UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Filed by a party other than the Registrant ☐

|

Check the appropriate box:

|

||

|

☐

|

|

Preliminary proxy statement

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☒

|

|

Definitive proxy statement

|

|

☐

|

|

Definitive additional materials

|

|

☐

|

|

Soliciting material pursuant to § 240.14a-12

|

(Name of Registrant as Specified in Its Charter)

_____________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (Check the appropriate box):

|

|

☒

|

|

No fee required.

|

||

|

|

|

||||

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

||

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

||||

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

||

|

|

|

||||

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid

|

||

|

|

|

|

previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

||

|

|

|

||||

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

|

(4)

|

|

Date Filed:

|

VISHAY INTERTECHNOLOGY, INC.

63 LANCASTER AVENUE

MALVERN, PENNSYLVANIA 19355

April 4, 2023

Dear Stockholder:

You are cordially invited to attend the 2023 Annual Meeting of Stockholders of Vishay Intertechnology, Inc., to be held at 9:00 a.m., U.S. eastern time, on Tuesday, May 23, 2023.

Vishay has adopted a virtual annual meeting in 2023. The annual meeting will be accessible to stockholders via the Internet at www.virtualshareholdermeeting.com/VSH2023. To

participate, stockholders will need the control number included on the attached Notice of Annual Meeting of Stockholders, on your proxy card, or on your voting instruction form. Those without a control number may attend as guests of the meeting, but

they will not have the option to vote their shares during the meeting or ask questions during the virtual event.

During the annual meeting, we will discuss each item of business described in the attached Notice of Annual Meeting of Stockholders and proxy statement.

On behalf of the Board of Directors, I would like to express our appreciation for your continued interest in the affairs of Vishay. We hope you will be able to attend the virtual

annual meeting. Whether or not you expect to attend the virtual annual meeting, and regardless of the number of shares you own, it is important that your shares are represented and voted at the annual meeting. Therefore, you are encouraged to sign,

date, and return the enclosed proxy card in the return envelope provided, or follow the instructions to vote online, so that your shares will be represented and voted at the annual meeting.

Sincerely,

Marc Zandman

Executive Chair of the Board of Directors

Executive Chair of the Board of Directors

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held May 23, 2023.

The following materials, also included with this Notice, are available for viewing on the Internet:

Proxy Statement for the 2023 Annual Meeting of Stockholders

2022 Annual Report to Stockholders

To view these materials, visit ir.vishay.com.

VISHAY INTERTECHNOLOGY, INC.

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

TUESDAY, MAY 23, 2023

Virtual Shareholder Meeting

www.virtualshareholdermeeting.com/VSH2023

ITEMS OF BUSINESS:

1. the election of one director to hold office until 2025 and three directors to hold office until 2026;

2. the ratification of our independent registered public accounting firm;

3. the advisory vote on executive compensation;

4. approval of the 2023

Long-Term Incentive Plan;

5. approval of an amendment to the

Company's Corrected Amended and Restated Certificate of Incorporation to limit the liability of certain officers of the Company as permitted by 2022 amendments to Delaware law regarding officer exculpation; and

6. such other business as may be brought properly before the meeting.

ADJOURNMENTS AND POSTPONEMENTS:

Any action on the items of business described above may be considered at the virtual Annual Meeting at the time and on the date specified above or at any time and date to which the Annual Meeting may

be properly adjourned or postponed.

RECORD DATE:

The stockholders of record at the close of business on March 27, 2023, will be entitled to vote at the virtual Annual Meeting or at any adjournment thereof.

VOTING:

Whether or not you expect to participate in the online meeting, please complete, date, and sign the enclosed proxy card and return it without delay in the enclosed envelope which

requires no additional postage if mailed in the United States. If you are enrolled in our electronic proxy materials delivery service and received these proxy materials via the Internet, you will need to follow the procedures for online voting to vote

your shares.

By Order of the Board of Directors,

Peter Henrici

Corporate Secretary

Corporate Secretary

Malvern, Pennsylvania

April 4, 2023

This page left intentionally blank.

TABLE OF CONTENTS

| 2023 Proxy Statement | Summary |

|

Table of Contents |

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy

statement carefully before voting.

| Date and Time |  |

|

Meeting Location |  |

|

Record Date

|

|

Voting

|

|

|

| Tuesday, May 23, 2023, at 9:00 a.m. U.S. eastern time |

|

Virtual Shareholder Meeting

www.virtualshareholdermeeting.com/VSH2023

|

|

March 27, 2023

|

Each share of common stock will be entitled to one vote and each share of Class B common stock will be entitled to 10 votes

with respect to each matter to be voted on at the annual meeting.

|

|||||

|

PROPOSAL

|

BOARD RECOMMENDATION

|

PAGE REFERENCE

|

|

|

①

|

The election of one director to hold office until 2025 and three directors to hold office until 2026

|

FOR ALL

|

20

|

|

②

|

The ratification of our independent registered public accounting firm

|

FOR

|

23 |

| ③ | The advisory vote on executive compensation | FOR |

70 |

| ④ | Approval of the 2023 Long-Term Incentive Plan |

FOR |

71 |

|

⑤

|

Approval of an amendment to the Company's Corrected Amended and Restated Certificate of Incorporation to limit the liability of certain officers of the Company as

permitted by 2022 amendments to Delaware law regarding officer exculpation

|

FOR |

80 |

|

NAME

|

AGE

|

DIRECTOR SINCE

|

TERM EXPIRING

|

OCCUPATION

|

QUALIFICATIONS

|

INDEPENDENT

|

COMMITTEE OF THE BOARD

|

|||

|

E

|

A

|

NCG

|

CC

|

|||||||

| Joel Smejkal |

56 |

2023 |

2025 |

President and CEO, Vishay

Intertechnology, Inc. |

Leadership, Electronics Industry, Company, Global | M |

||||

|

Michael J. Cody

|

73

|

2018

|

2026

|

Retired VP - Corporate Development, Raytheon Company

|

Leadership, Complementary Industry, Finance, M&A

|

✓ | M |

M |

||

| Dr. Abraham Ludomirski |

71 |

2003 |

2026 |

Founder and Managing Director

of Vitalife Fund |

Leadership, Global |

✓ |

|

C |

M |

|

| Raanan Zilberman |

62 |

2017 | 2026 |

Former President and CEO, Caesarstone, Ltd. |

Leadership, Electronics Industry, Company, Global, M&A |

✓ | M |

M | ||

|

E

|

Executive Committee

|

|

A

|

Audit Committee

|

|

NCG

|

Nominating and Corporate Governance Committee

|

|

CC

|

Compensation Committee

|

|

C

|

Committee Chair

|

|

M

|

Committee Member

|

The Audit Committee of the Board of Directors has determined to reappoint the public accounting firm of Ernst & Young LLP as the independent registered public accounting firm to

audit our financial statements for the year ending December 31, 2023, as well as to audit the effectiveness of our internal control over financial reporting. Although stockholder approval for the appointment of Ernst & Young LLP is not required,

we are continuing our practice of submitting the selection of the independent registered public accounting firm to stockholders for their ratification.

As part of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, Congress adopted Section 14A of the Securities Exchange Act of 1934, as amended (the "Exchange Act") pursuant to which the Board is

giving our stockholders an opportunity to approve on an advisory, or non-binding, basis, the compensation of our Named Executive Officers, as disclosed in this proxy statement.

The Compensation Committee of the Board of Directors is responsible for establishing and approving the compensation of the Chief Executive Officer, and the other Named Executive Officers, and administering Vishay's

incentive compensation and equity-based plans.

As discussed in greater detail in "Executive Compensation – Compensation Discussion and Analysis," Vishay's compensation programs are designed to support our business goals and promote the short- and long-term

profitable growth of the Company. The compensation program is structured to help to recruit, retain, and motivate key employees who can function effectively both in periods of recession and economic upturn.

The compensation arrangements are designed to provide an incentive for positive performance while avoiding the encouragement of inappropriate risk-taking.

The compensation arrangements vary among our Named Executive Officers, but generally include:

|

A market-competitive

base salary

|

|

Cash incentive compensation

a portion of which is based on Company-wide achievements and another portion of which is based on personal achievements, with a cap to discourage inappropriate risk-taking

|

|

Equity-based compensation

a portion of which vests only upon the achievement of three-year performance metrics and the balance of which vests on January 1 of the third year following the grant date

|

|

|

|

|

|

|

|

Deferred cash compensation and retirement benefits

generally payable at retirement / termination of employment

|

|

Deferred equity compensation

in the form of phantom stock units payable at retirement / termination of employment for certain of our Named Executive Officers

|

|

Perquisites and other personal benefits

|

This proxy statement includes a comprehensive "Summary Compensation Table" that presents compensation earned by our Named Executive Officers in accordance with Securities and Exchange Commission ("SEC") rules. Some of

the compensation reported in the Summary Compensation Table, including certain equity-based compensation, deferred cash compensation, retirement benefits, and phantom stock units, has not yet been realized by the executives, and in the case of

equity-compensation measured on the grant date, might never be fully realized.

The Board of Directors believes that our executive compensation program is appropriately designed to support the Company's long-term success by achieving the following objectives: attracting and retaining talented

senior executives, tying executive pay to Company and individual performance, supporting our annual and long-term business strategies, and aligning executives' interests with those of the stockholders. Accordingly, the Board of Directors recommends

that you vote FOR approval of the compensation of our Named Executive Officers (see Proposal Three).

The Board of Directors has approved,

and is proposing that the stockholders approve, the 2023 Long-Term Incentive Plan (the "2023 Plan"). The 2023 Plan allows the Company to grant stock options, stock appreciation rights, restricted stock, restricted stock units, other stock-based

awards, phantom stock units, and other cash-based awards to employees, directors, consultants, and other service providers of the Company and its affiliates. We believe that the 2023 Plan will enhance the long-term performance of the Company

because it will provide the selected participants with an incentive to improve the growth and profitability of the Company by acquiring a proprietary interest in the success of the Company. Stockholder approval of the 2023 Plan will, among other

changes, increase the total number of shares available for issuance to our employees and other service providers. The Board of Directors recommends a vote FOR the approval of the 2023 Long-Term Incentive Plan (see Proposal Four).

Article Ninth of the Company's Corrected Amended and Restated Certificate of Incorporation (the "Certificate of Incorporation") currently provides for the Company to limit monetary liability of directors in certain

circumstances in accordance with Delaware law. The State of Delaware, which is the Company’s state of incorporation, enacted legislation in 2022 that enables Delaware companies to limit the liability of certain of their officers in limited

circumstances. In light of this update, we are proposing to amend the Certificate of Incorporation to add a provision exculpating certain of the Company’s officers from liability in specific circumstances, as permitted by Delaware law. The 2022

Delaware legislation only permits, and our proposed amendment would only permit, exculpation for direct claims (as opposed to derivative claims made by stockholders on behalf of the Company) and would not apply to breaches of the duty of loyalty,

acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law, or any transaction in which the officer derived an improper personal benefit. The rationale for so limiting the scope of liability is to strike

a balance between stockholders’ interest in accountability and their interest in the Company being able to attract and retain quality officers to work on its behalf.

The Board of Director desires to amend the Certificate of Incorporation to include provisions consistent with the governing statutes contained in Delaware law as set forth in Proposal Five (the "Proposed Amendment").

The Board of Directors believes it is appropriate for public companies in states, like Delaware, that allow exculpation of officers to provide such protection in their certificates of incorporation. Officers are often required to make decisions in

response to time-sensitive opportunities and challenges, which can create substantial risk of investigations, claims, actions, suits or proceedings seeking to impose liability on the basis of hindsight, especially in the current litigious environment

and regardless of merit.

Prior to the 2022 amendments to Delaware law, Delaware corporations were able to exculpate directors from personal liability for monetary damages associated with breaches of the duty of care, but that protection did not extend to officers. Consequently, stockholder plaintiffs have employed a tactic of bringing certain claims, that would otherwise be exculpated if brought against directors, against individual officers to avoid dismissal of such claims. The 2022 amendments to Delaware law were adopted to address inconsistent treatment between officers and directors and address rising litigation and insurance costs for stockholders. Our Board of Directors believes it is in the best interests of the stockholders for the Company to provide for consistent officer and director exculpation to better protect against these matters.

Our Board of Directors also believes that limiting concern about personal risk would empower officers to best exercise their business judgment in furtherance of stockholder interests. We expect our peers to adopt

exculpation clauses that limit the personal liability of officers in their certificates of incorporation. Failing to adopt the Proposed Amendment could impact our recruitment and retention of qualified officer candidates who conclude that their

potential exposure to liabilities, costs of defense and other risks of proceedings exceeds the benefits of serving as an officer of the Company.

The Board of Directors recommends a vote FOR the

approval of the Amendment to the Company's Certificate of Incorporation to limit the liability of certain officers of the Company as permitted by 2022 amendments to Delaware law regarding officer exculpation (see proposal Five).

Vishay understands that corporate governance practices change and are constantly evolving. We currently employ the following corporate governance best practices:

|

Board Governance

|

||

|

•

|

Separate Executive Chair of the Board and Chief Executive Officer;

|

||

|

•

|

All directors are required to attend at least 75% of all meetings on an annual basis;

|

||

|

•

|

Significant stock ownership guidelines for directors, equal to five times the value of their annual cash retainer (subject to a five year phase-in);

|

||

|

•

|

Annual self-evaluations of Board as a whole;

|

||

|

•

|

No restrictions on directors' access to management or employees; and

|

||

|

•

|

Board oversees the Company's strategic priorities and risk management.

|

||

|

|

|

|

|

|

Committee Governance

|

||

|

•

|

Audit Committee composed entirely of independent directors;

|

||

|

•

|

Compensation Committee composed entirely of independent directors; and

|

||

| • | Nominating and Corporate Governance Committee composed entirely of independent directors. | ||

|

|

|

||

|

|

|

|

|

|

Responsible Compensation and Planning

|

||

|

•

|

Cap on bonuses;

|

||

|

•

|

Nominating and Corporate Governance Committee has primary responsibility for Chief Executive Officer and key executive succession planning;

|

||

| • |

Succession and executive development are discussed with the Chief Executive Officer, as well as without the Chief Executive Officer present in executive sessions; | ||

| • | Stock ownership guidelines; |

||

| • | Formal policy prohibiting directors and

officers from hedging or pledging of Company Stock; and |

||

|

•

|

Formal clawback policy for incentive-based cash and equity awards in the event of an accounting restatement.

|

||

|

|

|

|

|

|

Independent Experience

|

||

|

•

|

Highly-experienced directors in a wide range of industries;

|

||

|

•

|

All directors possess a significant level of knowledge regarding Vishay and our industry;

|

||

|

•

|

All of our current directors received a majority of the votes cast by holders of common stock who are unaffiliated with the current Class B stockholders when they last stood for election at an annual meeting

of stockholders, other than Joel Smejkal, who was appointed to the Board effective January 1, 2023, and therefore has not previously stood for election;

|

||

|

•

|

Independent directors meet in regularly scheduled executive sessions and, when required, in special executive sessions;

|

||

|

•

|

Only three directors serving on the boards of other public companies; and

|

||

|

•

|

No director serving on more than one other public company board.

|

||

|

|

|

|

|

|

Audit Integrity

|

||

|

•

|

Auditor is independent;

|

||

|

•

|

Non-audit fees are reasonable relative to audit and audit-related fees; and

|

||

|

•

|

Lead audit partner must be rotated after five years, which provides the Company and its stockholders the benefit of new thinking and approaches. | ||

|

Recent

Developments |

||

| • |

Amendments to executive employment

agreements which remove single trigger change-in-control accelerated vesting for future equity awards to most executives; |

||

| • | Equity awards to executive officers

in 2023 include market-based vesting conditions to better align compensation with stock performance; |

||

| • |

Introducing broad-based equity compensation program (see Proposal 4) to better align all levels of management with stockholder interests; and

|

||

| • | Amendment to

executive stock ownership guidelines to require the CEO to own stock equal to three-times base salary. |

||

The following table summarizes the current directors as of March 27, 2023:

| COMMITTEE OF THE BOARD | |||||||||||||||||

|

NAME

|

|

AGE

|

|

DIRECTOR SINCE

|

|

CLASS / TERM EXPIRING

|

|

OCCUPATION

|

|

QUALIFICATIONS

|

|

INDEPENDENT

|

|

E

|

A

|

NCG

|

CC

|

| Joel Smejkal(1) | 56 | 2023 |

I / 2025 | President and CEO, Vishay Intertechnology, Inc. | Leadership, Electronics Industry, Company, Global | M | |||||||||||

|

Michael J. Cody(1)

|

73 |

|

2018 |

II / 2026 |

Retired VP - Corporate Development, Raytheon Company

|

Leadership, Complementary Industry, Finance, M&A

|

✓ | M |

M |

||||||||

|

Dr. Abraham Ludomirski(1)

|

71 |

2003 |

II / 2026 |

Founder and Managing Director of Vitalife Fund | Leadership, Complementary Industry, Finance, Global | ✓ | C |

M |

|||||||||

| Raanan Zilberman(1) | 62 |

2017 |

II / 2026 |

Former President and CEO, Caesarstone, Ltd. | Leadership, Electronics Industry, Company, Global, M&A | ✓ | M | M | |||||||||

|

Marc Zandman

|

61 |

2001 |

III / 2024

|

Executive Chair of the Board, Chief Business Development Officer, Vishay Intertechnology, Inc.

|

Leadership, Electronics Industry, Company, Global

|

C | |||||||||||

|

Ruta Zandman

|

85 |

2001

|

III / 2024

|

Private Stockholder

|

Leadership, Electronics Industry, Company, Global

|

||||||||||||

|

Ziv Shoshani

|

56 | 2001 |

III / 2024

|

President and CEO, Vishay Precision Group, Inc.

|

Leadership, Electronics Industry, Company, Global

|

||||||||||||

| Jeffrey H. Vanneste | 63 | 2019 |

III / 2024

|

Retired SVP and CFO, Lear Corporation | Leadership, Complementary Industry, Finance | ✓ | C(FE) |

||||||||||

| Dr. Renee B. Booth |

64 |

2022 |

I / 2025 |

President, Leadership Solutions, Inc. | Leadership, Complementary Industry, Global, HR | ✓ | M |

||||||||||

| Dr. Michiko Kurahashi |

63 |

2022 |

I / 2025 |

Former Chief Marketing Officer, AXIS Capital; Adjunct Professor, New York University |

Leadership, Complementary Industry, Global, Marketing | ✓ | |||||||||||

| Timothy V. Talbert |

76 |

2013 |

I / 2025 |

Retired Sr. VP Credit and Originations, Lease Corporation of America ("LCA"); Retired President, LCA Bank Corporation | Leadership, Finance, Compliance | ✓ | C |

||||||||||

|

(1)

|

|

Nominees for election at 2023 annual meeting

|

|

E:

|

|

Executive Committee

|

|

A:

|

|

Audit Committee

|

|

NCG:

|

|

Nominating and Corporate Governance Committee

|

|

CC:

|

|

Compensation Committee

|

|

C:

|

|

Committee Chair

|

|

M:

|

|

Committee Member

|

|

(FE):

|

|

Financial Expert

|

While holders of our common stock and Class B common stock vote together as a single class on most matters, including the election of directors, all of our

current directors received a majority of the votes cast by holders of common stock who are unaffiliated with the current Class B stockholders when they last stood for election at an annual meeting of stockholders, other than Joel Smejkal, who was

appointed to the Board effective January 1, 2023.

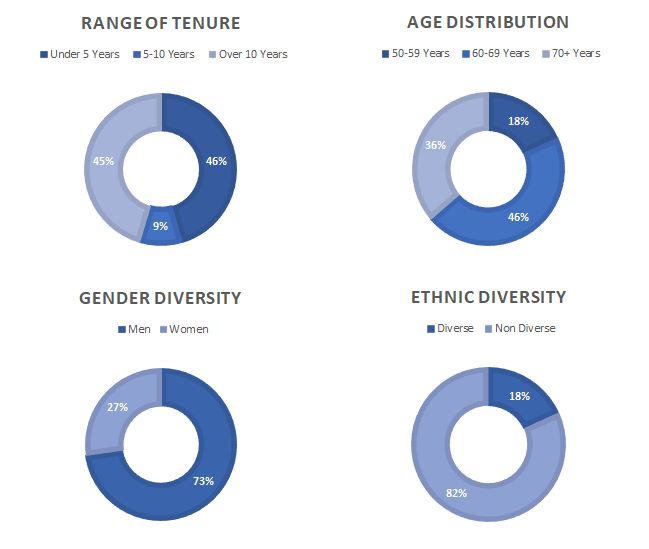

The directors exhibit a variety of competencies,

professional experience, and backgrounds, and contribute diverse viewpoints and perspectives to our Board. While the Board benefits from the experience and institutional knowledge that our longer-serving directors bring, it has also brought in new

perspectives and ideas through new director appointments in recent years.

|

Joel Smejkal was appointed President and Chief Executive Officer and elected to the Vishay Board and to the Executive Committee, effective January 1, 2023, following Dr. Gerald Paul's previously announced retirement. Mr. Smejkal has held various positions of increasing responsibility since joining Vishay in 1990 including Executive Vice President - Corporate Business Development (2020 - 2022), Executive Vice President and Business Head Passive Components (2017 - 2020) and Senior Vice President Global Distribution Sales (2012 - 2016). Mr. Smejkal's experience with Vishay includes worldwide and divisional leadership roles in engineering, marketing, operations and sales. He was a product developer of 18 U.S. Patents for the Power Metal Strip® resistor technology and brings significant business development, marketing and sales experience. |

|

Michael J. Cody was, from 2009 until his retirement in 2017, Vice President of Corporate Development at Raytheon Company, a technology company specializing in defense, civil government and cybersecurity solutions. At Raytheon, Mr. Cody was responsible for overseeing all merger and acquisition activity, where he executed 18 transactions aggregating in excess of $4.3 billion in transaction value. From 2007-2009, Mr. Cody was a founding partner of Meadowood Capital LLC, a private equity firm focused on technology companies. From 1997 to 2007, Mr. Cody was Vice President of Corporate Development at EMC Corporation, a developer and provider of information infrastructure technology. Mr. Cody has previously served on the boards of Safeguard Scientific, Inc., a NYSE listed private equity and venture capital firm; and MTI Ltd., a private company in the UK specializing in cloud, security, and infrastructure. Mr. Cody brings to the Board extensive knowledge and experience with mergers and acquisitions as well as experience with technology and defense businesses. Additionally, Mr. Cody's experience as a director of publicly traded and private companies allows him to bring an important perspective to the Board. | |

|

Dr. Abraham Ludomirski is the founder and, for more than

the past five years, managing director of Vitalife Fund, a venture capital company specializing in high-tech electronic medical devices. He serves on the board of directors of POCARED Diagnostics, Ltd., Newpace Ltd., Sensible Medical

Innovations Ltd., and Trig Medical, as well as serving as the Chairman of the Board of ENDOSPAN Ltd. and Endoran. He also serves as CEO of Illumigyn. He previously served on the board of Recro Pharma, Inc. and DIR Technologies. Dr.

Ludomirski earned his M.D. at the Sackler Tel-Aviv University Medical School, specializing in OBGYN and completed his fellowship at the University of Pennsylvania in maternal fetal medicine. In addition to his general familiarity with

corporate affairs and governance, Dr. Ludomirski's work in the high-tech venture capital and medical fields gives him a valuable perspective on investment in innovative technologies.

|

|

|

Raanan Zilberman was Chief Executive Officer of Caesarstone Ltd., a NASDAQ-listed multinational manufacturer of high quality engineered quartz surfaces with operations in the U.S., Canada, Australia, the U.K., and

Israel, from February 2017 to March 2018. Prior to that, from 2008 to 2016, Mr. Zilberman served as Chief Executive Officer of Eden Springs, a Swiss-based leading provider of water and coffee services to European workplaces with

production facilities and subsidiaries in 18 European countries that was formed by a series of acquisitions that Mr. Zilberman led. From 2005 to 2007, Mr. Zilberman was Chief Executive Officer of Danone Springs, a joint venture between

Danone, a multinational food manufacturer, and Eden Springs, with a European-wide water production and distribution footprint. From 2000 to 2002, Mr. Zilberman served as Chief Executive Officer of Tedea Huntleigh, a company listed on the

Tel Aviv Stock Exchange engaged in the production and marketing of electromechanical sensors. Tedea Huntleigh was acquired by Vishay in 2002, and from 2002 to 2004, Mr. Zilberman was President of Vishay's transducers business, which was

formed from a series of five acquisitions. From 1997 to 1999, Mr. Zilberman served as Chief Operating Officer of Tadiran Appliances, a manufacturer of air conditioners and refrigerators and a subsidiary of Carrier Global. Mr. Zilberman's

previous service as a Chief Executive Officer of publicly traded multinational companies, including his experience in M&A, allows him to bring an important perspective to the Board. Additionally, his past experience with Vishay

provides him with valuable insight of our business and operations.

|

|

Marc Zandman is Executive Chair of

the Board of Directors, the Chief Business Development Officer, and President of Vishay Israel Ltd. Mr. Zandman has been President of Vishay Israel Ltd. since 1998 and a Director of Vishay since 2001. Mr. Zandman was Vice Chair of

the Board from 2003 to June 2011, Chief Administration Officer from 2007 to June 2011, and Group Vice President of Vishay Measurements Group from 2002 to 2004. Mr. Zandman has served in various other capacities with Vishay since

1984. Mr. Zandman has served as the non-executive Chairman of the Board of Directors of Vishay Precision Group since the spin-off from Vishay on July 6, 2010. He is the son of the late Dr. Felix Zandman, founder and Vishay's former

Executive Chairman. As Executive Chair and Chief Business Development Officer, Mr. Zandman has a breadth of knowledge concerning the Company's businesses, as well as close familiarity with the Company's Israel operations where the

Company conducts significant research and development and manufacturing activities.

|

|

|

Ruta Zandman is a private stockholder and the wife of the late Dr. Felix Zandman, Vishay's founder and former Executive Chairman. Mrs. Zandman has sole or shared voting power over approximately 43.6% of the Company's total voting power, for which it is deemed appropriate that she serve as a member of the Company's Board. Mrs. Zandman was employed by Vishay as a public relations associate from 1993 to May 2011, and usually accompanied Dr. Zandman as a representative of Vishay; she provides the Board with valuable insight into the Company and its history, as well as her understanding of Dr. Zandman's vision and the evolution of our operations. | |

|

Ziv Shoshani is Chief Executive Officer and President, and a member of the board of directors of Vishay Precision Group, Inc., an independent, publicly-traded company spun off from Vishay on July 6, 2010. Mr. Shoshani was Chief Operating Officer of Vishay from January 1, 2007 to November 1, 2009, and had been Executive Vice President of Vishay from 2000 until the date of the spin-off, with various areas of responsibility, including Executive Vice President of the Capacitors and the Resistors businesses, as well as heading the Measurements Group and Foil Divisions. Mr. Shoshani was employed by Vishay Intertechnology, Inc. from 1995 to 2010, and has been a member of the Vishay Intertechnology, Inc. Board of Directors since 2001. Mr. Shoshani's long-standing dedication to our Company, exemplified by his extensive management experience with Vishay Intertechnology prior to the VPG spin-off, as well as his experience as the CEO of a publicly-traded company, provide him with valuable insight into our business and operations, and makes him a valuable advisor to the Board. Mr. Shoshani is a nephew of Ruta Zandman. | |

|

Jeffrey H. Vanneste served, from 2012 until his retirement in 2019, as Senior Vice President and Chief Financial Officer of Lear Corporation, a global automotive technology leader in seating and electrical and electronic

systems. Prior to joining Lear, Mr. Vanneste served as Executive Vice President and Chief Financial Officer for International Automotive Components Group ("IAC")

from 2011 to 2012 and as Chief Financial Officer for IAC North America from 2007 to 2012. Prior to joining IAC, Mr. Vanneste worked with Lear Corporation in finance positions of increasing responsibility over more than 15 years.

Mr. Vanneste served on the board of TI Fluid Systems, PLC, a leading global manufacturer of fluid storage, carrying and delivery systems listed on the London Stock Exchange, where he was Chair of the Audit and Risk Committee until

2022. Our Board appointed Mr. Vanneste to become Chair of the Audit Committee effective immediately prior to the commencement of the 2022 annual meeting, and our Board has determined that Mr. Vanneste qualifies as an Audit Committee

financial expert under the rules of the SEC. Mr. Vanneste’s experience as the Chief Financial Officer of a multinational, publicly-traded company and as a board member of another publicly-traded company allows him to bring an

important perspective to the Board and the Audit Committee.

|

|

Dr. Renee B. Booth has served since 1999 as President of Leadership Solutions, Inc., a boutique human

resources consulting firm specializing in leadership assessment, selection, development and motivation. Prior to founding Leadership Solutions, Inc., Dr. Booth was the Eastern Regional Practice Leader for the Human Capital Group

of Watson Wyatt Worldwide. Dr. Booth also served as Senior Vice President, Corporate Human Resources of financial services company ADVANTA Corporation, and spent more than a decade in senior positions with Hay Management

Consultants. Dr. Booth is a Board of Trustee member at the Franklin Institute in Philadelphia where she serves on the Executive Committee and as Chair of the Education Committee and was past Chair of the Compensation Committee.

She previously served as a Board member of Kenexa, a human capital solutions provider, which was acquired by IBM and where she was Chair of the Compensation Committee. Dr. Booth received a B.A. in psychology from the University of

Maryland and a M.S. and Ph.D. in industrial/organizational psychology from the Pennsylvania State University. Dr. Booth brings to the Board extensive

organizational experience with leadership assessment and development. Additionally, Dr. Booth’s current and prior positions as a director provide important expertise with human capital matters.

|

|

|

Dr. Michiko Kurahashi has served since 2020 as an adjunct professor at New York University educating executives, graduate students,

and undergraduates in the current trends in marketing, communications, public relations, and digital marketing technology applicable to a wide range of businesses and industries. From 2016 to 2020, Dr. Kurahashi was Chief

Marketing Officer at AXIS Capital (NYSE: AXS), a global commercial insurer and reinsurer. In that role, Dr. Kurahashi launched the firm’s new “One AXIS” brand, implemented AI-driven marketing initiatives and streamlined marketing

processes. Prior to that, Dr. Kurahashi was Head of Marketing at CIT Bank, an online bank, and held senior marketing and communication positions at global financial institutions including UBS AG and HSBC Private Bank. Throughout

her career, Dr. Kurahashi has won numerous industry awards for her work. Dr. Kurahashi received a B.A. in sociology from the University of Michigan – Ann Arbor; a M.A. in social stratification theory and a Ph.D. in quantitative

research, labor markets from Cornell University. Dr. Kurahashi’s deep knowledge of corporate brand strategy and digital marketing expertise provides the Board with a key strategic and operational perspective in a

continuously changing marketplace.

|

|

|

Timothy V. Talbert retired in 2018 from his positions as Senior Vice President of Credit and Originations for Lease Corporation of America ("LCA"), a national equipment lessor (since July 2000) and President of the LCA Bank Corporation, a bank that augments LCA's funding capacity (since its founding in January 2006). Previously, Mr. Talbert was Senior Vice President and Director of Asset Based Lending and Equipment Leasing of Huntington National Bank from 1997 to 2000; and prior to that, served in a variety of positions with Comerica Bank for more than 25 years. Mr. Talbert previously served on the board of directors and was a member of the audit committee of Siliconix incorporated, a NASDAQ-listed manufacturer of power semiconductors of which the Company owned an 80.4% interest, from 2001 until the Company acquired the noncontrolling interests in 2005. Mr. Talbert has also served on the board of Vishay Precision Group since it was spun off from the Company in 2010. Mr. Talbert's previous and current service as a director of publicly traded companies allows him to bring an important perspective to the Board. Additionally, Mr. Talbert's service as the president of a federally regulated institution gives him relevant understanding of compliance with complex regulations and current accounting rules which add invaluable expertise to our Board. |

Other Information Concerning Directors

Dr. Gerald Paul retired from his positions of President and Chief Executive Officer of the Company and Class I Director of the Board effective December 31, 2022. The Company expresses its gratitude and appreciation for

the many years of exemplary service that Dr. Paul provided to the Company and its stockholders.

Pursuant to our Non-Employee Director Compensation Plan, our non-employee directors were compensated as follows in 2022:

|

•

|

An annualized cash retainer of $70,000, paid in two semi-annual installments;

|

|

•

|

An additional $12,000 for each member of the Audit Committee, other than the Chair who receives $30,000;

|

| • | An additional $10,000 for each member of the Compensation Committee, other than the Chair who receives $20,000; |

|

•

|

An additional $5,000 for each member of the Nominating and Corporate Governance Committee, other than the Chair who receives $15,000; and

|

| • | An annual grant of Restricted Stock Units ("RSUs") on the first stock trading day of the year, determined as a total incentive value of

$180,000 divided by the closing stock price of the last trading day of the previous fiscal year, vesting in 3 years or ratably upon earlier cessation of service (other than for cause). |

Additional cash compensation was paid to the Chair of the Nominating and Corporate Governance Committee ($50,000) and to each other member of the

Nominating and Corporate Governance Committee ($40,000) for substantial non-recurring services provided during 2022 in connection with CEO and key executive succession planning and transition. Mrs. Ruta Zandman received additional cash compensation

of $150,000 in 2022 for her role as the director responsible for preserving the memory of the late Dr. Felix Zandman and the Company's corporate history.

Board members do not receive a per-meeting fee. Our employee directors are not separately compensated for services performed as directors. The Board evaluates

director compensation annually.

The following table provides information with respect to the compensation paid or provided to the Company's non-employee directors during 2022:

|

NAME

|

FEES EARNED AND PAID IN CASH

|

|

STOCK

AWARDS(1)(6)

|

|

TOTAL

|

|

|||||

| Dr. Renee B. Booth |

$ |

80,000 | $ |

172,995 | $ |

252,995 | |||||

| Michael J. Cody | $ | 127,000 | $ | 172,995 | $ | 299,995 | |||||

| Dr. Michiko Kurahashi |

$ |

70,000 | $ |

172,995 | $ |

242,995 | |||||

|

Dr. Abraham Ludomirski

|

$

|

145,000

|

|

$

|

172,995

|

|

$

|

317,995

|

|

||

|

Ziv Shoshani

|

$

|

70,000

|

|

$

|

172,995

|

|

$

|

242,995

|

|

||

|

Timothy V. Talbert

|

$

|

90,000

|

|

$

|

172,995

|

|

$

|

262,995

|

|

||

| Jeffrey H. Vanneste(2) |

$ |

91,000 |

$ |

172,995 | $ |

263,995 |

|||||

| Thomas C. Wertheimer(3) |

$ |

55,000 |

$ |

172,995 |

$ |

227,995 |

|||||

|

Ruta Zandman(4)

|

$

|

220,000

|

|

|

$

|

172,995

|

|

$

|

392,995

|

|

|

|

Raanan Zilberman(5)

|

$

|

121,000

|

|

$

|

172,995

|

|

$

|

293,995

|

|

||

|

(1)

|

Amounts represent the fair value of the RSUs granted, determined in accordance with FASB ASC Topic 718 in the year of grant. The grant-date fair value is based on the same assumptions

described in Note 12 of our consolidated financial statements included in our Form 10-K filed on February 22, 2023, including the consideration of the present value of assumed dividends which are not received by the RSU holder during the

vesting period. Accordingly, the value of stock awards in the table above will be different than the stated “incentive value” described above. The grant-date fair value is recognized for accounting purposes over the respective vesting

periods.

|

| (2) |

Mr. Vanneste was appointed Chair of the Audit Committee effective May 24, 2022. The associated Committee Chair fees paid to

Mr. Vanneste in 2022 were prorated. |

| (3) |

Mr. Wertheimer retired from the Board effective May 24, 2022. Upon his retirement, Mr. Wertheimer's outstanding restricted stock units vested proportionally, and the unvested portion of such awards were forfeited. Although we have shown the full grant date fair value of his stock award in accordance with SEC rules, the grant date fair value of the portion of his 2022 stock award that vested was $22,744. |

| (4) |

Effective January 1, 2012, Mrs. Ruta Zandman was appointed as the director responsible for preserving the memory of the late Dr. Felix Zandman and the Company's corporate history. For her

continued service on this project, Mrs. Zandman receives $150,000 per annum in addition to her Board of Directors cash retainer of $70,000.

|

| (5) |

Mr. Zilberman was appointed to the Audit Committee effective May 24, 2022. The associated Committee fees paid to Mr.

Zilberman in 2022 were prorated. |

| (6) |

As of December 31, 2022, the aggregate number of stock awards outstanding was as follows:

|

|

NAME

|

TOTAL STOCK AWARDS OUTSTANDING

|

|||

| Dr. Renee B. Booth |

8,230 |

|||

| Michael J. Cody | 24,671 |

|||

| Dr. Michiko Kurahashi |

8,230 | |||

|

Dr. Abraham Ludomirski

|

|

24,671

|

|

|

|

Ziv Shoshani

|

|

24,671

|

|

|

|

Timothy V. Talbert

|

|

24,671

|

|

|

|

Jeffrey H. Vanneste

|

|

24,671

|

|

|

|

Ruta Zandman

|

|

24,671

|

|

|

|

Raanan Zilberman

|

|

24,671

|

|

|

To further align the interests of the Company's directors with its stockholders, the Board adopted stock ownership guidelines in 2016 applicable to the Company's

directors, which guidelines were amended and restated as of January 1, 2021 (the "Stock Ownership Guidelines"). The Stock Ownership Guidelines are as follows:

|

•

|

Each non-employee director should own an amount of shares of Vishay Common Stock equal to 5 times the value of the director's annual cash retainer, subject to a 5-year

phase-in period; and

|

|

•

|

Following the 5-year phase-in period, non-employee directors who do not meet the required ownership threshold would receive shares in place of the director's annual cash retainer and be

subject to stock transfer restrictions until such time as the ownership threshold is satisfied.

|

The following will be

considered "owned" for the purposes of the Stock Ownership Guidelines:

|

•

|

All shares underlying each non-employee director's outstanding time-based restricted stock and time-based restricted stock unit awards, whether or not vested;

|

|

•

|

Shares owned outright or otherwise beneficially owned by the non-employee director, his or her spouse and minor children, and any trust for the principal benefit of those individuals; and

|

|

•

|

Shares beneficially owned, whether directly or indirectly, by any investment fund or similar entity with which the non-employee director is affiliated.

|

Compliance for non-employee directors will be measured on the first

trading day in January of each year.

The following table summarizes non-employee director compliance status with the Stock Ownership Guidelines as of January 3, 2023:

|

DIRECTOR

|

STATUS

|

|

|

| Dr. Renee B. Booth |

Compliant |

||

| Michael J. Cody |

Compliant

|

||

| Dr. Michiko Kurahashi |

Compliant |

||

|

Dr. Abraham Ludomirski

|

Compliant

|

|

|

|

Ziv Shoshani

|

Compliant

|

|

|

|

Timothy V. Talbert

|

Compliant

|

|

|

| Jeffrey H. Vanneste |

Compliant |

||

|

Ruta Zandman

|

Compliant

|

|

|

|

Raanan Zilberman

|

Compliant

|

|

Corporate governance is the process by which companies govern themselves.

At Vishay, day-to-day business activities are carried out by our employees under the direction and supervision of our CEO. The Board of Directors oversees these activities. In doing

so, each director is required to use his or her business judgment in the best interests of Vishay and its stockholders. The Board's primary responsibilities include:

|

•

|

Review of Vishay's performance, strategies, and major decisions;

|

|

•

|

Oversight of Vishay's compliance with legal and regulatory requirements and the integrity of its financial statements;

|

|

•

|

Oversight of management, including review of the CEO's performance and succession planning for key management roles;

|

| • | Oversight of risk management; and |

| • | Oversight of compensation for the CEO, key executives and the Board, as well as oversight of compensation policies and programs for all employees. |

Additional description of the Board's responsibilities is included in our Corporate Governance Principles, which is available to stockholders on our website and in print upon request,

as described below.

Various corporate governance related documents are available on our website. These include:

|

•

|

Corporate Governance Principles

|

|

•

|

Code of Business Conduct and Ethics

|

|

•

|

Code of Ethics for Financial Officers

|

| • | Audit Committee Charter |

| • | Nominating and Corporate Governance Committee Charter |

| • | Compensation Committee Charter |

| • | Executive Stock Ownership Guidelines |

| • |

Director Stock Ownership Guidelines |

| • | Clawback Policy |

| • | Hedging - Pledging Policy |

| • | Nominating and Corporate Governance Committee Policy Regarding Qualification of Directors |

| • | Related Party Transactions Policy |

| • | Ethics Helpline |

To view these documents, access ir.Vishay.com and click on "Corporate Governance." Any of these documents can be obtained in print by any stockholder upon written request to

Vishay's investor relations department.

We intend to post any amendments to or any waivers from, a provision of our Code of Business Conduct and Ethics or Code of Ethics for Financial Officers on our website.

Vishay has a staggered Board of Directors divided into three classes. The number of directors is fixed by the Board of Directors, subject to a minimum of three and a maximum of fifteen directors as

provided in the Company's charter documents. As described in Proposal One, one director is nominated for election as a Class I director for a term expiring at the annual meeting of stockholders in 2025 and three directors are nominated for election

as Class II directors for a term expiring at the annual meeting of stockholders in 2026. Biographical information on each of the current and nominated directors is included under the heading "Directors" on page 5.

The Board has adopted a formal set of director qualification standards used to determine director independence which meet the independence requirements of the NYSE corporate governance listing

standards. The Board has determined that, to be considered independent, a director may not have a direct or indirect material relationship with the Company other than as a director. A material relationship is one which impairs or inhibits, or has

the potential to impair or inhibit, a director's exercise of critical and disinterested judgment on behalf of the Company and its stockholders. The materiality standard applied by the Board includes, but is not limited to, the disqualifying

relationships set forth in the governance listing standards of the NYSE. The standards specify the criteria for determining director independence, including strict guidelines for directors and their immediate families regarding employment or

affiliation with us or our independent registered public accounting firm. The standards also prohibit the Audit Committee members from having any direct or indirect financial relationship with us.

The Nominating and Corporate Governance Committee, with the help of counsel, has reviewed the applicable legal standards for Board and committee member independence, the Company's

standards of independence and applied the criteria to determine "audit committee financial expert status". The Committee has also reviewed a summary of the answers to annual questionnaires completed by each director. On the basis of this review the

Committee has communicated its findings to the full Board and the Board has affirmatively concluded that Dr. Renee B. Booth, Michael J. Cody, Dr. Michiko Kurahashi, Dr. Abraham Ludomirski, Timothy Talbert, Jeffrey H. Vanneste, and Raanan

Zilberman qualify as independent directors. Each of the Audit Committee, the Nominating and Corporate Governance Committee, and the Compensation Committee of the Board is composed entirely of independent directors.

The Board of Directors met ten times during the year ended December 31, 2022. Regularly scheduled executive sessions of the Board's independent directors were also held. In 2022,

each director attended at least 75% of the aggregate number of meetings of the Board of Directors and any committee on which such director served. Vishay's policy on director attendance at annual meetings of stockholders is included in

Vishay's Corporate Governance Principles which may be found on our website at ir.Vishay.com.

|

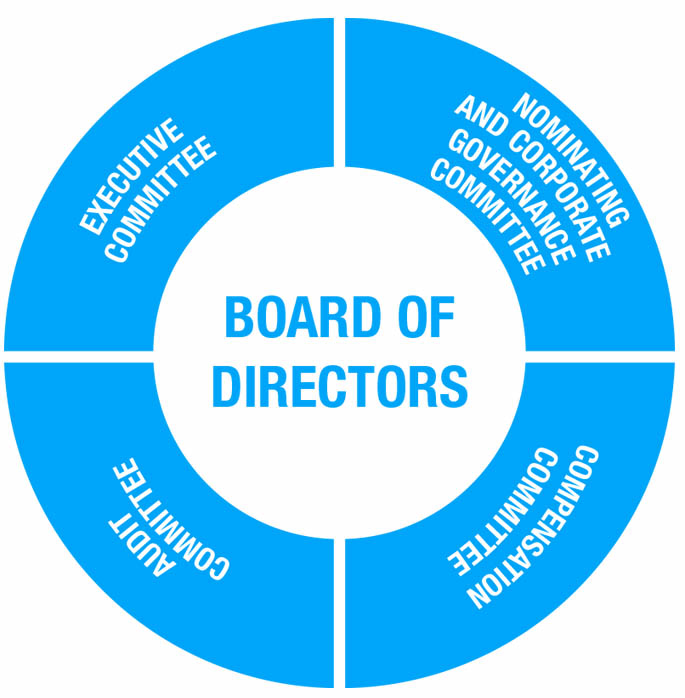

The Board of Directors maintains an Executive Committee, a Nominating and Corporate Governance Committee, an Audit Committee, and a Compensation Committee. Each Committee is described below. Copies of all committee charters are

available on our website and in print upon request. The composition of these Committees is summarized under "Directors" above.

|

|

|

|

Executive Committee - The Executive Committee is

authorized to exercise all functions of the Board of Directors in the intervals between meetings of the Board to the extent delegated by the Board and as permitted by Delaware law. The current Chair of the Committee is Mr. Zandman.

Nominating and Corporate Governance Committee - The

functions of the Nominating and Corporate Governance Committee include identifying individuals qualified to become members of the Board; selecting or recommending that the Board of Directors select the director nominees for the next annual meeting of

stockholders; developing and recommending to the Board Executive Officer succession plans; developing and recommending to the Board a set of corporate governance principles for Vishay; overseeing the evaluation of the Board and the management of

Vishay; administering Vishay's Related Party Transactions Policy; and performing other related functions specified in the committee's charter. The current Chair of the Committee is Dr. Abraham Ludomirski.

Audit Committee - The functions of the Audit

Committee include overseeing Vishay's accounting and financial reporting processes; overseeing the audits of our consolidated financial statements and the effectiveness of our internal control over financial reporting; assisting the Board in its

oversight of the integrity of our financial statements, our compliance with legal and regulatory requirements, the independence and qualifications of our independent registered public accounting firm, and the performance of our internal audit

function and independent registered public accounting firm; and performing other related functions specified in the committee's charter, including the administration of the Company's Stockholder Return Policy. The Audit Committee consists of at least

three non-management directors, each of whom satisfies the independence requirements of the rules of the SEC and the governance listing requirements of the NYSE. All of the members of the Committee also satisfy the financial literacy requirements of

the NYSE and our Board has determined that Mr. Jeffrey H. Vanneste, the current Chair of the committee, qualifies as an Audit Committee financial expert under the rules of the SEC.

Compensation Committee - The functions of the

Compensation Committee include evaluating the performance of the Chief Executive Officer; establishing and approving all compensation for our Executive Officers; making recommendations to the Board with respect to compensation of non-employee

directors; making recommendations to the Board with respect to, and administering, our incentive compensation plans and equity based compensation plans; and performing other related functions specified in the Committee's charter. The current Chair of

the Committee is Mr. Timothy Talbert. Also see "Executive Compensation."

The Chair of the Compensation Committee presides at the executive sessions of the Board's independent directors.

|

Executive Committee(1)

|

Audit Committee

|

Nominating and Corporate Governance Committee

|

Compensation Committee

|

|

Number of Meetings during 2022

|

-

|

10

|

5

|

7

|

|

(1)

|

The Executive Committee meets informally throughout the year to discuss various business issues. Informal meetings are not included in the number of meetings disclosed above.

|

The Board believes that it is important and in the Company's best interests to retain the flexibility to combine or separate the responsibilities of the offices of Chair of the

Board and CEO, as determined by the Board from time to time. The Board separated the positions of Chair and CEO in 2004 when the Company's late founder and Chairman, Dr. Felix Zandman, stepped down from his position as our CEO to focus mainly on

technical and business development issues. Mr. Marc Zandman succeeded Dr. Zandman as Executive Chair of the Board of Directors and Chief Business Development Officer upon Dr. Zandman's passing. Mr. Marc Zandman is significantly involved with the

Company's strategic direction as our Executive Chair and Chief Business Development Officer, overseeing our acquisition strategy. Accordingly, the Company believes that it is appropriate that he serve as Executive Chair. At the same time, the

active membership of our CEO on the Board assures our Board of the benefit of the CEO's comprehensive knowledge of the Company's business, operations, industry environment and competitive challenges.

As contemplated by our succession plan, Dr. Paul resigned from the Board of Directors upon his retirement as President and CEO effective December 31, 2022. The Board has determined

to retain the separation between the Chair and CEO roles. The Board appointed Joel Smejkal to succeed Dr. Paul as President and CEO, and appointed Mr. Smejkal to the Board of Directors effective January 1, 2023, to fill the vacancy presented by Dr.

Paul's resignation. Mr. Zandman will remain Executive Chair of the Board.

Independent directors and management have different perspectives and roles in strategy development. Our independent directors bring oversight skills and experience from outside the

Company and the industry, while our CEO and Executive Chair bring Company-specific expertise. This structure permits open discussion and assessment of the Company's ability to manage the risks and challenges the Company faces and provides the

appropriate balance between strategy development and independent oversight of management.

The independent directors meet in regularly scheduled executive sessions and when required, in special executive sessions.

Management continually monitors the material risks facing the Company, including financial risk, strategic risk, operational risk, cybersecurity risk, and legal and compliance risk.

The Board of Directors is responsible for exercising oversight of management's identification and management of, and planning for, those risks. Although the Board is ultimately responsible for risk oversight at the Company, the Board has delegated to

certain committees oversight responsibility for those risks that are directly related to their area of focus.

|

The Audit Committee reviews our policies and guidelines with respect to risk assessment

and risk management, including our material financial risk exposures and cybersecurity risk, and oversees the steps management has taken to monitor and control those exposures.

|

|

The Compensation Committee considers risk issues when establishing and administering our compensation programs for executive

officers and other key personnel.

|

|

The Nominating and Corporate Governance Committee

oversees corporate governance risks, including matters relating to the composition and organization of the Board and recommends

to the Board how its effectiveness can be improved by changes in its composition and organization.

|

Each of these committees routinely reports to the Board on the management of these specific risk areas. To permit the Board and its committees to perform their respective risk

oversight roles, individual members of management who supervise the Company's risk management report directly to the Board or the relevant committee of the Board responsible for overseeing the management of specific risks, as applicable.

The Board believes that full and open communication between management and the Board is essential for effective risk management and oversight. Members of the Company's senior

management regularly attend Board and committee meetings and are available to address any questions or concerns raised on matters related to risk management. The Board and its committees exercise their risk oversight function by carefully evaluating

the reports they receive from management and by making inquiries of management with respect to areas of particular interest to the Board.

In selecting candidates for nomination at the annual meeting of our stockholders, the Nominating and Corporate Governance Committee begins by determining whether the incumbent

directors whose terms expire at the meeting desire and are qualified to continue their service on the Board. We are of the view that the repeated service of qualified incumbents promotes stability and continuity in the boardroom, giving us the benefit

of the familiarity and insight into our affairs that our directors have accumulated during their tenure and contributing to the Board's ability to work as a collective body. Accordingly, it is the policy of the Committee, absent special circumstances,

to nominate qualified incumbent directors who continue to satisfy the Committee's criteria for membership on the Board, who the Committee believes will continue to make important contributions to the Board, and who consent to stand for re-election and,

if re-elected, to continue their service on the Board. If there are Board positions for which the Committee will not be re-nominating a qualified incumbent, the Committee will solicit recommendations for nominees from persons who the Committee

believes are likely to be familiar with qualified candidates, including members of the Board and senior management.

The Committee may also engage an independent search firm to assist in identifying qualified candidates. Where such a search firm is engaged, the Committee will set the fees and scope

of engagement. The Committee will review and evaluate each candidate who it believes merits serious consideration, taking into account all available information concerning the candidate, the qualifications for Board membership established by the

Committee, the existing composition and mix of talent and expertise on the Board and other factors that it deems relevant. In conducting its review and evaluation, the Committee may solicit the views of management and other members of the Board and

may, if deemed helpful, conduct interviews of proposed candidates. The Committee will evaluate candidates recommended by stockholders in the same manner as candidates recommended by other persons, except that the Committee may consider, as one of the

factors in its evaluation of stockholder recommended candidates, the size and duration of the interest of the recommending stockholder or stockholder group in the equity of Vishay and whether the stockholders or stockholder group intend to continue

holding its interest through the annual meeting date.

Candidates for nomination to our Board are selected by the Nominating and Corporate Governance Committee in accordance with the Committee's charter, our Certificate of Incorporation,

our Bylaws and our Corporate Governance Principles. Under our Nominating and Corporate Governance Committee Policy Regarding Qualifications of Directors, which can be found on our website, we require that all candidates for director (including the

continued service of existing members) be persons of integrity and sound ethical character; be able to represent all stockholders fairly; have no interests that materially conflict with those of Vishay and its stockholders; have demonstrated

professional achievement; have meaningful management, advisory or policy making experience; have a general appreciation of the major business issues facing the Company; and have adequate time to devote to serve on the Board of Directors. When

considering nominees, the Nominating and Corporate Governance Committee may also consider whether the candidate possesses the qualifications, experience and skills it considers appropriate in the context of the Board's overall composition and needs. A

limited exception to some of these requirements, other than the requirements of integrity and ethics and the absence of material conflict, may be made for a holder of substantial voting power. Additionally, directors may not stand for re-election

after the age of 75 unless the Board makes an affirmative determination that, because of the importance and value of the continued service of a director, the retirement policy should be waived, and in no event may a director stand for re-election after

the age of 85. This policy does not apply to any person who controls more than 20% of the voting power of the Company. We also require that a majority of directors be independent; at least three of the directors have the financial literacy necessary

for service on the Audit Committee and at least one of these directors qualifies as an Audit Committee financial expert; at least some of the independent directors have served as senior executives of public or substantial private companies; and at

least some of the independent directors have general familiarity with the industries in which we operate. Additionally, while the Company does not have a formal policy with respect to the consideration of diversity in identifying director candidates,

the benefits of board diversity are considered in the nominations process, including diversity of background and experience. A detailed description of the qualifications required of candidates for director, as well as the specific qualities or skills

we believe should be possessed by one or more directors, can be found on our website under our Nominating and Corporate Governance Committee Policy Regarding Qualifications of Directors.

To assist it with its evaluation of the director nominees for election at the 2023 annual meeting of stockholders, the Nominating and Corporate Governance Committee took into account

all of the factors listed above. In the section "Directors", under the headings "Nominee for Term Expiring 2025" and "Nominees for Terms Expiring 2026", we provide an overview of each nominee's principal occupation, together with the qualifications,

key attributes and skills that the Nominating and Corporate Governance Committee and the Board believes will best serve the interests of the Board, the Company and our stockholders.

Yes. The Nominating and Corporate Governance Committee will consider recommendations for director nominations submitted by stockholders entitled to vote generally in the election of

directors. Submissions must be made in accordance with the Committee's procedures, as outlined below and set forth on our website. For each annual meeting of our stockholders, the Committee will accept for consideration only one recommendation from

any stockholder or affiliated group of stockholders. The Committee will only consider candidates who satisfy our minimum qualifications for director, as summarized in this proxy statement and as set forth on our website. In considering a stockholder

recommendation, the Committee will take into account, among other factors, the size and duration of the recommending stockholder's ownership interest in Vishay and whether the stockholder intends to continue holding that interest through the annual

meeting date. Stockholders should be aware, as discussed above, that it is our general policy to re-nominate qualified incumbent directors and that, absent special circumstances, the Committee will not consider other candidates when a qualified

incumbent director consents to stand for re-election.

A stockholder wishing to recommend to the Nominating and Corporate Governance Committee a candidate for election as director must submit the recommendation in writing, addressed to

the Committee, care of our Corporate Secretary, at Vishay Intertechnology, Inc., 63 Lancaster Avenue, Malvern, PA 19355. Submissions must be made by mail, courier, or personal delivery. E-mailed submissions will not be considered. Submissions

recommending candidates for election at an annual meeting of stockholders must generally be received no later than 120 calendar days prior to the first anniversary of the date of the proxy statement for the prior annual meeting of stockholders. In the

event that the date of an annual meeting of stockholders is more than 30 days following the first anniversary date of the annual meeting of stockholders for the prior year, the submission must be made a reasonable time in advance of the mailing of our

proxy statement for the current year. Each nominating recommendation must be accompanied by the information called for by our "Procedures for Securityholders' Submission of Nominating Recommendations". This includes specified information concerning

the stockholder or group of stockholders making the recommendation and the proposed nominee, any relationships between the recommending stockholder or stockholders and the proposed nominee and the qualifications of the proposed nominee to serve as

director. The recommendation must also be accompanied by the consent of the proposed nominee to serve if nominated and elected and the agreement of the nominee to be contacted by the Committee, if the Committee decides in its discretion to do so.

Vishay stockholders may communicate with the Board of Directors, any committee of the Board or any individual director, and any interested party may communicate with the independent

directors of the Board as a group, by delivering such communications either in writing addressed or by e-mail to:

|

|

By Mail

|

|

|

By e-mail

|

||

|

Corporate Secretary

Vishay Intertechnology, Inc.

63 Lancaster Avenue

Malvern, PA 19355

|

|

boardofdirectors@Vishay.com

Communications should not exceed 1,000 words

|

All communications must be accompanied by the following information: (i) if the person submitting the communication is a securityholder, a statement of the type and amount of the

securities of Vishay that the person holds; (ii) if the person submitting the communication is not a securityholder and is submitting the communication to the independent directors as an interested party, the nature of the person's interest in Vishay;

(iii) any special interest, meaning an interest not in the capacity as a securityholder of Vishay, of the person in the subject matter of the communication; and (iv) the address, telephone number and e-mail address, if any, of the person submitting the

communication. Communications addressed to directors may, at the direction of the directors, be shared with Vishay's management.

ELECTION OF DIRECTORS

Our stockholders will be asked to consider one nominee for election to our Board to serve as a Class I director for a term expiring at the annual meeting of stockholders in 2025, and

three nominees for election to our Board to serve as Class II directors for a term expiring at the annual meeting of stockholders in 2026, and until their successors, if any, are elected or appointed, or their earlier death, resignation, retirement,

disqualification or removal. The nominees are:

| Class I nominees: | |

|

Joel Smejkal |

| Class II nominees: |

|

|

Michael J. Cody

|

| |

|

|

Dr. Abraham Ludomirski

|

| |

|

|

Raanan Zilberman |

Mr. Smejkal was appointed to the Board as a Class I Director on January 1, 2023, to fill the vacancy created by Dr. Paul's resignation. Although the other Class I Directors are not

up for election until the annual meeting of stockholders in 2025, Mr. Smejkal is being nominated as a Class I Director as a result of his recent appointment to the Board.

Each nominees' current positions and offices, tenure as a Vishay director, their respective committee memberships, and their qualifications are set forth under "Directors" beginning

on page 5. All of the nominees are current Vishay directors. The Nominating and Corporate Governance Committee reviewed the qualifications of each of the nominees and recommended to our Board that each nominee be submitted to a vote of our stockholders

at the Annual Meeting. The Board approved the Committee's recommendation at its meeting on February 21, 2023.

Each of the nominees has agreed to be named and to serve if elected. We have no reason to believe that any of the nominees will be unable or unwilling to serve if elected.

If any nominee for director becomes unavailable for election, the proxies will be voted for such substitute nominee(s) as the Board of Directors may propose. If you voted for the

unavailable nominee, your vote will be cast for his or her replacement.

|

The Board of Directors recommends that you vote "FOR ALL" the nominees

for election as Class I and Class II directors.

|

Management is responsible for maintaining effective internal control over financial reporting, for assessing the effectiveness of internal control over financial reporting, and for

preparing our consolidated financial statements. Our independent registered public accounting firm is responsible for, among other things, performing an independent audit of our consolidated financial statements in accordance with standards of the

Public Company Accounting Oversight Board (United States) ("PCAOB") and issuing a report thereon. Our independent registered public accounting firm is also responsible for auditing the effectiveness of our internal control over financial reporting in

accordance with standards of the PCAOB, and issuing a report thereon. It is the responsibility of the Audit Committee to monitor and oversee these processes.