Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(MARK ONE)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended August 31, 2013

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 1-13419

Lindsay Corporation

(Exact name of registrant as specified in its charter)

| Delaware | 47-0554096 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 2222 North 111th Street, Omaha, Nebraska | 68164 | |

| (Address of principal executive offices) | (Zip Code) | |

402-829-6800

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $1.00 par value | New York Stock Exchange, Inc. (Symbol LNN) |

Indicate by check mark if the registrant is a well-known seasoned issuer, (as defined in Rule 405 of the Securities Act). Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of Common Stock of the registrant, all of which is voting, held by non-affiliates based on the closing sales price on the New York Stock Exchange, Inc. on February 28, 2013 was $1,073,694,887.

As of October 11, 2013, 12,872,801 shares of the registrant’s Common Stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement pertaining to the Registrant’s 2013 annual stockholders’ meeting are incorporated herein by reference into Part III.

Table of Contents

2

Table of Contents

INTRODUCTION

Lindsay Corporation, along with its subsidiaries (collectively called “Lindsay” or the “Company”), is a global leader in providing a variety of proprietary water management and road infrastructure products and services. The Company has been involved in the manufacture and distribution of agricultural equipment since 1955 and has grown from a regional company to an international agribusiness and highway infrastructure firm with worldwide sales and distribution. Lindsay, a Delaware corporation, maintains its corporate offices in Omaha, Nebraska. The Company has operations which are categorized into two major reporting segments. Industry segment information about Lindsay is included in Note Q to the consolidated financial statements.

Irrigation Segment – The Company’s irrigation segment includes the manufacture and marketing of center pivot, lateral move, and hose reel irrigation systems which are used principally in the agricultural industry to increase or stabilize crop production while conserving water, energy and labor. The irrigation segment also manufactures and markets repair and replacement parts for its irrigation systems and controls, and designs and manufactures water pumping stations and controls for the agriculture, golf, landscape and municipal markets. The Company continues to strengthen irrigation product offerings through innovative technology such as GPS positioning and guidance, variable rate irrigation, wireless irrigation management, and smartphone applications. On August 16, 2013, the Company acquired Claude Laval Corporation, which manufactures and distributes LAKOS® separators and filtration solutions for groundwater, agriculture, industrial and heat transfer markets, worldwide. The Company’s principal irrigation manufacturing facilities are located in Lindsay, Nebraska, Hartland, Wisconsin, and Fresno, California. Internationally, the Company has production operations in Brazil, France, China, and South Africa as well as distribution operations in Australia and New Zealand. The Company also exports equipment from the U.S. to other international markets.

Infrastructure Segment – The Company’s infrastructure segment includes the manufacture and marketing of moveable barriers, specialty barriers, crash cushions and end terminals, road marking and road safety equipment, large diameter steel tubing, railroad signals and structures, and outsourced manufacturing services. The principal infrastructure manufacturing facilities are located in Rio Vista, California, Milan, Italy, and Omaha, Nebraska.

PRODUCTS BY SEGMENT

IRRIGATION SEGMENT

Products - The Company manufactures and markets its center pivot and lateral move irrigation systems in the U.S. and internationally under its Zimmatic® brand. The Company also manufactures and markets separate lines of center pivot and lateral move irrigation equipment for use on smaller fields under its Greenfield® brand, and hose reel travelers under the Perrot™ and Greenfield® brands in Europe and South Africa. The Company also produces or markets irrigation controls, chemical injection systems and remote monitoring and control systems which it sells under its GrowSmart® brand. In addition to whole systems, the Company manufactures and markets repair and replacement parts for its irrigation systems and controls. The Company also designs and manufactures water pumping stations and controls for the agriculture, golf, landscape and municipal markets and filtration solutions for groundwater, agriculture, industrial and heat transfer markets, worldwide.

The Company’s irrigation systems are primarily of the standard sized center pivot type, with a small portion of its products consisting of the lateral move type. Both are automatic, continuous move systems consisting of sprinklers mounted on a water carrying pipeline which is supported approximately 11 feet off the ground by a truss system suspended between moving towers.

A typical center pivot is approximately 1,300 feet long and is designed to circle within a quarter-section of land, which comprises 160 acres, wherein it irrigates approximately 130 to 135 acres. A center pivot or lateral move system can also be custom designed and can irrigate from 25 to 600+ acres.

3

Table of Contents

A center pivot system represents a significant investment to a farmer. In a dry land conversion to center pivot irrigation, approximately one-half of the investment is for the pivot itself, and the remainder is attributable to installation of additional equipment such as wells, pumps, underground water pipes, electrical supply and a concrete pad upon which the pivot is anchored. The Company’s center pivot and lateral move irrigation systems can be enhanced with a family of integrated proprietary products such as water pumping station controls.

The Company also manufactures and distributes hose reel travelers. Hose reel travelers are typically deployed in smaller or irregular fields and usually are easy to operate, easy to move from field to field, and a lower investment than a typical standard center pivot.

The Company also markets pivot monitoring and control systems, which include remote telemetry and a web or personal computer hosted data acquisition and monitoring application available through the Company’s subscription-based service. These systems allow growers to monitor their pivot systems, accumulate data on the operation of the systems, and control the pivots from a remote location by logging onto an internet web site. The pivot monitoring and control systems are marketed under the FieldNET® product name.

Other Types of Irrigation – Center pivot and lateral move irrigation systems compete with three other types of irrigation: flood, drip, and other mechanical devices such as hose reel travelers and solid set sprinklers. The bulk of the worldwide irrigation is accomplished by the traditional method of flood irrigation. Flood irrigation is accomplished by either flooding an entire field, or by providing a water source (ditches or a pipe) along the side of a field, which is planed and slopes slightly away from the water source. The water is released to the crop rows through gates in the ditch or pipe, or through siphon tubes arching over the ditch wall into some of the crop rows. It runs down through the crop row until it reaches the far end of the row, at which time the water source is moved and another set of rows are flooded. A significant disadvantage or limitation of flood irrigation is that it cannot be used to irrigate uneven, hilly, or rolling terrain or fields. In “drip” or “low flow” irrigation, perforated plastic pipe or tape is installed on the ground or buried underground at the root level. Several other types of mechanical devices, such as hose reel travelers, irrigate the remaining irrigated acres.

Center pivot, lateral move, and hose reel traveler irrigation offers significant advantages when compared with other types of irrigation. It requires less labor and monitoring; can be used on sandy ground, which, due to poor water retention ability, must have water applied frequently; can be used on uneven ground, thereby allowing previously unsuitable land to be brought into production; can also be used for the application of fertilizers, insecticides, herbicides, or other chemicals (termed “fertigation” or “chemigation”); and conserves water and chemicals through precise control of the amount and timing of the application.

Markets - Water is an essential and critical requirement for crop production, and the extent, regularity, and frequency of water application can be a critical factor in crop quality and yield. The fundamental factors which govern the demand for center pivot and lateral move systems are essentially the same in both the U.S. and international markets. Demand for center pivot and lateral move systems is determined by whether the value of the increased crop production attributable to center pivot or lateral move irrigation exceeds any increased costs associated with purchasing, installing, and operating the equipment. Thus, the decision to purchase a center pivot or lateral move system, in part, reflects the profitability of agricultural production, which is determined primarily by the prices of agricultural commodities and other farming inputs.

The current demand for center pivot systems has three sources: conversion to center pivot systems from less water efficient, more labor intensive types of irrigation; replacement of older center pivot systems, which are beyond their useful lives or are technologically obsolete; and conversion of dry land farming to irrigated farming. In addition, demand for center pivots and lateral move irrigation equipment depends upon the need for the particular operational characteristics and advantages of such systems in relation to alternative types of irrigation, primarily flood. More efficient use of the basic natural resources of land, water, and energy helps drive demand for center pivot and lateral move irrigation equipment. Increasing global population not only increases demand for agricultural output, but also places additional and competing demands on land, water, and energy. The Company expects demand for center pivots and lateral move systems to continue to increase relative to other irrigation methods because center pivot and lateral move systems are preferred where the soil is sandy, the terrain is not flat, the land area to be irrigated is sizeable; there is a shortage of reliable labor; water supply is restricted and conservation is critical; and/or fertigation or chemigation will be utilized.

4

Table of Contents

United States Market – In the United States, the Company sells its branded irrigation systems, including Zimmatic®, to over 200 independent dealer locations, who resell to their customer, the farmer. Dealers assess their customer’s requirements, assemble and erect the system in the field, and provide additional system components, primarily relating to water supply (wells, pumps, pipes) and electrical supply (on-site generation or hook-up to power lines). Lindsay dealers generally are established local agribusinesses, many of which also deal in related products, such as well drilling and water pump equipment, farm implements, grain handling and storage systems, and farm structures.

International Market – Over the years, the Company has sold center pivot and lateral move irrigation systems throughout the world. The Company has production and sales operations in Brazil, France, China, and South Africa as well as distribution and sales operations in Australia and New Zealand serving the key South American, European, Chinese, African, Australian, and New Zealand markets. The Company also exports equipment from the U.S. to other international markets. Although the majority of the Company’s U.S. export sales are denominated in U.S. dollars, there are approximately 19 percent of total Company sales conducted in local currencies outside of the U.S. dollar in fiscal 2013 and 2012. The Company generally ships against prepayments or U.S. bank confirmed irrevocable letters of credit or other secured means.

The Company’s international markets differ with respect to the need for irrigation, the ability to pay, demand, customer type, government support of agriculture, marketing and sales methods, equipment requirements, and the difficulty of on-site erection. The Company’s industry position is such that it believes that it will likely be considered as a potential supplier for most major international agricultural development projects utilizing center pivot or lateral move irrigation systems.

Competition – Four primary manufacturers control a substantial majority of the U.S. center pivot irrigation system industry. The international irrigation market includes participation and competition by the leading U.S. manufacturers as well as various regional manufacturers. The Company competes in certain product lines with several manufacturers, some of whom may have greater financial resources than the Company. The Company competes by continuously improving its products through ongoing research and development activities. The Company continues to strengthen irrigation product offerings through innovative technology such as GPS positioning and guidance, variable rate irrigation, wireless irrigation management, and smartphone applications as well as through acquisition of products and services that allow the Company to provide a more comprehensive solution to growers’ needs. The Company’s engineering and research expenses related to irrigation totaled approximately $8.1 million, $6.0 million, and $6.1 million for fiscal years 2013, 2012, and 2011, respectively. Competition also occurs in areas of price and seasonal programs, product quality, durability, controls, product characteristics, retention and reputation of local dealers, customer service, and, at certain times of the year, the availability of systems and their delivery time. The Company believes it competes favorably with respect to all of these factors.

INFRASTRUCTURE SEGMENT

Products – Quickchange® Moveable Barrier™ The Company’s Quickchange® Moveable Barrier™ system, commonly known as the Road Zipper System™, is composed of three parts: 1) T-shaped concrete barriers that are connected to form a continuous wall, 2) a Barrier Transfer Machine™ (“BTM™”) capable of moving the barrier laterally across the pavement, and 3) the variable length barriers necessary for accommodating curves. A barrier element is approximately 32 inches high, 13-24 inches wide, 3 feet long and weighs 1,500 pounds. The barrier elements are interconnected by very heavy duty steel hinges to form a continuous barrier. The BTM™ employs an inverted S-shaped conveyor mechanism that lifts the barrier, moving it laterally before setting it back on the roadway surface.

In permanent applications, the Road Zipper System™ increases capacity and reduces congestion by varying the number of traffic lanes to match the traffic demand. Roadways with fixed medians have a set number of lanes in each direction and cannot adjust to traffic demands that may change over the course of a day, or to capacity reductions caused by traffic incidents or road repair and maintenance. Applications include high volume highways where expansion may not be feasible due to lack of additional right-of-way, environmental concerns, or insufficient funding. The Road Zipper System™ is particularly useful in busy commuter corridors and at choke points such as bridges and tunnels. Road Zipper Systems™ can also be deployed at roadway or roadside construction sites to accelerate construction, improve traffic flow and safeguard work crews and motorists by positively separating the work area and traffic. Examples of types of work completed with the help of a Road Zipper System™ include highway reconstruction, paving and resurfacing, road widening, median and shoulder construction, and repairs to tunnels and bridges.

5

Table of Contents

The Company offers a variety of equipment lease options for Road Zipper Systems™ and BTM™ equipment used in construction applications. The leases extend for periods of three months or more for equipment already existing in the Company’s lease fleet. Longer lease periods may be required for specialty equipment that must be built for specific projects.

These systems have been in use since 1987. Typical sales for a highway safety or road improvement project range from $2.0 - $20.0 million, making them significant capital investments.

Crash Cushions and End Terminals – The Company offers a complete line of redirective and non-redirective crash cushions which are used to enhance highway safety at locations such as toll booths, freeway off-ramps, medians and roadside barrier ends, bridge supports, utility poles and other fixed roadway hazards. The Company’s primary crash cushion products cover a full range of lengths, widths, speed capacities and application accessories and include the following brand names: TAU®, Universal TAU-II®, TAU-II-R™, TAU-B_NR™, ABSORB 350® and Walt™. In addition to these products the Company also offers guardrail end terminal products such as the X-Tension™ and TESI® systems. The crash cushions and end terminal products compete with other vendors in the world market. These systems are generally sold through a distribution channel that is domiciled in particular geographic areas.

Specialty Barriers – The Company also offers specialty barrier products such as the SAB™, ArmorGuard™, PaveGuard™ and DR46™ portable barrier and/or barrier gate systems. These products offer portability and flexibility in setting up and modifying barriers in work areas and provide quick opening, high containment gates for use in median or roadside barriers. The gates are generally used to create openings in barrier walls of various types for both construction and incident management purposes. The DR46™ is an energy absorbing barrier to shield motorcyclists from impacting guardrail posts which is an area of focus for reducing the amount and severity of injuries.

Road Marking and Road Safety Equipment – The Company also offers preformed tape and a line of road safety accessory products. The preformed tape is used primarily in temporary applications such as markings for work zones, street crossings, and road center lines or boundaries. The road safety equipment consists of mostly plastic and rubber products used for delineation, slowing traffic, and signaling. The Company also manages an ISO 17025 certified testing laboratory that performs full-scale impact testing of highway safety products in accordance with the National Cooperative Highway Research Program (“NCHRP”) Report 350, the Manual for Assessing Safety Hardware (“MASH”), and the European Norms (“EN1317 Norms”) for these types of products. The NCHRP Report 350 and MASH guidelines are procedures required by the U.S. Department of Transportation Federal Highway Administration for the safety performance evaluation of highway features. The EN1317 Norms are being used to qualify roadway safety products for the European markets.

Other Products – The Company’s Diversified Manufacturing and Tubing business unit manufactures and markets large diameter steel tubing and railroad signals and structures, and provides outsourced manufacturing and production services for other companies. The Company continues to develop new relationships for infrastructure manufacturing in industries outside of agriculture and irrigation. The Company’s customer base includes certain large industrial companies and railroads. Each customer benefits from the Company’s design and engineering capabilities as well as the Company’s ability to provide a wide spectrum of manufacturing services, including welding, machining, painting, forming, galvanizing and assembling hydraulic, electrical, and mechanical components.

Markets – The Company’s primary infrastructure market includes moveable concrete barriers, delineation systems, crash cushions and similar protective equipment. The U.S. roadway infrastructure market includes projects such as new roadway construction, bridges, tunnels, maintenance and resurfacing, the purchase of rights-of-way for roadway expansion and development of technologies for relief of roadway congestion. Much of the U.S. highway infrastructure market is driven by government (state and federal) spending programs. For example, the U.S. government funds highway and road improvements through the Federal Highway Trust Fund Program. This program provides funding to improve the nation’s roadway system. Matching funding from the various states may be required as a condition of federal funding. In the long term, the Company believes that the federal program provides a solid platform for growth in the U.S. market, as it is generally acknowledged that additional funding will be required for infrastructure development and maintenance in the future.

6

Table of Contents

The global market for the Company’s infrastructure products continues to be driven by population growth and the need for improved road safety. The international market is presently very different from country to country. The standardization in performance requirements and acceptance criteria for highway safety devices adopted by the European Committee for Standardization is expected to lead to greater uniformity and a larger installation program. Prevention programs put in place in various countries to lower highway traffic fatalities may also lead to greater demand. The Company has recently started distributing infrastructure products in South America, the Middle East and Asia. The Company will continue expanding in markets as populations grow and markets become more established.

Competition – The Company competes in certain product lines with several manufacturers, some of whom may have greater financial resources than the Company. The Company competes by continuously improving its products through ongoing research and development activities. The Company’s engineering and research expenses related to infrastructure products totaled approximately $3.3 million, $3.5 million and $4.3 million for fiscal years 2013, 2012 and 2011, respectively. The Company competes with certain products and companies in its crash cushion business, but has limited competition in its moveable barrier line, as there is not another moveable barrier product today comparable to the Road Zipper System™. However, the Company’s barrier product does compete with traditional “safety shaped” concrete barriers and other safety barriers.

Distribution methods and channels – The Company has production and sales operations in the United States and Italy. Sales efforts consist of both direct sales and sales programs managed by its network of distributors and third-party representatives. The sales teams have responsibility for new business development and assisting distributors and dealers in soliciting large projects and new customers. The distributor and dealer networks have exclusive territories and are responsible for developing sales and providing service, including product maintenance, repair and installation. The typical dealer sells an array of safety supplies, road signs, crash cushions, delineation equipment and other highway products. Customers include Departments of Transportation, municipal transportation road agencies, roadway contractors, subcontractors, distributors and dealers. Due to the project nature of the roadway construction and congestion management markets, the Company’s customer base changes from year-to-year. Due to the limited life of projects, it is rare that a single customer will account for a significant amount of revenues in consecutive years. The customer base also varies depending on the type of product sold. The Company’s moveable barrier products are typically sold to transportation agencies or the contractors or suppliers serving those agencies. In contrast, distributors account for a majority of crash cushion sales since those products have lower price points and tend to have shorter lead times.

GENERAL

Certain information generally applicable to both of the Company’s reportable segments is set forth below.

The following table describes the Company’s total irrigation and infrastructure revenues for the past three years. United States export revenue is included in International based on the region of destination.

| For the years ended August 31, | ||||||||||||||||||||||||

| $ in millions |

2013 | 2012 | 2011 | |||||||||||||||||||||

| % of Total | % of Total | % of Total | ||||||||||||||||||||||

| Revenues | Revenues | Revenues | Revenues | Revenues | Revenues | |||||||||||||||||||

| United States |

$ | 428.9 | 62 | $ | 354.6 | 64 | $ | 307.7 | 64 | |||||||||||||||

| International |

$ | 261.9 | 38 | $ | 196.7 | 36 | $ | 171.2 | 36 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Revenues |

$ | 690.8 | 100 | $ | 551.3 | 100 | $ | 478.9 | 100 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

SEASONALITY

Irrigation equipment sales are seasonal by nature. Farmers generally order systems to be delivered and installed before the growing season. Shipments to customers located in Northern Hemisphere countries usually peak during the Company’s second and third fiscal quarters for the spring planting period. Sales of infrastructure products are traditionally higher during prime road construction seasons and lower in the winter. The primary construction season for Northern Hemisphere countries is from March until late September which corresponds to the Company’s third and fourth fiscal quarters.

CUSTOMERS

The Company is not dependent for a material part of either segment’s business upon a single customer or upon a limited number of customers. The loss of any one customer would not have a material adverse effect on the Company’s financial condition, results of operations or cash flow.

7

Table of Contents

ORDER BACKLOG

As of August 31, 2013, the Company has an order backlog of $66.5 million compared with $57.1 million at August 31, 2012. The Company’s backlog can fluctuate from period to period due to the seasonality, cyclicality, timing and execution of contracts. Typically, the Company’s backlog of firm orders at any point in time represents only a portion of the revenue it expects to realize during the following three-month period. However, the timing related to certain project oriented contracts may extend longer than three months.

RAW MATERIALS AND COMPONENTS

Raw materials used by the Company include coil steel, angle steel, plate steel, zinc, tires, gearboxes, concrete, rebar, fasteners, and electrical and hydraulic components (motors, switches, cable, valves, hose and stators). The Company has, on occasion, faced shortages of certain such materials. The Company believes it currently has ready access to adequate supplies of raw materials and components.

CAPITAL EXPENDITURES

Capital expenditures for fiscal 2013, 2012, and 2011 were $11.1 million, $9.9 million and $8.4 million, respectively. Capital expenditures for fiscal 2014 are estimated to be approximately $20.0 million to $25.0 million largely focused on manufacturing capacity expansion and productivity improvements. The Company’s management does maintain flexibility to modify the amount and timing of some of the planned expenditures in response to economic conditions.

PATENTS, TRADEMARKS, AND LICENSES

Lindsay’s Zimmatic®, Greenfield®, GrowSmart®, Perrot™, Road Zipper System™, Quickchange® Moveable Barrier™, ABSORB 350®, FieldNET®, TAU®, Universal TAU-II®, TAU-II-R™, TAU-B_NR™, X-Tension™, CableGuard™, TESI™, SAB™, ArmourGuard™, PaveGuard™, DR46™, U-MAD™, LAKOS® and other trademarks are registered or applied for in the major markets in which the Company sells its products. Lindsay follows a policy of applying for patents on all significant patentable inventions in markets deemed appropriate. Although the Company believes it is important to follow a patent protection policy, Lindsay’s business is not dependent, to any material extent, on any single patent or group of patents.

EMPLOYEES

The number of persons employed by the Company and its wholly-owned subsidiaries at fiscal year ends 2013, 2012, and 2011 were 1,262, 1,082 and 999, respectively. None of the Company’s U.S. employees are represented by a union. Certain of the Company’s non-U.S. employees are unionized due to local governmental regulations.

ENVIRONMENTAL AND HEALTH AND SAFETY MATTERS

Like other manufacturing concerns, the Company is subject to numerous laws and regulations that govern environmental and occupational health and safety matters. The Company believes that its operations are substantially in compliance with all such applicable laws and regulations and that it holds all necessary permits in each jurisdiction in which its facilities are located. Environmental and health and safety regulations are subject to change and interpretation. In some cases, compliance with applicable regulations or standards may require the Company to make additional capital and operational expenditures. The Company, however, is not currently aware of any material capital expenditures required to comply with such regulations, other than as described in Note N, Commitments and Contingencies, to the Company’s consolidated financial statements and does not believe that these matters, individually or in the aggregate, are likely to have a material adverse effect on the Company’s consolidated financial condition.

8

Table of Contents

FINANCIAL INFORMATION ABOUT FOREIGN AND U.S. OPERATIONS

The Company’s primary production facilities are located in the United States. The Company has smaller production and sales operations in Brazil, France, Italy, China, and South Africa as well as distribution and sales operations in Australia and New Zealand. Most of the Company’s financial transactions are in U.S. dollars, although some export sales and sales from the Company’s foreign subsidiaries are conducted in local currencies. Approximately 19 percent of total consolidated Company sales were conducted in local currencies in fiscal 2013 and 2012. To reduce the uncertainty of foreign currency exchange rate movements on these sales and purchase commitments conducted in local currencies, the Company monitors its risk of foreign currency fluctuations and, at times, may enter into forward exchange or option contracts for transactions denominated in a currency other than the functional currency of the Company’s operations.

In addition to the transactional foreign currency exposures mentioned above, the Company also has translation exposure resulting from translating the financial statements of its international subsidiaries into U.S. dollars. In order to reduce this translation exposure, the Company, at times, utilizes foreign currency forward contracts to hedge its net investment exposure in its foreign operations. For information on the Company’s foreign currency risks, see Item 7A of Part II of this report.

INFORMATION AVAILABLE ON THE LINDSAY WEBSITE

The Company makes available free of charge on its website homepage, under the tab “Investor Relations – SEC Filings”, its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after the Company electronically files such material with, or furnishes it to, the SEC. The Company’s internet address is http://www.lindsay.com; however, information posted on its website is not part of this Annual Report on Form 10-K. The following documents are also posted on the Company’s website homepage, under the tabs “Investor Relations – Governance – Committees” and “Investor Relations – Governance – Ethics”:

Audit Committee Charter

Compensation Committee Charter

Corporate Governance and Nominating Committee Charter

Code of Business Conduct and Ethics

Corporate Governance Principles

Code of Ethical Conduct

Employee Complaint Procedures for Accounting and Auditing Matters

Special Toll-Free Hotline Number and E-mail Address for Making Confidential or Anonymous Complaints

These documents are also available in print to any stockholder upon request, by sending a letter addressed to the Secretary of the Company.

9

Table of Contents

The following are certain of the more significant risks that may affect the Company’s business, financial condition and results of operations.

The Company’s irrigation revenues are highly dependent on the agricultural industry and weather conditions. The Company’s irrigation revenues are highly dependent upon the need for irrigated agricultural crop production which, in turn, depends upon many factors, including total worldwide crop production, the profitability of agricultural crop production, agricultural commodity prices, net farm income, availability of financing for farmers, governmental policies regarding the agricultural sector, water and energy conservation policies, the regularity of rainfall, regional climate change, and foreign currency exchange rates. As farm income decreases, farmers may postpone capital expenditures or seek less expensive irrigation alternatives.

Weather conditions, particularly during the planting and early growing season, can significantly affect the purchasing decisions of purchasers of irrigation equipment. Natural calamities such as regional floods, hurricanes or other storms, and droughts can have significant effects on seasonal irrigation demand. Drought conditions, which generally impact irrigation equipment demand positively over the long term, can adversely affect demand if water sources become unavailable or if governments impose water restriction policies to reduce overall water availability.

The Company’s infrastructure revenues are highly dependent on government funding of transportation projects. The demand for the Company’s infrastructure products depends to a large degree on the amount of government spending authorized to improve road and highway systems. For example, the U.S. government funds highway and road improvements through the Federal Highway Trust Fund Program and matching funding from states may be required as a condition of federal funding. If highway funding is reduced or delayed, it may reduce demand for the Company’s infrastructure products.

The Company’s profitability may be negatively affected by increases in the cost of raw materials, as well as in the cost of energy. Certain of the Company’s input costs, such as the cost of steel, zinc, and other raw materials, may increase rapidly from time to time. Because there is a level of price competition in the market for irrigation equipment and certain infrastructure products, the Company may not be able to recoup increases in these costs through price increases for its products, which would result in reduced profitability. Whether increased operating costs can be passed through to the customer depends on a number of factors, including farm income and the price of competing products. The cost of raw materials can be volatile and is dependent on a number of factors, including availability, demand, and freight costs.

The Company’s profitability may be negatively affected by the disruption or termination of the supply of parts, materials, and components from third-party suppliers. The Company uses a limited number of suppliers for certain parts, materials, and components in the manufacturing process. Disruptions or delays in supply or significant price increases from these suppliers could adversely affect the Company’s operations and profitability. Such disruptions, terminations or cost increases could result in cost inefficiencies, delayed sales or reduced sales.

The Company’s international equipment sales are highly dependent on foreign market conditions and are subject to additional risk and restrictions. For the fiscal year ended August 31, 2013, approximately 38 percent of the Company’s consolidated revenues were generated from international sales and United States export revenue to international regions. Specifically, international revenues are primarily generated from Australia, New Zealand, Canada, Central and Western Europe, Mexico, the Middle East, Africa, China, Russia/Ukraine, and Central and South America. In addition to risks relating to general economic and political stability in these countries, the Company’s international sales are affected by international trade barriers, including governmental policies on tariffs, taxes, import or export licensing requirements, trade sanctions, and foreign currency exchange rates. Although the Company generally ships against prepayments or U.S. bank confirmed irrevocable letters of credit or other secured means, the ability to execute against these contracts in certain markets and local laws can affect the Company’s ability to collect amounts when due. The Company does business in a number of countries that are particularly susceptible to disruption from changing social economic conditions as well as terrorism, political hostilities, sanctions, war and similar incidents.

10

Table of Contents

Compliance with applicable environmental and health and safety regulations or standards may require additional capital and operational expenditures. Like other manufacturing concerns, the Company is subject to numerous laws and regulations which govern environmental and occupational health and safety matters. The Company believes that its operations are substantially in compliance with all such applicable laws and regulations and that it holds all necessary permits in each jurisdiction in which its facilities are located. Environmental and health and safety regulations are subject to change and interpretation. Compliance with applicable regulations or standards may require the Company to make additional capital and operational expenditures.

The Company’s Lindsay, Nebraska site was added to the list of priority superfund sites of the U.S. Environmental Protection Agency (the “EPA”) in 1989. The Company and its environmental consultants have developed a remedial action work plan, under which the Company continues to work with the EPA to define and implement steps to better contain and remediate the remaining contamination. Although the Company has accrued all reasonably estimable costs associated with remediation of the site, it is expected that additional testing and environmental monitoring and remediation could be required in the future as part of the Company’s ongoing discussions with the EPA regarding the development and implementation of the remedial action plans. In addition, the current investigation has not yet been completed and does not include all potentially affected areas on the site. Due to the current stage of discussions with the EPA and the uncertainty of the remediation actions that may be required with respect to these affected areas, the Company believes that meaningful estimates of costs or range of costs cannot currently be made and accordingly have not been accrued. The Company’s ongoing remediation activities at its Lindsay, Nebraska facility are described in Note N, Commitments and Contingencies, to the Company’s consolidated financial statements.

The Company’s consolidated financial results are reported in U.S. dollars while certain assets and other reported items are denominated in the currencies of other countries, creating currency translation risk. The reporting currency for the Company’s consolidated financial statements is the U.S. dollar. Certain of the Company’s assets, liabilities, expenses and revenues are denominated in other countries’ currencies. Those assets, liabilities, expenses and revenues are translated into U.S. dollars at the applicable exchange rates to prepare the Company’s consolidated financial statements. Therefore, increases or decreases in exchange rates between the U.S. dollar and those other currencies affect the value of those items as reflected in the Company’s consolidated financial statements. Substantial fluctuations in the value of the U.S. dollar compared to those other currencies could have a significant impact on the Company’s results.

Expansion of the Company’s business may result in unanticipated adverse consequences. The Company routinely considers possible expansions of the business, both domestically and in foreign locations. Acquisitions, partnerships, joint ventures or other similar major investments require significant managerial resources, which may be diverted from the Company’s other business activities. The risks of any expansion of the business through investments, acquisitions, partnerships or joint ventures are increased due to the significant capital and other resources that the Company may have to commit to any such expansion, which may not be recoverable if the expansion initiative to which they were devoted is not fully implemented or is ultimately unsuccessful. As a result of these risks and other factors, including general economic risk, the Company may not be able to realize projected returns from any recent or future acquisitions, partnerships, joint ventures or other investments.

ITEM 1B – Unresolved Staff Comments

None.

11

Table of Contents

The Company’s facilities are well maintained, in good operating condition and are suitable for present purposes. These facilities, together with both short-term and long-term planned capital expenditures, are expected to meet the Company’s manufacturing needs in the foreseeable future. The Company does not anticipate any difficulty in retaining occupancy of any leased facilities, either by renewing leases prior to expiration or by replacing them with equivalent leased facilities. The following are the Company’s significant properties.

| Segment |

Geographic Location (s) |

Own/ Lease |

Lease Expiration |

Square Feet |

Property Description | |||||||||

| Corporate |

Omaha, Nebraska | Lease | 2019 | 30,000 | Corporate headquarters | |||||||||

| Irrigation |

Lindsay, Nebraska | Own | N/A | 300,000 | Principal U.S. manufacturing plant consists of eight separate buildings located on 122 acres | |||||||||

| Irrigation |

Fresno, California | Own | N/A | 94,000 | Manufacturing plant consists of three separate buildings for filtration products | |||||||||

| Infrastructure |

Omaha, Nebraska | Own | N/A | 83,000 | Manufacturing plant for infrastructure products located on six acres | |||||||||

| Irrigation |

Hartland, Wisconsin | Own | N/A | 73,000 | Two commercial buildings on five acres for the design and manufacture of water pumping stations and controls for the agriculture, golf, landscape and municipal markets | |||||||||

| Irrigation |

La Chapelle, France | Own | N/A | 72,000 | Manufacturing plant for irrigation products for the European markets, consists of three separate buildings situated on 3.5 acres | |||||||||

| Irrigation |

Mogi Mirim, Sao Paulo, Brazil |

Lease | 2014 | 67,000 | Manufacturing plant for irrigation products for the Brazilian market, consists of two buildings | |||||||||

| Irrigation |

Tianjin, China and Beijing, China |

Lease | 2015 | 58,400 | Manufacturing plant and office facilities for irrigation products for the Chinese market | |||||||||

| Infrastructure |

Milan, Italy | Own | N/A | 45,000 | Manufacturing plant for infrastructure products | |||||||||

| Infrastructure |

Rio Vista, California |

Own | N/A | 30,000 | Manufacturing plant for infrastructure products located on seven acres | |||||||||

| Irrigation |

Pasco, Grandview, and Othello, Washington; Hermiston, Oregon |

Lease | 2014 - 2022 | 28,900 | Retail irrigation operations in four leased buildings | |||||||||

| Irrigation |

Amarillo, Texas | Lease | 2017 | 22,000 | Warehouse facility for irrigation products | |||||||||

| Irrigation |

Kraaifontein, South Africa |

Lease | 2016 | 23,900 | Manufacturing and warehouse facility for the sub-Saharan Africa markets | |||||||||

| Irrigation |

Milford, Nebraska; Sioux Falls, South Dakota |

Lease | 2015 | 16,400 | Manufacturing, engineering, and office locations related to Digitec, Inc. | |||||||||

| Irrigation |

Pasco, Washington; Hermiston, Oregon; Portland, Oregon |

Lease | 2014 - 2018 | 22,500 | Office and warehouse locations related to IRZ Consulting, LLC | |||||||||

| Irrigation |

Paul, Idaho | Lease | 2017 | 11,400 | Warehouse facility for irrigation products | |||||||||

| Irrigation |

Toowoomba, Queensland, Australia; Feilding, New Zealand |

Lease | 2014 | 8,000 | Warehouse facilities for the Australian and New Zealand markets | |||||||||

12

Table of Contents

In the ordinary course of its business operations, the Company is involved, from time to time, in commercial litigation, employment disputes, administrative proceedings, and other legal proceedings. No such current proceedings, individually or in the aggregate, are expected to have a material effect on the business or financial condition of the Company.

ITEM 4 – Mine Safety Disclosures

Not applicable

ITEM 5 - Market For the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Lindsay Common Stock trades on the New York Stock Exchange, Inc. (NYSE) under the ticker symbol LNN. As of October 3, 2013, there were approximately 178 stockholders of record.

The following table sets forth for the periods indicated the range of the high and low stock prices and dividends paid per share:

| Fiscal 2013 Stock Price | Fiscal 2012 Stock Price | |||||||||||||||||||||||

| High | Low | Dividends | High | Low | Dividends | |||||||||||||||||||

| First Quarter |

$ | 80.48 | $ | 64.52 | $ | 0.115 | $ | 63.40 | $ | 46.03 | $ | 0.090 | ||||||||||||

| Second Quarter |

$ | 94.90 | $ | 73.86 | $ | 0.115 | $ | 67.27 | $ | 49.17 | $ | 0.090 | ||||||||||||

| Third Quarter |

$ | 94.50 | $ | 73.43 | $ | 0.115 | $ | 70.13 | $ | 52.98 | $ | 0.090 | ||||||||||||

| Fourth Quarter |

$ | 82.23 | $ | 72.54 | $ | 0.130 | $ | 74.62 | $ | 52.68 | $ | 0.115 | ||||||||||||

| Year |

$ | 94.90 | $ | 64.52 | $ | 0.475 | $ | 74.62 | $ | 46.03 | $ | 0.385 | ||||||||||||

The Company currently expects that cash dividends comparable to those paid historically will continue to be paid in the future, although there can be no assurance as to future dividends as they depend on future earnings, capital requirements and financial condition.

Purchases of equity securities by the issuer and affiliated purchases - The Company made no repurchases of its Common Stock under the Company’s stock repurchase plan during the fiscal year ended August 31, 2013; therefore, tabular disclosure is not presented. From time to time, the Company’s Board of Directors has authorized management to repurchase shares of the Company’s Common Stock. Under this share repurchase plan, management has existing authorization to purchase, without further announcement, up to 881,139 shares of the Company’s Common Stock in the open market or otherwise.

13

Table of Contents

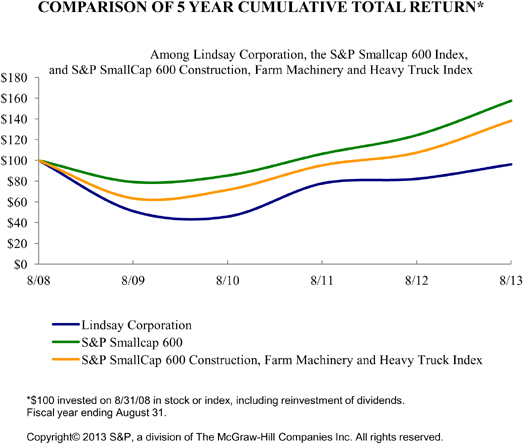

Peer Performance Table - The graph below compares the cumulative 5-year total return attained by stockholders on the Company’s Common Stock relative to the cumulative total returns of the S&P Small Cap 600 Index and the S&P 600 Construction, Farm Machinery and Heavy Truck index for the five-year period ended August 31, 2013. An investment of $100 (with the reinvestment of all dividends) is assumed to have been made in the Company’s Common Stock and in each of the indexes on August 31, 2008 and the graph shows its relative performance through August 31, 2013.

| 8/31/2008 | 8/31/2009 | 8/31/2010 | 8/31/2011 | 8/31/2012 | 8/31/2013 | |||||||||||||||||||

| Lindsay Corporation |

100.00 | 51.11 | 45.81 | 77.70 | 82.15 | 96.11 | ||||||||||||||||||

| S&P Smallcap 600 |

100.00 | 79.27 | 85.46 | 106.34 | 124.32 | 157.50 | ||||||||||||||||||

| S&P SmallCap 600 Construction, Farm Machinery and Heavy Truck Index |

100.00 | 63.48 | 74.61 | 95.23 | 107.45 | 138.14 | ||||||||||||||||||

The stock price performance included in this graph is not necessarily indicative of future stock price performance.

14

Table of Contents

ITEM 6 – Selected Financial Data

| For the Years Ended August 31, | ||||||||||||||||||||

| $ in millions, except per share amounts |

2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||

| Operating revenues |

$ | 690.8 | $ | 551.3 | $ | 478.9 | $ | 358.4 | $ | 336.2 | ||||||||||

| Gross profit |

$ | 194.8 | $ | 148.5 | $ | 129.8 | $ | 98.9 | $ | 80.6 | ||||||||||

| Gross margin |

28.2 | % | 26.9 | % | 27.1 | % | 27.6 | % | 24.0 | % | ||||||||||

| Operating expenses |

$ | 87.8 | $ | 83.0 | $ | 73.2 | $ | 61.1 | $ | 58.2 | ||||||||||

| Operating income |

$ | 107.1 | $ | 65.5 | $ | 56.6 | $ | 37.8 | $ | 22.4 | ||||||||||

| Operating margin |

15.5 | % | 11.9 | % | 11.8 | % | 10.6 | % | 6.7 | % | ||||||||||

| Net earnings |

$ | 70.6 | $ | 43.3 | $ | 36.8 | $ | 24.9 | $ | 13.8 | ||||||||||

| Net margin |

10.2 | % | 7.9 | % | 7.7 | % | 6.9 | % | 4.1 | % | ||||||||||

| Diluted net earnings per share |

$ | 5.47 | $ | 3.38 | $ | 2.90 | $ | 1.98 | $ | 1.11 | ||||||||||

| Cash dividends per share |

$ | 0.475 | $ | 0.385 | $ | 0.345 | $ | 0.325 | $ | 0.305 | ||||||||||

| Property, plant and equipment, net |

$ | 65.1 | $ | 56.2 | $ | 58.5 | $ | 57.6 | $ | 59.6 | ||||||||||

| Total assets |

$ | 512.3 | $ | 415.5 | $ | 381.1 | $ | 325.5 | $ | 307.9 | ||||||||||

| Long-term obligations |

$ | — | $ | — | $ | 4.3 | $ | 8.6 | $ | 19.5 | ||||||||||

| Return on beginning assets (1) |

17.0 | % | 11.4 | % | 11.3 | % | 8.1 | % | 4.2 | % | ||||||||||

| Diluted weighted average shares |

12,901 | 12,810 | 12,692 | 12,585 | 12,461 | |||||||||||||||

| (1) | Defined as net earnings divided by beginning of period total assets. |

ITEM 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operations

Concerning Forward-Looking Statements - This Annual Report on Form 10-K contains not only historical information, but also forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Statements that are not historical are forward-looking and reflect expectations for future Company performance. In addition, forward-looking statements may be made orally or in press releases, conferences, reports, on the Company’s worldwide web site, or otherwise, in the future by or on behalf of the Company. When used by or on behalf of the Company, the words “expect,” “anticipate,” “estimate,” “believe,” “intend” and similar expressions generally identify forward-looking statements. The entire section entitled “Market Conditions and Outlook” should be considered forward-looking statements. For these statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements involve a number of risks and uncertainties, including but not limited to those discussed in the “Risk Factors” section contained in Item 1A. Readers should not place undue reliance on any forward-looking statement and should recognize that the statements are predictions of future results which may not occur as anticipated. Actual results could differ materially from those anticipated in the forward-looking statements and from historical results, due to the risks and uncertainties described herein, as well as others not now anticipated. The risks and uncertainties described herein are not exclusive and further information concerning the Company and its businesses, including factors that potentially could materially affect the Company’s financial results, may emerge from time to time. Except as required by law, the Company assumes no obligation to update forward-looking statements to reflect actual results or changes in factors or assumptions affecting such forward-looking statements.

15

Table of Contents

Overview

The Company manufactures and markets Zimmatic®, Greenfield® and Perrot™ center pivot, lateral move, and hose reel irrigation systems. The Company also produces and markets irrigation controls, chemical injection systems and remote monitoring and control systems which it sells under its GrowSmart® brand. These products are used by farmers to increase or stabilize crop production while conserving water, energy, and labor. Through its acquisitions, the Company has been able to enhance its capabilities in providing innovative, turn-key solutions to customers through the integration of its proprietary pump stations, controls and designs. The Company sells its irrigation products primarily to a world-wide independent dealer network, who resell to their customer, the farmer. The Company’s primary production facilities are located in the United States. The Company has smaller production and sales operations in Brazil, France, China, and South Africa as well as distribution and sales operations in Australia and New Zealand. The Company also manufactures and markets various infrastructure products, including moveable barriers for traffic lane management, crash cushions, preformed reflective pavement tapes and other road safety devices, through its production facilities in the United States and Italy and has produced road safety products in irrigation manufacturing facilities in China and Brazil. In addition, the Company’s infrastructure segment produces large diameter steel tubing and railroad signals and structures, and provides outsourced manufacturing and production services for other companies.

For the business overall, the global, long-term drivers of water conservation, population growth, increasing importance of biofuels, and the need for safer, more efficient transportation solutions remain positive. Key factors which impact demand for the Company’s irrigation products include agricultural commodity prices, net farm income, worldwide agricultural crop production, the profitability of agricultural crop production, availability of financing, governmental policies regarding the agricultural sector, water and energy conservation policies, the regularity of rainfall, regional climate change, and foreign currency exchange rates. A key factor which impacts demand for the Company’s infrastructure products is the amount of spending authorized by governments to improve road and highway systems. Much of the U.S. highway infrastructure market is driven by government spending programs. For example, the U.S. government funds highway and road improvements through the Federal Highway Trust Fund Program. This program provides funding to improve the nation’s roadway system. Matching funding from the various states may be required as a condition of federal funding.

The Company continues to have an ongoing, structured, acquisition process that it expects to generate additional growth opportunities throughout the world in water and infrastructure. Lindsay is committed to achieving earnings growth by global market expansion, improvements in margins, and strategic acquisitions. On August 16, 2013, the Company acquired 100 percent of the outstanding common shares of Claude Laval Corporation, a California corporation that manufactures and distributes LAKOS® separators and filtration solutions for groundwater, agriculture, industrial and heat transfer markets, worldwide. Since 2001, the Company has added to its operations in Europe, South America, South Africa, Australia, New Zealand and China. The addition of those operations has allowed the Company to strengthen its market position in those regions, yet they remain relatively small in scale. As a result, none of the international operations has achieved the operating margin of the United States based irrigation operations.

16

Table of Contents

New Accounting Standards Issued But Not Yet Adopted

See Note B, New Accounting Pronouncements, to the Company’s consolidated financial statements for information regarding recently issued accounting pronouncements.

Critical Accounting Policies and Estimates

In preparing the consolidated financial statements in conformity with U.S. generally accepted accounting principles (“GAAP”), management must make a variety of decisions which impact the reported amounts and the related disclosures. Such decisions include the selection of the appropriate accounting principles to be applied and the assumptions on which to base accounting estimates. In reaching such decisions, management applies judgment based on its understanding and analysis of the relevant facts and circumstances. Certain of the Company’s accounting policies are critical, as these policies are most important to the presentation of the Company’s consolidated results of operations and financial condition. They require the greatest use of judgments and estimates by management based on the Company’s historical experience and management’s knowledge and understanding of current facts and circumstances. Management periodically re-evaluates and adjusts the estimates that are used as circumstances change.

Following are the accounting policies management considers critical to the Company’s consolidated results of operations and financial condition:

Revenue Recognition

The Company’s revenue recognition accounting policy is critical because it can significantly impact the Company’s consolidated results of operations and financial condition. The Company’s basic criteria necessary for revenue recognition are: 1) evidence of a sales arrangement exists, 2) delivery of goods has occurred, 3) the seller’s price to the buyer is fixed or determinable, and 4) collectability is reasonably assured. The Company recognizes revenue when these criteria have been met and when title and risk of loss transfers to the customer. The Company generally has no post-delivery obligations to its independent dealers other than standard warranties. Revenues and gross profits on intercompany sales are eliminated in consolidation.

Revenues from the sale of the Company’s products are recognized based on the delivery terms in the sales contract. If an arrangement involves multiple deliverables, the delivered items are considered separate units of accounting if the items have value on a stand-alone basis and there is objective and reliable evidence of their fair values. Revenues from the arrangement are allocated to the separate units of accounting based on their objectively determined fair value.

The Company offers a subscription-based service for wireless management and recognizes subscription revenue on a straight-line basis over the contract term. The Company leases certain infrastructure property held for lease to customers such as moveable concrete barriers and Road Zipper SystemsTM. Revenues for the lease of infrastructure property held for lease are recognized on a straight-line basis over the lease term. If an infrastructure project is completed ahead of schedule and prior to the lease term end date, the Company accelerates the lease term and the timing of recognized revenue once the Company is no longer required to perform under the lease contract.

The costs related to revenues are recognized in the same period in which the specific revenues are recorded. Shipping and handling fees billed to customers are reported in revenue. Shipping and handling costs incurred by the Company are included in cost of sales. Customer rebates, cash discounts and other sales incentives are recorded as a reduction of revenues at the time of the original sale. Estimates used in the recognition of operating revenues and cost of operating revenues include, but are not limited to, estimates for product warranties, product rebates, cash discounts and fair value of separate units of accounting on multiple deliverables.

17

Table of Contents

Inventories

The Company’s accounting policy on inventories is critical because the valuation and costing of inventory is essential to the presentation of the Company’s consolidated results of operations and financial condition. Inventories are stated at the lower of cost or market. Cost is determined by the last-in, first-out (LIFO) method for the Company’s Lindsay, Nebraska inventory and two warehouses in Idaho and Texas. Cost is determined by the first-in, first-out (FIFO) method for inventory at operating locations in Nebraska, California, Wisconsin, China and Australia. Cost is determined by the weighted average cost method for inventory at the Company’s other operating locations in Washington, Brazil, France, Italy and South Africa. At all locations, the Company reserves for obsolete, slow moving, and excess inventory by estimating the net realizable value based on the potential future use of such inventory.

Environmental Remediation Liabilities

The Company’s accounting policy on environmental remediation is critical because it requires significant judgments and estimates by management, involves changing regulations and approaches to remediation plans, and any revisions could be material to the operating results of any fiscal quarter or fiscal year. The Company is subject to an array of environmental laws and regulations relating to the protection of the environment. In particular, the Company committed to remediate environmental contamination of the groundwater at and adjacent to its Lindsay, Nebraska facility (the “site”) with the EPA. The Company and its environmental consultants have developed a remedial action work plan, under which the Company continues to work with the EPA to define and implement steps to better contain and remediate the remaining contamination.

Environmental remediation liabilities include costs directly associated with site investigation and clean up, such as materials, external contractor costs and incremental internal costs directly related to the remedy. Estimates used to record environmental remediation liabilities are based on the Company’s best estimate of probable future costs based on site-specific facts and circumstances. Estimates of the cost for the likely remedy are developed using internal resources or by third-party environmental engineers or other service providers. The Company records the undiscounted environmental remediation liabilities that represent the points in the range of estimates that are most probable or the minimum amount when no amount within the range is a better estimate than any other amount.

In fiscal 2013, the Company and the EPA conducted a periodic five-year review of the status of the remediation of the contamination of the site. The Company intends to complete additional investigation of the soil and groundwater on the site during the first half of fiscal 2014. The Company will then assess whether it will need to revise its remediation plan in order to come to an agreement with the EPA on how to proceed. The Company anticipates there could be revisions to the current remediation plan as a result of these activities and as additional information is obtained. Any revisions could be material to the operating results of any fiscal quarter or fiscal year. The Company does not expect such additional expenses would have a material adverse effect on its liquidity or financial condition.

The Company accrues the anticipated cost of environmental remediation when the obligation is probable and can be reasonably estimated. Although the Company has accrued all reasonably estimable costs associated with remediation of the site, it is expected that additional testing and environmental monitoring and remediation could be required in the future as part of the Company’s ongoing discussions with the EPA regarding the development and implementation of the remedial action plans. In addition, the current investigation has not yet been completed and does not include all potentially affected areas on the site. Due to the current stage of discussions with the EPA and the uncertainty of the remediation actions that may be required with respect to these affected areas, the Company believes that meaningful estimates of costs or range of costs cannot currently be made and accordingly have not been accrued.

18

Table of Contents

Valuation of Goodwill and Identifiable Intangible Assets

The Company’s accounting policy on valuation of goodwill and identifiable intangible assets is critical because it requires significant judgments and estimates by management and can significantly impact the Company’s consolidated results of operations and financial condition. Assessment of the potential impairment of goodwill and identifiable intangible assets is an integral part of the Company’s normal ongoing review of operations. Testing for potential impairment of these assets is significantly dependent on numerous assumptions and reflects management’s best estimates at a particular point in time. The dynamic economic environments in which the Company’s businesses operate and key economic and business assumptions related to projected selling prices, market growth, inflation rates and operating expense ratios, can significantly affect the outcome of impairment tests. Estimates based on these assumptions may differ significantly from actual results. Changes in factors and assumptions used in assessing potential impairments can have a significant impact on the existence and magnitude of impairments, as well as the time in which such impairments are recognized.

Goodwill represents the excess of the purchase price over the fair value of net assets acquired in a business combination. Acquired intangible assets are recognized separately from goodwill. Goodwill and intangible assets with indefinite useful lives are tested for impairment at least annually at August 31 and whenever triggering events or changes in circumstances indicate its carrying value may not be recoverable. The Company performs the impairment analysis at the reporting unit level using a two-step impairment test. Fair value is typically estimated using a discounted cash flow analysis, which requires the Company to estimate the future cash flows anticipated to be generated by the particular assets being tested for impairment as well as to select a discount rate to measure the present value of the anticipated cash flows. When determining future cash flow estimates, the Company considers historical results adjusted to reflect current and anticipated operating conditions. Estimating future cash flows requires significant judgment and assumptions by management in such areas as future economic conditions, industry-specific conditions, product pricing, and necessary capital expenditures. To the extent that the reporting unit is unable to achieve these assumptions, impairment losses may emerge. The Company updated its impairment evaluation of goodwill and intangible assets with indefinite useful lives at August 31, 2013.

The estimated fair value of each of the Company’s reporting units exceeded the respective carrying values by more than 10 percent. Accordingly, no impairment losses were indicated as a result of the annual impairment testing for fiscal years 2013, 2012, and 2011. If assumptions on discount rates and future cash flows change as a result of events or circumstances, and the Company believes that the long-term profitability may have declined in value, then the Company may record impairment charges, resulting in lower profits. Sales and profitability of each of the Company’s reporting units may fluctuate from year to year and within a year. In the evaluation of the fair value of reporting units, the Company looks at the long-term prospects for the reporting unit and recognizes that current performance may not be the best indicator of future prospects or value, which requires management judgment.

Indefinite life intangible assets primarily consist of tradenames/trademarks. The fair value of these assets are determined using a “relief from royalty” analysis that determines the fair value of each trademark through use of a discounted cash flow model that incorporates an estimated “royalty rate” the Company would be able to charge a third party for the use of the particular trademark. When determining the future cash flow estimates, the Company must estimate future net sales and a fair market royalty rate for each applicable tradename at an appropriate discount rate to measure the present value of the anticipated cash flows. Estimating future net sales requires significant judgment by management in such areas as future economic conditions, industry-specific conditions, product pricing, and consumer trends.

19

Table of Contents

Executive Overview

Operating revenues for the year ended August 31, 2013 increased by 25 percent to $690.8 million compared with $551.3 million for the year ended August 31, 2012. The trend for fiscal 2013 included higher demand for irrigation systems stimulated by positive drivers in the agricultural economy and lower demand for infrastructure products due to government funding issues and project delays. The record sales in U.S. and international irrigation markets have led to record results driven by positive farmer sentiment toward capital investments, increased farm income, and concern over drought conditions. As drought conditions in the 2012 growing season across the U.S. pushed commodity prices higher, the recognition of the importance of efficient, mechanical irrigation rose, creating greater demand for irrigation equipment in fiscal 2013.

Gross margin was 28.2 percent for fiscal 2013 compared to 26.9 percent for the prior fiscal year as higher gross margins were realized in the irrigation segment, while infrastructure gross margins were relatively flat year over year. Irrigation segment gross margins increased by 1.0 percentage point primarily due to a strong pricing environment combined with increased manufacturing productivity and leverage.

Net earnings were $70.6 million or $5.47 per diluted share for the year ended August 31, 2013 compared with $43.3 million or $3.38 per diluted share for the same prior year period. The prior year period included a $7.2 million accrual for environmental remediation at the Company’s Lindsay, Nebraska facility, which lowered earnings by $0.37 per diluted share.

Market Conditions and Outlook

Farm commodity prices declined during the fourth quarter of fiscal 2013 on indications of strong yields in the current growing season and a decreasing impact of drought conditions in the U.S. Corn Belt. Despite these influences, order volumes remained high by historical fourth quarter standards, although less than those during the same time of the prior year. As of August 27, 2013, the U.S. Department of Agriculture (“USDA”) forecasted U.S. 2013 net farm income to be $120.6 billion, which would be the highest on record and 63 percent higher than the ten-year average. At this point, the Company believes farmer sentiment regarding capital goods purchases is becoming more conservative than in fiscal 2013 due to lower commodity prices and the anticipated expiration of the Section 179 tax deduction, but this shift in sentiment is offset in part by strong balance sheets and high net farm income. Irrigation equipment demand for 2014 and beyond is currently unclear and will be driven by farmer sentiment and influenced by weather conditions, commodity prices, stock-to-use ratios, and farm income potential. Demand for the Company’s irrigation equipment is closely aligned with net farm income and commodity prices and can fluctuate significantly on a quarterly or annual basis. Changing farm subsidies and capital investment tax benefits by the U.S. federal government may positively or adversely impact irrigation equipment demand.

The Company believes the most significant opportunities for growth over the next several years are in international markets, where irrigation use is significantly less developed, and demand is driven primarily by food security, water scarcity and population growth. In most of these international markets, mechanized irrigation represents substantial yield enhancement opportunities, while still having minimal market penetration. While the irrigation revenues in the developing regions are more variable and project based, they represent substantial long-term growth opportunities, facilitated by the Company’s global presence.

Infrastructure demand, including for Road Zipper SystemTM projects, has proven to be challenging due to constricted government funding and project delays. The infrastructure segment continues to experience revenue and profit volatility due to the project nature of the Road Zipper SystemsTM and the fixed nature of some operating expenses. The Company believes in the opportunity for Road Zipper SystemsTM to drive significant profitability over the long term as a superior solution to worldwide traffic congestion, lost productivity and energy waste.

Although the environment for infrastructure sales continues to be constrained by longer-term funding uncertainty, the Company remains focused on taking appropriate actions to rationalize its cost base and improve sales and marketing activities to improve profitability if and when the market eventually strengthens. The Company does not anticipate a strong turnaround in government infrastructure spending in fiscal 2014. However, the Company believes it has sizeable market penetration opportunities for road safety products and Road Zipper SystemsTM in the future. Demand for the Company’s transportation safety products continues to be driven by population growth and the need for improved road safety.

20

Table of Contents

As of August 31, 2013, the Company has an order backlog of $66.5 million compared with $57.1 million at August 31, 2012. The increase in current year backlog from August 31, 2012 reflects $4.7 million carryover volume from the Iraq order announced in the second fiscal quarter. Backlog has increased year over year in international irrigation and infrastructure, while backlog in U.S. irrigation has decreased. The Company’s backlog can fluctuate from period to period due to the seasonality, cyclicality, timing and execution of contracts. Typically, the Company’s backlog at any point in time represents only a portion of the revenue it expects to realize during the following three month period. However, the timing related to certain project oriented contracts may extend longer than three months.

For the business overall, the global, long-term drivers of water conservation, population growth, increasing importance of biofuels, and the need for safer, more efficient transportation solutions remain positive. The Company is focused on seeking accretive, synergistic acquisitions. The Company is committed to creating value for shareholders through multiple strategies, including continual investment in core businesses, strategic acquisitions, dividends and share repurchases.

Results of Operations

The following “Fiscal 2013 Compared to Fiscal 2012” and the “Fiscal 2012 Compared to Fiscal 2011” sections present an analysis of the Company’s consolidated operating results displayed in the Consolidated Statements of Operations and should be read together with the information in Note Q, Industry Segment Information, to the consolidated financial statements.

Fiscal 2013 Compared to Fiscal 2012

The following table provides highlights for fiscal 2013 compared with fiscal 2012: