UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For

the quarterly period ended

OR

For the transition period from to

Commission

File Number:

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s

telephone number, including area code:

Blue Water Vaccines Inc.

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of exchange on which registered | ||

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | ||

| ☒ | Smaller reporting company | ||||

| Emerging growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 726(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No

As of May 12, 2023, the registrant had

TABLE OF CONTENTS

| Page | ||

| Cautionary Note Regarding Forward-Looking Statements | ii | |

| PART I. | FINANCIAL INFORMATION | 1 |

| Item 1. | Condensed Financial Statements (unaudited). | 1 |

| Condensed Balance Sheets | 1 | |

| Condensed Statements of Operations | 2 | |

| Condensed Statements of Stockholders’ Equity | 3 | |

| Condensed Statements of Cash Flows | 4 | |

| Notes to Unaudited Condensed Financial Statements | 5 | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. | 17 |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk. | 28 |

| Item 4. | Controls and Procedures. | 28 |

| PART II. | OTHER INFORMATION | 29 |

| Item 1. | Legal Proceedings. | 29 |

| Item 1A. | Risk Factors. | 29 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds. | 32 |

| Item 3. | Defaults Upon Senior Securities. | 32 |

| Item 4. | Mine Safety Disclosures. | 32 |

| Item 5. | Other Information. | 32 |

| Item 6. | Exhibits. | 33 |

| Signatures | 34 |

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (this “Report”) contains forward-looking statements that reflect our current expectations and views of future events. The forward-looking statements are contained principally in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Readers are cautioned that known and unknown risks, uncertainties and other factors, including those over which we may have no control and others listed in the “Risk Factors” section of this Report, may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements.

In some cases, you can identify forward-looking statements by the words “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “objective,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue” and “ongoing,” or the negative of these terms, or other comparable terminology intended to identify statements about the future, although not all forward-looking statements contain these words. These statements relate to future events or our future financial performance or condition and involve known and unknown risks, uncertainties and other factors that could cause our actual results, levels of activity, performance or achievement to differ materially from those expressed or implied by these forward-looking statements. These forward-looking statements include, but are not limited to, statements about:

| ● | our projected financial position and estimated cash burn rate; |

| ● | our estimates regarding expenses, future revenues and capital requirements; |

| ● | our ability to continue as a going concern; |

| ● | our need to raise substantial additional capital to fund our operations; |

| ● | the success, cost and timing of our clinical trials; |

| ● | our ability to obtain the necessary regulatory approvals to market and commercialize our products and product candidates; |

| ● | the ultimate impact of the ongoing COVID-19 pandemic, or any other health epidemic, on our business, our clinical trials, our research programs, healthcare systems or the global economy as a whole; |

| ● | the potential that results of pre-clinical and clinical trials indicate our current product candidates or any future product candidates we may seek to develop are unsafe or ineffective; |

| ● | the results of market research conducted by us or others; |

| ● | our ability to obtain and maintain intellectual property protection for our current product candidates; |

| ● | our ability to protect our intellectual property rights and the potential for us to incur substantial costs from lawsuits to enforce or protect our intellectual property rights; |

ii

| ● | the possibility that a third party may claim we or our third-party licensors have infringed, misappropriated or otherwise violated their intellectual property rights and that we may incur substantial costs and be required to devote substantial time defending against claims against us; |

| ● | our reliance on third parties, including manufacturers and logistics companies; |

| ● | the success of competing therapies and products that are or become available; |

| ● | our ability to commercialize ENTADFI®; |

| ● | our ability to successfully compete against current and future competitors; |

| ● | our ability to expand our organization to accommodate potential growth and our ability to retain and attract key personnel; |

| ● | the potential for us to incur substantial costs resulting from product liability lawsuits against us and the potential for these product liability lawsuits to cause us to limit our commercialization of our product candidates; |

| ● | market acceptance of our products and product candidates, the size and growth of the potential markets for our current product candidates and any future product candidates we may seek to develop, and our ability to serve those markets; and |

| ● | the successful development of our commercialization capabilities, including sales and marketing capabilities. |

These forward-looking statements involve numerous risks and uncertainties. Although we believe that our expectations expressed in these forward-looking statements are reasonable, our expectations may later be found to be incorrect. Our actual results of operations or the results of other matters that we anticipate herein could be materially different from our expectations. Important risks and factors that could cause our actual results to be materially different from our expectations are generally set forth in “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and other sections in this Report. You should thoroughly read this Report and the documents that we refer to with the understanding that our actual future results may be materially different from and worse than what we expect. We qualify all of our forward-looking statements by these cautionary statements.

The forward-looking statements made in this Report relate only to events or information as of the date on which the statements are made in this Report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this Report and the documents that we refer to in this Report and have filed as exhibits to this Report, completely and with the understanding that our actual future results may be materially different from what we expect.

iii

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

BLUE

WATER BIOTECH, INC.

Condensed Balance Sheets

| March 31, 2023 | December 31, 2022 | |||||||

| ASSETS | (Unaudited) | |||||||

| Current assets | ||||||||

| Cash | $ | $ | ||||||

| Restricted cash | — | |||||||

| Prepaid expenses and other current assets | ||||||||

| Deferred offering costs | — | |||||||

| Receivable from related parties | ||||||||

| Total current assets | ||||||||

| Prepaid expenses, long-term | ||||||||

| Property and equipment, net | ||||||||

| Total assets | $ | $ | ||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities | ||||||||

| Accounts payable | $ | $ | ||||||

| Accrued expenses | ||||||||

| Contingent warrant liability | ||||||||

| Total current liabilities | ||||||||

| Total liabilities | ||||||||

| Commitments and Contingencies (see Note 7) | ||||||||

| Stockholders’ equity | ||||||||

| Preferred stock, $ | ||||||||

| Common stock, $ | ||||||||

| Additional paid-in-capital | ||||||||

| Treasury stock, at cost; | ( | ) | ( | ) | ||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Total stockholders’ equity | ||||||||

| Total liabilities and stockholders’ equity | $ | $ | ||||||

The accompanying notes are an integral part of these condensed financial statements.

1

BLUE

WATER BIOTECH, INC.

Condensed Statements of Operations

(Unaudited)

| Three Months Ended March 31, 2023 | Three Months Ended March 31, 2022 | |||||||

| Operating expenses | ||||||||

| General and administrative | $ | $ | ||||||

| Research and development | ||||||||

| Total operating expenses | ||||||||

| Loss from operations | ( | ) | ( | ) | ||||

| Other income | ||||||||

| Change in fair value of contingent warrant liability | ( | ) | ||||||

| Total other income | ( | ) | ||||||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Cumulative preferred stock dividends | ||||||||

| Net loss applicable to common stockholders | ( | ) | ( | ) | ||||

| $ | ( | ) | $ | ( | ) | |||

The accompanying notes are an integral part of these condensed financial statements.

2

BLUE

WATER BIOTECH, INC.

Condensed Statements of Stockholders’ Equity

(Unaudited)

| Additional | Total | |||||||||||||||||||||||||||||||||||

| Preferred Stock | Common Stock | Paid-in | Treasury Stock | Accumulated | Stockholders’ | |||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Capital | Shares | Amount | Deficit | Equity | ||||||||||||||||||||||||||||

| Balance at December 31, 2022 | $ | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||||||||||

| Exercise of pre-funded warrants | — | ( | ) | — | ||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | |||||||||||||||||||||||||||||||||

| Purchase of treasury shares | — | — | ( | ) | ( | ) | ( | ) | ||||||||||||||||||||||||||||

| Net loss | — | — | — | ( | ) | ( | ) | |||||||||||||||||||||||||||||

| Balance at March 31, 2023 | — | $ | — | $ | $ | ( | ) | $ | ( | ) | ( | ) | $ | |||||||||||||||||||||||

| Additional | Total | |||||||||||||||||||||||||||||||||||

| Preferred Stock | Common Stock | Paid-in | Treasury Stock | Accumulated | Stockholders’ | |||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Capital | Shares | Amount | Deficit | Equity | ||||||||||||||||||||||||||||

| Balance at December 31, 2021 | $ | $ | $ | $ | $ | ( | ) | $ | ||||||||||||||||||||||||||||

| Issuance of common stock in initial public offering, net of $ | — | |||||||||||||||||||||||||||||||||||

| Conversion of convertible preferred stock to common stock upon initial public offering | ( | ) | ( | ) | ( | ) | ||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | ||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | ( | ) | ( | ) | |||||||||||||||||||||||||||||

| Balance at March 31, 2022 | — | $ | — | $ | $ | — | $ | — | $ | ( | ) | $ | ||||||||||||||||||||||||

The accompanying notes are an integral part of these condensed financial statements.

3

BLUE

WATER BIOTECH, INC.

Condensed Statements of Cash Flows

(Unaudited)

| Three Months Ended March 31, 2023 | Three Months Ended March 31, 2022 | |||||||

| Cash flows from operating activities | ||||||||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Stock-based compensation | ||||||||

| Depreciation expense | ||||||||

| Change in fair value of contingent warrant liability | ( | ) | ||||||

| Changes in assets and liabilities: | ||||||||

| Prepaid expenses and other current assets | ( | ) | ||||||

| Receivable from related parties | ( | ) | ( | ) | ||||

| Prepaid expenses, long-term | ( | ) | ||||||

| Deposit | ( | ) | ||||||

| Accrued expenses | ( | ) | ||||||

| Accounts payable | ( | ) | ||||||

| Net cash used in operating activities | ( | ) | ( | ) | ||||

| Cash flows from investing activities | ||||||||

| Purchase of property and equipment | ( | ) | ( | ) | ||||

| Net cash used in investing activities | ( | ) | ( | ) | ||||

| Cash flows from financing activities | ||||||||

| Purchase of treasury shares | ( | ) | ||||||

| Payment of deferred offering costs | ( | ) | ( | ) | ||||

| Proceeds from issuance of common stock in initial public offering, net of underwriting discount | ||||||||

| Payments of initial public offering costs | ( | ) | ||||||

| Net cash provided by (used in) financing activities | ( | ) | ||||||

| Net increase (decrease) in cash and restricted cash | ( | ) | ||||||

| Cash and restricted cash, beginning of period | ||||||||

| Cash and restricted cash, end of period | $ | $ | ||||||

| Noncash investing and financing activities: | ||||||||

| Deferred offering costs included in accounts payable and accrued expenses | $ | $ | ||||||

| Deferred offering costs previously prepaid | $ | ( | ) | $ | ||||

| Exercise of pre-funded warrants | $ | $ | ||||||

| Conversion of convertible preferred stock to common stock upon initial public offering | $ | $ | ||||||

| Initial public offering costs included in accounts payable | $ | $ | ||||||

The accompanying notes are an integral part of these condensed financial statements.

4

BLUE

WATER BIOTECH, INC.

Notes to Condensed Financial Statements

(Unaudited)

Note 1 — Organization and Basis of Presentation

Organization and Nature of Operations

Blue Water Biotech, Inc. (formerly Blue Water Vaccines Inc.) (the “Company”) was formed on October 26, 2018, to focus on the research and development of transformational vaccines to prevent infectious diseases worldwide. The Company’s lead vaccine candidate, BWV-201, is a live attenuated, intranasally delivered, serotype independent Streptococcus pneumoniae vaccine targeting S. pneumo-induced acute otitis media and pneumococcal pneumonia. BWV’s influenza vaccine candidates, BWV-101 and BWV-102, are being investigated as a universal influenza vaccine with the potential to protect against all influenza strains and a pre-pandemic H1 influenza vaccine, respectively. In addition to exploratory analysis for applications in flu vaccines, the Company’s virus-like particle platform is being utilized to investigate and develop vaccine candidates against norovirus, rotavirus, malaria, monkeypox, and Marburg virus disease. Finally, the Company is developing a live attenuated, orally delivered Chlamydia vaccine. All of the Company’s vaccine candidates are in the pre-clinical developmental stage. In addition, in April 2023, the Company acquired ENTADFI®, with plans to commercialize it. ENTADFI® is an FDA-approved, once daily pill that combines finasteride and tadalafil for the treatment of benign prostatic hyperplasia. This combination allows men to receive treatment for their symptoms of benign prostatic hyperplasia without the negative sexual side effects typically seen in patients on finasteride alone.

Effective April 21, 2023, the Company changed its corporate name from “Blue Water Vaccines Inc.” to “Blue Water Biotech, Inc.” See Note 11.

Initial Public Offering

On

February 23, 2022, the Company completed its initial public offering (“IPO”) in which the Company issued and sold

Basis of Presentation

The Company’s unaudited condensed financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

Unaudited Interim Financial Statements

The accompanying condensed balance sheet as of March 31, 2023, and the condensed statements of operations, the condensed statements of changes in stockholders’ equity, and the condensed statements of cash flows for the three months ended March 31, 2023 and 2022 are unaudited. These unaudited interim financial statements have been prepared on the same basis as the audited financial statements, and in management’s opinion, include all adjustments, consisting of only normal recurring adjustments, necessary for the fair statement of the Company’s financial position as of March 31, 2023 and its results of operations and cash flows for the three months ended March 31, 2023 and 2022. The financial data and the other financial information disclosed in the notes to these condensed financial statements related to the three-month periods are also unaudited. Operating results for the three months ended March 31, 2023 are not necessarily indicative of the results that may be expected for the year ending December 31, 2023, any other interim periods, or any future year or period. The unaudited condensed financial statements included in this Report should be read in conjunction with the audited financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, which includes a broader discussion of the Company’s business and the risks inherent therein.

5

BLUE WATER BIOTECH, INC.

Notes to Condensed Financial Statements

(Unaudited)

Note 2 — Going Concern and Management’s Plans

The

Company’s operating activities to date have been devoted to seeking licenses and engaging in research and development activities.

The Company’s product candidates currently under development will require significant additional research and development efforts

prior to commercialization. The Company has financed its operations since inception primarily using proceeds received from seed investors,

and proceeds received from its IPO and private placement issuances in April and August 2022 (the “Private Placements”), see

Note 6. During 2022, the Company completed its IPO and the Private Placements in which the Company received an aggregate of approximately

$

The Company has incurred substantial operating

losses since inception and expects to continue to incur significant operating losses for the foreseeable future. As of March 31, 2023,

the Company had cash of approximately $

These factors, along with the Company’s forecasted future cash flows, indicate that the Company will be unable to meet its contractual commitments and obligations as they come due in the ordinary course of business within one year following the issuance of these condensed financial statements. The Company will require significant additional capital to fund its continuing operations, satisfy existing and future obligations and liabilities, and otherwise support the Company’s working capital needs and business activities, including the commercialization of ENTADFI® and the development and commercialization of its current product candidates and future product candidates. Management’s plans include generating product revenue from sales of ENTADFI®, which is subject to successful commercialization activities, some of which are outside of the Company’s control, including but not limited to, securing contracts with wholesalers and third party payers, securing contracts with third-party logistics providers, obtaining required licensure in various jurisdictions, and building a salesforce, as well as attempting to secure additional required funding through equity or debt financings if available; however, there are currently no commitments in place for further financing nor is there any assurance that such financing will be available to the Company on favorable terms, if at all. If the Company is unable to secure additional capital, it may be required to curtail any clinical trials, development and/or commercialization of products and product candidates, and it may take additional measures to reduce expenses in order to conserve its cash in amounts sufficient to sustain operations and meet its obligations.

Because of historical and expected operating losses and net operating cash flow deficits, there is substantial doubt about the Company’s ability to continue as a going concern for one year from the issuance of the condensed financial statements, which is not alleviated by management’s plans. The condensed financial statements have been prepared assuming the Company will continue as a going concern. These condensed financial statements do not include any adjustments that might be necessary from the outcome of this uncertainty.

Note 3 — Summary of Significant Accounting Policies

During the three months ended March 31, 2023, there were no changes to the Company’s significant accounting policies as described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, except for the following:

Restricted Cash

Restricted cash maintained under agreements that legally restrict the use of such funds is not included with cash and is reported as a separate line item on the condensed balance sheet. Restricted cash as of March 31, 2023, primarily consists of earnest money deposited in a financial institution for a potential asset acquisition. Subsequent to March 31, 2023, the funds were released from escrow to the Company and reclassified from restricted cash to cash.

A reconciliation of the Company’s cash and restricted cash in the condensed balance sheet to cash and restricted cash in the condensed statement of cash flows as of March 31, 2023 and is as follows:

| As of March 31, 2023 | As of December 31, 2022 | |||||||

| Cash | $ | $ | ||||||

| Restricted cash | ||||||||

| Cash and restricted cash | $ | $ | ||||||

New Accounting Pronouncements

The Company’s management does not believe that any recently issued, but not yet effective, accounting standards if currently adopted would have a material effect on the accompanying condensed financial statements.

6

BLUE WATER BIOTECH, INC.

Notes to Condensed Financial Statements

(Unaudited)

Note 4 — Balance Sheet Details

Prepaid Expenses and Other Current Assets

Prepaid expenses and other current assets consisted of the following as of March 31, 2023 and December 31, 2022:

| As of March 31, 2023 | As of December 31, 2022 | |||||||

| Prepaid research and development | $ | $ | ||||||

| Prepaid insurance | ||||||||

| Prepaid other | ||||||||

| Total | $ | $ | ||||||

Accrued Expenses

Accrued expenses consisted of the following as of March 31, 2023 and December 31, 2022:

| As of March 31, 2023 | As of December 31, 2022 | |||||||

| Accrued license fees | $ | $ | ||||||

| Accrued research and development | ||||||||

| Accrued deferred offering costs | ||||||||

| Accrued compensation | ||||||||

| Accrued franchise taxes | ||||||||

| Accrued director fees | ||||||||

| Accrued other | ||||||||

| Total | $ | $ | ||||||

Note 5 — Significant Agreements

Oxford University Innovation Limited

In

December 2018, the Company entered into an option agreement with Oxford University Innovation (“OUI”), which was a

precursor to a license agreement (the “OUI Agreement”), dated July 16, 2019. Under the terms of the OUI Agreement, the

Company holds an exclusive, worldwide license to certain specified patent rights and biological materials relating to the use of

epitopes of limited variability and virus-like particle products and practice processes that are covered by the licensed patent

rights and biological materials for the purpose of developing and commercializing a vaccine product candidate for influenza. The

Company is obligated to use its best efforts to develop and market Licensed Products, as defined in the OUI Agreement, in accordance

with its development plan, report to OUI on progress, achieve the following milestones and must pay OUI nonrefundable milestone fees

when it achieves them: initiation of first Phase I study; initiation of first Phase II study; initiation of first Phase III/pivotal

registration studies; first submission of application for regulatory approval (BLA/NDA); marketing authorization in the United

States; marketing authorization in any EU country; marketing authorization in Japan; first marketing authorization in any other

country; first commercial sale in Japan; first commercial sale in any ROW country; first year that annual sales equal or exceed

certain thresholds. The OUI Agreement also requires the Company to pay certain milestone and royalty payments in the future, as the

related contingent events occur. The OUI Agreement will expire upon

7

BLUE WATER BIOTECH, INC.

Notes to Condensed Financial Statements

(Unaudited)

Note 5 — Significant Agreements (cont.)

St. Jude Children’s Hospital

The Company entered into a license agreement (the “St. Jude Agreement”), dated January 27, 2020, with St. Jude Children’s Research Hospital (“St. Jude”). Under the terms of the St. Jude Agreement, the Company holds an exclusive, worldwide license to certain specified patent rights and biological materials relating to the use of live attenuated streptococcus pneumoniae and practice processes that are covered by the licensed patent rights and biological materials for the purpose of developing and commercializing a vaccine product candidate for streptococcus pneumoniae. The St. Jude Agreement requires the Company to pay certain milestone and royalty payments in the future, as the related contingent events occur. The St. Jude Agreement will expire upon the expiration of the last valid claim contained in the licensed patent rights, unless terminated earlier. The Company is obligated to use commercially reasonable efforts to develop and commercialize the licensed product(s). The milestones include the following events: (i) complete IND enabling study; (ii) initiate animal toxicology study; (iii) file IND; (iv) complete Phase I Clinical Trial; (v) commence Phase II Clinical Trial; (vi) commence Phase III Clinical Trial; and, (vii) regulatory approval, U.S. or foreign equivalent. If the Company fails to achieve the development milestones contained in the St. Jude Agreement, and if the Company and St. Jude fail to agree upon a mutually satisfactory revised timeline, St. Jude will have the right to terminate the St. Jude Agreement. Either party may terminate the St. Jude Agreement in the event the other party (a) files or has filed against it a petition under the Bankruptcy Act (among other things) or (b) fails to perform or otherwise breaches its obligations under the St. Jude Agreement, and has not cured such failure or breach within sixty (60) days. The Company may terminate for any reason on thirty (30) days written notice. On May 11, 2022, the Company entered into an amendment to the St. Jude Agreement, whereby the royalty terms, milestone payments and licensing fees were amended, and a revised development milestone timeline was agreed to. On March 22, 2023, the Company entered into another amendment to the St. Jude Agreement, whereby the development milestone timeline was further revised and which had no financial impact.

Cincinnati Children’s Hospital Medical Center

The

Company entered into a license agreement (the “CHMC Agreement”), dated June 1, 2021, with Children’s Hospital Medical

Center, d/b/a Cincinnati Children’s Hospital Medical Center (“CHMC”). Under the terms of the CHMC Agreement, the Company

holds an exclusive, worldwide license (other than the excluded field of immunization against, and prevention, control, or reduction in

the severity of gastroenteritis caused by rotavirus and norovirus in China and Hong Kong) to certain specified patent and biological

materials relating to the use of norovirus nanoparticles and practice processes that are covered by the licensed patent rights and biological

materials for the purpose of developing and commercializing CHMC patents and related technology directed to a virus-like particle vaccine

platform that utilizes nanoparticle delivery technology that may have potential broad application to develop vaccines for multiple infectious

diseases. The term of the CHMC Agreement begins on the effective date and extends on a jurisdiction by jurisdiction and product by product

basis until the later of: (i) the last to expire licensed patent; (ii)

8

BLUE WATER BIOTECH, INC.

Notes to Condensed Financial Statements

(Unaudited)

Note 5 — Significant Agreements (cont.)

Ology Bioservices, Inc. (which was later acquired by National Resilience, Inc.)

The Company entered into a Master Services Agreement (“Ology MSA”), dated July 19, 2019, with Ology, Inc. (“Ology”) to provide services from time to time, including but not limited to technology transfer, process development, analytical method optimization, cGMP manufacture, regulatory affairs, and stability studies of biologic products. Pursuant to the Ology MSA, the Company and Ology shall enter into a Project Addendum for each project to be governed by the terms and conditions of the Ology MSA.

The

Company has entered into two Project Addendums as of December 31, 2022. The initial Project Addendum was executed on October 18, 2019

and the Company was required to pay Ology an aggregate of approximately $

During

2022, the Company entered into three amendments to the Ology MSA to adjust the scope of work defined in the second Project Addendum.

During the three months ended March 31,

2023 the Company incurred related research and development expenses of approximately $

University of Texas Health Science Center at San Antonio

The

Company entered into a patent and technology license agreement (the “UT Health Agreement”), dated November 18, 2022, with

the University of Texas Health Science Center at San Antonio (“UT Health”). Under the terms of the UT Health Agreement, the

Company holds an exclusive, worldwide license (other than the excluded field of vectors, as defined in the UT Health Agreement) to certain

specified patent rights relating to the development of a live attenuated, oral Chlamydia vaccine candidate.

Co-development Agreement with AbVacc, Inc.

On

February 1, 2023, the Company entered into a co-development agreement (the “Co-Development Agreement”) with AbVacc, Inc.

(“AbVacc”), for the purpose of conducting research aimed at co-development of specific vaccine candidates, including monkeypox

and Marburg virus disease with the potential to expand to others using the Norovirus nanoparticle platform (“Co-Development Project”),

and to govern the sharing of materials and information, as defined in the Co-Development Agreement, for the Co-Development Project. Under

the Co-Development Agreement, AbVacc and the Company will collaborate, through a joint development committee, to establish and implement

a development plan or statement of work for each Co-Development Project targeted product. Under the Co-Development Agreement, either

the Company or AbVacc, whichever party is the primary sponsor of any resulting product (as defined in the Co-Development Agreement),

will be obligated to compensate the other party for certain milestone payments that would range between $

9

BLUE WATER BIOTECH, INC.

Notes to Condensed Financial Statements

(Unaudited)

Note 6 — Stockholders’ Equity

Authorized Capital

On

February 23, 2022, in connection with the closing of the IPO, the Company filed with the Secretary of State of the State of Delaware

its second amended and restated certificate of incorporation (the “A&R COI”), which became effective immediately. There

was no change to the Company’s authorized shares of common stock and preferred stock of

Common Stock

As

of March 31, 2023 and December 31, 2022, there were

Holders of the Company’s common stock are entitled to one vote for each share held of record, and are entitled upon liquidation of the Company to share ratably in the net assets of the Company available for distribution after payment of all obligations of the Company and after provision has been made with respect to each class of stock, if any, having preference over the common stock. The shares of common stock are not redeemable and have no preemptive or similar rights.

On

February 17, 2022, the Company entered into an underwriting agreement (the “Underwriting Agreement”) with Boustead Securities,

LLC, acting as representative of the underwriters (“Boustead”), in relation to the Company’s IPO, pursuant to which

the Company agreed to sell to the underwriters an aggregate of

Treasury Stock

On November 10, 2022, the board of directors of

the Company (the “Board”) approved a stock repurchase program (the “Repurchase Program”) to allow the Company

to repurchase up to

During

the three months ended March 31, 2023, the Company repurchased

Private Investments in Public Equity

April Private Placement

On

April 19, 2022, the Company consummated the closing of a private placement (the “April Private Placement”), pursuant to the

terms and conditions of a securities purchase agreement, dated as of April 13, 2022. At the closing of the April Private Placement, the

Company issued

H.C.

Wainwright & Co., LLC (“Wainwright”) acted as the exclusive placement agent for the April Private Placement. The Company

agreed to pay Wainwright a placement agent fee and management fee equal to

10

BLUE WATER BIOTECH, INC.

Notes to Condensed Financial Statements

(Unaudited)

Note 6 — Stockholders’ Equity (cont.)

The Company evaluated the terms of the April Private Placement Warrants and determined that they should be classified as equity instruments based upon accounting guidance provided in ASC 480 and ASC 815-40. Since the Company determined that the April Private Placement Warrants were equity-classified, the Company recorded the proceeds from the April Private Placement, net of issuance costs, within common stock at par value and the balance of the net proceeds to additional paid in capital.

The Company evaluated the terms of the April Contingent Warrants and determined that they should be classified as a liability based upon accounting guidance provided in ASC 815-40. Since the April Contingent Warrants are a form of compensation to Wainwright, the Company recorded the value of the liability as a reduction of additional paid in capital, with subsequent changes in the value of the liability recorded in other income in the accompanying statements of operations.

August Private Placement

On

August 11, 2022, the Company consummated the closing of a private placement (the “August Private Placement”), pursuant to

the terms and conditions of a securities purchase agreement, dated as of August 9, 2022. At the closing of the August Private Placement,

the Company issued

Wainwright

acted as the exclusive placement agent for the August Private Placement. The Company agreed to pay Wainwright a placement agent fee and

management fee equal to

The Company evaluated the terms of the August Private Placement Warrants and determined that they should be classified as equity instruments based upon accounting guidance provided in ASC 480 and ASC 815-40. Since the Company determined that the August Private Placement Warrants were equity-classified, the Company recorded the proceeds from the August Private Placement, net of issuance costs, within common stock at par value and the balance of the net proceeds to additional paid in capital.

The

investors in the April Private Placement agreed to cancel the aggregate of

The

Company evaluated the terms of the August Contingent Warrants and determined that they should be classified as a liability based upon

accounting guidance provided in ASC 815-40. As a result of the exchange of the preferred investment options issued in the April Private

Placement, the underlying equity-linked instruments that would trigger issuance of the April Contingent Warrants was replaced, and therefore

the

11

BLUE WATER BIOTECH, INC.

Notes to Condensed Financial Statements

(Unaudited)

Note 6 — Stockholders’ Equity (cont.)

At the Market Offering Agreement

On

March 29, 2023, the Company entered into an At The Market Offering Agreement (the “ATM Agreement”) with H.C. Wainwright &

Co., LLC, as sales agent (the “Agent”), to create an at-the-market equity program under which it may sell up to $

Sales of the Shares, if any, under the ATM Agreement may be made in transactions that are deemed to be “at-the-market equity offerings” as defined in Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), including sales made by means of ordinary brokers’ transactions, including on the Nasdaq Capital Market, at prevailing market prices at the time of sale or as otherwise agreed with the Agent. The Company has no obligation to sell, and the Agent is not obligated to buy or sell, any of the Shares under the Agreement and may at any time suspend offers under the Agreement or terminate the Agreement. The ATM Offering will terminate upon the termination of the ATM Agreement as permitted therein.

The Shares will be issued pursuant to the Company’s previously filed Registration Statement on Form S-3 (File No. 333-270383) that was declared effective on March 16, 2023 and a prospectus supplement and accompanying prospectus relating to the ATM Offering filed with the with the Securities and Exchange Commission (“SEC”) on March 29, 2023.

Deferred offering costs associated with the ATM Agreement are reclassified to additional paid in capital on a pro-rata basis when the Company completes offerings under the ATM Agreement. Any remaining deferred costs will be expensed to the statements of operations should the planned offering be abandoned.

As of March 31, 2023, no shares have been sold under the ATM Offering.

Warrants

The following summarizes activity related to the Company’s outstanding warrants, excluding contingent warrants issuable upon exercise of the preferred investment options, for the three months ended March 31, 2023:

| Weighted | ||||||||||||

| Average | ||||||||||||

| Weighted | Remaining | |||||||||||

| Average | Contractual | |||||||||||

| Number of | Exercise | Life | ||||||||||

| Shares | Price | (in years) | ||||||||||

| Outstanding as of December 31, 2022 | $ | |||||||||||

| Granted | ||||||||||||

| Exercised | ( | ) | ||||||||||

| Cancelled | ||||||||||||

| Outstanding as of March 31, 2023 | ||||||||||||

| Warrants vested and exercisable as of March 31, 2023 | $ | |||||||||||

As

of March 31, 2023, the outstanding warrants include

Additionally,

as of March 31, 2023 and December 31, 2022, the value of the April Contingent Warrants and the August Contingent Warrants (collectively

the “Contingent Warrants”) was approximately $

Equity Incentive Plans

The

Company’s 2019 Equity Incentive Plan (the “2019 Plan”) was adopted by the Board and by its stockholders on July 1,

2019. The Company has reserved

12

BLUE WATER BIOTECH, INC.

Notes to Condensed Financial Statements

(Unaudited)

Note 6 — Stockholders’ Equity (cont.)

In

addition, on February 23, 2022 and in connection with the closing of the IPO, the Board adopted the Company’s 2022 Equity Incentive

Plan (the “2022 Plan”), which is the successor and continuation of the Company’s 2019 Plan. Under the 2022 Plan, the

Company may grant stock options, restricted stock, restricted stock units, stock appreciation rights, and other forms of awards to employees,

directors and consultants of the Company. Upon its effectiveness, a total of

Stock Options

The following summarizes activity related to the Company’s stock options under the 2019 Plan and the 2022 Plan for the three months ended March 31, 2023:

| Weighted | ||||||||||||||||

| Average | ||||||||||||||||

| Weighted | Remaining | |||||||||||||||

| Average | Total | Contractual | ||||||||||||||

| Number of | Exercise | Intrinsic | Life | |||||||||||||

| Shares | Price | Value | (in years) | |||||||||||||

| Outstanding as of December 31, 2022 | $ | $ | ||||||||||||||

| Granted | ||||||||||||||||

| Forfeited / cancelled | ( | ) | ||||||||||||||

| Exercised | ||||||||||||||||

| Outstanding as of March 31, 2023 | $ | |||||||||||||||

| Options vested and exercisable as of March 31, 2023 | $ | $ | ||||||||||||||

The fair value of options granted in 2023 was estimated using the following assumptions:

| For the Three Months Ended March 31, | ||||

| 2023 | ||||

| Exercise price | $ | |||

| Term (years) | ||||

| Expected stock price volatility | % | |||

| Risk-free rate of interest | % | |||

The

weighted average grant date fair value of stock options granted during the three months ended March 31, 2023 was $

Stock-Based Compensation

Stock-based compensation expense for the three months ended March 31, 2023 and 2022 was as follows:

| For the Three Months Ended | ||||||||

| March 31, | ||||||||

| 2023 | 2022 | |||||||

| General and administrative | $ | $ | ||||||

| Research and development | ||||||||

| Total | $ | $ | ||||||

As

of March 31, 2023, unrecognized stock-based compensation expense relating to outstanding stock options is approximately $

13

BLUE WATER BIOTECH, INC.

Notes to Condensed Financial Statements

(Unaudited)

Note 7 — Commitments and Contingencies

Office Leases

The

Company entered into a short-term lease in Palm Beach, Florida with an unrelated party, with a commencement date of May 1, 2022, for

approximately $

Litigation

From time to time, the Company may be subject to various legal proceedings and claims that arise in the ordinary course of its business activities. As of March 31, 2023, the Company is not a party to any material legal proceedings and is not aware of any pending or threatened claims.

Registration Rights Agreements

In connection with the April Private Placement (see Note 6), the Company entered into a Registration Rights Agreement with the purchasers, dated as of April 13, 2022 (the “April Registration Rights Agreement”). The April Registration Rights Agreement provides that the Company shall file a registration statement covering the resale of all of the registrable securities (as defined in the April Registration Rights Agreement) with the SEC. The registration statement on Form S-1 required under the April Registration Rights Agreement was filed with the SEC on May 3, 2022, and became effective on May 20, 2022. A post-effective amendment to the Form S-1 on Form S-3 relating to such registration statement was filed with the SEC on April 28, 2023.

In connection with the August Private Placement (see Note 6), the Company entered into a Registration Rights Agreement with the purchasers, dated as of August 9, 2022 (the “August Registration Rights Agreement”). The August Registration Rights Agreement provides that the Company shall file a registration statement covering the resale of all of the registrable securities (as defined in the August Registration Rights Agreement) with the SEC. The registration statement on Form S-1 required under the August Registration Rights Agreement was filed with the SEC on August 29, 2022, and became effective on September 19, 2022. A post-effective amendment to the Form S-1 on Form S-3 relating to such registration statement was filed with the SEC on April 28, 2023.

Upon

the occurrence of any Event (as defined in the April Registration Rights Agreement and the August Registration Rights Agreement), which,

among others, prohibits the purchasers from reselling the securities for more than ten consecutive calendar days or more than an aggregate

of fifteen calendar days during any 12-month period, and should the registration statement cease to remain continuously effective, the

Company would be obligated to pay to each purchaser, on each monthly anniversary of each such Event, an amount in cash, as partial liquidated

damages and not as a penalty, equal to the product of

Milestone and Royalty Obligations

The

Company has entered into various license agreements with third parties that obligate the Company to pay certain development, regulatory,

and commercial milestones, which aggregate to $

Indemnification

In the normal course of business, the Company enters into contracts and agreements that contain a variety of representations and warranties and provide for general indemnifications. The Company’s exposure under these agreements is unknown because it involves claims that may be made against the Company in the future but have not yet been made. To date, the Company has not paid any claims or been required to defend any action related to its indemnification obligations. However, the Company may incur charges in the future as a result of these indemnification obligations.

Risks and Uncertainties — COVID-19

Management continues to evaluate the impact of the COVID-19 pandemic on the industry and has concluded that while it is reasonably possible that the virus could have a negative effect on the Company’s financial position, results of its operations and/or search for drug candidates, the specific impact is not readily determinable as of the date of these financial statements. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

14

BLUE WATER BIOTECH, INC.

Notes to Condensed Financial Statements

(Unaudited)

Note 8 — Related Party Transactions

The

Company originally engaged the Chief Executive Officer, who is also the Board Chairman and prior to the close of the IPO, sole common

stockholder of the Company, pursuant to a consulting agreement commencing October 22, 2018, which called for the Company to pay for consulting

services performed on a monthly basis. Upon the close of the Company’s IPO, the consulting agreement was terminated and the CEO’s

employment agreement became effective. During the three months ended March 31, 2022, the Company incurred approximately $

During 2022 the Company entered into a lease agreement that was personally guaranteed by the Company’s CEO. The lease expired on April 30, 2023. See Note 7.

During the year ended December 31, 2022, the

Company’s compensation committee approved one-time bonus awards of $

As

of March 31, 2023 and December 31, 2022, the Company has a receivable from related party of approximately $

A former director of the Company, who currently serves on the Company’s Scientific Advisory Board, serves on the Advisory Board for the Cincinnati Children’s Hospital Medical Center Innovation Fund, which is affiliated with CHMC. The Company has an exclusive license agreement with CHMC as disclosed in Note 5. This director resigned from the Board upon the close of the IPO.

Note 9 — Income Taxes

No provision for federal, state or foreign income taxes has been recorded for the three months ended March 31, 2023 and 2022. The Company has incurred net operating losses for all of the periods presented and has not reflected any benefit of such net operating loss carryforwards in the accompanying condensed financial statements due to uncertainty around utilizing these tax attributes within their respective carryforward periods. The Company has recorded a full valuation allowance against all of its deferred tax assets as it is not more likely than not that such assets will be realized in the near future. The Company’s policy is to recognize interest expense and penalties related to income tax matters as income tax expense. For the three months ended March 31, 2023 and 2022, the Company has not recognized any interest or penalties related to income taxes.

Note 10 — Net Loss Per Share

Basic loss per share is computed by dividing the net income or loss applicable to common shares by the weighted average number of common shares outstanding during the period, including pre-funded warrants because their exercise requires only nominal consideration for delivery of shares. Diluted earnings per share is computed using the weighted average number of common shares and, if dilutive, potential common shares outstanding during the period. Potential common shares consist of the Company’s warrants and options. Diluted loss per share excludes stock options and warrants from the calculation of net loss per share if their effect would be anti-dilutive.

The two-class method is used to determine earnings per share based on participation rights of participating securities in any undistributed earnings. Each preferred stock that includes rights to participate in distributed earnings is considered a participating security and the Company uses the two-class method to calculate net income available to the Company’s common stockholders per common share — basic and diluted.

The following securities were excluded from the computation of diluted shares outstanding due to the losses incurred in the periods presented, as they would have had an anti-dilutive impact on the Company’s net loss:

| Three Months Ended March 31, | ||||||||

| 2023 | 2022 | |||||||

| Options to purchase shares of common stock | ||||||||

| Warrants | ||||||||

| Total | ||||||||

15

BLUE WATER BIOTECH, INC.

Notes to Condensed Financial Statements

(Unaudited)

Note 11 — Subsequent Events

On

April 19, 2023, the Company entered into an Asset Purchase Agreement (the "APA") with Veru Inc. (the "Seller").

Pursuant to, and subject to the terms and conditions of, the APA, the Company purchased substantially all of the assets related to the

Seller’s ENTADFI® product (“ENTADFI®”)

and assumed certain liabilities of the Seller (the “Transaction”) for a total possible consideration of $

In

accordance with the APA, the Company agreed to provide the Seller with initial consideration totaling $

Additionally,

the terms of the APA require

In

connection with the Transaction, the Company also assumed royalty and milestone obligations under an asset purchase agreement for

tadalafil-finasteride combination entered into by the Seller and Camargo Pharmaceutical Services, LLC on December 11, 2017 (the “Camargo

Obligations”). The Camargo Obligations assumed by the Company include a

Also

in connection with the Transaction, and pursuant to the APA, the Company entered into non-competition and non-solicitation agreements

(the “Non-Competition Agreements”) with two of the Seller’s key stockholders and employees (the “Restricted Parties”).

The Non-Competition Agreements generally prohibit the Restricted Parties from either directly or indirectly engaging in the Restricted

Business (as such term is defined in the APA) for a period of

The allocation of the purchase price to the underlying assets acquired and liabilities assumed is subject to a formal valuation process. Due to the limited time since the closing of the acquisition, the valuation efforts and related acquisition accounting are incomplete at the time of filing of these condensed financial statements. As a result, the Company is unable to provide amounts recognized as of the acquisition date for major classes of assets and liabilities acquired. The purchase price allocation, and other disclosures required in accordance with authoritative guidance, will be included in the quarterly report on Form 10-Q for the quarter ended June 30, 2023.

On April 21, 2023, the Company filed an amendment to its A&R COI with the Secretary of State of Delaware to change its corporate name from “Blue Water Vaccines Inc.” to “Blue Water Biotech, Inc.”. The name change was effective as of April 21, 2023. In connection with the name change, the Company amended the Company’s bylaws to reflect the corporate name Blue Water Biotech, Inc., also effective on April 21, 2023. No other changes were made to the bylaws.

On May 9, 2023, the Company’s

compensation committee approved the issuance of restricted stock, granted under the Company’s 2022 Plan to the Company’s executive

officers, employees, and certain of the Company’s consultants. The restricted shares granted totaled

16

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our financial statements and the related notes to those statements included elsewhere in this Report and with the audited financial statements and the related notes included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as filed with the SEC, on March 9, 2023. In addition to historical financial information, the following discussion and analysis contains forward-looking statements that involve risks, uncertainties, and assumptions. Some of the numbers included herein have been rounded for the convenience of presentation. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of many factors. See “Cautionary Note Regarding Forward-Looking Statements.”

Overview

We are a biotechnology company focused on developing transformational therapies to address significant health challenges globally. We hold exclusive, global rights to novel technology licensed from renowned research institutions around the world, including St. Jude, the University of Oxford, CHMC, and UT Health. We believe that our pipeline and vaccine platform are synergistic for developing next generation preventive vaccines to improve both health outcomes and quality of life globally. Outside of our vaccine franchise, we own ENTADFI®, an FDA-approved, once daily pill that combines finasteride and tadalafil for the treatment of benign prostatic hyperplasia (“BPH”). This combination allows men to receive treatment for their symptoms of BPH without the negative sexual side effects typically seen in patients on finasteride alone.

Since December 31, 2022, key development affecting our business include:

| ● | Entered into an At The Market Offering Agreement: On March 29, 2023, the Company entered into the ATM Agreement with the Agent, H.C. Wainwright & Co., LLC, to create an at-the-market equity program under which it may sell up to $3,900,000 of shares of the Company’s common stock from time to time through the Agent. Under the ATM Agreement, the Agent will be entitled to a commission at a fixed rate of 3.0% of the gross proceeds from each sale of shares of the Company’s common stock under the ATM Agreement. |

| ● | Completed Acquisition of ENTADFI®, an FDA-Approved Benign Prostatic Hyperplasia Asset: On April 19, 2023, the Company entered into the APA with Veru Inc., pursuant to which the Company purchased substantially all of the assets related to the Veru Inc.’s ENTADFI® product and assumed certain liabilities of Veru Inc. Under this agreement, the Company purchased ENTADFI® for a total consideration of up to $100 million, with $20 million paid in defined tranches through September 2024, and the possibility of an additional $80 million based on predetermined annual sales milestones. |

| ● | Hired Key Personnel to Support Commercial Operations and Corporate Development: In February 2023, the Company announced the appointment of seasoned commercial operations leader, Frank Jaeger, as Senior Vice President of Marketing and Business Development. The Company will leverage Mr. Jaeger’s experience, specifically in men’s health through his experience with JATENZO® and AndroGel 1.62%, in the official launch of ENTADFI® and its anticipated success within the BPH market. Also, in May 2023, the Company announced the appointment of Jay Newmark, M.D., MBA, a board-certified urologist with decades of medical and commercial Men’s Health experience, as Chief Medical Officer to support the launch of ENTADFI®. Dr. Newmark’s engagement with the Company will expire in June 2023, but he will support launch activities until his departure. The Company will rely heavily on Mr. Jaeger to ensure successful launch and future sales of ENTADFI®. |

| ● | Announced Timothy Ramdeen to the Board of Directors: In January 2023, the Company announced the appointment of seasoned public market and private equity investment leader, Timothy Ramdeen, to the Board. Mr. Ramdeen has nearly a decade of experience in private equity and hedge fund investing, capital markets, and company formation. |

| ● | Presented at Key Scientific and Investor Conferences: Throughout the first quarter of 2023 and to date, the Company’s management presented its corporate overview and Company updates at key investor, financial, and scientific conferences to highlight the value story of the BWV pipeline and target leaders within the investment community. In January 2023, the Company presented an overview of its vaccine candidate pipeline and progress at Biotech Showcase 2023 during the 41st annual J.P. Morgan Healthcare Conference Week in San Francisco, California. In addition, the Company’s management participated in the World Vaccine Congress Washington D.C. in April 2023. To promote ENTADFI® and connect with leaders in the urology space, the Company’s management sponsored a booth at the American Urological Association Annual Meeting 2023 in Chicago, Illinois. |

| ● | Announced Joint Development Agreement with AbVacc for Marburg and Monkeypox Vaccine Candidates: In February 2023, the Company announced a partnership with AbVacc for the joint development of novel vaccine candidates targeting monkeypox, Marburg virus disease, among others. Vaccine candidates will utilize the Company’s norovirus shell and protrusion virus-like particle platform, which allows for the presentation of multiple antigens on the surface of either the S or P particle of a norovirus backbone. Under this agreement, the Company and AbVacc will work collaboratively to identify appropriate antigens to use within this platform and will work toward clinical development of vaccine candidates. |

| ● | Signed Sponsored Research Agreement with The University of Texas Health Science Center at San Antonio for Non-Human Primate Study for Chlamydia Vaccine Development: In March 2023, the Company signed a sponsored research agreement with UT Health to initiate a non-human primate study for the Company’s live attenuated, orally delivered Chlamydia vaccine, BWV-401. In this study, non-human primates will be vaccinated with BWV-401 and subsequently challenged against Chlamydia to validate they hypothesis that this vaccine is both safe and efficacious in a human-like model. |

17

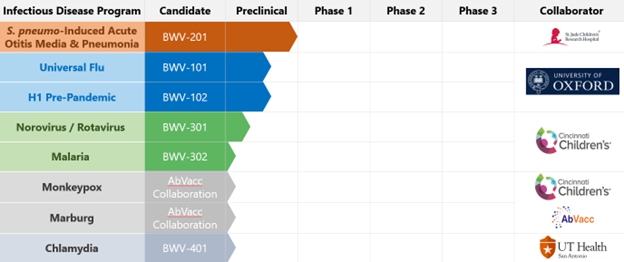

An updated summary of the Company’s pipeline for all vaccine candidates is provided as follows:

Since our inception in October 2018 until April 2023, when we acquired ENTADFI®, we have devoted substantially all of our resources to performing research and development, undertaking preclinical studies and enabling manufacturing activities in support of our product development efforts, hiring personnel, acquiring and developing our technology and vaccine candidates, organizing and staffing our company, performing business planning, establishing our intellectual property portfolio and raising capital to support and expand such activities. We do not have any products approved for sale, aside from ENTADFI®, and have not generated any revenue from product sales. To date, we have financed our operations primarily with proceeds from our sale of preferred securities to seed investors, the close of the IPO, and the close of the Private Placements. We will continue to require additional capital to commercialize ENTADFI® and develop our vaccine candidates and fund operations for the foreseeable future. Accordingly, until such time as we can generate significant revenue from sales of our vaccine candidates or other products, if ever, we expect to finance our cash needs through public or private equity or debt financings, third-party (including government) funding and marketing and distribution arrangements, as well as other collaborations, strategic alliances and licensing arrangements, or any combination of these approaches.

We have incurred net losses since inception and expect to continue to incur net losses in the foreseeable future. Our net losses may fluctuate significantly from quarter-to-quarter and year-to-year, depending in large part on the timing of our preclinical studies, clinical trials and manufacturing activities, our expenditures on other research and development activities and commercialization activities. As of March 31, 2023, the Company had working capital of approximately $19.7 million and an accumulated deficit of approximately $22.2 million. We will need to raise additional capital to sustain operations within the one-year period following the issuance of the accompanying condensed financial statements.

While we believe that we can raise additional capital to fund our planned operations, until we generate revenue sufficient to support self-sustaining cash flows, if ever, we will need to raise additional capital to fund our continued operations, including our product development and commercialization activities related to our current and future products. There can be no assurance that additional capital will be available to us on acceptable terms, or at all, or that we will ever generate revenue sufficient to provide for self-sustaining cash flows. These circumstances raise substantial doubt about our ability to continue as a going concern. The accompanying financial statements do not include any adjustment that might be necessary if the Company is unable to continue as a going concern.

18

We do not expect to generate any revenue from our vaccine candidates until we successfully complete development and obtain regulatory approval, which we expect will take a number of years. Our lead vaccine candidate, BWV-201, is anticipated to enter a Phase I clinical trial in 2024. Given ENTADFI® is currently approved, we expect to generate revenue from this product’s sales in the near term. Although we anticipate sales of ENTADFI® to offset some expenses relating to its commercial scale up and development, as well as the development of our vaccine candidates in the future, we expect our expenses will increase substantially in connection with our ongoing activities, as we:

| ● | advance vaccine candidates through preclinical studies and clinical trials; |

| ● | require the manufacture of supplies for our preclinical studies and clinical trials; |

| ● | pursue regulatory approval of vaccine candidates; |

| ● | hire additional personnel; |

| ● | operate as a public company; |

| ● | acquire, discover, validate and develop additional vaccine candidates; and |

| ● | obtain, maintain, expand and protect our intellectual property portfolio. |

| ● | Commercialize and launch ENTADFI® |

We rely and will continue to rely on third parties in the conduct of our preclinical studies and clinical trials as well as for the manufacturing and supply of our vaccine candidates and ENTADFI®. We have no internal manufacturing capabilities, and we will continue to rely on third parties, of which the main suppliers are single-source suppliers, for our preclinical, clinical trial materials, and our commercial product. As we have a product in commercial stage, we are seeking to build a robust and efficient commercial team to accommodate this development. This includes appropriate personnel and third party relationships and contracts to execute our commercialization strategy. Accordingly, we also expect to incur significant commercialization expenses related to product sales, marketing, manufacturing and distribution for those products.

Because of the numerous risks and uncertainties associated with vaccine development, we are unable to predict the timing or amount of increased expenses or when or if we will be able to achieve or maintain profitability. Even if we are able to generate revenue from the sale of our vaccines and ENTADFI®, we may not become profitable. If we fail to become profitable or are unable to sustain profitability on a continuing basis, then we may be unable to continue our operations at planned levels and may be forced to reduce our operations.

Certain Significant Relationships

We have entered into grant, license and collaboration arrangements with various third parties as summarized below. For further details regarding these and other agreements, see Notes 5 and 7 to each of our audited financial statements included in the Form 10-K and unaudited financial statements included elsewhere in this Report.

Ology MSA

In July 2019, we entered into a development and manufacturing master services agreement with Ology, pursuant to which Ology is obligated to perform manufacturing process development and clinical manufacture and supply of components.

The Company entered into an initial Project Addendum on October 18, 2019 and the Company was required to pay Ology an aggregate of approximately $4 million. Due to unforeseen delays associated with COVID-19, the Company and Ology entered into a letter agreement dated January 9, 2020 to stop work on the project, at which point, the Company had paid Ology $100,000 for services. The second Project Addendum was executed May 21, 2021, pursuant to which the Company is obligated to pay Ology an aggregate amount of approximately $2.8 million, plus reimbursement for materials and outsourced testing, which will be billed at cost plus 15%.

During 2022, the Company entered into three amendments to the Ology MSA, to adjust the scope of work defined in the second Project Addendum. The amendments resulted in a net increase to the Company’s obligations under the second Project Addendum of $154,000. On March 27, 2023, the second Project Addendum to the Ology MSA was further amended to increase the scope of the project, resulting in an increase to the Company’s obligations of $180,000 under the Ology MSA.

For additional details regarding our relationship with Ology, see Note 5 to our condensed financial statements included elsewhere in this Report.

Cincinnati Children’s Hospital Medical Center Agreement

On June 1, 2021, we entered into an exclusive, worldwide license agreement with CHMC, pursuant to which we obtained the right to develop and commercialize certain CHMC patents and related technology directed at a virus-like particle vaccine platform that utilizes nanoparticle delivery technology, which may have potential broad application to develop vaccines for multiple infectious diseases.

19

Under the CHMC Agreement, we agreed to pay CHMC certain license fees, deferred license fees, development milestone fees, and running royalties beginning on the first net sale (among others). For additional details regarding our relationship with CHMC, see Note 5 to our financial statements included elsewhere in this Report. The CHMC license includes the following patents:

| U.S. Patent Application No. |

U.S. Patent No. | Granted Claim Type | U.S. Expiration | Foreign

Counterparts | ||||

| 12/797,396 | 8,486,421 | Compositions of the vaccine/vaccine platform | 1/13/2031 | CN107043408B

EP2440582B1 JP5894528B2 | ||||

| 13/924,906 | 9,096,644 | Method of treatment | 9/20/2030 | CN107043408B

EP2440582B1 JP5894528B2 | ||||

| 13/803,057 | 9,562,077 | Compositions of the vaccine platform | 4/10/2034 | none | ||||

| 16/489,095 | pending | pending** | [3/15/2038]* | Pending

applications in Canada, China, EU, Hong Kong and Japan | ||||

| 63/149,742

(filed 2/16/2021) |

pending | pending** | [February 2042]# | TBD | ||||

| 63/162,369

(filed 3/17/2021) |

pending | pending** | [March 2042]# | TBD |

| * | Projected expiration if patent issues: 20 years from earliest non-provisional application filing date. |

| # | Non-provisional application not yet filed. Expiration projected 21 years from provisional application filing date. Dependent on timely conversion to non-provisional application and issuance of patent. |

| ** | This is a pending application. Claim type will be determined after U.S. prosecution is complete. The claim type sought includes compositions of the vaccine and vaccine platform. |

Oxford University Innovation Limited Agreement

On July 16, 2019, we entered into an exclusive, worldwide license agreement with Oxford University Innovation Limited, pursuant to which we obtained the right to develop and commercialize certain licensed technology entitled “Immunogenic Composition.”

Under the OUI Agreement, we agreed to fund three years’ worth of salaries for Dr. Craig Thompson in the University’ Department of Zoology through a sponsored research agreement with Oxford University, as well as royalties on all net sales of licensed products, along with certain development and milestone payments (among others). For additional details regarding our relationship with OUI, see Note 5 to our financial statements included elsewhere in this Report. The OUI license includes:

| U.S. Patent

Application No. |

U.S. Patent No. | Granted Claim Type | U.S. Expiration | Foreign

Counterparts | ||||

| 16/326,749 | 11,123,422 | Compositions and method of treatment | 8/25/2037 | Pending applications in Australia, Canada, China, EU and Japan | ||||

| 17/458,712 | pending | pending** | [8/25/2037]* |

| * | Projected expiration if patent issues: 20 years from earliest non-provisional application filing date. |

| ** | This is a pending application. Claim type will be determined after U.S. prosecution is complete. The claim type sought includes compositions of the compositions and method of treatment. |

20

St. Jude Children’s Research Hospital, Inc. Agreement

On January 27, 2020, we entered into an exclusive, worldwide license agreement with St. Jude, pursuant to which we acquired the right to develop certain licensed products and produce vaccines for use in humans.

Under the St. Jude Agreement, we agreed to pay an initial license fee, an annual maintenance fee, milestone payments, patent reimbursement, and running royalties based on the net sales of licensed products. On May 11, 2022, the Company and St. Jude entered into the St. Jude Amendment. The St. Jude Amendment provides for a revised development milestone timeline, a one-time license fee of $5,000, and an increase to the royalty rate from 4% to 5%. The St. Jude Amendment also provides for an increase to the contingent milestone payments, from $1.0 million to $1.9 million in the aggregate; specifically, development milestones of $0.3 million, regulatory milestones of $0.6 million, and commercial milestones of $1.0 million. On March 22, 2023, the Company entered into another amendment to the St. Jude Agreement, whereby the development milestone timeline was further revised. For additional details regarding our relationship with St. Jude, see Notes 5 to our financial statements included elsewhere in this Report. The St. Jude license includes:

| U.S. Patent Application No. | U.S. Patent No. | Granted Claim Type | U.S. Expiration | Foreign

Counterparts | ||||

| 14/345,988 | 9,265,819 | Compositions and method of treatment | 9/19/2032 | none | ||||

| 17/602,414# | pending | pending** | [3/12/2040]* | Pending Applications in: Australia, Brazil, Canada, China, Europe, Hong Kong, Japan and Korea |

| * | Projected expiration if patent issues: 20 years from earliest non-provisional application filing date. |

| # | U.S. National stage entry of WO 2020/183420 (PCT/IB2020/052250). |

| ** | This is a pending application. Claim type will be determined after U.S. prosecution is complete. The claim type sought includes compositions of the compositions and method of treatment. |

AbVacc Co-Development Agreement

On February 1, 2023, the Company entered into the Co-Development Agreement with AbVacc for the purpose of conducting research aimed at co-development of specific vaccine candidates, including monkeypox and Marburg virus disease with the potential to expand to others using the Norovirus nanoparticle platform, and to govern the sharing of materials and information, as defined in the agreement, for the Co-Development Project. Under the Co-Development Agreement, AbVacc and the Company will collaborate, through a joint development committee, to establish and implement a development plan or statement of work for each Co-Development Project targeted product. Under the Co-Development Agreement, either the Company or AbVacc, whichever party is the primary sponsor of any resulting product (as defined in the Co-Development Agreement), will be obligated to compensate the other party for certain milestone payments that would range between $2.1 million and $4.75 million, plus royalties of between 2% to 4%. The term of the Co-Development Agreement is three years from the effective date, unless previously terminated by either party, in accordance with the Co-Development Agreement.

Butantan Letter of Intent

On May 19, 2022, the Company and Instituto Butantan (“Butantan”) entered into a letter of intent, pursuant to which the Company and Butantan intend to establish a future technological collaboration in order to improve Butantan’s platform and develop the universal influenza vaccine candidate in collaboration with the Company.

21

COVID-19 Impacts

We are continuing to closely monitor the impact of the global COVID-19 pandemic on our business and are taking proactive efforts designed to protect the health and safety of our employees and to maintain business continuity. We believe that the measures we are implementing are appropriate, and we will continue to monitor and seek to comply with guidance from governmental authorities and adjust our activities as appropriate. Based on guidance issued by federal, state and local authorities, we transitioned to a remote work model for a vast majority of our employees in March 2020. The COVID-19 pandemic has resulted in an impact to our development timelines, as the pandemic continues, we could continue to see an impact on our ability to advance our programs, obtain supplies from our contract manufacturer or interact with regulators, ethics committees or other important agencies due to limitations in regulatory authority, employee resources or otherwise. In any event, if the COVID-19 pandemic continues and persists for an extended period of time, we could experience significant disruptions to our development timelines, which would adversely affect our business, financial condition, results of operations and growth prospects.