UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

[X] |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

|

For the quarterly period ended September 30, 2018 |

or

|

[ ] |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

|

For the transition period from ________ to ________ |

Commission File Number 001-35929

National Research Corporation

(Exact name of Registrant as specified in its charter)

|

Wisconsin |

|

47-0634000 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

|

incorporation or organization) |

|

Identification No.) |

|

|

1245 Q Street, Lincoln, Nebraska 68508 |

|

|

|

(Address of principal executive offices) (Zip Code) |

|

|

|

(402) 475-2525 |

|

|

|

(Registrant’s telephone number, including area code) |

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

Accelerated filer |

☒ |

|

Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

|

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.)

Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock as of the latest practicable date.

Common Stock, $.001 par value, outstanding as of October 26, 2018: 24,762,212

FORM 10-Q INDEX

For the Quarter Ended September 30, 2018

|

|

|

Page No. |

|

|

|

|

|

|

|

PART I. |

|

||

|

|

|

|

|

|

|

Item 1. |

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

5 |

|

|

|

|

6 |

|

|

|

|

7 |

|

|

|

|

8 |

|

|

|

|

9-22 |

|

|

|

|

|

|

|

|

Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

23-29 |

|

|

|

|

|

|

|

Item 3. |

30 |

|

|

|

|

|

|

|

|

Item 4. |

30 |

|

|

|

|

|

|

|

PART II. |

|||

|

|

|

|

|

|

|

Item 1. |

31 |

|

|

|

|

|

|

|

|

Item 1A. |

31 |

|

|

|

|

|

|

|

|

Item 2. |

31 |

|

|

|

|

|

|

|

|

Item 6. |

32 |

|

|

|

|

|

|

|

|

33 |

||

Special Note Regarding Forward-Looking Statements

Certain matters discussed in this Quarterly Report on Form 10-Q are “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements can generally be identified as such because the context of the statement includes phrases such as National Research Corporation, doing business as NRC Health (“NRC Health,” the “Company,” “we,” “our,” “us” or similar terms), “believes,” “expects,” or other words of similar import. Similarly, statements that describe the Company’s future plans, objectives or goals are also forward-looking statements. Such forward-looking statements are subject to certain risks and uncertainties which could cause actual results or outcomes to differ materially from those currently anticipated. Factors that could affect actual results or outcomes include, without limitation, the following factors:

|

|

● |

The possibility of non-renewal of the Company’s client service contracts and retention of key clients; |

|

|

● |

The Company’s ability to compete in its markets, which are highly competitive, and the possibility of increased price pressure and expenses; |

|

|

● |

The effects of an economic downturn; |

|

|

● |

The impact of consolidation in the healthcare industry; |

|

|

● |

The impact of federal healthcare reform legislation or other regulatory changes; |

|

|

● |

The Company’s ability to attract and retain key managers and other personnel; |

|

|

● |

The possibility that the Company’s intellectual property and other proprietary information technology could be copied or independently developed by its competitors; |

|

|

● |

The possibility that the Company could be subject to security breaches or computer viruses; and |

|

|

● |

The factors set forth under the caption “Risk Factors” in Part I, Item 1A of the Company’s Annual Report on Form 10-K for the year ended December 31, 2017, as such section may be updated or supplemented by Part II, Item 1A of the Company’s subsequently filed Quarterly Reports on Form 10-Q (including this Report). |

Shareholders, potential investors and other readers are urged to consider these and other factors in evaluating the forward-looking statements, and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements included are only made as of the date of this Quarterly Report on Form 10-Q and the Company undertakes no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances except as required by the federal securities laws.

PART I – Financial Information

NATIONAL RESEARCH CORPORATION AND SUBSIDIARY

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share amounts and par value)

|

September 30, 2018 |

December 31, 2017 |

|||||||

|

(unaudited) |

||||||||

|

Assets |

||||||||

|

Current assets: |

||||||||

|

Cash and cash equivalents |

$ | 7,273 | $ | 34,733 | ||||

|

Trade accounts receivable, less allowance for doubtful accounts of $197 and $200, respectively |

16,544 | 14,806 | ||||||

|

Prepaid expenses |

3,674 | 2,310 | ||||||

|

Income taxes receivable |

1,001 | 375 | ||||||

|

Other current assets |

278 | 35 | ||||||

|

Total current assets |

28,770 | 52,259 | ||||||

|

Net property and equipment |

14,269 | 12,359 | ||||||

|

Intangible assets, net |

2,260 | 2,764 | ||||||

|

Goodwill |

57,955 | 58,021 | ||||||

|

Deferred contract costs, net |

3,371 | -- | ||||||

|

Other |

2,092 | 1,913 | ||||||

|

Total assets |

$ | 108,717 | $ | 127,316 | ||||

|

Liabilities and Shareholders’ Equity |

||||||||

|

Current liabilities: |

||||||||

|

Current portion of notes payable |

$ | 3,623 | $ | 1,067 | ||||

|

Accounts payable |

839 | 593 | ||||||

|

Accrued wages, bonus and profit sharing |

4,586 | 6,597 | ||||||

|

Accrued expenses |

3,266 | 2,882 | ||||||

|

Current portion of capital lease obligations |

202 | 71 | ||||||

|

Income taxes payable |

70 | -- | ||||||

|

Dividends payable |

4,209 | 4,222 | ||||||

|

Deferred revenue |

18,642 | 16,878 | ||||||

|

Total current liabilities |

35,437 | 32,310 | ||||||

|

Notes payable, net of current portion |

35,109 | - | ||||||

|

Deferred income taxes |

6,599 | 4,030 | ||||||

|

Other long term liabilities |

1,433 | 935 | ||||||

|

Total liabilities |

78,578 | 37,275 | ||||||

|

Shareholders’ equity: |

||||||||

|

Preferred stock, $0.01 par value, authorized 2,000,000 shares, none issued |

-- | -- | ||||||

|

Common Stock (formerly Class A), $0.001 par value; authorized 60,000,000 shares, issued 29,830,307 in 2018 and 25,835,230 in 2017, outstanding 24,762,212 in 2018 and 20,936,703 in 2017 |

30 | 26 | ||||||

|

Class B Common stock, $0.001 par value; 4,319,256 issued and 3,535,238 outstanding in 2017 |

-- | 4 | ||||||

|

Additional paid-in capital |

156,384 | 51,025 | ||||||

|

Retained earnings (accumulated deficit) |

(97,027 |

) |

77,574 | |||||

|

Accumulated other comprehensive (loss) income |

(2,053 |

) |

(1,635 |

) |

||||

|

Treasury stock, at cost; 5,068,095 Common (formerly Class A) shares in 2018 and 4,898,527 in 2017 and 784,018 Class B shares in 2017 |

(27,195 |

) |

(36,953 |

) |

||||

|

Total shareholders’ equity |

30,139 | 90,041 | ||||||

|

Total liabilities and shareholders’ equity |

$ | 108,717 | $ | 127,316 | ||||

See accompanying notes to condensed consolidated financial statements

NATIONAL RESEARCH CORPORATION AND SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(In thousands, except for per share amounts, unaudited)

|

Three months ended |

Nine months ended |

|||||||||||||||

|

2018 |

2017 |

2018 |

2017 |

|||||||||||||

|

Revenue |

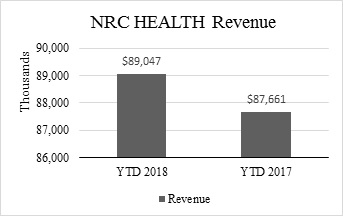

$ | 30,013 | $ | 28,951 | $ | 89,047 | $ | 87,661 | ||||||||

|

Operating expenses: |

||||||||||||||||

|

Direct |

11,780 | 12,267 | 35,685 | 36,706 | ||||||||||||

|

Selling, general and administrative |

7,679 | 8,430 | 23,486 | 22,021 | ||||||||||||

|

Depreciation and amortization |

1,388 | 1,132 | 3,996 | 3,376 | ||||||||||||

|

Total operating expenses |

20,847 | 21,829 | 63,167 | 62,103 | ||||||||||||

|

Operating income |

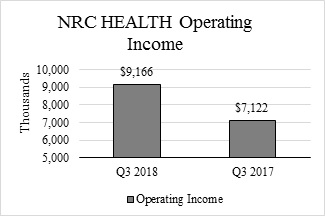

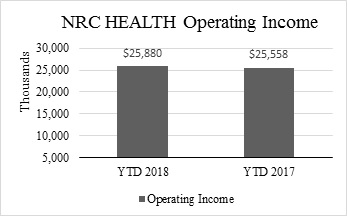

9,166 | 7,122 | 25,880 | 25,558 | ||||||||||||

|

Other income (expense): |

||||||||||||||||

|

Interest income |

3 | 29 | 57 | 58 | ||||||||||||

|

Interest expense |

(544 |

) |

(18 |

) |

(990 |

) |

(68 |

) |

||||||||

|

Other, net |

(242 |

) |

40 | 222 | 76 | |||||||||||

|

Total other (expense) income |

(783 |

) |

51 | (711 |

) |

66 | ||||||||||

|

Income before income taxes |

8,383 | 7,173 | 25,169 | 25,624 | ||||||||||||

|

Provision for income taxes |

1,391 | 3,020 | 2,923 | 9,198 | ||||||||||||

|

Net income |

$ | 6,992 | $ | 4,153 | $ | 22,246 | $ | 16,426 | ||||||||

|

Earnings Per Share of Common Stock: |

||||||||||||||||

|

Basic Earnings Per Share: |

||||||||||||||||

|

Common (formerly Class A) |

$ | 0.28 | $ | 0.10 | $ | 0.76 | $ | 0.39 | ||||||||

|

Class B |

$ | -- | $ | 0.59 | $ | 1.31 | $ | 2.34 | ||||||||

|

Diluted Earnings Per Share: |

||||||||||||||||

|

Common (formerly Class A) |

$ | 0.27 | $ | 0.09 | $ | 0.73 | $ | 0.38 | ||||||||

|

Class B |

$ | -- | $ | 0.57 | $ | 1.27 | $ | 2.28 | ||||||||

|

Dividends Per Share of Common Stock: |

||||||||||||||||

|

Common (formerly Class A) |

$ | 0.17 | $ | 0.10 | $ | 0.44 | $ | 0.30 | ||||||||

|

Class B |

$ | -- | $ | 0.60 | $ | 0.60 | $ | 1.80 | ||||||||

|

Weighted average shares and share equivalents outstanding: |

||||||||||||||||

|

Common (formerly Class A) – basic |

24,671 | 20,788 | 23,184 | 20,759 | ||||||||||||

|

Class B – basic |

-- | 3,514 | 3,527 | 3,514 | ||||||||||||

|

Common (formerly Class A) – diluted |

25,526 | 21,740 | 24,083 | 21,537 | ||||||||||||

|

Class B – diluted |

-- | 3,620 | 3,628 | 3,595 | ||||||||||||

See accompanying notes to condensed consolidated financial statements

NATIONAL RESEARCH CORPORATION AND SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(In thousands, unaudited)

|

Three months ended |

Nine months ended September 30, |

|||||||||||||||

|

2018 |

2017 |

2018 |

2017 |

|||||||||||||

|

Net income |

$ | 6,992 | $ | 4,153 | $ | 22,246 | $ | 16,426 | ||||||||

|

Other comprehensive income: |

||||||||||||||||

|

Foreign currency translation adjustment |

280 | 599 | (418 |

) |

1,098 | |||||||||||

|

Other comprehensive income |

$ | 280 | $ | 599 | $ | (418 |

) |

$ | 1,098 | |||||||

|

Comprehensive Income |

$ | 7,272 | $ | 4,752 | $ | 21,828 | $ | 17,524 | ||||||||

See accompanying notes to condensed consolidated financial statements.

NATIONAL RESEARCH CORPORATION AND SUBSIDIARY

CONDENSED Consolidated Statements of Shareholders’ Equity

(In thousands, except share and per share amounts, unaudited)

|

Common (formerly Class A) |

Class B Common |

Additional |

Retained (Accumulated deficit) |

Accumulated Other |

Treasury Stock |

Total |

||||||||||||||||||||||

|

Balances at December 31, 2017 |

$ | 26 | $ | 4 | $ | 51,025 | $ | 77,574 | $ | (1,635 |

) |

$ | (36,953 |

) |

$ | 90,041 | ||||||||||||

|

Purchase of 169,568 shares of class A and 3,677 shares of class B treasury stock |

-- | -- | -- | -- | -- | (6,141 |

) |

(6,141 |

) |

|||||||||||||||||||

|

Issuance of 380,958 class A common shares and 9,296 class B common shares for the exercise of stock options |

-- | -- | 5,429 | -- | -- | -- | 5,429 | |||||||||||||||||||||

|

Issuance of restricted common shares, net of forfeitures (3,496 class A shares) |

-- | -- | -- | -- | -- | -- | -- | |||||||||||||||||||||

|

Non-cash stock compensation expense |

-- | -- | 1,255 | -- | -- | -- | 1,255 | |||||||||||||||||||||

|

Settlement of restricted common shares and stock options in connection with Recapitalization for cash of $3,271 and 90,369 class A common shares |

- | -- | (2,548 |

) |

-- | -- | (723 |

) |

(3,271 |

) |

||||||||||||||||||

|

Settlement of class B common shares in connection with Recapitalization (3,527,246 class B common shares exchanged for $69,099 cash and 3,527,246 class A common shares) |

4 | -- | 118,335 | -- | -- | (187,438 |

) |

(69,099 |

) |

|||||||||||||||||||

|

Retirement of class B common shares in connection with Recapitalization (retirement of 4,328,552 class B common shares) |

-- | (4 |

) |

(17,112 |

) |

(186,944 |

) |

-- | 204,060 | -- | ||||||||||||||||||

|

Dividends declared of $0.44 and $0.60 per A and B common share, respectively |

-- | -- | -- | (12,638 |

) |

-- | -- | (12,638 |

) |

|||||||||||||||||||

|

Cumulative effect adjustment for adoption of ASC 606 |

-- | -- | -- | 2,735 | -- | -- | 2,735 | |||||||||||||||||||||

|

Other comprehensive income, foreign currency translation adjustment |

-- | -- | -- | -- | (418 |

) |

-- | (418 |

) |

|||||||||||||||||||

|

Net income |

-- | -- | -- | 22,246 | -- | -- | 22,246 | |||||||||||||||||||||

|

Balances at September 30, 2018 |

$ | 30 | $ | -- | $ | 156,384 | $ | (97,027 |

) |

$ | (2,053 |

) |

$ | (27,195 |

) |

$ | 30,139 | |||||||||||

See accompanying notes to condensed consolidated financial statements.

NATIONAL RESEARCH CORPORATION AND SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands, unaudited)

|

Nine months ended |

||||||||

|

September 30, |

||||||||

|

2018 |

2017 |

|||||||

|

Cash flows from operating activities: |

||||||||

|

Net income |

$ | 22,246 | $ | 16,426 | ||||

|

Adjustments to reconcile net income to net cash provided by operating activities: |

||||||||

|

Depreciation and amortization |

3,996 | 3,376 | ||||||

|

Deferred income taxes |

1,775 | 184 | ||||||

|

Reserve for uncertain tax positions |

(297 |

) |

112 | |||||

|

Non-cash share-based compensation expense |

1,255 | 1,273 | ||||||

|

Loss on disposal of property and equipment |

212 | -- | ||||||

|

Net changes in assets and liabilities: |

||||||||

|

Trade accounts receivable |

(1,842 |

) |

(2,298 |

) |

||||

|

Prepaid expenses and other current assets |

(1,632 |

) |

(1,274 |

) |

||||

|

Deferred contract costs, net |

1 | -- | ||||||

|

Accounts payable |

147 | (108 |

) |

|||||

|

Accrued expenses, wages, bonuses and profit sharing |

(1,310 |

) |

(293 |

) |

||||

|

Income taxes receivable and payable |

(554 |

) |

1,157 | |||||

|

Deferred revenue |

1,939 | 2,925 | ||||||

|

Net cash provided by operating activities |

25,936 | 21,480 | ||||||

|

Cash flows from investing activities: |

||||||||

|

Purchases of equity investment |

-- | (1,300 |

) |

|||||

|

Purchases of intangible Content License |

-- | (250 |

) |

|||||

|

Purchases of property and equipment |

(4,858 |

) |

(3,347 |

) |

||||

|

Net cash used in investing activities |

(4,858 |

) |

(4,897 |

) |

||||

|

Cash flows from financing activities: |

||||||||

|

Payments related to Recapitalization |

(72,370 |

) |

-- | |||||

|

Proceeds from issuance of note payable |

40,000 | -- | ||||||

|

Borrowings on line of credit |

2,500 | -- | ||||||

|

Payments on line of credit |

(2,500 |

) |

-- | |||||

|

Payment of debt issuance costs |

(187 |

) |

-- | |||||

|

Payments on notes payable |

(2,170 |

) |

(1,847 |

) |

||||

|

Payments on capital lease obligations |

(104 |

) |

(81 |

) |

||||

|

Payment of employee payroll tax withholdings on share-based awards exercised |

(712 |

) |

(105 |

) |

||||

|

Payment of dividends on common stock |

(12,650 |

) |

(12,649 |

) |

||||

|

Net cash used in financing activities |

(48,193 |

) |

(14,682 |

) |

||||

|

Effect of exchange rate changes on cash |

(345 |

) |

828 | |||||

|

Change in cash and cash equivalents |

(27,460 |

) |

2,729 | |||||

|

Cash and cash equivalents at beginning of period |

34,733 | 33,021 | ||||||

|

Cash and cash equivalents at end of period |

$ | 7,273 | $ | 35,750 | ||||

|

Supplemental disclosure of cash paid for: |

||||||||

|

Interest, net of capitalized amounts |

$ | 767 | $ | 65 | ||||

|

Income taxes |

$ | 2,017 | $ | 7,749 | ||||

|

Supplemental disclosure of non-cash investing and financing activities: |

||||||||

|

Common stock (formerly class A) issued in the Recapitalization in exchange for then-existing class B shares and options. |

$ | 121,371 | $ | -- | ||||

|

Capital lease obligations originated for property and equipment |

$ | 879 | $ | 74 | ||||

|

Stock tendered to the Company for cashless exercise of stock options in connection with equity incentive plans |

$ | 5,429 | $ | 2,123 | ||||

See accompanying notes to condensed consolidated financial statements.

NATIONAL RESEARCH CORPORATION AND SUBSIDIARY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

1. |

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Description of business and basis of presentation

National Research Corporation, doing business as NRC Health (“NRC Health,” the “Company,” “we,” “our,” “us” or similar terms), is a leading provider of analytics and insights that facilitate measurement and improvement of the patient and employee experience while also increasing patient engagement and customer loyalty for healthcare providers, payers and other healthcare organizations in the United States and Canada.

The Company’s six operating segments are aggregated into one reporting segment because they have similar economic characteristics and meet the other aggregation criteria from the Financial Accounting Standards Board (“FASB”) guidance on segment disclosure. The six operating segments are Experience, The Governance Institute, Market Insights, Transparency, NRC Health Canada and Transitions (formerly Connect), which offer a portfolio of solutions that address specific needs around market insight, experience, transparency and governance for healthcare providers, payers and other healthcare organizations.

The condensed consolidated balance sheet of the Company at December 31, 2017 was derived from the Company’s audited consolidated balance sheet as of that date. All other financial statements contained herein are unaudited and, in the opinion of management, include all adjustments (consisting only of normal recurring adjustments) the Company considers necessary for a fair presentation of financial position, results of operations and cash flows in accordance with accounting principles generally accepted in the United States.

Information and footnote disclosures included in financial statements prepared in accordance with accounting principles generally accepted in the United States have been condensed or omitted. These condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and notes thereto that are included in the Company’s Form 10-K for the year ended December 31, 2017, filed with the Securities and Exchange Commission (the “SEC”) on March 14, 2018.

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

The condensed consolidated financial statements include the accounts of the Company and its wholly-owned subsidiary, National Research Corporation Canada, doing business as NRC Health Canada. All significant intercompany transactions and balances have been eliminated.

The Company’s Canadian subsidiary uses as its functional currency the local currency of the country in which it operates. It translates its assets and liabilities into U.S. dollars at the exchange rate in effect at the balance sheet date. It translates its revenue and expenses at the average exchange rate during the period. The Company includes translation gains and losses in accumulated other comprehensive income (loss), a component of shareholders’ equity. Gains and losses related to transactions denominated in a currency other than the functional currency of the country in which the Company operates and short-term intercompany accounts are included in other income (expense) in the consolidated statements of income.

Revenue Recognition

On January 1, 2018, the Company adopted Accounting Standards Update (“ASU”) 2014-09, Revenue- Revenue from Contracts with Customers and all related amendments (“ASC 606” or “new revenue standard”) using the modified retrospective method for all incomplete contracts as of the date of adoption. The Company applied the practical expedient to reflect the total of all contract modifications occurring before January 1, 2018 in the transaction price and performance obligations at transition rather than accounting for each modification separately. Results for reporting periods beginning on or after January 1, 2018 are presented under ASC 606, while prior period amounts are not adjusted and continue to be reported under the accounting standards in effect for the prior period. As discussed in more detail below and under “Deferred Contract Costs”, the largest impact of implementing the new revenue standard was the deferral and amortization of direct and incremental costs of obtaining contracts. In addition, there were other revisions to the revenue recognition primarily related to performance obligation determinations and estimating variable consideration. The Company recorded a transition adjustment of approximately $2.7 million, net of $814,000 of tax, to the opening balance of retained earnings.

The Company derives a majority of its revenues from its annually renewable subscription-based service agreements with its customers, which include performance measurement and improvement services, healthcare analytics and governance education services. Such agreements are generally cancelable on short or no notice without penalty. See Note 3 for further information about the Company's contracts with customers. Under ASC 606, the Company accounts for revenue using the following steps:

|

|

● |

Identify the contract, or contracts, with a customer |

|

|

● |

Identify the performance obligations in the contract |

|

|

● |

Determine the transaction price |

|

|

● |

Allocate the transaction price to the identified performance obligations |

|

|

● |

Recognize revenue when, or as, the Company satisfies the performance obligations. |

The Company’s revenue arrangements with a client may include combinations of more than one service offering which may be executed at the same time, or within close proximity of one another. The Company combines contracts with the same customer into a single contract for accounting purposes when the contract is entered into at or near the same time and the contracts are negotiated together. For contracts that contain more than one separately identifiable performance obligation, the total transaction price is allocated to the identified performance obligations based upon the relative stand-alone selling prices of the performance obligations. The stand-alone selling prices are based on an observable price for services sold to other comparable customers, when available, or an estimated selling price using a cost-plus margin or residual approach. The Company estimates the amount of total contract consideration it expects to receive for variable arrangements based on the most likely amount it expects to earn from the arrangement based on the expected quantities of services it expects to provide and the contractual pricing based on those quantities. The Company only includes some or a portion of variable consideration in the transaction price when it is probable that a significant reversal in the amount of cumulative revenue recognized will not occur. The Company considers the sensitivity of the estimate, its relationship and experience with the client and variable services being performed, the range of possible revenue amounts and the magnitude of the variable consideration to the overall arrangement.

Prior to 2018, total contract consideration was allocated to each separate unit of accounting that was separately sold by the Company or a competitor, based on relative selling price using a selling price hierarchy: vendor-specific objective evidence (“VSOE”), if available, third-party evidence (“TPE”) if VSOE was not available, or estimated selling price if VSOE nor TPE was available. VSOE was established based on the services normal selling prices and discounts for the specific services when sold separately. TPE was established by evaluating similar competitor services in standalone arrangements. If neither existed for a deliverable, the best estimate of the selling price (“ESP”) was used for that deliverable based on list price, representing a component of management’s market strategy, and an analysis of historical prices for bundled and standalone arrangements. Revenue allocated to an element was limited to revenue that was not subject to refund or otherwise represented contingent revenue.

The Company’s arrangements with customers consist principally of four different types of arrangements: 1) subscription-based service agreements; 2) one-time specified services performed at a single point in time; 3) fixed, non-subscription service agreements; and 4) unit-priced service agreements.

Subscription-based services - Services that are provided under subscription-based service agreements are usually for a twelve month period and represent a single promise to stand ready to provide reporting, tools and services throughout the subscription period as requested by the customer. These agreements are renewable at the option of the customer at the completion of the initial contract term for an agreed upon price increase each year. These agreements represent a series of distinct monthly services that are substantially the same, with the same pattern of transfer to the customer as the customer receives and consumes the benefits throughout the contract period. Accordingly, subscription services are recognized ratably over the subscription period. Subscription services are typically billed annually in advance but may also be billed on a quarterly and monthly basis.

One-time services – These agreements typically require the Company to perform a specific one-time service in a particular month. The Company is entitled to fixed payment upon completion of the service. Under these arrangements, the Company recognizes revenue at the point in time the service is completed by the Company and accepted by the customer.

Fixed, non-subscription services – These arrangements typically require the Company to perform an unspecified amount of services for a fixed price during a fixed period of time. Revenues are recognized over time based upon the costs incurred to date in relation to the total estimated contract costs. In determining cost estimates, management uses historical and forecasted cost information which is based on estimated volumes, external and internal costs and other factors necessary in estimating the total costs over the term of the contract. Changes in estimates are accounted for using a cumulative catch up adjustment which could impact the amount and timing of revenue for any period. Prior to 2018, these arrangements were recognized under the proportional performance method based on cost inputs, output measures or key milestones such as survey set-up, survey mailings, survey returns and reporting.

Unit-price services – These arrangements typically require the Company to perform certain services on a periodic basis as requested by the customer for a per-unit amount which is typically billed in the month following the performance of the service. Revenue under these arrangements is recognized over the time the services are performed at the per-unit amount.

The Company recognizes contract assets or unbilled receivables related to revenue recognized for services completed but not invoiced to the clients. Unbilled receivables are classified as receivables when the Company has an unconditional right to contract consideration. A contract liability is recognized as deferred revenue when we invoice clients in advance of performing the related services under the terms of a contract. Deferred revenue is recognized as revenue when we have satisfied the related performance obligation.

The following tables summarize the impact the adoption of ASC 606 had on the Company’s consolidated financial statements (in thousands, except per share data):

Consolidated balance sheet:

|

As reported September 30, 2018 |

Adjustments |

Balances without Adoption of ASC 606 |

||||||||||

|

Accounts receivable, net |

$ | 16,544 | $ | 1 | $ | 16,545 | ||||||

|

Other current assets |

278 | (68 |

) |

210 | ||||||||

|

All other current assets |

11,948 | -- | 11,948 | |||||||||

|

Total current assets |

28,770 | (67 |

) |

28,703 | ||||||||

|

Deferred contract costs |

3,371 | (3,371 |

) |

-- | ||||||||

|

All other noncurrent assets |

76,576 | -- | 76,576 | |||||||||

|

Total assets |

$ | 108,717 | $ | (3,438 |

) |

$ | 105,279 | |||||

|

Deferred revenue |

$ | 18,642 | $ | 330 | $ | 18,972 | ||||||

|

Other current liabilities |

16,795 | -- | 16,795 | |||||||||

|

Total current liabilities |

35,437 | 330 | 35,767 | |||||||||

|

Deferred income taxes |

6,599 | (865 |

) |

5,734 | ||||||||

|

Other long term liabilities |

36,542 | -- | 36,542 | |||||||||

|

Total liabilities |

78,578 | (535 |

) |

78,043 | ||||||||

|

Retained earnings |

(97,027 |

) |

(2,905 |

) |

(99,932 |

) |

||||||

|

Accumulated other comprehensive income |

(2,053 |

) |

2 | (2,051 |

) |

|||||||

|

Other stockholders’ equity |

129,219 | -- | 129,219 | |||||||||

|

Total stockholders’ equity |

30,139 | (2,903 |

) |

27,236 | ||||||||

|

Total liabilities and stockholders’ equity |

$ | 108,717 | $ | (3,438 |

) |

$ | 105,279 | |||||

Consolidated statement of income:

|

Three months ended September 30, 2018 |

Nine months ended September 30, 2018 |

|||||||||||||||||||||||

|

As reported |

Adjustments |

Balances Without Adoption of ASC 606 |

As reported |

Adjustments |

Balances Without Adoption of ASC 606 |

|||||||||||||||||||

|

Revenue |

$ | 30,013 | $ | (269 |

) |

$ | 29,744 | $ | 89,047 | $ | (221 |

) |

$ | 88,826 | ||||||||||

|

Direct expenses |

11,780 | (14 |

) |

11,766 | 35,685 | (73 |

) |

35,612 | ||||||||||||||||

|

Selling, general and administrative |

7,679 | 16 | 7,695 | 23,486 | 73 | 23,559 | ||||||||||||||||||

|

Depreciation and amortization |

1,388 | -- | 1,388 | 3,996 | -- | 3,996 | ||||||||||||||||||

|

Total operating expenses |

20,847 | 2 | 20,849 | 63,167 | -- | 63,167 | ||||||||||||||||||

|

Operating income |

9,166 | (271 |

) |

8,895 | 25,880 | (221 |

) |

25,659 | ||||||||||||||||

|

Other income (expense) |

(783 |

) |

-- | (783 |

) |

(711 |

) |

-- | (711 |

) |

||||||||||||||

|

Income before income taxes |

8,383 | (271 |

) |

8,112 | 25,169 | (221 |

) |

24,948 | ||||||||||||||||

|

Provision (benefit) for income taxes |

1,391 | (63 |

) |

1,328 | 2,923 | (51 |

) |

2,872 | ||||||||||||||||

|

Net income |

$ | 6,992 | $ | (208 |

) |

$ | 6,784 | $ | 22,246 | $ | (170 |

) |

$ | 22,076 | ||||||||||

|

Earnings per share of common stock: |

||||||||||||||||||||||||

|

Basic earnings per share: |

||||||||||||||||||||||||

|

Common (formerly Class A) |

$ | 0.28 | $ | (0.01 |

) |

$ | 0.27 | $ | 0.76 | $ | (0.01 |

) |

$ | 0.75 | ||||||||||

|

Class B |

-- | -- | -- | 1.31 | -- | 1.31 | ||||||||||||||||||

|

Diluted earnings per share: |

||||||||||||||||||||||||

|

Common (formerly Class A) |

$ | 0.27 | $ | (0.01 |

) |

$ | 0.26 | $ | 0.73 | $ | (0.01 |

) |

$ | 0.72 | ||||||||||

|

Class B |

-- | -- | -- | 1.27 | 0.01 | 1.28 | ||||||||||||||||||

Consolidated statement of comprehensive income:

|

Three months ended September 30, 2018 |

Nine months ended September 30, 2018 |

|||||||||||||||||||||||

|

As reported |

Adjustments |

Balances without adoption of ASC 606 |

As reported |

Adjustments |

Balances without adoption of ASC 606 |

|||||||||||||||||||

|

Net Income |

$ | 6,992 | $ | (208 |

) |

$ | 6,784 | $ | 22,246 | $ | (170 |

) |

$ | 22,076 | ||||||||||

|

Cumulative translation adjustment |

280 | -- | 280 | (418 |

) |

2 | (416 |

) |

||||||||||||||||

|

Comprehensive Income |

$ | 7,272 | $ | (208 |

) |

$ | 7,064 | $ | 21,828 | $ | (168 |

) |

$ | 21,660 | ||||||||||

Consolidated statement of cash flows:

|

Nine months ended September 30, 2018 |

||||||||||||

|

As reported |

Adjustments |

Balances without adoption of ASC 606 |

||||||||||

|

Cash flows from operating activities: |

||||||||||||

|

Net income |

$ | 22,246 | $ | (170 |

) |

$ | 22,076 | |||||

|

Adjustments to reconcile net income to net cash provided by operating activities: |

||||||||||||

|

Depreciation and amortization |

3,996 | -- | 3,996 | |||||||||

|

Deferred income taxes |

1,775 | (51 |

) |

1,724 | ||||||||

|

Reserve for uncertain tax positions |

(297 |

) |

-- | (297 |

) |

|||||||

|

Non-cash share-based compensation expense |

1,254 | -- | 1,254 | |||||||||

|

Loss on disposal of property and equipment |

212 | -- | 212 | |||||||||

|

Change in assets and liabilities: |

||||||||||||

|

Trade accounts receivable and unbilled revenue |

(1,841 |

) |

132 | (1,709 |

) |

|||||||

|

Prepaid expenses and other current assets |

(1,632 |

) |

(6 |

) |

(1,638 |

) |

||||||

|

Deferred contract costs |

1 | -- | 1 | |||||||||

|

Accounts payable |

147 | -- | 147 | |||||||||

|

Accrued expenses, wages, bonus and profit sharing |

(1,310 |

) |

-- | (1,310 |

) |

|||||||

|

Income taxes receivable and payable |

(554 |

) |

-- | (554 |

) |

|||||||

|

Deferred revenue |

1,939 | 93 | 2,032 | |||||||||

|

Net cash provided by operating activities |

25,936 | (2 |

) |

25,934 | ||||||||

|

Net cash used in investing activities |

(4,858 |

) |

-- | (4,858 |

) |

|||||||

|

Net cash used in financing activities |

(48,193 |

) |

-- | (48,193 |

) |

|||||||

|

Effect of exchange rate changes on cash |

(345 |

) |

2 | (343 |

) |

|||||||

|

Change in cash and cash equivalents |

(27,460 |

) |

-- | (27,460 |

) |

|||||||

|

Cash and cash equivalents at beginning of period |

34,733 | -- | 34,733 | |||||||||

|

Cash and cash equivalents at end of period |

$ | 7,273 | -- | $ | 7,273 | |||||||

Deferred Contract Costs

Deferred contract costs, net is stated at gross deferred costs less accumulated amortization. Beginning January 1, 2018, with the adoption of the new revenue standard, the Company defers commissions and incentives, including payroll taxes, if they are incremental and recoverable costs of obtaining a renewable customer contract. Deferred contract costs are amortized over the estimated term of the contract, including renewals, which generally ranges from three to five years. The contract term was estimated by considering factors such as historical customer attrition rates and product life. The amortization period is adjusted for significant changes in the estimated remaining term of a contract. An impairment of deferred contract costs is recognized when the unamortized balance of deferred contract costs exceeds the remaining amount of consideration the Company expects to receive less than the expected future costs directly related to providing those services. The Company deferred incremental costs of obtaining a contract of $616,000 and $1.9 million in the three and nine months ended September 30, 2018, respectively. Total amortization was $614,000 and $1.9 million for the three and nine months ended September 30, 2018, respectively. Amortization of deferred contract costs included in direct expenses was $13,000 and $73,000 for the three and nine months ended September 30, 2018, respectively. Amortization of deferred contract costs included in selling, general and administrative expenses was $601,000 and $1.8 million for the three and nine months ended September 30, 2018, respectively. Additional expense included in selling, general and administrative expenses for impairment of costs capitalized due to lost clients was $12,000 and $31,000 in the three and nine months ended September 30, 2018, respectively. The Company has elected the practical expedient to expense contract costs when incurred for any nonrenewable contracts with a term of one year or less. Prior to 2018, all commissions and incentives were expensed as incurred. The Company recorded a transition adjustment on January 1, 2018 as an increase to retained earnings of $2.6 million, net of $776,000 of tax, to reflect $3.4 million of commissions and incentives related to contracts that began prior to 2018, net of accumulated amortization.

Fair Value Measurements

The Company’s valuation techniques are based on maximizing observable inputs and minimizing the use of unobservable inputs when measuring fair value. Observable inputs reflect readily obtainable data from independent sources, while unobservable inputs reflect the Company’s market assumptions. The inputs are then classified into the following hierarchy: (1) Level 1 Inputs—quoted prices in active markets for identical assets and liabilities; (2) Level 2 Inputs—observable market-based inputs other than Level 1 inputs, such as quoted prices for similar assets or liabilities in active markets, quoted prices for similar or identical assets or liabilities in markets that are not active, or other inputs that are observable or can be corroborated by observable market data; and (3) Level 3 Inputs—unobservable inputs.

Commercial paper and Eurodollar deposits are included in cash equivalents and are valued at amortized cost, which approximates fair value due to their short-term nature. Eurodollar deposits are United States dollars deposited in a foreign bank branch of a United States bank and have daily liquidity. Both of these are included as a Level 2 measurement in the table below.

The following details the Company’s financial assets and liabilities within the fair value hierarchy at September 30, 2018 and December 31, 2017:

Fair Values Measured on a Recurring Basis

|

Level 1 |

Level 2 |

Level 3 |

Total |

|||||||||||||

|

(In thousands) |

||||||||||||||||

|

As of September 30, 2018 |

||||||||||||||||

|

Money Market Funds |

$ | 784 | $ | -- | $ | -- | $ | 784 | ||||||||

|

Total |

$ | 784 | $ | -- | $ | -- | $ | 784 | ||||||||

|

As of December 31, 2017 |

||||||||||||||||

|

Money Market Funds |

$ | 13,971 | $ | -- | $ | -- | $ | 13,971 | ||||||||

|

Commercial Paper |

-- | 10,490 | -- | 10,490 | ||||||||||||

|

Eurodollar Deposits |

-- | 10,017 | -- | 10,017 | ||||||||||||

|

Total |

$ | 13,971 | $ | 20,507 | $ | -- | $ | 34,478 | ||||||||

There were no transfers between levels during the three month period ended September 30, 2018.

The Company's long-term debt is recorded at historical cost. The fair value of long-term debt is classified in Level 2 of the fair value hierarchy and was estimated based primarily on estimated current rates available for debt of the same remaining duration and adjusted for nonperformance and credit. The following are the carrying amount and estimated fair values of long-term debt:

|

September 30, 2018 |

December 31, 2017 |

|||||||

|

(In thousands) |

||||||||

|

Total carrying amount of long-term debt |

$ | 38,897 | $ | 1,067 | ||||

|

Estimated fair value of long-term debt |

$ | 38,926 | $ | 1,066 | ||||

The Company believes that the carrying amounts of trade accounts receivable, accounts payable and accrued expenses approximate their fair value due to the short maturity of those instruments. Long-lived assets that are not recognized or disclosed at fair value in the financial statements on a recurring basis, which includes property and equipment, goodwill, intangibles, and cost method investments are measured at fair value in certain circumstances (for example, when there is evidence of impairment). As of September 30, 2018, and December 31, 2017, there was no indication of impairment related to these assets.

Contingencies

From time to time, the Company is involved in certain claims and litigation arising in the normal course of business. Management assesses the probability of loss for such contingencies and recognizes a liability when a loss is probable and estimable.

Since the September 2017 announcement of the original proposed recapitalization plan (“Original Transaction”) (see Note 2), three purported class action and/or derivative complaints have been filed in state or federal courts by three individuals claiming to be shareholders of the Company. All of the complaints name as defendants the Company and the individual directors of the Company. Two of these lawsuits were filed in the United States District Court for the District of Nebraska— a putative class action lawsuit captioned Gennaro v. National Research Corporation, et al., which was filed on November 15, 2017, and a putative class and derivative action lawsuit captioned Gerson v. Hays, et al., which was filed on November 16, 2017. These lawsuits were consolidated by order of the federal court under the caption In re National Research Corporation Shareholder Litigation. A third lawsuit was filed in the Circuit Court for Milwaukee County, Wisconsin—a putative class action lawsuit captioned Apfel v. Hays, et al., which was filed on December 1, 2017. The allegations in all of the lawsuits were very similar. The plaintiffs alleged, among other things, that the defendants breached their fiduciary duties in connection with the allegedly unfair proposed transaction, at an allegedly unfair price, conducted in an allegedly unfair and conflicted process and in alleged violation of Wisconsin law and the Company’s Articles of Incorporation. The plaintiffs in these lawsuits sought, among other things, an injunction enjoining the defendants from consummating the Original Transaction, damages, equitable relief and an award of attorneys’ fees and costs of litigation. After the announcement of a revised proposed recapitalization plan (the “Recapitalization”), the plaintiffs abandoned their efforts to enjoin the transaction. However, the plaintiffs in In re National Research Corporation Shareholder Litigation in Nebraska filed an Amended Complaint on March 23, 2018 seeking damages for alleged breach of fiduciary duties in connection with the Original Transaction and alleged omission of material facts in the proxy statement relating to the Recapitalization. The plaintiffs in the Apfel case in Wisconsin filed an amended complaint on April 4, 2018 seeking damages for alleged breach of fiduciary duties in connection with the Original Transaction and the Recapitalization. The Company and its directors will defend themselves against these lawsuits vigorously, and have moved to dismiss both lawsuits. On September 9, 2018, the Wisconsin Circuit Court granted the defendants’ motion to dismiss, but judgment has not yet been entered. On October 9, 2018, the federal court in Nebraska granted the defendants’ motion to dismiss and entered judgment in the case the same day. As of September 30, 2018, no losses have been accrued as the Company does not believe the losses are probable or estimable.

Recent Accounting Pronouncements Not Yet Adopted

In January 2016, the FASB issued ASU 2016-01, Financial Instruments—Overall: Recognition and Measurement of Financial Assets and Financial Liabilities. ASU 2016-01 changes certain recognition, measurement, presentation and disclosure aspects related to financial instruments. ASU 2016-01 is effective for financial statements issued for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years. Early adoption is not permitted. The Company believes its adoption will not significantly impact the Company’s results of operations and financial position.

The FASB issued ASU 2016-02, Leases (Topic 842) in February 2016 and ASU 2018-11, Leases – Targeted Improvements in July 2018. ASU 2016-02 requires lessees to recognize a lease liability and a right-to-use asset for all leases, including operating leases, with a term greater than twelve months on its balance sheet. The guidance is effective in fiscal years beginning after December 15, 2018, with early adoption permitted. Originally, a modified retrospective transition method was required, but ASU 2018-11 added the additional transition method to adopt the new guidance as of the adoption date and recognize a cumulative-effect adjustment to the beginning balance of retained earnings in the period of adoption. As of September 30, 2018, the Company had approximately $3.0 million of operating lease commitments which would be recorded on the balance sheet under the new guidance. However, the Company is currently in the process of further evaluating the impact that this new guidance will have on its consolidated financial statements and does not plan to elect early adoption. The Company plans to adopt ASU 2016-02 using the optional transitional method by recording a cumulative-effect adjustment as of January 1, 2019 and expects to utilize the optional practical expedients to not reassess whether expired or existing contracts contain leases, not reassess the lease classification for expired or existing leases and reassess initial direct costs for existing leases.

In June 2016, the FASB issued ASU 2016-13, Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. This ASU will require the measurement of all expected credit losses for financial assets, including trade receivables, held at the reporting date based on historical experience, current conditions, and reasonable and supportable forecasts. The guidance is effective for annual reporting periods beginning after December 15, 2019 and interim periods within those fiscal years. The Company believes its adoption will not significantly impact the Company’s results of operations and financial position.

In August 2018, the FASB issued ASU 2018-15, Intangibles-Goodwill and Other-Internal-Use Software (Subtopic 350-40). This ASU aligns the requirements for capitalizing implementation costs incurred in a hosting arrangement that is a service contract with the requirements for capitalizing implementation costs incurred to develop or obtain internal-use software (and hosting arrangements that include an internal use software license). The guidance is effective for annual reporting periods beginning after December 15, 2019 and interim periods within those fiscal years. Early adoption is permitted. The Company is currently evaluating the impact that this guidance will have upon the Company’s results of operations and financial position and has not yet determined whether early adoption will be elected.

|

2. |

RECAPITALIZATION |

On April 16, 2018, the shareholders of the Company approved, among other things, an amendment to the Company’s Amended and Restated Articles of Incorporation (the "Articles") to effect the Recapitalization pursuant to which each share of the Company’s then-existing class B common stock was exchanged for one share of the Company’s then-existing class A common stock plus $19.59 in cash, without interest. On April 17, 2018, the Company filed an amendment to its Articles effecting the Recapitalization and then a further amendment and restatement of the Company’s Articles which resulted in the elimination of the Company’s class B common stock and the reclassification of the Company’s class A common stock as a share of Common Stock, par value $0.001 per share (“Common Stock”). The Company issued 3,617,615 shares of Common Stock and paid $72.4 million in exchange for all class B shares outstanding and to settle outstanding share based awards for class B common stock. The Common Stock continues to trade on The NASDAQ Global Market under the revised symbol “NRC.”

In connection with the Recapitalization, on April 18, 2018, the Company entered into a credit agreement with First National Bank of Omaha, a national banking association (“FNB”), as described in Note 5.

|

3. |

CONTRACTS WITH CUSTOMERS |

The following table disaggregates revenue for the three and nine month periods ending September 30, 2018 based on timing of revenue recognition (In thousands):

|

Three months ended September 30, 2018 |

Nine months ended September 30, 2018 |

|||||||

|

Subscription services recognized ratably over time |

$ | 26,328 | $ | 77,769 | ||||

|

Services recognized at a point in time |

784 | 2,685 | ||||||

|

Fixed, non-subscription recognized over time |

996 | 2,775 | ||||||

|

Unit price services recognized over time |

1,905 | 5,818 | ||||||

|

Total revenue |

$ | 30,013 | $ | 89,047 | ||||

The following table provides information about receivables, contract assets, and contract liabilities from contracts with customers (In thousands):

|

|

Balance at 1/1/2018 |

|||||||

|

Accounts receivables |

$ | 16,544 | $ | 14,674 | ||||

|

Contract assets included in other current assets |

$ | 68 | $ | 74 | ||||

|

Deferred Revenue |

$ | (18,642 |

) |

$ | (16,642 |

) |

||

|

(1) Represents the December 31, 2017 balance adjusted for the ASC 606 transition adjustments. |

||||||||

Significant changes in contract assets and contract liabilities during 2018 are as follows (in thousands):

|

Nine months ended September 30, 2018 |

|||||||

|

Contract Asset |

Deferred Revenue |

||||||

|

Increase (Decrease) |

|||||||

|

Revenue recognized that was included in deferred revenue at beginning of period due to completion of services |

$ | - | $ | (15,363 |

) |

||

|

Increases due to invoicing of client, net of amounts recognized as revenue |

- | 17,522 | |||||

|

Decreases due to completion of services (or portion of services) and transferred to accounts receivable |

(71 |

) |

- | ||||

|

Change due to cumulative catch-up adjustments arising from changes in expected contract consideration |

(145 |

) |

|||||

|

Decreases due to impairment |

- | - | |||||

|

Increases due to revenue recognized in the period with additional performance obligations before invoicing |

65 | - | |||||

The Company has elected to apply the practical expedient to not disclose the value of unsatisfied performance obligations for contracts with an original expected length of one year or less. Total remaining contract revenue for contracts with original duration of greater than one year expected to be recognized in the future related to performance obligations that are unsatisfied at September 30, 2018 approximated $578,000, of which $144,000, $370,000 and $64,000 will be recognized during the remainder of 2018, 2019 and 2020, respectively.

|

4. |

INCOME TAXES |

The effective tax rate for the three-month period ended September 30, 2018 decreased to 16.6% compared to 42.1% for the same period in 2017 mainly due to a reduction in the corporate tax rate from 35% to 21% due to the Tax Cut and Jobs Act (the “Tax Act”) that was enacted on December 22, 2017, a tax depreciation method change election for software development creating an income tax benefit of $308,000, decreased non-deductible Recapitalization expenses of $384,000 and other state tax and uncertain tax position adjustments decreasing tax by $179,000 over the same period last year. In addition, the Company had increased tax benefits of $161,000 from the exercise of options and dividends paid to non-vested shareholders. The effective tax rate for the nine-month period ended September 30, 2018 decreased to 11.6% compared to 35.9% for the same period in 2017. The effective tax rate was lower mainly due to income tax benefits from the Recapitalization, due to accelerated vesting of restricted stock and settlement of options of $1.1 million and the reduction in the corporate tax rate from 35% to 21% due to the Tax Act. In addition, the Company had increased tax benefits of $1.7 million from the exercise of options and dividends paid to non-vested shareholders, a tax depreciation method change election for software development costs creating an income tax benefit of $308,000, decreased non-deductible Recapitalization expenses of $247,000, and other state tax and uncertain tax position adjustments decreasing taxes by $179,000 over the same period last year.

As permitted by Staff Accounting Bulletin No. 118, the Company made reasonable estimates and recorded a provisional net tax benefit of $1.9 million as of December 31, 2017 related to the following elements of the Tax Act:

|

● |

Reduction in the U.S. Federal Corporate Tax Rate: The Tax Act reduces the corporate tax rate to 21%, effective January 1, 2018. Recorded a decrease related to deferred tax assets and liabilities with a corresponding net adjustment to deferred income tax benefit for the year ended December 31, 2017. |

|

● |

Availability of 100% bonus depreciation on assets placed in service after September 27, 2017 |

|

● |

Certain stock compensation plans potentially subject to limitations as to deductibility |

The above items were final as of September 30, 2018, and no material adjustments were made to the provisional amounts recorded as of December 31, 2017. Under the Tax Act, the Company was also subject to a one-time mandatory deemed repatriation tax on accumulated non-U.S. earnings. The estimates booked as of December 31, 2017 have been finalized and no material adjustments were made to the financials.

|

5. |

NOTES PAYABLE |

The Company’s long term debt consists of the following:

|

September 30, 2018 |

December 31, 2017 |

|||||||

|

Term Loans |

$ | 38,897 | $ | 1,067 | ||||

|

Less: current portion |

(3,623 |

) |

(1,067 |

) |

||||

|

Less: unamortized debt issuance costs |

(165 |

) |

— | |||||

|

Notes payable, net of current portion |

$ | 35,109 | $ | — | ||||

The balance on the Company’s former term note with US Bank was paid in full in March 2018.

On April 18, 2018, in connection with the Recapitalization, the Company entered into a credit agreement (the “Credit Agreement”) with FNB providing for (i) a $15,000,000 revolving credit facility (the “Line of Credit”), (ii) a $40,000,000 term loan (the “Term Loan”) and (iii) a $15,000,000 delayed draw-dawn term facility (the “Delayed Draw Term Loan” and, together with the Line of Credit and the Term Loan, the “Credit Facilities”). The Company used the Term Loan to fund, in part, the cash portion paid to holders of the Company’s then-existing class B common stock in connection with the Recapitalization and the accompanying exchange of outstanding equity awards tied to the class B common stock, as well as for the costs of the Recapitalization. The Delayed Draw Term Loan may be used to fund any permitted future business acquisitions or repurchasing of the Company’s Common Stock and the Line of Credit will be used to fund ongoing working capital needs and other general corporate purposes, including to pay the fees and expenses incurred in connection with the Recapitalization and the Credit Agreement.

The Term Loan is payable in monthly installments of $462,988 through April 2020 and $526,362 thereafter, with a balloon payment due at maturity in April 2023. The Term Loan bears interest at a fixed rate of 5%.

Borrowings under the Line of Credit and the Delayed Draw Term Loan, if any, bear interest at a floating rate equal to the 30-day London Interbank Offered Rate plus 225 basis points (4.36% at September 30, 2018). Interest on the Line of Credit accrues and is payable monthly. Principal amounts outstanding under the Line of Credit are due and payable in full at maturity, in April 2021. As of September 30, 2018, the Line of Credit did not have a balance. The weighted average borrowings on the Line of Credit for the three and nine months ended September 30, 2018 was $587,000 and $486,000 respectively. The weighted average interest on borrowings on the Line of Credit for the three and nine months ended September 30, 2018 was 4.35% and 4.25%, respectively. There have been no borrowings on the Delayed Draw Term Loan since origination.

The Company paid a one-time fee equal to 0.25% of the amount borrowed under the Term Loan at the closing of the Credit Facilities. The Company is also obligated to pay ongoing unused commitment fees quarterly in arrears pursuant to the Line of Credit and the Delayed Draw Term Loan facility at a rate of 0.20% per annum based on the actual daily unused portions of the Line of Credit and the Delayed Draw Term Loan facility, respectively.

The Credit Agreement is collateralized by substantially all of the Company’s assets and contains customary representations, warranties, affirmative and negative covenants (including financial covenants) and events of default. The negative covenants include, among other things, restrictions regarding the incurrence of indebtedness and liens, repurchases of the Company’s Common Stock and acquisitions, subject in each case to certain exceptions. The Credit Agreement also contains certain financial covenants with respect to a minimum fixed charge coverage ratio of 1.10x and a maximum cash flow leverage ratio of 3.00x or less. As of September 30, 2018, the Company was in compliance with its financial covenants.

Scheduled maturities of notes payable at September 30, 2018 are as follows:

|

Remainder of 2018 |

$ | 901 | ||

|

2019 |

3,715 | |||

|

2020 |

4,418 | |||

|

2021 |

4,916 | |||

|

2022 |

5,171 | |||

|

Thereafter |

19,776 |

|

6. |

SHARE-BASED COMPENSATION |

The Company measures and recognizes compensation expense for all share-based payments based on the grant-date fair value of those awards. All of the Company’s existing stock option awards and unvested stock awards have been determined to be equity-classified awards. As described in Note 2, the Company completed a Recapitalization in April which, among other things, settled all then-existing outstanding class B share-based awards and resulted in the elimination of the class B common stock. As a result, the Company accelerated vesting of all outstanding class B share based awards, resulting in accelerated share-based compensation of $331,000 in the three and six month periods ended June 30, 2018. All outstanding class B share based awards were then settled for the same stock to cash proportion of the class B common stock described in Note 2, less the exercise price, if any, which approximated the awards’ intrinsic value.

The Company’s 2001 Equity Incentive Plan provided for the granting of stock options, stock appreciation rights, restricted stock, performance shares and other share-based awards and benefits up to an aggregate of 1,800,000 shares of the Company's former class A common stock and 300,000 shares of the Company's former class B common stock. Stock options granted could have been either nonqualified or incentive stock options. Stock options vest over one to five years following the date of grant and option terms are generally five to ten years following the date of grant.

The Company’s 2004 Non-Employee Director Stock Plan, as amended (the “2004 Director Plan”), is a nonqualified plan that provides for the granting of options with respect to an aggregate of 3,000,000 shares of the Company's Common Stock and, prior to the Recapitalization, 500,000 shares of the Company's former class B common stock. The 2004 Director Plan provides for grants of nonqualified stock options to each director of the Company who is not employed by the Company. Beginning in 2018, on the date of each annual meeting of shareholders of the Company, options to purchase shares of Common Stock equal to an aggregate grant date fair value of $100,000 are granted to each non-employee director that is elected or retained as a director at such meeting. Stock options vest approximately one year following the date of grant and option terms are generally ten years following the date of grant, or three years in the case of termination of the outside director’s service.

The Company’s 2006 Equity Incentive Plan, as amended, provides for the granting of stock options, stock appreciation rights, restricted stock, performance shares and other share-based awards and benefits up to an aggregate of 1,800,000 shares of Common Stock and, prior to the Recapitalization, 300,000 shares of the Company’s former class B common stock. Stock options granted may be either incentive stock options or nonqualified stock options. Vesting terms vary with each grant and option terms are generally five to ten years following the date of grant.

The Company granted options to purchase 116,276 shares of the Company’s Common Stock during the nine-month period ended September 30, 2018. Options to purchase shares of common stock were granted with exercise prices equal to the fair value of the common stock on the date of grant. The fair value of the stock options granted was estimated using a Black-Scholes valuation model with the following weighted average assumptions:

|

2018 |

2017 |

|||||||||||

|

Common Stock (formerly Class A) |

Class A |

Class B |

||||||||||

|

Expected dividend yield at date of grant |

2.59 | % | 2.62 | % | 8.06 | % | ||||||

|

Expected stock price volatility |

32.47 | % | 32.45 | % | 26.75 | % | ||||||

|

Risk-free interest rate |

2.51 | % | 2.18 | % | 2.18 | % | ||||||

|

Expected life of options (in years) |

7.3 | 6.8 | 6.8 | |||||||||

The risk-free interest rate assumptions were based on the U.S. Treasury yield curve in effect at the time of the grant. The expected volatility was based on historical monthly price changes of the Company’s common stock based on the expected life of the options at the date of grant. The expected life of options is the average number of years the Company estimates that options will be outstanding. The Company considers groups of associates that have similar historical exercise behavior separately for valuation purposes.

The following table summarizes stock option activity under the Company’s 2001 and 2006 Equity Incentive Plans and the 2004 Director Plan for the nine months ended September 30, 2018:

|

Number of |

Weighted Average Exercise Price |

Weighted Average Remaining Contractual Terms (Years) |

Aggregate Intrinsic Value (In thousands) |

|||||||||||||

|

Common Stock (formerly Class A) |

||||||||||||||||

|

Outstanding at December 31, 2017 |

1,746,634 | $ | 13.88 | |||||||||||||

|

Granted |

116,276 | $ | 36.12 | |||||||||||||

|

Exercised |

(380,958 |

) |

$ | 13.82 | $ | 8,048 | ||||||||||

|

Forfeited |

(21,383 |

) |

$ | 26.18 | ||||||||||||

|

Outstanding at September 30, 2018 |

1,460,569 | $ | 15.49 | 4.92 | $ | 33,756 | ||||||||||

|

Exercisable at September 30, 2018 |

1,068,429 | $ | 13.26 | 3.84 | $ | 27,077 | ||||||||||

|

Class B |

||||||||||||||||

|

Outstanding at December 31, 2017 |

276,716 | $ | 31.78 | |||||||||||||

|

Granted |

-- | $ | -- | |||||||||||||

|

Exercised/Settled in Recapitalization |

(276,716 |

) |

$ | 31.78 | $ | 5,937 | ||||||||||

|

Forfeited |

-- | $ | -- | |||||||||||||

|

Outstanding at September 30, 2018 |

-- | $ | -- | -- | $ | -- | ||||||||||

|

Exercisable at September 30, 2018 |

-- | $ | -- | -- | $ | -- | ||||||||||

As of September 30, 2018 the total unrecognized compensation cost related to non-vested stock option awards was approximately $1.4 million and is expected to be recognized over a weighted average period of 2.94 years.

The following table summarizes information for the nine months ended September 30, 2018, regarding non-vested stock granted to associates under the 2001 and 2006 Equity Incentive Plans:

|

Common (formerly Class A) Shares Outstanding |

Common (formerly Class A) Weighted Average Grant Date Fair Value Per Share |

Class B Shares Outstanding |

Class B Weighted Average Grant Date Fair Value Per Share |

|||||||||||||

|

Outstanding at December 31, 2017 |

81,667 | $ | 13.80 | 13,611 | $ | 36.65 | ||||||||||

|

Granted |

6,793 | 36.80 | -- | -- | ||||||||||||

|

Vested/Settled in Recapitalization |

-- | -- | (13,611 |

) |

36.65 | |||||||||||

|

Forfeited |

(10,289 |

) |

$ | 15.23 | -- | $ | -- | |||||||||

|

Outstanding at September 30, 2018 |

78,171 | $ | 15.61 | -- | $ | -- | ||||||||||

As of September 30, 2018, the total unrecognized compensation cost related to non-vested stock awards was approximately $532,000 and is expected to be recognized over a weighted average period of 2.74 years.

|

7. |

GOODWILL AND OTHER INTANGIBLE ASSETS |

The following represents a summary of changes in the Company’s carrying amount of goodwill for the nine months ended September 30, 2018:

|

(In thousands) |

||||

|

Balance as of December 31, 2017 |

$ | 58,021 | ||

|

Foreign currency translation |

(66 |

) |

||

|

Balance as of September 30, 2018 |

$ | 57,955 | ||

Intangible assets consisted of the following:

|

September 30, 2018 |

December 31, 2017 |

|||||||

|

(In thousands) |

||||||||

|

Non-amortizing other intangible assets: |

||||||||

|

Trade name |

$ | 1,191 | $ | 1,191 | ||||

|

Amortizing other intangible assets: |

||||||||

|

Customer related |

9,340 | 9,347 | ||||||

|

Technology |

1,360 | 1,360 | ||||||

|

Trade name |

1,572 | 1,572 | ||||||

|

Total other intangible assets |

13,463 | 13,470 | ||||||

|

Accumulated amortization |

(11,203 |

) |

(10,706 |

) |

||||

|

Other intangible assets, net |

$ | 2,260 | $ | 2,764 | ||||

|

8. |

PROPERTY AND EQUIPMENT |

|

September 30, 2018 |

December 31, 2017 |

|||||||

|

(In thousands) |

||||||||

|

Property and equipment |

$ | 45,094 | $ | 40,206 | ||||

|

Accumulated depreciation |

(30,825 |

) |

(27,847 |

) |

||||

|

Property and equipment, net |

$ | 14,269 | $ | 12,359 | ||||

|

9. |

EARNINGS PER SHARE |

Net income per share of the Company's former class A common stock and former class B common stock was computed using the two-class method. Basic net income per share is computed by allocating undistributed earnings to common shares and using the weighted-average number of common shares outstanding during the period.

Diluted net income per share is computed using the weighted-average number of common shares and, if dilutive, the potential common shares outstanding during the period. Potential common shares consist of the incremental common shares issuable upon the exercise of stock options and vesting of restricted stock. The dilutive effect of outstanding stock options is reflected in diluted earnings per share by application of the treasury stock method.

The liquidation rights and the rights upon the consummation of an extraordinary transaction were the same for the holders of the Company's former class A common stock and former class B common stock. Other than share distributions and liquidation rights, the amount of any dividend or other distribution payable on each share of former class A common stock was equal to one-sixth (1/6th) of the amount of any such dividend or other distribution payable on each share of former class B common stock until the Recapitalization. As a result, the undistributed earnings for each period are allocated based on the contractual participation rights of the former class A and former class B common stock as if the earnings for the period had been distributed.

As described in Note 2, the Company completed a Recapitalization in April 2018 which settled all then-existing outstanding class B share-based awards, resulted in the elimination of the class B common stock and reclassified class A common stock to Common Stock. The Recapitalization was effective on April 17, 2018. Therefore, income was allocated between the former class A and class B common stock using the two-class method through April 16, 2018, and fully allocated to the Common Stock (formerly class A) following the Recapitalization.

For the three months ended September 30, 2018, 107,512 options of former class A shares have been excluded from the diluted net income per share computation because the exercise or grant price exceeded the fair market value.

|

For the Three Months Ended September 30, 2018 |

For the Three Months Ended September 30, 2017 |

|||||||||||||||

|

Common Stock (formerly Class A) |

Class B Common Stock |

Common Stock (formerly Class A) |

Class B Common Stock |

|||||||||||||

|

(In thousands, except per share data) |

||||||||||||||||

|

Numerator for net income per share - basic: |

||||||||||||||||

|

Net income |

$ | 6,992 | $ | -- | $ | 2,062 | $ | 2,091 | ||||||||

|

Allocation of distributed and undistributed income to unvested restricted stock shareholders |

(22 |

) |

-- | (15 |

) |

(15 |

) |

|||||||||

|

Net income attributable to common shareholders |

$ | 6,970 | $ | -- | $ | 2,047 | $ | 2,076 | ||||||||

|

Denominator for net income per share - basic: |

||||||||||||||||

|

Weighted average common shares outstanding - basic |

24,671 | -- | 20,788 | 3,514 | ||||||||||||

|

Net income per share – basic |