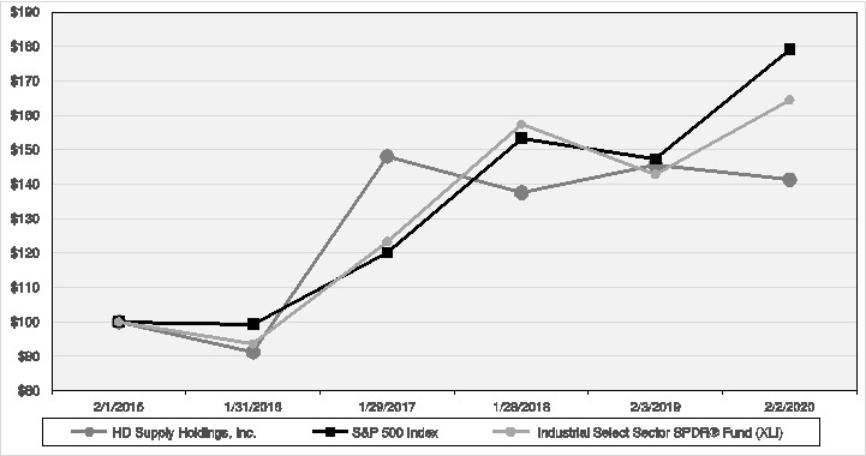

NASDAQ and each index on February 1, 2015 and assumes all dividends were reinvested on the date paid. The points on the graph represent fiscal year-end amounts based on the last trading day in each fiscal year.

| HD Supply |

|

| Industrial Select | |||||

Holdings, Inc. | S&P 500 Index | SPDR® Fund (XLI) | |||||||

February 1, 2015 | $ | 100 | $ | 100 | $ | 100 | |||

January 31, 2016 | $ | 91 | $ | 99 | $ | 94 | |||

January 29, 2017 | $ | 148 | $ | 120 | $ | 123 | |||

January 28, 2018 | $ | 137 | $ | 153 | $ | 157 | |||

February 3, 2019 | $ | 146 | $ | 147 | $ | 143 | |||

February 2, 2020 | $ | 141 | $ | 179 | $ | 165 | |||

Issuer Purchases of Equity Securities

On March 12, 2020, the Company’s Board of Directors authorized a new share repurchase program for the repurchase of up to an aggregate $500 million of its common stock. The Company will conduct repurchases under the share repurchase program in the open market and through broker negotiated purchases in compliance with Rule 10b5-1 and Rule 10b-18 of the Securities Exchange Act of 1934, and subject to market conditions, restrictive covenants contained in existing debt agreements, applicable legal requirements, and other relevant factors. This share repurchase program does not obligate the Company to acquire any particular amount of its common stock, and it may be terminated at any time at the Company’s discretion.

On November 30, 2018, the Company’s Board of Directors authorized a share repurchase program for the repurchase of up to an aggregate $500 million of its common stock in accordance with guidelines specified under Rule 10b5-1 and Rule 10b-18 of the Exchange Act. Holdings completed the repurchase of all $500 million of common stock authorized under this share repurchase program in January 2020, purchasing approximately 13.0 million shares at an average price of $38.61 per share.

In fiscal 2014, Holdings’ Board of Directors authorized a share repurchase program to be funded from cash proceeds received from exercises of employee stock options. This share repurchase program does not obligate Holdings to acquire any particular amount of common stock, and it may be terminated at any time at Holdings’ discretion. During fiscal 2019, Holdings repurchased approximately 0.2 million shares at an average price of $42.25 per share.

35