On September 1, 2022, Starbucks announced that Laxman Narasimhan would become Starbucks next ceo following a six-month immersion program pursuant to which, among other things, he visited stores, trained and worked as a barista, visited manufacturing plants and coffee farms, and engaged with partners.

On September 13, 2022, at Starbucks 2022 Investor Day, Starbucks provided an in-depth review of its recently announced Reinvention Plan, which contemplated targeted investments in partners, customers, and stores to enhance store sales and store count growth and expand margins. As a core part of this plan, Starbucks also introduced various initiatives to improve the partner experience, including expanded tipping, new well-being benefits, investments in store managers, such as new leadership trainings, and investments in equipment and technology designed to improve the partner experience.

On March 20, 2023, Starbucks announced, effective on such date, that Mr. Narasimhan had assumed the role of ceo.

On March 23, 2023, as part of the board’s ongoing refreshment process, each of Isabel Ge Mahe, Clara Shih, and Joshua Cooper Ramo were not renominated for election at the 2023 Annual Meeting. At the 2023 Annual Meeting on March 23, 2023, Beth Ford and Mr. Narasimhan were each elected to the board.

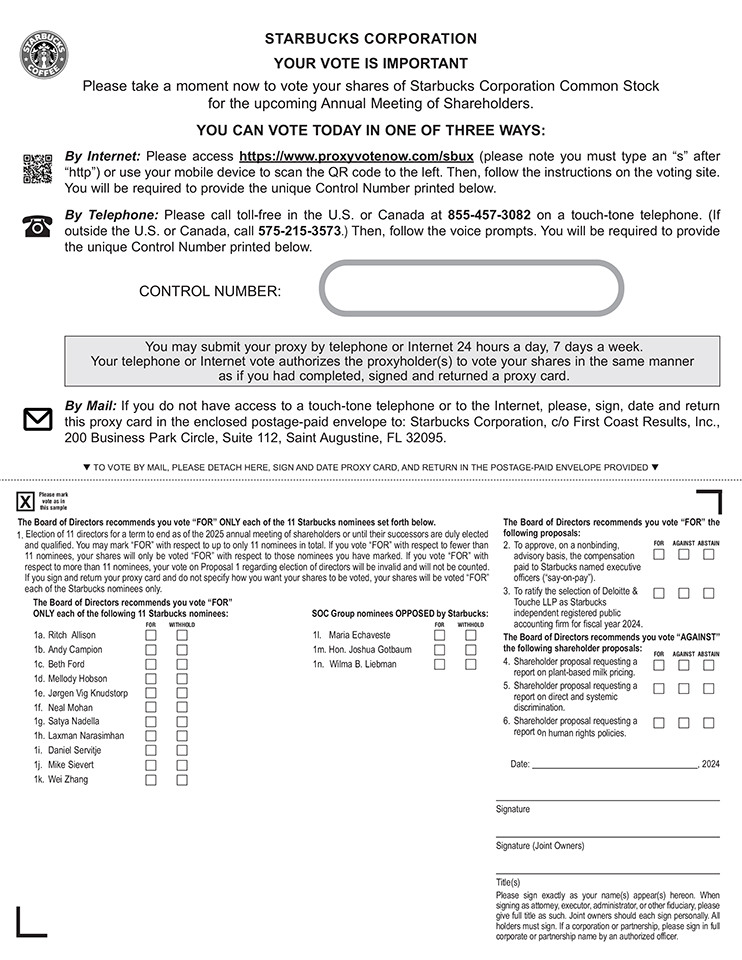

At the 2023 Annual Meeting, proponents of a shareholder proposal (the “assessment proposal”) requested that the board commission and oversee an independent, third-party assessment of Starbucks adherence to its stated commitment to workers’ freedom of association and collective bargaining rights (such requested assessment, the “FOA/CB Assessment”). The board recommended against the assessment proposal, citing Starbucks historic investments and commitment to partners and ongoing efforts to improve partner relations and Starbucks then-current intention to undertake such a review and report as part of its Human Rights Impact Assessment. The assessment proposal passed at the 2023 Annual Meeting. The board appreciated, took seriously, and promptly undertook to follow through on the assessment proposal. As contemplated by the assessment proposal, the board engaged an independent, third-party assessor to conduct the FOA/CB Assessment. The Nominating/Governance Committee, the board, the ceo and management team, and our legal, labor relations, and communications teams, each fully cooperated with and supported the efforts of the third-party assessor, including by providing significant access to public and non-public documents and personnel.

Also at the 2023 Annual Meeting, shareholders considered a shareholder proposal supported by SOC requesting that the board amend its Corporate Governance Principles and Practices for the Board of Directors (the “Governance Principles”) to revise its ceo succession planning policy (the “SOC succession planning proposal”). Following engagement with SOC, and substantial incorporation of its proposed changes to the Governance Principles, the board recommended against the SOC succession planning proposal. The SOC succession planning proposal was not approved by shareholders at the 2023 Annual Meeting.

As stated in our 2023 proxy statement:

In furtherance of ongoing board refreshment, the Nominating and Corporate Governance Committee is currently engaged in an ongoing recruitment process, with Beth Ford, the chief executive officer of Land O Lakes, being nominated to stand for election as a director at the 2023 annual meeting of shareholders. The board is committed to ensuring that it remains composed of directors who are equipped to oversee the success of the business, striving to maintain an appropriate balance of diversity, skills, and tenure in its composition, and intends to increase its gender diversity over the next few years.

The board has also sought to increase its size consistent with the size of boards at similarly significant, international, and complex public companies. In furtherance of these efforts, following the 2023 Annual Meeting and prior to any outreach from SOC or its representatives regarding the SOC Group’s nomination of three director candidates, the board, working with its consultants, identified and reviewed more than 200 potential candidates for nomination to the board. Following a selection and screening process overseen by Jørgen Vig Knudstorp, chair of the Nominating/Governance Committee, certain members of the board met with more than 20 of the potential directors so identified, including Neal Mohan, Daniel Servitje, and Mike Sievert. Following Starbucks receipt of the SOC nomination on November 21, 2023, and in light of the organizational and logistical details related to appointing new directors, the Nominating/Governance Committee and board postponed definitive action on board appointments and nominations for election to the board at the Annual Meeting while evaluating the SOC Group Nominees’ candidacy and addressing such organizational and logistical details.

On September 13, 2023, Starbucks announced that Howard Schultz was resigning from the board, effective as of such date, and that Wei Zhang, an independent director, had been appointed to the board, effective as of October 1, 2023, which is the date on which Ms. Zhang joined the board.

On September 27, 2023, representatives of SOC submitted to Starbucks a shareholder proposal for consideration at the Annual Meeting. This proposal requested that Starbucks amend its bylaws to eliminate indemnification of Starbucks directors and officers if such persons were named in an action undertaken by the NLRB or by any other actor pursuant to or entailing alleged violations of the National Labor Relations Act, except as otherwise ordered by a court, mandated by certain provisions of Washington state law, or required by the Starbucks articles of incorporation (the “SOC 2024 bylaw proposal”).

Following receipt of the SOC 2024 bylaw proposal, Starbucks submitted a “no-action” letter to the SEC seeking to exclude the SOC 2024 bylaw proposal from the 2024 proxy statement on the grounds that the requested bylaw amendment was vague and indefinite and would cause Starbucks to violate Washington law.

|

|

|

|

|

| 11 |

|

STARBUCKS 2024 PROXY |

|

PROXY SUMMARY |

| |

|

|

|

|