can they thrive.

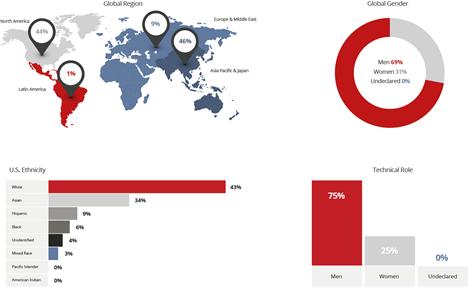

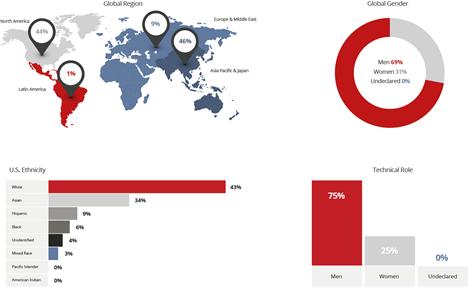

To solve tomorrow’s cybersecurity challenges, we know that our industry needs a more diverse, innovative workforce. To fulfill our mission to protect all that matters, we stand firm in our commitment to drive this change. But first, we must understand who we are today to define our journey ahead. As of December 25, 2021, McAfee employed 2,262 employees in 32 countries worldwide. Of these employees, 434 are expected to transfer to McAfee Enterprise in 2022 as a result of the divestiture which occurred in July 2021. The core McAfee population demographic was as follows:

To contribute a more diverse workforce to the cybersecurity industry, we know that we will need to exercise genuine, authentic, and transparent recruiting and hiring practices aligned with our values. That’s why we support techniques and programs designed specifically to connect us with people of all backgrounds:

12

Real collaboration, innovation, and impact happens in workplaces where you can express yourself authentically. That’s why we work hard to ensure life at McAfee is one where our employees can be authentic, engage with others, and reach the best versions of themselves, both at the office and away from it:

A more detailed overview of McAfee’s inclusion and diversity practices can be viewed at https://www.mcafee.com/en-us/consumer-corporate/inclusion-diversity.html.

AVAILABLE INFORMATION

Our internet website is www.mcafee.com. We make available on the Investor Relations section of our website, free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, Proxy Statements, and Forms 3, 4 and 5, and amendments to those reports as soon as reasonably practicable after filing such documents with, or furnishing such documents to, the Securities and Exchange Commission (“SEC”). The SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

On the Investor Relations section of our website, we webcast our earnings calls and certain events we participate in or host with members of the investment community. Additionally, we provide notifications of news or announcements regarding our financial performance, including SEC filings, investor events, press and earnings releases. Further corporate governance information, including our board committee charters, and, code of ethics, is also available on our Investor Relations website under the heading "Corporate Governance—Documents & Charters."

Our internet website is included herein as an inactive textual reference only. The information contained on our website is not incorporated by reference herein and should not be considered part of this report.

13

Item 1A. Risk Factors

Risks Related to the Merger

The announcement and pendency of the proposed Merger may adversely affect our business, financial condition and results of operations.

On November 5, 2021, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Condor BidCo, Inc., a Delaware corporation (“Parent”), and Condor Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of Parent (“Merger Subsidiary”), pursuant to which Merger Subsidiary will merge with and into the Company whereupon the separate corporate existence of Merger Subsidiary will cease and the Company will be the surviving corporation in the Merger and will continue as a wholly owned subsidiary of Parent (the “Merger”). Uncertainty about the effect of the proposed Merger on our employees, customers, and other parties may have an adverse effect on our business, financial condition and results of operation regardless of whether the proposed Merger is completed. These risks to our business include the following, all of which could be exacerbated by a delay in the completion of the proposed Merger:

Additionally, in approving the Merger Agreement, our board of directors considered a number of factors and potential benefits, including the fact that the Merger consideration to be received by holders of our common stock represented an approximately 22.6% premium to our unaffected share price of $21.21 on November 4, 2021, the day prior to initial media speculation of a transaction. If the Merger is not completed, neither the Company nor the holders of our common stock will realize this benefit of the Merger. Moreover, we would have incurred substantial transaction-related fees and costs and the loss of management time and resources

Failure to consummate the proposed Merger within the expected timeframe or at all could have a material adverse impact on our business, financial condition and results of operations.

There can be no assurance that the proposed Merger will be consummated. The consummation of the proposed Merger is subject to customary closing conditions. The obligation of each party to consummate the Merger is also conditioned upon the other party’s representations and warranties being true and correct to the extent specified in the Merger Agreement and the other party having performed in all material respects its obligations under the Merger Agreement. There can be no assurance that these and other conditions to closing will be satisfied in a timely manner or at all.

The Merger Agreement also includes customary termination provision for both the Company and Parent, subject, in certain circumstances, to the payment by the Company of a termination fee of 1.25% or 2.5% of the Company’s equity value. If we are required to make this payment, doing so may materially adversely affect our business, financial condition and results of operations.

14

There can be no assurance that a remedy will be available to us in the event of a breach of the Merger Agreement by Parent or its affiliates or that we will wholly or partially recover for any damages incurred by us in connection with the proposed Merger. A failed transaction may result in negative publicity and a negative impression of us among our customers or in the investment community or business community generally. Further, any disruptions to our business resulting from the announcement and pendency of the proposed Merger, including any adverse changes in our relationships with our customers, partners, suppliers and employees, could continue or accelerate in the event of a failed transaction. In addition, if the proposed Merger is not completed, and there are no other parties willing and able to acquire the Company at a price of $26.00 per share or higher, on terms acceptable to us, the share price of our Class A common stock will likely decline to the extent that the current market price of our common stock reflects an assumption that the proposed Merger will be completed. Also, we have incurred, and will continue to incur, significant costs, expenses and fees for professional services and other transaction costs in connection with the proposed Merger, for which we will have received little or no benefit if the proposed Merger is not completed. Many of these fees and costs will be payable by us even if the proposed Merger is not completed and may relate to activities that we would not have undertaken other than to complete the proposed Merger.

Prior to the completion of the Merger or the termination of the Merger Agreement in accordance with its terms, we are prohibited from entering into certain transactions and taking certain actions that might otherwise be beneficial to us and our stockholders.

After the date of the Merger Agreement and prior to the effective time, the Merger Agreement restricts us from taking specified actions without the consent of the Parent (which consent may not be unreasonably withheld, conditioned or delayed) and requires that our business be conducted in all material respects in the ordinary course of business. These restrictions may prevent us from making appropriate changes to our businesses or organizational structures or from pursuing attractive business opportunities that may arise prior to the completion of the Merger and could have the effect of delaying or preventing other strategic transactions. Adverse effects arising from the pendency of the Merger could be exacerbated by any delays in consummation of the Merger or termination of the Merger Agreement.

The Merger, including uncertainty regarding the Merger, may cause customers, suppliers, distributors or strategic partners to delay or defer decisions, which could negatively affect our business and adversely affect our ability to effectively manage our business.

The Merger will happen only if certain conditions are met. Many of the conditions are outside our control, and both we and Parent also have the right to terminate the Merger Agreement in certain circumstances. Accordingly, there may be uncertainty regarding the completion of the Merger. This uncertainty may cause customers, suppliers, distributors, strategic partners or others that deal with us to delay or defer entering into contracts with us or making other decisions concerning us or seek to change or cancel existing business relationships, which could negatively affect our business. Any delay or deferral of those decisions or changes in existing agreements could have a material adverse effect on our business, regardless of whether the Merger is ultimately completed.

The Merger may cause difficulty in attracting, motivating and retaining employees.

Our current and prospective employees may experience uncertainty about their future role with the Company until strategies with regard to these employees are announced or executed, which may impair our ability to attract, retain and motivate key management, technical, business development, operational and customer-facing employees and other personnel prior to the Merger. If we are unable to retain and replace personnel, we could face disruptions in our operations, loss of existing customers, loss of key information, expertise or know-how, and unanticipated additional recruitment and training costs.

The Merger Agreement limits our ability to pursue alternatives to the Merger and may discourage other companies from trying to acquire us for greater consideration than what the Parent has agreed to pay.

The Merger Agreement contains provisions that make it more difficult for us to sell our business to a company other than the Parent. These provisions include a general prohibition on us soliciting any acquisition proposal or offer for a competing transaction. If we or the Parent terminate the Merger Agreement and we agree to be or are subsequently acquired by another company, we may in some circumstances be required to pay to Parent a termination fee of 1.25% or 2.5% of the Company’s equity value.

15

These provisions might discourage a third party that has an interest in acquiring all or a significant part of the Company from considering or proposing an acquisition, even if the party were prepared to pay consideration with a higher per share cash or market value than the cash value proposed to be received in the Merger, or might result in a potential competing acquirer proposing to pay a lower price than it might otherwise have proposed to pay because of the added expense of the termination fee that may become payable in certain circumstances.

Stockholder litigation could result in substantial costs and may delay or prevent the Merger from being completed.

Stockholder lawsuits are often brought against public companies that have entered into merger agreements. As of the date of this Annual Report on Form 10-K, the Company has received three demand letters on behalf of purported stockholders of the Company challenging certain disclosures in the definitive proxy statement filed with the SEC on January 4, 2022 (the “Definitive Proxy Statement”). In addition, five stockholder complains relating to the Merger have been filed, four of which allege that the Definitive Proxy Statement is false and/or misleading and asserts claims for violations of Sections 14(a) and 20(a) of the Exchange Act and SEC Rule 14a-9 against the Company and its directors and the fifth alleges that the preliminary proxy statement filed with the SEC on December 21, 2021 is false and/or misleading and asserts claims for violations of Section 14(a) and 20(a) of the Exchange Act and SEC Rule 14a-9 against the Company and its directors. Each of the complains purport to seek, among other things, injunctive relief preventing the Merger, damages, and an award of plaintiffs’ costs and expenses, including reasonable attorneys’ and expert fees. The Company believes that the claims asserted in the demand letters and complaints are without merit. However, defending against these claims can result in substantial costs and divert management time and resources. Such claims could prevent or delay the consummation of the Merger, including through an injunction, and result in additional costs to us. The ultimate resolution of these lawsuits cannot be predicted, and an adverse ruling in any such lawsuit may cause the Merger to be delayed or not to be completed, which could cause us not to realize some or all of the anticipated benefits of the Merger.

Risks Related to the COVID-19 Pandemic

The COVID-19 pandemic has affected how we are operating our business, and the duration and extent to which this will impact our future results of operations and overall financial performance remains uncertain.

The COVID-19 pandemic is having widespread, rapidly evolving, and unpredictable impacts on global society, economies, financial markets, and business practices. Federal, state and foreign governments have implemented measures to contain the virus, including social distancing, travel restrictions, border closures, limitations on public gatherings, work from home, and closure of non-essential businesses. At the onset of the COVID-19 pandemic, we implemented work-from-home requirements, made substantial modifications to employee travel policies, and cancelled or shifted marketing and other corporate events to virtual-only formats. While we have adjusted our current policies and procedures in accordance with public health guidance that is available, we cannot be certain that similar precautionary measures will not be necessary in the future, and any such precautionary measures could negatively affect our customer success efforts, sales and marketing efforts, delay and lengthen our sales cycles, or create operational or other challenges, any of which could harm our business and results of operations. In addition, the COVID-19 pandemic has disrupted the operations of many of our channel partners, and may continue to disrupt their operations, for an indefinite period of time, including as a result of any future public health precautionary measures, uncertainty in the financial markets, or other harm to their businesses and financial results, resulting in delayed purchasing decisions, extended payment terms, and postponed or cancelled projects, all of which could negatively impact our business and results of operations, including our revenue and cash flows. Further, if the COVID-19 pandemic has a substantial impact on our employees’, partners’, or third-party service providers’ health, attendance, or productivity in the future, our results of operations and overall financial performance may be adversely impacted.

16

The ultimate duration and extent of the impact from the COVID-19 pandemic depends on future developments that cannot be accurately forecasted at this time, such as the efficacy of new vaccines, the efficiency and scope of global inoculation efforts, the severity and transmission rate of the disease and new variants, the actions of governments, businesses and individuals in response to the pandemic, the extent and effectiveness of containment actions, the impact on economic activity, and the impact of these and other factors on our employees, partners, and third-party service providers. This uncertainty also affects management’s accounting estimates and assumptions, which could result in greater variability in a variety of areas that depend on these estimates and assumptions, including those related to investments, receivables, retention rates, renewal and pricing. For example, we have experienced growth and increased demand for our solutions in recent quarters, which may be due in part to greater demand for devices or our solutions in response to the COVID-19 pandemic. We cannot determine what, if any, portion of our growth in net revenue, the number of our Direct to Consumer Subscribers, or any other measures of our performance during 2021 was the result of such responses to the COVID-19 pandemic. However, if we are unable to successfully drive renewals of new subscriptions and retention of new customers in future periods, including any such new subscriptions or new customers that may be related to the response to the COVID-19 pandemic, or if global conditions and macroeconomic forces, including those related to the COVID-19 pandemic, reduce demand for solutions in the future, we may be unsuccessful in sustaining our recent growth rates. In addition, the extent to which the COVID-19 pandemic will continue to drive demand for devices is uncertain, and if demand for devices decreases, we may experience slower growth in future periods. These uncertainties may increase variability in our future results of operations and adversely impact our ability to accurately forecast changes in our business performance and financial condition in future periods. If we are not able to respond to and manage the impact of such events effectively or if global economic conditions do not improve, or deteriorate further, our business, financial condition, results of operations, and cash flows could be adversely affected.

Risks Related to the Recent Sale of our Enterprise Business

If we are unsuccessful at executing our business plan and necessary transition activities as a standalone consumer cybersecurity company following the recent sale of our Enterprise Business, our business and results of operations may be adversely affected and our ability to invest in and grow our business could be limited.

On July 27, 2021, we completed the sale of our Enterprise Business to STG, which divestiture comprised a substantially whole operating segment. This and other operational transitions have involved turnover in management and other key personnel and changes in our strategic direction. Transitions of this type can be disruptive, result in the loss of focus and employee morale and make the execution of business strategies more difficult. We also expect to pay approximately $300 million in additional one-time separation costs and stranded cost optimization, a portion of which will be expenses paid by proceeds from the transaction. We have also entered into a transition service agreement under which we will provide assistance to STG including, but not limited to, business support services and information technology services as well as a commercial services agreement, under which we will provide certain product services and licensed technology, including certain threat intelligence data, that has historically been provided to the Enterprise Business. We may experience delays in the anticipated timing of activities related to such transitions and higher than expected or unanticipated execution costs. If we do not succeed in executing on these transition activities while achieving our cost optimization goals, or if these efforts are more costly or time-consuming than expected, our business and results of operations may be adversely affected, which could limit our ability to invest in and grow our business.

We may not achieve the intended benefits of the sale of our Enterprise Business.

We may not realize some or all of the anticipated benefits from the sale of our Enterprise Business. The resource constraints as a result of our focus on completing the transaction, which include the loss of employees, could have a continuing impact on the execution of our business strategy and our overall operating results. Further, our remaining employees may become concerned about the future of our remaining operations and lose focus or seek other employment. There can be no guarantee that the divestiture will result in stronger long term financial and operational results for our remaining consumer business.

Additionally, in connection with the divestiture, our Board of Directors returned a portion of the proceeds of the sale of our Enterprise Business in the form of distributions paid to holders of LLC Units of FTW, including McAfee Corp., and to holders of our Class A common stock in the form of a special dividend of $4.50 per share to holders of record of our Class A common stock as of August 13, 2021. The use of proceeds in this manner could impair our future financial growth.

17

Our future results of operations are dependent solely on the operations of our pure play consumer cyber security business and will differ materially from our previous results.

The Enterprise Business generated approximately 46% of total combined company revenue for fiscal 2020, and approximately 51% of total combined company revenue for fiscal 2019. Accordingly, our future financial results will differ materially from our previous results since our future financial results are dependent solely on our consumer operations. Any downturn in our consumer business could have a material adverse effect on our future operating results and financial condition and could materially and adversely affect the trading price of our outstanding securities.

Risks Related to Competition and Industry Trends

The cybersecurity market is rapidly evolving and becoming increasingly competitive in response to continually evolving cybersecurity threats from a variety of increasingly sophisticated cyberattackers. If we fail to anticipate changing customer requirements or industry and market developments, or we fail to adapt our business model to keep pace with evolving market trends, our financial performance will suffer.

The cybersecurity market is characterized by continual changes in customer preferences and requirements, frequent and rapid technological developments and continually evolving market trends. We must continually address the challenges of dynamic, and accelerating market trends, such as the emergence of new cybersecurity threats, the continued decline in the sale of new personal computers, and the rise of mobility and cloud-based solutions, all of which make satisfying our customers’ diverse and evolving needs more challenging.

The technology underlying our solutions is particularly complex because it must effectively and efficiently identify and respond to new and increasingly sophisticated threats while meeting other stringent technical requirements in areas of performance, usability, and availability. Although our customers expect new solutions and enhancements to be rapidly introduced to respond to new cybersecurity threats, product development requires significant investment, the efficacy of new technologies is inherently uncertain, and the timing for commercial release and availability of new solutions and enhancements is uncertain. We may be unable to develop new technologies to keep pace with evolving threats or experience unanticipated delays in the availability of new solutions, and therefore fail to meet customer expectations. If we fail to anticipate or address the evolving and rigorous needs of our customers, or we do not respond quickly to shifting customer expectations or demands by developing and releasing new solutions or enhancements that can respond effectively and efficiently to new cybersecurity threats on an ongoing and timely basis, our competitive position, business, and financial results will be harmed.

The introduction of new products or services by competitors, market acceptance of products or services based on emerging or alternative technologies, and the evolution of new standards, whether formalized or otherwise, could each render our existing solutions obsolete or make it easier for other products or services to compete with our solutions. In addition, modern cyberattackers are skilled at adapting to new technologies and developing new methods of breaching customers. We must continuously work to ensure our solutions protect against the increased volume and complexity of the cybersecurity threat landscape. Changes in the nature of advanced cybersecurity threats could result in a shift in cybersecurity spending and preferences away from solutions such as ours. If our solutions are not viewed by our customers as necessary or effective in addressing their cybersecurity needs, then our revenues may not grow as quickly as expected, or may decline, and our business could suffer.

We cannot be sure that we will accurately predict how the cybersecurity markets in which we compete or intend to compete will evolve. Failure on our part to anticipate changes in our markets and to develop solutions and enhancements that meet the demands of those markets will significantly impair our business, financial condition, results of operations, and cash flows.

We operate in a highly competitive environment, and we expect competitive pressures to increase in the future, which could cause us to lose market share.

The markets for our solutions are highly competitive, and we expect both the requirements and pricing competition to increase, particularly given the increasingly sophisticated attacks, changing customer preferences and requirements, current economic pressures, and market consolidation. Competitive pressures in these markets may result in price reductions, reduced margins, loss of market share and inability to gain market share, and a decline in sales, any one of which could seriously impact our business, financial condition, results of operations, and cash flows.

We face competition from players, such as NortonLifelock, Avast/AVG, Kaspersky, Trend Micro, ESET, and Microsoft, which expanded from desktop anti-malware into mobile, security, VPN, and identity protection among others. At the same time we compete with point-tool providers, such as Cujo and Dojo in the home IoT space or AnchorFree, ExpressVPN, and ProtonVPN in the network security space, across our full consumer offering.

18

In addition to competing with these and other vendors directly for sales to end-users of our products, we compete with several of them for the opportunity to have our products bundled with the product offerings of our strategic partners, including computer hardware OEMs, ISPs, mobile carriers, and other distribution partners. Our competitors could gain market segment share from us if any of these strategic partners replace our solutions with those of our competitors or if these partners more actively promote our competitors’ offerings than ours. In addition, vendors who have bundled our products with theirs may choose to bundle their products with their own or other vendors’ software or may limit our access to standard product interfaces and inhibit our ability to develop products for their platform. We also face competition from many smaller companies that specialize in particular segments of the markets in which we compete, including Crowdstrike, VMware, Netskope, and Zscaler. In the future, further product development by these providers could cause our products and services to become redundant or lose market segment share, which could significantly impact our sales and financial results.

We face growing competition from network equipment, computer hardware manufacturers, large operating system providers, telecommunication companies, and other large or diversified technology companies. Examples of large, diversified competitors include Microsoft, International Business Machines Corporation, and Dell Technologies. Large vendors of hardware or operating system software increasingly incorporate cybersecurity functionality into their products and services, and enhance that functionality either through internal development or through strategic alliances or acquisitions. Similarly, telecommunications providers are increasingly investing in the enhancement of the cybersecurity functionality in the devices and services they offer. Certain of our current and potential competitors may have competitive advantages such as longer operating histories, more extensive international operations, larger product development and strategic acquisition budgets, and greater financial, technical, sales, and marketing resources than we do. Such competitors also may have well-established relationships with our current and potential customers and extensive knowledge of our industry and the markets in which we compete and intend to compete. As a result, such competitors may be able to respond more quickly to new or emerging technologies and changes in customer requirements, or to devote greater resources to the development, marketing, sale, and support of their products. These competitors have made strategic acquisitions or established cooperative relationships among themselves or with other providers, thereby increasing their ability to provide a broader suite of products, and potentially causing customers to decrease purchases of, or defer purchasing decisions with respect to, our products and services. Additionally, some or all of our solutions may rely upon access to certain hardware or software interfaces. These competitors may limit our access to such interfaces or may provide greater or earlier access available to others. These actions could adversely affect the operations of our products relative to competitors or render our solutions inoperative.

Cybersecurity protection is also offered by certain of our competitors at prices lower than our prices or, in some cases, free of charge. Other companies bundle their own or our competitors’ lower-priced or free cybersecurity products with their own computer hardware or software product offerings in a manner that discourages users from purchasing our products and subscriptions. Our competitive position could be adversely affected to the extent that our current or potential customers perceive these cybersecurity products as replacing the need for our products or if they render our solutions unmarketable—even if these competitive products are inferior to or more limited than our products and services. The expansion of these competitive trends could have a significant negative impact on our sales and financial results by causing, among other things, price reductions of our products, reduced profitability, and loss of market share.

To compete successfully, we must continue to develop new solutions and enhance existing solutions, effectively adapt to changes in the technology or rights held by our competitors, respond to competitive strategies, and effectively adapt to technological changes within the consumer cybersecurity market. If we are unsuccessful in responding to our competitors, our competitive position and our financial results could be adversely affected.

Our business depends substantially on our ability to retain customers and to expand sales of our solutions to them. If we are unable to retain our customers or to expand our product offerings, our future results of operations will be harmed.

For us to maintain or improve our results of operations in a market that is rapidly evolving and places a premium on market-leading solutions, it is important that we retain existing customers and that our customers expand their use of our solutions. Our customers have no obligation to renew their subscription with us upon their expiration. Retention rates may decline or fluctuate as a result of a number of factors, including but not limited to the level of our customers’ satisfaction or dissatisfaction with our solutions, our prices and the prices of competing products or services, industry consolidation, the effects of global economic conditions, new technologies, changes in our customers’ spending levels, and changes in how our customers perceive the cybersecurity threats. In addition, a significant portion of our renewals come from autorenewal arrangements incorporated within our solutions. Any changes in the laws regarding autorenewal arrangements could adversely affect our ability to retain consumer customers and harm our financial condition and operating performance.

19

In addition, our ability to generate revenue and maintain or improve our results of operations partly depends on our ability to cross-sell our solutions to our existing customers. We expect our ability to successfully cross-sell our solutions will be one of the most significant factors influencing our growth. We may not be successful in cross-selling our solutions because our customers may find our additional solutions unnecessary or unattractive. Our failure to sell additional solutions to our existing and new customers could adversely affect our ability to grow our business.

We may need to change our pricing models to compete successfully.

The intense competition we face in the cybersecurity market, in addition to general economic and business conditions (including the economic volatility resulting from the COVID-19 pandemic), can result in downward pressure on the prices of our solutions. If our competitors offer significant discounts on competing products or services, or develop products or services that our customers believe are more valuable or cost-effective, we may be required to decrease our prices or offer other incentives in order to compete successfully. Additionally, if we increase prices for our solutions, demand for our solutions could decline as customers adopt less expensive competing products and our market share could suffer. If we do not adapt our pricing models to reflect changes in customer use of our products or changes in customer demand, our revenues could decrease.

Any broad-based change to our pricing strategy could cause our revenues to decline or could delay future sales as our sales force implements and our customers adjust to the new pricing terms. We or our competitors may bundle products for promotional purposes or as a long-term go-to-market or pricing strategy or provide price guarantees to certain customers as part of our overall sales strategy. These practices could, over time, significantly limit our flexibility to change prices for existing solutions and to establish prices for new or enhanced products and services. Any such changes could reduce our margins and adversely affect our results of operations.

If cybersecurity industry analysts publish unfavorable or inaccurate research reports about our business, our financial performance could be harmed.

An increasing number of independent industry analysts and researchers regularly evaluate, compare, and publish reviews regarding the performance, efficiency, and functionality of cybersecurity products and services, including our own solutions. The market’s perception of our solutions may be significantly influenced by these reviews. We do not have any control over the content of these independent industry analysts and research reports, or the methodology they use to evaluate our solutions, which may be flawed or incomplete. Demand for our solutions could be harmed if these industry analysts publish negative reviews of our solutions or do not view us as a market leader. If we are unable to maintain a strong reputation, sales to new and existing customers and renewals could be adversely affected, and our financial performance could be harmed.

Risks Related to Our Financial and Operating Performance

Our results of operations can be difficult to predict and may fluctuate significantly, which could result in a failure to meet investor expectations.

Our results of operations have in the past varied, and may in the future vary, significantly from period to period due to a number of factors, many of which are outside of our control, including the macroeconomic environment. These factors limit our ability to accurately predict our results of operations and include factors discussed throughout this “Risk Factors” section, including the following:

20

Furthermore, a high percentage of our expenses, including those related to overhead, research and development, sales and marketing, and general and administrative functions are generally fixed in nature in the short term. As a result, if our net revenue is less than forecasted, we may not be able to effectively reduce such expenses to compensate for the revenue shortfall and our results of operations will be adversely affected. We also expect the recent sale of our Enterprise Business to lead to increased costs that were previously allocated to both segments to now be part of continuing operations, which will have a dilutive impact on operating margins. We also expect to pay approximately $300 million in additional one-time separation costs and stranded cost optimization, a portion of which will be expenses paid by proceeds from the transaction. In addition, our ability to maintain or expand our operating margins may be limited given economic and competitive conditions, and we therefore could be reliant upon our ability to continually identify and implement operational improvements in order to maintain or reduce expense levels. There can be no assurance that we will be able to maintain or expand our current operating margins in the future.

We derive revenue from the sale of security products and subscriptions or a combination of these items, which may decline.

Our sales may decline and fluctuate as a result of a number of factors, including our customers’ level of satisfaction with our products and services, the prices of our products and services, the prices of products and services offered by our competitors, reductions in our customers’ spending levels, and other factors beyond our control. We also derive part of our revenue through indirect agreements with third parties including mobile providers, ISPs, electronics retailers, ecommerce sites, and search providers. Any change in these agreements, in indirect party’s demand with end consumers in mobile, ISP, and retail, in user search behavior, advertising market for search or ecosystem changes could adversely affect our revenue. If our sales decline, our revenue and revenue growth may decline, and our business will suffer. We recognize a majority of revenue as control of the goods and services is transferred to our customer. As a result, a majority of revenue we report each quarter is the recognition of deferred revenue from subscriptions entered into during previous quarters. Consequently, a decline in sales in any single quarter will not be fully or immediately reflected in revenue in that quarter but will continue to negatively affect our revenue in future quarters. Accordingly, the effect of significant downturns in sales is not reflected in full in our results of operations until future periods. Furthermore, it is difficult for us to rapidly increase our revenue through additional sales in any period, as revenue from subscriptions must be recognized over the applicable future time period. Finally, any increase in the average term of a subscription would result in revenue for such subscriptions being recognized over longer periods of time.

The sudden and significant economic downturn or volatility in the economy in the United States and our other major markets could have a material adverse impact on our business, financial condition, results of operations, or cash flows.

We operate globally and as a result our business and revenues are impacted by global macroeconomic conditions. In recent periods, investor and customer concerns about the global economic outlook, which significantly increased in 2020 and early 2021 due to the COVID-19 pandemic, have adversely affected market and business conditions in general. In addition, a weakening of economic conditions, including from a worsening of the ongoing labor shortage or rise in inflation, could lead to reductions in demand for our solutions. Weakened economic conditions or a recession could reduce the amounts that customers are willing or able to spend on our products and solutions, and could make it more difficult for us to compete against less expensive and free products for new customers. Furthermore, a high percentage of our expenses, including those related to overhead, research and development, sales and marketing, and general and administrative functions are generally fixed in nature in the short term. If we are not able to timely and appropriately adapt to changes resulting from a weak economic environment, it could have an adverse impact on our business, financial condition, results of operations, and cash flows.

We have experienced net losses in recent periods and may not maintain profitability in the future.

We experienced net losses of $236 million and $289 million for fiscal 2019 and 2020, respectively. While we have experienced revenue growth over these same periods, we may not be able to sustain or increase our growth or maintain profitability in the future or on a consistent basis. In recent years, we have changed our portfolio of products and invested in research and development to develop new products and enhance current solutions.

21

We also expect to continue to invest for future growth. We expect that to achieve profitability we will be required to increase revenues, manage our cost structure, and avoid significant liabilities. Revenue growth may slow, revenue may decline, or we may incur significant losses in the future for a number of possible reasons, increasing competition, a decrease in the growth of the markets in which we operate, or if we fail for any reason to continue to capitalize on growth opportunities. We also expect the recent sale of our enterprise business to lead to increased costs that were previously allocated to both segments to now be part of continuing operations, which will have a dilutive impact on operating margins. Additionally, we may encounter unforeseen operating expenses, difficulties, complications, delays, and other unknown factors that may result in losses in future periods. If these losses exceed our expectations or our revenue growth expectations are not met in future periods, our financial performance may be harmed.

Changes in tax laws or in their implementation may adversely affect our business and financial condition.

Changes in tax law may adversely affect our business or financial condition. As part of Congress’s response to the COVID-19 pandemic, the Families First Coronavirus Response Act, commonly referred to as the FFCR Act, was enacted on March 18, 2020, the Coronavirus Aid, Relief, and Economic Security Act, commonly referred to as the CARES Act, was enacted on March 27, 2020, the act commonly known as the Consolidated Appropriations Act, 2021 was enacted on December 27, 2020, and the act commonly known as the American Rescue Plan Act was enacted on March 11, 2021. Each contains numerous tax provisions. In particular, the CARES Act retroactively and temporarily (for taxable years beginning before January 1, 2021) suspended application of the 80%-of-taxable-income limitation on the use of NOLs, which was enacted as part of the TCJA. It also provided that NOLs arising in any taxable year beginning after December 31, 2017 and before January 1, 2021 are generally eligible to be carried back up to five years. The CARES Act also temporarily (for taxable years beginning in 2019 or 2020) relaxed the limitation of the tax deductibility for net interest expense by increasing the limitation from 30% to 50% of adjusted taxable income.